© 2014 Ambac Financial Group, Inc. One State Street Plaza, New York, NY 10004 All Rights Reserved | 800-221-1854 | www.ambac.com 6 FIRST QUARTER 2016 HIGHLIGHTS MAY 10, 2016

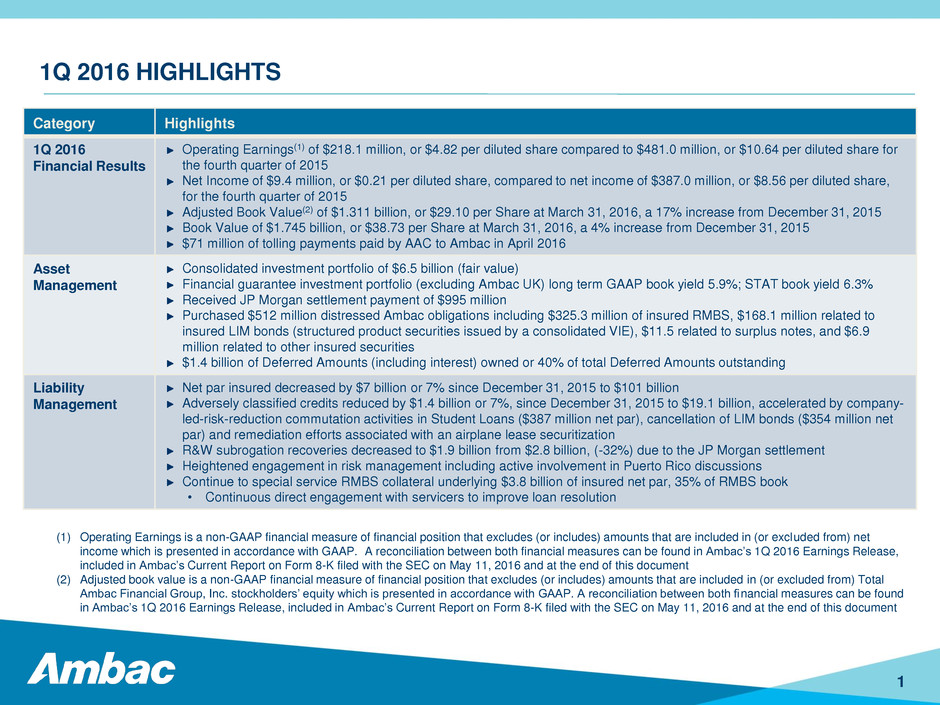

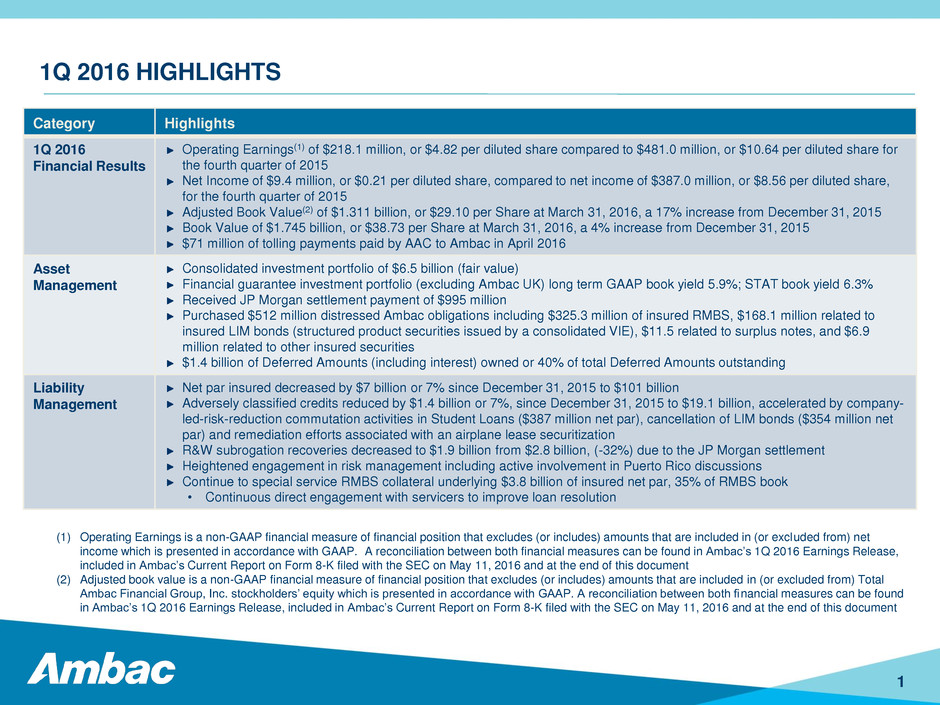

1Q 2016 HIGHLIGHTS 1 Category Highlights 1Q 2016 Financial Results Operating Earnings(1) of $218.1 million, or $4.82 per diluted share compared to $481.0 million, or $10.64 per diluted share for the fourth quarter of 2015 Net Income of $9.4 million, or $0.21 per diluted share, compared to net income of $387.0 million, or $8.56 per diluted share, for the fourth quarter of 2015 Adjusted Book Value(2) of $1.311 billion, or $29.10 per Share at March 31, 2016, a 17% increase from December 31, 2015 Book Value of $1.745 billion, or $38.73 per Share at March 31, 2016, a 4% increase from December 31, 2015 $71 million of tolling payments paid by AAC to Ambac in April 2016 Asset Management Consolidated investment portfolio of $6.5 billion (fair value) Financial guarantee investment portfolio (excluding Ambac UK) long term GAAP book yield 5.9%; STAT book yield 6.3% Received JP Morgan settlement payment of $995 million Purchased $512 million distressed Ambac obligations including $325.3 million of insured RMBS, $168.1 million related to insured LIM bonds (structured product securities issued by a consolidated VIE), $11.5 related to surplus notes, and $6.9 million related to other insured securities $1.4 billion of Deferred Amounts (including interest) owned or 40% of total Deferred Amounts outstanding Liability Management Net par insured decreased by $7 billion or 7% since December 31, 2015 to $101 billion Adversely classified credits reduced by $1.4 billion or 7%, since December 31, 2015 to $19.1 billion, accelerated by company- led-risk-reduction commutation activities in Student Loans ($387 million net par), cancellation of LIM bonds ($354 million net par) and remediation efforts associated with an airplane lease securitization R&W subrogation recoveries decreased to $1.9 billion from $2.8 billion, (-32%) due to the JP Morgan settlement Heightened engagement in risk management including active involvement in Puerto Rico discussions Continue to special service RMBS collateral underlying $3.8 billion of insured net par, 35% of RMBS book • Continuous direct engagement with servicers to improve loan resolution (1) Operating Earnings is a non-GAAP financial measure of financial position that excludes (or includes) amounts that are included in (or excluded from) net income which is presented in accordance with GAAP. A reconciliation between both financial measures can be found in Ambac’s 1Q 2016 Earnings Release, included in Ambac’s Current Report on Form 8-K filed with the SEC on May 11, 2016 and at the end of this document (2) Adjusted book value is a non-GAAP financial measure of financial position that excludes (or includes) amounts that are included in (or excluded from) Total Ambac Financial Group, Inc. stockholders’ equity which is presented in accordance with GAAP. A reconciliation between both financial measures can be found in Ambac’s 1Q 2016 Earnings Release, included in Ambac’s Current Report on Form 8-K filed with the SEC on May 11, 2016 and at the end of this document

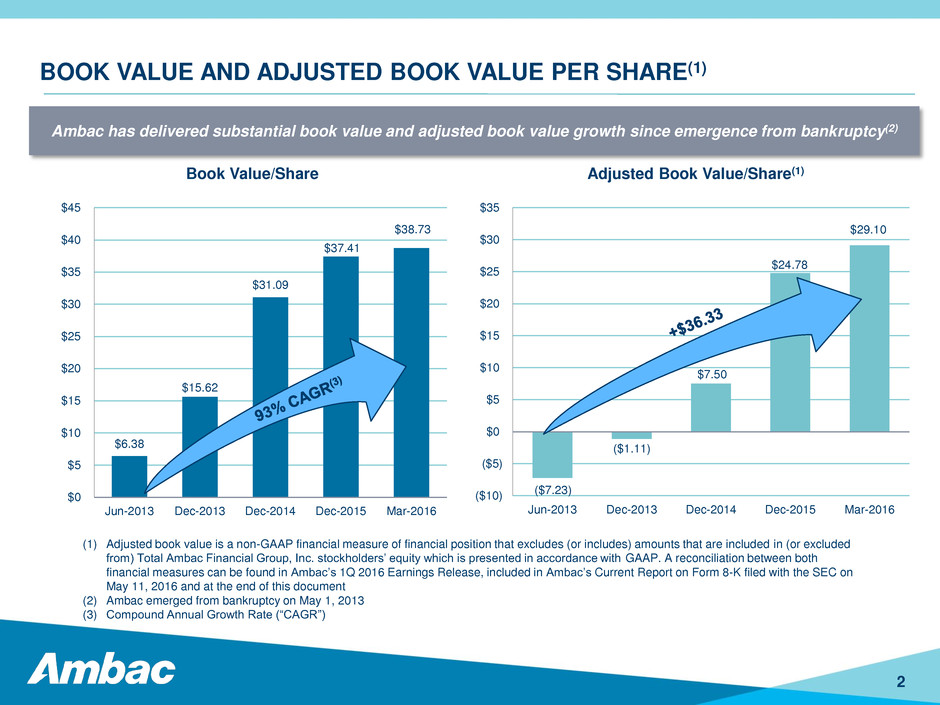

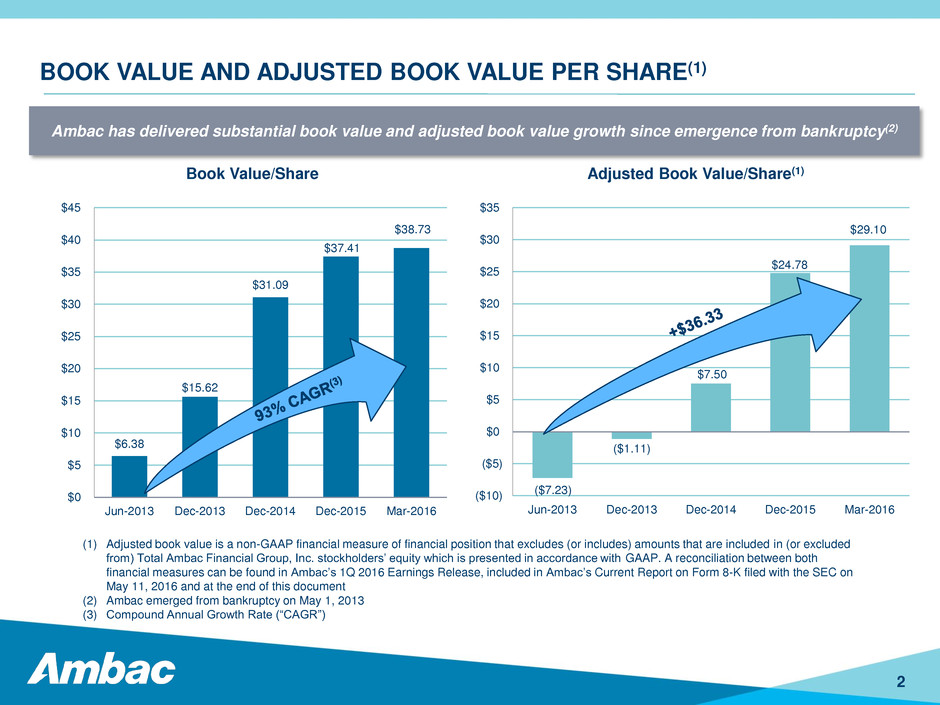

BOOK VALUE AND ADJUSTED BOOK VALUE PER SHARE(1) Ambac has delivered substantial book value and adjusted book value growth since emergence from bankruptcy(2) 2 ($7.23) ($1.11) $7.50 $24.78 $29.10 ($10) ($5) $0 $5 $10 $15 $20 $25 $30 $35 Jun-2013 Dec-2013 Dec-2014 Dec-2015 Mar-2016 $6.38 $15.62 $31.09 $37.41 $38.73 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 Jun-2013 Dec-2013 Dec-2014 Dec-2015 Mar-2016 Book Value/Share Adjusted Book Value/Share(1) (1) Adjusted book value is a non-GAAP financial measure of financial position that excludes (or includes) amounts that are included in (or excluded from) Total Ambac Financial Group, Inc. stockholders’ equity which is presented in accordance with GAAP. A reconciliation between both financial measures can be found in Ambac’s 1Q 2016 Earnings Release, included in Ambac’s Current Report on Form 8-K filed with the SEC on May 11, 2016 and at the end of this document (2) Ambac emerged from bankruptcy on May 1, 2013 (3) Compound Annual Growth Rate (“CAGR”)

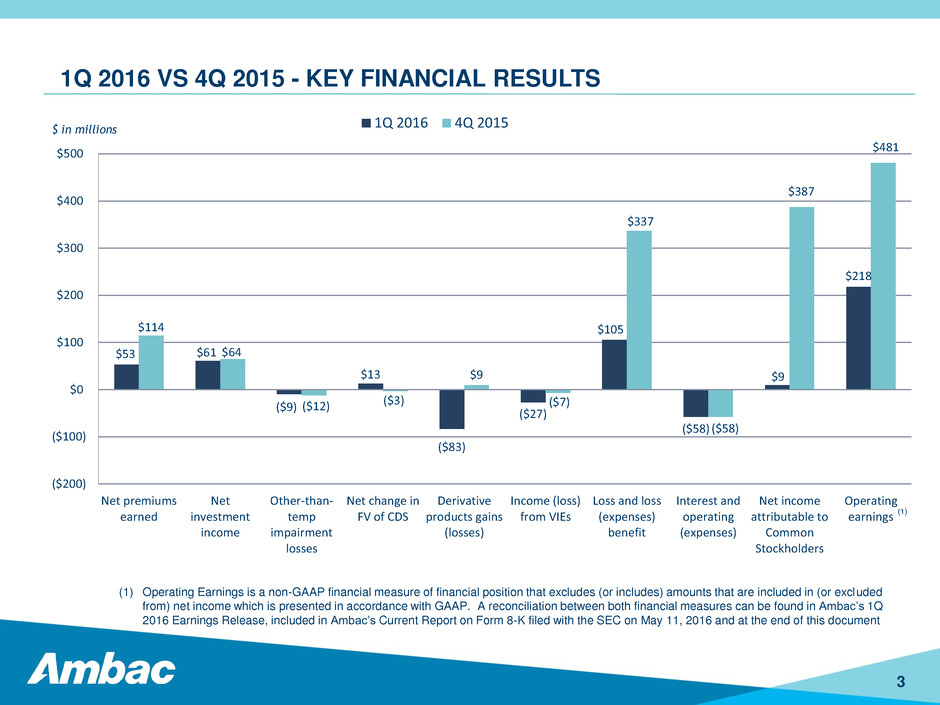

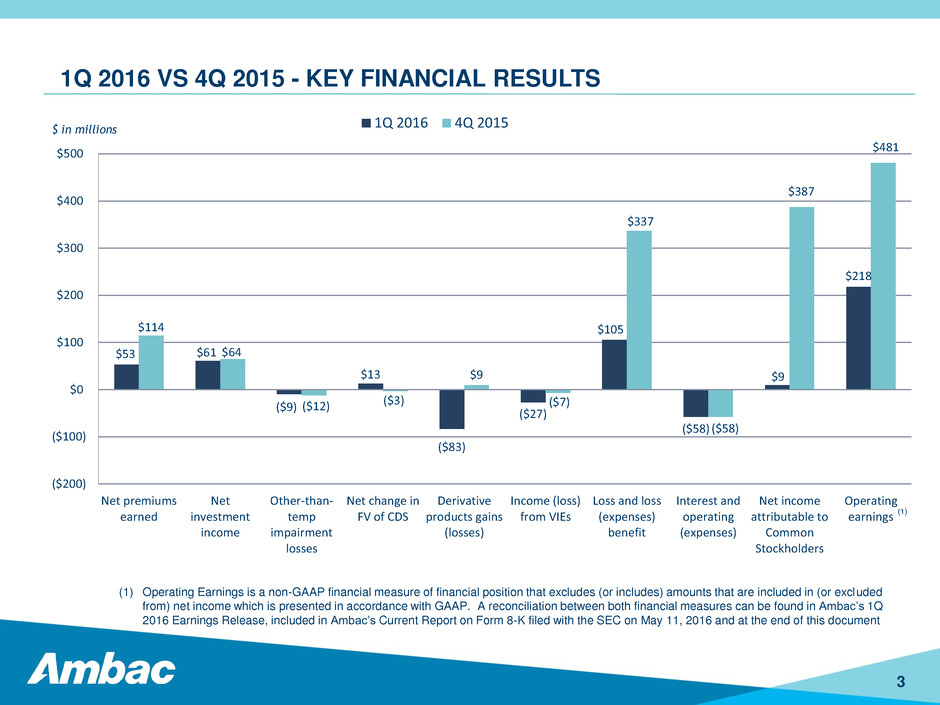

$53 $61 ($9) $13 ($83) ($27) $105 ($58) $9 $218 $114 $64 ($12) ($3) $9 ($7) $337 ($58) $387 $481 ($200) ($100) $0 $100 $200 $300 $400 $500 Net premiums earned Net investment income Other-than- temp impairment losses Net change in FV of CDS Derivative products gains (losses) Income (loss) from VIEs Loss and loss (expenses) benefit Interest and operating (expenses) Net income attributable to Common Stockholders Operating earnings 1Q 2016 4Q 2015 1Q 2016 VS 4Q 2015 - KEY FINANCIAL RESULTS 3 $ in millions (1) Operating Earnings is a non-GAAP financial measure of financial position that excludes (or includes) amounts that are included in (or excluded from) net income which is presented in accordance with GAAP. A reconciliation between both financial measures can be found in Ambac’s 1Q 2016 Earnings Release, included in Ambac’s Current Report on Form 8-K filed with the SEC on May 11, 2016 and at the end of this document (1)

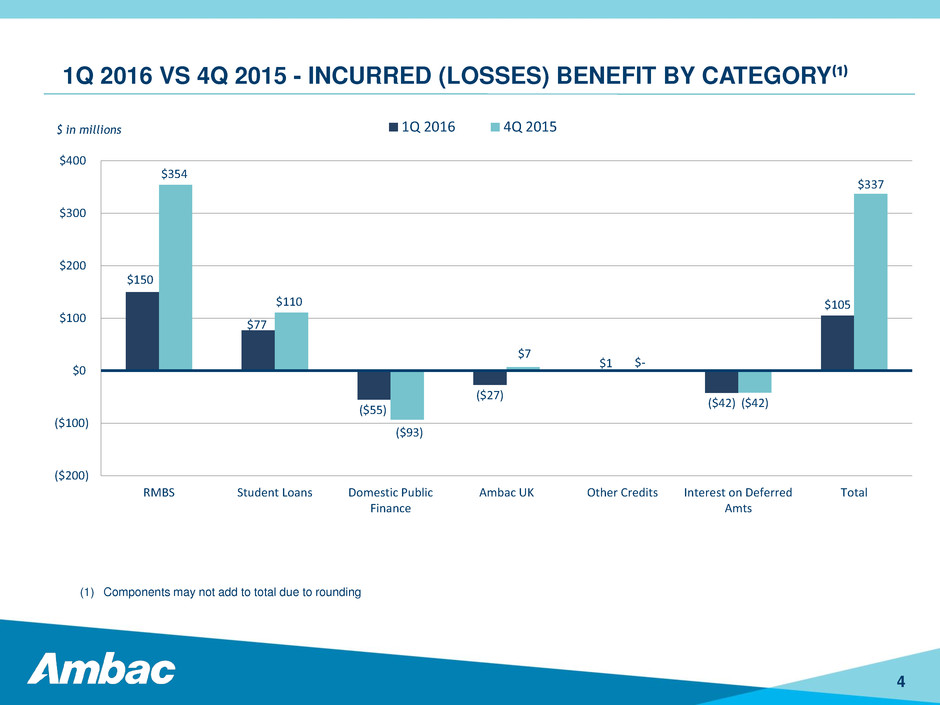

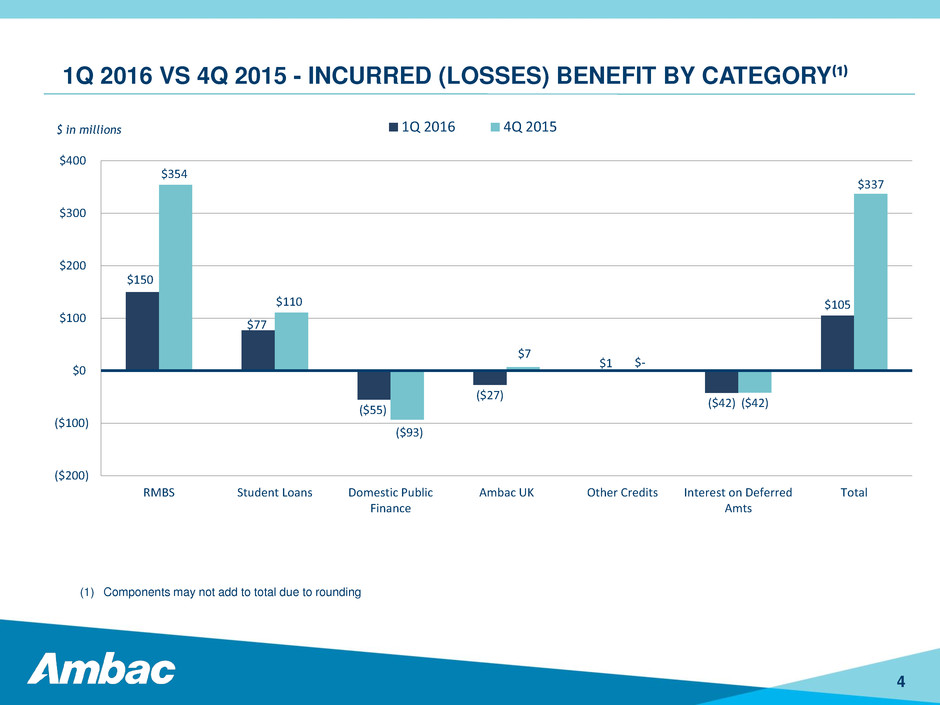

1Q 2016 VS 4Q 2015 - INCURRED (LOSSES) BENEFIT BY CATEGORY⁽¹⁾ 4 $150 $77 ($55) ($27) $1 ($42) $105 $354 $110 ($93) $7 $- ($42) $337 ($200) ($100) $0 $100 $200 $300 $400 RMBS Student Loans Domestic Public Finance Ambac UK Other Credits Interest on Deferred Amts Total 1Q 2016 4Q 2015 (1) Components may not add to total due to rounding $ in millions

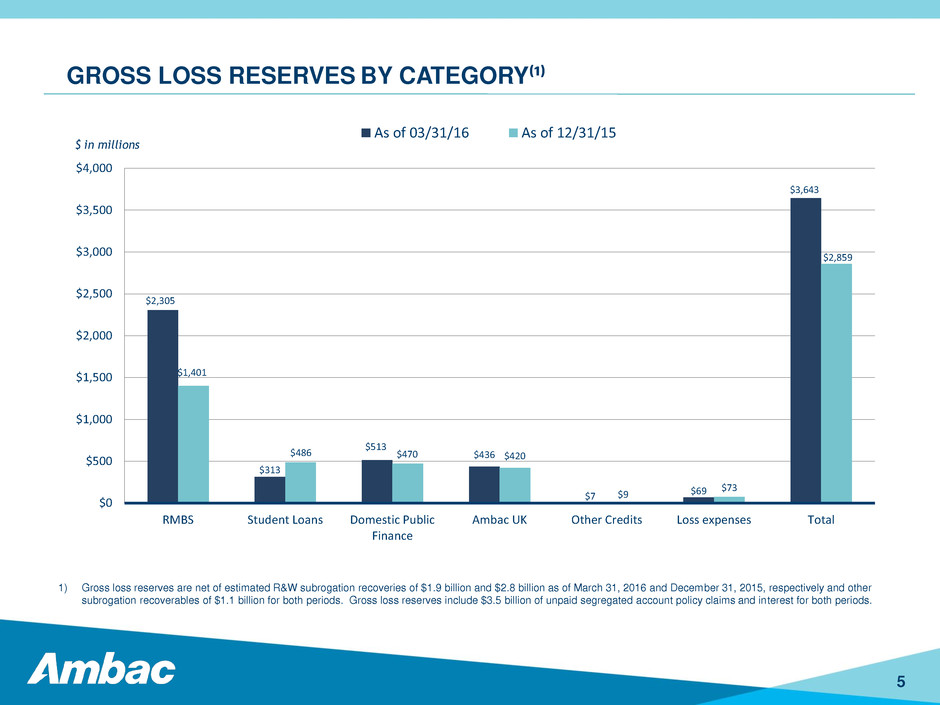

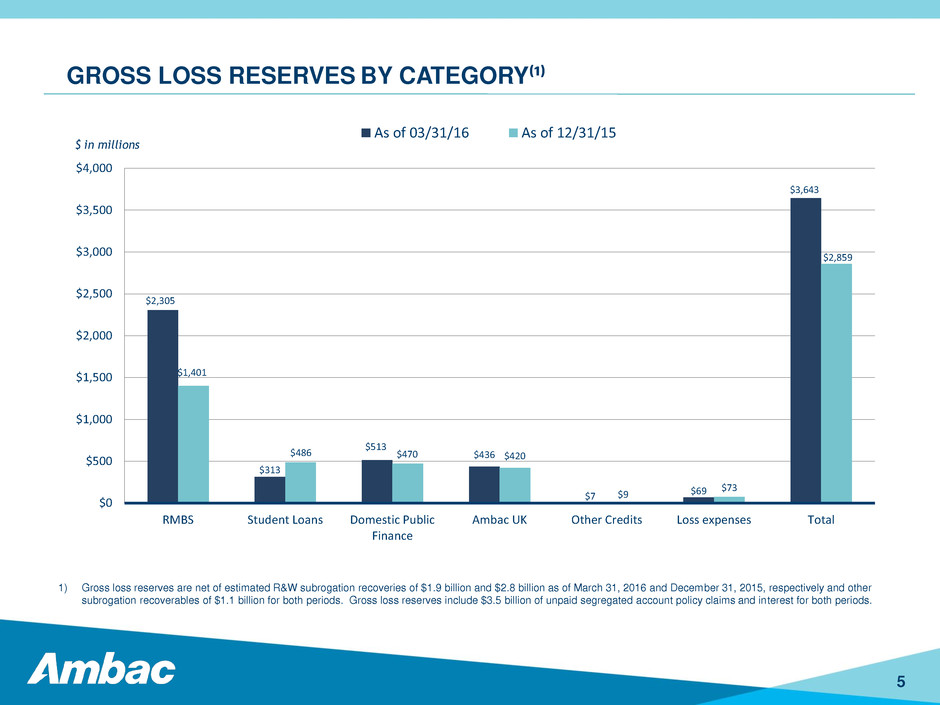

$2,305 $313 $513 $436 $7 $69 $3,643 $1,401 $486 $470 $420 $9 $73 $2,859 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 RMBS Student Loans Domestic Public Finance Ambac UK Other Credits Loss expenses Total As of 03/31/16 As of 12/31/15 $ in millions GROSS LOSS RESERVES BY CATEGORY⁽¹⁾ 5 1) Gross loss reserves are net of estimated R&W subrogation recoveries of $1.9 billion and $2.8 billion as of March 31, 2016 and December 31, 2015, respectively and other subrogation recoverables of $1.1 billion for both periods. Gross loss reserves include $3.5 billion of unpaid segregated account policy claims and interest for both periods.

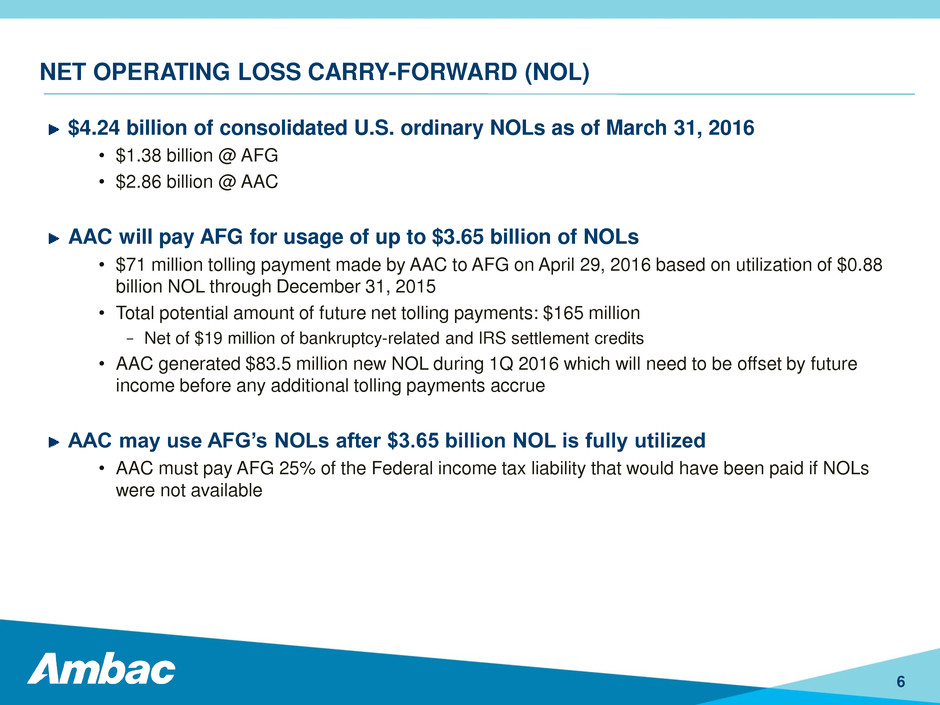

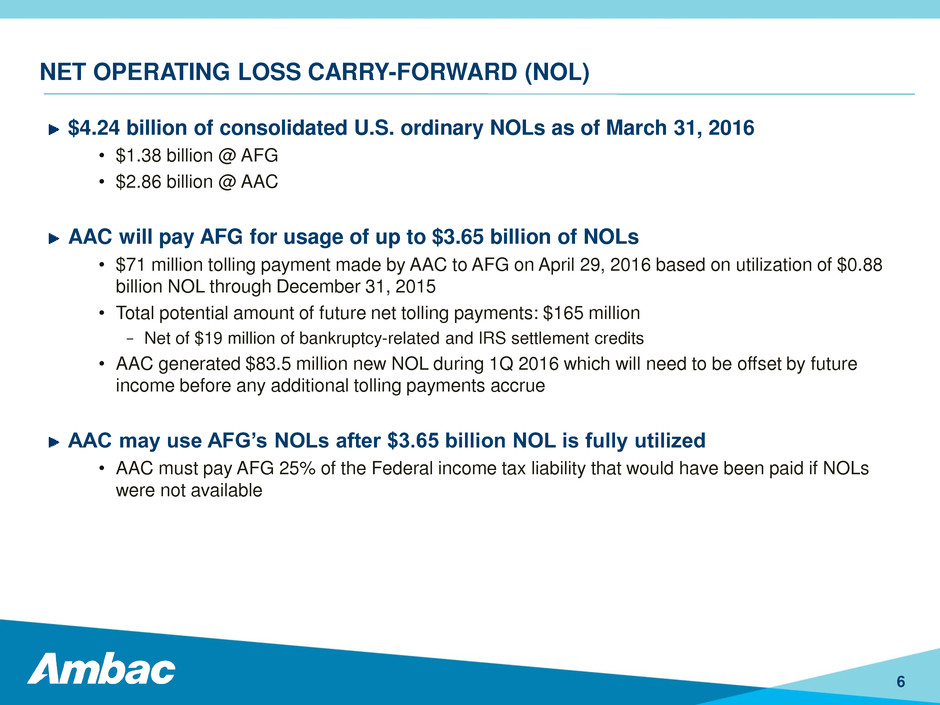

NET OPERATING LOSS CARRY-FORWARD (NOL) $4.24 billion of consolidated U.S. ordinary NOLs as of March 31, 2016 • $1.38 billion @ AFG • $2.86 billion @ AAC AAC will pay AFG for usage of up to $3.65 billion of NOLs • $71 million tolling payment made by AAC to AFG on April 29, 2016 based on utilization of $0.88 billion NOL through December 31, 2015 • Total potential amount of future net tolling payments: $165 million − Net of $19 million of bankruptcy-related and IRS settlement credits • AAC generated $83.5 million new NOL during 1Q 2016 which will need to be offset by future income before any additional tolling payments accrue AAC may use AFG’s NOLs after $3.65 billion NOL is fully utilized • AAC must pay AFG 25% of the Federal income tax liability that would have been paid if NOLs were not available 6

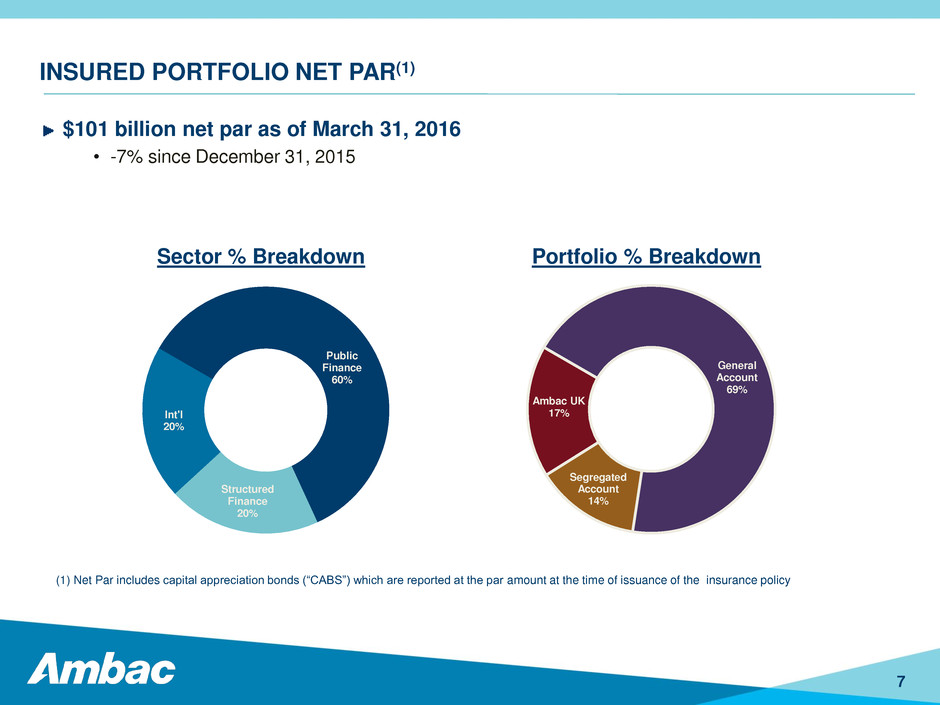

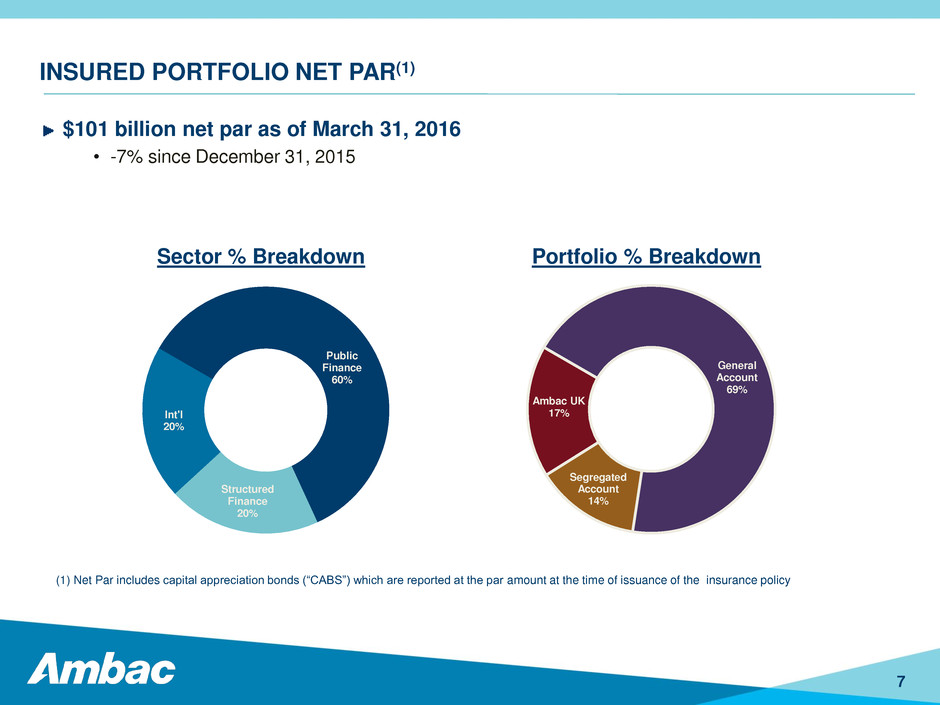

INSURED PORTFOLIO NET PAR(1) $101 billion net par as of March 31, 2016 • -7% since December 31, 2015 7 Public Finance 60% Structured Finance 20% Int'l 20% General Account 69% Segregated Account 14% Ambac UK 17% Portfolio % Breakdown Sector % Breakdown (1) Net Par includes capital appreciation bonds (“CABS”) which are reported at the par amount at the time of issuance of the insurance policy

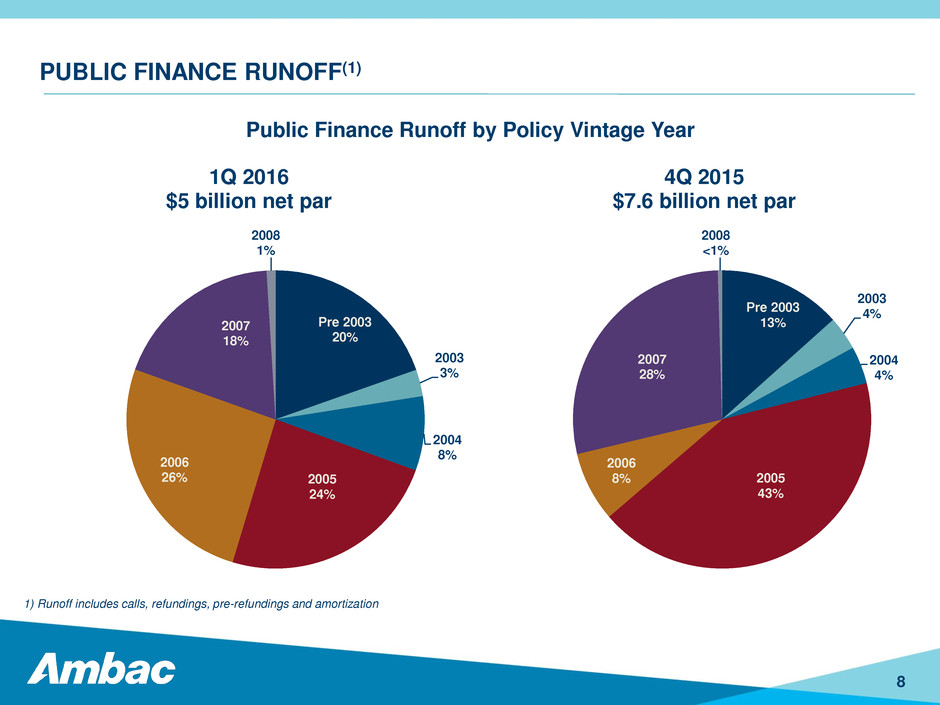

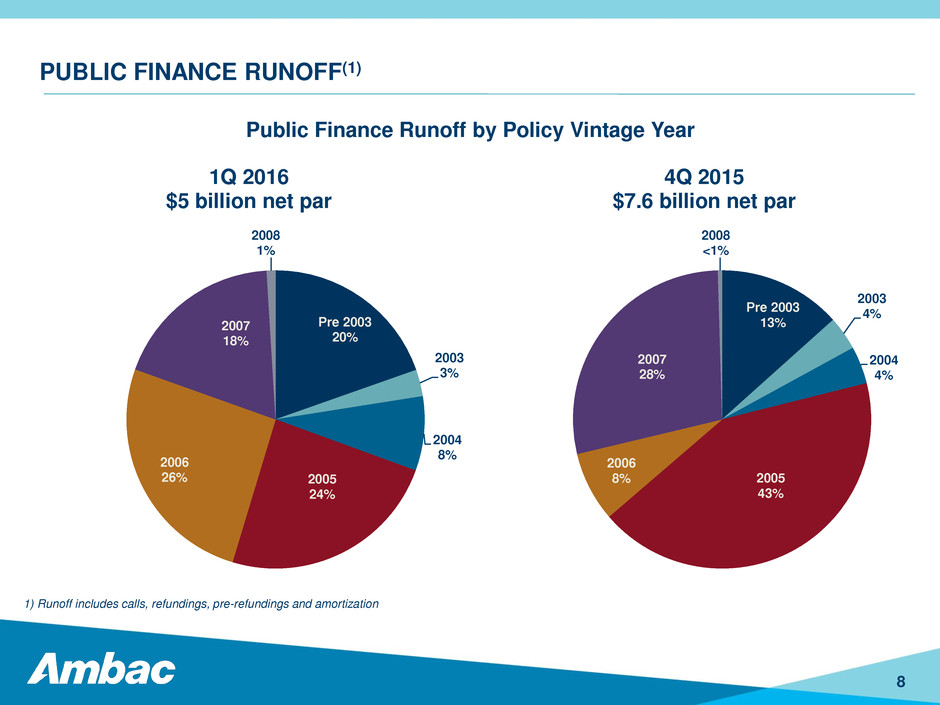

8 1) Runoff includes calls, refundings, pre-refundings and amortization PUBLIC FINANCE RUNOFF(1) Public Finance Runoff by Policy Vintage Year Pre 2003 13% 2003 4% 2004 4% 2005 43% 2006 8% 2007 28% 2008 <1% 4Q 2015 $7.6 billion net par Pre 2003 20% 2003 3% 2004 8% 2005 24% 2006 26% 2007 18% 2008 1% 1Q 2016 $5 billion net par

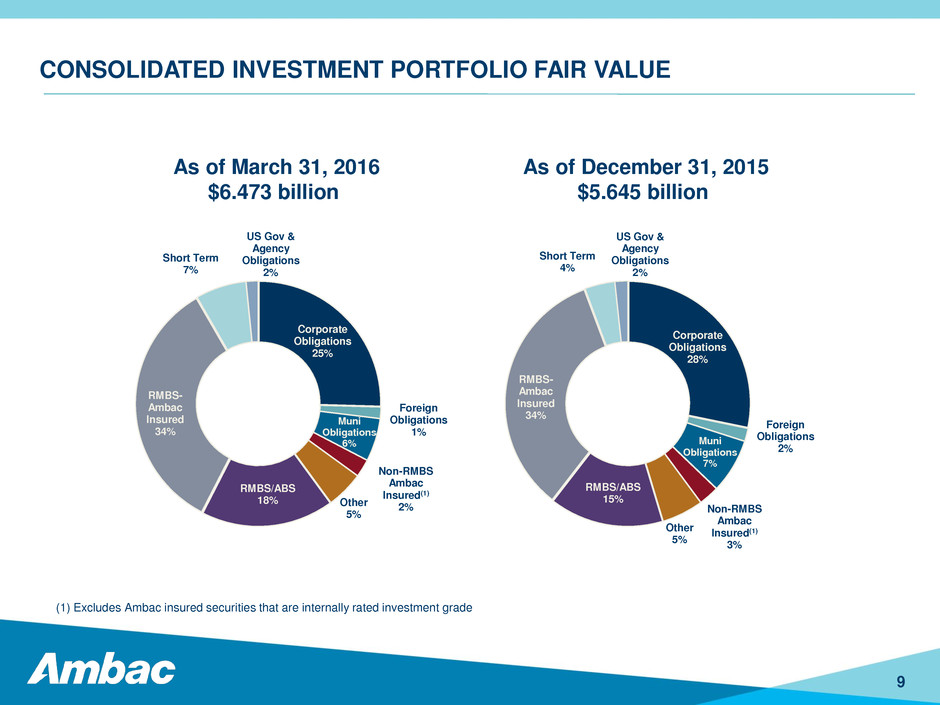

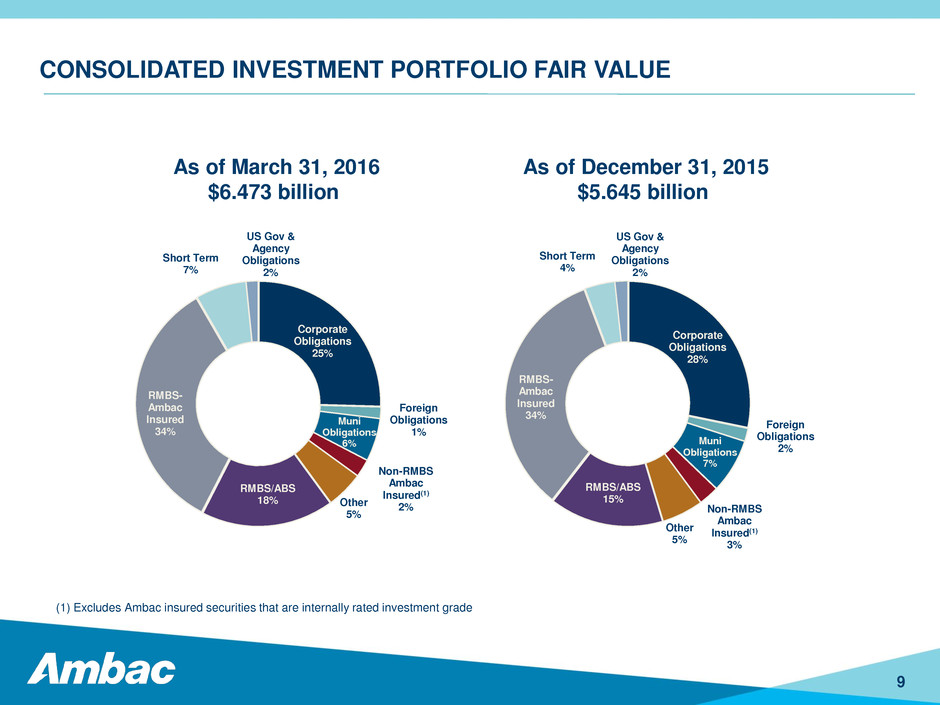

CONSOLIDATED INVESTMENT PORTFOLIO FAIR VALUE 9 As of March 31, 2016 $6.473 billion As of December 31, 2015 $5.645 billion Corporate Obligations 25% Foreign Obligations 1% Muni Obligations 6% Non-RMBS Ambac Insured(1) 2% Other 5% RMBS/ABS 18% RMBS- Ambac Insured 34% Short Term 7% US Gov & Agency Obligations 2% (1) Excludes Ambac insured securities that are internally rated investment grade Corporate Obligations 28% Foreign Obligations 2% Muni Obligations 7% Non-RMBS Ambac Insured(1) 3% Other 5% RMBS/ABS 15% RMBS- Ambac Insured 34% Short Term 4% US Gov & Agency Obligations 2%

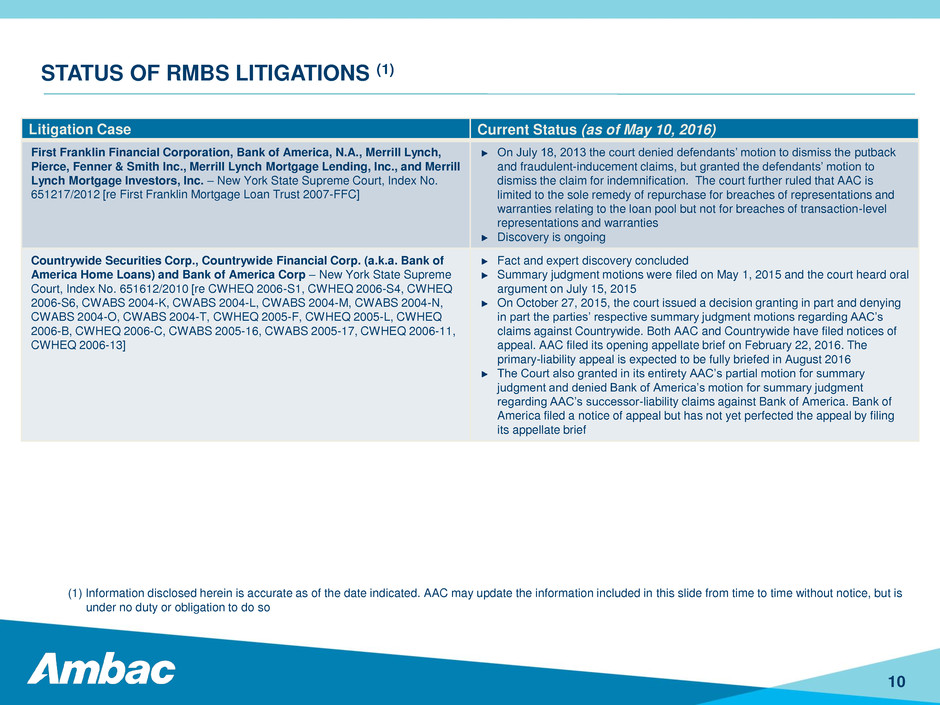

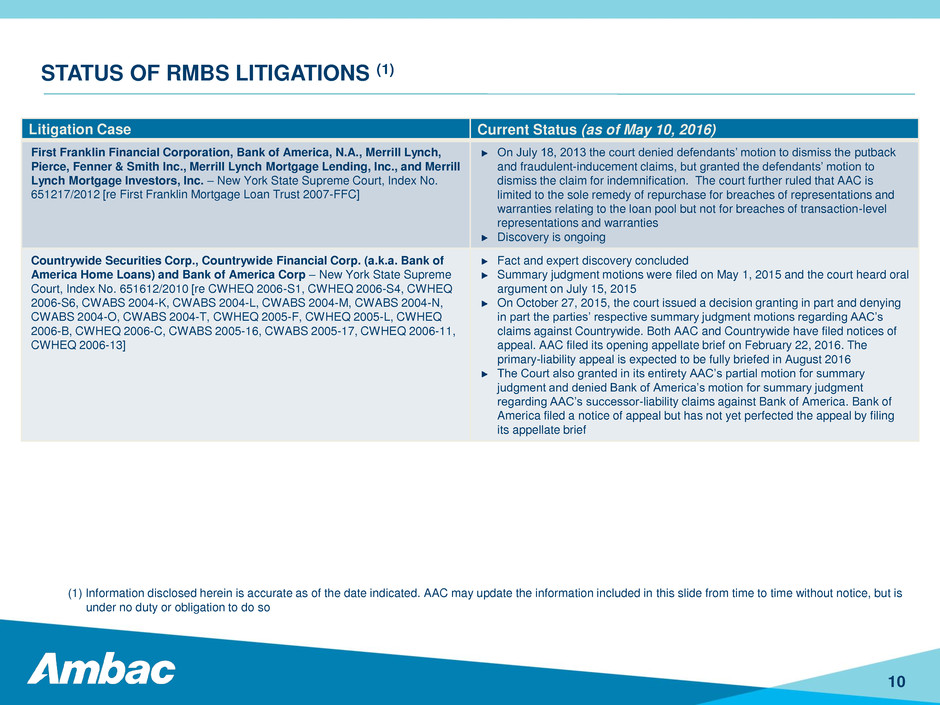

STATUS OF RMBS LITIGATIONS (1) Litigation Case Current Status (as of May 10, 2016) First Franklin Financial Corporation, Bank of America, N.A., Merrill Lynch, Pierce, Fenner & Smith Inc., Merrill Lynch Mortgage Lending, Inc., and Merrill Lynch Mortgage Investors, Inc. – New York State Supreme Court, Index No. 651217/2012 [re First Franklin Mortgage Loan Trust 2007-FFC] On July 18, 2013 the court denied defendants’ motion to dismiss the putback and fraudulent-inducement claims, but granted the defendants’ motion to dismiss the claim for indemnification. The court further ruled that AAC is limited to the sole remedy of repurchase for breaches of representations and warranties relating to the loan pool but not for breaches of transaction-level representations and warranties Discovery is ongoing Countrywide Securities Corp., Countrywide Financial Corp. (a.k.a. Bank of America Home Loans) and Bank of America Corp – New York State Supreme Court, Index No. 651612/2010 [re CWHEQ 2006-S1, CWHEQ 2006-S4, CWHEQ 2006-S6, CWABS 2004-K, CWABS 2004-L, CWABS 2004-M, CWABS 2004-N, CWABS 2004-O, CWABS 2004-T, CWHEQ 2005-F, CWHEQ 2005-L, CWHEQ 2006-B, CWHEQ 2006-C, CWABS 2005-16, CWABS 2005-17, CWHEQ 2006-11, CWHEQ 2006-13] Fact and expert discovery concluded Summary judgment motions were filed on May 1, 2015 and the court heard oral argument on July 15, 2015 On October 27, 2015, the court issued a decision granting in part and denying in part the parties’ respective summary judgment motions regarding AAC’s claims against Countrywide. Both AAC and Countrywide have filed notices of appeal. AAC filed its opening appellate brief on February 22, 2016. The primary-liability appeal is expected to be fully briefed in August 2016 The Court also granted in its entirety AAC’s partial motion for summary judgment and denied Bank of America’s motion for summary judgment regarding AAC’s successor-liability claims against Bank of America. Bank of America filed a notice of appeal but has not yet perfected the appeal by filing its appellate brief 10 (1) Information disclosed herein is accurate as of the date indicated. AAC may update the information included in this slide from time to time without notice, but is under no duty or obligation to do so

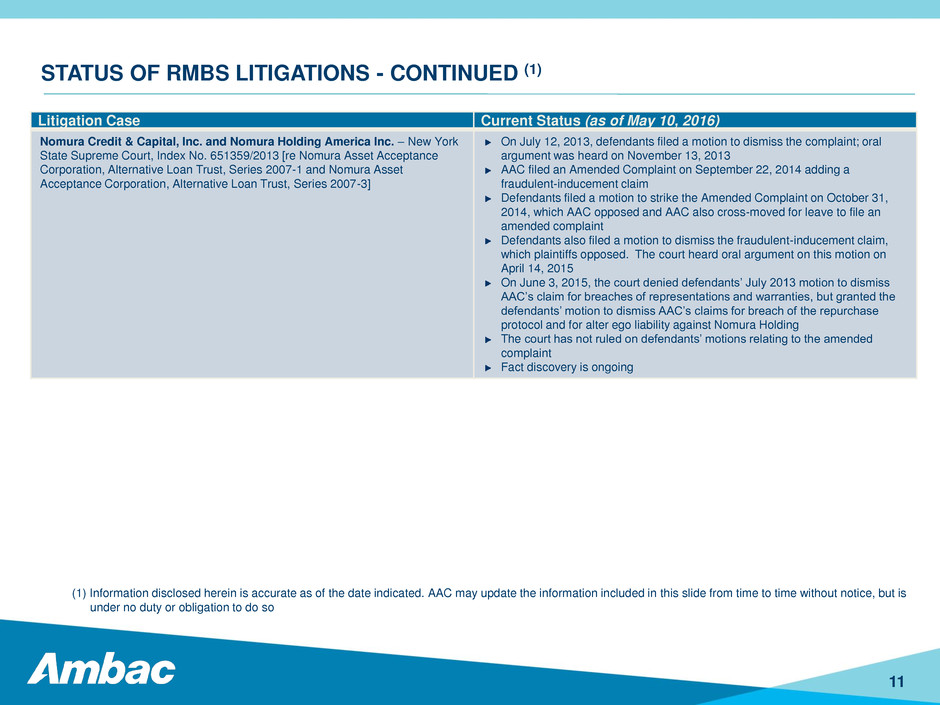

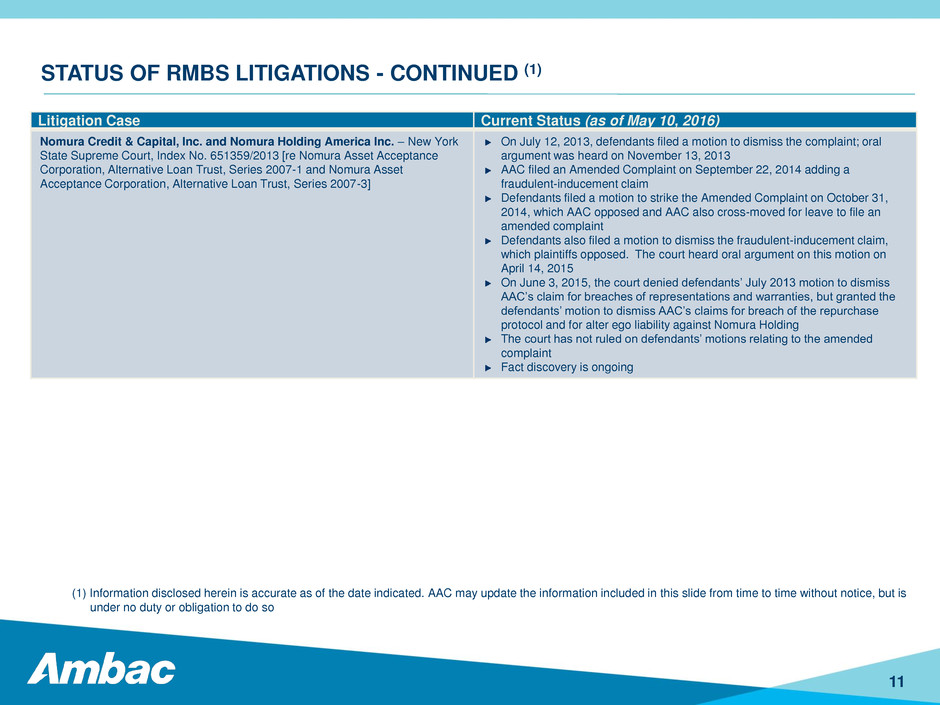

STATUS OF RMBS LITIGATIONS - CONTINUED (1) Litigation Case Current Status (as of May 10, 2016) Nomura Credit & Capital, Inc. and Nomura Holding America Inc. – New York State Supreme Court, Index No. 651359/2013 [re Nomura Asset Acceptance Corporation, Alternative Loan Trust, Series 2007-1 and Nomura Asset Acceptance Corporation, Alternative Loan Trust, Series 2007-3] On July 12, 2013, defendants filed a motion to dismiss the complaint; oral argument was heard on November 13, 2013 AAC filed an Amended Complaint on September 22, 2014 adding a fraudulent-inducement claim Defendants filed a motion to strike the Amended Complaint on October 31, 2014, which AAC opposed and AAC also cross-moved for leave to file an amended complaint Defendants also filed a motion to dismiss the fraudulent-inducement claim, which plaintiffs opposed. The court heard oral argument on this motion on April 14, 2015 On June 3, 2015, the court denied defendants’ July 2013 motion to dismiss AAC’s claim for breaches of representations and warranties, but granted the defendants’ motion to dismiss AAC’s claims for breach of the repurchase protocol and for alter ego liability against Nomura Holding The court has not ruled on defendants’ motions relating to the amended complaint Fact discovery is ongoing 11 (1) Information disclosed herein is accurate as of the date indicated. AAC may update the information included in this slide from time to time without notice, but is under no duty or obligation to do so

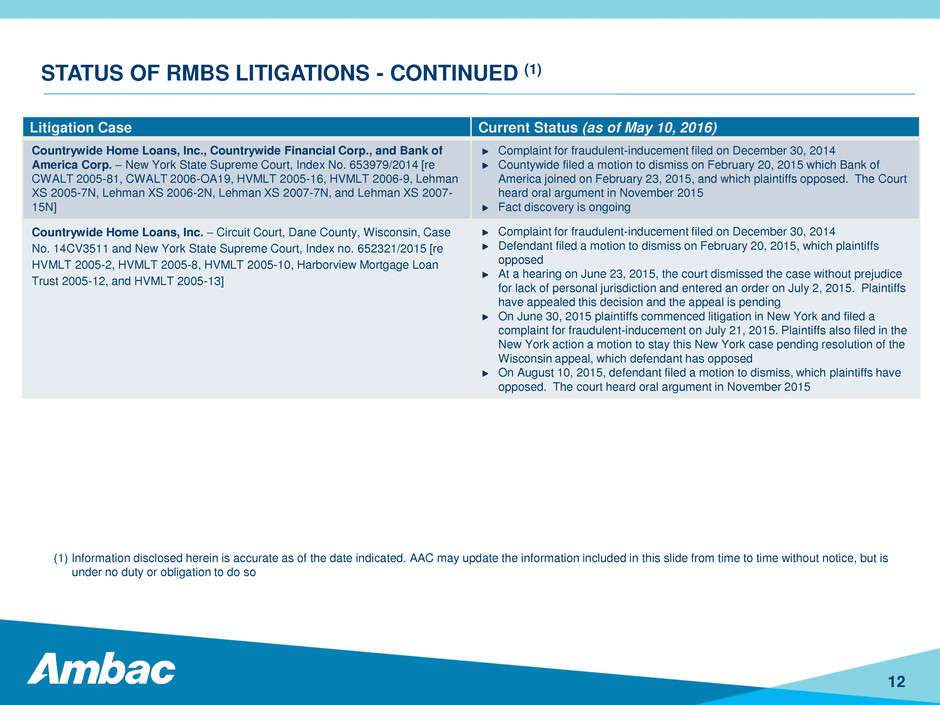

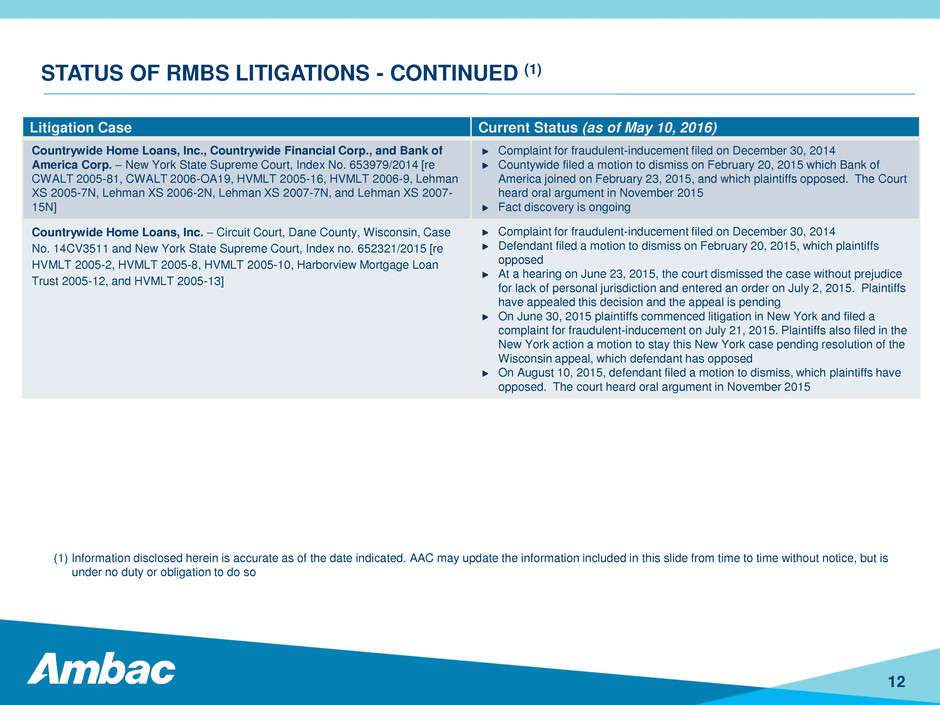

STATUS OF RMBS LITIGATIONS - CONTINUED (1) Litigation Case Current Status (as of May 10, 2016) Countrywide Home Loans, Inc., Countrywide Financial Corp., and Bank of America Corp. – New York State Supreme Court, Index No. 653979/2014 [re CWALT 2005-81, CWALT 2006-OA19, HVMLT 2005-16, HVMLT 2006-9, Lehman XS 2005-7N, Lehman XS 2006-2N, Lehman XS 2007-7N, and Lehman XS 2007- 15N] Complaint for fraudulent-inducement filed on December 30, 2014 Countywide filed a motion to dismiss on February 20, 2015 which Bank of America joined on February 23, 2015, and which plaintiffs opposed. The Court heard oral argument in November 2015 Fact discovery is ongoing Countrywide Home Loans, Inc. – Circuit Court, Dane County, Wisconsin, Case No. 14CV3511 and New York State Supreme Court, Index no. 652321/2015 [re HVMLT 2005-2, HVMLT 2005-8, HVMLT 2005-10, Harborview Mortgage Loan Trust 2005-12, and HVMLT 2005-13] Complaint for fraudulent-inducement filed on December 30, 2014 Defendant filed a motion to dismiss on February 20, 2015, which plaintiffs opposed At a hearing on June 23, 2015, the court dismissed the case without prejudice for lack of personal jurisdiction and entered an order on July 2, 2015. Plaintiffs have appealed this decision and the appeal is pending On June 30, 2015 plaintiffs commenced litigation in New York and filed a complaint for fraudulent-inducement on July 21, 2015. Plaintiffs also filed in the New York action a motion to stay this New York case pending resolution of the Wisconsin appeal, which defendant has opposed On August 10, 2015, defendant filed a motion to dismiss, which plaintiffs have opposed. The court heard oral argument in November 2015 12 (1) Information disclosed herein is accurate as of the date indicated. AAC may update the information included in this slide from time to time without notice, but is under no duty or obligation to do so

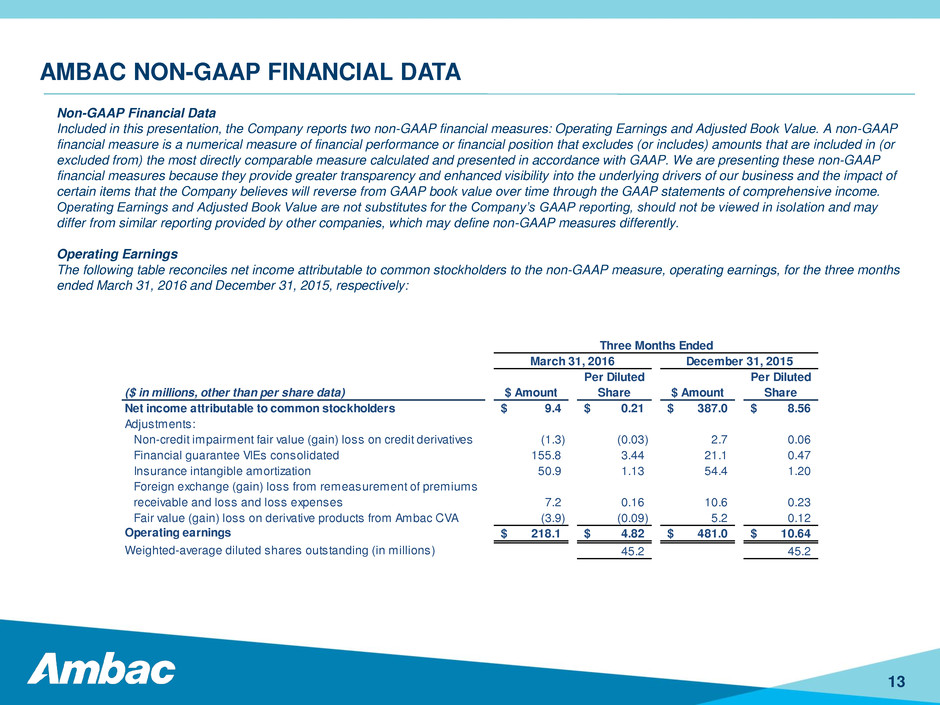

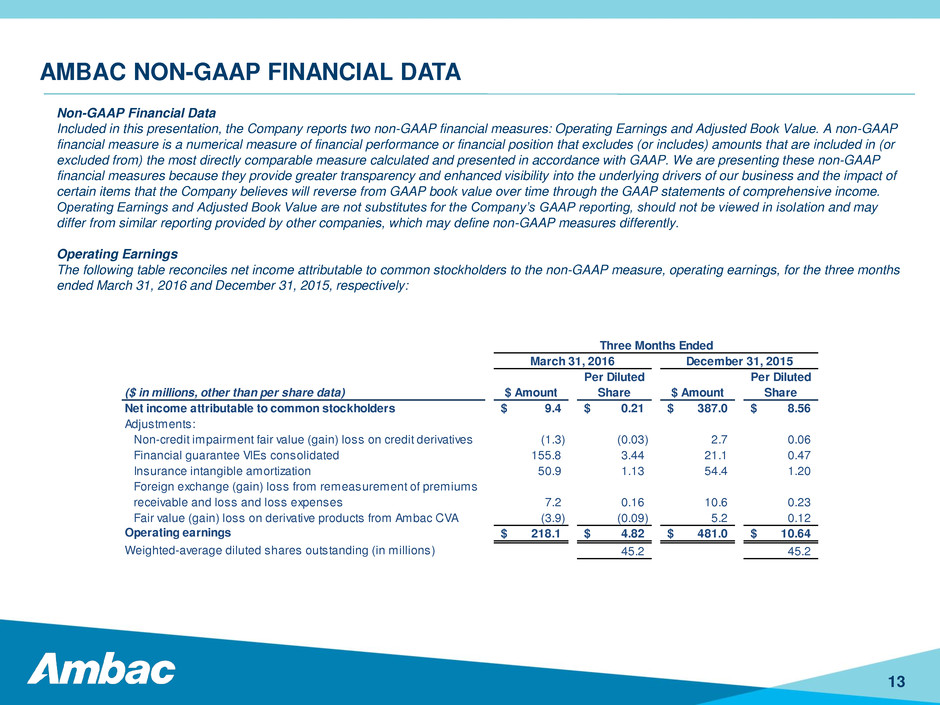

Non-GAAP Financial Data Included in this presentation, the Company reports two non-GAAP financial measures: Operating Earnings and Adjusted Book Value. A non-GAAP financial measure is a numerical measure of financial performance or financial position that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We are presenting these non-GAAP financial measures because they provide greater transparency and enhanced visibility into the underlying drivers of our business and the impact of certain items that the Company believes will reverse from GAAP book value over time through the GAAP statements of comprehensive income. Operating Earnings and Adjusted Book Value are not substitutes for the Company’s GAAP reporting, should not be viewed in isolation and may differ from similar reporting provided by other companies, which may define non-GAAP measures differently. Operating Earnings The following table reconciles net income attributable to common stockholders to the non-GAAP measure, operating earnings, for the three months ended March 31, 2016 and December 31, 2015, respectively: 13 AMBAC NON-GAAP FINANCIAL DATA Per Diluted Per Diluted ($ in illions, h r than per share data) $ Amount Share $ Amount Share Net inc m attr butable to common stockholders 9.4$ 0.21$ 387.0$ 8.56$ Adjustments: N n-cr dit impairment fair value (gain) loss on credit derivatives (1.3) (0.03) 2.7 0.06 Financial guarantee VIEs consolidated 155.8 3.44 21.1 0.47 Insurance intangible amortization 50.9 1.13 54.4 1.20 Foreign exchange (gain) loss from remeasurement of premiums receivable and loss and loss expenses 7.2 0.16 10.6 0.23 Fair value (gain) loss on derivative products from Ambac CVA (3.9) (0.09) 5.2 0.12 Operating earnings 218.1$ 4.82$ 481.0$ 10.64$ Weighted-average diluted shares outstanding (in millions) 45.2 45.2 Three Months Ended March 31, 2016 December 31, 2015

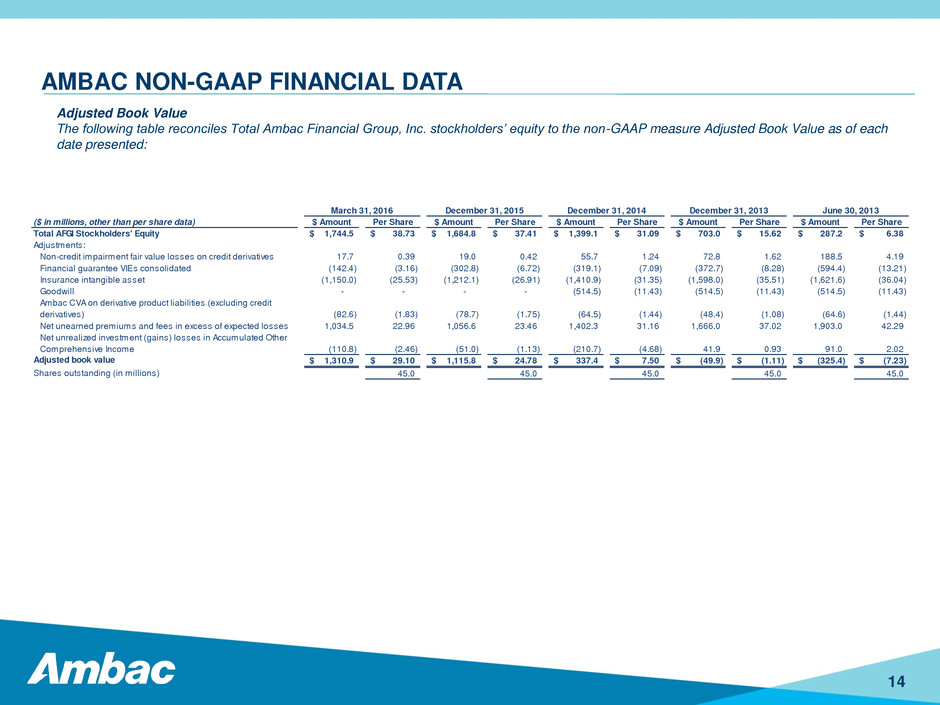

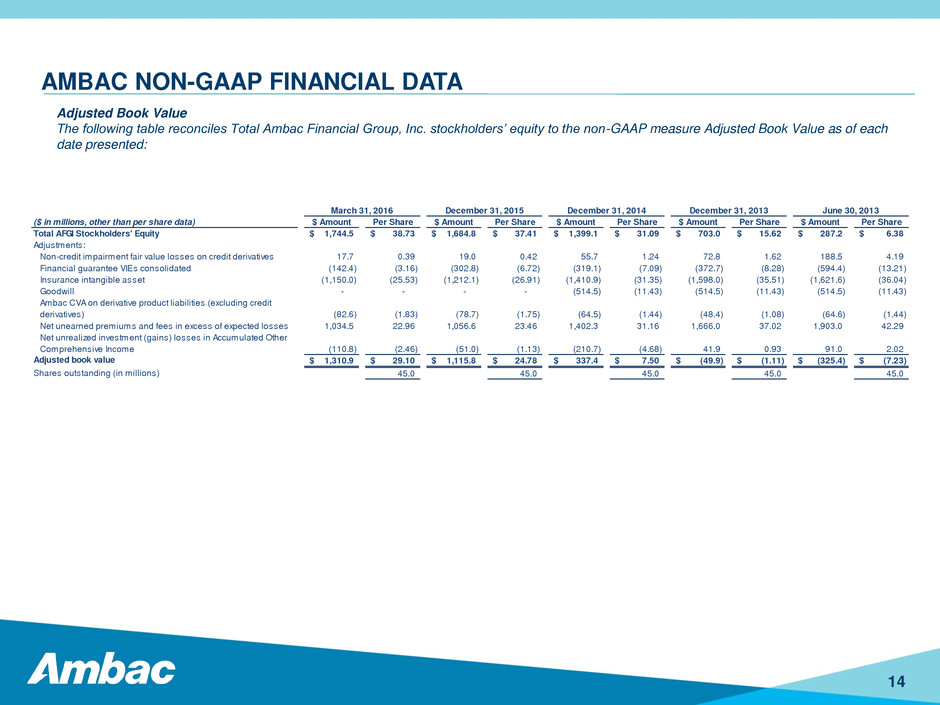

Adjusted Book Value The following table reconciles Total Ambac Financial Group, Inc. stockholders’ equity to the non-GAAP measure Adjusted Book Value as of each date presented: 14 AMBAC NON-GAAP FINANCIAL DATA ($ in millions, other than per share data) $ Amount Per Share $ Amount Per Share $ Amount Per Share $ Amount Per Share $ Amount Per Share Total AFGI Stockholders' Equity 1,744.5$ 38.73$ 1,684.8$ 37.41$ 1,399.1$ 31.09$ 703.0$ 15.62$ 287.2$ 6.38$ Adjustments: Non-credit impairment fair value losses on credit derivatives 17.7 0.39 19.0 0.42 55.7 1.24 72.8 1.62 188.5 4.19 Financial guarantee VIEs consolidated (142.4) (3.16) (302.8) (6.72) (319.1) (7.09) (372.7) (8.28) (594.4) (13.21) Insurance int ngible asset (1,150.0) (25.53) (1,212.1) (26.91) (1,410.9) (31.35) (1,598.0) (35.51) (1,621.6) (36.04) Goodwill - - - - (514.5) (11.43) (514.5) (11.43) (514.5) (11.43) Ambac CVA on derivative product liabilities (excluding credit derivatives) (82.6) (1.83) (78.7) (1.75) (64.5) (1.44) (48.4) (1.08) (64.6) (1.44) Net unearned premiums and fees in excess of expected losses 1,034.5 22.96 1,056.6 23.46 1,402.3 31.16 1,666.0 37.02 1,903.0 42.29 Net unrealized invest ent (gains) losses in Accumulated Other Comprehensive Income (110.8) (2.46) (51.0) (1.13) (210.7) (4.68) 41.9 0.93 91.0 2.02 Adjusted book value 1,310.9$ 29.10$ 1,115.8$ 24.78$ 337.4$ 7.50$ (49.9)$ (1.11)$ (325.4)$ (7.23)$ Shares outstanding (in millions) 45.0 45.0 45.0 45.0 45.0 June 30, 2013March 31, 2016 December 31, 2013December 31, 2015 December 31, 2014

FORWARD LOOKING STATEMENT In this presentation, we have included statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “potential,” “going forward,” “looking ahead” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which, may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements include, among others, those discussed under “Risk Factors” described in our most recent SEC filed quarterly or annual report. Any or all of management’s forward-looking statements here or in other publications may turn out to be incorrect and are based on management’s current belief or opinions. Ambac’s actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among events, risks, uncertainties or factors that could cause actual results to differ materially are: (1) volatility in the price of Ambac’s common stock; (2) uncertainty concerning our ability to achieve value for holders of Ambac securities, whether from Ambac Assurance Corporation (“AAC”) or from new business opportunities; (3) dilution of current shareholder value or adverse effects on our share price resulting from the issuance of additional shares of common stock; (4) adverse effects on our share price resulting from future offerings of debt or equity securities that rank senior to our common stock; (5) potential of rehabilitation proceedings against AAC; (6) decisions made by the Rehabilitator of the Segregated Account of AAC (the “Segregated Account”) for the benefit of policyholders that may result in material adverse consequences for Ambac’s security holders; (7) our inability to realize the expected recoveries included in our financial statements; (8) intercompany disputes or disputes with the rehabilitator of the Segregated Account; (9) our inability to monetize assets, restructure or exchange outstanding debt and insurance obligations, or the failure of any such transaction to deliver anticipated results; (10) our results of operations may be adversely affected by events or circumstances that result in the accelerated amortization of our insurance intangible asset; (11) increased fiscal stress experienced by issuers of public finance obligations or an increased incidence of Chapter 9 filings by municipal issuers; (12) adverse tax consequences or other costs resulting from the Segregated Account rehabilitation plan, from rules and procedures governing the payment of permitted policy claims, or from the characterization of our surplus notes as equity; (13) credit risk throughout our business, including but not limited to credit risk related to residential mortgage-backed securities, student loan and other asset securitizations, collateralized loan obligations, public finance obligations and exposures to reinsurers; (14) risks attendant to the change in composition of securities in our investment portfolio; (15) inadequacy of reserves established for losses and loss expenses; (16) the risk that our risk management policies and practices do not anticipate certain risks and/ or the magnitude of potential for loss as a result of unforeseen risks; (17) changes in prevailing interest rates; (18) factors that may influence the amount of installment premiums paid to Ambac, including the Segregated Account rehabilitation proceedings; (19) default by one or more of AAC’s portfolio investments, insured issuers or counterparties; (20) market risks impacting assets in our investment portfolio or the value of our assets posted as collateral in respect of investment agreements and interest rate swap transactions; (21) risks relating to determinations of amounts of impairments taken on investments; (22) the risk of litigation and regulatory inquiries or investigations, and the risk of adverse outcomes in connection therewith, which could have a material adverse effect on our business, operations, financial position, profitability or cash flows; (23) our inability to realize value from Ambac Assurance UK Limited ("Ambac UK"); (24) system security risks; (25) market spreads and pricing on derivative products insured or issued by Ambac or its subsidiaries; (26) the risk of volatility in income and earnings, including volatility due to the application of fair value accounting; (27) changes in accounting principles or practices that may impact Ambac’s reported financial results; (28) legislative and regulatory developments; (29) operational risks, including with respect to internal processes, risk models, systems and employees, and failures in services or products provided by third parties; (30) Ambac’s financial position and the Segregated Account rehabilitation proceedings that may prompt departures of key employees and may impact our ability to attract qualified executives and employees; and (31) other risks and uncertainties that have not been identified at this time. 15

Important Information Ambac Financial Group, Inc., ("Ambac") filed a definitive proxy statement with the Securities and Exchange Commission ("SEC") on April 20, 2016 in connection with its 2016 Annual Meeting. STOCKHOLDERS ARE URGED TO READ THIS PROXY STATEMENT, THE ACCOMPANYING WHITE PROXY CARD AND OTHER RELEVANT DOCUMENTS FILED BY AMBAC WITH THE SEC IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov and through the website maintained by Ambac at http://ir.ambac.com. Certain Information Regarding Participants Ambac, its directors and certain of its officers and other employees may be deemed to be participants in the solicitation of Ambac's stockholders in connection with its 2016 annual meeting. Information regarding the names, affiliations and direct and indirect interests (by security holdings or otherwise) of these persons can be found in Ambac's definitive proxy statement for its 2016 Annual Meeting, which was filed with the SEC on April 20, 2016. To the extent holdings of Ambac’s securities by such persons have changed since the amounts printed in the 2016 definitive proxy statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement and, to the extent applicable, will be updated in other materials to be filed with the SEC in connection with Ambac’s 2016 Annual Meeting. Stockholders may obtain a free copy of the proxy statement and other documents filed by Ambac with the SEC from the sources listed above. About Ambac Ambac Financial Group, Inc. ("Ambac"), headquartered in New York City, is a holding company whose subsidiaries, including its principal operating subsidiary, Ambac Assurance Corporation ("Ambac Assurance"), Everspan Financial Guarantee Corp., and Ambac Assurance UK Limited, provide financial guarantees and other financial services to clients in both the public and private sectors globally. Ambac Assurance, including the Segregated Account of Ambac Assurance (in rehabilitation), is a guarantor of public finance and structured finance obligations. Ambac is also selectively exploring opportunities involving the acquisition and/or development of new businesses. Ambac‘s common stock trades on the NASDAQ Global Select Market under the symbol “AMBC”. The Amended and Restated Certificate of Incorporation of Ambac contains substantial restrictions on the ability to transfer Ambac’s common stock. Subject to limited exceptions, any attempted transfer of common stock shall be prohibited and void to the extent that, as a result of such transfer (or any series of transfers of which such transfer is a part), any person or group of persons shall become a holder of 5% or more of Ambac’s common stock. Ambac is committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, we use our website to convey information about our businesses, including the anticipated release of quarterly financial results, quarterly financial, statistical and business-related information, and the posting of updates to the status of certain primary residential mortgage backed securities litigations. For more information, please go to www.ambac.com. 16

© 2014 Ambac Financial Group, Inc. One State Street Plaza, New York, NY 10004 All Rights Reserved | 800-221-1854 | www.ambac.com 6