UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06312

The Lazard Funds, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

(Address of principal executive offices) (Zip code)

Mark R. Anderson, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 632-6000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/20

ITEM 1. REPORTS TO STOCKHOLDERS.

Lazard Funds

Annual Report

December 31, 2020

Alternatives Funds

Lazard Enhanced Opportunities Portfolio

The Lazard Funds, Inc. Table of Contents

Please consider the Portfolio’s investment objectives, risks, charges and expenses carefully before investing. For more complete information about The Lazard Funds, Inc. (the “Fund”), you may obtain a prospectus or the Portfolio’s summary prospectus by calling 800-823-6300, or online, at ww.lazardassetmanagement.com. Read the prospectus or the Portfolio’s summary prospectus carefully before you invest. The prospectus and the Portfolio’s summary prospectus contain the investment objectives, risks, charges, expenses and other information about the Portfolio, which are not detailed in this report

Distributed by Lazard Asset Management Securities LLC.

Annual Report 1

The Lazard Funds, Inc. A Message from Lazard (unaudited)

Dear Shareholder,

As 2020 began, the outbreak of a novel coronavirus (“COVID-19”) turned into a fast-spreading pandemic, rattling global markets. Worldwide lockdowns led to a severe equity market sell-off in February and March, as well as a sharp decline in oil markets. By the conclusion of the year, COVID-19 continued to wreak havoc across much of the world, but many global equity markets closed 2020 near all-time highs. Markets rose generally steadily after the sell-off on the back of unprecedented support from global central banks and government treasuries and the introduction of several promising vaccines.

In the United States, Democrats won control of the White House and Congress in November elections. The US equity market closed 2020 near an all-time peak, and nominal yields in various US fixed income market segments closed at or near all-time lows, fueled by trillions of dollars in monetary and fiscal stimulus.

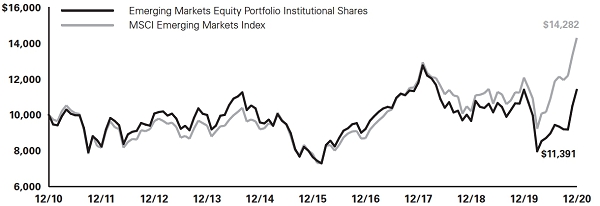

COVID-19 also severely debilitated economic activity in the emerging markets, but the recovery in emerging markets equities that began in late March picked up steam in the fourth quarter thanks to vaccine breakthroughs and the US election outcome. As a result, the MSCI Emerging Markets® Index outperformed global developed markets equities in 2020.

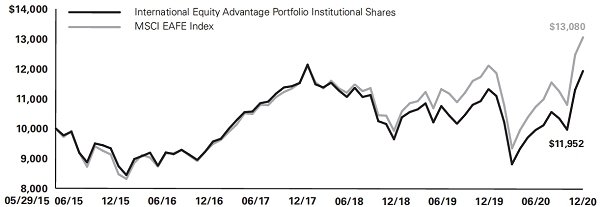

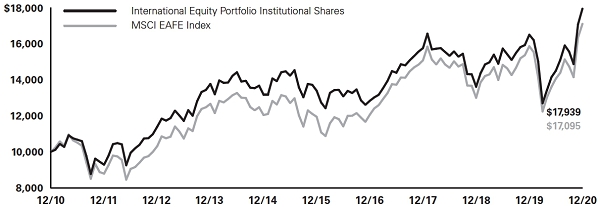

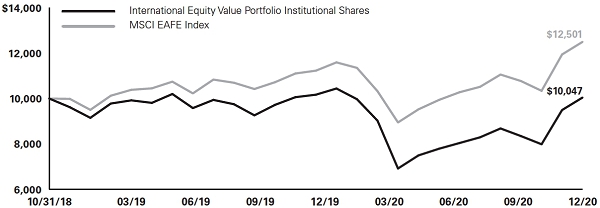

In Europe, interest rates have never been as low, and central bank balance sheets have never been as inflated, as they were at year-end. With an agreement now in place for the exit of the United Kingdom from the European Union, the years-long “Brexit” saga may be one less uncertainty the market has to grapple with in the year ahead.

As we write, many countries are facing record levels of new COVID-19 infections, spurring renewed economic lockdowns and increasing the risk that many companies, particularly small businesses, might not make it to the other side of this pandemic. Were that to happen, it could send a negative signal to markets equal and opposite to the positive news of the vaccines toward the end

2 Annual Report

of the last year. Investors face a timing conundrum, but it could well be darkest before the dawn.

Despite these challenges, we are optimistic for 2021 and believe that as the world does eventually return to something like the pre-pandemic days, fundamental analysis and stock selection will be crucial drivers for performance. We are privileged that you have turned to Lazard for your investment needs and value your continued confidence in our investment management capabilities. We continue to strive for the long-term patterns of performance pursued by the various investment strategies employed.

Sincerely,

Lazard Asset Management LLC

Annual Report 3

The Lazard Funds, Inc. Investment Overview (unaudited)

Market Overview

The year was defined by the rapid spread of COVID-19, leading to government-mandated lockdowns, halts in economic activity, and widespread social distancing. Equity markets sold-off dramatically in March before reaching numerous all-time highs throughout the year, thereby creating significant opportunities for value extraction in the hedged convertibles space.

A by-product of the March sell-off was a surge in primary convertible issuances, as many non-traditional convertible issuers (e.g., cruise lines, airlines, etc.) sought liquidity, with nearly $160 billion of new paper coming to market in 2020, a calendar year record. Interest rates declined dramatically (the yield on the benchmark 10-Year US Treasury note reached an all-time low of 51 basis points), causing the cost of leverage to decline by more than 70%. Elevated equity volatility, a positive factor for hedged convertibles, also added to the multi-year cheapness within the hedged convertibles space. The CBOE Volatility® Index (VIX) reached a peak in March and generally trended downward, with periodic spikes, for the rest of the year. Although the VIX has been trending downward since March 2020, equity volatility remains elevated relative to previous years.

Government stimulus, low interest rates, and positive news regarding COVID-19 vaccines supported equity markets (with notable sell-offs in September and October), with the NASDAQ Composite Index, the S&P 500® Index and the Dow Jones Industrial Average reaching all-time highs throughout the year.

Lazard Enhanced Opportunities Portfolio

For the year ended December 31, 2020, the Lazard Enhanced Opportunities Portfolio’s Institutional Shares posted a total return of 9.87%, while Open Shares posted a total return of 9.59%, as compared with the 52.05% return for the ICE BofAML US Convertible ex Mandatory® Index and the 6.61% return for the HFRX Global Hedge Fund® Index.

The Portfolio provided downside risk-mitigation when markets sold-off dramatically in March (and generated positive absolute

4 Annual Report

returns from April through December). While the S&P 500 Index and the Russell 2000® Index declined 12% and 22%, respectively, for the month, the Portfolio’s return in March avoided such a dramatic declines. The Portfolio’s performance in March was impacted as long-only investors, who represent approximately two-thirds of the convertible securities marketplace, made sales into the accelerated risk-off environment. These sales resulted in unrealized, marked-to-market losses for the affected securities held in the Portfolio. Post-March, the Portfolio benefited from improvement in COVID-19-impacted names, specifically in the travel and leisure space, elevated equity volatility, and negotiated transactions with issuers.

The Portfolio uses derivatives such as options, both opportunistically and for hedging purposes. Additionally, the Portfolio implements currency forwards to hedge the currency exposure of non-US dollar-denominated securities. For the year, the use of derivatives contributed positively to performance.

Annual Report 5

The Lazard Funds, Inc. Performance Overview (unaudited)

Lazard Enhanced Opportunities Portfolio

Comparison of Changes in Value of $10,000 Investment in the Institutional Shares of Lazard Enhanced Opportunities Portfolio, the ICE BofAML U.S. Convertible ex Mandatory® Index and the HFRX Global Hedge Fund® Index*

Average Annual Total Returns*

Periods Ended December 31, 2020

| | One | Five | Since | |

| | Year | Years | Inception | † |

| Institutional Shares | 9.87% | 5.07% | 3.80% | |

| Open Shares | 9.59% | 4.81% | 3.54% | |

| ICE BofAML U.S. Convertible ex Mandatory Index | 52.05% | 19.42% | 15.40% | |

| HFRX Global Hedge Fund Index | 6.61% | 3.25% | 2.07% | |

| † | The inception date for the Portfolio was December 31, 2014. |

Notes to Performance Overviews:

| * | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio may have been waived or reimbursed by Lazard Asset Management LLC, the Fund’s investment manager (the “Investment Manager”), State Street Bank and Trust Company, the Fund’s administrator (“State Street”), or DST Asset Manager Solutions, Inc., the Fund’s transfer agent and dividend disbursing agent (“DST”); without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with US Generally Accepted Accounting Principles (“GAAP”), if any, and may differ from amounts reported in the financial highlights. For Institutional Shares and Open Shares, a one-time voluntary reimbursement by State Street increased the total return ratio by 0.49% for year ended December 31, 2017. |

| | |

| | The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or the redemption of Portfolio shares. |

6 Annual Report

| | The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The indices are unmanaged, have no fees or costs and are not available for investment. |

| | |

| | The ICE BofAML U.S. Convertible ex Mandatory Index measures the performance of convertible securities of all corporate sectors with a par amount of $25 million or more and a maturity of at least one year and excludes preferred equity redemption stocks and converted securities. |

| | |

| | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies, including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event-driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| | |

| | The performance of Institutional Shares and Open Shares may vary, primarily based on the differences in fees borne by shareholders investing in different classes. |

Annual Report 7

The Lazard Funds, Inc.

Information About the Portfolio’s Expenses (unaudited)

Expense Example

As a shareholder in the Portfolio, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Open Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from July 1, 2020 through December 31, 2020 and held for the entire period.

Actual Expenses

For each share class of the Portfolio, the first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each share class of the Portfolio, the second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

8 Annual Report

| Portfolio | Beginning

Account

Value

7/1/20 | Ending

Account

Value

12/31/20 | Expenses

Paid During

Period*

7/1/20 -

12/31/20 | Annualized

Expense Ratio

During Period

7/1/20 -

12/31/20 | |

| | | | | | |

| Enhanced Opportunities† | | | | | |

| Institutional Shares | | | | | |

| Actual | $1,000.00 | $1,129.40 | $11.88 | 2.22% | |

| Hypothetical (5% Return Before Expenses) | $1,000.00 | $1,013.98 | $11.24 | 2.22% | |

| Open Shares | | | | | |

| Actual | $1,000.00 | $1,129.20 | $10.28 | 1.92% | |

| Hypothetical (5% Return Before Expenses) | $1,000.00 | $1,015.48 | $9.73 | 1.92% | |

| * | Expenses are equal to the annualized expense ratio, net of expenses waivers and reimbursements, of each Share class multiplied by the average account value over the period, multiplied by 184/366 (to reflect one-half year period). |

| | |

| † | The expense ratios include dividend and borrowing expenses on securities sold short. |

Annual Report 9

The Lazard Funds, Inc. Portfolio Holdings Presented by

Asset Class/Sector December 31, 2020

| | | Lazard Enhanced

Opportunities Portfolio | | |

| Asset Class/Sector | | Long | * | | Short | † | |

| | | | | | | | |

| Convertible Corporate Bonds | | | | | | | | | |

| Communication Services | | | 11.0 | % | | | — | % | |

| Consumer Discretionary | | | 8.3 | | | | — | | |

| Consumer Staples | | | 2.1 | | | | — | | |

| Energy | | | 1.6 | | | | — | | |

| Financials | | | 11.6 | | | | — | | |

| Health Care | | | 20.9 | | | | — | | |

| Industrials | | | 7.9 | | | | — | | |

| Information Technology | | | 26.4 | | | | — | | |

| Materials | | | 0.4 | | | | — | | |

| Real Estate | | | 2.0 | | | | — | | |

| Utilities | | | 0.5 | | | | — | | |

| Equity | | | | | | | | | |

| Communication Services | | | — | | | | –13.4 | | |

| Consumer Discretionary | | | — | | | | –10.3 | | |

| Consumer Staples | | | — | | | | –1.8 | | |

| Energy | | | — | | | | –1.1 | | |

| Financials | | | 0.1 | | | | –5.2 | | |

| Health Care | | | 0.0 | # | | | –21.1 | | |

| Industrials | | | — | | | | –7.8 | | |

| Information Technology | | | 0.0 | # | | | –31.3 | | |

| Materials | | | — | | | | –0.2 | | |

| Real Estate | | | — | | | | –4.9 | | |

| Utilities | | | — | | | | –0.3 | | |

| Exchange Traded Funds | | | — | | | | –2.6 | | |

| Short-Term Investments | | | 7.2 | | | | — | | |

| Total Investments | | | 100.0 | % | | | –100.0 | % | |

| * | Represents percentage of total investments excluding securities sold short. |

| † | Represents percentage of total securities sold short. |

| # | Amount is less than 0.05%. |

10 Annual Report

The Lazard Funds, Inc. Portfolio of Investments

December 31, 2020

| Description | | | | Shares | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio | | | | | | | | | | |

| | | | | | | | | | | |

| Common Stocks | 0.1% | | | | | | | | | | |

| | | | | | | | | | | |

| United States | 0.1% | | | | | | | | | | |

| Alder Biopharmaceuticals, Inc. (*), (‡) | | | | | 3,247 | | | $ | 2,857 | |

| Hope Bancorp, Inc. (±) | | | | | 2,100 | | | | 22,911 | |

| Silicon Laboratories, Inc. (*), (±) | | | | | 17 | | | | 2,165 | |

| | | | | | | | | | 27,933 | |

| | | | | | | | | | | |

Total Common Stocks

(Cost $24,990) | | | | | | | | | 27,933 | |

| | | | | | | | | | | |

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Convertible Corporate Bonds | 173.5% | | | | | | | | | | |

| | | | | | | | | | | |

| Brazil | 0.6% | | | | | | | | | | |

GOL Equity Finance SA,

3.750%, 07/15/24 (#), (±) | | USD | | | 134 | | | $ | 116,258 | |

| | | | | | | | | | | |

| Canada | 10.4% | | | | | | | | | | |

Aphria, Inc.,

5.250%, 06/01/24 (±) | | USD | | | 323 | | | | 341,371 | |

Aurora Cannabis, Inc.,

5.500%, 02/28/24 (±) | | USD | | | 424 | | | | 316,940 | |

Canadian Solar, Inc.,

2.500%, 10/01/25 (#), (±) | | USD | | | 119 | | | | 186,429 | |

Canopy Growth Corp.,

4.250%, 07/15/23 (#), (±) | | CAD | | | 362 | | | | 293,988 | |

Colliers International Group, Inc.,

4.000%, 06/01/25 (#), (±) | | USD | | | 155 | | | | 266,988 | |

Element Fleet Management Corp.,

4.250%, 06/30/24 (±) | | CAD | | | 153 | | | | 154,436 | |

Pretium Resources, Inc.,

2.250%, 03/15/22 (±) | | USD | | | 152 | | | | 162,640 | |

Shopify, Inc.,

0.125%, 11/01/25 (±) | | USD | | | 128 | | | | 150,720 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 11

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

Tricon Residential, Inc.,

5.750%, 03/31/22 (±) | | USD | | | 174 | | | $ | 179,220 | |

| | | | | | | | | | 2,052,732 | |

| | | | | | | | | | | |

| Chile | 0.5% | | | | | | | | | | |

Liberty Latin America, Ltd.,

2.000%, 07/15/24 (±) | | USD | | | 100 | | | | 95,023 | |

| | | | | | | | | | | |

| Hong Kong | 0.5% | | | | | | | | | | |

Seaspan Corp.,

3.750%, 12/15/25 (±) | | USD | | | 99 | | | | 106,225 | |

| | | | | | | | | | | |

| Israel | 0.5% | | | | | | | | | | |

Fiverr International, Ltd.,

0.000%, 11/01/25 (±) | | USD | | | 79 | | | | 95,345 | |

| | | | | | | | | | | |

| Netherlands | 0.6% | | | | | | | | | | |

Pharming Group NV,

3.000%, 01/21/25 (±) | | EUR | | | 100 | | | | 109,136 | |

| | | | | | | | | | | |

| Norway | 1.4% | | | | | | | | | | |

SFL Corp., Ltd.,

5.750%, 10/15/21 (±) | | USD | | | 282 | | | | 276,332 | |

| | | | | | | | | | | |

| Panama | 1.7% | | | | | | | | | | |

Copa Holdings SA,

4.500%, 04/15/25 (±) | | USD | | | 201 | | | | 338,924 | |

| | | | | | | | | | | |

| United States | 157.3% | | | | | | | | | | |

1Life Healthcare, Inc.,

3.000%, 06/15/25 (±) | | USD | | | 179 | | | | 224,452 | |

8x8, Inc.,

0.500%, 02/01/24 (±) | | USD | | | 299 | | | | 433,931 | |

Aerie Pharmaceuticals, Inc.,

1.500%, 10/01/24 (±) | | USD | | | 66 | | | | 60,518 | |

Air Transport Services Group, Inc.,

1.125%, 10/15/24 (±) | | USD | | | 213 | | | | 252,812 | |

The accompanying notes are an integral part of these financial statements.

12 Annual Report

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

Alteryx, Inc.,

0.500%, 08/01/24 (±) | | USD | | | 202 | | | $ | 208,965 | |

American Airlines Group, Inc.,

6.500%, 07/01/25 (±) | | USD | | | 235 | | | | 294,588 | |

Apellis Pharmaceuticals, Inc.,

3.500%, 09/15/26 (±) | | USD | | | 157 | | | | 263,403 | |

Arbor Realty Trust, Inc.,

4.750%, 11/01/22 (±) | | USD | | | 295 | | | | 295,268 | |

Arch Resources, Inc.,

5.250%, 11/15/25 (±) | | USD | | | 91 | | | | 127,974 | |

| Atlas Air Worldwide Holdings, Inc.: | | | | | | | | | | |

| 2.250%, 06/01/22 (±) | | USD | | | 224 | | | | 232,455 | |

| 1.875%, 06/01/24 (±) | | USD | | | 203 | | | | 230,312 | |

Avadel Finance Cayman, Ltd.,

4.500%, 02/01/23 (±) | | USD | | | 187 | | | | 186,305 | |

Avaya Holdings Corp.,

2.250%, 06/15/23 (±) | | USD | | | 200 | | | | 208,333 | |

Bloomin’ Brands, Inc.,

5.000%, 05/01/25 (±) | | USD | | | 169 | | | | 310,333 | |

Bridgebio Pharma, Inc.,

2.500%, 03/15/27 (±) | | USD | | | 157 | | | | 289,404 | |

Cardlytics, Inc.,

1.000%, 09/15/25 (±) | | USD | | | 110 | | | | 200,940 | |

Cinemark Holdings, Inc.,

4.500%, 08/15/25 (±) | | USD | | | 256 | | | | 373,628 | |

Coherus Biosciences, Inc.,

1.500%, 04/15/26 (±) | | USD | | | 153 | | | | 176,211 | |

Collegium Pharmaceutical, Inc.,

2.625%, 02/15/26 (±) | | USD | | | 146 | | | | 144,430 | |

CONMED Corp.,

2.625%, 02/01/24 (±) | | USD | | | 179 | | | | 250,219 | |

Coupa Software, Inc.,

0.375%, 06/15/26 (±) | | USD | | | 134 | | | | 180,199 | |

CryoPort, Inc.,

3.000%, 06/01/25 (±) | | USD | | | 108 | | | | 213,712 | |

CSG Systems International, Inc.,

4.250%, 03/15/36 (±) | | USD | | | 325 | | | | 342,063 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 13

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

CyberArk Software, Ltd.,

0.000%, 11/15/24 (±) | | USD | | | 90 | | | $ | 109,182 | |

DISH Network Corp.,

0.000%, 12/15/25 (±) | | USD | | | 276 | | | | 277,305 | |

| Encore Capital Group, Inc.: | | | | | | | | | | |

| 2.875%, 03/15/21 (±) | | USD | | | 281 | | | | 279,747 | |

| 3.250%, 03/15/22 (±) | | USD | | | 348 | | | | 377,107 | |

| 3.250%, 10/01/25 (±) | | USD | | | 214 | | | | 250,290 | |

Envestnet, Inc.,

1.750%, 06/01/23 (±) | | USD | | | 171 | | | | 225,867 | |

Envista Holdings Corp.,

2.375%, 06/01/25 (±) | | USD | | | 188 | | | | 326,699 | |

Everbridge, Inc.,

0.125%, 12/15/24 (±) | | USD | | | 179 | | | | 265,746 | |

EZCORP, Inc.,

2.875%, 07/01/24 (±) | | USD | | | 99 | | | | 89,894 | |

FireEye, Inc.,

0.875%, 06/01/24 (±) | | USD | | | 99 | | | | 120,267 | |

Five9, Inc.,

0.500%, 06/01/25 (±) | | USD | | | 43 | | | | 62,464 | |

Flexion Therapeutics, Inc.,

3.375%, 05/01/24 (±) | | USD | | | 273 | | | | 240,923 | |

Fortive Corp.,

0.875%, 02/15/22 (±) | | USD | | | 192 | | | | 197,507 | |

FTI Consulting, Inc.,

2.000%, 08/15/23 (±) | | USD | | | 155 | | | | 193,673 | |

Gossamer Bio, Inc.,

5.000%, 06/01/27 (±) | | USD | | | 97 | | | | 87,380 | |

Guardant Health, Inc.,

0.000%, 11/15/27 (±) | | USD | | | 223 | | | | 260,916 | |

Guess?, Inc.,

2.000%, 04/15/24 (±) | | USD | | | 213 | | | | 236,839 | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc.,

0.000%, 08/15/23 (±) | | USD | | | 173 | | | | 232,909 | |

Health Catalyst, Inc.,

2.500%, 04/15/25 (±) | | USD | | | 171 | | | | 270,242 | |

The accompanying notes are an integral part of these financial statements.

14 Annual Report

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

Helix Energy Solutions Group, Inc.,

6.750%, 02/15/26 (±) | | USD | | | 194 | | | $ | 201,489 | |

Herbalife Nutrition, Ltd.,

2.625%, 03/15/24 (±) | | USD | | | 384 | | | | 409,043 | |

Hope Bancorp, Inc.,

2.000%, 05/15/38 (±) | | USD | | | 238 | | | | 221,419 | |

i3 Verticals LLC,

1.000%, 02/15/25 (±) | | USD | | | 174 | | | | 178,956 | |

II-VI, Inc.,

0.250%, 09/01/22 (±) | | USD | | | 179 | | | | 298,881 | |

IIP Operating Partnership LP,

3.750%, 02/21/24 (±) | | USD | | | 210 | | | | 586,933 | |

Impinj, Inc.,

2.000%, 12/15/26 (#), (±) | | USD | | | 136 | | | | 184,928 | |

Innoviva, Inc.,

2.125%, 01/15/23 (±) | | USD | | | 385 | | | | 382,930 | |

Insmed, Inc.,

1.750%, 01/15/25 (±) | | USD | | | 170 | | | | 190,776 | |

Integra LifeSciences Holdings Corp.,

0.500%, 08/15/25 (±) | | USD | | | 134 | | | | 147,456 | |

Intercept Pharmaceuticals, Inc.,

2.000%, 05/15/26 (±) | | USD | | | 163 | | | | 97,048 | |

| Ironwood Pharmaceuticals, Inc.: | | | | | | | | | | |

| 2.250%, 06/15/22 (±) | | USD | | | 128 | | | | 137,887 | |

| 1.500%, 06/15/26 (±) | | USD | | | 128 | | | | 143,479 | |

| j2 Global, Inc.: | | | | | | | | | | |

| 1.750%, 11/01/26 (±) | | USD | | | 139 | | | | 144,051 | |

| 3.250%, 06/15/29 (±) | | USD | | | 341 | | | | 499,188 | |

Jazz Investments I, Ltd.,

2.000%, 06/15/26 (±) | | USD | | | 174 | | | | 226,436 | |

JPMorgan Chase Financial Co. LLC,

0.250%, 05/01/23 (±) | | USD | | | 341 | | | | 365,723 | |

Kaman Corp.,

3.250%, 05/01/24 (±) | | USD | | | 256 | | | | 294,847 | |

Karyopharm Therapeutics, Inc.,

3.000%, 10/15/25 (±) | | USD | | | 173 | | | | 215,282 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 15

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

KBR, Inc.,

2.500%, 11/01/23 (±) | | USD | | | 268 | | | $ | 366,665 | |

Knowles Corp.,

3.250%, 11/01/21 (±) | | USD | | | 157 | | | | 177,701 | |

LendingTree, Inc.,

0.500%, 07/15/25 (±) | | USD | | | 192 | | | | 186,745 | |

Liberty Broadband Corp.,

1.250%, 09/30/50 (±) | | USD | | | 256 | | | | 258,435 | |

| Liberty Interactive LLC: | | | | | | | | | | |

| 4.000%, 11/15/29 (±) | | USD | | | 251 | | | | 192,159 | |

| 3.750%, 02/15/30 (±) | | USD | | | 42 | | | | 32,418 | |

Liberty Media Corp-Liberty Formula One,

1.000%, 01/30/23 (±) | | USD | | | 172 | | | | 219,170 | |

| Liberty Media Corp.: | | | | | | | | | | |

| 2.125%, 03/31/48 (±) | | USD | | | 261 | | | | 271,579 | |

| 2.250%, 12/01/48 (±) | | USD | | | 214 | | | | 261,050 | |

| 2.750%, 12/01/49 (±) | | USD | | | 256 | | | | 264,064 | |

| 0.500%, 12/01/50 (±) | | USD | | | 122 | | | | 129,396 | |

Ligand Pharmaceuticals, Inc.,

0.750%, 05/15/23 (±) | | USD | | | 188 | | | | 176,905 | |

LivaNova USA, Inc.,

3.000%, 12/15/25 (±) | | USD | | | 58 | | | | 75,835 | |

| Live Nation Entertainment, Inc.: | | | | | | | | | | |

| 2.500%, 03/15/23 (±) | | USD | | | 258 | | | | 333,026 | |

| 2.000%, 02/15/25 (±) | | USD | | | 85 | | | | 89,950 | |

LivePerson, Inc.,

0.750%, 03/01/24 (±) | | USD | | | 155 | | | | 273,499 | |

Lyft, Inc.,

1.500%, 05/15/25 (±) | | USD | | | 134 | | | | 198,516 | |

Marriott Vacations Worldwide Corp.,

1.500%, 09/15/22 (±) | | USD | | | 345 | | | | 390,532 | |

Mesa Laboratories, Inc.,

1.375%, 08/15/25 (±) | | USD | | | 78 | | | | 93,109 | |

MicroStrategy, Inc.,

0.750%, 12/15/25 (±) | | USD | | | 82 | | | | 105,778 | |

MongoDB, Inc.,

0.250%, 01/15/26 (±) | | USD | | | 192 | | | | 345,642 | |

The accompanying notes are an integral part of these financial statements.

16 Annual Report

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

National Vision Holdings, Inc.,

2.500%, 05/15/25 (±) | | USD | | | 201 | | | $ | 324,113 | |

Nevro Corp.,

2.750%, 04/01/25 (±) | | USD | | | 129 | | | | 233,893 | |

NextEra Energy Partners L.P.,

0.000%, 11/15/25 (±) | | USD | | | 170 | | | | 169,629 | |

Nuance Communications, Inc.,

1.000%, 12/15/35 (±) | | USD | | | 165 | | | | 307,094 | |

Nutanix, Inc.,

0.000%, 01/15/23 (±) | | USD | | | 256 | | | | 258,377 | |

| NuVasive, Inc.: | | | | | | | | | | |

| 2.250%, 03/15/21 (±) | | USD | | | 256 | | | | 257,903 | |

| 1.000%, 06/01/23 (±) | | USD | | | 248 | | | | 254,186 | |

| 0.375%, 03/15/25 (±) | | USD | | | 112 | | | | 108,625 | |

Okta, Inc.,

0.375%, 06/15/26 (±) | | USD | | | 167 | | | | 214,056 | |

Omeros Corp.,

5.250%, 02/15/26 (±) | | USD | | | 128 | | | | 135,117 | |

OSI Systems, Inc.,

1.250%, 09/01/22 (±) | | USD | | | 203 | | | | 216,572 | |

Patrick Industries, Inc.,

1.000%, 02/01/23 (±) | | USD | | | 341 | | | | 360,039 | |

PennyMac Corp.,

5.500%, 11/01/24 (±) | | USD | | | 286 | | | | 280,995 | |

Perficient, Inc.,

1.250%, 08/01/25 (±) | | USD | | | 233 | | | | 265,970 | |

PetIQ, Inc.,

4.000%, 06/01/26 (±) | | USD | | | 163 | | | | 247,436 | |

PRA Group, Inc.,

3.500%, 06/01/23 (±) | | USD | | | 254 | | | | 275,533 | |

| PROS Holdings, Inc.: | | | | | | | | | | |

| 1.000%, 05/15/24 (±) | | USD | | | 169 | | | | 178,998 | |

| 2.250%, 09/15/27 (±) | | USD | | | 89 | | | | 125,529 | |

Pure Storage, Inc.,

0.125%, 04/15/23 (±) | | USD | | | 295 | | | | 324,387 | |

Q2 Holdings, Inc.,

0.125%, 11/15/25 (±) | | USD | | | 134 | | | | 149,094 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 17

| Description | | Security

Currency | | Principal

Amount

(000) | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

Radius Health, Inc.,

3.000%, 09/01/24 (±) | | USD | | | 119 | | | $ | 106,367 | |

Rambus, Inc.,

1.375%, 02/01/23 (±) | | USD | | | 179 | | | | 201,163 | |

Redfin Corp.,

0.000%, 10/15/25 (±) | | USD | | | 235 | | | | 280,860 | |

Redwood Trust, Inc.,

4.750%, 08/15/23 (±) | | USD | | | 389 | | | | 366,808 | |

Revance Therapeutics, Inc.,

1.750%, 02/15/27 (±) | | USD | | | 175 | | | | 196,263 | |

RH,

0.000%, 09/15/24 (±) | | USD | | | 165 | | | | 360,377 | |

Royal Caribbean Cruises, Ltd.,

2.875%, 11/15/23 (±) | | USD | | | 215 | | | | 256,925 | |

Sailpoint Technologies Holdings, Inc.,

0.125%, 09/15/24 (±) | | USD | | | 196 | | | | 381,683 | |

Shift4 Payments, Inc.,

0.000%, 12/15/25 (±) | | USD | | | 107 | | | | 130,570 | |

Slack Technologies, Inc.,

0.500%, 04/15/25 (±) | | USD | | | 78 | | | | 114,408 | |

SMART Global Holdings, Inc.,

2.250%, 02/15/26 (±) | | USD | | | 194 | | | | 220,011 | |

Snap, Inc.,

0.250%, 05/01/25 (±) | | USD | | | 134 | | | | 315,555 | |

SolarEdge Technologies, Inc.,

0.000%, 09/15/25 (±) | | USD | | | 99 | | | | 136,083 | |

Splunk, Inc.,

1.125%, 06/15/27 (±) | | USD | | | 268 | | | | 278,547 | |

Stride, Inc.,

1.125%, 09/01/27 (±) | | USD | | | 184 | | | | 149,306 | |

Synaptics, Inc.,

0.500%, 06/15/22 (±) | | USD | | | 179 | | | | 246,820 | |

Tabula Rasa HealthCare, Inc.,

1.750%, 02/15/26 (±) | | USD | | | 155 | | | | 147,281 | |

TechTarget, Inc.,

0.125%, 12/15/25 (±) | | USD | | | 201 | | | | 218,054 | |

The accompanying notes are an integral part of these financial statements.

18 Annual Report

| Description | | Security

Currency | | Principal

Amount

(000) | | | | Fair

Value | |

| | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | |

| | | | | | | | | | | |

The Chefs’ Warehouse, Inc.,

1.875%, 12/01/24 (±) | | USD | | | 43 | | | $ | 41,351 | |

The Greenbrier Cos., Inc.,

2.875%, 02/01/24 (±) | | USD | | | 187 | | | | 188,958 | |

The Marcus Corp.,

5.000%, 09/15/25 (±) | | USD | | | 107 | | | | 153,461 | |

The Middleby Corp.,

1.000%, 09/01/25 (±) | | USD | | | 134 | | | | 163,648 | |

Turning Point Brands, Inc.,

2.500%, 07/15/24 (±) | | USD | | | 283 | | | | 318,187 | |

Uber Technologies, Inc.,

0.000%, 12/15/25 (±) | | USD | | | 212 | | | | 216,884 | |

Under Armour, Inc.,

1.500%, 06/01/24 (±) | | USD | | | 112 | | | | 184,614 | |

Varex Imaging Corp.,

4.000%, 06/01/25 (±) | | USD | | | 102 | | | | 107,430 | |

Verint Systems, Inc.

1.500%, 06/01/21 (±) | | USD | | | 235 | | | | 257,691 | |

Vishay Intertechnology, Inc.,

2.250%, 06/15/25 (±) | | USD | | | 256 | | | | 266,649 | |

Wayfair, Inc.,

0.625%, 10/01/25 (±) | | USD | | | 201 | | | | 189,670 | |

Winnebago Industries, Inc.,

1.500%, 04/01/25 (±) | | USD | | | 175 | | | | 207,250 | |

Workiva, Inc.,

1.125%, 08/15/26 (±) | | USD | | | 100 | | | | 133,676 | |

Zillow Group, Inc.,

1.500%, 07/01/23 (±) | | USD | | | 222 | | | | 377,439 | |

Zogenix, Inc.,

2.750%, 10/01/27 (±) | | USD | | | 139 | | | | 153,189 | |

Zscaler, Inc.,

0.125%, 07/01/25 (±) | | USD | | | 179 | | | | 266,087 | |

| | | | | | | | | | 30,995,149 | |

Total Convertible Corporate Bonds

(Cost $29,658,161) | | | | | | | | | 34,185,124 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 19

| Description | | Counterparty | | Number of

Contracts | | | Exercise

Price | | | Notional

Amount | | | Fair

Value | |

| | | | | | | | | | | | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Purchased Options | 0.0% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Call | | | | | | | | | | | | | | | | | | |

Cinemark Holdings, Inc.

Expires 02/19/21 | | MSC | | | 8 | | | $ | 20 | | | $ | 800 | | | $ | 1,096 | |

II-VI, Inc.

Expires 01/15/21 | | MSC | | | 1 | | | | 75 | | | | 100 | | | | 345 | |

Marcus Corp.

Expires 02/19/21 | | MSC | | | 8 | | | | 18 | | | | 800 | | | | 400 | |

On Semiconductor Corp

Expires 01/29/21 | | MSC | | | 4 | | | | 35 | | | | 400 | | | | 280 | |

Sabre Corp.

Expires 02/19/21 | | MSC | | | 8 | | | | 15 | | | | 800 | | | | 296 | |

| | | | | | | | | | | | | | | | | |

| Put | | | | | | | | | | | | | | | | | | |

American Airlines Group, Inc.

Expires 01/15/21 | | MSC | | | 8 | | | | 12 | | | | 800 | | | | 48 | |

American Airlines Group, Inc.

Expires 01/15/21 | | MSC | | | 8 | | | | 13 | | | | 800 | | | | 88 | |

Ishares 7-10 year Treasury Bond

Expires 02/19/21 | | MSC | | | 49 | | | | 117 | | | | 4,900 | | | | 1,029 | |

Marcus Corp.

Expires 01/15/21 | | MSC | | | 9 | | | | 10 | | | | 900 | | | | 90 | |

Total Purchased Options

(Cost $4,647) | | | | | | | | | | | | | | | | | 3,672 | |

| Description | | Shares | | | Fair

Value | |

| |

| Short-Term Investments | 13.5% | | | | | | | | |

| | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class,

0.01% (7 day yield)

(Cost $2,658,914) | | | 2,658,914 | | | | 2,658,914 | |

The accompanying notes are an integral part of these financial statements.

20 Annual Report

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

Total Investments excluding Securities Sold Short | 187.1%

(Cost $32,346,712) | | | | | | $ | 36,875,643 | |

| | | | | | | | | |

| Securities Sold Short | (90.9)% | | | | | | | | |

| | | | | | | | | |

| Common Stocks | (88.5)% | | | | | | | | |

| | | | | | | | | |

| Brazil | (0.2)% | | | | | | | | |

| Gol Linhas Aereas Inteligentes SA ADR | | | (3,352 | ) | | | (32,917 | ) |

| | | | | | | | | |

| Canada | (3.9)% | | | | | | | | |

| Aphria, Inc. | | | (21,309 | ) | | | (147,458 | ) |

| Atlas Corp. | | | (2,589 | ) | | | (28,065 | ) |

| Canadian Solar, Inc. | | | (2,694 | ) | | | (138,040 | ) |

| Canopy Growth Corp. | | | (4,212 | ) | | | (103,637 | ) |

| Colliers International Group, Inc. | | | (2,330 | ) | | | (207,673 | ) |

| Element Fleet Management Corp. | | | (7,926 | ) | | | (83,314 | ) |

| Pretium Resources, Inc. | | | (2,664 | ) | | | (30,583 | ) |

| Shopify, Inc., Class A | | | (33 | ) | | | (37,354 | ) |

| | | | | | | | (776,124 | ) |

| Chile | (0.1)% | | | | | | | | |

| Liberty Latin America, Ltd., Class C | | | (2,140 | ) | | | (23,733 | ) |

| | | | | | | | | |

| Israel | (0.3)% | | | | | | | | |

| Fiverr International, Ltd. | | | (273 | ) | | | (53,262 | ) |

| | | | | | | | | |

| Netherlands | (0.1)% | | | | | | | | |

| Pharming Group NV | | | (12,500 | ) | | | (19,475 | ) |

| | | | | | | | | |

| Norway | (0.0%) | | | | | | | | |

| SFL Corp., Ltd. | | | (1,467 | ) | | | (9,213 | ) |

| | | | | | | | | |

| Panama | (1.4)% | | | | | | | | |

| Copa Holdings SA, Class A | | | (3,518 | ) | | | (271,695 | ) |

The accompanying notes are an integral part of these financial statements.

Annual Report 21

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| United States | (82.5)% | | | | | | | | |

| 1Life Healthcare, Inc. | | | (3,063 | ) | | $ | (133,700 | ) |

| 8x8, Inc. | | | (9,778 | ) | | | (337,048 | ) |

| Aerie Pharmaceuticals, Inc. | | | (1,348 | ) | | | (18,211 | ) |

| Air Transport Services Group, Inc. | | | (4,669 | ) | | | (146,326 | ) |

| Alteryx, Inc., Class A | | | (22 | ) | | | (2,679 | ) |

| American Airlines Group, Inc. | | | (13,056 | ) | | | (205,893 | ) |

| Apellis Pharmaceuticals, Inc. | | | (3,258 | ) | | | (186,358 | ) |

| Arbor Realty Trust, Inc. REIT | | | (4,216 | ) | | | (59,783 | ) |

| Arch Resources, Inc. | | | (2,127 | ) | | | (93,099 | ) |

| Atlas Air Worldwide Holdings, Inc. | | | (3,216 | ) | | | (175,401 | ) |

| Avadel Pharmaceuticals PLC ADR | �� | | (7,643 | ) | | | (51,055 | ) |

| Avaya Holdings Corp. | | | (3,143 | ) | | | (60,188 | ) |

| Bloomin’ Brands, Inc. | | | (13,007 | ) | | | (252,596 | ) |

| Bridgebio Pharma, Inc. | | | (3,265 | ) | | | (232,174 | ) |

| Cardlytics, Inc. | | | (1,125 | ) | | | (160,616 | ) |

| Charter Communications, Inc., Class A | | | (15 | ) | | | (9,923 | ) |

| Cinemark Holdings, Inc. | | | (16,746 | ) | | | (291,548 | ) |

| Coherus Biosciences, Inc. | | | (6,444 | ) | | | (111,997 | ) |

| Collegium Pharmaceutical, Inc. | | | (3,649 | ) | | | (73,089 | ) |

| CONMED Corp. | | | (1,542 | ) | | | (172,704 | ) |

| Coupa Software, Inc. | | | (339 | ) | | | (114,890 | ) |

| CryoPort, Inc. | | | (4,038 | ) | | | (177,187 | ) |

| CSG Systems International, Inc. | | | (1,148 | ) | | | (51,740 | ) |

| CyberArk Software, Ltd. | | | (334 | ) | | | (53,971 | ) |

| DISH Network Corp., Class A | | | (4,384 | ) | | | (141,779 | ) |

| Encore Capital Group, Inc. | | | (8,828 | ) | | | (343,851 | ) |

| Envestnet, Inc. | | | (1,792 | ) | | | (147,464 | ) |

| Envista Holdings Corp. | | | (7,795 | ) | | | (262,925 | ) |

| Everbridge, Inc. | | | (1,290 | ) | | | (192,300 | ) |

| EZCORP, Inc. Class A | | | (4,146 | ) | | | (19,859 | ) |

| FireEye, Inc. | | | (2,917 | ) | | | (67,266 | ) |

| Five9, Inc. | | | (249 | ) | | | (43,426 | ) |

| Flexion Therapeutics, Inc. | | | (4,456 | ) | | | (51,422 | ) |

| FTI Consulting, Inc. | | | (1,035 | ) | | | (115,630 | ) |

| Gossamer Bio, Inc. | | | (5,106 | ) | | | (49,375 | ) |

The accompanying notes are an integral part of these financial statements.

22 Annual Report

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Guardant Health, Inc. | | | (1,292 | ) | | $ | (166,513 | ) |

| Guess?, Inc. | | | (5,770 | ) | | | (130,517 | ) |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. REIT | | | (2,684 | ) | | | (170,246 | ) |

| Health Catalyst, Inc. | | | (4,928 | ) | | | (214,516 | ) |

| Helix Energy Solutions Group, Inc. | | | (20,600 | ) | | | (86,520 | ) |

| Herbalife Nutrition, Ltd. | | | (3,305 | ) | | | (158,805 | ) |

| I3 Verticals, Inc., Class A | | | (3,158 | ) | | | (104,846 | ) |

| II-VI, Inc. | | | (3,471 | ) | | | (263,657 | ) |

| Impinj, Inc. | | | (3,553 | ) | | | (148,764 | ) |

| Innovative Industrial Properties, Inc. REIT | | | (2,957 | ) | | | (541,515 | ) |

| Innoviva, Inc. | | | (3,604 | ) | | | (44,654 | ) |

| Insmed, Inc. | | | (2,830 | ) | | | (94,211 | ) |

| Integra LifeSciences Holdings Corp. | | | (903 | ) | | | (58,623 | ) |

| Intercept Pharmaceuticals, Inc. | | | (1,051 | ) | | | (25,960 | ) |

| Ironwood Pharmaceuticals, Inc. | | | (10,499 | ) | | | (119,584 | ) |

| j2 Global, Inc. | | | (5,408 | ) | | | (528,308 | ) |

| Jazz Pharmaceuticals PLC | | | (730 | ) | | | (120,486 | ) |

| Kaman Corp. | | | (1,937 | ) | | | (110,661 | ) |

| Karyopharm Therapeutics, Inc. | | | (8,081 | ) | | | (125,094 | ) |

| KBR, Inc. | | | (8,231 | ) | | | (254,585 | ) |

| Knowles Corp. | | | (2,897 | ) | | | (53,392 | ) |

| Liberty Media Corp-Liberty Formula One, Class C | | | (3,491 | ) | | | (148,717 | ) |

| Liberty Media Corp.-Liberty SiriusXM, Class A | | | (5,681 | ) | | | (245,362 | ) |

| Ligand Pharmaceuticals, Inc. | | | (155 | ) | | | (15,415 | ) |

| LivaNova PLC | | | (727 | ) | | | (48,135 | ) |

| Live Nation Entertainment, Inc. | | | (5,810 | ) | | | (426,919 | ) |

| LivePerson, Inc. | | | (3,482 | ) | | | (216,685 | ) |

| Lyft, Inc., Class A | | | (2,809 | ) | | | (138,006 | ) |

| Marriott Vacations Worldwide Corp. | | | (1,334 | ) | | | (183,051 | ) |

| Mesa Laboratories, Inc. | | | (218 | ) | | | (62,487 | ) |

| MicroStrategy, Inc., Class A | | | (158 | ) | | | (61,391 | ) |

| MongoDB, Inc. | | | (783 | ) | | | (281,128 | ) |

| National Vision Holdings, Inc. | | | (5,763 | ) | | | (261,006 | ) |

| Nevro Corp. | | | (1,079 | ) | | | (186,775 | ) |

| NextEra Energy Partners L.P. | | | (781 | ) | | | (52,366 | ) |

The accompanying notes are an integral part of these financial statements.

Annual Report 23

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Nuance Communications, Inc. | | | (6,277 | ) | | $ | (276,753 | ) |

| Nutanix, Inc., Class A | | | (1,246 | ) | | | (39,710 | ) |

| NuVasive, Inc. | | | (1,632 | ) | | | (91,931 | ) |

| Okta, Inc. | | | (536 | ) | | | (136,283 | ) |

| Omeros Corp. | | | (5,874 | ) | | | (83,910 | ) |

| OSI Systems, Inc. | | | (850 | ) | | | (79,237 | ) |

| Patrick Industries, Inc. | | | (1,942 | ) | | | (132,736 | ) |

| PennyMac Mortgage Investment Trust REIT | | | (2,736 | ) | | | (48,126 | ) |

| Perficient, Inc. | | | (3,283 | ) | | | (156,435 | ) |

| PetIQ, Inc. | | | (4,677 | ) | | | (179,831 | ) |

| PRA Group, Inc. | | | (2,694 | ) | | | (106,844 | ) |

| PROS Holdings, Inc. | | | (3,482 | ) | | | (176,781 | ) |

| Pure Storage, Inc., Class A | | | (5,498 | ) | | | (124,310 | ) |

| Q2 Holdings, Inc. | | | (357 | ) | | | (45,171 | ) |

| Radius Health, Inc. | | | (1,356 | ) | | | (24,218 | ) |

| Rambus, Inc. | | | (5,346 | ) | | | (93,341 | ) |

| Redfin Corp. | | | (1,886 | ) | | | (129,436 | ) |

| Redwood Trust, Inc. REIT | | | (1,870 | ) | | | (16,419 | ) |

| Revance Therapeutics, Inc. | | | (4,452 | ) | | | (126,170 | ) |

| RH | | | (728 | ) | | | (325,795 | ) |

| Royal Caribbean Cruises, Ltd. | | | (1,925 | ) | | | (143,778 | ) |

| SailPoint Technologies Holding, Inc. | | | (6,250 | ) | | | (332,750 | ) |

| Shift4 Payments, Inc., Class A | | | (648 | ) | | | (48,859 | ) |

| Sirius XM Holdings, Inc. | | | (25,657 | ) | | | (163,435 | ) |

| Slack Technologies, Inc., Class A | | | (1,469 | ) | | | (62,051 | ) |

| SMART Global Holdings, Inc. | | | (3,925 | ) | | | (147,698 | ) |

| Snap, Inc., Class A | | | (5,772 | ) | | | (289,004 | ) |

| SolarEdge Technologies, Inc. | | | (271 | ) | | | (86,482 | ) |

| Splunk, Inc. | | | (341 | ) | | | (57,932 | ) |

| Stride, Inc. | | | (1,704 | ) | | | (36,176 | ) |

| Synaptics, Inc. | | | (1,634 | ) | | | (157,518 | ) |

| Tabula Rasa HealthCare, Inc. | | | (1,330 | ) | | | (56,977 | ) |

| TechTarget, Inc. | | | (1,051 | ) | | | (62,125 | ) |

| The Greenbrier Cos., Inc. | | | (943 | ) | | | (34,306 | ) |

| The Marcus Corp. | | | (8,261 | ) | | | (111,358 | ) |

| The Middleby Corp. | | | (605 | ) | | | (77,997 | ) |

The accompanying notes are an integral part of these financial statements.

24 Annual Report

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Enhanced Opportunities Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Turning Point Brands, Inc. | | | (3,505 | ) | | $ | (156,183 | ) |

| Uber Technologies, Inc. | | | (1,021 | ) | | | (52,071 | ) |

| Under Armour, Inc., Class C | | | (9,666 | ) | | | (143,830 | ) |

| Varex Imaging Corp. | | | (3,708 | ) | | | (61,849 | ) |

| Verint Systems, Inc. | | | (2,005 | ) | | | (134,696 | ) |

| Vishay Intertechnology, Inc. | | | (1,011 | ) | | | (20,938 | ) |

| Voya Financial, Inc. | | | (1,513 | ) | | | (88,980 | ) |

| Wayfair, Inc., Class A | | | (288 | ) | | | (65,033 | ) |

| Winnebago Industries, Inc. | | | (2,022 | ) | | | (121,199 | ) |

| Workiva, Inc. | | | (1,012 | ) | | | (92,719 | ) |

| Zillow Group, Inc. Class C | | | (2,496 | ) | | | (323,981 | ) |

| Zogenix, Inc. | | | (4,502 | ) | | | (89,995 | ) |

| Zscaler, Inc. | | | (932 | ) | | | (186,130 | ) |

| | | | | | | | (16,255,860 | ) |

| | | | | | | | | |

Total Common Stocks

(Proceeds $14,167,637) | | | | | | | (17,442,279 | ) |

| | | | | | | | | |

| Exchange-Traded Fund | (2.4)% | | | | | | | | |

| | | | | | | | | |

| United States | (2.4)% | | | | | | | | |

| iShares 7-10 Year Treasury Bond ETF | | | (3,936 | ) | | | (472,123 | ) |

| | | | | | | | | |

Total Exchange-Traded Funds

(Proceeds $471,363) | | | | | | | (472,123 | ) |

| | | | | | | | | |

Total Securities Sold Short

(Proceeds $14,639,000) | | | | | | | (17,914,402 | ) |

| | | | | | | | | |

Total Investments | 96.2%

(Cost and short proceeds $17,707,712) (») | | | | | | $ | 18,961,241 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 3.8% | | | | | | | 743,758 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 19,704,999 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 25

Lazard Enhanced Opportunities Portfolio (concluded)

Forward Currency Contracts open at December 31, 2020:

Currency

Purchased | | Quantity | | Currency

Sold | | Quantity | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

| | | | | | | | | | | | | | | | | |

| EUR | | 201,000 | | USD | | 245,132 | | SSB | | 03/25/21 | | | $ | 863 | | |

| USD | | 208,250 | | CAD | | 265,000 | | SSB | | 03/25/21 | | | | 18 | | |

| USD | | 342,901 | | EUR | | 279,000 | | SSB | | 03/25/21 | | | | 1,446 | | |

| Total gross unrealized appreciation on Forward Currency Contracts | | | | | $ | 2,327 | | |

Written Options open at December 31, 2020:

| Description | | Counterparty | | Number

of

Contracts | | Strike

Price | | | Expiration

Date | | Notional

Amount | | | Premiums | | | Fair

Value | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Put | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cinemark Holdings, Inc. | | MSC | | | 8 | | | $ | 15.00 | | | 02/19/21 | | $ | 800 | | | | $ | 802 | | | $ | (840 | ) |

| Synaptic, Inc. | | MSC | | | 6 | | | | 70.00 | | | 02/19/21 | | | 600 | | | | | 728 | | | | (600 | ) |

| Verint Systems, Inc. | | MSC | | | 2 | | | | 55.00 | | | 02/19/21 | | | 200 | | | | | 142 | | | | (100 | ) |

| Verint Systems, Inc. | | MSC | | | 3 | | | | 60.00 | | | 02/19/21 | | | 300 | | | | | 507 | | | | (330 | ) |

| Total Written Options | | | | | 19 | | | | | | | | | | | | | | $ | 2,179 | | | $ | (1,870 | ) |

The accompanying notes are an integral part of these financial statements.

26 Annual Report

The Lazard Funds, Inc. Notes to Portfolio of Investments

December 31, 2020

| (*) | | Non-income producing security. |

| (‡) | | Security valued using Level 2 inputs, based on reference to a similar security which was trading on an active market, under GAAP hierarchy - see Note 9 in the Notes to Financial Statements. |

| (±) | | Some or all of this security position has been pledged to cover collateral requirements on securities sold short. |

| (#) | | Pursuant to Rule 144A under the Securities Act of 1933, these securities may only be traded among “qualified institutional buyers.” At December 31, 2020, these securities amounted to 5.3% of net assets. |

| (») | | The Portfolio, at all times, maintains portfolio securities in sufficient amount to cover its obligations related to investments in forward currency contracts. |

Security Abbreviations:

| ADR | — | American Depositary Receipt |

| ETF | — | Exchange-Traded Fund |

| REIT | — | Real Estate Investment Trust |

Currency Abbreviations:

| EUR | — | Euro | | CAD | — | Canadian Dollar |

| USD | — | United States Dollar | | | | |

Counterparty Abbreviations:

| MSC | — | Morgan Stanley & Co. Inc. |

| SSB | — | State Street Bank and Trust Co. |

Portfolio holdings by industry (as a percentage of net assets), for the Portfolio previously presented by country:

| Industry† | | Long | | | Short | | |

| | | | | | | | | | |

| Common Stocks and Convertible Corporate Bonds | | | | | | | | | |

| Aerospace & Defense | | | 1.5 | % | | | –0.6 | % | |

| Air Freight & Logistics | | | 3.6 | | | | –1.6 | | |

| Airlines | | | 3.8 | | | | –2.6 | | |

| Auto Components | | | 1.8 | | | | –0.7 | | |

| Automobiles | | | 1.1 | | | | –0.6 | | |

| Banks | | | 1.2 | | | | — | | |

| Biotechnology | | | 11.3 | | | | –5.4 | | |

| Capital Markets | | | 1.9 | | | | — | | |

| Consumer Finance | | | 7.4 | | | | –2.4 | | |

| Diversified Consumer Services | | | 0.8 | | | | –0.2 | | |

| Diversified Financial Services | | | 1.7 | | | | –0.9 | | |

| Diversified Telecommunication Services | | | 0.5 | | | | –0.1 | | |

| Electronic Equipment, Instruments & Components | | | 4.9 | | | | –2.1 | | |

| Energy Equipment & Services | | | 1.0 | | | | –0.4 | | |

| Entertainment | | | 4.8 | | | | –5.0 | | |

| Equity Real Estate Investment Trusts (REITs) | | | 3.0 | | | | –2.7 | | |

| Food & Staples Retailing | | | 0.2 | | | | — | | |

The accompanying notes are an integral part of these financial statements.

Annual Report 27

| Industry† | | Long | | | Short | | |

| | | | | | | | | | |

| Common Stocks and Convertible Corporate Bonds (continued) | | | | | | | | | |

| Health Care Equipment & Supplies | | | 10.5 | % | | | –5.7 | % | |

| Health Care Providers & Services | | | 3.7 | | | | –2.4 | | |

| Health Care Technology | | | 2.1 | | | | –1.4 | | |

| Hotels, Restaurants & Leisure | | | 4.9 | | | | –2.9 | | |

| Independent Power & Renewable Electricity Producers | | | 0.9 | | | | –0.3 | | |

| Interactive Media & Services | | | 4.0 | | | | –3.1 | | |

| Internet & Direct Marketing Retail | | | 1.0 | | | | –0.6 | | |

| IT Services | | | 10.1 | | | | –5.4 | | |

| Machinery | | | 2.8 | | | | –0.6 | | |

| Marine | | | — | | | | –0.1 | | |

| Media | | | 11.8 | | | | –4.0 | | |

| Metals & Mining | | | 0.8 | | | | –0.2 | | |

| Mortgage Real Estate Investment Trusts (REITs) | | | 6.0 | | | | –1.5 | | |

| Oil, Gas & Consumable Fuels | | | 2.6 | | | | –0.5 | | |

| Personal Products | | | 2.1 | | | | –0.8 | | |

| Pharmaceuticals | | | 11.4 | | | | –4.4 | | |

| Professional Services | | | 1.0 | | | | –0.6 | | |

| Real Estate Management & Development | | | 3.7 | | | | –1.7 | | |

| Road & Rail | | | 2.1 | | | | –1.0 | | |

| Semiconductors & Semiconductor Equipment | | | 6.0 | | | | –3.9 | | |

| Software | | | 26.8 | | | | –16.4 | | |

| Specialty Retail | | | 4.7 | | | | –3.6 | | |

| Technology Hardware, Storage & Peripherals | | | 1.6 | | | | –0.6 | | |

| Textiles, Apparel & Luxury Goods | | | 0.9 | | | | –0.7 | | |

| Tobacco | | | 1.6 | | | | –0.8 | | |

| Subtotal | | | 173.6 | | | | –88.5 | | |

| Exchange Traded Funds | | | — | | | | –2.4 | | |

| Short-Term Investments | | | 13.5 | | | | — | | |

| Total Investments | | | 187.1 | % | | | –90.9 | % | |

| † | Industry classifications may be different than those used for compliance monitoring purposes. |

The accompanying notes are an integral part of these financial statements.

28 Annual Report

The Lazard Funds, Inc. Statement of Assets and Liabilities

| December 31, 2020 | Lazard

Enhanced

Opportunities

Portfolio | |

| ASSETS | | | | |

| Investments in securities, at fair value | | $ | 36,875,643 | |

| Cash | | | 3,998 | |

| Receivables for: | | | | |

| Investments sold | | | 1,720,697 | |

| Dividends and interest | | | 155,935 | |

| Capital stock sold | | | 15,000 | |

| Cash collateral due from broker on options | | | 83,000 | |

| Amount due from Investment Manager (Note 3) | | | 13,664 | |

| Gross unrealized appreciation on forward currency contracts | | | 2,327 | |

| Total assets | | | 38,870,264 | |

| | | | | |

| LIABILITIES | | | | |

| Securities sold short, at fair value | | | 17,914,402 | |

| Foreign currency due to custodian | | | 2,602 | |

| Payables for: | | | | |

| Accrued custodian fees | | | 52,457 | |

| Accrued professional services | | | 32,285 | |

| Accrued directors’ fees | | | 64 | |

| Investments purchased | | | 1,142,230 | |

| Dividends on securities sold short | | | 8,471 | |

| Written options, at fair value | | | 1,870 | |

| Other accrued expenses and payables | | | 10,884 | |

| Total liabilities | | | 19,165,265 | |

| Net assets | | $ | 19,704,999 | |

| | | | | |

| NET ASSETS | | | | |

| Paid in capital | | $ | 19,716,851 | |

| Distributable earnings (Accumulated loss) | | | (11,852 | ) |

| Net assets | | $ | 19,704,999 | |

| Institutional Shares | | | | |

| Net assets | | $ | 19,537,447 | |

| Shares of capital stock outstanding* | | | 2,140,850 | |

| Net asset value, offering and redemption price per share | | $ | 9.13 | |

| | | | | |

| Open Shares | | | | |

| Net assets | | $ | 167,552 | |

| Shares of capital stock outstanding* | | | 18,359 | |

| Net asset value, offering and redemption price per share | | $ | 9.13 | |

| Cost of investments in securities | | $ | 32,346,712 | |

| Proceeds received from securities sold short | | $ | 14,639,000 | |

| Proceeds received from written options | | $ | 2,179 | |

| * $0.001 par value, 6,900,000,000 shares authorized for the Portfolios in total. |

The accompanying notes are an integral part of these financial statements.

Annual Report 29

The Lazard Funds, Inc. Statement of Operations

| For the Year Ended December 31, 2020 | Lazard

Enhanced

Opportunities

Portfolio | |

| Investment Income (Loss) | | | | |

| | | | | |

| Income | | | | |

| Interest | | $ | 576,257 | |

| Dividends | | | 4,440 | |

| Total investment income* | | | 580,697 | |

| | | | | |

| Expenses | | | | |

| Management fees (Note 3) | | | 124,144 | |

| Custodian fees | | | 91,331 | |

| Professional services | | | 49,567 | |

| Registration fees | | | 36,146 | |

| Administration fees | | | 25,865 | |

| Shareholders’ reports | | | 24,837 | |

| Shareholders’ services | | | 9,259 | |

| Directors’ fees and expenses | | | 5,541 | |

| Distribution fees (Open Shares) | | | 1,012 | |

| Other | | | 6,535 | |

| Total gross expenses before expenses on securities sold short | | | 374,237 | |

| Broker expense on securities sold short | | | 89,524 | |

| Dividend expense on securities sold short | | | 38,129 | |

| Total gross expenses | | | 501,890 | |

| Management fees waived and expenses reimbursed | | | (209,374 | ) |

| Total net expenses | | | 292,516 | |

| Net investment income (loss) | | | 288,181 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 2,271,862 | |

| Securities sold short | | | (2,077,543 | ) |

| Foreign currency transactions | | | (3,978 | ) |

| Forward currency contracts | | | (8,786 | ) |

| Futures contracts | | | 35,174 | |

| Written options | | | 20,920 | |

| Total net realized gain (loss) | | | 237,649 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 4,277,873 | |

| Securities sold short | | | (2,910,199 | ) |

| Foreign currency translations | | | 71 | |

| Forward currency contracts | | | 4,141 | |

| Written options | | | 530 | |

| Total net change in unrealized appreciation (depreciation) | | | 1,372,416 | |

| Net realized and unrealized gain (loss) | | | 1,610,065 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 1,898,246 | |

| * Net of foreign withholding taxes of | | $ | 11 | |

The accompanying notes are an integral part of these financial statements.

30 Annual Report

The Lazard Funds, Inc. Statement of Changes in Net Assets

| | | Lazard

Enhanced Opportunities Portfolio | |

| | | Year Ended

December 31, 2020 | | | Year Ended

December 31, 2019 | |

| Increase in Net Assets | | | | | | | | | | |

| | | | | | | | | | | |

| Operations | | | | | | | | | | |

| Net investment income (loss) | | | $ | 288,181 | | | | $ | 123,402 | |

| Net realized gain (loss) | | | | 237,649 | | | | | 205,536 | |

| Net change in unrealized appreciation (depreciation) | | | | 1,372,416 | | | | | 473,630 | |

| Net increase (decrease) in net assets resulting from operations | | | | 1,898,246 | | | | | 802,568 | |

| | | | | | | | | | | |

| Distributions to shareholders (Note 2(h)) | | | | | | | | | | |

| Net investment income and net realized gains | | | | | | | | | | |

| Institutional Shares | | | | (1,185,411 | ) | | | | (90,507 | ) |

| Open Shares | | | | (9,395 | ) | | | | (1,247 | ) |

| Net decrease in net assets resulting from distributions | | | | (1,194,806 | ) | | | | (91,754 | ) |

| | | | | | | | | | | |

| Capital stock transactions | | | | | | | | | | |

| Net proceeds from sales | | | | | | | | | | |

| Institutional Shares | | | | 11,095,505 | | | | | 1,320,608 | |

| Open Shares | | | | 3,369,722 | | | | | 42,717 | |

| Net proceeds from reinvestment of distributions | | | | | | | | | | |

| Institutional Shares | | | | 1,185,411 | | | | | 90,507 | |

| Open Shares | | | | 9,395 | | | | | 1,247 | |

| Cost of shares redeemed | | | | | | | | | | |

| Institutional Shares | | | | (2,567,231 | ) | | | | (9,075,438 | ) |

| Open Shares | | | | (3,436,893 | ) | | | | (33,358 | ) |

| Net increase (decrease) in net assets from capital stock transactions | | | | 9,655,909 | | | | | (7,653,717 | ) |

| Total increase (decrease) in net assets | | | | 10,359,349 | | | | | (6,942,903 | ) |

| Net assets at beginning of period | | | | 9,345,650 | | | | | 16,288,553 | |

| Net assets at end of period | | | $ | 19,704,999 | | | | $ | 9,345,650 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 31

| | | Lazard

Enhanced Opportunities Portfolio | |

| | | Year Ended

December 31, 2020 | | | Year Ended

December 31, 2019 | |

| Shares issued and redeemed | | | | | | | | | | |

| | | | | | | | | | | |

| Institutional Shares | | | | | | | | | | |

| Shares outstanding at beginning of period | | | | 1,043,282 | | | | | 1,948,553 | |

| Shares sold | | | | 1,253,802 | | | | | 155,988 | |

| Shares issued to shareholders from reinvestment of distributions | | | | 130,284 | | | | | 10,308 | |

| Shares redeemed | | | | (286,518 | ) | | | | (1,071,567 | ) |

| Net increase (decrease) | | | | 1,097,568 | | | | | (905,271 | ) |

| Shares outstanding at end of period | | | | 2,140,850 | | | | | 1,043,282 | |

| | | | | | | | | | | |

| Open Shares | | | | | | | | | | |

| Shares outstanding at beginning of period | | | | 13,910 | | | | | 12,624 | |

| Shares sold | | | | 402,978 | | | | | 4,922 | |

| Shares issued to shareholders from reinvestment of distributions | | | | 1,035 | | | | | 142 | |

| Shares redeemed | | | | (399,564 | ) | | | | (3,778 | ) |

| Net increase (decrease) | | | | 4,449 | | | | | 1,286 | |

| Shares outstanding at end of period | | | | 18,359 | | | | | 13,910 | |

The accompanying notes are an integral part of these financial statements.

32 Annual Report

The Lazard Funds, Inc. Financial Highlights

LAZARD ENHANCED OPPORTUNITIES PORTFOLIO

Selected data for a share

of capital stock outstanding | Year Ended | |

| throughout each period | 12/31/20 | | 12/31/19 | | 12/31/18 | | 12/31/17 | | 12/31/16 | |

| Institutional Shares | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 8.84 | | | $ | 8.31 | | | $ | 8.67 | | | $ | 9.16 | | | $ | 8.89 | |

| Income (Loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | 0.20 | | | | 0.10 | | | | 0.06 | | | | 0.11 | ^ | | | 0.05 | |

| Net realized and unrealized gain (loss) | | | 0.69 | | | | 0.52 | | | | (0.20 | ) | | | 0.40 | | | | 0.35 | |

| Total from investment operations | | | 0.89 | | | | 0.62 | | | | (0.14 | ) | | | 0.51 | | | | 0.40 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.22 | ) | | | — | | | | (0.10 | ) | | | (0.17 | ) | | | (0.08 | ) |

| Net realized gains | | | (0.38 | ) | | | (0.09 | ) | | | (0.12 | ) | | | (0.83 | ) | | | (0.05 | ) |

| Total distributions | | | (0.60 | ) | | | (0.09 | ) | | | (0.22 | ) | | | (1.00 | ) | | | (0.13 | ) |

| Net asset value, end of period | | $ | 9.13 | | | $ | 8.84 | | | $ | 8.31 | | | $ | 8.67 | | | $ | 9.16 | |

| Total Return (b) | | | 10.11 | % | | | 7.44 | % | | | –1.66 | % | | | 5.56 | %^ | | | 4.50 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 19,537 | | | $ | 9,223 | | | $ | 16,184 | | | $ | 15,206 | | | $ | 14,077 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 2.23 | % | | | 2.71 | % | | | 2.36 | % | | | 2.78 | %^ | | | 1.79 | % |

| Gross expenses | | | 3.79 | % | | | 5.52 | % | | | 3.80 | % | | | 5.02 | %^ | | | 3.60 | % |

| Gross expenses, excluding expenses on securities sold short | | | 2.82 | % | | | 4.06 | % | | | 2.71 | % | | | 3.45 | % | | | 3.51 | % |

| Net investment income (loss) | | | 2.22 | % | | | 1.19 | % | | | 0.73 | % | | | 1.20 | % | | | 0.57 | % |

| Portfolio turnover rate: | | | | | | | | | | | | | | | | | | | | |

| Excluding securities sold short | | | 167 | % | | | 272 | % | | | 312 | % | | | 210 | % | | | 247 | % |

| Including securities sold short | | | 241 | % | | | 354 | % | | | 409 | % | | | 310 | % | | | 340 | % |

The accompanying notes are an integral part of these financial statements.

Annual Report 33

Selected data for a share

of capital stock outstanding | Year Ended | |

| throughout each period | 12/31/20 | | 12/31/19 | | 12/31/18 | | 12/31/17 | | 12/31/16 | |

| Open Shares | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 8.82 | | | $ | 8.30 | | | $ | 8.65 | | | $ | 9.15 | | | $ | 8.89 | |

| Income (Loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | 0.16 | | | | 0.10 | | | | 0.04 | | | | 0.10 | ^ | | | 0.04 | |

| Net realized and unrealized gain (loss) | | | 0.70 | | | | 0.51 | | | | (0.19 | ) | | | 0.37 | | | | 0.33 | |

| Total from investment operations | | | 0.86 | | | | 0.61 | | | | (0.15 | ) | | | 0.47 | | | | 0.37 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.17 | ) | | | — | | | | (0.08 | ) | | | (0.14 | ) | | | (0.06 | ) |

| Net realized gains | | | (0.38 | ) | | | (0.09 | ) | | | (0.12 | ) | | | (0.83 | ) | | | (0.05 | ) |

| Total distributions | | | (0.55 | ) | | | (0.09 | ) | | | (0.20 | ) | | | (0.97 | ) | | | (0.11 | ) |

| Net asset value, end of period | | $ | 9.13 | | | $ | 8.82 | | | $ | 8.30 | | | $ | 8.65 | | | $ | 9.15 | |

| Total Return (b) | | | 9.83 | % | | | 7.33 | % | | | –1.80 | % | | | 5.16 | %^ | | | 4.13 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 168 | | | $ | 123 | | | $ | 105 | | | $ | 117 | | | $ | 112 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 2.45 | % | | | 2.83 | % | | | 2.60 | % | | | 3.01 | %^ | | | 2.07 | % |

| Gross expenses | | | 4.94 | % | | | 13.76 | % | | | 14.49 | % | | | 16.40 | %^ | | | 15.58 | % |

| Gross expenses, excluding expenses on securities sold short | | | 3.99 | % | | | 12.30 | % | | | 13.40 | % | | | 14.85 | % | | | 15.46 | % |

| Net investment income (loss) | | | 1.75 | % | | | 1.10 | % | | | 0.48 | % | | | 1.06 | % | | | 0.45 | % |

| Portfolio turnover rate: | | | | | | | | | | | | | | | | | | | | |

| Excluding securities sold short | | | 167 | % | | | 272 | % | | | 312 | % | | | 210 | % | | | 247 | % |

| Including securities sold short | | | 241 | % | | | 354 | % | | | 409 | % | | | 310 | % | | | 340 | % |

| ^ | A one-time voluntary reimbursement by the administrator increased the net investment income per share amount of $0.04 per share. For Institutional Shares and Open Shares, the one-time voluntary reimbursement by the administrator increased the total return ratio by 0.49%, decreased the gross expense and net expense ratios by 0.44% and increased the net investment income (loss) ratio by 0.44%. |

| (a) | Net investment income (loss) has been computed using the average shares method. |

| (b) | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio may have been waived or reimbursed by the Investment Manager, State Street or DST; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. |

The accompanying notes are an integral part of these financial statements.

34 Annual Report

The Lazard Funds, Inc. Notes to Financial Statements

December 31, 2020

1. Organization

The Lazard Funds, Inc. was incorporated in Maryland on May 17, 1991 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. As of December 31, 2020, the Fund was comprised of thirty no-load portfolios (each referred to as a “Portfolio”). This report includes only the financial statements of the Lazard Enhanced Opportunities Portfolio (“Enhanced Opportunities”). The financial statements of the other twenty-nine Portfolios are presented separately.

The Portfolio is operated as a “non-diversified” fund, as defined in the 1940 Act.

The Portfolio currently offers Institutional Shares and Open Shares. Each share class is identical except as to minimum investment requirements; the services offered to, and expenses borne by, each class; and the availability of Service Payments (as defined in the Fund’s prospectus).

2. Significant Accounting Policies

The accompanying financial statements are presented in conformity with GAAP. The Fund is an investment company and therefore applies specialized accounting guidance in accordance with Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements:

(a) Valuation of Investments—Equity securities traded on a securities exchange or market, including exchange-traded option contracts, rights and warrants, are valued at the last reported sales price (for US listed equity securities) or the closing price (for non-US listed equity securities) on the exchange or market on which the security is principally traded or, for securities trading on the NASDAQ National Market System (“NASDAQ”), the NASDAQ Official Closing Price. If there is no available closing price for a non-US listed equity security, the last reported sales price is used. If there are no reported sales of a security on the valuation date, the security is valued at the most recent quoted bid price on such date reported by such principal exchange or market. Futures

Annual Report 35

contracts are valued at the settlement price on the exchange on which the contract is principally traded. Over-the-counter swap agreements are valued by an independent pricing service and centrally cleared swaps are valued at the last reported sale on the clearing exchange. Forward currency contracts generally are valued using quotations from an independent pricing service. Investments in money market funds are valued at the fund’s net asset value (“NAV”) per share.

Bonds and other fixed-income securities that are not exchange-traded are valued on the basis of prices provided by independent pricing services which are based on, among other things, trading in securities with similar characteristics, brokers’ quotations and/or a matrix system which considers such factors as other security prices, yields and maturities.

Calculation of the Portfolio’s NAV may not take place contemporaneously with the determination of the prices of portfolio assets used in such calculation. Trading on certain non-US securities exchanges or markets, such as those in Europe and Asia, ordinarily may be completed before the close of business on each business day in New York (i.e., a day on which the New York Stock Exchange (the “NYSE”) is open). In addition, securities trading in a particular non-US country or countries, may not take place on all business days in New York and on which the NAV of the Portfolio is calculated.

If a significant event materially affecting the value of securities occurs between the close of the exchange or market on which the security is principally traded and the time when the Portfolio’s NAV is calculated, or when current market quotations otherwise are determined not to be readily available or reliable (including restricted or other illiquid securities such as certain derivative instruments), such securities will be valued at their fair value as determined by, or in accordance with procedures approved by, the Fund’s Board of Directors (the “Board”). The fair value of non-US securities may be determined with the assistance of an independent pricing service using correlations between the movement of prices of such securities and indices of US securities and other appropriate indicators, such as closing market prices of

36 Annual Report

relevant American Depositary Receipts (“ADRs”) or futures contracts. Certain non-US securities may trade on days when the Portfolio is not open for business, thus affecting the value of the Portfolio’s assets on days when Portfolio shareholders may not be able to buy or sell Portfolio shares.

The Valuation Committee of the Investment Manager, which is subject to the oversight of the Board, may evaluate a variety of factors to determine the fair value of securities for which market quotations are determined not to be readily available or reliable. These factors include, but are not limited to, the type of security, the value of comparable securities, observations from financial institutions and relevant news events. Input from the Investment Manager’s portfolio management team also will be considered.

The effect of using fair value pricing is that the NAV of the Portfolio will reflect the affected securities’ values as determined in the judgment of the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price securities may result in a value that is different from the most recent closing price of a security and from the prices used by other investment companies to calculate their portfolios’ NAVs.

(b) Portfolio Securities Transactions and Investment Income—Portfolio securities transactions are accounted for on trade date. Realized gain (loss) on sales of investments are recorded on a specific identification basis. Dividend income and dividend expenses on short sales are recorded on the ex-dividend date except for certain dividends from non-US securities where the dividend rate is not available. In such cases, the dividend is recorded as soon as the information is received by the Portfolio. Interest income, if any, is accrued daily. The Portfolio amortizes premiums and accretes discounts on fixed-income securities using the effective yield method.

The Portfolio may be subject to taxes imposed by non-US countries in which it invests. Such taxes are generally based upon income earned or capital gains (realized and/or unrealized). If applicable, the Portfolio accrues and applies such taxes to net investment income, net realized gains and net unrealized gains

Annual Report 37

concurrent with the recognition of income earned or capital gains (realized and/or unrealized) from the applicable portfolio securities.

(c) Foreign Currency Translation and Forward Currency Contracts—The accounting records of the Fund are maintained in US dollars. Portfolio securities and other assets and liabilities denominated in a foreign currency are translated daily into US dollars at the prevailing rates of exchange. Purchases and sales of securities, income receipts and expense payments are translated into US dollars at the prevailing exchange rates on the respective transaction dates.

The Portfolio does not isolate the portion of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in their market prices. Such fluctuations are included in net realized and unrealized gain (loss) on investments.