UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

| | | |

| þ | Filed by the Registrant | ¨ | Filed by a Party other than the Registrant |

| | | | |

| CHECK THE APPROPRIATE BOX: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

IDEXX Laboratories, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

| | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| | 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

| | 3) | Filing Party: |

| | 4) | Date Filed: |

|

| |

| Lawrence D. Kingsley

Independent Non-Executive Board Chair |

March 26, 2020

Dear Shareholders and Other Stakeholders,

In November 2019, I assumed the role of independent Non-Executive Board Chair, succeeding Jon Ayers, who stepped down, after serving for more than 17 years as Board Chair, President and Chief Executive Officer (CEO) of IDEXX, following a cycling accident that resulted in a paralyzing spinal cord injury.

The Board is grateful to Jon for his leadership, vision and unwavering commitment over his distinguished and long tenure with IDEXX. Under his stewardship, IDEXX created significant long-term value and built a strong foundation for continued and enduring growth. We are pleased that Jon remains an IDEXX Director and serves as an external Senior Advisor to the Company.

In October 2019, the Board appointed Jay Mazelsky – who was our Executive Vice President responsible for the North American Companion Animal Group business since August 2012 – as our President and CEO and a Director, following a four-month intensive and thorough succession- and transition-planning process led by the Board, during which time Jay served as Interim President and CEO. Jay is an exceptionally talented and well-respected leader with a deep understanding of IDEXX, our markets, our customer-driven focus and our innovative products and services. Jay brings a compelling strategic vision for continued long-term, sustainable growth at IDEXX, and the Board looks forward to the Company’s continued success under his leadership.

Our recent leadership transition was effected without disruption to our business, results and long-term strategy to drive sustainable and enduring value-creation for our stakeholders. The smooth and seamless transition is a testament to executive succession-planning and talent development at IDEXX, which has built a deep and strong senior management bench.

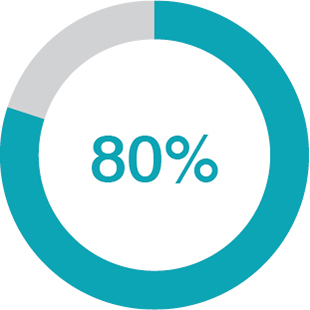

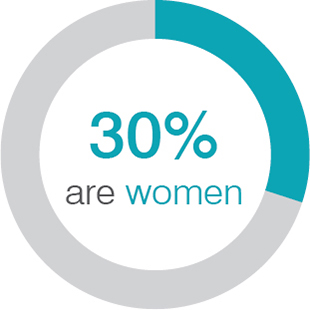

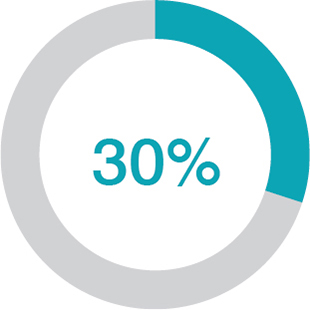

Our Board has a consistent focus on Board refreshment and diversity, and we believe our Directors possess a wide variety of relevant skills, backgrounds, experiences and perspectives to enable the Board to effectively oversee our innovative businesses in rapidly evolving markets. We have added seven new independent Directors in the past eight years, including the addition of Sam Samad, the Chief Financial Officer of Illumina, Inc., in July 2019. We are also proud that 30 percent of our Board is composed of women and 30 percent of our Directors were born and raised outside the United States.

It is my privilege to serve as IDEXX’s independent Non-Executive Board Chair, and I look forward to working closely with the Board, Jay and the senior leadership team to continue IDEXX’s successful track record of creating exceptional long-term value for our customers, employees and shareholders.

Sincerely,

|

| |

| Jonathan J. Mazelsky

President and Chief Executive Officer |

March 26, 2020

Dear Colleagues, Shareholders and Other Stakeholders,

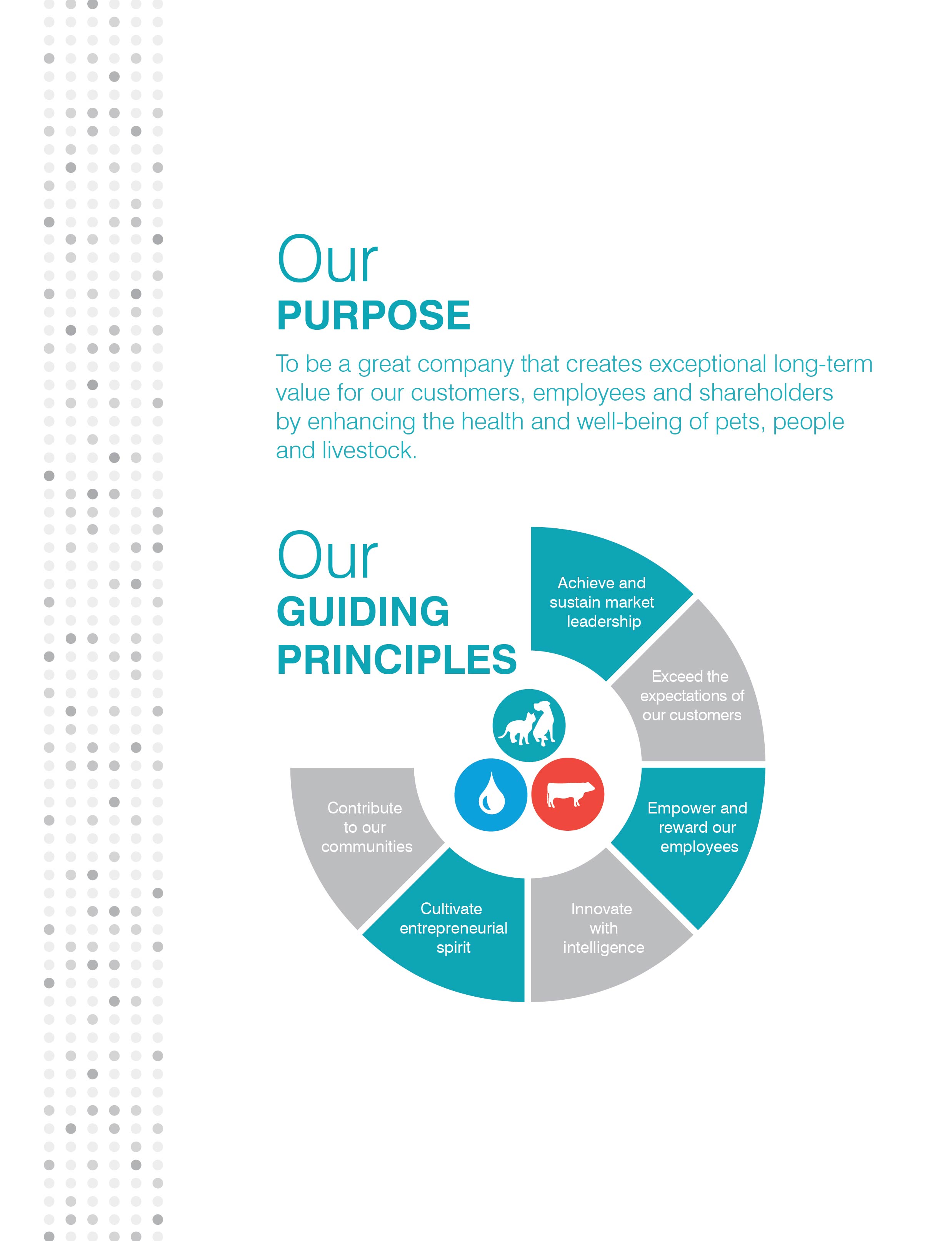

As I continue in my first full year as President and Chief Executive Officer of IDEXX, I remain excited to lead this extraordinary Company in the next phase of its growth and development. Through innovation and customer focus, we support and partner with veterinarians around the world in advancing the science and practice of veterinary medicine in pursuit of our Purpose – To be a great company that creates exceptional long-term value for our customers, employees, and shareholders by enhancing the health and well-being of pets, people and livestock. We see tremendous runway for sustained double-digit organic revenue growth supported by a global addressable companion animal diagnostics market opportunity estimated to be over $30 billion.

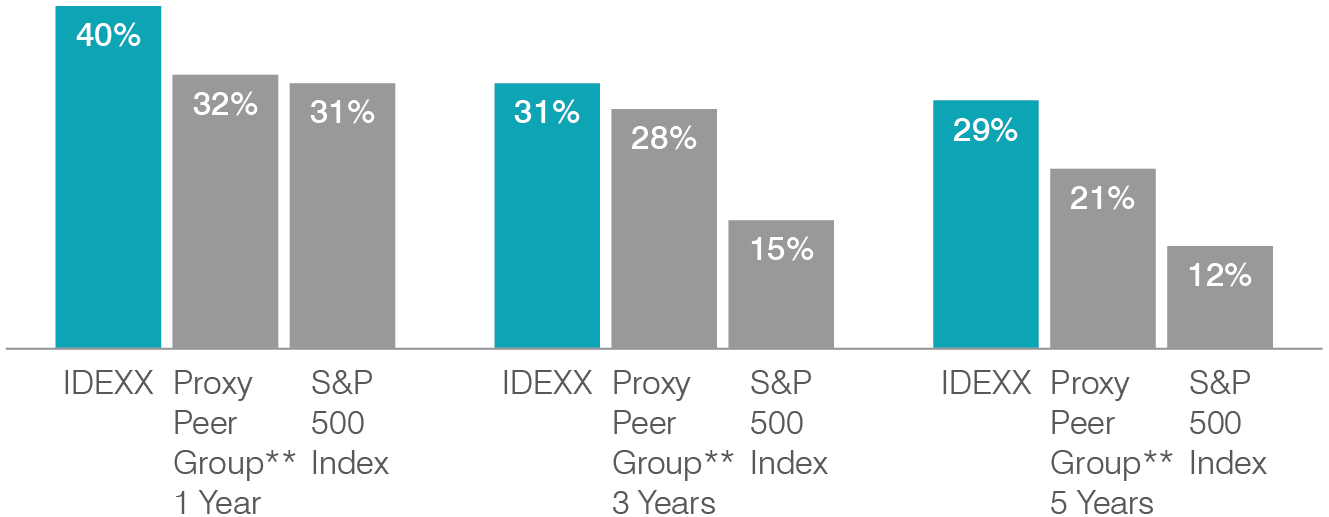

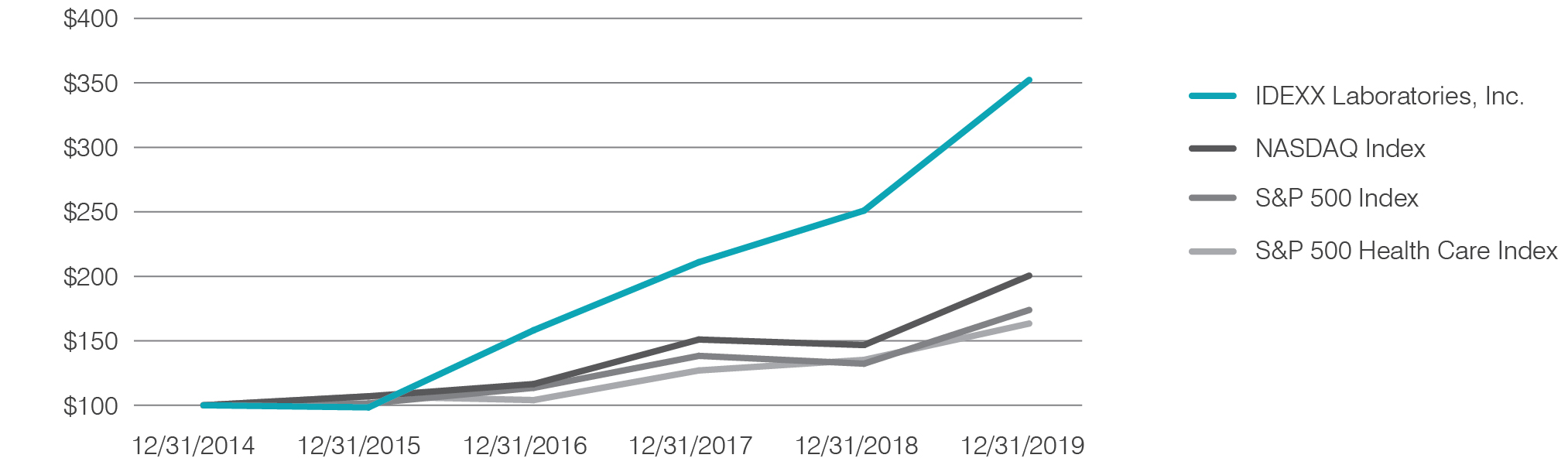

During 2019, IDEXX delivered another year of strong growth and financial performance, with 9% revenue growth over the prior year, driven by 10% organic revenue growth, and growth of diluted earnings per share (EPS) of 15% (or comparable constant currency EPS growth of 21%).1 In addition, our annual total shareholder return in 2019 was 40%, which outperformed the benchmark S&P 500® Index by 9% and the S&P 500® Healthcare Index by 19%.2

To satisfy our long-term strategy of innovation and global customer focus, we are building on our strong foundation to further strengthen our Purpose-driven culture in support of advancing pet healthcare standards of care around the world. For example:

| |

| • | Sustained Track Record of Innovation – Our substantial R&D investments over the years have resulted in novel, proprietary diagnostic and software product and service introductions, such as our IDEXX SDMA® Test, the SediVue Dx® Urine Sediment Analyzer and our IDEXX Digital CytologyTM service launched in North America in February 2020, as well as the addition of eight important new real-time tests to the Catalyst Dx® and Catalyst One® chemistry analyzers’ test menus in eight years, including our Bile Acids test announced commercially in January 2020. |

| |

| • | Senior Leadership Evolution Supporting Global Commercial Efforts and Growth – In January 2020, we announced senior leadership changes that resulted in some of our most talented senior executives, with more than 50 combined years of leadership experience at IDEXX, assuming new global roles or additional responsibilities. These new global roles – including a Chief Commercial Officer and a Chief Marketing Officer – and changes in responsibilities among the members of my leadership team will support global development of Companion Animal Group (CAG) market segments, enhance our global CAG commercial efforts and foster greater integration and efficiencies across regions. |

| |

| • | Enabling Our People and Organization to Do Business Ethically and in Alignment with Our Purpose – In 2019, we hired a Head of Corporate Responsibility to lead our global corporate responsibility strategy and activities, and we hired a Head of Diversity and Inclusion to further enhance our strategic plan for global diversity and inclusion. We also rolled out a new Global Whistleblower Policy that supplements our Code of Ethics and clearly describes how any IDEXXer may report ethical or other concerns and our strict non-retaliation policy and an updated, innovative training for all our managers to enable our leaders to work with their teams to put our Purpose into practice and to “live” our Code of Ethics. |

Our success has always depended on the efforts of our dedicated and talented employees, and I thank our more than 9,000 employees around the world who enable us to achieve our Purpose every day.

Finally, on behalf all IDEXXers, we thank Jon Ayers, who served as our Board Chair, President and Chief Executive Officer for more than 17 years, for his visionary leadership that laid the foundation for our continued success and growth. I am pleased to work with Jon as a fellow Director and in his role as a Senior Advisor to the Company.

Thank you for your continued support of IDEXX and our Purpose. We look forward to joining you at our 2020 Annual Meeting on May 6, 2020.

Sincerely,

| |

| 1 | Information regarding organic revenue growth and comparable constant currency EPS growth, which are non-GAAP financial measures, and their calculation is provided in Appendix A. |

| |

| 2 | Based on total return to shareholders, assuming dividend reinvestment for those companies issuing dividends, for the twelve-month period ended December 31, 2019. |

Table of Contents

|

|

BASIS OF PRESENTATION IDEXX Laboratories, Inc. is a Delaware corporation incorporated in 1983 with principal executive offices located at One IDEXX Drive, Westbrook, Maine 04092. Unless the context indicates otherwise, references in this Proxy Statement to “we”, “us”, “our”, the “Company” or “IDEXX” refer to IDEXX Laboratories, Inc. and its consolidated subsidiaries. Our website is located at www.idexx.com. References to our website in this Proxy Statement are inactive textual references only, and the contents of our website are not incorporated by reference into this Proxy Statement for any purpose. |

Proxy Summary

This summary highlights selected information that is contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider prior to voting your shares. You should carefully read both this entire Proxy Statement and our 2019 Annual Report on Form 10-K filed with the SEC on February 14, 2020 before voting.

2020 Annual Meeting Information

|

| | |

| DATE AND TIME:

Wednesday, May 6, 2020,

10:00 a.m., Eastern Time | PRE-MEETING FORUM: Our online pre-meeting forum can be accessed at www.proxyvote.com for beneficial owners and www.proxyvote.com/idxx for registered shareholders. At this online pre-meeting forum, you can submit questions in writing in advance of our 2020 Annual Meeting, vote, view the Rules of Conduct and Procedures relating to the 2020 Annual Meeting and access copies of proxy materials and our annual report. |

| LOCATION: Online virtual meeting at www.virtualshareholdermeeting.com/IDXX2020. |

Virtual Shareholder Meeting

After holding a virtual-only annual meeting of shareholders in 2017, 2018, and 2019, the Board determined, after discussion and consideration, to continue with this format for our 2020 annual meeting of shareholders. In making this determination, the Board considered a number of factors, including our global shareholder base and the technology available to support our virtual meeting format, which is designed to assure our shareholders the same rights and opportunities to ask questions and participate in our virtual 2020 Annual Meeting as they would at an in-person meeting.

A more detailed description regarding the format of the virtual 2020 Annual Meeting and how to ask questions and participate in the meeting is provided in the Notice of 2020 Annual Meeting of Shareholders on page 21, under “Virtual Shareholder Meeting” on page 41 and under “General Information about the 2020 Annual Meeting and Voting” on page 92. Shareholder Voting Matters Summary

|

| | | |

| Proposal | Board Vote

Recommendation | Page Number for

More Information |

Proposal One – Election of Directors | FOR each nominee | | |

Proposal Two – Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | | |

Proposal Three – Advisory Vote to Approve Executive Compensation | FOR | | |

How to Vote

It is important that your shares be represented and voted at the 2020 Annual Meeting. You can submit a proxy by telephone or via the Internet. Alternatively, you may request a paper proxy card by calling the appropriate number set forth below, which you may complete, sign and return by mail. Registered holders and beneficial owners of our stock will be able to vote their shares electronically at the annual meeting, which will be a completely online virtual meeting of shareholders.

|

| | |

For registered holders: (Your shares are registered in your name with our transfer agent American Stock Transfer & Trust Company) | | For beneficial owners: (You hold your shares in a brokerage account or by a bank or other holder of record (that is, in “street name”)) |

BY TELEPHONE

In the U.S., you can vote your shares toll-free by calling

1-800-690-6903.* | BY TELEPHONE

You can vote your shares toll-free by calling

1-800-454-8683.* |

BY INTERNET

You can vote your shares online before the meeting at www.proxyvote.com. During the meeting, you can vote your shares at www.virtualshareholdermeeting.com/IDXX2020.* | BY INTERNET

You can vote your shares online before the meeting at www.proxyvote.com. During the meeting, you can vote your shares at www.virtualshareholdermeeting.com/IDXX2020.* |

BY MAIL

You can vote by mail using a paper proxy card, which you may request by calling 1-800-579-1639, or by email at sendmaterial@proxyvote.com. | BY MAIL

You can vote by mail by using the paper proxy card or voting instruction form. Mark, sign and date your proxy card and return it in the postage-paid envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| |

| * | You will need your 16-digit control number available from the Notice sent to you from Broadridge. |

Whether you are a registered holder or a beneficial owner, you may vote online at the 2020 Annual Meeting. You will need to enter your control number (included in your Notice of Internet Availability, your proxy card or the voting instructions that accompanied your proxy materials) to vote your shares at the 2020 Annual Meeting. Even if you plan to attend the virtual 2020 Annual Meeting, we encourage you to vote in advance by telephone, over the Internet or by mail as described above. This will ensure that your vote will be counted if you are unable to, or later decide not to, participate in the virtual meeting.

About IDEXX

IDEXX was incorporated in Delaware in 1983 and is headquartered in Westbrook, Maine. IDEXX is included in the S&P 500® Index and is a leader in pet healthcare innovation, serving practicing veterinarians around the world with a broad range of diagnostic and information technology-based products and services in our Companion Animal Group (CAG) business. IDEXX is also a worldwide leader in providing diagnostic tests and information for livestock and poultry and tests for the quality and safety of water and milk and sells a line of portable electrolytes and blood gas analyzers for the human point-of-care medical diagnostics market.

Our CAG business is our largest business segment, representing 88% of our revenues in 2019, and we offer a full CAG diagnostic solution, including innovative and proprietary products and services available only from IDEXX.

Generating Long-Term Value

We aim to generate long-term value by successfully executing our Purpose-driven, long-term strategy:

|

| | |

• Focus on Growing, Highly Attractive Markets, Including the Global Pet Healthcare Market – We serve global markets with excellent long-term secular growth characteristics. In fact, we estimate that the total global addressable companion animal diagnostics market opportunity is over $30 billion. We focus on expanding our core markets by bringing unique product and service innovations to market and driving their broad adoption. • Sustained Investment in Innovation – We aim to advance global pet healthcare standards of care through innovation, supporting the long-term development of our largest market. Our substantial R&D investments since 1998 enable our novel, proprietary diagnostic and software product and service introductions, afford unparalleled new product development capability and result in a robust pipeline. In addition, our innovative diagnostic solutions are fully backed by peer-reviewed and third-party studies, where possible, that confirm their unique claims and capabilities. • Customer Focus – We have the largest and most-experienced companion animal diagnostics field-based professional organization in the world, which enables us to develop and strengthen our relationships with our customers, including individual veterinarians, and drive faster adoption of our unique innovations and advances in pet healthcare standards, and we continue to invest in our customer development capabilities. • Expansion of Our Recurring Revenue Business Model – Our business is designed around a durable, recurring revenue business model, with robust growth and profit characteristics and supported by our extraordinary customer loyalty and retention rates, which range from 96% to 99.9%, depending on the product line and geography. We estimate that our recurring revenue has grown from 81% of our total revenue in 2010 to 89% in 2019, and the largest contributor is our CAG Diagnostics business, which constituted 76% of our total 2019 revenue. | | |

| | Highly Attractive Global Pet Healthcare Market |

| | Global pet healthcare is our largest market. Some factors driving its long-term growth include: • The enduring bond between pets and their owners, viewed by many as family members. • The growing strength and importance of this bond for successive generations of pet owners. • Owners’ ever-increasing desire to support the health and well-being of their pets and their willingness to commit their time and money toward veterinary care. • Veterinary care providers’ ever-advancing ability to provide a high medical standard of pet care. • Our innovations in diagnostic insights, which: • Expand the veterinarian’s medical toolkit. • Enable pets – who cannot speak for themselves – to communicate more precisely their health status and problems. • The increasing emphasis on preventive care for pets – including the growing use of diagnostics as a cost-effective part of routine annual preventive care protocols – which enables earlier detection of important medical conditions and may improve the pets’ prognoses. |

| | |

| | |

| |

| • | Commitment to Sustained Growth in Financial Performance – As we invest in innovation and customer development capabilities, we remain committed to delivering strong financial results that drive growth in shareholder value. We have a consistent track record of organic revenue growth, operating margin expansion, strong free cash flow generation and a disciplined approach to capital allocation. As a result, our after-tax return on invested capital, excluding cash and investments, in 2019 was 46%.* |

_______________

| |

* | Information regarding after-tax return, excluding cash and investments, and its calculation is provided in Appendix A. |

We believe that successful execution of this strategy will result in delivery of our long-term financial goals, as reflected in our long-term financial potential model:** |

| | | | | | |

Revenue Growth

10%+ | + | Operating Margin

Expansion

50 – 100 bps | + | Capital Allocation

Leverage

1% – 2%

Incremental EPS Growth | | Long-Term

EPS Growth Potential

15% – 20% |

Leadership Succession and Transitions

This past year, IDEXX accomplished a critically important and smooth leadership transition. On June 27, 2019, Jonathan Ayers suffered a paralyzing spinal cord injury from a cycling accident. Due to his injury and ongoing rehabilitation needs, Mr. Ayers stepped down as our Board Chair, President and CEO, while remaining a Board member and becoming a Senior Advisor to IDEXX.

Jonathan (Jay) Mazelsky, who had been serving as our Executive Vice President responsible for the North American CAG business since August 2012, was appointed our Interim President and CEO, effective June 28, 2019, in accordance with the Board’s emergency succession plan. In addition, in support of this transition, our Chief Financial Officer Brian McKeon assumed additional oversight responsibilities for certain business lines, while continuing to serve as our CFO.

Following an intensive and thorough succession and transition planning process that spanned nearly four months, the Board appointed Mr. Mazelsky as our President and CEO and elected him as a Director, effective October 23, 2019. In addition, the Board appointed Lawrence Kingsley, who had served as our independent Lead Director since May 2018, as our independent Non-Executive Board Chair, effective November 1, 2019.

The Board believes that this leadership structure best serves the needs of the Board, IDEXX and our shareholders and other stakeholders at this time and effectively allocates responsibility and oversight between management and the Board based on the current characteristics, facts and circumstances relevant to IDEXX. Going forward, the Board will continue to evaluate its leadership structure in order to ensure it aligns with and appropriately supports the evolving needs and circumstances of the Board, IDEXX and our shareholders and other stakeholders.

For more information, see the “CEO Transition” section of this Proxy Statement beginning on page 57 and the “Board Leadership Structure” section of this Proxy Statement beginning on page 34. Key Business Highlights

IDEXX’s Innovation Built on Decades of Sustained R&D Investment and Capability Development

Consistent with our Guiding Principle to innovate with intelligence, we have made significant R&D investments for decades, which, combined with our deep knowledge of our customers and their needs, have enabled us to introduce a steady stream of innovative, proprietary CAG diagnostic and software products and services.

Our product innovations increasingly integrate and leverage machine learning and other forms of artificial intelligence (AI). Because of the information-based nature of diagnostics, we believe that the further application of AI, combined with the possibilities of our already developed global-installed base of analyzers connected real-time with IDEXX, present vast opportunities for future innovations.

_______________

| |

| ** | Our long-term financial potential model represents our projected annual gains, assuming that foreign currency exchange rates remain the same and excluding year-over-year changes in share-based compensation tax benefits and non-recurring or unusual items. |

10 | 2020 Proxy Statement

Some CAG Product Innovations

|

| | |

| | | |

| Unique, Differentiated Assay Development | IDEXX SDMA® Test – Detecting the renal biomarker SDMA helps veterinarians identify impairment of a patient’s renal glomerular filtration rate, or GFR, which is a serious medical condition that may result from various medical conditions and diseases. With early detection, veterinarians have more options to diagnose, treat and manage disease. In October 2019, SDMA-based staging guidelines were included in the International Renal Interest Society’s chronic kidney disease staging guidelines, in recognition of how SDMA reflects kidney function. We believe our proprietary IDEXX SDMA Test highly differentiates our offering. |

| | |

| | | |

| | | |

| Instrument Platform Development | Catalyst One® Chemistry Analyzer – Delivers real-time chemistry, electrolytes and immunoassay results from a blood sample drawn during a patient visit. Integrates with most customer practice management systems, while also being connected real-time with IDEXX for support and continued software upgrades, as part of our Technology for Life approach. Catalyst Dx® and Catalyst One Chemistry Analyzers Test Menu Expansion – Part of our Technology for Life commitment to our customers, eight important new real-time tests have been added to the test menu in eight years, including our Bile Acids Test announced commercially in January 2020. Catalyst® SDMA Test – Launched in 2018, enables real-time measurement of SDMA as part of a routine chemistry test panel on our Catalyst Dx and Catalyst One analyzers. We have achieved a rapid rate of adoption with more than half of our Catalyst Dx and Catalyst One analyzer customers globally having run Catalyst SDMA. |

| | |

| | | |

| | | |

| Customer-Facing Software

| IDEXX Cornerstone® Software – A veterinary practice management system that incorporates features streamlining veterinary clinic workflows and enabling efficient operations and revenue capture. In March 2019, we upgraded IDEXX Cornerstone software to version 9.1, which significantly improves the user experience, and well over half of the installed base upgraded by the end of 2019. |

| | |

| | | |

| | | |

| Connectivity Systems | Rapid IDEXX Digital Cytology Service – Launched in February 2020 in North America, uses whole-slide imaging technology to capture and digitally transmit high-resolution slide images, enabling veterinarians to obtain cytology results and interpretations from IDEXX’s world-class global network of veterinary clinical pathologists in 2 hours or less, 24 hours a day, 7 days a week, 365 days a year, through VetConnect® Plus software. Providing earlier cytology results enhances faster veterinary clinical decision-making, eases pet owner uncertainty and advances the standard of care. |

| | |

| | | |

| | | |

| AI and Machine Learning | SediVue Dx® Urine Sediment Analyzer – Automates urine sediment analysis, a traditionally laborious and variable process, while expanding its clinical value by finding more underlying disease and finding it earlier. The SediVue Dx analyzer uses proprietary neural network algorithms similar to facial recognition technology to identify clinically relevant urine sediment particles and captures high-contrast digital images that become part of the permanent patient record. By using a growing image bank, now including 350 million images from five million patient samples, IDEXX leverages its algorithmic software and machine learning, a form of AI, to continuously improve the algorithms’ ability to identify abnormalities in urine samples. IDEXX Web PACS Diagnostic Imaging Platform – Launching in the first quarter of 2020, leverages AI to implement “hanging protocols” on this platform, automatically correcting image orientation and sorting images by body part. This will be the first use of AI in veterinary radiology, saving administrative time for veterinarians, veterinary staff and radiologists. All of our digital imaging systems work with our cloud-based IDEXX Web PACS software, now in use at over 4,500 locations, to securely store images and view images on any device. |

| | |

| | | |

IDEXX Preventive Care – An Innovative, Customer-Focused Product and Service Offering

As veterinary medicine advances, supported by IDEXX diagnostic innovations, the relevance and medical benefits of running diagnostic tests on pets during wellness visits as part of a preventive care protocol are growing. Leveraging medical insights supported by big data studies and our deep understanding of our customers’ needs and concerns, we created an innovative, customer-focused turnkey solution for our customers that want to implement preventive care protocols:

IDEXX Preventive Care.

2020 Proxy Statement | 11

IDEXX Preventive Care combines our proprietary diagnostic tests in preventive care profiles that are uniquely designed for well patient testing, together with staff training and consultation services and pet owner communications materials to assist and support veterinary practices that want to implement preventive care protocols for their patients. IDEXX Preventive Care not only supports the advancement of veterinary standards of care, it also represents a significant growth opportunity for us with a total addressable U.S. market that we estimate to be $3.0 billion. Since the launch of IDEXX Preventive Care in 2017, we have enrolled over 3,800 practices in North America in IDEXX Preventive Care. |

| | |

2019 Global Premium Instrument Placements • More than 7,500 Catalyst One and Catalyst Dx chemistry instruments –Catalyst instruments represent over 75% of our more than 56,000 chemistry instruments global installed base. • Almost 4,000 premium hematology instruments, resulting in an ~31,500 global installed base. • Almost 2,400 SediVue Dx Urine Sediment Analyzers, resulting in an ~8,900 global installed base. | | Expanded Customer Development Capability We believe that developing and deepening strong relationships with our veterinarian customers help to deliver better care to patients, drive broader adoption of our products and services and maintain high customer loyalty. To advance our U.S. customer presence, in 2015 we transitioned to a model in which we directly market our CAG products to veterinarians. We also executed similar all-direct strategies in international segments in recent years. Today, almost 99% of our CAG products and services are sold in countries where we have a direct presence. In addition, in recent years, we have expanded our global field organization to levels required to execute our growth strategy. Since the end of 2011, our global CAG field-based professional staffing has grown almost 2.5 times, from 390 to 950. |

| |

| | |

Senior Leadership Evolution Supporting Global Commercial Efforts and Growth

In January 2020, we announced senior leadership changes to support global development of CAG market segments, enhance our global CAG commercial efforts and foster greater integration and efficiencies across regions:

| |

| • | James Polewaczyk, who previously led our North America CAG commercial operations since our U.S. all-direct initiative described above, became our Chief Commercial Officer overseeing CAG commercial operations globally. |

| |

| • | Kathy Turner, who previously led our CAG commercial operations in Europe and Asia, became our Chief Marketing Officer, responsible for our commercial marketing efforts worldwide, including global medical affairs and global marketing centers of excellence. |

| |

| • | Michael Erickson, who previously led our Veterinary Software and Services line of business, now leads Global Corporate Accounts to support these strategic partners on an increasingly global basis. |

| |

| • | Tina Hunt, who leads our in-clinic CAG Diagnostics portfolio globally, also took on responsibility for worldwide operations. |

| |

| • | Michael Lane, who leads our Global Reference Laboratories business, assumed additional responsibility for our worldwide information technology organization. |

Commitment to Corporate Responsibility, Sustainability and Diversity and Inclusion

Corporate responsibility is core to our culture and reflected in our environmental, social and governance (ESG) activities. We prioritize investments aligned with our Purpose, conduct ourselves with the highest ethical standards, empower and reward our employees, promote a culture that values diversity and inclusion and seek to enhance sustainability in our facilities and operations. We believe our corporate responsibility activities benefit the communities where we live and work and enable our continued, long-term value-creation for the benefit of all our stakeholders.

As part of our commitment to human capital management, we partner with organizations that promote human-animal connections and science, technology, engineering and math (STEM) education. For example, IDEXX is a founding partner in The Roux Institute at Northeastern University, a new professional graduate school and research institute to be located in Portland, Maine and designed to educate generations of talent for the digital and life sciences sector and drive economic growth in Portland and northern New England – one of the communities and regions where we live and work.

In 2019, we hired a Head of Corporate Responsibility to lead our global corporate responsibility strategy and activities, and we hired a Head of Diversity and Inclusion to further enhance our strategic plan for global diversity and inclusion. These important additions to the Company will help us advance our effort to incorporate material ESG issues into our strategy and business operations in support of our long-term financial performance.

To learn more about corporate responsibility at IDEXX, please visit the Corporate Responsibility section of our website (www.idexx.com).

12 | 2020 Proxy Statement

2019 Financial Performance Highlights‡

For more complete information, review our 2019 Annual Report on Form 10-K filed with the SEC on February 14, 2020, which can be accessed on our website (www.idexx.com).

|

| | | | |

| | | | |

+11% growth in CAG Diagnostics recurring revenue, or +12% organic revenue growth, over 2018 | | 23% of revenue +80 bps over 2018 on reported basis +120 bps over 2018 on comparable constant currency basis | | +21% over 2018 on comparable constant currency basis |

|

| | | | |

| | | | | |

| OPERATING CASH FLOW | | FREE CASH FLOW | | ROIC |

| $459 million | | $304 million | | 46% |

| +15% over 2018 | | +7% over 2018 and 71% of net income | | |

| | | | | |

| | | | | |

| | | | | |

CAPITAL ALLOCATED TO SHARE REPURCHASES, 2014 – 2019† |

| $1.7 billion | | 14% | | $123.43 |

| Capital allocated to share repurchases | | Percentage of outstanding shares repurchased | | Average share repurchase price |

| | | | | |

|

| |

| Comparison of Cumulative Five-Year Total Shareholder Return* |

|

| |

| ‡ | Information regarding the following non-GAAP financial measures and their calculation is provided in Appendix A: organic revenue growth, comparable constant currency operating margin improvement, comparable constant currency EPS growth, free cash flow, ratio of free cash flow to net income and after-tax return on invested capital, excluding cash and investments (ROIC). |

| |

| † | For the period from December 31, 2014 to December 31, 2019. The average purchase price per share of our stock has been adjusted for the effect of the two-for-one split of our common stock effected in the form of a common stock dividend paid on June 15, 2015. |

| |

| * | Assumes the investment of $100 on December 31, 2014 in IDEXX’s common stock, the S&P 500 Index, the S&P 500 Health Care Index and the NASDAQ Stock Market Index (U.S. Companies) (NASDAQ Index) and the reinvestment of dividends, if any. |

2020 Proxy Statement | 13

|

| | | | | | | | |

| PROPOSAL ONE | | | | | |

| | | |

| | Election of Directors The Board has nominated Rebecca M. Henderson, PhD, Lawrence D. Kingsley and Sophie V. Vandebroek, PhD to serve as Class II Directors with a term expiring at the 2023 Annual Meeting. | |

| | | |

| | Name | Age | Director Since | Independent | Committees | Other Current Public

Company Board Service | |

| | Rebecca M. Henderson, PhD | 59 | July 2003 | | Compensation

Finance (Chair) | Amgen, Inc. | |

| | Lawrence D. Kingsley | 57 | October 2016 | | Compensation

Nominating and Governance | Polaris Industries Inc.

Rockwell Automation Inc. | |

| | Sophie V. Vandebroek, PhD | 58 | July 2013 | | Finance

Nominating and Governance | None | |

| | | |

| | The Board of Directors recommends a vote “FOR” the three Director nominees up for election | |

| | | See page 25 for further information about our Director nominees | |

Board Composition and Skills

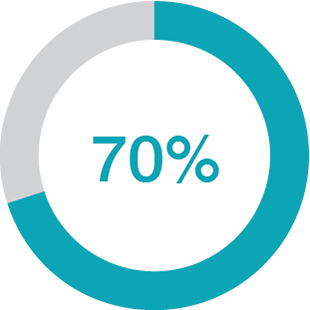

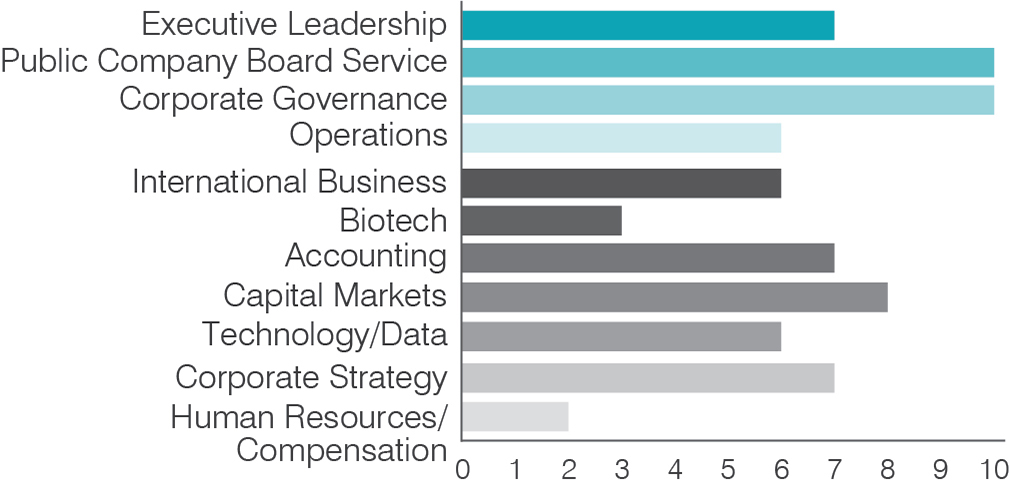

The following summarizes key information regarding the composition and qualifications of our Board as described in our Directors’ biographical information under “Director Nominees and Board Biographies” beginning on page 25. |

| | | | | | | |

| Director Independence | Gender Diversity | Born and Raised Outside U.S. | Former or Current CEOs |

| | | |

| | | | |

| | | |

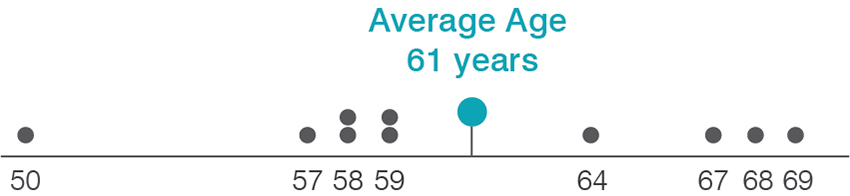

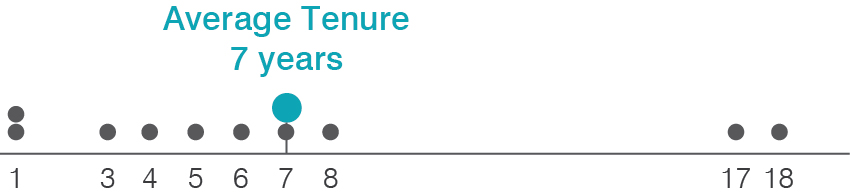

| Director Age | Average Age 61 years 50 57 57 58 58 59 59 64 67 68 69 | Director Skills and Qualifications |

| |

| |

| Director Tenure | Average Tenure 7 years 1 1 3 4 5 6 7 8 17 18 |

|

| | |

14 | 2020 Proxy Statement

Notable Corporate Governance Highlights

We believe that our commitment to high ethical standards and good governance practices contributes to our creation of long-term stakeholder value by:

| |

| • | Strengthening Board and management accountability and effectiveness; |

| |

| • | Promoting alignment with the long-term interests of our shareholders and other stakeholders; and |

| |

| • | Helping to maintain our shareholders’ and other stakeholders’ trust in our Company. |

Our engaged and diverse Board has implemented and maintained strong corporate governance policies. In addition, the Board actively oversees the development and execution by management of long-term strategies for durable growth and stakeholder value-creation, and the Board plays a key oversight role in risk management. We believe that the Board’s stewardship in these areas and our strong governance policies and practices summarized below have enabled IDEXX to achieve strong financial performance relative to its peers and the S&P 500 Index.

The Board regularly assesses the corporate governance landscape to identify best practices that it believes will enable us to fulfill our Purpose and support the creation of exceptional long-term stakeholder value. Most recently, the Board adopted the following practices:

| |

| • | Independent Non-Executive Board Chair elected in November 2019 in connection with our CEO transition; in view of the current, specific characteristics and facts and circumstances relevant to IDEXX, the Nominating and Governance Committee and the Board determined that separating the roles of Board Chair and CEO remains appropriate at this time. |

| |

| • | Proxy access by-law adopted in December 2017 that permits a shareholder, or a group of up to twenty shareholders, owning at least 3% in aggregate of our outstanding common stock continuously for at least three years, to nominate and include in our annual meeting proxy materials two individuals or 20% of the number of Directors serving on the Board, whichever is greater, as Director nominees, provided that the nominating shareholder(s) and Director nominees satisfy the requirements of the proxy access bylaw provisions. |

| |

| • | See “Shareholder Recommendation and Nomination of Directors” on page 24 and “Requirements for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders” on page 96. |

| |

| • | A majority-voting standard in uncontested elections adopted in December 2015. |

| |

| • | See “Majority Voting and Director Resignation” on page 24. |

| |

| • | An anti-pledging policy, adopted in December 2015, that prohibits our executive officers and Directors from pledging or otherwise encumbering IDEXX equity securities. |

| |

| • | See “Anti-Hedging and Short Sale and Anti-Pledging Policies” on page 41. |

For more information about our corporate governance policies and practices, see the Corporate Governance section of this Proxy Statement beginning on page 22.

2020 Proxy Statement | 15

|

| | | | | | | | |

| PROPOSAL TWO | | | | |

| | | |

| | Ratification of Appointment of Independent Registered Public Accounting Firm PricewaterhouseCoopers LLP (PwC) has been appointed to serve as our independent registered public accounting firm for 2020 and, while not required by law, the Board believes that it is advisable to give shareholders an opportunity to ratify this selection. The following table summarizes the fees for services provided by PwC during 2019 and 2018. | |

| | | |

| | | Fiscal Years Ended December 31, | |

| | | 2019 ($) | 2018 ($) | |

| | Audit fees | 2,071,155 |

| 2,123,435 |

| |

| | Audit-related fees | — |

| 50,000 |

| |

| | Tax fees | 436,522 |

| 275,184 |

| |

| | All other fees | 900 |

| 900 |

| |

| | Total fees | 2,508,577 |

| 2,449,519 |

| |

| | | | | |

| | The Board of Directors recommends a vote “FOR” this item | |

| | | See page 49 for further information about our independent auditors | |

|

| | | | |

| PROPOSAL THREE | | |

| | | |

| | Advisory Vote to Approve Executive Compensation (“say-on-pay”) We are asking our shareholders to approve, on an advisory (non-binding) basis, the compensation of our named executive officers (NEOs) as disclosed in this Proxy Statement. At our 2019 Annual Meeting, our shareholders voted 96% in favor of approving the compensation of our NEOs. | |

| | | |

| | The Board of Directors recommends a vote “FOR” this item | |

| | | See below and page 53 for further information about our executive compensation program | |

16 | 2020 Proxy Statement

Executive Compensation Highlights

These executive compensation highlights should be read in conjunction with the Executive Compensation section of this Proxy Statement, including the Compensation Discussion and Analysis section, for additional information about our executive compensation philosophy and program and the compensation awarded to each of our NEOs, including our CEO, beginning on page 56. Our Executive Compensation Philosophy and Program

Our executive compensation philosophy is simple – we want to attract, motivate and retain talented executives who are aligned with and passionate about our Purpose: to be a great company that creates exceptional long-term value for our customers, employees and shareholders by enhancing the health and well-being of pets, people and livestock.

We believe that executing this philosophy through our executive compensation program and practices, including a strong focus on pay-for-performance based compensation elements, will support long-term value-creation for our shareholders, customers, employees and other stakeholders through driving our strategy of innovation, continued revenue growth, margin improvement and efficient capital allocation.

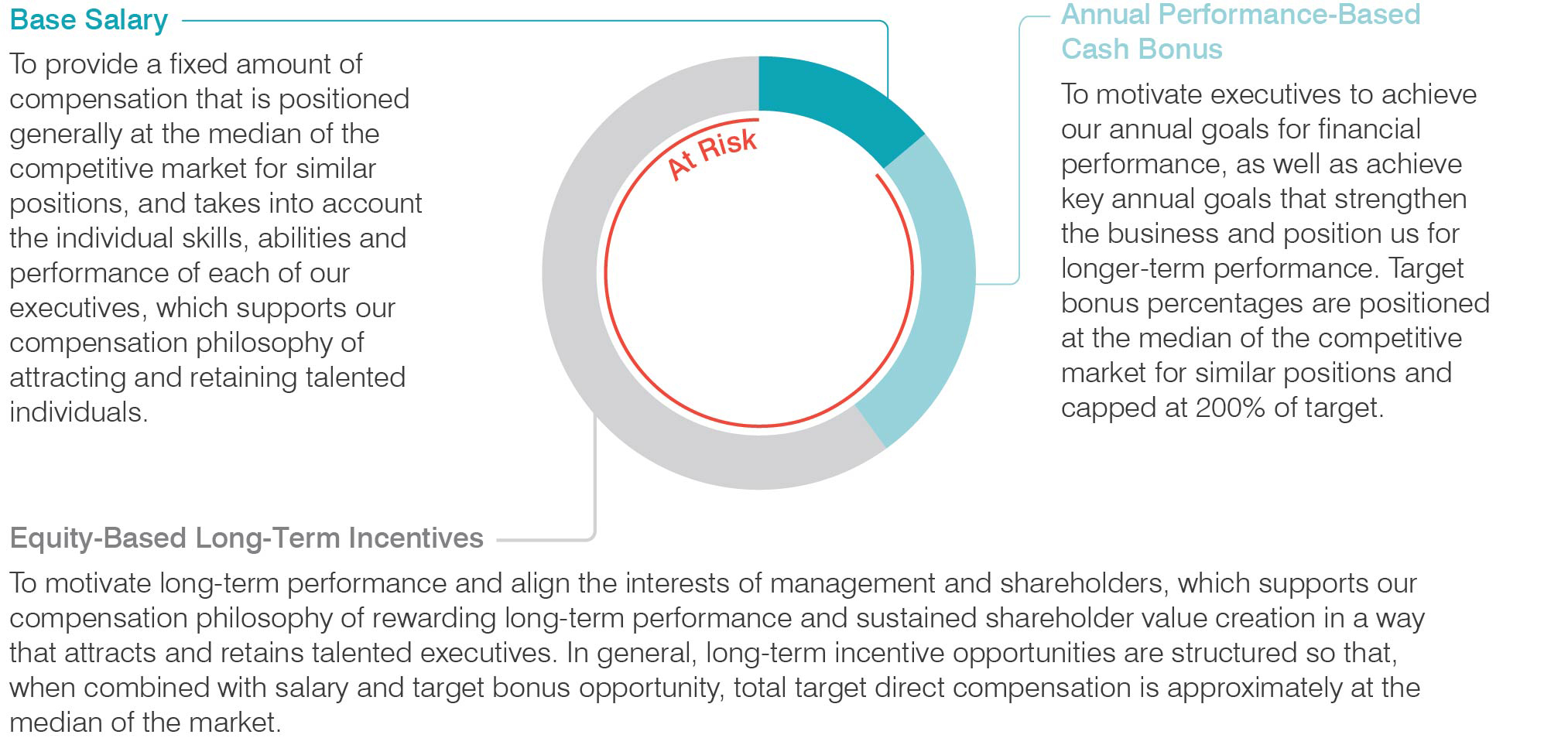

Our Executive Compensation Program

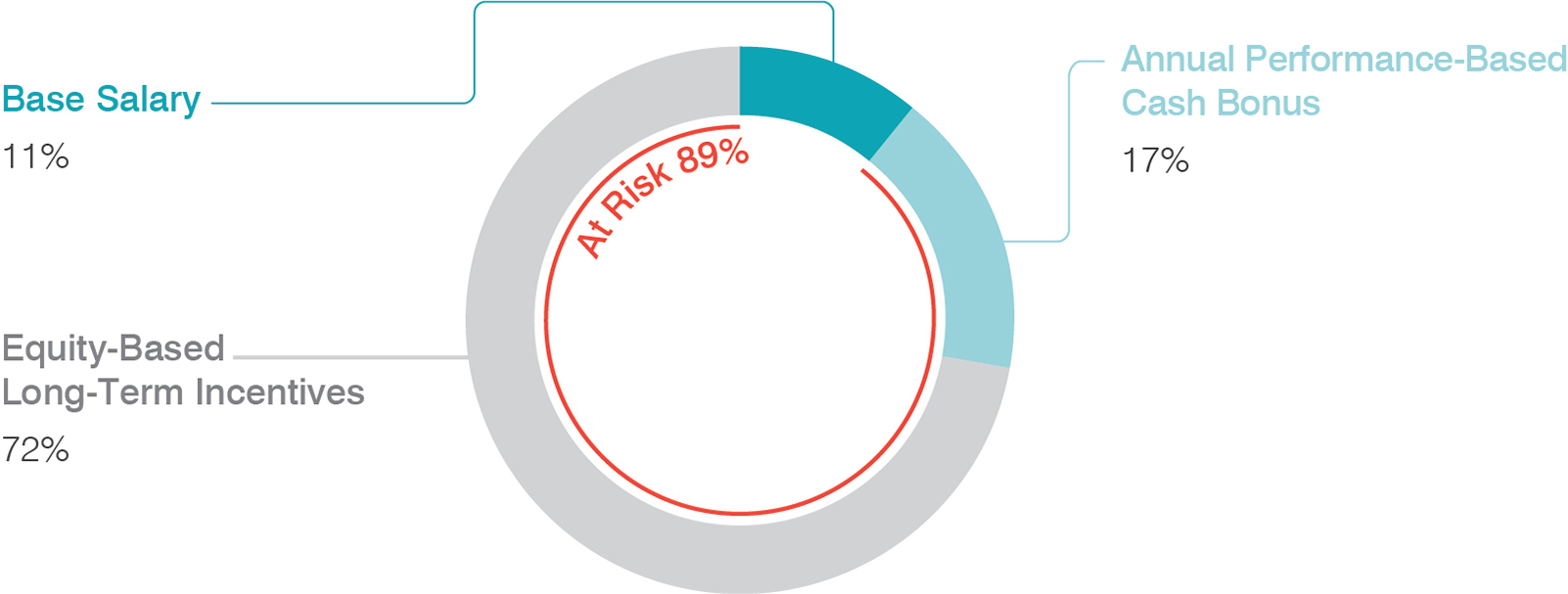

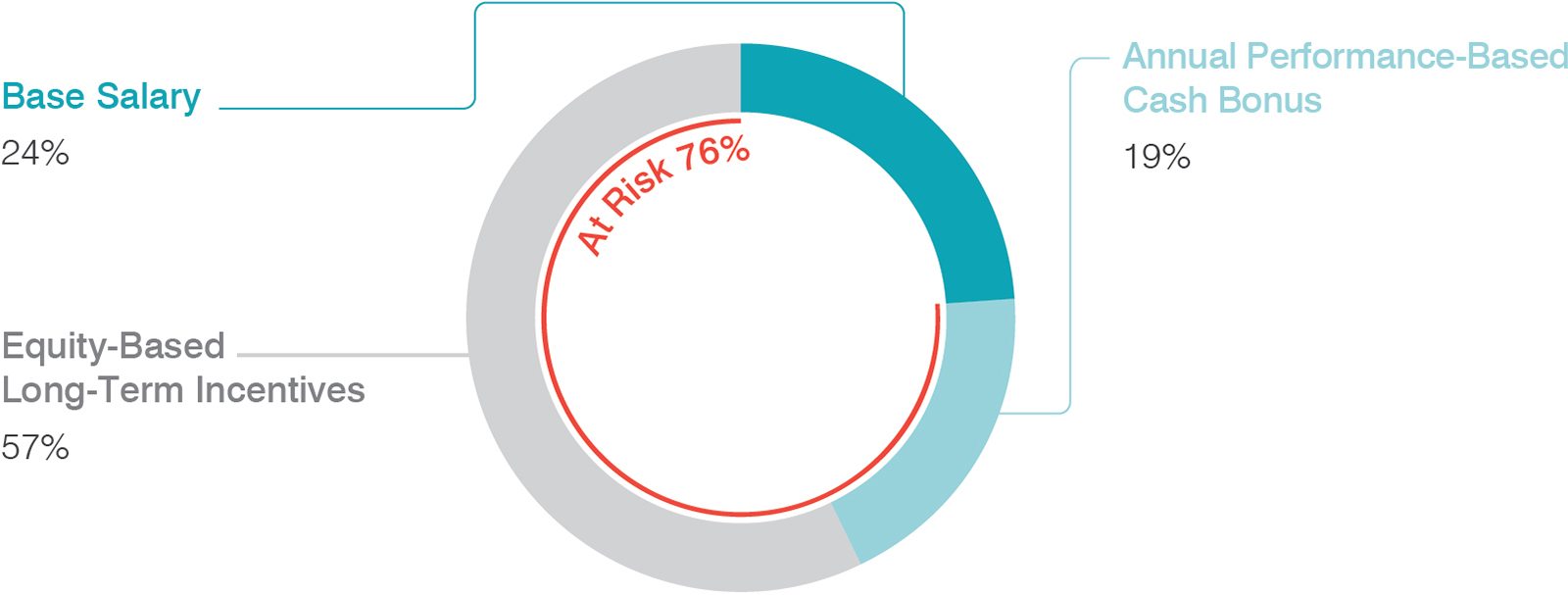

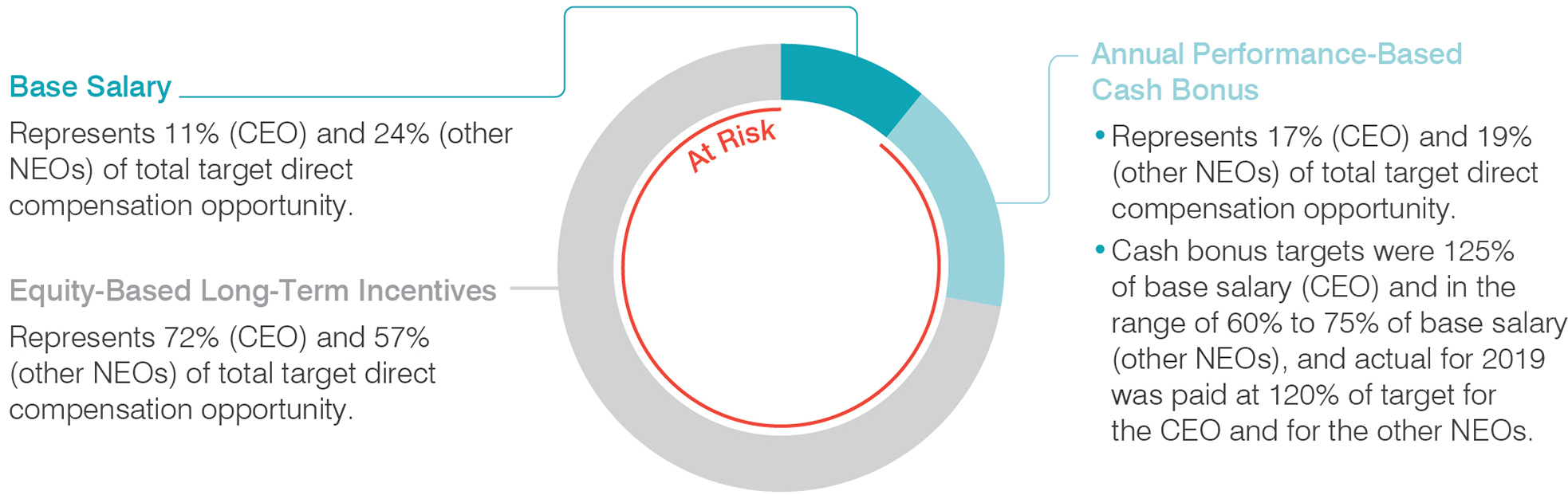

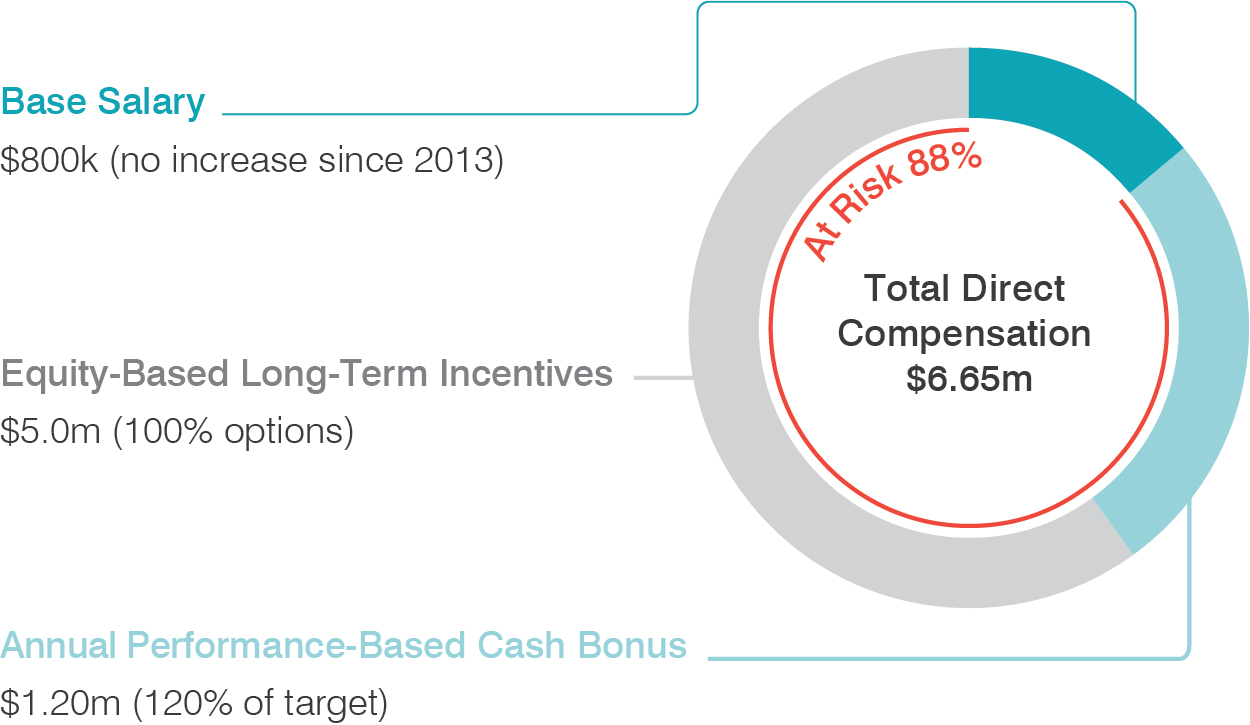

Our executive compensation program consists of three key elements, base salary, annual performance-based cash bonus and equity-based long-term incentives, which in total are targeted at the median of our competitive market. Because it relates most directly to the creation of shareholder value over time, variable, at risk compensation is a higher percentage of total compensation for our senior executives, including our NEOs, than for our other employees. The total 2019 direct compensation mix for our CEO and our other NEOs is detailed below:

|

|

Elements of 2019 Direct Compensation for CEO* and Other NEOs† (Average) |

|

| Base Salary Represents 11% (CEO) and 24% (other NEOs) of total target direct compensation opportunity. Equity-Based Long-Term Incentives Represents 72% (CEO) and 57% (other NEOs) of total target direct compensation opportunity. Annual Performance-Based Cash Bonus Represents 17% (CEO) and 19% (other NEOs) of total target direct compensation opportunity. Cash bonus targets were 125% of base salary (CEO) and in the range of 60% to 75% of base salary (other NEOs), and actual for 2019 was paid at 120% of target for the CEO and for the other NEOs. At Risk |

| |

| * | Reflects Mr. Ayers’s annual base salary for 2019 prior to his separation from the Company as an employee and February 2019 annual equity award, as well as the annual performance-based cash bonus that Mr. Ayers would have received for 2019, had he remained our President and CEO throughout 2019, calculated by applying the same overall performance factor – 120% – that was used to calculate our other NEOs’ bonuses. |

| |

| † | “Equity-Based Long-Term Incentives” includes only annual equity awards and Ms. Underberg’s equity award granted in February 2019 when she commenced employment with the Company, and excludes Mr. McKeon’s additional one-time equity award granted in August 2019. “Annual Performance-Based Cash Bonus” includes only annual performance-based cash bonuses, and excludes Ms. Underberg’s signing bonus in connection with her hiring in February 2019. |

2020 Proxy Statement | 17

Annual Performance-Based Cash Bonus

The target amount of the annual performance-based cash bonus award for each NEO is a percentage of his or her annual base salary, and the award amount is capped at 200% of this target.

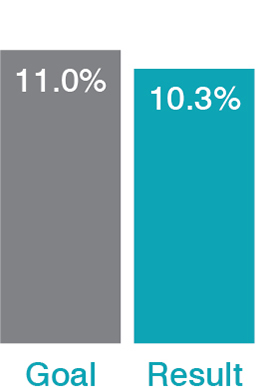

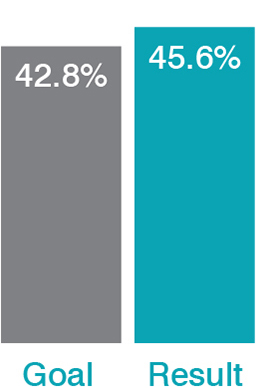

Actual amounts of the annual performance-based cash bonuses are calculated based on the achievement of both financial and non-financial performance goals, which results in the determination of an overall performance factor: |

|

| Annual Performance-Based Cash Bonus – Overall Performance Factor Determination* |

|

| | | | | | |

| Factor | | Weighting | | Metrics/Goals | | Objective |

Financial

performance | | | | • Organic revenue growth (40%) • Operating profit (20%) • Earnings per share (diluted) (20%) • After-tax return on invested capital, excluding cash and investments (ROIC) (20%) | | Measure performance against shareholder value drivers |

Non-financial

performance | | | | • Operational improvements • Achievement of upgrades to global IT platforms • Execution of key risk management initiatives • Hiring and development of key leadership talent, including gender and ethnically diverse talent • Organizational infrastructure advancements to support corporate responsibility strategy and reporting | | Support near-term performance of our long-term business objectives to strengthen the business in support of long-term performance |

| |

| * | The Compensation Committee annually establishes the respective weightings of the financial and non-financial performance factors, and for 2020, the Compensation Committee increased the weighting of the financial performance factor to 60% and decreased the weighting of the non-financial performance factor to 40%. |

In 2019, the overall performance factor was calculated as 120% for each of the NEOs based on achievement of the financial and non-financial performance goals described above. The Compensation Committee also considered the relative contributions made by each NEO to the achievement of the Company’s financial and non-financial goals, as well as other factors, such as the scope of and tenure in their roles at the Company, in determining the final amount of each award.

Equity-Based Long-Term Incentives

Our equity-based long-term incentives consist of stock options and restricted stock units. These equity incentives have a five-year or, beginning with the February 2020 grants, four-year vesting schedule, which in either case is longer than median market practice, and are more heavily weighted in the form of stock options for our senior executives. We believe that these types of equity incentives drive closer alignment with the long-term interests of our shareholders.

18 | 2020 Proxy Statement

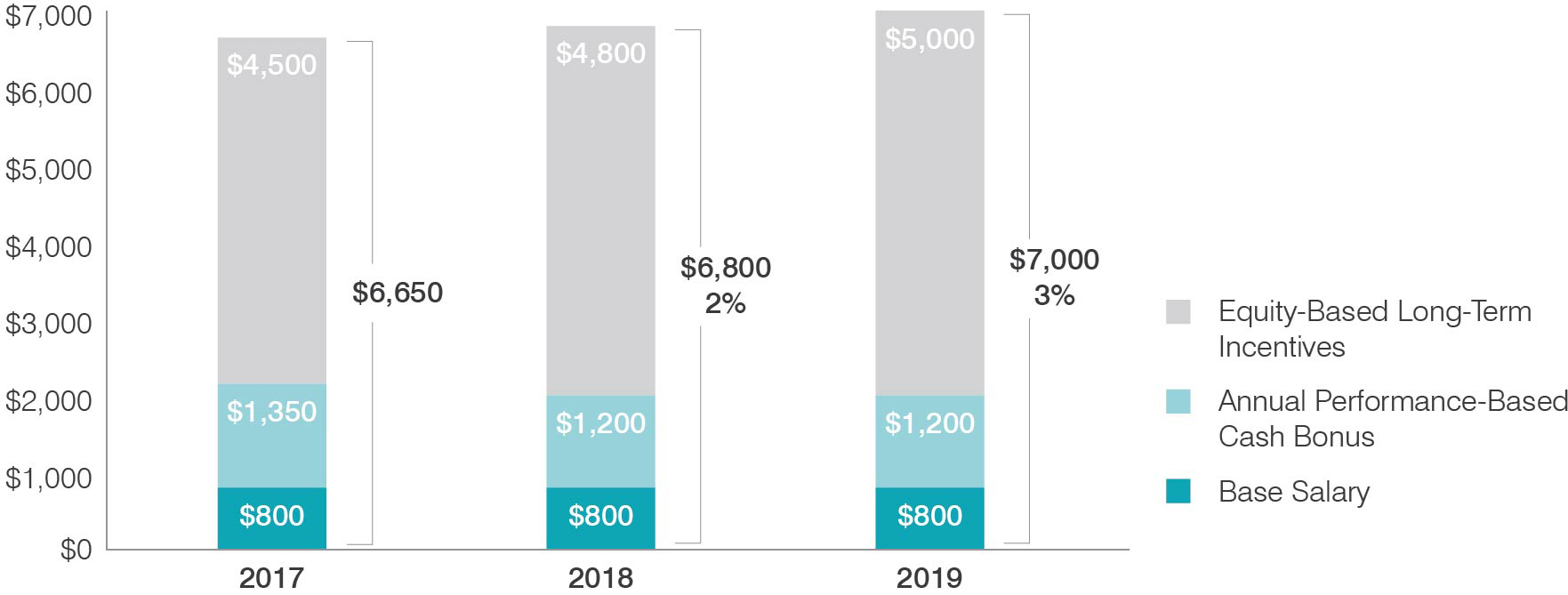

2019 CEO Compensation

The total compensation for our CEO that was determined by the Compensation Committee prior to the CEO transition that we experienced in 2019 is as follows:

|

| |

| Mr. Ayers’s 2019 compensation was competitively structured and ranked below the median as compared to our peer group. In addition, a significant portion of his 2019 compensation was at risk and tied to our operating or stock price performance. Our 1-, 3- and 5-year total shareholder return for the period ended December 31, 2019 was between the 55th and 89th percentiles of our peer group. For more information regarding our total shareholder return relative to our peer group, see the chart on page 71. |

| Base Salary $800k (no increase since 2013) Equity-Based Long-Term Incentives $5.0m (100% options) Annual Performance-Based Cash Bonus $1.20m (120% of target) At Risk 88% Total Direct Compensation $6.65m |

| |

| * | Reflects Mr. Ayers’s annual base salary for 2019 prior to his separation from the Company as an employee and February 2019 annual equity award, as well as the annual performance-based cash bonus that Mr. Ayers would have received for 2019, had he remained our President and CEO throughout 2019, calculated by applying the same overall performance factor – 120% – that was used to calculate our other NEOs’ bonuses. |

For more information regarding compensation determinations made with respect to our CEO position in 2019, including compensation paid to each of Mr. Ayers and Mr. Mazelsky in connection with our CEO transition, see “CEO Transition and CEO Compensation Decisions” on page 57, “CEO Pay-for-Performance Alignment” on page 60 and “How We Paid Our NEOs in 2019” beginning on page 68. Recent Noteworthy Compensation Actions

In 2019, we implemented the following noteworthy changes to our executive compensation program, policies and practices:

| |

| • | We shortened the employee equity award vesting schedule to a four-year period (as compared to a five-year period) for awards granted in 2020 and later. We believe that this change optimizes the effectiveness of our equity awards to attract and retain key talent. |

| |

| • | A shortened vesting period enhances our ability to attract key talent by aligning our employee equity award vesting schedule more closely with typical market practice and enabling our employees to realize the value of their equity awards more quickly. |

| |

| • | Our employee equity awards will continue to serve as an important retention tool because a four-year vesting schedule remains longer than median market practice. |

| |

| • | Our employee equity awards granted in 2018 and 2019 permit continued vesting for two vesting periods after retirement for eligible employees. Eligibility criteria include having been employed by IDEXX or any of its subsidiaries for at least ten years, retiring from IDEXX at the age of 60 years or older and providing written notice to IDEXX at least six months prior to retirement. We removed these provisions from our employee equity awards granted in 2020 and later. Our stock options, however, remain exercisable by our employees for two years after retirement if the employee retires at or after the age of 60 and after having been employed by IDEXX for at least ten years. |

| |

| • | The 2020 Executive Incentive Plan adopted by the Compensation Committee in February 2020 provides that each participating senior executive’s annual performance-based cash bonus amount will be determined based on an overall performance factor, calculated using a financial performance factor and a non-financial performance factor. For 2019, the financial performance factor and non-financial performance factor were equally weighted in calculating the overall performance factor. For 2020, the Compensation Committee changed the weighting of these factors by increasing the weight of the financial performance factor to 60% and decreasing the weight of the non-financial performance factor to 40%. |

2020 Proxy Statement | 19

Executive Compensation Program at a Glance

We seek to promote the long-term interests of our shareholders through our prudent compensation practices and policies:

Executive Compensation Program Design

|

| | |

| What We Do | | What We Don’t Do |

Align pay with our performance by having a weighted average of 82% of 2019 target total direct compensation for our NEOs consist of performance-based compensation Align pay with our performance by having a weighted average of 82% of 2019 target total direct compensation for our NEOs consist of performance-based compensation Generally target total direct compensation for our NEOs at the median of our peer group Generally target total direct compensation for our NEOs at the median of our peer group Focus, in part, on effectiveness of management to invest in the future of the business through its innovation, employees, systems and processes Focus, in part, on effectiveness of management to invest in the future of the business through its innovation, employees, systems and processes | |  No uncapped payouts under our Executive Incentive Plan No uncapped payouts under our Executive Incentive Plan |

Equity-Award-Related Practices

|

| | |

| What We Do | | What We Don’t Do |

Grant all equity awards with a five-year or, beginning with February 2020 grants, four-year, vesting schedule, in either case longer than median market practice Grant all equity awards with a five-year or, beginning with February 2020 grants, four-year, vesting schedule, in either case longer than median market practice Apply a one-year minimum vesting period to equity awards granted to employees Apply a one-year minimum vesting period to equity awards granted to employees Minimum fair market value exercise price for options Minimum fair market value exercise price for options Include non-competition, non-solicitation and related forfeiture provisions in our equity award agreements for our executives Include non-competition, non-solicitation and related forfeiture provisions in our equity award agreements for our executives | |  No dividends or dividend equivalents on unearned equity awards No dividends or dividend equivalents on unearned equity awards No backdating of options and no repricing or buyout of underwater stock options without shareholder approval No backdating of options and no repricing or buyout of underwater stock options without shareholder approval |

Compensation Governance and Risk Mitigation

|

| | |

| What We Do | | What We Don’t Do |

Review our peer group annually and engage in rigorous, annual benchmarking to align our executive compensation program with the market Review our peer group annually and engage in rigorous, annual benchmarking to align our executive compensation program with the market Review and verify annually the independence of the Compensation Committee’s independent compensation consultant Review and verify annually the independence of the Compensation Committee’s independent compensation consultant Conduct an annual compensation program risk assessment Conduct an annual compensation program risk assessment Provide limited benefits and perquisites to our senior executives that are not otherwise made available to our other salaried employees Provide limited benefits and perquisites to our senior executives that are not otherwise made available to our other salaried employees Require our senior executives to satisfy strict and meaningful stock ownership guidelines to strengthen the alignment with our shareholders’ interests Require our senior executives to satisfy strict and meaningful stock ownership guidelines to strengthen the alignment with our shareholders’ interests Maintain a clawback policy that allows us to recover annual and long-term performance-based compensation if we are required to restate our financial results, other than a restatement due to changes in accounting principles or applicable law Maintain a clawback policy that allows us to recover annual and long-term performance-based compensation if we are required to restate our financial results, other than a restatement due to changes in accounting principles or applicable law Hold an advisory vote on executive compensation on an annual basis to provide our shareholders with an opportunity to give feedback on our executive compensation program Hold an advisory vote on executive compensation on an annual basis to provide our shareholders with an opportunity to give feedback on our executive compensation program Cap annual performance-based cash bonuses at 200% of target Cap annual performance-based cash bonuses at 200% of target | |  No employment contracts other than with our CEO No employment contracts other than with our CEO No tax gross-ups of perquisites or 280G excise taxes, except standard tax equalization measures for expatriates, relocation costs and de minimis amounts for spousal and partner travel expenses to our annual President’s Club events No tax gross-ups of perquisites or 280G excise taxes, except standard tax equalization measures for expatriates, relocation costs and de minimis amounts for spousal and partner travel expenses to our annual President’s Club events No supplemental executive retirement plan No supplemental executive retirement plan No single-trigger change-in-control bonus payments or vesting of equity awards (except for 25% vesting of equity awards upon a change-in-control) No single-trigger change-in-control bonus payments or vesting of equity awards (except for 25% vesting of equity awards upon a change-in-control) No stock options granted below fair market value No stock options granted below fair market value No allowance for pledging of our common stock by executive officers and Directors No allowance for pledging of our common stock by executive officers and Directors No allowance for employees to hedge or sell short our common stock No allowance for employees to hedge or sell short our common stock |

20 | 2020 Proxy Statement

One IDEXX Drive

Westbrook, Maine, 04092

Notice of 2020 Annual Meeting

of Shareholders

NOTICE IS HEREBY GIVEN of the 2020 annual meeting of shareholders (2020 Annual Meeting) of IDEXX Laboratories, Inc. As described below, the 2020 Annual Meeting will be a completely virtual meeting of shareholders held over the Internet, and shareholders will be able to attend the 2020 Annual Meeting, vote their shares electronically and submit their questions during the live audio webcast of the 2020 Annual Meeting by visiting www.virtualshareholdermeeting.com/IDXX2020 and entering their control number. We will first make available to our shareholders this Proxy Statement and the form of proxy relating to the 2020 Annual Meeting, as well as our 2019 Annual Report on Form 10-K filed with the SEC on February 14, 2020, on or about March 26, 2020. The 2020 Annual Meeting will be held:

|

| | |

| | | PURPOSE OF 2020 ANNUAL MEETING 1. Election of Directors. To elect the three Class II Directors named in the attached proxy statement for three-year terms (Proposal One); 2. Ratification of Appointment of Independent Registered Public Accounting Firm. To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year (Proposal Two); 3. Advisory Vote to Approve Executive Compensation. To approve a non-binding advisory resolution on the Company’s executive compensation (Proposal Three); and 4. Other Business. To conduct such other business as may properly come before the 2020 Annual Meeting or any adjournments thereof, including approving any such adjournment, if necessary. |

| DATE AND TIME Wednesday, May 6, 2020, 10:00 a.m.,

Eastern Time |

| LOCATION Virtual meeting online via audio webcast at www.virtualshareholdermeeting.com/IDXX2020 |

| RECORD DATE The Company’s Board of Directors has fixed the close of business on March 9, 2020 as the record date for the determination of shareholders entitled to notice of and to vote at the 2020 Annual Meeting. |

| | |

VIRTUAL MEETING ADMISSION

Shareholders of record as of March 9, 2020, will be able to participate in the 2020 Annual Meeting by visiting www.virtualshareholdermeeting.com/IDXX2020. To participate in the 2020 Annual Meeting, shareholders of record will need the control number included on their Notice of Internet Availability of the proxy materials, on their proxy card or on the instructions that accompanied their proxy materials. The annual meeting will begin promptly at 10:00 a.m., Eastern Time. Online check-in will begin at 9:30 a.m., Eastern Time, and you should allow ample time for the online check-in procedures.

PRE-MEETING FORUM

The online format for our 2020 Annual Meeting also allows us to communicate more effectively with you through our online pre-meeting forum, which can be accessed at www.proxyvote.com for beneficial owners and www.proxyvote.com/idxx for registered shareholders. At this online pre-meeting forum, you can submit questions in advance of our 2020 Annual Meeting, vote, view the Rules of Conduct and Procedures relating to the 2020 Annual Meeting and access copies of proxy materials and our annual report.

By order of the Board of Directors,

Sharon E. Underberg

Corporate Vice President,

General Counsel and Corporate Secretary

Westbrook, Maine

March 26, 2020

2020 Proxy Statement | 21

Corporate Governance

Proposal One – Election of Directors

Our Board of Directors is divided into three classes, and members of each class hold office for three-year terms as set forth below:

| |

| • | Class I Directors – currently three Directors whose terms expire at the 2021 Annual Meeting; |

| |

| • | Class II Directors – currently three Directors whose terms expire at the 2020 Annual Meeting; and |

| |

| • | Class III Directors – currently four Directors whose terms expire at the 2022 Annual Meeting. |

Upon recommendation of the Nominating and Governance Committee, the Board has nominated Dr. Rebecca M. Henderson, Mr. Lawrence D. Kinsgley, and Dr. Sophie V. Vandebroek, our three current Class II Directors, for re-election as Class II Directors, and shareholders are being asked to elect them for three-year terms expiring at the 2023 Annual Meeting.

This section includes additional information about Board refreshment and succession planning and the Director nomination process, including requisite criteria, experiences, qualification and skills, as well as the Class II Director nominees and the Board.

|

| | |

| RECOMMENDATION OF THE BOARD OF DIRECTORS |

The Board of Directors recommends that you vote “FOR” the election of Dr. Henderson, Mr. Kingsley and Dr. Vandebroek. | |

Board Refreshment and Succession Planning

The Nominating and Governance Committee identifies, reviews and recommends candidates for nomination to our Board in accordance with its charter and our Corporate Governance Guidelines. To ensure that it is selecting candidates who will contribute to Board effectiveness and the continued fulfillment of our Purpose, the Nominating and Governance Committee actively plans for Board succession and refreshment throughout the entire year:

|

| |

Strategic and Risk Review

This annual strategic planning process and enterprise risk assessment informs the Nominating and Governance Committee’s understanding of the specific skill sets that would contribute to Board effectiveness |

| | |

Board Self-Assessment

Nominating and Governance Committee uses this annual assessment to identify any future needs – particularly in light of our long-term strategy, risks and potential Director retirements |

| | |

Board Composition Review

Nominating and Governance Committee annually reviews the Board composition and each Director’s skill set |

| | |

Recruitment and Nomination Process

Nominating and Governance Committee identifies and evaluates potential candidates, and the Board recommends nominees |

| | |

Election

Shareholders vote on nominees |

|

| Seven new independent Directors joined the Board in the past eight years |

22 | 2020 Proxy Statement

Each year, the Nominating and Governance Committee leverages insights from the Board’s annual review of our long-term strategic plan and related risk assessment to identify the capabilities, skills and experiences that it believes would best enable our Board to support our Purpose, including the creation of exceptional long-term shareholder value, in both the present time and the future.

The Nominating and Governance Committee then considers the results of our annual Board self-assessment and evaluates the Board’s composition and each Director’s skill set to determine whether our Directors’ current capabilities, skills and experiences align with the long-term needs of our Board.

Based on its review, coupled with our Director age limit in our Corporate Governance Guidelines – which requires each Director to retire at the next Annual Meeting after his or her 73rd birthday, except as may be approved by the Board – the Nominating and Governance Committee determines whether and when Board refreshment is needed, as well as the capabilities, skills and experiences that candidates should possess.

The Nominating and Governance Committee then engages in the process described below under “Director Nomination Process.” Once candidates are recommended to the Board, the Board selects nominees to be voted upon by our shareholders, or if a candidate is recommended to fill a Board vacancy, he or she may be elected by the vote of a majority of the Directors then in office.

Director Nomination Process

|

| | | |

| 1 | | 2 | |

| | |

The Nominating and Governance Committee identifies, evaluates, recruits and makes recommendations to the Board regarding candidates for election by the shareholders or to fill vacancies on the Board using the criteria described below. The process followed by the Nominating and Governance Committee includes: • Receiving recommendations from the Board, management and shareholders; • Actively seeking out and identifying diverse potential candidates who fit the Board’s search criteria; • Holding meetings to evaluate biographical information and background material relating to potential candidates; and • Interviewing selected candidates. | In addition, the Nominating and Governance Committee, in some instances, will engage an executive search firm to assist in recruiting candidates. In such cases, the executive search firm assists the Nominating and Governance Committee in: • Identifying a diverse slate of potential candidates who fit the Board’s search criteria; • Obtaining candidate resumes and other biographical information; • Conducting initial interviews to assess candidates’ qualifications, fit and interest in serving on the Board; • Scheduling interviews with the Nominating and Governance Committee, other members of the Board and management; • Performing reference checks; and • Assisting in finalizing arrangements with candidates who receive an offer to join the Board. |

Criteria and Experiences, Qualifications and Skills

To be considered for nomination to the Board, a candidate must meet the following minimum criteria:

| |

| • | Reputation for integrity, honesty and adherence to high ethical standards; |

| |

| • | Demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to our current and long-term objectives; |

| |

| • | Willingness and ability to contribute positively to our decision-making process; |

| |

| • | Record of substantial achievement in one or more areas that are relevant to us and a general understanding of the issues facing public companies of a size and operational scope similar to us; |

| |

| • | Commitment to understanding us and our industry and to devoting adequate time and effort to Board responsibilities, including regularly attending and participating in Board and Committee meetings; |

| |

| • | Interest in and understanding of the sometimes conflicting interests of our various constituencies, which include shareholders, employees, customers, government entities, creditors and the general public, and willingness to act in the interests of all shareholders; and |

| |

| • | Absence of any conflict of interest, or appearance of a conflict of interest, that would impair the Director’s ability to represent the interests of all of our shareholders and to fulfill the responsibilities of a Director. |

2020 Proxy Statement | 23

The Nominating and Governance Committee and the Board are also focused on ensuring that a wide range of backgrounds and experiences are represented on our Board and consider the value of diversity of all types in the Director nomination process. For more information, see the discussion under “Diversity” on page 38. In addition, in evaluating potential candidates, the Nominating and Governance Committee considers whether the candidates possess the desired capabilities, skills and experiences that would best enable our Board to support our Purpose, including the creation of exceptional long-term shareholder value, in both the present time and the future, as described above under “Board Refreshment and Succession Planning,” and whether the candidates meet the other applicable requirements under the Corporate Governance Guidelines, including the Director independence requirements described under “Director Independence” beginning on page 32 and the maximum number of directorships generally permitted for our Directors. The Corporate Governance Guidelines provide that, unless an exception has been granted by the Board: | |

| • | Directors cannot serve on more than four other public company boards; |

| |

| • | Audit Committee members cannot serve on more than two other public company audit committees or, if an Audit Committee member is a retired certified public accountant, chief financial officer or controller, or is a retired executive with similar experience, then he or she cannot serve on more than three other public company audit committees; and |

| |

| • | Directors who are CEOs of other public companies cannot serve on more than two other public company boards (including the board of their employer). |

Shareholder Recommendation and Nomination of Directors

Shareholders who want to recommend a nominee for Director should submit the name of the nominee to our Corporate Vice President, General Counsel and Corporate Secretary at our principal executive offices, together with biographical information and background material sufficient for the Nominating and Governance Committee to evaluate the recommended candidate based on its selection criteria, as well as a statement as to whether the shareholder or group of shareholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date the recommendation is made. Assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Governance Committee will apply the same criteria, and follow substantially the same process, in considering each qualifying shareholder recommendation as it does in considering other candidates. If the Board determines to nominate a shareholder-recommended candidate and recommends his or her election, then his or her name will be included on the proxy card for our next Annual Meeting.

Shareholders also have the right under our Amended and Restated By-Laws to nominate Director candidates directly, without any action or recommendation on the part of the Nominating and Governance Committee or the Board, by following the procedures described under “Requirements for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders” beginning on page 96. Candidates nominated by shareholders directly in accordance with the procedures set forth in our Amended and Restated By-Laws will not be included on our proxy card for the next Annual Meeting, but may be included on proxies the nominating shareholders seek independently, unless both the nominating shareholder(s) and the candidates nominated by them satisfy the requirements of our proxy access bylaw, as described above under “Notable Corporate Governance Highlights” on page 15. Majority Voting and Director Resignation

Our Amended and Restated By-Laws provide that, in an election of Directors where the number of nominees does not exceed the number of Directors to be elected, a nominee who does not receive a majority of votes cast with respect to his or her election will not be elected.

Pursuant to our Director Resignation Policy included in our Corporate Governance Guidelines, a Director who is not re-elected is required to promptly tender his or her resignation, and the Nominating and Governance Committee would make a recommendation to the Board as to whether to accept the resignation. Following the Nominating and Governance Committee’s recommendation, the Board would determine whether or not to accept that Director’s resignation, considering any factors it deems relevant. Under this policy, the Board is required to act on the recommendation of the Nominating and Governance Committee within 90 days of the certification of the shareholder vote.

24 | 2020 Proxy Statement

Director Nominees and Board Biographies

Upon recommendation of the Nominating and Governance Committee, the Board has nominated Dr. Rebecca M. Henderson, Mr. Lawrence D. Kingsley and Dr. Sophie V. Vandebroek, our current Class II Directors, for re-election as Class II Directors, and shareholders are being asked to re-elect them for three-year terms expiring at the 2023 Annual Meeting.

Dr. Rebecca M. Henderson, Mr. Lawrence D. Kingsley and Dr. Sophie V. Vandebroek each meet NASDAQ Stock Market (NASDAQ) independence requirements, and all of our nominees have consented to serve, if elected. If any of the nominees becomes unable to serve, proxies can be voted for a substitute nominee, or the Board may choose to reduce the size of the Board.

In February 2020, the Nominating and Governance Committee reviewed the experience, qualifications, attributes and skills of each of the current Directors and the Class II Director nominees and concluded that each Class II Director nominee has the requisite background, qualifications and personal characteristics to serve as a Director in light of the Company’s business and structure.

Biographical information for all of our Directors, including the Class II Director nominees, is provided below, along with information regarding some key experiences, qualifications, attributes and skills that our Directors bring to the Board. These below-described key experiences, qualifications, attributes and skills contributed to each Director’s selection as a Board member and each Class II Director nominee’s nomination for re-election at our 2020 Annual Meeting. There are no family relationships among the executive officers or Directors of IDEXX.

For a summary of key information regarding the composition and qualifications of our Board, see the information above on page 14 under “Board Composition and Skills.”

2020 Proxy Statement | 25

Class II Directors Whose Terms Would Expire in 2023

|

| | |

| | Rebecca M. Henderson, PhD |

| | Dr. Henderson has been the John and Natty McArthur University Professor at Harvard University since 2011. Before joining Harvard’s faculty, from 1998 to 2009 Dr. Henderson served as the Eastman Kodak Professor of Management, Sloan School of the Massachusetts Institute of Technology. Dr. Henderson is also a research fellow at the National Bureau of Economic Research and a fellow of both the British Academy and the American Academy of Arts and Sciences. Dr. Henderson holds an undergraduate degree from the Massachusetts Institute of Technology and a Ph.D. in business economics from Harvard University. Qualifications As a Harvard Business School professor of general management and strategy and an author of both books and articles regarding sustainability, strategy and innovation, Dr. Henderson brings substantial expertise in corporate strategy, sustainability, compensation practices, corporate responsibility and governance issues, with a particular focus on high-technology businesses. This expertise, combined with her deep knowledge of and insight into our businesses, operations and organization from her more than sixteen years of service on the Board, uniquely positions Dr. Henderson to offer valuable insights into the organizational and strategic issues faced by IDEXX. |

| | |

Independent Director Age: 59 Director since: July 2003 Committees: Compensation

Finance (Chair) Other current public company director service: • Amgen, Inc. (since 2009) | |

| | | |

|

| | |

| | Lawrence D. Kingsley |