We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow. Q2 2022 Earnings Call August 2, 2022

2Sterling: Second Quarter 2022 DISCLOSURE: Forward-Looking Statements This presentation contains, and the officers and directors of the Company may from time to time make, statements that are considered forward- looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our business strategy; our financial strategy; our industry outlook; and our expected margin growth; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this presentation, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this presentation are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. This presentation may contain the financial measures: adjusted net income, EBITDA, adjusted EBITDA, and adjusted EPS, which are not calculated in accordance with U.S. GAAP. If presented, a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measure will be provided in the Appendix to this presentation.

3Sterling: Second Quarter 2022 In June 2022, we aligned our name to better reflect our position as a market-leading infrastructure solutions provider driven by our entrepreneurial spirit and customer-centric culture along with a focused, disciplined and bold determination. We are… Sterling Infrastructure, Inc. Delivering value-added solutions by our commitment to our growth strategy: Solidify the Base | Grow High-Margin Products | Expansion into Adjacent Markets Focused on our key objectives: Bottom-line Growth | Risk Reduction | Exceed Peer Performance We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow.

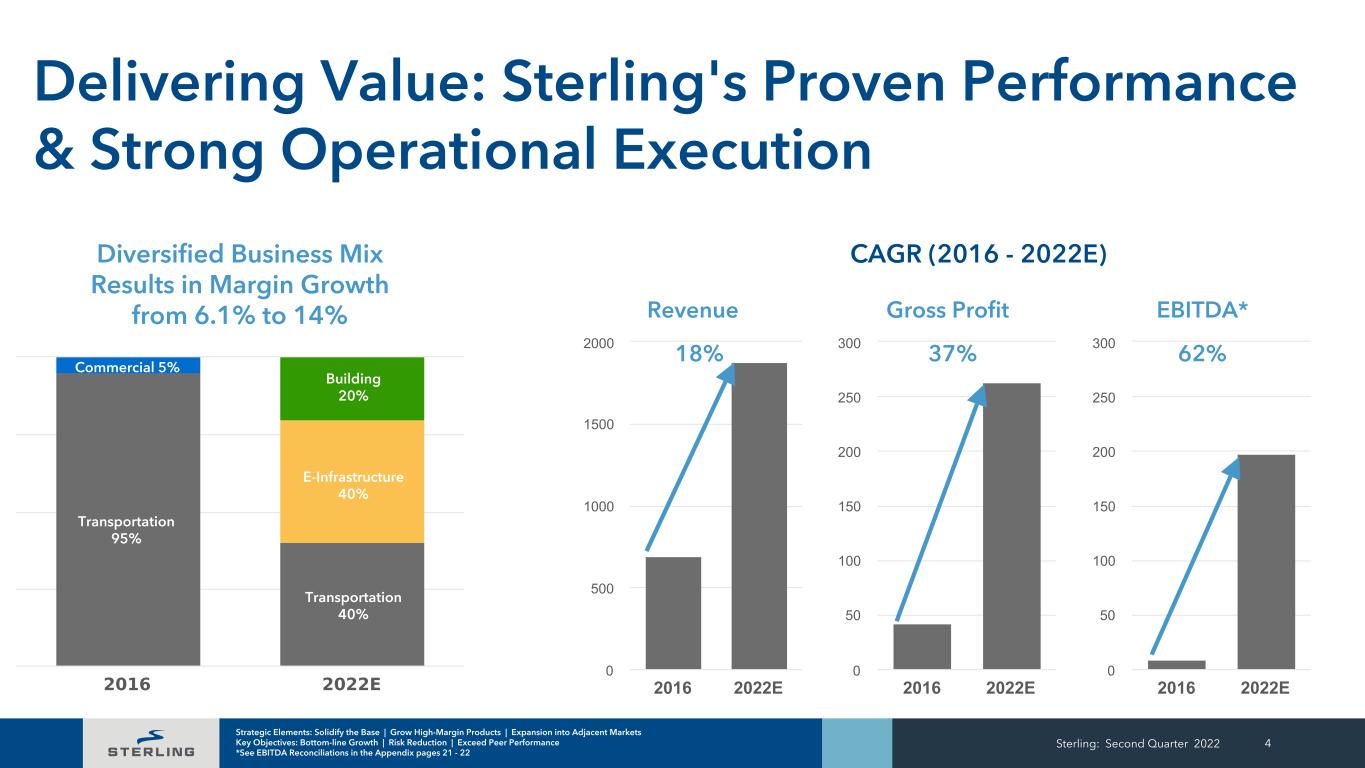

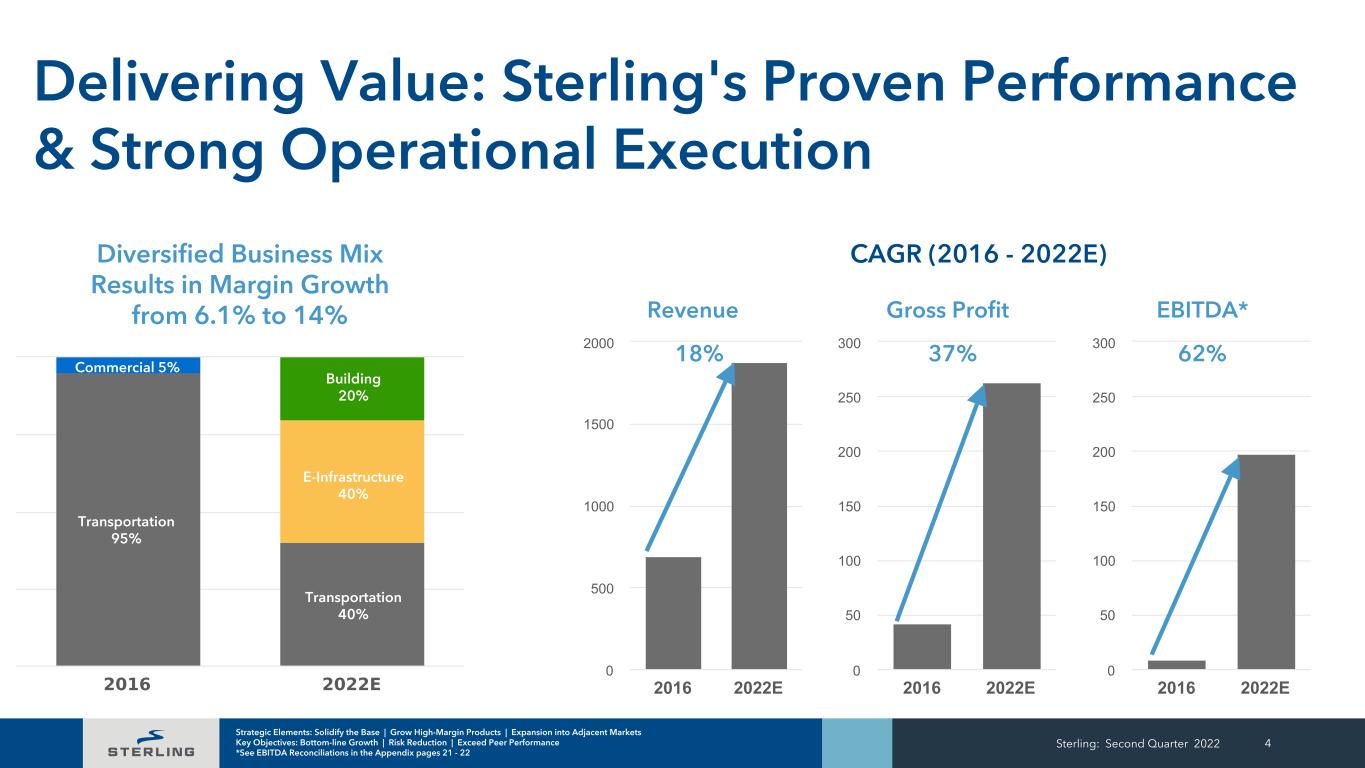

Sterling: Second Quarter 2022 4 Delivering Value: Sterling's Proven Performance & Strong Operational Execution Strategic Elements: Solidify the Base | Grow High-Margin Products | Expansion into Adjacent Markets Key Objectives: Bottom-line Growth | Risk Reduction | Exceed Peer Performance *See EBITDA Reconciliations in the Appendix pages 21 - 22 2016 2022E 0 500 1000 1500 2000 2016 2022E 0 50 100 150 200 250 300 2016 2022E 0 50 100 150 200 250 300 Diversified Business Mix Results in Margin Growth from 6.1% to 14% Revenue CAGR (2016 - 2022E) Gross Profit EBITDA* 18% 37% 62% Building 20% E-Infrastructure 40% Transportation 40% Transportation 95% Commercial 5%

Sterling: Second Quarter 2022 5 Successful Strategic Business Transformation Created Sterling Infrastructure, Inc. *See EBITDA Reconciliations in the Appendix pages 21 - 22 2016 2017 2018 2019 2020 2021 2022E $— $50 $100 $150 $200 Heavy Civil & Residential EBITDA* (2016 - 2022E) E-Infrastructure, Building & Transportation Heavy Civil, Residential & Specialty

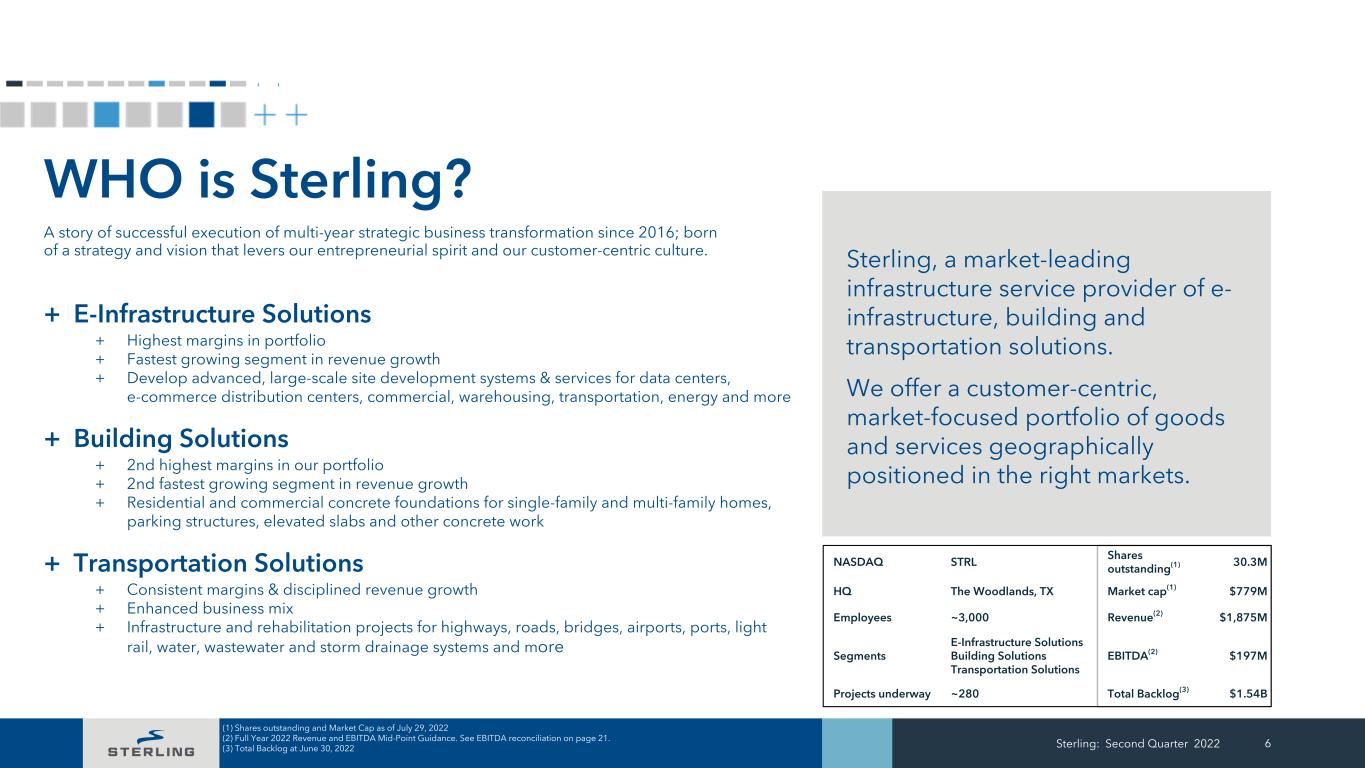

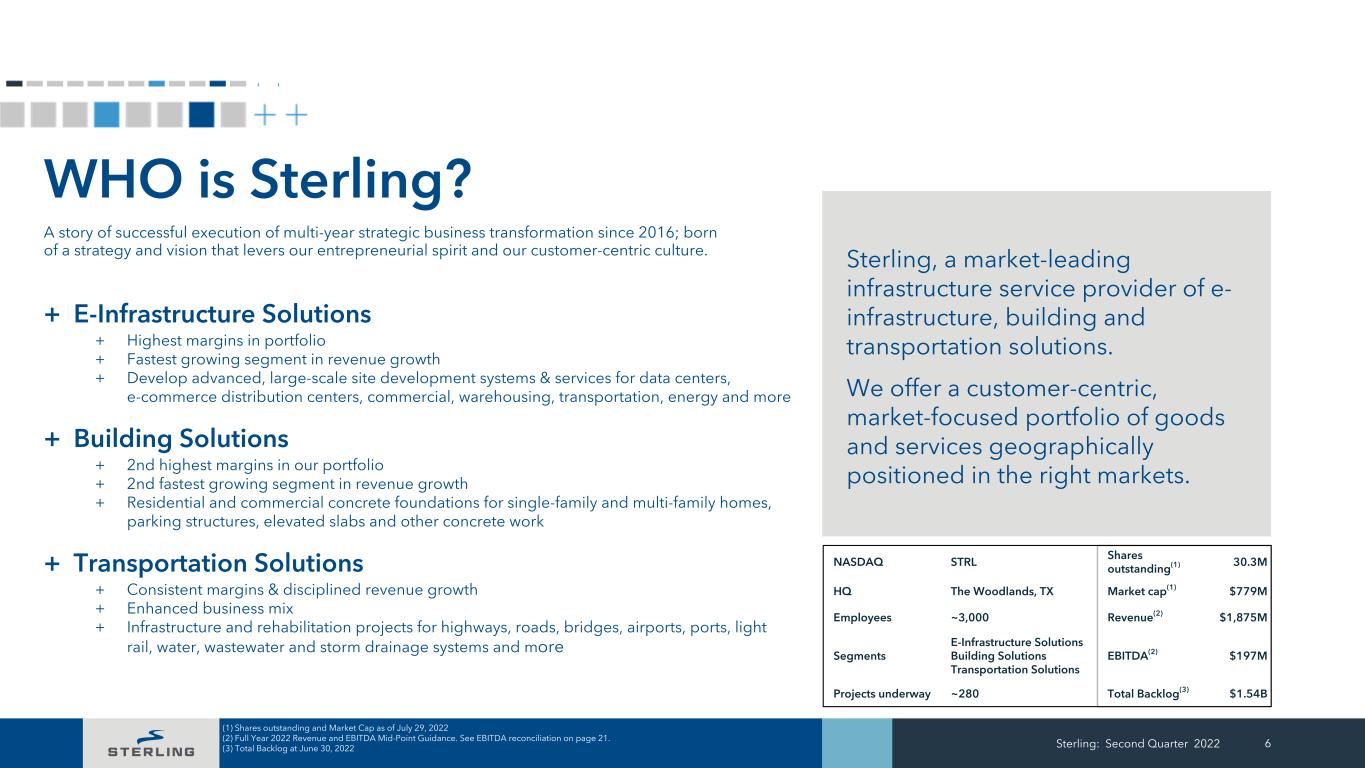

WHO is Sterling? A story of successful execution of multi-year strategic business transformation since 2016; born of a strategy and vision that levers our entrepreneurial spirit and our customer-centric culture. + E-Infrastructure Solutions + Highest margins in portfolio + Fastest growing segment in revenue growth + Develop advanced, large-scale site development systems & services for data centers, e-commerce distribution centers, commercial, warehousing, transportation, energy and more + Building Solutions + 2nd highest margins in our portfolio + 2nd fastest growing segment in revenue growth + Residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs and other concrete work + Transportation Solutions + Consistent margins & disciplined revenue growth + Enhanced business mix + Infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, light rail, water, wastewater and storm drainage systems and more Sterling: Second Quarter 2022 6 Sterling, a market-leading infrastructure service provider of e- infrastructure, building and transportation solutions. We offer a customer-centric, market-focused portfolio of goods and services geographically positioned in the right markets. NASDAQ STRL Shares outstanding(1) 30.3M HQ The Woodlands, TX Market cap(1) $779M Employees ~3,000 Revenue(2) $1,875M Segments E-Infrastructure Solutions Building Solutions Transportation Solutions EBITDA(2) $197M Projects underway ~280 Total Backlog(3) $1.54B (1) Shares outstanding and Market Cap as of July 29, 2022 (2) Full Year 2022 Revenue and EBITDA Mid-Point Guidance. See EBITDA reconciliation on page 21. (3) Total Backlog at June 30, 2022

Sterling: Second Quarter 2022 7 Sterling's Expanded Geographic Footprint in Strong Markets with Top Customers E-Infrastructure Solutions + Expanded geographic footprint providing value-added solutions to blue-chip customers in all major East Coast markets Building Solutions + Expanded geographic footprint serving the Nation's Top Builders in the Nation's Top Housing Markets: Texas & Arizona Transportation Solutions + Geographic footprint provides infrastructure solutions in the Pacific & Rocky Mountain States and Texas

Sterling: Second Quarter 2022 8 WHY Sterling? + We build value for investors seeking high margins, healthy cash flow, proven performance and strong operational execution + Committed to our strategic vision, our blueprint for bottom-line growth, reducing risk and consistently outperforming peers + We are levering the foundation we built to take Sterling to a whole new level + Platforms in higher-margin, specialty-end markets with a broadened portfolio of products, services & customers + Recent Petillo acquisition positions Sterling to be an industry leader of e-infrastructure specialty site development services Five Year Stock Price Performance Sterling vs S&P 500* Sterling exceeded S&P 500 by 32.3% Five Year Stock Price Performance Sterling vs Peers* *Stock Price Performance as of July 29, 2022 closing

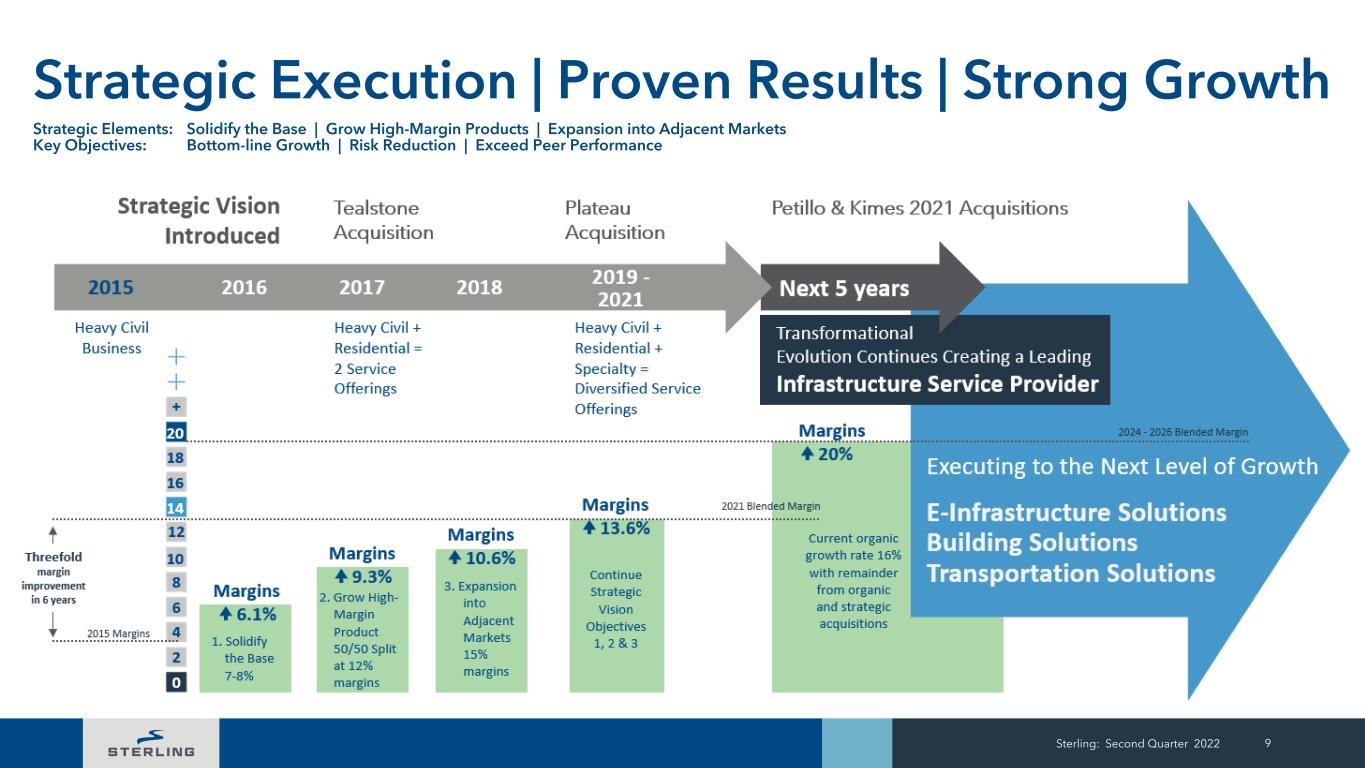

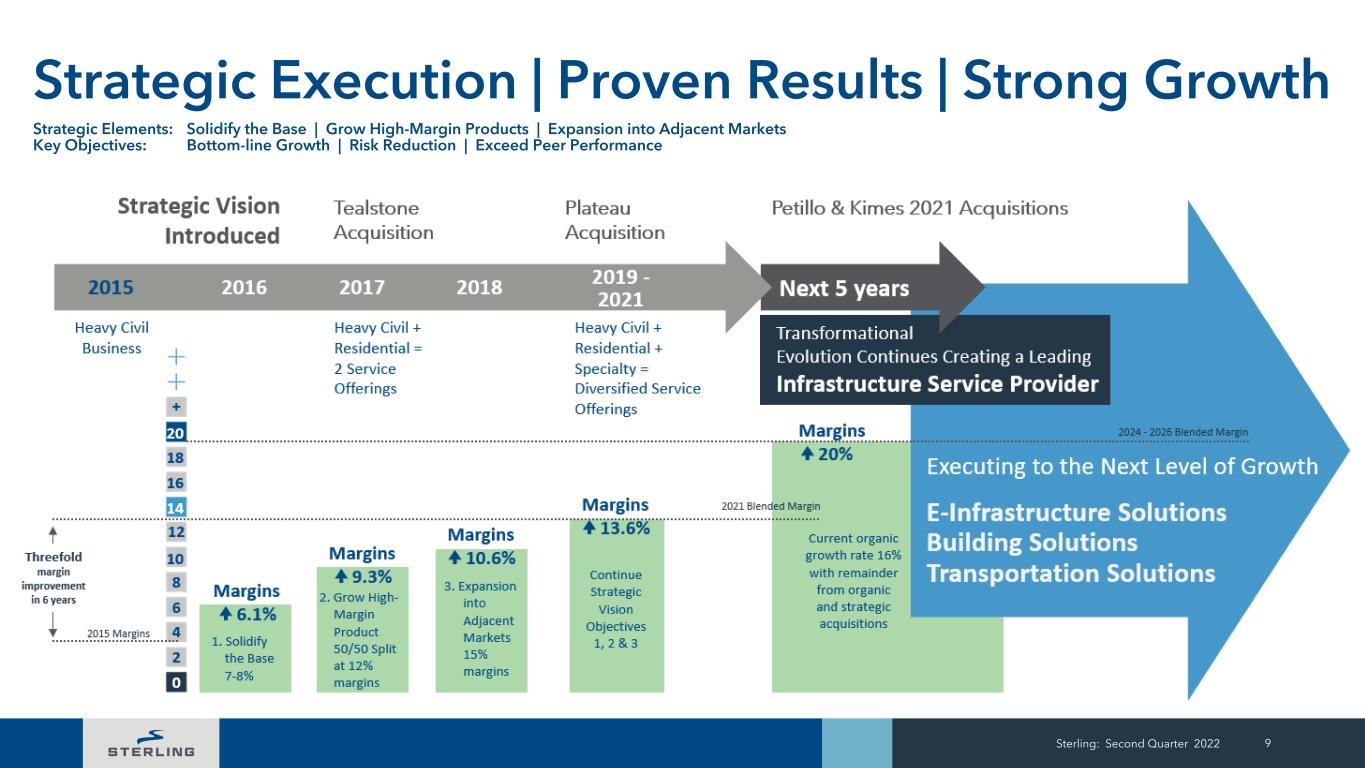

Sterling: Second Quarter 2022 9 Strategic Execution | Proven Results | Strong Growth Strategic Elements: Solidify the Base | Grow High-Margin Products | Expansion into Adjacent Markets Key Objectives: Bottom-line Growth | Risk Reduction | Exceed Peer Performance

Protecting Habitats Onsite project management controls for avoidance, minimization and mitigation measures. A Florida site development project took careful measures to protect the federally protected burrowing owl by fencing around the nesting trees during the entire project. The Sterling Way Taking care of our employees, customers, the environment and our communities is what we do every day Sterling: Second Quarter 2022 10 Reducing our Carbon Footprint A Nashville project blasted, moved and crushed rock all onsite. The rock was used for several scope items alleviating the need for the rock to be hauled from a rock quarry in and out of the project site. Material recycling resulted in lower transportation costs and a reduction of our carbon footprint. Protecting the Community Measures regularly practiced at project sites are safety barriers to protect workers, neighboring communities, vegetation and habitats. With our Rolled Ankle Protection Program in place, an Atlanta project crushed tons of rock to create safe walking paths for all workers. Onsite equipment repair eliminates equipment hauled to be serviced outside of project area Accelerated Bridge Construction, an innovative construction method used to + Reduce onsite construction time for building/ replacing/ rehabilitating bridges + Improve work-zone safety for traveling public and workers Some of our recent awards: + Associated General Contractors of America (AGC) Construction Safety Champion of the Year 2021 + 2021 2nd place AGC Construction Safety Excellence Award in the Heavy Division for over 800,000 hours + 2020 American Road and Transportation Builders National Safety Award for the over 1,000,000 category Examples of our Safe and Sound safety program: + Daily Safety Briefings + Daily Safety Observations program + Job Hazard Analysis completed on major task Safety

+ Second Quarter 2022 Results Sterling: Second Quarter 2022 11

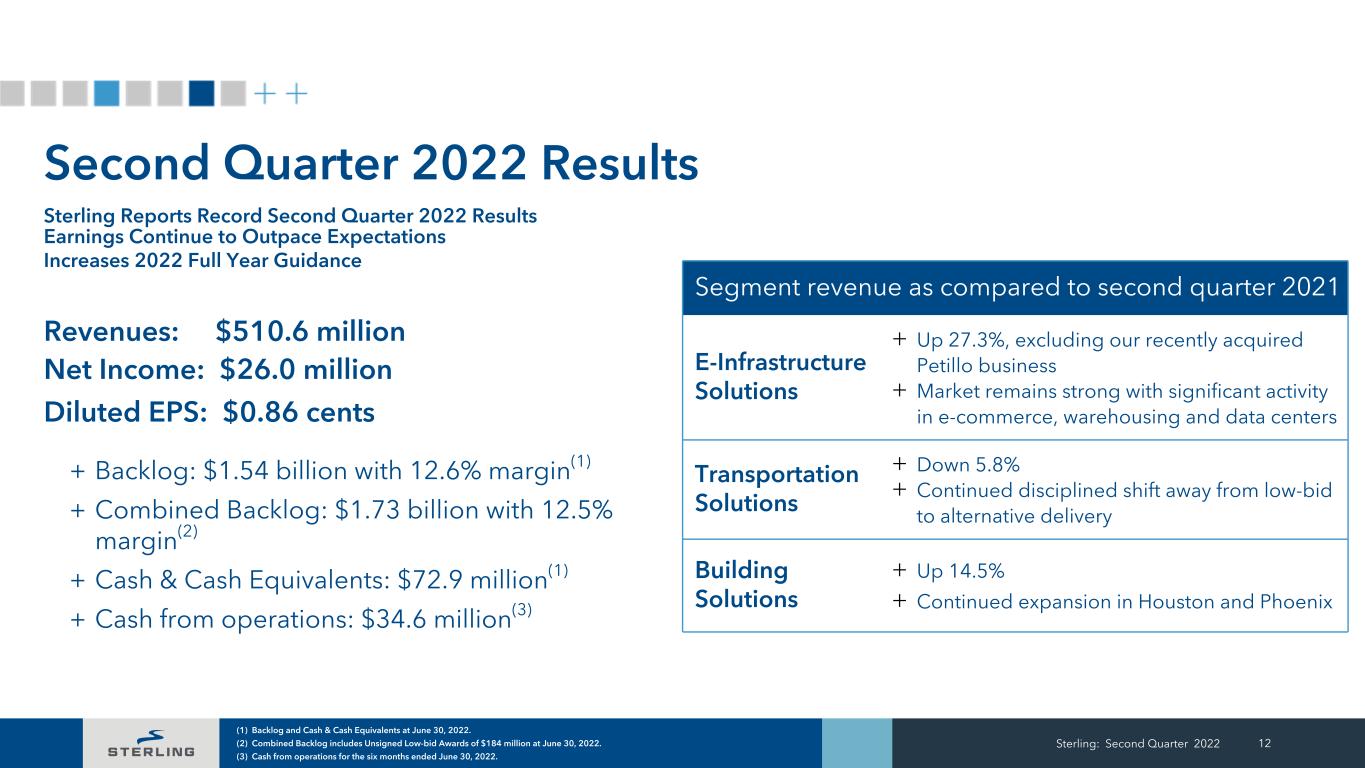

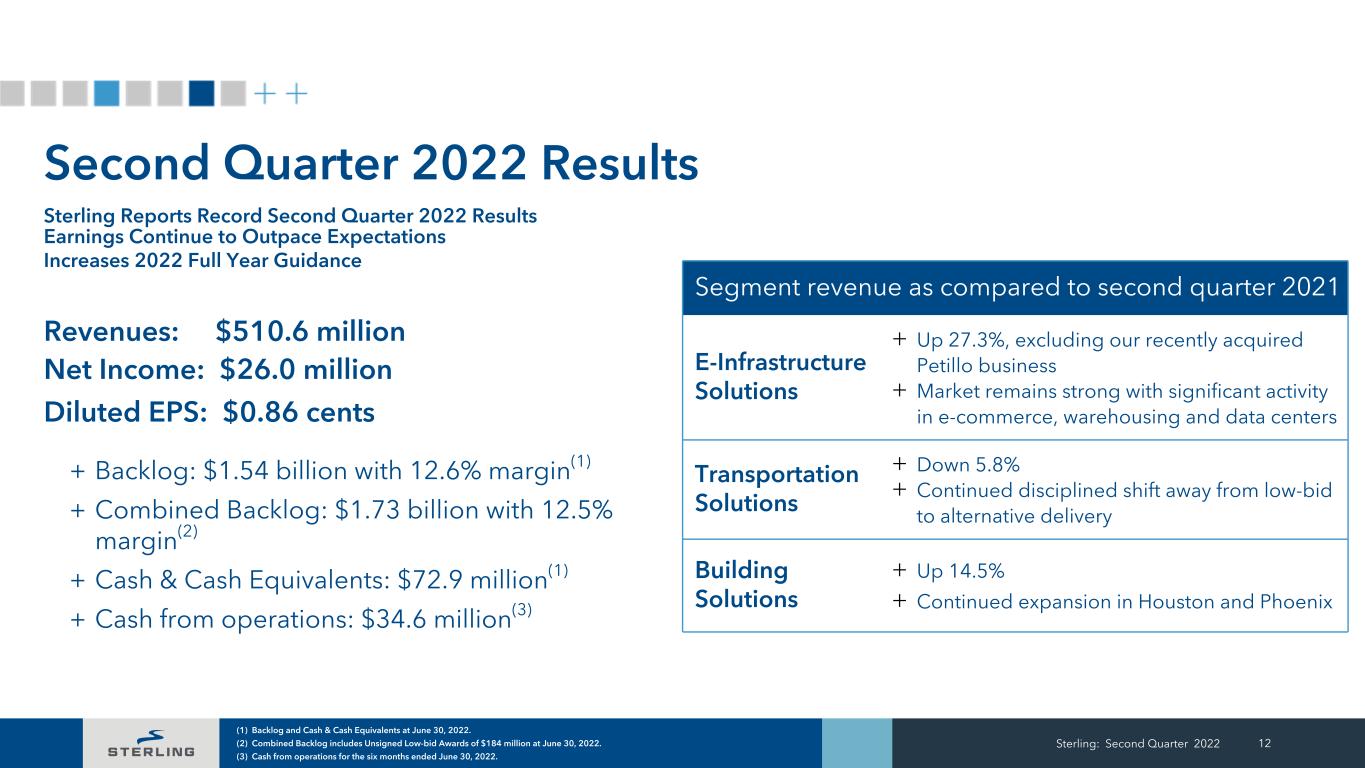

Second Quarter 2022 Results Sterling Reports Record Second Quarter 2022 Results Earnings Continue to Outpace Expectations Increases 2022 Full Year Guidance Revenues: $510.6 million Net Income: $26.0 million Diluted EPS: $0.86 cents + Backlog: $1.54 billion with 12.6% margin(1) + Combined Backlog: $1.73 billion with 12.5% margin(2) + Cash & Cash Equivalents: $72.9 million(1) + Cash from operations: $34.6 million(3) Sterling: Second Quarter 2022 12 (1) Backlog and Cash & Cash Equivalents at June 30, 2022. (2) Combined Backlog includes Unsigned Low-bid Awards of $184 million at June 30, 2022. (3) Cash from operations for the six months ended June 30, 2022. Segment revenue as compared to second quarter 2021 E-Infrastructure Solutions + Up 27.3%, excluding our recently acquired Petillo business + Market remains strong with significant activity in e-commerce, warehousing and data centers Transportation Solutions + Down 5.8% + Continued disciplined shift away from low-bid to alternative delivery Building Solutions + Up 14.5% + Continued expansion in Houston and Phoenix

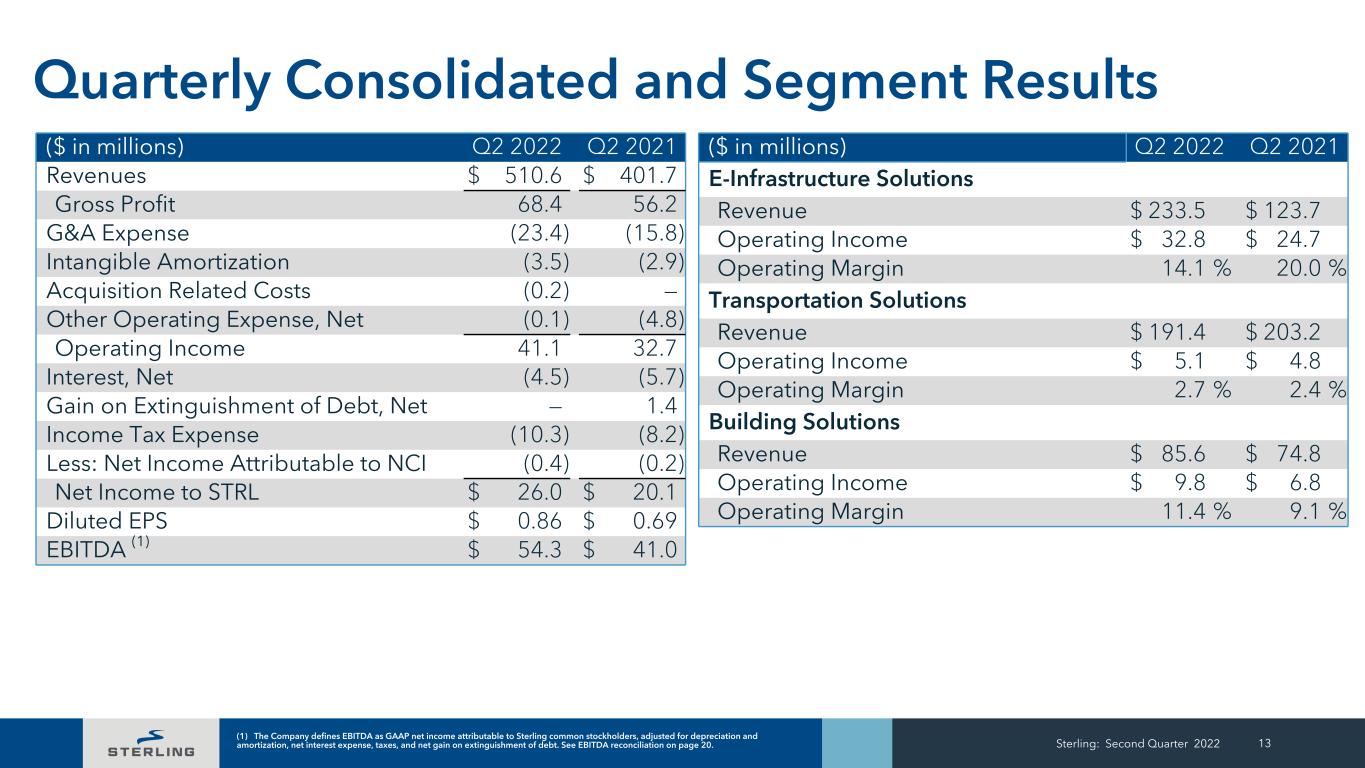

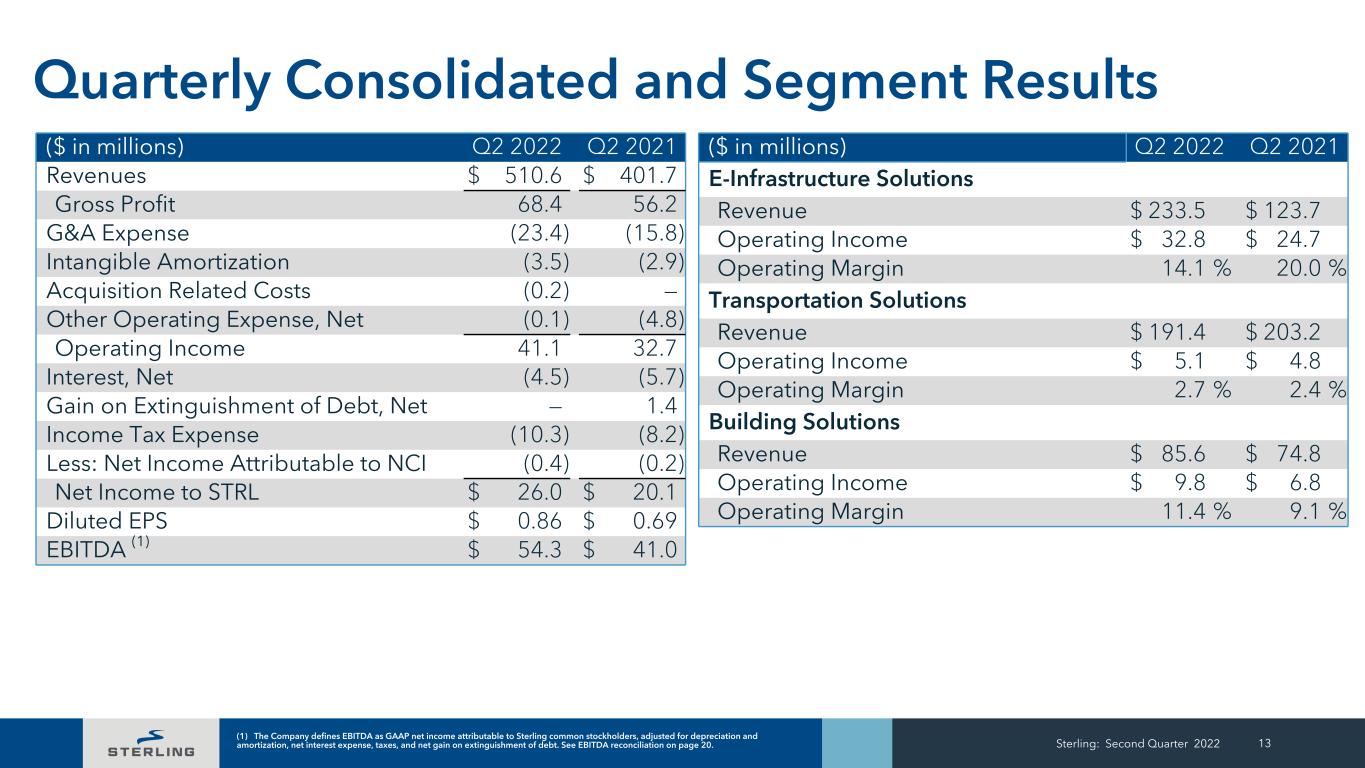

Sterling: Second Quarter 2022 13 Quarterly Consolidated and Segment Results ($ in millions) Q2 2022 Q2 2021 Revenues $ 510.6 $ 401.7 Gross Profit 68.4 56.2 G&A Expense (23.4) (15.8) Intangible Amortization (3.5) (2.9) Acquisition Related Costs (0.2) — Other Operating Expense, Net (0.1) (4.8) Operating Income 41.1 32.7 Interest, Net (4.5) (5.7) Gain on Extinguishment of Debt, Net — 1.4 Income Tax Expense (10.3) (8.2) Less: Net Income Attributable to NCI (0.4) (0.2) Net Income to STRL $ 26.0 $ 20.1 Diluted EPS $ 0.86 $ 0.69 EBITDA (1) $ 54.3 $ 41.0 ($ in millions) Q2 2022 Q2 2021 E-Infrastructure Solutions Revenue $ 233.5 $ 123.7 Operating Income $ 32.8 $ 24.7 Operating Margin 14.1 % 20.0 % Transportation Solutions Revenue $ 191.4 $ 203.2 Operating Income $ 5.1 $ 4.8 Operating Margin 2.7 % 2.4 % Building Solutions Revenue $ 85.6 $ 74.8 Operating Income $ 9.8 $ 6.8 Operating Margin 11.4 % 9.1 % (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense, taxes, and net gain on extinguishment of debt. See EBITDA reconciliation on page 20.

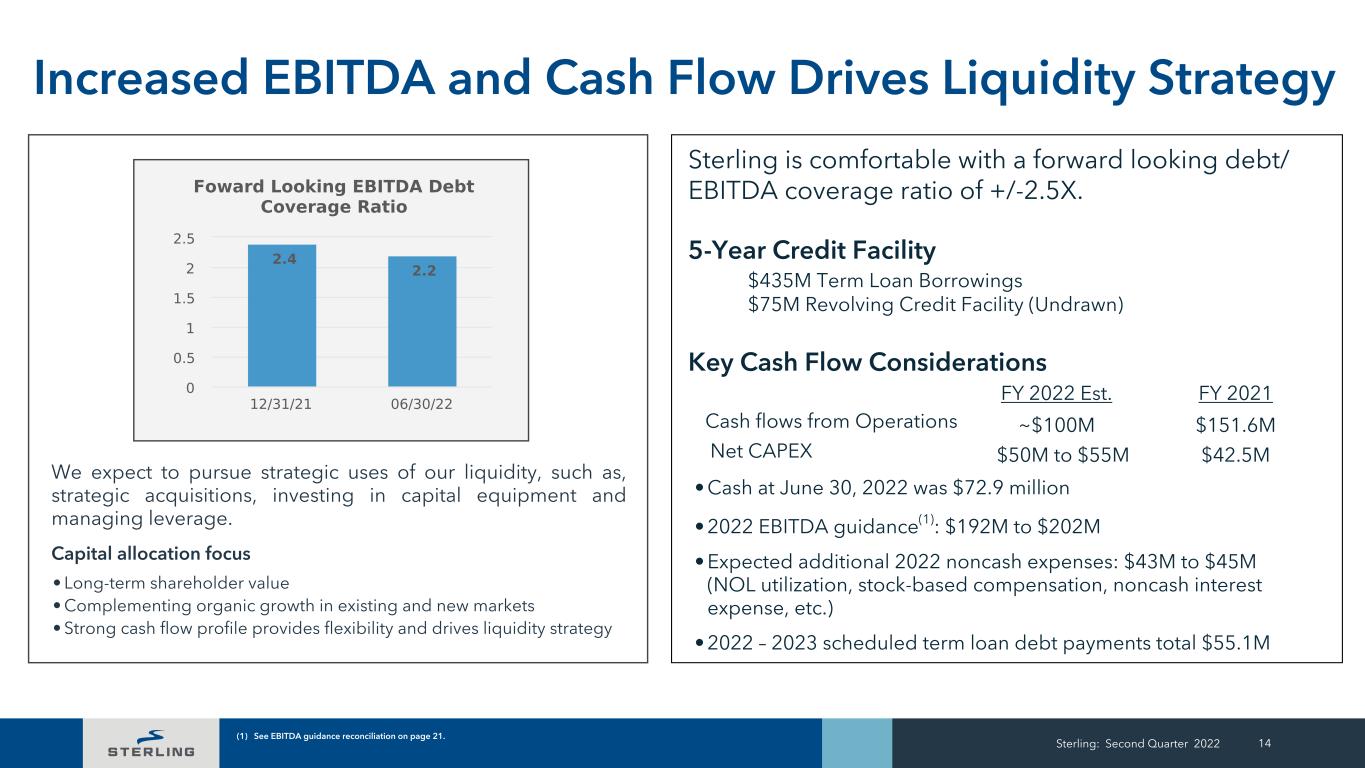

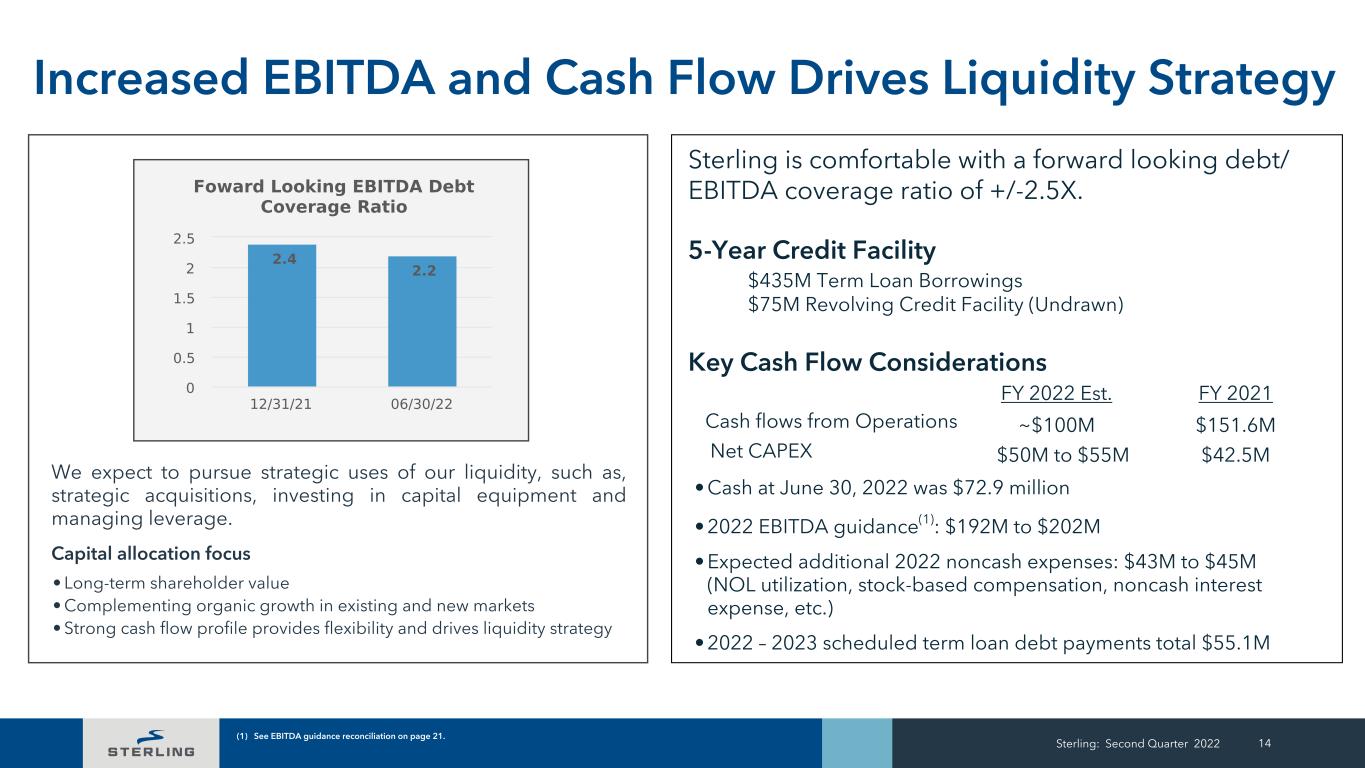

Sterling: Second Quarter 2022 14 Increased EBITDA and Cash Flow Drives Liquidity Strategy We expect to pursue strategic uses of our liquidity, such as, strategic acquisitions, investing in capital equipment and managing leverage. Capital allocation focus • Long-term shareholder value • Complementing organic growth in existing and new markets • Strong cash flow profile provides flexibility and drives liquidity strategy Sterling is comfortable with a forward looking debt/ EBITDA coverage ratio of +/-2.5X. 5-Year Credit Facility $435M Term Loan Borrowings $75M Revolving Credit Facility (Undrawn) Key Cash Flow Considerations FY 2022 Est. FY 2021 Cash flows from Operations ~$100M $151.6M Net CAPEX $50M to $55M $42.5M • Cash at June 30, 2022 was $72.9 million • 2022 EBITDA guidance(1): $192M to $202M • Expected additional 2022 noncash expenses: $43M to $45M (NOL utilization, stock-based compensation, noncash interest expense, etc.) • 2022 – 2023 scheduled term loan debt payments total $55.1M (1) See EBITDA guidance reconciliation on page 21.

Sterling: Second Quarter 2022 15 Contact Us Sterling Ron Ballschmiede, Chief Financial Officer Mary Morley, Investor Relations Sterling Infrastructure, Inc. Tel: (281) 214-0777 The Equity Group Inc. Jeremy Hellman Tel: (212) 836-9626 jhellman@equityny.com

+ Appendix Sterling: Second Quarter 2022 16

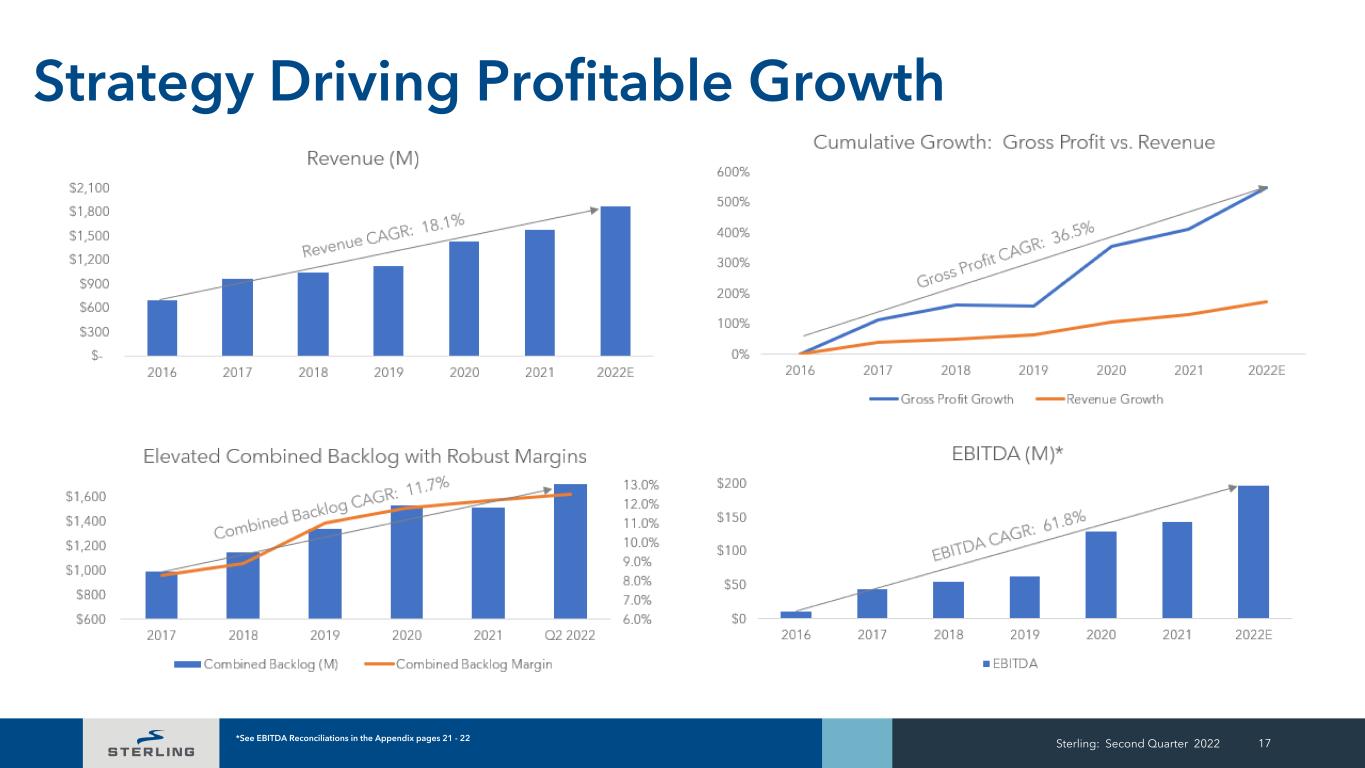

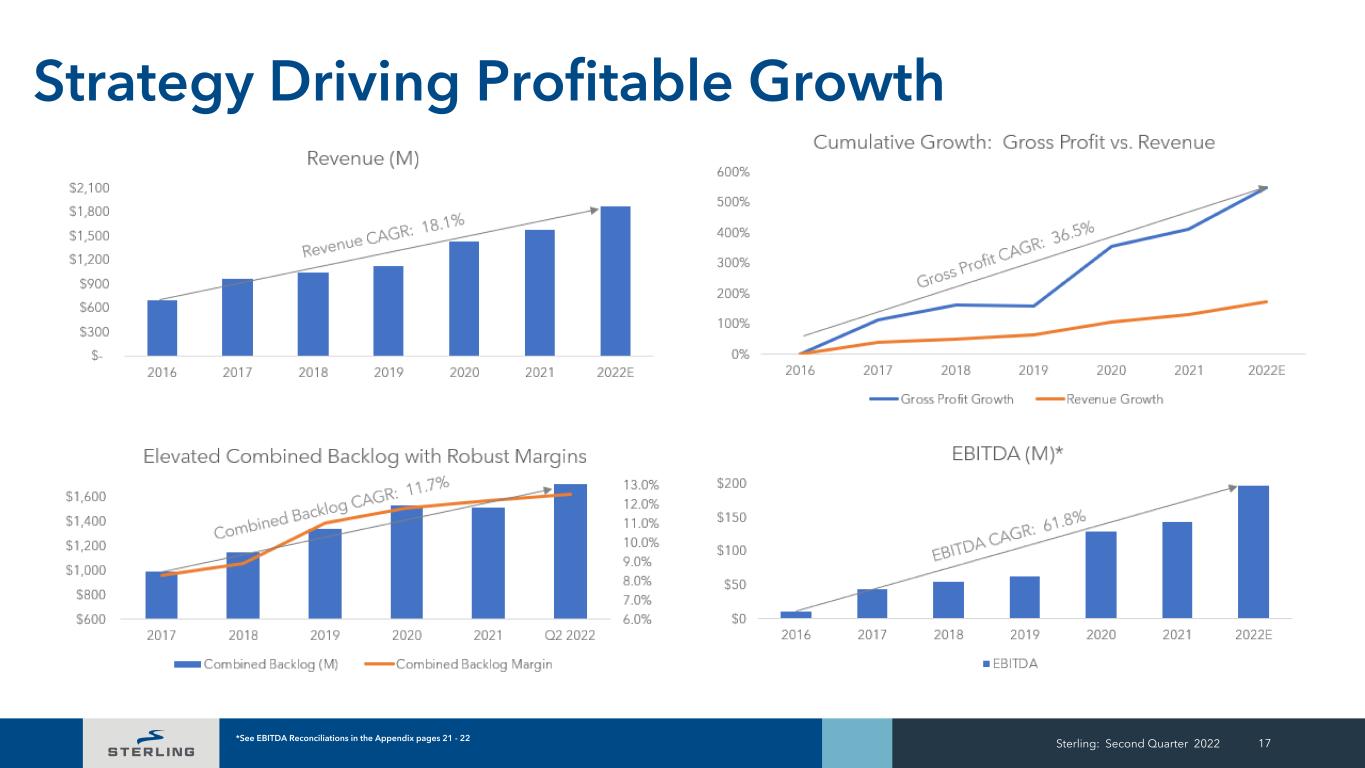

Sterling: Second Quarter 2022 17 Strategy Driving Profitable Growth *See EBITDA Reconciliations in the Appendix pages 21 - 22

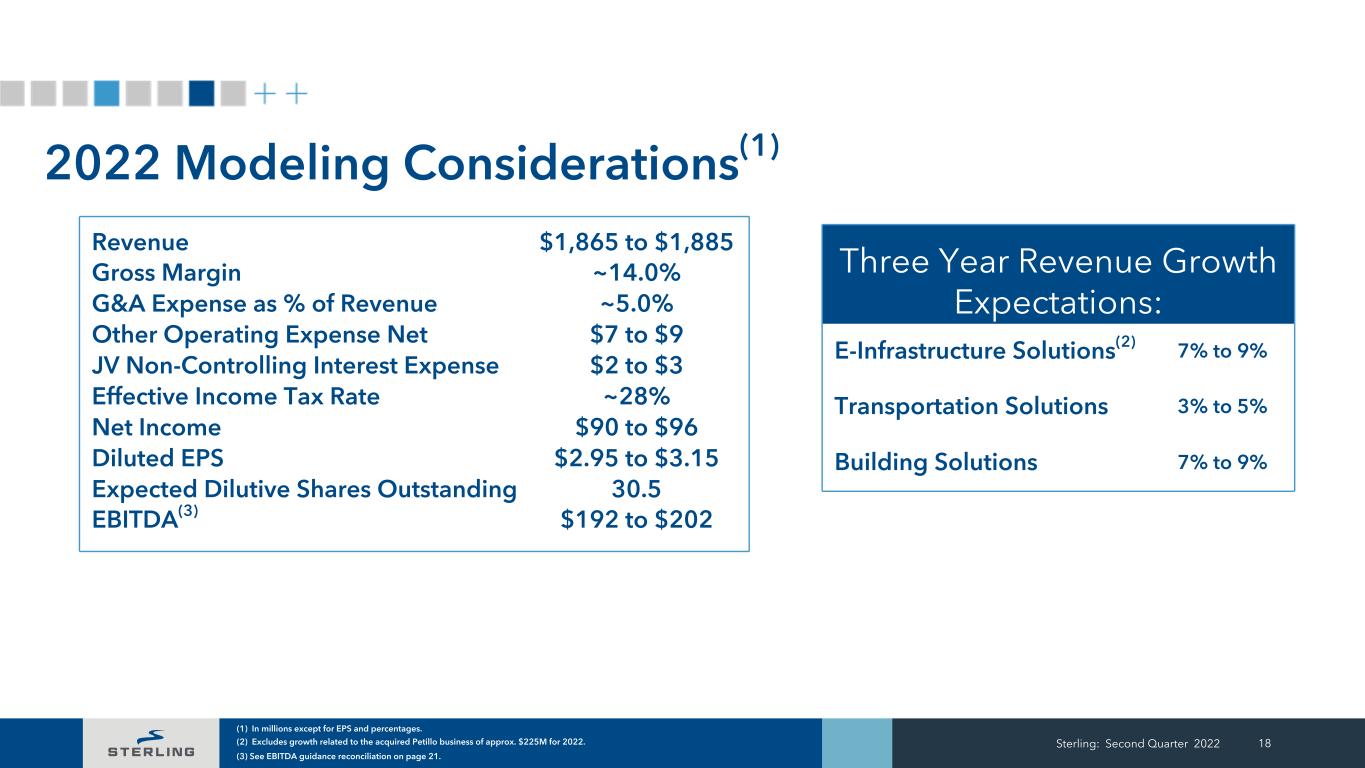

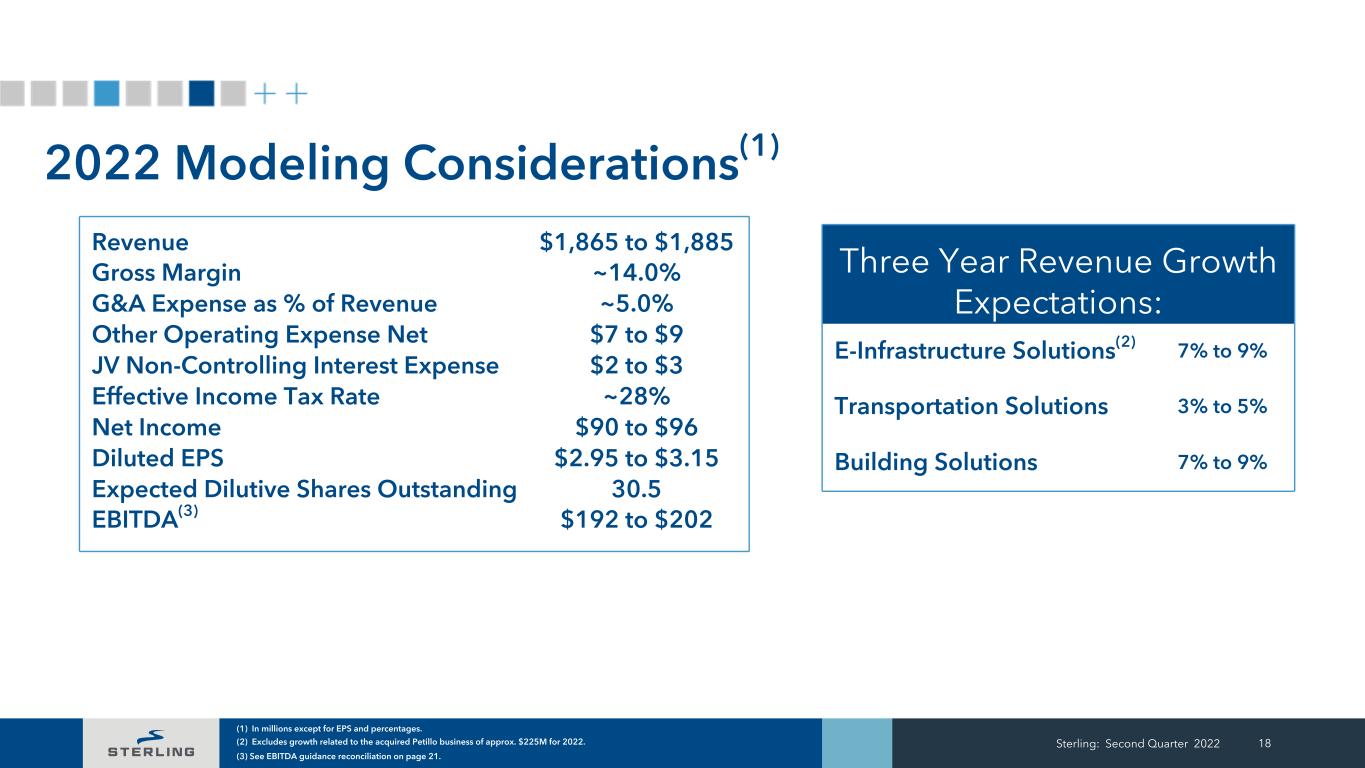

2022 Modeling Considerations(1) Sterling: Second Quarter 2022 18 (1) In millions except for EPS and percentages. (2) Excludes growth related to the acquired Petillo business of approx. $225M for 2022. (3) See EBITDA guidance reconciliation on page 21. Three Year Revenue Growth Expectations: E-Infrastructure Solutions(2) 7% to 9% Transportation Solutions 3% to 5% Building Solutions 7% to 9% Revenue $1,865 to $1,885 Gross Margin ~14.0% G&A Expense as % of Revenue ~5.0% Other Operating Expense Net $7 to $9 JV Non-Controlling Interest Expense $2 to $3 Effective Income Tax Rate ~28% Net Income $90 to $96 Diluted EPS $2.95 to $3.15 Expected Dilutive Shares Outstanding 30.5 EBITDA(3) $192 to $202

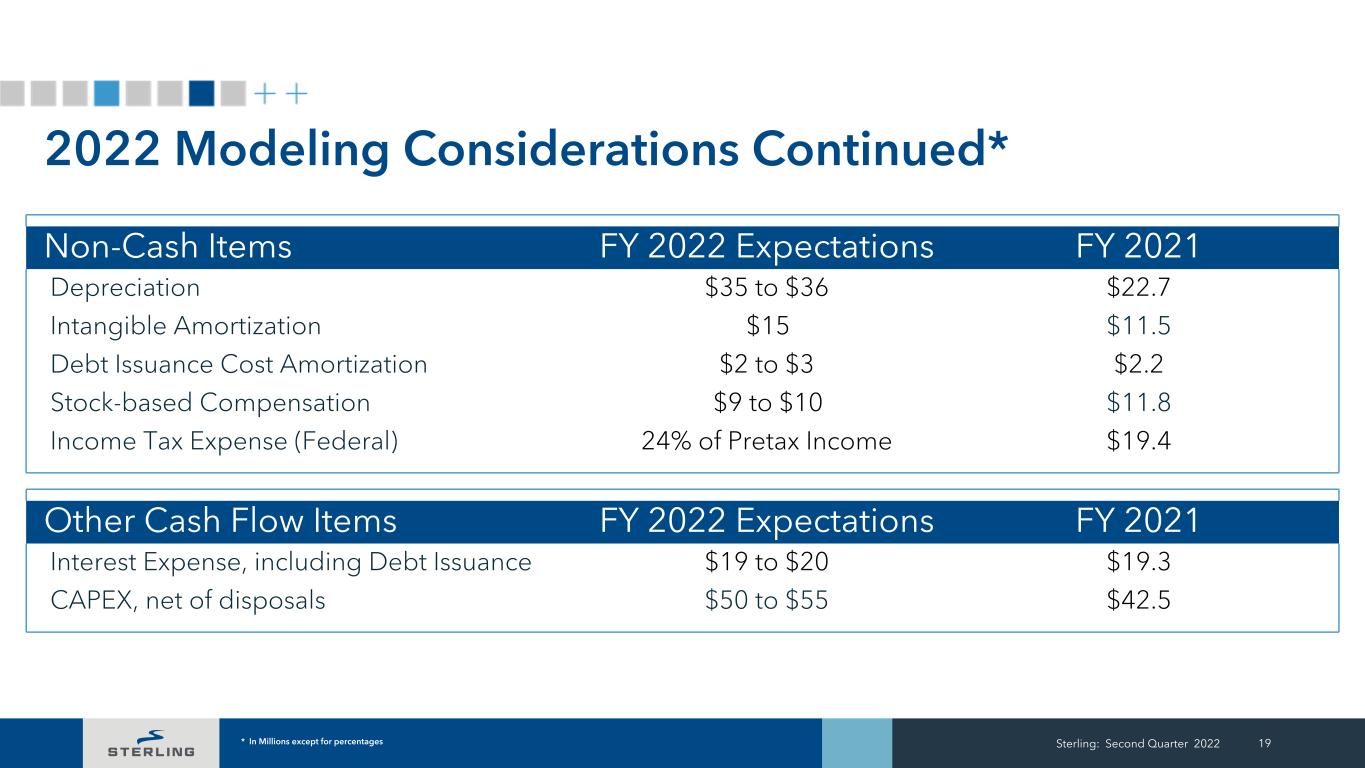

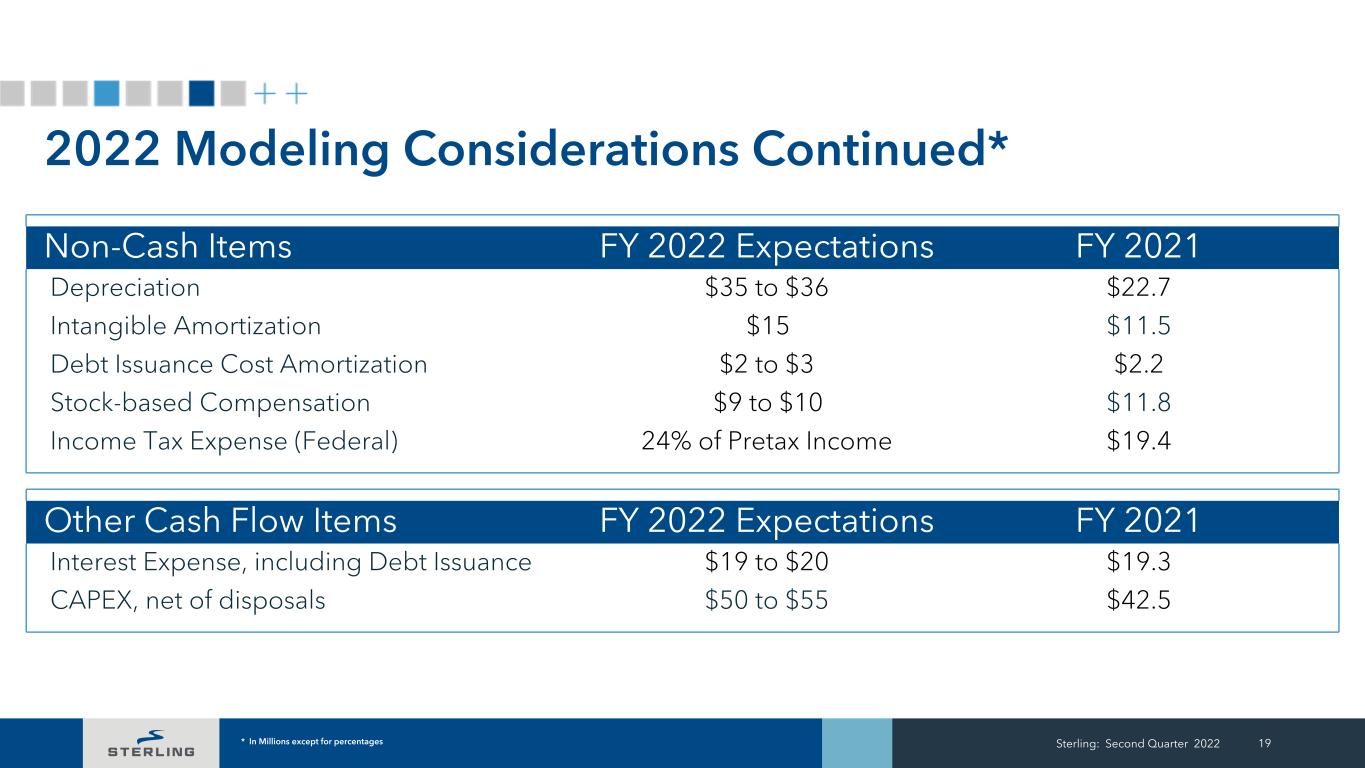

Sterling: Second Quarter 2022 19 2022 Modeling Considerations Continued* * In Millions except for percentages Non-Cash Items FY 2022 Expectations FY 2021 Depreciation $35 to $36 $22.7 Intangible Amortization $15 $11.5 Debt Issuance Cost Amortization $2 to $3 $2.2 Stock-based Compensation $9 to $10 $11.8 Income Tax Expense (Federal) 24% of Pretax Income $19.4 Other Cash Flow Items FY 2022 Expectations FY 2021 Interest Expense, including Debt Issuance $19 to $20 $19.3 CAPEX, net of disposals $50 to $55 $42.5

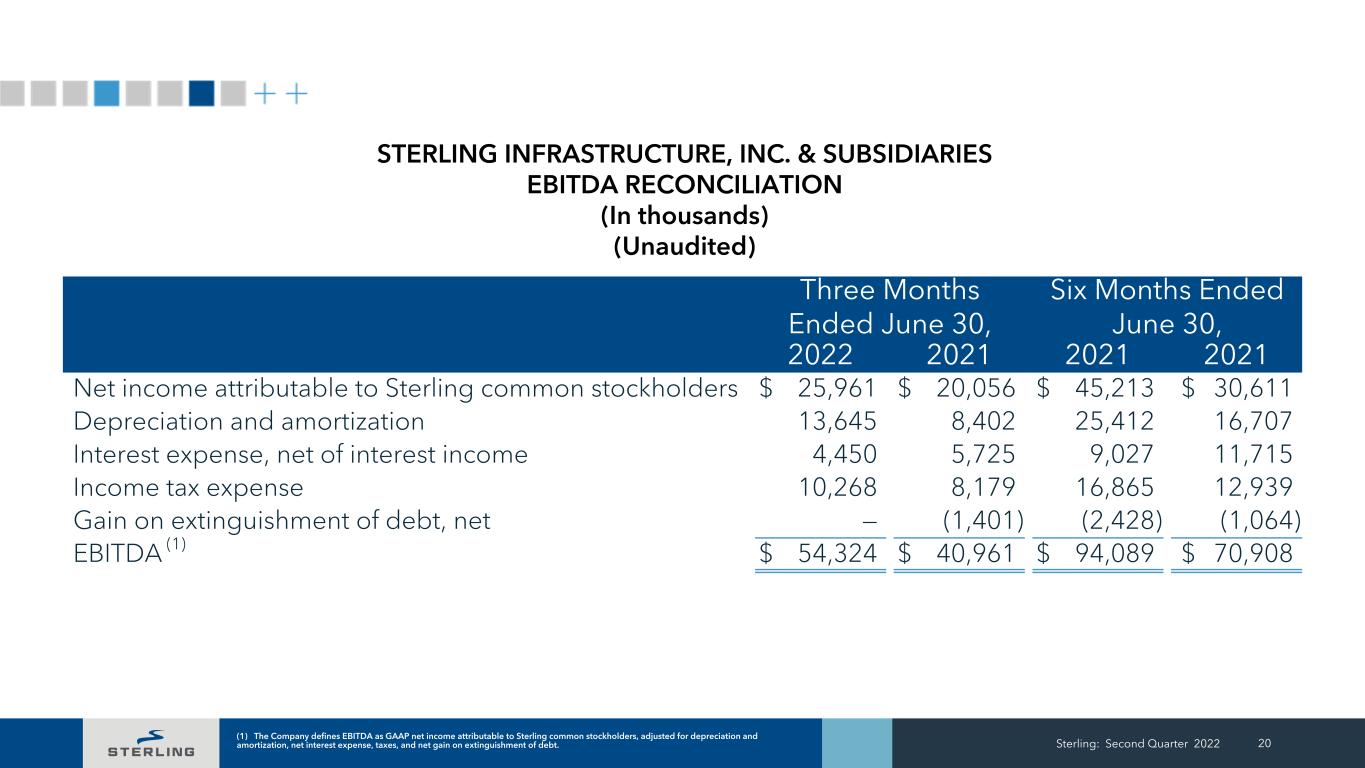

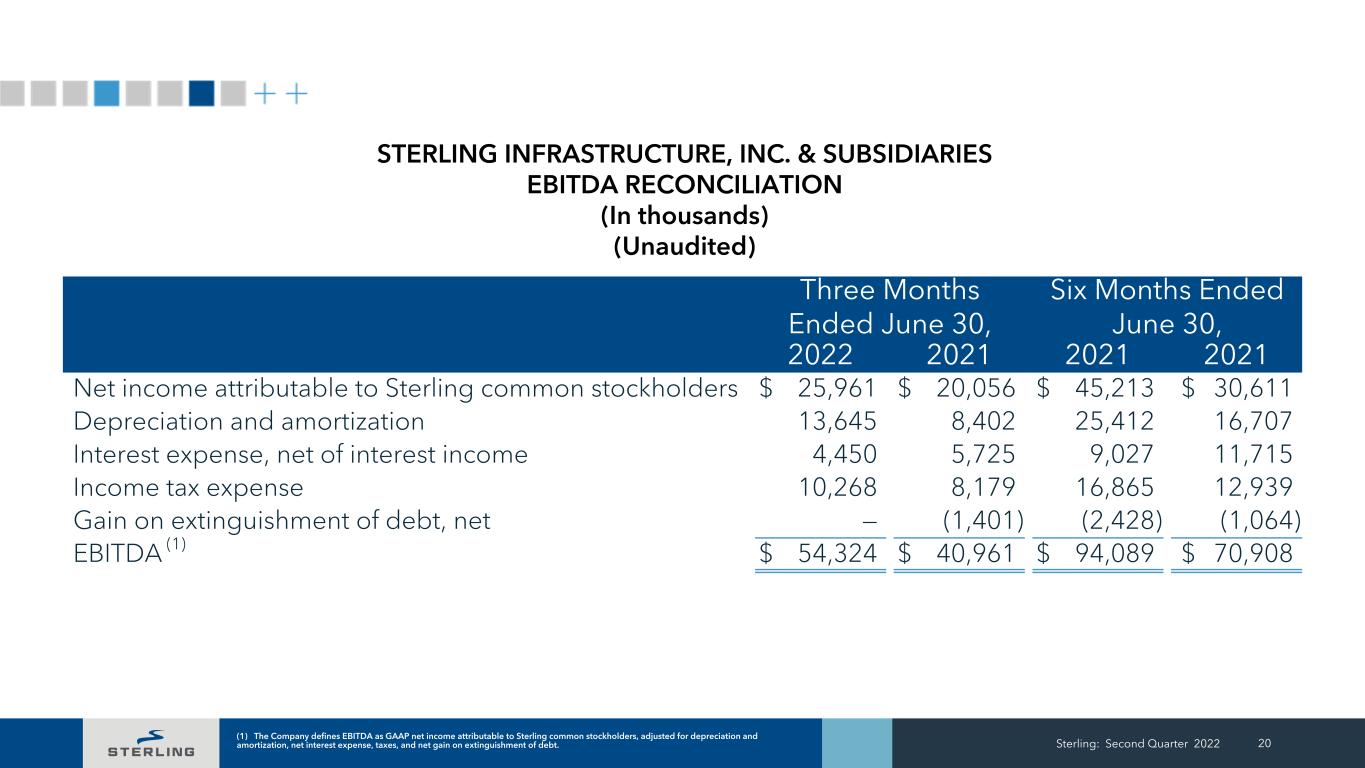

Sterling: Second Quarter 2022 20 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense, taxes, and net gain on extinguishment of debt. Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2021 2021 Net income attributable to Sterling common stockholders $ 25,961 $ 20,056 $ 45,213 $ 30,611 Depreciation and amortization 13,645 8,402 25,412 16,707 Interest expense, net of interest income 4,450 5,725 9,027 11,715 Income tax expense 10,268 8,179 16,865 12,939 Gain on extinguishment of debt, net — (1,401) (2,428) (1,064) EBITDA (1) $ 54,324 $ 40,961 $ 94,089 $ 70,908 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES EBITDA RECONCILIATION (In thousands) (Unaudited)

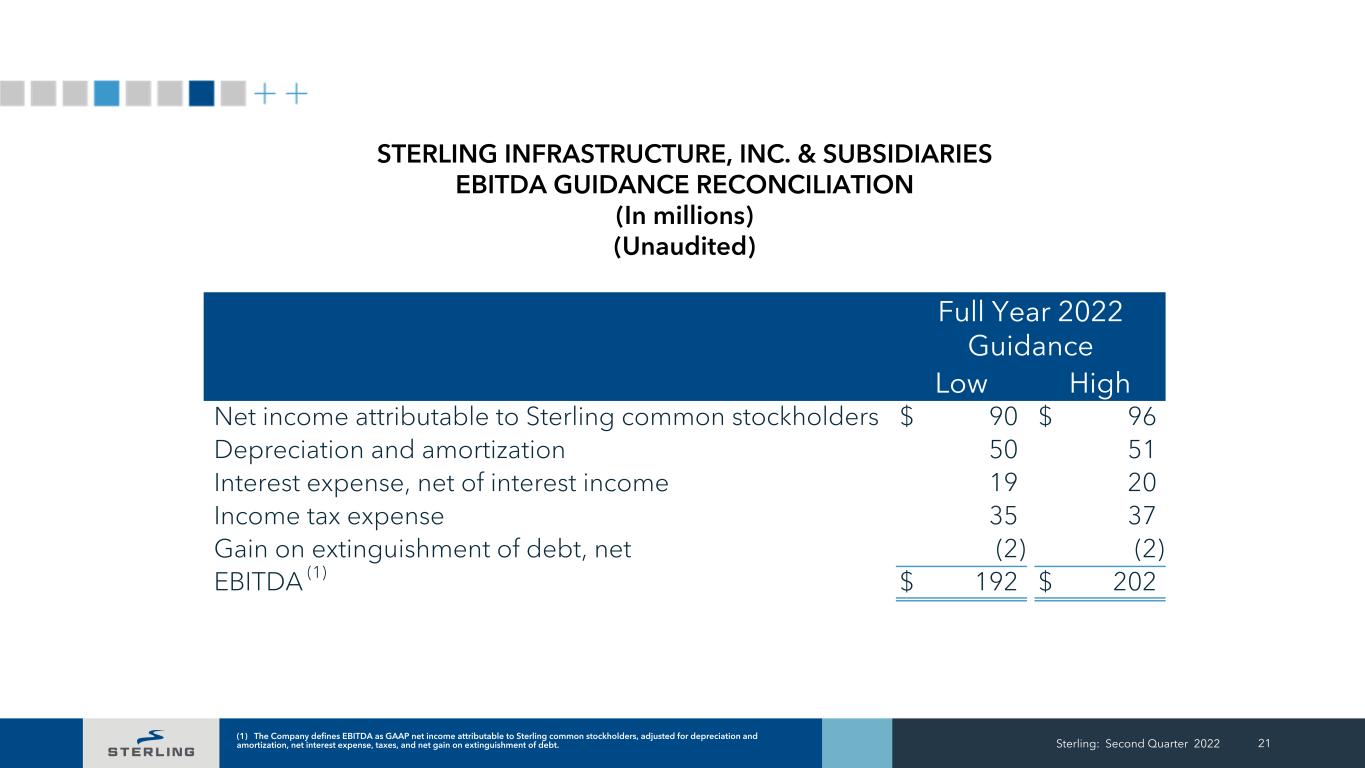

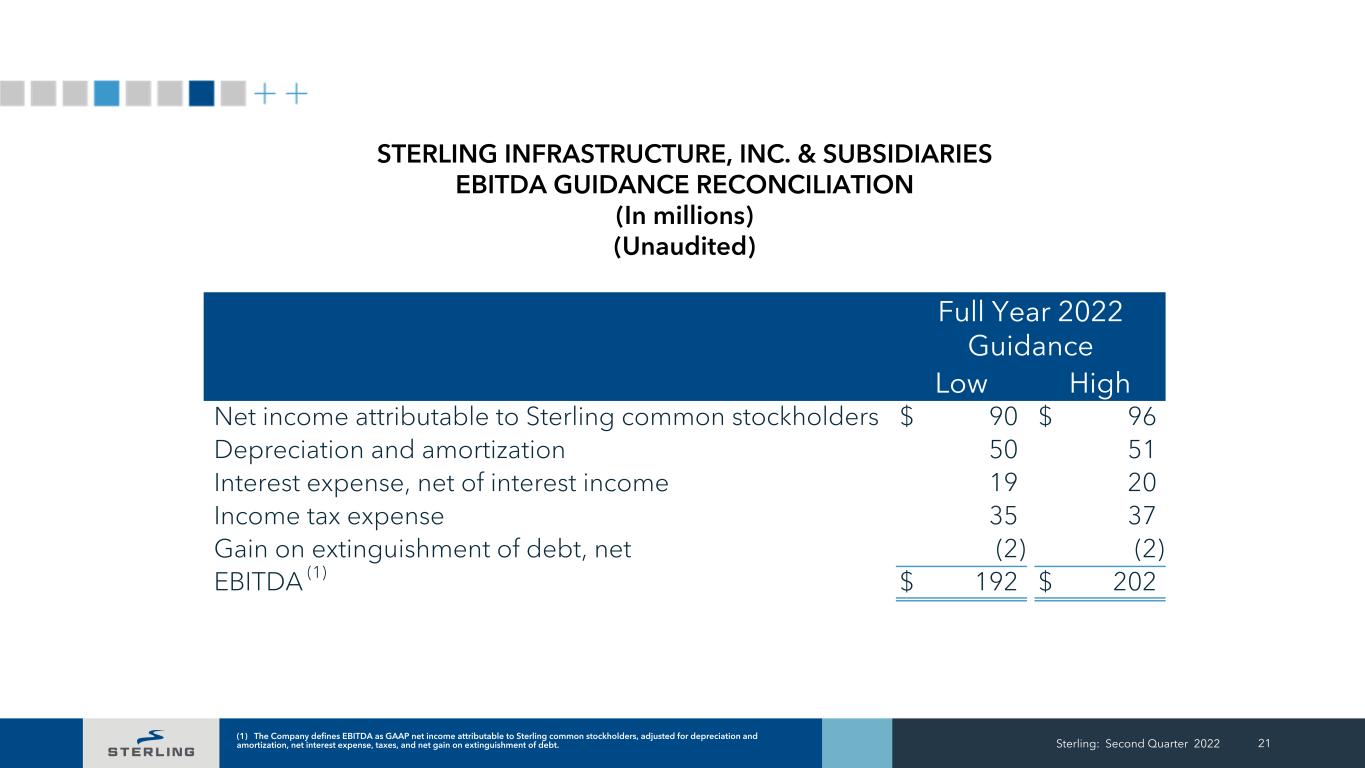

Sterling: Second Quarter 2022 21 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense, taxes, and net gain on extinguishment of debt. Full Year 2022 Guidance Low High Net income attributable to Sterling common stockholders $ 90 $ 96 Depreciation and amortization 50 51 Interest expense, net of interest income 19 20 Income tax expense 35 37 Gain on extinguishment of debt, net (2) (2) EBITDA (1) $ 192 $ 202 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES EBITDA GUIDANCE RECONCILIATION (In millions) (Unaudited)

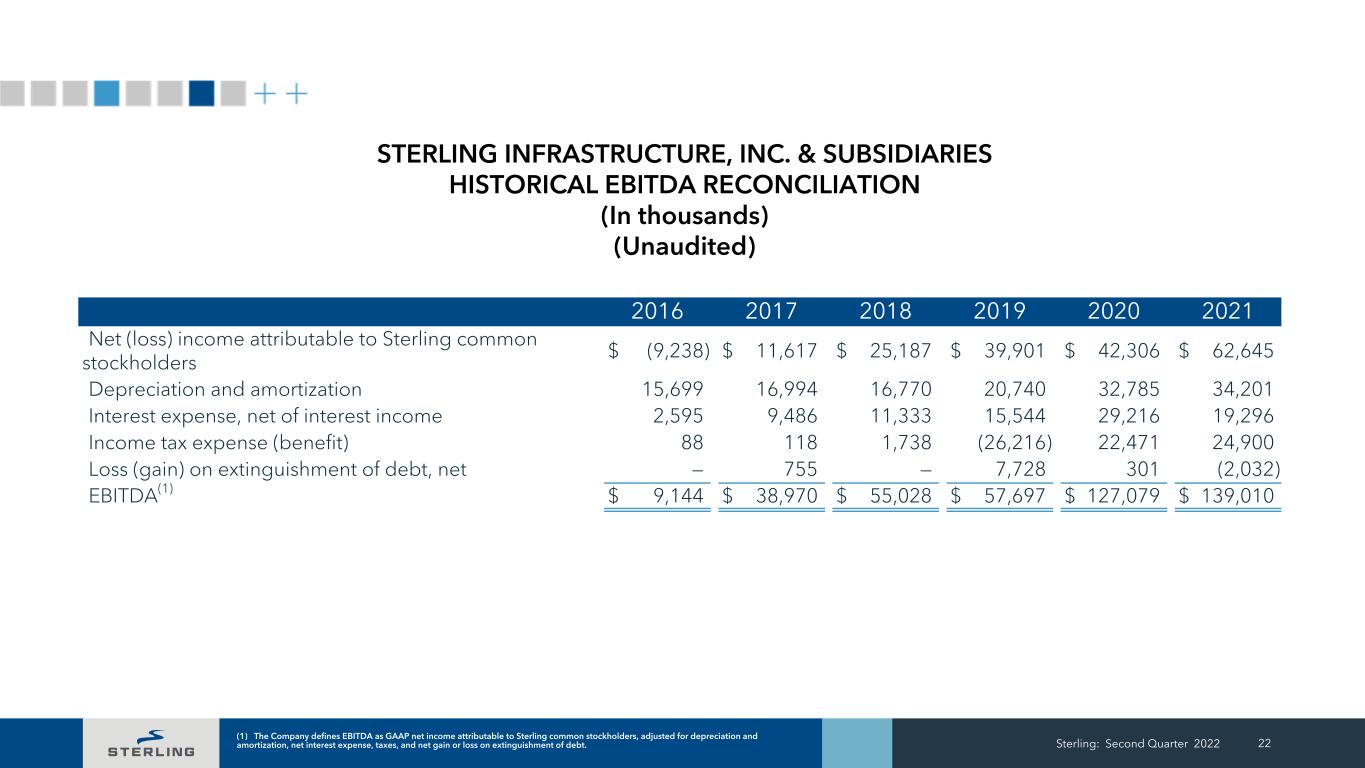

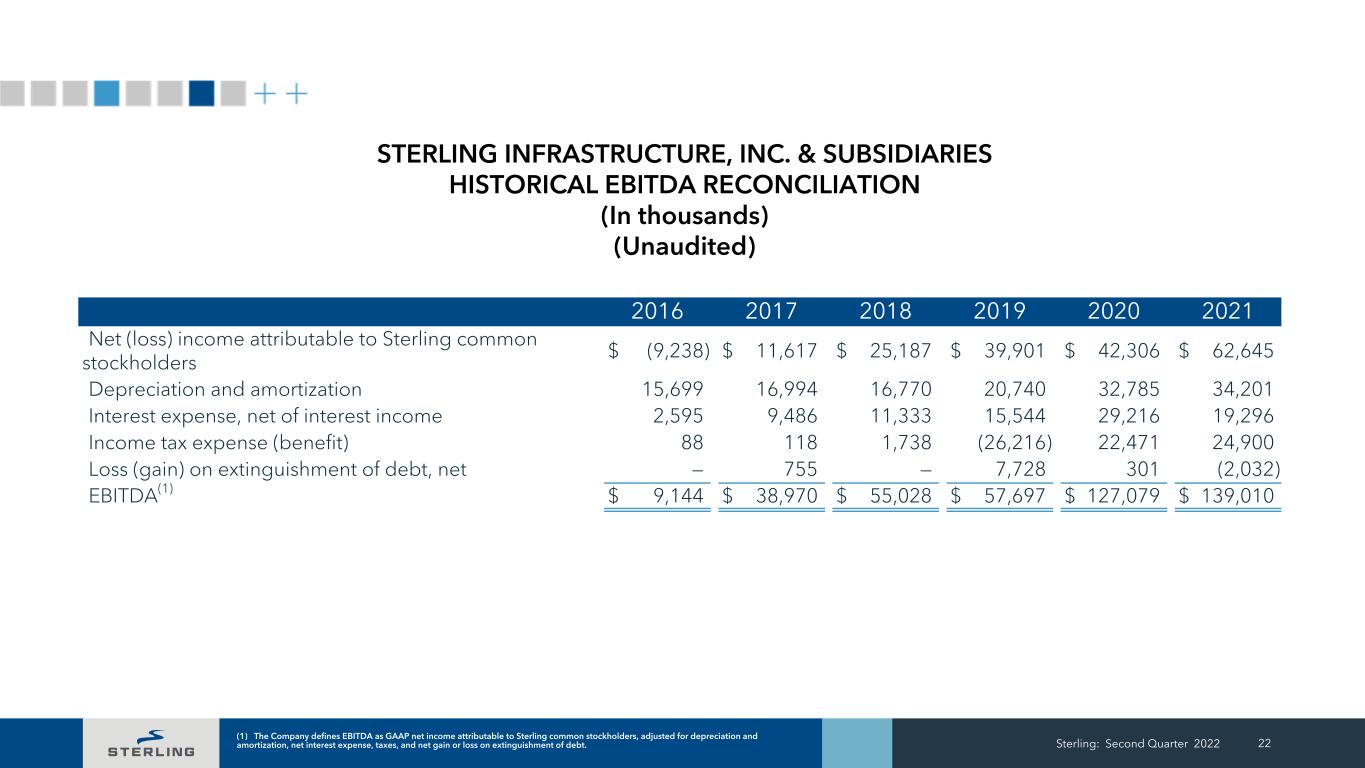

Sterling: Second Quarter 2022 22 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense, taxes, and net gain or loss on extinguishment of debt. 2016 2017 2018 2019 2020 2021 Net (loss) income attributable to Sterling common stockholders $ (9,238) $ 11,617 $ 25,187 $ 39,901 $ 42,306 $ 62,645 Depreciation and amortization 15,699 16,994 16,770 20,740 32,785 34,201 Interest expense, net of interest income 2,595 9,486 11,333 15,544 29,216 19,296 Income tax expense (benefit) 88 118 1,738 (26,216) 22,471 24,900 Loss (gain) on extinguishment of debt, net — 755 — 7,728 301 (2,032) EBITDA(1) $ 9,144 $ 38,970 $ 55,028 $ 57,697 $ 127,079 $ 139,010 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES HISTORICAL EBITDA RECONCILIATION (In thousands) (Unaudited)

ESG at Sterling: The Sterling Way Our Core Values: Safety, Respect and Trust, Excellence, Integrity At Sterling, we understand that what we do has an immediate and significant positive impact on improving human conditions + We build our businesses around meeting the needs of the people we serve providing infrastructure solutions and services for the betterment of our ever-growing society today and tomorrow + Taking care of our employees, customers, the environment and our communities is what we do every day, that’s The Sterling Way Governance & Ethics + Our commitment to an ethical culture starts at the highest level with oversight from our Board of Directors & Executive Leadership Team + Our Chief Compliance Officer leads the ethics and compliance activities Sterling: Second Quarter 2022 23 Building a Better Tomorrow. The Sterling Way - 2022 Sustainability Report published March 23, 2022. The report can be accessed via the Sterling Way (ESG) section of the Company’s website at https:// www.strlco.com/sustainability

THANK YOU We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow.