Second Quarter 2019 Earnings Conference Call July 24, 2019 1

Legal Disclaimers Forward-Looking Statements: This presentation contains statements that are based on management’s beliefs, assumptions, current expectations, estimates, and projections about BOK Financial Corporation, the financial services industry, and the economy generally. These remarks constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of such words, and similar expressions are intended to identify such forward- looking statements. Management judgments relating to, and discussion of the provision and allowance for credit losses involve judgments as to future events and are inherently forward-looking statements. Assessments that BOK Financial’s acquisitions, including its latest acquisition of CoBiz Financial, Inc., and other growth endeavors will be profitable are necessary statements of belief as to the outcome of future events, based in part on information provided by others which BOKF has not independently verified. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expressed, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to, changes in interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and non-traditional competitors, changes in banking regulations, tax laws, prices, levies, and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. There may also be difficulties and delays in integrating CoBiz Financial Inc.'s business or fully realizing cost savings and other benefits including, but not limited to, business disruption and customer acceptance of BOK Financial Corporation's products and services. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at www.BOKF.com. All data is presented as of June 30, 2019 unless otherwise noted. 2

Steven G. Bradshaw Chief Executive Officer 3

Second Quarter Summary Net Income $137.6$137.6 $117.3 $114.4 $110.6 Q2 2019 Q1 2019 Q2 2018 $108.5 $1.93 $1.79 Diluted EPS $1.93 $1.54 $1.75 $1.75 $1.50 $1.54 Net income before taxes $175.4 $140.2 $148.5 Net income attributable to BOKF shareholders $137.6 $110.6 $114.4 2Q18 3Q18 4Q18 1Q19 2Q19 Net income attributable to shareholders Net income per share - diluted Noteworthy items impacting second quarter profitability • Continued, broad-based loan growth. • Added $1.2 billion to securities portfolio to help support net interest income in a falling rate environment. • Fee income driven by strong performance in Brokerage & Trading and Mortgage. • Diligent expense management with realization of acquisition expense synergies. • $5 million in loan loss provision due to continued loan growth. 4

Additional Details Quarterly Year over $billions Q2 2019 Growth Year Growth Period-End Loans $22.3 2.3% 23.6% Average Loans $22.0 1.1% 24.0% Period-End Deposits $25.3 (0.1)% 14.1% Average Deposits $25.2 2.2% 14.1% Fiduciary Assets $49.3 6.2% 5.9% Assets Under Management or in Custody $81.8 3.7% 3.7% • Loan growth continues, led by strength in Energy and Commercial Real Estate. • Average deposits up on a quarterly basis, year-over-year growth CoBiz related. • Fiduciary assets and assets under management up again this quarter on favorable equity markets and strong asset gathering activities. • $20 million in share repurchases in Q2. 5

Steven Nell Chief Financial Officer 6

Net Interest Revenue and Margin ($millions) Q2 2019 Q1 2019 Q4 2018 Q3 2018 Q2 2018 Net interest revenue $285.4 $278.1 $285.7 $240.9 $238.6 Provision for credit losses $5.0 $8.0 $9.0 $4.0 $— NIR after provision $280.4 $270.1 $276.7 $236.9 $238.6 Net interest margin 3.30% 3.30% 3.40% 3.21% 3.17% • Net interest income increased $7.3 million from the previous quarter. • Net interest margin was flat from the previous quarter. • 10 basis point increase due to: • $3.4 million interest recovery • Increase in discount accretion from CoBiz– Up from $7.8 million in the first quarter to $13.4 million this quarter. • 10 basis point decrease due to: • Lower loan yields from variable rate loans priced off LIBOR. • Continued increase in deposit exception pricing for commercial clients. • Expansion of our fixed-income mortgage-backed securities portfolio. 7

Fees and Commissions Revenue, $mil Growth: Quarterly, Quarterly, Year Trailing 12 Q2 2019 Sequential over Year Months Brokerage and Trading $40.5 28.2% 53.0% 12.8% Transaction Card 21.9 5.7% 4.5% 1.1% Fiduciary and Asset Management 45.0 3.8% 8.0% 1.8% Deposit Service Charges and Fees 28.1 (0.6)% 0.9% 0.2% Mortgage Banking 28.1 18.0% 6.8% 1.9% Other Revenue 12.4 (2.5)% (10.7)% (2.7)% Total Fees and Commissions $176.1 9.7% 12.0% 2.9% • Brokerage and Trading: Up largely due to strong mortgage backed security trading results. • Mortgage Banking: Lower mortgage interest rates led to a significant increase in applications and commitments. • All other fee revenues increased $2.4 million, or 2.2% over the previous quarter, largely due to seasonal factors. 8

Expenses %Incr. %Incr. ($mil) Q2 2019 Q1 2019 Q2 2018 Seq. YOY Personnel expense $160.3 $169.2 $138.9 (5.3)% 15.4% Other operating expense $116.8 $117.9 $107.5 (1.0)% 8.6% Total operating expense $277.1 $287.2 $246.5 (3.5)% 12.4% Efficiency Ratio 59.51% 64.80% 61.77% • Excluding CoBiz integration costs, personnel expense decreased $5.6 million as expected cost efficiencies from CoBiz are realized. • Excluding CoBiz integration costs, non-personnel expense increased $8.3 million. • Business promotion expense increased $2.9 million primarily due to increased seasonal advertisement spending and brand promotion in CO and AZ. • Insurance expense increased $1.9 million largely due to adjustments to deposit insurance expense related to CoBiz integration. • Increase in professional fees and services of $1.7 million and mortgage banking costs of $1.6 million were partially offset by a decrease in net losses and expenses of repossessed assets of $1.4 million. • A $1.0 million charitable donation was made to the BOKF Foundation in the second quarter. 9

Forecast and Assumptions • Mid single digit loan growth with continued strength in Energy, Healthcare and General C&I. • Provision levels moving forward will be influenced by loan growth, but are expected to be at similar dollar levels to the past couple of quarters. • Interest rate decreases forecasted by the market will continue to put downward pressure on net interest margin. • Revenue from fee-generating businesses, particularly Brokerage & Trading and Mortgage, could continue to benefit from lower interest rates. • Will attempt to maintain an efficiency ratio at or below 60%, as long as the environment remains favorable for revenue. • Capital strategy will support organic balance sheet growth and modest opportunistic share repurchases. Capital ratios are expected to improve over time. • Blended federal and state effective tax rate of 22-23% going forward. • CECL implementation on schedule. • Little impact to core allowance for loan losses. • Will be required to add an allowance for approximately $2.5 billion of acquired loans from CoBiz. • Additional allowance will be required on approximately $3.3 billion of government guaranteed, residential mortgage loans for exposure outside of the guarantee. 10

Stacy Kymes EVP-Corporate Banking 11

Loan Portfolio ($mil) Seq. Jun 30, Mar 31, Loan 2019 2019 Growth Energy $3,921.4 $3,705.1 5.8% Services 3,309.5 3,287.6 0.7% Healthcare 2,926.5 2,915.9 0.4% Wholesale/retail 1,793.1 1,706.9 5.1% Manufacturing 761.4 742.4 2.6% Public Finance 795.7 803.1 (0.9)% Other 829.5 801.1 3.5% Total C&I $14,336.9 $13,962.0 2.7% Commercial Real Estate 4,710.0 4,600.7 2.4% Residential Mortgage 2,170.8 2,192.6 (1.0)% Personal 1,037.9 1,003.7 3.4% Total Loans $22,255.7 $21,759.0 2.3% • Strong growth in energy and wholesale/retail the primary drivers of overall C&I growth. • Commercial Real Estate portfolio growth following wave of paydowns in the first quarter. 12

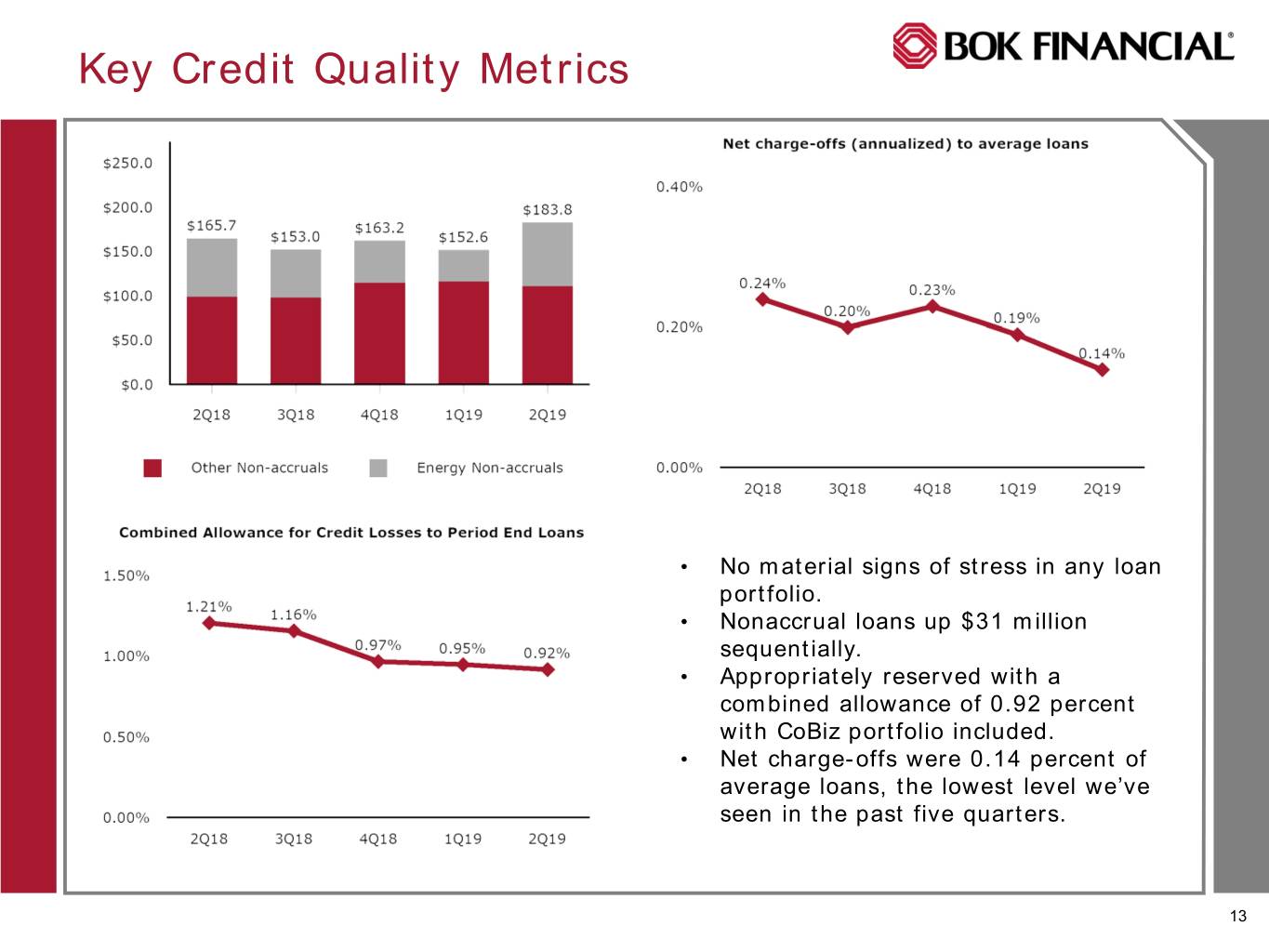

Key Credit Quality Metrics • No material signs of stress in any loan portfolio. • Nonaccrual loans up $31 million sequentially. • Appropriately reserved with a combined allowance of 0.92 percent with CoBiz portfolio included. • Net charge-offs were 0.14 percent of average loans, the lowest level we’ve seen in the past five quarters. 13

Steven G. Bradshaw Chief Executive Officer 14

Question and Answer Session 15