UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20649

SCHEDULE 14A

(Rule 14a - 101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant T

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement |

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| T Definitive Proxy Statement | |

| o Definitive Additional Materials |

o Soliciting Material Pursuant to § 240.14a-12 |

ADDvantage Technologies Group, Inc.

(Name of Registrant As Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| T | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title to each class of securities to which transaction applies: |

___________________________________________________________________________

| 2) | Aggregate number of securities to which transaction applies: |

___________________________________________________________________________

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0- 11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

____________________________________________________________________________

| 4) | Proposed maximum aggregate value of transaction: |

____________________________________________________________________________

| 5) | Total fee paid: |

____________________________________________________________________________

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid: _________________________________________________________________________

2) Form, Schedule or Registration Statement No.: _________________________________________________________

3) Filing Party: ___________________________________________________________________________________

4) Date Filed: ____________________________________________________________________________________

ADDvantage Technologies Group, Inc.

1221 East Houston

Broken Arrow, Oklahoma 74012

NOTICE OF ANNUAL MEETING

Date: Tuesday, March 6, 2007

Time: 10:00 A.M.

Place: Corporate Office of ADDvantage Technologies Group, Inc.

1221 East Houston

Broken Arrow, Oklahoma 74012

Matters to be voted on:

1. Election of five directors. |

2. Ratification of the appointment of Hogan & Slovacek as our independent auditors for 2007. |

| 3. Any other business properly brought before the shareholders at the meeting |

| By Order of the Board of Directors, |

/s/: Daniel E. O'Keefe

| Daniel E. O'Keefe, Chief Financial Officer and Secretary |

January 19, 2007

| CONTENTS | |

| Page | |

PROXY STATEMENT

Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope. This proxy statement has information about the annual meeting and was prepared by our management for the Board of Directors. This proxy statement is first being sent to shareholders on or about February 5, 2007. Please note that our annual report accompanies this mailing of the proxy statement.

2

ADDvantage Technologies Group, Inc.

1221 East Houston

Broken Arrow, Oklahoma 74012

PROXY STATEMENT FOR 2007 ANNUAL MEETING

Who can attend the annual meeting?

All stockholders of the record date, January 17, 2007.

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares on January 17, 2007. A total of 10,233,756 shares of common stock can vote at the annual meeting. You get one vote for each share of common stock. We do not recognize cumulative voting for the election of our directors. The enclosed proxy card shows the number of shares you can vote.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the annual meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote for each of the five directors and for the ratification of Hogan & Slovacek as independent auditors.

What if other matters come up at the annual meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares as they see fit.

Can I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you can change your vote either by giving our secretary a written notice revoking your proxy card or by signing, dating and returning to us a new proxy card. We will honor the proxy card with the latest date. Attendance at the annual meeting will not, by itself, revoke your proxy card.

Can I vote in person at the annual meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you can attend the annual meeting and vote your shares in person. If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

How are votes counted?

We will hold the annual meeting if holders of a majority of the shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card. Votes will be tabulated by an inspector of election appointed by our Board of Directors. Abstentions from voting, which you may specify on the ratification of the appointment of Hogan & Slovacek as independent auditors, will have the effect of a negative vote.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (so-called “broker nonvotes”), the nominee may vote them on the proposals to elect directors and to ratify the appointment of Hogan & Slovacek as our independent auditors. Additionally, broker nonvotes will be counted as present to determine if a quorum exists.

What percentage of stock are the directors and executive officers entitled to vote at the annual meeting?

Together, they own 4,519,000 shares of our common stock, or 44.2% of the stock entitled to vote at the Annual Meeting.

Who are the largest principal stockholders?

Kenneth A. Chymiak, our Chief Executive Officer, beneficially owns 2,046,000 shares of our common stock, or 20.0% of the stock entitled to vote at the Annual Meeting. David E. Chymiak, our Vice President and Chairman of the Board, beneficially owns 2,414,000 shares of our common stock, or 23.6% of the stock entitled to vote at the Annual Meeting.

Who pays for this proxy solicitation?

The accompanying proxy is solicited by and on behalf of our Board of Directors, and the entire cost will be paid by us. In addition to sending you these materials, some of our employees may contact you by telephone, by mail or in person. None of these employees will receive any extra compensation for doing this, but they may be reimbursed for their out-of-pocket expenses incurred while assisting us in soliciting your proxy.

3

We have three executive officers. Our officers are elected by our Board of Directors and serve at the pleasure of the board.

David E. Chymiak

Biographical information for Mr. Chymiak, the Chairman of our Board since 1999, is set forth below in Proposal No. 1, Election of Directors.

Kenneth A. Chymiak

Biographical information for Mr. Chymiak, our President and Chief Executive Officer since 1999, is set forth below in Proposal No. 1, Election of Directors.

Daniel E. O'Keefe

Daniel E. O'Keefe, 38, has been our Vice President, Chief Financial Officer and Secretary since March 6, 2006. Mr. O'Keefe has approximately 16 years of finance and management experience. Prior to joining us, Mr. O'Keefe served as president of Interstate Express, Inc., a subsidiary of LinkAmerica Corporation, from 2001 through December 2005. Under Mr. O’Keefe’s leadership, revenue for Interstate Express climbed to $30 million in 2005 from $13 million in 2001. From 1997-2001, Mr. O’Keefe served as the corporate controller for LinkAmerica Corporation, a private company with revenues of $130 million in 2001.

Mr. O'Keefe also served as a senior accountant for PricewaterhouseCoopers from 1990 to 1993, where he was responsible for the review of financial statements, audit activities, preparation of management reports including recommendations for enhanced reporting systems and controls, and more, on behalf of numerous private and publicly traded companies. Mr. O'Keefe graduated with a B.S. in accounting from the University of Kansas in 1990 and became a C.P.A. in the state of Oklahoma in 1993.

BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table shows the number of shares of common stock or preferred stock beneficially owned (as of January 17, 2007) by:

| · | each person known by us who beneficially owns more than 5% of any class of our voting stock; |

| · | each director and nominee for director; |

| · | each executive officer named in the Summary Compensation Table on page 11; and |

| · | our directors and executive officers as a group. |

Except as otherwise indicated, the beneficial owners listed in the table have sole voting and investment powers of their shares.

4

Beneficial Ownership

Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned (1) | Percent of Class (1) | Number of Shares of Series B Preferred Stock Beneficially Owned | Percent of Class |

David E. Chymiak 1221 East Houston Broken Arrow, OK 74012 | 2,429,000 (2) | 23.7% | 150,000 | 50.0% |

Kenneth A. Chymiak 1221 East Houston Broken Arrow, OK 74012 | 2,061,000 (2)(7) | 20.1% | 150,000 (10) | 50.0% |

Susan C. Chymiak 1221 East Houston Broken Arrow, OK 74012 | 2,061,000 (2)(8) | 20.1% | 150,000 (11) | 50.0% |

Freddie H. Gibson 8008 S. Erie Avenue Tulsa, OK 74136 | 15,000 (4) | * | -0- | -0- |

Henry F. McCabe 7225 S. 85th E. Avenue Tulsa, OK 74133 | 12,000 (5) | * | -0- | -0- |

Daniel E. O'Keefe 1221 East Houston Broken Arrow, OK 74012 | 7,500 (6) | * | -0- | -0- |

Stephen J. Tyde 1900 Sandwedge Place Wilmington, NC 28405 | 35,000 (3)(9) | * | -0- | -0- |

All Executive Officers and Directors as a group (7 persons) | 4,559,500 (12) | 44.4% | 300,000 | 100% |

_____________________________

* Less than one percent.

| (1) | Shares which an individual has the right to acquire within 60 days pursuant to the exercise of options are deemed to be outstanding for the purpose of computing the percentage ownership of such individual, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table or the percentage ownership of all officers and directors as a group. |

(2) Includes 15,000 shares subject to stock options which are fully exercisable.

(3) Includes 11,000 shares subject to stock options which are fully exercisable.

(4) Includes 12,000 shares subject to stock options which are fully exercisable.

(5) Includes 10,000 shares subject to stock options which are fully exercisable.

(6) Includes 2,500 shares subject to stock options which will become exercisable on March 6, 2007.

(7) Of the shares beneficially owned by Mr. Chymiak, 265,000 are held of record by him as trustee of the Ken Chymiak Revocable Trust and 1,796,000 are held of record by his spouse, Susan C. Chymiak as trustee of the Susan Chymiak Revocable Trust. Mr. Chymiak has sole voting and investment power over those shares held of record by him. Mr. Chymiak disclaims beneficial ownership of the shares held by his wife.

(8) Of the shares beneficially owned by Ms. Chymiak, 1,796,000 are held of record by her as trustee of the Susan Chymiak Revocable Trust and 265,000 are held of record by her spouse, Kenneth A. Chymiak as trustee of the Ken Chymiak Revocable Trust. Ms. Chymiak has sole voting and investment power over those shares held of record by her. Ms. Chymiak disclaims beneficial ownership of the shares held by her husband.

(9) Includes 7,000 shares owned by Mr. Tyde's wife.

| (10) | Of the shares beneficially owned by Mr. Chymiak, 75,000 are held of record by him as trustee of the Ken Chymiak Revocable Trust and 75,000 are held of record by his spouse, Susan C. Chymiak as trustee of the Susan Chymiak Revocable Trust. |

| (11) | Of the shares beneficially owned by Ms. Chymiak, 75,000 are held of record by her as trustee of the Susan Chymiak Revocable Trust and 75,000 are held of record by her spouse, Kenneth A. Chymiak as trustee of the Ken Chymiak Revocable Trust. |

(12) Includes 66,500 shares subject to stock options of which 64,000 are fully exercisable and 2,500 become exercisable on March 6, 2007.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)(c) |

| Equity compensation plans approved by security holders | 104,750 | $3.83 | 759,652 |

| Equity compensation plans not approved by security holders | 0 | 0 | 0 |

| Total | 104,750 | $3.83 | 759,652 |

5

Election of Directors

Our entire Board of Directors will be elected at the annual meeting. The directors will be elected for one-year terms expiring at the next annual meeting. Our bylaws provide that our Board shall consist of not less than one nor more than nine directors, as determined from time to time by board resolution. Our Board has established the number of directors at five.

Vote Required. The five nominees receiving the highest number of votes will be elected. Votes withheld for a nominee will not be counted. You get one vote for each of your shares of common stock for each of the directorships.

Nominations. At the annual meeting, we will nominate as directors the persons named in this proxy statement. Although we do not know of any reason why one of these nominees might not be able to serve, our Board of Directors will propose a substitute nominee if any nominee is unavailable for election.

General Information About the Nominees. All of the nominees are currently directors of ADDvantage. Each has agreed to be named in this proxy statement and to serve as director if elected. The ages listed for the nominees are as of January 19, 2007.

David E. Chymiak Director since 1999

David E. Chymiak, 61, has been the Chairman of our Board since 1999. He is also the President and a director of our wholly owned subsidiary, Tulsat Corporation, which he acquired with Kenneth A. Chymiak in 1985. David E. Chymiak is the brother of Kenneth A. Chymiak, our President and Chief Executive Officer.

Kenneth A. Chymiak Director since 1999

Kenneth A. Chymiak, 60, has been our President and Chief Executive Officer since 1999. He has also been the Executive Vice President and a director of our wholly owned subsidiary, Tulsat Corporation, which he acquired with David E. Chymiak in 1985. Kenneth A. Chymiak is the brother of David E. Chymiak, our Chairman of the Board since 1999.

Freddie H. Gibson Director since 1999

Freddie H. Gibson, 59, has been with the Heat Transfer Equipment Company in Tulsa, Oklahoma since 1988. First as President and now CEO, he has served since 1994 with responsibilities for the financial and accounting controls, financial reporting, management of staff coordination and short and long-term planning. Prior to his tenure with Heat Transfer Equipment, Mr. Gibson served as President of Interactive Computer Systems from 1980-1988. He also served as the Controller and Systems Manager for two other companies and began his career with Arthur Andersen & Co. in their administrative services division. Mr. Gibson holds a Bachelor of Science degree in Business Administration from Oklahoma State University.

Stephen J. Tyde Director since 1999

Stephen J. Tyde, 59, is the founder of The Pump & Motor Works, Inc., a re-manufacturer of industrial pumps, motors, transformers and switchgear (to 20,000 hp). After 20 years in the turbo machinery business, Mr. Tyde started The Pump & Motor Works in 1989 and developed it to a multi-million dollar operation before his divestiture in 2001. During that time, Mr. Tyde oversaw all aspects of the company and retained personal responsibility for financial planning, reporting and controls. He continues to serve on a part-time basis as Vice President. Since 2001, Mr. Tyde has served as the sole owner and Chief Operating Officer of P&MW Holding, Inc., an industrial real estate company. Stephen J. Tyde received an undergraduate degree in Business Administration from The Ohio State University, a Masters Degree in Business Administration from George Washington University, and has studied engineering at the University of Pittsburgh. Mr. Tyde is the Chairman of our Audit, Compensation and Corporate Governance and Nominating committees.

Henry F. McCabe Director since 2004

Henry F. McCabe, 84, is chairman of the board of McCabe Industrial Minerals Inc. in Tulsa, Oklahoma, where he has served as Chief Executive Officer since 1976. McCabe Industrial Minerals operates manufacturing and processing plants in Nebraska, Kansas and Oklahoma, which provide granules for asphalt shingle manufacturers. Mr. McCabe was Co-Founder of the company in 1976 and engages in numerous other business enterprises.

Board of Directors

Board Independence. The Board of Directors has determined that Messrs. Gibson, Tyde and McCabe have no relationship with us that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that such individuals are independent under the rules and listing standards of the American Stock Exchange ("AMEX").

Committees of the Board. The Board of Directors has three committees, the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. The following describes the functions and membership of each committee and the number of times it met during our fiscal year ended September 30, 2006:

6

Audit Committee

The functions and members of the Audit Committee are set forth below. Stephen J. Tyde is the chairman of the Audit Committee. The Audit Committee met four times during fiscal 2006. Each meeting was held prior to the reporting of our quarterly financial results.

Functions Members

| · | Selects the firm that will serve as our independent auditors Stephen J. Tyde |

0;

| · | Reviews scope and results of audits with independent Freddie H. Gibson |

auditors, compliance with any of our accounting policies

and procedures and the adequacy of our system of internal Henry F. McCabe

controls

| · | Oversees quarterly reporting |

· Performs the other functions listed in the Charter of the Audit

Committee which may be found on our website at www.addvantagetech.com.

Report of the Audit Committee

The Audit Committee of our Board of Directors is comprised of three directors who are not officers. Under currently applicable rules, all members are “independent” as defined under the American Stock Exchange listing standards. The Audit Committee reviews our financial reporting process on behalf of the Board of Directors. The Audit Committee’s policy is to submit all proposed non-audit services to the Audit Committee chairman, who considers and pre-approves all engagements for audit or non-audit services rendered by our independent auditors. The Audit Committee approved 100% of such services in 2006 under its pre-approval policy. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In connection with its function to oversee and monitor our financial reporting process, the Audit Committee has done the following:

| - | selected Hogan and Slovacek as our independent accountants for the audit of the fiscal 2006 financial statements. The Audit Committee’s decision to change our independent accountant as described herein under “Change in Company’s Certifying Accountant.” |

| - | reviewed and discussed the audited financial statements for the fiscal year ended September 30, 2006, with management; |

| - | discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU Section 380); |

| - | received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with the independent accountant the independent accountant's independence; and |

| - | based on the review and discussions referred to above, recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for fiscal year 2006 for filing with the Securities and Exchange Commission (the "SEC"). |

Stephen J. Tyde Freddie H. Gibson Henry F. McCabe

Audit Committee Financial Expert

The SEC has adopted rules pursuant to the provisions of the Sarbanes-Oxley Act requiring audit committees to include an “audit committee financial expert,” defined as a person who has the following attributes:

1) an understanding of generally accepted accounting principles and financial statements;

2) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves;

3) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities;

4) an understanding of internal control over financial reporting; and

5) an understanding of audit committee functions.

The financial expert will have to possess all of the attributes listed above to qualify as an audit committee financial expert. Our Board of Directors has determined that each Audit Committee member is financially literate under the current listing standards of the American Stock Exchange. The Board also determined that Stephen J. Tyde and Freddie H. Gibson, both independent directors, qualify as "audit committee financial experts" as defined by the SEC in rules adopted pursuant to the Sarbanes-Oxley Act of 2002.

7

Compensation Committee

The functions and members of the Compensation Committee are set forth below. Stephen Tyde is Chairman of the Compensation Committee, which met twice during fiscal 2006.

Functions Members

| · | Reviews and monitors performance of our officers Stephen J. Tyde |

; Freddie H. Gibson

| · | Approves compensation and benefits programs of our officers |

&# 160; Henry F. McCabe

Report of the Compensation Committee

The Compensation Committee of our Board of Directors is comprised of three directors who are not officers. Under currently applicable rules, all members are “independent” as defined under the American Stock Exchange listing standards. The Compensation Committee is responsible for the review of the performance of our Chief Executive Officer and other key executive officers. The Compensation Committee subscribes to a total compensation program composed of three elements:

| · | base salary |

| · | annual incentives, and |

| · | long-term incentives. |

In formulating and implementing compensation policy and structure and making recommendations, the committee has adopted a philosophy that a substantial portion of the total compensation should be related to our financial performance. Accordingly, the compensation program recommended and approved this year has been structured to include annual incentive compensation based upon achieving a minimum revenue growth threshold and minimum growth of our earnings before interest and taxes (EBIT). The committee believes that the performance-based incentive program approved is crucial in attracting high caliber executives necessary for the successful conduct of our business.

A goal of the committee is maintaining total compensation on a basis consistent with similar companies that generate similar revenues and achieve similar EBIT margins, as well as other strategic and performance characteristics. The committee reviews the salary of Kenneth A. Chymiak, President and Chief Executive Officer (CEO) and David E. Chymiak, Vice President and Chairman of the Board (VP and Chairman) and reviews the recommendations of Messrs. Chymiak regarding the compensation for the other executive officers.

2006 Executive Officer Total Compensation Review

From fiscal 2001 to 2005, there were no material increases in salary or other compensation paid to the CEO, VP and Chairman or other key executive officers.

During fiscal 2006, the Committee met to review the adequacy of the compensation of CEO and VP and Chairman. The review included analyzing the compensation packages of key executives who work for outside companies of similar size and/or industry. The comparison also included a breakdown of the total compensation by type including base pay, bonus pay and equity compensation, including stock options. The Committee concluded the base pay of Kenneth A. Chymiak and David E. Chymiak was at the lower end of the comparable range of total compensation paid to other executives of similar companies. The Committee recommended and approved a $100,000 base pay increase for these two positions but the proposed increase was denied by these two executives. The Committee then recommended and approved a compensation increase for these two executives of 11 percent, to $250,000, and recommended and approved the Senior Management Incentive Compensation Plan to provide further incentives for our key executives.

The Senior Management Incentive Compensation Plan provides an annual bonus of varying amounts from 25% up to 100% of the CEO’s base pay, and corresponding varying awards to other executives, based on achieving a revenue growth hurdle and exceeding historical earnings before interest and taxes (EBIT). In order for any executive to earn the initial bonus level, we must achieve a Sales Threshold of at least 12.5% growth in total revenues over our previous year and reach an EBIT Target, calculated by multiplying the average EBIT percentage of revenue for the previous three years by the Sales Threshold. The bonus is increased in varying amounts to the percentage the EBIT Target is exceeded. The maximum bonus of 100% is awarded to the CEO if we meet the Sales Threshold and exceed the EBIT Target by more than 150%. The minimum Sales Threshold was not achieved during fiscal 2006. As such, no annual bonus awards were made under the Senior Management Incentive Compensation Plan.

We maintain our 1998 Incentive Stock Plan for the purpose of making long term incentive awards to our CEO, other executive officers, directors and employees. The plan is administered by the Board of Directors and any awards made are considered by the Compensation Committee in evaluating the total compensation of the CEO and other executive officers. Stock options were granted to the CEO and other executive officers during fiscal 2006 as described herein under “Summary Compensation Table,” and to directors as described herein under “Compensation of Directors.”

Our future compensation policies will be developed in light of our profitability and with the goal of rewarding members of management for their contributions to our success.

Stephen J. Tyde Freddie H. Gibson Henry F. McCabe

Compensation Committee Interlocks and Insider Participation

During 2006, the Compensation Committee was comprised of Stephen J. Tyde, Freddie H. Gibson and Henry F. McCabe, all of whom are non-employee directors. During 2006, none of our executive officers served on the board of directors or on the compensation committee of any other entity who had an executive officer that served either on our Board of Directors or on its Compensation Committee.

8

Corporate Governance and Nominating Committee

The functions and members of the Corporate Governance and Nominating Committee are set forth below. Stephen Tyde is Chairman of the Corporate Governance and Nominating Committee. The Committee met one time during fiscal 2006.

Functions Members

| · | Provides oversight of the governance of the Board of Directors Stephen J. Tyde |

| · | Makes recommendations to the Board as a whole concerning board size, |

make-up structure and compensation Freddie H. Gibson

| · | Identifies individuals qualified to become Board members |

| · | Selects or recommends that the Board select the director nominees Henry F. McCabe |

to stand for election at the annual meeting of shareholders

| · | Recommends to the Board nominees for the positions of Chairman |

of the Board, chairmen of the various committees of the board, and members

of the various committees of the board

| · | Reviewing, monitoring and approving compliance with our Code of Business |

Conduct and Ethics

| · | Considering, reviewing and approving potential conflict of interests involving |

Board members or corporate officers

| · | Performs other functions listed in the Charter of the Corporate Governance and Nominating Committee which may be found on our website at www.addvantagetech.com. |

The Corporate Governance and Nominating Committee is comprised of three directors who are not officers. Under currently applicable rules, all members are “independent” as defined under the American Stock Exchange listing standards.

The Corporate Governance and Nominating Committee’s criteria and process for identifying and evaluating the candidates that it selects, or recommends to the full Board for selection, as director nominees, are: (i) regular review of composition and size of the board; (ii) review of qualifications of candidates properly recommended or nominated by any qualifying shareholder; (iii) evaluation of the performance of the Board and qualification of members of the Board eligible for re-election: and (iv) consideration of the suitability of each candidate, including current members of the board, in light of the size and composition of the board. After such review and consideration, the Corporate Governance and Nominating Committee will recommend a slate of director nominees.

While the Corporate Governance and Nominating Committee has not established specific minimum requirements for director candidates, other than they be at least 21 years of age, the committee believes that candidates and nominees must reflect a board that is comprised of directors who: (i) are predominantly independent; (ii) are of high integrity; (iii) have qualifications that will increase overall board effectiveness; and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members.

The Corporate Governance and Nominating Committee has adopted a policy with regard to the consideration of director candidates recommended by shareholders. The Corporate Governance and Nominating Committee will consider director candidates recommended by any shareholder holding 10,000 shares of our common stock for at least 12 months prior to the date of submission of the recommendation or nomination. Additionally, a recommending shareholder shall submit a written statement in support of the candidate, particularly within the context of the criteria for board membership, including issues of character, judgment, age, independence, expertise, corporate experience, length of service, other commitments and the like, personal references, and a written indication by the candidate of his/her willingness to serve, if elected, and evidence of the nominating person’s ownership of our stock sufficient to meet any applicable stock ownership requirements set forth in our corporate governance guidelines.

Board Meetings

Our Board held four meetings during fiscal 2006. Each director attended all meetings of the Board and the committees on which he served.

Shareholder Communication with the Board of Directors and Committees

Communication with the Board of Directors or any of the Committees should be directed to the attention of Stephen J. Tyde. Written correspondence to Mr. Tyde may be delivered to our executive offices, 1221 East Houston, Broken Arrow, Oklahoma, 74012. All security holder communications directed to Mr. Tyde will be promptly forwarded to him. All Board members are encouraged, but not required, to attend our annual meeting. Last year, all of our Board members attended our annual meeting.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics which is applicable to all of our directors, officers and employees. A copy of our Code of Business Conduct and Ethics is posted on our website at www.addvantagetech.com.

9

In fiscal 1999, Chymiak Investments, L.L.C., which is owned by David E. Chymiak and Kenneth A. Chymiak, purchased from Tulsat Corporation on September 30, 1999, the real estate and improvements comprising the headquarters and a substantial portion of the other office and warehouse space of Tulsat Corporation for a price of $1,286,000. The price represented the appraised value of the property less the sales commission and other sales expenses that would have been incurred by Tulsat Corporation if it had sold the property to a third party in an arm’s-length transaction. Tulsat Corporation entered into a five-year lease commencing October 1, 1999 with Chymiak Investments, L.L.C. covering the property. This lease was renewed on October 1, 2004. During 2006 we relocated our corporate offices to our new location, described later herein. We continue to use this facility as an overflow warehouse and, as such, we continue to lease this facility under the terms of the existing lease agreement which will expire on September 30, 2008.

During fiscal 2006, we leased eight separate properties in Broken Arrow, Oklahoma from two companies owned by David E. Chymiak and Kenneth A. Chymiak, including the property described in the preceding paragraph. The combined lease payments made during fiscal 2006 on these properties totaled $465,840. During the fiscal year, we began consolidating our operations into a new larger facility, discussed below, and as a result have vacated six of these leased properties. We currently continue to lease the remaining two properties as overflow warehouses.

Future minimum lease payments under these leases are as follows:

2007 $ 321,840

2008 321,840

& #160; $ 643,680

On November 20, 2006, we purchased real estate, consisting of an office and warehouse facility located on ten acres in Broken Arrow, OK, from Chymiak Investments, LLC for $3,250,000. The office and warehouse facility is currently being utilized as our headquarters and the office and warehouse of our subsidiary, Tulsat Corporation. The office and warehouse facility contains approximately 100,000 square feet of gross building area and was recently renovated and modified for our specific use. This transaction was reviewed by our Corporate Governance and Nominating Committee. The Committee evaluated several options for leasing the building from Chymiak Investments, LLC and financing options related to purchasing the real estate. In determining whether to lease the property from Chymiak Investments, LLC or purchase the property the Committee reviewed a "Lease vs. Buy" analysis performed by our management showing the costs associated with leasing the property would be greater than the costs associated with owning the real estate. Based on the review of our liquidity and the financial benefits associated with owning the property, the Committee recommended that we purchase the property for a fair and reasonable price. In evaluating the reasonableness of the purchase price, the Committee reviewed a detail of the expenses paid by Chymiak Investments LLC identifying the money spent to purchase the building and modify it for our specific use totaling approximately $3.250 million, a third party independent appraisal showing the appraised value at $3.420 million and an insurance report from a third party property insurer identifying the replacement cost for the real estate at $5.4 million. Based on the evaluation, the Committee recommended, and the Board of Directors approved, the purchase of the real estate by us for $3.25 million.

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of our common stock to report their initial ownership of our common stock and any subsequent changes in that ownership to the SEC and to furnish us with a copy of each of these reports. SEC regulations impose specific due dates for these reports and we are required to disclose in this proxy statement any failure to file by these dates during fiscal 2006.

Based solely on the review of the copies of these reports furnished to us and written representations that no other reports were required, during and with respect to the fiscal year ended September 30, 2006, we believe that these persons have complied with all applicable filing requirements.

10

Compensation of Directors

We pay our three non-employee directors $500 per quarter and $500 for each board meeting and $250 for each committee meeting or telephonic board or committee meeting the director attends. The chairman of the audit committee receives an additional $250 per quarter. In addition, directors are eligible to receive awards of options to purchase shares of our common stock each year after the annual shareholders meeting. These annual rewards have ranged between 1,000 and 5,000 shares. We reimburse all directors for out-of-pocket expenses incurred by them in connection with their service on our Board and any Board committee. During the fiscal year ended September 30, 2006, Henry McCabe, Fred Gibson and Steve Tyde received directors' fees of $5,750, $5,750 and $6,750, respectively. In addition, each of the directors received an award of stock options on March 6, 2006 to purchase 5,000 shares of common stock at an exercise price of $5.78 per share. Directors who were our employees received no additional cash compensation for their services on our Board of Directors.

Annual Compensation | Long-Term Compensation | ||||

| Number of Shares | |||||

| Name and | Salary | Bonus | Other Annual | Under lying Options | |

Principal Position | Year | ($)(1) | ($)(2) | Compensation | Granted |

| David E. Chymiak | 2006 | 239,232 | -0- | 11,211 | 5,000 |

| Chairman | 2005 | 225,000 | -0- | 10,500 | 5,000 |

| 2004 | 225,000 | -0- | 10,837 | 1,000 | |

| Kenneth A. Chymiak | 2006 | 239,232 | -0- | 11,211 | 5,000 |

| President and Chief Executive Officer | 2005 | 225,000 | -0- | 10,500 | 5,000 |

| 2004 | 225,000 | -0- | 10,837 | 1,000 | |

| Daniel E. O'Keefe | 2006 | 75,000 | -0- | -0- | 10,000 |

| Vice President and Chief Financial Officer | |||||

_______

| (1) | These amounts represent the salaries paid to these officers by Tulsat Corporation, our wholly owned subsidiary. |

| (2) | Other annual compensation in 2006, 2005, and 2004 represents our contributions on behalf of each of the individuals to their 401(k) Plan accounts. |

(3) The salary for Mr. O'Keefe is from his hire of March 6th, 2006.

Option Grants During Fiscal 2006

The following table sets forth information regarding options granted during fiscal 2006 to named executive officers.

Name | Shares Under lying Options Granted | % of Total Options Granted to Employees in Fiscal Year | Exercise Price ($/Sh) | Expiration Date | Potential Realizable Value at Annual Rates of Stock Price Appreciation for Option Term (3) 5% 10% | |

| Kenneth A. Chymiak | 5,000(1) | 14.3% | $ 5.78 | 3/6/16 | $18,175 | $46,059 |

| David E. Chymiak | 5,000(1) | 14.3% | $ 5.78 | 3/6/16 | $18,175 | $46,059 |

| Daniel E. O'Keefe | 10,000(2) | 28.6% | $ 5.78 | 3/6/16 | $36,350 | $92,118 |

(1) These options are fully vested and exercisable at date of grant.

(2) These options vest over four years in equal increments of 2,500 shares per year.

(3) The dollar amounts under these columns represent the potential realizable value of each grant of option assuming that the market price of our common stock appreciates in value from the date of grant at the 5% and 10% annualized rates prescribed by the SEC for purposes of this table and are not intended to forecast possible future appreciation, if any, of the price of our common stock.

Option Exercises and Year-End Option Value Table

There were no stock options exercised by the named executive officers during fiscal 2006. The following table sets forth information regarding the value of unexercised stock options held by each of the named executive officers as of the year ended September 30, 2006.

Name | Number of Shares Acquired on Exercise | Value Realized | Number of Shares of Common Stock Underlying Unexercised Options at September 30, 2006 Exercisable Unexercisable | Value of Unexercised In-the-Money Options at September 30, 2006 Exercisable Unexercisable |

| Kenneth A. Chymiak | - | - | 15,000 - | $ 8,795 - |

| David E. Chymiak | - | - | 15,000 - | $ 8,795 - |

| Daniel E. O'Keefe | - | - | 2,500(1) 7,500 | - - |

(1) Shares become exercisable on March 6, 2007.

11

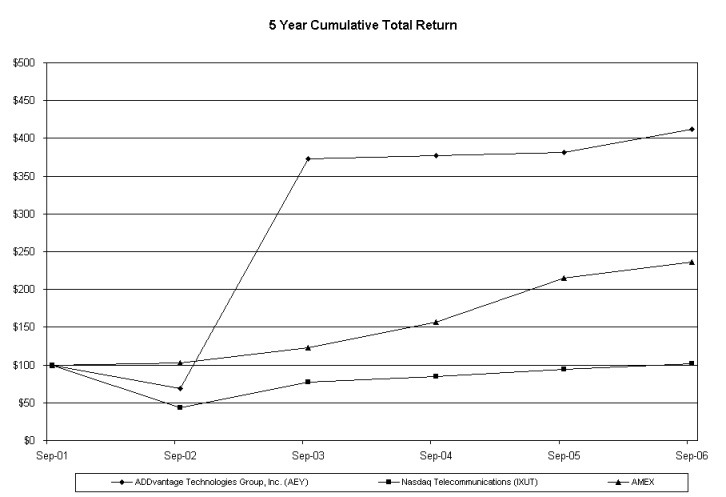

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on our common stock (symbol: AEY) against the cumulative total return of the American Stock Exchange (symbol: XAX) and the Index for the Nasdaq Telecommunications Stocks (symbol: IXUT) for the period of five fiscal years commencing October 1, 2001 and ending September 30, 2006. The graph assumes that the value of the investment in our common stock and each index was $100 on September 30, 2001.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among ADDvantage Technologies Group, Inc., and the NASDAQ Telecommunications Index and the American Stock Exchange Index

* $100 invested on September 30, 2001 in our stock or on September 30, 2001 in each index -

including reinvestment of dividends.

Cumulative Total Return | ||||||

| 9/28/01 | 9/30/02 | 9/30/03 | 9/30/04 | 9/30/05 | 9/30/06 | |

| ADDvantage Technologies Group, Inc. | $100.00 | $68.63 | $372.55 | $377.45 | $381.37 | $411.76 |

| American Stock Exchange | 100.00 | 102.29 | 122.51 | 157.25 | 214.76 | 235.77 |

| Nasdaq Telecommunications | 100.00 | 43.54 | 76.88 | 85.18 | 94.58 | 101.85 |

12

Ratification Of Independent Auditors

We recommend that you vote for the ratification of the appointment of Hogan & Slovacek.

Our Audit Committee has selected the accounting firm of Hogan & Slovacek as our independent auditors to examine our financial statements for the fiscal year ending September 30, 2007. Hogan & Slovacek has been our independent auditor since they were engaged by our Audit Committee on January 26, 2006. Prior to their engagement, Tullius Taylor Sartain & Sartain had been our independent auditor since 1994.

Representatives from Hogan and Slovacek will attend the Annual Meeting to answer appropriate questions and make statements if they desire.

Change in Company's Certifying Accountant

On January 17, 2006, we and the Chairman of the Audit Committee of our Board of Directors were advised by letter of the same date that Tullius Taylor Sartain & Sartain LLP ("Tullius"), the principal accountant engaged to audit our financial statements, would resign as our independent registered public accounting firm. The effective date of the resignation was the date of completion of Tullius' review of our Quarterly Report on Form 10-Q for the first quarterly period ended December 31, 2005, which we filed on February 13, 2006.

The reports of Tullius on our consolidated financial statements for each of the two fiscal years ended September 30, 2005, did not contain an adverse opinion or a disclaimer of opinion, and were not qualified as to uncertainties, audit scope or accounting principles.

The Audit Committee was informed of, but neither recommended nor approved, the termination of the client-auditor relationship with Tullius.

During our two fiscal years ended September 30, 2005, and for the period from October 1, 2005, through the date of Tullius' letter of resignation, there were no disagreements with Tullius on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Tullius, would have caused them to make reference to the subject matter of their disagreement in their reports on our consolidated financial statements for such periods.

During the period of October 1, 2005, through the date of Tullius' letter of resignation, there were no reportable events as defined by paragraph (a)(1)(v) of Item 304 of Regulation S-K promulgated by the SEC.

We provided Tullius with copies of both of our Current reports on Form 8-K reporting this event and asked Tullius to furnish us with letters addressed to the SEC stating whether Tullius agrees with the statements we made by and, if not, stating the respects in which it does not agree. Tullius furnished such letters to us, indicating to the SEC that it was in agreement with our statements concerning Tullius.

On January 26, 2006, the Audit Committee engaged Hogan & Slovacek to serve as the principal accountant to audit our financial statements for the current fiscal year.

During our two fiscal years ended September 30, 2005, and for the period from October 1, 2005, through the date of such engagement, we did not consult with Hogan & Slovacek regarding the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, or any other matters or reportable events described in Items 304(a)(2)(i) and (ii) of Regulation S-K.

PRINCIPAL ACCOUNTING FEES AND SERVICES

Hogan & Slovacek ("Hogan") served as our independent auditor since they were engaged by our Audit Committee on January 26, 2006 and examined our financial statements for the fiscal year ended September 30, 2006. Tullius served as our independent auditor from 1994 until its resignation discussed above, and examined our financial statements for the fiscal year ended September 30, 2005. Our Audit Committee considered whether the provisions for the tax services and other services by both Hogan and Tullius were compatible with maintaining their independence and determined that they were.

Fees Incurred by the Company for Tullius Taylor Sartain & Sartain LLP and Hogan & Slovacek

The following table shows the fees for professional audit services provided by Hogan and Tullius for the audits of our annual financial statements for the years ended September 30, 2006 and 2005 and fees billed for other services during those periods.

| 2006 | 2005 | ||||||||||||

Hogan | Tullius | Hogan | Tullius | ||||||||||

| Audit Fees | $ | 71,500 | $ | 8,600 | - | $ | 63,710 | ||||||

| Audit -Related Fees | 3,600 | 3,000 | - | 1,410 | |||||||||

| Tax Fees | 18,620 | 0 | - | 9,275 | |||||||||

| All Other Fees | - | - | - | - | |||||||||

| Total | $ | 93,720 | $ | 11,600 | - | $ | 74,395 | ||||||

Notes to Table:

(1) | Audit fees represent fees for professional services provided in connection with the audit of our financial statements and review of our quarterly financial statements and audit services provided in connection with the issuance of comfort letters, consents, and assistance with review of documents filed with the SEC. |

13

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. During the year the Audit Committee approved all of the services performed by the independent accounting firms. The fees billed for these services approximated 100% of the pre-approved amounts.

Before engagement of the independent registered public accounting firm for the next year’s audit, management will submit a list of services and related fees expected to be rendered during that year within each of the following four categories of services to the Audit Committee for approval:

| 1. | Audit services include audit work performed on the financial statements, internal control over financial reporting, as well as work that generally only the independent registered public accounting firm can reasonably be expected to provide, including comfort letters, statutory audits, and discussions surrounding the proper application of financial accounting and/or reporting standards. |

| 2. | Audit-Related services are for assurance and related services that are traditionally performed by the independent registered public accounting firm, including due diligence related to mergers and acquisitions, employee benefit plan audits, and special procedures required to meet certain regulatory requirements. |

| 3. | Tax services include all services, except those services specifically related to the audit of the financial statements, performed by the independent registered public accounting firm’s tax personnel, including tax analysis; assisting with coordination of execution of tax related activities, primarily in the area of corporate development; supporting other tax related regulatory requirements; and tax compliance and reporting. |

| 4. | Other Fees are those associated with services not captured in the other categories. We generally don’t request such services from the independent registered public accounting firm. |

Before engagement, the Audit Committee pre-approves the independent registered public accounting firm’s services within each category. During the year, circumstances may arise when it may become necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval categories. In those instances, the Audit Committee requires specific pre-approval before engaging the independent registered public accounting firm.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

If you want to include a shareholder proposal in the proxy statement for the 2008 annual meeting, it must be delivered to our executive offices, 1221 East Houston, Broken Arrow, Oklahoma, 74012, on or before October 8, 2007. In addition, if you wish to present a proposal at the 2008 annual meeting that will not be included in our proxy statement and you fail to notify us by December 22, 2007, then the proxies solicited by our Board for the 2008 annual meeting will include discretionary authority to vote on your proposal in the event that it is properly brought before the meeting.

At the date of mailing of this proxy statement, we are not aware of any business to be presented at the annual meeting other than the proposal discussed above. If other proposals are properly brought before the meeting, any proxies returned to us will be voted as the proxyholders see fit.

You can obtain a copy of our Annual Report on Form 10-K for the year ended September 30, 2006 at no charge by writing to us at 1221 East Houston, Broken Arrow, Oklahoma, 74012. This document and other information may also be accessed from our website at www.addvantagetech.com.

Only one annual report and proxy statement are being delivered to multiple shareholders who share one address, unless we have received instructions to the contrary. We will provide a separate copy of the annual report and proxy statement to a shareholder at a shared address to which single copies were delivered upon request sent in writing to 1221 East Houston, Broken Arrow, Oklahoma, 74012, or by calling (918) 251-9121. If you wish to receive a separate annual report and proxy statement in the future, or if you currently receive multiple copies of the annual report and proxy statement and wish to request delivery of only single copies, you may notify us at the same address or phone number.

14