UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-6302 |

|

Cohen & Steers Realty Shares, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Adam M. Derechin

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2008 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS REALTY SHARES, INC.

To Our Shareholders:

We are pleased to submit to you our report for the year ended December 31, 2008. The net asset value at that date was $37.01 per share. In addition, a regular dividend of $0.658 per share was declared for shareholders of record on December 18, 2008 and was paid on December 19, 2008.a

The total returns, including income and change in net asset value, for the Fund and the comparative benchmarks were:

| | | Six Months Ended

December 31, 2008 | | Year Ended

December 31, 2008 | |

| Cohen & Steers Realty Shares | | | –32.65 | % | | | –34.40 | % | |

| FTSE NAREIT Equity REIT Indexb | | | –35.41 | % | | | –37.73 | % | |

| S&P 500 Indexb | | | –28.47 | % | | | –36.99 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of the Fund current to the most recent month-end can be obtained by visiting our Web site at cohenandsteers.com.

Investment Review

The year was volatile for equities in the United States and around the world. It began with a sell-off driven by a fresh wave of write-downs from major banks, followed by the hastily arranged sale of Bear Stearns to JPMorgan Chase. The shocks kept coming, picking up speed in September with the U.S. government takeover of Fannie Mae and Freddie Mac, Lehman Brothers' bankruptcy and the nationalization of insurance giant AIG.

Amid concerns that the entire financial system could be at risk, the U.S. Congress, Treasury secretary and Federal Reserve chairman structured a $700 billion rescue package that has been used to buy preferred shares in banks to bolster capital and encourage lending. The Fed and other central banks dropped interest rates and implemented stimulus packages in a coordinated effort to break the credit freeze and kick-start the global economy.

a Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes. The final tax treatment of these distributions is reported to shareholders after the close of the calendar year.

b The FTSE NAREIT Equity REIT Index is an unmanaged, market capitalization weighted index of all publicly traded REITs that invest predominantly in the equity ownership of real estate. The index is designed to reflect the performance of all publicly traded equity REITs as a whole. The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance.

1

COHEN & STEERS REALTY SHARES, INC.

REITs in line with the broad stock market

Real estate securities had a positive year-to-date return through September, outperforming the broad stock market by a substantial margin before declining in the fourth-quarter sell-off. For the year, they performed in line with the S&P 500 Index. Given a weakening economy and tight credit, the market further downgraded property value estimates—although the absence of transactions has made it increasingly difficult to support those estimates. Investors questioned whether real estate companies would be able to refinance maturing debt on favorable terms.

Most property sectors had double-digit declines for the year. REITs with the strongest balance sheets generally outperformed the index, especially in the fourth quarter. The self storage sector (which had a total return of +5.1% for the year) was the only sector to post a gain; it is dominated by Public Storage, a company with a debt-free balance sheet. Health care (–12.0%) was cushioned by its perceived defensive nature. The apartment sector (–25.1%) also outperformed, due to relatively favorable fundamentals—demand for rental property was supported by weakness in the housing and mortgage markets.

The industrial sector (–67.5%), which contained certain companies (such as ProLogis) whose business models were more dependent on transactional income, had the poorest performance, as the absence of financing affected their ability to find buyers, and declining cash flows weakened balance sheets. The regional mall sector (–60.6%) was hurt by retailer bankruptcy liquidations and moderating consumer spending. The shopping center sector (–38.8%), which is more represented by consumer staples retailers, performed in line with the index. The office sector (–41.1%) struggled, with particular weakness among companies focused on areas with large financial services industries.

The Fund had a steep decline

The Fund declined in a poor year for real estate securities, although it outperformed its benchmark. Stock selection contributed to relative return in most sectors, particularly the regional mall, industrial, hotel and shopping center sectors. We attribute this to our focus on companies with little development exposure and durable earnings streams. In the regional mall sector, stock selection benefited from our decision to exit General Growth Properties in the second half of the period, when our analysis of its balance sheet indicated that the company faced unavoidable distress. The stock lost nearly all of its value for the year. Our underweight in the industrial sector and overweight in self storage also helped returns.

Factors that hindered relative performance included our underweight in health care; we viewed the premium on its defensiveness as excessive. Our overweight in the regional mall sector detracted from performance, more than countering the stock selection effect. Our overweight and stock selection in the office sector hampered performance; this was largely due to the poor performance of Maguire Properties. The stock was hurt by concerns over the company's debt and its presence in Orange County, California, a market threatened by mortgage-related declines in employment.

2

COHEN & STEERS REALTY SHARES, INC.

Investment Outlook

We expect to see an average 4% decline in cash flows over the next year (more bearish views on equities in the S&P 500 Index suggest a 12% drop). However, this reflects softening demand, not oversupply, which in some past cycles weighed heavily on real estate companies. Given this outlook for fundamentals, vacancy rates are likely to rise, but not reach the highs seen in previous difficult cycles.

Until banks start lending again, and as long as the windows for unsecured bonds and commercial mortgage-backed securities stay closed, REIT balance sheets will remain under pressure. That said, we believe that the vast majority of these companies are structurally sound, and that they will have sufficient operating capital to navigate 2009 successfully. Some real estate companies may cut dividends to preserve cash and strengthen their balance sheets; others may recapitalize through dilutive equity offerings. At some point, the lending environment will improve as banks reconsider the opportunity costs of holding cash and investing in low-yield securities.

In our view, much pessimism has already been factored into U.S. REIT share prices, which are trading at cash flow multiples at the lower end of the range seen over the past two decades. As investors seek higher income and returns, they may target real estate securities, which had an average dividend yield of 7.6% at the end of the period, compared with 3.2% for the S&P 500 Index and a yield of 2.3% for the 10-year Treasury.

A focus on balance sheets

We favor companies with strong balance sheets and visible, relatively stable earnings. At the same time, we recognize that there are an increasing number of attractive risk-adjusted investment opportunities with companies that have been, in our view, unduly punished in the past year's "flight to safety." We view with interest those companies that have adapted to the current environment and are following through on their strategies. Although some are priced at distressed levels (with stock multiples as low as 2x future cash flows), we believe very few companies will fail, and many will produce outstanding returns in time. To that end, we have increased the number of holdings in the portfolio in order to take advantage of the higher potential total returns these companies offer.

3

COHEN & STEERS REALTY SHARES, INC.

| |  | |

|

| MARTIN COHEN | | ROBERT H. STEERS | |

|

| Co-chairman | | Co-chairman | |

|

| |  | |

|

| JOSEPH M. HARVEY | | JON CHEIGH | |

|

| Portfolio Manager | | Portfolio Manager | |

|

The views and opinions in the preceding commentary are subject to change. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about any of our funds, visit cohenandsteers.com, where you will find daily net asset values, fund fact sheets and portfolio highlights. You can also access newsletters, education tools and market updates covering the global real estate, listed infrastructure, utilities, large cap value and preferred securities sectors.

In addition, our Web site contains comprehensive information about our firm, including our most recent press releases, profiles of our senior investment professionals and an overview of our investment approach.

4

COHEN & STEERS REALTY SHARES, INC.

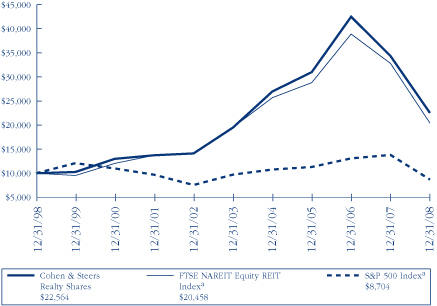

Performance Review (Unaudited)

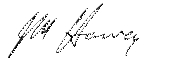

Growth of a $10,000 Investment

Average Annual Total Returns For the Periods Ended December 31, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Since Inceptionb | |

| Fund | | | –34.40 | % | | | 2.95 | % | | | 8.48 | % | | | 10.54 | % | |

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month-end can be obtained by visiting our Web site at cohenandsteers.com. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The annual expense ratio as reported in the prospectus dated May 1, 2008 was 0.95%.

a The comparative indices are not adjusted to reflect expenses or other fees that the SEC requires to be reflected in the Fund's performance. The Fund's performance assumes the reinvestment of all dividends and distributions. For more information, including charges and expenses, please read the prospectus carefully before you invest.

b Inception date of July 2, 1991.

5

COHEN & STEERS REALTY SHARES, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees and (2) ongoing costs including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2008—December 31, 2008.

Actual Expenses

The first line of the table below provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period *

July 1, 2008–

December 31, 2008 | |

| Actual (–32.65% return) | | $ | 1,000.00 | | | $ | 673.50 | | | $ | 4.33 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,019.96 | | | $ | 5.23 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.03% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

6

COHEN & STEERS REALTY SHARES, INC.

DECEMBER 31, 2008

Top Ten Holdings

(Unaudited)

| Security | | Value | | % of

Net

Assets | |

| Simon Property Group | | $ | 121,130,874 | | | | 8.7 | % | |

| Public Storage | | | 96,176,556 | | | | 6.9 | | |

| Vornado Realty Trust | | | 93,141,897 | | | | 6.7 | | |

| Equity Residential | | | 74,587,394 | | | | 5.4 | | |

| Boston Properties | | | 73,134,160 | | | | 5.3 | | |

| Federal Realty Investment Trust | | | 52,242,555 | | | | 3.8 | | |

| Host Hotels & Resorts | | | 48,686,538 | | | | 3.5 | | |

| Regency Centers Corp. | | | 48,624,554 | | | | 3.5 | | |

| Ventas | | | 38,909,745 | | | | 2.8 | | |

| HCP | | | 37,872,754 | | | | 2.7 | | |

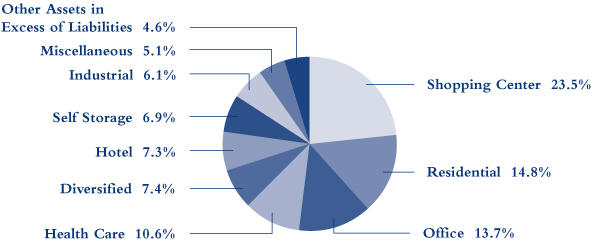

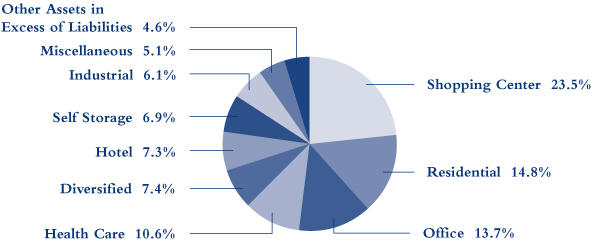

Sector Breakdown

(Based on Net Assets)

(Unaudited)

7

COHEN & STEERS REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS

December 31, 2008

| | | | | Number

of Shares | | Value | |

| COMMON STOCK | | | 95.4 | % | | | | | | | | | |

| DIVERSIFIED | | | 7.4 | % | | | | | | | | | |

| Brookfield Properties Corp. | | | | | | | 1,120,312 | | | $ | 8,660,012 | | |

| Forest City Enterprises | | | | | | | 134,609 | | | | 901,880 | | |

| Vornado Realty Trust | | | | | | | 1,543,362 | | | | 93,141,897 | | |

| | | | | | | | 102,703,789 | | |

| HEALTH CARE | | | 10.6 | % | | | | | | | | | |

| HCP | | | | | | | 1,363,801 | | | | 37,872,754 | | |

| Health Care REIT | | | | | | | 660,502 | | | | 27,873,184 | | |

| Nationwide Health Properties | | | | | | | 1,177,193 | | | | 33,808,983 | | |

| Omega Healthcare Investors | | | | | | | 541,446 | | | | 8,646,893 | | |

| Ventas | | | | | | | 1,159,063 | | | | 38,909,745 | | |

| | | | | | | | 147,111,559 | | |

| HOTEL | | | | | | | | | | | 7.3 | % | |

| Hospitality Properties Trust | | | | | | | 1,986,806 | | | | 29,543,805 | | |

| Host Hotels & Resorts | | | | | | | 6,431,511 | | | | 48,686,538 | | |

| Starwood Hotels & Resorts Worldwide | | | | | | | 1,280,035 | | | | 22,912,627 | | |

| | | | | | | | 101,142,970 | | |

| INDUSTRIAL | | | 6.1 | % | | | | | | | | | |

| AMB Property Corp. | | | | | | | 825,595 | | | | 19,335,435 | | |

| DCT Industrial Trust | | | | | | | 3,341,441 | | | | 16,907,692 | | |

| EastGroup Properties | | | | | | | 290,649 | | | | 10,341,291 | | |

| ProLogis | | | | | | | 2,717,156 | | | | 37,741,297 | | |

| | | | | | | | 84,325,715 | | |

See accompanying notes to financial statements.

8

COHEN & STEERS REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

| | | | | Number

of Shares | | Value | |

| OFFICE | | | 13.7 | % | | | | | | | | | |

| BioMed Realty Trust | | | | | | | 1,218,919 | | | $ | 14,285,731 | | |

| Boston Properties | | | | | | | 1,329,712 | | | | 73,134,160 | | |

| Brandywine Realty Trust | | | | | | | 1,128,675 | | | | 8,702,084 | | |

| Douglas Emmett | | | | | | | 1,681,056 | | | | 21,954,591 | | |

| Highwoods Properties | | | | | | | 105,595 | | | | 2,889,079 | | |

| Kilroy Realty Corp. | | | | | | | 626,367 | | | | 20,958,240 | | |

| Liberty Property Trust | | | | | | | 919,028 | | | | 20,981,409 | | |

| Mack-Cali Realty Corp. | | | | | | | 886,234 | | | | 21,712,733 | | |

| Maguire Properties | | | | | | | 652,901 | | | | 953,236 | | |

| SL Green Realty Corp. | | | | | | | 214,197 | | | | 5,547,702 | | |

| | | | | | | | 191,118,965 | | |

| OFFICE/INDUSTRIAL | | | 1.0 | % | | | | | | | | | |

| PS Business Parks | | | | | | | 299,493 | | | | 13,375,357 | | |

| RESIDENTIAL | | | 14.8 | % | | | | | | | | | |

| APARTMENT | | | 13.2 | % | | | | | | | | | |

| American Campus Communities | | | | | | | 320,273 | | | | 6,559,191 | | |

| Apartment Investment & Management Co. | | | | | | | 1,569,655 | | | | 18,129,515 | | |

| AvalonBay Communities | | | | | | | 504,802 | | | | 30,580,905 | | |

| BRE Properties | | | | | | | 227,110 | | | | 6,354,538 | | |

| Camden Property Trust | | | | | | | 214,885 | | | | 6,734,496 | | |

| Education Realty Trust | | | | | | | 217,397 | | | | 1,134,813 | | |

| Equity Residential | | | | | | | 2,501,254 | | | | 74,587,394 | | |

| Essex Property Trust | | | | | | | 329,132 | | | | 25,260,881 | | |

| UDR | | | | | | | 1,074,356 | | | | 14,815,369 | | |

| | | | | | | | 184,157,102 | | |

| MANUFACTURED HOME | | | 1.6 | % | | | | | | | | | |

| Equity Lifestyle Properties | | | | | | | 588,553 | | | | 22,576,893 | | |

| TOTAL RESIDENTIAL | | | | | | | | | | | 206,733,995 | | |

See accompanying notes to financial statements.

9

COHEN & STEERS REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

| | | | | Number

of Shares | | Value | |

| SELF STORAGE | | | 6.9 | % | | | | | | | | | |

| Public Storage | | | | | | | 1,209,768 | | | $ | 96,176,556 | | |

| SHOPPING CENTER | | | 23.5 | % | | | | | | | | | |

| COMMUNITY CENTER | | | 10.2 | % | | | | | | | | | |

| Developers Diversified Realty Corp. | | | | | | | 3,407,254 | | | | 16,627,399 | | |

| Federal Realty Investment Trust | | | | | | | 841,536 | | | | 52,242,555 | | |

| Kimco Realty Corp. | | | | | | | 509,997 | | | | 9,322,745 | | |

| Regency Centers Corp. | | | | | | | 1,041,211 | | | | 48,624,554 | | |

| Weingarten Realty Investors | | | | | | | 761,508 | | | | 15,755,601 | | |

| | | | | | | | 142,572,854 | | |

| FREE STANDING | | | 0.5 | % | | | | | | | | | |

| National Retail Properties | | | | | | | 406,630 | | | | 6,989,970 | | |

| REGIONAL MALL | | | 12.8 | % | | | | | | | | | |

| CBL & Associates Properties | | | | | | | 649,673 | | | | 4,222,875 | | |

| Macerich Co. | | | | | | | 1,624,505 | | | | 29,501,011 | | |

| Simon Property Group | | | | | | | 2,279,896 | | | | 121,130,874 | | |

| Taubman Centers | | | | | | | 893,929 | | | | 22,759,432 | | |

| | | | | | | | 177,614,192 | | |

| TOTAL SHOPPING CENTER | | | | | | | | | | | 327,177,016 | | |

See accompanying notes to financial statements.

10

COHEN & STEERS REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

| | | | | Number

of Shares | | Value | |

| SPECIALTY | | | 4.1 | % | | | | | | | | | |

| Corrections Corp of Americaa | | | | | | | 337,479 | | | $ | 5,521,156 | | |

| Digital Realty Trust | | | | | | | 480,393 | | | | 15,780,910 | | |

| Plum Creek Timber Co. | | | | | | | 665,109 | | | | 23,105,887 | | |

| Rayonier | | | | | | | 426,984 | | | | 13,385,948 | | |

| | | | | | | | 57,793,901 | | |

| TOTAL INVESTMENTS (Identified cost—$1,301,577,442) | | | 95.4 | % | | | | | | | 1,327,659,823 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | | | 4.6 | % | | | | | | | 64,428,669 | | |

NET ASSETS (Equivalent to $37.01 per share based on 37,616,160

shares of common stock outstanding) | | | 100.0 | % | | | | | | $ | 1,392,088,492 | | |

Glossary of Portfolio Abbreviation

REIT Real Estate Investment Trust

Note: Percentages indicated are based on the net assets of the Fund.

a Non-income producing security.

See accompanying notes to financial statements.

11

COHEN & STEERS REALTY SHARES, INC.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2008

| ASSETS: | |

| Investments in securities, at value (Identified cost—$1,301,577,442) | | $ | 1,327,659,823 | | |

| Cash | | | 44,679,533 | | |

| Receivable for investment securities sold | | | 16,241,820 | | |

| Dividends receivable | | | 14,168,437 | | |

| Receivable for Fund shares sold | | | 9,471,246 | | |

| Other assets | | | 64,500 | | |

| Total Assets | | | 1,412,285,359 | | |

| LIABILITIES: | |

| Payable for investment securities purchased | | | 13,451,367 | | |

| Payable for Fund shares redeemed | | | 5,073,938 | | |

| Payable for investment advisory fees | | | 918,647 | | |

| Payable for administration fees | | | 21,615 | | |

| Payable for directors' fees | | | 2,120 | | |

| Other liabilities | | | 729,180 | | |

| Total Liabilities | | | 20,196,867 | | |

NET ASSETS applicable to 37,616,160 shares of $0.001 par value of common stock

outstanding | | $ | 1,392,088,492 | | |

| NET ASSET VALUE PER SHARE: | |

| ($1,392,088,492 ÷ 37,616,160 shares outstanding) | | $ | 37.01 | | |

| NET ASSETS consist of: | |

| Paid-in-capital | | $ | 1,770,100,112 | | |

| Accumulated undistributed net investment income | | | 3,104,314 | | |

| Accumulated net realized loss | | | (407,198,315 | ) | |

| Net unrealized appreciation | | | 26,082,381 | | |

| | | $ | 1,392,088,492 | | |

See accompanying notes to financial statements.

12

COHEN & STEERS REALTY SHARES, INC.

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2008

| Investment Income: | |

| Dividend income (net of $74,656 of foreign withholding tax) | | $ | 63,266,565 | | |

| Interest income | | | 649,254 | | |

| Total Income | | | 63,915,819 | | |

| Expenses: | |

| Investment advisory fees | | | 17,142,986 | | |

| Transfer agent fees and expenses | | | 1,972,153 | | |

| Administration fees | | | 734,119 | | |

| Reports to shareholders | | | 377,078 | | |

| Custodian fees and expenses | | | 187,124 | | |

| Professional fees | | | 151,331 | | |

| Line of credit fees | | | 72,328 | | |

| Directors' fees and expenses | | | 53,316 | | |

| Registration and filing fees | | | 38,893 | | |

| Miscellaneous | | | 117,845 | | |

| Total Expenses | | | 20,847,173 | | |

| Net Investment Income | | | 43,068,646 | | |

| Net Realized and Unrealized Loss: | |

| Net realized loss | | | (381,976,408 | ) | |

| Net change in unrealized appreciation | | | (463,138,364 | ) | |

| Net realized and unrealized loss | | | (845,114,772 | ) | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (802,046,126 | ) | |

See accompanying notes to financial statements.

13

COHEN & STEERS REALTY SHARES, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | For the

Year Ended

December 31, 2008 | | For the

Year Ended

December 31, 2007 | |

| Change in Net Assets: | |

| From Operations: | |

| Net investment income | | $ | 43,068,646 | | | $ | 39,701,677 | | |

| Net realized gain (loss) | | | (381,976,408 | ) | | | 468,079,489 | | |

| Net change in unrealized appreciation | | | (463,138,364 | ) | | | (1,135,088,153 | ) | |

| Net decrease in net assets resulting from operations | | | (802,046,126 | ) | | | (627,306,987 | ) | |

| Dividends and Distributions to Shareholders from: | |

| Net investment income | | | (46,900,374 | ) | | | (36,692,790 | ) | |

| Net realized gain | | | — | | | | (424,150,489 | ) | |

| Tax return of capital | | | (30,926,409 | ) | | | — | | |

| Total dividends and distributions to shareholders | | | (77,826,783 | ) | | | (460,843,279 | ) | |

| Capital Stock Transactions: | |

| Decrease in net assets from fund share transactions | | | (23,138,230 | ) | | | (218,690,650 | ) | |

| Total decrease in net assets | | | (903,011,139 | ) | | | (1,306,840,916 | ) | |

| Net Assets: | |

| Beginning of year | | | 2,295,099,631 | | | | 3,601,940,547 | | |

| End of yeara | | $ | 1,392,088,492 | | | $ | 2,295,099,631 | | |

a Includes undistributed net investment income of $3,104,314 and $5,839,244, respectively.

See accompanying notes to financial statements.

14

COHEN & STEERS REALTY SHARES, INC.

FINANCIAL HIGHLIGHTS

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | For the Year ended December 31, | |

| Per Share Operating Performance: | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| Net asset value, beginning of year | | $ | 58.80 | | | $ | 89.45 | | | $ | 72.59 | | | $ | 69.66 | | | $ | 55.64 | | |

| Income from investment operations: | |

| Net investment income | | | 1.15 | | | | 1.24 | a | | | 0.91 | | | | 1.04 | | | | 1.21 | | |

| Net realized and unrealized gain (loss) | | | (20.93 | ) | | | (18.21 | ) | | | 25.52 | | | | 9.17 | | | | 19.71 | | |

Total income (loss) from investment

operations | | | (19.78 | ) | | | (16.97 | ) | | | 26.43 | | | | 10.21 | | | | 20.92 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (1.22 | ) | | | (1.09 | ) | | | (0.91 | ) | | | (1.04 | ) | | | (1.21 | ) | |

| Net realized gain | | | — | | | | (12.63 | ) | | | (8.14 | ) | | | (5.80 | ) | | | (5.32 | ) | |

| Tax return of capital | | | (0.80 | ) | | | — | | | | (0.53 | ) | | | (0.46 | ) | | | (0.38 | ) | |

Total dividends and distributions to

shareholders | | | (2.02 | ) | | | (13.72 | ) | | | (9.58 | ) | | | (7.30 | ) | | | (6.91 | ) | |

| Redemption fees retained by the fund | | | 0.01 | | | | 0.04 | | | | 0.01 | | | | 0.02 | | | | 0.01 | | |

| Net increase (decrease) in net asset value | | | (21.79 | ) | | | (30.65 | ) | | | 16.86 | | | | 2.93 | | | | 14.02 | | |

| Net asset value, end of year | | $ | 37.01 | | | $ | 58.80 | | | $ | 89.45 | | | $ | 72.59 | | | $ | 69.66 | | |

| Total investment return | | | –34.40 | % | | | –19.19 | % | | | 37.13 | % | | | 14.89 | % | | | 38.48 | % | |

| Ratios/Supplemental Data: | |

| Net assets, end of year (in millions) | | $ | 1,392.1 | | | $ | 2,295.1 | | | $ | 3,601.9 | | | $ | 2,466.0 | | | $ | 2,264.7 | | |

| Ratio of expenses to average daily net assets | | | 1.00 | % | | | 0.95 | % | | | 0.96 | % | | | 0.97 | % | | | 1.01 | % | |

Ratio of net investment income to average daily

net assets | | | 2.06 | % | | | 1.21 | % | | | 1.08 | % | | | 1.45 | % | | | 2.00 | % | |

| Portfolio turnover rate | | | 99 | % | | | 58 | % | | | 31 | % | | | 28 | % | | | 29 | % | |

a 15.1% of net investment income was attributable to a special dividend paid by Boston Properties, Inc.

See accompanying notes to financial statements.

15

COHEN & STEERS REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS

Note 1. Significant Accounting Policies

Cohen & Steers Realty Shares, Inc. (the Fund) was incorporated under the laws of the State of Maryland on April 26, 1991 and is registered under the Investment Company Act of 1940, as amended, as a nondiversified, open-end management investment company. The Fund's investment objective is total return.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange are valued, except as indicated below, at the last sale price reflected at the close of the New York Stock Exchange on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day or, if no asked price is available, at the bid price.

Securities not listed on the New York Stock Exchange but listed on other domestic or foreign securities exchanges or admitted to trading on the National Association of Securities Dealers Automated Quotations, Inc. (Nasdaq) national market system are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the tape at the close of the exchange representing the principal market for such securities.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the advisor) to be over-the-counter, but excluding securities admitted to trading on the Nasdaq National List, are valued at the official closing prices as reported by Nasdaq, the National Quotation Bureau, or such other comparable sources as the Board of Directors deem appropriate to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day, or if no asked price is available, at the bid price. Where securities are traded on more than one exchange and also over-the-counter, the securities will generally be valued using the quotations the Board of Directors believes most closely reflect the value of such securities.

Securities for which market prices are unavailable, or securities for which the advisor determines that bid and/or asked price does not reflect market value, will be valued at fair value pursuant to procedures approved by the Fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems

16

COHEN & STEERS REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

appropriate. These may include recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The Fund's use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Short-term debt securities, which have a maturity date of 60 days or less, are valued at amortized cost, which approximates value.

The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, "Fair Value Measurements" ("FAS 157"), effective January 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market the most advantageous market for the investment or liability. FAS 157 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund's investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2008 in valuing the Fund's investments carried at value:

| | | | | Fair Value Measurements at December 31, 2008 Using | |

| | | Total | | Quoted Prices In

Active Market for

Identical Assets

(Level 1) | | Significant

Other Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

| Investments in Securities | | $ | 1,327,659,823 | | | $ | 1,327,659,823 | | | $ | — | | | $ | — | | |

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend

17

COHEN & STEERS REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

income is recorded on the ex-dividend date. The Fund records distributions received in excess of income from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The Fund adjusts the estimated amounts of the components of distributions (and consequently its net investment income) as an increase to unrealized appreciation/(depreciation) and realized gain/(loss) on investments as necessary once the issuers provide information about the actual composition of the distributions.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid quarterly. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund based on the net asset value per share at the close of business on the payable date unless the shareholder has elected to have them paid in cash.

Distributions paid by the Fund are subject to recharacterization for tax purposes. Based upon the results of operations for the year ended December 31, 2008, a portion of the dividends have been reclassified to return of capital.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Accordingly, no provision for federal income or excise tax is necessary. The Fund has adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position must meet before being recognized in the financial statements. An assessment of the Fund's tax positions has been made and it has been determined that there is no impact to the Fund's financial statements. Each of the Fund's federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Note 2. Investment Advisory and Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: The advisor serves as the Fund's investment advisor pursuant to an investment advisory agreement (the advisory agreement). Under the terms of the advisory agreement, the advisor provides the Fund with the day-to-day investment decisions and generally manages the Fund's investments in accordance with the stated policies of the Fund, subject to the supervision of the Fund's Board of Directors. For the services provided to the Fund, the advisor receives a fee, accrued daily and paid monthly, at the annual rate of 0.85% for the first $1.5 billion and 0.75% thereafter of the average daily net assets of the Fund.

18

COHEN & STEERS REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Administration Fees: The Fund has entered into an administration agreement with the advisor under which the advisor performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.02% of the Fund's average daily net assets. For the year ended December 31, 2008, the Fund paid the advisor $418,152 in fees under this administration agreement. Additionally, the Fund pays State Street Bank and Trust Company as sub-administrator under a Fund accounting and administration agreement.

Directors' and Officers' Fees: Certain directors and officers of the Fund are also directors, officers, and/or employees of the advisor. The Fund does not pay compensation to any affiliated directors and officers except for the Chief Compliance Officer, who received $37,631 from the Fund for the year ended December 31, 2008.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the year ended December 31, 2008 totaled $2,013,009,124 and $2,096,697,631, respectively.

Note 4. Income Tax Information

The tax character of dividends and distributions paid was as follows:

| | | For the Year Ended

December 31, | |

| | | 2008 | | 2007 | |

| Ordinary income | | $ | 46,900,374 | | | $ | 75,581,264 | | |

| Long-term capital gains | | | — | | | | 385,262,015 | | |

| Tax return of capital | | | 30,926,409 | | | | — | | |

| Total dividends and distribution | | $ | 77,826,783 | | | $ | 460,843,279 | | |

As of December 31, 2008, the tax-basis components of accumulated earnings and the federal tax cost were as follows:

| Gross unrealized appreciation | | $ | 81,896,409 | | |

| Gross unrealized depreciation | | | (197,218,032 | ) | |

| Net unrealized depreciation | | $ | (115,321,623 | ) | |

| Cost for federal income tax purposes | | $ | 1,442,981,446 | | |

As of December 31, 2008, the Fund had a net capital loss carryforward of $265,794,308, which will expire on December 31, 2016. This carryforward may be used to offset future capital gains to the extent provided by regulations.

19

COHEN & STEERS REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

As of December 31, 2008, the Fund had temporary book/tax differences primarily attributable to wash sales on portfolio securities and permanent book/tax differences primarily attributable to income redesignations. To reflect reclassifications arising from the permanent differences, paid-in capital was credited $515,588, accumulated net realized loss was charged $1,612,386 and accumulated net investment income was credited $1,096,798. Net assets were not affected by this reclassification.

Note 5. Capital Stock

The Fund is authorized to issue 200 million shares of capital stock at a par value of $0.001 per share. The Board of Directors of the Fund is authorized to reclassify and issue any unissued shares of the Fund without shareholder approval. Transactions in Fund shares were as follows:

| | | For the

Year Ended

December 31, 2008 | | For the

Year Ended

December 31, 2007 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Sold | | | 12,427,856 | | | $ | 650,183,964 | | | | 10,195,337 | | | $ | 900,518,114 | | |

Issued as reinvestment of dividends

and distributions | | | 1,461,207 | | | | 71,362,810 | | | | 7,023,478 | | | | 428,947,952 | | |

| Redeemed | | | (15,305,055 | ) | | | (745,004,459 | ) | | | (18,454,343 | ) | | | (1,549,610,014 | ) | |

| Redemption fees retained by Funda | | | — | | | | 319,455 | | | | — | | | | 1,453,298 | | |

| Net increase (decrease) | | | (1,415,992 | ) | | $ | (23,138,230 | ) | | | (1,235,528 | ) | | $ | (218,690,650 | ) | |

a The Fund may charge a 2% redemption fee on shares sold within 60 days of the time of purchase. Redemption fees are paid directly to the Fund. Prior to September 28, 2007, the redemption fee was charged at a rate of 1% on shares sold within six months of the time of purchase.

Note 6. Borrowings

The Fund, in conjunction with other Cohen & Steers open-end funds, is a party to a $200,000,000 syndicated credit agreement (the credit agreement) with State Street Bank and Trust Company, as administrative agent and operations agent, and the lenders identified in the credit agreement, which expires December 2009. The Fund pays a commitment fee of 0.15% per annum on its proportionate share of the unused portion of the credit agreement.

During the year ended December 31, 2008, the Fund did not borrow under the credit agreement.

20

COHEN & STEERS REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Note 7. Other

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 8. New Accounting Pronouncement

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities ("FAS 161"), an amendment of FASB Statement No. 133. FAS 161 requires enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for, and (c) how derivative instruments and related hedged items affect the Fund's financial position, financial performance, and cash flows. Management is currently evaluating the impact the adoption of this pronouncement will have on the Fund's financial statements. FAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008.

21

COHEN & STEERS REALTY SHARES, INC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Cohen & Steers Realty Shares, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Cohen & Steers Realty Shares, Inc. (the "Fund") at December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial state ments in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2008 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 18, 2009

22

COHEN & STEERS REALTY SHARES, INC.

TAX INFORMATION—2008 (Unaudited)

Pursuant to the Jobs and Growth Relief Reconciliation Act of 2003, the Fund designates qualified dividend income of $1,970,194.

OTHER INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 800-330-7348, (ii) on our Web site at cohenandsteers.com or (iii) on the Securities and Exchange Commission's Web site at http://www.sec.gov. In addition, the Fund's proxy voting record for the most recent 12-month period ended June 30 is available (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC's Web site at http://www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund's Forms N-Q are available (i) without charge, upon request by calling 800-330-7348, or (ii) on the SEC's Web site at http://www.sec.gov. In addition, the Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Please note that the distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes. The Fund may also pay distributions in excess of the Fund's net investment company taxable income and this excess would be a tax-free return of capital distributed from the Fund's assets. The final tax treatment of all distributions is reported to shareholders on their 1099-DIV forms, which are mailed after the close of each calendar year.

23

COHEN & STEERS REALTY SHARES, INC.

MANAGEMENT OF THE FUND

The business and affairs of the Fund are managed under the direction of the Board of Directors. The Board of Directors approves all significant agreements between the Fund and persons or companies furnishing services to it, including the Fund's agreements with its advisor, administrator, custodian and transfer agent. The management of the Fund's day-to-day operations is delegated to its officers, the advisor and the Fund's administrator, subject always to the investment objective and policies of the Fund and to the general supervision of the Board of Directors.

The directors and officers of the Fund and their principal occupations during the past five years are set forth below. The statement of additional information (SAI) includes additional information about Fund directors and is available, without charge, upon request by calling 1-800-330-7348.

| Name, Address and Age* | | Position(s)

Held

With Fund | | Term of

Office | | Principal Occupation

During Past 5 Years

(Including Other

Directorships Held) | | Number of

Funds Within

Fund

Complex

Overseen by

Director

(Including

the Fund) | | Length

of Time

Served** | |

| Interested Directors1 | |

|

Robert H. Steers

Age: 55 | | Director and Co-Chairman | | Until next election of directors | | Co-Chairman and Co-Chief Executive Officer of Cohen & Steers Capital Management, Inc. (CSCM), the fund's investment manager, and its parent company, Cohen & Steers, Inc. (CNS) since 2004. Vice President and Director, Cohen & Steers Securities, LLC (CSSL), the Cohen & Steers open-end funds' distributor. Prior thereto, Chairman of CSCM and the Cohen & Steers funds. | | | 21 | | | 1991 to present | |

|

Martin Cohen

Age: 60 | | Director and Co-Chairman | | Until next election of directors | | Co-Chairman and Co-Chief Executive Officer of CSCM and CNS. Vice President and Director of CSSL. Prior thereto, President of the CSCM and the Cohen & Steers funds. | | | 21 | | | 1991 to present | |

|

(table continued on next page)

* The address for each director is 280 Park Avenue, New York, NY 10017.

** The length of time served represents the year in which the director was first elected or appointed to any fund in the Cohen & Steers fund complex.

1 "Interested person", as defined in the 1940 Act, of the Fund because of affiliation with CSCM.

24

COHEN & STEERS REALTY SHARES, INC.

(table continued from previous page)

| Name, Address and Age* | | Position(s)

Held

With Fund | | Term of

Office | | Principal Occupation

During Past 5 Years

(Including Other

Directorships Held) | | Number of

Funds Within

Fund

Complex

Overseen by

Director

(Including

the Fund) | | Length

of Time

Served** | |

| Disinterested Directors | |

|

Bonnie Cohen2

Age: 66 | | Director | | Until next election of directors | | Consultant. Director, Reis, Inc. (formerly Wellsford Real Property); Vice-Chair of the Board of Global Heritage Fund; Investment Committee, The Moriah Fund; Advisory Committee member, The Posse Foundation; Vice-Chair, District of Columbia Public Libraries; Board member, Washington National Opera. Former Under Secretary of State for Management, United States Department of State, 1996-2000. | | | 21 | | | 2001 to present | |

|

George Grossman

Age: 55 | | Director | | Until next election of directors | | Attorney-at-law | | | 21 | | | 1993 to present | |

|

Richard E. Kroon

Age: 66 | | Director | | Until next election of directors | | Member of Investment Committee, Monmouth University; retired Chairman and Managing Partner of the Sprout Group venture capital funds, then an affiliate of Donaldson, Lufkin & Jenrette Securities Corporation; and former Chairman of the National Venture Capital Association. | | | 21 | | | 2004 to present | |

|

Richard J. Norman

Age: 65 | | Director | | Until next election of directors | | Private Investor. Advisory Board Member of the Salvation Army. Member of the Chaplain's Core—DC Department of Corrections. Prior thereto, Investment Representative of Morgan Stanley Dean Witter. | | | 21 | | | 2001 to present | |

|

(table continued on next page)

* The address for each director is 280 Park Avenue, New York, NY 10017.

** The length of time served represents the year in which the director was first elected or appointed to any fund in the Cohen & Steers fund complex.

2 Martin Cohen and Bonnie Cohen are not related.

25

COHEN & STEERS REALTY SHARES, INC.

(table continued from previous page)

| Name, Address and Age* | | Position(s)

Held

With Fund | | Term of

Office | | Principal Occupation

During Past 5 Years

(Including Other

Directorships Held) | | Number of

Funds Within

Fund

Complex

Overseen by

Director

(Including

the Fund) | | Length

of Time

Served** | |

Frank K. Ross

Age: 65 | | Director | | Until next election of directors | | Professor of Accounting, Howard University; Board member of Pepco Holdings, Inc. (electric utility). Formerly, Midatlantic Area Managing Partner for Audit and Risk Advisory Services at KPMG LLP and Managing Partner of its Washington, DC office. | | | 21 | | | 2004 to present | |

|

Willard H. Smith Jr.

Age: 72 | | Director | | Until next election of directors | | Board member of Essex Property Trust Inc., Realty Income Corporation and Crest Net Lease, Inc. Managing Director at Merrill Lynch & Co., Equity Capital Markets Division from 1983 to 1995. | | | 21 | | | 1996 to present | |

|

C. Edward Ward Jr.

Age: 62 | | Director | | Until next election of directors | | Member of the Board of Trustees of Directors Manhattan College, Riverdale, New York. Formerly head of closed-end fund listings for the New York Stock Exchange. | | | 21 | | | 2004 to present | |

|

* The address for each director is 280 Park Avenue, New York, NY 10017.

** The length of time served represents the year in which the director was first elected or appointed to any fund in the Cohen & Steers fund complex.

26

COHEN & STEERS REALTY SHARES, INC.

The officers of the Fund (other than Messrs. Cohen and Steers, whose biographies are provided above), their address, their ages and their principal occupations for at least the past five years are set forth below.

| Name, Address and Age* | | Position(s) Held

With Fund | | Principal Occupation During Past 5 Years | | Length

of Time

Served** | |

Adam M. Derechin

Age: 44 | | President and Chief Executive Officer | | Chief Operating Officer of CSCM (since 2003) and CNS (since 2004). Prior to that, Senior Vice President of CSCM and Vice President and Assistant Treasurer of the Cohen & Steers funds. | | Since 2005 | |

|

Joseph M. Harvey

Age: 45 | | Vice President | | President and Chief Investment Officer of CSCM (since 2003) and President of CNS (since 2004). Prior to that, Senior Vice President and Director of Investment Research of CSCM. | | Since 2004 | |

|

Jon Cheigh

Age: 36 | | Vice President | | Senior Vice President of CSCM since 2005. Prior to that, vice president and research analyst for Security Capital. | | Since 2007 | |

|

Francis C. Poli

Age: 46 | | Secretary | | Executive Vice President, Secretary and General Counsel of CSCM and CNS since March 2007. Prior thereto, General Counsel of Allianz Global Investors of America LP. | | Since 2007 | |

|

James Giallanza

Age: 42 | | Treasurer and Chief Financial Officer | | Senior Vice President of CSCM since September 2006. Prior thereto, Deputy Head of the US Funds Administration and Treasurer & CFO of various mutual funds within the Legg Mason (formally Citigroup Asset Management) fund complex from August 2004 to September 2006; Director/Controller of the US wholesale business at UBS Global Asset Management (U.S.) from September 2001 to July 2004. | | Since 2006 | |

|

Lisa D. Phelan

Age: 40 | | Chief Compliance Officer | | Senior Vice President & Director of Compliance of CSCM since January 2006. Chief Compliance Officer of CSSL since 2004. Prior to that, Compliance Officer of CSCM since 2004. Chief Compliance Officer, Avatar Associates & Overture Asset Managers, 2003-2004. First VP, Risk Management, Prudential Securities, Inc. 2000-2003. | | Since 2006 | |

|

* The address of each officer is 280 Park Avenue, New York, NY 10017.

** Officers serve one-year terms. The length of time served represents the year in which the officer was first elected to that position in any fund in the Cohen & Steers fund complex. All of the officers listed above are officers of one or more of the other funds in the complex.

27

COHEN & STEERS REALTY SHARES, INC.

Meet the Cohen & Steers family of open-end funds:

COHEN & STEERS

REALTY SHARES

• Designed for investors seeking total return, investing primarily in REITs

• Symbol: CSRSX

COHEN & STEERS

REALTY INCOME FUND

• Designed for investors seeking maximum total return, investing primarily in real estate securities with an emphasis on both income and capital appreciation

• Symbols: CSEIX, CSBIX, CSCIX, CSDIX

COHEN & STEERS

INTERNATIONAL REALTY FUND

• Designed for investors seeking total return, investing primarily in international real estate securities

• Symbols: IRFAX, IRFCX, IRFIX

COHEN & STEERS

DIVIDEND VALUE FUND

• Designed for investors seeking high current income and long-term growth of income and capital appreciation, investing primarily in dividend paying common stocks and preferred stocks

• Symbols: DVFAX, DVFCX, DVFIX

COHEN & STEERS

INSTITUTIONAL GLOBAL REALTY SHARES

• Designed for institutional investors seeking total return, investing primarily in global real estate securities

• Symbol: GRSIX

COHEN & STEERS

INSTITUTIONAL REALTY SHARES

• Designed for institutional investors seeking total return, investing primarily in REITs

• Symbol: CSRIX

COHEN & STEERS

GLOBAL REALTY SHARES

• Designed for investors seeking total return, investing primarily in global real estate equity securities

• Symbols: CSFAX, CSFBX, CSFCX, CSSPX

COHEN & STEERS

GLOBAL INFRASTRUCTURE FUND

• Designed for investors seeking total return, investing primarily in global infrastructure securities

• Symbols: CSUAX, CSUBX, CSUCX, CSUIX

COHEN & STEERS

ASIA PACIFIC REALTY SHARES

• Designed for investors seeking total return, investing primarily in real estate securities located in the Asia Pacific region

• Symbols: APFAX, APFCX, APFIX

COHEN & STEERS

EUROPEAN REALTY SHARES

• Designed for investors seeking total return, investing primarily in real estate securities located in Europe

• Symbols: EURAX, EURCX, EURIX

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. A prospectus containing this and other information can be obtained by calling 800-330-7348 or by visiting cohenandsteers.com. Please read the prospectus carefully before investing.

Cohen & Steers Securities, LLC, Distributor

28

COHEN & STEERS REALTY SHARES, INC.

OFFICERS AND DIRECTORS

Robert H. Steers

Director and co-chairman

Martin Cohen

Director and co-chairman

Bonnie Cohen

Director

George Grossman

Director

Richard E. Kroon

Director

Richard J. Norman

Director

Frank K. Ross

Director

Willard H. Smith Jr.

Director

C. Edward Ward, Jr.

Director

Adam M. Derechin

President and chief executive officer

Joseph M. Harvey

Vice president

Jon Cheigh

Vice President

Francis C. Poli

Secretary

James Giallanza

Treasurer and chief financial officer

Lisa D. Phelan

Chief compliance officer

KEY INFORMATION

Investment Advisor

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, NY 10017

(212) 832-3232

Fund Subadministrator and Custodian

State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111

Transfer Agent

Boston Financial Data Services, Inc.

2 Heritage Drive

North Quincy, MA 02171

(800) 437-9912

Legal Counsel

Stroock & Stroock & Lavan LLP

180 Maiden Lane

New York, NY 10038

Distributor

Cohen & Steers Securities, LLC

280 Park Avenue

New York, NY 10017

Nasdaq Symbol: CSRSX

Web site: cohenandsteers.com

This report is authorized for delivery only to shareholders of Cohen & Steers Realty Shares, Inc. unless accompanied or preceded by the delivery of a currently effective prospectus setting forth details of the Fund. Past performance is of course no guarantee of future results and your investment may be worth more or less at the time you sell.

29

COHEN & STEERS

REALTY SHARES

280 PARK AVENUE

NEW YORK, NY 10017

eDelivery NOW AVAILABLE

Stop traditional mail delivery; receive your shareholder reports and prospectus online.

Sign up at cohenandsteers.com

ANNUAL REPORT

DECEMBER 31, 2008

CSRSXAR

Item 2. Code of Ethics.

The registrant has adopted a Code of Ethics that applies to its Principal Executive Officer and Principal Financial Officer. The registrant undertakes to provide to any person without charge, upon request, a copy of the Code of Ethics. Such request can be made by calling 800-330-7348 or writing to the Secretary of the registrant, 280 Park Avenue, New York, NY 10017.

Item 3. Audit Committee Financial Expert.

The registrant’s board has determined that Frank K. Ross, a member of the board’s audit committee, is an “audit committee financial expert”. Mr. Ross is “independent,” as such term is defined in this Item.

Item 4. Principal Accountant Fees and Services.

(a) — (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

| | 2008 | | 2007 | |

Audit Fees | | $ | 48,000 | | $ | 46,000 | |

Audit-Related Fees | | 0 | | 8,500 | |

Tax Fees | | 19,635 | | 13,300 | |

All Other Fees | | — | | — | |

| | | | | | | |

Audit-related fees were billed in connection with agreed upon procedures performed by the registrant’s principal accountant relating to after-tax return calculations. Tax fees were billed in connection with the preparation of tax returns, calculation and designation of dividends and other miscellaneous tax services.

Aggregate fees billed by the registrant’s principal accountant for the last two fiscal years for non-audit services provided to the registrant’s investment adviser (not including a sub-adviser whose role is primarily portfolio management and is subcontracted or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registered investment company, where the engagement relates directly to the operations and financial reporting of the registrant, were as follows:

| | 2008 | | 2007 | |

Audit-Related Fees | | — | | — | |

Tax Fees | | — | | — | |

All Other Fees | | $ | 110,000 | | $ | 109,000 | |

| | | | | | | |

These other fees were billed in connection with internal control reviews.

(e)(1) The audit committee is required to pre-approve audit and non-audit services performed for the registrant by the principal accountant. The audit committee also is required to pre-approve non-audit services performed by the registrant’s principal accountant for the registrant’s

investment adviser and any sub-adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and/or to any entity controlling, controlled by or under common control with the registrant’s investment adviser that provides ongoing services to the registrant, if the engagement for services relates directly to the operations and financial reporting of the registrant.

The audit committee may delegate pre-approval authority to one or more of its members who are independent members of the board of directors of the registrant. The member or members to whom such authority is delegated shall report any pre-approval decisions to the audit committee at its next scheduled meeting. The audit committee may not delegate its responsibility to pre-approve services to be performed by the registrant’s principal accountant to the investment adviser.

(e) (2) No services included in (b) – (d) above were approved by the audit committee pursuant to paragraphs (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) For the fiscal years ended December 31, 2008 and December 31, 2007, the aggregate fees billed by the registrant’s principal accountant for non-audit services rendered to the registrant and for non-audit services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and/or to any entity controlling, controlled by or under common control with the registrant’s investment adviser that provides ongoing services to the registrant were $129,635 and $78,300, respectively.

(h) The registrant’s audit committee considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and/or to any entity controlling, controlled by or under common control with the registrant’s investment adviser that provides ongoing services to the registrant that were not required to be pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X was compatible with maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Included in Item 1 above.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, based upon such officers’ evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(b) There were no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a) (2) Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(b) Certifications of chief executive officer and chief financial officer as required by Rule 30a- 2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COHEN & STEERS REALTY SHARES, INC.

By: | /s/ | Adam M. Derechin | |

| | Name: Adam M. Derechin | |

| | Title: President and Chief Executive Officer | |

| |

Date: March 2, 2009 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/ | Adam M. Derechin | |

| Name: | Adam M. Derechin | |

| Title: | President and Chief Executive Officer | |

| | (principal executive officer) | |

By: | /s/ | James Giallanza | |

| Name: | James Giallanza | |

| Title: | Treasurer | |

| | (principal financial officer) | |

| | | |

| | | |

Date: March 2, 2009 | |