- AMBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ambac Financial (AMBC) DEF 14ADefinitive proxy

Filed: 30 Mar 07, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Ambac Financial Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

AMBAC FINANCIAL GROUP, INC.

NOTICEOF

2007 ANNUAL MEETING

OF STOCKHOLDERSANDPROXY STATEMENT

Meeting Date:

Tuesday, May 8, 2007

at 11:30 A.M. (local time)

Meeting Place:

Ambac Financial Group, Inc.

One State Street Plaza

New York, New York 10004

Ambac Financial Group, Inc.

One State Street Plaza

New York, NY 10004

212.668.0340

NOTICEOF 2007 ANNUAL MEETINGOF STOCKHOLDERS

March 30, 2007

Dear Stockholders:

We will hold the 2007 Annual Meeting of Stockholders on Tuesday, May 8, 2007 at 11:30 a.m. (Eastern Standard Time) at our executive offices at One State Street Plaza in New York City. At the Annual Meeting, we will ask you to:

| · | Elect eight directors; |

| · | Ratify the selection of KPMG LLP, an independent registered public accounting firm, as Ambac’s independent auditors for 2007; and |

| · | Consider any other business that is properly presented at the Annual Meeting. |

You may vote at the Annual Meeting if you were an Ambac stockholder at the close of business on March 9, 2007.

Along with the attached Proxy Statement, we are also sending you the Ambac 2006 Annual Report, which includes our 2006 Annual Report on Form 10-K and financial statements.

Anne Gill Kelly

Managing Director, Corporate Secretary

and Assistant General Counsel

Ambac Financial Group, Inc.

One State Street Plaza

New York, NY 10004

212.668.0340

March 30, 2007

Dear Stockholders:

It is our pleasure to invite you to Ambac’s 2007 Annual Meeting of Stockholders.

We will hold the meeting on Tuesday, May 8, 2007, at 11:30 a.m. at our executive offices in New York City. At the stockholders meeting, I will cover the business items, review the major developments of 2006 and answer your questions.

This booklet includes the Notice of the 2007 Annual Meeting of Stockholders and the Proxy Statement. The Proxy Statement describes the business that we will conduct at the meeting.

Your vote is important. Most stockholders have a choice of voting on the Internet, by telephone, or by mail using a traditional proxy card. Please refer to the proxy card or other voting instructions included with these proxy materials for information on the voting methods available to you.If you vote by telephone or on the Internet, you do not need to return your proxy card.

We look forward to seeing you at the meeting.

Sincerely,

|

Robert J. Genader |

Chairman, President and Chief Executive Officer |

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

What is the Difference Between Holding Shares as a Stockholder of Record and as a Beneficial Owner? | 2 | |

| 2 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 5 | ||

What Are the Costs of Soliciting these Proxies and Who Will Pay Them? | 5 | |

| 5 | ||

| 5 | ||

Can a Stockholder Communicate Directly with our Board? If so, How? | 5 | |

| 6 | ||

| 7 | ||

| 7 | ||

How Much Stock is Owned By Directors and Executive Officers? | 8 | |

Did Ambac Insiders Comply with Section 16(a) Beneficial Ownership Reporting in 2006? | 10 | |

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 15 | ||

| 19 | ||

| 22 | ||

| 24 | ||

| 24 | ||

| 27 | ||

| 29 | ||

| 31 | ||

Executive Compensation | ||

| 32 | ||

| 43 | ||

| 44 | ||

| 46 | ||

| 47 | ||

| 50 | ||

| 51 | ||

| 53 | ||

| 55 | ||

| 56 | ||

| 56 | ||

| 59 | ||

| 61 | ||

| A-1 |

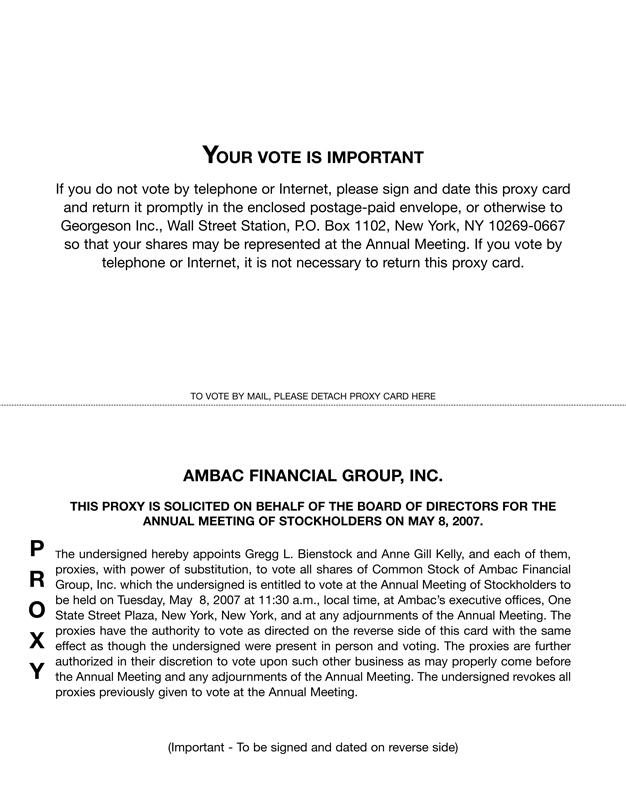

PROXY STATEMENT FOR THE AMBAC FINANCIAL GROUP, INC.

2007 ANNUAL MEETINGOF STOCKHOLDERS

INFORMATION ABOUT THE ANNUAL MEETINGAND VOTING

Why Did You Send Me this Proxy Statement?

We sent you this Proxy Statement and the enclosed proxy card because Ambac’s Board of Directors is soliciting your proxy to vote at the 2007 Annual Meeting of Stockholders.

This Proxy Statement summarizes the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. You may simply complete, sign and return the enclosed proxy card or vote by telephone or over the Internet.

What Proposals will be Voted on at the Annual Meeting?

There are two proposals scheduled to be voted on at the Annual Meeting:

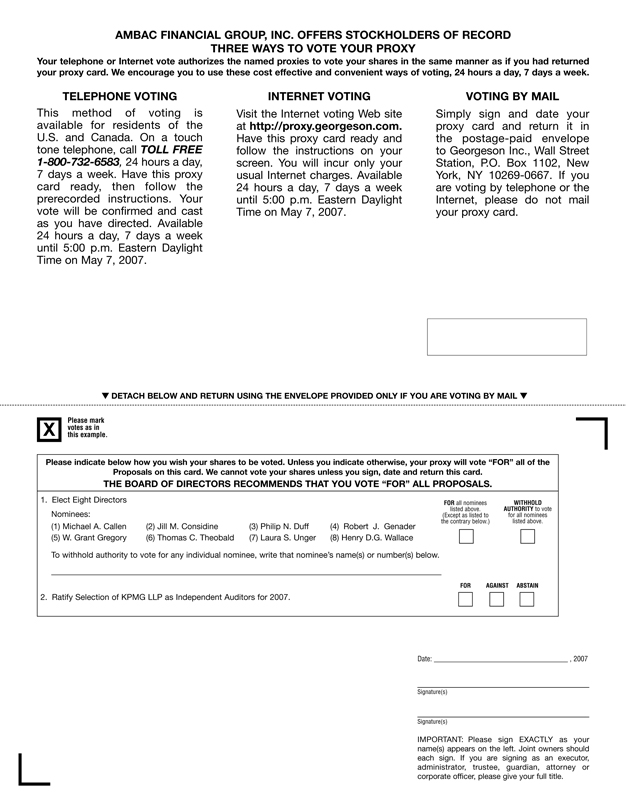

| · | The election of eight directors; and |

| · | The ratification of the selection of KPMG LLP, an independent registered public accounting firm, as Ambac’s independent auditors for 2007. |

What is Ambac’s Board’s voting recommendation?

Ambac’s Board recommends that you vote your shares “FOR” each of the nominees of the Board, and “FOR” the ratification of the selection of KPMG LLP, an independent registered public accounting firm, as Ambac’s independent auditors for 2007.

March 9, 2007 is the record date for the Annual Meeting. If you owned Ambac common stock at the close of business on March 9, 2007, you are entitled to vote. On that date, there were 101,794,142 shares of Ambac common stock outstanding and entitled to vote at the Annual Meeting. Ambac common stock is our only class of voting stock. We will begin mailing this Proxy Statement on March 30, 2007 to all stockholders entitled to vote.

You have one vote for each share of Ambac common stock that you owned at the close of business on March 9, 2007. The proxy card indicates the number.

What is the Difference Between Holding Shares as a Stockholder of Record and as a Beneficial Owner?

Most stockholders of Ambac hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with Ambac’s transfer agent, Citibank, you are considered, with respect to those shares, the stockholder of record and these proxy materials are being sent to you directly by Ambac. As the stockholder of record, you have the right to grant your voting proxy directly to Ambac or to vote in person at the Annual Meeting. Ambac has enclosed a proxy card for you to use. You may also vote on the Internet or by telephone as described below under the heading “May I Vote by Telephone or Via the Internet?”

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee on how to vote your shares and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may only vote these shares in person at the Annual Meeting if you follow the instructions described below under the heading “How Do I Vote In Person at the Annual Meeting?”. Your broker or nominee has enclosed a voting instruction card for you to use in directing your broker or nominee as to how to vote your shares. You may also vote on the Internet or by telephone as described below under the heading “May I Vote by Telephone or Via the Internet?”.

If you properly fill in your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board:

| · | “FOR”Proposal 1(Elect Eight Directors); and |

| · | “FOR” Proposal 2(Ratify Selection of KPMG LLP, an independent registered public accounting firm, as Independent Auditors for 2007). |

If any other matter is presented, your proxy will vote in accordance with his or her best judgment. At the time we began printing this Proxy Statement, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this Proxy Statement.

May I Vote by Telephone or Via the Internet?

Yes. Instead of submitting your vote by mail on the enclosed proxy card, you may be able to vote via the Internet or by telephone. Please note that there are separate Internet and telephone arrangements

2

depending on whether you are a stockholder of record(that is, if you hold your stock in your own name), or whether you are a beneficial owner and hold your shares in “street name”(that is, if your stock is held in the name of your broker or bank).

If you are a stockholder of record, you may vote by telephone, or electronically through the Internet, by following the instructions provided on your proxy card.

If you are a beneficial owner and held your shares in “street name”, you should refer to the instructions provided by your bank or broker to determine whether you will be able to vote by telephone or electronically.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. If you vote by telephone or via the Internet, you may incur costs, such as usage charges from Internet access providers and telephone companies. You will be responsible for those costs.

Whether or not you plan to attend the Annual Meeting, we urge you to vote. Returning the proxy card or voting by telephone or over the Internet will not affect your right to attend the Annual Meeting and vote.

Yes. If you change your mind after you send in your proxy card, you may revoke your proxy by following any of the procedures described below. To revoke your proxy:

| · | Send in another signed proxy with a later date; |

| · | Send a letter revoking your proxy to Ambac’s Corporate Secretary at the address indicated on page 61 under “Information about Stockholder Proposals”; or |

| · | Attend the Annual Meeting and vote in person. |

How Do I Vote in Person at the Annual Meeting?

You may vote shares held directly in your name as the stockholder of record in person at the Annual Meeting. If you choose to vote your shares in person at the Annual Meeting, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, Ambac recommends that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Shares beneficially owned and held in “street name” may be voted in person by you only if you obtain a signed proxy from the stockholder of record giving you the right to vote the shares. If your shares are held in the name of your broker, bank or other nominee, you must bring to the Annual Meeting an account statement or letter from the broker, bank or other nominee indicating that you are the owner of the shares and a signed proxy from the stockholder of record giving you the right to vote the shares. The account statement or letter must show that you were beneficial owner of the shares on March 9, 2007.

3

How Do Employees in the Ambac Stock Fund Vote?

If you are an employee who participates in our Savings Incentive Plan (“SIP”), you are receiving this material because of shares held for you in the Ambac Stock Fund in the SIP. The SIP Trustee will send you a voting instruction card instead of a proxy card. This voting instruction card will indicate the number of shares of Ambac common stock credited to your account in the Ambac Stock Fund as of March 9, 2007.

| · | If you complete, sign and return the voting instruction card on time, the SIP trustee will vote the shares as you have directed. |

| · | If you do not complete, sign and return the voting instruction card on time, the SIP trustee will not vote the shares credited to your account. |

What Votes Need to be Present to Hold the Annual Meeting?

We need a majority of the shares of Ambac common stock outstanding on March 9, 2007 to be present, in person or by proxy, to hold the Annual Meeting.

What Vote Is Required to Approve Each Proposal?

Proposal 1: Elect Eight Directors | The eight nominees for director who receive the most votes will be elected. If you do not vote for a nominee, or you indicate “withhold authority to vote” for any nominee on your proxy card, your vote will not count either for or against the nominee. | |

Proposal 2: Ratify Selection of Independent Auditors | The affirmative vote of a majority of the votes present and entitled to vote at the Annual Meeting is required to ratify the selection of KPMG LLP, an independent registered public accounting firm, as independent auditors for 2007. If you “abstain” from voting, it has the same effect as if you voted “against” this proposal. | |

In the election of directors, your vote may be cast “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. For other proposals, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN”. If you “ABSTAIN”, it has the same effect as a vote “AGAINST”. If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board.

What Is the Effect of Broker Non-Votes?

A broker “non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Under the rules of the New York Stock Exchange, if your broker holds your shares in its “street” name, the broker may vote your shares on Proposal 1(Elect Eight Directors) and Proposal 2(Ratify Selection of Independent Auditors) even if it does not receive instructions from you.

4

We maintain a policy of keeping all the proxies and ballots confidential. The Inspectors of Election will forward to management any written comments that you make on the proxy card.

If More than One Member of My Household Owns Shares, Will We Receive Separate Annual Meeting Materials?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we are sending only one Annual Report and Proxy Statement to stockholders who have the same address and last name unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This “householding” practice reduces our printing and postage costs. Stockholders may request a separate copy of the Annual Report and Proxy Statement as follows:

| · | Stockholders of record wishing to discontinue or begin householding, or any stockholder of record residing at a household address wanting to request delivery of a copy of the Annual Report and Proxy Statement, should contact our transfer agent, Citibank, N.A., at 212-816-6672 or may write to Citibank Stockholder Services at P.O. Box 43077, Providence, Rhode Island 02940-3077. |

| · | Stockholders whose shares are held in “street name” can request information about householding from their banks, brokers or other holders of record. |

What Are the Costs of Soliciting these Proxies and Who Will Pay Them?

Ambac will pay all the costs of soliciting these proxies. Although we are mailing these proxy materials, our directors and employees may also solicit proxies by telephone, by fax or other electronic means of communication, or in person. We will reimburse banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you. Georgeson Shareholder is assisting us with the solicitation of proxies for a fee of $8,500 plus out-of-pocket expenses.

Where Can I Find the Voting Results?

We will publish the voting results in ourForm 10-Qfor the second quarter of 2007, which we will file with the SEC in August 2007. You can find the Form 10-Q on Ambac’s website atwww.ambac.com.

Do Directors Attend the Annual Meeting?

Ambac encourages directors to attend Ambac’s Annual Meeting of Stockholders. Last year, all of our directors attended the Annual Meeting.

Can a Stockholder Communicate Directly with our Board? If so, How?

Stockholders and other interested parties may communicate with Ambac’s Presiding Director, Michael Callen, by sending him an e-mail atleaddirector@ambac.com or by writing Mr. Callen c/o Ambac Financial Group, Inc., Attn: Corporate Secretary, One State Street Plaza, New York, New York 10004. You also may

5

communicate with other members of our Board by writing to Ambac’s Corporate Secretary at Ambac Financial Group, Inc., One State Street Plaza, New York, New York 10004 or by sending an e-mail to Ambac’s Corporate Secretary atakelly@ambac.com. Ambac’s Corporate Secretary will then forward your questions or comments directly to the Board.

Communications are distributed to the Presiding Director, the Board, or to any individual director or directors as appropriate, depending on facts and circumstances outlined in the communication. In that regard, the Presiding Director and Ambac’s Board of Directors have requested that certain items that are unrelated to the duties and responsibilities of the Board should be excluded, such as:

| · | spam; |

| · | junk mail and mass mailings; |

| · | product inquiries; |

| · | new product suggestions; |

| · | resumes and other forms of job inquiries; |

| · | surveys; and |

| · | business solicitations or advertisements. |

In addition, material that is indirectly hostile, threatening, illegal or similarly unsuitable will not be forwarded. Any communication that is relevant to Ambac’s business and is not forwarded will be retained for one year and will be made available to the Presiding Director and any other independent director on request. The independent directors grant the Corporate Secretary discretion to decide what correspondence shall be shared with Ambac management and specifically instruct that any personal employee complaints be forwarded to our Human Resources Department.

Whom Should I Call If I Have Any Questions?

If you have any questions about the Annual Meeting or voting, please contactAnne Gill Kelly, our Corporate Secretary, at (212) 208-3355 or atakelly@ambac.com.

If you have any questions about your ownership of Ambac common stock, please contactPeter R. Poillon, Managing Director, Investor Relations, at (212) 208-3333 or atppoillon@ambac.com.

6

INFORMATION ABOUT AMBAC COMMON STOCK OWNERSHIP

Which Stockholders own at least 5% of Ambac?

The following table shows all persons we know to be direct or indirect owners of at least 5% of Ambac common stock as of December 31, 2006. Our information is based on reports filed with the SEC by each of the firms listed in the table below. You may obtain these reports from the SEC.

| Name and Address of Beneficial Owner | Number of Shares Owned Beneficially | Percent of Class (%) | ||

| Goldman, Sachs Asset Management, L.P. | 8,238,671 | 7.8 | ||

32 Old Slip New York, New York 10005 | ||||

| J.P. Morgan Chase & Co. | 5,778,739 | 5.4 | ||

270 Park Avenue New York, New York 10017 | ||||

7

How Much Stock is Owned By Directors and Executive Officers?

The following table shows the Ambac common stock owned directly or indirectly by Ambac’s directors, director nominees and executive officers as of February 1, 2007. No director, director nominee or executive officer beneficially owns 1% or more of the shares of Ambac common stock. All directors, director nominees and executive officers as a group beneficially own 1.56% of the shares of Ambac common stock.

| Name of Beneficial Owner | Number of Shares Beneficially Owned (1)(2)(3)(4)(5) | Percent of Class | Unvested RSUs(6) | PSUs(7) | Total Holdings (including RSUs and PSUs) | ||||||

Non-Employee Directors and Director Nominees | |||||||||||

Michael A. Callen | 29,064 | — | 3,844 | 13,165 | 46,073 | ||||||

Jill M. Considine | 20,538 | — | 3,828 | 5,646 | 30,012 | ||||||

Philip N. Duff | — | — | — | — | — | ||||||

W. Grant Gregory | 29,529 | — | 3,844 | 10,479 | 43,852 | ||||||

Phillip B. Lassiter | 227,587 | — | 3,833 | — | 231,420 | ||||||

Thomas C. Theobald | 11,537 | — | 3,828 | 1,558 | 16,923 | ||||||

Laura S. Unger | 7,699 | — | 3,823 | 1,058 | 12,580 | ||||||

Henry D.G. Wallace | 1,748 | — | 3,833 | 1,239 | 6,820 | ||||||

Executive Officers | |||||||||||

Robert J. Genader | 770,896 | — | 73,751 | 0 | 844,647 | ||||||

Sean T. Leonard | — | — | 13,597 | 0 | 13,597 | ||||||

Douglas C. Renfield-Miller | 80,620 | — | 19,613 | 0 | 100,233 | ||||||

John W. Uhlein III | 129,033 | — | 18,154 | 0 | 147,187 | ||||||

William T. McKinnon | 40,339 | — | 23,943 | 0 | 64,282 | ||||||

All executive officers and directors as | 1,649,986 | 1.56 | % | 1,933,165 | |||||||

| (1) | To our knowledge, except for Mr. Genader, who shares voting and investment power with his spouse, each of the directors and named executive officers has sole voting and investment power over his or her shares held in his or her name. |

| (2) | The number of shares shown for Mr. Lassiter includes 12,000 shares owned by his spouse in her IRA. Mr. Lassiter disclaims beneficial ownership of these shares. |

The number of shares shown for Mr. Uhlein includes 90 shares owned by his spouse in her IRA.

The number of shares shown for Mr. Theobald includes 2,000 shares for which Mr. Theobald acts as trustee for each of two children. There are 1,000 shares in a separate trust for each child. Mr. Theobald disclaims beneficial ownership of these 2,000 shares.

| (3) | The number of shares shown for each director and named executive officer includes shares that may be acquired upon exercise of stock options that were exercisable as of February 1, 2007 or that will become exercisable within 60 days after February 1, 2007. These shares are shown in the following table: |

Non-Employee Directors and | Number Of Shares | Executive Officers | Number Of Shares | |||

Mr. Callen | 15,000 | Mr. Genader | 305,000 | |||

Ms. Considine | 15,626 | Mr. Leonard | — | |||

Mr. Duff | — | Mr. Renfield-Miller | 48,000 | |||

Mr. Lassiter | — | Mr. Uhlein | 53,000 | |||

Mr. Gregory | 15,000 | Mr. McKinnon | 24,750 | |||

Mr. Theobald | — | |||||

Ms. Unger | 5,938 | |||||

Mr. Wallace | — |

8

| (4) | The number of shares shown for each executive officer also includes the number of shares of Ambac common stock owned indirectly as of February 1, 2007 by the executive officer in our Savings Incentive Plan (“SIP”). Our information on these shares is based on reports from the SIP Trustee. |

| (5) | The number of shares shown for Messrs. Genader, Leonard, Renfield-Miller, Uhlein, and McKinnon includes vested restricted stock units (“RSUs”) awarded under our equity plans. These RSUs are shown in the following table: |

Executive Officers | Number of Vested RSUs | |

Mr. Genader | 462,952 | |

Mr. Leonard | — | |

Mr. Renfield-Miller | 32,231 | |

Mr. Uhlein | 74,423 | |

Mr. McKinnon | 8,878 | |

Directors and Director Nominees | Number of Vested RSUs | |

Mr. Callen | 5,695 | |

Ms. Considine | 4,023 | |

Mr. Duff | — | |

Mr. Gregory | 4,813 | |

Mr. Lassiter | — | |

Mr. Theobald | 660 | |

Ms. Unger | 882 | |

Mr. Wallace | — | |

| (6) | This column shows the following grants of RSUs under the 1997 Non-Employee Directors Equity Plan: 3,000 RSUs to each of Messrs. Callen and Gregory at the 2002 Annual Meeting and accrued dividends, 3,000 RSUs to Ms. Unger at the 2003 Annual Meeting and accrued dividends, 3,028 RSUs to Messrs. Lassiter and Wallace at the 2004 Annual Meeting and accrued dividends, 3,043 RSUs to Ms. Considine and Mr. Theobald at the 2005 Annual Meeting and accrued dividends. These RSUs generally will vest on the date of the Annual Meeting held in the fifth calendar year following the date of grant. At that time, each of these directors will receive one share of Ambac common stock in settlement of each RSU. For more information on these RSUs, see below at page 15 under “How We Compensate Directors.” |

In addition, this column includes the 739 RSUs and accrued dividends that were granted to each of Messrs. Callen, Gregory, Lassiter, Theobald and Wallace, Ms. Considine and Ms. Unger at the 2006 Annual Meeting under the 1997 Non-Employee Directors Equity Plan. These RSUs generally will vest on the date of the Annual Meeting held in the first calendar year following the date of grant. At that time, each of these directors will receive one share of Ambac common stock in settlement of each RSU. For more information on these RSUs, see below at page 15 under “How We Compensate Directors.”

This column also shows RSUs for Messrs. Genader and Renfield-Miller that were awarded as part of each named executive officer’s 2003 bonus, 2004 bonus, 2005 bonus and 2006 bonus pursuant to the Ambac Deferred Compensation SubPlan of the 1997 Equity Plan (the “SubPlan”) and accrued dividends and their long-term compensation awards granted in 2004, 2005, 2006, and 2007 and accrued dividends. For Mr. McKinnon, it includes RSUs awarded as part of his 2003 bonus, 2004 bonus and 2005 bonus and accrued dividends and his long-term compensation awards granted in 2004, 2005, 2006, and 2007 and accrued dividends. It also includes RSUs for Mr. Uhlein that were awarded as part of his 2003 and 2005 bonus pursuant to the SubPlan and accrued dividends and his long-term compensation awards granted in 2004, 2005, 2006, and 2007 and accrued dividends. See page 33 for more detailed descriptions of these awards made pursuant to the SubPlan. This column also includes RSUs that were awarded to Mr. Leonard upon his election as Chief Financial Officer in July 2005, his RSUs that were awarded as part of his 2006 bonus pursuant to the SubPlan and accrued dividends, and his long-term compensation awards granted in 2006 and 2007 and accrued dividends.

| (7) | Under Ambac’s Deferred Compensation Plan for Outside Directors, directors may defer their cash compensation. If a director has elected to defer cash compensation into Phantom Stock Units (“PSUs”), these PSUs are shown in this column. For more information on the Deferred Compensation Plan, see page 16. |

9

Did Ambac Insiders Comply with Section 16(a) Beneficial Ownership Reporting in 2006?

Section 16(a) of the Securities Exchange Act of 1934 requires that our insiders—our directors, executive officers, and greater-than-10% stockholders—file reports with the SEC and the New York Stock Exchange on their initial beneficial ownership of Ambac common stock and any subsequent changes. Our insiders must also provide us with copies of the reports.

We reviewed copies of all reports furnished to us and obtained written representations from our insiders that no other reports were required. Based on this, we believe that all of our insiders complied with their filing requirements for 2006, except that, due to administrative error, the settlement of a restricted stock unit award made to Mr. Shoback on November 27, 2006 was not timely reported. The filing was made one day later than required under SEC reporting rules.

10

The Board oversees the business of Ambac and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed by discussing matters with the Chief Executive Officer, other key executives and our principal external advisors (legal counsel, outside auditors, investment bankers and other consultants) by reading the reports and other materials that they request or that we send them regularly and by participating in Board and committee meetings.

The Board usually meets five times per year in regularly scheduled meetings, but will meet more often if necessary. The Board met five times during 2006. All directors attended at least 81% of the Board meetings and meetings of the committees of which they were members.

Each of our directors also serves as a director of our principal operating subsidiary, Ambac Assurance Corporation, a leading triple-A rated financial guarantee insurance company.

Ambac’s Corporate Governance Guidelines express the Board’s belief that a substantial majority of Ambac’s directors should qualify as “independent” directors under the guidelines of the New York Stock Exchange (“NYSE”). In accordance with NYSE rules, the Board affirmatively determines the independence of each Director and nominee for election as a Director in accordance with its Policy Regarding Determination of Independence (“Director Independence Policy”), which includes all elements of independence as set forth in the NYSE listing standards. The Director Independence Policy is attached to this proxy statement as Appendix A and is also appended to Ambac’s Corporate Governance Guidelines available atwww.ambac.com. Under the Director Independence Policy, a director is not independent if he or she has a direct or indirect material relationship with Ambac. The Governance Committee annually reviews the relationships that each director has with Ambac. In conducting this review, the Governance Committee considers all relevant facts and circumstances, including the director’s commercial, banking, consulting, legal, accounting, charitable and familial relationships and such other criteria as the Governance Committee may determine from time to time.

Following such annual review, the Governance Committee reports its conclusions to the full Board, and only those directors whom the Board affirmatively determines to have no material relationship with Ambac and otherwise satisfy the Director Independence Policy are considered independent directors.

Based on the review and recommendation of the Governance Committee, the Board has determined that the following directors are independent within the meaning of Ambac’s Director Independence Policy: Michael A. Callen, Jill M. Considine, Thomas C. Theobald, Laura S. Unger and Henry D.G. Wallace. The Board also determined that each of Robert J. Genader, Phillip B. Lassiter, and W. Grant Gregory has a material relationship with Ambac based on the following: in the case of Mr. Genader, he serves as our President and Chief Executive Officer; in the case of Mr. Lassiter, he served as Ambac’s Chief Executive Officer until January 27, 2004; and, in the case of Mr. Gregory, he is now the President of Operations for an affiliate of a company, with which Ambac has a significant commercial relationship. Messrs. Genader, Lassiter and Gregory are deemed by the Board not to be independent under Ambac’s Director Independence Policy. The Board has further determined that, if elected, Mr. Duff would be independent within the meaning of Ambac’s Director Independence Policy.

11

The Board has three standing committees: the Audit and Risk Assessment Committee, the Compensation Committee and the Governance Committee. None of the directors who serve as members of these committees is, or has ever been, an employee of Ambac or our subsidiaries. All of the directors, who serve as members of these committees, are independent in accordance with the rules of the NYSE and Ambac’s Director Independence Policy.

| The Audit and Risk Assessment Committee | The Audit and Risk Assessment Committee (i) selects the independent auditors, (ii) approves the scope of the annual audit by the independent auditors and our internal auditors, (iii) reviews audit findings and accounting policies, (iv) pre-approves all audit, audit-related and other services, if any, to be provided by the independent auditors, (v) assesses the adequacy of internal controls and risk management, (vi) reviews and approves Ambac’s financial disclosures and (vii) oversees compliance with Ambac’s Code of Business Conduct.

Additionally, the Audit and Risk Assessment Committee reviews and monitors the adequacy of Ambac’s portfolio risk management, which includes reviewing (i) its adversely classified credits, (ii) the sufficiency of its loss reserves and (iii) its economic risk capital. The Audit and Risk Assessment Committee also reviews compliance with risk management and underwriting policies related to Ambac’s insured book of business, derivatives business and investment portfolios. The Audit and Risk Assessment Committee also meets privately, outside the presence of Ambac management, with both the independent auditors and the internal auditors. The Audit and Risk Assessment Committee’s Report for 2006 is printed below at pages 22 and 23.

Four out of five of our members of the Audit and Risk Assessment Committee qualify as “audit committee financial experts” as such term is defined in the applicable SEC regulations. For a list of “audit committee financial experts”, please see the “Audit and Risk Assessment Committee Report on page 22.

The Board has adopted a written charter for the Audit and Risk Assessment Committee. A copy of the Charter is available at our website:http://www.ambac.com. A copy of the Audit and Risk Assessment Committee Charter is also available to stockholders free of charge on request to Anne Gill Kelly, our Corporate Secretary, at 212-208-3355 orakelly@ambac.com.

The Audit and Risk Assessment Committee met eight times during 2006.

Messrs. Callen, Theobald and Wallace, Ms. Considine and Ms. Unger currently serve as members of the Audit and Risk Assessment Committee. Mr. Wallace serves as Chair of the Audit and Risk Assessment Committee. |

12

| The Governance Committee | The Governance Committee is responsible for monitoring Ambac’s corporate governance policies and procedures and identifying, evaluating and recommending qualified candidates to the Board for election as directors. Through its monitoring of Ambac’s corporate governance policies and procedures, it is responsible for making recommendations concerning the size, committee structure, composition of the Board and committees, fees for the Board and criteria for retention of directors.

The Governance Committee will consider individuals recommended by stockholders for nomination as a director in accordance with the procedures described on page 61 under “Information About Stockholder Proposals.”

The Governance Committee reviews with the Board on an annual basis the appropriate skills and characteristics required of Board members in the context of the then-current composition of the Board. This assessment includes, in addition to the qualities of intellect, integrity and judgment, diversity, a strong understanding of finance and senior management experience.

The Governance Committee evaluates all nominees for director based on these criteria, including nominees recommended by stockholders. Under the Governance Committee’s charter, the Governance Committee has the sole authority to retain and terminate any search firm used to identify director candidates and to approve the fees and other retention terms for such firm.

At the direction of the Chair of the Governance Committee, each director was asked to identify potential board candidates with finance experience. Mr. Gregory provided the name of Philip N. Duff to the Governance Committee to consider for inclusion in a list of potential directors. After the Governance Committee reviewed the list of potential director candidates submitted by all of the directors, the Governance Committee determined that Mr. Duff best fit its criteria. The Governance Committee Chair then asked several members to meet with Mr. Duff as a director candidate. All Committee members who met with Mr. Duff recommended him as a potential director to the Committee. The Committee, in turn, unanimously recommended to the full Board that Mr. Duff be nominated for election. The Board followed the Committee’s recommendation.

The Board has adopted a written charter for the Governance Committee. A copy of the Governance Committee charter is available at our website:http://www.ambac.com. A copy of the Governance Committee charter is also available to stockholders free of charge on request to Anne Gill Kelly, our Corporate Secretary, at 212-208-3355 or atakelly@ambac.com.

The Governance Committee met six times during 2006.

Messrs. Callen, Theobald and Wallace and Ms. Considine and Ms. Unger currently serve as members of the Governance Committee. Ms. Considine serves as Chair of the Governance Committee. |

13

| The Compensation Committee | The Compensation Committee oversees Ambac’s compensation and employee benefit plans and practices. As outlined in its Charter, the Compensation Committee (i) evaluates the performance of the Named Executive Officers (the “NEOs”), including the Chief Executive Officer and determines and approves the compensation of each of them; (ii) determines and approves the compensation of all other executive officers; (iii) reviews and evaluates succession planning for the Chairman, CEO and other key management positions; (iv) administers the Ambac 1997 Equity Plan and has the sole authority for awards made under the plan; (v) administers the Ambac 1997 Executive Incentive Plan (the “EIP”), the Ambac Deferred Compensation Plan for Outside Directors and the Ambac 1997 Senior Officer Deferred Compensation SubPlan of the 1997 Equity Plan (the “SubPlan”); and (vi) evaluates existing and proposed employee benefit plans and approves all substantive plan changes. | |

| The Compensation Committee also provides oversight in the development, implementation and effectiveness of Ambac’s Human Resources function, including but not limited to those policies and strategies regarding retention, career development and progression, diversity and other employment practices. The Compensation Committee is also responsible for periodically reviewing Ambac’s plans regarding succession of senior management. | ||

| The Committee has engaged Johnson Associates, an outside human resources consulting firm, to provide peer company compensation data and conduct an annual review of its total compensation program for its executive officers. Management also provides information and proposals for the committee’s consideration. While the CEO and the SVP, HR attend Committee meetings regularly by invitation, the Committee is the final decision maker for the NEOs’ and other executive officers’ compensation. The Committee also considers certain matters in executive session. The Committee’s Chairman reports to the Board on actions taken at each meeting. The Committee has authority to retain, approve fees for and terminate independent advisors to assist in fulfillment of its responsibilities. | ||

The Board has adopted a written charter for the Compensation Committee. A copy of the charter is available at our website:http://www.ambac.com. A copy of the Compensation Committee charter is also available to stockholders free of charge on request to Anne Gill Kelly, our Corporate Secretary, at 212-208-3355 or atakelly@ambac.com.

The Compensation Committee met three times during 2006.

Messrs. Callen, Theobald and Wallace, Ms. Considine and Ms. Unger currently serve as members of the Compensation Committee. Mr. Callen serves as Chair of the Compensation Committee. | ||

14

| Annual Cash Fee | We compensate directors who are not employees of Ambac or our subsidiaries with an annual cash fee of $80,000 per year. | |

| Non-Executive Chairman Fee | Phillip B. Lassiter served as Chairman of the Board and Chief Executive Officer of Ambac from our initial public offering in 1991 until his retirement on January 27, 2004. Mr. Lassiter continued to serve Ambac as Non-Executive Chairman of the Board from January 27, 2004 until July 24, 2006 when he resigned as Ambac’s Non-Executive Chairman. For his service as Non-executive Chairman from January 1, 2006 to July 24, 2006, Mr. Lassiter was paid $141,984, a pro rated portion of his $250,000 annual Non-Executive Chairman fee. | |

| Annual Award of Restricted Stock Units | On the date of the Annual Meeting, we grant each non-employee director an annual award of restricted stock units (“RSUs”) equal to (A) $60,000 divided by (B) the closing price of a share of Common Stock as reported on the New York Stock Exchange. The RSUs will accumulate dividend equivalents during the restricted period. The RSUs generally will vest on the first anniversary of the date of the grant and will be settled by the delivery of one share of Ambac common stock for each RSU. | |

| Award of Restricted Stock Units Every Five Years | Ambac also grants each non-employee director RSUs equal to (A) $210,000 divided by (B) the closing price of a share of Common Stock as reported on the NYSE on the date of the Annual Meeting at which the director is first elected to the Board.

· These RSUs will accumulate dividend equivalents during the restricted period. These RSUs generally will vest on the date of the Annual Meeting held in the fifth year following the date of grant and will be settled by the delivery of one share of Ambac common stock for each RSU. However, if a director (i) is required to retire due to Ambac’s mandatory retirement policy, (ii) retires at 62 after five or more years of service on Ambac’s Board of Directors or (iii) ceases to be a member as a result of death or permanent disability or a Change in Control of Ambac, unvested RSUs will vest and be settled as soon as practicable after the director’s termination on the Board.

· If the non-employee director remains on the Board after the first award of RSUs vests, Ambac will grant the director a second award of RSUs, valued at $210,000 subject to similar vesting conditions and restrictions on transfer. | |

| Presiding Director Fee | We also pay an annual fee of $25,000 to Ambac’s Presiding Director. For more information regarding the Presiding Director please see page 19 below. | |

| Fee for Chairing a Committee | We pay an annual fee of $10,000 to each non-employee director who chairs either the Governance Committee or the Compensation Committee. If a non-employee director chairs the Audit and Risk Assessment Committee, he or she earns an annual fee of $20,000. | |

| No Committee or Meeting Fees | We do not pay our non-employee directors additional fees for participating on committees of the Board or attending meetings of the Board or of the committees on which they serve. | |

15

| Expenses and Benefits | Ambac reimburses all directors for travel and other related expenses incurred in attending stockholder, Board and committee meetings. We provide non-employee directors with life and health insurance benefits, if they so elect. We also allow them to participate in our Matching Gift Program, under which Ambac will match gifts by non-employee directors to qualified organizations up to $20,000 per year. | |

| The Deferred Compensation Plan | Under the Ambac Deferred Compensation Plan for Outside Directors, non-employee directors may elect to defer all or part of their director compensation that is paid in cash.

· At the director’s election, we credit deferrals to a bookkeeping account that we maintain on the director’s behalf either as a cash credit(which we credit with interest quarterly at a 90-day commercial paper composite rate published by the Federal Reserve Bank), or as phantom stock units (“PSUs”) based on the market value of Ambac’s common stock(which we credit with quarterly dividend equivalents in additional PSUs) or as performance units measured by the performance of those mutual funds the director selects out of a limited group of funds.

· We do not fund the Ambac Deferred Compensation Plan for Outside Directors. We settle accounts only in cash. | |

| Service on the Ambac Assurance Board | Ambac Assurance does not pay its non-employee directors an annual fee or any other fee for serving on its Board of Directors. | |

| Directors who are Ambac Employees | We do not compensate our employees or employees of our subsidiaries for service as a director. We do, however, reimburse them for travel and other related expenses. | |

| Director Compensation Table | Name(a) | Fees Earned or Paid in Cash ($)(b)(1) | Stock Awards ($)(c)(2) | Option Awards ($)(d)(3) | All Other ($)(g)(4) | Total ($)(h) | ||||||

| Michael A. Callen | 98,009 | 180,501 | 0 | 0 | 278,510 | |||||||

| Jill M. Considine | 90,000 | 310,500 | 0 | 14,200 | 414,700 | |||||||

| W. Grant Gregory | 103,658 | 180,501 | 0 | 15,000 | 299,159 | |||||||

| Phillip B. Lassiter | 221,984 | 268,500 | 0 | 15,000 | 505,484 | |||||||

| Thomas C. Theobald | 80,000 | 102,000 | 0 | 15,000 | 197,000 | |||||||

| Laura S. Unger | 80,000 | 95,952 | 0 | 15,030 | 190,982 | |||||||

| Henry D.G. Wallace | 93,333 | 102,000 | 0 | 0 | 195,333 | |||||||

(1) This amount includes any fees deferred by our directors into Phantom Stock Units (“PSUs”) pursuant to Ambac’s Director Deferred Compensation Plan.

In addition to the annual retainer of $80,000 paid to each of our directors:

· Michael Callen earned an additional $6,667, prorated, for his role as Chairman of the Audit and Risk Assessment Committee (term ended on May 2, 2006); an additional $6,667, prorated, for his role as Chairman of the Compensation Committee (term commenced on May 2, 2006) and an additional $4,675, prorated, for his role as Presiding Director (term commenced on October 23, 2006). | ||

16

· Phillip Lassiter received an additional prorated annual fee of $141,984 for his services as Non-Executive Chairman for the period from January 1, 2006 through July 24, 2006.

· Jill Considine earned an additional $10,000 for her role as Chairman of the Governance Committee.

· W. Grant Gregory earned an additional $3,333, prorated, for his role as Chairman of the Compensation Committee (term ended on May 2, 2006) and an additional $20,325, prorated, for his role as Presiding Director (term ended on October 23, 2006).

· Henry D. G. Wallace earned an additional $13,333, prorated, for his role as Chairman of the Audit and Risk Assessment Committee (term commenced on May 2, 2006).

(2) Represents the compensation costs for financial reporting purposes for the year under FAS 123R. See Note 13 to the Audited Financial Statements contained in Ambac’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006 for the assumptions made in determining FAS 123R values. There can be no assurance that the FAS 123R amounts will be realized. Column (c) of the Director Compensation Table includes a portion of each director’s five year restricted stock award. The five year grants reflected in the Table for Messrs: Lassiter, Wallace and Theobald and Ms. Considine have a grant date fair value of $210,000.(See above on page 15 for a more detailed description of these awards.) The five year grants reflected in the Table for Messrs. Callen and Gregory and Ms. Unger have a grant date fair value of $195,885, $195,885 and $179,760, respectively. In addition, the amounts for Messrs. Callen, Gregory and Lassiter and Ms. Considine include accelerated costs due to unvested amounts being recognized in 2006 because they are eligible for immediate vesting at retirement.

The grant date fair value of the 2006 award made to each non-employee director was $60,000. In 2006, this was the only award made to each director.

At December 31, 2006, the aggregate number of restricted stock units (“RSUs”) outstanding was: Mr. Callen—9,539 RSUs; Ms. Considine—7,851 RSUs; Mr. Gregory—8,657 RSUs; Mr. Lassiter—3,833 RSUs; Mr. Theobald—4,488 RSUs; Ms. Unger—4,705 RSUs and Mr. Wallace—3,833 RSUs.

Of the RSUs reported above, the following RSUs were vested but deferred: Mr. Callen—5,695 RSUs; Ms. Considine—4,023 RSUs; Mr. Gregory—4,813 RSUs; Mr. Lassiter—0 RSUs; Mr. Theobald—660 RSUs; Ms. Unger—882 RSUs and Mr. Wallace—0 RSUs.

(3) No stock options have been granted since May 2003, as the stock option program for directors was discontinued in 2004. All expenses related to the stock options were previously reported. Aggregate total numbers of stock option awards outstanding are shown below. All outstanding stock options have vested.

At December 31, 2006, the aggregate number of stock option awards outstanding was: Mr. Callen—15,000 options; Ms. Considine—15,626 options; Mr. Gregory—15,000 options and Ms. Unger—5,938 options.

(4) The amounts shown represent matching corporate contributions made by Ambac on behalf of the directors to charitable organizations under the Ambac Matching Gifts Program. |

17

| Director Stock Ownership Guidelines | In May 2004, Ambac’s Governance Committee established stock ownership requirements for its directors. Ambac now requires each director to own, within five years of first being elected, shares of Ambac Common Stock having a value equal to at least five times the director’s annual cash retainer. Messrs. Callen, Gregory, Lassiter, Wallace and Theobald and Ms. Considine have all met their stock ownership requirements. Ms. Unger, who has not yet been a member of the Board for five years, has made significant progress toward her ownership target of $400,000, currently owning a value of $383,222. | |

18

| In General | Our Board of Directors has maintained corporate governance policies for many years. We have reviewed internally and with the Board the provisions of the Sarbanes-Oxley Act of 2002, the rules of the SEC and the NYSE’s listing standards regarding corporate governance policies and processes and are in compliance with the rules and listing standards. We have adopted charters for our Compensation Committee, Audit and Risk Assessment Committee and Governance Committee consistent with the applicable rules and standards. In December 2006, the Governance Committee made certain revisions to the Corporate Governance Guidelines. A copy of the revised Corporate Governance Guidelines is available at our website:http://www.ambac.com. A copy of the Corporate Governance Guidelines is also available to stockholders free of charge on request to Anne Gill Kelly, our Corporate Secretary, at 212-208-3355 or atakelly@ambac.com. | |

| Presiding Independent Director | On an annual basis, the non-employee Directors will select a non-employee member of the Board to serve as the Presiding Director. The Presiding Director shall be independent as defined under the listing standards of the New York Stock Exchange. In October 2006, the non-employee directors appointed Michael Callen to serve as the Presiding Director. Mr. Callen replaced W. Grant Gregory who was appointed in May 2006, due to Mr. Gregory’s new employment as the President of Operations for an affiliate of a company with which Ambac has a significant commercial relationship. As a result of his new employment relationship, Mr. Gregory was determined to no longer be independent.

The Presiding Director has the following duties: | |

· Chair all meetings of the Board at which the Chairman is not present;

· Meet with the CEO for a preliminary review of financial results and to establish and approve agenda items for the next regular meeting;

· Coordinate and develop the executive session agenda and chair all executive sessions of non-employee and independent Directors;

· Consult with the CEO regarding information to be provided to the Directors, providing feedback on its quality, quantity and timeliness;

· Act as the principal liaison between the independent Directors and the CEO on sensitive issues and provide comments, suggestions, feedback and other information to the CEO after executive sessions;

· Confer with the CEO on issues of heightened importance that may involve action by the Board; | ||

19

· Communicate to the CEO, the results of the Compensation Committee’s annual performance evaluation of the CEO;

· Retain, at the Board’s direction, outside advisors and consultants who directly report to the Board of Directors;

· Work with the Governance Committee and the CEO to identify the Board’s compositional needs and criteria for Director candidates;

· Be available, as appropriate, for direct communication with major stockholders;

· In the event of the incapacity of the CEO, direct the Secretary of the Company to take all necessary and appropriate action to call a special meeting of the Board; and

· Perform such other duties as may reasonably be requested by the Board in furtherance of the Board’s duties and responsibilities. | ||

| Non-Employee Director Meetings | Pursuant to Ambac’s Corporate Governance Guidelines, non-employee directors will meet regularly following the Board meetings to discuss, without the presence of management, those items presented at the previous Board and Committee meetings. In addition, if any non-employee directors are not independent, then the independent directors shall schedule an independent director session at least once per year. The Presiding Director leads the non-employee board sessions and independent director sessions. The non-employee directors held five meetings in 2006, one of which consisted solely of the independent non-employee directors.

Ambac’s non-employee directors also hold executive sessions without management during Committee meetings to address various matters, including the report of the independent auditor, the review of the CEO and the Chairman succession plans, the criteria upon which the performance of the CEO and other senior managers is assessed, the performance of the CEO against such criteria, the compensation of the CEO, and other relevant matters. These Committee executive sessions are led by the Chair of the Committee for which the executive session is held. | |

| Other Corporate Governance Highlights | · Our practice has always been to have a substantial majority (75%) of non-employee independent directors. | |

· Since becoming a public company in 1991, only non-employee independent directors have comprised our Audit and Risk Assessment, Compensation and Governance Committees. | ||

· All of the members of the Audit and Risk Assessment Committee meet the NYSE standards for financial literacy. | ||

20

· Four out of five of our members of the Audit and Risk Assessment Committee qualify as “audit committee financial experts” as such term is defined in the applicable SEC regulations. For a list of “audit committee financial experts”, please see page 22 under “Audit and Risk Assessment Committee Report.” | ||

· Our Corporate Governance Guidelines provide that no director may serve on the board of more than five public companies, including Ambac. The CEO of Ambac may not serve on the board of more than three public companies, including Ambac. | ||

· Our Audit and Risk Assessment Committee hires, determines the compensation of, and decides the scope of services performed by, our independent auditors. It also has the authority to retain outside advisors. | ||

· No member of the Audit and Risk Assessment Committee may serve on more than three public companies’ audit committees, including the Audit and Risk Assessment Committee of Ambac. | ||

· Our Compensation Committee has the authority to retain independent consultants, and, in fiscal 2006, engaged Johnson Associates, Inc. to assist it. It also evaluates the performance of the Chief Executive Officer and discusses the evaluation with all non-employee directors in executive session. | ||

· Our Board policy opposes, and the Ambac 1997 Equity Plan prohibits, the re-pricing of our outstanding stock options. Further, the Board does not, and has not permitted, backdating of stock options. | ||

· Our Board has adopted a Code of Conduct applicable to all directors, officers and employees that sets forth basic principles to guide their day-to-day activities. The Code of Conduct addresses, among other things, conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of company assets (including computer and telecommunications resources), media contact and public discussion, compliance with laws and regulations (including insider trading laws) and reporting illegal or unethical behavior. A copy of the Code of Conduct is available at our website:http://www.ambac.com. A copy of the Code of Conduct is also available to stockholders free of charge on request to Anne Gill Kelly, our Corporate Secretary, at 212-208-3355 or atakelly@ambac.com. | ||

· Ambac’s Non-Employee Directors Equity Plan awards only restricted stock unit awards to directors. | ||

21

THE AUDITAND RISK ASSESSMENT COMMITTEE REPORT

The Audit and Risk Assessment Committee of Ambac is responsible for providing independent, objective oversight of Ambac’s accounting functions and internal controls and risk management. The Audit and Risk Assessment Committee selects the independent auditors. The Audit and Risk Assessment Committee is currently composed of five independent directors, each of whom is independent as defined under the rules of the NYSE. In accordance with Section 407 of the Sarbanes-Oxley Act of 2002, Ambac has identified the following four members of the Audit and Risk Assessment Committee as “audit committee financial experts”: Messrs. Callen, Theobald and Wallace and Ms. Considine.

The Audit and Risk Assessment Committee operates under a written charter adopted by the Board of Directors. A copy of the charter is available at Ambac’s website:http://www.ambac.com. The Audit and Risk Assessment Committee regularly reviews its charter to ensure that it is meeting all relevant Audit and Risk Assessment Committee policy requirements of the SEC, the Public Company Accounting Oversight Board and the NYSE.

Management is responsible for the preparation, presentation and integrity of Ambac’s financial statements, accounting and financial reporting principles and the establishment and effectiveness of internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for performing an independent audit of Ambac’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States), expressing an opinion, based on their audit, as to whether the financial statements fairly present, in all material respects, the financial position, results of operation and cash flows of Ambac in conformity with generally accepted accounting principles and auditing management’s assessment of and the effective operation of internal control over financial reporting. The Audit and Risk Assessment Committee’s responsibility is to monitor and oversee these processes. However, none of the members of the Audit and Risk Assessment Committee is professionally engaged in the practice of accounting or auditing nor are all of our members experts in those fields. The Audit and Risk Assessment Committee relies without independent verification on the information provided to it and on the representations made by management and the independent auditors.

We held eight meetings during 2006. The meetings were designed, among other things, to facilitate and encourage communication among the Audit and Risk Assessment Committee, management, the internal auditors and Ambac’s independent auditors, KPMG LLP, an independent registered public accounting firm. We discussed with Ambac’s internal auditors and KPMG LLP the overall scope and plans for their respective audits. We met with the internal auditors and KPMG LLP, with and without management present, to discuss the results of their examinations and their evaluations of Ambac’s internal controls.

We have reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2006 with management, the internal auditors and KPMG LLP. We also discussed with management and KPMG LLP the process used to support certifications by Ambac’s Chief Executive Officer and Chief Financial Officer that are required by the SEC and the Sarbanes-Oxley Act of 2002 to accompany Ambac’s periodic filings with the SEC.

We also discussed with KPMG LLP matters required to be discussed with audit committees under auditing standards, including, among other things, matters related to the conduct of the audit of Ambac’s consolidated financial statements and the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

22

KPMG LLP also provided to us the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and we discussed with them their independence from Ambac. When determining KPMG LLP’s independence, we considered whether their provision of services to Ambac beyond those rendered in connection with their audit of Ambac’s consolidated financial statements and reviews of Ambac’s consolidated financial statements included in its Quarterly Reports on Form 10-Q was compatible with maintaining their independence. We also reviewed, among other things, the audit and non-audit services performed by, and the amount of fees paid for such services to, KPMG LLP. The Committee concluded that KPMG LLP, an independent registered public accounting firm, is independent from Ambac and its management.

Based upon the review and discussions referred to above, we recommended to the Board of Directors, and the Board of Directors has approved, that Ambac’s audited financial statements be included in Ambac’s Annual Report on SEC Form 10-K for the year ended December 31, 2006. We also selected KPMG LLP, an independent registered public accounting firm, as Ambac’s independent auditors for 2007.

| The Audit and Risk Assessment Committee | ||

Henry D.G. Wallace,Chairman Michael Callen Jill M. Considine Thomas C. Theobald Laura S. Unger | ||

March 21, 2007 | ||

23

INFORMATION ABOUTTHE EXECUTIVE OFFICERS

These are the biographies of Ambac’s current executive officers, except for Mr. Genader, Ambac’s Chairman, President and Chief Executive Officer, whose biography is included below at page 56 under “Proposal 1: Elect Eight Directors.”

Douglas C. Renfield- Miller Age 53 | Executive Vice President In July 2006, Mr. Renfield-Miller was named Executive Vice President of Ambac and Ambac Assurance. From January 2004 to July 2006, Mr. Renfield-Miller served Ambac and Ambac Assurance as a Senior Managing Director. He also has served as the Chairman of Ambac Assurance UK Limited since April 2005. Mr. Renfield-Miller is responsible for Ambac’s international offices encompassing London, Milan, Sydney and Tokyo. Prior to moving to London Mr. Renfield-Miller worked in New York overseeing Ambac’s Structured Credit, Commercial ABS, Derivatives and Investment Agreement businesses as well as Ambac’s operations in the Asia/Pacific Region and the Emerging Markets. Mr. Renfield-Miller joined Ambac and Ambac Assurance in April, 2000 as a Managing Director. Before joining Ambac, Mr. Renfield-Miller was a Managing Director with UBS’ Principal Finance and Credit Arbitrage group. Mr. Renfield-Miller joined UBS in 1987 and had also served in various other management positions in New York and Zurich during his 13-year career, including Head of Structured Finance in the Americas and Global Advisor for Structured Finance. | |

John W. Uhlein III Age 50 | Executive Vice President Since December 2003, Mr. Uhlein has served as an Executive Vice President of Ambac and Ambac Assurance. He is responsible for the commercial and consumer Asset-Backed Securities, Leasing and Asset Finance, Conduits, Structured Energy, Structured Insurance, Student Loans, Utilities and Emerging Markets groups. From 1996 through April 2005, Mr. Uhlein ran Ambac’s European operations based in London and served as Chairman of Ambac Assurance UK Limited, Ambac’s international triple-A rated financial guarantee subsidiary. He was also responsible for Ambac’s Consumer Asset-Backed, Global Utilities, Conduit and Structured Insurance Groups. From January 1996 to December 2003, Mr. Uhlein was a Managing Director. Mr. Uhlein joined Ambac in September 1993 as a First Vice President and spearheaded Ambac’s expansion into the international markets in 1994. Prior to joining Ambac, Mr. Uhlein was a Managing Director at Financial Security Assurance in its international department. | |

Gregg L. Bienstock Age 42 | Senior Vice President, Chief Administrative Officer and Employment Counsel Since January 2005, Mr. Bienstock has served as Senior Vice President, Chief Administrative Officer and Employment Counsel of Ambac and Ambac Assurance. From January 1999 to January 2005, Mr. Bienstock | |

24

| served as Managing Director, Human Resources and Employment Counsel of Ambac and Ambac Assurance. Mr. Bienstock has executive responsibility for Human Resources, Corporate Governance, Global Marketing, Administration and Technology. Mr. Bienstock served as First Vice President, Director of Human Resources and Employment Counsel of Ambac and Ambac Assurance from February 1997 to January 1999. Mr. Bienstock joined Ambac from the Bristol Myers-Squibb Corporation, where he served as a Director of Human Resources from February 1996 to February 1997. From September 1993 to February 1996, Mr. Bienstock was an associate with the New York law firm of Proskauer Rose LLP. Prior to joining Proskauer, from April 1992 to September 1993, Mr. Bienstock was an Assistant General Counsel for the Mayor’s Office of Labor Relations for the City of New York. | ||

Kevin J. Doyle Age 50 | Senior Vice President and General Counsel In January 2005, Mr. Doyle was named Senior Vice President and General Counsel of Ambac and Ambac Assurance. Since January 2000, Mr. Doyle has served as General Counsel of Ambac and Ambac Assurance and Ambac’s Chief Legal Officer. Mr. Doyle also has executive responsibility for internal audit. In January 2000, Mr. Doyle was named Managing Director and General Counsel of Ambac and Ambac Assurance. From January 1996 to January 2000, Mr. Doyle served as the Managing Director and General Counsel of the Specialized Finance Division of Ambac Assurance. Mr. Doyle served as First Vice President and General Counsel of the Specialized Finance Division of Ambac Assurance from July 1995 to January 1996. Mr. Doyle joined Ambac Assurance as a Vice President and Assistant General Counsel from the New York law firm LeBoeuf, Lamb, Greene & MacRae in 1991. | |

Thomas J. Gandolfo Age 46 | Senior Managing Director Since June 2005, Mr. Gandolfo has served as a Senior Managing Director of Ambac and Ambac Assurance. He is currently the head of Global Structured Credit, Derivative Products, Fixed Income Investment Management and Risk Transfer groups. Prior to assuming his current responsibilities, Mr. Gandolfo served as Senior Vice President and Chief Financial Officer. As CFO, he oversaw Financial Control, Investment Management and Investor Relations. Mr. Gandolfo joined Ambac in 1994 as Controller of Ambac’s Investment Agreement business. He was promoted to Corporate Controller in July 1998 and CFO in January 2003. Prior to joining Ambac, Mr. Gandolfo spent eight years at PricewaterhouseCoopers LLP and was a Senior Manager in their Financial Services Industry Specialty Unit. | |

Sean T. Leonard Age 42 | Senior Vice President and Chief Financial Officer In June 2005, Mr. Leonard joined Ambac and Ambac Assurance as Senior Vice President and Chief Financial Officer. In addition to his position as Ambac’s Chief Financial Officer, Mr. Leonard also has executive responsibility for managing Ambac’s Investor and Rating Agency Relations. Mr. Leonard came to Ambac from PricewaterhouseCoopers LLP, where he was a partner in their Structured Finance Group and Financial Services Group from July 2000 to June 2005. Before July 2000 | |

25

| Mr. Leonard, served as a Senior Manager for PricewaterhouseCoopers LLP. From July 1998 to June 2000, Mr. Leonard also served as a practice fellow at the Financial Accounting Standards Board. In addition, since June 2005, Mr. Leonard has served as Chair of the Finance Committee of the Association of Financial Guarantors. | ||

Kathleen A. McDonough Age 52 | Senior Managing Director Since January 2004, Ms. McDonough has served as a Senior Managing Director of Ambac and Ambac Assurance. She is responsible for the Public Finance Division’s West Region and General Municipal Underwriting businesses and North American Project Finance. She served as a Managing Director in the Public Finance Division from January 1996 to January 2004. Prior to January 1996, she served as the General Counsel of the Public Finance Department. She joined Ambac in July 1991 as Vice President and Assistant General Counsel from Orrick, Herrington & Sutcliffe where she was an associate specializing in municipal finance and securities law. | |

William T. McKinnon Age 57 | Senior Managing Director and Chief Risk Officer In January 2004, Mr. McKinnon was named a Senior Managing Director of Ambac and Ambac Assurance. Since February 2000, Mr. McKinnon has served as Ambac’s Chief Risk Officer and is responsible for maintaining the soundness of the book of business through the establishment of policies and procedures and underwriting guidelines for the various business segments. From February 2000 to January 2004, Mr. McKinnon was Managing Director and the Chief Risk Officer. From October 1998 to February 2000, Mr. McKinnon was a Managing Director and Head of Credit Risk Management for the Specialized Finance Division. From January 1992 to October 1998, Mr. McKinnon was a First Vice President in the asset-backed securities department. Mr. McKinnon joined Ambac as a First Vice President in January 1989 where he was responsible for remediation, management of the classified credit process and had oversight for financial institution risk. Prior to joining Ambac, Mr. McKinnon worked at Citibank in various corporate banking capacities for 10 years. | |

Robert G. Shoback Age 47 | Senior Managing Director Since January 2004, Mr. Shoback has served as a Senior Managing Director of Ambac and Ambac Assurance. He is responsible for the Public Finance Division’s East Region, Structured Real Estate Group and Healthcare Group. He served as a Managing Director in the Public Finance Division from November 1998 to January 2004. He joined Ambac in November 1998 from Lehman Brothers where he served as a Senior Vice President in its municipal bond department. Prior to Lehman Brothers, Mr. Shoback had worked in the Public Finance Division at Donaldson, Lufkin & Jenrette from 1986 to 1994. | |

David W. Wallis Age 47 | Senior Managing Director Since July 2005, Mr. Wallis has served as a Senior Managing Director and Head of Portfolio and Market Risk Management of Ambac and Ambac Assurance. He is responsible for the group’s monitoring of individual | |

26

| credit exposures and portfolio trends as well as remediation efforts of stressed credits. From July 1999 to June 2005, Mr. Wallis served Ambac as a Managing Director. Mr. Wallis joined Ambac in the London office in 1996 as a First Vice President where he helped develop and lead our European Structured Finance and Securitization business. In 2003, he transferred to Ambac’s New York headquarters where he was a member of the Credit Risk Management team. Prior to joining Ambac in 1996, he was an investment banker at NatWest in the Debt Structuring Group. |

Employment Agreement with William T. McKinnon

In General | On July 19, 2004, Ambac entered an employment agreement with Mr. McKinnon which expired on July 30, 2006. On January 30, 2007, Ambac entered into a new employment agreement with Mr. McKinnon which will expire on January 30, 2009 (the “Term”) with the following terms: | |

Ambac’s employment agreement with Mr. McKinnon (the “McKinnon Agreement”) provides that he will serve as Senior Managing Director and Chief Risk Officer. | ||

Base Salary | Mr. McKinnon’s base salary shall not be less than $400,000. | |

Special Equity Grant | The Compensation Committee granted Mr. McKinnon 8,595 restricted stock units (“RSUs”) valued at $750,000 based on the Fair Market Value of Ambac’s Common Stock on January 29, 2007, the date of the award grant. All of the RSUs will vest on the third anniversary of the date of the grant (that is, on January 29, 2010); provided however, that if Mr. McKinnon elects to retire any time prior to this third anniversary of the date of grant, only that portion of RSUs proportionate to time worked (defined as the number of whole months worked from the Term through the retirement date divided by thirty-six (36)) will vest. Regardless of when they vest, the RSUs will be delivered to Mr. McKinnon on July 29, 2010 or the six month anniversary of the termination of his employment, whichever is sooner. | |

| Minimum Guaranteed Bonus and Long-Term Incentive Compensation for 2008 and 2009 | Mr. McKinnon is guaranteed a minimum bonus of $800,000 for the 2007 performance year and a minimum bonus of $850,000 for the 2008 performance year. Mr. McKinnon is guaranteed minimum long-term incentive compensation awards under the Equity Plan as follows:

· January 2008: $325,000 in stock options and $425,000 in RSUs; and

· January 2009: $325,000 in stock options and $425,000 in RSUs.

The stock options and RSUs corresponding to such amounts shall be subject to the vesting requirements and other terms and conditions applicable to equity awards made at the same time to Ambac’s other senior executives. | |

27

| Continuation at the End of Term | If Mr. McKinnon’s employment with Ambac continues “at will” following the expiration of the Term, his annual salary will not be decreased during the first year of “at will” employment and Mr. McKinnon will continue to be eligible for a bonus and to participate in the long-term incentive programs of Ambac. | |

Payments and Benefits | If Mr. McKinnon’s employment is terminated by Ambac other than for “Cause”, or if he resigns for “Good Reason” Mr. McKinnon will receive, all compensation provided for in the McKinnon Agreement (as described above) during the Term. If Mr. McKinnon was terminated other than for “Cause”, or if he resigned for “Good Reason”, Mr. McKinnon would receive $4.7 million under the McKinnon Agreement. Other than the special equity award, which would be delivered on July 29, 2010 or the six month anniversary of the termination of the McKinnon Agreement, whichever is earlier, the amount due under his Agreement would be payable in a lump sum. (Since his Agreement was not in place at the end of the fiscal year we have used February 1, 2007 as the potential termination date in calculating this valuation.) | |

— Good Reason | · For purpose of the McKinnon Agreement, “Good Reason” shall mean Ambac’s failure to pay any amount due to Mr. McKinnon under the McKinnon Agreement. | |

— Cause | · For purpose of the McKinnon Agreement, “Cause” means any of the following: (i) the willful commission of acts that are dishonest and demonstrably and materially injurious to Ambac or any of its affiliates; (ii) the conviction of a felonious act resulting in material harm to the financial condition or business reputation of Ambac or any of its affiliates; (iii) a breach of any of the covenants set forth in the Agreement; or (iv) continuous failure to perform his duties as Senior Managing Director and Chief Risk Officer. | |

Change in Control Benefits | All stock options and other awards under the Ambac 1997 Equity Plan that are made to Mr. McKinnon after January 1, 1998 will vest in full upon the occurrence of a “Change in Control” (as defined below), whether or not his employment is subsequently terminated. | |

In addition, if Mr. McKinnon’s employment terminates following a Change in Control, his severance and benefit amounts would be calculated and paid in the same manner as we describe below under “Management Retention Agreements with Executive Officers.”

Mr. McKinnon would also be entitled to the “gross up” payment described in that section. | ||