- AMBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ambac Financial (AMBC) DEF 14ADefinitive proxy

Filed: 28 Mar 03, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Ambac Financial Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

AMBAC FINANCIAL GROUP, INC.

NOTICEOF

2003 ANNUAL MEETING

OF STOCKHOLDERS

AND

PROXY STATEMENT

Meeting Date:

Tuesday, May 6, 2003

at 11:30 A.M. (local time)

Meeting Place:

Ambac Financial Group, Inc.

One State Street Plaza

New York, New York 10004

Ambac Financial Group, Inc.

One State Street Plaza

New York, NY 10004

212.668.0340

Phillip B. Lassiter

Chairman and

Chief Executive Officer

March 28, 2003

Dear Stockholders:

It is my pleasure to invite you to Ambac’s 2003 Annual Meeting of Stockholders.

We will hold the meeting on Tuesday, May 6, 2003, at 11:30 a.m. at our executive offices in New York City. In addition to the formal items of business, I will review the major developments of 2002 and answer your questions.

This booklet includes the Notice of Annual Meeting and the Proxy Statement. The Proxy Statement describes the business that we will conduct at the meeting.

Your vote is important. Most shareholders have a choice of voting on the Internet, by telephone, or by mail using a traditional proxy card. Please refer to the proxy card or other voting instructions included with these proxy materials for information on the voting methods available to you.If you vote by telephone or on the Internet, you do not need to return your proxy card.

We look forward to seeing you at the meeting.

Sincerely,

Ambac Financial Group, Inc.

One State Street Plaza

New York, NY 10004

212.668.0340

NOTICEOF 2003 ANNUAL MEETINGOF STOCKHOLDERS

March 28, 2003

Dear Stockholders:

We will hold the 2003 Annual Meeting of Stockholders on Tuesday, May 6, 2003 at 11:30 a.m. (local time) at our executive offices at One State Street Plaza in New York City. At our Annual Meeting, we will ask you to:

| · | Elect eight directors; |

| · | Approve Amendments to the Ambac 1997 Equity Plan; |

| · | Ratify the selection of KPMG LLP as independent auditors for 2003; and |

| · | Consider any other business that is properly presented at the Annual Meeting. |

You may vote at the Annual Meeting if you were an Ambac stockholder at the close of business on March 11, 2003.

Along with the attached Proxy Statement, we are also sending you the Ambac 2002 Annual Report, which includes our financial statements.

Anne G. Gill

First Vice President, Corporate Secretary

and Assistant General Counsel

1 | ||

Why Did You Send Me this Proxy Statement? | 1 | |

Who Is Entitled to Vote? | 1 | |

How Many Votes Do I Have? | 1 | |

How Do I Vote by Proxy? | 1 | |

May I Vote by Telephone or Via the Internet? | 2 | |

May I Revoke My Proxy? | 2 | |

How Do I Vote in Person? | 2 | |

How Do Employees in the Ambac Stock Fund Vote? | 3 | |

What Votes Do We Need to be Present to Hold the Annual Meeting? | 3 | |

What Vote Is Required to Approve Each Proposal? | 3 | |

What Is the Effect of Broker Non-Votes? | 3 | |

Is Voting Confidential? | 4 | |

If More than One Member of My Household Owns Shares, Will We Receive Separate Annual Meeting Materials? | 4 | |

What Are the Costs of Soliciting these Proxies and Who Will Pay Them? | 4 | |

How Do I Obtain an Annual Report on Form 10-K? | 5 | |

Where Can I Find the Voting Results? | 5 | |

Whom Should I Call If I Have Any Questions? | 5 | |

6 | ||

Which Stockholders own at least 5% of Ambac? | 6 | |

How Much Stock is Owned By Directors and Executive Officers? | 7 | |

Did Ambac Insiders Comply with Section 16(a) Beneficial Ownership Reporting in 2002? | 8 | |

9 | ||

The Board of Directors | 9 | |

The Committees of the Board | 9 | |

How We Compensate Directors | 10 | |

Corporate Governance | 12 | |

13 | ||

15 | ||

The Executive Officers | 15 | |

How We Compensate Executive Officers | 17 | |

The Pension Plan | 19 | |

Employment Agreement with the Chief Executive Officer | 21 | |

Management Retention Agreements with Executive Officers | 22 | |

Report On Executive Compensation For 2002 By The Compensation And Organization Committee | 25 | |

30 | ||

31 | ||

Proposal 2: Approve Amendments to the Ambac 1997 Equity Plan | 33 | |

Summary of the Proposal | 33 | |

Principal Features of the Plan | 34 | |

Plan Benefits | 37 | |

Equity Compensation Plan Information | 38 | |

Proposal 3: Ratify Selection of KPMG LLP as Independent Auditors for 2003 | 39 | |

Audit and All Other Fees | 39 | |

41 |

PROXY STATEMENTFORTHE AMBAC FINANCIAL GROUP, INC.

2003 ANNUAL MEETINGOF STOCKHOLDERS

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why Did You Send Me this Proxy Statement?

We sent you this Proxy Statement and the enclosed proxy card because Ambac’s Board of Directors is soliciting your proxy to vote at the 2003 Annual Meeting of Stockholders.

This Proxy Statement summarizes the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. You may simply complete, sign and return the enclosed proxy card or vote by telephone or over the Internet.

Who Is Entitled to Vote?

March 11, 2003 is the record date for the meeting. If you owned Ambac common stock at the close of business on March 11, 2003, you are entitled to vote. On that date, there were 106,069,280 shares of Ambac common stock outstanding and entitled to vote at the meeting. Ambac common stock is our only class of voting stock. We will begin mailing this Proxy Statement on March 28, 2003 to all stockholders entitled to vote.

How Many Votes Do I Have?

You have one vote for each share of Ambac common stock that you owned at the close of business on March 11, 2003. The proxy card indicates the number.

How Do I Vote by Proxy?

If you properly fill in your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board:

| · | “FOR” Proposal 1(Elect Eight Directors); and |

| · | “FOR” Proposal 2(Approve Amendments to the Ambac 1997 Equity Plan); and |

| · | “FOR” Proposal 3(Ratify Selection of KPMG LLP as Independent Auditors for 2003). |

If any other matter is presented, your proxy will vote in accordance with his or her best judgment. At the time we began printing this Proxy Statement, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this Proxy Statement.

May I Vote by Telephone or Via the Internet?

Yes. Instead of submitting your vote by mail on the enclosed proxy card, you may be able to vote via the Internet or by telephone. Please note that there are separate Internet and telephone arrangements depending on whether you are a registered stockholder (that is, if you hold your stock in your own name), or whether you hold your shares in “street name” (that is, if your stock is held in the name of your broker or bank).

If you are a registered stockholder, you may vote by telephone, or electronically through the Internet, by following the instructions provided on your proxy card.

If your shares are held in “street name”, you may need to contact your bank or broker to determine whether you will be able to vote by telephone or electronically.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. If you vote via the Internet, you may incur costs, such as usage charges from Internet access providers and telephone companies. You will be responsible for those costs.

Whether you plan to attend the Annual Meeting or not, we urge you to vote. Returning the proxy card or voting by telephone or over the Internet will not affect your right to attend the Annual Meeting and vote. |

May I Revoke My Proxy?

Yes. You may change your mind after you send in your proxy card by following any of these procedures. To revoke your proxy:

| · | Send in another signed proxy with a later date; or |

| · | Send a letter revoking your proxy to Ambac’s Corporate Secretary at the address indicated on page 41 under “Information about Stockholder Proposals”; or |

| · | Attend the Annual Meeting and vote in person. |

How Do I Vote in Person?

If you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive.

If your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee. The account statement or letter must show that you were the direct or indirect (beneficial) owner of the shares on March 11, 2003.

2

How Do Employees in the Ambac Stock Fund Vote?

If you are an employee who participates in our Savings Incentive Plan (“SIP”), you are receiving this material because of shares held for you in the Ambac Stock Fund in the SIP. The SIP Trustee will send you a voting instruction card instead of a proxy card. This voting instruction card will indicate the number of shares of Ambac common stock credited to your account in the Ambac Stock Fund as of March 11, 2003.

| · | If you complete, sign and return the voting instruction card on time, the SIP Trustee will vote the shares as you have directed. |

| · | If you do not complete, sign and return the voting instruction card on time, the SIP Trustee will not vote the shares credited to your account. |

What Votes Do We Need to be Present to Hold the Annual Meeting?

We need a majority of the shares of Ambac common stock outstanding on March 11, 2003 to be present, in person or by proxy, to hold the Annual Meeting.

What Vote Is Required to Approve Each Proposal?

Proposal 1: | The eight nominees for director who receive the most votes will be elected. If you do not vote for a nominee, or you indicate “withhold authority to vote” for any nominee on your proxy card, your vote will not count either for or against the nominee. |

Proposal 2: | The affirmative vote of a majority of the votes present and entitled to vote at the Annual Meeting is required to approve the proposed amendments to the Ambac 1997 Equity Plan. So, if you “abstain” from voting, it has the same effect as if you voted “against” this proposal. |

Proposal 3: | The affirmative vote of a majority of the votes present and entitled to vote at the Annual Meeting is required to ratify the selection of independent auditors. So, if you “abstain” from voting, it has the same effect as if you voted “against” this proposal. |

What Is the Effect of Broker Non-Votes?

A broker “non-vote” occurs when a broker holding shares for a beneficial owner does note vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Under the rules of the New York Stock Exchange, if your broker holds your shares in its “street” name, the broker may vote your shares on Proposal 1 (Elect Eight Directors) and Proposal 3 (Ratify Selection of Auditors) even if it does not receive instructions from

3

you. However, your broker may not vote your shares on Proposal 2 (Approve Amendments to the Ambac 1997 Equity Plan) unless you give him or her specific voting instructions. A broker non-vote will have no effect on the outcome of this proposal.

Is Voting Confidential?

We maintain a policy of keeping all the proxies, ballots and voting tabulations confidential. The Inspectors of Election will forward to management any written comments that you make on the proxy card.

If More than One Member of My Household Owns Shares, Will We Receive Separate Annual Meeting Materials?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we are sending only one Annual Report and Proxy Statement to stockholders who have the same address and last name unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This “householding” practice reduces our printing and postage costs. Stockholders may request a separate copy of the Annual Report and Proxy Statement as follows:

| · | Record stockholders wishing to discontinue or begin householding, or any record stockholder residing at a household address wanting to request delivery of a copy of the Annual Report and Proxy Statement, should contact our transfer agent, Citibank, N.A., at 212-657-5997 or may write to Citibank at 111 Wall Street, 5th Floor, New York, New York 10043. |

| · | Beneficial stockholders can request information about householding from their banks, brokers or other holders of record. |

What Are the Costs of Soliciting these Proxies and Who Will Pay Them?

Ambac will pay all the costs of soliciting these proxies. Although we are mailing these proxy materials, our directors and employees may also solicit proxies by telephone, by fax or other electronic means of communication, or in person. We will reimburse banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you. Georgeson Shareholder Communications, Inc. is assisting us with the solicitation of proxies for a fee of $8,500 plus out-of-pocket expenses.

4

How Do I Obtain an Annual Report on Form 10-K?

We have filed our Annual Report on Form 10-K for the year ended December 31, 2002 with the Securities and Exchange Commission. Our Form 10-K contains information that is not included in our Annual Report that we are sending you with this Proxy Statement. You can find the Form 10-K on Ambac’s website atwww.ambac.com. You also may ask us for a copy and we will send you one without charge. Please write to:

Investor Relations

Ambac Financial Group, Inc.

One State Street Plaza

New York, New York 10004

| Attention: | Peter R. Poillon, First Vice President |

| and Director of Investor Relations |

or contact Mr. Poillon at (212) 208-3333 or atppoillon@ambac.com.

Where Can I Find the Voting Results?

We will publish the voting results in ourForm 10-Qfor the second quarter of 2003, which we will file with the SEC in August 2003. You can find the Form 10-Q on Ambac’s website atwww.ambac.com.

Whom Should I Call If I Have Any Questions?

If you have any questions about the Annual Meeting or voting, please contactAnne Gill, our Corporate Secretary, at (212) 208-3355 or atagill@ambac.com.

If you have any questions about your ownership of Ambac common stock, please callPeter Poillon, First Vice President and Director of Investor Relations, at (212) 208-3333 or atppoillon@ambac.com.

5

INFORMATION ABOUT AMBAC COMMON STOCK OWNERSHIP

Which Stockholders own at least 5% of Ambac?

The following table shows all persons we know to be direct or indirect owners of at least 5% of Ambac common stock as of December 31, 2002. Our information is based on reports filed with the Securities and Exchange Commission by each of the firms listed in the table below. You may obtain these reports from the SEC.

Number of Shares Owned Beneficially | Percent of Class | ||||

J.P. Morgan Chase & Co. | 11,016,631 | 10.3 | % | ||

270 Park Avenue New York, New York 10017 | |||||

Wellington Management Company, LLP | 7,332,879 | 6.9 | % | ||

75 State Street Boston, Massachusetts 02109 | |||||

Goldman Sachs & Co. | 7,306,108 | 6.9 | % | ||

85 Broad Street New York, New York 10004 | |||||

Citigroup Inc. | 5,982,798 | 5.6 | % | ||

339 Park Avenue New York, New York 10043 | |||||

6

How Much Stock is Owned By Directors and Executive Officers?

The following table shows the Ambac common stock owned directly or indirectly by Ambac’s directors and executive officers as of February 1, 2003. Except for Mr. Lassiter, no director or executive officer beneficially owns 1% or more of the shares of Ambac common stock. All directors and executive officers as a group beneficially own 3.64% of the shares of Ambac common stock.

Name of Beneficial Owner | Shares Beneficially Owned (1)(2)(3)(4)(5) | Percent of Class | Unvested RSUs(6) | PSUs(7) | Total Holdings (including RSUs and PSUs) | |||||

Outside Directors | ||||||||||

Michael A. Callen | 38,666 | — | 3,014 | 8,750 | 50,430 | |||||

Renso L. Caporali | 23,719 | — | 3,053 | 6,591 | 33,363 | |||||

Jill M. Considine | 8,134 | — | 3,053 | 1,581 | 12,768 | |||||

Richard Dulude | 29,408 | — | 3,014 | 9,532 | 41,954 | |||||

W. Grant Gregory | 23,490 | — | 3,014 | 10,183 | 36,687 | |||||

Laura S. Unger | 0 | — | 0 | 0 | 0 | |||||

Executive Officers | ||||||||||

Phillip B. Lassiter | 1,853,568 | 1.75% | 53,271 | 0 | 1,906,839 | |||||

Robert J. Genader | 806,903 | — | 12,934 | 0 | 819,868 | |||||

Frank J. Bivona | 386,331 | — | 2,283 | 0 | 388,614 | |||||

David L. Boyle | 353,766 | — | 6,946 | 0 | 360,712 | |||||

Kevin J. Doyle | 92,183 | — | 1,828 | 0 | 94,011 | |||||

All executive officers and directors | 3,855,863 | 3.64% | 99,923 | 36,637 | 3,992,424 | |||||

| (1) | To our knowledge, except for Messrs. Lassiter, Genader, Boyle and Doyle, who share voting and investment power with their spouses, each of the directors and executive officers has sole voting and investment power over his shares. |

| (2) | The number of shares shown for Mr. Lassiter includes 12,000 shares owned by his spouse. Mr. Lassiter disclaims beneficial ownership of these shares. |

| The number of shares shown for Mr. Boyle includes 500 shares owned by his spouse. Mr. Boyle disclaims beneficial ownership of these shares. |

| The number of shares shown for Mr. Gregory includes 2,345 shares held in the Gregory 1997 Children’s Trust, of which his daughter is a beneficiary. Mr. Gregory has neither the power to vote these shares nor the power to direct their disposition and he disclaims beneficial ownership of these shares. |

| (3) | The number of shares shown for each director and executive officer includes shares that may be acquired upon exercise of stock options that were exercisable as of February 1, 2003 or that will become exercisable within 60 days after February 1, 2003. These shares are shown in the following table |

Outside Directors | Number Of Shares | Executive Officers | Number Of Shares | |||

Mr. Callen | 16,500 | Mr. Lassiter | 708,070 | |||

Dr. Caporali | 13,500 | Mr. Genader | 417,759 | |||

Ms. Considine | 8,126 | Mr. Bivona | 270,000 | |||

Mr. Dulude | 16,500 | Mr. Boyle | 337,564 | |||

Mr. Gregory | 16,500 | Mr. Doyle | 81,750 |

| (4) | The number of shares shown for each executive officer also includes the number of shares of Ambac common stock owned indirectly as of February 1, 2003 by these executive officers in our Savings Incentive Plan (“SIP ”). Our information on these shares is based on reports from the SIP Trustee. |

7

| (5) | The number of shares shown for Messrs. Lassiter, Genader, Bivona, Boyle and Doyle include vested restricted stock units (“RSUs”) that we awarded under our equity plans. These RSUs are shown in the following table: |

Executive Officers | Number of Vested RSUs | |

Mr. Lassiter | 988,134 | |

Mr. Genader | 345,458 | |

Mr. Bivona | 99,954 | |

Mr. Boyle | 6,304 | |

Mr. Doyle | 0 |

| (6) | This column shows the 3,000 RSUs that were granted to each of Messrs. Callen, Dulude and Gregory at the 2002 Annual Meeting under the 1997 Non-Employee Directors Equity Plan and accrued dividends and the 3,000 RSUs that were granted to Dr. Caporali and Ms. Considine at the 2000 Annual Meeting under the 1997 Non-Employee Directors Equity Plan and accrued dividends. These RSUs generally will vest on the date of the Annual Meeting held in the fifth calendar year following the date of grant. At that time, each of these directors will receive one share of Ambac common stock in settlement of each RSU. For more information on these RSUs, see below at page 10 under “How We Compensate Directors.” |

| This column also shows RSUs for Messrs. Lassiter, Genader, Bivona, Boyle and Doyle that were awarded as part of each executive officer’s 2000 bonus, 2001 bonus and 2002 bonus pursuant to the Ambac Deferred Compensation Sub-Plan of the 1997 Equity Plan (the “Sub-Plan”) and accrued dividends. See page 27 for more detailed descriptions of these awards made pursuant to the Sub-Plan. |

| (7) | Under Ambac’s Deferred Compensation Plan, directors may defer their cash compensation. If a director has elected to defer cash compensation into Phantom Stock Units (“PSUs”), these PSUs are shown in this column. For more information on the Deferred Compensation Plan, see below at page 11. |

Did Ambac Insiders Comply with Section 16(a) Beneficial Ownership Reporting in 2002?

Section 16(a) of the Securities Exchange Act of 1934 requires that our insiders—our directors, executive officers, and greater-than-10% stockholders—file reports with the SEC and the New York Stock Exchange on their initial beneficial ownership of Ambac common stock and any subsequent changes. They must also provide us with copies of the reports.

We reviewed copies of all reports furnished to us and obtained written representations that no other reports were required. Based on this, we believe that all of our insiders complied with their filing requirements for 2002, except that, due to the adoption of new SEC rules changing the requirements for the reporting of dividends on company stock awards, phantom stock unit dividends and restricted stock unit dividends awarded on September 4, 2002 to our outside directors (Messrs. Callen, Dulude and Gregory, Dr. Caporali and Ms. Considine) and our executive officers (Messrs. Lassiter, Genader, Bivona, Boyle, Doyle and Bienstock) were not reported on a timely basis. The filings were made on October 10, 2002.

8

The Board of Directors

The Board of Directors oversees the business of Ambac and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed by discussing matters with the Chairman, other key executives and our principal external advisers (legal counsel, outside auditors, investment bankers and other consultants) by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings.

Ambac’s Board usually meets five times per year in regularly scheduled meetings, but will meet more often if necessary. The Board met five times during 2002. All directors attended at least 75% of the Board meetings and meetings of the Committees of which they were members.

Each of our directors also serves as a director of our principal operating subsidiary, Ambac Assurance Corporation, a leading triple-A rated financial guarantee insurance company.

The Committees of the Board

The Board has three standing committees: the Audit Committee, the Compensation and Organization Committee and the Nominating and Corporate Governance Committee. None of the directors who serve as members of these committees is, or has ever been, an employee of Ambac or our subsidiaries.

The Audit | The Audit Committee recommends the selection of the independent auditors to the Board, approves the scope of the annual audit by the independent auditors and our internal auditors, reviews audit findings and accounting policies, assesses the adequacy of internal controls and risk management, reviews and approves Ambac’s financial disclosures and oversees compliance with Ambac’s Code of Business Conduct. The Committee also meets privately, outside the presence of Ambac management, with both the independent auditors and the internal auditors. Under the rules of the New York Stock Exchange, all of the members of the Audit Committee are independent. The Committee’s Report for 2002 is printed below at pages 13 and 14. |

The Board has adopted a written charter for the Audit Committee. A copy of the Charter was attached as an appendix to Ambac’s proxy statement for the 2002 Annual Meeting. |

The Committee met eight times during 2002. |

Messrs. Callen, Dulude and Gregory and Dr. Caporali and Ms. Considine and Ms. Unger currently serve as members of the Committee. Mr. Callen serves as Chairman of the Committee. |

9

The Compensation | The Compensation and Organization Committee establishes and approves all elements of compensation for the executive officers. Each year, as the SEC requires, the Committee reports to you on executive compensation. The Committee’s Report on Executive Compensation for 2002 is printed below, starting at page 25. |

The Committee administers Ambac’s 1997 Equity Plan and has sole authority for awards under the plan. The Committee evaluates existing and proposed employee benefit plans and may approve of plan changes. The Committee also administers the 1997 Executive Incentive Plan and Ambac’s Deferred Compensation Plan for Outside Directors and Ambac’s Senior Officer Deferred Compensation Sub-Plan of the 1997 Equity Plan. The Committee is also responsible for periodically reviewing Ambac’s plans regarding succession of senior management. |

The Committee met three times during 2002. |

Messrs. Callen, Dulude and Gregory and Dr. Caporali and Ms. Considine and Ms. Unger currently serve as members of the Committee. Mr. Dulude serves as Chairman of the Committee. |

The Nominating | The Nominating and Corporate Governance Committee is responsible for monitoring Ambac’s corporate governance policies and procedures and identifying and recommending qualified candidates to the Board for election as directors. Through its monitoring of Ambac’s corporate governance policies and procedures, it is responsible for making recommendations concerning the size, composition, committee structure and composition, and fees for the Board and criteria for tenure and retention of directors. |

The Committee will consider individuals recommended by stockholders for nomination as a director in accordance with the procedures described on page 41 under “Information About Stockholder Proposals.” |

The Committee met three times during 2002. |

Messrs. Callen and Gregory and Ms. Considine and Ms. Unger currently serve as members of the Committee. Mr. Gregory serves as Chairman of the Committee. |

How We Compensate Directors

Annual | We compensate directors who are not employees of Ambac or our subsidiaries with an annual cash fee of $30,000 per year. |

Annual Stock | We also grant each non-employee director 3,750 stock options on the date of each annual meeting. These options have an exercise price equal to the average of the high and low trading price of our stock on the New York |

10

Stock Exchange on the date of grant. The options generally will vest on the first anniversary of the date of the grant and expire on the date of the annual meeting held in the seventh calendar year following the date of the grant. |

| Award of Restricted Stock Units Every Five Years | · | Ambac grants each non-employee director 3,000 restricted stock units (“RSUs”) at the annual meeting at which the director is first elected to the Board. |

| · | These RSUs generally will vest on the date of the annual meeting held in the fifth year following the date of grant and will be settled by the delivery of one share of Ambac common stock for each RSU. |

| · | If the director remains on the Board after the first award of RSUs vests, Ambac will grant the director a second award of 3,000 RSUs, subject to similar vesting conditions and restrictions on transfer. |

Meeting Fees | We also pay each non-employee director a meeting fee of: |

| · | $1,250 for attendance at each meeting of stockholders and each Board meeting; and |

| · | $1,250 for attendance at each committee meeting. |

Fee for Chairing | We pay an annual fee of $2,500 to each non-employee director who chairs a committee. |

Expenses and | Ambac reimburses all directors for travel and other related expenses incurred in attending stockholder, Board and committee meetings. |

We provide non-employee directors with life and health insurance benefits. We also allow them to participate in our Matching Gift Program up to $20,000. Under this Program, Ambac will match gifts by directors to qualified organizations. |

The Deferred | Under our Deferred Compensation Plan for Outside Directors, non-employee directors may elect to defer all or part of their director compensation that is paid in cash. |

| · | At the director’s election, we credit deferrals to a bookkeeping account that we maintain on the director’s behalf either as a cash credit (which we credit with interest quarterly at a 90-day commercial paper composite rate published by the Federal Reserve Bank), or as phantom stock units (“PSU”) based on the market value of Ambac common stock (on which we pay quarterly dividend equivalents in additional PSUs) or as performance units measured by the performance of those mutual funds the director selects out of a limited group of funds. |

| · | We do not fund the Deferred Compensation Plan. We settle accounts only in cash. |

11

Service on the | Although Ambac Assurance does not pay its non-employee directors an annual fee for serving on its Board of Directors, it does pay them meeting fees (in the same amounts as we do for the Ambac Board) and reimburses all directors for expenses. |

Directors who | We do not compensate our employees or employees of our subsidiaries for service as a director. We do, however, reimburse them for travel and other related expenses. |

Corporate Governance

Our Board of Directors has maintained corporate governance policies for many years and has updated them from time to time. Our Board has had in place several of the NYSE’s proposed corporate governance requirements for many years. |

Existing corporate governance highlights |

| · | Our Board has asubstantial majority (75%) of non-employee directors. |

| · | Since we went public in 1991, only non-employee directors have comprised our Audit, Compensation and Organization and Nominating and Corporate Governance committees. |

| · | All of our Audit Committee members meet the current NYSE standards for independence and financial literacy. Five out of six of our members of the Audit Committee qualify as audit committee financial experts under applicable SEC rules. |

| · | Our Audit Committee hires, determines the compensation of, and decides the scope of services performed by, our independent auditors. It also has the authority to retain outside advisors. |

| · | Our Board policy prohibits our directors entering into paid consulting agreements with Ambac. |

| · | Our Compensation and Organization Committee has the authority to retain independent consultants, and, in fiscal 2002, engaged Johnson Associates, Inc. to assist it. It also evaluates the CEO and President and discusses the evaluation with all non-employee directors in executive session. |

| · | Our Board policy opposes, and our 1997 Equity Plan prohibits, the re-pricing of our outstanding stock options. |

Recent developments |

Our Nominating and Corporate Governance Committee reviewed various corporate governance proposals during 2002 and recommended changes to existing policies and practices to the full Board. Our Board has adopted: (1) corporate governance guidelines; (2) charters for the Compensation and Organization Committee and the Nominating and Corporate Governance Committee; (3) a revised and expanded definition of independence for our directors for fiscal 2003; and (4) a revised Code of Ethics and Business Conduct for all directors, officers and employees. |

12

The Audit Committee of Ambac is responsible for providing independent, objective oversight of Ambac’s accounting functions and internal controls and risk management. The Audit Committee recommends the selection of the independent auditors to the Board. The Audit Committee is currently composed of six independent directors, each of whom is independent as defined under the rules of the New York Stock Exchange. The Audit Committee operates under a written charter adopted by the Board of Directors, which was filed as an appendix to Ambac’s proxy statement for the 2002 Annual Meeting.

Management is responsible for Ambac’s internal controls and financial reporting process. The independent auditors are responsible for performing an independent audit of Ambac’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. However, none of the members of the Committee is professionally engaged in the practice of accounting or auditing nor are all of our members experts in those fields. The Committee relies without independent verification on the information provided to it and on the representations made by management and the independent auditors.

We held eight meetings during 2002. The meetings were designed, among other things, to facilitate and encourage communication among the Committee, management, the internal auditors and Ambac’s independent auditors, KPMG LLP. We discussed with Ambac’s internal auditors and KPMG LLP the overall scope and plans for their respective audits. We met with the internal auditors and KPMG LLP, with and without management present, to discuss the results of their examinations and their evaluations of Ambac’s internal controls.

We have reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2002 with management, the internal auditors and KPMG LLP. We also discussed with management and KPMG LLP the process used to support certifications by Ambac’s Chief Executive Officer and Chief Financial Officer that are required by the Securities and Exchange Commission and the Sarbanes-Oxley Act of 2002 to accompany Ambac’s periodic filings with the Securities and Exchange Commission.

We also discussed with KPMG LLP matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters related to the conduct of the audit of Ambac’s consolidated financial statements and the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees).

KPMG LLP also provided to us the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and we discussed with them their independence from Ambac. When considering KPMG LLP’s independence, we considered whether their provision of services to Ambac beyond those rendered in connection with their audit of Ambac’s consolidated financial statements and reviews of Ambac’s consolidated financial statements included in its Quarterly Reports on Form 10-Q was compatible with maintaining their independence. We also reviewed, among other things, the audit and non-audit services performed by, and the amount of fees paid for such services to, KPMG LLP.

13

Based upon the review and discussions referred to above, we recommended to the Board of Directors, and the Board of Directors has approved, that Ambac’s audited financial statements be included in Ambac’s Annual Report on SEC Form 10-K for the fiscal year December 31, 2002. We also recommended the selection of KPMG LLP as Ambac’s independent auditors for 2003 and, based on that recommendation, the Board has selected KPMG LLP as Ambac’s independent auditors for 2003.

We have been advised by KPMG LLP that neither the firm, nor any member of the firm, has any financial interest, direct or indirect, in any capacity in Ambac or its subsidiaries.

The Audit Committee

Michael A. Callen,Chairman Renso L. Caporali | ||

March 25, 2003 | Jill M. Considine Richard Dulude W. Grant Gregory Laura S. Unger |

14

INFORMATION ABOUT THE EXECUTIVE OFFICERS

The Executive Officers

These are the biographies of Ambac’s current executive officers, except for Mr. Lassiter, the Chief Executive Officer, and Mr. Genader, the President and Chief Operating Officer, whose biographies are included below at pages 31 and 32 under “Proposal 1: Elect Eight Directors.”

David L. Boyle | Vice Chairman—Portfolio Risk Assessment and Internal Audit Group |

Age 56 | Mr. Boyle was named Vice Chairman of Ambac’s Portfolio Risk Assessment and Internal Audit Group in February 2000. The Portfolio Risk Assessment and Internal Audit Group is responsible for surveillance and remediation of Ambac’s specialized finance and public finance portfolios, risk analysis and reporting on such matters to Ambac’s Audit Committee. The Portfolio Risk Assessment and Internal Audit Group is also responsible for reinsurance and risk transfer, rating agency relationships and technology. In January 2003, Mr. Boyle also assumed executive responsibility for Ambac’s cash management services. Mr. Boyle previously served as Vice Chairman of the Municipal Financial Services Group from January 1998 to February 2000. Mr. Boyle joined Ambac and Ambac Assurance in March 1997 as Senior Vice President of the Financial Management Services Division. He became an Executive Vice President in July 1997. Mr. Boyle also serves as a trustee of Cadre Institutional Investors Trust. Mr. Boyle joined Ambac from Citibank where, as a Managing Director, he held various management positions in corporate banking over a 22-year career. |

Thomas J. Gandolfo | Senior Vice President and Chief Financial Officer |

Age 42 | In January 2003, Mr. Gandolfo was named Senior Vice President and Chief Financial Officer of Ambac and Ambac Assurance. In addition to his position as Ambac’s Chief Financial Officer, Mr. Gandolfo also has executive responsibility for managing Ambac’s investor and public relations. Mr. Gandolfo served as Managing Director and Controller of Ambac from July 1998 to January 2003. He joined Ambac in 1994 as Vice President and Controller of Ambac’s investment agreement business. Mr. Gandolfo joined Ambac from Price Waterhouse, where he was a CPA and Senior Manager in their Financial Services Specialty Unit. |

Howard Pfeffer | Senior Managing Director—Public Finance Division, Investment Management and Financial Services Group |

Since 1998, Mr. Pfeffer has served as Senior Managing Director and Head of Ambac Assurance’s Public Finance Department. In January 2003, he was also named as Head of Ambac’s Investment Management Group. The Investment Management and Financial Services Group is responsible for managing Ambac’s investment portfolios and its asset and liability management services. In October 1998, Mr. Pfeffer became a Senior Managing Director. From 1989 to October 1998, Mr. Pfeffer ran Ambac’s Structured Finance Group, which was responsible for Ambac’s mortgage-backed, home equity loan, student loan and multi-family housing |

15

securitization business. In 1989, Mr. Pfeffer joined Ambac from Citicorp where he was a Vice President in the Municipal Division of Citicorp and had responsibility for structured finance products and transactions. |

Gregg L. Bienstock | Managing Director, Human Resources and Employment Counsel |

Age 38 | Mr. Bienstock has been Managing Director, Human Resources and Employment Counsel since January 1999. Mr. Bienstock has executive responsibility for corporate governance, corporate marketing and corporate administration. Mr. Bienstock served as First Vice President, Director of Human Resources and Employment Counsel of Ambac and Ambac Assurance from February 1997 to January 1999. Mr. Bienstock joined Ambac from the Bristol Myers-Squibb Corporation, where he served as a Director of Human Resources from February 1996 to February 1997. From September 1993 to February 1996, Mr. Bienstock was an associate with the New York law firm of Proskauer Rose LLP. Prior to joining Proskauer, from April 1992 to September 1993, Mr. Bienstock was an Assistant General Counsel for the Mayor’s Office of Labor Relations for the City of New York. |

Kevin J. Doyle | Managing Director and General Counsel |

Age 46 | Mr. Doyle was named Managing Director and General Counsel of Ambac and Ambac Assurance in January 2000. Mr. Doyle is Ambac’s chief legal officer. From January 1996 to January 2000, Mr. Doyle served as the Managing Director and General Counsel of the Specialized Finance Division of Ambac Assurance. Mr. Doyle served as First Vice President and General Counsel of the Specialized Finance Division of Ambac Assurance from July 1995 to January 1996. Mr. Doyle joined Ambac Assurance as a Vice President and Assistant General Counsel from the New York law firm LeBoeuf, Lamb, Greene & MacRae in 1991. |

16

How We Compensate Executive Officers

The tables on pages 17 through 19 show salaries, bonuses and other compensation paid during the last three years, options granted in 2002, options exercised in 2002 and option values as of year-end 2002 for the Chief Executive Officer and our next four most highly compensated executive officers.

SUMMARY COMPENSATION TABLE

Annual Compensation | Long-Term Compensation Awards | |||||||||||||||

Name and Principal Position | Year | Salary($) | Bonus($) | Restricted Stock Units($)(1) | Securities Underlying Options(2) | All Other Compensation ($)(3) | ||||||||||

Phillip B. Lassiter | 2002 | $ | 660,000 | $ | 750,000 | $ | 333,386 | 250,000 | $ | 56,051 | ||||||

Chairman and | 2001 2000 |

| 620,000 620,000 |

| 930,000 930,000 |

| 413,335 413,335 | 503,242 287,232 |

| 66,302 78,509 | ||||||

Robert J. Genader | 2002 |

| 400,000 |

| 600,000 |

| 266,697 | 120,000 |

| 36,191 | ||||||

President and Chief | 2001 2000 |

| 400,000 345,000 |

| 637,500 600,000 |

| 283,335 266,685 | 180,259 140,241 |

| 46,499 31,049 | ||||||

Frank J. Bivona(4) | 2002 |

| 310,000 |

| 300,000 |

| 0 | 85,000 |

| 29,916 | ||||||

Vice Chairman—Finance and | 2001 2000 |

| 310,000 270,000 |

| 352,500 318,750 |

| 156,695 141,687 | 75,000 86,730 |

| 38,400 24,301 | ||||||

David L. Boyle | 2002 |

| 350,000 |

| 318,750 |

| 141,685 | 87,800 |

| 28,114 | ||||||

Vice Chairman—Portfolio | 2001 2000 |

| 330,000 330,000 |

| 337,500 318,750 |

| 150,036 141,687 | 75,000 90,000 |

| 40,200 29,699 | ||||||

Kevin J. Doyle | 2002 |

| 184,000 |

| 375,000 |

| 0 | 20,000 |

| 15,827 | ||||||

Managing Director | 2001 2000 |

| 174,000 174,000 |

| 335,000 232,500 |

| 0 103,346 | 18,000 21,750 |

| 26,160 15,660 | ||||||

| (1) | Pursuant to the Ambac Deferred Compensation Sub-Plan of the 1997 Equity Plan (the “Sub-Plan”), the Compensation and Organization Committee paid 25% of each executive officer’s bonus for 2000 in restricted stock units (“RSUs”). For 2001, the Compensation and Organization Committee paid 25% of Messrs. Lassiter, Genader, Bivona and Boyle’s bonus in RSUs and for 2002, 25% of Messrs. Lassiter, Genader and Boyle’s bonuses were paid in RSUs. Amounts shown in this column are based on the market value of the underlying Common Stock on the date of grant and do not reflect the discount attributed to such value by the Committee to take account of vesting requirements, restrictions on transfer and other limitations. See page 27 for more detailed descriptions of these awards made pursuant to the Sub-Plan. As dividends are paid on the common stock, dividend equivalents are accrued on the RSUs as additional RSUs and vest according to the same schedule. |

| The total number of RSUs held by the named executive officers as of December 31, 2002, and the total value of these RSUs (based on the $56.24 per share closing price of Ambac common stock on the New York Stock Exchange on Tuesday, December 31, 2002) were as follows: Mr. Lassiter—1,002,231 RSUs ($56,365,471); Mr. Genader—353,641 RSUs ($19,888,770); Mr. Bivona—102,905 RSUs ($5,787,377); Mr. Boyle—12,490 RSUs ($702,438); and Mr. Doyle—3,119 RSUs ($175,413). |

17

| (2) | The number of securities underlying options for 2000, 2001 and 2002 includes restoration options awarded upon the exercise of stock options in accordance with Ambac’s Restoration Option Program. For the specific breakdown of option and restoration option grants made in 2002, please refer below to the table on this page 18 under “Option Grants in 2002.” For a more detailed description of our Restoration Option Program, please see footnote 2 under the “Option Grants in 2002” table on this page 18. |

| (3) | The column called “All Other Compensation” includes the amounts that Ambac contributed or credited on behalf of the named officers in 2002 to (a) our Savings Incentive Plan (the “SIP ”), and (b) our Non-Qualified SIP. We credit amounts that we are precluded from contributing to the SIP because of limitations under the Internal Revenue Code to accounts that we maintain under Ambac’s Non-Qualified SIP. |

Contributions to the SIP | Credits to the Non-Qualified | |||||

Mr. Lassiter | $ | 15,700 | $ | 40,351 | ||

Mr. Genader |

| 13,892 |

| 22,299 | ||

Mr. Bivona |

| 14,354 |

| 15,562 | ||

Mr. Boyle |

| 14,914 |

| 13,200 | ||

Mr. Doyle |

| 13,867 |

| 1,960 | ||

| (4) | Mr. Bivona resigned as Chief Financial Officer effective January 21, 2003 and as Vice Chairman effective February 28, 2003. Thomas J. Gandolfo replaced Mr. Bivona as Chief Financial Officer effective as of January 21, 2003. Please see page 15 under “Executive Officers” for Mr. Gandolfo’s biography. |

OPTION GRANTS IN 2002

Individual Grants | |||||||||||||||

Number of Securities Underlying Options Granted (#) | Percent of Total Options Granted to Employees in 2002 | Exercise Price | Expiration Date | Grant Date | |||||||||||

Name | Options(1) | Restoration Options(2) | |||||||||||||

Phillip B. Lassiter | 250,000 | 16.19 | % | $ | 58.93 | 1/22/09 | $ | 5,191,154 | |||||||

Robert J. Genader | 120,000 | 7.77 |

|

| 58.93 | 1/22/09 |

| 2,491,754 | |||||||

Frank J. Bivona | 85,000 | 5.50 |

|

| 58.93 | 1/22/09 |

| 1,764,992 | |||||||

David L. Boyle | 85,000 | 5.50 |

|

| 58.93 | 1/22/09 |

| 1,764,992 | |||||||

2,800 | .18 |

|

| 64.53 | 4/30/04 |

| 24,122 | ||||||||

Kevin J. Doyle | 20,000 | 1.30 |

|

| 58.93 | 1/22/09 |

| 415,292 | |||||||

| (1) | Options awarded to the named executive officers by the Compensation and Organization Committee were long-term incentive awards granted on January 22, 2002. Each executive officer’s options will vest in two equal installments when the market price of Ambac common stock meets or exceeds $75.00 and $90.00 for twenty consecutive trading days or no later than the sixth anniversary of the grant date. Vesting is accelerated upon retirement, death or permanent disability. Generally, all of the executive officers’ options will expire seven years from the date of grant or earlier if employment terminates. |

| (2) | Restoration options were awarded upon the exercise of stock options in accordance with Ambac’s Restoration Option Program. A restoration option is awarded automatically when the underlying option is exercised by tendering shares of common stock to pay the exercise price. Each restoration option will vest one year from the date of grant, at an exercise price equal to the fair market value of Ambac common stock on the date the underlying option is exercised, and otherwise has the same exercise, transfer and expiration provisions as its underlying option. |

| (3) | The exercise price per share is the fair market value of the common stock on the date of grant. We determine this by calculating the average of the high and low price of Ambac common stock on the New York Stock Exchange on the date of grant. |

18

| (4) | We calculated these values by using the Black-Scholes stock option pricing model as follows: |

For the January Option Grants. The model that we applied uses the grant date of January 22, 2002. The fair market value of Ambac Common Stock on that date was $58.93 per share as we discussed above. The model assumes: (a) a risk-free rate of return of 4.26% (which was the yield on a U.S. Treasury Strip zero coupon bond with a maturity that approximates the term of the option); (b) stock price volatility of 31.90%; (c) a constant dividend yield of 0.61% based on the quarterly cash dividend rate at the time of grant on Ambac common stock; and (d) an exercise date, on average, of 5.5 years after grant.

For the Restoration Option Grants. We use the following assumptions in applying the model for each Restoration Option Grant: (a) a risk-free rate of return equal to the yield on grant date of a U.S. Treasury Strip zero coupon bond with a maturity that approximates the term of the option; (b) stock price volatility of Ambac common stock calculated using month-end closing prices of Ambac common stock on the New York Stock Exchange for the three year period prior to the grant date; (c) a constant dividend yield based on the quarterly cash dividend rate at the time of grant on Ambac common stock; and (d) exercise of the restoration option at the end of its term.

We did not adjust the model for non-transferability, risk of forfeiture, or vesting restrictions. The actual value (if any) an executive officer receives from a stock option will depend upon the amount by which the market price of Ambac common stock exceeds the exercise price of the option on the date of exercise. The hypothetical values are presented pursuant to SEC rules and there can be no assurance that the amount stated as “Grant Date Present Value” will actually be realized.

AGGREGATED OPTION EXERCISES DURING 2002AND YEAR-END OPTION VALUES

Number of Shares Acquired on Exercise | Value | Number of Securities Underlying Unexercised Options Held at | Value of Unexercised In-the-Money Options Held at December 31, 2002 ($)(1) | ||||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Phillip B. Lassiter | 0 | $ | 0 | 708,070 | 362,500 | $ | 6,105,329 | $ | 853,166 | ||||||

Robert J. Genader | 95,241 |

| 4,008,310 | 417,759 | 175,000 |

| 7,615,879 |

| 417,104 | ||||||

Frank J. Bivona | 165,959 |

| 7,074,480 | 270,000 | 122,500 |

| 6,627,991 |

| 284,389 | ||||||

David L. Boyle | 8,436 |

| 363,662 | 344,064 | 125,300 |

| 8,289,335 |

| 284,389 | ||||||

Kevin J. Doyle | 12,000 |

| 609,749 | 81,750 | 29,000 |

| 2,090,444 |

| 68,253 | ||||||

| (1) | This valuation represents the difference between $56.24, the closing price of Ambac common stock on the New York Stock Exchange on Tuesday, December 31, 2002, and the exercise price of the stock options. “In-the-money” stock options are options for which the exercise price is less than the market price of the underlying stock on a particular date. |

The Pension Plan

Ambac’s Pension Plan is a defined benefit pension plan intended to be tax-qualified under Section 401(a) of the Internal Revenue Code.

| · | In general, officers and employees of Ambac and its subsidiaries become participants in the Pension Plan after one year of service. All executive officers participate in the Pension Plan. Non-employee directors of Ambac and our subsidiaries are not eligible to participate in the Pension Plan. |

| · | Benefits under the Pension Plan vest after five years. Upon normal retirement at age 65, a retired employee receives an annual pension from the Pension Plan, subject to a statutory limit. The Pension Plan also contains provisions for early retirement and survivor benefits. |

19

The table below illustrates the annual pension benefits payable to executive officers under the Pension Plan. The table also reflects the excess and supplemental benefit plans that we have established to provide retirement benefits over Internal Revenue Code limitations. We calculated the benefits before offsetting (a) an employee’s primary Social Security benefit and (b) benefits payable under the retirement plan of Citibank, N.A., Ambac’s former parent company (the “Citibank Plan”). Benefits shown in the table reflect a straight life form of annuity benefit. If payment is made in the form of a joint and survivor annuity, the annual amounts of benefit could be substantially below those illustrated.

Average Covered Compensation | Years of Service at Transition Date | Total Years of Service at Retirement | ||||||||||||||||||

10 | 15 | 20 | 25 | 30 | 35 | |||||||||||||||

$ 150,000 | 30 |

| NA |

| NA |

| NA |

| NA | $ | 90,000 | $ | 97,500 | |||||||

15 |

| NA | $ | 45,000 | $ | 52,500 | $ | 60,000 |

| 67,500 |

| 75,000 | ||||||||

0 | $ | 15,000 |

| 22,500 |

| 30,000 |

| 37,500 |

| 45,000 |

| 52,500 | ||||||||

200,000 | 30 |

| NA |

| NA |

| NA |

| NA |

| 120,000 |

| 130,000 | |||||||

15 |

| NA |

| 60,000 |

| 70,000 |

| 80,000 |

| 90,000 |

| 100,000 | ||||||||

0 |

| 20,000 |

| 30,000 |

| 40,000 |

| 50,000 |

| 60,000 |

| 70,000 | ||||||||

500,000 | 30 |

| NA |

| NA |

| NA |

| NA |

| 300,000 |

| 325,000 | |||||||

15 |

| NA |

| 150,000 |

| 175,000 |

| 200,000 |

| 225,000 |

| 250,000 | ||||||||

0 |

| 50,000 |

| 75,000 |

| 100,000 |

| 125,000 |

| 150,000 |

| 175,000 | ||||||||

1,000,000 | 30 |

| NA |

| NA |

| NA |

| NA |

| 600,000 |

| 650,000 | |||||||

15 |

| NA |

| 300,000 |

| 350,000 |

| 400,000 |

| 450,000 |

| 500,000 | ||||||||

0 |

| 100,000 |

| 150,000 |

| 200,000 |

| 250,000 |

| 300,000 |

| 350,000 | ||||||||

1,500,000 | 30 |

| NA |

| NA |

| NA |

| NA |

| 900,000 |

| 975,000 | |||||||

15 |

| NA |

| 450,000 |

| 525,000 |

| 600,000 |

| 675,000 |

| 750,000 | ||||||||

0 |

| 150,000 |

| 225,000 |

| 300,000 |

| 375,000 |

| 450,000 |

| 525,000 | ||||||||

2,000,000 | 30 |

| NA |

| NA |

| NA |

| NA |

| 1,200,000 |

| 1,300,000 | |||||||

15 |

| NA |

| 600,000 |

| 700,000 |

| 800,000 |

| 900,000 |

| 1,000,000 | ||||||||

0 |

| 200,000 |

| 300,000 |

| 400,000 |

| 500,000 |

| 600,000 |

| 700,000 | ||||||||

2,500,000 | 30 |

| NA |

| NA |

| NA |

| NA |

| 1,500,000 |

| 1,625,000 | |||||||

15 |

| NA |

| 750,000 |

| 875,000 |

| 1,000,000 |

| 1,125,000 |

| 1,250,000 | ||||||||

0 |

| 250,000 |

| 375,000 |

| 500,000 |

| 625,000 |

| 600,000 |

| 875,000 | ||||||||

Service from 1992 | For service on or after January 1, 1992, the annual retirement benefit is equal to 1% (without an offset for any Social Security benefits) of an employee’s Average Compensation (as described in the next sentence) multiplied by the employee’s years of credited service. “Average Compensation” is defined, generally, as average annual base salary (which, in the case of executive officers identified in the Summary Compensation Table on page 17, is the amount shown under the column called “Salary”) for the five highest consecutive paid years of the ten years of employment preceding retirement. |

Service before 1992 | For service prior to January 1, 1992, the annual retirement benefit is equal to 2% (with an offset for Social Security benefits) of an employee’s Average Compensation (determined as if the employee retired on December 31, 1991) multiplied by years of credited service up to thirty years. |

20

Years of Service | In view of the change in the formula for determining benefits under the Pension Plan that became effective as of January 1, 1992 (the “Transition Date”), we prepared the above table to show the benefits payable depending on how many years of service the executive officer would have: |

| · | prior to the Transition Date, and |

| · | at Retirement. |

In order to simplify the chart, we show only 0, 15 and 30 years of service at Transition, since those values cover the range for our executive officers. |

The years of credited service under the Pension Plan (including credit for years of past service under the Citibank Plan) as of December 31, 2002 for executive officers named in the Summary Compensation Table were as follows: Mr. Lassiter—33 years, Mr. Genader—28 years, Mr. Bivona— 25 years, Mr. Boyle—12 years, and Mr. Doyle—11 years. |

Under the terms of a special pension arrangement for Mr. Boyle, he has been credited with an additional six years of service. |

The benefits payable under the Pension Plan to employees who receive credit for years of past service under the Citibank Plan will be reduced by the amount of any benefits payable under the Citibank Plan. |

Employment Agreement with the Chief Executive Officer

In General | Ambac’s employment agreement with Mr. Lassiter provides that he shall serve as the Chairman and Chief Executive Officer and as a director. |

| · | The agreement has a two year term, which is extended on a daily basis, until Ambac or Mr. Lassiter terminates it. |

| · | Mr. Lassiter is to receive a base salary at a rate not less than his current rate. |

| · | He is to participate in bonus arrangements under which he is eligible to earn an annual bonus based on Ambac’s achieving certain performance goals to be established by the Board. |

Supplemental | Mr. Lassiter has a supplemental pension benefit based on the benefit formula of the Pension Plan that was in effect until the end of 1991. The formula, however, will take into account his bonus compensation (including that portion of his bonus paid in RSUs) and will be determined without giving effect to provisions of the Internal Revenue Code that limit the amount of compensation that may be taken into account in calculating benefits and the amount of annual benefits that may be paid. Mr. Lassiter’s supplemental pension benefit will be reduced, however, to take account of |

21

enhancements in Ambac’s contributions to the Savings Incentive Plan (“SIP”) that we introduced in 1992. |

Payments and | If Mr. Lassiter’s employment is terminated other than for “Cause” (as we define it below), or if he resigns for “Good Reason” (as we define it below), Mr. Lassiter will: |

| — After Termination or Resignation | · | receive, for the remainder of the term (which typically would be for two years), compensation at an annualized rate equal to the sum of his base annual salary and target bonus at the time of termination; |

| · | be fully vested in all awards under the 1991 Stock Incentive Plan and the 1997 Equity Plan; |

| · | receive a lump-sum payment equal to the amount that we would have contributed to his account under the SIP and any nonqualified plan we maintained during the two years following termination; |

| · | be credited with an additional two years of service under the Pension Plan; and |

| · | continue to participate in all Ambac medical and other welfare plans for a limited time following termination. |

— After | All stock options and other awards under the 1997 Equity Plan that are made to Mr. Lassiter after January 1, 1998 will vest in full upon the occurrence of a “Change in Control” (as we define it below), whether or not his employment is subsequently terminated. |

In addition, if Mr. Lassiter’s employment terminates following a Change in Control, his severance amount would be calculated and paid in the same manner as we describe below under “Management Retention Agreements with Executive Officers.” |

Mr. Lassiter would also be entitled to the “gross up” payment described in that section. |

Other Restrictions | Mr. Lassiter will be subject to certain restrictions prohibiting him from engaging in competition with Ambac or any of our subsidiaries (except that these restrictions will not apply following a Change in Control) and from divulging any confidential or proprietary information he obtained while he was our employee. |

Management Retention Agreements with Executive Officers

In General | We have entered into management retention agreements with each of our executive officers (other than Mr. Lassiter) to provide for payments and |

22

certain benefits if they are terminated following a “Change in Control” (as we define it below). |

Payments and | If there is a Change in Control and, within three years of the Change in Control, the executive’s employment is terminated by Ambac or its successor other than for “Cause” (as we define it below), or if the executive resigns for “Good Reason” (as we define it below), the executive will: |

| · | receive cash payments equal to two times the sum of (a) the executive’s highest annual base salary and (b) the product of the executive’s highest bonus percentage (as a percentage of base salary) times his highest base salary; |

| · | be fully vested in all stock options and other awards under the 1991 Stock Incentive Plan and the 1997 Equity Plan; |

| · | receive a lump-sum payment equal to the amount that we would have contributed to the executive’s account under the SIP and any nonqualified plan we maintained during the two years following termination; |

| · | be credited with an additional two years of service under the Pension Plan; and |

| · | continue to participate in Ambac’s medical and other welfare benefits programs for a limited time following termination. |

All stock options and other awards under the 1997 Equity Plan that are made to executive officers after January 1, 1998 will vest in full upon the occurrence of a Change in Control, whether or not the executive’s employment is subsequently terminated.

The agreements also provide for a “gross up” payment in an amount that is intended to make the executive whole, on an after-tax basis, for any excise tax (but not any other tax) imposed on the payments described above.

Definitions

The following definitions are used in the Management Retention Agreements and the Employment Agreement with the Chief Executive Officer described above:

“Change in Control” | A “Change in Control” generally occurs if: |

| · | an individual, entity or group acquires beneficial ownership of 20% or more of the outstanding common stock. Acquisitions by Ambac and its affiliates or any employee benefit plan that they sponsor and certain acquisitions by persons who owned at least 15% of the outstanding |

23

shares of common stock on January 31, 1996 are not considered a change in control; |

| · | the individuals who, as of January 29, 1997, constitute the Board, and subsequently elected members of the Board whose election is approved or recommended by at least a majority of these members or their successors whose election was so approved or recommended, cease for any reason to constitute at least a majority of the Board; or |

| · | our stockholders approve a merger or similar business combination, or a sale of all or substantially all of Ambac’s assets, unless the Ambac stockholders immediately prior to the completion of the transaction will continue to own at least 70% of outstanding shares and voting power of the corporation that results from the transaction. |

“Cause” | “Cause” for an executive’s termination generally includes: |

| · | the willful commission of acts that are dishonest and demonstrably and materially injurious to Ambac; |

| · | the conviction of certain felonies; or |

| · | a material breach of any of the executive’s agreements concerning confidentiality and proprietary information. |

An executive’s termination will not be considered to have been for Cause unless at least three-quarters of the members of the Board adopt a resolution finding that the executive has engaged in conduct that constitutes Cause as defined in the agreement. |

“Good Reason” | An executive will generally have “Good Reason” to terminate his employment if: |

| · | there is substantial adverse change in the executive’s duties or responsibilities; |

| · | the office of the executive is relocated more than 25 miles from the location where the executive worked immediately prior to the Change in Control; or |

| · | Ambac fails to honor its obligations under the agreement. |

During a 30-day period following the first anniversary of a Change in Control, a resignation by the executive for any reason will be considered a termination for Good Reason. |

24

REPORT ON EXECUTIVE COMPENSATION FOR 2002

BY THE COMPENSATION AND ORGANIZATION COMMITTEE

The Compensation and Organization Committee of the Board administers Ambac’s executive compensation program. The members of the Committee are independent non-employee, non-affiliated directors. The Committee has furnished the following report on executive compensation for 2002:

What is Our Executive Compensation Philosophy?

The Committee has designed Ambac’s executive compensation program to support what we believe to be an appropriate relationship between executive pay and the creation of stockholder value. To emphasize this relationship, we link a significant portion of executive compensation to the market performance of Ambac common stock. The objectives of our program are:

| · | To support a pay-for-performance policy that differentiates bonus amounts among all executives based on both their individual performance, the performance of their respective groups and the performance of Ambac; |

| · | To align the interests of executives with the long-term interests of stockholders through stock option and restricted stock unit awards whose value over time depends upon the market value of Ambac’s common stock; |

| · | To provide compensation comparable to that offered by other leading companies in our industry, enabling Ambac to compete for and retain talented executives who are critical to our long-term success; and |

| · | To motivate key executives to achieve strategic business initiatives and to reward them for their achievement. |

What are the Elements of Executive Compensation?

We compensate our executives through base salary, bonus (paid in a combination of cash and restricted stock units) and long-term incentive awards in the form of stock options. We target total compensation for our executive officers so that at least 50% (and in the case of the Chairman, 75%) consists of bonus and long term incentive awards. In this way, a significant portion of the value ultimately realized by the executives will depend upon Ambac’s performance and can be considered “at risk.”

Our executives participate in retirement plans, health plans, and other voluntary benefit plans that we make available to all Ambac employees generally. We also provide our executives with long-term disability insurance for the cash bonus portion of their annual compensation. In addition, we offer our executives and managing directors a voluntary deferred compensation program.

25

Ambac has also entered into management retention agreements with our executive officers to provide for certain payments and other benefits if they are terminated following a change in control of Ambac. These agreements, and the employment agreement with Ambac’s Chief Executive Officer, which includes comparable change in control provisions, are discussed elsewhere in the Proxy Statement.

How Did We Determine Base Salaries for 2002?

In General | We annually review the base salaries of our executives to determine if adjustments are appropriate to ensure that their salaries are competitive and that they reflect the executive’s increased responsibilities as Ambac grows. |

For executives other than the Chief Executive Officer, we also consider the recommendations of Mr. Lassiter, Ambac’s Chairman and Chief Executive Officer. |

Comparative Data | In conducting our review for 2002, we considered comparative data prepared by both Ambac’s senior human resources officer and by Johnson Associates, Inc., the Committee’s outside consultant for executive compensation. |

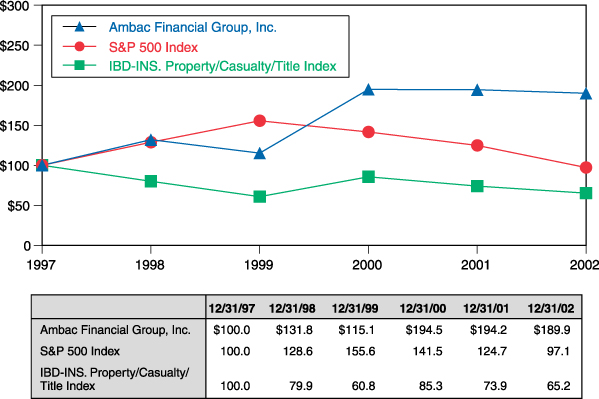

The comparison group we chose for compensation purposes (the “Comparison Group”) consisted mainly of our competitors in the financial guarantee insurance industry. The index we chose for our performance graph was the Investor’s Business Daily Insurance Property/Casualty/Title Index. This was the publicly available index that we found best corresponded to our business and included the greatest number of companies in the Comparison Group. The performance graph follows this Report in the Proxy Statement. |

We obtained data for the Comparison Group from a number of sources, including proxy statements, public information available from regulatory agencies and surveys by consulting firms. We used this comparative data as a benchmark in reaching our own determination of what were appropriate salary levels for our executives. |

Base Salaries | Although the data for the Comparison Group supported an increase in base salaries for 2002, the Committee accepted Mr. Lassiter’s recommendation to only increase those base salaries of those named executives who had not received an increase last year. We note that the base salaries of our executives (excluding the Chief Executive Officer) are generally at or below the median for salaries of executives in the Comparison Group. The base salary for each of the named executive officers is reported in the “Summary Compensation Table” elsewhere in the Proxy Statement. |

26

Base Salary | The Committee increased the base salary of Mr. Lassiter for 2002 by approximately 6.5% from $620,000 to $660,000. We note that Mr. Lassiter’s base salary in 2001 was below the 25th percentile for salaries of chief executive officers in the Comparison Group. |

How Did We Determine Bonuses for 2002?

2002 Overall | In January 2003, the Committee evaluated Ambac’s performance during 2002 under each of the nine categories set out in the EIP: return on equity; core/operating earnings growth; total return to stockholders; expense management; risk management; market share/position; industry leadership/image building; new products/initiatives; and organizational development/corporate culture. We did not weight the categories but instead arrived at an overall “grade” for corporate performance. We determined Ambac’s overall performance to be “very good” based on its particularly strong performance in the categories of return on equity, core/operating earnings growth, expense management and market share/position. The Committee, however, noted Ambac’s $91 million after-tax writedown in its $12.5 billion investment portfolio, representing National Century Financial Enterprises asset-backed securities. Although these uninsured securities were rated triple-A three weeks prior to writedown, the Committee and management felt the writedown should be factored into the overall performance equation. |

Bonuses | The Committee awarded bonus compensation for 2002 to each executive based on the executive’s scope of responsibility, individual performance and specific contribution to Ambac’s overall performance. We again considered the Chief Executive Officer’s recommendations and also took into account the comparative data. The bonus for each of the named executive officers is reported in the “Summary Compensation Table” elsewhere in the Proxy Statement. |

Under the Ambac Senior Officer Deferred Compensation Sub-Plan of the 1997 Equity Plan, 25% of each executive officer’s bonus is paid in RSUs unless the executive officer has satisfied the stock ownership target under the Ambac’s Stock Ownership Guidelines. An executive who has met the ownership target may elect to receive 25% of his or her bonus in the form of RSUs. Except for Messrs. Bivona and Doyle, each executive officer elected to receive 25% of his bonus in the form of RSUs. Bonus amounts are reported in the Summary Compensation Table elsewhere in this Proxy Statement. |

The value we ascribed to the RSUs awarded under the Sub-Plan for 2002 was based on a 25% discount from the market value of Ambac’s common stock on the date of grant. The Committee decided to discount these RSUs in order to account for vesting requirements and restrictions on transfer of |

27

the RSUs. Accordingly, the value we ascribed to the RSUs differs from the amounts reported in the Summary Compensation Table under the column headed “Annual Compensation—Restricted Stock Units”, as those amounts, in accordance with SEC requirements, are based on the market price of the Common Stock on the date of grant. |

Bonuses | At our meeting in January 2002, the Committee selected Messrs. Lassiter and Genader as the only executives to participate in the EIP. We then established a formula under the EIP for determining Mr. Lassiter’s and Mr. Genader’s bonuses for the performance year. The formula emphasized return on equity and core earnings growth. |

In January 2003, we applied the formula and awarded Mr. Lassiter a bonus of $1,000,000 and Mr. Genader a bonus of $800,000. Although we had the authority to award a higher bonus under the formula for Messrs. Lassiter and Genader, given all of the factors discussed above, the Committee awarded Messrs. Lassiter and Genader less than the maximum amount under the formula. Pursuant to the Sub-Plan, Messrs. Lassiter and Genader elected to receive 25% of their bonuses in the form of RSUs having the terms described above. |

For 2003, we selected Messrs. Lassiter and Genader as the only executive officers to participate in the EIP. |

What Were the Long-Term Incentive Awards in 2002?

2002 Grants | In 2002, we provided long-term incentive awards for executives by granting stock options. These awards provide compensation to executives only if shareholder value increases. We believe these awards focus executives on Ambac’s long-term success. In determining the number of stock options awarded, we reviewed surveys of similar awards given by companies within the Comparison Group and the executive’s past performance. We also considered the number of stock options previously granted to executives. |

This year again, we decided to award performance-based stock options to all of our executive officers and managing directors. These options vest only if the share price of Ambac’s common stock meets certain targets. For 2002, each of the options granted to the executives will vest in two equal installments when the market price of Ambac common stock meets or exceeds $75.00 and $90.00 for twenty consecutive trading days or no later than the sixth anniversary of the grant date. As we have done since 1997, we again limited the term of the stock options to seven years. The theoretical value of stock options awarded to each of the executives (including Mr. Lassiter) was in the top quarter of recent awards given by companies within the Comparison Group. The theoretical value and number of stock options awarded to each of the named executive officers is reported in the “Option Grants in 2002” table elsewhere in the Proxy Statement. |

28

What is Our Position on Maximizing the Deductibility of Executive Compensation?