UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| |

Filed by the Registrant ý Filed by a Party other than the Registrant ¨ |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240. 14a-12 |

|

| | | | |

| STATE AUTO FINANCIAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

STATE AUTO FINANCIAL CORPORATION

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

Date and Time: Friday, May 11, 2018, at 11:00 a.m., local time

Place: State Auto Financial Corporation's principal executive offices, 518 East Broad Street, Columbus, Ohio 43215

Items of Business: At the 2018 Annual Meeting of Shareholders, shareholders will consider and vote on the following matters:

| |

| 1. | Election of three Class III directors, each to hold office for a three-year term and one Class II director to hold office for a two-year term (the remaining term for that class of directors) and in each case until a successor is elected and qualified; |

| |

| 2. | Ratification of the selection of Ernst & Young LLP as State Auto Financial Corporation's independent registered public accounting firm for 2018; |

| |

| 3. | Non-binding and advisory vote on the compensation of State Auto Financial Corporation's Named Executive Officers as disclosed in the Proxy Statement for the 2018 Annual Meeting of Shareholders; and |

| |

| 4. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Record Date: State Auto Financial Corporation shareholders as of the close of business on March 16, 2018, will be entitled to vote at the 2018 Annual Meeting of Shareholders and any adjournment of the meeting.

Delivery of Proxy Materials: We will first mail the Notice of Internet Availability of Proxy Materials to our shareholders on or about March 26, 2018. On or about the same day, we will begin mailing paper copies of our proxy materials to shareholders who have requested them.

Voting: Your vote is very important to us. We hope you will attend the 2018 Annual Meeting of Shareholders in person. Whether or not you attend in person, please, as soon as possible, indicate your voting instructions by telephone, via the Internet or by mailing your signed proxy card in the enclosed return envelope, which requires no postage, if the Proxy Statement was mailed to you. If you attend the meeting and wish to vote, you may withdraw any previously-voted proxy.

|

| |

| | By Order of the Board of Directors |

| | |

| | MELISSA A. CENTERS |

| | Secretary |

| | |

| Dated: March 26, 2018 | |

PROXY STATEMENT TABLE OF CONTENTS

STATE AUTO FINANCIAL CORPORATION

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. Defined terms used in this summary have the meanings given to such terms elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider in voting your common shares, and you should read the entire Proxy Statement carefully before voting. For more complete information regarding State Auto Financial Corporation's ("STFC" or "the Company") performance for the fiscal year ended December 31, 2017 ("2017 fiscal year"), please review the Company's Annual Report on Form 10-K for the 2017 fiscal year.

|

| | |

| 2018 ANNUAL MEETING OF SHAREHOLDERS |

Date and Time May 11, 2018, 11:00 a.m. local time | Place 518 East Broad Street Columbus, Ohio 43215 | Record Date You may vote if you were a shareholder of record at the close of business on March 16, 2018 |

|

| | | | |

| VOTING MATTERS AND BOARD RECOMMENDATIONS |

The following table summarizes the proposals to be voted upon at the 2018 Annual Meeting of Shareholders and the Board's recommendations with respect to each proposal.

|

| | | |

| Proposal | | Board Vote Recommendation | Page Reference (for more detail) |

| Proposal 1 | Election of Directors | FOR each Nominee | |

| Proposal 2 | Ratification of Ernst & Young LLP as the Company's Independent Registered Public Accounting Firm | FOR | |

| Proposal 3 | Advisory Vote to Approve Compensation of Company's Named Executive Officers | FOR | |

Our Board of Directors is not aware of any matter that will be presented for a vote at the 2018 Annual Meeting of Shareholders other than those shown above.

State Automobile Mutual Insurance Company ("State Auto Mutual") owns approximately 60.6% of the outstanding common shares of STFC. State Auto Mutual has expressed an intention to vote FOR each of the voting matters listed above.

|

| | |

| How to Vote |

: Internet | Visit the applicable voting website (www.proxyvote.com) until 11:59 p.m. Eastern Standard Time on May 10, 2018. |

( Telephone | Within the United States, United States Territories and Canada, call 1-800-690-6903 until 11:59 p.m. Eastern Standard Time on May 10, 2018. |

, Mail | Complete, sign, date and return your proxy card or voting instruction form in the self-addressed envelope provided. Documents returned by mail must be received by May 10, 2018. |

? In Person | Attend the 2018 Annual Meeting of Shareholders. |

|

| | | | | | | | | | | | |

| Name | | Age | | STFC Director Since | | Principal Occupation | | Independent Yes No | | Current Committee Memberships* | | Other Public Company Boards |

| Michael J. Fiorile | | 63 | | 2015 | | Chairman and Chief Executive Officer of The Dispatch Printing Co. | | ü | | N&G and Risk | | Beasley Media Group, LLC |

| Michael E. LaRocco | | 61 | | 2015 | | Chairman, President and Chief Executive Officer of STFC | | ü | | I&F | | None |

| Eileen A. Mallesch | | 62 | | 2010 | | Retired | | ü | | Audit, Comp, and Indep | | Fifth Third Bancorp and Libbey Inc. |

| Setareh Pouraghabagher | | 47 | | 2017 | | Faculty at California Polytechnic State University's Orfalea College of Business | | ü | | Audit, Indep, N&G and Risk | | None |

| | | | | | | | | | | | | |

| *Audit = Audit Committee; Comp = Compensation Committee; Indep = Independent Committee; I&F = Investment and Finance Committee; N&G = Nominating and Governance Committee; Risk = Risk Committee |

|

| | | | |

| DIRECTORS CONTINUING IN OFFICE |

|

| | | | | | | | | | | | |

| Name | | Age | | STFC Director Since | | Principal Occupation | | Independent Yes No | | Current Committee Memberships* | | Other Public Company Boards |

| Robert E. Baker | | 71 | | 2007 | | Executive Vice President of DHR International, Inc. | | ü | | Audit and Comp | | None |

| Kym M. Hubbard | | 60 | | 2016 | | Retired | | ü | | Audit, Comp, Indep and I&F | | None |

| Thomas E. Markert | | 60 | | 2007 | | Executive | | ü | | Comp, Indep, N&G and Risk | | None |

David R. Meuse Lead Director | | 72 | | 2006 | | Senior Advisor of Stonehenge Partners Corp. | | ü | | Audit, Indep and I&F | | None |

| S. Elaine Roberts | | 65 | | 2002 | | Retired | | ü | | Comp, Indep, N&G and Risk | | None |

| | | | | | | | | | | | | |

| *Audit = Audit Committee; Comp = Compensation Committee; Indep = Independent Committee; I&F = Investment and Finance Committee; N&G = Nominating and Governance Committee; Risk = Risk Committee |

|

| | | | |

| CORPORATE GOVERNANCE HIGHLIGHTS |

|

| | | | | |

| § | 8 of our 9 directors are independent | § | Independent Lead Director | § | Policy prohibiting hedging of Company shares |

| § | Audit Committee is comprised only of independent directors | § | All current directors own Company common shares or restricted share units | § | No shareholder rights plan or "poison pill" |

| § | Compensation Committee is comprised only of independent directors | § | Annual Board and Committee self-evaluations | § | Majority voting policy for incumbent directors |

| § | Nominating and Governance Committee is comprised only of independent directors | § | Stock ownership guidelines for directors and executive officers | § | Restrictions on pledging Company shares by directors and executive officers |

| § | Risk Committee is comprised only of independent directors | § | Annual advisory vote on executive compensation | § | Mandatory retirement age for directors |

| § | Compensation "clawback" obligations imposed on Named Executive Officers | § | Over 94% average Board and Committee meeting attendance in 2017 | § | No super majority vote of shareholders to approve amendments to charters or bylaws (approved by two-thirds of the Board) |

| § | Board participation in executive succession planning | § | 4 of our 9 directors are women | § | Risk oversight by full Board and committees |

Our 2017 results (on a GAAP basis unless otherwise noted) include:

|

| | | | | |

| § | Pre-tax income of $33.4 million, which represented an increase of $14.2 million compared to 2016 | § | Net written premium of $1,269.3 million, which represented a 1.9% decrease compared to 2016 | § | Stock price increased approximately 8.6% from December 31, 2016, to December 31, 2017 |

| § | Net investment income of $78.8 million, which represented a 5.5% increase compared to 2016 | § | Combined ratio of 107.7%, which represented a 1.5 point increase compared to 2016 | § | Dividends paid per share of $0.40 |

| § | Favorable development of prior accident year losses and loss expenses of $46.6 million compared to adverse development of $27.0 million in 2016. | § | Statutory personal insurance segment combined ratio of 102.4%, which represented a 0.6 point improvement compared to 2016 | § | Book value per share of $20.76 at December 31, 2017, which represented a decrease of $0.55 per share from December 31, 2016 |

| § | Net loss of $10.7 million, which represented a decrease of $31.7 million from 2016. 2017 results included a provisional net charge of $36.4 million due to the revaluation of our deferred tax assets | § | Statutory commercial insurance segment combined ratio of 102.6%, which represented a 5.1 point improvement compared to 2016 | § | Return on average equity of (1.2)%, which represented a 3.6 point decrease compared to 2016 |

|

| | | | |

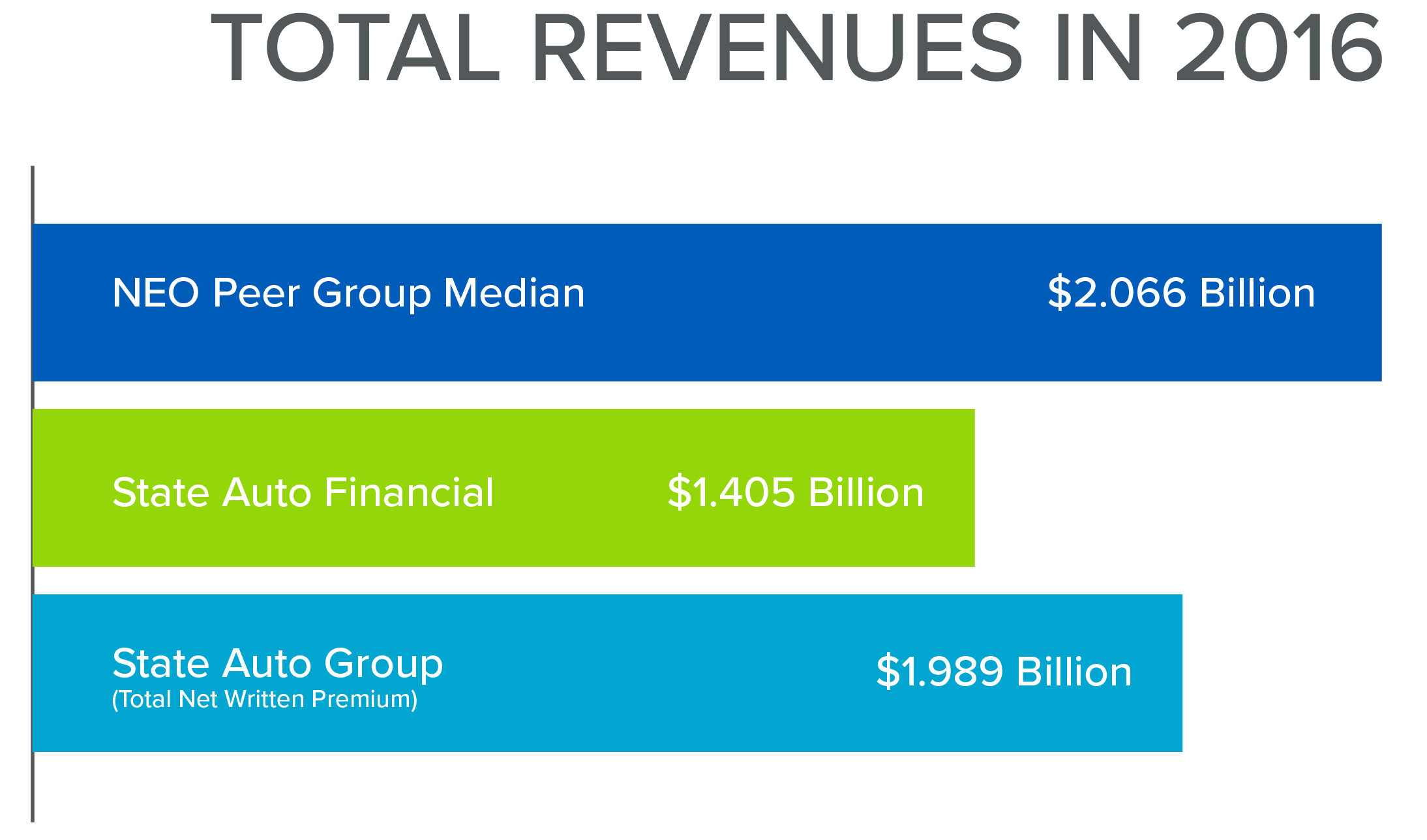

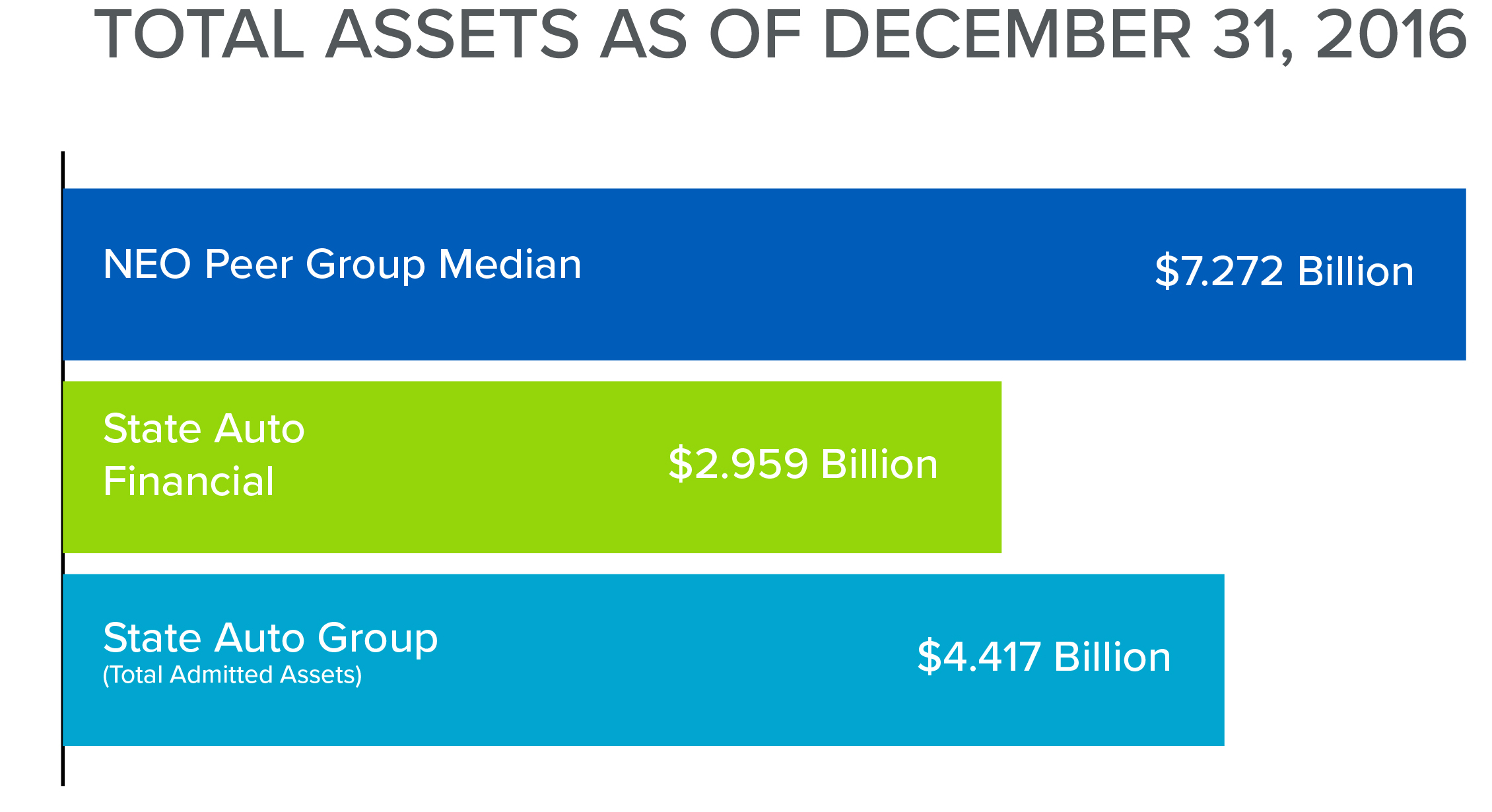

| IMPACT OF STATE AUTO GROUP ON 2017 COMPENSATION OF NEOs |

Because our Named Executive Officers ("NEOs") perform services for the Company, State Auto Mutual and other members of the State Auto Group1, we generally allocated the compensation expenses in 2017 for such services 65% to the Company and its subsidiaries and 35% to State Auto Mutual and certain of its subsidiaries and affiliates.

|

| | | | |

| 2017 EXECUTIVE COMPENATION HIGHLIGHTS |

| |

| • | Base Salary. The salaries of our NEOs increased on average by 5.5% in 2017, which is consistent with the practices of other financial services and insurance companies. |

| |

| • | Short-Term Cash Compensation. None of the NEOs earned a performance bonus award for 2017 under the State Auto Financial Corporation One Team Incentive Plan ("OTIP"). |

| |

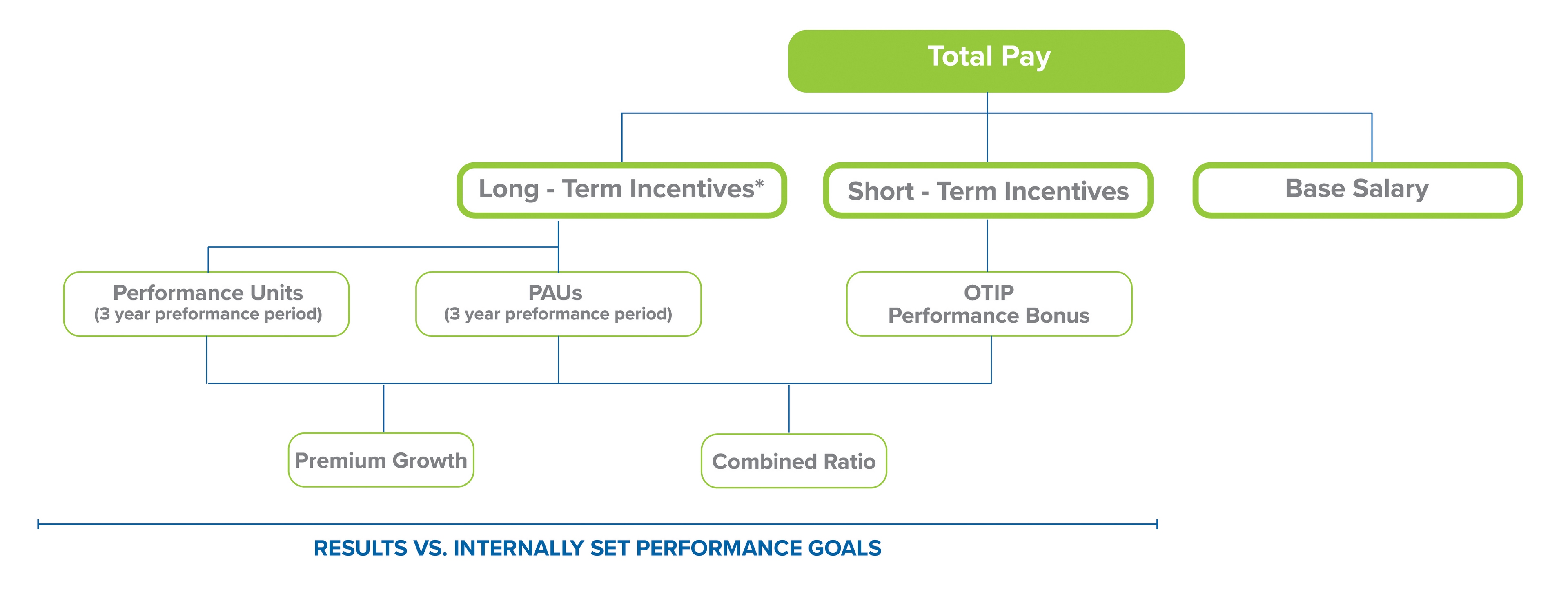

| • | Long -Term Incentive Compensation. In 2017, we awarded performance units and cash-based performance award units ("PAUs") to our NEOs under the State Auto Financial Corporation 2017 Long-Term Incentive Plan ("2017 Long-Term Incentive Plan"). The performance units and PAUs will vest and be earned, if at all, after the completion of the performance period, which is the three-year period from January 1, 2017, through December 31, 2019, based on our net written premium growth and combined ratio during the performance period. |

Based on the approval of the "say-on-pay" vote at our 2017 Annual Meeting of Shareholders (by more than 99% of the votes cast), the Compensation Committee did not make any changes to our executive compensation program as a result of the 2017 "say-on-pay" vote.

1 The State Auto Group refers to (1) the insurance subsidiaries of State Auto Financial Corporation: State Auto Property & Casualty Insurance Company ("State Auto P&C"), Milbank Insurance Company ("Milbank") and State Auto Insurance Company of Ohio ("SAOH") and to (2) State Automobile Mutual Insurance Company ("State Auto Mutual") and its insurance subsidiaries and affiliates: State Auto Insurance Company of Wisconsin ("SAWI"), Meridian Security Insurance Company ("Meridian"), Patrons Mutual Insurance Company of Connecticut ("Patrons"), Rockhill Insurance Company ("RIC"), Plaza Insurance Company ("Plaza"), American Compensation Insurance Company ("ACIC") and Bloomington Compensation Insurance Company ("BCIC").

|

| | | | |

| PRIMARY COMPONENTS OF OUR 2017 EXECUTIVE COMPENSATION PROGRAM |

|

| | | | |

| Component | | Form | | Key Features |

| Base Salary | | Cash | | Intended to attract and retain top-caliber executives. Generally based on the median level of base salary for the executive in our competitive market, but may vary based on the executive's scope of responsibility or unique skills or expertise. |

| Short-Term Incentive | | Cash | | Intended to: (i) provide incentives and rewards to executives who achieve performance goals and strategic objectives that significantly contribute to long-term profitable growth; (ii) focus executives on the key measures we believe will drive superior performance and increase shareholder value over the long term; and (iii) assist us in recruiting and retaining highly talented executives by providing competitive total rewards. Payouts determined based on net written premium growth and combined ratio over a one-year performance period. Payouts range from 0% of target payout, if we fail to meet the minimum performance goals for both of the performance measures, to 300% of target payout, if we achieve the maximum performance goals for both of the performance measures. |

| Performance Award Units | | Cash | | Intended to: (i) more effectively incentivize our executives by providing significant upside potential to our executives, if they deliver exceptional results; (ii) better focus our executives on achieving profitable growth, which the Compensation Committee believes to represent the most critical result for delivering long-term success and shareholder value; and (iii) be more consistent with structure of the OTIP performance bonus awards and the performance unit awards, which the Compensation Committee believes will solidify our One Team structure. Payouts determined based on net written premium growth and combined ratio over a three-year performance period. Payouts range from 0% of target payout, if we fail to meet the minimum performance goals for both of the performance measures, to 500% of target payout, if we achieve the maximum performance goals for both of the performance measures. Represented 50% of the total long-term incentive opportunity awarded to each executive in 2017. |

| Performance Units | | Equity | | Intended to: (i) more effectively incentivize our executives by providing significant upside potential to our executives, if they deliver exceptional results; (ii) better focus our executives on achieving profitable growth, which the Compensation Committee believes to represent the most critical result for delivering long-term success and shareholder value; (iii) be more consistent with structure of the OTIP performance bonus awards and the PAU awards, which the Compensation Committee believes will solidify our One Team structure; and (iv) further our focus on pay-for-performance. Payouts determined based on net written premium growth and combined ratio over a three-year performance period. Payouts range from zero performance units, if we fail to meet the minimum performance goals for both of the performance measures, to 500% of the target number of performance units, if we achieve the maximum performance goals for both of the performance measures. Represented 50% of the total long-term incentive opportunity awarded to each executive in 2017.

|

| Perquisites | | Cash; Benefits | | Intended to attract and retain top-caliber executives. Are limited in value and participation. |

The portion of the performance-based compensation awarded to our NEOs for 2017 performance is determined by the results we and the State Auto Group achieve with respect to certain financial measures. See below the "Compensation Discussion and Analysis" section of this Proxy Statement for more information regarding our executive compensation program and the performance-based compensation awarded to our NEOs in 2017.

QUESTIONS AND ANSWERS ABOUT THE

2018 ANNUAL MEETING OF SHAREHOLDERS AND VOTING

|

| | | | |

| Why Did I Receive a Notice of Internet Availability of Proxy Materials in the Mail Instead of a Full Set of Printed Proxy Materials? |

Pursuant to rules adopted by the Securities and Exchange Commission ("SEC"), we are making our proxy materials available to our shareholders electronically via the Internet. On or about March 26, 2018, we will mail the Notice of Internet Availability of Proxy Materials to our shareholders who held shares at the close of business on the record date, other than those shareholders who previously requested paper delivery of communications from us. The Notice of Internet Availability of Proxy Materials contains instructions on how to access an electronic version of our proxy materials, including this Proxy Statement and our 2017 Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the 2017 fiscal year. The Notice of Internet Availability of Proxy Materials also contains instructions on how to request a paper copy of this Proxy Statement, including a form of proxy. We believe this process will allow us to provide you with the information you need in a timely manner, while conserving natural resources and lowering the costs of printing and distributing our proxy materials.

|

| | | | |

| Why Did I Receive These Proxy Materials? |

You received these proxy materials because the Board of Directors is soliciting a proxy to vote your shares at the 2018 Annual Meeting of the Shareholders (the "Annual Meeting"). This Proxy Statement contains information we are required to provide to you under the SEC rules and is intended to assist you in making an informed vote.

All properly executed written proxies and all properly completed proxies submitted by telephone or Internet that are delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with the directions given in the proxy, unless the proxy is revoked before the completion of voting at the Annual Meeting.

A proxy is your legal designation of another person to vote the stock you own. The Board of Directors has designated Michael E. LaRocco and, in the event he is unable to act, Melissa A. Centers and Steven E. English to act as the proxy for the Annual Meeting.

The record date for the Annual Meeting is March 16, 2018 (the "Record Date"). The Record Date is established by the Board of Directors as required by Ohio law. Only shareholders of record at the close of business on the Record Date are entitled to: (a) receive notice of the Annual Meeting and (b) vote at the Annual Meeting and at any adjournment of the meeting.

Each shareholder of record on the Record Date is entitled to one vote for each common share held. On the Record Date, there were 42,852,237 common shares outstanding.

|

| | | | |

| What is the Difference Between a Shareholder of Record and a Shareholder Who Holds Common Shares in Street Name? |

If your common shares are registered in your name with the Company's transfer agent, you are considered a "shareholder of record" of those shares. Alternatively, if your common shares are held for you in the name of your broker, bank or other similar organization, your shares are held in "street name." If your shares are held in "street name," you are the beneficial owner of those shares and the organization is the "shareholder of record," not you.

It is important that you vote your shares if you are a shareholder of record and, if you hold shares in street name, you provide appropriate voting instructions to your broker, bank or other similar institutions as discussed in the answer below to "Will My Shares Be Voted if I Do Not Provide My Proxy or Voting Instructions?"

|

| | | | |

| What Are the Different Methods I Can Use to Vote My Shares of Common Shares? |

By Telephone or Internet: All shareholders of record may vote their common shares by telephone (within the United States, U.S. territories and Canada, there is no charge for the call) or by the Internet, using the procedures and instructions described in the proxy card and other enclosures. Street name holders may vote by telephone or the Internet, if their brokers, bankers or other similar institutions make those methods available. If that is the case, each broker, bank or other similar institution will enclose instructions with the proxy card.

In Writing: All shareholders may vote by mailing their completed and signed proxy card (in the case of shareholders of record) or their completed and signed voting instruction form (in case of street name holders).

In Person: All shareholders of record may vote in person at the Annual Meeting. Street name holders must obtain a legal proxy from their broker, bank or other similar institution and bring the legal proxy to the Annual Meeting in order to vote in person.

It is our long-standing practice to hold the votes of each shareholder in confidence from directors, officers and associates, except: (a) as necessary to meet applicable legal requirements and to assert or defend claims for or against the Company; (b) in the case of a contested proxy solicitation; (c) if a shareholder makes a written comment on the proxy card or otherwise communicates his or her vote to the Company; or (d) to allow the inspectors of election to certify the results of the vote.

|

| | | | |

| Who Will Count the Votes Case at the Annual Meeting? |

The Company will appoint one or more inspectors of election to serve at the Annual Meeting. The inspectors of election for the Annual Meeting will determine the number of votes cast by holders of common shares for all matters. Preliminary voting results will be announced at the Annual Meeting, if practicable, and final results will be announced when certified by the inspectors of election.

|

| | | | |

| How Can I Find the Voting Results of the Annual Meeting? |

We will include the voting results in a Current Report on Form 8-K, which we will file with the SEC no later than four business days following the completion of the Annual Meeting. We will amend this filing to include final results if the inspectors of election have not certified the results by the time the original Current Report on Form 8-K is filed.

|

| | | | |

| What Happens if I Do Not Specify a Choice For a Matter When Returning A Proxy? |

Shareholders should specify their voting choice for each matter on the accompanying proxy card. If you sign and return your proxy card, yet do not make a specific choice for one or more matters, unvoted matters will be voted (1) "FOR" the election of the nominees listed in this proxy statement as Class III and Class II directors; (2) "FOR" the ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2018; and (3) "FOR" the approval of the compensation of the Company's Named Executive Officers as disclosed in this Proxy Statement.

|

| | | | |

| What Does it Mean if I Receive More Than One Proxy Card? |

It means you have multiple accounts with brokers and/or our transfer agent. Please vote all of the shares represented by each proxy card. We recommend you contact your broker or our transfer agent to consolidate as many accounts as possible under the same address. Our transfer agent is Computershare.

|

| | | | |

| Will My Shares Be Voted if I Do Not Provide My Proxy or Voting Instructions? |

Shareholders of Record: If you are a shareholder of record, your shares will not be voted if you do not provide your proxy unless you vote in person at the Annual Meeting. It is, therefore, important you vote your shares.

Street Name Holders: If your shares are held in street name and you do not provide your voting instructions to your bank, broker or other similar institution, your shares will be voted by your broker, bank or similar institution only under certain circumstances. In general, banks, brokers and other similar institutions have discretionary voting authority on behalf of their customers with respect to "routine" matters when they do not receive timely voting instructions from their customers. Banks, brokers and other similar institutions do not have discretionary voting authority on behalf of their customers with respect to "non-routine" matters, and a broker non-vote occurs when a broker does not receive voting instructions from its customer on a non-routine matter.

Only the ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm is considered a "routine" matter for which brokers, banks or other similar institutions may vote uninstructed shares. The other proposals to be voted on at the Annual Meeting are considered "non-routine" matters, so the broker, bank or other similar institution cannot vote your shares on any of the other proposals unless you provide the broker, bank or other similar institution voting instructions for each of these matters. If you do not provide voting instructions on a non-routine matter, your shares will not be voted on that matter, which is referred to as a "broker non-vote." It is, therefore, important that you vote your shares.

|

| | | | |

| Are Abstentions and Broker Non-Votes Counted? |

Abstentions and broker non-votes on one or more matters to be voted on at the Annual Meeting will not be considered votes cast and, therefore, will not affect the outcome of the vote on those matters at the Annual Meeting.

|

| | | | |

| How Can I Revoke a Proxy or Change My Vote? |

If you are a shareholder of record, you can revoke a proxy or change your vote before the completion of voting at the Annual Meeting by: (a) giving written notice to the Company's Corporate Secretary by e-mail to corporatesecretary@stateauto.com or in writing to the Corporate Secretary at our principal executive offices, 518 East Broad Street, Columbus, Ohio 43215; (b) delivering a later-dated proxy; or (c) voting in person at the meeting.

If your shares are held in a street name, you should follow the instructions provided by your broker, bank or other similar institution to revoke or change your voting instructions.

|

| | | | |

| Who Will Pay For the Cost of the Proxy Solicitation? |

We will bear the cost of solicitation of proxies. In addition to the use of the mail, proxies may be solicited personally, by telephone or electronic mail. Proxies may be solicited by our directors, officers and regular associates, who will not receive any additional compensation for their solicitation services. We will reimburse banks, brokers and nominees for their out-of-pocket expenses incurred in sending proxy material to the beneficial owners of shares held by them. If there are follow-up requests for proxies, we may employ other persons for such purpose.

|

| | | | |

| Who Can Attend the 2018 Annual Meeting? |

Only shareholders who owned shares as of the record date are permitted to attend the Annual Meeting. If you hold your shares through a broker, bank or similar institution, you may attend the Annual Meeting only if you bring a legal proxy or a copy of the statement (such as a brokerage statement) from your broker, bank or other record owner reflecting your stock ownership as of the record date. Additionally, in order to be admitted to the Annual Meeting, all shareholders who are not associates of the State Auto Group must present a government-issued picture identification to verify their identity.

|

| | | | |

| May Shareholders Ask Questions at the Annual Meeting? |

Yes. Michael E. LaRocco, our Chairman, President and Chief Executive Officer, will answer shareholders' questions during the question and answer period of the Annual Meeting. In order to provide an opportunity for everyone who wishes to ask a question, each shareholder will be limited to two minutes. Shareholders may ask a second question if all others have first had their turn and if time allows. When speaking, shareholders must direct questions to the Chairman and confine their questions to matters that directly relate to the business of the Annual Meeting.

|

| | | | |

| How Many Votes Must Be Present to Hold the Annual Meeting? |

In order for us to conduct the Annual Meeting, a majority of the Company's outstanding common shares as of the record date for the meeting (March 16, 2018), must be present in person or by proxy at the Annual Meeting. This is referred to as a quorum.

Your shares are counted as present at the Annual Meeting if you attend the meeting and vote in person or if you properly return a proxy by Internet, telephone or mail.

Abstentions and shares of record held by a broker, bank or other similar institution ("broker shares") that are voted on any matter are also included in determining the number of shares present. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

PROPOSAL ONE: ELECTION OF DIRECTORS

|

| | | | |

| Nominees for Class III and Class II Directors |

The number of directors is currently fixed at nine. Our Board of Directors is divided into three classes: Class I, Class II and Class III, with three directors in each class. The term of office of directors in one class expires annually at each annual meeting of shareholders at such time as their successors are elected and qualified. Directors in each class are elected for three-year terms.

The term of office of the Class III directors expires concurrently with the holding of the Annual Meeting. Michael J. Fiorile, Michael E. LaRocco and Eileen A. Mallesch, all recommended by the Nominating and Governance Committee of our Board of Directors, have been nominated for election as Class III directors at the Annual Meeting for a three-year term expiring at the 2021 annual meeting of shareholders. Mr. Fiorile, Mr. LaRocco and Ms. Mallesch are incumbent Class III directors.

Setareh Pouraghabagher was appointed by the Board of Directors in June of 2017 to fill a vacancy among the Class II directors, in accordance with the Company's Code of Regulations. In accordance with our Code of Regulations and Corporate Governance Guidelines, our shareholders will be given the opportunity to elect Ms. Pouraghabagher as a director at our Annual Meeting. On the recommendation of the Nominating and Governance Committee, our Board has nominated Ms. Pouraghabagher for election as a Class II director at the Annual Meeting for a two-year term (the remaining term for that class of directors), expiring at the 2020 annual meeting of shareholders.

Each of the nominees has consented to being named in this Proxy Statement and to serve if elected. In the event any nominee named below is unable to serve (which is not anticipated), the persons named in the proxy may vote for another nominee of their choice.

Proxies cannot be voted at the Annual Meeting for a greater number of persons than the four nominees named in this Proxy Statement.

|

| | | | |

| Board Recommendation |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH OF THE THREE NOMINEES NAMED BELOW AS CLASS III DIRECTORS AND "FOR" THE ELECTION OF THE PERSON NAMED BELOW AS A NOMINEE FOR CLASS II DIRECTOR. |

|

| | | | |

| Backgrounds of Class III Directors Nominees (Terms expiring in 2021) |

|

| |

| Michael J. Fiorile | |

| Age: 63 |

STFC Director Since: 2015 |

Committees Served in 2017: Nominating and Governance (Chair) and Risk (Chair) |

Mr. Fiorile has also been a director of State Auto Mutual since 2003. Mr. Fiorile has served as Chairman and Chief Executive Officer of The Dispatch Printing Company, a privately owned, regional broadcast media and real estate company, since July 2016. Prior to taking his current position with The Dispatch Printing Company, Mr. Fiorile served as the company's Vice Chairman and Chief Executive Officer from September 2015 until July 2016; as its President and Chief Executive Officer from January 2013 until September 2015; as its President and Chief Operating Officer from January 2008 until January 2013; and as its President from January 2005 until January 2008. He also serves as Chairman and Chief Executive Officer of the company's subsidiary, Dispatch Broadcast Group, which includes television and radio stations. He has held several executive positions within Dispatch Broadcast Group since 1994. Mr. Fiorile also serves on the board of directors of the Beasley Media Group, LLC, a publicly traded owner/operator of radio stations based in Naples, Florida.

Mr. Fiorile has been nominated for election as a director because of his extensive experience as a senior executive of a privately held corporation, in particular his management experience with the operation of regulated entities. Mr. Fiorile also brings his extensive experience and familiarity with the State Auto Group.

|

| |

| Michael E. LaRocco | |

| Age: 61 |

STFC Director Since: 2015 |

Committees Served in 2017: Investment and Finance |

Mr. LaRocco has been a director and President and Chief Executive Officer of the Company since May 2015 and Chairman of the Company since January 2016. Mr. LaRocco has also served as President and Chief Executive Officer of State Auto P&C, Milbank and SAOH, each a wholly owned subsidiary of the Company, since May 2015, and as Chairman of State Auto P&C, Milbank and SAOH since January 2016. Mr. LaRocco has served as President, Chief Executive Officer and a director of State Auto Mutual since May 2015. Prior to joining the State Auto Group, Mr. LaRocco was with Business Insurance Direct, LLC ("BID"), an online seller of general liability and property insurance to small businesses, from December 2011 until April 2015. From January 2013 to July 2014, he was Chief Executive Officer of AssureStart Insurance Agency LLC ("AssureStart"), an online seller of general liability and property insurance to small businesses. BID had owned a minority interest in AssureStart until selling its interest to the majority owner of AssureStart in December 2014. Mr. LaRocco served as President and Chief Executive Officer of Fireman's Fund Insurance Company, a property and casualty insurance company, from March 2008 to July 2011. Previously, he was an executive for Safeco Insurance Companies, which are property and casualty insurance companies, from July 2001 to July 2006.

Mr. LaRocco has been nominated for election as a director because of his extensive and valuable experience gained over his career in the property and casualty insurance industry, including underwriting, sales, marketing, general management and many years as a senior executive of property and casualty insurance companies. In addition, he brings valuable experience in strategic planning, leadership development, product development and online marketing.

|

| |

| Eileen A. Mallesch | |

| Age: 62 |

STFC Director Since: 2010 |

Committees Served in 2017: Audit (Chair), Compensation, and Independent |

Ms. Mallesch served as Senior Vice President and Chief Financial Officer of Nationwide Property and Casualty Insurance Company from November 2005 until her retirement in December 2009. She served as Senior Vice President and Chief Financial Officer of Genworth Life Insurance Company from April 2003 to November 2005. Prior to that, she was Vice President and Chief Financial Officer of General Electric Financial Employer Services Group from September 2000 to April 2003. Ms. Mallesch also serves as a director of the following publicly traded companies: Fifth Third Bancorp and Libbey Inc.

Ms. Mallesch has been nominated for election as a director because of her extensive knowledge and experience in the areas of auditing, finance, enterprise risk management, taxation and mergers and acquisitions, particularly in the insurance industry. Ms. Mallesch qualifies as an "audit committee financial expert" under the SEC and Nasdaq Rules. She also brings gender diversity to the Board and is a Certified Public Accountant and NACD Governance Fellow.

|

| | | | |

| Background of Class II Director Nominee (Term Expiring in 2020) |

|

| |

| Setareh Pouraghabagher |

| Age: 47 |

STFC Director Since: 2017 |

Committees Served in 2017: Audit, Independent, Nominating and Governance, and Risk |

Ms. Pouraghabagher currently serves as a faculty member and executive partner at California Polytechnic State University's Orfalea College of Business. Prior to joining the University in January 2015, Ms. Pouraghabagher served as the Chief Administrative Officer of QBE Insurance of North America, a top 20 global public insurer, from June 2011 until November 2013. She also served in chief roles of finance and operations for Balboa Insurance, a division of Bank of America, from June 2008 until June 2011, and previously a division of Countrywide, from September 2002 until June 2008. Before starting her career in the insurance industry, Ms. Pouraghabagher served as Vice President, Finance & Administration for Xavor Corporation, a private technology services provider for enterprise eBusiness customers, from September 2000 until July 2002 and as Chief Financial Officer and Controller for Wellspring Solutions, Inc., a private software technology company, from October 1997 until September 2000. Ms. Pouraghabagher began her career in 1994 at Deloitte as a Senior Accountant.

Ms. Pouraghabagher has been nominated for election as a director because of her executive leadership experience and extensive knowledge and experience in the areas of finance, enterprise risk management, accounting, strategy, talent management, and mergers and acquisitions, particularly in the insurance industry. Ms. Pouraghabagher qualifies as an "audit committee financial expert" under the SEC and Nasdaq Rules. She also brings gender and geographic diversity to the Board and is a Certified Public Accountant.

|

| | | | |

| Backgrounds of Continuing Class I Directors (Terms expiring in 2019) |

|

| |

| Robert E. Baker | |

| Age: 71 |

STFC Director Since: 2007 |

Committees Served in 2017: Audit and Compensation (Chair) |

Mr. Baker has also been a director of State Auto Mutual since March 2015. Mr. Baker has served as Executive Vice President of DHR International, Inc., an executive search firm, since June 2010. Mr. Baker was President of Puroast Coffee Inc., a maker of specialty coffee products, from 2004 until accepting his current position. He served as Vice President of Corporate Marketing for ConAgra Foods, Inc., one of North America’s largest packaged food companies, from 1999 to 2004. Mr. Baker was a director of CoolBrands International Inc., a publicly traded Canadian corporation focused on the manufacturing and marketing of ice cream and frozen snack products, from February 2006 to November 2007. He was also a director of Natural Golf Corporation, a publicly traded company offering golf instruction and equipment, from 2004 to 2006.

Mr. Baker was last nominated in 2016 to serve as a director because of his experience as a senior executive of both publicly traded and privately held companies and his former experience as a director of publicly traded companies. He also brings racial and geographic diversity to the Board. In addition, Mr. Baker brings significant expertise in compensation, marketing, strategic planning and branding to the Board.

|

| |

| Kym M. Hubbard | |

| Age: 60 |

STFC Director Since: 2016 |

Committees Served in 2017: Audit, Independent, Compensation, and Investment and Finance |

Ms. Hubbard served as Treasurer, Chief Investment Officer, and Global Investment Head of Ernst & Young LLP, a global assurance, tax and advisory services company, from July 2008 until her retirement in April 2016. Prior to joining Ernst & Young LLP, Ms. Hubbard served as the Executive Director of the Illinois Finance Authority, a component unit of the State of Illinois that provides capital access services for non-profit and for-profit entities in Illinois, from April 2006 until July 2008. Ms. Hubbard has also served as a Trustee for PIMCO Funds, PIMCO Variable Insurance Trust and PIMCO EFT Trust since February 2017.

Ms. Hubbard was last nominated in 2017 to serve as a director because of her extensive knowledge and experience in the areas of investments and finance. She also brings gender, racial and geographic diversity to the Board.

|

| |

| Thomas E. Markert | |

| Age: 60 |

STFC Director Since: 2007 |

Committees Served in 2017: Compensation, Independent (Chair), Nominating and Governance, and Risk |

Mr. Markert is an executive in the fields of marketing, branding and market research. Mr. Markert served as the Chief Executive Officer of ORC International, one of the world's leading market research companies, from November 2016 until January 2018. Prior to that, he served as Executive Vice President of Research Now Group, Inc., a global online sampling and online data collection company, from August 2014 until November 2015; as the Chief Executive Officer of Digital Tailwind LLC, a digital marketing agency, from April 2012 until May 2014; as an officer of the Business Solutions Division of Office Depot, Inc., a global supplier of office products and services, from May 2008 until April 2012; as Chief Executive Officer of Ipsos Loyalty Worldwide, a division of Ipsos, a leading global provider of survey-based research, from May 2007 to May 2008; and as Global Chief Marketing and Client Service Officer of ACNielsen, a leading global provider of marketing research and information services, from January 2004 until May 2007. Mr. Markert has also served on the board of directors of True Value Company, a retailer-owned wholesaler of hardware and related products, since April 2013.

Mr. Markert was last nominated in 2016 to serve as a director because of his experience as a senior executive of both publicly traded and privately held companies. He also brings geographic diversity to the Board. In addition, Mr. Markert brings significant expertise in traditional and digital marketing, social media, branding and market research to the Board.

|

| | | | |

| Backgrounds of Continuing Class II Directors (Terms Expiring in 2020) |

|

| |

| David R. Meuse | |

| Age: 72 |

STFC Director Since: 2006 |

Committees Served in 2017: Audit, Independent, and Investment and Finance (Chair) |

Mr. Meuse has served as the Company's Lead Director since 2015. Mr. Meuse has served as a Senior Advisor of Stonehenge Partners Corp., a privately held provider of financial and advisory resources, since July 2016. From September 1999 until July 2016, Mr. Meuse was a Principal of Stonehenge Partners Corp. Prior to that time, Mr. Meuse held executive positions at various investment banking firms, including Banc One Capital Holdings Corporation and Meuse, Rinker, Chapman, Endres & Brooks.

Mr. Meuse was Chairman of Diamond Hill Investment Group, Inc., a publicly traded company providing investment advisory and fund administration services, from August 2000 to April 2011. Mr. Meuse also serves on the board of directors of several privately held companies and non-profit organizations.

Mr. Meuse was last nominated in 2017 to serve as a director because of his experience as a senior executive, his former experience as a director of publicly traded companies and his knowledge with acquisitions and divestitures. In addition, Mr. Meuse brings significant expertise in investments, investment management, and financial market matters to the Board.

|

| |

| S. Elaine Roberts | |

| Age: 65 |

STFC Director Since: 2002 |

Committees Served in 2017: Compensation, Independent, Nominating and Governance, and Risk |

Ms. Roberts served as President and Chief Executive Officer of the Columbus Regional Airport Authority, a public port authority which oversees the operations of John Glenn Columbus International, Rickenbacker International and Bolton Field airports, in Ohio from January 2003 until her retirement in December 2017.

Ms. Roberts was last nominated in 2017 to serve as a director because of her experience as a senior executive, in particular her senior management experience with the operation of a regulated entity. Ms. Roberts also has a legal background as an attorney, and she brings gender diversity to the Board.

|

| | | | |

| Majority Voting Policy for Incumbent Directors |

Our Board of Directors has adopted a majority voting policy for incumbent directors (the "Majority Voting Policy") which is reflected in our Corporate Governance Guidelines. The Majority Voting Policy provides, if a nominee for director who is an incumbent director does not receive the vote of at least the majority of the votes cast at any meeting for the election of directors at which a quorum is present, and no successor has been elected at such meeting, then that incumbent director will promptly tender his or her resignation to the Board of Directors. For purposes of the Majority Voting Policy, a majority of votes cast means the number of common shares voted "for" a director's election exceeds 50% of the number of votes cast with respect to that director's election or, in the case where the number of nominees exceeds the number of directors to be elected, cast with respect to election of directors generally. Votes cast (i) include votes to withhold authority in each case; and (ii) exclude abstentions with respect to that director's election or, in the case where the number of nominees exceeds the number of directors to be elected, abstentions with respect to election of directors generally. The Nominating and Governance Committee will make a recommendation to our Board of Directors as to whether to accept or reject the tendered resignation, or whether other action should be taken. Our Board of Directors will act on the tendered resignation, taking into account the Nominating and Governance Committee's recommendation, and publicly disclose (by a press release, a filing with the SEC or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision within 90 days from the date of the certification of the election results. The Nominating and Governance Committee, in making its recommendation, and our Board of Directors, in making its decision, may each consider any factors or other information the Nominating and Governance Committee or Board, as the case may be, considers appropriate and relevant. The director who tenders his or her resignation will not participate in the recommendation of the Nominating and Governance Committee or the decision of our Board of Directors with respect to his or her resignation. If such incumbent director's resignation is not accepted by our Board of Directors, such director will continue to serve until the next annual meeting and until his or her successor is duly elected, or his or her earlier resignation or removal. If a director's resignation is accepted by our Board of Directors, then our Board of Directors, in its sole discretion, may fill any resulting vacancy pursuant to the provisions of our Code of Regulations and Corporate Governance Guidelines.

PROPOSAL TWO: RATIFICATION OF SELECTION OF ERNST & YOUNG LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Company's Board of Directors has selected Ernst & Young LLP as the Company's independent registered public accounting firm for 2018. Ernst & Young LLP has served as the Company's independent registered public accounting firm since 1994.

|

| | | | |

| Reasons for Shareholder Approval; Board Recommendation |

The Audit Committee and the Board of Directors believe the appointment of Ernst & Young LLP for 2018 is appropriate because of the firm's reputation, qualifications and experience. Although not required, the Board of Directors is submitting the selection of Ernst & Young LLP to the Company's shareholders for ratification as a matter of good corporate practice.

The favorable vote of a majority of the outstanding common shares present at the Annual Meeting is required to approve the ratification of the selection of Ernst & Young LLP. Abstentions on this Proposal will have the same effect as a vote against it. Proposal Two is considered a routine matter on which a broker or other nominee has discretionary authority to vote. Accordingly, brokers, banks and other similar institutions may vote unrestricted shares of their clients on this Proposal.

The Audit Committee will reconsider the appointment of Ernst & Young LLP if its selection is not ratified by the Company's shareholders. Even if the selection of Ernst & Young LLP is ratified by shareholders, the Audit Committee, in its discretion, could decide to terminate the engagement of Ernst & Young LLP and to engage another independent registered public accounting firm if the Audit Committee determines such action to be in the best interests of the Company and our shareholders.

|

| | | | |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2018. |

PROPOSAL THREE: ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT

We are asking shareholders to approve, on a non-binding and advisory basis, the compensation of the Company's Named Executive Officers as disclosed in this Proxy Statement.

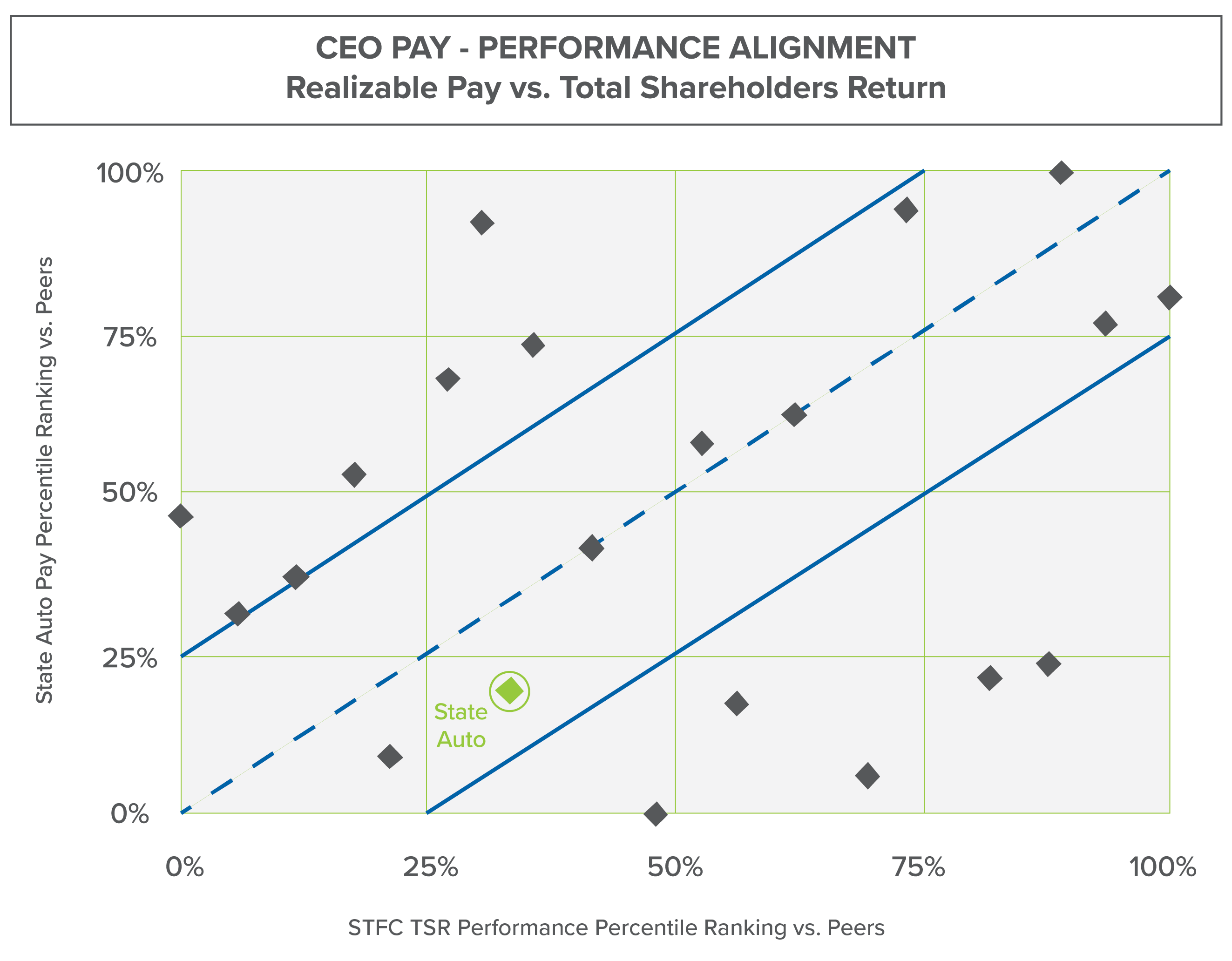

STFC's compensation policies and practices reward performance, support our business strategies and align our Named Executive Officers' interests with the long-term interests of our shareholders. The Board of Directors and the Compensation Committee believe the policies and practices articulated in the "Compensation Discussion and Analysis" section of this Proxy Statement are effective in achieving the objectives of our executive compensation program. The Board of Directors urges you to read the "Compensation Discussion and Analysis" section of this Proxy Statement, which describes in more detail how our executive compensation policies and practices operate and are designed to achieve the objectives of our executive compensation programs, as well as the tables, notes and narrative disclosure relating to the compensation of the Named Executive Officers, which provide detailed information on the compensation of our Named Executive Officers. We are asking shareholders to approve the following advisory resolution at the Annual Meeting:

RESOLVED, that the shareholders of the Company approve, on an advisory basis, the compensation of the Company's Named Executive Officers as disclosed in the Proxy Statement for the Company's 2018 Annual Meeting of Shareholders under the "Compensation Discussion and Analysis" section and the tables, notes and narrative disclosure relating to the compensation of the Named Executive Officers of the Company. |

| | | | |

| Reasons for Shareholder Approval; Board Recommendation |

This advisory vote on executive compensation is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the policies and practices described in this Proxy Statement. This vote on executive compensation is advisory and, therefore, is not binding on the Company, the Board of Directors or the Compensation Committee. However, the Board of Directors and the Compensation Committee will review and consider the voting results when making future decisions regarding our executive compensation program.

The favorable vote of a majority of the outstanding common shares voted on this advisory Proposal is required to approve the non-binding vote. Abstentions on the Proposal will have the same effect as not voting or expressing a preference, as the case may be. Abstentions and broker non-votes will not have a positive or negative effect on the outcome of this Proposal.

|

| | | | |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS. |

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

|

| | | | |

| Relationship with State Auto Mutual |

Our parent is State Auto Mutual, a mutual insurance company organized in 1921. State Auto Mutual currently owns approximately 60.6% of the outstanding common shares of STFC. In 1990, State Auto Mutual engaged in a corporate restructuring which, among other things, resulted in the formation of STFC as a wholly owned subsidiary of State Auto Mutual. In 1991, State Auto Mutual sold approximately 30% of its ownership interest in STFC in a public stock offering. While State Auto Mutual's ownership interest in STFC has declined since STFC's initial public offering, the State Auto Mutual Board has made public its determination that it is in the best interest of State Auto Mutual to maintain a majority ownership interest in STFC.

We qualify as a "controlled company" under the Nasdaq listing rules because State Auto Mutual owns more than a majority of the voting power for the election of our directors. A controlled company is exempt from a number of Nasdaq corporate governance requirements. Notwithstanding this qualification, our corporate governance operates in a manner consistent with that of a non-controlled company. For example, a majority of the members of our Board are independent directors as determined under the Nasdaq listing rules. See below "Directors—Director Independence." In addition, after careful independent consideration and evaluation by the Nominating and Governance Committees of both State Auto Mutual and STFC in 2014 (focused on the improvement of communications between the boards, enhanced knowledge transfer and sharing, cost saving and efficiency), two independent directors serve on both the State Auto Mutual and STFC boards. We and our subsidiaries operate and manage our businesses in conjunction with State Auto Mutual and its subsidiaries and affiliates under various management and cost sharing agreements under the leadership and direction of the same senior management team. In addition, our insurance subsidiaries participate in a pooling arrangement with State Auto Mutual and certain of its insurance subsidiaries and affiliates. This pooling arrangement covers all of the property and casualty insurance written by our insurance subsidiaries. See below "Related Person Transactions—Transactions Involving State Auto Mutual" for additional information concerning these intercompany agreements and arrangements. The primary responsibility of the Board of Directors is to foster the long-term success of the Company. In fulfilling this role, each director must exercise his or her best business judgment. The Board has responsibility for establishing broad corporate policies, setting strategic direction and overseeing management, which is responsible for the day-to-day operations of the Company and its subsidiaries and State Auto Mutual and its subsidiaries and affiliates. The Board has established committees to assist in fulfilling its oversight responsibilities.

We are managed under the direction of our Board in the interest of all shareholders. Our Board delegates its authority to our senior executive team to manage the day-to-day operations and ongoing affairs of our business. Our Board requires our senior executive team review major initiatives and actions with our Board prior to implementation.

Historically, because of our corporate structure, our Company and State Auto Mutual had a leadership structure whereby the same person served as both chairman and chief executive officer of both companies. However, in 2015 it was determined it was in the best interests of shareholders and policyholders to have a leadership structure whereby the parent company, State Auto Mutual, had an independent chairman and that the subsidiary, STFC, would be more effective and efficient with a combined chairman and chief executive officer. Accordingly, as of January 1, 2016, our Board elected Mr. LaRocco to serve as Chairman of the Board in addition to serving as our Chief Executive Officer. Conversely, the State Auto Mutual Board of Directors separated the duties of chairman and chief executive officer and elected James E. Kunk, an independent director, as its Chairman, with Mr. LaRocco continuing to serve as the Chief Executive Officer of State Auto Mutual.

Irrespective of whether or not the positions of chief executive officer and chairman are combined or separated, our Board has adopted a governance structure which includes:

| |

| • | A Board composed entirely of independent directors as determined under the Nasdaq listing rules, other than the Company's chief executive officer; |

| |

| • | A Board composed of a majority of directors independent from State Auto Mutual; |

| |

| • | An Independent Committee composed entirely of directors independent from State Auto Mutual and as determined under the Nasdaq listing rules; |

| |

| • | Audit and Compensation Committees composed entirely of independent directors as determined under the Nasdaq listing rules; and |

| |

| • | Established governance structures, processes and ethics guidelines. |

Under the historical structure our Board decided to maintain, we have a designated Lead Director. Our Lead Director's responsibilities include, among other things, leading the executive session of our independent directors, being a primary advisor to and principal point of contact with our chairman and chief executive officer, working with our chairman and soliciting input from other Board members to develop a regular board meeting schedule and an agenda for each meeting, securing input from other directors on agenda items, ensuring the adequate flow of information from management to our Board and delivering the chief executive officer's performance evaluation on behalf of the Compensation Committee of our Board. Our current Lead Director is David R. Meuse, who has served in such position since May of 2015.

Currently, there are nine directors. If all four nominees are elected directors at the Annual Meeting there will be nine directors on the Board.

The Board is committed to periodically reviewing the Board's composition to ensure they have the right mix of skills, experience and tenure. The Board believes each director contributes to the overall diversity by providing a variety of personal and professional experiences and backgrounds. The Board also believes, as shown below, the current directors and nominees reflect an appropriate diversity of gender, age, race, geographical background and experience.

|

| | | |

| DIRECTOR SKILLS AND EXPERIENCE |

| § | Regulated industries experience | § | Marketing and branding experience |

| § | Chief executive officer experience | § | Compensation and recruiting experience |

| § | Financial expertise, including chief financial officer experience | § | Property and casualty industry experience |

| § | Public company board experience | § | Risk management experience |

|

| | | | |

| Board Meetings and Attendance |

The Board holds regular meetings typically during the months of March, May, August and November, and holds special meetings when necessary. Our Board of Directors held four Board meetings during the fiscal year which ended December 31, 2017. In addition, on at least an annual basis, the Board and management discuss our strategic direction, succession planning, opportunities and threats to our industry.

Our Board meets in executive session, without management present, prior to each regular quarterly Board meeting. Consistent with our Corporate Governance Guidelines and the Nasdaq listing rules, during 2017 there were four executive sessions with only independent directors present. In addition, following each regular quarterly Board meeting, our Board meets in executive session with the State Auto Mutual Board of Directors, without management present. Our Corporate Governance Guidelines provide the Lead Director acts as the presiding director at these executive sessions.

Directors are expected to attend Board meetings, meetings of the Committees on which they serve and the annual meeting of shareholders, with the understanding that on occasion a director may be unable to attend a meeting. Six of our current directors attended 100% of the Board meetings and the meetings of all committees on which they served. Two other current directors attended over 90% of the Board meetings and the meetings of all committees on which they served. One other director attended over 83% of the Board meetings and the meetings of all committees on which she served. The Company's Corporate Governance Guidelines provide directors are expected to attend our annual meetings of shareholders. All of our directors who were members of the Board at the time of last year's annual meeting of shareholders attended that meeting.

|

| | | | |

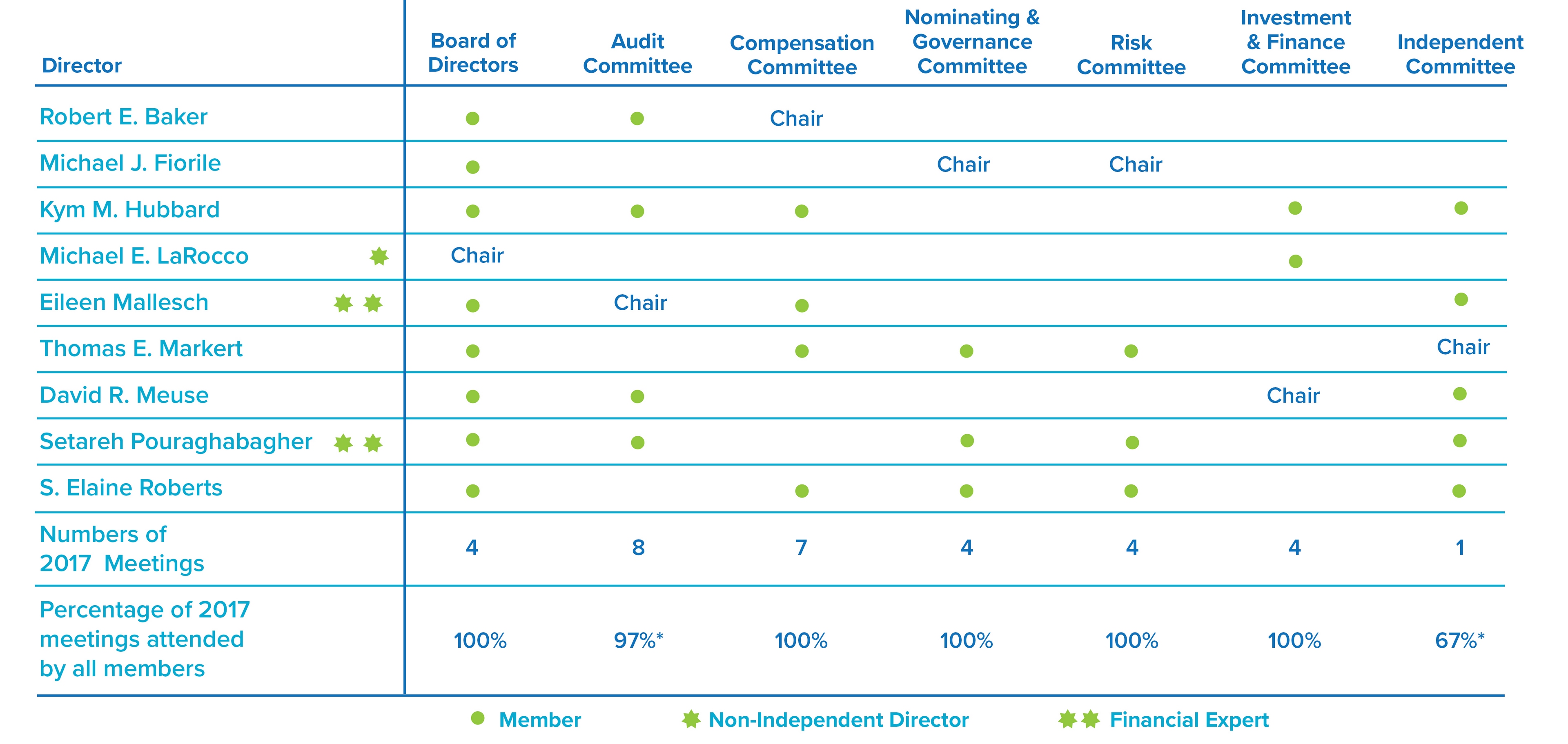

| Committees of the Board of Directors |

Our Board has established an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, a Risk Committee, an Investment and Finance Committee and a standing Independent Committee. All of the members of the Audit, Compensation, Nominating and Governance, Risk and Independent Committees are independent as determined by the Nasdaq listing rules. In addition, all of the members of the Audit and Compensation Committees are independent under the heightened standards of independence under the applicable rules of the SEC and Nasdaq. Finally, none of the members of the Independent Committee serve as directors of State Auto Mutual. Our Board has adopted charters for each of the foregoing committees. See below "Availability of Corporate Governance Documents." The table below shows the current chairs and membership of the Board and each standing board committee, the independent status of each Board member and the number of Board and Board committee meetings held in fiscal year 2017.

*Ms. Hubbard and Ms. Pouraghabagher attended all of the Board meetings but were unable to attend the Independent Committee meeting. Mr. Meuse attended all of the Board meetings but was unable to attend one Audit Committee meeting. All other Board members attended 100% of the Board meetings and committee meetings held while they were a member of the Board or committees.

Audit Committee

The Audit Committee is charged with several responsibilities, including: (1) appointment, compensation, evaluation, retention and oversight of the work performed by our independent registered public accounting firm; (2) reviewing our accounting functions, operations and management; (3) considering the adequacy and effectiveness of our internal controls and internal auditing methods and procedures; (4) meeting and consulting with our independent registered public accounting firm and with our financial and accounting personnel concerning the foregoing matters; (5) reviewing with our independent registered public accounting firm the scope of their audit and the results of their examination of our financial statements; (6) participating in the process of administering our Associate Code of Business Conduct, Code of Ethics for Senior Financial Officers, and our Board of Directors' Ethical Principles as set forth in our Corporate Governance Guidelines; (7) establishing procedures for receipt, retention and treatment of compliance regarding accounting, internal accounting controls or auditing matters, including procedures for the confidential, anonymous submission by associates of concerns regarding accounting or auditing matters; and (8) approving in advance any other work performed by our independent registered public accounting firm that it is permitted by law to perform for us. The Audit Committee also prepares the Report of the Audit Committee that SEC rules require the Company to include in this Proxy Statement. See below "Audit Committee Matters—Audit Committee Report for the Fiscal Year Ending December 31, 2017." Compensation Committee

The Compensation Committee is charged with several responsibilities, including: (1) evaluating and approving the compensation and fringe benefits provided to our executive officers and adopting compensation policies and practices that appropriately align pay and performance; (2) approving stock-based compensation plans and grants thereunder to associates or members of the Board; and (3) evaluating the compensation provided to the members of the Board and its committees.

Our executive officers also serve as executive officers of State Auto Mutual, and, in general, during 2017 the compensation expenses associated with our executive officers were allocated 65% to us and our subsidiaries and 35% to State Auto Mutual and its subsidiaries and affiliates under the Pooling Arrangement. See below "Related Person Transactions—Transactions Involving State Auto Mutual." It is for this reason the Board of Directors of State Auto Mutual has its own compensation committee. The members of the State Auto Mutual Compensation Committee attend meetings of our Compensation Committee with regard to the compensation and benefit matters applicable to our and their executive officers, and report on such matters to the State Auto Mutual Board of Directors. Present members of the State Auto Mutual compensation committee are Chairperson Robert E. Baker, Michael J. Fiorile, James E. Kunk and Dwight E. Smith. See below "Compensation Committee Matters." Nominating and Governance Committee

The Nominating and Governance Committee is charged with several responsibilities, including: (1) recommending nominees for election as directors; (2) reviewing the performance of our Board and individual directors; and (3) annually reviewing and recommending to our Board changes to our Corporate Governance Guidelines and Board of Directors' Ethical Principles. See below "Nomination of Directors." Risk Committee

The Risk Committee's purpose is to assist the Board in fulfilling its risk management oversight responsibilities, including oversight of the Company's enterprise risk management systems and processes. Some of the Risk Committee's chief duties include: (1) reviewing with management the Company's risk appetite statement; (2) monitoring and discussing with management the Company's major enterprise risk exposures and the strategies and programs addressing these exposures; and (3) discussing information and technology risks with management. See below "The Board's Role in Enterprise Risk Management." Investment and Finance Committee

The Investment and Finance Committee oversees our investment functions and those of our insurance subsidiaries. Its duties and responsibilities include considering and determining the Company's investment policy and guidelines to be recommended to the Board and upon approval from the Board, to be implemented by the Company. The Investment and Finance Committee ensures the investments and investment practices contemplated reflect the Company's objectives and constraints.

Independent Committee of STFC and State Auto Mutual

Both STFC and State Auto Mutual have standing Independent Committees. The members of the STFC Independent Committee must be independent from State Auto management and State Auto Mutual. Likewise, the members of the State Auto Mutual Independent Committee must be independent from State Auto management and STFC. The members of both Independent Committees must also be independent as determined under the Nasdaq listing rules.

These Independent Committees principally serve to review related person transactions between or among us and our subsidiaries, and State Auto Mutual and its subsidiaries and affiliates. Accordingly, before our Company and State Auto Mutual may enter into a related person transaction, each of these Independent Committees must separately review the agreement and separately recommend approval to their respective Boards. Also, each of these Independent Committees separately reviews, on an annual basis, related person transactions which by their terms contain no specific termination date or which renew automatically at the end of the current term, and each of these Independent Committees separately decides whether to recommend that their respective Boards approve the renewal of such related person transaction.

These Independent Committees also help to determine which entity, our Company or State Auto Mutual, is best suited to take advantage of transactional opportunities presented by a third party. In evaluating business opportunities, these Independent Committees may elect to meet jointly, but in any event it is understood that each Independent Committee must receive substantially identical information in making its respective evaluation of the business opportunity. In this context, our Independent Committee strives to vigorously protect the interests of STFC and its shareholders, considering only the merits of the proposal, free from extraneous considerations or influences. As part of the review process, each of these Independent Committees must separately evaluate the business opportunity and separately recommend approval to their respective Boards before the two Boards of Directors may vote on any joint recommendation to proceed with the business transaction.

|

| | | | |

| The Board's Role in Enterprise Risk Management |

Risk management activities include the development of strategies and implementation of actions intended to anticipate, identify, assess, monitor, mitigate and manage risks. Our Board views enterprise risk management as an integral part of our business and strategic planning.

Our senior management has direct responsibility for enterprise risk management. We utilize an enterprise risk management working committee comprised of our Chief Risk Officer ("CRO") and key members of management selected by State Auto senior executives representing the entire Company. The CRO reports the activities of the committee including escalating appropriate issues and recommendations to senior management and the Board’s Risk Committee.

Responsibilities of the enterprise risk working committee include providing guidance and support for development and refinement of the overall risk management program, including policies, procedures, systems, processes, ensuring best practices are periodically evaluated, agreed upon and implemented. Among other things, this Committee works with business units across the Company in carrying out its responsibility of anticipating, identifying, assessing, monitoring, mitigating and managing risks that could materially impact the Company, including its reputation, and the successful execution of its strategy.

Our Board's role in the process of enterprise risk management is one of oversight. The independent structure of our Board enables objective oversight of the process through a governance structure that includes our Board and senior management. Our Board has established a Risk Committee whose primary responsibility is to assist the Board in fulfilling its oversight responsibilities, including oversight of the Company's enterprise risk management systems and processes. The Risk Committee's charter specifies that the Risk Committee is responsible to review with management the Company's risk appetite, including quarterly reviews to measure compliance with the risk appetite. The charter also provides that the Risk Committee is responsible to monitor and discuss with management the Company's major enterprise risk exposures and the strategies and programs management has implemented or anticipates implementing into its practices, processes and control structure to address these exposures. The Risk Committee discusses with management at least annually information and technology risks, including business continuity and crisis management. Cyber security related risks are reviewed quarterly so the Risk Committee is aware of the Company's performance in this rapidly changing area. The Risk Committee annually reviews and evaluates the Risk Committee's own effectiveness in performing its enterprise risk management oversight duties. The Risk Committee provides quarterly reports on its enterprise risk oversight activities to our Board.

To assist the Risk Committee in discharging its duties under its charter, the enterprise risk management working committee provides quarterly reports which monitor the status of major risks inherent in our business, including credit, market, liquidity, underwriting, operational, strategic, legal, litigation, compliance and regulatory risks. In addition, the Risk Committee regularly meets with our CRO, who reports to the Chief Financial Officer. The CRO has direct access to the Risk Committee, including quarterly executive sessions without other members of management in attendance. Besides meeting with the CRO, the Risk Committee also meets periodically with other members of management as the Risk Committee deems appropriate.

Other Board committees provide enterprise risk management oversight in their specific areas of responsibility. The Risk Committee coordinates with these Board committees to avoid overlaps as well as potential gaps in overseeing the Company’s enterprise risk management.

The Audit Committee is responsible for oversight of risks related to accounting, auditing and financial reporting, establishing and maintaining effective internal controls, and the process for establishing insurance reserves. Management provides periodic reports on these and other related risks, and the Audit Committee meets periodically with our officers responsible for the adequacy of legal and regulatory compliance. The CRO and General Counsel have direct access to the Audit Committee, including quarterly executive sessions without other members of management in attendance.

The Investment and Finance Committee considers financial risks relevant to our investment portfolio and activities, including credit and market risks, capital management and availability, liquidity and financing arrangements.

The Compensation Committee oversees the risks related to human capital and people risk, including our compensation plans and arrangements. As required by its charter, the Compensation Committee annually reviews and monitors incentive compensation arrangements to confirm incentive pay policies and practices do not encourage unnecessary risk taking and are aligned with competitive market practices, utilizing our independent compensation consultant and outside legal counsel in this process. The Compensation Committee reviews and discusses, at least annually, the relationship between the Company's risk management policies and practices, corporate strategy and executive management compensation. Also, the Compensation Committee annually reviews and discusses with our Company's management any disclosures required by SEC rules and regulations relating to the Company's compensation risk management. This discussion includes, among other things, whether and the extent to which the Company compensates and incentivizes our associates in ways that may create risks that are reasonably likely to have a material adverse effect on the Company.

Risk Assessment in Compensation Programs

Following the Compensation Committee's review with senior management, our independent compensation consultant and outside legal counsel of potential risks within the compensation programs, the Compensation Committee has concluded no risks exist due to the compensation programs that are reasonably likely to have a material adverse effect on the Company.

Nomination of Directors