4

5

6

Ambac Financial Group, Inc. and Subsidiaries

| | | 2002

| | | 2001

| | | 2000

| |

| | | (Dollars in millions, except per share amounts) | |

STATEMENT OF OPERATIONS HIGHLIGHTS | | | | | | | | | | | | |

Gross premiums written | | $ | 904.0 | | | $ | 683.3 | | | $ | 483.1 | |

Net premiums earned and other credit enhancement fees | | | 500.3 | | | | 400.4 | | | | 323.4 | |

Net investment income | | | 297.3 | | | | 267.8 | | | | 241.0 | |

Interest income from investment and payment agreements | | | 255.0 | | | | 249.9 | | | | 303.2 | |

Financial services—other revenue | | | 30.6 | | | | 37.8 | | | | 42.5 | |

Total revenue | | | 971.8 | | | | 960.4 | | | | 904.3 | |

Losses and loss adjustment expenses | | | 26.7 | | | | 20.0 | | | | 15.0 | |

Financial guarantee underwriting and operating expenses | | | 76.5 | | | | 68.0 | | | | 55.2 | |

Interest expense from investment and payment agreements | | | 231.3 | | | | 235.4 | | | | 283.0 | |

Financial services—other expenses | | | 22.2 | | | | 21.8 | | | | 24.8 | |

Interest expense | | | 43.7 | | | | 40.4 | | | | 37.5 | |

Net income | | | 432.6 | | | | 432.9 | | | | 366.2 | |

Net income per share: | | | | | | | | | | | | |

Basic | | | 4.08 | | | | 4.10 | | | | 3.49 | |

Diluted | | | 3.97 | | | | 3.97 | | | | 3.41 | |

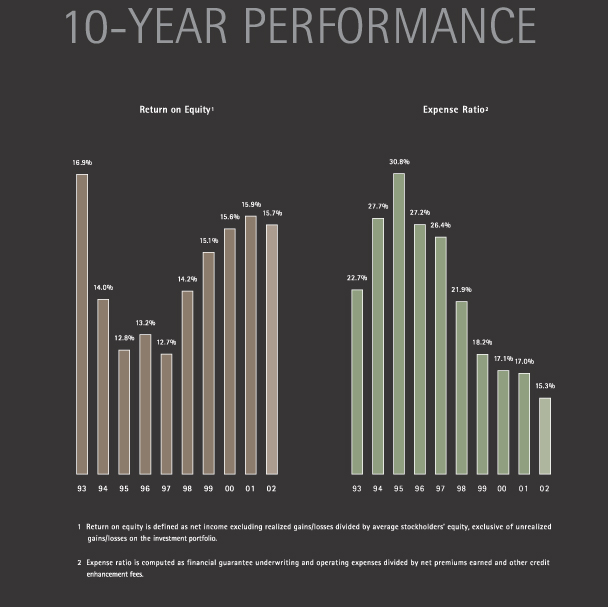

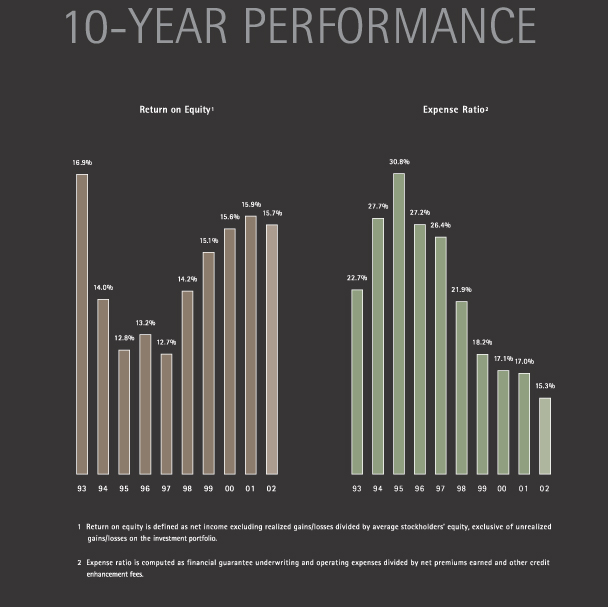

Return on equity1 | | | 13.1 | % | | | 15.5 | % | | | 15.9 | % |

Return on equity2 | | | 15.7 | % | | | 15.9 | % | | | 15.6 | % |

Cash dividends declared per common share | | | 0.380 | | | | 0.340 | | | | 0.307 | |

| | |

|

|

| |

|

|

| |

|

|

|

|

BALANCE SHEET HIGHLIGHTS | | | | | | | | | | | | |

Total investments, at fair value | | $ | 12,539.3 | | | $ | 10,287.9 | | | $ | 8,323.9 | |

Prepaid reinsurance | | | 296.1 | | | | 267.7 | | | | 242.6 | |

Total assets | | | 15,355.5 | | | | 12,339.5 | | | | 10,120.2 | |

Unearned premiums | | | 2,128.8 | | | | 1,780.3 | | | | 1,546.3 | |

Losses and loss adjustment expense reserve | | | 172.1 | | | | 151.1 | | | | 132.4 | |

Obligations under investment agreements, investment repurchase agreements and payment agreements | | | 7,282.9 | | | | 5,511.9 | | | | 4,892.9 | |

Debentures | | | 616.7 | | | | 619.3 | | | | 424.1 | |

Total stockholders’ equity | | | 3,625.2 | | | | 2,983.7 | | | | 2,596.1 | |

| | |

|

|

| |

|

|

| |

|

|

|

| 1 | | Defined as net income divided by average stockholders’ equity. |

| 2 | | Defined as net income excluding realized gains/losses divided by average stockholders’ equity, exclusive of unrealized gains/losses on the investment portfolio. |

7

FINANCIAL HIGHLIGHTS

1999

| | | 1998

| | | 1997

| | | 1996

| | | 1995

| | | 1994

| | | 1993

| |

$ | 445.2 | | | $ | 361.0 | | | $ | 286.2 | | | $ | 247.2 | | | $ | 193.3 | | | $ | 189.9 | | | $ | 318.3 | |

| 268.3 | | | | 213.0 | | | | 154.0 | | | | 136.6 | | | | 111.8 | | | | 117.5 | | | | 152.0 | |

| 209.3 | | | | 186.2 | | | | 159.7 | | | | 144.9 | | | | 131.0 | | | | 117.1 | | | | 104.6 | |

| 323.2 | | | | 281.9 | | | | 200.3 | | | | 165.2 | | | | 137.4 | | | | 106.0 | | | | 51.6 | |

| 28.0 | | | | 31.2 | | | | 21.6 | | | | 11.3 | | | | 3.4 | | | | 2.8 | | | | — | |

| 832.8 | | | | 720.6 | | | | 568.4 | | | | 607.4 | | | | 409.9 | | | | 366.4 | | | | 370.6 | |

| 11.0 | | | | 6.0 | | | | 2.9 | | | | 3.8 | | | | 3.4 | | | | 2.6 | | | | (1.8 | ) |

| 48.8 | | | | 46.7 | | | | 40.7 | | | | 37.2 | | | | 34.5 | | | | 32.8 | | | | 34.5 | |

| 299.5 | | | | 263.6 | | | | 186.7 | | | | 154.5 | | | | 127.7 | | | | 92.4 | | | | 43.0 | |

| 25.8 | | | | 35.5 | | | | 28.0 | | | | 12.0 | | | | 7.8 | | | | 6.1 | | | | 2.0 | |

| 36.5 | | | | 32.8 | | | | 21.3 | | | | 20.9 | | | | 20.9 | | | | 18.8 | | | | 15.8 | |

| 307.9 | | | | 254.0 | | | | 223.0 | | | | 276.3 | | | | 167.6 | | | | 141.1 | | | | 179.3 | |

|

| 2.94 | | | | 2.42 | | | | 2.12 | | | | 2.63 | | | | 1.59 | | | | 1.34 | | | | 1.69 | |

| 2.88 | | | | 2.37 | | | | 2.09 | | | | 2.60 | | | | 1.58 | | | | 1.32 | | | | 1.68 | |

| 15.0 | % | | | 12.8 | % | | | 12.8 | % | | | 18.3 | % | | | 13.8 | % | | | 13.2 | % | | | 18.3 | % |

| 15.1 | % | | | 14.2 | % | | | 12.7 | % | | | 13.2 | % | | | 12.8 | % | | | 14.0 | % | | | 16.9 | % |

| 0.280 | | | | 0.253 | | | | 0.230 | | | | 0.205 | | | | 0.185 | | | | 0.165 | | | | 0.150 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

$ | 8,962.5 | | | $ | 8,748.4 | | | $ | 6,915.1 | | | $ | 5,200.5 | | | $ | 4,441.6 | | | $ | 3,764.2 | | | $ | 3,132.7 | |

| 218.0 | | | | 199.9 | | | | 183.5 | | | | 168.8 | | | | 153.4 | | | | 139.9 | | | | 161.3 | |

| 11,344.6 | | | | 11,212.3 | | | | 8,291.7 | | | | 5,876.4 | | | | 5,309.3 | | | | 4,287.0 | | | | 3,807.2 | |

| 1,431.1 | | | | 1,294.2 | | | | 1,179.0 | | | | 991.2 | | | | 903.0 | | | | 836.6 | | | | 782.8 | |

| 121.0 | | | | 115.8 | | | | 103.3 | | | | 60.6 | | | | 66.0 | | | | 65.7 | | | | 64.0 | |

|

| 6,140.3 | | | | 5,956.8 | | | | 4,321.0 | | | | 2,754.6 | | | | 2,426.9 | | | | 2,025.3 | | | | 1,477.7 | |

| 424.0 | | | | 423.9 | | | | 223.9 | | | | 223.8 | | | | 223.7 | | | | 223.7 | | | | 223.6 | |

| 2,018.5 | | | | 2,096.1 | | | | 1,872.5 | | | | 1,615.0 | | | | 1,404.0 | | | | 1,033.5 | | | | 1,099.7 | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

25

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

GENERAL

Ambac Financial Group, Inc., headquartered in New York City, is a holding company whose subsidiaries provide financial guarantees and financial services to clients in both the public and private sectors around the world.

The following paragraphs describe the consolidated results of operations of Ambac and its subsidiaries for 2002, 2001 and 2000, and its financial condition as of December 31, 2002 and 2001. These results are presented for Ambac’s two reportable segments: Financial Guarantee and Financial Services. Management has identified the accounting for loss and loss adjustment expenses and the valuation of financial instruments as critical accounting policies. These policies are discussed in the applicable sections of this document. This discussion should be read in conjunction with the consolidated financial statements and notes thereon included elsewhere in this report.

Materials in this annual report may contain information that includes or is based upon forward-looking statements within the meaning of the Securities Litigation Reform Act of 1995. Forward-looking statements present Ambac’s expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts and relate to future operating or financial performance.

Any or all of Ambac’s forward-looking statements here or in other publications may turn out to be wrong and are based on current expectations and the current economic environment. Ambac’s actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among factors that could cause actual results to differ materially are: (1) changes in the economic, credit or interest rate environment in the United States and abroad; (2) the level of activity within the national and worldwide debt markets; (3) competitive conditions and pricing levels; (4) legislative and regulatory developments; (5) changes in tax laws; (6) the policies and actions of the United States and other governments and (7) other risks and uncertainties that have not been identified at this time. Ambac is not obligated to publicly correct or update any forward-looking statement if we later become aware that it is not likely to be achieved, except as required by law. You are advised, however, to consult any further disclosures we make on related subjects in Ambac’s reports to the Securities and Exchange Commission.

RESULTS OF OPERATIONS

Consolidated Net Income. Ambac’s net income in 2002 was $432.6 million or $3.97 per diluted share flat, compared to $432.9 million or $3.97 per diluted share in 2001. Ambac’s income before income taxes was $564.2 million in 2002, a 1% decrease from income before income taxes of $568.7 million in 2001. Of the $564.2 million of income before income taxes in 2002, $712.9 million was from Financial Guarantee, $(102.8) million from Financial Services and $(45.9) million from Corporate. Corporate consists primarily of Ambac’s interest expense. That compares to income (loss) before income taxes in 2001 of $583.9 million, $27.4 million and $(42.6) million from Financial Guarantee, Financial Services and Corporate, respectively. Financial guarantee income before income taxes increased as a result of (i) higher net premiums earned and other credit enhancement fees, (ii) higher net investment income and (iii) higher net realized investment gains, offset by (i) higher unrealized losses on credit derivative contracts, (ii) higher operating expenses and (iii) a higher provision for losses and loss adjustment expenses. The Financial Services decline is primarily attributable to net realized investment losses of $134.1 million.

Ambac’s net income in 2001 increased 18% from $366.2 million, and 16% from $3.41 per diluted share, in 2000. This increase was attributable to growth in Financial Guarantee operating income partially offset by a decline in Financial Services net income. Ambac’s 2001 income before income taxes increased 18% from $482.1 million in 2000. Income (loss) before income taxes in 2000 consisted of $495.2 million from Financial Guarantee, $28.7 million from Financial Services and $(41.8) million from Corporate.

FINANCIAL GUARANTEE

Ambac provides financial guarantees for debt obligations through its principal operating subsidiary Ambac Assurance Corporation, as well as credit protection in the form of structured credit derivatives through Ambac Credit Products LLC, a wholly-owned subsidiary of Ambac Assurance. Ambac provides these services in three principal markets: public finance, structured finance and international finance.

Public finance obligations are bonds issued by states, municipalities and other governmental or not-for-profit entities located in the United States (“Public Finance”). Bond proceeds are used to finance or refinance a broad spectrum of

26

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

public purpose initiatives, including education, utility, transportation, health care and other general purpose projects. Although Ambac generally guarantees the full range of Public Finance obligations, Ambac concentrates on those deals that require more structuring skills. Certain projects, which had been financed by the local or U.S. government alone are now being financed through public-private partnerships. In these transactions, debt service on the bonds, rather than being paid solely by tax revenues or other governmental funds, are being paid from a variety of revenue sources, including revenues derived from the project itself. Examples of these deals include stadium financings, student housing and military housing.

Structured finance obligations include the securitization of a variety of asset types such as mortgages, home equity loans, leases and pooled debt obligations originated in the United States (“Structured Finance”). Currently, the largest component of Ambac’s Structured Finance business relates to the securitization of mortgages and home equity loans. Another target area in Structured Finance is the credit enhancement of pooled debt obligations including structured credit derivatives. These transactions involve the securitization of a portfolio of corporate bonds and loan obligations and asset-backed securities (the “Securitized Assets”). Ambac’s exposure to these Securitized Assets is mitigated through first loss protection. Typically, first loss protection is in the form of over-collateralization (i.e., the principal amount of the Securitized Assets exceeds the principal amount of the structured finance obligations guaranteed by Ambac Assurance), which allows the transaction to experience defaults among the Securitized Assets before a default is experienced on the structured finance obligations.

International finance obligations include public purpose infrastructure projects and asset-backed securities originated outside of the United States (“International Finance”). Ambac’s emphasis internationally has been on Western Europe, Japan and Australia. In the United Kingdom, Ambac has participated extensively in the Private Finance Initiative whereby the government has been privatizing certain activities. In Japan, Ambac has an alliance with Sampo Japan Financial Guarantee Insurance Co. Ltd. Ambac also participates in developing markets through certain structures such as pooled debt obligations or future flow transactions. Future flow transactions essentially securitize future revenue streams derived from operating receivables or the sale of commodities.

Gross Par Value Written. Ambac Assurance guaranteed $116.4 billion of par value bonds during 2002, an increase of 29% from $90.1 billion in 2001. Par value written during 2001 increased 17% compared to $77.0 billion written during 2000. Par value written during 2002 comprised $43.7 billion from the guarantee of Public Finance obligations, $47.5 billion from Structured Finance obligations and $25.2 billion from International Finance obligations, versus $33.2 billion, $37.4 billion and $19.5 billion, respectively, in 2001 and $19.6 billion, $33.9 billion and $23.5 billion, respectively, in 2000.The 2002 increase in guaranteed Public Finance obligations was affected by a 25% increase in total Public Finance issuance, an increase in insured market penetration from 47% in 2001 to 49% in 2002, partially offset by a decrease in Ambac’s Public Finance market share during the period from 25% in 2001 to 21% in 2002. The increase in total issuance was largely the result of the lower interest rate environment causing an increase in both the refinancing and new money components of the market during 2002. The increase in guaranteed Structured Finance obligations during 2002 resulted from higher mortgage-backed guarantees and greater penetration into other consumer asset-backed markets (auto rental and credit card securitizations). International Finance obligations guaranteed during 2002 increased primarily due to higher structured credit derivatives written.

The following table provides a breakdown of guaranteed net par outstanding by market sector:

| | | 2002

| | 2001

|

| | | (Dollars in billions) |

Public Finance | | $ | 206.5 | | $ | 185.0 |

Structured Finance | | | 105.0 | | | 88.7 |

International Finance | | | 67.7 | | | 44.3 |

| | |

|

| |

|

|

Total net par outstanding | | $ | 379.2 | | $ | 318.0 |

| | |

|

| |

|

|

27

Gross Premiums Written. Ambac receives insurance premiums either upfront at policy issuance or on an installment basis over the life of the transaction. The collection method is determined at the time of policy issuance. Gross premiums written in 2002 were $904.0 million, an increase of 32% from $683.3 million in 2001. Up-front premiums written in 2002 were $552.6 million, an increase of 25% from $440.8 million. This increase is a result of increased business activity in Public and Structured Finance, partially offset by lower up-front International Finance gross premiums written. Installment premiums written in 2002 were $351.4 million, an increase of 45% from $242.5 million in 2001. The growth in installment premiums is due to the growing book of business in all segments with written premiums of $99.5 million from transactions guaranteed in 2002. Gross premiums written in 2001 increased 41% from $483.1 million in 2000. This is a result of increased business activity in all markets, particularly Public Finance. The following table sets forth the amounts of gross premiums written and related gross par written by type:

| | | 2002

| | 2001

| | 2000

|

| | | Gross Premiums Written

| | Gross Par Written

| | Gross Premiums Written

| | Gross Par Written

| | Gross Premiums Written

| | Gross Par Written

|

| | | (Dollars in millions) |

Public Finance: | | | | | | | | | | | | | | | | | | |

Up-front | | $ | 462.1 | | $ | 39,283 | | $ | 323.7 | | $ | 30,414 | | $ | 160.5 | | $ | 17,536 |

Installment | | | 42.2 | | | 4,448 | | | 25.4 | | | 2,797 | | | 20.1 | | | 2,101 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total Public Finance | | | 504.3 | | | 43,731 | | | 349.1 | | | 33,211 | | | 180.6 | | | 19,637 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Structured Finance: | | | | | | | | | | | | | | | | | | |

Up-front | | | 57.9 | | | 3,498 | | | 40.6 | | | 3,016 | | | 82.8 | | | 3,641 |

Installment | | | 204.6 | | | 43,947 | | | 152.5 | | | 34,437 | | | 116.7 | | | 30,224 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total Structured Finance | | | 262.5 | | | 47,445 | | | 193.1 | | | 37,453 | | | 199.5 | | | 33,865 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

International Finance: | | | | | | | | | | | | | | | | | | |

Up-front | | | 32.6 | | | 1,662 | | | 76.5 | | | 2,965 | | | 52.6 | | | 3,103 |

Installment | | | 104.6 | | | 23,539 | | | 64.6 | | | 16,504 | | | 50.4 | | | 20,379 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total International Finance | | | 137.2 | | | 25,201 | | | 141.1 | | | 19,469 | | | 103.0 | | | 23,482 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total | | $ | 904.0 | | $ | 116,377 | | $ | 683.3 | | $ | 90,133 | | $ | 483.1 | | $ | 76,984 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total up-front | | $ | 552.6 | | $ | 44,443 | | $ | 440.8 | | $ | 36,395 | | $ | 295.9 | | $ | 24,280 |

Total installment | | | 351.4 | | | 71,934 | | | 242.5 | | | 53,738 | | | 187.2 | | | 52,704 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total | | $ | 904.0 | | $ | 116,377 | | $ | 683.3 | | $ | 90,133 | | $ | 483.1 | | $ | 76,984 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Adjusted Gross Premiums. Adjusted gross premiums written, which is not promulgated under accounting principles generally accepted in the United States of America (“GAAP”), is used by management, equity analysts and investors to measure the financial results of Ambac. Adjusted gross premiums written, which Ambac reports as analytical data, is defined as gross (direct and assumed) up-front premiums written plus the present value of estimated future installment premiums written on insurance policies and structured credit derivatives issued in the period. The definition of adjusted gross premiums written used by Ambac may differ from definitions of adjusted gross premiums written used by other public holding companies of financial guarantee insurers. Adjusted gross premiums written were $1,299.5 million in 2002, up 33% from $974.3 million in 2001. The increase was due to increased activity in all markets. Public Finance adjusted gross premiums were $552.8 million in 2002, up 51% from $366.9 million in 2001. This increase resulted from higher issuance, and higher insured penetration, partially offset by a decrease in market share, as discussed above under “Gross Par Value Written.” Structured Finance adjusted gross premiums were $441.2 million in 2002, up 39% from $318.5 million in 2001. This increase resulted from strong business activity in pooled debt, investor-owned utility and consumer asset-backed transactions, particularly mortgage, auto and credit card asset types. International Finance adjusted gross premiums were $305.5 million in 2002, up 6% from $288.9 million in 2001.

International Finance business continues to be dominated by large transactions with the top ten deals comprising $149.1 million and $153.3 million in 2002 and 2001, respectively. These deals represent 49% and 53% of total International Finance adjusted gross premiums written for 2002 and 2001, respectively. The activity in 2002 was represented by a broad spectrum of bond types, specifically utilities, commercial asset-backed securitizations, private finance initiatives in the United Kingdom and future flow transactions. Adjusted gross premiums written in 2001 increased 37% from $710.7 million in 2000. The increase in 2001 was due to increased activity in all markets. The aggregate net present value, calculated at a 7% discount rate, of estimated future installment premiums was $1,342.2 million at December 31, 2002, up 36% from $986.8 million at December 31, 2001.

Ceded Premiums Written. Ceded premiums written in 2002 were $113.5 million, up 19% from $95.5 million in 2001. Ceded premiums written as a percentage of gross premiums written were 13% and 14% for 2002 and 2001, respectively. This decline was primarily due to lower ceded premiums of Public Finance transactions. Ceded premiums written in 2001 were up 18% from $80.8 million in 2000. The increase in ceded premiums written in 2001 was largely due to higher cessions of Public Finance premiums pursuant to a reinsurance surplus share treaty that Ambac Assurance implemented during 2001,

28

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

partially offset by lower cessions on International Finance transactions. Ceded premiums written were 17% of gross premiums written in 2000.

The reinsurance of risk does not relieve Ambac of its original liability to its policyholders. In the event that any of Ambac’s reinsurers are unable to meet their obligations under reinsurance contracts, Ambac would be liable for such defaulted amounts. To minimize exposure to significant losses from reinsurers, Ambac (i) evaluates the financial condition of its reinsurers; (ii) has collateral provisions in certain reinsurance contracts and (iii) has certain termination triggers that can be exercised by Ambac in the event of a rating downgrade of a reinsurer. Ambac held letters of credit and collateral amounting to approximately $135.7 million from its reinsurers as of December 31, 2002. The following table provides ceded par outstanding by financial strength rating of Ambac’s reinsurers, on a Standard and Poor’s (“S&P”) basis:

| | | 2002

| | 2001

|

| | | (Dollars in billions) |

AAA | | $ | 23.8 | | $ | 38.3 |

AA | | | 20.4 | | | 0.9 |

| | |

|

| |

|

|

Total | | $ | 44.2 | | $ | 39.2 |

| | |

|

| |

|

|

During 2002, S&P lowered the financial strength rating of a number of Ambac’s reinsurers from AAA to AA. Additionally, on January 13, 2003 S&P lowered the financial strength rating of AXA Re Finance S.A. from AAA to BBB. This downgrade was attributable to AXA Re Finance S.A.’s decision to cease writing new financial guarantee business. At December 31, 2002, par ceded to AXA Re Finance S.A. was $8.3 billion. The downgrade of AXA Re Finance S.A. has triggered Ambac’s ability to terminate all Ambac/AXA Re’s reinsurance agreements. Ambac is currently exploring all options on this book of business.

Net Premiums Earned and Other Credit Enhancement Fees. Net premiums earned and other credit enhancement fees during 2002 were $500.3 million, an increase of 25% from $400.4 million in 2001. This increase was primarily the result of the larger Financial Guarantee book of business, higher refundings, calls, and other accelerations of previously insured obligations (collectively referred to as “refundings”) during the year and higher other credit enhancement fees earned from the structured credit derivatives business.

When an issue insured by Ambac Assurance has been refunded or called, any remaining unearned premium (net of refunding credits, if any) is earned at that time. Earnings on refundings typically relate to transactions where the premium is paid up-front for the life of the policy. Refunding levels vary depending upon a number of conditions, primarily the relationship between current interest rates and interest rates on outstanding debt. Net premiums earned during 2002 included $52.0 million (net income per diluted share effect of $0.27) from refundings of previously insured issues. Net premiums earned in 2001 included $38.6 million (net income per diluted share effect of $0.20) from refundings. The current low interest rate environment has prompted the relatively high level of accelerated earnings. When interest rates rise in the future, accelerated earnings should decline.

Excluding the effect of accelerated earnings related to refundings, normal net premiums earned (which is defined as net premiums earned less refundings) in 2002 were $419.5 million, an increase of 23% from $340.1 million in 2001. Normal net premiums earned for the year ended December 31, 2002 increased 14%, 19% and 56% for Public, Structured and International Finance, respectively, from the year ended December 31, 2001. Public Finance earned premium growth resulted from increased activity in that market over the year, enhanced by the continued focus on structured and innovative municipal transactions. Normal earned premium growth for Structured Finance continues to be driven by strong writings in consumer asset-backed transactions partially offset by the continued high level of pay-downs of the existing mortgage-backed book. International Finance net earned premium growth resulted from strong activity in pooled debt obligations, future flow and asset-backed transactions.

Other credit enhancement fees in 2002, which is primarily comprised of fees received from the structured credit derivatives product, were $28.8 million, an increase of 33% from $21.7 million in 2001. This increase was due to rapid growth in the structured credit derivative business in 2001 and 2002.

Net premiums earned and other credit enhancement fees during 2001 increased 24% from $323.4 million in 2000. This increase was primarily the result of the larger Financial Guarantee book of business, higher refundings and higher other credit enhancement fees earned from the structured credit derivatives business. Net premiums earned in 2000 included $22.2 million (net income per diluted share effect of $0.12) from refundings. Excluding the effect of accelerated earnings related to refundings, normal net premiums earned in 2001 increased 18% from $289.0 million in 2000. Other credit enhancement fees increased 78% from $12.2 million in 2000.

The following table provides a breakdown of net premiums earned by market sector and other credit enhancement fees:

| | | 2002

| | 2001

| | 2000

|

| | | (Dollars in millions) |

Public Finance | | $ | 156.3 | | $ | 137.2 | | $ | 126.4 |

Structured Finance | | | 174.7 | | | 146.3 | | | 119.4 |

International Finance | | | 88.5 | | | 56.6 | | | 43.2 |

| | |

|

| |

|

| |

|

|

Total normal premiums earned | | | 419.5 | | | 340.1 | | | 289.0 |

Refundings | | | 52.0 | | | 38.6 | | | 22.2 |

| | |

|

| |

|

| |

|

|

Total net premiums earned | | | 471.5 | | | 378.7 | | | 311.2 |

Other credit enhancement fees | | | 28.8 | | | 21.7 | | | 12.2 |

| | |

|

| |

|

| |

|

|

Total net premiums earned and other credit enhancement fees | | $ | 500.3 | | $ | 400.4 | | $ | 323.4 |

| | |

|

| |

|

| |

|

|

29

Net Investment Income. Net investment income in 2002 was $297.3 million, an increase of 11% from $267.8 million in 2001. The increase was attributable to: (i) the growth of the investment portfolio resulting from the growth in the Financial Guarantee book of business, partially offset by a lower reinvestment rate due to the current interest rate environment; and (ii) a capital contribution from Ambac Financial Group, Inc. to Ambac Assurance totaling approximately $176 million during the fourth quarter of 2001. The contribution was in the form of taxable investment securities. Investments in tax-exempt securities amounted to 71% of the total fair value of the portfolio as of December 31, 2002, versus 65% and 72% as of December 31, 2001 and December 31, 2000, respectively. The average pre-tax yield-to-maturity on the investment portfolio was 5.18% as of December 31, 2002 compared with 5.74% and 6.20% at December 31, 2001 and 2000, respectively. Net investment income in 2001 increased 11% from $241.0 million in 2000. This increase was primarily attributable to the growth of the investment portfolio resulting from the growth in the Financial Guarantee book of business, partially offset by a lower reinvestment rate due to the interest rate environment, and a capital contribution from Ambac Financial Group, Inc. to Ambac Assurance during the fourth quarter of 2001 as mentioned above.

Net Realized Investment Gains. Net realized investment gains in 2002 were $40.9 million, compared to net realized gains of $2.1 million and $0.7 million in 2001 and 2000, respectively. The following table details amounts included in net realized gains:

| | | 2002

| | 2001

| | | 2000

| |

| | | (Dollars in millions) | |

Net gains on securities sold | | $ | 39.1 | | $ | 5.3 | | | $ | 4.2 | |

Foreign exchange gains (losses) on investments | | | 1.8 | | | (3.2 | ) | | | (3.5 | ) |

| | |

|

| |

|

|

| |

|

|

|

Net realized gains | | $ | 40.9 | | $ | 2.1 | | | $ | 0.7 | |

| | |

|

| |

|

|

| |

|

|

|

Net gains on securities sold are generated as a result of the ongoing management of the investment portfolio. Foreign exchange gains and losses result from investing in short-term foreign currency denominated securities.

Net Unrealized Losses on Credit Derivative Contracts. Net unrealized losses on credit derivative contracts in 2002 were $27.9 million, compared to net unrealized losses of $3.6 million and $4.1 million in 2001 and 2000, respectively. The change in estimated fair value of structured credit derivative contracts reflects net mark-to-market gains and losses due to changes in credit spreads on the underlying obligations. Additionally, realized net losses paid on structured credit derivatives totaled $5.8 million in the year ended December 31, 2002, compared with none in 2001 and 2000.

Other Income. Other income in 2002 was $5.5 million, an increase of 6% from $5.2 million in 2001. Included in other income are deal structuring fees and commitment fees. Other income increased 18% in 2001 from $4.4 million in 2000.

Losses and Loss Adjustment Expenses. Losses and loss adjustment expenses in 2002 were $26.7 million, versus $20.0 million in 2001 and $15.0 million in 2000. Losses and loss adjustment expenses are based upon estimates of the ultimate aggregate losses inherent in the Financial Guarantee portfolio. In most instances, claim payments are forecasted in advance as a result of Ambac’s active surveillance of the insured book of business. Based upon company and industry experience, claim payments become probable and estimable once the issuer’s credit profile has migrated to certain impaired credit levels. The insured party has the right to a claim under Ambac’s financial insurance policy at the first scheduled debt service date of the defaulted obligation. The trustee for the insured obligation notifies Ambac of the payment default so that a claim payment can be made. The trustee reports payment defaults at or prior to the scheduled payment date. Subsequent claims would be paid if payment defaults continue and would be based on the originally scheduled interest and principal payment schedule.

The liability for losses and loss adjustment expenses consists of case basis credit and active credit reserves. Case basis credit reserves are established for losses on guaranteed obligations that have already defaulted. These reserves are established in an amount that is sufficient to cover the present value of the anticipated defaulted debt service payments over the expected period of default and estimated expenses associated with settling the claims, less estimated recoveries under collateral and subrogation rights. As noted above, the payment pattern and ultimate costs are fixed and determinable on an individual claim basis (i.e., the originally scheduled debt service of the insured obligation). Ambac discounts these reserves in accordance with discount rates prescribed or permitted by state regulatory authorities. In addition, we, consistent with industry practice, establish and accrue an active credit reserve, which is separate from the case basis credit reserves noted above. We believe, based on our active surveillance of the insured portfolio, along with historical defaults and related loss data and current economic factors, that additional losses are inherent in our portfolio. Current economic factors considered include estimates of current defaults and recovery values from collateral or subrogation rights. The active credit reserve is established based upon probable debt service defaults from incurred losses, as a result of credit deterioration. Reserve amounts are reasonably estimated based on management’s review of each credit. Active surveillance of the insured portfolio enables Ambac to track credit migration of insured obligations from period to period.

30

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Our Surveillance group, which is comprised of senior credit professionals, all of whom are independent from transaction execution, is responsible for extensive ongoing review of every credit Ambac has exposure to. At least monthly, Senior Finance and Credit Management meets with Surveillance to review the status of their work. During the monthly review, Senior Management determines the adequacy of Ambac’s loss reserves and makes any necessary adjustments. The following table summarizes Ambac’s loss reserves split between case basis credit loss reserves and active credit reserves at December 31, 2002 and 2001:

| | | 2002

| | 2001

|

| | | (Dollars in millions) |

Net loss and loss adjustment expense reserves: | | | | | | |

Case basis credit reserves* | | $ | 49.0 | | $ | 23.4 |

Active credit reserves | | | 118.6 | | | 126.7 |

| | |

|

| |

|

|

Total | | $ | 167.6 | | $ | 150.1 |

| | |

|

| |

|

|

| * | | After netting reinsurance recoverable on unpaid losses amounting to $4.6 million and $1.0 million in 2002 and 2001, respectively. |

The following table summarizes the changes in the total net loss reserves for the years ended December 31, 2002 and 2001:

| | | 2002

| | | 2001

| |

| | | (Dollars in millions) | |

Beginning balance of net loss reserves | | $ | 150.1 | | | $ | 131.3 | |

Additions to loss reserves | | | 26.7 | | | | 20.0 | |

Losses paid | | | (11.1 | ) | | | (2.6 | ) |

Recoveries of paid losses from reinsurers | | | 1.3 | | | | — | |

Recoveries of previously paid losses | | | 0.6 | | | | 1.4 | |

| | |

|

|

| |

|

|

|

Ending balance of net loss reserves | | $ | 167.6 | | | $ | 150.1 | |

| | |

|

|

| |

|

|

|

At December 31, 2002 case basis credit reserves are sufficient to cover required debt service through 2026 totaling $69.5 million. Annual debt service payments are $17.5 million, $18.9 million, $6.1 million, $3.7 million and $3.6 million for 2003, 2004, 2005, 2006 and 2007, respectively. Additions (reductions) made to the case basis credit reserve totaled $25.6 million, $(0.1) million and $12.7 million in 2002, 2001 and 2000, respectively. The increase in the 2002 case basis credit reserve is primarily attributable to credit deterioration on a mortgage-backed issue. At December 31, 2002, case basis credit reserves were $26.1 million for this issue. Additionally, Ambac paid $3.4 million relating to this issue in 2002.

The following tables provide details of net losses paid for the years ended December 31, 2002, 2001 and 2000 and net case reserves at December 31, 2002 and December 31, 2001:

| | | 2002

| | 2001

| | 2000

|

| | | (Dollars in millions) |

Net losses paid: | | | | | | | | | |

Public Finance | | $ | 6.4 | | $ | 2.6 | | $ | 4.6 |

Structured Finance | | | 3.4 | | | — | | | — |

International Finance | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

|

Total | | $ | 9.8 | | $ | 2.6 | | $ | 4.6 |

| | |

|

| |

|

| |

|

|

| | | 2002

| | 2001

|

| | | (Dollars in millions) |

Net case basis credit reserves: | | | | | | |

Public Finance | | $ | 19.0 | | $ | 23.4 |

Structured Finance | | | 26.1 | | | — |

International Finance | | | 3.9 | | | — |

| | |

|

| |

|

|

Total | | $ | 49.0 | | $ | 23.4 |

| | |

|

| |

|

|

Ambac Assurance’s management believes that the reserves for losses and loss adjustment expenses are adequate to cover the ultimate net cost of claims, but the reserves are necessarily based on estimates and there can be no assurance that the ultimate liability will not exceed such estimates.

Underwriting and Operating Expenses. Underwriting and operating expenses of $76.5 million in 2002 increased by 13% from $68.0 million in 2001. Underwriting and operating expenses in 2001 increased 23% from $55.2 million in 2000. Underwriting and operating expenses consist of gross underwriting and operating expenses, less the deferral to future periods of expenses and reinsurance commissions related to the acquisition of new insurance contracts, plus the amortization of previously deferred expenses and reinsurance commissions. In 2002, gross underwriting and operating expenses were $117.7 million, an increase of 19% from $99.3 million in 2001. During 2001, gross underwriting and operating expenses increased 12% from $88.6 million in 2000. The increases in gross underwriting and operating expenses in both 2002 and 2001 reflect the overall increased business activity in those years and are primarily attributable to higher compensation costs related to the addition of staff and higher premium taxes. Underwriting and operating expenses deferred were $73.1 million, $59.5 million, and $55.8 million in 2002, 2001 and 2000, respectively. The amortization of previously deferred expenses and reinsurance commissions was $32.3 million, $28.2 million, and $22.5 million in 2002, 2001 and 2000, respectively. The high level of refundings contributed to the increase in amortization of previously deferred expenses in 2002 as any deferred costs associated with a refunded issue is fully amortized at the time of refunding.

31

FINANCIAL SERVICES

Through its Financial Services subsidiaries, Ambac provides financial and investment products including investment agreements, interest rate swaps, total return swaps, funding conduits, investment advisory and cash management services, to municipalities and their authorities, school districts, health care organizations and asset-backed issuers.

Financial Services net revenue is defined and analyzed by management as gross interest income less gross interest expense from investment and payment agreements plus other revenue, and excludes net realized and unrealized losses. Net revenues in 2002 increased 4% to $54.3 million from $52.2 million in 2001. This increase is primarily due to higher investment agreement net interest income due to higher interest rate spreads and higher volume, partially offset by lower interest rate swap revenues. Revenues from investment advisory and cash management decreased 3% in 2002 compared to 2001. Net revenues in 2001 decreased 17% from $62.7 million in 2000. This decrease in net revenue from 2000 to 2001 was primarily due to lower revenues from interest rate swaps and lower investment agreement net interest income due to lower interest rate spreads, partially offset by higher volume. Revenues from investment advisory and cash management increased 6% in 2001 compared to 2000.

Net realized investment losses in 2002 were $134.1 million, resulting primarily from a write-down of asset-backed notes issued by National Century Financial Enterprises, Inc. (“NCFE”). These notes, which were rated triple-A until October 25, 2002, have defaulted and NCFE filed for protection under Chapter 11 of the U.S. Bankruptcy Code in November 2002. The NCFE notes, which are backed by health care receivables, have been written down to approximately 20% of par value, which represents Ambac’s best estimate of its future recovery based on existing facts and circumstances.

Financial Services other expenses in 2002 were $22.2 million, an increase of 2% from $21.8 million in 2001. Other expenses in 2001 decreased 12% from $24.8 million in 2000.

CORPORATE ITEMS

Interest Expense. Interest expense was $43.7 million, $40.4 million and $37.5 million in 2002, 2001 and 2000, respectively. The 2002 increase is primarily attributable to Ambac’s issuance of $200 million in debentures in October 2001, partially offset by lower bank fees associated with capital facilities.

Income Taxes. Income taxes for 2002 were at an effective rate of 23.3%, compared to 23.9% and 24.1% for 2001 and 2000, respectively. The decrease in the effective tax rate in 2002 as compared to 2001 is primarily due to the NCFE loss and the related reduction in taxable profits. The decrease in the effective tax rate in 2001 as compared to 2000 is due to a favorable settlement of a state income tax audit, partially offset by increased underwriting profits.

LIQUIDITY AND CAPITAL RESOURCES

Ambac Financial Group, Inc. Liquidity. Ambac’s liquidity, both on a short-term basis (for the next twelve months) and a long-term basis (beyond the next twelve months), is largely dependent upon: (i) Ambac Assurance’s ability to pay dividends or make other payments to Ambac; (ii) external financings; and (iii) investment income from its investment portfolio. Pursuant to Wisconsin insurance laws, Ambac Assurance may declare dividends, provided that, after giving effect to the distribution, it would not violate certain statutory equity, solvency and asset tests. Based upon these tests, without regulatory approval, the maximum amount that will be available during 2003 for payment by Ambac Assurance is approximately $223 million. During 2002, Ambac Assurance paid dividends of $78.0 million on its common stock to Ambac.

Ambac’s principal uses of liquidity are for the payment of its operating expenses, income taxes, interest on its debt, dividends on its shares of common stock, purchases of its common stock in the open market and capital investments in its subsidiaries. Ambac contributed $50 million to Ambac Capital Corporation during 2002. Based on the amount of dividends that it expects to receive from Ambac Assurance and other subsidiaries during 2003, and the income it expects to receive from its investment portfolio, management believes that Ambac will have sufficient liquidity to satisfy its needs over the next twelve months, including the ability to pay dividends on its common stock in accordance with its dividend policy. Beyond the next twelve months, Ambac Assurance’s ability to declare and pay dividends to Ambac may be influenced by a variety of factors including adverse market changes, insurance regulatory changes and changes in general economic conditions. Consequently, although management believes that Ambac will continue to have sufficient liquidity to meet its debt service and other obligations over the long term, no guarantee can be given that Ambac Assurance will be able to dividend amounts sufficient to pay all of Ambac’s operating expenses, debt service obligations and dividends on its common stock.

32

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Ambac Assurance Liquidity. The principal uses of Ambac Assurance’s liquidity are the payment of operating expenses, claims paid, reinsurance premiums, taxes, dividends to Ambac, and capital investments in its subsidiaries. Management believes that Ambac Assurance’s operating liquidity needs can be funded exclusively from its operating cash flow. The principal sources of Ambac Assurance’s liquidity are gross premiums written, scheduled investment maturities, net investment income and receipts from structured credit derivatives.

Financial Services Liquidity. The principal uses of liquidity by Financial Services subsidiaries are payment of investment agreement obligations pursuant to defined terms, net obligations under interest rate swaps and related hedges, operating expenses, income taxes, and dividends to Ambac. Management believes that its Financial Services liquidity needs can be funded primarily from its operating cash flow and the maturity of its invested assets. The principal sources of this segment’s liquidity are proceeds from issuance of investment agreements, net investment income, maturities of securities from its investment portfolio (which are invested with the objective of matching the maturity schedule of its obligations under the investment agreements), net receipts from interest rate swaps and related hedges, and fees for investment management services. Additionally, from time to time, liquidity needs of the Financial Services subsidiaries are satisfied by short-term intercompany loans from Ambac Assurance. The investment objectives with respect to investment agreements are to achieve the highest after-tax total return, subject to a minimum average quality rating of Aa/AA on invested assets, and to maintain cash flow matching of invested assets to funded liabilities to minimize interest rate and liquidity exposure. Financial Services subsidiaries maintain a portion of their assets in short-term investments and repurchase agreements in order to meet unexpected liquidity needs.

Credit Facilities. Ambac and Ambac Assurance have a revolving credit facility with six major international banks for $300 million, which expires in July 2003 and provides a two-year term loan provision. The facility is available for general corporate purposes, including the payment of claims. As of December 31, 2002 and 2001, no amounts were outstanding under this credit facility. This facility’s financial covenants require that Ambac: (i) maintain as of the end of each fiscal quarter a debt to capital ratio of not more than 30% and (ii) maintain at all times total stockholders’ equity equal to or greater than $1.75 billion.

Capital Support. Ambac Assurance has a series of perpetual put options on its own preferred stock. The counterparty to these put options are trusts established by a major investment bank. The trusts were created as a vehicle for providing capital support to Ambac Assurance by allowing it to obtain immediate access to new capital at its sole discretion at any time through the exercise of the put option. If the put option were exercised, the preferred stock holdings of Ambac Assurance would give investors the rights of an equity investor in Ambac Assurance. Such rights are subordinate to insurance claims, as well as to the general unsecured creditors of Ambac Assurance. If exercised, Ambac Assurance would receive up to $800 million in return for the issuance of its own perpetual preferred stock, the proceeds of which may be used for any purpose including the payment of claims. Dividend payments on the preferred stock are cumulative only if Ambac Assurance pays dividends on its common stock. Each trust is restricted to holding high quality short-term commercial paper investments to ensure that it can meet its obligations under the put option. To fund these investments, each trust has issued its own auction market perpetual preferred stock. Ambac Assurance pays a floating put option fee. Each trust is rated AA/Aa2 by Standard & Poor’s and Moody’s, respectively.

Stock Repurchase Program. The Board of Directors of Ambac has authorized the establishment of a stock repurchase program that permits the repurchase of up to 12,000,000 shares of Ambac’s common stock. During 2002, Ambac acquired approximately 695,000 shares for an aggregate amount of $41.1 million. Since inception of the Stock Repurchase Program, Ambac has acquired approximately 8,967,000 shares for an aggregate amount of $265.9 million.

Balance Sheet. Total assets as of December 31, 2002 were $15.36 billion, an increase of 24% from $12.34 billion at December 31, 2001. This increase was due primarily to cash generated from business written during 2002 and higher volume in the guaranteed investment agreement business. Stockholders’ equity as of December 31, 2002 was $3.63 billion, an increase of 22% from $2.98 billion at year-end 2001. The increase stemmed primarily from net income for the year and an increase in the fair market value of the investment portfolio due to a decline in interest rates during the year.

33

The following table summarizes the composition of the fair value of Ambac’s investment portfolio by segment at December 31, 2002 and 2001:

| | | Financial Guarantee

| | | Financial Services

| | | Corporate

| | | Total

| |

| | | (Dollars in millions) | |

2002: | | | | | | | | | | | | | | | | |

Fixed income securities: | | | | | | | | | | | | | | | | |

Municipal obligations | | $ | 4,470.1 | | | $ | 417.8 | | | $ | — | | | $ | 4,887.9 | |

Corporate obligations | | | 432.5 | | | | 1,136.8 | | | | — | | | | 1,569.3 | |

Foreign government obligations | | | 120.6 | | | | — | | | | — | | | | 120.6 | |

U.S. government obligations | | | 101.6 | | | | 6.6 | | | | — | | | | 108.2 | |

Mortgage and asset-backed securities (includes U.S. government agency obligations) | | | 846.0 | | | | 4,048.0 | | | | 17.6 | | | | 4,911.6 | |

Other | | | 1.7 | | | | — | | | | 0.6 | | | | 2.3 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 5,972.5 | | | | 5,609.2 | | | | 18.2 | | | | 11,599.9 | |

Short-term | | | 284.3 | | | | 71.6 | | | | 39.9 | | | | 395.8 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 6,256.8 | | | | 5,680.8 | | | | 58.1 | | | | 11,995.7 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Fixed income securities pledged as collateral: | | | | | | | | | | | | | | | | |

Mortgage and asset-backed securities (includes U.S. government agency obligations) | | | — | | | | 543.6 | | | | — | | | | 543.6 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total investments | | $ | 6,256.8 | | | $ | 6,224.4 | | | $ | 58.1 | | | $ | 12,539.3 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Percent total | | | 49.9 | % | | | 49.6 | % | | | 0.5 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

2001: | | | | | | | | | | | | | | | | |

Fixed income securities: | | | | | | | | | | | | | | | | |

Municipal obligations | | $ | 3,540.3 | | | $ | 144.5 | | | $ | — | | | $ | 3,684.8 | |

Corporate obligations | | | 656.2 | | | | 674.4 | | | | — | | | | 1,330.6 | |

Foreign government obligations | | | 96.6 | | | | — | | | | — | | | | 96.6 | |

U.S. government obligations | | | 54.8 | | | | 6.0 | | | | 17.5 | | | | 78.3 | |

Mortgage and asset-backed securities (including U.S. government agency obligations) | | | 735.2 | | | | 2,530.4 | | | | 13.3 | | | | 3,278.9 | |

Other | | | 1.4 | | | | — | | | | 0.8 | | | | 2.2 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 5,084.5 | | | | 3,355.3 | | | | 31.6 | | | | 8,471.4 | |

Short-term | | | 170.6 | | | | 225.2 | | | | 19.2 | | | | 415.0 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 5,255.1 | | | | 3,580.5 | | | | 50.8 | | | | 8,886.4 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Fixed income securities pledged as collateral: | | | | | | | | | | | | | | | | |

Mortgage and asset-backed securities (including U.S. government agency obligations) | | | — | | | | 1,401.5 | | | | — | | | | 1,401.5 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total investments | | $ | 5,255.1 | | | $ | 4,982.0 | | | $ | 50.8 | | | $ | 10,287.9 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Percent total | | | 51.1 | % | | | 48.4 | % | | | 0.5 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ambac has a formal review process for all securities in its investment portfolio, including a review for impairment losses. Factors considered when assessing impairment include: (i) securities whose market values have declined by 20% or more below amortized cost for a continuous period of at least six months; (ii) recent credit downgrades by rating agencies; (iii) the financial condition of the issuer; (iv) whether scheduled interest payments are past due; and (v) whether Ambac has the ability and intent to hold the security for a sufficient period of time to allow for anticipated recoveries in fair value. If we believe a decline in the value of a particular investment is temporary, we record the decline as an unrealized loss in Accumulated Other Comprehensive Income in stockholders’ equity on our Consolidated Balance Sheets. If we believe the decline is “other than temporary,” we write-down the carrying value of the investment and record a loss on our Consolidated Statements of Operations. Ambac’s assessment of a decline in value includes management’s current judgment of the factors noted above. If that judgment changes in the future, Ambac may ultimately record a loss after having originally concluded that the decline in value was temporary. The following table summarizes the total pre-tax gross unrealized loss recorded in Accumulated Other Comprehensive Income in stockholders’ equity at December 31, 2002 and 2001 by investment category:

| | | 2002 Gross Unrealized Losses

| | 2001 Gross Unrealized Losses

|

| | | (Dollars in millions) |

Fixed income securities: | | | | | | |

Municipal obligations | | $ | 4.6 | | $ | 29.8 |

Corporate obligations | | | 27.8 | | | 42.6 |

Foreign government obligations | | | — | | | 1.1 |

U.S. government obligations | | | 0.3 | | | 1.2 |

Mortgage and asset-backed securities | | | 4.3 | | | 20.8 |

| | |

|

| |

|

|

Total | | $ | 37.0 | | $ | 95.5 |

| | |

|

| |

|

|

34

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

The following table summarizes, for all securities in an unrealized loss position as of December 31, 2002 and 2001, the aggregate fair value and gross unrealized loss by length of time those securities have been continuously in an unrealized loss position:

| | | 2002

| | 2001

|

| | | Estimated Fair Value

| | Gross Unrealized Losses

| | Estimated Fair Value

| | Gross Unrealized Losses

|

| | | (Dollars in millions) |

Municipal obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | $ | 146.1 | | $ | 2.4 | | $ | 1,010.2 | | $ | 23.6 |

7– 12 months | | | 0.9 | | | 0.3 | | | 0.4 | | | 0.1 |

Greater than 12 months | | | 26.9 | | | 1.9 | | | 91.9 | | | 6.1 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 173.9 | | | 4.6 | | | 1,102.5 | | | 29.8 |

| | |

|

| |

|

| |

|

| |

|

|

Corporate obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 461.1 | | | 7.5 | | | 339.5 | | | 10.4 |

7– 12 months | | | 18.5 | | | 2.2 | | | 4.5 | | | 0.4 |

Greater than 12 months | | | 106.7 | | | 18.1 | | | 258.0 | | | 31.8 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 586.3 | | | 27.8 | | | 602.0 | | | 42.6 |

| | |

|

| |

|

| |

|

| |

|

|

Foreign government obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 1.6 | | | — | | | 44.6 | | | 1.1 |

7– 12 months | | | — | | | — | | | — | | | — |

Greater than 12 months | | | — | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 1.6 | | | — | | | 44.6 | | | 1.1 |

| | |

|

| |

|

| |

|

| |

|

|

U.S. government obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 15.9 | | | 0.3 | | | 18.3 | | | 1.2 |

7– 12 months | | | — | | | — | | | — | | | — |

Greater than 12 months | | | — | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 15.9 | | | 0.3 | | | 18.3 | | | 1.2 |

| | |

|

| |

|

| |

|

| |

|

|

Mortgage and asset-backed securities in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 576.8 | | | 3.2 | | | 1,348.6 | | | 18.2 |

7– 12 months | | | 11.7 | | | 0.1 | | | — | | | — |

Greater than 12 months | | | 33.1 | | | 1.0 | | | 15.2 | | | 2.6 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 621.6 | | | 4.3 | | | 1,363.8 | | | 20.8 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 1,399.3 | | $ | 37.0 | | $ | 3,131.2 | | $ | 95.5 |

| | |

|

| |

|

| |

|

| |

|

|

There were no individual securities with material unrealized losses as of December 31, 2002 and 2001. As of December 31, 2002 below investment grade securities and non-rated securities which were in an unrealized loss position had a fair value of $46.7 million and unrealized loss of $5.0 million, which represented 3% of the total fair value and 14% of total pre-tax unrealized losses shown in the above table. As of December 31, 2001 below investment grade securities and non-rated securities which were in an unrealized loss position had a fair value of $26.9 million and an unrealized loss of $5.3 million, which represented 1% of the total fair value and 6% of total pre-tax unrealized loss as shown in the above table.

35

The following table summarizes amortized cost and fair value for all securities in an unrealized loss position as of December 31, 2002 and 2001, by contractual maturity date:

| | | 2002

| | 2001

|

| | | Amortized Cost

| | Estimated Fair Value

| | Amortized Cost

| | Estimated Fair Value

|

| | | (Dollars in millions) |

Municipal obligations: | | | | | | | | | | | | |

Due in one year or less | | $ | — | | $ | — | | $ | 1.5 | | $ | 1.2 |

Due after one year through five years | | | — | | | — | | | 0.1 | | | 0.1 |

Due after five years through ten years | | | 10.8 | | | 10.6 | | | 298.7 | | | 294.7 |

Due after ten years | | | 167.7 | | | 163.3 | | | 832.0 | | | 806.5 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 178.5 | | | 173.9 | | | 1,132.3 | | | 1,102.5 |

| | |

|

| |

|

| |

|

| |

|

|

Corporate obligations: | | | | | | | | | | | | |

Due in one year or less | | | — | | | — | | | — | | | — |

Due after one year through five years | | | 228.7 | | | 223.0 | | | 12.7 | | | 12.5 |

Due after five years through ten years | | | 29.6 | | | 29.3 | | | 70.3 | | | 69.3 |

Due after ten years | | | 355.8 | | | 334.0 | | | 561.6 | | | 520.2 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 614.1 | | | 586.3 | | | 644.6 | | | 602.0 |

| | |

|

| |

|

| |

|

| |

|

|

Foreign government obligations: | | | | | | | | | | | | |

Due in one year or less | | | 1.6 | | | 1.6 | | | — | | | — |

Due after one year through five years | | | — | | | — | | | 45.4 | | | 44.4 |

Due after five years through ten years | | | — | | | — | | | — | | | — |

Due after ten years | | | — | | | — | | | 0.3 | | | 0.2 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 1.6 | | | 1.6 | | | 45.7 | | | 44.6 |

| | |

|

| |

|

| |

|

| |

|

|

U.S. government obligations: | | | | | | | | | | | | |

Due in one year or less | | | — | | | — | | | 0.8 | | | 0.8 |

Due after one year through five years | | | 16.2 | | | 15.9 | | | — | | | — |

Due after five years through ten years | | | — | | | — | | | — | | | — |

Due after ten years | | | — | | | — | | | 18.7 | | | 17.5 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 16.2 | | | 15.9 | | | 19.5 | | | 18.3 |

| | |

|

| |

|

| |

|

| |

|

|

Mortgage and asset-backed securities | | | 625.9 | | | 621.6 | | | 1,384.6 | | | 1,363.8 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 1,436.3 | | $ | 1,399.3 | | $ | 3,226.7 | | $ | 3,131.2 |

| | |

|

| |

|

| |

|

| |

|

|

The investment portfolio includes non-publicly traded securities with a carrying value of $148 million. Fair values for these securities are based on quotes obtained from brokers, if available. For those fixed rate securities where broker quotes were not available, fair values are based on internal valuation models. For floating rate securities where broker quotes were not available, fair values are based on the lower of amortized cost or internal valuation models. Key inputs to the internal valuation models include maturity date, coupon and generic yield curves for industry and credit rating characteristics that closely match those characteristics of the specific investment securities being valued. The valuation results from these models could differ materially from amounts that would actually be realized in the market.

36

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

The following table summarizes, for all securities sold at a loss during 2002 and 2001, the aggregate fair value and realized loss by length of time those securities were continuously in an unrealized loss position prior to the sales date:

| | | 2002

| | 2001

|

| | | Estimated Fair Value

| | Gross Realized Losses

| | Estimated Fair Value

| | Gross Realized Losses

|

| | | (Dollars in millions) |

Municipal obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | $ | 20.2 | | $ | 0.4 | | $ | 38.6 | | $ | 0.4 |

7– 12 months | | | — | | | — | | | 1.0 | | | — |

Greater than 12 months | | | 0.8 | | | — | | | 92.3 | | | 3.3 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 21.0 | | | 0.4 | | | 131.9 | | | 3.7 |

| | |

|

| |

|

| |

|

| |

|

|

Corporate obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 45.9 | | | 0.6 | | | 34.9 | | | 2.4 |

7– 12 months | | | — | | | — | | | — | | | — |

Greater than 12 months | | | 42.1 | | | 9.0 | | | 31.9 | | | 1.9 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 88.0 | | | 9.6 | | | 66.8 | | | 4.3 |

| | |

|

| |

|

| |

|

| |

|

|

Foreign government obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | — | | | — | | | 12.4 | | | 1.2 |

7– 12 months | | | 6.8 | | | 0.1 | | | — | | | — |

Greater than 12 months | | | — | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 6.8 | | | 0.1 | | | 12.4 | | | 1.2 |

| | |

|

| |

|

| |

|

| |

|

|

U.S. government obligations in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | — | | | — | | | 16.6 | | | 1.0 |

7– 12 months | | | 18.0 | | | 0.7 | | | — | | | — |

Greater than 12 months | | | — | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 18.0 | | | 0.7 | | | 16.6 | | | 1.0 |

| | |

|

| |

|

| |

|

| |

|

|

Mortgage and asset-backed securities in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 215.3 | | | 1.0 | | | 74.2 | | | 0.7 |

7– 12 months | | | 4.0 | | | — | | | — | | | — |

Greater than 12 months | | | 3.8 | | | — | | | 48.8 | | | 2.2 |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 223.1 | | | 1.0 | | | 123.0 | | | 2.9 |

| | |

|

| |

|

| |

|

| |

|

|

Other securities in continuous unrealized loss for: | | | | | | | | | | | | |

0–6 months | | | 37.0 | | | 1.3 | | | 184.7 | | | 7.7 |

7– 12 months | | | — | | | — | | | — | | | — |

Greater than 12 months | | | — | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

|

| | | | 37.0 | | | 1.3 | | | 184.7 | | | 7.7 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | $ | 393.9 | | $ | 13.1 | | $ | 535.4 | | $ | 20.8 |

| | |

|

| |

|

| |

|

| |

|

|

As noted in the “Results of Operations” section, included in 2002 net realized losses was an impairment write-down of $139.7 million, which was excluded from the table above. There were no impairment write-downs during 2001 and 2000. The remaining net realized losses included in the 2002, 2001 and 2000 Consolidated Statements of Operations were the result of security sales made in the usual course of business in order to achieve Ambac’s investment objectives for the Financial Guarantee and Financial Services investment portfolios discussed below.

Ambac’s investment objectives for the Financial Guarantee portfolio are to maintain an investment duration that closely approximates the expected duration of related financial guarantee liabilities and achieve the highest after-tax net investment income, while maintaining a conservative credit risk profile. The Financial Guarantee investment portfolio is subject to internal investment guidelines, which are approved by Ambac’s Board of Directors. Such guidelines set forth minimum credit rating requirements and credit risk concentration limits.

37

The following table provides the ratings distribution of the Financial Guarantee investment portfolio at December 31, 2002 and 2001:

Rating(1):

| | 2002

| | | 2001

| |

AAA(2) | | 73 | % | | 65 | % |

AA | | 16 | | | 19 | |

A | | 7 | | | 11 | |

BBB | | 1 | | | 2 | |

Below investment grade | | 1 | | | <1 | |

Not rated | | 2 | | | 3 | |

| | |

|

| |

|

|

| | | 100 | % | | 100 | % |

| | |

|

| |

|

|

| (1) | | Ratings represent Standard & Poor’s classifications. If unavailable, Moody’s rating is used. |

| (2) | | Includes U.S. Treasury and agency obligations, which comprised approximately 15% and 13% of the Financial Guarantee investment portfolio as of December 31, 2002 and 2001, respectively. |

Approximately 98% and 85% of the mortgage and asset-backed securities in the Financial Guarantee portfolio is composed of securities issued by various U.S. government agencies, as of December 31, 2002 and 2001, respectively.

Short-term investments in the Financial Guarantee portfolio consisted primarily of money market funds, foreign and domestic time deposits, and discount notes.

The Financial Services investment portfolio consists primarily of assets funded with the proceeds from the issuance of investment agreement liabilities. The investment objectives of the portfolio are to match the investment security maturity schedule to the maturity schedule of related liabilities under the investment agreements and achieve the highest after-tax net investment income. The investment portfolio is subject to internal investment guidelines, which are approved by Ambac’s Board of Directors. Such guidelines set forth minimum credit rating requirements and credit risk concentration limits.

The following table provides the ratings distribution of the Financial Services investment portfolio at December 31, 2002 and 2001:

Rating(1):

| | 2002

| | | 2001

| |

AAA(2) | | 88 | % | | 88 | % |

AA | | 2 | | | 4 | |

A | | 6 | | | 6 | |

BBB | | 3 | | | 2 | |

Below investment grade | | 1 | | | <1 | |

Not rated | | — | | | <1 | |

| | |

|

| |

|

|

| | | 100 | % | | 100 | % |

| | |

|

| |

|

|

| (1) | | Ratings represent Standard & Poor’s classifications. If unavailable, Moody’s rating is used. |

| (2) | | Includes U.S. Treasury and agency obligations, which comprised approximately 44% and 34% of the Financial Services investment portfolio as of December 31, 2002 and 2001, respectively. |

Approximately 59% and 69% of the mortgage and asset-backed securities in the Financial Services portfolio is composed of securities issued by various U.S. government agencies, as of December 31, 2002 and 2001, respectively.

Short-term investments in the Financial Services portfolio consisted of money market funds.

Ambac enters into derivative contracts classified as held for trading purposes. Changes in the fair value of derivative contracts classified as held for trading purposes are recognized immediately in net income. In determining fair value, Ambac uses information provided by independent external sources or, when independent information is not available, internal valuation models are used. Internal valuation models include estimates, made by management, which utilize current and historical market data. The valuation results from internal models could differ materially from amounts that would be realized in the market. The net fair value of derivative contracts classified as held for trading purposes was $56 million at December 31, 2002. Of that amount, $(9) million was determined using internal valuation models and $65 million was provided by external sources. Contracts with maturities in excess of 5 years accounted for $83 million of the net fair value. Contracts with maturities of 5 years or less accounted for $(27) million of net fair value.

Special Purpose Entities. Ambac has transferred third-party debt obligations to two special purpose entities. The business purpose of these entities is to provide some of our financial guarantee clients with funding for their debt obligations. These special purpose entities meet the characteristics of Qualifying Special Purpose Entities (“QSPEs”) in accordance with Statement of Financial Accounting Standards 140 “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.” The QSPEs are not consolidated in Ambac’s consolidated financial statements. The QSPEs are legal entities that are demonstrably distinct from Ambac. Ambac, its affiliates or its agents cannot unilaterally dissolve the QSPEs. The QSPEs permitted activities are limited to (i) purchasing assets from Ambac, which are defined in the governing documents of the QSPEs, (ii) issuing Medium Term Notes (“MTNs”) to fund such purchase, (iii) executing derivative hedges and (iv) providing related administrative services. The QSPEs hold only passive debt obligations transferred to it by Ambac, passive derivative financial instruments used for hedging purposes and cash collected from assets that it holds pending distribution to the MTN holders. The QSPEs do not hold equity or other types of securities that would allow for voting rights, significant influence of contractual options such as the right to unconditionally put or call a financial instrument. The legal documents that established the QSPEs or created the beneficial interests in the transferred assets do not permit the sale or other disposal of the transferred financial assets except for disposals in automatic response to the terms of such financial assets (this would include only issuer call provisions). These required disposals are outside the control of Ambac, its affiliates and the QSPEs. Beneficial interest holders do not have the rights to put their beneficial interest back to the QSPEs.

As of December 31, 2002, there have been 12 individual transactions processed through the QSPEs. In each case, Ambac sells fixed income debt obligations issued by third parties to the QSPEs. Ambac receives cash consideration for all assets transferred to the QSPEs. Ambac surrenders control over the transferred debt obligations. There are no agreements that entitle or obligate Ambac to repurchase or redeem assets. The QSPEs are structured as bankruptcy remote entities. Ambac management believes that the assets transferred represent a true sale and the

38

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

assets held by the QSPEs are beyond the reach of Ambac and its creditors, even in bankruptcy or other receivership. Legal counsel has concurred with management’s belief and has provided Ambac true sale and non-substantive consolidation opinions. The purchase by the QSPEs is financed through the issuance of MTNs, which are collateralized by the purchased assets. Derivative contracts may be used for hedging purposes only. Derivative hedges are established at the time MTNs are issued to purchase debt obligations. Ambac Assurance may issue a financial guarantee insurance policy on the assets sold, the MTNs issued and the derivative contracts used. As of December 31, 2002, Ambac Assurance had financial guarantee insurance policies issued for all assets owned, MTNs issued and derivative contracts used by the QSPEs.

Ambac’s exposure under these financial guarantee insurance policies is included in the disclosure in Note 12 “Guarantees in Force” to the consolidated financial statements. Pursuant to the terms of Ambac Assurance’s insurance policy, insurance premiums are paid to Ambac Assurance by the QSPEs and are earned in a manner consistent with other insurance policies, over the risk period. Any losses incurred would be included in Ambac’s Consolidated Statements of Operations. To date, no losses have been recognized. Under the terms of an Administrative Agency Agreement, Ambac provides some administrative services, primarily collecting amounts due on the obligations and making interest payments on the MTNs.

Assets sold to the QSPEs during 2002, 2001 and 2000 were $350.0 million, $793.4 million and $159.9 million, respectively. No gains or losses were recognized on these sales. As of December 31, 2002, the estimated fair value of financial assets, MTN liabilities and derivative hedge liabilities were $1,347.3 million, $1,263.5 million and $91.0 million, respectively. When market quotes are not available, estimated fair value is determined utilizing valuation models. These models include estimates, made by Ambac management, which utilize current market information. The valuation results from these models could differ materially from amounts that would actually be realized in the market. Ambac Assurance received gross premiums and other fees for issuing financial guarantee policies on the assets, MTNs and derivative contracts of $19.3 million, $23.7 million and $3.2 million for the years ended December 31, 2002, 2001 and 2000, respectively. Ambac received fees for providing administrative services amounting to $0.1 million, $0.3 million and $0.2 million for 2002, 2001 and 2000, respectively.