UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

| | |

| | | |

| | SCHEDULE 14A | |

| | | |

| PROXY STATEMENT PURSUANT TO SECTION 14(A) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

| (AMENDMENT NO. ____) |

| | | |

Filed by the Registrant x Filed by a Party other than the Registrant o

|

| | |

| Check the appropriate box: |

| | | |

| o | | Preliminary Proxy Statement |

| | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| o | | Definitive Proxy Statement |

| | |

| o | | Definitive Additional Materials |

| | |

| x | | Soliciting Material Pursuant to §240.14a-12 |

|

|

| AMBAC FINANCIAL GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| | | | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| | | | | |

| x | | No fee required. |

| | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which the transaction applies: |

| | | (2) | | Aggregate number of securities to which the transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | |

| o | | Fee paid previously with preliminary materials. |

| | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount previously paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

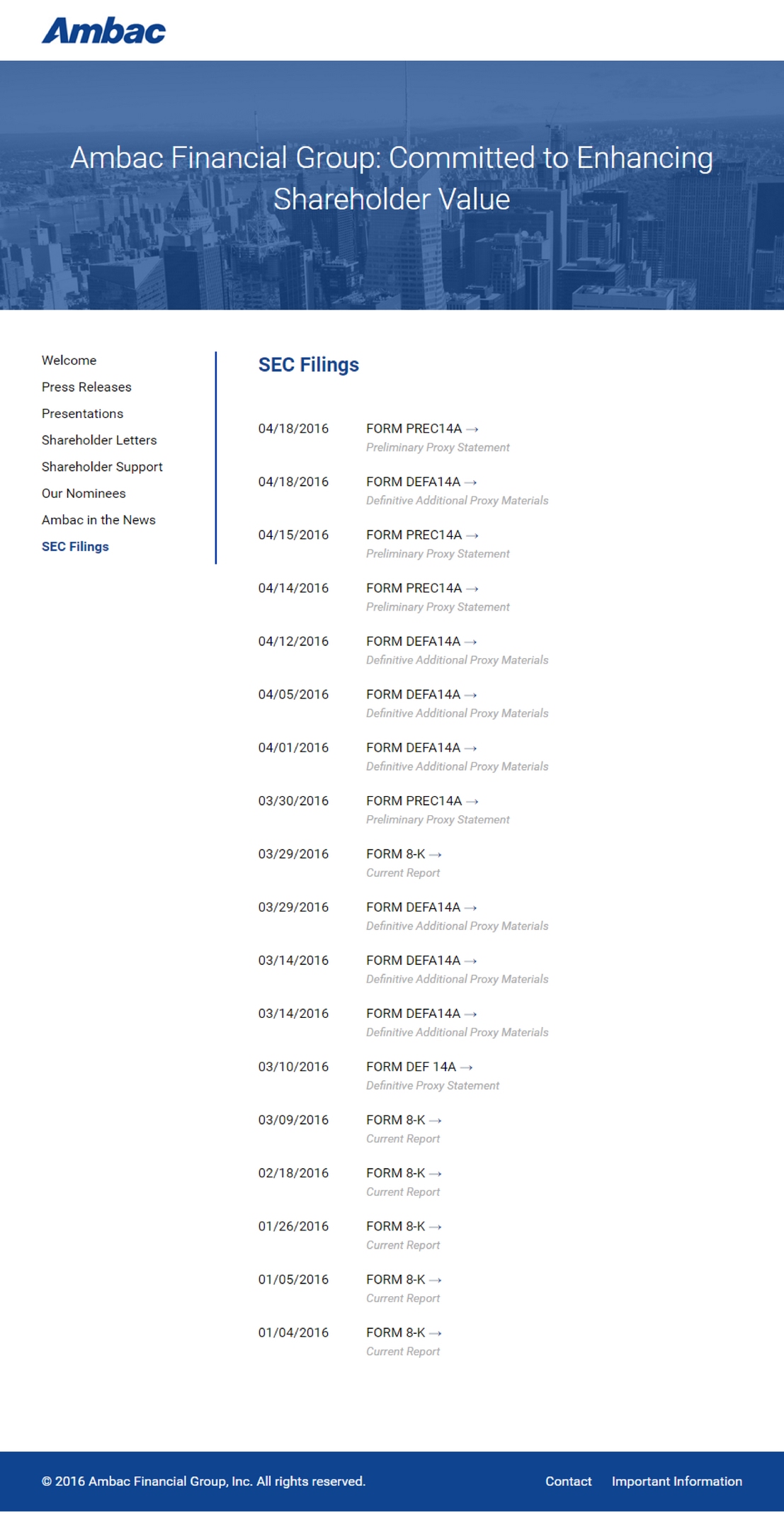

On April 18, 2016, Ambac Financial Group, Inc. launched the following content on its website, www.ambacforshareholders.com:

"NADER TAVAKOLI ON CNBC" INTERVIEW WITH NADER TAVAKOLI

INTERVIEWER: MICHELLE CARUSO-CABRERA

MEDIA ID: NADER-TAVAKOLI-CNBCUS-11-FEB-16-5.5MB.MP4

* * *TRANSCRIBER'S NOTE: BACKGROUND NOISE AND VOICES THROUGHOUT. NOTED ONLY WHEN PARTICULARLY INTRUSIVE.* * *

MICHELLE CARUSO-CABRERA:

You guys were talking about debt related to what's happening within the oil sector. We're talking about debt related to Puerto Rico. They've got massive debts. And sitting here with me is the CEO of Ambac. He's Nader Tavakoli. Good to have you here, Mr. Tavakoli.

NADER TAVAKOLI:

Thank you for having me.

MICHELLE CARUSO-CABRERA:

You have a lot of money on the line here, because you insured bonds that right now are facing restructuring, so you'd have to pay out. How's it going at this point? Are you confident that a deal can get done?

NADER TAVAKOLI:

Well, we're hopeful that a deal to get done. But we're not really sure what the parameters and the framework of that deal look like, because we haven't gotten financials from the commonwealth.

MICHELLE CARUSO-CABRERA:

They're behind by two years at this point.

NADER TAVAKOLI:

Yeah, they have not issued a full-year financial statement under this governor.

MICHELLE CARUSO-CABRERA:

Yeah, it's-- it's-- it's tough. The accounting here in-- in Puerto Rico is tough. We had on Jim Millstein. He's the guy you're facing off on the other side of the table in this negotiation. He would be far more artful, far more glib. But I'm gonna boil down the-- the-- kinda the little bit of trash talking that happened between you two on the stage here at-- at a conference.

"You guys are crybabies. You insure bonds. They got-- they have too much debt here. The debt's gonna get written down. And take your lumps. That's what you do for a living. And then you-- you wrote-- you wrote bad insurance. That's your problem."

NADER TAVAKOLI:

Right. Well-- (LAUGH) well, you know-- the problem with that theory is that the facts sorta get in the way. I mean, we have not seen any financials to demonstrate the need for a restructuring. We've had a couple of paid-for professional reports from Dr. Krueger and others. And when you open those reports up, the first page says, "Don't rely on anything in here, because we had access to partial information and no audited numbers."

And so we're being asked to take a leap of faith -- when in fact we'd like to sit down and talk about the facts and what the numbers are -- around the -- around the vehicles to which we provided guarantees. And the other thing that they're doing is they're trying to do a backdoor substantive cons -- consolidation of 18 different borrowers. Each of those borrowers has their own credit characteristics and their own legal -- sanctity. And we would like to talk about the ones that we insured -- as opposed to throwing the $72 billion into a pot as to-- as though there's $72 billion of commonwealth debt.

MICHELLE CARUSO-CABRERA:

Speaking of debt, we just had-- super interesting conversation was just happening on the show related to what's happening with the oil and gas sector. You used to work a lot in high yields. The high yield market. The carnage there. The yields -- the-- the spread's widening. What signals is that sending? W -- there's talk of whether there's a recession coming in the United States. Do you have any opinion on that, what the high-yield market is signaling?

NADER TAVAKOLI:

Well, it looks like it's due to a number of things. One of them-- one of them certainly is the ripple effect of energy crisis, and what that's doing to the global capital environment. And the other is probably China. And China devaluation, and the China economy as a whole.

The other thing that's going on is just an absence of buyers. I mean, we now have a d-- regulatory environment where the bid has been taken out of the market to the extent that bid was provided by-- capital providers, brokers and banks and so on. And so when sellers come into the market, you don't have that bid there. And there's just an absence of buyers right now, given all the uncertainty around energy, around China, and so on.

MICHELLE CARUSO-CABRERA:

And-- is this spec-- specifically to this issue of lack of liquidity in the bond market that we've heard so much about?

NADER TAVAKOLI:

That's right.

MICHELLE CARUSO-CABRERA:

When it comes, to, though, if there is a recession in the United States, what does that mean to all the municipal bonds that you've insured? Are-- are you worried about that at this point? How much would you be on the hook for? Have you modeled that out?

NADER TAVAKOLI:

Yeah, I mean, we have a large municipal bond portfolio. It's running off pretty dramatically. But-- once you get past some of our bigger exposures like Puerto Rico, we actually have a very high-grade diversified portfolio. We obviously go through it from a risk perspective all the time.

We're not seeing any particular worry points. And on the whole, the municipal finance market has been doing very well. Municipal revenues are on the uptick. There's-- capital coming into the municipal bond market in large sums. And so we don't see any particular problems there, even though spreads are widening a little bit. We're not really seeing any cause for large concern.

MICHELLE CARUSO-CABRERA:

What about in areas where there's lots of oil and gas money that drove the economy? Are those municipalities under threat in any way?

NADER TAVAKOLI:

Yeah, those are certainly-- concerns, and we've gone through our portfolio. We don't see anything there. And they tend to be, in terms of the-- their debt situation, those tend to be smaller municipalities if they have debt. And a lot of those-- jurisdictions have been doing so well, to where they don't have very large amounts of debt--

MICHELLE CARUSO-CABRERA:

They-- they didn't borrow money. (LAUGH) Your stock's gettin' hit very hard in the last year. Why do you think that is?

NADER TAVAKOLI:

It's correlated to Puerto Rico. It's really, if you-- if you chart our stock movements against developments in Puerto Rico, you'll say-- see that there's basically a correlation of one. And -- there's a fair amount of uncertainty around the Puerto Rico exposure, even though I think that as it relates to the holding company stock, it's -- you know - we -- we don't-- we don't necessarily see the basis for it.

MICHELLE CARUSO-CABRERA:

Thanks so much for coming on, Mr. Tavakoli.

NADER TAVAKOLI:

Thank you very much.

MICHELLE CARUSO-CABRERA:

Nader Tavakoli is the CEO of Ambac -- joining us live here in Puerto Rico.

* * *END OF TRANSCRIPT* * *

"NADER TAVAKOLI ON CNBC" INTERVIEW WITH NADER TAVAKOLI

INTERVIEWERS: KATE KELLY, TYLER MATHISEN

MEDIA ID: NADER-TAVAKOLI-CNBCUS-14-JAN-16-5.5MB.MP4

TYLER MATHISEN:

Bond insurers are now suing Puerto Rico over debt defaults, and Ambac is one of them. Kate Kelly joins us now with (MUSIC) Ambac's CEO in a Power Lunch Exclusive. Kate?

KATE KELLY:

Tyler, thank you so much. And Nader Tavakoli-- new CEO of-- Ambac. Thank you so much for joining us for this.

NADER TAVAKOLI:

Thank you for having me.

KATE KELLY:

Thank you. And-- and we do want to get to Puerto Rico. Before we do that, overnight, some surprising news that some of your top shareholders who are also creditors in some-- instruments tied to residential mortgage-backed securities from the financial crisis that you insure, I think I got all that right-- are frustrated with your tenure, and your handling, specifically, of some claims on those R.M.B.S. securities, even calling for your ouster. How do you respond to all that. Is this-- is that over the top?

NADER TAVAKOLI:

Yeah, we're not aware of any shareholders calling for my-- ouster, so it was interesting to read that. But we have a very big balance sheet. We have-- we sit on over $100 billion of secured-- (CLEARS THROAT) debt obligations at the insurance subsidiary. And many of those obligations trade in the public markets.

So we have people who take positions in those-- bond obligations. And it seems as though one or two of those-- creditors also happen to own stock. And they've been putting pressure on the company for an acceleration of those payments. We've made it clear to them that this is a decision for the commissioner of insurance to make, not our decision. They don't seem to like that answer. But to the extent that it's up to us, we obvious have to act in the best interest of--

TYLER MATHISEN:

So-- so you-- you-- whether (CLEARS THROAT) they have called for your ouster or not, you-- you concede that there-- there-- there are points of contention between you-- and the pace at which you resolve some of the claims that those shareholders-- hold?

NADER TAVAKOLI:

Yeah, Tyler-- it's really not our decision. It's the commissioner's decision.

KATE KELLY:

And the state of Wisconsin.

NADER TAVAKOLI:

And the state of Wisconsin, where we're domiciled. Where the insurance company is domiciled. And so they have been-- our understanding is they've also been pressuring the commissioner. And the commissioner is-- also has an obligation to the policyholders at large, just as we do.

And obviously we have a fiduciary obligation to our shareholders to do the right thing for the shareholders at large, not for a couple of aggressive sh-- hedge funds who happen to own some stock. So we feel our obligations very strongly. And that's why we-- brought the complaint against Puerto Rico as we did last week. And-- so we're gonna do what's in the best interest of the company, to the extent that it's in (BACKGROUND VOICE) our control. And again, on this issue, really, it's in the control of the commissioner of insurance.

KATE KELLY:

Okay. (BACKGROUND VOICE) Speaking of Puerto Rico and the lawsuit-- I know that you-- filed laws-- filed the suit somewhat reluctantly, and taking issue with the way in which, really, Puerto Rico has handled the payment or non-payment in a few cases, of its debt obligations. This $70 billion debt load that its governor has deemed unpayable. Can you talk a little bit about the mentality behind filing suit? I know you're a bit limited in what you can say. But how high are the stakes here? Why does it matter for Ambac? Why does it matter for the American investor public?

NADER TAVAKOLI:

Yeah, unfortunately I am limited, given that it's a lawsuit, in what I can say. But you know, it really, you know, I'm a former lawyer. Lawsuits should be a last resort. And we really did this reluctantly. We didn't want to have to do this.

But Puerto Rico has done a lot of talking about how they'd like to talk to creditors, but-- there really hasn't been much actual engagement, and it's very frustrating. And ag-- again, as I said before, we have an obligation to our stakeholders and shareholders. And we're in a situation where we feel that the commonwealth has blatantly violated their own los-- laws, as well as the constitution of the United States. And so we have an obligation to enforce their obligations to us and our stakeholders. And so we-- we had to file that lawsuit as we did.

KATE KELLY:

Talk a little bit more about Puerto Rico's stance. They've said they want to negotiate with creditors. They've said-- the g-- governor told me on an interview on this show he didn't want to spend dollars defending lawsuits that he could be spending to benefit the citizens of the island, or-- or make good on their debt. Is there a game of brinksmanship here, and what does it consist of?

NADER TAVAKOLI:

Yeah, the governor's making all of his bets, and their bankruptcy professionals are making all of their bets on getting bankruptcy. And they're spending a lot of time and effort and money-- including a big P.R. machine-- endeavoring to do that.

KATE KELLY:

Specifically to-- to get a Super Chapter 9 capability from the U.S. Congress?

NADER TAVAKOLI:

Yeah, I think they would settle for Chapter 9. But obviously the administration's proposal is around the Super Chapter 9. We think it's a dreadful idea. We think--

KATE KELLY:

Why?

NADER TAVAKOLI:

--that it would be a horrible idea for the people of Puerto Rico. We think it'll be very hard for the-- (BACKGROUND VOICE) for the commonwealth to regain credibility. Because what they're talking about is applying bankruptcy retroactively to obligations that were issued with a clear understanding that there would not be a bankruptcy.

But that aside, all it's gonna do is to increase litigation, increase delays, increase brinksmanship. (BACKGROUND VOICE) We're gonna be years down the road and hundreds of millions of dollars in incremental expenses. And very little will be resolved. The case of Detroit being a perfect example, where they spent $180 million, and the city still does not have access to the capital markets, and it was a big failure.

TYLER MATHISEN:

So let me understand two things, if I might. Your principal contention in this-- action against Puerto Rico is that they-- violated laws by diverting revenue streams from other bonds, right? That had revenue streams behind them, to pay obligations-- general obligation bonds or whatever. Is that-- have I got that right?

NADER TAVAKOLI:

Well, they-- part of our contention is that they actually didn't do that. They did it to pay other things. Other general account expenses--

TYLER MATHISEN:

To pay other things. To pay-- pay operating expenses.

NADER TAVAKOLI:

--and there's a very clear prescriptions in the constitution and enabling laws as to what they can and can't do--

TYLER MATHISEN:

So what is your company's overall exposure to these Puerto Rican-- bonds? These-- these obligations--

NADER TAVAKOLI:

Right. We have $2.2 billion of guarantees in force at net par, what we call net par, at original issue amount-- on underlying bonds that have been issued by a various-- number of five different entities-- in Puerto Rico. This is another piece of this fallacy that has been propagated, where-- that there's $72 billion of commonwealth debt.

That debt's actually issued by 18 different entities on Puerto Rico. I don't want to get into too much detail on that. But that's-- that's an important factor, in that the commonwealth and their bankruptcy advisors are trying to effectively consolidate all of these entities into one big ball of wax. And that's just not the case. Each of these entities have their own structure and their own credit qualities.

KATE KELLY:

Nader, we're gonna have to run in a second, but let me ask you a final question. You don't think Chapter 9's a great idea. You're suing over these clawbacks. What do you think about some other measures on the table, including the possibility of a control board?

NADER TAVAKOLI:

Well, we think that the g-- that this is a mismanagement issue. You know, the commonwealth was really coming into fiscal balance a couple years ago, when this governor came into office. We think that--

KATE KELLY:

Even though he says he inherited the crisis?

NADER TAVAKOLI:

Yes, no, the b-- the-- the deficit had gone from a substantial amount to less than $500 million. And then the governor pivoted to asking for default and bankruptcy, partially, we think, as a political move. But in any event, be it-- be it as it may, be think that a control board-- look, the control board worked beautifully for Washington D.C. 20 years ago.

We had a Democratic president. We have a Republican congress. They saw their way clear to putting in a powerful control board. Four years later, five years l-- later, Washington was fixed, and the rest is history, in terms of that city's comeback. We've seen this repeatedly. Obviously Ambac being a very big insurer of municipal debt. We have seen many, many instances of cities and states getting into financial trouble, and then working their way out by following fiscal discipline, as opposed to following a path of rewriting their contracts and their laws.

KATE KELLY:

So fair to say you would be in favor of that, if that were a possibility?

NADER TAVAKOLI:

We would be in favor of that, and be-- would be willing to work constructively in that process. And we would be willing to think about alternatives to lawsuits, for sure, in that kind of process.

TYLER MATHISEN:

All right.

KATE KELLY:

Thank you so much. Nader Tavakoli, CEO of Ambac.

TYLER MATHISEN:

Kate. Mr. Tavakoli. Thank you very much.

* * *END OF TRANSCRIPT* * *