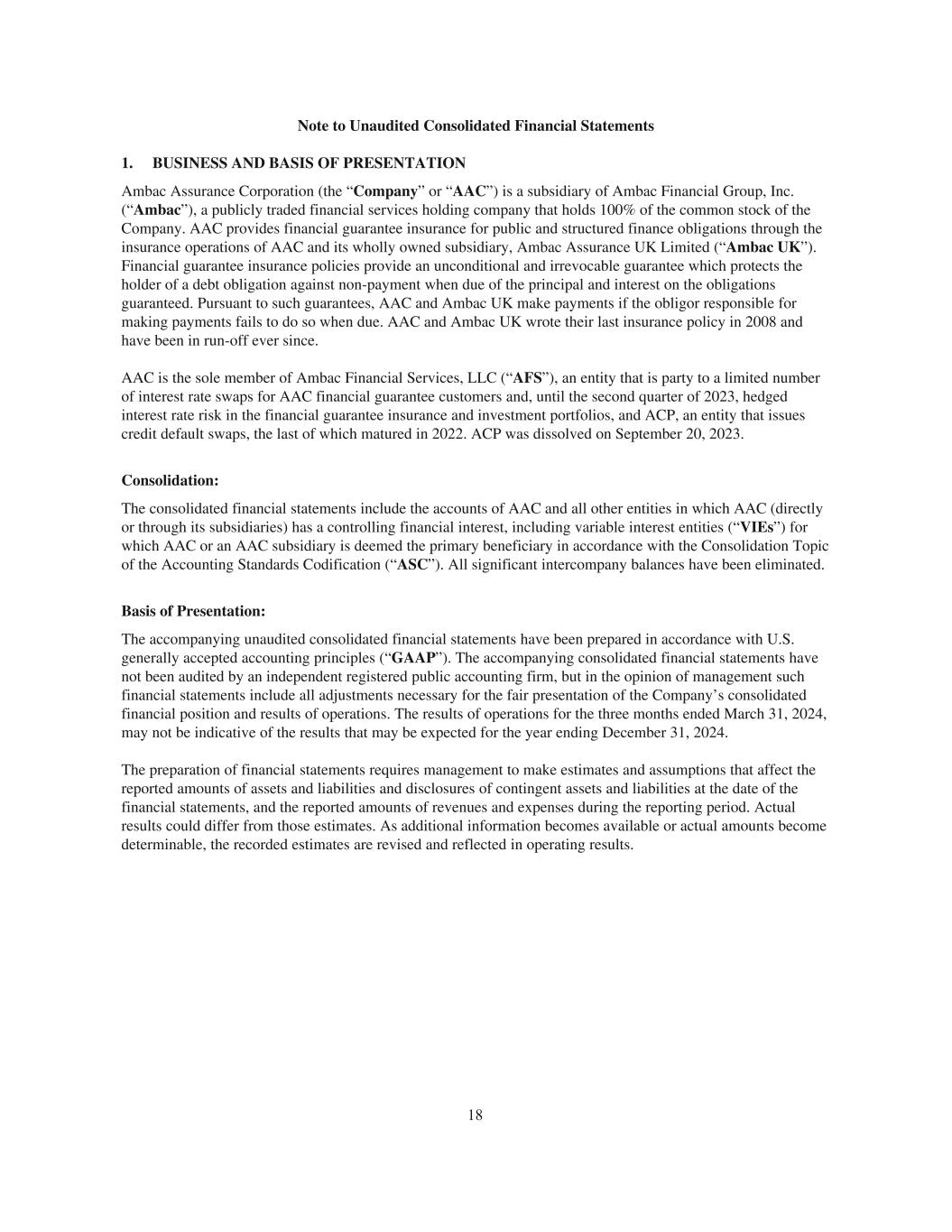

PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION The following preliminary unaudited pro forma combined financial information gives effect to the following transactions by Ambac Financial Group, Inc (“Ambac”), collectively the “Transactions”: • Ambac’s disposition of 100% of the common stock of Ambac Assurance Corporation (“AAC”) under the terms of a Stock Purchase Agreement dated June 4, 2024, with American Acorn Corporation (“Buyer”), a Delaware corporation owned by funds managed by Oaktree Capital Management, L.P., pursuant to which, subject to the conditions set forth therein, Ambac will sell all the issued and outstanding shares of common stock, par value $2.50 per share, of AAC to Buyer for aggregate consideration of $420 million in cash (the “AAC Transaction”). At the closing of the AAC Transaction, Ambac will issue to Buyer or its designee a warrant (the “Warrant”) exercisable for a number of shares of common stock, par value $0.01, of Ambac representing 9.9% of the fully diluted shares of Ambac’s common stock as of March 31, 2024, pro forma for the issuance of the Warrant (the “Warrant Shares”). The Warrant will have an exercise price per share of $18.50 with a six and a half- year term from the date of issuance and will be immediately exercisable. • Ambac’s acquisition of 60% of Beat Capital Partners Limited and subsidiaries (“Beat”), effective July 31, 2024, for total consideration of approximately £226.4 million, approximately $38.4 million (based on the terms of the Beat Transaction, whereas the value at July 31, 2024 was $29.2 million) which was satisfied through the issuance of shares of common stock, par value $0.01 per share, of Ambac (“Ambac Common Stock”) to certain Sellers and the remainder in cash (the “Beat Transaction”). The Transactions have been accounted for in the preliminary unaudited pro forma combined statement of operations (the “pro forma statement of operations”) for the three months ended March 31, 2024, and the year ended December 31, 2023, as if they had been completed on January 1, 2023. The preliminary unaudited pro forma combined balance sheet as of March 31, 2024, gives effect to the Transactions as if they occurred on March 31, 2024. The following preliminary unaudited pro forma combined financial statements and related notes as of and for the three months ended March 31, 2024, and for the year ended December 31, 2023, have been derived from, and should be read in conjunction with, (i) the historical audited consolidated financial statements of Ambac and accompanying notes included in Ambac’s Annual Report on Form 10-K for the year ended December 31, 2023, (ii) the historical unaudited consolidated financial statements of Ambac and related notes included in Ambac’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024, (iii) the historical audited combined financial statements of Beat and related notes for the year ended December 31, 2023, and (iv) the historical unaudited combined financial statements of Beat for the three months ended March 31, 2024. In accordance with Article 11 of Regulation S-X, the preliminary unaudited pro forma combined financial statements were prepared for illustrative and informational purposes only and are not intended to represent what our results of operations or financial position would have been had the Transactions occurred on the dates noted above, nor what they will be for any future periods. The pro forma adjustments are based on available information and certain assumptions that management believes are factually supportable. In the opinion of our management, all adjustments necessary to present fairly the preliminary unaudited pro forma combined financial statements have been made. The preliminary unaudited pro forma combined financial statements do not include the realization of any cost savings from operating efficiencies or synergies that might result from the Transactions. Additionally, we anticipate that certain nonrecurring charges will be incurred in connection with the Transactions, the substantial majority of which consist of fees paid to investment bankers, legal counsel and other professional advisors. Any such charge could affect the future results of the post-acquisition company in the period in which such charges are incurred; however, these costs are not expected to be incurred in any period beyond twelve months from the closing date of the Transactions. Accordingly, the pro forma statement of 1

operations for the year ended December 31, 2023, reflects the effects of these non-recurring charges, which are not included in the historical statements of operations of Ambac, AAC or Beat for the year ended December 31, 2023. In connection with the Beat Transaction, the preliminary unaudited pro forma combined financial statements have been prepared using the acquisition method of accounting for business combinations under generally accepted accounting principles in the United State of America (“US GAAP”), in accordance with Accounting Standards Codifications (ASC) 805, Business Combinations. Under the acquisition method of accounting, the purchase price is allocated to the underlying tangible and intangible assets acquired, liabilities assumed and noncontrolling interests based upon their estimated fair values as of the acquisition date, with any excess purchase price allocated to goodwill. Ambac has made a preliminary allocation of the purchase price as of the assumed acquisition date of March 31, 2024, using information currently available. We estimated the fair value of Beat’s assets, liabilities and noncontrolling interests based on reviews of Beat’s historical audited financial statements, preliminary valuation studies, discussions with Beat management and other due diligence procedures. The assumptions and estimates used to determine the preliminary purchase price allocation and fair value adjustments are described in the notes accompanying the preliminary unaudited pro forma combined financial statements. The final determination of the fair value of Beat’s assets, liabilities and noncontrolling interests will be based on the actual net tangible and intangible assets, liabilities and noncontrolling interests of Beat that exist as of the closing date of the acquisition and therefore, cannot be made prior to the completion of the acquisition. As a result, the unaudited pro forma purchase price adjustments related to the acquisition are preliminary and subject to further adjustments as additional information becomes available and as additional analyses are performed. The final valuation may be materially different than the estimated values assumed in the preliminary unaudited pro forma combined financial statements. The preliminary unaudited pro forma combined financial statements contain certain reclassification adjustments to conform the historical Beat financial statement presentation to our financial statement presentation. For purposes of the preliminary unaudited pro forma combined financial statements presented below; it is assumed that we will fund the cash consideration with cash on hand and proceeds from the AAC Transaction. In connection with Ambac’s disposition of 100% of AAC’s common stock, the preliminary unaudited pro forma combined financial statements have been prepared using the guidance in ASC 810, Consolidations. Under ASC 810, a parent shall deconsolidate a subsidiary as of the date the parent ceases to have a controlling financial interest in the subsidiary by recognizing a gain or loss in net income measured as the difference between the fair value of any consideration received and the carrying amount of the subsidiary’s assets and liabilities at the date of sale. Components of the gain/loss calculation are described in further detail in Note 1. AAC has historically been managed and operated in the normal course with other Ambac businesses and has been identified as the Legacy Financial Guarantee Segment in Ambac’s SEC filings. Therefore, the accompanying adjustments to the combined financial statements have been derived from the accounting records of Ambac and are in accordance with US GAAP. The indebtedness incurred to finance the Beat Transaction is included in the preliminary unaudited pro forma combined financial statements reflecting terms and rates Ambac has agreed to with the funding bank. 2

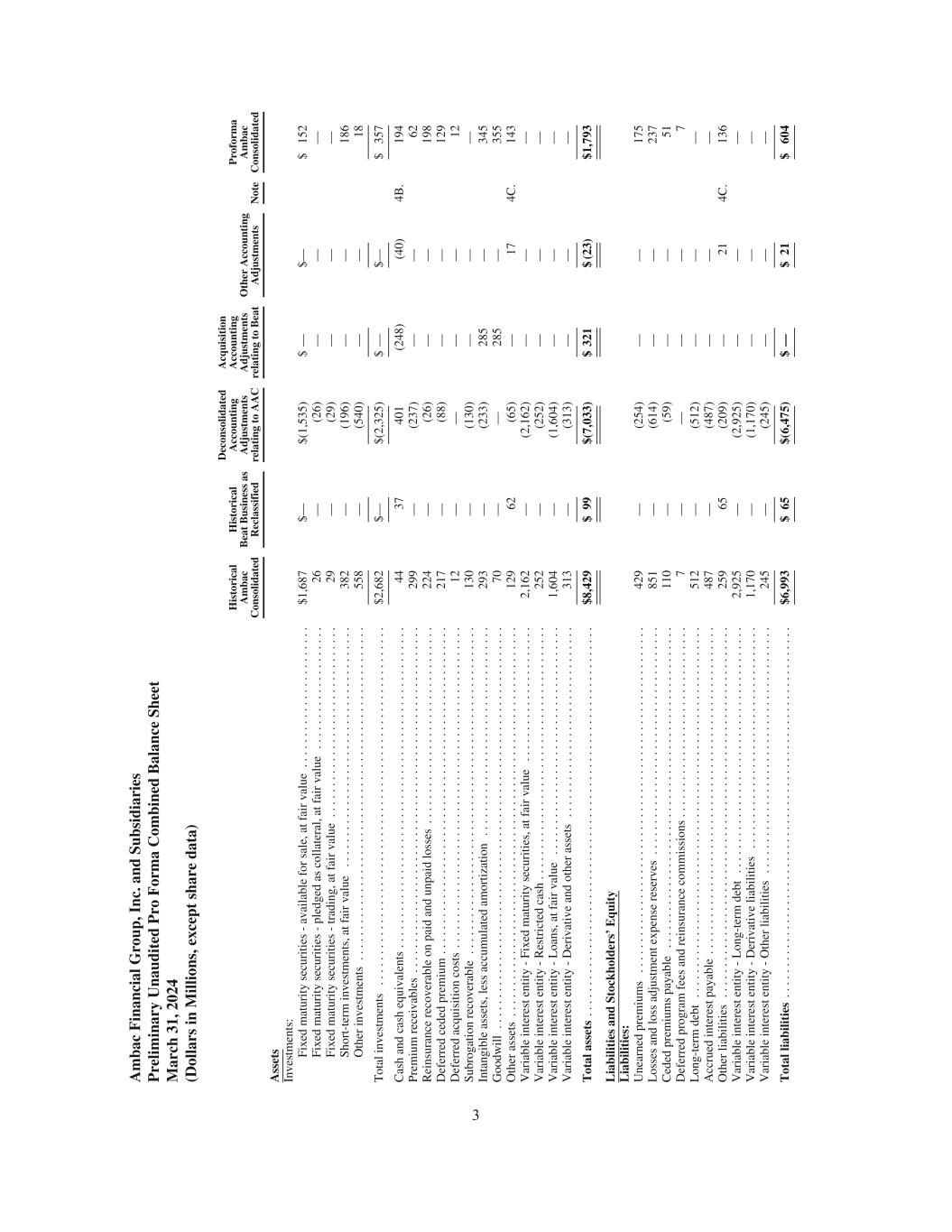

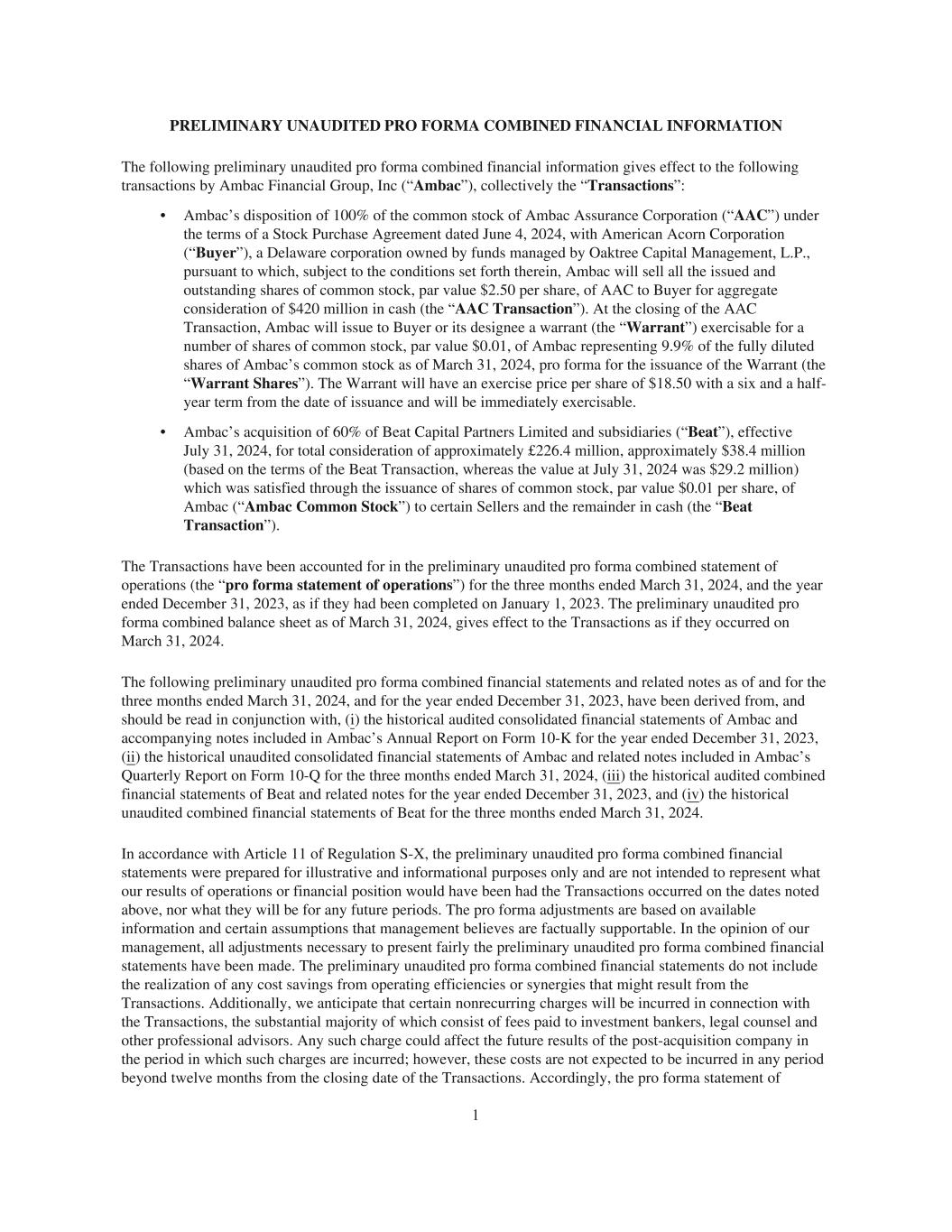

A m ba c F in an ci al G ro up , I nc . a nd S ub si di ar ie s P re lim in ar y U na ud it ed P ro F or m a C om bi ne d B al an ce S he et M ar ch 3 1, 2 02 4 (D ol la rs in M ill io ns , e xc ep t sh ar e da ta ) H is to ri ca l A m ba c C on so lid at ed H is to ri ca l B ea t B us in es s as R ec la ss if ie d D ec on so lid at ed A cc ou nt in g A dj us tm en ts re la ti ng t o A A C A cq ui si ti on A cc ou nt in g A dj us tm en ts re la ti ng t o B ea t O th er A cc ou nt in g A dj us tm en ts N ot e P ro fo rm a A m ba c C on so lid at ed A ss et s In ve st m en ts : Fi xe d m at ur ity s ec ur iti es - a va ila bl e fo r sa le , a t f ai r va lu e .. .. .. .. .. .. .. .. .. .. .. . $1 ,6 87 $— $( 1, 53 5) $ — $— $ 15 2 Fi xe d m at ur ity s ec ur iti es - p le dg ed a s co lla te ra l, at f ai r va lu e .. .. .. .. .. .. .. .. .. .. 26 — (2 6) — — — Fi xe d m at ur ity s ec ur iti es - tr ad in g, a t f ai r va lu e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 29 — (2 9) — — — Sh or t- te rm in ve st m en ts , a t f ai r va lu e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 38 2 — (1 96 ) — — 18 6 O th er in ve st m en ts . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 55 8 — (5 40 ) — — 18 T ot al in ve st m en ts .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $2 ,6 82 $— $( 2, 32 5) $ — $— $ 35 7 C as h an d ca sh e qu iv al en ts . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 44 37 40 1 (2 48 ) (4 0) 4B . 19 4 Pr em iu m r ec ei va bl es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 29 9 — (2 37 ) — — 62 R ei ns ur an ce r ec ov er ab le o n pa id a nd u np ai d lo ss es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 22 4 — (2 6) — — 19 8 D ef er re d ce de d pr em iu m . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 21 7 — (8 8) — — 12 9 D ef er re d ac qu is iti on c os ts . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 12 — — — — 12 Su br og at io n re co ve ra bl e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 13 0 — (1 30 ) — — — In ta ng ib le a ss et s, le ss a cc um ul at ed a m or tiz at io n .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 29 3 — (2 33 ) 28 5 — 34 5 G oo dw ill . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 70 — — 28 5 — 35 5 O th er a ss et s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 12 9 62 (6 5) — 17 4C . 14 3 V ar ia bl e in te re st e nt ity - F ix ed m at ur ity s ec ur iti es , a t f ai r va lu e .. .. .. .. .. .. .. .. .. .. .. 2, 16 2 — (2 ,1 62 ) — — — V ar ia bl e in te re st e nt ity - R es tr ic te d ca sh . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 25 2 — (2 52 ) — — — V ar ia bl e in te re st e nt ity - L oa ns , a t f ai r va lu e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 1, 60 4 — (1 ,6 04 ) — — — V ar ia bl e in te re st e nt ity - D er iv at iv e an d ot he r as se ts . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 31 3 — (3 13 ) — — — T ot al a ss et s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $8 ,4 29 $ 99 $( 7, 03 3) $ 32 1 $ (2 3) $1 ,7 93 L ia bi lit ie s an d St oc kh ol de rs ’ E qu it y L ia bi lit ie s: U ne ar ne d pr em iu m s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 42 9 — (2 54 ) — — 17 5 L os se s an d lo ss a dj us tm en t e xp en se r es er ve s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 85 1 — (6 14 ) — — 23 7 C ed ed p re m iu m s pa ya bl e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 11 0 — (5 9) — — 51 D ef er re d pr og ra m f ee s an d re in su ra nc e co m m is si on s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 7 — — — — 7 L on g- te rm d eb t .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 51 2 — (5 12 ) — — — A cc ru ed in te re st p ay ab le . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 48 7 — (4 87 ) — — — O th er li ab ili tie s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 25 9 65 (2 09 ) — 21 4C . 13 6 V ar ia bl e in te re st e nt ity - L on g- te rm d eb t .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 2, 92 5 — (2 ,9 25 ) — — — V ar ia bl e in te re st e nt ity - D er iv at iv e lia bi lit ie s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 1, 17 0 — (1 ,1 70 ) — — — V ar ia bl e in te re st e nt ity - O th er li ab ili tie s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 24 5 — (2 45 ) — — — T ot al li ab ili ti es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $6 ,9 93 $ 65 $( 6, 47 5) $ — $ 21 $ 60 4 3

H is to ri ca l A m ba c C on so lid at ed H is to ri ca l B ea t B us in es s as R ec la ss if ie d D ec on so lid at ed A cc ou nt in g A dj us tm en ts re la ti ng t o A A C A cq ui si ti on A cc ou nt in g A dj us tm en ts re la ti ng t o B ea t O th er A cc ou nt in g A dj us tm en ts N ot e P ro fo rm a A m ba c C on so lid at ed R ed ee m ab le n on co nt ro lli ng in te re st .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $ 17 $— $ — $1 91 $— $ 20 8 St oc kh ol de rs ’ e qu it y: Pr ef er re d st oc k .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. — — — — — — C om m on s to ck .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. — — — — — — A dd iti on al p ai d- in c ap ita l .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 29 1 — 16 38 — 34 5 A cc um ul at ed o th er c om pr eh en si ve in co m e (l os s) .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . (1 75 ) — 16 9 — — (6 ) R et ai ne d ea rn in gs .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 1, 26 6 — (6 92 ) — (4 4) 4B ./4 C . 53 0 Pa re nt c om pa ny n et in ve st m en t . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . — 28 — (2 8) — — T re as ur y st oc k, s ha re s at c os t .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . (1 7) — — — (1 7) T ot al A m ba c F in an ci al G ro up , I nc . s to ck ho ld er s’ e qu it y .. .. .. .. .. .. .. .. .. .. .. .. . $1 ,3 65 $ 28 $ (5 08 ) $ 10 $ (4 4) $ 85 2 N on re de em ab le n on co nt ro lli ng in te re st .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 53 5 (5 1) 12 0 — 12 7 T ot al s to ck ho ld er s’ e qu it y .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $1 ,4 18 $ 34 $ (5 58 ) $1 30 $ (4 4) $ 98 0 T ot al li ab ili ti es , r ed ee m ab le n on co nt ro lli ng in te re st a nd s to ck ho ld er s’ e qu it y .. .. .. .. $8 ,4 29 $ 99 $( 7, 03 3) $3 21 $ (2 3) $1 ,7 93 4

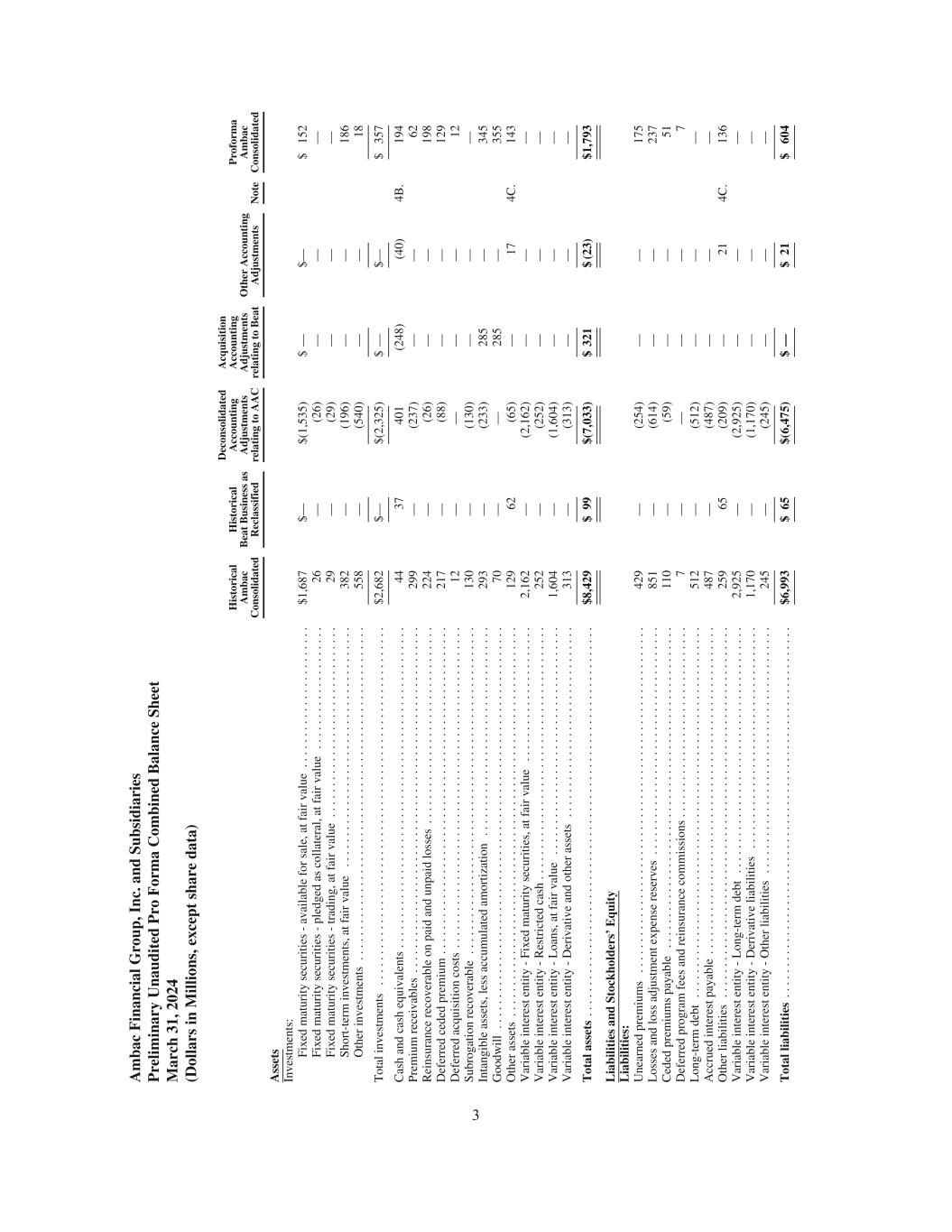

A m ba c F in an ci al G ro up , I nc . a nd S ub si di ar ie s P re lim in ar y U na ud it ed P ro F or m a C om bi ne d St at em en t of O pe ra ti on s Y ea r E nd ed D ec em be r 31 , 2 02 3 (D ol la rs in M ill io ns , e xc ep t sh ar e da ta ) H is to ri ca l A m ba c C on so lid at ed H is to ri ca l B ea t B us in es s as R ec la ss if ie d P ro fo rm a D ec on so lid at ed A cc ou nt in g A dj us tm en ts re la ti ng to A A C O th er A cc ou nt in g A dj us tm en ts N ot e A m ba c C on so lid at ed R ev en ue s N et p re m iu m s ea rn ed . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $ 78 $ — $ (2 6) $— $ 52 C om m is si on in co m e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 51 50 — — 10 1 Pr og ra m f ee s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 8 — — — 8 N et in ve st m en t i nc om e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 14 0 1 (1 27 ) 8 4A . 22 N et in ve st m en t g ai ns ( lo ss es ), in cl ud in g im pa ir m en ts .. .. .. .. .. .. .. .. .. .. .. . (2 2) — 23 — 1 N et g ai ns ( lo ss es ) on d er iv at iv e co nt ra ct s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . (1 ) — 1 — — O th er in co m e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 11 8 (1 1) — 8 In co m e (l os s) o n va ri ab le in te re st e nt iti es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 3 — (3 ) — — T ot al r ev en ue s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 26 9 $ 59 $( 14 4) $ 8 $ 19 2 E xp en se s L os se s an d lo ss a dj us tm en t e xp en se s (b en ef it) . .. .. .. .. .. .. .. .. .. .. .. .. .. .. (3 3) — 69 — 36 A m or tiz at io n of d ef er re d ac qu is iti on c os ts , n et . .. .. .. .. .. .. .. .. .. .. .. .. .. .. 11 — — — 11 C om m is si on e xp en se . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 29 — — — 29 G en er al a nd a dm in is tr at iv e ex pe ns es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 15 6 43 (1 08 ) 28 4B ./4 C . 11 9 In ta ng ib le a m or tiz at io n .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 29 — (2 5) 28 4D . 33 In te re st e xp en se . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 64 — (6 4) — — L os s on D is po sa l .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. — — 66 3 19 4B ./4 C . 68 2 T ot al e xp en se s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 25 7 $ 43 $ 53 6 $ 75 $ 91 0 P re -t ax in co m e (l os s) . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 12 $ 16 $( 68 0) $ (6 8) $ (7 19 ) Pr ov is io n (b en ef it) f or in co m e ta xe s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 7 5 (8 ) — 4 N et in co m e (l os s) .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 5 $ 11 $( 67 2) $ (6 8) $ (7 22 ) L es s: n et ( ga in ) lo ss a ttr ib ut ab le to n on co nt ro lli ng in te re st . .. .. .. .. .. .. (1 ) (5 ) — (5 ) (1 1) N et in co m e (l os s) a tt ri bu ta bl e to c om m on s to ck ho ld er s .. .. .. .. .. .. .. .. .. . $ 4 $ 6 $( 67 2) $ (7 2) $ (7 33 ) W ei gh te d av er ag e nu m be r of c om m on s ha re s ou ts ta nd in g: B as ic .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 45 ,6 36 ,6 49 2, 21 6, 02 3 — — 47 ,8 52 ,6 72 D ilu te d .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 46 ,5 40 ,7 06 2, 21 6, 02 3 — — 47 ,8 52 ,6 72 N et in co m e (l os s) p er s ha re a tt ri bu ta bl e to c om m on s to ck ho ld er s: B as ic .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 0. 18 $ (1 5. 23 ) D ilu te d .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $ 0. 18 $ (1 5. 23 ) 5

A m ba c F in an ci al G ro up , I nc . a nd S ub si di ar ie s P re lim in ar y U na ud it ed P ro F or m a C om bi ne d St at em en t of O pe ra ti on s T hr ee M on th s E nd ed M ar ch 3 1, 2 02 4 (D ol la rs in M ill io ns , e xc ep t sh ar e da ta ) H is to ri ca l A m ba c C on so lid at ed H is to ri ca l B ea t B us in es s as R ec la ss if ie d D ec on so lid at ed A cc ou nt in g A dj us tm en ts re la ti ng t o A A C O th er A cc ou nt in g A dj us tm en ts N ot e P ro fo rm a A m ba c C on so lid at ed R ev en ue s N et p re m iu m s ea rn ed . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 33 $ — $ (7 ) $ — $ 26 C om m is si on in co m e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 18 15 — — 33 Pr og ra m f ee s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 3 — — — 3 N et in ve st m en t i nc om e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 42 — (3 8) 2 4A . 6 N et in ve st m en t g ai ns ( lo ss es ), in cl ud in g im pa ir m en ts . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 1 — (1 ) — — N et g ai ns ( lo ss es ) on d er iv at iv e co nt ra ct s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 2 — (2 ) — — O th er in co m e .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 3 3 (3 ) — 3 In co m e (l os s) o n va ri ab le in te re st e nt iti es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 3 — (3 ) — — T ot al r ev en ue s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $ 10 3 $ 18 $ (5 3) $ 2 $ 70 E xp en se s L os se s an d lo ss a dj us tm en t e xp en se s (b en ef it) .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. (1 ) — 21 — 20 A m or tiz at io n of d ef er re d ac qu is iti on c os ts , n et . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 4 — — — 4 C om m is si on e xp en se . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 10 — — — 10 G en er al a nd a dm in is tr at iv e ex pe ns es . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 36 11 (2 2) 1 4C . 27 In ta ng ib le a m or tiz at io n .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 12 — (1 1) 7 4D . 8 In te re st e xp en se .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 16 — (1 6) 0 0 T ot al e xp en se s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 77 $ 11 $ (2 8) $ 8 $ 68 P re -t ax in co m e (l os s) .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 26 $ 7 $ (2 5) $ (6 ) $ 2 Pr ov is io n (b en ef it) f or in co m e ta xe s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 5 2 (5 ) — 2 N et in co m e (l os s) . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $ 21 $ 5 $ (2 0) $ (6 ) $ (1 ) L es s: n et ( ga in ) lo ss a ttr ib ut ab le to n on co nt ro lli ng in te re st . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. (1 ) (1 ) — (1 ) (4 ) N et in co m e (l os s) a tt ri bu ta bl e to c om m on s to ck ho ld er s .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 20 $ 3 $ (2 0) $ (8 ) $ (4 ) W ei gh te d av er ag e nu m be r of c om m on s ha re s ou ts ta nd in g: B as ic . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. 45 ,8 27 ,0 76 2, 21 6, 02 3 — — 48 ,0 43 ,0 99 D ilu te d .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . 46 ,3 48 ,7 76 2, 21 6, 02 3 — — 48 ,0 43 ,0 99 N et in co m e (l os s) p er s ha re a tt ri bu ta bl e to c om m on s to ck ho ld er s: B as ic . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. $ 0. 44 $ (0 .0 9) D ilu te d .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . $ 0. 43 $ (0 .0 9) 6

NOTES TO PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS (Dollar amounts in Millions, Except Share Amounts) 1. BASIS OF PRESENTATION The preliminary unaudited pro forma combined financial statements have been derived from the historical consolidated financial statements of Ambac Financial Group, Inc (“Ambac”), Ambac Assurance Corporation (“AAC”) and Beat Capital Partners Limited (“Beat”) in accordance with generally accepted accounting principles in the United State of America (“US GAAP”) and are presented in U.S. dollars. As discussed in Note 5, certain of Beat’s historical amounts have been reclassified to conform to Ambac’s financial statement presentation, and pro forma adjustments have been made to reflect the Transactions and additional accounting adjustments. The AAC Transaction (as defined below) is being accounted for as a deconsolidation of a subsidiary under ASC 810 Consolidations, which requires an entity to derecognize assets as of the date the parent ceases to have a controlling financial interest in that subsidiary. At the date of deconsolidation, the entity shall recognize a gain or loss in net income attributable to the parent, measured as the difference between (a) the aggregate of the (i) fair value of any consideration received; (ii) fair value of any retained noncontrolling investment in the former subsidiary at the date the subsidiary is deconsolidated; and (iii) carrying amount of any noncontrolling interest in the former subsidiary (including any accumulated other comprehensive income attributable to the noncontrolling interest) at the date the subsidiary is deconsolidated and (b) the carrying amount of the former subsidiary’s assets and liabilities. The Beat Transaction (as defined below) is being accounted for as a business combination using the acquisition method of accounting under US GAAP, in accordance with the provisions of ASC 805, Business Combinations which requires assets acquired and liabilities assumed to be recorded at their acquisition date fair value. ASC 820, Fair Value Measurements, defines the term “fair value” as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Fair value measurements can be highly subjective, and it is possible the application of reasonable judgement could develop different assumptions resulting in a range of alternative estimates using the same facts and circumstances. As of the date of this proxy statement, Ambac has not completed the detailed valuation studies necessary to determine the fair value of Beat’s assets to be acquired, the liabilities to be assumed, interests of noncontrolling shareholders and the related allocations of purchase price. Therefore, the allocation of the purchase price as reflected in the preliminary unaudited pro forma combined financial statements is based upon management’s preliminary estimates of the fair value of the assets acquired and liabilities assumed. We estimated the fair value of Beat’s assets and liabilities based on reviews of Beat’s historical audited financial statements, discussions with Beat management and other due diligence procedures. The final determination of the fair value of Beat’s assets and liabilities will be based on the actual net tangible and intangible assets, liabilities and noncontrolling interests of Beat that exist as of the closing date of the acquisition. As a result, the pro forma purchase price adjustments related to the acquisition are preliminary and subject to further adjustments as additional information becomes available and as additional analyses are performed. The final valuation may be materially different than the estimated values assumed in the preliminary unaudited pro forma combined financial statements. The AAC Transaction and Beat Transaction (the “Transactions”) and the related transaction accounting adjustments are described in the accompanying notes to the preliminary unaudited pro forma combined financial statements. In accordance with Article 11 of Regulation S-X, the preliminary unaudited pro forma combined financial statements were prepared for illustrative and informational purposes only and are not intended to represent what our results of operations or financial position would have been had the Transactions occurred on the dates noted above, nor what they will be for any future periods. The pro forma adjustments are based on available information and certain assumptions that management believes are factually supportable. In the opinion of our management, all adjustments necessary to present fairly the preliminary unaudited pro forma combined 7

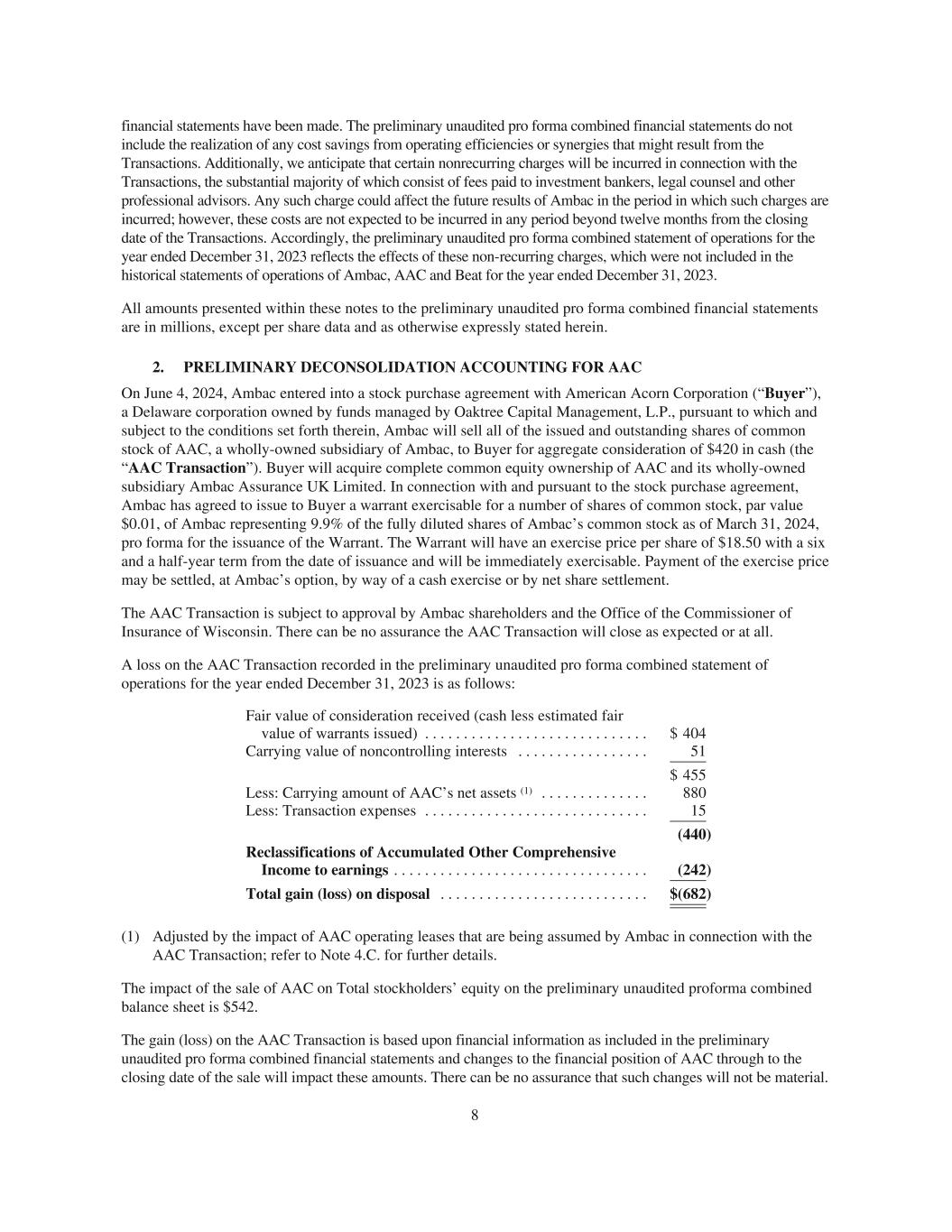

financial statements have been made. The preliminary unaudited pro forma combined financial statements do not include the realization of any cost savings from operating efficiencies or synergies that might result from the Transactions. Additionally, we anticipate that certain nonrecurring charges will be incurred in connection with the Transactions, the substantial majority of which consist of fees paid to investment bankers, legal counsel and other professional advisors. Any such charge could affect the future results of Ambac in the period in which such charges are incurred; however, these costs are not expected to be incurred in any period beyond twelve months from the closing date of the Transactions. Accordingly, the preliminary unaudited pro forma combined statement of operations for the year ended December 31, 2023 reflects the effects of these non-recurring charges, which were not included in the historical statements of operations of Ambac, AAC and Beat for the year ended December 31, 2023. All amounts presented within these notes to the preliminary unaudited pro forma combined financial statements are in millions, except per share data and as otherwise expressly stated herein. 2. PRELIMINARY DECONSOLIDATION ACCOUNTING FOR AAC On June 4, 2024, Ambac entered into a stock purchase agreement with American Acorn Corporation (“Buyer”), a Delaware corporation owned by funds managed by Oaktree Capital Management, L.P., pursuant to which and subject to the conditions set forth therein, Ambac will sell all of the issued and outstanding shares of common stock of AAC, a wholly-owned subsidiary of Ambac, to Buyer for aggregate consideration of $420 in cash (the “AAC Transaction”). Buyer will acquire complete common equity ownership of AAC and its wholly-owned subsidiary Ambac Assurance UK Limited. In connection with and pursuant to the stock purchase agreement, Ambac has agreed to issue to Buyer a warrant exercisable for a number of shares of common stock, par value $0.01, of Ambac representing 9.9% of the fully diluted shares of Ambac’s common stock as of March 31, 2024, pro forma for the issuance of the Warrant. The Warrant will have an exercise price per share of $18.50 with a six and a half-year term from the date of issuance and will be immediately exercisable. Payment of the exercise price may be settled, at Ambac’s option, by way of a cash exercise or by net share settlement. The AAC Transaction is subject to approval by Ambac shareholders and the Office of the Commissioner of Insurance of Wisconsin. There can be no assurance the AAC Transaction will close as expected or at all. A loss on the AAC Transaction recorded in the preliminary unaudited pro forma combined statement of operations for the year ended December 31, 2023 is as follows: Fair value of consideration received (cash less estimated fair value of warrants issued) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 404 Carrying value of noncontrolling interests . . . . . . . . . . . . . . . . . 51 $ 455 Less: Carrying amount of AAC’s net assets (1) . . . . . . . . . . . . . . 880 Less: Transaction expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 (440) Reclassifications of Accumulated Other Comprehensive Income to earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (242) Total gain (loss) on disposal . . . . . . . . . . . . . . . . . . . . . . . . . . . $(682) (1) Adjusted by the impact of AAC operating leases that are being assumed by Ambac in connection with the AAC Transaction; refer to Note 4.C. for further details. The impact of the sale of AAC on Total stockholders’ equity on the preliminary unaudited proforma combined balance sheet is $542. The gain (loss) on the AAC Transaction is based upon financial information as included in the preliminary unaudited pro forma combined financial statements and changes to the financial position of AAC through to the closing date of the sale will impact these amounts. There can be no assurance that such changes will not be material. 8

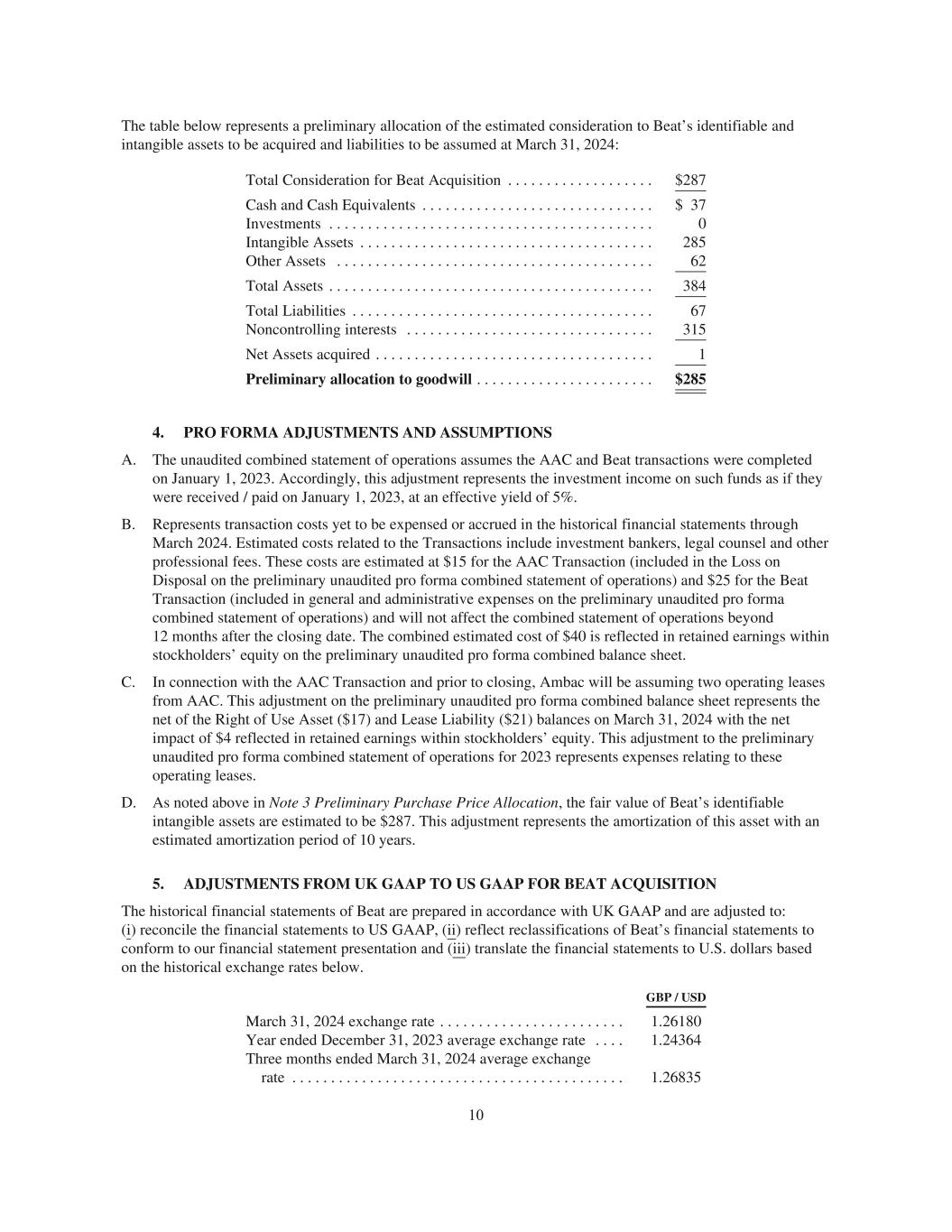

3. PRELIMINARY PURCHASE PRICE ALLOCATION FOR BEAT ACQUISITION On August 1, 2024, the Company completed a transaction pursuant to a share purchase agreement (the “Beat Purchase Agreement”), by and among the Company, Cirrata V LLC, a Delaware limited liability company and an indirect wholly owned subsidiary of Ambac (the “Purchaser”), certain sellers set forth therein (the “Sellers”) and Beat, pursuant to which, and upon the terms and subject to the conditions set forth therein effective July 31, 2024, the Purchaser purchased from the Sellers approximately 60% of the entire issued share capital of Beat, for total consideration of approximately £226.4, approximately $38.4 (based on the terms of the Beat Transaction, whereas the value at July 31, 2024 was $29.2) of which was satisfied through the issuance of Ambac Common Stock to certain Sellers and the remainder in cash (the “Beat Transaction”). Beat’s management team and Bain Capital Credit LP (“Bain” and, together with certain members of Beat’s management team, the “Rollover Shareholders”) each retained approximately 20% of Beat’s issued share capital immediately after closing. Ambac funded the cash portion of the consideration with a combination of available cash, approximately $65 of funding from AAC and approximately $150 of new indebtedness (the “Credit Facility”) maturing in 364 days funded by a global bank with an interest rate that approximates 10%. Funding received from AAC and the Credit Facility are required to be repaid upon closing of the sale of AAC. For purposes of this pro forma, both the acquisition of Beat and the sale of AAC are assumed to have occurred simultaneously and accordingly, such debt and related interest expenses are not included in the pro forma balance sheet or statement of operations, respectively. If the AAC sale does not occur within 364 days of funding of the Credit Facility or if the sale does not occur, Ambac will need to refinance such short-term debt with longer-term debt. Ambac issued 2,216,023 shares of Ambac Common Stock (the “Consideration Stock”) in partial satisfaction of the consideration, in an amount valued at approximately $39 divided based on a volume weighted average price (“VWAP”) of $17.31 per share of Ambac Common Stock. The VWAP was determined based on the 25 consecutive trading days prior to (but not including) the date of the announcement of the Beat Transaction. Ambac will issue the Consideration Stock free and clear of any liens or restrictions (other than those arising under state and federal securities laws of the United States). The Consideration Stock has not been registered under the Securities Act in reliance upon an exemption from registration pursuant to Section 4(a)(2) of the Securities Act. The preliminary purchase price allocation of Beat is subject to change due to several factors, including, but not limited to: • Changes in the estimated fair value of identifiable intangible assets, primarily from distribution relationships. Distribution relationships are important because of the propensity of these parties to generate predictable, recurring future revenue for Beat. Such changes can result from our additional valuation analysis on relationship retention, changes in discount rates and other factors. • Changes in the estimated fair value of noncontrolling interests held by Rollover Shareholders, which are subject to changes to ownership via put and call options, and the existing noncontrolling interests of Beat’s subsidiaries. 9

The table below represents a preliminary allocation of the estimated consideration to Beat’s identifiable and intangible assets to be acquired and liabilities to be assumed at March 31, 2024: Total Consideration for Beat Acquisition . . . . . . . . . . . . . . . . . . . $287 Cash and Cash Equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 37 Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Intangible Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 285 Other Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62 Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 384 Total Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 Noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315 Net Assets acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 Preliminary allocation to goodwill . . . . . . . . . . . . . . . . . . . . . . . $285 4. PRO FORMA ADJUSTMENTS AND ASSUMPTIONS A. The unaudited combined statement of operations assumes the AAC and Beat transactions were completed on January 1, 2023. Accordingly, this adjustment represents the investment income on such funds as if they were received / paid on January 1, 2023, at an effective yield of 5%. B. Represents transaction costs yet to be expensed or accrued in the historical financial statements through March 2024. Estimated costs related to the Transactions include investment bankers, legal counsel and other professional fees. These costs are estimated at $15 for the AAC Transaction (included in the Loss on Disposal on the preliminary unaudited pro forma combined statement of operations) and $25 for the Beat Transaction (included in general and administrative expenses on the preliminary unaudited pro forma combined statement of operations) and will not affect the combined statement of operations beyond 12 months after the closing date. The combined estimated cost of $40 is reflected in retained earnings within stockholders’ equity on the preliminary unaudited pro forma combined balance sheet. C. In connection with the AAC Transaction and prior to closing, Ambac will be assuming two operating leases from AAC. This adjustment on the preliminary unaudited pro forma combined balance sheet represents the net of the Right of Use Asset ($17) and Lease Liability ($21) balances on March 31, 2024 with the net impact of $4 reflected in retained earnings within stockholders’ equity. This adjustment to the preliminary unaudited pro forma combined statement of operations for 2023 represents expenses relating to these operating leases. D. As noted above in Note 3 Preliminary Purchase Price Allocation, the fair value of Beat’s identifiable intangible assets are estimated to be $287. This adjustment represents the amortization of this asset with an estimated amortization period of 10 years. 5. ADJUSTMENTS FROM UK GAAP TO US GAAP FOR BEAT ACQUISITION The historical financial statements of Beat are prepared in accordance with UK GAAP and are adjusted to: (i) reconcile the financial statements to US GAAP, (ii) reflect reclassifications of Beat’s financial statements to conform to our financial statement presentation and (iii) translate the financial statements to U.S. dollars based on the historical exchange rates below. GBP / USD March 31, 2024 exchange rate . . . . . . . . . . . . . . . . . . . . . . . . 1.26180 Year ended December 31, 2023 average exchange rate . . . . 1.24364 Three months ended March 31, 2024 average exchange rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.26835 10

As a result of the significant impact of the Balance Sheet from the proposed sale of AAC, Ambac will consider a more expanded presentation of other assets and other liabilities in future fillings. (a) The amounts below represent results as of March 31, 2024: Beat (in GBP, in UK GAAP) US GAAP Adjustments(1) Reclassifications Historical Beat Business as Reclassified (in GBP) Historical Beat Business as Reclassified (in USD) ASSETS Cash and Cash Equivalents . . . . . . . . . . . . . $ 29 — — $ 29 37 Investments . . . . . . . . . . . . . . . . . . . . . . . . . — — — — — Debtors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 2 5 — — Prepayments and accrued income . . . . . . . . 32 8 (40) — — Fixed Assets . . . . . . . . . . . . . . . . . . . . . . . . . 3 — (3) — — Other Assets . . . . . . . . . . . . . . . . . . . . . . . . . — 1 48 49 62 Total Assets $ 68 $ 10 $— $ 78 $ 99 LIABILITIES AND CAPITAL Other Creditors . . . . . . . . . . . . . . . . . . . . . . 6 — (6) — — Deferred Income . . . . . . . . . . . . . . . . . . . . . 34 — (34) — — Accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 5 (9) — — Taxation and Social Security . . . . . . . . . . . . — 1 (1) — — Other Liabilities . . . . . . . . . . . . . . . . . . . . . . — 1 51 51 65 Total Liabilities $ 44 $ 7 $— $ 51 $ 65 Shareholders Equity . . . . . . . . . . . . . . . . . . . 19 3 — 22 28 Non-redeemable NCI . . . . . . . . . . . . . . . . . . 4 0 — 4 5 Total Capital $ 24 $ 1 $— $ 27 $ 34 Total Liabilities, NCI & Capital $ 68 $ 10 $— $ 78 $ 99 (1) Reflects adjustments to reconcile UK GAAP per the footnotes to the financial statements of Beat, including (a) profit-sharing commissions, (b) bonus accruals, (c) leases and (d) the income tax impact of these adjustments. 11

(b) The amounts below represent results for the year ended December 31, 2023: Beat (in GBP, in UK GAAP) US GAAP Adjustments(1) Reclassifications Historical Beat Business as Reclassified (in GBP) Historical Beat Business as Reclassified (in USD) Revenues Turnover . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 47 $— $ (47) $— $— Commission income . . . . . . . . . . . . . . . . . . — — 40 40 50 Net investment income . . . . . . . . . . . . . . . . 1 — — 1 1 Exchange (losses) gains . . . . . . . . . . . . . . . . (1) — 1 — — Other comprehensive income . . . . . . . . . . . 1 — (1) — — Other income . . . . . . . . . . . . . . . . . . . . . . . . — — 6 7 8 Total revenues $ 47 $ 1 $— $ 48 $ 59 Expenses General and administrative expenses . . . . . 33 — — 33 43 Interest expense . . . . . . . . . . . . . . . . . . . . . . — — — — 0 Total expenses $ 33 $— $— $ 34 $ 43 Pre-tax income (loss) $ 14 $— $— $ 13 $ 16 Provision (benefit) for income taxes . . . . . . 4 (1) — 4 5 Net income (loss) $ 10 $— (1) $— $ 9 $ 11 Less: net (gain) loss attributable to noncontrolling interest . . . . . . . . . . . . . . . (4) — — (4) (5) Net income (loss) attributable to common stockholders $ 5 $— $— $ 5 $ 6 (1) Reflects adjustments to reconcile UK GAAP to US GAAP per the footnotes to the financial statements of Beat, including (a) profit-sharing commissions, (b) bonus accruals, (c) leases and (d) the income tax impact of these adjustments. 12

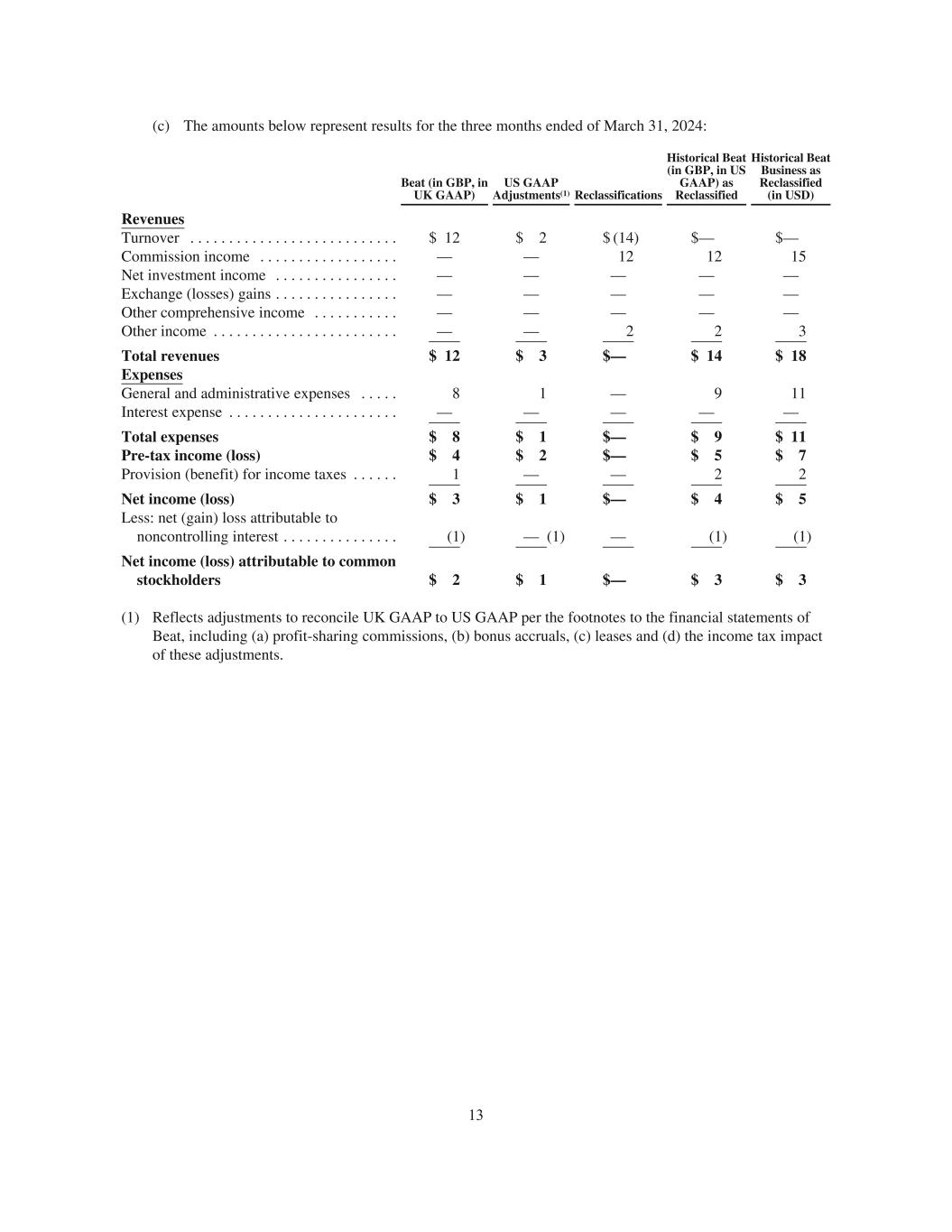

(c) The amounts below represent results for the three months ended of March 31, 2024: Beat (in GBP, in UK GAAP) US GAAP Adjustments(1) Reclassifications Historical Beat (in GBP, in US GAAP) as Reclassified Historical Beat Business as Reclassified (in USD) Revenues Turnover . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12 $ 2 $ (14) $— $— Commission income . . . . . . . . . . . . . . . . . . — — 12 12 15 Net investment income . . . . . . . . . . . . . . . . — — — — — Exchange (losses) gains . . . . . . . . . . . . . . . . — — — — — Other comprehensive income . . . . . . . . . . . — — — — — Other income . . . . . . . . . . . . . . . . . . . . . . . . — — 2 2 3 Total revenues $ 12 $ 3 $— $ 14 $ 18 Expenses General and administrative expenses . . . . . 8 1 — 9 11 Interest expense . . . . . . . . . . . . . . . . . . . . . . — — — — — Total expenses $ 8 $ 1 $— $ 9 $ 11 Pre-tax income (loss) $ 4 $ 2 $— $ 5 $ 7 Provision (benefit) for income taxes . . . . . . 1 — — 2 2 Net income (loss) $ 3 $ 1 $— $ 4 $ 5 Less: net (gain) loss attributable to noncontrolling interest . . . . . . . . . . . . . . . (1) — (1) — (1) (1) Net income (loss) attributable to common stockholders $ 2 $ 1 $— $ 3 $ 3 (1) Reflects adjustments to reconcile UK GAAP to US GAAP per the footnotes to the financial statements of Beat, including (a) profit-sharing commissions, (b) bonus accruals, (c) leases and (d) the income tax impact of these adjustments. 13

U.S. GAAP CONSOLIDATED FINANCIAL STATEMENTS OF AMBAC ASSURANCE CORPORATION AND SUBSIDIARIES Consolidated Balance Sheets March 31, 2024 December 31, (Dollars in millions) (Unaudited) 2023 2022 ASSETS: Investments: Fixed maturity securities, at fair value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,535 $ 1,575 $ 1,280 Fixed maturity securities pledged as collateral, at fair value . . . . . . . . . . . . . . 26 — — Fixed maturity securities - trading, at fair value . . . . . . . . . . . . . . . . . . . . . . . 29 27 59 Short-term investments, at fair value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 196 225 303 Short-term investments pledged as collateral, at fair value . . . . . . . . . . . . . . . — 27 64 Other investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 540 457 552 Total investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,325 2,310 2,259 Cash and cash equivlents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 9 24 Premium receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 237 244 254 Reinsurance recoverable on paid and unpaid losses . . . . . . . . . . . . . . . . . . . . . . . . . 26 30 33 Deferred ceded premium . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88 93 55 Subrogation recoverable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130 137 271 Intangible assets, less accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . 233 245 266 Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 74 76 Variable interest entity assets: Fixed maturity securities, at fair value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,162 2,167 1,967 Restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 252 246 17 Loans, at fair value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,604 1,663 1,829 Derivative and other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 313 318 241 TOTAL ASSETS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,453 $ 7,536 $ 7,291 LIABILITIES AND STOCKHOLDERS’ EQUITY: LIABILITIES: Unearned premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 254 $ 267 $ 286 Loss and loss adjustment expense reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 614 696 715 Ceded premiums payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59 61 19 Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 512 508 639 Accrued interest payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 487 475 427 Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 209 152 169 Variable interest entity liabilities: Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,925 2,967 3,107 Derivative liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,170 1,197 1,048 Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 245 240 5 TOTAL LIABILITIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,475 6,563 6,415 STOCKHOLDERS’ EQUITY: Preferred stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 5 5 Common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82 82 82 Additional paid-in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,906 4,906 4,906 Accumulated other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . (190) (175) (263) Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,825) (3,845) (3,854) TOTAL STOCKHOLDERS’ EQUITY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 978 973 876 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY . . . . . . . . . . . . . . $ 7,453 $ 7,536 $ 7,291 See accompanying Note to Unaudited Consolidated Financial Statements 14

U.S. GAAP CONSOLIDATED FINANCIAL STATEMENTS OF AMBAC ASSURANCE CORPORATION AND SUBSIDIARIES Consolidated Statements of Total Comprehensive Income (Loss) Three Months Ended March 31, 2024 Year Ended December 31, (Dollars in millions) (Unaudited) 2023 2022 REVENUES: Net premiums earned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7 $ 26 $ 42 Net investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 127 12 Net investment gains (losses), including impairments . . . . . . . . . . . . . . . 1 (23) 48 Net gains (losses) on derivative contracts . . . . . . . . . . . . . . . . . . . . . . . . 2 (1) 128 Net realized gains on extinguishment of debt . . . . . . . . . . . . . . . . . . . . . — — 81 Income (losses) on variable interest entities . . . . . . . . . . . . . . . . . . . . . . 3 3 21 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11 10 Litigation recoveries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 126 TOTAL REVENUES AND OTHER INCOME . . . . . . . . . . . . . . . . . . . . . 53 144 468 EXPENSES: Losses and loss adjustment expenses (benefit) . . . . . . . . . . . . . . . . . . . . (21) (69) (406) General and administrative expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 108 104 Intangible amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 25 44 Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 64 178 TOTAL EXPENSES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 127 (79) PRETAX INCOME (LOSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 17 546 Provision (benefit) for income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 8 3 NET INCOME (LOSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 20 $ 9 $ 543 Unrealized gains (losses) on securities, net of income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7) 47 (227) Gains (losses) on foreign currency translation, net of income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8) 40 (85) Credit risk changes of fair value option liabilities, net of income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — Changes to postretirement benefit, net of income tax provisions (benefit) . . . — 2 (1) TOTAL OTHER COMPREHENSIVE INCOME (LOSS), NET OF INCOME TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15) 88 (312) TOTAL COMPREHENSIVE INCOME . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5 $ 97 $ 231 See accompanying Note to Unaudited Consolidated Financial Statements 15

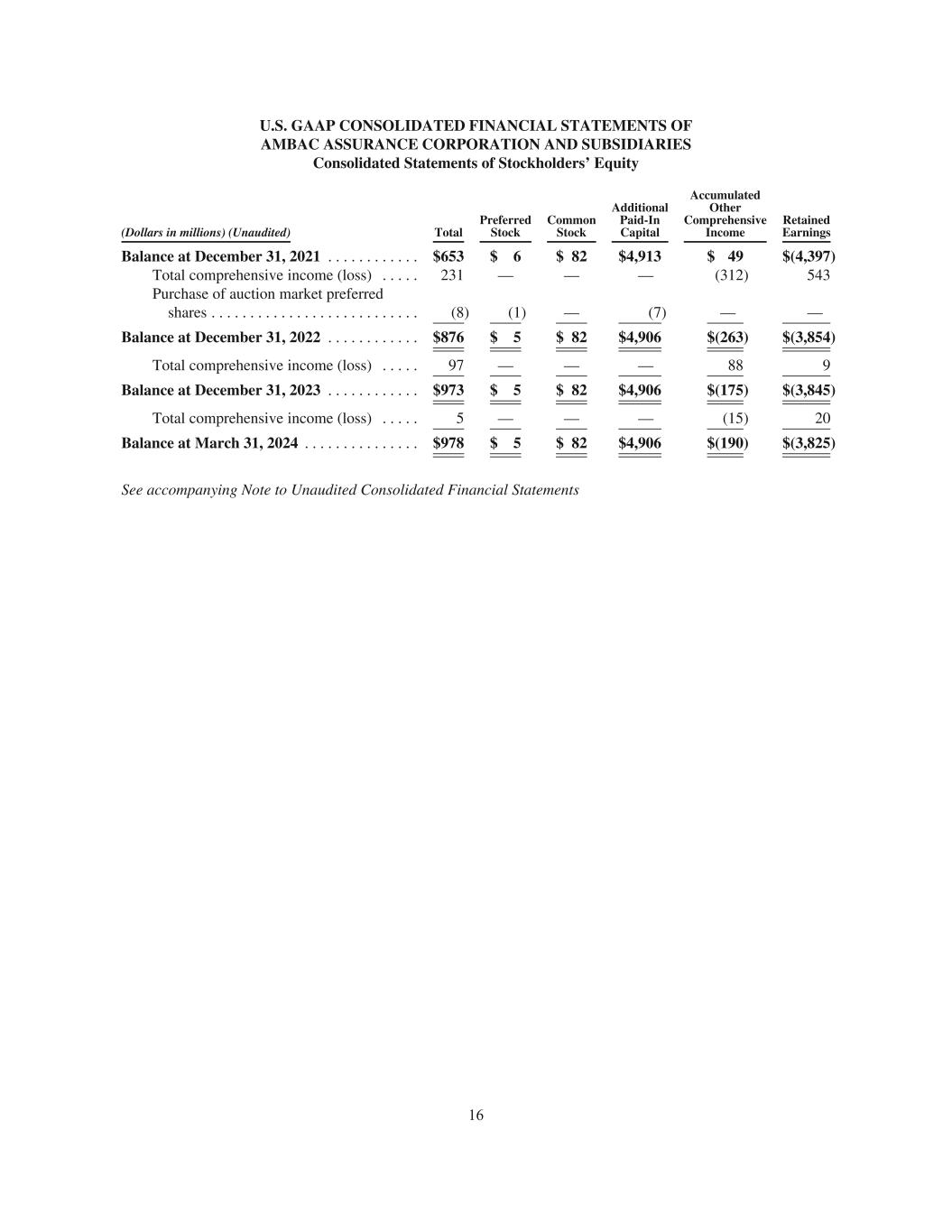

U.S. GAAP CONSOLIDATED FINANCIAL STATEMENTS OF AMBAC ASSURANCE CORPORATION AND SUBSIDIARIES Consolidated Statements of Stockholders’ Equity (Dollars in millions) (Unaudited) Total Preferred Stock Common Stock Additional Paid-In Capital Accumulated Other Comprehensive Income Retained Earnings Balance at December 31, 2021 . . . . . . . . . . . . $653 $ 6 $ 82 $4,913 $ 49 $(4,397) Total comprehensive income (loss) . . . . . 231 — — — (312) 543 Purchase of auction market preferred shares . . . . . . . . . . . . . . . . . . . . . . . . . . . (8) (1) — (7) — — Balance at December 31, 2022 . . . . . . . . . . . . $876 $ 5 $ 82 $4,906 $(263) $(3,854) Total comprehensive income (loss) . . . . . 97 — — — 88 9 Balance at December 31, 2023 . . . . . . . . . . . . $973 $ 5 $ 82 $4,906 $(175) $(3,845) Total comprehensive income (loss) . . . . . 5 — — — (15) 20 Balance at March 31, 2024 . . . . . . . . . . . . . . . $978 $ 5 $ 82 $4,906 $(190) $(3,825) See accompanying Note to Unaudited Consolidated Financial Statements 16

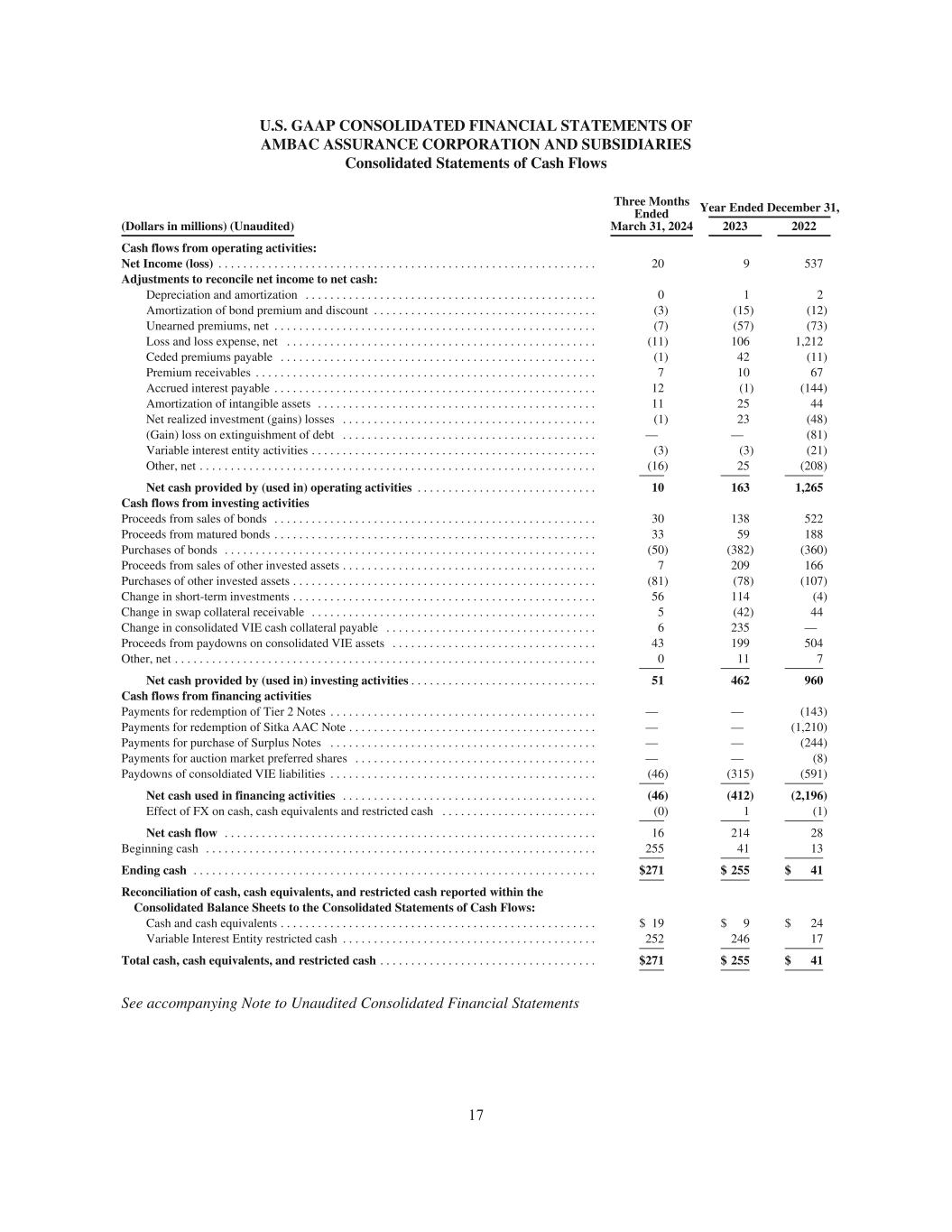

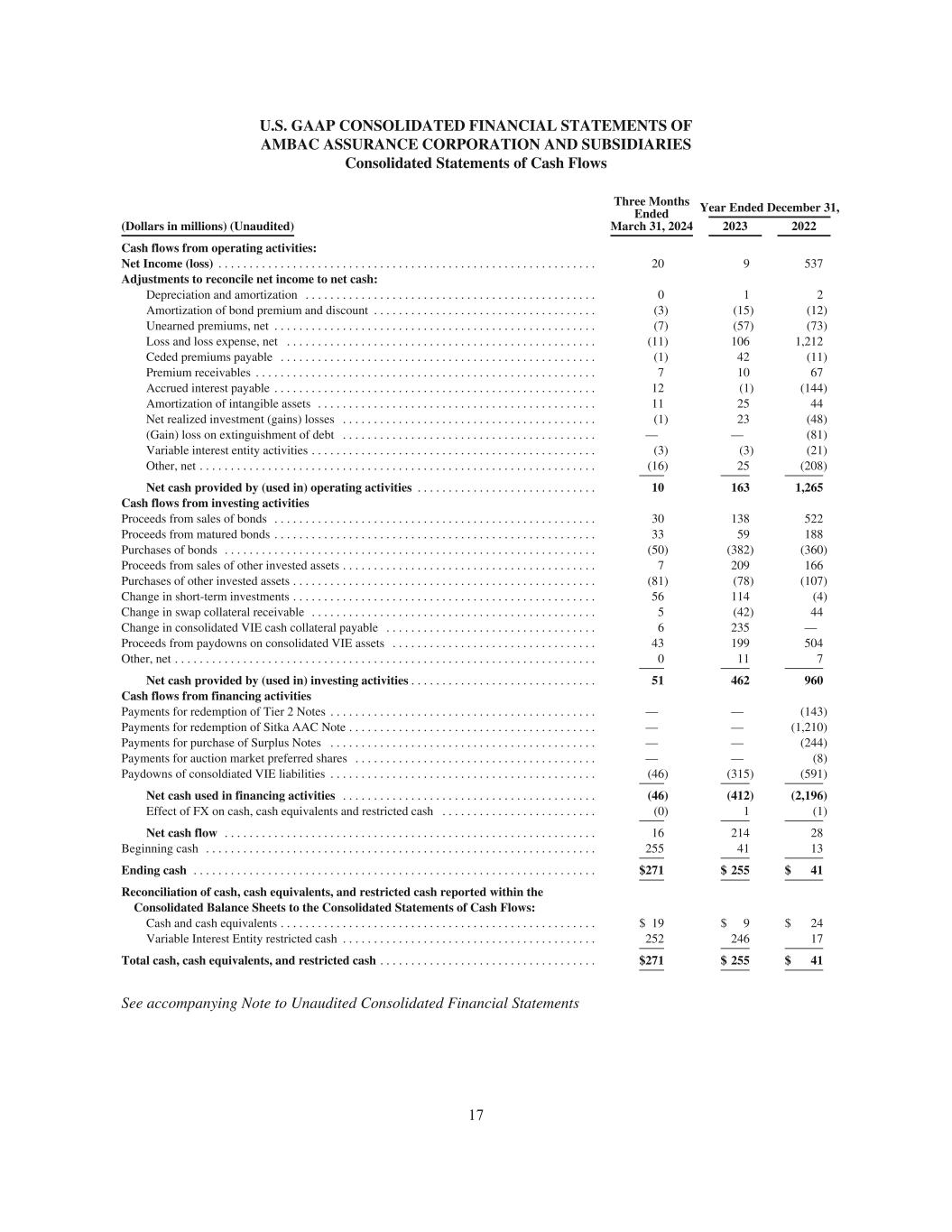

U.S. GAAP CONSOLIDATED FINANCIAL STATEMENTS OF AMBAC ASSURANCE CORPORATION AND SUBSIDIARIES Consolidated Statements of Cash Flows Three Months Ended March 31, 2024 Year Ended December 31, (Dollars in millions) (Unaudited) 2023 2022 Cash flows from operating activities: Net Income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 9 537 Adjustments to reconcile net income to net cash: Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 1 2 Amortization of bond premium and discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3) (15) (12) Unearned premiums, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7) (57) (73) Loss and loss expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11) 106 1,212 Ceded premiums payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) 42 (11) Premium receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 10 67 Accrued interest payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 (1) (144) Amortization of intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 25 44 Net realized investment (gains) losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) 23 (48) (Gain) loss on extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (81) Variable interest entity activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3) (3) (21) Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16) 25 (208) Net cash provided by (used in) operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 163 1,265 Cash flows from investing activities Proceeds from sales of bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30 138 522 Proceeds from matured bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 59 188 Purchases of bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (50) (382) (360) Proceeds from sales of other invested assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 209 166 Purchases of other invested assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (81) (78) (107) Change in short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56 114 (4) Change in swap collateral receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 (42) 44 Change in consolidated VIE cash collateral payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 235 — Proceeds from paydowns on consolidated VIE assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43 199 504 Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 11 7 Net cash provided by (used in) investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 462 960 Cash flows from financing activities Payments for redemption of Tier 2 Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (143) Payments for redemption of Sitka AAC Note . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (1,210) Payments for purchase of Surplus Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (244) Payments for auction market preferred shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (8) Paydowns of consoldiated VIE liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (46) (315) (591) Net cash used in financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (46) (412) (2,196) Effect of FX on cash, cash equivalents and restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . (0) 1 (1) Net cash flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 214 28 Beginning cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 255 41 13 Ending cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $271 $ 255 $ 41 Reconciliation of cash, cash equivalents, and restricted cash reported within the Consolidated Balance Sheets to the Consolidated Statements of Cash Flows: Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 19 $ 9 $ 24 Variable Interest Entity restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 252 246 17 Total cash, cash equivalents, and restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $271 $ 255 $ 41 See accompanying Note to Unaudited Consolidated Financial Statements 17

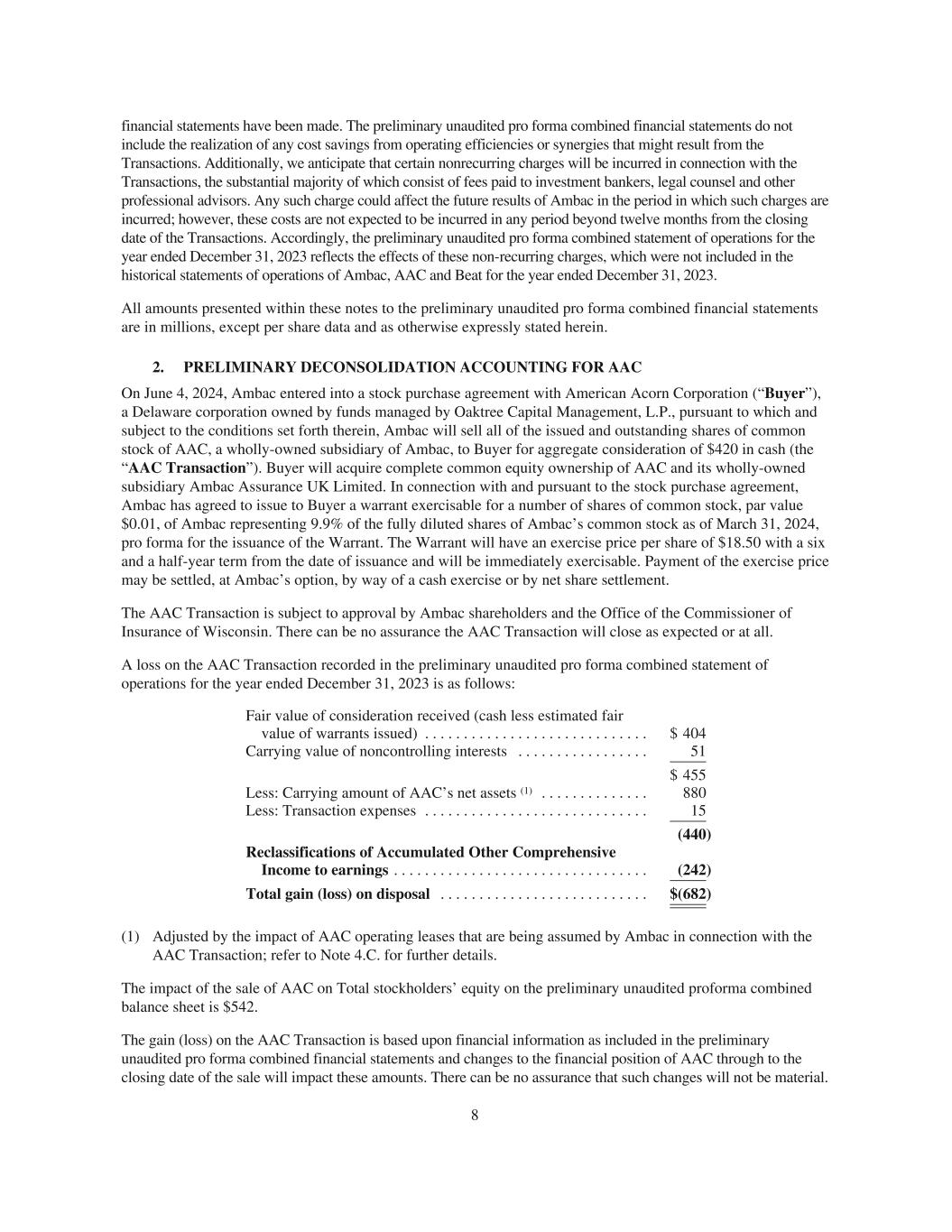

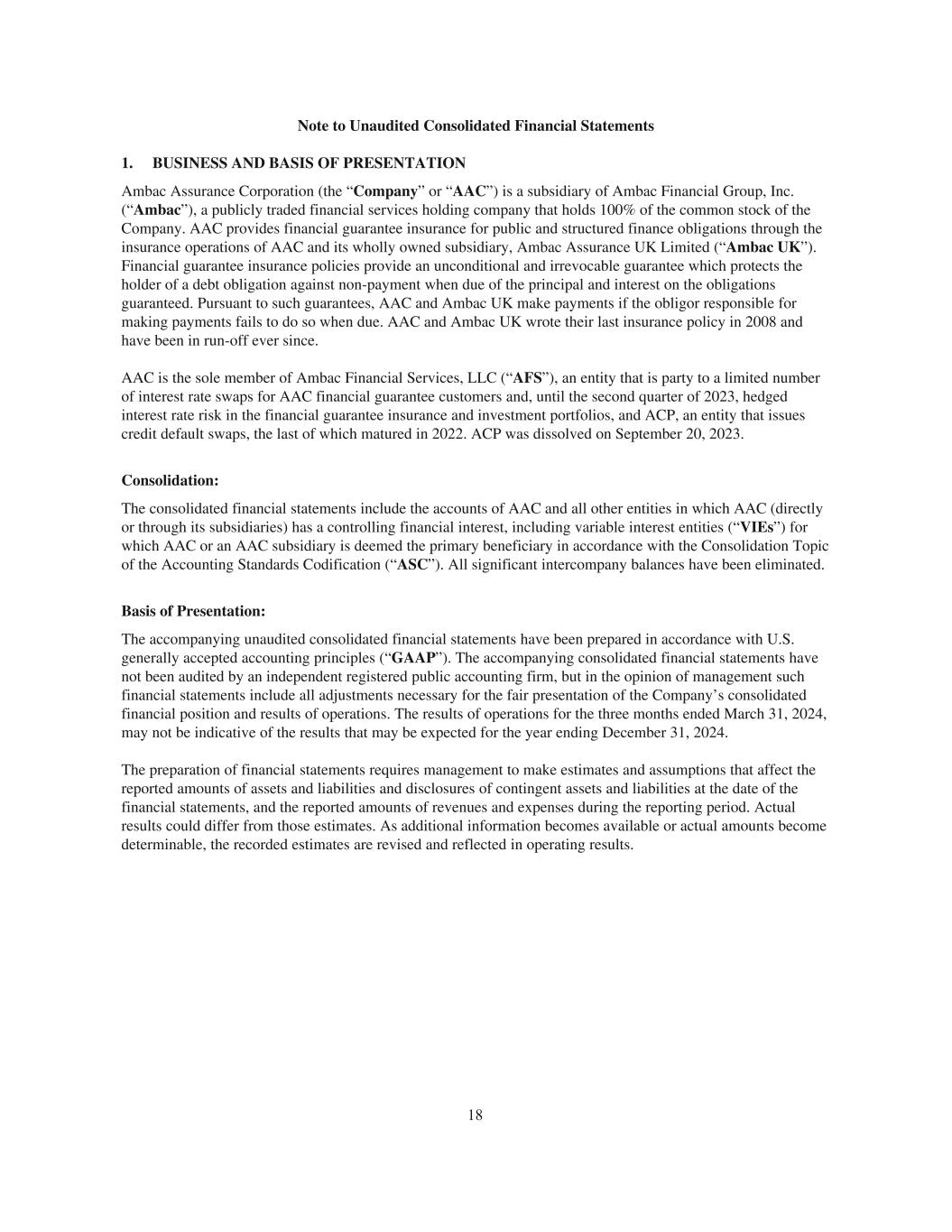

Note to Unaudited Consolidated Financial Statements 1. BUSINESS AND BASIS OF PRESENTATION Ambac Assurance Corporation (the “Company” or “AAC”) is a subsidiary of Ambac Financial Group, Inc. (“Ambac”), a publicly traded financial services holding company that holds 100% of the common stock of the Company. AAC provides financial guarantee insurance for public and structured finance obligations through the insurance operations of AAC and its wholly owned subsidiary, Ambac Assurance UK Limited (“Ambac UK”). Financial guarantee insurance policies provide an unconditional and irrevocable guarantee which protects the holder of a debt obligation against non-payment when due of the principal and interest on the obligations guaranteed. Pursuant to such guarantees, AAC and Ambac UK make payments if the obligor responsible for making payments fails to do so when due. AAC and Ambac UK wrote their last insurance policy in 2008 and have been in run-off ever since. AAC is the sole member of Ambac Financial Services, LLC (“AFS”), an entity that is party to a limited number of interest rate swaps for AAC financial guarantee customers and, until the second quarter of 2023, hedged interest rate risk in the financial guarantee insurance and investment portfolios, and ACP, an entity that issues credit default swaps, the last of which matured in 2022. ACP was dissolved on September 20, 2023. Consolidation: The consolidated financial statements include the accounts of AAC and all other entities in which AAC (directly or through its subsidiaries) has a controlling financial interest, including variable interest entities (“VIEs”) for which AAC or an AAC subsidiary is deemed the primary beneficiary in accordance with the Consolidation Topic of the Accounting Standards Codification (“ASC”). All significant intercompany balances have been eliminated. Basis of Presentation: The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The accompanying consolidated financial statements have not been audited by an independent registered public accounting firm, but in the opinion of management such financial statements include all adjustments necessary for the fair presentation of the Company’s consolidated financial position and results of operations. The results of operations for the three months ended March 31, 2024, may not be indicative of the results that may be expected for the year ending December 31, 2024. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. As additional information becomes available or actual amounts become determinable, the recorded estimates are revised and reflected in operating results. 18