UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | SolicitingMaterial Pursuant to Section 240.14a-12 |

ANNTAYLOR STORES CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

(set forth the amount on which the filing fee is calculated and state how it was determined):

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 28, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of AnnTaylor Stores Corporation (the “Company”) will be held at 9:00 A.M., local time, on Thursday, April 28, 2005, at The Peninsula Hotel, 700 Fifth Avenue, New York, New York 10019, for the following purposes:

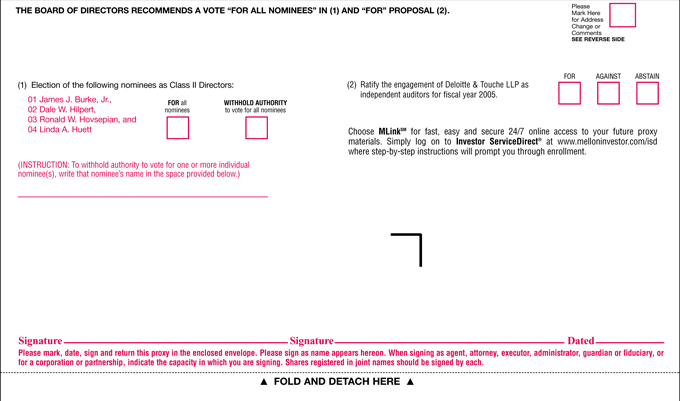

| | 1. | To elect four Class II Directors of the Company, each to serve for a term of three years; |

| | 2. | To ratify the engagement by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the Company’s independent auditors for fiscal year 2005; and |

| | 3. | To transact such other business as may properly come before the meeting and any adjournments or postponements thereof. |

Only stockholders of record at the close of business on Thursday, March 3, 2005 are entitled to notice of and to vote at the Annual Meeting and at any and all adjournments or postponements thereof.

|

By Order of the Board of Directors, |

|

|

Barbara K. Eisenberg Secretary |

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE ENCOURAGED TO VOTE BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND MAILING IT TO THE COMPANY IN THE ENCLOSED, POSTAGE-PAID ENVELOPE AS SOON AS POSSIBLE. IF INTERNET VOTING IS AVAILABLE TO YOU, VOTING INSTRUCTIONS ARE PRINTED ON THE PROXY CARD SENT TO YOU. VOTING BY PROXY WILL NOT PREVENT YOU FROM ATTENDING THE MEETING AND VOTING IN PERSON IF YOU SO DESIRE.

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 28, 2005

PROXY STATEMENT

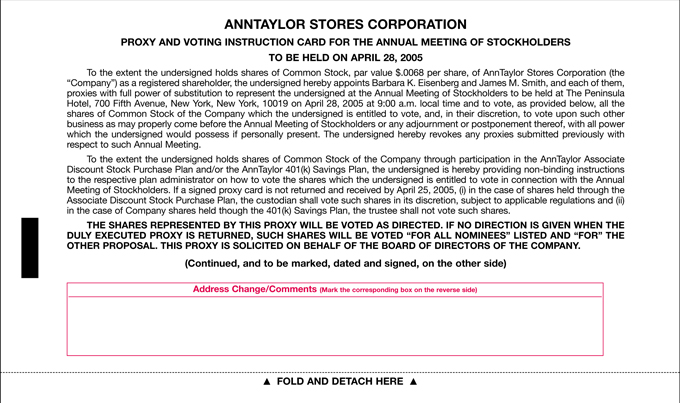

This Proxy Statement is being furnished to the stockholders of AnnTaylor Stores Corporation, a Delaware corporation (the “Company”), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the Annual Meeting of Stockholders of the Company, to be held at 9:00 A.M., local time, on Thursday, April 28, 2005, at The Peninsula Hotel, 700 Fifth Avenue, New York, New York, 10019 and at any and all adjournments or postponements thereof. At the Annual Meeting, the stockholders of the Company are being asked to consider and vote upon the: (1) election of four Class II Directors, each to serve for a term of three years; and (2) ratification of the engagement of the Company’s independent auditors for fiscal year 2005.

The mailing of this Proxy Statement and the accompanying form of proxy to the stockholders of the Company is expected to commence on or about April 1, 2005.

VOTING RIGHTS AND SOLICITATION OF PROXIES

Only holders of record of the Company’s common stock, par value $.0068 per share (the “Common Stock”), at the close of business on March 3, 2005 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, there were 71,678,727 shares of Common Stock outstanding. The presence, either in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding on the Record Date is necessary to constitute a quorum at the Annual Meeting. All abstentions will be included as shares that are present and entitled to vote for purposes of determining the presence of a quorum at the meeting. If you hold your shares in “street name” through a broker or other nominee, shares represented by “broker non-votes” will be counted in determining whether there is a quorum but will not be counted as votes cast on any matter.

Each stockholder is entitled to one vote per share for each share of Common Stock held of record in such stockholder’s name as of the Record Date on any matter submitted to a vote of stockholders at the Annual Meeting.

The Class II Directors will be elected by the affirmative vote of holders of a plurality of the shares of Common Stock represented and voting in person or by proxy and entitled to vote at the Annual Meeting. With respect to approval of Proposal 2, the affirmative vote of the holders of a majority of the shares of the Company’s Common Stock represented in person or by proxy and entitled to vote at the Annual Meeting is required for approval.

In determining whether each of the proposals submitted to a vote of the stockholders has received the requisite number of affirmative votes, (i) abstentions will not be counted as votes cast in connection with determining the plurality required to elect Directors and will have no effect on the outcome of that vote, and (ii) abstentions will be counted as shares present and entitled to vote and will have the same effect as a vote against Proposal 2.

Shares of Common Stock that are represented by properly executed proxies and received in time for voting at the Annual Meeting (and that have not been revoked) will be voted in accordance with the instructions indicated on the proxy. In the absence of specific instructions to the contrary, the persons named in the

accompanying form of proxy intend to vote all properly executed proxies received by them for the election of the Board of Directors’ nominees for Class II Directors and in favor of Proposal 2.

For stockholders who are participants in the Company’s Associate Discount Stock Purchase Plan and/or who hold shares of Company stock through the Company’s 401(k) Savings Plan, the enclosed proxy card also serves as voting instructions to the respective plan custodian or trustee, as the case may be. If the signed proxy card is not received by April 25, 2005, (i) in the case of shares held through the Associate Discount Stock Purchase Plan, the custodian shall vote such shares in its discretion, subject to applicable regulations and (ii) in the case of Company shares held through the 401(k) Savings Plan, the trustee shall not vote such shares.

No business other than as set forth in the accompanying Notice of Annual Meeting of Stockholders is expected to come before the Annual Meeting, but should any other matter requiring a vote of stockholders be properly brought before the Annual Meeting, it is the intention of the persons named in the enclosed form of proxy to vote such proxy in accordance with their best judgment on such matters. Stockholders who execute the enclosed proxy may still attend the Annual Meeting and vote in person.

Any proxy may be revoked at any time before it is exercised by providing written notice of revocation to the Corporate Secretary of the Company, 1372 Broadway, New York, New York 10018, by executing a proxy bearing a later date, or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not, however, in and of itself constitute a revocation of a proxy or an earlier vote.

Solicitation will be made by mail, and may be made personally or by telephone by officers and other employees of the Company who will not receive additional compensation for solicitation. The Company has retained Morrow & Co., Inc. (“Morrow”), a professional soliciting organization, to assist in soliciting proxies from brokerage firms, custodians, and other fiduciaries. The Company expects the fees for Morrow to be approximately $7,500 plus expenses. The cost of this solicitation will be borne by the Company.

The principal executive offices of the Company are located at 142 West 57th Street, New York, New York 10019.

PROPOSAL 1

ELECTION OF CLASS II DIRECTORS

The Board of Directors of the Company is divided into three classes, designated Class I, Class II and Class III, each serving staggered three-year terms. The Company’s Certificate of Incorporation requires that such classes be as nearly equal in number of Directors as possible.

At the Annual Meeting, four Class II Directors are to be elected to serve three-year terms ending at the Annual Meeting of Stockholders to be held in 2008, or until their respective successors are elected and qualified. The Board of Directors has nominated for re-election James J. Burke, Jr., Dale W. Hilpert, Ronald W. Hovsepian and Linda A. Huett as Class II Directors. Each of the four nominees has consented to serve as a Director if elected at the Annual Meeting and, to the best knowledge of the Board of Directors, each of such nominees is and will be able to serve if so elected. In the event that any of these nominees should be unavailable to stand for election before the Annual Meeting, the persons named in the accompanying proxy intend to vote for such other person, if any, as may be designated by the Board of Directors in the place of a nominee unable to serve. The Board of Directors has determined that each of the nominees for re-election is independent under the New York Stock Exchange (“NYSE”) listed company rules and applicable law. See “Corporate Governance—Independence.”

The Board of Directors recommends that stockholders vote

“FOR” the Company’s nominees for Class II Directors.

2

Set forth below is a brief biography of each nominee for election as a Class II Director and of all other members of the Board of Directors who will continue in office.

Nominees for Election as Class II Directors

Term Expiring 2008

James J. Burke, Jr., age 53. Mr. Burke has been a Director of the Company since 1989 and was a Director of the Company’s wholly-owned subsidiary, AnnTaylor, Inc. (“Ann Taylor”) from 1989 to 2001. He has been a partner and director of Stonington Partners, Inc., a private investment firm, since 1993. Mr. Burke also served as a consultant to Merrill Lynch Capital Partners, Inc., an investment firm, from 1994 through 2000. Mr. Burke was formerly Chairman of Eerie World Entertainment, L.L.C., a restaurant company which was reorganized under Chapter 11 of the U.S. Bankruptcy Code (the “Bankruptcy Code”) in 2001.

Dale W. Hilpert, age 62. Mr. Hilpert was elected a Director of the Company in November, 2004. Since January, 2004, he has been Chairman, Chief Executive Officer and President of Footstar, Inc., a footwear retailer that filed under Chapter 11 of the Bankruptcy Code in March, 2004. Prior to joining Footstar, he was Chief Executive Officer of Williams-Sonoma, Inc., a specialty retailer of home furnishings, from 2001 to 2003. Mr. Hilpert was Chairman and Chief Executive Officer of Foot Locker, Inc., a retailer of athletic footwear and apparel, from 1999 to 2001. He is also a director of Signet Group PLC (doing business as Kay Jewelers in the United States).

Ronald W. Hovsepian, age 43. Mr. Hovsepian has been a Director of the Company since 1998 and was a Director of Ann Taylor from 1998 to 2001. He has been President, North America of Novell, Inc. (“Novell”), a technology company, since 2003. During 2002, Mr. Hovsepian was a Managing Director of Bear Stearns Asset Management, a technology venture capital fund. From 2000 to 2002, Mr. Hovsepian was a Managing Director of Internet Capital Group (“ICG”), a venture capital firm. Prior to ICG, he was Vice President of business development at International Business Machines Corporation, a technology company, from 1999 to 2000.

Linda A. Huett, age 60. Ms. Huett was elected a Director of the Company in March, 2005. Since 2000, she has been President and Chief Executive Officer of Weight Watchers International, Inc. (“Weight Watchers”), a global branded consumer company and provider of weight-loss services, and was President from 1999 until then. Ms. Huett is also a director of Weight Watchers.

Incumbent Class III Directors

Term Expiring 2006

Wesley E. Cantrell, age 70. Mr. Cantrell has been a Director of the Company since 1998 and was a Director of Ann Taylor from 1998 to 2001. He was Chief Executive Officer of Lanier WorldWide, Inc., a supplier of automated office imaging equipment and systems, from 1987 to 2001, and Chairman of its Board of Directors from 1999 to 2001.

Kay Krill, age 49. Ms. Krill was elected President of the Company and a member of the Board of Directors in November, 2004. She was President of AnnTaylor Loft from 2001 until then and was Executive Vice President, Merchandise and Design of that division from 1998 to 2001. She will be succeeding Mr. Spainhour as Chief Executive Officer when he retires on September 30, 2005.

Barbara A. Turf, age 62. Ms. Turf was elected a Director of the Company in September, 2004. She has been President of Euromarket Designs, Inc., a specialty retailer of housewares and home furnishings under the name Crate & Barrel, since 1996.

3

Incumbent Class I Directors

Term Expiring 2007

Robert C. Grayson, age 60. Mr. Grayson has been a Director of the Company since 1992 and was a Director of Ann Taylor, from 1992 to 2001. He has been President of Robert C. Grayson & Associates, Inc., a retail marketing consulting firm, since 1992 and Chairman of Berglass-Grayson, a management consulting firm, since 1995. Mr. Grayson is also a director of Kenneth Cole Productions, Inc.

J. Patrick Spainhour, age 54. Mr. Spainhour has been Chairman of the Board, Chief Executive Officer and a Director of the Company and Ann Taylor since 1996. He will be retiring as Chairman and Chief Executive Officer of the Company, effective September 30, 2005. Mr. Spainhour is also a director of Circuit City Stores, Inc.

Michael W. Trapp, age 65. Mr. Trapp has been a Director of the Company since 2003. He was a partner at Ernst & Young LLP, public accountants, from 1973 until his retirement in 2000, where he held various executive positions including Managing Partner for the Southeast area. He was also a member of Ernst & Young’s Partner Advisory Council. Mr. Trapp is currently a private investor. He is a director of Global Payments, Inc. and also chairman of its audit committee.

Board of Directors and Committee Meetings

The Company’s Board of Directors held 11 meetings in fiscal year 2004. Each Director attended at least 75% of the total number of Board meetings and meetings of Board Committees on which such Director served, other than Ms. Turf.

It is the Company’s policy that all Directors attend the Company’s Annual Meeting of Stockholders. All Directors attended the 2004 Annual Meeting of Stockholders, and it is anticipated that all Directors other than Ms. Turf will attend the 2005 Annual Meeting of Stockholders.

The Board of Directors has established standing Audit, Compensation and Nominating and Corporate Governance Committees, each of which is composed entirely of independent Directors, as defined by NYSE listing standards and applicable law. The membership and functions of the standing committees of the Board of Directors are as follows:

Audit Committee: The principal functions of the Audit Committee include assisting the Board of Directors in its oversight of (i) the integrity of the Company’s financial statements; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the qualifications and independence of the Company’s independent auditors; and (iv) the performance of the Company’s independent auditors and the Company’s internal audit function. The Audit Committee held six meetings in fiscal year 2004. The members of the Audit Committee are Messrs. Burke, Hilpert, Hovsepian and Trapp (Chairperson). The foregoing members all meet the Audit Committee independence and other requirements of the NYSE and applicable law. The Board of Directors has determined that Mr. Trapp qualifies as an “audit committee financial expert” within the meaning of the applicable rules of the Securities and Exchange Commission (the “Commission”).

Compensation Committee: The principal function of the Compensation Committee is to discharge the responsibilities of the Board of Directors relating to compensation philosophy and practices for the Company’s Chief Executive Officer, Leadership Council members and such other key management employees as the Compensation Committee may determine, to ensure that management’s interests are aligned with the interests of shareholders of the Company. The Compensation Committee also makes recommendations to the Board of Directors with respect to any proposed employee benefits plans, incentive compensation plans and equity-based plans. The Compensation Committee held six meetings in fiscal year 2004. The members of the Compensation Committee were Messrs. Cantrell, Grayson (Chairperson), Trapp and Ms. Turf during fiscal year 2004. Current Committee members are Messrs. Cantrell, Grayson (Chairperson) and Ms. Huett.

4

Nominating and Corporate Governance Committee: The principal functions of the Nominating and Corporate Governance Committee are to identify individuals qualified to become members of the Board of Directors, to recommend to the Board of Directors nominees for Directors for each annual meeting of stockholders and nominees for election to fill any vacancies on the Board of Directors and to address related matters. This Committee also develops and recommends to the Board of Directors corporate governance principles applicable to the Company and is responsible for leading the annual review of the Board’s performance. For information concerning the Committee’s consideration of nominees recommended by stockholders, see “Stockholder Proposals for the 2006 Annual Meeting.” The Committee held six meetings in fiscal year 2004. The members of the Nominating and Corporate Governance Committee were Messrs. Burke, Cantrell (Chairperson), Grayson and Hovsepian during fiscal year 2004. Current Committee members are Messrs. Burke, Cantrell (Chairperson), Hovsepian and Ms. Turf.

Compensation of Directors and Related Matters

Directors who are employees of the Company do not receive any compensation for serving on the Board of Directors of the Company. In fiscal year 2004, all other Directors (referred to below as “non-management Directors”) received an annual retainer of $30,000, plus $1,000 for each meeting of the Board or Committee of the Board that they attended and $500 for each Board or Committee written consent provided by the Director. Committee chairs received an annual fee of $5,000 for serving as chairperson. Each non-management Director also received an annual grant of options to purchase 7,500 shares of Common Stock awarded immediately after the Annual Meeting of Stockholders in 2004. Non-management Directors joining the Board receive an initial grant of options to purchase 16,875 shares. All stock option grants to Directors have an exercise price equal to the fair market value on the grant date of a share of Common Stock (determined as of the closing price on the preceding business day), have a term of 10 years and become exercisable and vest on the first anniversary of the date of grant. The stock options of a Director who later ceases to be a Director for any reason, other than removal for cause, remain exercisable, to the extent exercisable at the time of termination, for one year following such termination, but in no event later than the 10-year term of the stock options.

CORPORATE GOVERNANCE

Board Committee Charters

The charters for the Company’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are available free of charge on the Company’s website athttp://investor.anntaylor.com or upon written request to the Corporate Secretary, AnnTaylor Stores Corporation, 1372 Broadway, New York, NY 10018.

Corporate Governance Guidelines

The Board of Directors of the Company adopted the Corporate Governance Guidelines to assist the Board in the exercise of its responsibilities. The Company’s Corporate Governance Guidelines are available free of charge on the Company’s website athttp://investor.anntaylor.com or upon written request to the Corporate Secretary, AnnTaylor Stores Corporation, 1372 Broadway, New York, NY 10018.

Business Conduct Guidelines

The Company has Business Conduct Guidelines that apply to all Company associates, including its chief executive officer, chief financial officer and principal accounting officer/controller, as well as members of the Board of Directors. The Business Conduct Guidelines are available free of charge on the Company’s website athttp://investor.anntaylor.com or upon written request to the Corporate Secretary, AnnTaylor Stores Corporation, 1372 Broadway, New York, NY 10018. Any updates or amendments to the Business Conduct Guidelines, and any waiver that applies to a Director or executive officer, will also be posted on the website.

5

Independence

The Board has determined, after considering the relevant facts and circumstances, that all non-management Directors of the Company (James J. Burke, Jr., Wesley E. Cantrell, Robert C. Grayson, Dale W. Hilpert, Ronald W. Hovsepian, Linda A. Huett, Michael W. Trapp and Barbara A. Turf), comprising eight of the ten members of the Board, are independent under the NYSE listed company rules and applicable law. In addition, all Board Committee members meet the applicable independence requirements of the NYSE and applicable law.

Executive Sessions of Non-Management Directors

The Company’s independent Directors meet separately in executive session without employee Directors or representatives of management at each regularly scheduled Board meeting in accordance with the Company’s Corporate Governance Guidelines. The Chairperson of the Nominating and Corporate Governance Committee presides at such executive sessions.

Stockholder Communications with the Board of Directors

Security holders and other interested parties may contact the Board of Directors or the non-management Directors as a group, at the following address:

Board of Directors

or

Outside Directors

AnnTaylor Stores Corporation

1372 Broadway

New York, NY 10018

Communications regarding accounting, internal accounting controls or auditing matters may also be reported to the Company’s Board of Directors using the above address or through the Ann Taylor Financial Integrity Reporting Line. Information about how to contact the Board and the Financial Integrity Reporting Line is also available on the Company’s website athttp://investor.anntaylor.com. Information on the Company’s website is not incorporated by reference into this Proxy Statement.

PROPOSAL 2

RATIFICATION OF ENGAGEMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has engaged the firm of Deloitte & Touche LLP (“Deloitte”), Certified Public Accountants, as independent auditors to make an examination of the accounts of the Company for fiscal year 2005. Deloitte has served as the independent auditors of the Company since 1989.

Independent Auditor Fees and Services

The following table presents fees billed for professional services rendered by Deloitte for the fiscal years 2004 and 2003.

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees | | $ | 1,414,132 | | $ | 527,463 |

Audit-Related Fees (1) | | | 42,000 | | | 31,760 |

Tax Fees (2) | | | 178,695 | | | 307,999 |

All Other Fees | | | 0 | | | 0 |

| | |

|

| |

|

|

Deloitte Total Fees | | $ | 1,634,827 | | $ | 867,222 |

| | |

|

| |

|

|

| (1) | Audit-Related Fees represent fees billed for audits and other services related to the Company’s employee benefit plans and, in fiscal year 2004, included other services with respect to the Company’s convertible debt. |

(footnotes continued on next page)

6

(footnotes continued from previous page)

| (2) | Tax Fees represent fees billed for professional services rendered by Deloitte for tax compliance (including federal, state, local and international) and related matters such as tax examination assistance. |

Auditor Independence

The Audit Committee has considered whether the provision of the above-noted services is compatible with maintaining the auditor’s independence and has determined that the provision of such services has not adversely affected the auditor’s independence.

Policy on Audit Committee Pre-Approval of Audit and Permitted Non-Audit Services

The Audit Committee has established policies and procedures regarding pre-approval of audit, audit-related, tax, and other services that the independent auditors may perform for the Company. Under the policy, predictable and recurring services are generally approved by the Audit Committee on an annual basis. The Audit Committee must pre-approve on an individual basis any requests for audit, audit-related, tax, and other services not covered by the services that are pre-approved annually, subject to certainde minimis exceptions permitted under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for services other than audit, review or attest services.

The Audit Committee may delegate pre-approval authority to any of its members if the aggregate estimated fees for all current and future periods for which the services are to be rendered will not exceed a designated amount, and any such pre-approval must be reported at the next scheduled meeting of the Audit Committee.

The Audit Committee may prohibit services that in its view may compromise, or appear to compromise, the independence and objectivity of the independent auditor. The Audit Committee also periodically reviews a schedule of fees paid and payable to the independent auditors by type of service being or expected to be provided.

In fiscal year 2004, all fees for audit, audit-related, tax and other services performed by the independent auditors were pre-approved by the Audit Committee, except that 12% of audit-related fees were approved by the Audit Committee in reliance on the de minimis exception described above.

Although action by stockholders is not required by law, the Board of Directors has determined that it is desirable to request stockholder ratification of the engagement of the Company’s independent auditors. If stockholders do not approve ratification of the engagement of such auditors, the Audit Committee of the Board of Directors will reconsider the engagement.

Representatives of Deloitte are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

The Audit Committee of the Board of Directors

recommends that stockholders vote “FOR”

ratification of the engagement of Deloitte & Touche LLP as

independent auditors for the Company for fiscal year 2005.

7

AUDIT COMMITTEE REPORT

Introduction

The purpose of the Audit Committee is to provide assistance to the Board of Directors in fulfilling its obligations with respect to matters involving the accounting, auditing, financial reporting, internal controls and legal compliance functions of the Company and its subsidiaries, including, without limitation, assisting the Board of Directors in its oversight of (i) the integrity of the Company’s financial statements; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the qualifications and independence of the Company’s independent auditors; and (iv) the performance of the Company’s independent auditors and the Company’s internal audit function. In carrying out its oversight responsibilities, the Audit Committee is not itself responsible for the planning or conduct of audits or for any determination that the Company’s financial statements are complete and accurate or in accordance with generally accepted accounting principles. The Audit Committee recognizes that the Company’s management has the responsibility for the Company’s financial statements and the independent auditors have the responsibility to audit such financial statements in accordance with generally accepted auditing standards.

Structure and Membership

The Audit Committee is governed by a written charter, a copy of which can be found on the Company’s website athttp://investor.anntaylor.com. The Audit Committee consists of four Directors, all of whom meet the independence requirements of the NYSE and applicable law. No member of the Audit Committee is, or has been within the last three years, an officer of the Company or employed or affiliated with Deloitte. No member of the Audit Committee has any relationship with the Company that, in the opinion of the Board of Directors, would interfere with his independence from management and the Company. No member of the Audit Committee simultaneously serves on the audit committee of more than one other public company. In the judgment of the Board, each member of the Audit Committee is financially literate, and at least one member of the Audit Committee has accounting or related financial management expertise. In addition, Mr. Trapp has been determined to be the “audit committee financial expert.”

Audit Committee Activities

The Audit Committee generally meets six times annually, and the Chairperson reports to the Board of Directors periodically with respect to its activities and its recommendations. The Audit Committee periodically meets in executive session with each of the independent auditors, the Vice President of internal audit and the General Counsel.

In discharging its oversight responsibilities for fiscal year 2004, the Audit Committee: (1) reviewed and discussed the audited financial statements and critical accounting policies applied by the Company with management and the Company’s independent auditors, including reviewing the Company’s specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; (2) discussed with the Company’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended; (3) reviewed the written disclosures and the letter from the independent auditors required by the Independence Standards Board Standard No. 1, and discussed with the independent auditors any relationships that may affect the auditors’ objectivity and independence; (4) discussed with management, including the Company’s Risk Officer and Vice President of internal audit, and the independent auditors, the Company’s processes for risk assessment and management, major risk exposures and strategies to mitigate those risks; (5) engaged, approved the fees paid to, and evaluated the performance of the independent auditors; (6) reviewed with management the Company’s disclosure controls and procedures and the certifications of the Company’s Chief Executive Officer and Chief Financial Officer with respect to the Company’s periodic reports; and (7) reviewed with management and the independent auditors management’s annual report on internal control over financial reporting and the independent auditors’ report relating thereto. The Audit Committee also reviewed with Deloitte and management significant developments in accounting rules.

8

The Audit Committee has received written disclosure from Deloitte that it is independent, as required by the Independence Standards Board Standard No. 1. Deloitte informed the Audit Committee that it has disclosed to the Audit Committee in writing all relationships between Deloitte and the Company and its subsidiaries that, in Deloitte’s professional judgment, may reasonably be thought to bear on its independence. Deloitte also has confirmed that, in its professional judgment, it is independent of the Company within the meaning of the securities laws.

The Audit Committee also conferred periodically with the Company’s Vice President of internal audit regarding planned activities of the Company’s internal audit department and reviewed the results of such audits. It also reviewed the findings of the Company’s internal audit department and Deloitte on the adequacy and effectiveness of the Company’s internal accounting and financial controls and the results of fiscal policies and financial management of the Company. Additionally, the Audit Committee held discussions with management, including the Vice President of internal audit, to review the status of the Company’s compliance with the rules on internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements of the Company for the fiscal year ended January 29, 2005 and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” be included in the Company’s Annual Report on Form 10-K for such fiscal year, for filing with the Securities and Exchange Commission.

Michael W. Trapp(Chairperson)

James J. Burke, Jr.

Dale W. Hilpert

Ronald W. Hovsepian

9

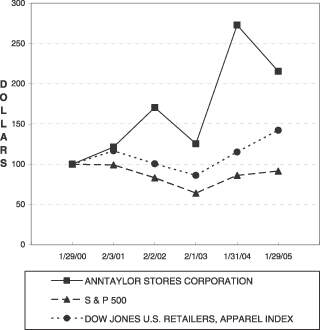

STOCK PERFORMANCE GRAPH

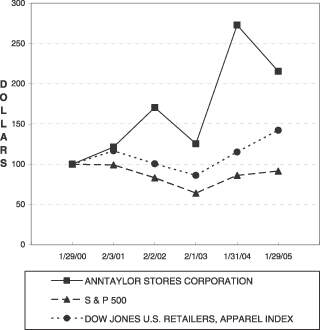

The following graph compares the percentage changes in the Company’s cumulative total stockholder return on the Company’s Common Stock for the five-year period ended January 29, 2005, with the cumulative total return on the Standard & Poor’s 500 Stock Index (“S&P 500”) and the Dow Jones U.S. Retailers, Apparel Index for the same period. In accordance with the rules of the Commission, the returns are indexed to a value of $100 at January 29, 2000 and assume that all dividends, if any, were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among AnnTaylor Stores Corporation, the S&P 500 Index

and the Dow Jones U.S. Retailers, Apparel Index

10

BENEFICIAL OWNERSHIP OF COMMON STOCK

Principal Stockholders

The following Table sets forth certain information as of February 21, 2005 concerning the beneficial ownership of the Company’s Common Stock by (i) each stockholder who is known by the Company to own beneficially in excess of 5% of the outstanding Common Stock, (ii) each current Director, (iii) the named executive officers listed in the Table entitled “Summary Compensation Table,” and (iv) all current Directors and executive officers as a group. Except as otherwise indicated, each stockholder listed below has sole voting and investment power with respect to his/her shares of Common Stock. The Commission has defined the term “beneficial ownership” to include any person who has or shares voting power or investment power with respect to any security or who has the right to acquire beneficial ownership of any security within 60 days. All share numbers in this Table have been adjusted for the May, 2002 and May, 2004 stock splits of the Common Stock.

| | | | | |

Name of Beneficial Owner

| | No. of

Shares of

Common Stock

| | Percent

of Class

| |

T. Rowe Price Associates, Inc. (a) | | 6,629,175 | | 9.39 | % |

FMR Corp. and affiliates (b) | | 5,200,000 | | 7.36 | % |

Mellon Financial Corporation (c) | | 4,581,831 | | 6.49 | % |

Barclays Global Investors, N.A. (d) | | 4,563,411 | | 6.46 | % |

The TCW Group, Inc. (e) | | 4,256,259 | | 6.03 | % |

J. Patrick Spainhour (f)(g) | | 2,091,349 | | 2.89 | % |

Kay Krill (g) | | 373,635 | | * | |

Dwight Meyer (g) | | 45,382 | | * | |

James M. Smith (g) | | 126,508 | | * | |

Anthony Romano (g) | | 53,581 | | * | |

Jerome M. Jessup (g) | | 73,460 | | * | |

James J. Burke, Jr. (g) | | 114,250 | | * | |

Wesley E. Cantrell (g) | | 42,375 | | * | |

Robert C. Grayson (g) | | 103,125 | | * | |

Dale W. Hilpert | | — | | * | |

Ronald W. Hovsepian (g) | | 46,875 | | * | |

Linda A. Huett | | — | | * | |

Michael W. Trapp (g) | | 16,875 | | * | |

Barbara A. Turf | | — | | * | |

All Executive Officers and Directors as a Group (14 persons)(g) | | 3,060,406 | | 4.20 | % |

| (a) | In an amended Schedule 13G filed with the Commission on February 15, 2005, T. Rowe Price Associates, Inc. (“Price Associates”) reported beneficial ownership of 6,629,175 shares. Price Associates has sole voting power over 972,750 shares and sole dispositive power over 6,629,175 shares. Price Associates’ address is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (b) | In a Schedule 13G filed with the Commission on February 14, 2005, FMR Corp., Edward C. Johnson 3d (“ECJ”) and Abigail P. Johnson reported beneficial ownership of 5,200,000 shares. Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR Corp. and an investment adviser, is the beneficial owner of 5,200,000 shares as a result of acting as investment adviser to various investment companies. ECJ, FMR Corp., through its control of Fidelity, and the Fidelity funds (the “Fidelity Funds”), each has sole power to dispose of the 5,200,000 shares owned by the Fidelity Funds. The Board of Trustees of the Fidelity Funds has the sole power to vote or direct the voting of the shares owned directly by such entity. The address for each of FMR Corp., ECJ and Abigail P. Johnson is 82 Devonshire Street, Boston, Massachusetts 02109. |

(footnotes continued on next page)

11

(footnotes continued from previous page)

| (c) | In a Schedule 13G filed with the Commission on February 10, 2005, Mellon Financial Corporation (“Mellon Financial”) reported beneficial ownership of 4,581,831 shares. Mellon Financial has sole voting power over 4,071,546 shares, shared voting power over 35,000 shares, sole dispositive power over 4,528,481 and shared dispositive power over 35,000 shares. Mellon Financial’s address is One Mellon Center, Pittsburgh, Pennsylvania 15258. |

| (d) | In a Schedule 13G filed with the Commission on February 17, 2004, Barclays Global Investors, N.A. (“Barclays”), Barclays Global Fund Advisors and Barclays Bank PLC reported beneficial ownership of 4,563,411 shares. Barclays, Barclays Global Fund Advisors and Barclays Bank PLC each have sole voting and dispositive power over 2,938,695 shares, 1,197,861 shares, and 59,400 shares, respectively. The address for Barclays and Barclays Global Fund Advisors is 45 Fremont Street, San Francisco, CA 94105, and the address for Barclays Bank PLC is 54 Lombard Street, London, England EC3P 3AH. |

| (e) | In a Schedule 13G filed with the Commission on February 14, 2005, The TCW Group (“TCW”), Inc. reported on behalf of the TCW Business Unit beneficial ownership of 4,256,259 shares. TCW has shared voting power over 3,983,919 shares and shared dispositive power over 4,256,259 shares. TCW’s address is 865 South Figueroa Street, Los Angeles, California 90017. |

| (f) | 27,000 of these shares are held by Par 4 Holdings, LLC, a limited liability company of which Mr. Spainhour and his spouse are the sole members. |

| (g) | The shares listed include shares subject to stock options that are or will become exercisable within 60 days of February 21, 2005 as follows: Mr. Spainhour, 1,751,250 shares; Ms. Krill, 142,812 shares; Mr. Meyer, 32,625 shares; Mr. Smith, 90,562; Mr. Romano, 33,751; Mr. Jessup, 37,500 shares; Mr. Burke, 25,500 shares; Mr. Cantrell, 42,375 shares; Mr. Grayson, 46,875 shares; Mr. Hovsepian, 46,875 shares; and Mr. Trapp, 16,875 shares. The shares listed also include restricted shares which have not yet vested and which are subject to forfeiture as follows: Mr. Spainhour, 85,751 shares; Ms. Krill, 190,688; Mr. Meyer, 11,063 shares; Mr. Smith, 18,563 shares; and Mr. Romano, 15,188 shares. |

SECTION 16(a) BENEFICIAL

OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s Directors and certain officers and holders of more than 10% of the Company’s Common Stock to file with the Commission and the NYSE reports of their ownership and changes in their ownership of Common Stock. Based solely on a review of copies of Section 16(a) reports furnished to the Company, or written representations from certain reporting persons, the Company believes that during fiscal year 2004 all transactions were reported on a timely basis, except that (i) Dwight Meyer, an executive officer, reported on a Form 4 filed on March 23, 2004 stock options he exercised on March 11, 2004 and March 15, 2004, as well as Common Stock he sold on March 11, 2004 and March 12, 2004 and (ii) Sallie DeMarsilis, a former executive officer, reported on a Form 4 filed on August 17, 2004 stock options she exercised on March 12, 2002.

EXECUTIVE OFFICERS

The following Table lists certain information regarding the executive officers of the Company:

| | |

Name

| | Position and Offices

|

| J. Patrick Spainhour | | Chairman of the Board and Chief Executive Officer |

| Kay Krill | | President and a Director |

| Barbara K. Eisenberg | | Executive Vice President, General Counsel and Secretary |

| Dwight Meyer | | Executive Vice President, Global Sourcing |

| James M. Smith | | Executive Vice President, Chief Financial Officer and Treasurer |

| Anthony Romano | | Executive Vice President, Corporate Operations |

12

Information regarding Mr. Spainhour and Ms. Krill is set forth above under “Incumbent Class I Directors” and “Incumbent Class III Directors,” respectively.

Barbara K. Eisenberg, age 59. Ms. Eisenberg was named Executive Vice President, General Counsel and Secretary in March, 2005. Prior thereto, she was Senior Vice President, General Counsel and Secretary from 2001 to 2005. Before joining the Company, Ms. Eisenberg was Senior Vice President, General Counsel and Corporate Secretary of J. Crew Group, Inc. from 1999 to 2001.

Dwight Meyer,age 52. Mr. Meyer has been Executive Vice President of Global Sourcing since 1996.

James M. Smith, age 43. Mr. Smith has been Executive Vice President, Chief Financial Officer and Treasurer since March, 2004. Prior thereto, he was Senior Vice President, Chief Financial Officer and Treasurer from 2001 to 2004 and Vice President, Controller and Assistant Treasurer from 1997 to 2001.

Anthony Romano, age 42. Mr. Romano has been Executive Vice President of Corporate Operations since March, 2004. Prior thereto, he was Senior Vice President of Logistics and Purchasing from 1997 to 2004.

13

COMPENSATION COMMITTEE REPORT

ON EXECUTIVE COMPENSATION

Compensation Philosophy

The Company’s compensation practices are designed to attract, retain and motivate highly talented, results-oriented executives of experience and ability, and to provide these executives with appropriate incentives to achieve the Company’s financial and strategic objectives. The Company’s compensation programs are designed to “pay for performance,” using a combination of annual base salary, a cash incentive compensation program that rewards executives for achievement of short-term objectives, and long-term incentive programs, including a long-term cash incentive compensation plan and stock incentive plans, that reward executives based on long-term corporate performance.

The Compensation Committee reviews the Company’s compensation practices and programs in consultation with a nationally recognized compensation consultant, which is engaged by the Compensation Committee and also performs other services for the Company. The Compensation Committee has the ultimate authority to engage and terminate the services of the compensation consultant. The compensation consultant assists the Compensation Committee in designing effective compensation programs, analyzing executive pay packages or contracts, and understanding the Company’s financial measures and how they relate to executive compensation. The compensation consultant also provides the Compensation Committee with information regarding industry compensation practices and developments and comparative data necessary to evaluate executive compensation. In fiscal year 2004 the Compensation Committee implemented certain adjustments to the Company’s programs, as described in more detail below, based on its comprehensive evaluation of the Company’s compensation practices conducted in 2003. The Company believes its compensation programs are designed to achieve the goals of its strategic plan and to align management with shareholders’ interests.

An executive’s annual base salary generally is intended to be positioned within a range comparable to the competitive median salary, but the executive’s targeted total compensation, including long-term incentives, is generally intended to be positioned above median, up to approximately the 75th percentile of competitive practice, provided that performance objectives are achieved. The Company may make adjustments to this compensation range to attract or retain key executive officers. In determining an individual executive’s total compensation, consideration is given to, among other things, the executive’s experience and anticipated contribution to the Company, each component of his or her compensation, and compensation paid to like executives at other companies. No specific weight is given to any of these considerations. The other companies used in evaluating the competitive position of the Company’s compensation programs, as well as for evaluating the compensation of individual executives, consist of companies in the apparel and retail industries with revenues at a level similar to that of the Company, including companies among the Dow Jones U.S. Retailers, Apparel Index, to the extent information is available. The Compensation Committee also considered executive compensation at other companies, with a focus on compensation for executives with similar responsibilities and skill sets.

Annual Cash Compensation

As noted above, an executive’s base salary typically is set at an amount that is approximately at the median range of compensation for equivalent positions. Thus, base compensation alone is less than the executive’s targeted total compensation level. A significant component of an executive’s total cash compensation consists of a short-term incentive bonus, which is intended to make executive compensation dependent on the Company’s performance and to provide executives with incentives to use their best efforts to cause the Company to achieve and exceed its strategic objectives. The Company’s performance-based incentive bonus plan is referred to as the Management Performance Compensation Plan (the “Performance Compensation Plan”).

14

Prior to fiscal year 2004, each year the Compensation Committee established an annual threshold net income target for the Company that had to be achieved under the Performance Compensation Plan before incentive compensation could be paid to a participant under the plan for the year. Effective for fiscal year 2004, the Performance Compensation Plan was redesigned to focus more on divisional results so that a participant could be rewarded for his or her contribution to the performance of a division of the Company. Accordingly, under the new plan, incentive compensation may be paid to a participant if certain financial targets for such division are met, even if the net income target for the Company as a whole is not achieved. The new plan also provides for work unit and/or individual performance objectives. As a result, the individual’s incentive compensation relates not only to the achievement of the Company’s profit objective, but also reflects the individual participant’s role in the Company, his or her scope of influence on corporate or divisional results and personal job performance. An incentive compensation matrix is also established for each incentive period that provides for increased payments under the plan for exceeding plan targets.

If the performance targets established under the Performance Compensation Plan are achieved, incentive compensation is paid such that, when added to the executive’s base compensation, the executive achieves his or her targeted total cash compensation level. If the performance targets are exceeded, the executive’s contribution to this performance is reflected by a greater incentive compensation payment under the plan. Similarly, failure to reach the stated performance objectives results in total cash compensation that is less than the executive’s targeted level. In fiscal year 2004, the AnnTaylor Loft and AnnTaylor Factory divisions exceeded their financial targets established by the Compensation Committee under the Performance Compensation Plan. During fiscal year 2004, the Company did not meet its financial targets. Accordingly payments will be made to certain participants in fiscal year 2005 under the Performance Compensation Plan for fiscal year 2004 based on the performance of such divisions.

Long-Term Compensation

The other principal components of executive compensation are the Company’s long-term incentive programs, which are intended to focus executives’ efforts on the Company’s growth, long-term financial performance and on enhancing the market value of the Company’s Common Stock. These objectives are achieved through its long-term cash incentive compensation plan originally approved by shareholders in 1998 (the “Prior Long-Term Plan”) and its 2004 long-term cash incentive compensation plan (the “2004 Long-Term Cash Plan”), which provide for cash rewards for achievement of long-term financial targets, as well as through its equity incentive plans, which give executives a financial interest as beneficial owners of Common Stock. The Prior Long-Term Plan is currently being phased out and will be replaced with the 2004 Long-Term Cash Plan, which was adopted by the Board of Directors and approved by shareholders in 2004.

Under both the Prior Long-Term Plan and 2004 Long-Term Cash Plan, each year the Compensation Committee designates a consecutive three-year period as a “performance cycle” and establishes a three-year performance target that has to be achieved by the end of the three-year cycle in order for incentive compensation to be paid under the plan at the end of the cycle. Under the Prior Long-Term Plan, the performance target was based on cumulative earnings per share, while under the 2004 Long-Term Cash Plan, the currently designated financial goals are return on invested capital and comparable store sales. The last potential payout under the Prior Long-Term Plan will be in 2006 for the 2003-2005 three-year cycle. The 2004 Long-Term Cash Plan commenced with the three-year cycle covering fiscal years 2004-2006, and the first payout under this Plan will be in 2007.

The Compensation Committee designated as participants under the Prior Long-Term Plan for the 2003-2005 cycle the executives who are Senior Vice Presidents or above. Participation in the 2004 Long-Term Cash Plan is limited to only Executive Vice Presidents or above and certain Senior Vice Presidents who were participating under the Prior Long-Term Plan.

15

No payments were made in fiscal year 2004 with respect to the 2001-2003 performance cycle under the Prior Long-Term Plan because the Company did not achieve the cumulative earnings per share target for that cycle. The Company exceeded the cumulative earnings per share target established under the Prior Long-Term Plan for the three-year performance cycle of fiscal 2002-2004, and accordingly, payments with respect to that cycle will be made in fiscal 2005. The 2003-2005 cycle under the Prior Long-Term Plan and the 2004-2006 cycle under the 2004 Long-Term Cash Plan are running concurrently and are in varying stages of completion, and it is anticipated that payments will be made with respect to these cycles.

Based on the compensation consultant’s recommendations, in 2004 the Company shifted annual equity grants for senior management from stock options to a mix of stock options and restricted stock. The exercise price for stock options is set at a price equal to the market price of the Common Stock at the time of the grant. As a result, the options do not have any intrinsic value to the executive unless the market price of the Common Stock rises. The Company believes that stock options and restricted stock awards further align executives’ interests with those of stockholders and focus management on building long-term stockholder value. The Company may also make grants of shares of restricted stock as special recognition for executives who make a superior contribution to achievement of the Company’s goals, or in acknowledgment of an executive’s potential for advancement beyond his/her current position.

Analysis of 2004 Compensation of Chief Executive Officer

The Compensation Committee reviews the total compensation for the Company’s Chairman and Chief Executive Officer annually and is responsible for establishing the compensation level and benefits for the Chief Executive Officer. As part of this review, the compensation consultant prepares and reviews with the Compensation Committee a financial analysis of each component of the Chief Executive Officer’s compensation. The Compensation Committee believes that a significant portion of the target compensation for the Chief Executive Officer should be represented by incentive, performance-based compensation that is payable only if the Company achieves its financial objectives. As a result, a significant portion of Mr. Spainhour’s annual cash compensation and long-term compensation is performance-based.

In determining Mr. Spainhour’s total compensation for fiscal year 2004, the Compensation Committee considered the terms of his employment agreement, his length of service with the Company as Chairman and Chief Executive Officer, the Company’s financial performance during the preceding year, future objectives and challenges for the Company, and Mr. Spainhour’s individual performance and contributions to the Company. The Compensation Committee also considered competitive data regarding salaries and incentives awarded to other chief executives in the Company’s industry and at the Company’s competitors, among other things. In making its compensation decisions with respect to Mr. Spainhour, the Compensation Committee reviewed all components of his compensation, including salary, annual bonus potential, equity and long-term incentive compensation, accumulated realized and unrealized stock option and restricted stock gains, and the dollar value to Mr. Spainhour and the cost to the Company of any perquisites. The Compensation Committee also considered the Company’s payout obligations to Mr. Spainhour under potential severance and change in control scenarios. See “Executive Compensation— Employment, Separation and Change in Control Agreements.” Mr. Spainhour does not participate in or receive any benefits under the Company’s deferred compensation plan.

Mr. Spainhour did not receive an increase in his base salary in 2004, but in May, 2004 he was awarded 30,000 shares of restricted stock and 90,000 stock options, with both grants vesting 25% per year on each of the first four anniversaries of the grant date. In addition, Mr. Spainhour received perquisites in fiscal year 2004 totaling approximately $3,300 for car service and approximately $3,600 for tax planning.

Mr. Spainhour’s target performance percentage under the Performance Compensation Plan is 80% of his base salary and under the Prior Long-Term Plan is 50% of his base salary. Both the AnnTaylor Loft and AnnTaylor Factory divisions achieved the financial targets relating to their divisions established by the Compensation Committee under the Performance Compensation Plan, and accordingly Mr. Spainhour was

16

entitled to receive a bonus payment for the performance of each of those divisions. He was not entitled to receive any bonus payments under the Performance Compensation Plan for the performance of the Ann Taylor division, or for the Company as a whole, as their financial targets were not met for fiscal year 2004. In addition, the Company met its cumulative earnings per share levels established under the Prior Long-Term Plan for the three-year performance cycle of fiscal years 2002-2004, and Mr. Spainhour will receive $684,000 for that cycle.

The Compensation Committee believes that based on its review of all components of Mr. Spainhour’s compensation, Mr. Spainhour’s total compensation is reasonable. The Compensation Committee also determined in December, 2004 to allow Mr. Spainhour’s employment agreement to renew automatically for another one-year term commencing on June 1, 2005.

As previously announced, in connection with the Company’s succession planning, Mr. Spainhour has decided to retire as Chairman of the Board and Chief Executive Officer of the Company, effective September 30, 2005. In connection with Mr. Spainhour’s retirement, Mr. Spainhour and the Company entered into a letter agreement (the “Letter Agreement”) described below under “Executive Compensation—Employment, Separation and Change in Control Agreements—Spainhour Retirement Agreement” setting forth certain financial terms relating to Mr. Spainhour’s retirement. The Compensation Committee believes that the compensation provided to Mr. Spainhour under the Letter Agreement is reasonable.

Compliance with Section 162(m) of the Internal Revenue Code

Section 162(m) of the Internal Revenue Code of 1986, as amended, (the “Code”) generally disallows deductions to publicly traded companies for compensation paid to its named executive officers in excess of $1 million in a taxable year. However, Section 162(m) provides certain exceptions, including an exception for “performance-based compensation,” paid pursuant to the terms of a compensation plan if certain requirements are satisfied. The Company believes that compensation paid under the Prior Long-Term Plan and 2004 Long-Term Cash Plan and the Performance Compensation Plan qualifies as performance-based compensation under Section 162(m) and thus compensation in excess of $1 million that is paid to the named executive officers pursuant to these plans should be deductible to the Company. However, if compliance with Section 162(m) regulations conflicts with the Company’s compensation philosophy or with what is believed to be the best interests of the Company and its stockholders, the Company may conclude that paying non-deductible compensation is more consistent with its compensation philosophy and in the Company’s and the stockholders’ best interests. During fiscal year 2004, certain shares of restricted stock that were previously granted to Mr. Spainhour and Ms. Krill, President of the Company, vested and, as a result, the total compensation for 2004 for each of Mr. Spainhour and Ms. Krill exceeded the limits imposed by Section 162(m) for deductibility by the Company of compensation paid to a named executive officer.

| Robert | C. Grayson(Chairperson) |

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

As of the Record Date, there were no Compensation Committee interlocks.

17

EXECUTIVE COMPENSATION

The following Table sets forth compensation information for fiscal years 2004, 2003 and 2002 for the Company’s (i) Chief Executive Officer, (ii) the four next most highly compensated executive officers and (iii) one other individual who would have been among the most highly compensated executive officers in fiscal year 2004 but for the fact that he was not an executive officer at the end of fiscal year 2004. All share numbers in this Table have been adjusted for the May, 2002 and May, 2004 stock splits of the Common Stock.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Long Term Compensation

| | |

| | | | | Annual Compensation

| | | Awards

| | Payouts

| | |

Name and Principal Position

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)(a)

| | | Other Annual

Compensation ($)

| | | Restricted

Stock

Awards

($) (b)(c)

| | | Securities

Underlying

Options (#)

| | LTIP

Payouts

($)

| | All Other

Compensation ($)(d)

|

J. Patrick Spainhour Chairman and Chief Executive Officer | | 2004

2003

2002 | | $

| 950,000

883,693

850,000 | | $

| 167,428

972,800

1,360,000 |

| |

| —

—

— |

| | $

$

| 809,800

1,589,600

— | (e)

(f)

| | 90,000

75,000

— | | —

—

— | | $

| 3,000

2,781

3,000 |

| | | | | | | | |

Kay Krill President and a Director | | 2004

2003

2002 | |

| 842,500

705,000

516,667 | |

| 805,600

1,000,000

690,000 |

| | $

$

| 64,575

65,866

— | (g)

(i)

| |

| 3,175,780

1,579,050

— | (h)

(j)

| | 202,500

202,500

— | | —

—

— | |

| 3,055

3,165

3,156 |

| | | | | | | | |

Dwight Meyer Executive Vice President, Global Sourcing | | 2004

2003

2002 | |

| 487,500

470,000

445,000 | |

| 103,704

266,190

337,043 |

| |

| —

—

— |

| |

| 112,950

76,240

— | (k)

(l)

| | 11,250

40,500

— | | —

—

— | |

| 3,009

3,037

3,000 |

| | | | | | | | |

James M. Smith Executive Vice President, Chief Financial Officer and Treasurer | | 2004

2003

2002 | |

| 360,000

304,167

266,667 | |

| 78,307

130,727

176,880 |

| |

| —

—

— |

| |

| 271,080

76,240

— | (m)

(n)

| | 22,500

33,750

— | | —

—

— | |

| 3,038

3,044

3,063 |

| | | | | | | | |

Anthony Romano Executive Vice President, Corporate Operations | | 2004

2003

2002 | |

| 348,333

284,500

257,000 | |

| 76,190

157,818

198,404 |

| |

| —

—

— |

| |

| 271,080

76,240

— | (o)

(p)

| | 22,500

33,750

— | | —

—

— | |

| 3,044

3,129

2,891 |

| | | | | | | | |

Jerome Jessup (q) Former Sr. Executive Vice President Merchandise & Design, Ann Taylor Stores | | 2004

2003

2002 | |

| 704,506

543,750

— | |

| —

394,035

— |

(t)

| | $

| 41,020

—

— | (r)

| |

| 677,700

828,100

— | (s)

(u)

| | 48,750

112,500

— | | —

—

— | |

| —

—

— |

| (a) | Bonus awards were earned pursuant to the Company’s Performance Compensation Plan. |

| (b) | All restricted shares vest upon the occurrence of an “Acceleration Event” as defined in the applicable plan. In addition, grantees are entitled to receive dividends on these restricted shares if any dividends are paid by the Company on its Common Stock. |

| (c) | As of January 29, 2005, each of the individuals listed below held the following aggregate numbers and values of unvested restricted stock: Mr. Spainhour, 85,751 shares ($1,827,354); Ms. Krill, 190,688 shares ($4,063,561); Mr. Meyer, 11,063 shares ($235,753); Mr. Smith, 18,563 shares ($395,578); and Mr. Romano, 15,188 shares ($323,656). |

| (d) | Represents contributions made by the Company on behalf of the named executive officers to its 401(k) Savings Plan. |

| (e) | Represents the market value on May 21, 2004, the date of grant, of 30,000 time-vesting restricted shares of Common Stock. The value of these shares as of January 29, 2005, was $639,300. Mr. Spainhour’s right to the 30,000 shares vest on each of the first four anniversaries of the grant date. |

| (f) | Represents the market value on December 1, 2003, the date of grant, of 60,000 time-vesting restricted shares of Common Stock. The value of these shares as of January 29, 2005, was $1,278,600. Mr. Spainhour’s right to the 60,000 shares vest on each of the first four anniversaries of the grant date. |

| (g) | Represents $41,751 attributable to the value of car service and $22,824 for reimbursement of taxes with respect to car service. |

(footnotes continued on next page)

18

(footnotes continued from previous page)

| (h) | Represents the market value on the date of the grant of 31,500 time-vesting and 100,000 performance-vesting restricted shares of Common Stock granted to Ms. Krill on March 8, 2004 and November 4, 2004, respectively. The value of these shares as of January 29, 2005 was $2,802,265. Ms. Krill’s right to the 31,500 time-vesting restricted shares vest on each of the first four anniversaries of the grant date. If the Company meets certain performance goals, Ms. Krill’s right to 33,333 of the performance-vesting shares vest on each of March 15, 2006 and 2007, and the remaining 33,334 shares vest on March 15, 2008. |

| (i) | Represents $42,063 attributable to the value of car service and $23,803 for reimbursement of taxes with respect to car service. |

| (j) | Represents the market value on the date of grant of 15,000 and 52,500 time-vesting restricted shares of Common Stock granted to Ms. Krill on March 11, 2003 and January 29, 2004, respectively. The value of these shares as of January 29, 2005 was $1,438,425. Ms. Krill’s right to the 15,000 shares vest on each of the first four anniversaries of the grant date. Her right to the 52,500 shares vest on each of the first three anniversaries of the grant date. |

| (k) | Represents the market value, on March 8, 2004, the date of grant, of 3,750 time-vesting restricted shares of Common Stock granted to Mr. Meyer. The value of these shares as of January 29, 2005 was $79,913. Mr. Meyer’s right to the 3,750 shares vest on each of the first four anniversaries of the grant date. |

| (l) | Represents the market value, on March 11, 2003, the date of grant, of 6,000 time-vesting restricted shares of Common Stock granted to Mr. Meyer. The value of these shares as of January 29, 2005 was $127,860. Mr. Meyer’s right to the 6,000 shares vest on each of the first four anniversaries of the grant date. |

| (m) | Represents the market value, on March 8, 2004, the date of grant, of 9,000 time-vesting restricted shares of Common Stock granted to Mr. Smith. The value of these shares as of January 29, 2005 was $191,790. Mr. Smith’s right to the 9,000 shares vest on each of the first four anniversaries of the grant date. |

| (n) | Represents the market value, on March 11, 2003, the date of grant, of 6,000 time-vesting restricted shares of Common Stock granted to Mr. Smith. The value of these shares as of January 29, 2005 was $127,860. Mr. Smith’s right to the 6,000 shares vest on each of the first four anniversaries of the grant date. |

| (o) | Represents the market value, on March 8, 2004, the date of grant, of 9,000 time-vesting restricted shares of Common Stock granted to Mr. Romano. The value of these shares as of January 29, 2005 was $191,790. Mr. Romano’s right to the 9,000 shares vest on each of the first four anniversaries of the grant date. |

| (p) | Represents the market value, on March 11, 2003, the date of grant, of 6,000 time-vesting restricted shares of Common Stock granted to Mr. Romano. The value of these shares as of January 29, 2005 was $127,860. Mr. Romano’s right to the 6,000 shares vest on each of the first four anniversaries of the grant date. |

| (q) | Mr. Jessup’s employment with the Company terminated effective January 10, 2005. Under Mr. Jessup’s employment agreement with the Company, Mr. Jessup is entitled to, among other things, severance payments and the acceleration of the vesting of restricted stock granted to him under the agreement, subject to Mr. Jessup’s compliance with the non-compete and non-solicitation provisions of such agreement. See “Employment, Separation and Change in Control Agreements—Jessup Employment Agreement” below for a description of Mr. Jessup’s employment agreement with the Company. |

| (r) | Represents $26,629 attributable to the value of car service and $14,391 for reimbursement of taxes with respect to car service. |

| (s) | Represents the market value, on March 8, 2004, the date of the grant, of 22,500 time-vesting restricted shares of Common Stock granted to Mr. Jessup. The value of these shares as of January 29, 2005 was $479,475. Upon the termination of Mr. Jessup’s employment with the Company effective January 10, 2005, the 22,500 shares were canceled. See “Employment, Separation and Change in Control Agreements – Jessup Employment Agreement.” |

| (t) | Includes $150,000 payable as a sign-on bonus in connection with Mr. Jessup’s commencement of employment in 2003. |

| (u) | Represents the market value, on May 1, 2003, the date of grant, of 17,499 performance-vesting and 35,001 time-vesting restricted shares of Common Stock granted to Mr. Jessup. The value of these shares as of January 29, 2005 was $1,118,775. Fifty percent of the performance-vesting restricted shares were to vest on May 1st in each of 2005 and 2006 if the Company achieved certain operating profit goals for fiscal years 2004 and 2005. Fifty percent of the time-vesting restricted shares vested on May 1, 2004 and 25% were to vest on each of May 1, 2005 and May 1, 2006. Upon the termination of Mr. Jessup’s employment with the Company effective January 10, 2005, 17,499 performance-vesting restricted shares and 17,499 time-vesting restricted shares vested. |

19

The following Table sets forth certain information with respect to stock options awarded during fiscal year 2004 to the named executive officers listed in the Table entitled “Summary Compensation Table,” and these option grants are also reflected in such Table. In accordance with Commission rules, the hypothetical realizable values for each option grant are shown based on compound annual rates of stock price appreciation of 5% and 10% from the grant date to the expiration date. The assumed rates of appreciation are prescribed by the Commission and are for illustrative purposes only; they are not intended to predict future stock prices, which will depend upon market conditions and the Company’s future performance and prospects.

Stock Options Granted in Fiscal Year 2004

| | | | | | | | | | | | | | | | | |

| | | # of Securities

Underlying

Options

Granted (a)

| | | % of Total # of

Options Granted

to Employees in

Fiscal 2004

| | | Exercise

Price

($/Share)

| | Expiration

Date

| | Potential Realizable Value at Assumed Annual Rates of

Stock Price Appreciation for Option Term (c)

|

Name

| | | | | | 5% ($)

| | 10% ($)

|

J. Patrick Spainhour | | 90,000 | | | 4.53 | % | | $ | 26.99 | | 5/21/2014 | | $ | 1,541,527 | | $ | 3,893,636 |

Kay Krill | | 52,500

150,000 |

(b) | | 2.64

7.56 | %

% | |

| 30.12

22.27 | | 3/8/2014

11/4/2014 | |

| 979,078

2,323,167 | |

| 2,495,674

5,677,943 |

Dwight Meyer | | 11,250 | | | 0.57 | % | | | 30.12 | | 3/8/2014 | | | 209,802 | | | 534,787 |

James M. Smith | | 22,500 | | | 1.13 | % | | | 30.12 | | 3/8/2014 | | | 419,605 | | | 1,069,575 |

Anthony Romano | | 22,500 | | | 1.13 | % | | | 30.12 | | 3/8/2014 | | | 419,605 | | | 1,069,575 |

Jerome Jessup (d) | | 48,750 | | | 2.46 | % | | | 30.12 | | — | | | — | | | — |

| (a) | Except as otherwise noted, options vest ¼ per year on each of the first four anniversaries of the date of grant, subject to earlier vesting upon the occurrence of an “Acceleration Event” as defined in the applicable plan. |

| (b) | Options vest 1/3 per year on each of the first three anniversaries of the date of grant, subject to earlier vesting upon the occurrence of an “Acceleration Event” as defined in the applicable plan. |

| (c) | These columns show the hypothetical realizable value of the options at the end of the ten-year term of the options, assuming that the market price of the Common Stock subject to the options appreciates in value at the annual rate indicated in the Table, from the date of grant to the end of the option term. |

| (d) | These stock options were canceled upon the termination of Mr. Jessup’s employment with the Company effective January 10, 2005. |

20

The following Table shows the (i) number of shares of Common Stock acquired by each named executive officer upon the exercise of Company stock options during fiscal year 2004, (ii) aggregate dollar value realized by each named executive officer upon such exercise, based upon the fair market value of the Common Stock on the date of exercise, (iii) number of all vested (exercisable) and unvested (not yet exercisable) stock options held by each named executive officer at the end of fiscal year 2004, and (iv) value of all such options that were “in the money” (i.e., the market price of the Common Stock was greater than the exercise price of the options) at the end of fiscal year 2004.

Aggregate Option Exercises in Fiscal 2004

and Fiscal Year End Option Values

| | | | | | | | | | |

Name

| | No. of Shares

Acquired on

Exercise of

Stock Options

| | $ Value

Realized

Upon Exercise

of Options

| | No. of Shares

Underlying

Unexercised Options at

End of Fiscal 2004

Exercisable/

Unexercisable

| | $ Value of Unexercised

In-the-Money Options at

End of Fiscal 2004

Exercisable/

Unexercisable (a)

|

J. Patrick Spainhour | | — | | | — | | 1,606,500 / 291,000 | | $ | 8,821,974 / $643,168 |

Kay Krill | | 59,253 | | $ | 671,096 | | 41,250 / 448,125 | | | 353,286 / 704,091 |

Dwight Meyer | | 39,937 | | | 605,075 | | 0 / 72,563 | | | 0 / 439,782 |

James M. Smith | | 11,248 | | | 148,154 | | 59,062 / 79,313 | | | 371,485 / 377,015 |

Anthony Romano | | 81,562 | | | 969,491 | | 0 / 78,751 | | | 0 / 396,232 |

Jerome Jessup | | — | | | — | | 37,500 / 75,000 | | | 207,626 / 415,253 |

| (a) | Calculated based on the closing market price of the Common Stock of $21.31 on January 28, 2005, the last trading day in fiscal year 2004, less the amount required to be paid upon exercise of the option. |

As described in the Compensation Committee Report above, under the Company’s 2004 Long-Term Cash Plan, each year the Compensation Committee designates a consecutive three-year period as a “performance cycle” and establishes three-year performance targets that must be achieved by the end of the three-year cycle, in order for incentive compensation to be paid under such plan at the end of the cycle. The following Table indicates the incentive compensation payments that the named executive officers would be entitled to receive under the 2004 Long-Term Cash Plan if the Company achieves the performance objectives established by the Compensation Committee for the three-year performance cycle comprising fiscal years 2004 to 2006. Target awards are expressed as a percentage of the named executive officer’s annual base salary in effect at the time of payment of the award. Payments under the 2004 Long-Term Cash Plan may exceed these target amounts, up to twice the targeted amount, if the Company exceeds the performance objectives, and may be less than the target amounts if the Company does not achieve the performance objectives.

Long Term Cash Incentive Compensation Plan

Awards in Fiscal Year 2004

| | | | | | | | | | | | | | |

| | | Percentage

of Annual

Salary

Awarded

| | | Performance

or Other

Period Until

Maturation

or Payout

| | Estimated Future Payouts under Non-Stock-Price-Based Plans (a)

|

Name

| | | | Threshold

(b)

| | Target

| | Maximum

(c)

|

J. Patrick Spainhour | | 50 | % | | 02/03/07 | | $ | 256,500 | | $ | 513,000 | | $ | 1,026,000 |

Kay Krill | | 50 | % | | 02/03/07 | | | 256,500 | | | 513,000 | | | 1,026,000 |

Dwight Meyer | | 30 | % | | 02/03/07 | | | 79,380 | | | 158,760 | | | 317,520 |

James M. Smith | | 30 | % | | 02/03/07 | | | 59,940 | | | 119,880 | | | 239,760 |

Anthony Romano | | 30 | % | | 02/03/07 | | | 58,320 | | | 116,640 | | | 233,280 |

| (a) | The dollar value of the estimated payout is based on an estimated annual salary at maturation of award. |

| (b) | The minimum amount payable under the plan is 50% of the target award, provided that minimum levels of performance by the Company, as measured by comparable store sales growth and average return on invested capital, are achieved. In the event that such minimum levels are not achieved, no payout is made under this plan. |

| (c) | The maximum amount payable under the plan is 200% of the target award, provided that the Company achieves a certain level of performance, as measured by comparable store sales growth and average return on invested capital. |

21

Pension Plan