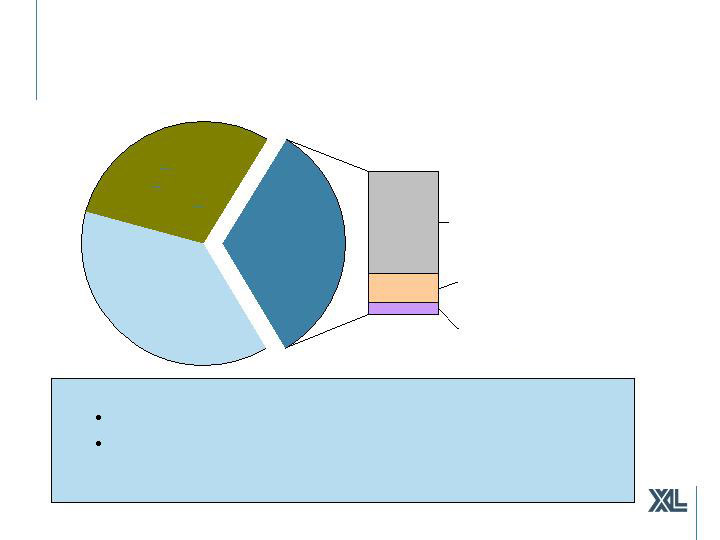

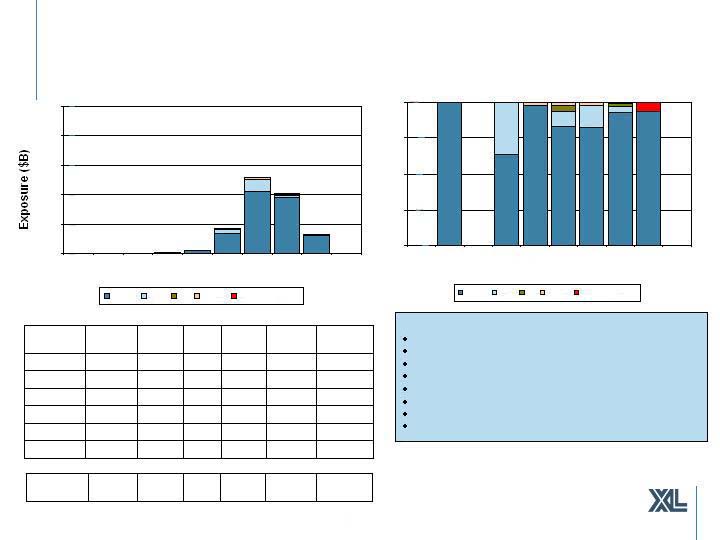

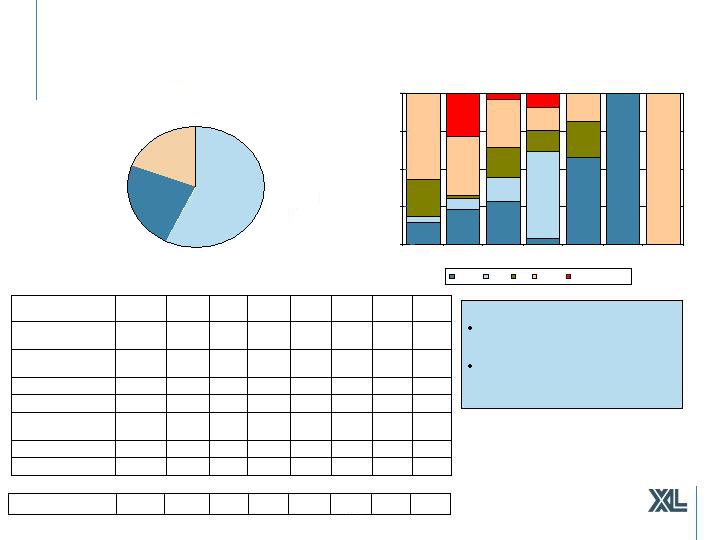

CMBS: $3.4 billion

As at June 30, 2008

Exposures in $Millions

Net Unrealized Gain (Loss) $Millions

(201)

(4)

(3)

(3)

(2)

(189)

Net

Unrealized (1)

Rating & Vintage Breakdown (%)

0.0%

25.0%

50.0%

75.0%

100.0%

Pre

2000

'00

'01

'02

'03

'04

'05

'06

'07

'08

AAA

AA

A

BBB

BB & Below

-

-

-

-

-

-

2008

371

1

1

6

2

361

2007

3,366

26

19

20

22

3,279

Total

4

2

12

BBB

15

2

3

AA

1,191

660

1,067

AAA

1,236

18

8

Other

668

1

3

2005

1,091

6

3

2006

Total

BB &

Below

A

Vintage

Rating & Vintage Breakdown ($B)

$-

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

$1.4

Pre

2000

'00

'01

'02

'03

'04

'05

'06

'07

'08

AAA

AA

A

BBB

BB & Below

Key Characteristics:

97% AAA; 91% Super/Senior tranches

Average Number of Loans: 166

51% of pools have > 140 loans

57% in Pre 2006 pools; 11% in 2007

Wtd Avg. Credit Enhancement: 26.3%, Levels>20%: 79%

Wtd. Avg. LTV: 67%, Wtd. Avg. DSCR: 1.6

41% experiencing 0% 60+ day delinquency; 78% have rates <1%

4 Securities ($5 million) downgraded in Q2’08

(1) Of the net unrealized losses on CMBS securities, $94 million is the result of the

weakening USD and is offset by the cumulative translation adjustment

11

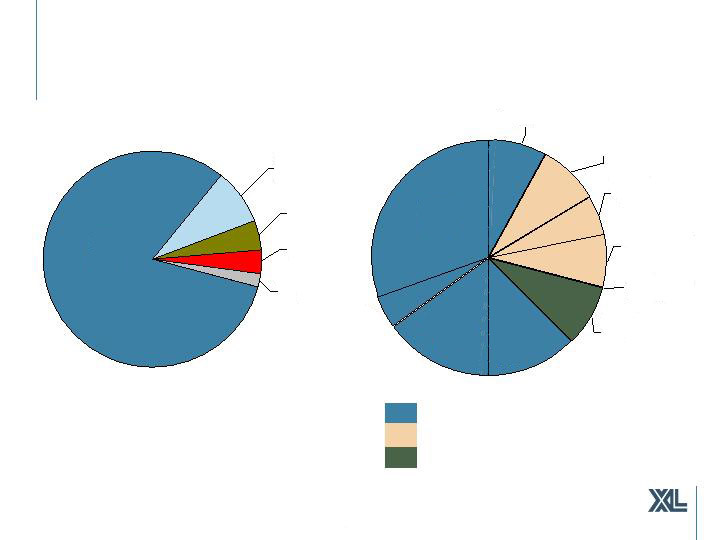

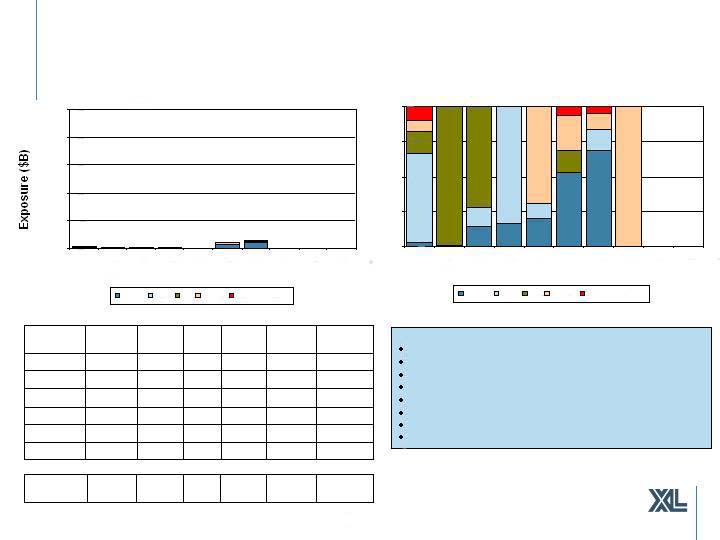

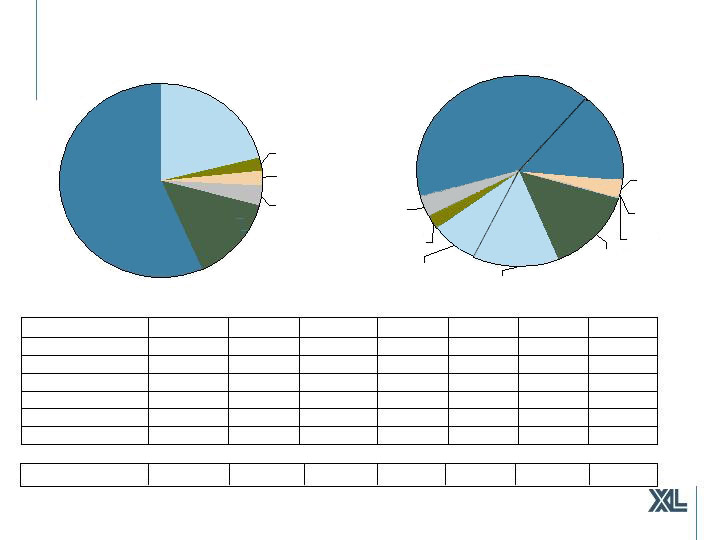

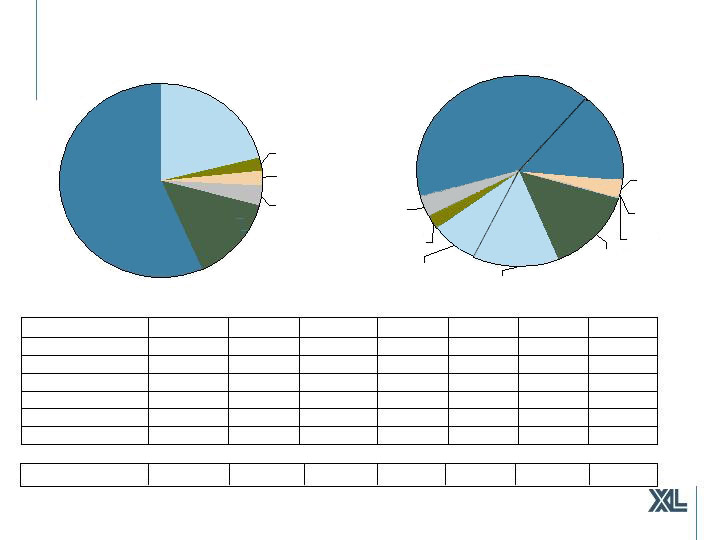

Guarantor Wrapped Assets: $533 million

As at June 30, 2008

By Sector ($M)

Structured

Credit, $305

Corporate,

$125

Muni, $103

Exposures in $Millions

Net Unrealized Gain (Loss) $Millions

(1)

-

(68)

-

(3)

(13)

(22)

(29)

Net Unrealized

Ratings of Underlying (%)

0.0%

25.0%

50.0%

75.0%

100.0%

AMBAC

FGIC

FSA

MBIA

MGIC

RAA

XLCA

AAA

AA

A

BBB

BB & Below

Notes:

Corporate bucket is made up of structured

corporate credit bonds of whole business

assets (non USD)

$57 million of the exposure above relates to “topical” structured credit ($37million Sub Prime; $14 million 2nd Lien; $7 million Alt-A)

128

-

-

1

8

33

51

35

Other

41

-

-

-

3

21

12

5

Auto ABS

57

1

8

-

4

14

10

20

“Topical” (Subprime,

2nd Lien, Alt-A)

150

31

-

46

MBIA

224

27

5

132

AMBAC

533

103

7

197

Total

-

-

11

-

8

Diversified Business

Securitization

-

-

-

-

2

Public Finance

Projects

1

8

12

19

119

Total

-

MGIC

4

FGIC

41

FSA

-

-

Municipal

RAA

SCA

Guarantor

12

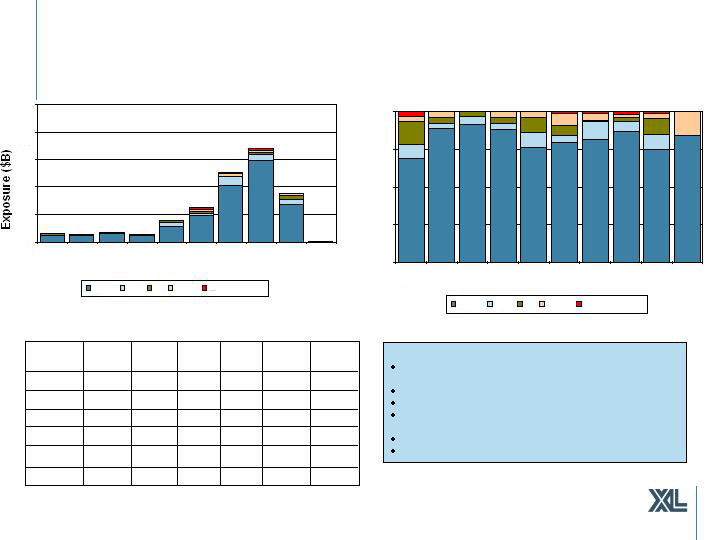

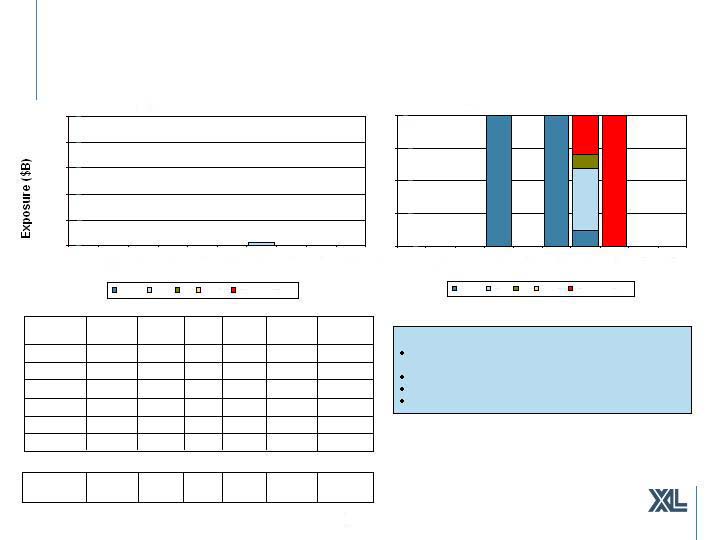

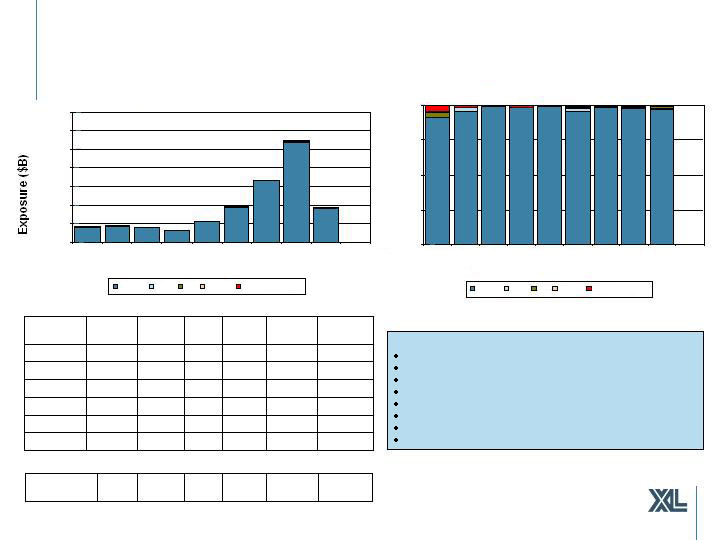

Consumer ABS: $1.5 billion

As at June 30, 2008

8%

117

-

-

-

-

-

117

Student Loan

1,532

558

857

Total

21

-

21

AAA

Wrapped

56%

2

2

30

15

787

Autos

100%

3

42

185

20

1,261

Total

40

BBB

5

AA

357

AAA

36%

1

155

Credit Card

% of

Total

BB &

Below

A

Exposures in $Millions

Credit Card Rating & Vintage Breakdown ($B)

$0.0

$0.1

$0.2

$0.3

$0.4

$0.5

$0.6

Pre

2000

'00

'01

'02

'03

'04

'05

'06

'07

AAA

AA

A

BBB

BB & Below

(4)

(24)

-

(18)

-

-

(2)

Net Unrealized

Net Unrealized Gain (Loss) $Millions

Autos:

Average credit support: 22.1%

11 bonds ($21 million) downgraded in Q2’08

Weighted average life 1.0 years

Credit Cards:

Average excess spread: 14%

Average credit enhancement to charge off

ratio: 4.05

Weighted average life 3.2 years

ABS Auto Rating & Vintage Breakdown ($B)

$0.0

$0.1

$0.2

$0.3

$0.4

$0.5

$0.6

Pre

2000

'00

'01

'02

'03

'04

'05

'06

'07

AAA

AA

A

BBB

BB & Below

13

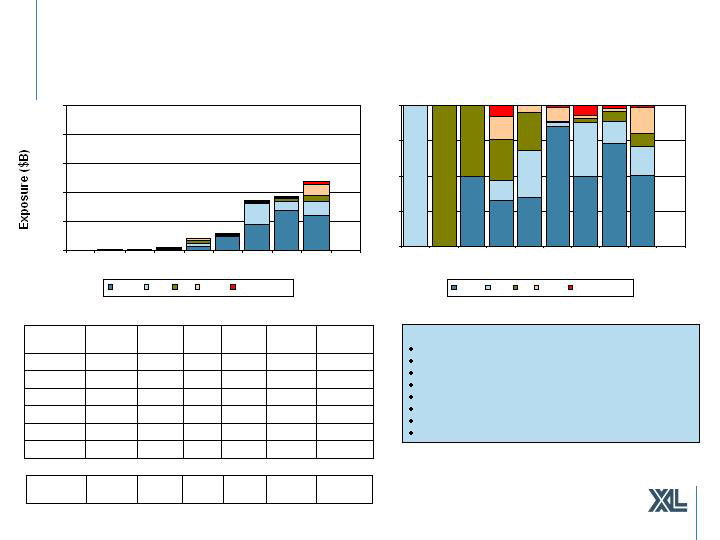

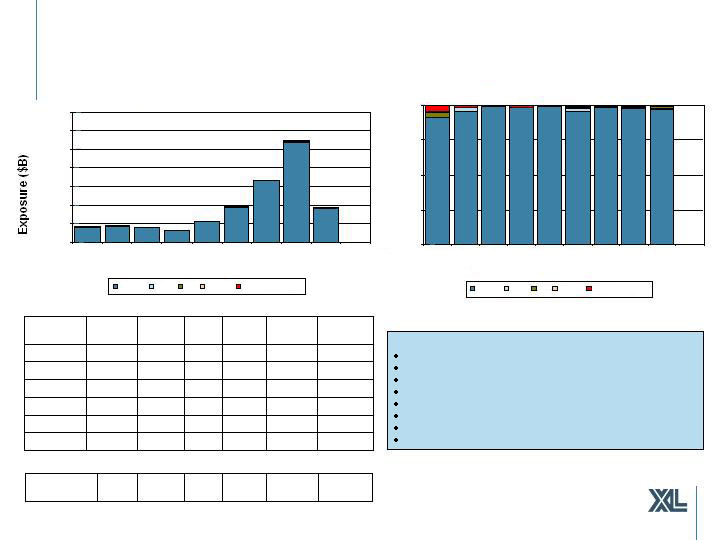

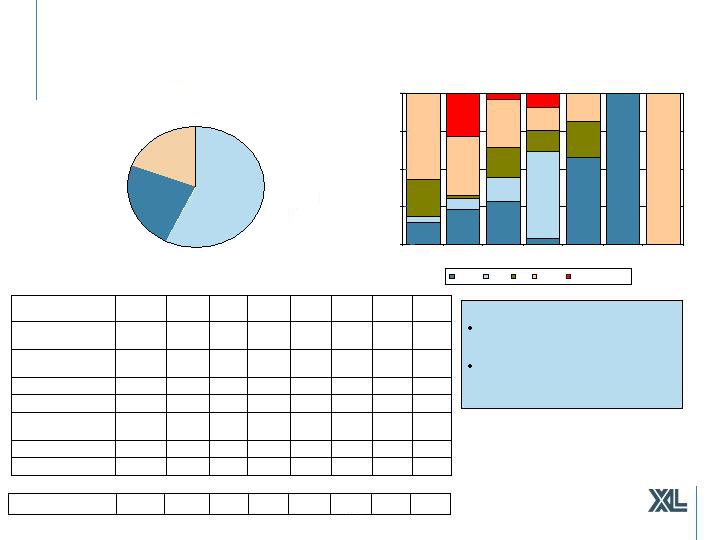

Total US Agency: $3.0 billion

As at June 30, 2008

71

-

-

-

-

71

GNMA

1,508

-

3

-

225

1,209

MBS

426

-

-

177

246

FHLB

97

-

-

-

97

Other

1,209

73

387

406

Senior Debt

17

-

10

7

Preferred Stock

241

-

4

60

Subordinated

626

-

FHLMC

1,683

1

FNMA

2,976

73

Total

1

-

Common Stock

Total

Farmer

Capital

FHLB

14%

Other

3%

Farmer Mac

2%

GNMA, 2%

FHLMC

21%

FNMA

58%

GNMA MBS

2%

Preferred Stock

1%

FNMA Debt

16%

Farmer Debt

2%

Common Equity

0%

FNMA MBS

42%

Other Debt

2%

FHLMC MBS

8%

FHLB Debt

14%

FHLMC Debt

13%

(1)

2

0

(8)

5

(8)

(6)

Net Unrealized

Total Agency Exposures in $Millions

Net Unrealized Gain (Loss) $Millions

14