UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06310

Legg Mason Partners Variable Income Trust

(Exact name of registrant as specified in charter)

| | |

| 125 Broad Street, New York, NY | | 10004 |

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: December 31,

Date of reporting period: June 30, 2007

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

SEMI-ANNUAL

REPORT

JUNE 30, 2007

Legg Mason Partners

Variable Global High Yield Bond Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED Ÿ NO BANK GUARANTEE Ÿ MAY LOSE VALUE

Legg Mason Partners

Variable Global High Yield Bond Portfolio

Semi-Annual Report • June 30, 2007

What’s

Inside

Portfolio Objective

The Portfolio seeks to maximize total return, consistent with the preservation of capital. This objective may be changed without shareholder approval.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

The U.S. economy weakened during the six-month reporting period ended June 30, 2007. U.S. gross domestic product (“GDP”)i expanded 2.5% in the fourth quarter of 2006. In the first quarter of 2007, GDP growth was a tepid 0.6%, according to the U.S. Commerce Department. This is the lowest growth rate since the fourth quarter of 2002. While consumer spending remained fairly solid, ongoing troubles in the housing market continued to negatively impact the economy. The advance estimate for second quarter 2007 GDP growth was a solid 3.4%, its fastest rate since the first quarter of 2006. While consumer spending slowed, this was offset by a sharp increase in business spending and exports.

After increasing the federal funds rateii to 5.25% in June 2006—the 17th consecutive rate hike—the Federal Reserve Board (“Fed”)iii held rates steady at its last eight meetings. In its statement accompanying the June 2007 meeting, the Fed stated: “The economy seems likely to continue to expand at a moderate pace over coming quarters.…Readings on core inflation have improved modestly in recent months. However, a sustained moderation in inflation pressures has yet to be convincingly demonstrated….In these circumstances, the Committee’s predominant policy concern remains the risk that inflation will fail to moderate as expected.”

During the six-month reporting period, both short- and long-term Treasury yields experienced periods of volatility. After falling during the first three months of the year, yields moved steadily higher over much of the second quarter of 2007. This was due, in part, to inflationary fears, a solid job market and mounting expectations that the Fed would not be cutting short-term rates in the foreseeable future. Two-year Treasury yields spiked to 5.10% on June 14th, versus a yield of 4.58% when the second quarter began.

Legg Mason Partners Variable Global High Yield Bond Portfolio I

Ten-year Treasury yields moved up even more dramatically, cresting at 5.26% on June 12th—their highest rate in five years. In contrast, the yield on the 10-year Treasury was 4.65% at the end of March. After their highs in mid June, yields then trended somewhat lower during the reporting period, as concerns regarding the subprime mortgage market triggered a flight to quality. As of June 30, 2007, the yields on two- and 10-year Treasuries were 4.87% and 5.03%, respectively. Looking at the six-month period as a whole, the overall bond market, as measured by the Lehman Brothers U.S. Aggregate Indexiv, returned 0.98%.

The high yield bond market generated solid results over the six-month period ended June 30, 2007. During that time, the Citigroup High Yield Market Indexv returned 2.66%. With interest rates relatively low, demand for higher yielding bonds remained strong. The high yield market was further aided by strong corporate profits and low default rates.

Despite periods of weakness, emerging markets debt generated positive results, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi gained 0.94% during the reporting period. Strong investor demand, an expanding global economy and solid domestic spending supported many emerging market countries.

Since the close of the reporting period, the U.S. fixed-income markets have experienced a period of extreme volatility which has negatively impacted market liquidity conditions. Initially, the concern on the part of market participants was limited to the subprime segment of the mortgage-backed market. However, these concerns have since broadened to include a wide range of financial institutions and markets. As a result, other fixed income instruments have experienced increased price volatility.

II Legg Mason Partners Variable Global High Yield Bond Portfolio

Performance Review

For the six months ended June 30, 2007, Class I shares of Legg Mason Partners Variable Global High Yield Bond Portfolio1 returned 2.53%. In comparison, the Portfolio’s unmanaged benchmark, the Citigroup High Yield Market Index, returned 2.66% and its Lipper Variable High Current Yield Funds Category Average2 increased 3.06%.

| | |

| Performance Snapshot as of June 30, 2007 (unaudited) | | |

| |

| | | Six Months |

Variable Global High Yield Bond Portfolio1 — Class I shares | | 2.53% |

| |

Citigroup High Yield Market Index | | 2.66% |

| |

Lipper Variable High Current Yield Funds Category Average | | 3.06% |

| |

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value, yields and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. |

| Class II shares returned 2.42% over the six months ended June 30, 2007. All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Portfolio expenses. |

| Performance figures reflect expense reimbursements and/or fee waivers, without which the performance would have been lower. |

The 30-Day SEC Yields for the period ending June 30, 2007 for Class I and II shares were 7.27% and 7.04%, respectively. Current expense reimbursements and/or fee waivers are voluntary, and may be reduced or terminated at any time. Absent current expense reimbursements and/or fee waivers, the 30-Day SEC Yields for Class I and II shares would have been unchanged. The 30-Day SEC Yield is the average annualized net investment income per share for the 30-day period indicated and is subject to change. |

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s most current prospectus dated April 30, 2007, the gross total operating expenses for Class I and Class II shares were 0.98% and 1.33%, respectively. As a result of an expense limitation, the ratio of expenses, other than interest, brokerage, taxes and extraordinary expenses, to average net assets will not exceed 1.00% and 1.25% for Class I and Class II Shares, respectively. This expense limitation can be reduced or terminated at any time. |

1 | | The Portfolio is an underlying investment option of various variable annuity and variable life insurance products. The Portfolio’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Portfolio. Past performance is no guarantee of future results. |

2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the six-month period ended June 30, 2007, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 105 funds in the Portfolio’s Lipper category. |

Legg Mason Partners Variable Global High Yield Bond Portfolio III

Special Shareholder Notices

Effective April 30, 2007, Western Asset Management Company Limited (“Western Asset Limited”) became an additional subadviser to the Portfolio, under an additional sub-advisory agreement between Western Asset Management Company (“Western Asset”) and Western Asset Limited. Western Asset and Western Asset Limited are wholly-owned subsidiaries of Legg Mason, Inc. Western Asset Limited provides certain advisory services to the Portfolio relating to currency transactions and investments in non-U.S. dollar denominated securities. Western Asset Limited has offices at 10 Exchange Place, London, England. Western Asset Limited acts as an investment adviser to institutional accounts, such as corporate pension plans, mutual funds, and endowment funds.

Effective May 17, 2007, the Portfolio is managed by a team of portfolio managers, sector specialists and other investment professionals led by the following individuals: S. Kenneth Leech, Stephen A. Walsh, Michael C. Buchanan, Keith J. Gardner, and Detlev S. Schlichter. Messrs. Leech, Walsh and Gardner have been employed with Western Asset for at least the past five years. Mr. Buchanan joined Western Asset in 2005. Mr. Schlichter is a portfolio manager with Western Asset Limited and has been employed as a portfolio manager with Western Asset Limited for at least the past five years. The team is responsible for overseeing the day-to-day operations of the Portfolio.

With a goal of moving the mutual funds formerly advised by Citigroup Asset Management (“CAM”) to a more cohesive and rational operating platform, Legg Mason, Inc. recommended a number of governance- and investment-related proposals to streamline and restructure the funds. The Boards of Directors/Trustees of the affected funds have carefully considered and approved these proposals and, where required, have obtained shareholder approval. As such, the following changes became effective during the month of April 2007:

| | • | | Funds Redomiciled and Single Form of Organization Adopted: The legacy CAM funds have been redomiciled to a single jurisdiction and a single form of corporate structure has been introduced. Equity funds have been grouped for organizational and governance purposes with other funds in the fund |

IV Legg Mason Partners Variable Global High Yield Bond Portfolio

| | complex that are predominantly equity funds, and fixed-income funds have been grouped with other funds that are predominantly fixed-income funds. Additionally, the funds have adopted a single form of organization as a Maryland business trust, with all funds operating under uniform charter documents. |

| | • | | New Boards Elected: New Boards have been elected for the legacy CAM funds. The 10 Boards previously overseeing the funds have been realigned and consolidated into 2 Boards, with the remaining Boards each overseeing a distinct asset class or product type: equity or fixed income. |

| | • | | Revised Fundamental Investment Policies Instituted: A uniform set of fundamental investment policies has been instituted for most funds, to the extent appropriate. Please note, however, that each fund will continue to be managed in accordance with its prospectus and statement of additional information, as well as any policies or guidelines that may have been established by the fund’s Board or investment manager. |

Information About Your Portfolio

As you may be aware, several issues in the mutual fund industry have come under the scrutiny of federal and state regulators. Affiliates of the Portfolio’s manager have, in recent years, received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Portfolio’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Portfolio is not in a position to predict the outcome of these requests and investigations.

Important information with regard to recent regulatory developments that may affect the Portfolio is contained in the Notes to Financial Statements included in this report.

Legg Mason Partners Variable Global High Yield Bond Portfolio V

As always, thank you for your continued confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

July 27, 2007

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: High yield bonds involve greater credit and liquidity risks than investment grade bonds. As interest rates rise, bond prices fall, reducing the value of the Portfolio’s share price. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. These risks are magnified in emerging or developing markets. The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Portfolio performance. Please see the Portfolio’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i | | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

ii | | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

iii | | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

iv | | The Lehman Brothers U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

v | | The Citigroup High Yield Market Index is a broad-based unmanaged index of high yield securities. |

vi | | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela. |

VI Legg Mason Partners Variable Global High Yield Bond Portfolio

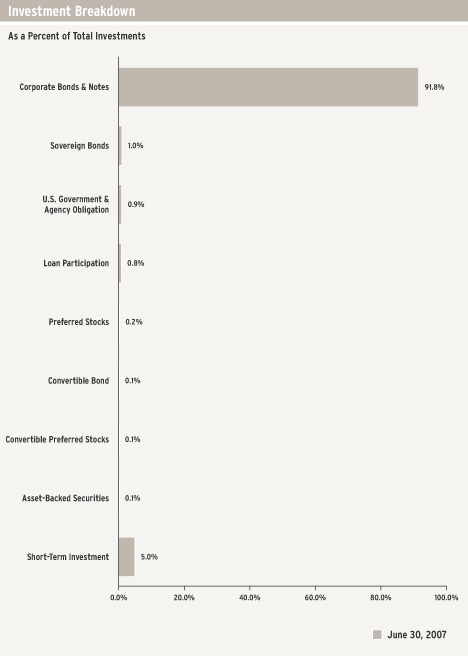

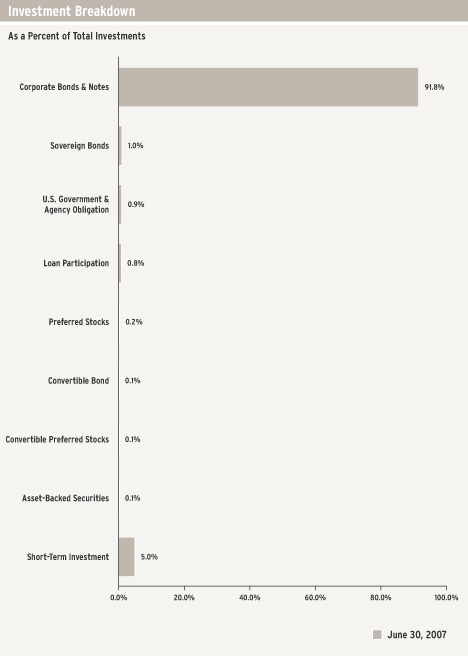

Fund at a Glance (unaudited)

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 1

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on January 1, 2007 and held for the six months ended June 30, 2007.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | | | | | | | | | | | |

| | | | | |

| | | Actual Total

Return(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

Class I | | 2.53 | % | | $ | 1,000.00 | | $ | 1,025.30 | | 0.93 | % | | $ | 4.67 |

| |

Class II | | 2.42 | | | | 1,000.00 | | | 1,024.20 | | 1.23 | | | | 6.17 |

| |

(1) | | For the six months ended June 30, 2007. |

(2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

(3) | | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

2 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) | | | | | | | | | |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

Class I | | 5.00 | % | | $ | 1,000.00 | | $ | 1,020.18 | | 0.93 | % | | $ | 4.66 |

| |

Class II | | 5.00 | | | | 1,000.00 | | | 1,018.70 | | 1.23 | | | | 6.16 |

| |

(1) | | For the six months ended June 30, 2007. |

(2) | | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 3

Schedule of Investments (June 30, 2007) (unaudited)

LEGG MASON PARTNERS VARIABLE GLOBAL HIGH YIELD BOND PORTFOLIO

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | CORPORATE BONDS & NOTES — 92.2% | | | | |

| | Aerospace & Defense — 2.0% | | | | |

| $ | 440,000 | | Alliant Techsystems Inc., Senior Subordinated Notes, 6.750% due 4/1/16 | | $ | 429,000 | |

| | | DRS Technologies Inc., Senior Subordinated Notes: | | | | |

| | 200,000 | | 6.875% due 11/1/13 | | | 195,000 | |

| | 315,000 | | 6.625% due 2/1/16 | | | 305,550 | |

| | 25,000 | | 7.625% due 2/1/18 | | | 25,375 | |

| | | Hawker Beechcraft Acquisition Co.: | | | | |

| | 765,000 | | Senior Notes, 8.875% due 4/1/15 (a)(b) | | | 789,862 | |

| | 380,000 | | Senior Subordinated Notes, 9.750% due 4/1/17 (a) | | | 398,050 | |

| | | L-3 Communications Corp., Senior Subordinated Notes: | | | | |

| | 380,000 | | 7.625% due 6/15/12 | | | 390,925 | |

| | 215,000 | | 6.375% due 10/15/15 | | | 204,250 | |

| | | |

| | | Total Aerospace & Defense | | | 2,738,012 | |

| | | |

| | Airlines — 0.4% | | | | |

| | | Continental Airlines Inc.: | | | | |

| | 335,000 | | Notes, 8.750% due 12/1/11 | | | 329,975 | |

| | | Pass-Through Certificates: | | | | |

| | 6,204 | | Series 981-C, 6.541% due 3/15/08 | | | 6,200 | |

| | 200,000 | | Series C, 7.339% due 4/19/14 | | | 197,500 | |

| | | |

| | | Total Airlines | | | 533,675 | |

| | | |

| | Auto Components — 1.2% | | | | |

| | 500,000 | | Keystone Automotive Operations Inc., Senior Subordinated Notes,

9.750% due 11/1/13 | | | 437,500 | |

| | 1,200,000 | | Visteon Corp., Senior Notes, 8.250% due 8/1/10 | | | 1,197,000 | |

| | | |

| | | Total Auto Components | | | 1,634,500 | |

| | | |

| | Automobiles — 2.2% | | | | |

| | | Ford Motor Co.: | | | | |

| | 130,000 | | Debentures, 8.875% due 1/15/22 | | | 115,050 | |

| | 800,000 | | Notes, 7.450% due 7/16/31 | | | 643,000 | |

| | 50,000 | | Senior Notes, 4.950% due 1/15/08 | | | 49,632 | |

| | | General Motors Corp.: | | | | |

| | 270,000 | | Notes, 7.200% due 1/15/11 | | | 260,212 | |

| | | Senior Debentures: | | | | |

| | 150,000 | | 8.250% due 7/15/23 | | | 137,438 | |

| | 1,880,000 | | 8.375% due 7/15/33 | | | 1,724,900 | |

| | | |

| | | Total Automobiles | | | 2,930,232 | |

| | | |

| | Beverages — 0.3% | | | | |

| | 370,000 | | Constellation Brands Inc., Senior Notes, 7.250% due 9/1/16 | | | 362,600 | |

| | | |

| | Building Products — 1.6% | | | | |

| | | Ainsworth Lumber Co., Ltd.: | | | | |

| | 170,000 | | 7.250% due 10/1/12 | | | 131,750 | |

| | 75,000 | | Senior Notes, 6.750% due 3/15/14 | | | 56,156 | |

See Notes to Financial Statements.

4 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Building Products — 1.6% (continued) | | | | |

| | | Associated Materials Inc.: | | | | |

| $ | 390,000 | | Senior Discount Notes, step bond to yield 16.602% due 3/1/14 | | $ | 292,500 | |

| | 650,000 | | Senior Subordinated Notes, 9.750% due 4/15/12 | | | 682,500 | |

| | 220,000 | | Nortek Inc., Senior Subordinated Notes, 8.500% due 9/1/14 | | | 210,650 | |

| | 1,150,000 | | NTK Holdings Inc., Senior Discount Notes, step bond to yield

11.373% due 3/1/14 | | | 839,500 | |

| | | |

| | | Total Building Products | | | 2,213,056 | |

| | | |

| | Capital Markets — 0.4% | | | | |

| | | E*TRADE Financial Corp., Senior Notes: | | | | |

| | 375,000 | | 7.375% due 9/15/13 | | | 382,500 | |

| | 100,000 | | 7.875% due 12/1/15 | | | 104,625 | |

| | | |

| | | Total Capital Markets | | | 487,125 | |

| | | |

| | Chemicals — 1.8% | | | | |

| | 150,000 | | Arco Chemical Co., Debentures, 9.800% due 2/1/20 | | | 163,500 | |

| | 114,000 | | Equistar Chemicals LP, Senior Notes, 10.625% due 5/1/11 | | | 120,555 | |

| | 685,000 | | Georgia Gulf Corp., 9.500% due 10/15/14 | | | 685,000 | |

| | 230,000 | | Huntsman International LLC, 7.875% due 11/15/14 | | | 247,537 | |

| | | Lyondell Chemical Co.: | | | | |

| | | Senior Notes: | | | | |

| | 150,000 | | 8.000% due 9/15/14 | | | 154,875 | |

| | 125,000 | | 8.250% due 9/15/16 | | | 131,250 | |

| | 10,000 | | Senior Secured Notes, 10.500% due 6/1/13 | | | 10,850 | |

| | 345,000 | | Methanex Corp., Senior Notes, 8.750% due 8/15/12 | | | 381,225 | |

| | 420,000 | | Montell Finance Co. BV, Debentures, 8.100% due 3/15/27 (a) | | | 384,300 | |

| | 150,000 | | Westlake Chemical Corp., Senior Notes, 6.625% due 1/15/16 | | | 142,875 | |

| | | |

| | | Total Chemicals | | | 2,421,967 | |

| | | |

| | Commercial Banks — 0.2% | | | | |

| | 100,000 | | ATF Capital BV, Senior Notes, 9.250% due 2/21/14 (a) | | | 106,750 | |

| | 210,000 | | TuranAlem Finance BV, Bonds, 8.250% due 1/22/37 (a) | | | 202,650 | |

| | | |

| | | Total Commercial Banks | | | 309,400 | |

| | | |

| | Commercial Services & Supplies — 2.6% | | | | |

| | 920,000 | | Allied Security Escrow Corp., Senior Subordinated Notes, 11.375% due 7/15/11 | | | 929,200 | |

| | 100,000 | | Allied Waste North America Inc., Senior Notes, Series B, 7.250% due 3/15/15 | | | 99,500 | |

| | 150,000 | | Ashtead Holdings PLC, Secured Notes, 8.625% due 8/1/15 (a) | | | 153,750 | |

| | 75,000 | | Corrections Corporation of America, Senior Notes, 6.750% due 1/31/14 | | | 73,688 | |

| | 975,000 | | DynCorp International LLC/DIV Capital Corporation, Senior Subordinated Notes, Series B, 9.500% due 2/15/13 | | | 1,042,031 | |

| | | Interface Inc.: | | | | |

| | 500,000 | | Senior Notes, 10.375% due 2/1/10 | | | 540,000 | |

| | 150,000 | | Senior Subordinated Notes, 9.500% due 2/1/14 | | | 162,375 | |

| | 485,000 | | Rental Services Corp., Senior Bonds, 9.500% due 12/1/14 (a) | | | 497,125 | |

| | 125,000 | | Safety-Kleen Services Inc., Senior Subordinated Notes, 9.250% due 6/1/08 (c)(d) | | | 125 | |

| | | |

| | | Total Commercial Services & Supplies | | | 3,497,794 | |

| | | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 5

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Communications Equipment — 0.4% | | | | |

| $ | 670,000 | | Lucent Technologies Inc., Debentures, 6.450% due 3/15/29 | | $ | 586,250 | |

| | | |

| | Consumer Finance — 3.9% | | | | |

| | 415,000 | | AmeriCredit Corp., Senior Notes, 8.500% due 7/1/15 (a) | | | 420,187 | |

| | | Ford Motor Credit Co.: | | | | |

| | | Notes: | | | | |

| | 445,000 | | 6.625% due 6/16/08 | | | 444,800 | |

| | 420,000 | | 9.806% due 4/15/12 (e) | | | 450,550 | |

| | 380,000 | | 7.000% due 10/1/13 | | | 352,501 | |

| | | Senior Notes: | | | | |

| | 585,000 | | 9.875% due 8/10/11 | | | 614,549 | |

| | 227,500 | | 8.105% due 1/13/12 (e) | | | 227,136 | |

| | 280,000 | | 8.000% due 12/15/16 | | | 268,631 | |

| | | General Motors Acceptance Corp.: | | | | |

| | 1,750,000 | | Bonds, 8.000% due 11/1/31 | | | 1,794,354 | |

| | 680,000 | | Notes, 6.875% due 8/28/12 | | | 665,287 | |

| | | |

| | | Total Consumer Finance | | | 5,237,995 | |

| | | |

| | Containers & Packaging — 2.5% | | | | |

| | 900,000 | | Graham Packaging Co. Inc., Senior Subordinated Notes, 9.875% due 10/15/14 | | | 914,625 | |

| | 625,000 | | Graphic Packaging International Corp., Senior Subordinated Notes,

9.500% due 8/15/13 | | | 652,344 | |

| | 370,000 | | Greif Inc., Senior Notes, 6.750% due 2/1/17 | | | 363,525 | |

| | | Owens-Brockway Glass Container Inc.: | | | | |

| | 275,000 | | Senior Notes, 8.250% due 5/15/13 | | | 286,000 | |

| | 150,000 | | Senior Secured Notes, 7.750% due 5/15/11 | | | 154,687 | |

| | 165,000 | | Plastipak Holdings Inc., Senior Notes, 8.500% due 12/15/15 (a) | | | 171,600 | |

| | 120,000 | | Radnor Holdings Corp., Senior Notes, 11.000% due 3/15/10 (c)(d) | | | 1,050 | |

| | 730,000 | | Smurfit-Stone Container Corp., Senior Notes, 8.000% due 3/15/17 | | | 711,750 | |

| | 175,000 | | Smurfit-Stone Container Enterprises Inc., Senior Notes, 8.375% due 7/1/12 | | | 176,094 | |

| | | |

| | | Total Containers & Packaging | | | 3,431,675 | |

| | | |

| | Diversified Consumer Services — 1.0% | | | | |

| | | Education Management LLC/Education Management Finance Corp.: | | | | |

| | 260,000 | | Senior Notes, 8.750% due 6/1/14 | | | 267,800 | |

| | 580,000 | | Senior Subordinated Notes, 10.250% due 6/1/16 | | | 613,350 | |

| | | Service Corp. International: | | | | |

| | 70,000 | | Debentures, 7.875% due 2/1/13 | | | 71,658 | |

| | | Senior Notes: | | | | |

| | 135,000 | | 7.625% due 10/1/18 | | | 137,363 | |

| | 235,000 | | 7.500% due 4/1/27 (a) | | | 222,662 | |

| | | |

| | | Total Diversified Consumer Services | | | 1,312,833 | |

| | | |

| | Diversified Financial Services — 4.7% | | | | |

| | 450,000 | | Basell AF SCA, Senior Secured Subordinated Second Priority Notes,

8.375% due 8/15/15 (a) | | | 433,125 | |

| | 280,000 | | CCM Merger Inc., Notes, 8.000% due 8/1/13 (a) | | | 280,000 | |

See Notes to Financial Statements.

6 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Diversified Financial Services — 4.7% (continued) | | | | |

| | | Dow Jones CDX HY, Pass-Through Certificates: | | | | |

| $ | 1,340,000 | | Series 7-T3, 8.000% due 12/29/11 (a) | | $ | 1,323,250 | |

| | 1,000,000 | | Series 8-T3, 7.500% due 6/29/12 (a)(f) | | | 948,750 | |

| | 620,000 | | JPMorgan Chase London, zero coupon bond to yield 9.312% due 11/8/07 (a) | | | 605,969 | |

| | 330,000 | | Milacron Escrow Corp., Senior Secured Notes, 11.500% due 5/15/11 | | | 320,925 | |

| | 340,000 | | PGS Solutions Inc., Senior Subordinated Notes, 9.625% due 2/15/15 (a) | | | 345,490 | |

| | 420,000 | | Smurfit Kappa Funding PLC, Senior Subordinated Notes, 7.750% due 4/1/15 | | | 422,625 | |

| | 500,000 | | Standard Aero Holdings Inc., 8.250% due 9/1/14 | | | 535,000 | |

| | 147,000 | | UCAR Finance Inc., Senior Notes, 10.250% due 2/15/12 | | | 154,718 | |

| | 1,000,000 | | Vanguard Health Holdings Co. II LLC, Senior Subordinated Notes,

9.000% due 10/1/14 | | | 995,000 | |

| | | |

| | | Total Diversified Financial Services | | | 6,364,852 | |

| | | |

| | Diversified Telecommunication Services — 6.7% | | | | |

| | 700,000 | | Cincinnati Bell Inc., Senior Notes, 7.000% due 2/15/15 | | | 689,500 | |

| | 20,000 | | Cincinnati Bell Telephone Co., Senior Debentures, 6.300% due 12/1/28 | | | 17,900 | |

| | | Citizens Communications Co.: | | | | |

| | 65,000 | | 7.050% due 10/1/46 | | | 53,625 | |

| | 80,000 | | Senior Bonds, 7.125% due 3/15/19 | | | 76,000 | |

| | 475,000 | | Senior Notes, 7.875% due 1/15/27 | | | 464,312 | |

| | 520,000 | | Hawaiian Telcom Communications Inc., Senior Subordinated Notes, Series B, 12.500% due 5/1/15 | | | 592,800 | |

| | 370,000 | | Inmarsat Finance II PLC, step bond to yield 8.062% due 11/15/12 | | | 354,737 | |

| | | Intelsat Bermuda Ltd.: | | | | |

| | 450,000 | | 9.250% due 6/15/16 | | | 480,375 | |

| | 810,000 | | Senior Notes, 11.250% due 6/15/16 | | | 911,250 | |

| | | Intelsat Corp.: | | | | |

| | 95,000 | | 9.000% due 6/15/16 | | | 99,988 | |

| | 49,000 | | Senior Notes, 9.000% due 8/15/14 | | | 51,328 | |

| | | Level 3 Financing Inc.: | | | | |

| | 710,000 | | 9.250% due 11/1/14 | | | 720,650 | |

| | | Senior Notes: | | | | |

| | 90,000 | | 9.150% due 2/15/15 (a)(e) | | | 90,450 | |

| | 40,000 | | 8.750% due 2/15/17 (a) | | | 39,750 | |

| | 485,000 | | Nordic Telephone Co. Holdings, Senior Secured Notes, 8.875% due 5/1/16 (a) | | | 516,525 | |

| | | NTL Cable PLC, Senior Notes: | | | | |

| | 115,000 | | 8.750% due 4/15/14 | | | 119,025 | |

| | 620,000 | | 9.125% due 8/15/16 | | | 652,550 | |

| | 310,000 | | PAETEC Holding Corp., Senior Secured Notes, 9.500% due 7/15/15 (a) | | | 314,262 | |

| | 100,000 | | Qwest Communications International Inc., Senior Notes, Series B,

7.500% due 2/15/14 | | | 101,750 | |

| | | Qwest Corp.: | | | | |

| | 945,000 | | Debentures, 6.875% due 9/15/33 | | | 890,662 | |

| | 65,000 | | Notes, 8.875% due 3/15/12 | | | 70,363 | |

| | 720,000 | | Senior Notes, 7.500% due 10/1/14 | | | 741,600 | |

| | 275,000 | | Umbrella Acquisition Inc., Senior Notes, 9.750% due 3/15/15 (a)(b) | | | 272,938 | |

| | 75,000 | | Wind Acquisition Finance SA, Senior Bond, 10.750% due 12/1/15 (a) | | | 86,438 | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 7

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Diversified Telecommunication Services — 6.7% (continued) | | | | |

| $ | 655,000 | | Windstream Corp., Senior Notes, 8.625% due 8/1/16 | | $ | 695,937 | |

| | | |

| | | Total Diversified Telecommunication Services | | | 9,104,715 | |

| | | |

| | Electric Utilities — 1.2% | | | | |

| | 290,000 | | IPALCO Enterprises Inc., Secured Notes, 8.625% due 11/14/11 | | | 311,750 | |

| | 379,834 | | Midwest Generation LLC, Pass-Through Certificates, Series B,

8.560% due 1/2/16 | | | 405,236 | |

| | 350,000 | | Orion Power Holdings Inc., Senior Notes, 12.000% due 5/1/10 | | | 397,250 | |

| | 580,000 | | VeraSun Energy Corp., Senior Notes, 9.375% due 6/1/17 (a) | | | 542,300 | |

| | | |

| | | Total Electric Utilities | | | 1,656,536 | |

| | | |

| | Electrical Equipment — 0.1% | | | | |

| | 85,000 | | Belden CDT Inc., Senior Subordinated Notes, 7.000% due 3/15/17 (a) | | | 84,150 | |

| | | |

| | Electronic Equipment & Instruments — 0.3% | | | | |

| | | NXP BV/NXP Funding LLC: | | | | |

| | 260,000 | | Senior Note, 7.875% due 10/15/14 | | | 257,400 | |

| | 135,000 | | Senior Unsubordinated Note, 9.500% due 10/15/15 | | | 133,650 | |

| | | |

| | | Total Electronic Equipment & Instruments | | | 391,050 | |

| | | |

| | Energy Equipment & Services — 1.3% | | | | |

| | 435,000 | | Complete Production Services Inc., Senior Notes, 8.000% due 12/15/16 (a) | | | 441,525 | |

| | 319,000 | | Dresser-Rand Group Inc., Senior Subordinated Notes, 7.375% due 11/1/14 | | | 321,791 | |

| | 500,000 | | GulfMark Offshore Inc., Senior Subordinated Notes, 7.750% due 7/15/14 | | | 507,500 | |

| | 130,000 | | Pride International Inc., Senior Notes, 7.375% due 7/15/14 | | | 130,975 | |

| | 300,000 | | Sonat Inc., Notes, 7.625% due 7/15/11 | | | 313,133 | |

| | 60,000 | | Southern Natural Gas Co., Senior Notes, 8.000% due 3/1/32 | | | 68,349 | |

| | | |

| | | Total Energy Equipment & Services | | | 1,783,273 | |

| | | |

| | Food & Staples Retailing — 0.3% | | | | |

| | 356,000 | | Delhaize America Inc., Debentures, 9.000% due 4/15/31 | | | 431,881 | |

| | | |

| | Food Products — 0.4% | | | | |

| | | Dole Food Co. Inc.: | | | | |

| | 100,000 | | Debentures, 8.750% due 7/15/13 | | | 98,000 | |

| | 425,000 | | Senior Notes, 7.250% due 6/15/10 | | | 412,250 | |

| | | |

| | | Total Food Products | | | 510,250 | |

| | | |

| | Gas Utilities — 0.5% | | | | |

| | 645,000 | | Suburban Propane Partners LP/Suburban Energy Finance Corp., Senior Notes, 6.875% due 12/15/13 | | | 625,650 | |

| | | |

| | Health Care Equipment & Supplies — 0.2% | | | | |

| | 280,000 | | Advanced Medical Optics Inc., Senior Subordinated Notes,

7.500% due 5/1/17 (a) | | | 266,000 | |

| | | |

| | Health Care Providers & Services — 5.4% | | | | |

| | | Community Health Systems Inc.: | | | | |

| | 1,060,000 | | Senior Notes, 8.875% due 7/15/15 (a) | | | 1,079,875 | |

| | 175,000 | | Senior Subordinated Notes, 6.500% due 12/15/12 | | | 182,651 | |

See Notes to Financial Statements.

8 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Health Care Providers & Services — 5.4% (continued) | | | | |

| | | DaVita Inc.: | | | | |

| | | Senior Notes: | | | | |

| $ | 175,000 | | 6.625% due 3/15/13 (a) | | $ | 171,719 | |

| | 30,000 | | 6.625% due 3/15/13 | | | 29,438 | |

| | 550,000 | | Senior Subordinated Notes, 7.250% due 3/15/15 | | | 545,875 | |

| | 200,000 | | Genesis HealthCare Corp., Senior Subordinated Notes, 8.000% due 10/15/13 | | | 213,480 | |

| | | HCA Inc.: | | | | |

| | 100,000 | | Notes, 6.375% due 1/15/15 | | | 85,250 | |

| | 570,000 | | Senior Notes, 6.500% due 2/15/16 | | | 485,213 | |

| | | Senior Secured Notes: | | | | |

| | 340,000 | | 9.250% due 11/15/16 (a) | | | 362,950 | |

| | 1,102,000 | | 9.625% due 11/15/16 (a)(b) | | | 1,187,405 | |

| | 250,000 | | IASIS Healthcare LLC/IASIS Capital Corp., Senior Subordinated Notes,

8.750% due 6/15/14 | | | 251,250 | |

| | | Tenet Healthcare Corp., Senior Notes: | | | | |

| | 232,000 | | 7.375% due 2/1/13 | | | 210,830 | |

| | 950,000 | | 9.875% due 7/1/14 | | | 945,250 | |

| | 620,000 | | Triad Hospitals Inc., Senior Subordinated Notes, 7.000% due 11/15/13 | | | 653,293 | |

| | | Universal Hospital Services Inc., Secured Notes: | | | | |

| | 125,000 | | 8.500% due 6/1/15 (a)(b) | | | 124,375 | |

| | 130,000 | | 8.759% due 6/1/15 (a)(e) | | | 130,650 | |

| | 615,000 | | US Oncology Holdings Inc., Senior Notes, 9.797% due 3/15/12 (a)(b) | | | 607,312 | |

| | | |

| | | Total Health Care Providers & Services | | | 7,266,816 | |

| | | |

| | Hotels, Restaurants & Leisure — 4.7% | | | | |

| | 75,000 | | AMC Entertainment Inc., Senior Subordinated Notes, 8.000% due 3/1/14 | | | 73,875 | |

| | 300,000 | | Boyd Gaming Corp., Senior Subordinated Notes, 6.750% due 4/15/14 | | | 295,500 | |

| | 610,000 | | Buffets Inc., Senior Notes, 12.500% due 11/1/14 | | | 587,125 | |

| | | Caesars Entertainment Inc.: | | | | |

| | 105,000 | | Senior Notes, 7.000% due 4/15/13 | | | 110,118 | |

| | 100,000 | | Senior Subordinated Notes, 8.125% due 5/15/11 | | | 104,875 | |

| | 175,000 | | Carrols Corp., Senior Subordinated Notes, 9.000% due 1/15/13 | | | 173,250 | |

| | 260,000 | | Choctaw Resort Development Enterprise, Senior Notes,

7.250% due 11/15/19 (a) | | | 257,400 | |

| | 160,000 | | Denny’s Holdings Inc., Senior Notes, 10.000% due 10/1/12 | | | 169,600 | |

| | 230,000 | | El Pollo Loco Inc., Senior Notes, 11.750% due 11/15/13 | | | 243,800 | |

| | 275,000 | | Fontainebleau Las Vegas Holdings LLC/Fontainebleau Las Vegas Capital Corp., 10.250% due 6/15/15 (a) | | | 272,250 | |

| | 175,000 | | Herbst Gaming Inc., Senior Subordinated Notes, 8.125% due 6/1/12 | | | 177,625 | |

| | 815,000 | | Inn of the Mountain Gods Resort & Casino, Senior Notes,

12.000% due 11/15/10 | | | 878,162 | |

| | 125,000 | | Isle of Capri Casinos Inc., Senior Subordinated Notes, 7.000% due 3/1/14 | | | 118,906 | |

| | 175,000 | | Las Vegas Sands Corp., Senior Notes, 6.375% due 2/15/15 | | | 167,344 | |

| | | MGM MIRAGE Inc.: | | | | |

| | 90,000 | | 7.500% due 6/1/16 | | | 85,837 | |

| | | Senior Notes: | | | | |

| | 360,000 | | 8.500% due 9/15/10 | | | 378,450 | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 9

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Hotels, Restaurants & Leisure — 4.7% (continued) | | | | |

| $ | 15,000 | | 6.750% due 9/1/12 | | $ | 14,400 | |

| | 20,000 | | 6.625% due 7/15/15 | | | 18,275 | |

| | 430,000 | | 7.625% due 1/15/17 | | | 411,187 | |

| | 45,000 | | Senior Subordinated Notes, 8.375% due 2/1/11 | | | 46,238 | |

| | 55,000 | | Mohegan Tribal Gaming Authority, Senior Subordinated Notes,

6.875% due 2/15/15 | | | 53,763 | |

| | 260,000 | | OSI Restaurant Partners Inc., Senior Notes, 10.000% due 6/15/15 (a) | | | 249,600 | |

| | | Pinnacle Entertainment Inc., Senior Subordinated Notes: | | | | |

| | 100,000 | | 8.250% due 3/15/12 | | | 103,500 | |

| | 100,000 | | 8.750% due 10/1/13 | | | 105,000 | |

| | 50,000 | | River Rock Entertainment Authority, Senior Notes, 9.750% due 11/1/11 | | | 52,750 | |

| | 215,000 | | Sbarro Inc., Senior Notes, 10.375% due 2/1/15 | | | 210,431 | |

| | | Snoqualmie Entertainment Authority, Senior Secured Notes: | | | | |

| | 125,000 | | 9.150% due 2/1/14 (a)(e) | | | 126,875 | |

| | 95,000 | | 9.125% due 2/1/15 (a) | | | 97,850 | |

| | | Station Casinos Inc.: | | | | |

| | | Senior Notes: | | | | |

| | 40,000 | | 6.000% due 4/1/12 | | | 37,800 | |

| | 425,000 | | 7.750% due 8/15/16 | | | 422,875 | |

| | | Senior Subordinated Notes: | | | | |

| | 65,000 | | 6.875% due 3/1/16 | | | 57,688 | |

| | 95,000 | | 6.625% due 3/15/18 | | | 82,175 | |

| | 200,000 | | Turning Stone Casino Resort Enterprise, Senior Notes, 9.125% due 12/15/10 (a) | | | 204,500 | |

| | | |

| | | Total Hotels, Restaurants & Leisure | | | 6,389,024 | |

| | | |

| | Household Durables — 1.7% | | | | |

| | 35,000 | | American Greetings Corp., Senior Notes, 7.375% due 6/1/16 | | | 35,525 | |

| | 445,000 | | Jarden Corp., Senior Subordinated Notes, 7.500% due 5/1/17 | | | 441,662 | |

| | | K Hovnanian Enterprises Inc., Senior Notes: | | | | |

| | 165,000 | | 7.500% due 5/15/16 | | | 150,975 | |

| | 575,000 | | 8.625% due 1/15/17 | | | 554,875 | |

| | 750,000 | | Norcraft Cos. LP/Norcraft Finance Corp., Senior Subordinated Notes,

9.000% due 11/1/11 | | | 778,125 | |

| | 210,000 | | Norcraft Holdings LP/Norcraft Capital Corp., Senior Discount Notes, step bond to yield 9.353% due 9/1/12 | | | 193,200 | |

| | 100,000 | | Sealy Mattress Co., Senior Subordinated Notes, 8.250% due 6/15/14 | | | 103,000 | |

| | | |

| | | Total Household Durables | | | 2,257,362 | |

| | | |

| | Household Products — 0.7% | | | | |

| | 10,000 | | American Achievement Corp., Senior Subordinated Notes, 8.250% due 4/1/12 | | | 10,125 | |

| | | Nutro Products Inc.: | | | | |

| | 115,000 | | Senior Notes, 9.370% due 10/15/13 (a)(e) | | | 121,969 | |

| | 370,000 | | Senior Subordinated Notes, 10.750% due 4/15/14 (a) | | | 431,806 | |

| | 150,000 | | Visant Holding Corp., Senior Notes, 8.750% due 12/1/13 | | | 156,750 | |

| | 165,000 | | Yankee Acquisition Corp., Series B, 9.750% due 2/15/17 | | | 160,462 | |

| | | |

| | | Total Household Products | | | 881,112 | |

| | | |

See Notes to Financial Statements.

10 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Independent Power Producers & Energy Traders — 3.9% | | | | |

| $ | 110,000 | | AES China Generating Co., Ltd., Class A, 8.250% due 6/26/10 | | $ | 110,009 | |

| | | AES Corp.: | | | | |

| | | Senior Notes: | | | | |

| | 50,000 | | 9.500% due 6/1/09 | | | 52,500 | |

| | 250,000 | | 9.375% due 9/15/10 | | | 267,187 | |

| | 270,000 | | 8.875% due 2/15/11 | | | 285,862 | |

| | 65,000 | | 7.750% due 3/1/14 | | | 65,488 | |

| | 70,000 | | Senior Secured Notes, 9.000% due 5/15/15 (a) | | | 74,463 | |

| | | Dynegy Holdings Inc.: | | | | |

| | 250,000 | | Senior Debentures, 7.625% due 10/15/26 | | | 222,500 | |

| | 720,000 | | Senior Notes, 7.750% due 6/1/19 (a) | | | 673,200 | |

| | | Edison Mission Energy, Senior Notes: | | | | |

| | 50,000 | | 7.500% due 6/15/13 | | | 49,750 | |

| | 290,000 | | 7.750% due 6/15/16 | | | 290,000 | |

| | 240,000 | | 7.200% due 5/15/19 (a) | | | 226,800 | |

| | 250,000 | | 7.625% due 5/15/27 (a) | | | 237,500 | |

| | 300,000 | | Mirant Americas Generation LLC, Senior Notes, 8.300% due 5/1/11 | | | 311,250 | |

| | 241,523 | | Mirant Mid Atlantic LLC, Pass-Through Certificates, Series B,

9.125% due 6/30/17 | | | 273,071 | |

| | 195,000 | | Mirant North America LLC, Senior Notes, 7.375% due 12/31/13 | | | 200,363 | |

| | | NRG Energy Inc., Senior Notes: | | | | |

| | 125,000 | | 7.250% due 2/1/14 | | | 125,625 | |

| | 1,395,000 | | 7.375% due 2/1/16 | | | 1,401,975 | |

| | 235,000 | | 7.375% due 1/15/17 | | | 236,469 | |

| | 120,000 | | TXU Corp., Senior Notes, Series Q, 6.500% due 11/15/24 | | | 99,823 | |

| | | |

| | | Total Independent Power Producers & Energy Traders | | | 5,203,835 | |

| | | |

| | Industrial Conglomerates — 0.2% | | | | |

| | 250,000 | | Sequa Corp., Senior Notes, 9.000% due 8/1/09 | | | 259,375 | |

| | | |

| | Insurance — 0.2% | | | | |

| | 230,000 | | Crum & Forster Holdings Corp., Senior Notes, 7.750% due 5/1/17 (a) | | | 225,975 | |

| | | |

| | Internet & Catalog Retail — 0.2% | | | | |

| | 275,000 | | FTD Inc., Senior Subordinated Notes, 7.750% due 2/15/14 | | | 273,625 | |

| | | |

| | IT Services — 0.7% | | | | |

| | | SunGard Data Systems Inc.: | | | | |

| | 232,000 | | Senior Notes, 9.125% due 8/15/13 | | | 238,670 | |

| | 725,000 | | Senior Subordinated Notes, 10.250% due 8/15/15 | | | 770,313 | |

| | | |

| | | Total IT Services | | | 1,008,983 | |

| | | |

| | Leisure Equipment & Products — 0.3% | | | | |

| | 445,000 | | WMG Acquisition Corp., Senior Subordinated Notes, 7.375% due 4/15/14 | | | 416,075 | |

| | | |

| | Machinery — 0.1% | | | | |

| | 170,000 | | American Railcar Industries Inc., Senior Notes, 7.500% due 3/1/14 | | | 170,000 | |

| | | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 11

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Media — 11.1% | | | | |

| | | Affinion Group Inc.: | | | | |

| $ | 685,000 | | Senior Notes, 10.125% due 10/15/13 | | $ | 734,662 | |

| | 260,000 | | Senior Subordinated Notes, 11.500% due 10/15/15 | | | 282,100 | |

| | 855,000 | | AMC Entertainment Inc., Senior Subordinated Notes, 11.000% due 2/1/16 | | | 949,050 | |

| | 180,000 | | Cablevision Systems Corp., Senior Notes, Series B, 8.000% due 4/15/12 | | | 178,650 | |

| | | CCH I Holdings LLC/CCH I Holdings Capital Corp.: | | | | |

| | 200,000 | | Senior Accreting Notes, 12.125% due 1/15/15 | | | 203,000 | |

| | 1,215,000 | | Senior Notes, 11.750% due 5/15/14 | | | 1,199,812 | |

| | 619,000 | | CCH I LLC/CCH Capital Corp., Senior Secured Notes, 11.000% due 10/1/15 | | | 649,176 | |

| | | CCH II LLC/CCH II Capital Corp., Senior Notes: | | | | |

| | 470,000 | | 10.250% due 9/15/10 | | | 493,500 | |

| | 317,000 | | 10.250% due 10/1/13 | | | 340,775 | |

| | 125,000 | | CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes,

8.750% due 11/15/13 | | | 127,813 | |

| | 170,000 | | Charter Communications Holdings LLC, Senior Discount Notes,

12.125% due 1/15/12 | | | 176,163 | |

| | 160,000 | | Charter Communications Holdings LLC/Charter Communications Holdings Capital Corp., Senior Discount Notes, 11.750% due 5/15/11 | | | 164,000 | |

| | 450,000 | | Charter Communications Operating LLC, Second Lien Senior Notes,

8.375% due 4/30/14 (a) | | | 460,125 | |

| | 150,000 | | Chukchansi Economic Development Authority, Senior Notes,

8.000% due 11/15/13 (a) | | | 153,750 | |

| | 425,000 | | CMP Susquehanna Corp., Senior Subordinated Notes,

10.125% due 5/15/14 (a) | | | 427,125 | |

| | | CSC Holdings Inc.: | | | | |

| | | Senior Debentures: | | | | |

| | 80,000 | | 7.875% due 2/15/18 | | | 77,600 | |

| | 230,000 | | 7.625% due 7/15/18 | | | 219,650 | |

| | 190,000 | | Series B, 8.125% due 8/15/09 | | | 194,275 | |

| | | Senior Notes: | | | | |

| | | Series B: | | | | |

| | 40,000 | | 8.125% due 7/15/09 | | | 40,900 | |

| | 290,000 | | 7.625% due 4/1/11 | | | 289,275 | |

| | 125,000 | | Series WI, 6.750% due 4/15/12 | | | 119,375 | |

| | 220,000 | | Dex Media Inc., Discount Notes, step bond to yield 8.345% due 11/15/13 | | | 208,175 | |

| | 73,000 | | Dex Media West LLC/Dex Media Finance Co., Senior Subordinated Notes, Series B, 9.875% due 8/15/13 | | | 78,475 | |

| | | EchoStar DBS Corp., Senior Notes: | | | | |

| | 770,000 | | 7.000% due 10/1/13 | | | 762,300 | |

| | 575,000 | | 6.625% due 10/1/14 | | | 550,562 | |

| | 150,000 | | 7.125% due 2/1/16 | | | 147,375 | |

| | 505,000 | | Idearc Inc., Senior Notes, 8.000% due 11/15/16 | | | 512,575 | |

| | 100,000 | | ION Media Networks Inc., Senior Secured Notes, 11.606% due 1/15/13 (a)(b) | | | 103,750 | |

| | 535,000 | | Lamar Media Corp., Senior Subordinated Notes, 6.625% due 8/15/15 | | | 509,587 | |

| | 305,000 | | Primedia Inc., Senior Notes, 8.875% due 5/15/11 | | | 314,913 | |

| | 400,000 | | Quebecor Media Inc., Senior Notes, 7.750% due 3/15/16 | | | 408,000 | |

See Notes to Financial Statements.

12 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Media — 11.1% (continued) | | | | |

| | | R.H. Donnelley Corp.: | | | | |

| | | Senior Discount Notes: | | | | |

| $ | 150,000 | | Series A-1, 6.875% due 1/15/13 | | $ | 142,875 | |

| | 200,000 | | Series A-2, 6.875% due 1/15/13 | | | 190,500 | |

| | 450,000 | | Senior Notes, Series A-3, 8.875% due 1/15/16 | | | 470,250 | |

| | 75,000 | | R.H. Donnelley Finance Corp. I, Senior Subordinated Notes,

10.875% due 12/15/12 (a) | | | 80,344 | |

| | 305,000 | | Rainbow National Services LLC, Senior Notes, 8.750% due 9/1/12 (a) | | | 318,725 | |

| | | Rogers Cable Inc.: | | | | |

| | 800,000 | | Senior Second Priority Debentures, 8.750% due 5/1/32 | | | 972,554 | |

| | 40,000 | | Senior Secured Second Priority Notes, 6.750% due 3/15/15 | | | 41,301 | |

| | 159,000 | | Sinclair Broadcast Group Inc., Senior Subordinated Notes, 8.000% due 3/15/12 | | | 163,770 | |

| | | TL Acquisitions Inc.: | | | | |

| | 600,000 | | Senior Notes, 10.500% due 1/15/15 (a) | | | 596,376 | |

| | 450,000 | | Senior Subordinated Notes, step bond to yield 13.250% due 7/15/15 (a)(f) | | | 338,063 | |

| | 200,000 | | Videotron Ltee., Senior Notes, 6.375% due 12/15/15 | | | 191,000 | |

| | | XM Satellite Radio Inc., Senior Notes: | | | | |

| | 80,000 | | 9.856% due 5/1/13 (e) | | | 77,600 | |

| | 275,000 | | 9.750% due 5/1/14 | | | 270,875 | |

| | | |

| | | Total Media | | | 14,930,721 | |

| | | |

| | Metals & Mining — 3.8% | | | | |

| | 55,000 | | Chaparral Steel Co., Senior Notes, 10.000% due 7/15/13 | | | 60,294 | |

| | 1,960,000 | | Freeport-McMoRan Copper & Gold Inc., Senior Notes, 8.375% due 4/1/17 | | | 2,097,200 | |

| | | Metals USA Holdings Corp., Senior Notes: | | | | |

| | 305,000 | | 11.356% due 1/15/12 (a)(b) | | | 306,525 | |

| | 340,000 | | 11.360% due 7/1/12 (a)(b) | | | 312,800 | |

| | 685,000 | | Metals USA Inc., Senior Secured Notes, 11.125% due 12/1/15 | | | 750,075 | |

| | 515,000 | | Noranda Aluminum Holding Corp., Senior Notes,

11.146% due 11/15/14 (a)(b)(e) | | | 504,700 | |

| | 570,000 | | Novelis Inc., Senior Notes, 7.250% due 2/15/15 | | | 587,812 | |

| | 415,000 | | Tube City IMS Corp., Senior Subordinated Notes, 9.750% due 2/1/15 (a) | | | 427,450 | |

| | 102,000 | | Vale Overseas Ltd., Notes, 6.250% due 1/23/17 | | | 101,676 | |

| | | |

| | | Total Metals & Mining | | | 5,148,532 | |

| | | |

| | Multiline Retail — 1.1% | | | | |

| | 550,000 | | Dollar General Corp., Senior Notes, 10.625% due 7/15/15 (a) | | | 533,500 | |

| | | Neiman Marcus Group Inc.: | | | | |

| | 295,000 | | Senior Notes, 9.000% due 10/15/15 (b) | | | 317,125 | |

| | 575,000 | | Senior Subordinated Notes, 10.375% due 10/15/15 | | | 635,375 | |

| | | |

| | | Total Multiline Retail | | | 1,486,000 | |

| | | |

| | Oil, Gas & Consumable Fuels — 9.3% | | | | |

| | 610,000 | | Belden & Blake Corp., Secured Notes, 8.750% due 7/15/12 | | | 628,300 | |

| | | Chesapeake Energy Corp., Senior Notes: | | | | |

| | 275,000 | | 7.500% due 6/15/14 | | | 279,812 | |

| | 50,000 | | 7.000% due 8/15/14 | | | 49,875 | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 13

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Oil, Gas & Consumable Fuels — 9.3% (continued) | | | | |

| $ | 60,000 | | 6.375% due 6/15/15 | | $ | 57,525 | |

| | 40,000 | | 6.625% due 1/15/16 | | | 38,700 | |

| | 210,000 | | 6.500% due 8/15/17 | | | 200,025 | |

| | 485,000 | | 6.250% due 1/15/18 | | | 455,294 | |

| | 120,000 | | Compagnie Generale de Geophysique SA, Senior Notes, 7.500% due 5/15/15 | | | 120,600 | |

| | 400,000 | | Corral Finans AB, 6.855% due 4/15/10 (a)(b)(e) | | | 400,000 | |

| | | El Paso Corp.: | | | | |

| | | Medium-Term Notes: | | | | |

| | 690,000 | | 7.800% due 8/1/31 | | | 702,183 | |

| | 925,000 | | 7.750% due 1/15/32 | | | 936,387 | |

| | 275,000 | | Notes, 7.875% due 6/15/12 | | | 288,831 | |

| | 560,000 | | Enterprise Products Operating LP, Junior Subordinated Notes,

8.375% due 8/1/66 (e) | | | 598,617 | |

| | 690,000 | | EXCO Resources Inc., Senior Notes, 7.250% due 1/15/11 | | | 690,000 | |

| | 325,000 | | Inergy LP/Inergy Finance Corp., Senior Notes, 6.875% due 12/15/14 | | | 309,562 | |

| | 405,000 | | International Coal Group Inc., Senior Notes, 10.250% due 7/15/14 | | | 420,694 | |

| | | Mariner Energy Inc., Senior Notes: | | | | |

| | 135,000 | | 7.500% due 4/15/13 | | | 132,975 | |

| | 225,000 | | 8.000% due 5/15/17 | | | 224,438 | |

| | 720,000 | | Northwest Pipeline Corp., Senior Notes, 7.000% due 6/15/16 | | | 754,200 | |

| | | OPTI Canada Inc., Senior Secured Notes: | | | | |

| | 100,000 | | 7.875% due 12/15/14 (a) | | | 100,500 | |

| | 200,000 | | 8.250% due 12/15/14 (a) | | | 204,000 | |

| | 200,000 | | Parker Drilling Co., Senior Notes, 9.625% due 10/1/13 | | | 214,500 | |

| | 260,000 | | Petrohawk Energy Corp., Senior Notes, 9.125% due 7/15/13 | | | 276,250 | |

| | | Petroplus Finance Ltd.: | | | | |

| | 150,000 | | 6.750% due 5/1/14 (a) | | | 145,125 | |

| | 240,000 | | 7.000% due 5/1/17 (a) | | | 232,200 | |

| | | Pogo Producing Co., Senior Subordinated Notes: | | | | |

| | 200,000 | | 7.875% due 5/1/13 | | | 205,000 | |

| | 100,000 | | Series B, 8.250% due 4/15/11 | | | 102,125 | |

| | 785,000 | | SemGroup LP, Senior Notes, 8.750% due 11/15/15 (a) | | | 792,850 | |

| | 20,000 | | SESI LLC, Senior Notes, 6.875% due 6/1/14 | | | 19,550 | |

| | | Stone Energy Corp., Senior Subordinated Notes: | | | | |

| | 960,000 | | 8.250% due 12/15/11 | | | 964,800 | |

| | 250,000 | | 6.750% due 12/15/14 | | | 231,250 | |

| | 330,000 | | W&T Offshore Inc., 8.250% due 6/15/14 (a) | | | 327,525 | |

| | | Whiting Petroleum Corp., Senior Subordinated Notes: | | | | |

| | 75,000 | | 7.250% due 5/1/12 | | | 71,625 | |

| | 250,000 | | 7.000% due 2/1/14 | | | 236,250 | |

| | | Williams Cos. Inc.: | | | | |

| | | Notes: | | | | |

| | 5,000 | | 7.875% due 9/1/21 | | | 5,400 | |

| | 900,000 | | 8.750% due 3/15/32 | | | 1,046,250 | |

| | 75,000 | | Senior Notes, 7.625% due 7/15/19 | | | 79,500 | |

| | | |

| | | Total Oil, Gas & Consumable Fuels | | | 12,542,718 | |

| | | |

See Notes to Financial Statements.

14 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Paper & Forest Products — 2.3% | | | | |

| | | Abitibi-Consolidated Co. of Canada: | | | | |

| $ | 395,000 | | 6.000% due 6/20/13 | | $ | 328,837 | |

| | 225,000 | | Senior Notes, 8.375% due 4/1/15 | | | 198,000 | |

| | | Abitibi-Consolidated Inc.: | | | | |

| | 110,000 | | 7.400% due 4/1/18 | | | 89,650 | |

| | 125,000 | | Notes, 8.550% due 8/1/10 | | | 120,000 | |

| | | Appleton Papers Inc.: | | | | |

| | 190,000 | | Senior Notes, 8.125% due 6/15/11 | | | 196,650 | |

| | 510,000 | | Senior Subordinated Notes, Series B, 9.750% due 6/15/14 | | | 538,050 | |

| | | NewPage Corp.: | | | | |

| | | Senior Secured Notes: | | | | |

| | 30,000 | | 10.000% due 5/1/12 | | | 32,550 | |

| | 790,000 | | 11.606% due 5/1/12 (e) | | | 865,050 | |

| | 35,000 | | Senior Subordinated Notes, 12.000% due 5/1/13 | | | 38,413 | |

| | 150,000 | | Smurfit Capital Funding PLC, Debentures, 7.500% due 11/20/25 | | | 151,875 | |

| | 520,000 | | Verso Paper Holdings LLC, Senior Subordinated Notes, 11.375% due 8/1/16 (a) | | | 557,700 | |

| | | |

| | | Total Paper & Forest Products | | | 3,116,775 | |

| | | |

| | Personal Products — 0.1% | | | | |

| | 150,000 | | Playtex Products Inc., Senior Subordinated Notes, 9.375% due 6/1/11 | | | 154,875 | |

| | | |

| | Pharmaceuticals — 0.8% | | | | |

| | 1,075,000 | | Leiner Health Products Inc., Senior Subordinated Notes, 11.000% due 6/1/12 | | | 1,021,250 | |

| | | |

| | Real Estate Investment Trusts (REITs) — 0.8% | | | | |

| | 15,000 | | Forest City Enterprises Inc., Senior Notes, 7.625% due 6/1/15 | | | 15,188 | |

| | | Host Marriott LP, Senior Notes: | | | | |

| | 300,000 | | 7.125% due 11/1/13 | | | 301,125 | |

| | 225,000 | | Series O, 6.375% due 3/15/15 | | | 217,125 | |

| | 135,000 | | Kimball Hill Inc., Senior Subordinated Notes, 10.500% due 12/15/12 | | | 123,525 | |

| | | Ventas Realty LP/Ventas Capital Corp., Senior Notes: | | | | |

| | 115,000 | | 6.500% due 6/1/16 | | | 112,700 | |

| | 365,000 | | 6.750% due 4/1/17 | | | 362,262 | |

| | | |

| | | Total Real Estate Investment Trusts (REITs) | | | 1,131,925 | |

| | | |

| | Real Estate Management & Development — 0.9% | | | | |

| | 295,000 | | Ashton Woods USA LLC/Ashton Woods Finance Co., Senior Subordinated Notes, 9.500% due 10/1/15 | | | 274,350 | |

| | 1,085,000 | | Realogy Corp., Senior Notes, 12.375% due 4/15/15 (a) | | | 992,775 | |

| | | |

| | | Total Real Estate Management & Development | | | 1,267,125 | |

| | | |

| | Road & Rail — 1.9% | | | | |

| | 705,000 | | Grupo Transportacion Ferroviaria Mexicana SA de CV, Senior Notes,

9.375% due 5/1/12 | | | 757,875 | |

| | | Hertz Corp.: | | | | |

| | 475,000 | | Senior Notes, 8.875% due 1/1/14 | | | 497,562 | |

| | 950,000 | | Senior Subordinated Notes, 10.500% due 1/1/16 | | | 1,054,500 | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 15

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Road & Rail — 1.9% (continued) | | | | |

| $ | 25,000 | | Horizon Lines LLC/Horizon Lines Holding Co., Senior Notes,

9.000% due 11/1/12 Kansas City Southern de Mexico, Senior Notes: | | $ | 26,563 | |

| | 40,000 | | 7.625% due 12/1/13 (a) | | | 40,000 | |

| | 130,000 | | 7.375% due 3/1/14 (a) | | | 129,350 | |

| | 105,000 | | Kansas City Southern Railway, Senior Notes, 7.500% due 6/15/09 | | | 104,737 | |

| | | |

| | | Total Road & Rail | | | 2,610,587 | |

| | | |

| | Semiconductors & Semiconductor Equipment — 0.3% | | | | |

| | 455,000 | | Freescale Semiconductor Inc., Senior Notes, 8.875% due 12/15/14 (a) | | | 436,800 | |

| | | |

| | Software — 0.4% | | | | |

| | 530,000 | | Activant Solutions Inc., Senior Subordinated Notes, 9.500% due 5/1/16 | | | 523,375 | |

| | | |

| | Specialty Retail — 0.8% | | | | |

| | | AutoNation Inc., Senior Notes: | | | | |

| | 215,000 | | 7.356% due 4/15/13 (e) | | | 215,538 | |

| | 80,000 | | 7.000% due 4/15/14 | | | 79,400 | |

| | 430,000 | | Blockbuster Inc., Senior Subordinated Notes, 9.000% due 9/1/12 | | | 399,900 | |

| | 300,000 | | Eye Care Centers of America, Senior Subordinated Notes, 10.750% due 2/15/15 | | | 332,250 | |

| | | |

| | | Total Specialty Retail | | | 1,027,088 | |

| | | |

| | Textiles, Apparel & Luxury Goods — 0.7% | | | | |

| | | Levi Strauss & Co., Senior Notes: | | | | |

| | 595,000 | | 9.750% due 1/15/15 | | | 639,625 | |

| | 215,000 | | 8.875% due 4/1/16 | | | 221,450 | |

| | 125,000 | | Simmons Bedding Co., Senior Subordinated Notes, 7.875% due 1/15/14 | | | 125,000 | |

| | | |

| | | Total Textiles, Apparel & Luxury Goods | | | 986,075 | |

| | | |

| | Tobacco — 0.3% | | | | |

| | | Alliance One International Inc., Senior Notes: | | | | |

| | 255,000 | | 8.500% due 5/15/12 (a) | | | 262,013 | |

| | 110,000 | | 11.000% due 5/15/12 | | | 121,275 | |

| | | |

| | | Total Tobacco | | | 383,288 | |

| | | |

| | Trading Companies & Distributors — 1.2% | | | | |

| | 365,000 | | Ashtead Capital Inc., Notes, 9.000% due 8/15/16 (a) | | | 384,163 | |

| | 365,000 | | H&E Equipment Services Inc., Senior Notes, 8.375% due 7/15/16 | | | 385,075 | |

| | 675,000 | | Penhall International Corp., Senior Secured Notes, 12.000% due 8/1/14 (a) | | | 732,375 | |

| | 110,000 | | TransDigm Inc., Senior Subordinated Notes, 7.750% due 7/15/14 (a) | | | 111,650 | |

| | | |

| | | Total Trading Companies & Distributors | | | 1,613,263 | |

| | | |

| | Transportation Infrastructure — 0.6% | | | | |

| | 930,000 | | Saint Acquisition Corp., Secured Notes, 12.500% due 5/15/17 (a) | | | 883,500 | |

| | | |

| | Wireless Telecommunication Services — 1.5% | | | | |

| | 75,000 | | American Tower Corp., Senior Notes, 7.500% due 5/1/12 | | | 77,438 | |

| | | MetroPCS Wireless Inc., Senior Notes: | | | | |

| | 175,000 | | 9.250% due 11/1/14 (a) | | | 181,562 | |

| | 20,000 | | 9.250% due 11/1/14 (a) | | | 20,750 | |

See Notes to Financial Statements.

16 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Wireless Telecommunication Services — 1.5% (continued) | | | | |

| $ | 30,000 | | Rogers Wireless Communications Inc., Senior Secured Notes,

7.250% due 12/15/12 | | $ | 31,711 | |

| | | Rural Cellular Corp.: | | | | |

| | 215,000 | | Senior Notes, 9.875% due 2/1/10 | | | 225,750 | |

| | 280,000 | | Senior Secured Notes, 8.250% due 3/15/12 | | | 287,700 | |

| | 370,000 | | Senior Subordinated Notes, 8.360% due 6/1/13 (a)(e) | | | 370,000 | |

| | 745,000 | | True Move Co., Ltd., 10.750% due 12/16/13 (a) | | | 793,425 | |

| | | |

| | | Total Wireless Telecommunication Services | | | 1,988,336 | |

| | | |

| | | TOTAL CORPORATE BONDS & NOTES

(Cost — $123,732,819) | | | 124,519,886 | |

| | | |

| | ASSET-BACKED SECURITIES — 0.1% | | | | |

| | Diversified Financial Services — 0.0% | | | | |

| | 123,463 | | Airplanes Pass-Through Trust, Subordinated Notes, Series D,

10.875% due 3/15/19 (c)(d)(f) | | | 0 | |

| | | |

| | Electric — 0.1% | | | | |

| | 97,429 | | Mirant Mid-Atlantic LLC, Series C, 10.060% due 12/30/28 | | | 116,976 | |

| | | |

| | | TOTAL ASSET-BACKED SECURITIES

(Cost — $249,891) | | | 116,976 | |

| | | |

| | CONVERTIBLE BOND — 0.1% | | | | |

| | Automobiles — 0.1% | | | | |

| | 130,000 | | Ford Motor Co., Senior Notes, 4.250% due 12/15/36

(Cost — $130,000) | | | 163,475 | |

| | | |

| | U.S. GOVERNMENT & AGENCY OBLIGATION — 0.9% | | | | |

| | U.S. Government Obligations — 0.9% | | | | |

| | 1,260,000 | | U.S. Treasury Notes, 4.750% due 5/31/12

(Cost - $1,253,829) | | | 1,250,551 | |

| | | |

| | LOAN PARTICIPATION — 0.8% | | | | |

| | Oil, Gas & Consumable Fuels — 0.8% | | | | |

| | 1,000,000 | | SandRidge Energy, Term Loan, 8.625% due 4/1/15 (e)

(Cost — $1,000,000) | | | 1,025,000 | |

| | | |

| | SOVEREIGN BONDS — 1.0% | | | | |

| | Brazil — 0.2% | | | | |

| | | Federative Republic of Brazil: | | | | |

| | 58,000 | | 7.125% due 1/20/37 | | | 62,814 | |

| | 36,000 | | 11.000% due 8/17/40 | | | 47,250 | |

| | 155,000 | | Collective Action Securities, Notes, 8.000% due 1/15/18 | | | 170,539 | |

| | | |

| | | Total Brazil | | | 280,603 | |

| | | |

| | Panama — 0.0% | | | | |

| | 63,000 | | Republic of Panama, 6.700% due 1/26/36 | | | 64,732 | |

| | | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 17

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Face

Amount | | Security | | Value | |

| | | | | | | |

| | Russia — 0.8% | | | | |

| | | Russian Federation: | | | | |

| $ | 65,000 | | 11.000% due 7/24/18 | | $ | 90,350 | |

| | 845,750 | | 7.500% due 3/31/30 (a) | | | 930,854 | |

| | | |

| | | Total Russia | | | 1,021,204 | |

| | | |

| | | TOTAL SOVEREIGN BONDS

(Cost — $1,226,014) | | | 1,366,539 | |

| | | |

| | |

| Shares | | | | | |

| | COMMON STOCKS — 0.0% | | | | |

| | CONSUMER DISCRETIONARY — 0.0% | | | | |

| | Household Durables — 0.0% | | | | |

| | 404,770 | | Home Interiors & Gifts Inc. (c)(f)* | | | 4,048 | |

| | | |

| | CONSUMER STAPLES — 0.0% | | | | |

| | Food Products — 0.0% | | | | |

| | 86 | | Imperial Sugar Co. | | | 2,648 | |

| | | |

| | INDUSTRIALS — 0.0% | | | | |

| | Commercial Services & Supplies — 0.0% | | | | |

| | 4,310 | | Continental AFA Dispensing Co. (c)(f)* | | | 0 | |

| | | |

| | | TOTAL COMMON STOCKS

(Cost — $169,440) | | | 6,696 | |

| | | |

| | ESCROWED SHARES — 0.0% | | | | |

| | 75,000 | | Pillowtex Corp. (c)(f)* (Cost — $0) | | | 0 | |

| | | |

| | PREFERRED STOCKS — 0.2% | | | | |

| | CONSUMER DISCRETIONARY — 0.2% | | | | |

| | Media — 0.1% | | | | |

| | 22 | | ION Media Networks Inc., (b) | | | 198,000 | |

| | | |

| | FINANCIALS — 0.0% | | | | |

| | Diversified Financial Services — 0.0% | | | | |

| | | TCR Holdings Corp.: | | | | |

| | 219 | | Class B Shares (c)(f)* | | | 0 | |

| | 121 | | Class C Shares (c)(f)* | | | 0 | |

| | 318 | | Class D Shares (c)(f)* | | | 1 | |

| | 658 | | Class E Shares (c)(f)* | | | 1 | |

| | | |

| | | TOTAL FINANCIALS | | | 2 | |

| | | |

| | | TOTAL PREFERRED STOCKS

(Cost — $161,228) | | | 198,002 | |

| | | |

See Notes to Financial Statements.

18 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Schedule of Investments (June 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

Shares | | Security | | Value | |

| | | | | | | |

| | CONVERTIBLE PREFERRED STOCKS — 0.1% | | | | |

| | ENERGY — 0.1% | | | | |

| | Oil, Gas & Consumable Fuels — 0.1% | | | | |

| | 575 | | Chesapeake Energy Corp., Convertible, 6.250% due 6/15/09

(Cost — $144,502) | | $ | 162,581 | |

| | | |

| |

| Warrants | | | |

| | WARRANTS — 0.0% | | | | |

| | 117,023 | | ContiFinancial Corp., Liquidating Trust, Units of Interest (Represents interest in a trust in the liquidation of ContiFinancial Corp. and its affiliates), Expires 3/25/05 (c)(f)* | | | 0 | |

| | 504 | | Pillowtex Corp., Expires 11/24/09 (c)(f)* | | | 0 | |

| | | |

| | | TOTAL WARRANTS

(Cost — $383) | | | 0 | |

| | | |

| | | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENT

(Cost — $128,068,106) | | | 128,809,706 | |

| | | |

| | |

Face

Amount | | | | | |

| | SHORT-TERM INVESTMENT — 5.0% | | | | |

| | Repurchase Agreement — 5.0% | | | | |

| $ | 6,779,000 | | Nomura Securities International Inc. repurchase agreement

dated 6/29/07, 5.260% due 7/2/07; Proceeds at maturity - $6,781,971; (Fully collateralized by a U.S government agency obligation, 5.280% due 2/28/12; Market value — $6,915,401) (g) (Cost — $6,779,000) | | | 6,779,000 | |

| | | |

| | | TOTAL INVESTMENTS — 100.4%

(Cost — $134,847,106#) | | | 135,588,706 | |

| | | Liabilities in Excess of Other Assets — (0.4)% | | | (482,527 | ) |

| | | |

| | | TOTAL NET ASSETS — 100.0% | | $ | 135,106,179 | |

| | | |

| * | | Non-income producing security. |

(a) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees, unless otherwise noted. |

(b) | | Payment-in-kind security for which part of the income earned may be paid as additional principal. |

(d) | | Security is currently in default. |

(e) | | Variable rate security. Interest rate disclosed is that which is in effect at June 30, 2007. |

(f) | | Security is valued in good faith at fair value by or under the direction of the Board of Trustees (See Note 1). |

(g) | | All or a portion of this security is segregated for extended settlements. |

| # | | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 19

Statement of Assets and Liabilities (June 30, 2007) (unaudited)

| | | |

| ASSETS: | | | |

Investments, at value (Cost — $134,847,106) | | $ | 135,588,706 |

Foreign currency, at value (Cost — $230,754) | | | 243,827 |

Cash | | | 36,195 |

Interest receivable | | | 2,694,042 |

Receivable for Fund shares sold | | | 709,523 |

Receivable for securities sold | | | 546,484 |

Prepaid expenses | | | 1,060 |

| |

Total Assets | | | 139,819,837 |

| |

| LIABILITIES: | | | |

Payable for securities purchased | | | 4,243,511 |

Payable for Fund shares repurchased | | | 306,898 |

Investment management fee payable | | | 89,323 |

Distribution fees payable | | | 6,500 |

Trustees’ fees payable | | | 3,473 |

Accrued expenses | | | 63,953 |

| |

Total Liabilities | | | 4,713,658 |

| |

Total Net Assets | | $ | 135,106,179 |

| |

| NET ASSETS: | | | |

Par value (Note 6) | | $ | 134 |

Paid-in capital in excess of par value | | | 129,202,945 |

Undistributed net investment income | | | 4,489,240 |

Accumulated net realized gain on investments | | | 659,187 |

Net unrealized appreciation on investments and foreign currencies | | | 754,673 |

| |

Total Net Assets | | $ | 135,106,179 |

| |

Shares Outstanding: | | | |

Class I | | | 10,250,179 |

|

Class II | | | 3,173,074 |

|

Net Asset Value: | | | |

Class I | | | $10.06 |

|

Class II | | | $10.08 |

| |

See Notes to Financial Statements.

20 Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report

Statement of Operations (For the six months ended June 30, 2007) (unaudited)

| | | | |

| INVESTMENT INCOME: | | | | |

Interest | | $ | 5,229,012 | |

Dividends | | | 4,504 | |

Income from securities lending | | | 302 | |

| | |

Total Investment Income | | | 5,233,818 | |

| | |

| EXPENSES: | | | | |

Investment management fee (Note 2) | | | 516,017 | |

Shareholder reports (Note 4) | | | 51,181 | |

Distribution fees (Notes 2 and 4) | | | 39,328 | |

Legal fees | | | 22,393 | |

Audit and tax | | | 10,096 | |

Trustees’ fees | | | 6,975 | |

Custody fees | | | 1,895 | |

Insurance | | | 734 | |

Transfer agent fees (Note 4) | | | 295 | |

Registration fees | | | 10 | |

Miscellaneous expenses | | | 3,661 | |

| | |

Total Expenses | | | 652,585 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (4,291 | ) |

| | |

Net Expenses | | | 648,294 | |

| | |

Net Investment Income | | | 4,585,524 | |

| | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

AND FOREIGN CURRENCY TRANSACTIONS (NOTES 1 AND 3): | | | | |

Net Realized Gain From Investment transactions | | | 827,225 | |

| | |

Change in Net Unrealized Appreciation/Depreciation From: | | | | |

Investments | | | (2,407,312 | ) |

Foreign currencies | | | 5,831 | |

| | |

Change in Net Unrealized Appreciation/Depreciation | | | (2,401,481 | ) |

| | |

Net Loss on Investments and Foreign Currency Transactions | | | (1,574,256 | ) |

| | |

Increase in Net Assets From Operations | | $ | 3,011,268 | |

| | |

See Notes to Financial Statements.

Legg Mason Partners Variable Global High Yield Bond Portfolio 2007 Semi-Annual Report 21

Statements of Changes in Net Assets

| | | | | | | | |

For the six months ended June 30, 2007 (unaudited) and the year ended December 31, 2006 | |

| | |

| | | 2007 | | | 2006 | |

| OPERATIONS: | | | | | | | | |

Net investment income | | $ | 4,585,524 | | | $ | 6,774,662 | |

Net realized gain | | | 827,225 | | | | 719,133 | |

Change in net unrealized appreciation/depreciation | | | (2,401,481 | ) | | | 2,603,495 | |

| | |

Increase in Net Assets From Operations | | | 3,011,268 | | | | 10,097,290 | |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTES 1 AND 5): | | | | | | | | |

Net investment income | | | (100,010 | ) | | | (6,795,008 | ) |

Net realized gains | | | (117,750 | ) | | | (687,212 | ) |

| | |

Decrease in Net Assets From Distributions to Shareholders | | | (217,760 | ) | | | (7,482,220 | ) |

| | |

| FUND SHARE TRANSACTIONS (NOTE 6): | | | | | | | | |

Net proceeds from sale of shares | | | 21,145,830 | | | | 58,165,075 | |

Reinvestment of distributions | | | 217,760 | | | | 7,482,220 | |

Cost of shares repurchased | | | (9,887,434 | ) | | | (19,395,500 | ) |

| | |

Increase in Net Assets From Fund Share Transactions | | | 11,476,156 | | | | 46,251,795 | |

| | |

Increase in Net Assets | | | 14,269,664 | | | | 48,866,865 | |

| NET ASSETS: | | | | | | | | |

Beginning of period | | | 120,836,515 | | | | 71,969,650 | |