If this Letter of Transmittal is signed by a person or persons other than the registered holder or holders of Old Notes, the Old Notes must be endorsed or accompanied by appropriate powers of attorney, in either case signed exactly as the name or names of the registered holder or holders appear on the Old Notes and with the signatures guaranteed.

If this Letter of Transmittal or any Old Notes or powers of attorney are signed by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, the person should so indicate when signing and, unless waived by us, proper evidence satisfactory to us of such person’s authority to so act must be submitted.

4. Special Issuance Instructions. Tendering Holders of Old Notes should indicate in the applicable box the name and address to which New Notes issued pursuant to the Exchange Offer are to be issued, if different from the name or address of the person(s) signing this Letter of Transmittal. In the case of issuance in a different name, the employer identification or social security number(s) of the person(s) named must also be indicated. Holders tendering Old Notes may request that Old Notes not exchanged be credited to such account maintained at DTC as such Holder may designate herein. If no such instructions are given, such Old Notes not exchanged will be returned to the name and address of the person(s) signing this Letter of Transmittal.

5. Transfer Taxes. Except as otherwise provided in this Instruction 5, the Issuer will pay any transfer taxes with respect to the transfer of Old Notes to it or its order pursuant to the Exchange Offer. If, however, New Notes or substitute Old Notes not exchanged are to be delivered to or registered or issued in the name of, any person other than the registered Holder(s) of the Old Notes tendered hereby, or if tendered Old Notes are registered in the name of any person other than the person(s) signing this Letter of Transmittal, or if a transfer tax is imposed for any reason other than the transfer of Old Notes to the Issuer or its order pursuant to the Exchange Offer, the amount of any such transfer taxes (whether imposed on the registered Holder(s) or any other person) payable on account of the transfer to such person will be payable by the Holder(s) tendering hereby. If satisfactory evidence of payment of such taxes or exemption therefrom is not submitted herewith, the amount of such transfer taxes will be billed directly to such tendering Holder(s).

6. Waiver of Conditions. The Issuer reserves the absolute right to waive satisfaction of any or all conditions enumerated in the Prospectus.

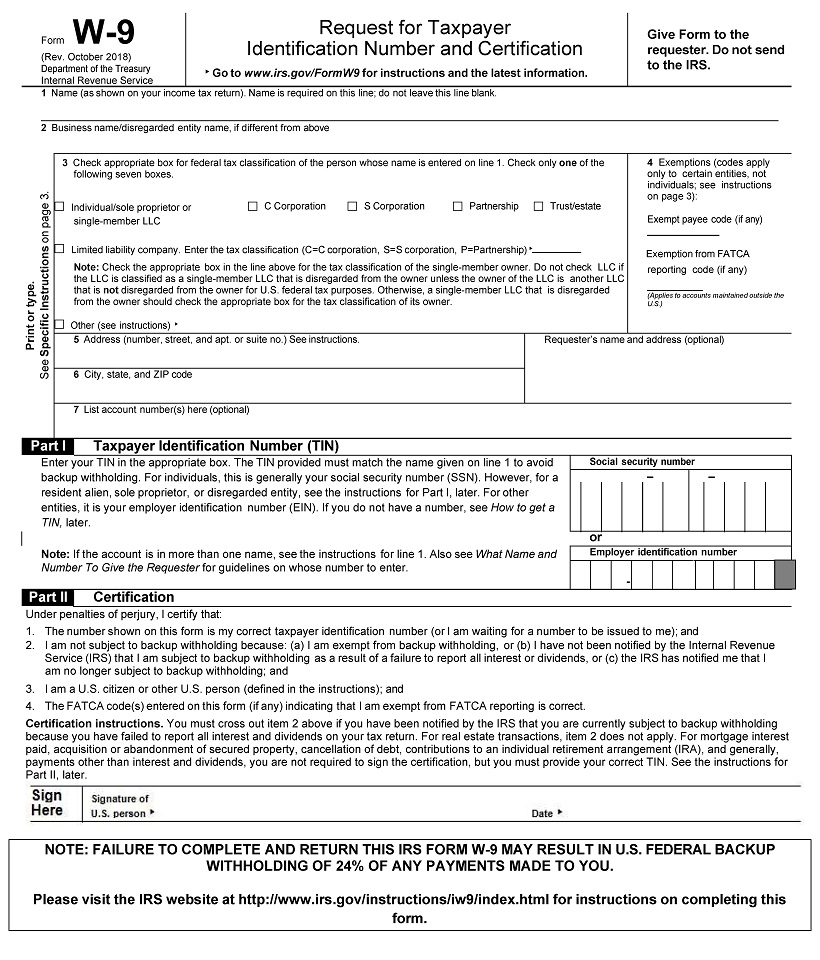

7. Taxpayer Identification Number; Backup Withholding; IRS Form W-9. U.S. federal income tax laws generally require that a tendering Holder that is a U.S. person (including a resident alien) provides the Exchange Agent with such Holder’s correct Taxpayer Identification Number (“TIN”) on IRS Form W-9, Request for Taxpayer Identification Number and Certification, below (the “IRS Form W-9”), which in the case of a Holder who is an individual, is his or her social security number. If the tendering Holder is a non-resident alien or a foreign entity, other requirements (as described below) will apply. If the Exchange Agent is not provided with the correct TIN or an adequate basis for an exemption from backup withholding, such tendering Holder may be subject to a $50 penalty imposed by the Internal Revenue Service (the “IRS”). In addition, failure to provide the Exchange Agent with the correct TIN or an adequate basis for an exemption from backup withholding may result in backup withholding on payments made to the tendering Holder pursuant to the Exchange Offer at a current rate of 24%. If withholding results in an overpayment of taxes, the Holder may obtain a refund from the IRS.

Exempt Holders of the Notes (including, among others, all corporations) are not subject to these backup withholding and reporting requirements. See the Instructions for the Requester of Form W-9 (the “W-9 Guidelines”) for additional instructions, which may be obtained via the IRS website at www.irs.gov.

To prevent backup withholding, each tendering Holder that is a U.S. person (including a resident alien) must provide its correct TIN by completing the IRS Form W-9 set forth below, certifying, under penalties of perjury, that such Holder is a U.S. person (including a resident alien), that the TIN provided is correct (or that such Holder is awaiting a TIN) and that (i) such Holder is exempt from backup withholding, (ii) such Holder has not been notified by the IRS that such Holder is subject to backup withholding as a result of a failure to report all interest or dividends, or (iii) the IRS has notified such Holder that such Holder is no longer subject to backup withholding. If the Old Notes are in more than one name or are not in the name of the actual owner, such Holder should consult the W-9 Guidelines for information on which TIN to report. If such Holder does not have a TIN, such Holder should consult the W-9 Guidelines for instructions on applying for a TIN, write “Applied For” in the space reserved for the TIN, as shown on IRS Form W-9. Note: Writing “Applied For” on the IRS Form W-9 means that such Holder has already applied for a TIN or that such Holder intends to apply for one in the near future. If such Holder does not provide its TIN to the Exchange Agent within 60 days, backup withholding will begin and continue until such Holder furnishes its TIN to the Exchange Agent.

10

Form W-9 Request for Taxpayer Identification Number and Certification (Rev. October 2018) Department of the Treasury Internal Revenue Service •Go to www.irs.gov/FormW9 for instructions and the latest information. 1 Name (as shown on your income tax return). Name is required on this line, do not leave this line blank. 2 Business name/disregarded entity name, if different from above 3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the following seven boxes. C Corporation s Corporation Partnership Trust’estate Individual/sole proprietor or single-member LLC Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) Note: Check the appropriate box in the line above for the tax classification of the single-member owner. Do not check LLC i the LLC is classified as a single-member LLC that is disregarded from the owner unless the owner of the LLC is another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a single-member LLC that is disregarded from the owner should check the appropriate box for the tax classification of its owner. Other (see instructions) 5 Address (number, street, and apt, or suite no.) See instructions. Requester’s name and address (optional) 6 City, state, and ZIP code 7 List account number(s) here (optional) Part I Taxpayer Identification Number (TIN) Social security number Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN, later. | or Employer identification number Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and Number To Give the Requester for guidelines on whose number to enter. Part II Certification Under penalties of perjury, I certify that 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and 3. I am a U.S. citizen or other U.S. person (defined in the instructions); and 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later. Sign Signature of Here U.S. person Date NOTE: FAILURE TO COMPLETE AND RETURN THIS IRS FORM W-9 MAY RESULT IN U.S. FEDERAL BACKUP WITHHOLDING OF 24% OF ANY PAYMENTS MADE TO YOU. Please visit the IRS website at http://www.irs.gov/instructions/iw9/index.html for instructions on completing this form. Print or type. See Specific Instructions on page 3. Give Form to the requester. Do not send to the IRS. 4 Exemptions (codes apply only to certain entises, not individuals; see instructions on page 3): Exempt payee code (if any)

Form W-9 Request for Taxpayer Identification Number and Certification (Rev. October 2018) Department of the Treasury Internal Revenue Service •Go to www.irs.gov/FormW9 for instructions and the latest information. 1 Name (as shown on your income tax return). Name is required on this line, do not leave this line blank. 2 Business name/disregarded entity name, if different from above 3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the following seven boxes. C Corporation s Corporation Partnership Trust’estate Individual/sole proprietor or single-member LLC Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) Note: Check the appropriate box in the line above for the tax classification of the single-member owner. Do not check LLC i the LLC is classified as a single-member LLC that is disregarded from the owner unless the owner of the LLC is another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a single-member LLC that is disregarded from the owner should check the appropriate box for the tax classification of its owner. Other (see instructions) 5 Address (number, street, and apt, or suite no.) See instructions. Requester’s name and address (optional) 6 City, state, and ZIP code 7 List account number(s) here (optional) Part I Taxpayer Identification Number (TIN) Social security number Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN, later. | or Employer identification number Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and Number To Give the Requester for guidelines on whose number to enter. Part II Certification Under penalties of perjury, I certify that 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and 3. I am a U.S. citizen or other U.S. person (defined in the instructions); and 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later. Sign Signature of Here U.S. person Date NOTE: FAILURE TO COMPLETE AND RETURN THIS IRS FORM W-9 MAY RESULT IN U.S. FEDERAL BACKUP WITHHOLDING OF 24% OF ANY PAYMENTS MADE TO YOU. Please visit the IRS website at http://www.irs.gov/instructions/iw9/index.html for instructions on completing this form. Print or type. See Specific Instructions on page 3. Give Form to the requester. Do not send to the IRS. 4 Exemptions (codes apply only to certain entises, not individuals; see instructions on page 3): Exempt payee code (if any)