UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-10804

XL GROUP LTD

(Exact name of registrant as specified in its charter)

|

| | |

Bermuda (State or other jurisdiction of incorporation or organization) | | 98-1304974 (I.R.S. Employer Identification No.) |

O'Hara House, One Bermudiana Road, Hamilton HM 08, Bermuda (Address of principal executive offices and zip code) | | (441) 292-8515 (Registrant's telephone number, including area code) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| common Shares, Par Value $0.01 per Share | | New York Stock Exchange |

| XLIT Ltd. 2.30% Senior Notes due 2018 | | New York Stock Exchange |

| XLIT Ltd. 5.75% Senior Notes due 2021 | | New York Stock Exchange |

| XLIT Ltd. 4.45% Subordinated Notes due 2025 | | New York Stock Exchange |

| XLIT Ltd. 5.25% Senior Notes due 2043 | | New York Stock Exchange |

| XLIT Ltd. 5.5% Subordinated Notes due 2045 | | New York Stock Exchange |

| XLIT Ltd. 3.25% Subordinated Notes due 2047 | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or a emerging growth company. See definition of "large accelerated filer, accelerated filer, smaller reporting company and emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨ Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with an new or reviewed financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity of the registrant held by non-affiliates of the registrant on June 30, 2017 was approximately $11.3 billion computed upon the basis of the closing sales price of the common shares on June 30, 2017. For purposes of this computation, common shares held by directors and officers of the registrant have been excluded. Such exclusion is not intended, nor shall it be deemed, to be an admission that such persons are affiliates of the registrant.

As of February 21, 2018, there were 256,915,044 outstanding common Shares, $0.01 par value per share, of the registrant.

XL GROUP LTD

TABLE OF CONTENTS

|

| | |

| | | Page |

| |

| | Explanatory Note | |

|

| Directors, Executive Officers and Corporate Governance | |

| Executive Compensation | |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Certain Relationships and Related Transactions, and Director Independence | |

| Principal Accountant Fees and Services | |

|

| Exhibits and Financial Statement Schedules | |

| | Signatures | |

| | | |

EXPLANATORY NOTE

XL Group Ltd (referred to as XL, the Company, we, our or us) is filing this Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to its Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was originally filed on February 23, 2018 (the “Original Form 10-K”) to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the above-referenced items to be incorporated by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year ended December 31, 2017.

On March 5, 2018, we announced that XL had entered into an agreement and plan of merger with AXA SA ("AXA"), under which AXA would acquire 100% of XL's common stock in exchange for cash proceeds in the aggregate of $15.3 billion (the "AXA transaction"). The AXA transaction is expected to close in the second half of 2018, subject to approval by XL's shareholders and other customary closing conditions, including the receipt of required regulatory approvals. For further information, see the Company's Current Report on Form 8-K filed on March 5, 2018.

Given the expected timing for the closing of the proposed AXA transaction, we are filing this Form 10-K/A to include Part III information because we do not intend to file a definitive proxy statement within the required time period. The impact of the AXA transaction on compensation arrangements has not been addressed in this Form 10-K/A. Except as otherwise specifically defined herein, all defined terms used in the Original Form 10-K shall have the same meanings in this Form 10-K/A.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), Items 10 through 14 of Part III of the Original Form 10-K are hereby amended and restated in their entirety. In addition, the Exhibit Index in Item 15 of Part IV of the Original Form 10-K is hereby amended and restated in its entirety to include the currently dated certifications required under Section 302 of the Sarbanes-Oxley Act of 2002, which are required to be filed as exhibits to this Form 10-K/A. Because no financial statements are contained within this Form 10-K/A, we are not filing currently dated certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as described above, this Form 10-K/A does not amend, modify or otherwise update any other information in the Original Form 10-K. Except as reflected herein, this Form 10-K/A speaks as of the original filing date of the Original Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the Original Form 10-K and with our filings with the SEC subsequent to the filing of the Original Form 10-K.

PART III

|

| | |

| ITEM 10. | | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Certain elements of the information required by this item relating to the executive officers of the Company may be found within Part I., Item 1. of the Original Form 10-K under the headings "Executive Officers of the Registrant." The balance of the information required by this item follows below.

Our Board of Directors

Our Board currently consists of 12 directors. We do not expect to hold an annual general meeting ("AGM") in 2018 if the AXA transaction is completed on the timeline currently contemplated. However, if the AXA transaction is delayed or terminated such that a 2018 AGM is required, with the exception of Mr. Nevels, each Director's term will end immediately following the date of our 2018 AGM unless re-elected. As previously announced, Mr. Nevels has notified the Company that he will not stand for re-election at the 2018 AGM.

|

| | | |

| RAMANI AYER |

| | | |

Age: 70 Director Since:

February 2011 Committees:

Compensation (Chair) Governance CSR Sub-Committee

Risk and Finance | Career Highlights > Chairman of the board of directors and Chief Executive Officer, The Hartford Financial Services Group Inc. (“The Hartford”), a (re)insurance company (February 1997–October 2009) |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Current member, and former Chairman, of the board of the Hartford Healthcare Corporation > Vice Chairman of the Connecticut Council for Education Reform > Director, The Cape Cod Foundation > Former Chairman of the American Insurance Association, the Property & Casualty CEO Roundtable and the Insurance Services Office > Former Chairman of the Hartford Hospital > Former member of the board of Maharishi University of Management KEY QUALIFICATIONS

During his 36-year career with The Hartford, Mr. Ayer held progressively senior roles. Mr. Ayer’s long tenure as the Chairman of the board and CEO of The Hartford, during which time he built the company into a recognized leader in P&C insurance, provides him a wealth of experience with respect to the varied and complex issues that confront large (re)insurers, such as the Company, and makes him well suited to serve as the Chairman of the Management Development and Compensation Committee (the "Compensation Committee"). In particular, Mr. Ayer’s vast knowledge and experience in the P&C space complement the expertise of our other Directors and benefits us as we continue to build on our solid foundation, global platform and depth of underwriting talent. |

|

| | | |

| DALE R. COMEY |

| | | |

Age: 77 Director Since:

November 2001 Committees:

Audit

Operations and Technology

Risk and Finance | Career Highlights > Executive Vice President, ITT Corporation (1990–1996), responsible for directing operations of several ITT business units, including ITT Hartford and ITT Financial Corporation > President of ITT Hartford’s Property & Casualty Insurance Business (1988–1990) |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Former Director, St. Francis Hospital and Medical Center, Hartford, Connecticut > Former Alternate Lead Director, XL Capital Ltd Board of Directors KEY QUALIFICATIONS

Mr. Comey brings an actuarial background and extensive operational and business leadership skills to the Board. Through his experience serving in various senior leadership positions with ITT Corporation, he has first-hand knowledge of the varied and complex financial, operational and governance issues that confront large (re)insurers, such as the Company. This experience makes him well-suited to serve as a Director of the Company. In addition, Mr. Comey’s experience gained from serving as a director of a non-profit institution adds to the depth and breadth of his knowledge of operations, strategy and best practices in corporate governance. |

|

| | | |

| CLAUS-MICHAEL DILL |

| | | |

Age: 64 Director Since:

August 2015 Committees:

Audit

Governance (Chair)

Risk and Finance | Career Highlights > Chief Executive Officer, Damp Holding AG, a hospital group (January 2006–December 2008) > Chief Executive Officer, AXA Konzern AG, a (re) insurer (April 1999–September 2005), responsible for operations in Germany and Central Europe, and member of the AXA Group Executive Committee > Chief Financial Officer and Group Management Board Member, Gerling Konzern AG, a (re)insurer (February 1995–April 1999), responsible for asset management/financials and strategic restructuring |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Prior chief executive officer and chief financial officer positions at Vereinte Insurance AG and other Swiss Re Group companies > Supervisory Board Member, MLP AG > Vice Chairman of the Supervisory Boards of HUK Coburg VaaG, HUK Coburg Holding AG and HUK Coburg Insurance AG > Former Supervisory Board Member and Chairman, General Reinsurance AG KEY QUALIFICATIONS Mr. Dill’s career in the insurance and reinsurance industries, spanning more than 30 years, includes experience serving as a chief executive officer, chief financial officer, and executive and non-executive director, among other management positions. He also possesses broad international experience, having worked across Europe, the United States, and Australasia. This combination of industry experience and geographic breadth makes Mr. Dill well-qualified to serve as a Director of our Board. |

|

| | | |

| ROBERT R. GLAUBER |

| | | |

Age: 79 Director Since: September 2006 Committees: Compensation Governance Risk and Finance (Chair) Other U.S. Listed Public

Company Directorships: Current: Northeast Bancorp Past Five years: Moody’s Corp. | Career Highlights > Chief Executive Officer, National Association of Securities Dealers (now FINRA), the private-sector regulator of the U.S. securities markets (2000–2006), and Chairman (2001–2006) > Under Secretary of the Treasury for Finance (1989–1992) > Harvard University, Harvard Business School Professor of Finance (1964–1989), Kennedy School Lecturer (1992–2000; 2007–Present) and Harvard Law School Visiting Professor (2007 and 2009) |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Executive Director of the Task Force (“Brady Commission”) appointed by President Reagan to report on the October 1987 stock market crash > Former independent Chairman of the Board, XL Group plc > Chairman of the Board of Directors, Northeast Bancorp > Former Director, Pioneer Global Asset Management S.p.A. (Milan) > Senior Advisor, Peter J. Solomon Co. (November 2006 to Present) > Former Director of Moody’s Corp, Federal Home Loan Mortgage Corp. (“Freddie Mac”), a number of Dreyfus mutual funds, the Korean Financial Service’s International Advisory Board and the Investment Company Institute > Former Vice Chairman of the Trustees, International Accounting Standards Board > Former President of the Metropolitan Opera Club, Overseer of the Boston Symphony Orchestra and Executive Committee member of the Metropolitan Opera Guild KEY QUALIFICATIONS Mr. Glauber’s strong management background in both the public and private sectors, and his expertise in financial services regulation, public policy and corporate governance provide him the consensus-building and leadership skills necessary to serve as a Director and the Chair of our Risk and Finance Committee. In addition, Mr. Glauber’s variety of experience serving as a current or former director of several large financial companies adds to the depth and range of his contribution to the Board. |

|

| | | |

| EDWARD J. KELLY, III |

| | | |

Age: 64 Director Since: August 2014 Committees: Audit

Governance CSR Sub-Committee

Risk and Finance Other U.S. Listed Public

Company Directorships: Current: CSX Corp.,

Metlife, Inc. | Career Highlights > Various executive leadership positions at Citigroup, Inc., a financial services corporation, including Chairman, Institutional Clients Group (January 2011–July 2014), Chairman, Global Banking (April 2010–January 2011), Vice Chairman (July 2009–March 2010), Chief Financial Officer (March 2009–July 2009), Head of Global Banking (September 2008–March 2009), President and Chief Executive Officer, Citi Alternative Investments (March 2008–August 2008) and President, Citi Alternative Investments (February 2008–March 2008) > Managing Director, The Carlyle Group, an asset management firm (June 2007–January 2008) > Chairman, CEO and President (March 2003–March 2007) and President and CEO (March 2001–March 2003), Mercantile Bankshares Corporation, a financial services corporation, and Vice Chairman, PNC Financial Services Group, following its acquisition of Mercantile (March 2007–June 2007) > Various executive leadership positions at J.P. Morgan & Co. (and its predecessor company J.P. Morgan & Co. Incorporated), a financial services corporation (1994–2001), including General Counsel and Managing Director and Head of Global Financial Institutions |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Partner, Davis Polk & Wardwell LLP, a law firm > Director, CSX Corp (July 2002–Present), currently serving as non-executive Chairman > Director, Metlife, Inc. (February 2015–Present) > Member, Board of Directors, Focused Ultrasound Foundation, a non-profit entity (June 2015–Present) > Former Director of The Hartford, Axis Capital Holdings Ltd. and Paris RE Holdings, among others KEY QUALIFICATIONS Mr. Kelly brings deep knowledge of the financial services industry and a unique perspective to the Company, particularly in the areas of capital management and strategic execution, as a result of his more than 25 years of operating, regulatory and investment experience in the financial services industry. This unique perspective, combined with his knowledge gained from serving as a current or past director of public corporations with global operations, provides him with a wealth of experience to draw from in his oversight role as a Director of the Company. |

|

| | | |

| JOSEPH MAURIELLO |

| | | |

Age: 73 Director Since: January 2006 Committees: Audit (Chair)

Operations and Technology

Risk and Finance Other U.S. Listed Public

Company Directorships: Past Five Years: Arcadia Resources, Inc. | Career Highlights > Numerous leadership positions during his 40-year career at the accounting firm KPMG, including Deputy Chairman and Chief Operating Officer and a Director of KPMG LLP (United States) and KPMG Americas Region (2004–2005) and Vice Chairman of Financial Services (2002–2004) |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Trustee, Fidelity Funds (July 2007–Present) > Member of the Board of Overseers, Peter J. Tobin School of Business at St. John’s University (January 2015–Present), and Member Emeritus of the Board of Overseers, School of Risk Management, Insurance and Actuarial Science of the Peter J. Tobin College of Business at St. John’s University > Trustee, St. Barnabas Medical Center (2003–Present) and RWJ Barnabas Health Care System (2008–Present) > Director, Lupus Research Alliance (2006–Present) > Former Director, Arcadia Resources, Inc. > Certified Public Accountant (Retired) in New York and Member of the American Institute of Certified Public Accountants KEY QUALIFICATIONS Mr. Mauriello’s significant experience in the independent public accounting and financial services industries, including a 40-year tenure in senior positions with the leading international accounting firm of KPMG, makes him well-qualified to serve in his current position as Chair of the Audit Committee. He has in-depth familiarity with financial accounting practices and reporting responsibilities, including those unique to property, casualty and specialty insurance and reinsurance companies. In addition, the Board benefits from Mr. Mauriello’s breadth of experience serving, or previously serving, on the boards of directors of other entities that have, or control other entities that have, publicly traded securities. |

|

| | | |

| MICHAEL S. MCGAVICK |

| | | |

Chief Executive Officer Age: 60 Director Since: April 2008 | Career Highlights > Chief Executive Officer, XL Group Ltd (May 2008–Present) > President and Chief Executive Officer (January 2001–December 2005) and Chairman (January 2002–December 2005), of Safeco Corporation, a (re)insurer > Various senior executive positions with CNA Financial Corporation (1995–2001), a (re)insurer, including President and Chief Operating Officer of its largest commercial insurance operating unit |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Member of the Geneva Association (2011–Present), currently serving as Chairman > Member, and former Chairman, of the American Insurance Association (2008–Present) > Member, the Global Reinsurance Forum (2009–Present) > Director, Save the Children Action Network, a non-profit social welfare organization (2015–Present) > Former Director, Blue Marble Microinsurance, an industry consortium focused on microinsurance (2015–2018) > Former Director, Insurance Information Institute (2008–2015) > Former Chairman of the Association of Bermuda Insurers and Reinsurers > Former Director of the American Insurance Association’s Superfund Improvement Project in Washington, D.C., serving as the Association’s lead strategist in working to transform U.S. Superfund environmental laws KEY QUALIFICATIONS Upon joining the Company in 2008, Mr. McGavick pioneered and led a successful turnaround of XL and several strategic actions. These actions initially included the successful implementation of our strategy to simplify our organizational structure, re-focus on core property, casualty and specialty insurance and reinsurance businesses, enhance our enterprise risk management capabilities and attract and retain industry talent. Further strategic advancements were made with the acquisition of Catlin, the reinsurance of the vast majority of our run-off life portfolio, and several smaller acquisitions to add teams and business lines to further grow the Company. Mr. McGavick provides innovative leadership and knowledge of all aspects of our business, and has a proven track record in the insurance industry, especially relating to turnaround management. The May 2015 acquisition of Catlin, which has strengthened the position and relevance of our core P&C business, and work to integrate Catlin’s businesses with the Company’s existing businesses, exemplifies Mr. McGavick’s leadership in action. In addition, Mr. McGavick’s previous political and public affairs experience and active involvement in various industry associations enhances his contribution to the Company and the Board. |

|

| | | |

| EUGENE M. MCQUADE |

| | | |

Independent Chairman Age: 69 Director Since: July 2004 Committees: Compensation Governance CSR Sub-Committee

Risk and Finance Other U.S. Listed Public

Company Directorships: Current: Citigroup, Inc. | Career Highlights > Vice Chairman, Citigroup Inc. (April 2014–May 2015), a financial services company > Chief Executive Officer, Citibank, N.A., a commercial bank (August 2009–April 2014) > Various senior positions in the financial services industry, including Vice Chairman and President of Merrill Lynch Banks (U.S.), President and Chief Operating Officer of Freddie Mac, President and Chief Operating Officer of FleetBoston Financial Corporation and, subsequent to Bank of America Corporation’s (“Bank of America”) acquisition of FleetBoston, President of Bank of America |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Director, Citigroup, Inc. (July 2015–Present) > Director, Citibank, N.A. (August 2009–Present) > Vice Chairman, Promontory Financial Group Advisory Board (July 2015–Present) > Trustee (2010–Present) and Board of Governors (2016–Present), Boys and Girls Club of America > Former Director of Bank of America, FleetBoston Financial Corporation and Freddie Mac KEY QUALIFICATIONS Mr. McQuade has extensive experience and financial expertise through his service in management positions such as CEO, president, vice chairman, chief financial officer and chief operating officer of several global, publicly traded financial institutions. This expertise makes him well-qualified to serve as the independent Chairman of our Board. In addition, the Board derives valuable insight and benefit from Mr. McQuade’s judgment and experience as a current or former member of the board of directors of several financial institutions. |

|

| | | |

| JAMES E. NEVELS |

| | | |

Age: 66 Director Since: October 2017 Committees: Audit Governance Risk and Finance Other U.S. Listed Public

Company Directorships: Current: Alcoa Corporation, First Data Corp, WestRock Corp Past Five Years: The Hershey Company, Tasty Baking Company | Career Highlights > Chairman and Founder, The Swarthmore Group, an investment advisory firm (1991–Present) > Former Director (January 2010–December 2015), Deputy Chairman (January 2012–January 2014) and Chairman (January 2014–December 2015), Federal Reserve Bank of Philadelphia > Former member (2004–2007) and Chairman (2005–2007) of the advisory committee to the Pension Benefit Guaranty Corporation |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Director, WestRock Company (2014–Present), currently serving as Lead Independent Director > Director, Alcoa Corporation (2016–Present) > Director, First Data Corp (2014–Present) > Former Chairman and Lead Independent Director of The Hershey Company and former Director of the Tasty Baking Company > Former Chairman of the Philadelphia School Reform Commission, overseeing the turnaround of the Philadelphia School System KEY QUALIFICATIONS Mr. Nevels' experience as an investment advisor provides him with deep expertise in the securities and investment industry. The Board also gains valuable insight from Mr. Nevels' broad financial and legal experience, as well as his corporate governance expertise gained from his experience as the current or former lead independent director or chairman of large public companies. The skills derived from this experience make him well-qualified to serve as a Director. |

|

| | | |

| ANNE STEVENS |

| | | |

Age: 69 Director Since: April 2014 Committees: Audit Operations and Technology (Chair)

Risk and Finance Other U.S. Listed Public

Company Directorships: Past Five Years: Lockheed Martin Corporation | Career Highlights > Chief Executive Officer of GKN plc (January 2018–Present), a global engineering company > Chief Executive Officer and Principal, SA IT Services, an information technology outsourcing company (June 2011–November 2013) and Chairman (June 2011–December 2014) > Chairman, President and Chief Executive Officer, Carpenter Technology Corporation (November 2006–November 2009) > Various senior management positions during 16 years with automaker Ford Motor Company, including Executive Vice President and Chief Operating Officer of The Americas (November 2005–October 2006), Group Vice President, Canada, Mexico and South America (October 2003–October 2005), Vice President, North America Vehicle Operations (August 2001–October 2003) and Vice President, North America Assembly Operations (April 2001–August 2001) |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Director, Lockheed Martin Corporation (2002–2017) > Director, Anglo American plc (2012–Present) > Director, GKN plc (2016–Present) > Trustee, Drexel University > Member of the National Academy of Engineering KEY QUALIFICATIONS Ms. Stevens obtained broad experience at Ford Motor Company in managing the challenges associated with global organizations, particularly in the areas of operations management, talent management and governance. The skills derived from this experience make her well-qualified to serve as a Director. The Board also derives benefit from her current or prior experience as director of three other publicly traded companies with global operations, and her past experience serving as the Chair of Lockheed Martin’s compensation committee from 2011 to 2015. |

|

| | | |

| SIR JOHN M. VEREKER |

| | | |

Age: 73 Director Since: November 2007 Committees: Compensation

Governance CSR Sub-Committee (Chair)

Risk and Finance | Career Highlights > Governor and Commander-in-Chief of Bermuda (April 2002–October 2007) > United Kingdom’s (“U.K.”) Permanent Secretary of the Department for International Development and of its predecessor, the Overseas Development Administration (1994–2002) > Various senior public sector roles, including serving as Private Secretary to three U.K. Ministers of Overseas Development, Deputy Secretary for the U.K. Department of Education and Science, and positions with the World Bank and the Policy Unit of the British Prime Minister’s Office |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE

> Governor, the Ditchley Foundation, a charitable organization focused on international relations research > Former Director, MWH Global, a wet infrastructure engineering company > Former board member of the British Council, the Institute of Development Studies and the Institute of Manpower Studies and Voluntary Services Overseas > Former Advisory Council member of the Center for Global Ethics and for the British Consultancy and Construction Bureau > Former Advisor to the U.N. Secretary-General’s Millennium Development Project > Former Member of the Volcker panel, which investigated the World Bank’s institutional integrity

KEY QUALIFICATIONS

As a result of his extensive career in the public sector, Sir John Vereker provides valuable insights to the Board in the areas of government relations and external affairs. In particular, Sir John Vereker’s significant public sector experience and previous leadership positions in Bermuda and the U.K. bring depth to the Board’s oversight of public policy matters on a global basis and makes him well-qualified to serve as a Director. |

|

| | | |

| BILLIE WILLIAMSON |

| | | |

Age: 65 Director Since: February 2018 Committees: Audit Risk and Finance

Other U.S. Listed Public

Company Directorships: Current: CSRA, Inc., Pentair plc Past Five Years: Janus Capital Group, Inc., Annies, Inc., Exelis, Inc.

| Career Highlights > Senior assurance partner of accounting firm Ernst & Young LLP (1998–2011), and member of the Americas Executive Board (2006–2008) and the U.S. Executive Board (2008–2011) > Senior Vice President, Finance, and Corporate Controller Marriott International (1996–1998) > Chief Financial Officer, AMX Corp. (1993–1996) |

OTHER PROFESSIONAL AND LEADERSHIP EXPERIENCE > Extensive accounting experience from her career with Ernst & Young spanning over three decades, including as Auditor (1974–1984) and Partner (1984–1993) > Director, CSRA, Inc., an information technology and professional services company (2015–Present) > Director, Pentair plc, a diversified industrial manufacturing company (2014–Present) > Director, Energy Future Holdings Corporation, an electric utility company (2013–Present) (formerly NYSE-listed) > Director, Pharos Business Development Company (2018–Present) > National Association of Corporate Directors Board Leadership Fellow KEY QUALIFICATIONS As a result of her career with Ernst & Young, Ms. Williamson possesses broad and deep public company auditing and audit process, financial reporting, corporate oversight and controls experience. In addition, her former leadership and strategic planning experience as a controller and chief financial officer, as well as her experience as a current or former director of several public companies, provides invaluable experience to our Board and its Audit and Risk and Finance Committees. |

Corporate Governance

DIRECTOR NOMINATION PROCESS

The Nominating, Governance and External Affairs Committee ("the Governance Committee") considers recommendations for new Board of Directors (the "Board") members from Directors, management and others, including shareholders. Shareholders may submit such recommendations to the Governance Committee in care of the Company Secretary at XL Group Ltd, O’Hara House, One Bermudiana Road, Hamilton HM 08, Bermuda. To aid the Governance Committee in reviewing any such recommendations, shareholders are requested to provide the information regarding the nominating shareholder and the proposed candidate set forth in section 12 of our bye-laws, including information that would be required in connection with a solicitation of proxies for the election of directors in a contested election pursuant to Section 14(a) of the Exchange Act, and a written statement from the proposed candidate that he or she is willing to be nominated and desires to serve if elected. Nominees for Director who are recommended by shareholders to the Governance Committee will be evaluated in the same manner as any other nominee for Director.

AUDIT COMMITTEE

Our Audit Committee is composed of six directors - Messrs. Mauriello (Chair), Comey, Dill, Kelly and Nevels and Ms. Stevens - each of whom has been determined to be "financially literate" as such term is defined by applicable NYSE and SEC requirements. In addition, the Board determined that Mr. Mauriello is an "audit committee financial expert" under SEC rules (and is considered independent under NYSE listing standards).

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires directors and executive officers and persons who own more than 10% of a registered class of our equity securities to file with the SEC and the NYSE reports on Forms 3, 4 and 5 concerning their ownership of our shares and other equity securities.

We believe that all of our Directors and executive officers who are Section 16 filers filed all of such reports on a timely basis during the year ended December 31, 2017.

CODE OF CONDUCT

We have adopted a Code of Conduct that applies to all of our Directors, officers (including the CEO) and employees. We will post on our website at www.xlgroup.com any amendment to or waiver under the Code of Conduct granted to our CEO, principal financial officer, principal accounting officer, controller or other person performing similar functions that relates to any element of the code of ethics definition set forth in Item 406 of Regulation S-K under U.S. federal securities laws.

|

| | |

| ITEM 11. | | EXECUTIVE COMPENSATION |

Executive Compensation

COMPENSATION DISCUSSION & ANALYSIS

The Compensation Discussion & Analysis (the "CD&A") describes the Company's compensation philosophy and program for the NEOs listed below during 2017. It also describes our 2017 performance and the compensation decisions made by the Compensation Committee (the “Committee” within this CD&A).

|

|

| 2017 Named Executive Officers |

| Michael McGavick – Chief Executive Officer |

Stephen Robb – Executive Vice President, Chief Financial Officer* |

Gregory Hendrick – President, Property & Casualty** |

| Charles Cooper – Executive Vice President, Chief Executive, Reinsurance |

| Kirstin Gould – Executive Vice President, General Counsel & Secretary |

Stephen Catlin – Former Executive Deputy Chairman# |

Peter Porrino – Former Executive Vice President, Chief Financial Officer^ |

| |

| * | Stephen Robb has served as Executive Vice President, Chief Financial Officer since May 1, 2017. |

| |

| ** | As previously announced, Gregory Hendrick had been promoted to the role of President and Chief Operating Officer, effective March 5, 2018. |

| |

# | Stephen Catlin served as Executive Deputy Chairman until May 15, 2017, at which time he became Special Advisor to the Chief Executive Officer; at year end 2017 he retired and became a consultant to the Company, effective January 1, 2018. |

| |

| ^ | Peter Porrino served as Executive Vice President, Chief Financial Officer until April 30, 2017 at which time he became Advisor to the Chief Executive Officer. |

EXECUTIVE SUMMARY

Announcement of Entry into Agreement and Plan of Merger with AXA

On March 5, 2018, we announced that XL had entered into an agreement and plan of merger with AXA, under which AXA would acquire 100% of XL's common stock in exchange for cash proceeds in the aggregate of $15.3 billion. The AXA transaction is expected to close in the second half of 2018, subject to approval by XL's shareholders and other customary closing conditions, including the receipt of required regulatory approvals. The impact of the AXA transaction on compensation arrangements has not been addressed in this Form 10-K/A. See the "Explanatory Note" for further information.

2017 Business Performance & Strategic Initiatives

XL’s strategy is to create an operating environment and culture attractive to the best talent in our industry, combined with an understanding of how technology enables our people to have superior insight, a lower cost base of operations, and the ability to innovate solutions and business models to keep up with the dynamic risks of our clients.

The execution of this strategy in 2017 produced solid underlying performance, which was overshadowed by significant natural catastrophe related losses which meant that our full year 2017 financial results were disappointing to us and to our shareholders. However, we feel positive about our market positioning across many important dimensions including: our solid capital position, progress made in our 2017 ex-catastrophe underwriting results, the many indicators of our growing market leadership and how we’ve put learnings from 2017 into practice to better position us for 2018 and the changing (re)insurance pricing environment.

|

| | |

| | 2017 PERFORMANCE SUMMARY > Earnings, ROE and Total Shareholder Return ("TSR"): Our earnings, ROE and TSR were impacted by the significant natural catastrophes in 2017. Our net loss in 2017 was $560 million and we generated an operating loss of $522 million compared to operating earnings of $461 million in 2016. Our ROE was -5.4% and our Operating ROE ex-integration and AOCI (as defined in Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations and Key Financial Measures) was -4.8%. While natural catastrophe losses in the second half of 2017 clearly impacted our full year results and generated a -3.5% TSR, we believe that our Operating ROE ex-integration and AOCI in the first half of the year of 6.1% signaled the growing earnings power our diversified platform is capable of delivering. > Underwriting & Portfolio Management: Underwriting results in 2017 were also negatively impacted by the significant catastrophes in the year as evidenced by a combined ratio ("CR") of 108.3%. Excluding the impact of these events, we delivered an insurance accident year ex-catastrophe CR of 91.6%, compared to 93.3% for 2016. > Market presence: Our P&C gross premiums written increased by 8% to $14.8 billion in 2017, compared to 2016, as our new product and innovation initiatives gained ground while we maintained our focus on disciplined underwriting. > Continuous Improvement: We continued to focus on driving operating expense leverage with investments in the business commensurate with growth in written premiums. Excluding integration costs, operating expenses decreased from $1.84 billion to $1.69 billion from 2016 to 2017, including the 2017 benefit of lower variable compensation costs resulting from the impact of the catastrophe losses on our results. > Capital Management: Our significant capital buffer allowed us to absorb natural catastrophe losses in 2017. At year-end, our capital position remained solid with a surplus to internal, rating agency and regulatory models. In 2017 we repurchased $572 million of XL common shares before we suspended our repurchase program during the third quarter. | |

| | FOCUSED ON OUR LONG-TERM STRATEGY In 2017, management continued to focus on driving our business strategy and operating plan by executing on key strategic initiatives, including: > Our diversified P&C portfolio: We believe our initiatives and actions in 2017 positioned us to benefit from expected rate changes and the accelerated use of alternative capital. These actions were intended to optimize the balance of risk and return, enhancing our catastrophe exposure profile while retaining a leading position in both the insurance and reinsurance businesses. > Innovation: We introduced 26 new or enhanced risk products while our internal innovation team, Accelerate, piloted AI, blockchain and advanced data solutions to create faster and better risk insight. Externally, XL Innovate, our venture capital arm, continued to invest in insuretech startups across a range of disruptive opportunities. > Implementation of a realigned P&C operating model: By streamlining the reporting and oversight of business units, we created clearer accountability and greater insight into the needs of clients and brokers. > Continued support of our Diversity & Inclusion strategy: Our Diversity & Inclusion strategy increases our ability to attract and retain talent in a way that differentiates us in our industry. | |

| | RECOGNITION FOR OUR ACHIEVEMENTS As a result of these efforts, we received recognition in 2017 for a number of achievements, including: > Highest in Customer Satisfaction among Large Commercial Insurers in the J.D. Power 2017 Large Commercial Insurance Study, conducted in the U.S. and Canada, for the second year in a row. > Top in the London Market Gracechurch Survey across nearly every metric, earning their Quality Marque, for the second year in a row. > Ranked #1 for industry product innovation by Advisen's 2017 Pacesetter Index for the second year in a row.

| |

Responsiveness to Our Shareholders

The Board is committed to ensuring we are responsive to our shareholders, including with respect to our compensation program. We regularly engage with shareholders during the year, and enhanced our engagement program beginning in 2016. In the lead up to our 2017 AGM we commenced a comprehensive, multi-stage engagement program to better understand the views of our shareholders. In light of the disappointing level of support for last year's Say on Pay vote, which was 68% favorable, our meetings following our 2017 AGM were particularly focused on understanding shareholders' viewpoints with respect to compensation. During our discussions, we asked for shareholders' input on our compensation program and solicited feedback on changes being considered to our compensation program.

MULTI-STAGE SHAREHOLDER ENGAGEMENT PROGRAM

We gained valuable insight into the governance and compensation matters that are important to our shareholders through our multi-stage engagement program. The feedback from our outreach efforts was shared with the Committee, the Governance Committee and the full Board, and factored into the Committee’s deliberations and decision making throughout the year. Our 2017 process included the following:

|

| | |

(1) ANNUAL MEETING Engaged in the lead-up to the 2017 AGM to understand concerns of investors (reached out to shareholders representing ~71% of our outstanding shares; engaged with ~37%) | (2) LISTENING TOUR Immediately following the 2017 AGM, we conducted a Listening Tour to receive feedback from shareholders in a timely manner to help inform the Compensation Committee’s next steps (reached out to shareholders representing ~55% of our outstanding shares; engaged with ~43%) | (3) BROAD-BASED OUTREACH Additional outreach to shareholders in late Fall 2017 to solicit feedback on changes being considered to our compensation program, as well as our corporate governance practices (reached out to shareholders representing ~66% of our outstanding shares; engaged with ~48%) |

ACTIONS TAKEN AS A RESULT OF SHAREHOLDER ENGAGEMENT

In connection with the Committee’s regular assessment of our compensation program, and informed by shareholders' feedback, we made the following decisions regarding our 2017 Annual Incentive Program ("AIP") payouts, as well as the structure of our 2018 compensation program: |

| | | | |

| | Shareholder Feedback | Actions We've Taken |

| AIP | > | Increase disclosure of the rigor of qualitative performance assessment | a | Added greater specificity around goal setting and assessment of operational and strategic objectives |

| | > | Consider relative performance in payout determination | a | Formalized the consideration of relative performance versus peers in determining final payouts |

| Long-Term Incentive Program ("LTIP") | | | Changes to 2018 Structure: |

| > | Desire to see closer alignment between CEO pay level, financial performance and TSR on absolute and relative basis | a | Consider relative performance over trailing three- and one-year periods in determining CEO's actual LTIP grant |

| > | Desire to see targets incentivize relative out-performance versus peers | a | Increase weighting of performance units ("PUs") within LTIP from 50% to 60%, placing more emphasis on performance-based awards |

| | | | a | Raise 2018 PU relative growth in book value per share plus dividends target to the 55th percentile |

| | | | a | Add a TSR modifier to PU awards to cap payout at target in the event of negative TSR performance |

Impact of 2017 Performance and Shareholder Feedback on CEO / NEO Pay

Our compensation program is designed to ensure strong alignment between executive pay, Company and individual performance and shareholder value creation by providing competitive target compensation that includes both short-term and long-term incentives that motivate and reward executives to achieve our near-term goals and longer-term strategic objectives.

2017 was a year where our performance was marked by headwinds primarily due to the high level of catastrophes occurring in the second half of the year. Our 2017 compensation program performed in line with the Committee’s expectations in a year of relative poor performance. Despite a solid first half of 2017, we failed to achieve our threshold CR goals for our annual incentive awards, resulting in a 0% performance factor for our quantitative annual program metric. While we achieved many of our strategic and operational objectives, as previously described and further outlined under Executive Compensation Components - AIP Award Determinations, given our absolute performance and relative TSR, the Committee determined that our most senior executives should not receive annual incentive award payouts for 2017.

2017 ANNUAL INCENTIVE PROGRAM PAYOUTS*

|

| | |

| NEO | Title | 2017 Annual Incentive |

| Michael McGavick | Chief Executive Officer Appointed March 2008 | Target Annual Incentive: $3,750,000 Annual Incentive Awarded: $0 (0% of target) |

| Stephen Robb | Chief Financial Officer Appointed May 2017 | Target Annual Incentive: $897,750 Annual Incentive Awarded: $269,325 (30% of target) |

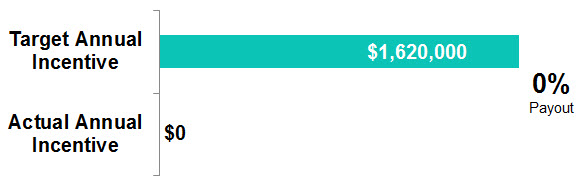

| Gregory Hendrick | President, Property & Casualty Appointed January 2017 | Target Annual Incentive: $1,620,000 Annual Incentive Awarded: $0 (0% of target) |

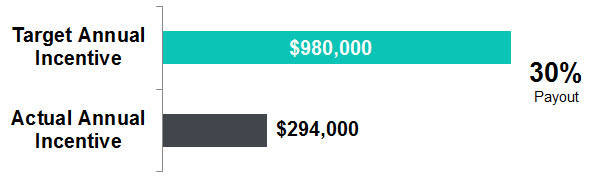

| Charles Cooper | Chief Executive, Reinsurance Appointed January 2017 | Target Annual Incentive: $980,000 Annual Incentive Awarded: $294,000 (30% of target) |

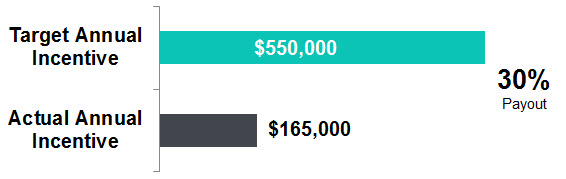

| Kirstin Gould | Executive Vice President, General Counsel & Secretary Appointed September 2007 | Target Annual Incentive: $550,000 Annual Incentive Awarded: $165,000 (30% of target) |

* Mr. Porrino and Mr. Catlin retired from their executive positions during 2017 and each remained with the Company in non-executive capacities. In light of their executive roles at the beginning of the year, their annual incentive awards were 0% of target, resulting in payouts of $0.

IMPACT ON PERFORMANCE UNITS VESTING IN 2017

The performance period for the 2015 PUs began on May 1, 2015 and ended on December 31, 2017. Based on relative TSR performance over the performance period, the 2015 PUs did not achieve the required threshold level of performance, resulting in a performance factor of 0%, and no payout for the NEOs.

NEW PROCESS FOR DETERMINING CEO LTIP AWARD

The process for determining our CEO's 2018 LTIP award included a formal review of relative performance against our performance peers to determine if a downward adjustment to the CEO's actual LTIP award versus target LTIP was appropriate. Under this new review process, if trailing performance relative to our performance peers was not at or above the top quartile of the market, the Committee had discretion to reduce the actual award. While this review was not formulaic and the Committee considered a number of performance metrics, it placed particular emphasis on trailing three-year and one-year TSR.

|

|

2018 CEO LTIP: > Based on the process outlined above, the Committee elected to reduce the CEO's 2018 LTIP award versus his 2018 target award (which was the same as his 2017 actual award) by $1.5 million given bottom quartile three-year TSR performance against our performance peers. |

TOTAL IMPACT OF MOST RECENT CEO PAY DECISIONS VERSUS TARGET

In direct response to shareholder feedback, in February 2018, the Committee decided to award no annual incentive to our CEO for the 2017 performance year and reduced his 2018 LTIP award by $1.5 million in light of relative performance against our performance peers. The combination of these pay decisions resulted in a 41% reduction (from $12,750,000 to $7,500,000) to the CEO's compensation as compared to his 2017 target compensation.

Strong Governance Practices

Our executive compensation practices continue to incorporate strong corporate governance features that include: |

| | | |

| a | Oversight of compensation and benefit programs by a Committee of independent Directors | a | No repricing or cash buy-outs of underwater stock options |

| a | Use of an independent executive compensation consulting firm that reports directly to the Committee and provides no other services to the Company | a | Significant XL share ownership requirements and the retention of 100% of shares earned from equity awards (net of taxes) for one year following vesting |

| a | Capped Annual Incentive awards | a | Prohibition against hedging and pledging XL shares |

| a | Grants of performance-contingent equity awards that require meeting established goals in order to receive an award | a | No excise tax gross-ups in any employment agreements entered into post-2009 |

| a | Annual assessment of potential risks associated with compensation plans, policies and practices | a | Executive participation in the same benefit programs as all other employees |

| a | A double-trigger change in control provision in equity awards granted after January 1, 2015 that provides for accelerated vesting only if XL terminates the executive’s employment without cause or the executive terminates employment for good reason following a change in control (unless the awards are not honored, assumed or substituted with substantially equivalent awards by the acquiring company)

| a | Formal shareholder engagement program covering strategy, governance and compensation practices |

| | a | Compensation clawback policy to recoup cash and equity awards from executives in the event of a material error, serious misconduct, or willful misconduct that results in a financial restatement

|

EXECUTIVE COMPENSATION COMPONENTS

Pay for Performance Philosophy

Our compensation program is designed to ensure strong alignment between executive pay and Company and individual performance by including both short-term and long-term incentives that motivate executives to achieve near-term goals and longer-term strategic objectives. The design of these programs is guided by the following principles:

GUIDING PRINCIPLES OF OUR COMPENSATION PROGRAM

|

| |

| a | Ensure alignment with shareholder interests and reward executives for enhancing long-term shareholder value |

| a | Consider multiple factors in setting target levels of compensation, including an executive’s role and responsibilities, performance, experience, expertise and competitor compensation information |

| a | Allocate total compensation among annual base salary, annual cash incentive and long-term incentive awards so that it is heavily weighted towards performance-based pay |

| a | Enable the attraction and retention of high caliber executive talent who will develop and successfully implement our business strategy |

| a | Include qualitative components and strong governance practices that mitigate risk and drive appropriate behaviors |

2017 Compensation Program and Changes to 2018 Compensation Program

Based on the Committee’s annual assessment of our compensation program and in response to the shareholder feedback we received through our multi-stage engagement program (detailed above), the Committee made the following changes to our 2017 program and the overall structure of our 2018 compensation program. Since many of our 2017 compensation award decisions and programs were already made by the time we received the 2017 Say on Pay vote and shareholder feedback, some of the changes did not take effect until our 2018 compensation program. These changes include:

|

| | | |

| Component | 2017 Program Pay Element | 2017 Metrics and Weighting | Key Changes, Outcomes & Impact to CEO |

Base Salary > Provides a fixed level of compensation for role and responsibilities | Cash | | > No changes |

Annual Incentive Program > Recognize and reward the achievement of annual financial and non-financial objectives that are aligned with the annual operating plan approved by the Board > Focus executives' attention on CR results and strategic and operational goals tailored to the executive

| Cash | 70% financial results (quantitative results), based on CR results relative to operating plan | > For 2017, added a formal assessment of relative performance against our performance peer group to inform final payouts > As a result of this formal assessment and the Committee's use of informed discretion, the CEO received no annual incentive award |

| 30% operational and strategic objectives (qualitative results) | > For 2018, added greater specificity around goal setting and assessment of operational and strategic objectives > Enhanced proxy disclosure regarding AIP process |

Long-Term Incentive Program > Reward for attaining long-term performance goals associated with XL's business strategy and operating plan > Align compensation with shareholder value creation | 50% PUs | 50% Operating ROE ex-integration and AOCI relative to plan 50% growth in book value per share + dividends relative to peers | > For 2018 LTIP awards, increased weighting of PUs within long-term incentive program from 50% to 60%, placing more emphasis on performance-based awards > Raised 2018 PU relative growth in book value per share plus dividends target from the 50th to the 55th percentile > Added a TSR modifier to 2018 PU awards to cap payouts at target in the event of negative TSR performance over the performance period > The CEO's actual 2018 LTIP grant size was informed by relative performance against our performance peer group, with emphasis on trailing three- and one-year TSR, and reduced by $1.5M versus target

|

> Focus attention on impact of long-term strategic decisions > Encourage retention of executives through the use of vesting requirements and overlapping performance periods | 50% Other Equity 25% Options / 25% Restricted Stock Units ("RSUs") | |

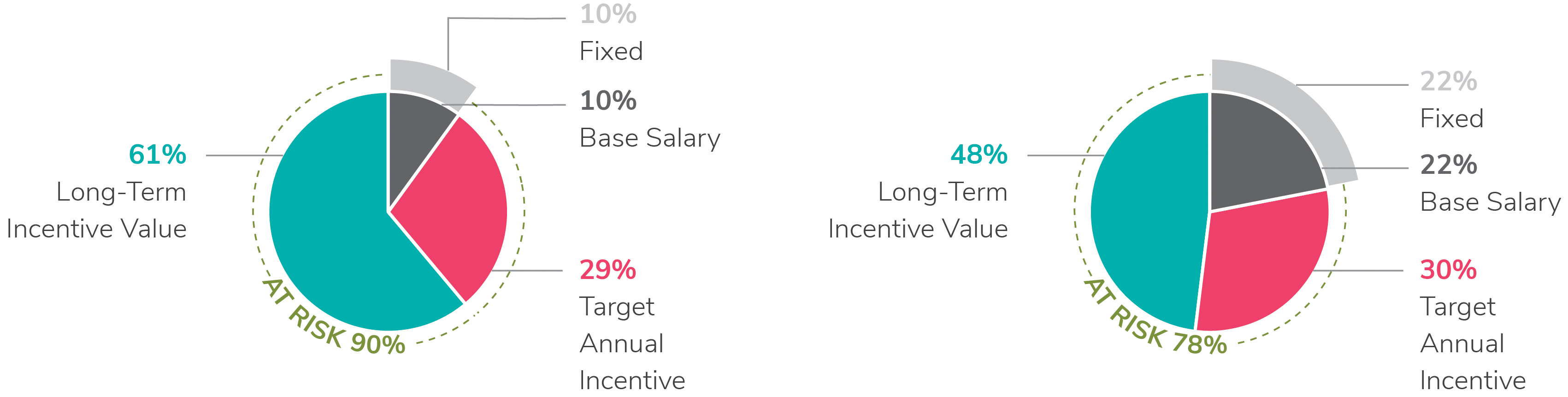

PAY MIX AND EMPHASIS ON AT-RISK PAY

As the charts below illustrate, the largest portion (78%) of our NEOs' Target Total Direct Compensation (the combination of base salary and target annual incentive and long-term incentive award opportunities) is at risk and determined based on their individual contributions, our financial performance versus stated objectives and stock price performance versus peers. The smallest component of compensation is fixed base salary. The Committee believes that delivering the majority of Target Total Direct Compensation in the form of variable, performance-based incentive pay creates a direct link between actual realized compensation, our financial results and the creation of long-term shareholder value.

|

| | | |

| CEO TARGET PAY MIX | NEO TARGET PAY MIX* |

*Excludes Messrs. Porrino and Catlin, who retired from their executive roles during 2017 but remained with the Company in non-executive roles.

|

| |

| 2018 LTIP CHANGES | 2018 LTIP SHIFT IN MIX |

In response to feedback from our shareholders, we made the following changes to our 2018 LTIP program: > Shifted the mix for 2018 LTIP awards to 60% PUs / 40% other equity, placing more emphasis on performance based awards. > Raised 2018 relative growth in book value per share plus dividends target to the 55th percentile. > Added a TSR modifier to PU awards to cap payouts at target in the event TSR performance is negative. | Performance Units

50% à 60% |

Other Equity

50% à 40% |

Benchmarking Compensation

The Committee annually reviews the compensation paid by the companies within our Compensation Peer Group to assess how target compensation for our executives is positioned. In addition, the Committee evaluates the Compensation Peer Group periodically to ensure it appropriately reflects our size, business mix of insurance and reinsurance operations, and competitors for executive talent. To more appropriately reflect XL’s larger size following the acquisition of Catlin Group Limited ("Catlin") in 2015, six additional companies were added to the Compensation Peer Group for 2017. These companies included The Progressive Corp., Lincoln National Corp., Marsh & McLennan Companies, Inc., Aon plc, Unum Group and Reinsurance Group of America, Inc. Since there are a limited number of companies from which to select peers with operations and size directly comparable to XL, this expansion of the peer group to include larger companies from the broader insurance industry was designed to position XL closer to the median of the Compensation Peer Group.

The Committee uses a separate and larger Performance Peer Group for evaluating our relative financial performance with respect to our performance-based LTIP awards. This Performance Peer Group includes companies that we compete with more directly for insurance and reinsurance business. We have chosen two separate peer groups because:

|

| |

> | For the Performance Peer Group, company size is less relevant than it is for a compensation peer group. Having separate groups allows us to include companies in the Performance Peer Group that are significantly larger or smaller than us, that would not be appropriate compensation peers. |

> | Since some performance peers are located outside the U.S., comparable compensation information is not always available for them. |

See Executive Compensation Components – Long-Term Incentives for more information on our Performance Peer Group.

The table below provides financial details for the 2017 Compensation Peer Group. These companies may be different from those identified in our Original Form 10-K as insurance and reinsurance competitors or those included in the indices against which we compare our performance, as many of the companies used in the Original Form 10-K comparisons may be of significantly different size and/or are not competitors for executive talent.

2017 COMPENSATION PEER GROUP AND 2017 FINANCIAL RESULTS

|

| | | | | | | | | | | | | |

| Company Name | | Revenues* | | Total

Assets* | | Market

Capitalization* |

| Chubb Ltd. | | $ | 32,376 |

| | | $ | 167,022 | | | $ | 67,780 | |

| The Travelers Companies, Inc. | | $ | 28,902 |

| | | $ | 103,483 | | | $ | 36,813 | |

| The Progressive Corp. | | $ | 26,815 |

| | | $ | 38,701 | | | $ | 32,761 | |

| The Hartford Financial Services Group | | $ | 16,974 |

| | | $ | 225,260 | | | $ | 20,083 | |

| Lincoln National Corp. | | $ | 14,257 |

| | | $ | 281,763 | | | $ | 16,765 | |

| Marsh & McLennan Companies, Inc. | | $ | 14,048 |

| | | $ | 20,429 | | | $ | 41,404 | |

| Reinsurance Group of America, Inc. | | $ | 12,516 |

| | | $ | 60,515 | | | $ | 10,050 | |

| XL Group Ltd | | $ | 11,328 |

| | | $ | 63,436 | | | $ | 9,002 | |

| Unum Group | | $ | 11,287 |

| | | $ | 64,013 | | | $ | 12,216 | |

| Aon plc | | $ | 10,037 |

| | | $ | 26,088 | | | $ | 33,178 | |

| CNA Financial Corporation | | $ | 9,542 |

| | | $ | 56,567 | | | $ | 14,387 | |

| W. R. Berkley Corporation | | $ | 7,685 |

| | | $ | 24,300 | | | $ | 8,707 | |

| Everest Re Group, Ltd. | | $ | 6,608 |

| | | $ | 23,592 | | | $ | 9,035 | |

| Alleghany Corporation | | $ | 6,425 |

| | | $ | 25,384 | | | $ | 9,174 | |

| Markel Corporation | | $ | 6,062 |

| | | $ | 32,805 | | | $ | 15,839 | |

| Arch Capital Group Ltd. | | $ | 5,512 |

| | | $ | 32,052 | | | $ | 12,404 | |

| Axis Capital Holdings Ltd. | | $ | 4,592 |

| | | $ | 24,760 | | | $ | 4,180 | |

| XL Group Ltd Percentile Rank | | | 56 |

| % | | | 69 | % | | | 13 | % |

*Millions of USD

The Committee evaluates each NEO’s Target Total Direct Compensation and the individual components relative to market data from the Compensation Peer Group, which is adjusted for company size where necessary. The process for determining compensation targets is not formulaic and market compensation data is only one of a number of factors that the Committee considers in setting pay. Other factors include each NEO’s specific roles and responsibilities, historical performance, expertise and experience, and unique business challenges.

Establishing 2017 Target Total Direct Compensation

The Committee reviewed competitive pay data for the Compensation Peer Group prepared by Meridian Compensation Partners, LLC ("Meridian"), its independent executive compensation consultant, in December 2016. After considering this compensation data as well as other criteria described above, the Committee established Target Total Direct Compensation for each NEO for 2017 as provided in the table below. Target Total Direct Compensation is discussed at the beginning of the year and approved in February, prior to any significant indication of the Company's full year 2018 financial performance. In setting NEO target compensation, the Committee does not attempt to position pay at any specific level relative to the competitive market.

Mr. Hendrick's Target Total Direct Compensation was increased for 2017 to reflect his promotion to a new role as President, Property and Casualty. Mr. Cooper was promoted to replace Mr. Hendrick as Chief Executive, Reinsurance. Mr. Porrino and Mr. Catlin each retired from their executive positions during 2017 and remained with the Company in a non-executive role. After stepping down from their executive roles, their Target Total Direct Compensation was reduced to reflect their more limited roles and responsibilities. As a result of Mr. Porrino's decision to retire as CFO, Mr. Robb was promoted to CFO in May 2017.

2016 AND 2017 NEO TARGET TOTAL COMPENSATION

|

| | | | | | |

| | Target Total Direct Compensation | |

| | | 2016 | | | 2017 | Rationale For Any Change |

| Michael McGavick | | | | | | |

| Chief Executive Officer | | | | | | |

| Base Salary | $ | 1,250,000 | | $ | 1,250,000 | No change |

| Target Annual Incentive | $ | 3,750,000 | | $ | 3,750,000 | |

| Long-Term Incentive Opportunity | $ | 7,750,000 | | $ | 7,750,000 | As previously discussed, under the new process for determining the CEO's LTIP award, the 2018 award was reduced by $1.5 million versus target. |

| Target Total Direct Compensation | $ | 12,750,000 | | $ | 12,750,000 |

| Stephen Robb | | | | | | |

| Executive Vice President, Chief Financial Officer | | | |

| Base Salary | | | | $ | 665,000 | New NEO |

| Target Annual Incentive | | | | $ | 897,750 | |

| Long-Term Incentive Opportunity | | | | $ | 1,500,000 | |

| Target Total Direct Compensation | | | | $ | 3,062,750 | |

| Gregory Hendrick* | | | | | | |

| President, Property & Casualty | | | | | | |

| Base Salary | $ | 800,000 | | $ | 900,000 | Increased to reflect promotion to a new |

| Target Annual Incentive | $ | 1,200,000 | | $ | 1,620,000 | role and greater responsibilities. |

| Long-Term Incentive Opportunity | $ | 2,200,000 | | $ | 2,980,000 | |

| Target Total Direct Compensation | $ | 4,200,000 | | $ | 5,500,000 | |

| Charles Cooper | | | | | | |

| Chief Executive, Reinsurance | | | | | | |

| Base Salary | | | | $ | 700,000 | New NEO |

| Target Annual Incentive | | | | $ | 980,000 | |

| Long-Term Incentive Opportunity | | | | $ | 1,000,000 | |

| Target Total Direct Compensation | | | | $ | 2,680,000 | |

| Kirstin Gould | | | | | | |

| Executive Vice President, General Counsel & Secretary | | |

| Base Salary | | | | $ | 550,000 | New NEO |

| Target Annual Incentive | | | | $ | 550,000 | |

| Long-Term Incentive Opportunity | | | | $ | 1,100,000 | |

| Target Total Direct Compensation | | | | $ | 2,200,000 | |

*XL announced that Mr. Hendrick had been promoted to the role of President and Chief Operating Officer, effective March 5, 2018. In recognition of his expanded role, Mr. Hendrick's 2018 LTIP target and actual award increased to $4,000,000.

Annual Incentives (Cash Award) - Performance Metrics and Goal Setting

OVERVIEW

XL’s AIP is designed to motivate executives to achieve specified performance goals that are established and approved by the Committee (or the Board in the case of the CEO) at the beginning of each year and that are aligned with the Company’s strategy and operating plan as approved by the Board. Enterprise and business segment performance goals are measured quantitatively (“Quantitative Goals”) and represent 70% of the individual’s target annual incentive opportunity. Individual strategic and operational performance goals (“Qualitative Goals”) represent 30% of the individual’s target annual incentive opportunity. The target annual incentive opportunity for each NEO is based upon the NEO's position and responsibilities and competitive market annual incentive opportunities for similar positions within our Compensation Peer Group, in addition to other factors such as each NEO's specific roles and responsibilities, historical performance, expertise and experience, and unique business challenges.

In response to shareholder feedback, we made the following changes to our AIP: |

| |

> | For 2017, added a formal assessment of absolute and relative performance against our performance peer group to inform final AIP payouts. |

> | For 2018, added greater specificity around goal setting and assessment of operational and strategic objectives and enhanced disclosure on the AIP process. |

QUANTITATIVE GOAL: COMBINED RATIO (70% WEIGHTING)

Consistent with prior years and our operating plan and business strategy, the Committee selected CR as the primary Quantitative Goal for the 2017 AIP because it is aligned with net income and is a standard measure of underwriting profitability used by the P&C industry. CR is the sum of losses and loss expenses, acquisition expenses and operating expenses divided by the net premiums earned by the Insurance or Reinsurance segments, and on a combined basis for the Enterprise. A CR of less than 100% indicates an underwriting profit; a CR greater than 100% reflects an underwriting loss.

Preliminary metrics for the 2017 Quantitative Goals were discussed with the Committee in December 2016 in conjunction with a review by the Board of the Company’s 2017 operating plan and budget. The determination of our annual performance goals is based on XL's operating plan, which is developed through an extensive review of the budget and plans for each of our business segments and functions, as well as our capital allocation program and prudent approach to reserving. We also consider peer performance and shareholder and analyst expectations as we develop our plan to ensure rigorous goals. Final 2017 Quantitative Goals were recommended by Mr. McGavick to the Committee in February 2017 and approved. The approved CR Quantitative Goals, which are provided in the table below, included performance targets and weightings to achieve threshold, target and maximum annual incentive levels for the Enterprise and each business segment.

QUALITATIVE GOALS (30% WEIGHTING)

Qualitative Goals are established to focus an executive’s attention on individual performance objectives and can include, but are not limited to, specific objectives regarding strategy, leadership, overall business performance, execution on new initiatives and improvements in operations. The Committee set Mr. McGavick’s Qualitative Goals after discussions with him and with the other independent Directors in early 2017. His Qualitative Goals were then reviewed by the Board in February 2017. Mr. McGavick collaborated with each NEO to establish his or her personal Qualitative Goals, which the Committee reviewed and discussed in February 2017.

Based on our discussions with shareholders during our 2017 outreach, the Committee determined to establish greater rigor in setting and measuring the Qualitative Goals for 2018.

INFORMED DISCRETION

In direct response to shareholder feedback, we have formalized our holistic review of quantitative and qualitative performance that the Committee uses to apply informed discretion. As part of this process, in determining the 2017 annual incentive awards, the Committee included a formal review of a number of relative and absolute performance criteria to determine if an upward or downward adjustment to individual executive payouts was warranted. This measurable, but not formulaic assessment, helps to ensure individual executive payouts reflect relative performance and performance against other measures that may not be reflected through the Quantitative and Qualitative Goals. Criteria reviewed can include, but are not limited to:

|

| |

> Shareholder value creation (TSR) > Actual versus anticipated catastrophe losses > Accident year performance | > Operating ROE ex-AOCI performance > Prior year development |

While both one- and three-year performance is considered, emphasis is placed on the most recent year's performance. Based on this review, the Committee may decide to adjust the payouts for some or all executives, depending on their area of responsibility and contribution to the year's results.

2017 PERFORMANCE VERSUS GOALS

The Committee reviewed our 2017 results against the Quantitative Goals. Despite a solid first half of 2017, we failed to achieve our threshold CR goals, resulting in a 0% performance factor for the quantitative AIP component.

The table below provides the 2017 CR Quantitative Goals, the results achieved against these goals and the associated performance factor. The performance factors are then weighted for each NEO at 70% for quantitative performance and 30% qualitative performance.

|

| | | | | | | | | | |

| | Quantitative Performance Goals | | | |

| Business Segment | Threshold*

(50% of Target) | | Target

(100% of Target) | | Maximum

(200% of Target) | | Actual

Result | | Performance

Factor | |

| Enterprise CR | 100.0 | % | 92.0 | % | 86.6 | % | 108.3 | % | 0.0 | % |

| Insurance CR | 100.0 | % | 93.9 | % | 89.2 | % | 106.8 | % | 0.0 | % |

| Reinsurance CR | 100.0 | % | 87.8 | % | 77.5 | % | 111.3 | % | 0.0 | % |

| |

| * | Performance below threshold goals results in no payout for the quantitative AIP component. |

The Committee then reviewed performance by each executive against Qualitative Goals and determined that each met or exceeded the vast majority of his or her qualitative objectives as described below under AIP Award Determinations. However, considering absolute and relative performance, as described above, the Committee determined to cap any NEO total annual incentive award at 30% of target and to apply negative discretion to the annual incentive awards for the CEO, former CFO, former Executive Deputy Chairman, and President, P&C to 0% of target.

AIP Award Determinations

|

| | | |

|

MICHAEL MCGAVICK Chief Executive Officer

| 2017 ANNUAL INCENTIVE |

|

| PERFORMANCE ASSESSMENT |

| Strategy & Growth |

| > | Performance excluding the natural catastrophes was solid with a P&C CR of 90.2%, a 0.5 point improvement from 90.7% in 2016 on the same basis. |

| > | P&C wrote $14.8 billion in gross written premiums in 2017 compared to $13.6 billion in 2016, an increase of 8.3%. |

| > | Net premiums earned increased 5.7% to $10.3 billion in 2017 from $9.8 billion in 2016. |

| > | Total revenues increased to $11.3 billion in 2017, a 7.4% increase over the $10.5 billion achieved in 2016. |

| > | Led the continued execution of XL's long-term strategy and partnered with the Board to explore and identify possible M&A opportunities. |

| Innovation & Continuous Improvement |

| > | Strategy of continuous improvement in client service validated as the Company retained its leadership position in the Gracechurch and J.D. Power surveys. |

| > | Conducted broad innovation communications throughout the year, supported by the Opportunity Tour, a series of 19 in-person town hall meetings conducted with Greg Hendrick. |

| Culture & Talent |

| > | Continued to develop senior leadership team and bench strength, including the internal promotion of Stephen Robb to CFO, the broadening of Greg Hendrick’s role to President, Property & Casualty, and the promotion of Charles Cooper to Chief Executive, Reinsurance. |

| > | Continued progress on our Diversity & Inclusion strategy with an increase in the percentage of women in middle and senior management positions, the graduation of our first Women's Executive Leadership Program and broader implementation of Inclusive Leader training, family friendly benefits, colleague resource groups, and diverse slate requirements for candidate searches. |

| > | Conducted colleague engagement survey with outstanding participation (90%) and very good results (75% engagement score). |

| AIP AWARD DETERMINATION |

>

| The Committee evaluated the performance of Mr. McGavick during 2017 relative to his Qualitative Goals. While the Committee determined that Mr. McGavick out-performed the majority of his Qualitative Goals, they considered the Company’s overall financial performance in 2017, including Operating ROE ex-AOCI, catastrophe losses as a percent of operating equity, and TSR relative to peers, and recommended that no annual incentive award be earned for 2017. The independent members of the Board ratified the Committee's recommendation. |

|

| | | |

|

STEPHEN ROBB Chief Financial Officer

| 2017 ANNUAL INCENTIVE |

|

| PERFORMANCE ASSESSMENT |

| Strategy & Growth |

| > | Oversaw a decrease in the underwriting expense ratio to 30.8% in 2017 from 32.0% in 2016. |

| > | Quickly established relationships with key investors upon transition to CFO role. |

| > | Led initial capital management efforts including a preference share tender offer and the issuance of €500 of subordinated debt. |

| > | Developed and managed tax strategy following passage of U.S. tax reform in late December. |

| > | Increased net investment income (excluding Life Funds withheld assets) by 5.3% to $651 million in 2017 relative to 2016. |

| Innovation & Continuous Improvement |

| > | Partnered with Chief Investment Officer to establish a new target operating model for the Investments Group in order to streamline operations and decision making and to gain efficiencies. |

| > | Oversaw the continued upgrading and restructuring of the Company's financial systems and led the simplification of the close process. |

| > | Led the restructuring of XL’s internal cost allocation process to ensure continued financial and tax efficiency. |

| Culture & Talent |

| > | Led the swift assembly of Finance Leadership Team and implementation of new finance career framework and finance leadership program. |

| AIP AWARD DETERMINATION |

>

| While Mr. McGavick determined, and the Committee agreed, that Mr. Robb met or exceeded each of his Qualitative Goals, they considered the Company's overall financial performance in 2017, and capped his annual incentive award at 30% of target, which resulted in a payout of $269,325. |

|

| | | |

|

GREGORY S. HENDRICK President, Property & Casualty

| 2017 ANNUAL INCENTIVE |

|

| PERFORMANCE ASSESSMENT |

| Strategy & Growth |

| > | The ex-catastrophe performance continued to show progress and Insurance achieved top-line growth goals, expense targets and an underlying profit metric (accident year CR excluding catastrophes) of 91.6% compared to 93.3% in 2016. |

| > | Increased new business through cross sell opportunities which contributed to an overall increase in gross written premiums to $14.8 billion in 2017 (compared to $13.6 billion in 2016). |

| Innovation & Continuous Improvement |

| > | Continued product redesign and enhancement resulting in top position for industry product innovation in Advisen Pacesetter index for the second year in a row. |

| > | Highest in J.D. Power customer satisfaction for large commercial insurers and major broker surveys continue to show XL Catlin claims as one of the top claim service providers in the marketplace. |

| Culture & Talent |

| > | Implemented a realigned P&C operating model by streamlining the reporting and oversight of business units, and creating clearer accountability and greater insight into the needs of clients and brokers. |

| > | 5% retention of high performing, high potential talent in Insurance. |

| AIP AWARD DETERMINATION |

>

| While Mr. McGavick determined, and the Committee agreed, that Mr. Hendrick met or exceeded each of his Qualitative Goals, they considered the Company's overall financial performance in 2017, and determined that no annual incentive award be earned for 2017. |

|

| | | |

|

CHARLES COOPER Chief Executive, Reinsurance

| 2017 ANNUAL INCENTIVE |

|

| PERFORMANCE ASSESSMENT |

| Strategy & Growth |