|

Filed by ANN INC. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: ANN INC. Commission File No.: 1-10738 Date: May 18, 2015 The following is an investor presentation used on a conference call held on May 18, 2015 relating to the announcement of the proposed merger between ascena retail group, inc. and ANN INC.

|

ascena to Acquire ANN INC.

Creates a Powerhouse in Women’s Specialty Apparel Retail May 18, 2015

Important Information

In connection with the proposed transaction, Ascena Retail Group, Inc. (“ascena”) intends to file with the SEC a registration statement on Form S-4 that will include a proxy statement of ANN INC. (“ANN”) that also constitutes a prospectus of ascena. Investors and security holders are urged to read the proxy statement/prospectus and other relevant documents filed with the SEC, when they become available, because they will contain important information about the proposed transaction.

Investors and security holders may obtain free copies of these documents, when they become available, and other documents filed with the SEC at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by ascena by contacting ascena Investor Relations at (551) 777-6895, or by e-mail at ascenainvestorrelations@ascenaretail.com. Investors and security holders may obtain free copies of the documents filed with the SEC by ANN by contacting ANN Investor Relations at (212) 541-3445, or by e-mail at investor_relations@ANNinc.com.

ascena and ANN and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about ascena’s directors and executive officers is available in ascena’s proxy statement for its 2014 Annual Meeting of Stockholders filed with the SEC on November 3, 2014. Information about directors and executive officers of ANN is available in the proxy statement for the 2015 Annual Meeting of Stockholders of ANN filed with the SEC on April

2, 2015. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from ascena or ANN using the sources indicated above.

This document and the information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

2

Forward-Looking Statements

In addition to historical information, this document contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which ascena and ANN operate and beliefs of and assumptions made by ascena management and ANN management, involve uncertainties that could significantly affect the financial results of ascena or ANN or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction involving ascena and ANN, including future financial and operating results, the combined company’s plans, objectives, ratings, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders, integrating ascena and ANN, providing stockholders with a more attractive currency, and the expected timetable for completing the proposed transaction — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks associated with the ability to consummate the merger and the timing of the closing of the merger; the ability to obtain requisite regulatory approvals; the ability to successfully integrate our operations and employees; the ability to realize anticipated benefits and synergies of the transaction; the potential impact of the announcement of the transaction or consummation of the transaction on relationships, including with employees, credit rating agencies, customers and competitors; the ability to retain key personnel; the ability to achieve performance targets; changes in financial markets, interest rates and foreign currency exchange rates; negative rating agency actions; and those additional risks and factors discussed in reports filed with the SEC by ascena and ANN from time to time, including those discussed under the heading “Risk Factors” in their respective most recently filed reports on Form 10-K and 10-Q. Neither ascena nor

ANN undertakes any duty to update any forward-looking statements contained herein.

3

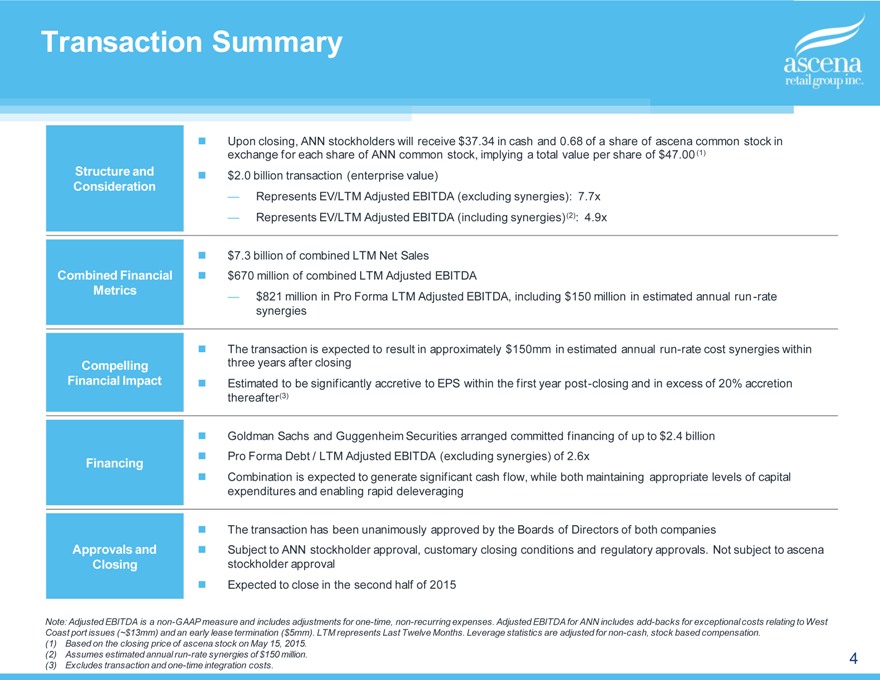

Transaction Summary

Structure and Consideration

Combined Financial Metrics

Compelling Financial Impact

Financing

Approvals and Closing

Upon closing, ANN stockholders will receive $37.34 in cash and 0.68 of a share of ascena common stock in exchange for each share of ANN common stock, implying a total value per share of $47.00 (1) $2.0 billion transaction (enterprise value)

Represents EV/LTM Adjusted EBITDA (excluding synergies): 7.7x

Represents EV/LTM Adjusted EBITDA (including synergies)(2): 4.9x

$7.3 billion of combined LTM Net Sales $670 million of combined LTM Adjusted EBITDA

$821 million in Pro Forma LTM Adjusted EBITDA, including $150 million in estimated annual run -rate synergies

The transaction is expected to result in approximately $150mm in estimated annual run-rate cost synergies within three years after closing Estimated to be significantly accretive to EPS within the first year post-closing and in excess of 20% accretion thereafter(3)

Goldman Sachs and Guggenheim Securities arranged committed financing of up to $2.4 billion Pro Forma Debt / LTM Adjusted EBITDA (excluding synergies) of 2.6x

Combination is expected to generate significant cash flow, while both maintaining appropriate levels of capital expenditures and enabling rapid deleveraging

The transaction has been unanimously approved by the Boards of Directors of both companies

Subject to ANN stockholder approval, customary closing conditions and regulatory approvals. Not subject to ascena stockholder approval Expected to close in the second half of 2015

Note: Adjusted EBITDA is a non-GAAP measure and includes adjustments for one-time, non-recurring expenses. Adjusted EBITDA for ANN includes add-backs for exceptional costs relating to West

Coast port issues (~$13mm) and an early lease termination ($5mm). LTM represents Last Twelve Months. Leverage statistics are adjusted for non-cash, stock based compensation.

(1) Based on the closing price of ascena stock on May 15, 2015.

(2) Assumes estimated annual run-rate synergies of $150 million.

(3) Excludes transaction and one-time integration costs.

4

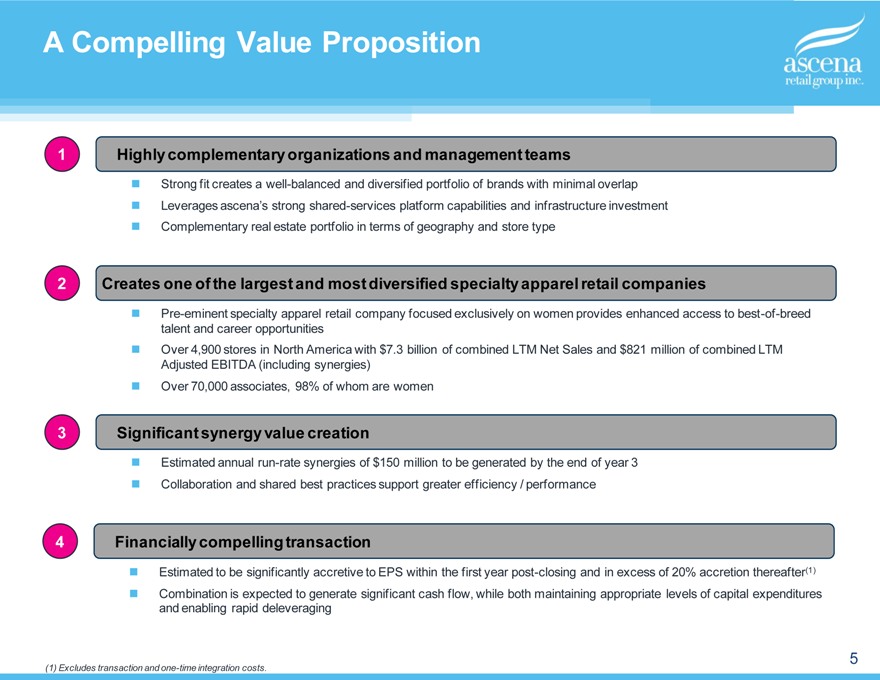

A Compelling Value Proposition

1 Highly complementary organizations and management teams

Strong fit creates a well-balanced and diversified portfolio of brands with minimal overlap ? Leverages ascena’s strong shared-services platform capabilities and infrastructure investment ? Complementary real estate portfolio in terms of geography and store type

2 Creates one of the largest and most diversified specialty apparel retail companies

Pre-eminent specialty apparel retail company focused exclusively on women provides enhanced access to best-of-breed talent and career opportunities ? Over 4,900 stores in North America with $7.3 billion of combined LTM Net Sales and $821 million of combined LTM

Adjusted EBITDA (including synergies)

Over 70,000 associates, 98% of whom are women

3 Significant synergy value creation

Estimated annual run-rate synergies of $150 million to be generated by the end of year 3 ? Collaboration and shared best practices support greater efficiency / performance

4 Financially compelling transaction

Estimated to be significantly accretive to EPS within the first year post-closing and in excess of 20% accretion thereafter(1) ? Combination is expected to generate significant cash flow, while both maintaining appropriate levels of capital expenditures and enabling rapid deleveraging

(1) Excludes transaction and one-time integration costs.

5

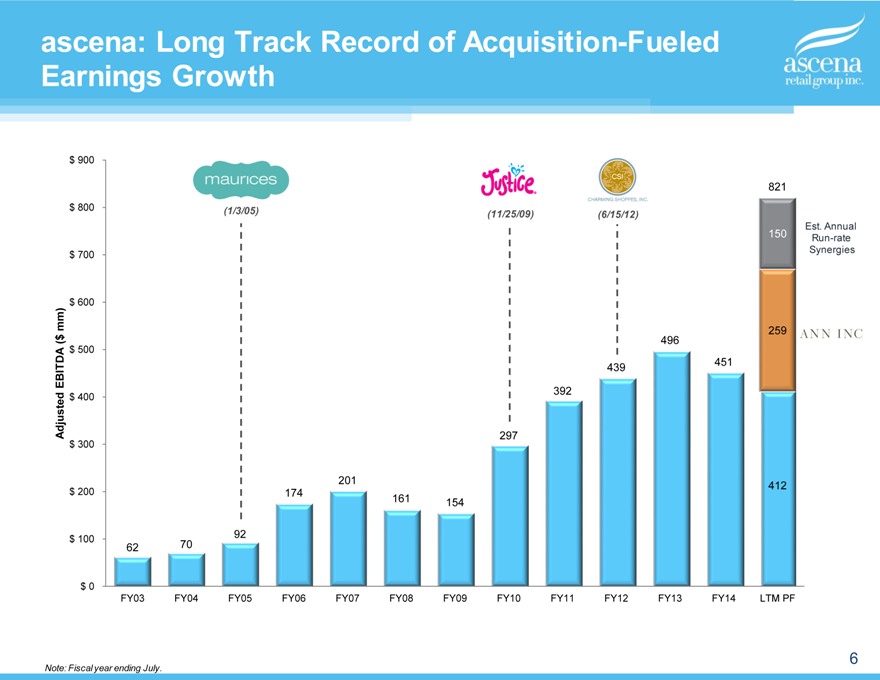

ascena: Long Track Record of Acquisition-Fueled Earnings Growth

$ 900

821

$ 800

(1/3/05) (11/25/09) (6/15/12)

Est. Annual

150 Run-rate

$ 700 Synergies

$ 600

mm) 259

( $ 496

$ 500

EBITDA 439 451

392

ed $ 400

just

d

A 297

$ 300

201 412

$ 200 174

161 154

$ 100 92

62 70

$ 0

FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 LTM PF

Note: Fiscal year ending July.

6

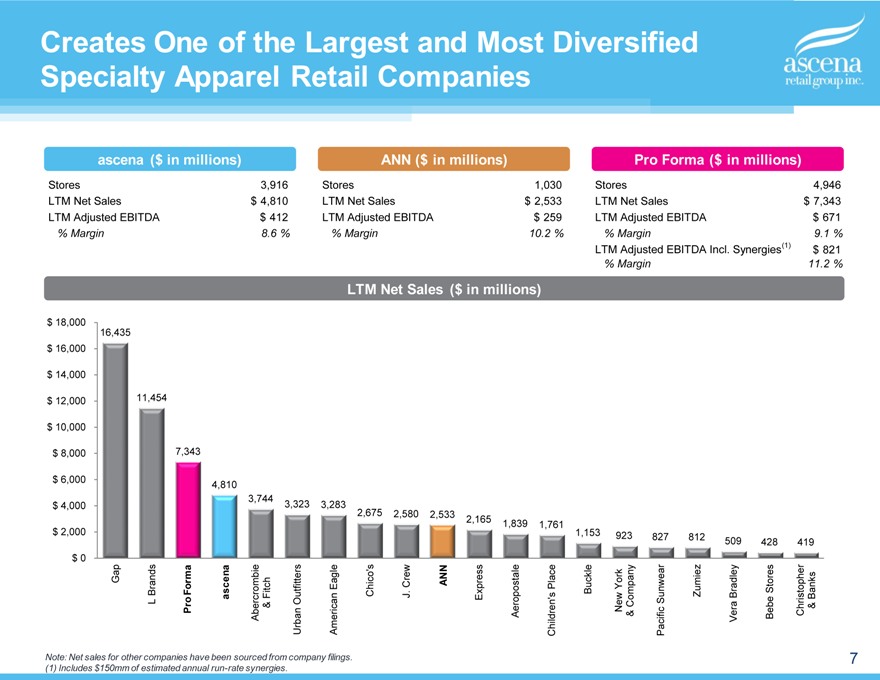

Creates One of the Largest and Most Diversified Specialty Apparel Retail Companies

ascena ($ in millions)

Stores 3,916

LTM Net Sales $ 4,810

LTM Adjusted EBITDA $ 412

% Margin 8.6 %

ANN ($ in millions)

Stores 1,030

LTM Net Sales $ 2,533

LTM Adjusted EBITDA $ 259

% Margin 10.2 %

Pro Forma ($ in millions)

Stores 4,946

LTM Net Sales $ 7,343

LTM Adjusted EBITDA $ 671

% Margin 9.1 %

LTM Adjusted EBITDA Incl. Synergies(1) $ 821

% Margin 11.2 %

LTM Net Sales ($ in millions)

$ $ $ $ $

$ $ $ $

$ 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000

0

Gap 16,435

L Brands 11,454

Pro F 7,343

as 4,810

Abercrombie

& Fitch 3,744

Urban Outfitters 3,323

American Eagle 3,283

Chico’s 2,675

J. Crew 2,580

2,533

Express 2,165

Aeropostale 1,839

Children’s Place 1,761

Buckle 1,153

New York 923

& Company

Pacific Sunwear 827

Zumiez 812

Vera Bradley 509

Bebe Stores 428

Christopher & Banks 419

Note: Net sales for other companies have been sourced from company filings.

(1) Includes $150mm of estimated annual run-rate synergies.

7

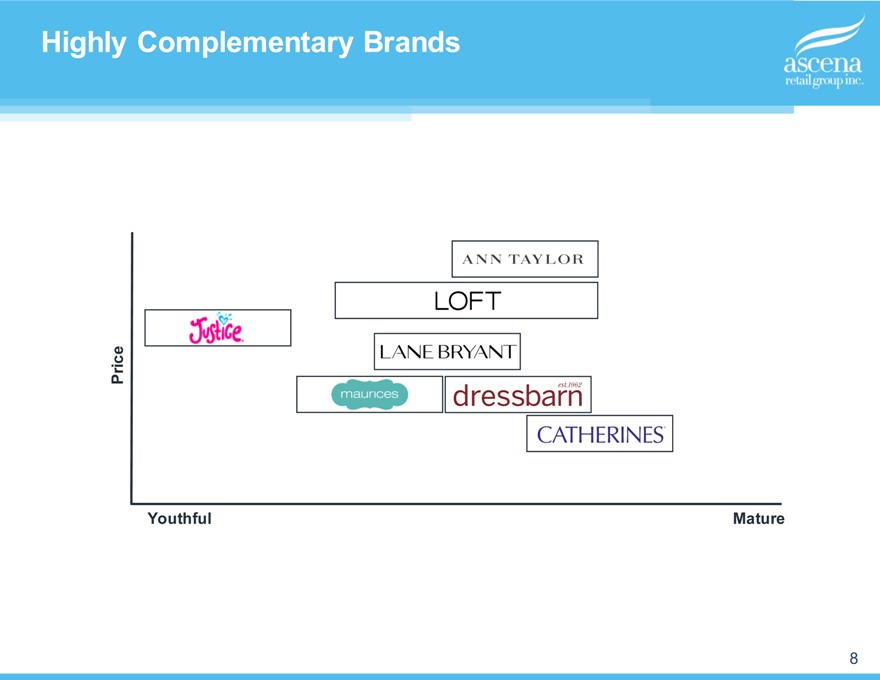

Highly Complementary Brands

Price

Youthful Mature

8

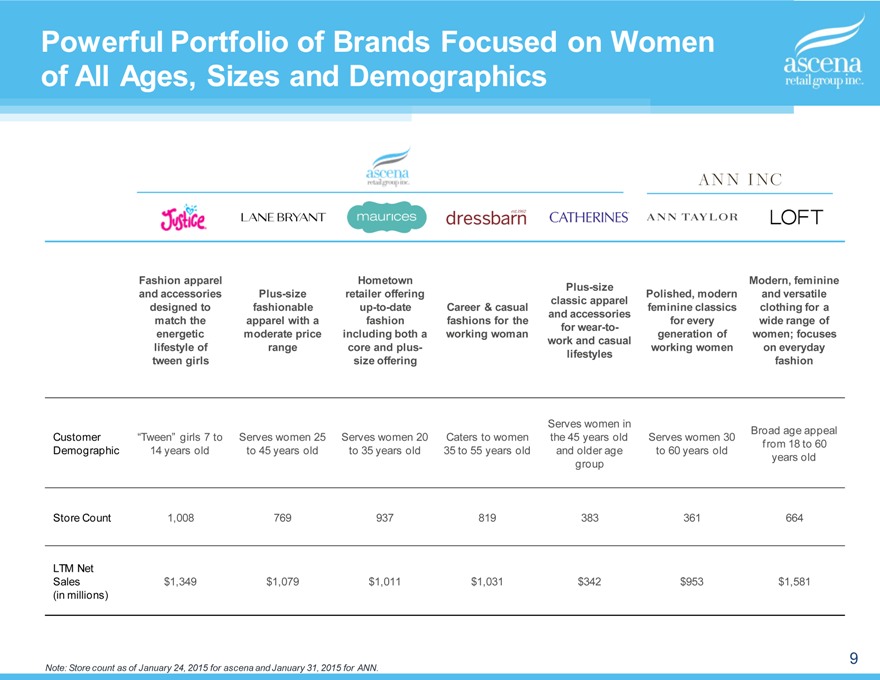

Powerful Portfolio of Brands Focused on Women of All Ages, Sizes and Demographics

Fashion apparel and accessories designed to match the energetic lifestyle of tween girls

Plus-size fashionable apparel with a moderate price range

Hometown retailer offering up-to-date fashion including both a core and plus-size offering

Career & casual fashions for the working woman

Plus-size classic apparel and accessories for wear-to-work and casual lifestyles

Polished, modern feminine classics for every generation of working women

Modern, feminine and versatile clothing for a wide range of women; focuses on everyday fashion

Serves women in Broad age appeal

Customer “Tween” girls 7 to Serves women 25 Serves women 20 Caters to women the 45 years old Serves women 30

Demographic 14 years old to 45 years old to 35 years old 35 to 55 years old and older age to 60 years old from 18 to 60

group years old

Store Count 1,008 769 937 819 383 361 664

LTM Net

Sales $1,349 $1,079 $1,011 $1,031 $342 $953 $1,581

(in millions)

Note: Store count as of January 24, 2015 for ascena and January 31, 2015 for ANN.

9

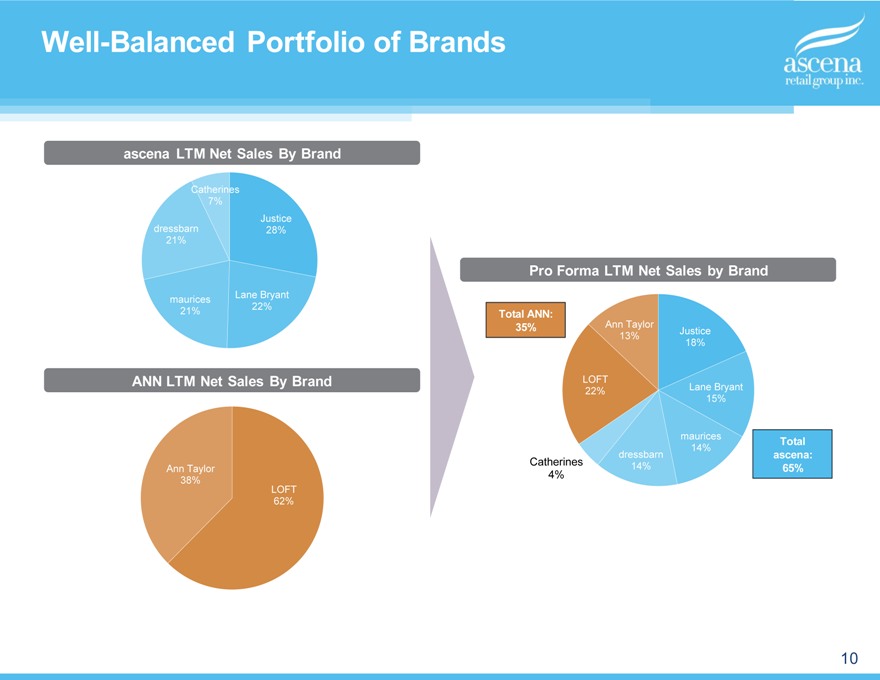

Well-Balanced Portfolio of Brands

ascena LTM Net Sales By Brand

?Catherines

7%

?Justice ?dressbarn 28% 21%

?Lane Bryant ?maurices

22% 21%

ANN LTM Net Sales By Brand

?AnnTaylor

38% ?LOFT

62%

Pro Forma LTM Net Sales by Brand

Total ANN:

35% ?Ann Taylor

?Justice

13%

18%

?LOFT

22% ?Lane Bryant

15%

?maurices

Total

14%

?dressbarn ascena:

Catherines 14%

65%

4%

10

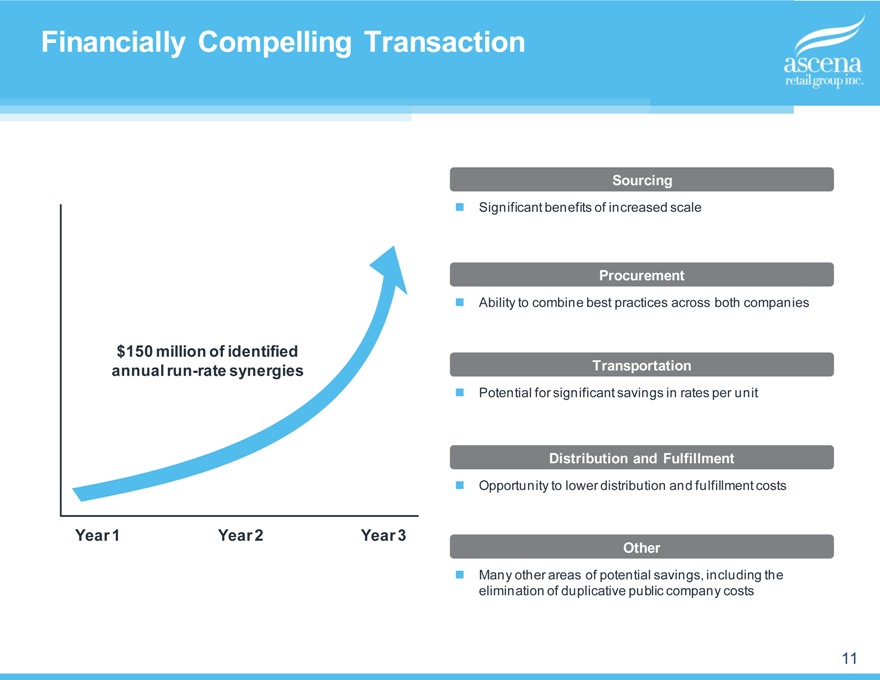

Financially Compelling Transaction

$150 million of identified annual run-rate synergies

Year 1 Year 2 Year 3

Sourcing

Significant benefits of increased scale

Procurement

Ability to combine best practices across both companies

Transportation

Potential for significant savings in rates per unit

Distribution and Fulfillment

Opportunity to lower distribution and fulfillment costs

Other

Many other areas of potential savings, including the elimination of duplicative public company costs

11