Exhibit 99.1

Investor Presentation March 2017

DISCLOSURE REGARDING FORWARD - LOOKING STATEMENTS This presentation contains, and the officers and directors of the Company may from time to time make, statements that are considered forward – looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 . These forward - looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about our : business strategy ; financial strategy ; and plans, objectives, expectations, forecasts, outlook and intentions . All of these types of statements, other than statements of historical fact included in this presentation, are forward - looking statements . In some cases, forward - looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology . The forward - looking statements contained in this presentation are largely based on our expectations, which reflect estimates and assumptions made by our management . These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors . Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control . In addition, management’s assumptions about future events may prove to be inaccurate . Management cautions all readers that the forward - looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward - looking events and circumstances will occur . Actual results may differ materially from those anticipated or implied in the forward - looking statements due to factors listed in the “Risk Factors” section in our filings with the U . S . Securities and Exchange Commission (“SEC”) and elsewhere in those filings . The forward - looking statements speak only as of the date made, and other than as required by law, we do not intend to publicly update or revise any forward - looking statements as a result of new information, future events or otherwise . These cautionary statements qualify all forward - looking statements attributable to us or persons acting on our behalf . STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 2

Heavy Highway 72% Rail/Airport 13% [CATEGORY NAME] [VALUE] Port 3% [CATEGORY NAME] [VALUE] Backlog by Project Type COMPANY OVERVIEW Leading heavy civil construction firm with strong competitive positions in the Western U.S. (1) Excludes ~1.9 mm of shares to be issued for pending Tealstone acquisition (2) As of 3/13/17 NASDAQ: STRL Headquarters: The Woodlands, TX Employees: ~1,900 Projects Underway: >140 Average Project Duration: 2 years Shares outstanding: 25.0 mm (1) Market cap: $247.7 mm (2) Revenues – FY’16: $690.1 mm P/BV: 2.19x (2 ) STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 3 FY 2016

4 INVESTMENT HIGHLIGHTS STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 4 New management team has made major progress with turnaround over past 24 months; expect continued operational improvement in 2017 Well positioned in attractive, project - rich geographies Broad range of capabilities supported by large, diverse equipment fleet and ample bonding capacity Strong bookings trends leading to record backlog with highest gross margins in more than five years Favorable government funding environment provides outlook for multi - year growth Significantly improved balance sheet provides greater liquidity at a reduced interest rate Pending acquisition enables expansion into adjacent markets, diversification of revenue streams and customer base with higher margin work

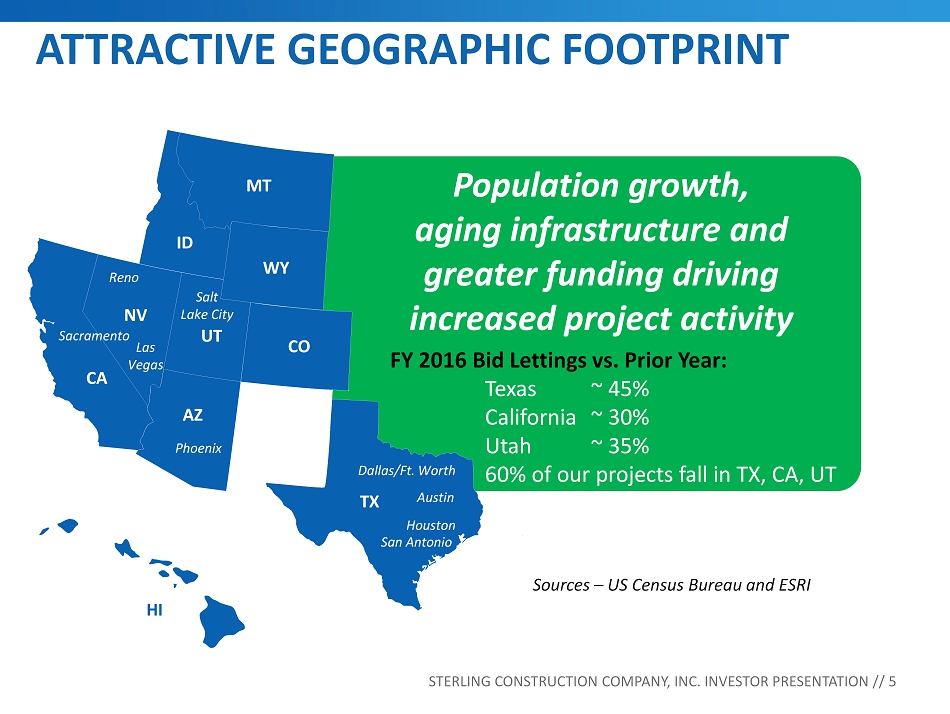

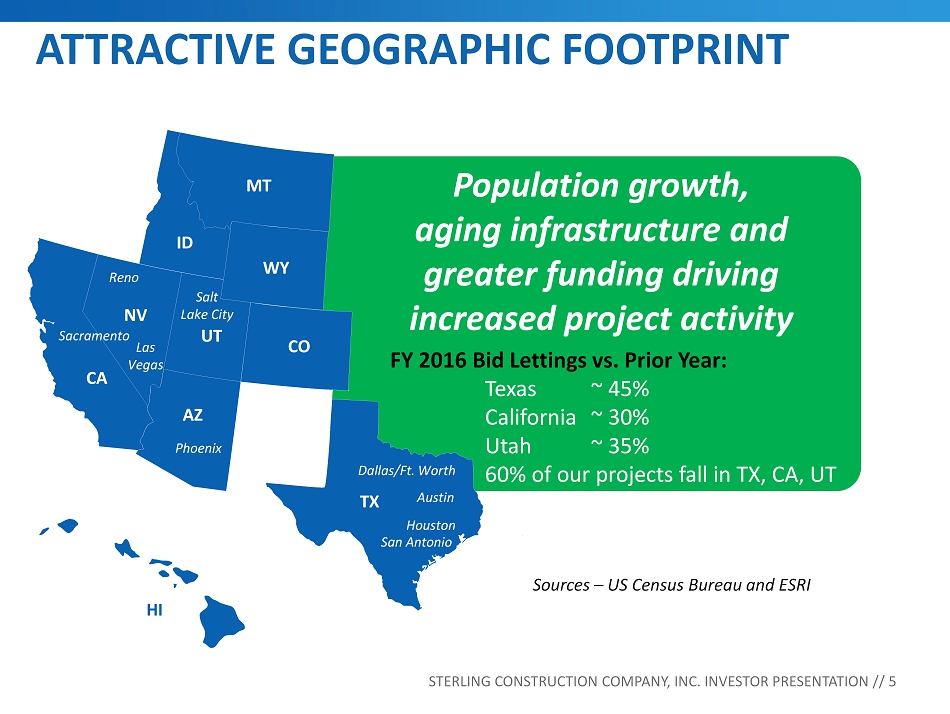

Population growth, aging infrastructure and greater funding driving increased project activity Sources – US Census Bureau and ESRI WA OR ID MT WY NV UT CO AZ CA N TX FL HI Salt Lake City Reno Sacramento Phoenix Las Vegas Dallas/Ft. Worth Austin Houston San Antonio FL ATTRACTIVE GEOGRAPHIC FOOTPRINT FY 2016 Bid Lettings vs. Prior Year: Texas ~ 45% California ~ 30% Utah ~ 35% 60% of our projects fall in TX, CA, UT STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 5

Broad Range of Capabilities Transportation Airport/Rail Specialty Structural Ports Water BROAD RANGE OF CAPABILITIES/END MARKETS

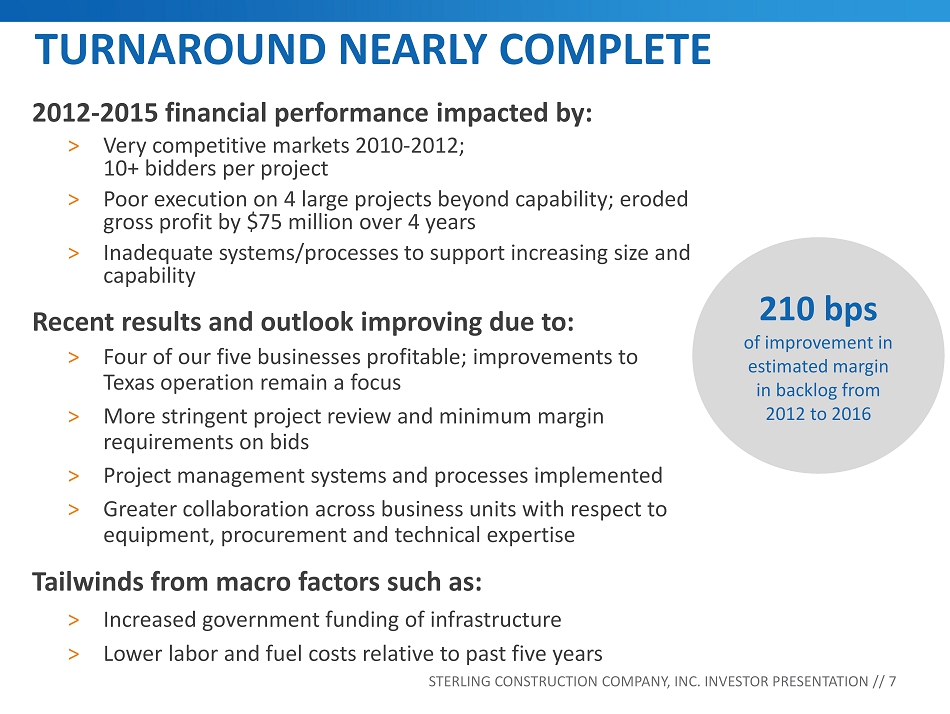

2012 - 2015 financial performance impacted by: > Very competitive markets 2010 - 2012; 10+ bidders per project > Poor execution on 4 large projects beyond capability; eroded gross profit by $75 million over 4 years > Inadequate systems/processes to support increasing size and capability Recent results and outlook improving due to: > Four of our five businesses profitable; improvements to Texas operation remain a focus > More stringent project review and minimum margin requirements on bids > Project management systems and processes implemented > Greater collaboration across business units with respect to equipment, procurement and technical expertise Tailwinds from macro factors such as: > Increased government funding of infrastructure > Lower labor and fuel costs relative to past five years 210 bps of improvement in estimated margin in backlog from 2012 to 2016 TURNAROUND NEARLY COMPLETE STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 7

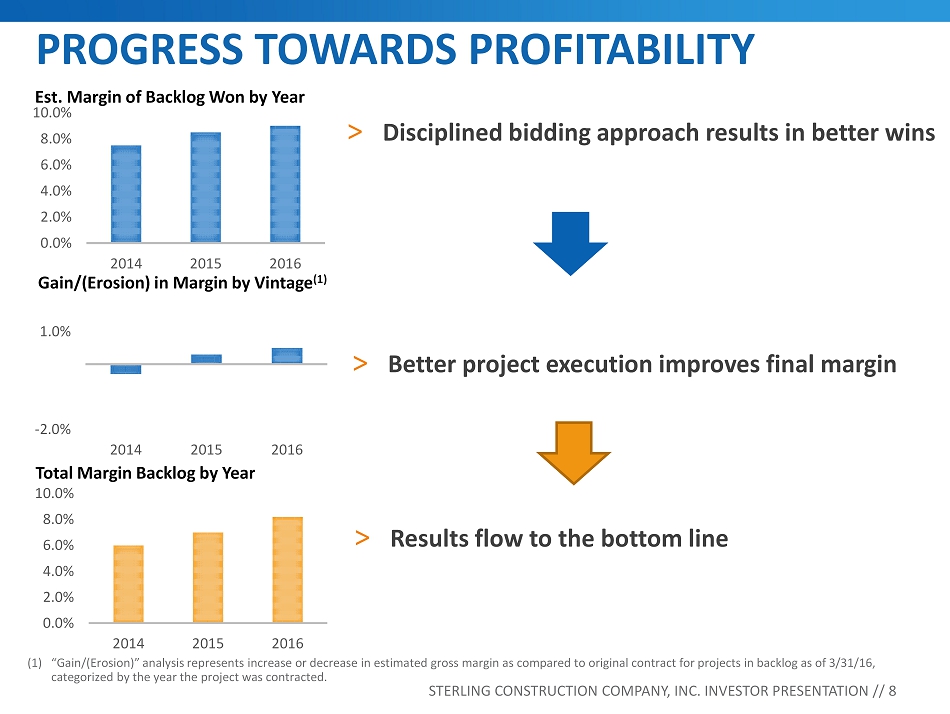

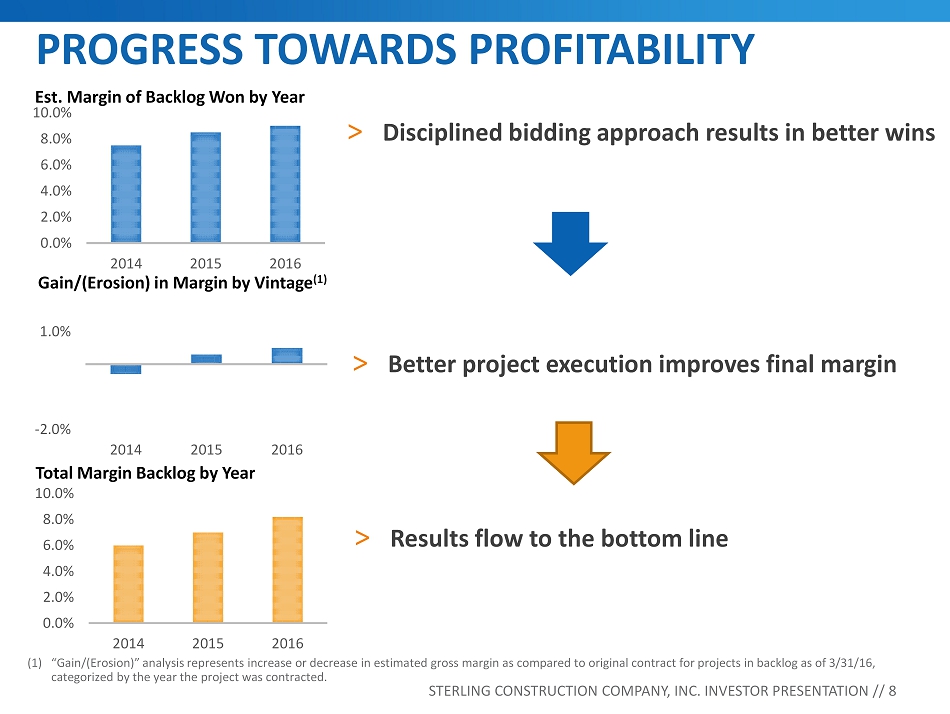

-2.0% 1.0% 2014 2015 2016 Gain/(Erosion) in Margin by Vintage (1) (1) “Gain/(Erosion)” analysis represents increase or decrease in estimated gross margin as compared to original contract for proj ect s in backlog as of 3/31/16, categorized by the year the project was contracted. 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2014 2015 2016 Total Margin Backlog by Year 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2014 2015 2016 Est. Margin of Backlog Won by Year PROGRESS TOWARDS PROFITABILITY STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 8 > Disciplined bidding approach results in better wins > Better project execution improves final margin > Results flow to the bottom line

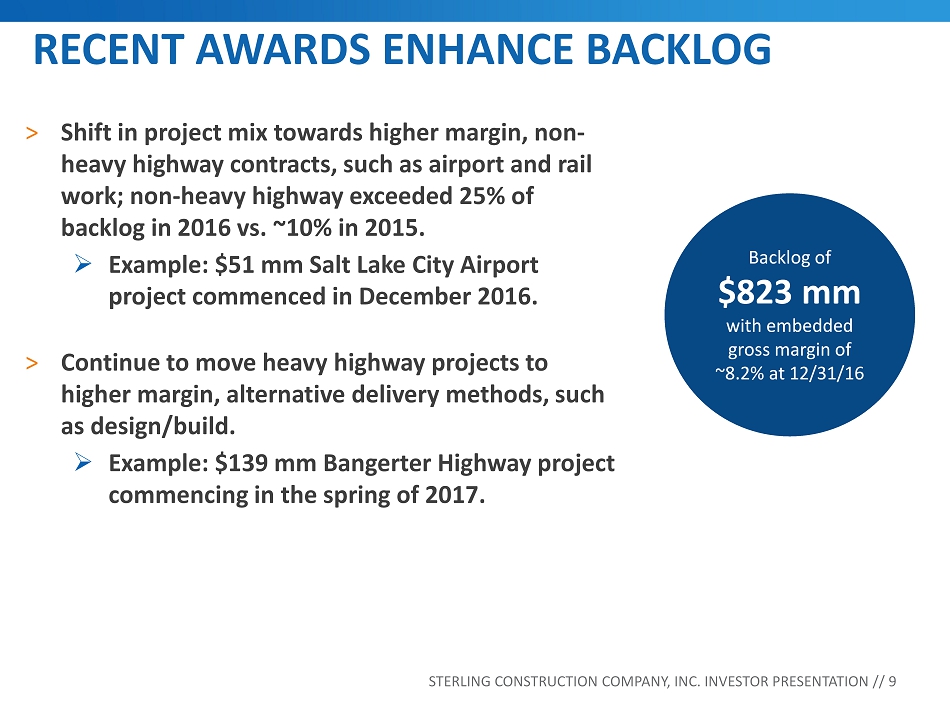

RECENT AWARDS ENHANCE BACKLOG Backlog of $823 mm with embedded gross margin of ~8.2% at 12/31/16 STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 9 > Shift in project mix towards higher margin, non - heavy highway contracts, such as airport and rail work; non - heavy highway exceeded 25% of backlog in 2016 vs. ~10% in 2015. » Example: $51 mm Salt Lake City Airport project commenced in December 2016. > Continue to move heavy highway projects to higher margin, alternative delivery methods, such as design/build. » Example: $139 mm Bangerter Highway project commencing in the spring of 2017.

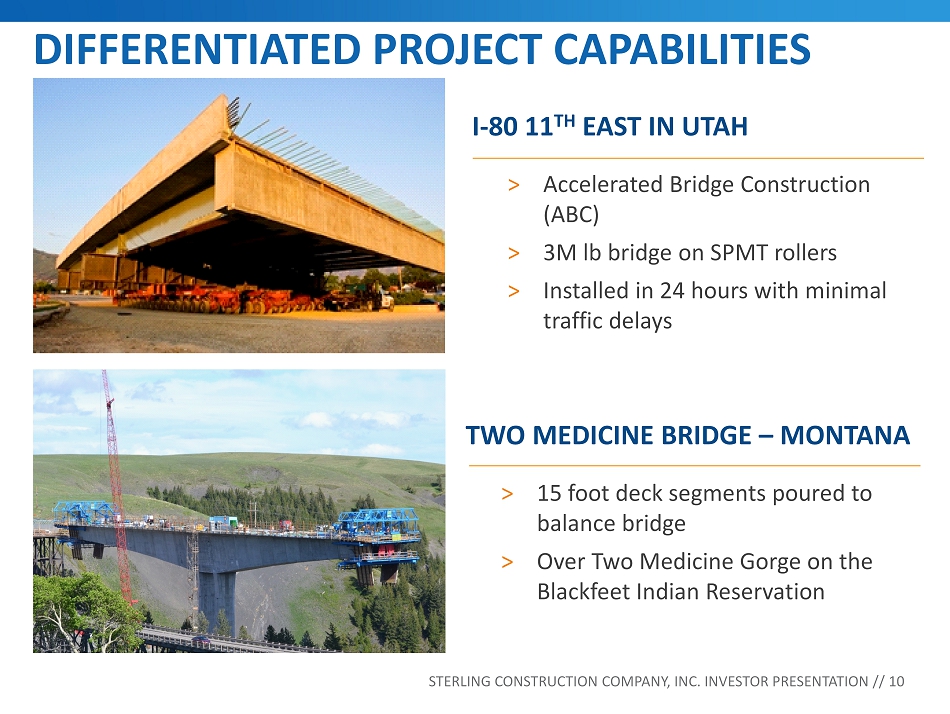

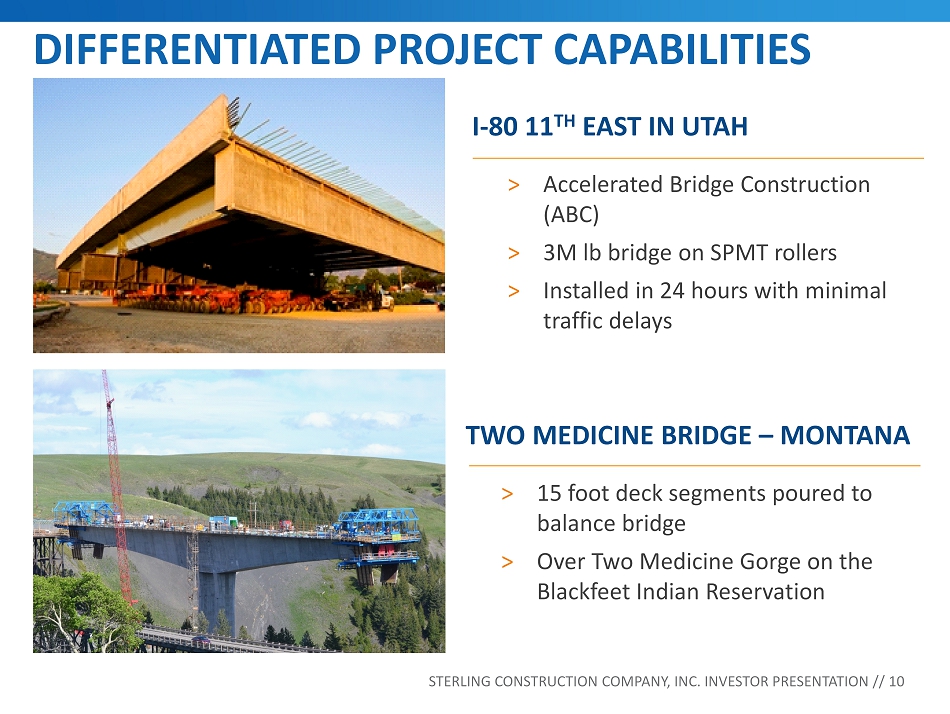

I - 80 11 TH EAST IN UTAH > Accelerated Bridge Construction (ABC) > 3M lb bridge on SPMT rollers > Installed in 24 hours with minimal traffic delays TWO MEDICINE BRIDGE – MONTANA > 15 foot deck segments poured to balance bridge > Over Two Medicine Gorge on the Blackfeet Indian Reservation DIFFERENTIATED PROJECT CAPABILITIES STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 10

POSITIVE TRENDS IN STATE AND LOCAL INITIATVES FOR TRANSPORTATION INFRASTRUCTURE > Proposition 7 provides TxDOT $2.5 billion per year > Proposition 1 provides $1.5 to $2 billion per year in 2016 - 2017 > Governor Brown’s “Senate Bill 1,” a $6 billion state transportation funding plan expected to pass during first quarter of 2017 > 20% gas tax increase effective January 2016 > Recently passed a $1 billion bond package for road improvements CA UT FAVORABLE FUNDING ENVIRONMENT TX Federal Highway Bill $305 B over next five years STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 11

TEALSTONE ACQUISITION 1 2

TEALSTONE - STRATEGIC RATIONALE STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 13 Expansion into adjacent markets. Diversifies revenue streams. Broadens customer base. Attractive margins. Provides operational synergies. Expertise presents expanded and attractive project opportunities.

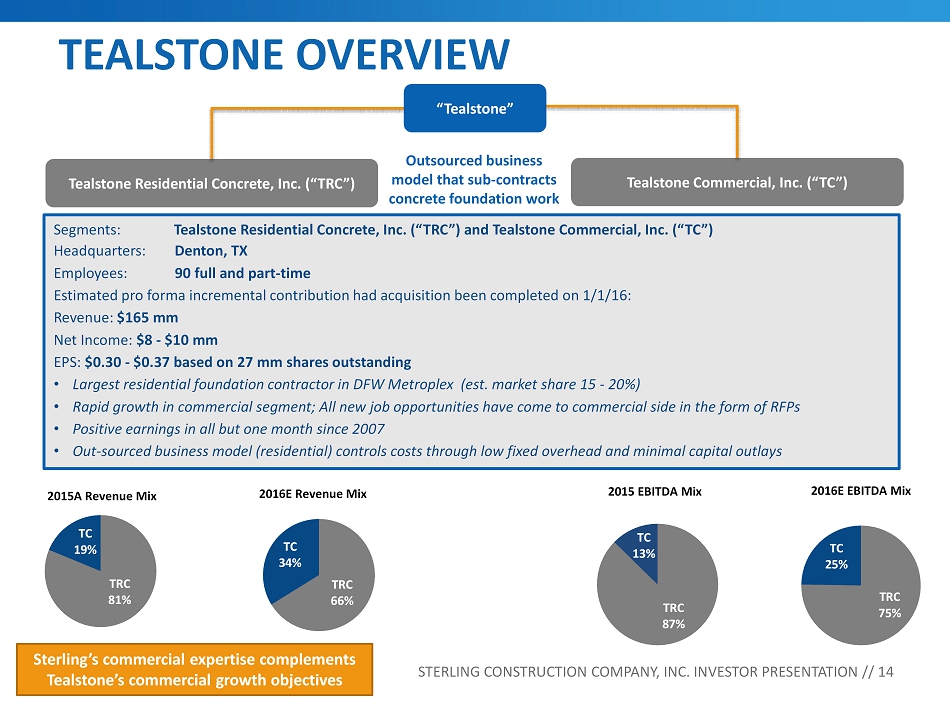

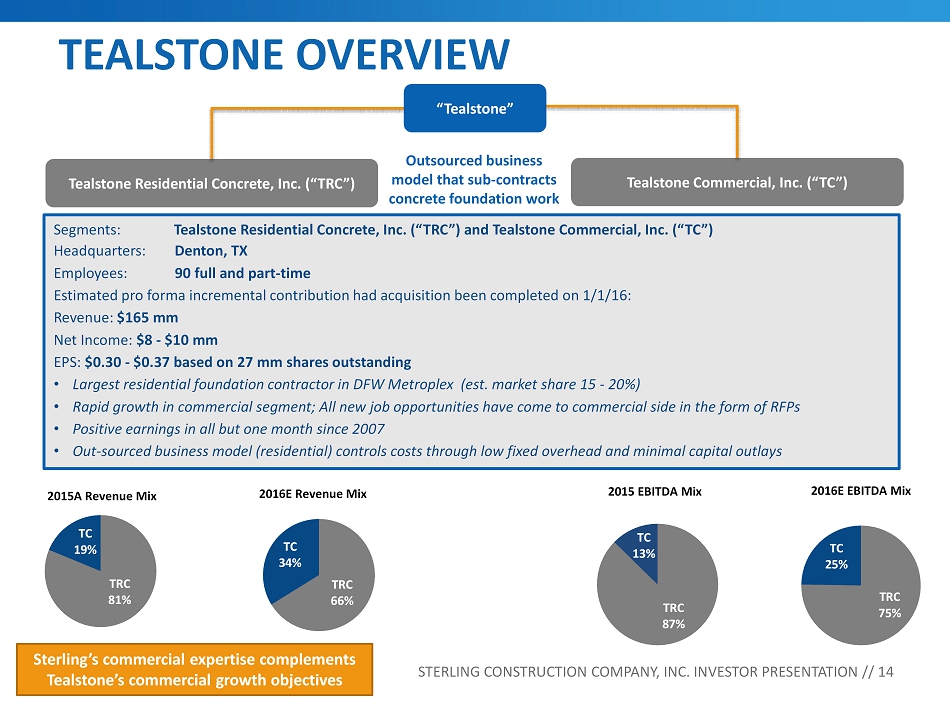

TEALSTONE OVERVIEW STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 14 Tealstone Commercial, Inc. (“TC”) Tealstone Residential Concrete, Inc. (“TRC”) “ Tealstone ” Outsourced business model that sub - contracts concrete foundation work Segments: Tealstone Residential Concrete, Inc. (“TRC”) and Tealstone Commercial, Inc. (“TC”) Headquarters: Denton, TX Employees: 90 full and part - time Estimated pro forma incremental contribution had acquisition been completed on 1/1/16: Revenue: $165 mm Net Income: $8 - $10 mm EPS: $0.30 - $0.37 based on 27 mm shares outstanding • Largest residential foundation contractor in DFW Metroplex (est. market share 15 - 20%) • Rapid growth in commercial segment; All new job opportunities have come to commercial side in the form of RFPs • Positive earnings in all but one month since 2007 • Out - sourced business model (residential) controls costs through low fixed overhead and minimal capital outlays TRC 87% TC 13% 2015 EBITDA Mix TRC 75 % TC 25% 2016E EBITDA Mix TRC 81 % TC 19% 2015A Revenue Mix TRC 66% TC 34% 2016E Revenue Mix Sterling’s commercial expertise complements Tealstone’s commercial growth objectives

STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 15 TEALSTONE RESIDENTIAL CONCRETE, INC. (“TRC”) > Largest residential concrete contractor in DFW Metroplex > Estimated market share 15 - 20% > Strong reputation among leading residential homebuilders > Turnkey concrete contracting > Foundations > Flatwork > Driveways, walkways > Sidewalks, A/C pad > Growth opportunities > Leverage relationships to expand throughout TX / adjacent states > Add complimentary lines > Roads > Curbing > Gutters > Small bridges Top 3 customers make up >60% of revenue: 1. D.R. Horton 2. Pulte Group 3. History Maker Homes

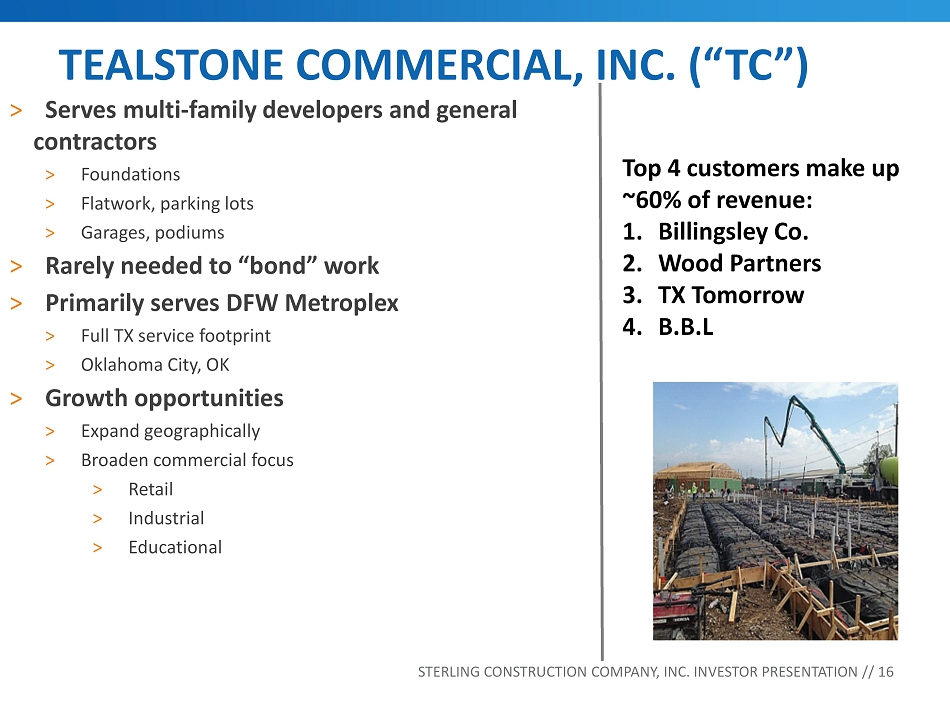

STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 16 TEALSTONE COMMERCIAL, INC. (“TC”) > Serves multi - family developers and general contractors > Foundations > Flatwork, parking lots > Garages, podiums > Rarely needed to “bond” work > Primarily serves DFW Metroplex > Full TX service footprint > Oklahoma City, OK > Growth opportunities > Expand geographically > Broaden commercial focus > Retail > Industrial > Educational Top 4 customers make up ~60% of revenue: 1. Billingsley Co. 2. Wood Partners 3. TX Tomorrow 4. B.B.L

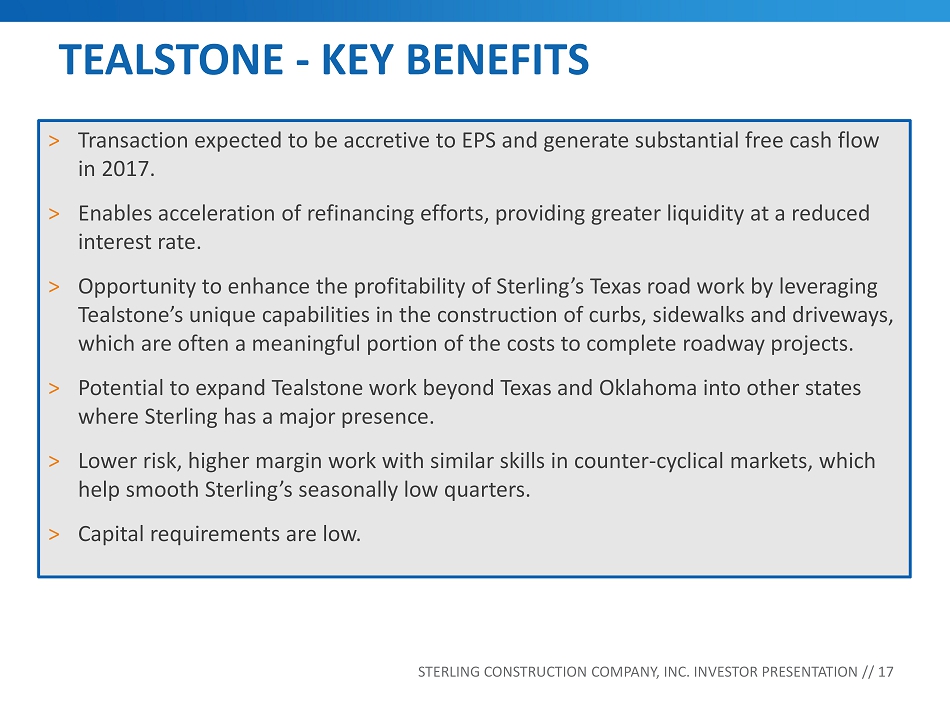

TEALSTONE - KEY BENEFITS STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 17 > Transaction expected to be accretive to EPS and generate substantial free cash flow in 2017. > Enables acceleration of refinancing efforts, providing greater liquidity at a reduced interest rate. > Opportunity to enhance the profitability of Sterling’s Texas road work by leveraging Tealstone’s unique capabilities in the construction of curbs, sidewalks and driveways, which are often a meaningful portion of the costs to complete roadway projects. > Potential to expand Tealstone work beyond Texas and Oklahoma into other states where Sterling has a major presence. > Lower risk, higher margin work with similar skills in counter - cyclical markets, which help smooth Sterling’s seasonally low quarters. > Capital requirements are low.

STERLING FINANCIAL SUMMARY

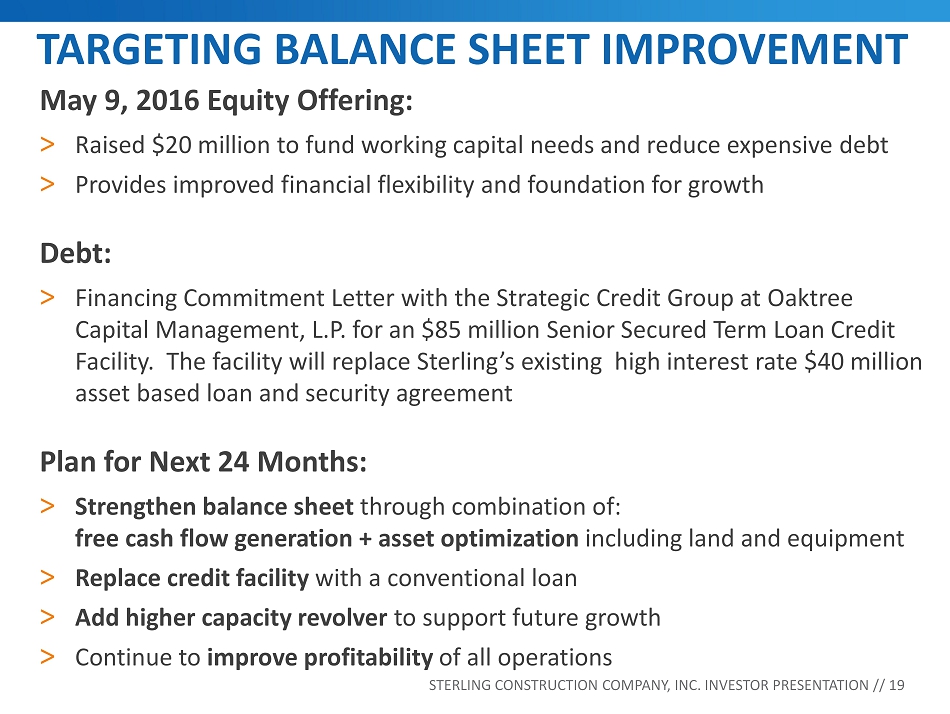

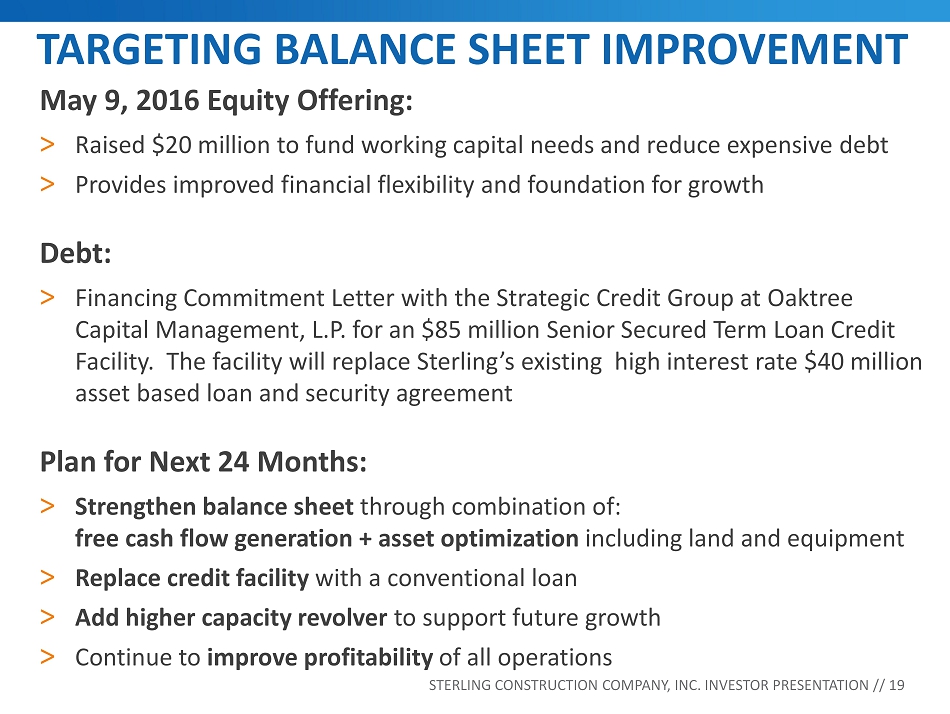

TARGETING BALANCE SHEET IMPROVEMENT May 9, 2016 Equity Offering: > Raised $20 million to fund working capital needs and reduce expensive debt > Provides improved financial flexibility and foundation for growth Debt: > Financing Commitment Letter with the Strategic Credit Group at Oaktree Capital Management, L.P. for an $85 million Senior Secured Term Loan Credit Facility. The facility will replace Sterling’s existing high interest rate $40 million asset based loan and security agreement Plan for Next 24 Months: > Strengthen balance sheet through combination of: free cash flow generation + asset optimization including land and equipment > Replace credit facility with a conventional loan > Add higher capacity revolver to support future growth > Continue to improve profitability of all operations STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 19

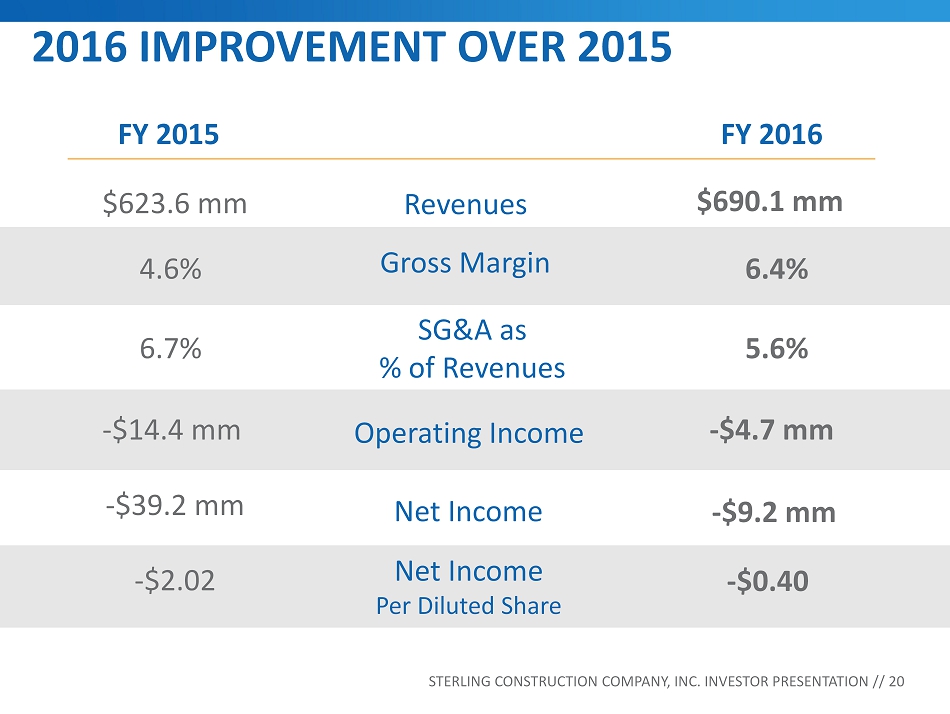

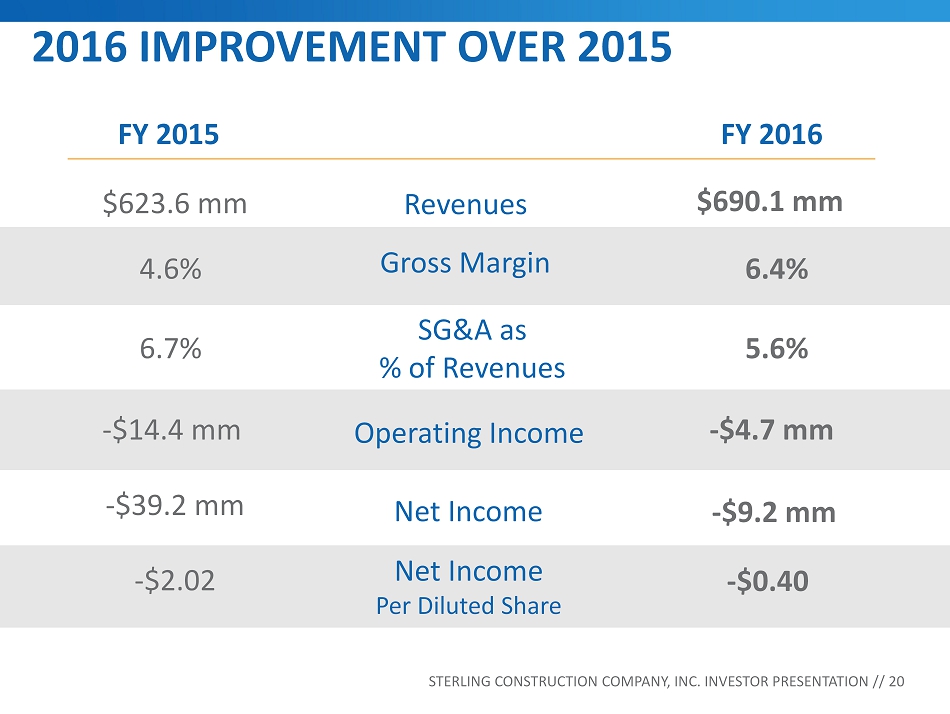

2016 IMPROVEMENT OVER 2015 FY 2015 FY 2016 Revenues $623.6 mm $690.1 mm Gross Margin 4.6% 6.4% SG&A as % of Revenues 6.7% 5.6% - $14.4 mm - $4.7 mm - $2.02 - $ 0.40 20 - $39.2 mm - $9.2 mm Net Income Net Income Per Diluted Share Operating Income STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 20

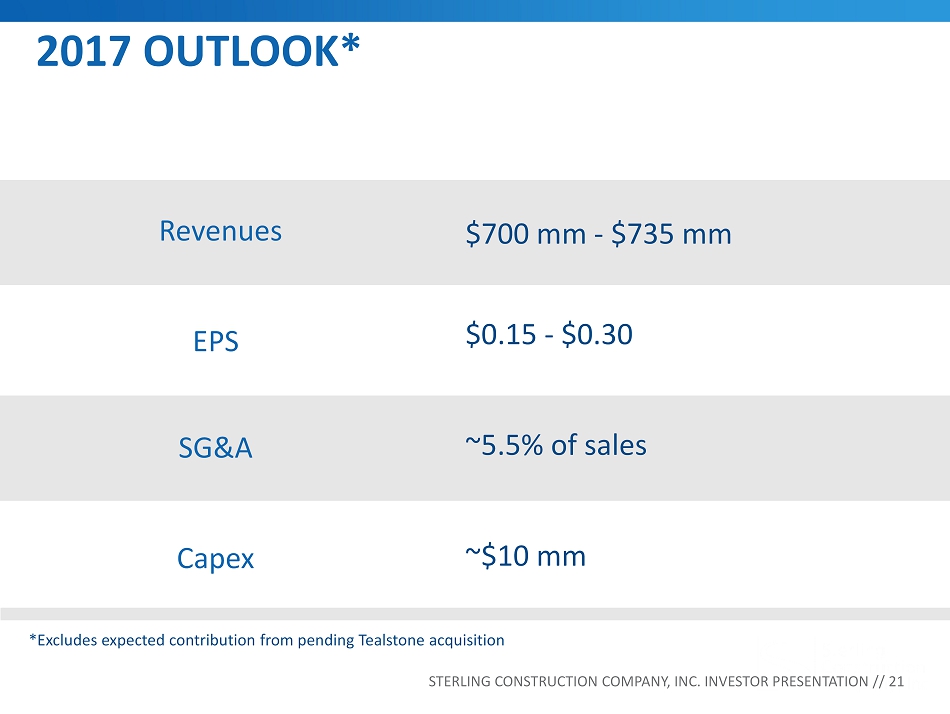

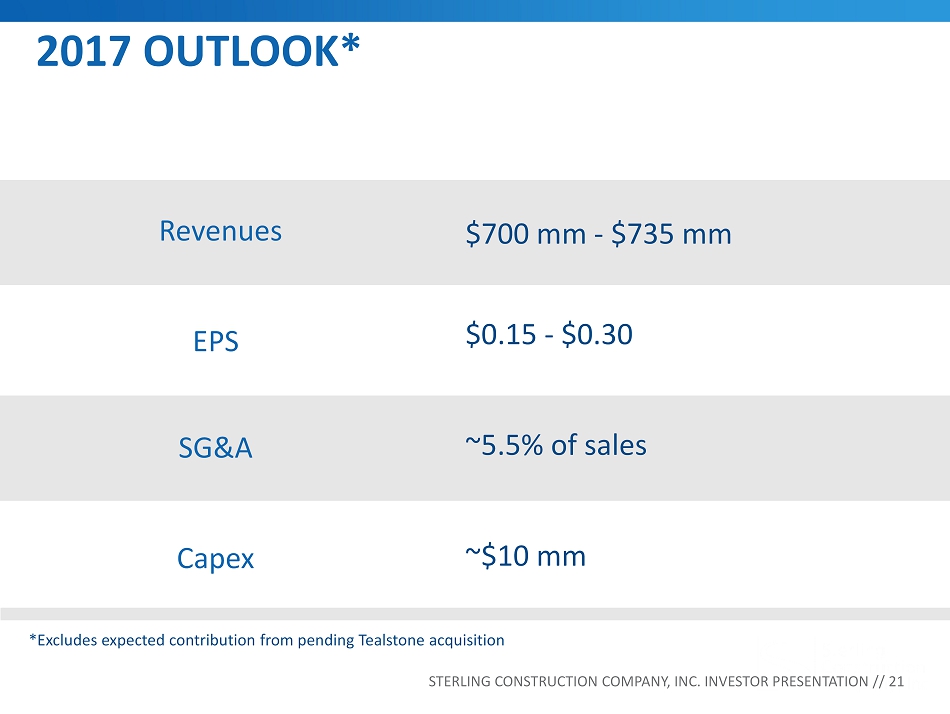

21 2017 OUTLOOK* Revenues $700 mm - $735 mm EPS SG&A Capex STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 21 $0.15 - $0.30 ~5.5% of sales ~$10 mm *Excludes expected contribution from pending Tealstone acquisition

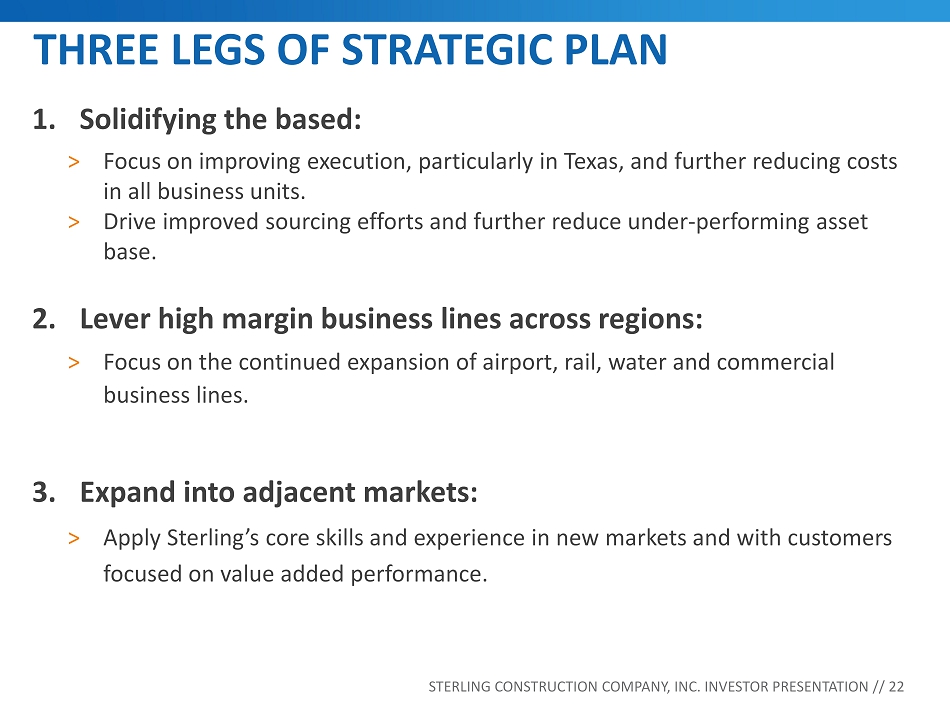

THREE LEGS OF STRATEGIC PLAN STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 22 1. Solidifying the based: > Focus on improving execution, particularly in Texas, and further reducing costs in all business units. > Drive improved sourcing efforts and further reduce under - performing asset base. 2. Lever high margin business lines across regions: > Focus on the continued expansion of airport, rail, water and commercial business lines. 3. Expand into adjacent markets: > Apply Sterling’s core skills and experience in new markets and with customers focused on value added performance.

4 INVESTMENT HIGHLIGHTS STERLING CONSTRUCTION COMPANY, INC. INVESTOR PRESENTATION // 23 New management team has made major progress with turnaround over past 24 months; expect continued operational improvement in 2017 Well positioned in attractive, project - rich geographies Broad range of capabilities supported by large, diverse equipment fleet and ample bonding capacity Strong bookings trends leading to record backlog with highest gross margins in more than five years Favorable government funding environment provides outlook for multi - year growth Significantly improved balance sheet provides greater liquidity at a reduced interest rate Pending acquisition enables expansion into adjacent markets, diversification of revenue streams and customer base with higher margin work

CONTACT US Jennifer Maxwell Director of Investor Relations 281 - 951 - 3560 Jennifer.Maxwell@strlco.com Fred Buonocore, CFA Senior Vice President 212 - 836 - 9607 fbuonocore@equityny.com Kevin Towle Associate 212 - 836 - 9620 ktowle@equityny.com www.strlco.com Company Representative Sterling Construction Company, Inc. Investor Relations Advisors The Equity Group Inc.