Exhibit (a)(1)(L)

Omnicare

Jeffries & Company, Inc.

Specialty and Post-Acute Services

June 15, 2004

Forward-Looking Statements

Except for historical information discussed, the statements made today are forward-looking statements that involve risks and uncertainties.

Investors are cautioned that such statements are only predictions and that actual events or results may differ materially.

These forward-looking statements speak only as of this date. We undertake no obligation to publicly release the results of any revisions to the forward-looking statements made today, to reflect events or circumstances after today or to reflect the occurrence of unanticipated events.

To facilitate comparisons and enhance understanding of core operating performance, certain financial measures have been adjusted from the comparable amount under generally accepted accounting principals (GAAP) to exclude the impact of special items. A detailed reconciliation of adjusted numbers to GAAP is posted on our web site at www.omnicare.com.

2

Omnicare’s Offer for NeighborCare

Premium Value and Certainty of Cash

•$ 30.00 per share in cash with fully committed financing

– 70% premium to stock price day prior to public announcement offer

– 40% premium to 30-day average stock price (ending May 21, 2004)

– 30% premium to analysts’ median 12-month stock price targets

–$ 4 per share more than NeighborCare’s previous all time high

• Equity Value: $1.3 billion

• Transaction Value: $1.5 billion(1)

• Tender offer expiration: July 7, 2004 (5:00 PM NYC time)

1. Calculated as equity value plus debt ($258 million), minority interest ($10 million) less cash ($91 million), as per public filings. 3

Omnicare’s Offer for NeighborCare

Creation of a Premier Institutional Pharmacy

• Stronger, more efficient company with greater resources to provide quality care and expanded services

• Annualized pro forma revenues of $5.4 billion and EBITDA of $634 million (pre-synergies)(1)

• Opportunities for good management talent in dynamic and rapidly growing healthcare services company

• Substantial benefits for both sets of shareholders and other constituencies

1. March 31, 2004 quarter annualized. EBITDA excludes NCRX “strategic planning, severance and other operating items.” 4

Omnicare’s Offer for NeighborCare

Value Creation for Both Sets of Shareholders

NeighborCare Omnicare

Premium valuation 9Premier institutional pharmacy

All-cash consideration 9Stronger combined company

No market or execution risk 9Substantial potential synergies

Immediacy and certainty 9Significantly accretive to EPS of value

Compelling Opportunity for all Shareholders

5

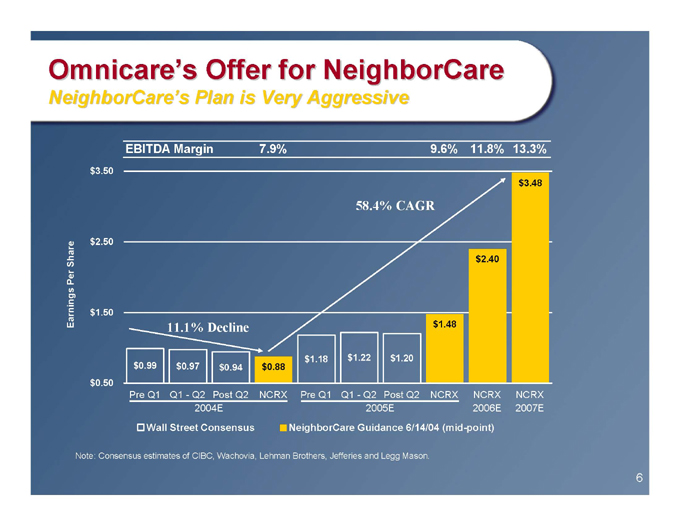

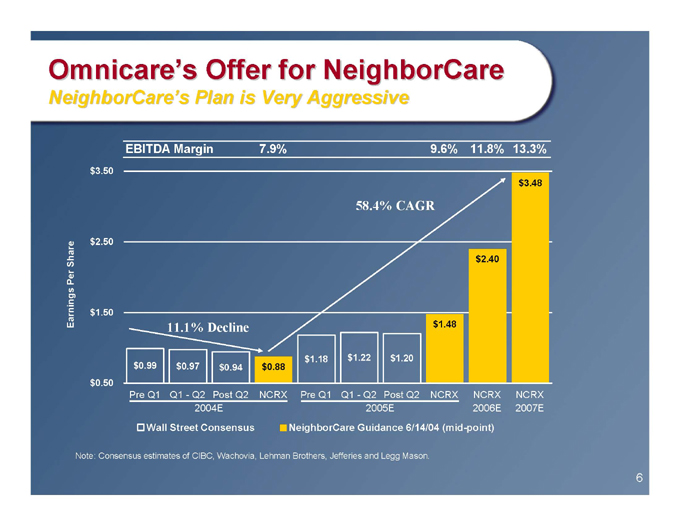

Omnicare’s Offer for NeighborCare

NeighborCare’s Plan is Very Aggressive

EBITDA Margin 7.9% 9.6% 11.8% 13.3%

$3.50 $3.48

58.4% CAGR

$2.50

Per Share $2.40 Earnings $1.50

11.1% Decline $1.48

$1.18 $1.22 $1.20 $0.99 $0.97 $0.94 $0.88 $0.50

Pre Q1 Q1—Q2 Post Q2 NCRX Pre Q1 Q1—Q2 Post Q2 NCRX NCRX NCRX

2004E 2005E 2006E 2007E

Wall Street Consensus NeighborCare Guidance 6/14/04 (mid-point)

Note: Consensus estimates of CIBC, Wachovia, Lehman Brothers, Jefferies and Legg Mason.

6

Omnicare’s Offer for NeighborCare

Transaction Summary

• Premium offer for shareholders and other constituents

• Immediate certainty of value – removal of market and execution risk

• Reaction from both sets of shareholders is exceptional

• Willing to discuss all aspects of the offer

7