EXHIBIT 99.1

Overview

We are a global power company. We own a portfolio of electricity generation and distribution businesses on five continents in 29 countries, with generation capacity totaling approximately 43,000 Megawatts (“MW”) and distribution networks serving over 11 million people as of December 31, 2008. In addition, we have more than 3,000 MW under construction in ten countries. Our global workforce of 25,000 people provides electricity to people in diverse markets ranging from urban centers in the United States to remote villages in India. We were incorporated in Delaware in 1981 and for almost three decades we have been committed to providing safe and reliable energy.

We own and operate two primary types of businesses. The first is our Generation business, where we own and/or operate power plants to generate and sell power to wholesale customers such as utilities and other intermediaries. The second is our Utilities business, where we own and/or operate utilities to distribute, transmit and sell electricity to end-user customers in the residential, commercial, industrial and governmental sectors in a defined service area.

Our assets are diverse with respect to fuel source and type of market, which helps reduce certain types of operating risk. Our portfolio employs a broad range of fuels, including coal, gas, fuel oil, biomass and renewable sources such as hydroelectric power, wind and solar, which reduces the risks associated with dependence on any one fuel source. Our presence in mature markets helps reduce the volatility associated with our businesses in faster-growing emerging markets. In addition, our Generation portfolio is largely contracted, which reduces the risk related to the market prices of electricity and fuel. We also attempt to limit risk by hedging much of our currency and commodity risk, and by matching the currency of most of our subsidiary debt to the revenue of the business that issued that debt. However, our business is still subject to these and other risks, which are further disclosed in Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the year ended December 31, 2008 (“the 2008 Form 10-K”) filed with the Securities and Exchange Commission (“SEC”) on February 26, 2009.

Our goal is to maximize value for our shareholders through continued focus on increasing the profitability of our existing portfolio and increasing free cash flow while managing our risk and employing rigorous capital allocation. We will continue to seek prudent expansion of our traditional Generation and Utilities lines of business, along with new investments in wind, solar, climate solutions and energy storage. Portfolio management has become an increased area of focus through which we have sold and will continue to sell or monetize a portion of certain businesses or assets when market values appear attractive. Furthermore, we will continue to focus on improving our business operations and management processes, including our internal controls over financial reporting.

Key Lines of Business

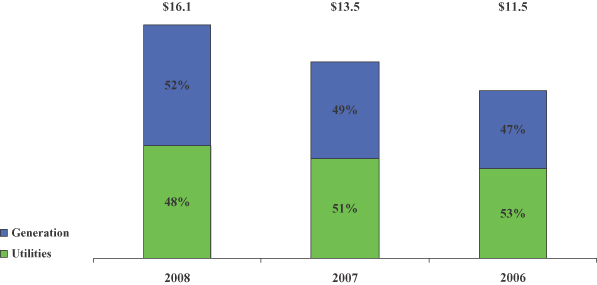

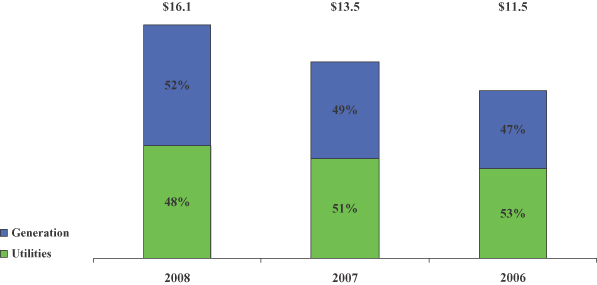

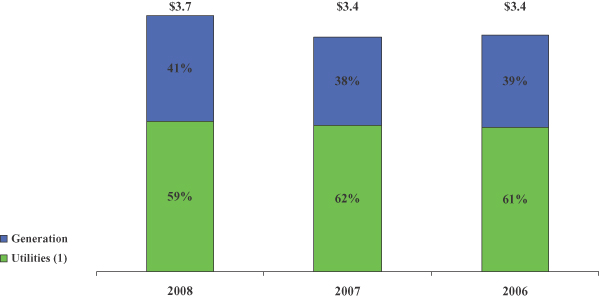

AES’s primary sources of revenue and gross margin today are from Generation and Utilities. These businesses are distinguished by the nature of the customers, operational differences, cost structure, regulatory environment and risk exposure. The breakout of revenue and gross margin between Generation and Utilities for the years ended December 31, 2008, 2007 and 2006, respectively is shown below.

Revenue

($ in billions)

Gross Margin

($ in billions)

| (1) | Utilities gross margin includes the margin from generation businesses owned by the Company and from whom the utility purchases energy. |

2

Generation

We currently own or operate a portfolio of approximately 38,000 MW, consisting of 93 Generation facilities in 26 countries on five continents at our generation businesses. We also have approximately 2,900 MW of capacity currently under construction in six countries. We are a major power source in many countries, such as Panama where we are the largest generator of electricity, and Chile, where AES Gener (“Gener”) is the second largest electricity generation company in terms of capacity. Our Generation business uses a wide range of technologies and fuel types including coal, combined-cycle gas turbines, hydroelectric power and biomass. Generation revenues were $8.3 billion, $6.6 billion and $5.4 billion for the years ended December 31, 2008, 2007 and 2006, respectively.

Performance drivers for our Generation businesses include, among other factors, plant reliability, fuel costs and fixed-cost management. Growth in the Generation business is largely tied to securing new power purchase agreements (“PPAs”), expanding capacity in our existing facilities and building new power plants.

The majority of the electricity produced by our Generation businesses is sold under long-term contracts, or PPAs, to wholesale customers. In 2008, approximately 61% of the revenue from our Generation business was from plants that operate under PPAs of five years or longer for 75% or more of their output capacity. These businesses often reduce their exposure to fuel supply risks by entering into long-term fuel supply contracts or fuel tolling contracts where the customer assumes full responsibility for purchasing and supplying the fuel to the power plant. These long-term contractual agreements result in relatively predictable cash flow and earnings and reduce exposure to volatility in the market price for electricity and fuel; however, the amount of earnings and cash flow predictability varies from business to business based on the degree to which its exposure is limited by the contracts it has negotiated.

Our Generation businesses with long-term contracts face most of their competition from other utilities and independent power producers (“IPPs”) prior to the execution of a power sales agreement during the development phase of a project or upon expiration of an existing agreement. Once a project is operational, we traditionally have faced limited competition due to the long-term nature of the generation contracts. However, as our existing contracts expire, the introduction of new competitive power markets has increased competition to attract new customers and maintain our current customer base.

The balance of our Generation business sells power through competitive markets under short-term contracts or directly in the spot market. As a result, the cash flows and earnings associated with these businesses are more sensitive to fluctuations in the market price for electricity, natural gas, coal and other fuels. However, for a number of these facilities, including our plants in New York, which include a fleet of coal fired plants, we have hedged the majority of our exposure to fuel, energy and emissions pricing for 2009. Competitive factors for these facilities include price, reliability, operational cost and third party credit requirements.

Utilities

AES utility businesses distribute power to over 11 million people in seven countries on five continents and consists primarily of 14 companies owned or operated under management agreements, each of which operate in defined service areas. These businesses also include 15 generation plants in two countries totaling approximately 4,400 MW. In addition, we have one generation plant under construction totaling 86 MW. These businesses have a variety of structures ranging from pure distribution businesses to fully integrated utilities, which generate, transmit and distribute power. Indianapolis Power & Light (“IPL”) has the exclusive right to provide retail services to approximately 470,000 customers in Indianapolis, Indiana. Eletropaulo Metropolitana Electricidad de São Paulo S.A (“AES Eletropaulo” or “Eletropaulo”), serving the São Paulo metropolitan region for over 100 years, has approximately six million customers and is the largest electricity distribution company in Brazil in terms of revenues and electricity distributed. In Cameroon, we are the primary generator and distributor of electricity and in El Salvador we provide distribution services to serve more than 80% of the country’s electricity customers. Utilities revenues were $7.8 billion, $6.9 billion and $6.2 billion for the years ended December 31, 2008, 2007 and 2006, respectively.

3

Performance drivers for Utilities include, but are not limited to, reliability of service; management of working capital; negotiation of tariff adjustments; compliance with extensive regulatory requirements; and in developing countries, reduction of commercial and technical losses. The results of operations of our Utilities businesses are sensitive to changes in economic growth and regulation and abnormal weather conditions in the area in which they operate.

Utilities face relatively little direct competition due to significant barriers to entry which are present in these markets. Where we do face competition is in our efforts to acquire existing businesses and develop new ones. In this arena, we compete against a number of other market participants, some of which have greater financial resources, have been engaged in distribution related businesses for longer periods of time and/or have accumulated more significant portfolios. Relevant competitive factors for our power distribution businesses include financial resources, governmental assistance, regulatory restrictions and access to non-recourse financing. In certain locations, our distribution businesses face increased competition as a result of changes in laws and regulations which allow wholesale and retail services to be provided on a competitive basis.

Renewables and Other Initiatives

In recent years, as demand for renewable sources of energy has grown, we have placed increasing emphasis on developing projects in wind, solar and other renewable initiatives including climate solutions projects In 2005, we started a wind generation business (“AES Wind Generation”), which currently has 16 plants in operation in three countries totaling over 1,200 MW and is one of the largest producers of wind power in the U.S. In addition, over 400 MW are under construction in four countries outside the U.S. In March 2008, we formed AES Solar Energy LLC (“AES Solar”), a joint venture with Riverstone Holdings, LLC (“Riverstone”), a private equity firm, which has since commenced commercial operations of eight plants totaling 24 MW of solar projects in Spain and has development potential in three other countries. In the area of climate solutions, we are developing and implementing projects to produce GHG credits and are currently developing projects in Asia, Europe and Latin America. In the U.S., we formed Greenhouse Gas Services, LLC as a joint venture with GE Energy Financial Services to create high quality verifiable emissions offsets for the voluntary U.S. market. We also formed a line of business to develop and implement utility scale energy storage systems (such as batteries), which store and release power when needed. While none of these initiatives are currently material to our operations, we believe that in the future, they may become a material contributor to our revenue and gross margin. However, there are risks associated with these initiatives, which are further disclosed in Item 1A—Risk Factors of the 2008 Form 10-K. As further described in “Our Organization and Segments” below, some of these projects are managed and reported within the region where they are located, while others are managed as separate business units and reported as set forth below.

Risks

We routinely encounter and address risks, some of which may cause our future results to be different, sometimes materially different, than we presently anticipate. The categories of risk we have identified in Item 1A—Risk Factors of the 2008 Form 10-K include the following:

| | • | | Risks associated with our operations in areas with extensive current and future governmental and environmental regulation; |

| | • | | Risks associated with our exposure to material litigation and regulatory proceedings; |

| | • | | Risks associated with our disclosure controls and internal controls over financial reporting; |

| | • | | Risks associated with our high levels of debt; |

| | • | | Risks associated with the operation of power plants; |

| | • | | Risks associated with revenue and earnings volatility; and |

| | • | | Risks associated with our ability to raise needed capital. |

4

The categories of risk identified above are discussed and explained in greater detail in Item 1A—Risk Factors of the 2008 Form 10-K. These risk factors should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), and the Consolidated Financial Statements and related notes included elsewhere in this report.

Our Organization and Segments

We believe our broad geographic footprint allows us to focus development in targeted markets with opportunities for new investment, and provides stability through our presence in more developed regions. In addition, our presence in each region affords us important relationships and helps us identify local markets with attractive opportunities for new investment. As a result, we have structured our organization into geographic regions, and each region is led by a regional president responsible for managing existing businesses. The regional presidents report to our Chief Operating Officer (“COO”), who in turn reports to our Chief Executive Officer (“CEO”). Both our CEO and COO are based in Arlington, Virginia.

Through the end of 2008, and as reflected in the 2008 Form 10-K, we organized our operations for management and external reporting purposes along two primary lines of business—the generation of electricity (“Generation”) and the distribution of electricity (“Utilities”) within four geographic regions: Latin America; North America; Europe & Africa; and Asia & the Middle East (“Asia”). Three regions, North America, Latin America and Europe & Africa, engage in both Generation and Utility businesses. Our Asia region only has Generation. This regional management structure resulted in the Company reporting seven segments. The reportable segments included Latin America Generation, Latin America Utilities, North America Generation, North America Utilities, Europe & Africa Generation, Europe & Africa Utilities and Asia Generation.

In 2008, AES Wind Generation, solar, climate solutions and certain other renewable initiatives were managed by our alternative energy group. The associated revenue, development and operational costs were reported under “Corporate and Other” since the results were not material to the presentation of our reportable segments. “Corporate and Other” also included corporate overhead costs which were not directly associated with the operations of our seven reportable segments; interest income and expense and other intercompany charges such as self-insurance premiums which are fully eliminated in consolidation.

In early 2009, we implemented certain internal organizational changes in an effort to streamline the organization. These changes affected how results are reported internally for management review. The new management reporting structure continues to be organized along our two lines of business, but there are now three regions: (1) Latin America & Africa; (2) North America and AES Wind; and (3) Europe, Middle East & Asia (collectively “EMEA”), each managed by a regional president. The Company no longer has a separate alternative energy group. Instead, AES Wind Generation is managed within our North America region while climate solutions projects are now managed and reported within the region in which they are located. Key climate solutions initiatives include investments in GHG initiatives, projects to create emissions offsets for the voluntary U.S. market, projects that produce certified emission reduction credits (“CERs”) and initiatives related to utility-scale energy storage systems (such as batteries) which store and release power when needed. AES Solar is accounted for using the equity method and will continue to be reflected in “Corporate and Other.” In addition to the change in regional management structure, with the exception of AES Wind Development, the Company now manages all development efforts centrally through a development group.

The new segment reporting structure uses the Company’s management reporting structure as its foundation. The Company’s segment reporting structure is organized along our two lines of business and three regions to reflect how the Company manages the business internally. The Company applied the guidance in SFAS No. 131,Disclosures about Segments of an Enterprise and Related Information (“SFAS No. 131”), which provides certain quantitative thresholds and aggregation criteria, and the Company concluded that it now has six reportable segments. This new segment structure is reflected in this Current Report on Form 8-K. The operating segments comprising the former Europe & Africa Generation and Utilities reportable segments are no longer managed together. Under the new management structure Africa is managed with the Latin America region and Europe is

5

managed with the Asia region. Only Europe—Generation was determined to be a reportable segment based on the Company’s application of SFAS No. 131. As described below, our Europe Utilities, Africa Utilities and Africa Generation operating segments are now reported within “Corporate and Other” because they do not meet the criteria to allow for aggregation with another operating segment or the quantitative thresholds that would require separate disclosure under SFAS No. 131.

Therefore, as a result of this analysis, the Company now reports six segments, which include:

| | • | | Latin America—Generation; |

| | • | | Latin America—Utilities; |

| | • | | North America—Generation; |

| | • | | North America—Utilities; |

“Corporate and Other” now includes corporate overhead costs which are not directly associated with the operations of our six reportable segments, other intercompany charges such as self-insurance premiums which are fully eliminated in consolidation. In addition, “Corporate and Other” includes the operating results of the Company’s Europe Utilities, Africa Utilities and Africa Generation businesses, AES Wind and development and operational costs related to the development group. AES Solar is accounted for under the equity method of accounting, therefore its operating results are included in “Net Equity in Earnings of Affiliates,” not in “Corporate and Other.” None of these operating segments are currently material to our presentation of reportable segments, individually or in the aggregate.

Latin America

Our Latin America operations accounted for 65%, 64% and 62% of consolidated AES revenues in 2008, 2007 and 2006, respectively. The following table provides highlights of our Latin America operations:

| | |

Countries | | Argentina, Brazil, Chile, Colombia, Dominican Republic, El Salvador and Panama |

Generation Capacity | | 11,054 Gross MW |

Utilities Penetration | | 8.5 million customers (47,782 Gigawatt Hours (“GWh”)) |

Generation Facilities | | 53 (including 7 under construction) |

Utilities Businesses | | 8 |

Key Generation Businesses | | Gener, Tietê and Alicura |

Key Utilities Businesses | | Eletropaulo and Sul |

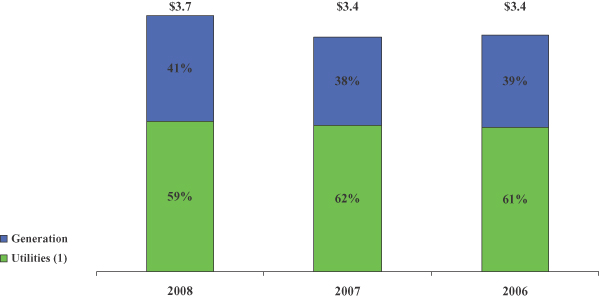

The graph below shows the breakdown between our Latin America Generation and Utilities segments as a percentage of total Latin America revenue and gross margin for the years ended December 31, 2008, 2007, and 2006. See Note 15—Segment and Geographic Information in the Consolidated Financial Statements in Item 8 of this Form 8-K for information on revenue from external customers, gross margin and total assets by segment.

6

Latin America Generation. Our largest generation business in Latin America, AES Tietê (“Tietê”), located in Brazil, represents approximately 15% of the total generation capacity in the state of São Paulo and is the ninth largest generator in Brazil. AES holds a 24% economic interest in Tietê. In Argentina, we are one of the largest private power generators contributing 12% of the country’s total power generation capacity. In Chile, we are the second largest generator of power. We currently have seven new generation plants under construction—five coal plants and one diesel plant in Chile and one hydro plant in Panama with a combined generation capacity of 1,715 MW.

Set forth below is a list of our Latin America Generation facilities:

Generation

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired

or Began

Operation |

Alicura | | Argentina | | Hydro | | 1,050 | | 99 | % | | 2000 |

Central Dique | | Argentina | | Gas / Diesel | | 68 | | 51 | % | | 1998 |

Gener—TermoAndes | | Argentina | | Gas / Diesel | | 643 | | 71 | % | | 2000 |

Paraná-GT | | Argentina | | Gas | | 845 | | 99 | % | | 2001 |

Quebrada de Ullum (1) | | Argentina | | Hydro | | 45 | | 0 | % | | 2004 |

Rio Juramento—Cabra Corral | | Argentina | | Hydro | | 102 | | 99 | % | | 1995 |

Rio Juramento—El Tunal | | Argentina | | Hydro | | 10 | | 99 | % | | 1995 |

San Juan—Sarmiento | | Argentina | | Gas | | 33 | | 99 | % | | 1996 |

San Juan—Ullum | | Argentina | | Hydro | | 45 | | 99 | % | | 1996 |

San Nicolás | | Argentina | | Coal / Gas / Oil | | 675 | | 99 | % | | 1993 |

Tietê (2) | | Brazil | | Hydro | | 2,651 | | 24 | % | | 1999 |

Uruguaiana | | Brazil | | Gas | | 639 | | 46 | % | | 2000 |

Gener—Electrica Santiago (3) | | Chile | | Gas / Diesel | | 479 | | 64 | % | | 2000 |

Gener—Energía Verde (4) | | Chile | | Biomass / Diesel | | 49 | | 71 | % | | 2000 |

Gener—Gener (5) | | Chile | | Hydro / Coal / Diesel | | 807 | | 71 | % | | 2000 |

Gener—Guacolda | | Chile | | Coal / Pet Coke | | 304 | | 35 | % | | 2000 |

Gener—Norgener | | Chile | | Coal / Pet Coke | | 277 | | 71 | % | | 2000 |

Chivor | | Colombia | | Hydro | | 1,000 | | 71 | % | | 2000 |

Andres | | Dominican Republic | | Gas | | 319 | | 100 | % | | 2003 |

Itabo (6) | | Dominican Republic | | Coal | | 295 | | 50 | % | | 2000 |

Los Mina | | Dominican Republic | | Gas | | 236 | | 100 | % | | 1996 |

Bayano | | Panama | | Hydro | | 260 | | 49 | % | | 1999 |

Chiriqui—Esti | | Panama | | Hydro | | 120 | | 49 | % | | 2003 |

Chiriqui—La Estrella | | Panama | | Hydro | | 48 | | 49 | % | | 1999 |

Chiriqui—Los Valles | | Panama | | Hydro | | 54 | | 49 | % | | 1999 |

| | | | | | | | | | | |

| | | | | | 11,054 | | | | | |

| | | | | | | | | | | |

| (1) | AES operates this facility through management or operations and maintenance agreements and owns no equity interest in this facility |

| (2) | Tietê plants: Água Vermelha, Bariri, Barra Bonita, Caconde, Euclides da Cunha, Ibitinga, Limoeiro, Mog-Guaçu, Nova Avanhandava and Promissão |

| (3) | Gener—Electrica Santiago plants: Renca and Nueva Renca |

| (4) | Gener—Energia Verde Plants: Constitución, Laja and San Francisco de Mostazal |

| (5) | Gener—Gener plants: Ventanas, Laguna Verde, Laguna Verde Turbogas, Alfalfal, Maitenas, Queltehues, Volcán and Los Vientos |

| (6) | Itabo plants: Itabo complex (two coal-fired steam turbines and one gas-fired steam turbine) |

7

Generation under construction

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Expected

Year of

Commercial

Operation |

Angamos | | Chile | | Coal | | 518 | | 71 | % | | 2011 |

Campiche | | Chile | | Coal | | 270 | | 71 | % | | 2011 |

Guacolda 3 | | Chile | | Coal | | 152 | | 35 | % | | 2009 |

Guacolda 4 | | Chile | | Coal | | 152 | | 35 | % | | 2010 |

Santa Lidia | | Chile | | Diesel | | 130 | | 71 | % | | 2009 |

Nueva Ventanas | | Chile | | Coal | | 270 | | 71 | % | | 2010 |

Changuinola I | | Panama | | Hydro | | 223 | | 83 | % | | 2011 |

| | | | | | | | | | | |

| | | | | | 1,715 | | | | | |

| | | | | | | | | | | |

Latin America Utilities. Each of our Utilities businesses in Latin America sells electricity under regulated tariff agreements and has transmission and distribution capabilities but none of them has generation capability. AES Eletropaulo, a consolidated subsidiary of which AES owns a 16% economic interest and which has served the São Paulo, Brazil area for over 100 years, has approximately six million customers and is the largest electricity distribution company in Brazil in terms of revenues and electricity distributed. Pursuant to its concession contract, AES Eletropaulo is entitled to distribute electricity in its service area until 2028. AES Eletropaulo’s service territory consists of 24 municipalities in the greater São Paulo metropolitan area and adjacent regions that account for approximately 15% of Brazil’s GDP and 44% of the population in the State of São Paulo, Brazil. AES Sul (“Sul”), a wholly owned subsidiary, serves over one million customers. In El Salvador, our Utilities businesses provide electricity to over 80% of the country, serving approximately one million customers.

Set forth below is a list of our Latin America Utilities facilities:

Distribution

| | | | | | | | | | | |

Business | | Location | | Approximate Number

of Customers Served

as of 12/31/2008 | | GWh Sold in

2008 | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired |

Edelap | | Argentina | | 311,000 | | 2,363 | | 90 | % | | 1998 |

Edes | | Argentina | | 163,000 | | 721 | | 90 | % | | 1997 |

Eletropaulo | | Brazil | | 5,832,000 | | 33,860 | | 16 | % | | 1998 |

Sul | | Brazil | | 1,128,000 | | 7,574 | | 100 | % | | 1997 |

CAESS | | El Salvador | | 507,000 | | 1,942 | | 75 | % | | 2000 |

CLESA | | El Salvador | | 292,000 | | 793 | | 64 | % | | 1998 |

DEUSEM | | El Salvador | | 59,000 | | 105 | | 74 | % | | 2000 |

EEO | | El Salvador | | 217,000 | | 424 | | 89 | % | | 2000 |

| | | | | | | | | | | |

| | | | 8,509,000 | | 47,782 | | | | | |

| | | | | | | | | | | |

In addition to the facilities identified in the table above, our Latin America Utilities segment includes AgCert and Nejapa, climate solutions projects that produce CER and GHG credits.

8

North America

Our North America operations accounted for 21%, 24% and 26% of consolidated revenues in 2008, 2007 and 2006, respectively. The following table provides highlights of our North America operations:

| | |

Countries | | U.S., Puerto Rico and Mexico |

Generation Capacity | | 13,368 Gross MW |

Utilities Penetration | | 470,000 customers (16,192 GWh) |

Generation Facilities | | 20 |

Utilities Businesses | | 1 Integrated Utility (includes 4 generation plants) |

Key Generation Businesses | | Eastern Energy (NY), Southland and TEG/TEP |

Key Utilities Businesses | | IPL |

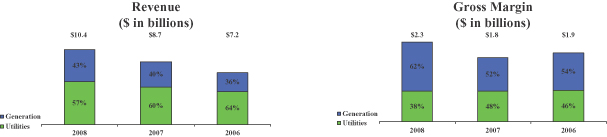

The graph below shows the breakdown between our North America Generation and Utilities segments as a percentage of total North America revenue and gross margin for the years ended December 31, 2008, 2007, and 2006. See Note 15—Segment and Geographic Information in the Consolidated Financial Statements in Item 8 of this Form 8-K for information on revenue from external customers, gross margin and total assets by segment.

North America Generation. Approximately 60% of the generation capacity sold to third parties is supported by long-term power purchase or tolling agreements. Our North America Generation businesses consist of seven gas-fired, ten coal-fired and three petroleum coke-fired plants in the United States, Puerto Rico and Mexico.

Four of our coal-fired plants, Cayuga, Greenridge, Somerset and Westover, representing capacity of 1,268 MW, operate together as one business, AES Eastern Energy. This business provides power to the Western New York power market under short-term contracts, as well as in the spot electricity market. We also operate three gas-fired plants, representing capacity of 4,327 MW, in the Los Angeles basin under a long-term tolling agreement. These plants are also operated as one business, AES Southland.

9

Set forth below is a list of our North America Generation facilities:

Generation

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired

or Began

Operation |

Mérida III | | Mexico | | Gas | | 484 | | 55 | % | | 2000 |

Termoelectrica del Golfo (TEG) | | Mexico | | Pet Coke | | 230 | | 99 | % | | 2007 |

Termoelectrica del Peñoles (TEP) | | Mexico | | Pet Coke | | 230 | | 99 | % | | 2007 |

Placerita | | USA - CA | | Gas | | 120 | | 100 | % | | 1989 |

Southland—Alamitos | | USA - CA | | Gas | | 2,047 | | 100 | % | | 1998 |

Southland—Huntington Beach | | USA - CA | | Gas | | 904 | | 100 | % | | 1998 |

Southland—Redondo Beach | | USA - CA | | Gas | | 1,376 | | 100 | % | | 1998 |

Thames | | USA - CT | | Coal | | 208 | | 100 | % | | 1990 |

Hawaii | | USA - HI | | Coal | | 203 | | 100 | % | | 1992 |

Warrior Run | | USA - MD | | Coal | | 205 | | 100 | % | | 2000 |

Red Oak | | USA - NJ | | Gas | | 832 | | 100 | % | | 2002 |

Cayuga | | USA - NY | | Coal | | 306 | | 100 | % | | 1999 |

Greenidge | | USA - NY | | Coal | | 161 | | 100 | % | | 1999 |

Somerset | | USA - NY | | Coal | | 675 | | 100 | % | | 1999 |

Westover | | USA - NY | | Coal | | 126 | | 100 | % | | 1999 |

Shady Point | | USA - OK | | Coal | | 320 | | 100 | % | | 1991 |

Beaver Valley | | USA - PA | | Coal | | 125 | | 100 | % | | 1985 |

Ironwood | | USA - PA | | Gas | | 710 | | 100 | % | | 2001 |

Puerto Rico | | USA - PR | | Coal | | 454 | | 100 | % | | 2002 |

Deepwater | | USA - TX | | Pet Coke | | 160 | | 100 | % | | 1986 |

| | | | | | | | | | | |

| | | | | | 9,876 | | | | | |

| | | | | | | | | | | |

In addition to the facilities identified in the table above, our North America Generation segment also includes climate solutions projects including Greenhouse Gas Services, LLC, a joint venture formed with GE Energy Financial Services to create high quality verifiable emissions offsets for the voluntary U.S. market, and a line of business formed to develop and implement utility-scale energy storage systems (such as batteries), which store and release power when needed.

North America Utilities. AES has one integrated utility in North America, IPL, which it owns through IPALCO Enterprises Inc. (“IPALCO”), the parent holding company of IPL. IPL generates, transmits, distributes and sells electricity to approximately 470,000 customers in the city of Indianapolis and neighboring areas within the state of Indiana. IPL owns and operates four generation facilities that provide essentially all of the electricity it distributes. The two largest generation facilities are primarily coal-fired plants. The third facility has a combination of units that use coal (base load capacity) and natural gas and/or oil (peaking capacity). The fourth facility is a small peaking station that uses gas-fired combustion turbine technology. IPL’s gross generation capability is 3,492 MW. More than half of IPL’s coal is provided by one supplier with which IPL has long-term contracts. A key driver for the business is tariff recovery for environmental projects through the rate adjustment process. IPL’s customers include residential, industrial, commercial and all other which made up 36%, 40%, 16% and 8%, respectively, of North America Utilities revenue for 2008.

10

IPL’s generation facilities

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired

or Began

Operation |

IPL (1) | | USA - IN | | Coal/Gas/Oil | | 3,492 | | 100 | % | | 2001 |

| (1) | IPL plants: Eagle Valley, Georgetown, Harding Street and Petersburg |

Distribution

| | | | | | | | | | | |

Business | | Location | | Approximate Number

of Customers Served

as of 12/31/2008 | | GWh Sold in

2008 | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired |

IPL | | USA - IN | | 470,000 | | 16,192 | | 100 | % | | 2001 |

Europe

The following table provides highlights of our Europe operations:

| | |

Countries | | Czech Republic, Hungary, Kazakhstan, Netherlands, Spain, U.K., Turkey and Ukraine |

Generation Capacity | | 10,185 Gross MW |

Utilities Penetration | | 1.8 million customers (9,296 GWh) |

Generation Facilities | | 19 (including 5 under construction) |

Utilities Businesses | | 4 |

Key Generation Businesses | | Kilroot, Tisza II |

Key Utilities Businesses | | Kyivoblenergo and Rivneenergo |

Our Utilities operations in Europe are discussed further under Corporate and Other below.

Europe Generation. Our Generation operations in Europe accounted for 7%, 7% and 7% of our consolidated revenues in 2008, 2007 and 2006, respectively. In 2006, we began commercial operation of AES Cartagena (“Cartagena”), our first power plant in Spain, with 1,199 MW capacity. The results of operations for Cartagena, an unconsolidated entity, are included in the Equity in Earnings of Affiliates line item on the Consolidated Statements of Operations and therefore not reflected in these segment operating results. Today, AES operates five power plants in Kazakhstan which account for almost 30% of the country’s total installed generation capacity. In 2008, we completed the sale of a generation plant and a coal mine in Kazakhstan, which we continue to operate under a management agreement through 2010. See Note 15—Segment and Geographic Information in the Consolidated Financial Statements in Item 8 of this Form 8-K for revenue, gross margin and total assets by segment. Key business drivers of this segment are: foreign currency exchange rates, new legislation and regulations including those related to the environment.

11

Set forth below is a list of our Europe Generation facilities:

Generation

| | | | | | | | | | | |

Business(1)(3) | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired

or Began

Operation |

Bohemia | | Czech Republic | | Coal/Biomass | | 50 | | 100 | % | | 2001 |

Borsod | | Hungary | | Biomass/Coal | | 56 | | 100 | % | | 1996 |

Tisza II | | Hungary | | Gas/Oil | | 900 | | 100 | % | | 1996 |

Tiszapalkonya | | Hungary | | Coal/Biomass | | 116 | | 100 | % | | 1996 |

Ekibastuz (2)(3) | | Kazakhstan | | Coal | | 4,000 | | 0 | % | | 1996 |

Shulbinsk HPP (2)(4) | | Kazakhstan | | Hydro | | 702 | | 0 | % | | 1997 |

Sogrinsk CHP | | Kazakhstan | | Coal | | 301 | | 100 | % | | 1997 |

Ust—Kamenogorsk HPP (2)(4) | | Kazakhstan | | Hydro | | 331 | | 0 | % | | 1997 |

Ust—Kamenogorsk CHP | | Kazakhstan | | Coal | | 1,354 | | 100 | % | | 1997 |

Elsta | | Netherlands | | Gas | | 630 | | 50 | % | | 1998 |

Cartagena | | Spain | | Gas | | 1,199 | | 71 | % | | 2006 |

Girlevik II-Mercan | | Turkey | | Hydro | | 12 | | 51 | % | | 2007 |

Yukari-Mercan | | Turkey | | Hydro | | 14 | | 51 | % | | 2007 |

Kilroot | | United Kingdom | | Coal / Oil | | 520 | | 99 | % | | 1992 |

| | | | | | | | | | | |

| | | | | | 10,185 | | | | | |

| | | | | | | | | | | |

| (1) | AES additionally manages the Maikuben West coal mine in Kazakhstan, supplying coal to AES businesses and third parties. |

| (2) | AES manages these facilities through management or O&M agreements and owns no equity interest in these businesses. |

| (3) | AES completed the sale of its indirect wholly-owned subsidiaries, the Ekibastuz generation plant and the Maikuben West coal mine in May 2008. AES now operates the facilities under a management agreement through 2010. |

| (4) | AES operates these facilities under concession agreements until 2017. |

Generation under construction

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Expected

Year of

Commercial

Operation |

I.C. Energy (1) | | Turkey | | Hydro | | 62 | | 51 | % | | 2010 |

Maritza East I | | Bulgaria | | Coal | | 670 | | 100 | % | | 2010 |

Kilroot OCGT | | United Kingdom | | Diesel | | 80 | | 99 | % | | 2009 |

| | | | | | | | | | | |

| | | | | | 812 | | | | | |

| | | | | | | | | | | |

| (1) | Joint Venture with I.C. Energy. I.C. Energy Plants: Damlapinar Konya, Kepezkaya Konya, and Kumkoy Samsun. The joint venture is an unconsolidated entity and accounted for under the equity method of accounting. |

12

Asia

Our Asia operations accounted for 8%, 6% and 6% of consolidated revenues in 2008, 2007 and 2006, respectively. Asia’s Generation business operates 13 power plants with a total capacity of 5,664 MW in eight countries and has one power plant under construction. In Asia, AES operates generation facilities only. See Note 15—Segment and Geographic Information in the Consolidated Financial Statements in Item 8 of this Form 8-K for revenue, gross margin and total assets by segment. The following table provides highlights of our Asia operations:

| | |

Countries | | China, Qatar, Pakistan, Oman, India, the Philippines, Sri Lanka and Jordan |

Generation Capacity | | 5,664 Gross MW |

Utilities Penetration | | N/A |

Generation Facilities | | 13 (including 1 under construction) |

Utilities Facilities | | None |

Key Businesses | | Yangcheng, Masinloc, Pak Gen and Lal Pir |

Asia Generation. Almost half of our generation capacity in Asia is located in China. In 1996, AES joined with Chinese partners to build Yangcheng, the first “coal-by-wire” power plant with the capacity of 2,100 MW. In 2003, AES started commercial operations of its combined power and desalination water facility in Oman, the first of its kind. We also have a combined power and desalination water facility, the first such facility to be awarded to the private sector, in Qatar. This facility generates over 18% of the country’s peak system capacity and 23% of the country’s water supply. In April 2008, the Company completed the purchase of a 92% interest in a 660 MW coal-fired thermal power generation facility in Masinloc, Philippines (“Masinloc”). AES Amman East (“Amman East”) is a 380 MW combined-cycle gas power plant under construction in Jordan. Amman East achieved simple cycle commercial operation in 2008 and is expected to achieve combined cycle operation in 2009.

Set forth below is a list of our generation facilities in Asia:

Generation

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired

or Began

Operation |

Aixi | | China | | Coal | | 51 | | 71 | % | | 1998 |

Chengdu | | China | | Gas | | 50 | | 35 | % | | 1997 |

Cili | | China | | Hydro | | 26 | | 51 | % | | 1994 |

Wuhu | | China | | Coal | | 250 | | 25 | % | | 1996 |

Yangcheng | | China | | Coal | | 2,100 | | 25 | % | | 2001 |

OPGC | | India | | Coal | | 420 | | 49 | % | | 1998 |

Barka | | Oman | | Gas | | 456 | | 35 | % | | 2003 |

Lal Pir | | Pakistan | | Oil | | 362 | | 55 | % | | 1997 |

Pak Gen | | Pakistan | | Oil | | 365 | | 55 | % | | 1998 |

Masinloc | | Philippines | | Coal | | 660 | | 92 | % | | 2008 |

Ras Laffan | | Qatar | | Gas | | 756 | | 55 | % | | 2003 |

Kelanitissa | | Sri Lanka | | Diesel | | 168 | | 90 | % | | 2003 |

| | | | | | | | | | | |

| | | | | | 5,664 | | | | | |

| | | | | | | | | | | |

13

Generation under construction

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Rounded) | | | Expected

Year of

Commercial

Operation |

Amman East(1) | | Jordan | | Gas | | 380 | | 37 | % | | 2009 |

| (1) | Construction of the Amman East power plant commenced in May 2007. |

Corporate and Other

“Corporate and Other” includes general and administrative expenses related to corporate staff functions and initiatives, executive management, finance, legal, human resources and information systems which are not allocable to our business segments and the effects of eliminating transactions, such as self insurance charges, between the operating segments and corporate. In addition, this category includes the net operating results from our Generation and Utilities businesses in Africa, Utilities businesses in Europe and AES Wind and other renewables projects and costs associated with our development group. These operations are immaterial for the purposes of separate segment disclosure. See Note 15—Segment and Geographic Information in the Consolidated Financial Statements in Item 8 of this Form 8-K for information on revenue from external customers, gross margin and total assets by segment.

In March 2008, we formed a joint venture called AES Solar LLC with Riverstone, a private equity firm to develop, own and operate solar installations. The joint venture is an unconsolidated entity and accounted for under the equity method of accounting. Since its launch, AES Solar has commenced commercial operations of 24 MW of solar projects in Spain and has development potential in three other countries.

Europe Utilities.Our distribution businesses in the Ukraine and Kazakhstan together serve approximately 1.8 million customers.

Distribution

| | | | | | | | | | | |

Business | | Location | | Approximate

Number of

Customers

Served as of

12/31/2008 | | GWh Sold in

2008 | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired |

Kievoblenergo | | Ukraine | | 835,000 | | 4,161 | | 89 | % | | 2001 |

Rivneenergo | | Ukraine | | 405,000 | | 1,791 | | 81 | % | | 2001 |

Eastern Kazakhstan REC(1)(2) | | Kazakhstan | | 459,000 | | 3,444 | | 0 | % | | |

Ust-Kamenogorsk Heat Nets(1)(3) | | Kazakhstan | | 96,000 | | — | | 0 | % | | |

| | | | | | | | | | | |

| | | | 1,795,000 | | 9,396 | | | | | |

| | | | | | | | | | | |

| (1) | AES operates these facilities through management agreements and owns no equity interest in these businesses. |

| (2) | Shygys Energo Trade, a retail electricity company, is 100% owned by Eastern Kazakhstan REC (“EK REC”) and purchases distribution service from EK REC and electricity in the wholesale electricity market and resells to the distributions customers of EK REC. |

| (3) | Ust-Kamenogorsk Heat Nets provide transmission and distribution of heat with a total heat generating capacity of 224 Gcal. |

Africa Generation.Generation capacity in Africa consists of Ebute, a 304 MW plant in Nigeria.

14

Generation

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired or

Began

Operation |

Ebute | | Nigeria | | Gas | | 304 | | 95 | % | | 2001 |

Generation under construction

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Expected

Year of

Commercial

Operation |

Dibamba | | Cameroon | | Heavy Fuel Oil | | 86 | | 56 | % | | 2009 |

Africa Utilities.AES acquired a 56% interest in an integrated utility Société Nationale d’Electricité (“Sonel”) in 2001. Sonel generates, transmits and distributes electricity to over half a million people and is the sole source of electricity in Cameroon.

Set forth below is a list of the generation facilities and distribution businesses in Africa:

Sonel’s generation facilities

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired or

Began

Operation |

Sonel(1) | | Cameroon | | Hydro/Diesel/Heavy

Fuel Oil | | 927 | | 56 | % | | 2001 |

| (1) | Sonel plants: Bafoussam, Bassa, Djamboutou, Edéa, Lagdo, Logbaba I, Limbé, Mefou, Oyomabang I, Oyomabang II and Song Loulou, and other small remote network units |

Distribution

| | | | | | | | | | | |

Business | | Location | | Approximate

Number of

Customers

Served as of

12/31/2008 | | GWh Sold in

2008 | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired |

Sonel | | Cameroon | | 571,000 | | 3,360 | | 56 | % | | 2001 |

Wind Generation. We own and operate 1,060 MW of wind generation capacity and operate an additional 215 MW capacity through operating and management agreements. Our wind business is located primarily in North America where we operate wind generation facilities that have generation capacity of 1,174 MW. Buffalo Gap III, a 170 MW capacity wind farm, commenced commercial operations in August 2008.

15

Set forth below is a list of AES Wind Generation facilities:

Generation

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Year

Acquired or

Began

Operation |

Hulunbeier(1) | | China | | Wind | | 50 | | 49 | % | | 2008 |

InnoVent | | France | | Wind | | 30 | | 40 | % | | 2007 |

Hargicourt | | France | | Wind | | 12 | | 40 | % | | 2008 |

Hescamps | | France | | Wind | | 5 | | 40 | % | | 2008 |

Plechatel | | France | | Wind | | 4 | | 40 | % | | 2008 |

Altamont | | USA - CA | | Wind | | 43 | | 100 | % | | 2005 |

Mountain View I & II(2) | | USA - CA | | Wind | | 67 | | 100 | % | | 2008 |

Palm Springs | | USA - CA | | Wind | | 30 | | 100 | % | | 2006 |

Tehachapi | | USA - CA | | Wind | | 58 | | 100 | % | | 2006 |

Storm Lake II(2) | | USA - IA | | Wind | | 80 | | 100 | % | | 2007 |

Lake Benton I(2) | | USA - MN | | Wind | | 107 | | 100 | % | | 2007 |

Condon(2) | | USA - OR | | Wind | | 50 | | 100 | % | | 2005 |

Buffalo Gap I(2) | | USA - TX | | Wind | | 121 | | 100 | % | | 2006 |

Buffalo Gap II(2) | | USA - TX | | Wind | | 233 | | 100 | % | | 2007 |

Buffalo Gap III (2) | | USA - TX | | Wind | | 170 | | 100 | % | | 2008 |

Wind generation facilities(3) | | USA | | Wind | | 215 | | 0 | % | | 2005 |

| | | | | | | | | | | |

| | | | | | 1,275 | | | | | |

| | | | | | | | | | | |

| (1) | Joint Venture with Guohua Energy Investment Co. Ltd. |

| (2) | AES owns these assets together with third party tax equity investors with variable ownership interests. The tax equity investors receive a portion of the economic attributes of the facilities, including tax attributes, that vary over the life of the projects. The proceeds from the issuance of tax equity are recorded as Noncontrolling Interest in the Company’s consolidated balance sheet. |

| (3) | AES operates these facilities through management or O&M agreements and owns no equity interest in these businesses. |

AES Wind Generation projects under construction

| | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest

(Percent, Rounded) | | | Expected

Year of

Commercial

Operation |

St. Nikolas | | Bulgaria | | Wind | | 156 | | 89 | % | | 2009 |

Guohua Energ Investment Co. Ltd.(1) | | China | | Wind | | 198 | | 49 | % | | 2009-2010 |

InnoVent(2) | | France | | Wind | | 34 | | 40 | % | | 2009 |

North Rhins | | Scotland | | Wind | | 22 | | 51 | % | | 2009 |

| | | | | | | | | | | |

| | | | | | 410 | | | | | |

| | | | | | | | | | | |

| (1) | Joint Ventures with Guohua Energy Investment Co. Ltd. Huanghua I & II, Chenbáerhe and Xinaèrhue. |

| (2) | InnoVent plants: Frenouville, Audrieu, Boisbergues, Gapree and Croixrault-Moyencourt. |

16

Financial Data by Country

The table below presents information about our consolidated operations and long-lived assets, by country, for each of the three years ended December 31, 2008, 2007 and 2006, respectively. Revenues are recognized in the country in which they are earned and assets are reflected in the country in which they are located.

| | | | | | | | | | | | | | | |

| | | Revenues | | Property, Plant &

Equipment, net |

| | | 2008 | | 2007 | | 2006 | | 2008 | | 2007 |

| | | (in millions) |

United States | | $ | 2,745 | | $ | 2,641 | | $ | 2,573 | | $ | 6,936 | | $ | 6,448 |

| | | | | | | | | | | | | | | |

Non-U.S. | | | | | | | | | | | | | | | |

Brazil | | | 5,501 | | | 4,748 | | | 4,119 | | | 4,206 | | | 5,369 |

Chile | | | 1,349 | | | 1,011 | | | 594 | | | 1,540 | | | 968 |

Argentina | | | 949 | | | 678 | | | 542 | | | 446 | | | 450 |

Pakistan | | | 607 | | | 396 | | | 318 | | | 204 | | | 265 |

Dominican Republic | | | 601 | | | 476 | | | 357 | | | 634 | | | 651 |

El Salvador | | | 484 | | | 479 | | | 437 | | | 255 | | | 249 |

Hungary | | | 466 | | | 344 | | | 304 | | | 211 | | | 241 |

Mexico | | | 463 | | | 399 | | | 185 | | | 819 | | | 838 |

Ukraine | | | 403 | | | 330 | | | 269 | | | 78 | | | 104 |

Cameroon | | | 379 | | | 330 | | | 300 | | | 579 | | | 504 |

United Kingdom | | | 342 | | | 235 | | | 222 | | | 308 | | | 383 |

Colombia | | | 291 | | | 213 | | | 184 | | | 395 | | | 393 |

Puerto Rico | | | 251 | | | 245 | | | 234 | | | 622 | | | 620 |

Kazakhstan | | | 234 | | | 284 | | | 215 | | | 56 | | | 52 |

Panama | | | 210 | | | 175 | | | 144 | | | 715 | | | 582 |

Sri Lanka | | | 184 | | | 123 | | | 92 | | | 79 | | | 83 |

Qatar | | | 161 | | | 178 | | | 169 | | | 526 | | | 552 |

Philippines(1) | | | 148 | | | — | | | — | | | 731 | | | — |

Oman | | | 105 | | | 105 | | | 114 | | | 321 | | | 331 |

Bulgaria(2) | | | — | | | — | | | 1 | | | 1,329 | | | 542 |

Other Non-U.S. | | | 197 | | | 126 | | | 136 | | | 413 | | | 349 |

| | | | | | | | | | | | | | | |

Total Non-U.S. | | | 13,325 | | | 10,875 | | | 8,936 | | | 14,467 | | | 13,526 |

| | | | | | | | | | | | | | | |

Total | | $ | 16,070 | | $ | 13,516 | | $ | 11,509 | | $ | 21,403 | | $ | 19,974 |

| | | | | | | | | | | | | | | |

| (1) | Acquired in May 2008, revenues represent results for a partial year. |

| (2) | Currently under development, facility is not operational at this time. |

17

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table sets forth our selected financial data as of the dates and for the periods indicated. You should read this data together with Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements and the notes thereto included in Item 8 in this Form 8-K. The selected financial data for each of the years in the five year period ended December 31, 2008 have been derived from our audited Consolidated Financial Statements. Our historical results are not necessarily indicative of our future results.

Acquisitions, disposals, reclassifications and changes in accounting principles affect the comparability of information included in the tables below. Please refer to the Notes to the Consolidated Financial Statements included in Item 8 Financial Statements and Supplementary Data of this Form 8-K for further explanation of the effect of such activities. Please also refer to Item 1A Risk Factors of the 2008 Form 10-K and Note 24—Risks and Uncertainties to the Consolidated Financial Statements included in Item 8 of this Form 8-K for certain risks and uncertainties that may cause the data reflected herein not to be indicative of our future financial condition or results of operations.

SELECTED FINANCIAL DATA

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| Statement of Operations Data | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (in millions, except per share amounts) | |

Revenues | | $ | 16,070 | | | $ | 13,516 | | | $ | 11,509 | | | $ | 10,183 | | | $ | 8,667 | |

Income from continuing operations attributable to The AES Corporation | | | 1,216 | | | | 487 | | | | 168 | | | | 355 | | | | 172 | |

Discontinued operations, net of tax | | | 18 | | | | (582 | ) | | | 58 | | | | 198 | | | | 143 | |

Extraordinary items, net of tax | | | — | | | | — | | | | 21 | | | | — | | | | — | |

Cumulative effect of change in accounting principle, net of tax | | | — | | | | — | | | | — | | | | (4 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to The AES Corporation | | $ | 1,234 | | | $ | (95 | ) | | $ | 247 | | | $ | 549 | | | $ | 315 | |

| | | | | | | | | | | | | | | | | | | | |

Basic (loss) earnings per share: | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations attributable to The AES Corporation, net of tax | | $ | 1.82 | | | $ | 0.73 | | | $ | 0.25 | | | $ | 0.54 | | | $ | 0.27 | |

Discontinued operations, net of tax | | | 0.02 | | | | (0.87 | ) | | | 0.09 | | | | 0.31 | | | | 0.22 | |

Extraordinary items, net of tax | | | — | | | | — | | | | 0.03 | | | | — | | | | — | |

Cumulative effect of change in accounting principle, net of tax | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share | | $ | 1.84 | | | $ | (0.14 | ) | | $ | 0.37 | | | $ | 0.84 | | | $ | 0.49 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted (loss) earnings per share: | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations attributable to The AES Corporation, net of tax | | $ | 1.80 | | | $ | 0.72 | | | $ | 0.25 | | | $ | 0.53 | | | $ | 0.27 | |

Discontinued operations, net of tax | | | 0.02 | | | | (0.86 | ) | | | 0.09 | | | | 0.31 | | | | 0.22 | |

Extraordinary items, net of tax | | | — | | | | — | | | | 0.03 | | | | — | | | | — | |

Cumulative effect of change in accounting principle, net of tax | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per share | | $ | 1.82 | | | $ | (0.14 | ) | | $ | 0.37 | | | $ | 0.83 | | | $ | 0.49 | |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | December 31, | |

| Balance Sheet Data: | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (in millions) | |

Total assets | | $ | 34,806 | | | $ | 34,453 | | | $ | 31,274 | | | $ | 29,025 | | | $ | 28,449 | |

Non-recourse debt (long-term) | | $ | 11,869 | | | $ | 11,293 | | | $ | 9,840 | | | $ | 10,308 | | | $ | 10,563 | |

Non-recourse debt (long-term)-Discontinued operations | | $ | — | | | $ | 37 | | | $ | 342 | | | $ | 467 | | | $ | 750 | |

Recourse debt (long-term) | | $ | 4,994 | | | $ | 5,332 | | | $ | 4,790 | | | $ | 4,682 | | | $ | 5,010 | |

Accumulated deficit | | $ | (8 | ) | | $ | (1,241 | ) | | $ | (1,093 | ) | | $ | (1,340 | ) | | $ | (1,889 | ) |

The AES Corporation stockholders’ equity | | $ | 3,669 | | | $ | 3,164 | | | $ | 2,979 | | | $ | 1,583 | | | $ | 997 | |

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview of Our Business

AES is a global power company. We own or operate a portfolio of electricity generation and distribution businesses with generation capacity totaling approximately 43,000 MW and distribution networks serving over 11 million people. In addition, we have more than 3,000 MW under construction in ten countries. Our global footprint includes operations in 29 countries on five continents with 83% of our revenue in 2008 generated outside the United States.

We operate two primary lines of business. The first is our Generation business, where we own and/or operate power plants to generate and sell power to wholesale customers such as utilities and other intermediaries. The second is our Utilities business, where we own and/or operate utilities to distribute, transmit and sell electricity to end-user customers in the residential, commercial, industrial and governmental sectors within a defined service area. Each of our primary lines of business generates approximately half of our revenues.

We are also continuing to expand our wind generation business and are pursuing additional renewables projects in solar, climate solutions, biomass and energy storage. These initiatives are not material contributors to our revenue, gross margin or income, but we believe that they may become material in the future.

Generation. We currently own or operate a portfolio of approximately 38,000 MW, consisting of 93 facilities in 26 countries on five continents at our generation businesses. We also have approximately 2,900 MW of capacity currently under construction in six countries. Our core Generation businesses use a wide range of technologies and fuel types including coal, combined-cycle gas turbines, hydroelectric power and biomass.

The majority of the electricity produced by our Generation businesses is sold under long-term contracts, or PPAs, to wholesale customers. Approximately 61% of the revenues from our Generation businesses during 2008 was derived from plants that operate under PPAs of five years or longer for 75% or more of their output capacity. These businesses often reduce their exposure to fuel supply risks by entering into long-term fuel supply contracts or fuel tolling contracts where the customer assumes full responsibility for purchasing and supplying the fuel to the power plant. These long-term contractual agreements result in relatively predictable cash flow and earnings and reduce exposure to volatility in the market price for electricity and fuel; however, the amount of earnings and cash flow predictability varies from business to business based on the degree to which its exposure is limited by the contracts that it has negotiated.

The balance of our Generation businesses sell power through competitive markets under short-term contracts or directly in the spot market. As a result, the cash flows and earnings associated with these businesses are more sensitive to fluctuations in the market price for electricity, natural gas, coal and other fuels. However, for a number of these facilities, including our plants in New York, which include a fleet of coal fired plants, we have hedged the majority of our exposure to fuel, energy and emissions pricing for 2009.

Utilities. Our Utilities businesses distribute power to more than 11 million people in seven countries on five continents. Our Utilities business consists primarily of 14 companies owned and/or operated under management agreements, all of which operate in a defined service area. These businesses also include 15 generation plants in two countries totaling approximately 4,400 MW. In addition, we have one generation plant under construction totaling 86 MW. These businesses have a variety of structures ranging from pure distribution businesses to fully integrated utilities, which generate, transmit and distribute power.

Renewables and Other Initiatives. In recent years, as demand for renewable sources of energy has grown, we have placed increasing emphasis on developing projects in wind, solar, energy storage and the creation of carbon offsets. AES Wind Generation, which is one of the largest producers of wind power in the U.S., has

19

16 wind generation facilities in three countries with over 1,200 MW in operation and 11 wind generation facilities under construction in four countries. AES Solar, our joint venture with Riverstone Holdings, was formed to develop, own and operate utility-scale photo voltaic (PV) solar installations. Since its launch, AES Solar has developed eight plants totaling 24 MW of solar projects in Spain. In climate solutions, we have developed and are implementing projects to produce GHG Credits. In the U.S., we formed Greenhouse Gas Services, LLC as a joint venture with GE Energy Financial Services to create high quality verifiable offsets for the voluntary U.S. market. We also have formed an initiative to develop and implement utility scale energy systems (such as batteries), which store and release power when needed. Climate solutions projects are managed within the regions and included in the operating results of the applicable reportable segments. While these renewables and other initiatives are not currently material to our operations, we believe that in the future, they may become a material contributor to our revenue and gross margin. However, there are risks associated with these initiatives, which are further disclosed in Item 1A—Risk Factors of the 2008 Form 10-K.

Our Organization and Segments. Through the end of 2008, and as reflected in the 2008 Form 10-K, the Company organized its operations for management and external reporting purposes along two primary lines of business—the generation of electricity (“Generation”) and the distribution of electricity (“Utilities”) within four defined geographic regions: Latin America; North America; Europe & Africa; and Asia and the Middle East (“Asia”). Three regions, North America, Latin America and Europe & Africa, are engaged in both Generation and Utility businesses. Our Asia region only has Generation businesses. This regional management structure resulted in the Company reporting seven segments. The reportable segments included Latin America Generation, Latin America Utilities, North America Generation, North America Utilities, Europe & Africa Generation, Europe & Africa Utilities and Asia Generation. In addition, the Company reported certain activities in “Corporate and Other” including corporate overhead costs which were not directly associated with the operations of our seven reportable segments; and other intercompany charges such as self-insurance premiums which were fully eliminated in consolidation. AES Wind Generation, solar, climate solutions and certain other initiatives were managed by our alternative energy group and the associated revenue, development and operational costs were reported under “Corporate and Other” since the results were not material to the presentation of the Company’s reportable segments.

In early 2009, we implemented certain internal organizational changes in an effort to streamline the organization. These changes affected how results are reported internally for management review. The new management reporting structure continues to be organized along our two lines of business, but there are now three regions: (1) Latin America & Africa; (2) North America and AES Wind; and (3) Europe, Middle East & Asia (collectively “EMEA”), each managed by a regional president. The Company no longer has an alternative energy group. Instead, AES Wind Generation is managed within our North America region while climate solutions projects are now managed and reported within the region in which they are located. Key climate solutions initiatives include investments in GHG initiatives, projects to create emissions offsets for the voluntary U.S. market, projects that produce certified emission reduction credits (“CERs”) and initiatives related to utility-scale energy storage systems (such as batteries) which store and release power when needed. AES Solar is accounted for using the equity method and will continue to be reflected in “Corporate and Other.” In addition to the change in regional management structure, with the exception of AES Wind Development, the Company now manages all development efforts centrally through a development group.

The new segment reporting structure uses the Company’s management reporting structure as its foundation. The Company’s segment reporting structure is organized along our two lines of business and three regions to reflect how the Company manages the business internally. The Company applied the guidance in SFAS No. 131, which provides certain quantitative thresholds and aggregation criteria, and the Company concluded that it now has six reportable segments. This new segment structure is reflected in this Current Report on Form 8-K. The operating segments comprising the former Europe & Africa Generation and Utilities reportable segments are no longer managed together. Under the new management structure, Africa is managed with the Latin America region and Europe is managed with the Asia region. Only Europe—Generation was determined to be a reportable segment based on the Company’s application of SFAS No. 131. As described below, our Europe Utilities, Africa

20

Utilities and Africa Generation operating segments are now reported within “Corporate and Other” because they do not meet the criteria to allow for aggregation with another operating segment or the quantitative thresholds that would require separate disclosure under SFAS No. 131.

Therefore, as a result of this analysis, the Company now reports six segments, which include:

| | • | | Latin America—Generation; |

| | • | | Latin America—Utilities; |

| | • | | North America—Generation; |

| | • | | North America—Utilities; |

“Corporate and Other” now includes corporate overhead costs which are not directly associated with the operations of our six reportable segments, other intercompany charges such as self-insurance premiums which are fully eliminated in consolidation. In addition, “Corporate and Other” includes the operating results of the Company’s Europe Utilities, Africa Utilities and Africa Generation businesses, AES Wind and development and operational costs related to the development group. AES Solar is accounted for under the equity method of accounting, therefore its operating results are included in “Net Equity in Earnings of Affiliates,” not in “Corporate and Other.” None of these operating segments are currently material to our presentation of reportable segments, individually or in the aggregate.

Key Drivers of Our Results of Operations. Our Utilities and Generation businesses are distinguished by the nature of their customers, operational differences, cost structure, regulatory environment and risk exposure. As a result, each line of business has slightly different drivers which affect operating results. Performance drivers for our Generation businesses include, among other things, plant availability and reliability, management of fixed and operational costs and the extent to which our plants have hedged their exposure to fuel cost volatility. For our Generation businesses which sell power under short-term contract or in the spot market one of the most crucial factors is the market price of electricity and the plant’s ability to generate electricity at a cost below that price. Growth in our Generation business is largely tied to securing new PPAs, expanding capacity in our existing facilities and building new power plants. Performance drivers for our Utilities businesses include, but are not limited to, reliability of service; negotiation of tariff adjustments; compliance with extensive regulatory requirements; management of working capital; and in developing countries, reduction of commercial and technical losses. The results of operations of our Utilities businesses are sensitive to changes in economic growth and weather conditions in the area in which they operate.

One of the key factors which affect both our revenue and costs of sales is changes in the cost of fuel. When fuel costs increase, many of our Generation businesses with long-term contracts and our Utilities are able to pass these costs on to the customer through fuel pass-through or fuel indexing arrangements in their contracts or through increases in tariff rates. Therefore, in a rising fuel cost environment as was the case in 2007 and much of 2008, increases in fuel costs for these businesses often resulted in increases in revenue (though not necessarily on a one-for-one basis). While these circumstances may not have a large impact on gross margin, they can significantly affect gross margin as a percentage of revenue. Other factors that can affect gross margin include our ability to expand the number of facilities we own; and in our existing plants, to sign up new customers and/or purchasing parties, collect receivables from existing customers and operate our plants more efficiently.

Another key driver of our results is the management of risk. Our assets are diverse with respect to fuel source and type of market, which helps reduce certain types of operating risk. Our portfolio employs a broad range of fuels, including coal, gas, fuel oil and renewable sources such as hydroelectric power, wind and solar, which reduces the risks associated with dependence on any one fuel source. For additional information regarding

21

our facilities see Item 1—Our Organization and Segments. Our presence in mature markets helps reduce the volatility associated with our businesses in faster-growing emerging markets. In addition, as noted above, our Generation portfolio is largely contracted, which reduces the risk related to the market prices of electricity and fuel. We also attempt to limit risk by hedging much of our currency and commodity risk, and by matching the currency of most of our subsidiary debt to the revenue of the business that issued that debt. However, our businesses are still subject to these risks, as further described in Item 1A—Risk Factors in the 2008 Form 10-K, “We may not be adequately hedged against our exposure to changes in commodity prices or interest rates.”

Highlights of 2008

Results of Operations. In 2008, management continued to focus its efforts on increasing shareholder value by improving operations, executing our growth strategy and strategically managing our portfolio of businesses. Our 2008 results of operations were positively impacted by a number of factors including the gain on the sale of Ekibastuz and Maikuben in Kazakhstan, higher generation rates, utilities tariffs and favorable foreign currency translation.

| | • | | revenues of $16.1 billion and gross margin of $3.7 billion, or 23% of revenue; |

| | • | | income from continuing operations attributable to The AES Corporation of $1.2 billion, or $1.80 per diluted share; and |

| | • | | cash flow from operating activities of $2.2 billion. |

Our results were negatively impacted by higher fuel costs in Asia and the unfavorable impact of mark-to-market adjustments on derivative instruments. We also saw an increase in fixed costs, primarily in Brazil and Cameroon, related to maintenance, higher provisions for bad debt, contractor services and higher purchased energy costs.

In the fourth quarter of 2008, and in response to the financial market crisis, we reviewed and prioritized projects in our development pipeline. As a result, we recognized an impairment charge of approximately $75 million ($34 million, net of noncontrolling interests and income taxes). The projects determined to be impaired primarily included two liquefied natural gas projects in North America and a non-power development project at one of our facilities in North America. As the Company continues to review and streamline its project pipeline, it is possible that further impairments could be identified in the future, some of which could be material. During 2008, we also recognized additional impairment charges of $36 million related to long-lived assets at Uruguaiana, our gas-powered generation plant in Brazil. The impairment was triggered by the combination of gas curtailments and increases in the spot market price of energy in 2007 that continued in 2008. Following an initial impairment charge in the fourth quarter of 2007, further charges were incurred in 2008 due to fixed asset purchase agreements in place. During the first half of 2008, we withdrew from projects in South Africa and Israel which resulted in impairment charges of $36 million. We also recognized an impairment of $18 million related to the shutdown of the Hefei plant in China.

Investment and Financing Activities. In addition to the financial results presented above, the additional highlights for the year ended December 31, 2008 include the following:

Financing activities

| | • | | We were able to refinance recourse debt at lower interest rates and with extended maturities, reducing our 2009 recourse debt maturities from $467 million at December 31, 2007 to $154 million at December 31, 2008. |

| | • | | Our consolidated subsidiaries raised approximately $2.7 billion in 2008 for the purposes of refinancing existing debt and to fund acquisitions and construction. For example, in October, the Company obtained approximately $1 billion in non-recourse financing to support the development of Angamos, a 518 MW coal-fired generation facility in Chile. Angamos is expected to begin commercial operations in 2011. |

22

| | • | | We reduced outstanding recourse debt by $360 million and repurchased 10.7 million shares of our common stock at a total cost of $143 million. |

Acquisitions

| | • | | In April, the Company completed the purchase of a 92% interest in Masinloc, a 660 gross MW coal-fired thermal power generation facility in Masinloc, Philippines. The purchase price was $930 million in cash (excluding anticipated improvements). Non-recourse financing of $665 million was obtained to fund the acquisition and improve the facilities. |

Investments in Renewable Energy and Related Projects

| | • | | Wind Generation—Highlights from AES Wind Generation include the following: |

| | • | | The Company expanded its portfolio of wind generation businesses with the acquisition of Mountain View Power Partners (“Mountain View”), which consists of 111 wind turbines with a capacity of 67 MW in Palm Springs, California. |

| | • | | In July, we acquired a 49% interest in Guohua Hulunbeier Wind Farm, a 49.5 MW wind farm development in China. The Company also reached a separate agreement with Guohua to move to phase II of our jointly-owned Huanghua wind project to expand the facility, doubling the capacity to 99 MW. AES has a 49% interest in the Huanghua Project. |

| | • | | In December, the Company obtained financing to build a 156 MW wind farm in Kavarna, the largest in Bulgaria, and a 22 MW wind farm in Scotland. Additionally we acquired a 34 MW wind farm from our affiliate, InnoVent. All three are expected to commence commercial operations in 2009. |

| | • | | Solar Energy—In March, the Company formed AES Solar, a joint venture with Riverstone. AES Solar will develop land-based solar photovoltaic panels that capture sunlight to convert into electricity that feed directly into power grids. AES Solar has commenced commercial operations of 24 MW solar projects in Spain. Under the terms of the agreement, the Company and Riverstone will each provide up to $500 million of capital over the next five years. Through December 31, 2008, the Company has contributed total capital of $135 million. |

| | • | | Climate Solutions—Highlights from our climate solutions activities include: |

| | • | | In April, the Company acquired the rights to the gas from a landfill project in El Salvador (“Nejapa”). Nejapa produces emission reduction credits and plans to build a 6 MW generation facility that could potentially increase to 25 MW in the future. |

| | • | | In June, as a result of a financial restructuring, the Company assumed 100% ownership of AgCert International Plc, an Irish company investing in GHG projects primarily in Brazil and Mexico. AgCert currently produces approximately 1.4 million tonnes per year of CERs. |

| | • | | In September, Greenhouse Gas Services LLC, the Company’s joint venture with General Electric, announced an agreement with Google to co-develop projects to reduce GHG emissions and produce GHG credits. The first project will capture methane gas in North Carolina. |

Construction

As of December 31, 2008, the Company has more than 3,000 Gross MW of new generation capacity. The projects under construction include 14 core power projects totaling 2,993 MW and 11 wind power projects totaling 410 MW.

| | • | | We began construction of Angamos, a 518 MW coal-fired generation facility in Chile expected to begin commercial operations in 2011. |

23

| | • | | We also further advanced our recent projects with the start of construction of three hydro projects in Turkey that are being developed through our investment made in May 2007 in the IC Ictas Energy Group. |

| | • | | In July, the Company achieved early successful testing of simple cycle operation for the Amman East facility in Jordan, a 380 MW natural gas-fired project expected to achieve full combined-cycle operation in the first half of 2009. |

| | • | | In August, the Company started commercial operations of the 170 MW Buffalo Gap III wind farm in Abilene, Texas, bringing the total wind generation capacity of the Buffalo Gap wind farm to 524 MW. |

For a complete listing of the Company’s projects under construction or in development please see Item 1—Our Organizations and Segments.

Portfolio Management

| | • | | In the first quarter of 2008, the Company finalized our termination agreement with the Chinese government and shut down Hefei, a 115 MW oil-fueled generation facility. The plant became the property of the Anhui Province and we received termination compensation of approximately $39 million in March 2008. |

| | • | | In May 2008, the Company completed the sale of Ekibastuz and Maikuben West, a coal-fired power plant and a coal mine with operations in Kazakhstan. Proceeds from the sale of these businesses totaled approximately $1.1 billion, a portion of which was used to pay down debt in June 2008. We have the opportunity to receive additional consideration of up to approximately $380 million under performance incentives and a management agreement to continue operation and management of the plants for the next three years. |