- BOKF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BOK Financial (BOKF) DEF 14ADefinitive proxy

Filed: 19 Mar 20, 10:23am

| X | Filed by Registrant | |

| Filed by a Party other than the Registrant | ||

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| X | Definitive Proxy Statement | |

| Definitive Additional Materials | ||

| Soliciting Material Pursuant to Section 240.14a-12 | ||

| BOK FINANCIAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| X | No fee required. | |

| Fee computed on table below per Exchange Act Rules 14-a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | ||

| 2) Aggregate number of securities to which transaction applies: | ||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) Proposed maximum aggregate value of transaction: | ||

| 5) Total fee paid: | ||

| Fee paid previously with preliminary materials. | ||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| 1) Amount Previously Paid: | ||

| 2) Form, Schedule or Registration Statement No.: | ||

| 3) Filing Party: | ||

| 4) Date Filed: | ||

| Executive Session Meetings | |

| Components of Executive Compensation | |

| Compensation Philosophy and Objectives | |

| Change in Control and Termination Benefits | |

| Pay Ratio Disclosure | |

| 1. | To fix the number of directors to be elected at twenty four (24) and to elect twenty four (24) persons as directors for a term of one year or until their successors have been elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending December 31, 2020; |

| 3. | To consider an advisory vote to approve the compensation of the named executive officers; and |

| 4. | To transact such other business as may properly be brought before the Annual Meeting or any adjournment or adjournments thereof. |

| Name & Address of Beneficial Owner | Beneficial Ownership | Percentage of Class | |

| George B. Kaiser P.O. Box 21468, Tulsa, Oklahoma 74121-1468 | 38,296,470 | 54.4% | |

| Name of Beneficial Owner | Amount & Nature of Beneficial Ownership(1) | Percent of Class(2) | ||

| Alan S. Armstrong | 2,025 | * | ||

| Norman P. Bagwell | 51,892 | (3) | * | |

| C. Fred Ball, Jr. | 8,007 | (4) | * | |

| Steven Bangert | 182,694 | (5) | * | |

| Peter C. Boylan, III | 6,870 | (6) | * | |

| Steven G. Bradshaw | 235,565 | (7) | * | |

| Chester E. Cadieux, III | 3,550 | * | ||

| Gerard P. Clancy | 711 | (8) | * | |

| John W. Coffey | 3,600 | * | ||

| Joseph W. Craft, III | 3,059 | * | ||

| Jack E. Finley | 600 | * | ||

| Scott B. Grauer | 56,031 | (9) | * | |

| David F. Griffin | 42,641 | (10) | * | |

| V. Burns Hargis | 18,030 | (11) | * | |

| Douglas D. Hawthorne | 4,664 | (12) | * | |

| Kimberley D. Henry | 1,650 | * | ||

| E. Carey Joullian, IV | 6,277 | (13) | * | |

| George B. Kaiser | 38,296,470 | (14) | 54.4% | |

| Stacy C. Kymes | 57,867 | (15) | * | |

| Stanley A. Lybarger | 33,159 | (16) | * | |

| Steven J. Malcolm | 4,042 | (17) | * | |

| Steven E. Nell | 80,556 | (18) | * | |

| E. C. Richards | 5,092 | (19) | * | |

| Claudia San Pedro | 450 | (20) | * | |

| Michael C. Turpen | 2,538 | * | ||

| R.A. Walker | 3,670 | * | ||

| Rose M. Washington | — | * | ||

| All directors, nominees and executive officers listed on pages 28-30 (34 persons) | 55.7% | |||

| ü | The Board of Directors recommends that you vote FOR the 24 nominees. | |||

| Name | Age | Principal Occupation and Business Experience During Last 5 Years and Directorships of Other Public Companies | First Year Became a Director |

| Alan S. Armstrong | 57 | Chief Executive Officer, President, and a Director of The Williams Companies, Inc. (energy holding company) since January 2011. Mr. Armstrong's qualifications to sit on our Board of Directors include his energy sector and management expertise, civic leadership experience, knowledge of our region and his public company experience. | 2013 |

| C. Fred Ball, Jr. | 75 | Chief Operating Officer of Spyglass Trading, LP (purchase, sale and brokerage of securities). Retired as Senior Chairman of BOT in January 2015, and formerly its Chairman, Chief Executive Officer, and President. Before joining BOT in 1997, Mr. Ball was Executive Vice President of Comerica Bank-Texas and later President of Comerica Securities, Inc. He is a director of Mid-Con Energy Partners, LP and serves on its audit committee. Mr. Ball’s qualifications to sit on our Board of Directors include his almost four decades of experience in the banking industry and his involvement with the Texas market. | 1999 |

| Steven Bangert | 63 | Vice-Chairman of Colorado-BOKF, NA. Mr. Bangert served as Chairman of the Board of Directors and Chief Executive Officer of CoBiz Financial, Inc. from September 1994 to September 2018 when it was acquired by BOK Financial Corporation. From August 1992 to March 1999, Mr. Bangert served as President and a director of Western Capital Holdings, Inc., formerly the bank holding company for River Valley Bank-Texas. From March 1992 to July 1998, Mr. Bangert also served as Chairman of the Board of River Valley Bank-Texas, and from April 1988 to July 1994, he served as Vice Chairman of the Board and Chief Executive Officer of River Valley Savings Bank-Illinois. From February 1994 to July 1998, Mr. Bangert served as a director and member of the Executive Committee of Lafayette American Bank. The Company believes Mr. Bangert's qualifications to serve as a director include his financial services industry experience, his merger and acquisition experience, his extensive board experience in the for-profit and not-for-profit world and his years of experience as a director of CoBiz Financial. | 2018 |

| Peter C. Boylan, III | 56 | Co-Founder, Chairman, Director, President, and Chief Executive Officer of Cypress Energy Holdings, LLC (a pipeline inspection and integrity company serving the energy sector) since 2012. Mr. Boylan is also Chairman and Chief Executive Officer of Cypress Energy Partners, GP, LLC, that controls Cypress Energy Partners, L.P. (NYSE-traded master limited partnership). From 1994 through 2004, Mr. Boylan served in a variety of senior executive management positions of various public and private companies controlled by Liberty Media Corporation. Mr. Boylan’s qualifications to sit on our Board of Directors include his substantial public company board and senior executive management and leadership experience, and industry-specific expertise across a variety of industries (including energy, technology, banking, and media). | 2005 |

| Steven G. Bradshaw | 60 | President and Chief Executive Officer. Mr. Bradshaw became the Chief Executive Officer at the Company in January 2014 after previously serving in a number of roles at the Company since joining in 1991. Most recently he served as Senior Executive Vice President and was responsible for all aspects of consumer banking, corporate marketing, mortgage banking, investment securities, trust activities, treasury services, international banking, community development and Community Reinvestment Act responsibilities for all seven banking divisions within the Company. He also served as chairman of the Company’s broker-dealer subsidiary, BOK Financial Securities, Inc. Mr. Bradshaw’s qualifications to sit on our Board of Directors include his position and years of leadership at the Company, and extensive knowledge of all aspects of our business. | 2014 |

| Chester E. Cadieux, III | 53 | Chairman and Chief Executive Officer of QuikTrip Corporation (a gasoline and retail convenience chain) since 2002. Mr. Cadieux previously served as Vice President of Sales at QuikTrip Corporation. Mr. Cadieux’s qualifications to sit on our Board of Directors include his knowledge of finance and accounting, his management experience, and his knowledge of all of our geographic markets. | 2005 |

| Gerard P. Clancy | 58 | Former President, University of Tulsa, serving from November 2016 to January 2020. Prior to becoming President, Dr. Clancy served as Vice President for Health Affairs, Dean of the Oxley College of Health Services and held the Oxley Foundation Chair in Community Medicine, all at the University of Tulsa. Dr. Clancy's qualification to sit on our Board of Directors include his thirty years of leadership as a physician, twenty years of leadership as an academic and his understanding of the local community. | 2018 |

| John W. Coffey | 57 | Private investor and Chartered Financial Analyst. Mr. Coffey retired from the position of Managing Director, Wellington Management Company, LLP, (a private, investment management company) which he held from September 2007 until June 2017. Mr. Coffey's qualifications to sit on our Board of Directors include his extensive financial services expertise, understanding of business value, business risk and strategic decision making and experience with finance, accounting, securities markets, corporate governance, mergers and acquisitions, risk assessment and government relations. | 2018 |

| Joseph W. Craft, III | 69 | President, Chief Executive Officer and Director of Alliance Resource Partners, L.P. (a diversified natural resource company) since 1999 and Chairman since 2019. Mr. Craft served as Chairman, President, Director and Chief Executive Officer of Alliance Holdings GP, L.P. from 2006-2018. Previously, he served as President of MAPCO Coal Inc. since 1986. Mr. Craft’s qualifications to sit on our Board of Directors include his extensive experience in corporate leadership, as well as his public company experience. | 2007 |

| Jack E. Finley | 72 | Self-employed certified public accountant. Mr. Finley was a partner with Grant Thornton LLP from 2001 to 2006. From 2011 to 2018 he was a banking industry senior advisor for Grant Thornton. Previously, he served as a National Practice Director at Hudson Financial Solutions and as an audit partner at KPMG. Mr. Finley's qualifications to sit on our Board of Directors include his four decades of experience as a certified public accountant and a partner at two international accounting firms, predominately focused on banking and other financial services. | 2017 |

| David F. Griffin | 54 | Chairman and Chief Executive Officer of Griffin Capital, L.L.C. President and Chief Executive Officer, Griffin Communications, L.L.C. (owns and operates CBS- and CW-affiliated television stations plus associated websites, billboards, and radio stations in Oklahoma). Mr. Griffin was formerly President and General Manager, KWTV-9 (Oklahoma City). Mr. Griffin’s qualifications to sit on our Board of Directors include his significant expertise, experience, and background in corporate management and his involvement with both the Oklahoma City and Tulsa markets. | 2003 |

| V. Burns Hargis | 74 | President, Oklahoma State University. Prior to becoming OSU President, Mr. Hargis served as Vice Chairman, BOK Financial and BOK and Director of BOK Financial Securities, Inc. since 1993. Mr. Hargis was formerly Attorney and Shareholder of the law firm of McAfee & Taft (Oklahoma City, Oklahoma). Mr. Hargis’ qualifications to sit on our Board of Directors include his nearly three decades practicing law with a focus on financial reporting and litigation, including representing financial institutions and their boards, as well as having served for many years as our Vice Chairman. | 1993 |

| Douglas D. Hawthorne | 72 | Advisor and former founding Chief Executive Officer Emeritus, Texas Health Resources. Prior to helping create Texas Health Resources in 1997, Mr. Hawthorne was Chief Executive Officer of Presbyterian Healthcare System. Mr. Hawthorne’s qualifications to sit on our Board of Directors include his knowledge of the healthcare sector and of the Texas market. | 2013 |

| Kimberley D. Henry | 55 | Executive director of Sarkeys Foundation, a private, charitable foundation that provides grants and gifts to Oklahoma’s non-profit organizations. Ms. Henry is the former First Lady of Oklahoma. Ms. Henry’s qualifications to sit on our Board of Directors include her knowledge of our geographic market, her leadership skills, and her extensive civic involvement, including participation on numerous boards of non-profit organizations. | 2015 |

| E. Carey Joullian, IV | 59 | Chairman, President and Chief Executive Officer of Mustang Fuel Corporation and subsidiaries; President and Manager, Joullian & Co., L.L.C.; Manager, JCAP, L.L.C. Mr. Joullian’s qualifications to sit on our Board of Directors include his significant experience and expertise in the oil and gas industry and his expertise in accounting. | 1995 |

| George B. Kaiser | 77 | Chairman of the Board and majority shareholder of BOK Financial and BOKF, NA; President, Chief Executive Officer, and principal owner of GBK Corporation, parent of Kaiser-Francis Oil Company (independent oil and gas exploration and production company); founder of Excelerate Energy and Argonaut Private Equity. Mr. Kaiser’s qualifications to sit on our Board of Directors include his four decades of executive leadership in the oil and gas industry, his broad perspective gained from involvement in diverse industries, his knowledge of our business, and his interest as the majority owner of our company. | 1990 |

| Stanley A. Lybarger | 70 | Vice Chairman of the Board. Former President and Chief Executive Officer of BOK Financial and BOKF. Mr. Lybarger was previously President of BOK Oklahoma City Regional Office and Executive Vice President of BOK with responsibility for corporate banking. He is a director and chairman of the audit committee of Cypress Energy Partners GP, LLC. Mr. Lybarger’s qualifications to sit on our Board of Directors include his prior role as our Chief Executive Officer, his three decades of leadership positions with BOKF, and his extensive knowledge of all facets of the banking industry. | 1991 |

| Steven J. Malcolm | 71 | Retired Chairman, President and Chief Executive Officer of The Williams Companies, Inc. (energy holding company) and Williams Partners L.P. Mr. Malcolm was previously President and Chief Executive Officer of Williams Energy Services after serving as senior vice president and general manager of Midstream Gas and Liquids for Williams Energy Services. In December 2011, Mr. Malcolm became a director of ONEOK, Inc. and ONEOK Partners. Mr. Malcolm’s qualifications to sit on our Board of Directors include his experience in the energy sector as well as his public company and executive management expertise. | 2002 |

| Steven E. Nell | 58 | Executive Vice President and Chief Financial Officer . Mr. Nell is responsible for all accounting and financial reporting, corporate tax, capital markets, mergers and acquisitions, and investor relations for the Company. Mr. Nell joined BOK Financial in 1992 as manager of management accounting. He was named controller of management accounting in 1996 and corporate controller in 1999. He became Chief Financial Officer in 2001. Before joining the Company in 1992, Mr. Nell was with Ernst & Young LLP for eight years auditing public and private companies. Mr. Nell’s qualifications to sit on our Board of Directors include his position and years of leadership at BOKF, and extensive knowledge of all aspects of our business. | 2018 |

| E.C. Richards | 70 | Managing Member of Core Investment Capital, LLC. Prior to September 1999, Mr. Richards served as Executive Vice President and Chief Operating Officer for Sooner Pipe Corporation (distributor of tubular products worldwide with domestic and international operations), a subsidiary of Oil States International. Mr. Richards previously served on the BOK Financial Board of Directors from 1997 through 2001. Mr. Richards’ qualifications to sit on our Board of Directors include his diverse background in the private equity and distribution industries and his civic involvement. | 2008 |

| Claudia San Pedro | 50 | President of SONIC, part of the Inspire Brands, Inc. family of restaurants. San Pedro assumed her role at SONIC in January 2018. She joined SONIC in 2006 as vice president of investor relations and treasurer. Ms. San Pedro was promoted to executive vice president and chief financial officer in 2015, and was responsible for SONIC’s financial planning practices, as well as the brand’s relationship with lending institutions, shareholders, and the financial community. Prior to joining SONIC, she served as the director for the Oklahoma Office of State Finance, appointed by Governor Brad Henry in 2005. Ms. San Pedro's qualifications to sit on our Board of Directors include her knowledge in finance and accounting, public company executive management experience and knowledge of retail marketing across our geographic markets. | 2019 |

| Michael C. Turpen | 70 | Partner at the law firm of Riggs, Abney, Neal, Turpen, Orbinson & Lewis in Oklahoma City, Oklahoma. Mr. Turpen previously served as Attorney General for the State of Oklahoma. He is serving his second 9-year term as a Regent for Oklahoma State Regents for Higher Education. Mr. Turpen's qualifications to sit on our Board of Directors include his legal expertise, his public services experience and leadership skills demonstrated through extensive involvement with non-profit boards and organizations. | 2011 |

| R.A. Walker | 63 | Served as president and chief executive officer of Anadarko Petroleum Corporation (Anadarko) from 2012 to 2019 and was named chairman in 2013. He joined Anadarko in 2005 as senior vice president-finance and chief financial officer, later serving as president and chief operating officer before becoming the chief executive officer. Mr. Walker is currently on the boards of ConocoPhillips and Health Care Services Corporation and is vice chairman and a member of the executive committee of the Business Council and the chairman of the Board of Trustees of the Houston Museum of Natural Science. Mr. Walker’s qualifications to sit on our Board of Directors include his knowledge of the energy sector and his public company expertise. | 2013 |

| Rose M. Washington | 55 | Chief Executive Officer, Tulsa Economic Development Corporation ("TEDC"), an entity promoting small business growth in the Tulsa region, since 2001. Ms. Washington served on the Board of Directors of the Federal Reserve Bank of Kansas City beginning in 2013, after having served three years on the Oklahoma City Branch board of directors, and served as Chair of the Federal Reserve Bank of Kansas City Board of Directors from January 2017 until December 2019. Before joining TEDC, Ms. Washington served as assistant vice president and director of the University of Southern California’s Division of External Relations, special assistant to the dean and director of placement at Jackson State University School of Business, and was an officer at Trustmark National Bank in Jackson, Mississippi. Ms. Washington's qualifications to sit on our board of directors include her extensive understanding of economic policy, knowledge of banking regulations and regulatory processes and her involvement with business development in our region. | Nominee |

| ü | The Board of Directors recommends that you vote FOR the ratification of the selection of Ernst & Young LLP as the independent auditor of BOK Financial and its subsidiaries for the fiscal year ending December 31, 2020. | |||

| • | the professional qualifications of EY and that of the lead audit partner and other key engagement members relative to the current and ongoing needs of the Company; |

| • | EY's historical and recent performance on the Company's audits, including the extent and quality of EY's communications with the Audit Committee thereto; |

| • | the appropriateness of EY's fees relative to both efficiency and audit quality; |

| • | EY's independence policies and processes for maintaining its independence; |

| • | EY's tenure as the Company's independent public accounting firm and its related depth of understanding of the Company's business, operations and systems and the Company's accounting policies and practices; and |

| • | EY's capability, expertise and efficiency in handling the breadth and complexity of the Company's operations. |

| ü | The Board of Directors recommends that you vote FOR the approval of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement. | |||

Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards(2) ($) | Total ($) |

| Alan S. Armstrong | 11,000 | 23,031 | 34,031 |

| C. Fred Ball, Jr. | 15,000 | 23,031 | 38,031 |

| Steven Bangert | 13,000 | 23,031 | 36,031 |

| Peter C. Boylan, III | 14,000 | 23,031 | 37,031 |

| Chester Cadieux, III | 10,250 | 23,031 | 33,281 |

| Gerard P. Clancy | 6,000 | 23,031 | 29,031 |

| John W. Coffey | 16,000 | 23,031 | 39,031 |

| Joseph W. Craft | 19,250 | 23,031 | 42,281 |

| Jack E. Finley | 20,750 | 23,031 | 43,781 |

| David F. Griffin | 20,500 | 23,031 | 43,531 |

| V. Burns Hargis | 11,000 | 23,031 | 34,031 |

| Douglas D. Hawthorne | 15,750 | 23,031 | 38,781 |

| Kimberley D. Henry | 8,000 | 23,031 | 31,031 |

| E. Carey Joullian, IV | 35,250 | 23,031 | 58,281 |

| Stanley A. Lybarger | 26,250 | 23,031 | 49,281 |

| Steven J. Malcolm | 10,250 | 23,031 | 33,281 |

| E.C. Richards | 9,250 | 23,031 | 32,281 |

| Claudia San Pedro | 11,250 | 23,031 | 34,281 |

| Michael C. Turpen | 11,000 | 23,031 | 34,031 |

| R. A. Walker | 9,500 | 23,031 | 32,531 |

| (1) | George B. Kaiser, a non-officer director, is not listed as he does not receive payment for serving as a director. |

| (2) | The BOK Financial Directors Stock Compensation Plan provides that the issuance price for the director compensation shares is the average of the mid-points between the highest price and the lowest price at which trades occurred on NASDAQ on the five trading days immediately preceding the end of the calendar quarter. Director shares were granted in 2019 at the following prices: first quarter, $79.83; second quarter, $74.62; third quarter, $80.05; and fourth quarter, $87.18. The Stock Awards column reflects actual payments made to the directors in 2019 for service in the fourth quarter of 2018 and the first three quarters of 2019. The total BOK Financial common stock owned by each director and nominee as of March 2, 2020 may be found in the Security Ownership of Certain Beneficial Owners and Management table on page 7. |

| Members | Responsibilities include oversight of |

Coffey (Chairman) Boylan Cadieux Clancy Finley Henry Malcolm Walker | • Enterprise-wide risk management • Capital planning and adequacy, including stress testing • Market risk including rate, price, and liquidity • Corporate-wide policy management framework • Risk transfer program • Mergers and acquisitions • Alternative investments • Operating risks including cybersecurity and information technology • Counterparty risk • Third party risk • Compliance with laws and regulations including data privacy • Reports of examinations from regulators |

| Members | Responsibilities include oversight of |

Joullian (Chairman)(1) Finley Hawthorne Lybarger San Pedro | • Accounting and financial reporting policies of the Company • Internal controls over financial reporting • Selection and reporting of the Company’s independent auditors • Audits of the financial statements of the Company • Related party reporting (other than related party credit transactions overseen by the Credit Committee) • Reports of internal audits • Review whistleblower complaints • Appropriateness of the allowance for loan losses and accrual for off-balance sheet credit losses • Appropriateness of the mortgage servicing rights valuation |

| (1) | The Board of Directors designated Mr. Joullian as its "audit committee financial expert," as defined in Item 407(d) of Regulation S-K. |

| Members | Responsibilities include approval or review of |

Craft (Chairman) Cadieux(1) Griffin(1) Kaiser(1) Malcolm Richards | • Compensation of the Chief Executive Officer • Compensation of direct reports to the Chief Executive Officer • Compensation of other officers participating in the Company’s Executive Incentive Plan • Compensation incentives to determine such incentives do not create an unacceptable level of risk |

| (1) | Members are non-voting on matters pertaining to 162(m) of the Internal Revenue Code. |

| Members | Responsibilities include oversight of |

Griffin (Chairman) Armstrong Ball Bangert Boylan Bradshaw Craft Hargis Kaiser Lybarger Richards Turpen | • Quality of the Company’s credit portfolio and trends affecting the credit portfolio (and reporting to the Board regarding such quality and trends) • Extension of credit exceeding amounts as determined from time to time by the Board • Effectiveness and administration of credit-related policies and related party credit transactions |

| Norman P. Bagwell | |

| Executive Vice President, Regional Banks | |

| Chairman and Chief Executive Officer, Bank of Texas | |

| Norman P. Bagwell, age 57, is Executive Vice President, Regional Banks and Chief Executive Officer and Chairman of Bank of Texas, with responsibility for the six regional markets and the Oklahoma City market, which includes all lines of business, with an emphasis on commercial and business banking. Mr. Bagwell has almost three decades of banking experience in Texas. Prior to joining Bank of Texas in 2008, he served as President of the Dallas Region for JPMorgan Chase, and previously served as President of the Dallas Region for Bank One. | |

| Steven G. Bradshaw | |

| President and Chief Executive Officer | |

| Steven G. Bradshaw, age 60, is President and Chief Executive Officer of the Company and BOKF, NA. Mr. Bradshaw became the chief executive in January 2014 after previously serving in a number of roles at the Company since joining the Company in 1991. Most recently he served as Senior Executive Vice President and was responsible for all aspects of consumer banking, corporate marketing, mortgage banking, investment securities, trust activities, treasury services, international banking, community development and Community Reinvestment Act responsibilities for all seven banking divisions within the Company. He also served as chairman of the Company’s broker-dealer subsidiary, BOK Financial Securities, Inc. | |

| Joseph A. Gottron, II | |

| Executive Vice President, Chief Information Officer | |

| Joseph A. Gottron, II, age 56, is Executive Vice President and Chief Information Officer of BOK Financial. Mr. Gottron was named Chief Information Officer in September 2017. In his role, Mr. Gottron leads the Operations and Technology division, which enables and supports almost every facet of the Company. Prior to joining in November 2016 as Chief Technology Officer, Mr. Gottron served as Chief Administrative Officer of Heartland Bank in Gahanna, Ohio. Prior leadership roles included eight years at Cardinal Health, where he held the position of Chief Information Officer of the Pharmaceutical Segment and six years at Huntington Bancshares, where he led the technology team as the Chief Information Officer. He started his career at IBM holding a variety of roles over the course of 16 years. | |

| Scott B. Grauer | |

Executive Vice President, Wealth Management | |

| Chief Executive Officer of BOK Financial Securities, Inc. | |

| Scott B. Grauer, age 55, is Executive Vice President, Wealth Management and Chief Executive Officer and Chairman of the Company’s broker-dealer subsidiary, BOK Financial Securities, Inc. In his current role, Mr. Grauer is responsible for the Company’s wealth management business lines in all markets, including Institutional Wealth, The Private Bank, and International Banking. He also serves as chairman of the Company’s registered investment advisers, Cavanal Hill Investment Management and BOK Financial Private Wealth, Inc., and BOK Financial Asset Management. Mr. Grauer joined the Company in 1991 as part of the company’s acquisition of an independent retail brokerage operation and was named manager of BOK Financial Securities, Inc. retail in 1996. In late 1999, he was named president and Chief Executive Officer of the firm and assumed responsibilities for retail, institutional and investment banking activities when BOK Financial first combined these units under one organization. | |

| Martin E. Grunst | |

| Executive Vice President and Chief Risk Officer | |

| Martin E. Grunst, age 53, is Executive Vice President and Chief Risk Officer. As Chief Risk Officer, Mr. Grunst is responsible for enterprise-wide risk management, information security, and ensuring the company’s compliance with government regulations. Mr. Grunst served as treasurer from 2009-2016. Before joining the Company as treasurer in 2009, he served as treasurer for Citizens Bank and Citizens Republic Bancorp in Michigan for six years, where he had the additional responsibility of managing corporate finance. Previously, Mr. Grunst was with Bank One (now JPMorgan Chase) in Columbus, Ohio, where he worked in treasury, corporate finance, and line of business finance roles, including asset liability manager and finance manager for Banc One Ohio Corporation, manager of acquisition planning for the credit card line of business, finance manager for commercial real estate lending, asset liability manager for the retail line of business, and finance manager for consumer lending. | |

| Rebecca D. Keesling | |

| Executive Vice President and Chief Auditor | |

| Rebecca D. Keesling, age 47, is Executive Vice President and Chief Auditor, responsible for ensuring the Company’s internal controls are designed properly and operating effectively and performing independent assessments of the Company’s compliance with various laws and regulations. Previously, Ms. Keesling was Senior Vice President and Manager of Loan Portfolio Reporting, where she managed a team responsible for financial reporting as it pertained to the loan portfolio and allowance for credit losses. Ms. Keesling joined the Company in 2004 as Vice President and Corporate Audit Manager. Prior to joining BOK Financial, Ms. Keesling spent 10 years in the public accounting industry primarily with Ernst & Young LLP auditing private and publicly owned companies. | |

| Stacy C. Kymes | |

| Executive Vice President, Corporate Banking | |

| Stacy C. Kymes, age 49, is Executive Vice President, Corporate Banking. Mr. Kymes oversees all the specialized banking areas within the Commercial Banking division, including energy, commercial real estate, healthcare, treasury services, and commercial strategies. He also has oversight for TransFund, the eighth largest ATM network in the US. Prior to his appointment to his current position in 2015, Mr. Kymes served as Chief Credit Officer and was responsible for all aspects of credit administration, including credit approval, policy administration, loan portfolio reporting, loan and appraisal review, and loan workouts. Mr. Kymes joined the Company in 1996 and has held a number of positions in various areas of the company’s finance and credit divisions including Chief Auditor, Controller, Director of Corporate Development and Treasurer. | |

| Derek S. Martin | |

| Executive Vice President, Consumer Banking Services | |

| Derek S. Martin, age 49, is Executive Vice President - Consumer Banking. Mr. Martin oversees all consumer, small business and mortgage banking functions operating under seven brands across eight states. He is also responsible for the Corporate Marketing division. He joined the Company in 1994 and has held a variety of roles across the consumer bank. Prior to his current position, he was the head of Strategic Services, which was responsible for strategy, digital banking and origination, business intelligence and analytics, operations, contact center, small business, credit delivery and various product lines. | |

| Marc C. Maun | |

| Executive Vice President and Chief Credit Officer | |

| Marc C. Maun, age 61, is Executive Vice President and Chief Credit Officer. Most recently, Mr. Maun served for two years as the Chairman and Chief Executive Officer of Bank of Oklahoma, Oklahoma City. Since joining BOK Financial in 1985, Mr. Maun has overseen significant business divisions such as Treasury, International Banking, Mergers and Acquisitions, Corporate Banking and Correspondent Banking. Before moving to Oklahoma City in 2013, Mr. Maun was chairman and Chief Executive Officer of Kansas City market. | |

| John C. Morrow | |

| Senior Vice President and Chief Accounting Officer | |

| John C. Morrow, age 64, is Senior Vice President and Chief Accounting Officer. Mr. Morrow is responsible for the Company’s financial reporting and accounting policies, internal controls over financial reporting, corporate tax, and accounting operations. He joined the Company as financial reporting manager in 1993 and became chief accounting officer in 2009. He was previously with Ernst & Young LLP for 10 years, primarily serving public and privately owned financial institutions. | |

| Steven E. Nell | |

| Executive Vice President and Chief Financial Officer | |

| Steven E. Nell, age 58, is Executive Vice President and Chief Financial Officer. Mr. Nell is responsible for all accounting and financial reporting, corporate tax, capital markets, mergers and acquisitions, and investor relations. Mr. Nell joined the Company in 1992 as manager of management accounting. He was named controller of management accounting in 1996 and corporate controller in 1999. He became Chief Financial Officer in 2001. Before joining the Company in 1992, Mr. Nell was with Ernst & Young LLP for eight years auditing public and private companies. | |

| Kelley E. Weil | |

| Chief Human Resources Officer | |

| Kelley E. Weil, age 43, is Executive Vice President, Chief Human Resource Officer. She is responsible for the design and delivery of the Company's human capital strategy, which focuses on strengthening the employee experience. Ms. Weil joined the Company in 2015 as the director of human resource operations and employee relations. Most recently, Ms. Weil worked for Williams Companies, Inc., where she served as director of human resources operations, employee relations and senior human resource business partner. Prior to relocating to Tulsa, her roles included senior vice president of human resources for PlainsCapital Bank, now a part of Hilltop Holdings, and director of employee benefits and talent acquisition for a 1,200-bed hospital, Covenant Health System. | |

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | Weighted-average exercise price of outstanding options, warrants, and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column) (1) | ||

| Equity compensation plans approved by security holders: | |||||

| (a) Stock options | 36,100 | $56.75 | 2,421,094 | ||

| (b) Non-vested common shares | 427,178 | Not applicable | Not applicable | ||

| (c) Non-vested restricted stock units | 46,689 | Not applicable | Not applicable | ||

| Sub-total | 509,967 | 2,421,094 | |||

| Equity compensation plans not approved by security holders | None | None | None | ||

| Total | 509,967 | 2,421,094 | |||

| (1) | Includes 378,069 shares of common stock which may be awarded pursuant to the BOK Financial Directors Stock Compensation Plan. |

| ▪ | Reward sustained, above peer performance |

| ▪ | Encourage both individual performance and teamwork |

| ▪ | Link compensation to operational and strategic results |

| ▪ | Align executive interests with shareholder interests |

| ▪ | Discourage inappropriate risk taking |

| ▪ | Keep BOK Financial compensation competitive with peer banks |

| ▪ | Create long-term commitment to the Company |

| ▪ | Salary |

| ▪ | Executive Incentive Compensation (annual and long-term) |

| ▪ | 401(k) Plan |

| Executive Name | Multiple of Base Salary |

| Steven G. Bradshaw | 6 X base salary |

| Steven E. Nell | 5 X base salary |

| Stacy C. Kymes | 4 X base salary |

| Scott B. Grauer | 4 X base salary |

| Norman P. Bagwell | 4 X base salary |

| • | EPS Growth is a component of the annual and long term incentive under the Executive Incentive Plan. |

| • | The Committee views EPS Growth as an important variable used in public markets to measure profitability and determine the Company’s stock price and, thus, shareholder value. |

| • | “Business Performance” is determined by comparing the two year average actual financial contribution of a business unit of the Company to its planned performance. Business Performance targets are established using standard Company methodologies and approved annually by the Committee. |

| • | Linking compensation to Business Performance motivates executives to achieve superior results in their particular business units, contributing to Company-wide profitability. |

| • | At the beginning of each year, the President and CEO meets with each of the named executives to establish individual strategic objectives. |

| • | Strategic Objectives focus the executive team on expanding organizational capabilities, optimizing business models, and managing risk. |

| • | Progress is discussed with each executive periodically throughout the year. |

| • | The Company’s internal compensation group completes an annual peer review of executive compensation using publicly available information, including proxy statements. |

| • | The Committee uses this information to assist in setting base salary and to establish annual and long-term compensation targets in accordance with the Plan. |

| • | The Committee annually updates the peer group of bank holding companies in accordance with the following guidelines that were updated at the end of 2015: |

| • | The peer banks will include only publicly-traded, SEC registered, United States bank holding companies (BHCs) with assets ranging from $10 billion smaller to $10 billion larger than BOKF, per the most recently filed annual report. |

| • | The peer group size will not be less than 14 nor greater than 24. If asset range causes a group of less than 14 peers, the next BHC, greater or smaller in asset size, will be included in the peer group. |

| • | The Committee uses the peer group for determining comparable executive compensation and relative EPS Growth. |

| Financial Institution | |

| Associated Banc-Corp | PacWest Bancorp |

| BankUnited, Inc. | Pinnacle Financial Partners, Inc. |

| Commerce Bancshares, Inc. | Sterling Bancorp |

| Cullen/Frost Bankers, Inc. | Synovus Financial Corp |

| East West Bancorp, Inc. | Texas Capital Bancshares, Inc. |

First Citizens Bancshares | Umpqua Holdings Corporation |

First Horizon National Corporation | Valley National Bancorp |

| F.N.B. Corporation | Webster Financial Corporation |

| Hancock Whitney Corporation | Wintrust Financial Corporation |

| IBERIABANK Corporation | |

| Executive Name | BOKF Base Pay Compared to Peer Median for Comparable Executive Position |

| Steven G. Bradshaw | 103% |

| Steven E. Nell | 113% |

| Stacy C. Kymes | 105% |

| Scott B. Grauer | 109% |

| Norman P. Bagwell | 103% |

| (i) | The target Annual Incentive Bonus for each named executive is determined annually by the Committee and is a percentage of base salary. The Committee reviews the median Annual Incentive Bonus for named executives’ Comparable Executive Position and adjusts the target Annual Incentive Bonus based upon factors determined by the Committee such as years in the position, responsibilities and performance (the “Annual Incentive Target”). A named executive is entitled to 200% of his Annual Incentive Target if the Company’s earnings per share for the performance period equals or exceeds $1.00 per share. The Committee may decrease the payout of the Annual Incentive Bonus based upon Earnings per Share Performance (described below) and Business Performance (described below) or such other factors as determined by the Committee. |

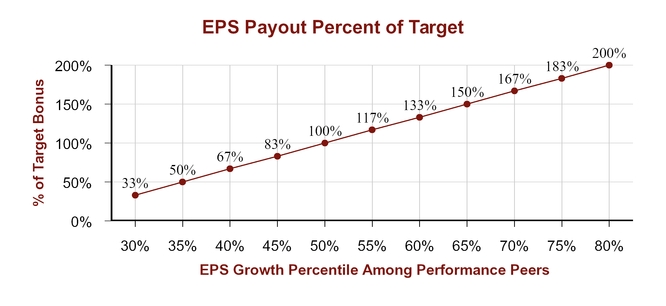

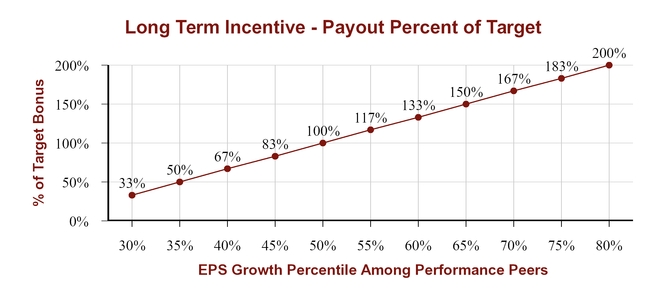

| (ii) | “Earnings Per Share Performance” is the percentile ranking of the Company after (a) calculating the two year average earnings per share growth (“Average Growth”) for each Performance Peer and for the Company and (b) ranking the Company’s Average Growth compared to the Peers Average Growth, starting with the highest Average Growth and ending with the lowest Average Growth. A named executive shall earn that portion of his or her Annual Incentive Bonus based upon Earnings Per Share Performance (an “EPS Bonus”) using a linear interpolation pursuant to which 0% of the EPS Bonus shall be earned if the Earnings Per Share Performance is below the 30th percentile, 33% of the EPS Bonus shall be earned if the Earnings Per Share Performance is at the 30th percentile, 100% of the EPS Bonus shall be earned if the Earnings Per Share Performance is at the 50th percentile, and 200% of the EPS Bonus shall be earned if the Earnings Per share Performance is at the 80th percentile or above, as illustrated in the following matrix: |

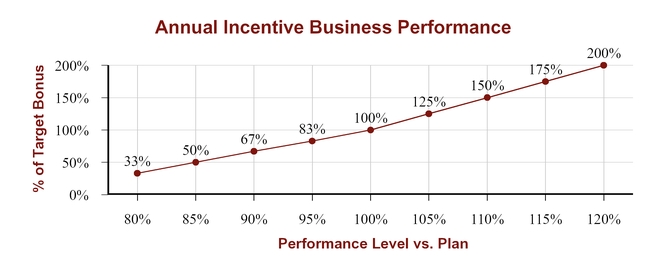

| (iii) | A named executive shall earn that portion of his Annual Incentive Bonus based upon Business Performance (the “Business Performance Bonus”) using a linear interpolation pursuant to which 0% of the Business Performance Bonus shall be earned if Business Performance is below 80%, 33% of the Business Performance Bonus shall be earned if 80% of Business Performance is achieved, 100% of the Business Performance Bonus shall be earned if 100% of Business Performance is achieved, and 200% of the Business Performance Bonus shall be earned if 120% or more of Business Performance is achieved as illustrated in the following matrix: |

| (iv) | Each named executive is eligible to receive 20% of his Annual Incentive Bonus based on the Strategic Objective goal achievement. The Strategic Objectives are established by the Chief Executive Officer and were reviewed and approved by the Committee on February 26, 2019 for service performed in 2019. Strategic Objectives recognize the importance of focus by the named executive on expanding organizational capabilities, optimizing business models, and managing risk. |

| (v) | For 2019, the Annual Incentive Targets and payouts for the named executives are as follows: |

| Annual Incentive Bonus Factors | ||||||||||

| Executive Name | Target Award % of Base | BOKF EPS Growth | Business Performance(2) | Strategic Objectives | Final Payouts (4) | |||||

| Weight | Payout (%) (1) | Weight | Payout (%) | Weight | Achieved (%)(3) | ($) | % of Base | |||

| Steven G. Bradshaw | 100% | 80% | 67% | —% | —% | 20% | 105% | $743,400 | 74% | |

| Steven E. Nell | 75% | 60% | 67% | 20% | 118% | 20% | 95% | $334,854 | 62% | |

| Stacy C. Kymes | 90% | 40% | 67% | 40% | 114% | 20% | 100% | $414,930 | 83% | |

| Scott B. Grauer | 75% | 40% | 67% | 40% | 98% | 20% | 100% | $332,562 | 64% | |

| Norman P. Bagwell | 90% | 40% | 67% | 40% | 89% | 20% | 95% | $342,940 | 73% | |

| (1) | For 2019, BOKF Earnings per Share performance percentile rank was 40% based on the 2018 peer group, resulting in a 67% payout. |

| (2) | Nell's Business Performance is based on overall Company performance; Kymes' Business Performance is based on the Commercial Banking business unit performance; Grauer's Business Performance is based on the Wealth Management business unit performance; and Bagwell's Business Performance is based on the Regional Banking unit performance. Targets are established annually by standard Company methodologies. |

| (3) | At the February 25, 2020 Compensation Committee meeting, Bradshaw presented his detailed assessments of the executives' performance against the strategic objectives established by the Committee, and the Committee approved those achievement percentages. Bradshaw's achievement percentage was determined by the Committee on that date. |

| (4) | Final payouts were approved by the Committee on February 25, 2020. |

| (i) | The Long Term Incentive Compensation target amount for each Comparable Executive Position at each Peer is calculated based upon such Peers' latest proxy statements (the “Peer Long Term Incentive Compensation Amount”). |

| (ii) | The Long Term Incentive Compensation awarded to each named executive is based upon the median of all the Peer Long Term Incentive Compensation Amounts corresponding to such Plan participant’s Comparable Executive Position, adjusted by the Committee using such factors as years in the position, responsibilities, and performance. The amounts paid to the Executives as restricted stock awards may be found in column (e) of the Summary Compensation Table on page 44. |

| (iii) | For 2019, the named executives were awarded the following percentage of Long Term Incentive Compensation: |

| Executive Name | 2019 LTI Target (as a % of base) | Performance-Based (as a % of target) | Service-Based (as a % of target) |

| Steven G. Bradshaw | 200% | 100% | - |

| Steven E. Nell | 115% | 70% | 30% |

| Stacy C. Kymes | 115% | 70% | 30% |

| Scott B. Grauer | 110% | 70% | 30% |

| Norman P. Bagwell | 105% | 70% | 30% |

| (i) | “Long Term Incentive EPS Performance” is the percentile ranking of the Company after (a) calculating the trailing three-year period earnings per share growth (determined as of the second anniversary of the end of the year in respect of which the performance-based restricted stocks were awarded) (the “Three Year EPS Average Growth”) for each Performance Peer and for the Company and (b) ranking the Company’s Three Year EPS Average Growth compared to the Peers’ Three Year EPS Growth Average, starting with the highest Three Year EPS Average Growth and ending with the lowest Three Year EPS Average Growth. |

| (ii) | Each annual award of performance-based restricted stocks or units are reviewed for performance as of the second year-end anniversary of the year in respect of which the performance-based restricted stocks were awarded (the “Reviewed Restricted Stocks”). A named executive shall earn Reviewed Restricted Stocks using a linear interpolation pursuant to which 0% of the Reviewed Restricted Stocks shall be earned if the Long Term Incentive EPS Performance is below the 30th percentile, 33% of the Reviewed Restricted Stocks shall be earned if the Long Term Incentive EPS Performance is at the 30th percentile, 100% of the Reviewed Restricted Stocks shall be earned if the Long Term Incentive EPS Performance is at the 50th percentile, and 200% of the Reviewed Restricted Stocks shall be earned if the Long Term Incentive EPS Performance is at the 80th percentile or above as illustrated in the following matrix: |

| (iii) | In the event that the Long Term Incentive EPS Performance is such that performance exceeds the target grant (e.g. 120% of target), the named executive receives an additional grant of performance-based restricted stock that equals the difference between the number of performance-based restricted stock that was granted at target and that which was earned pursuant to the immediately preceding paragraph (ii) (e.g. 20%) (the “Shares Exceeding Target”). The vesting and transfer restrictions on the Shares Exceeding Target shall be equal in duration to the Reviewed Restricted Stock. In the event that the Long Term Incentive EPS Performance is such that performance does not exceed the target grant, the named executive shall forfeit the performance-based restricted stock received in accordance with the preceding paragraph (ii) but not earned by the named executive. |

| (iv) | To the extent the Company’s earnings per share for the year in which service-based restricted stock or units are granted (the “Service-Based Performance Year”) does not equal or exceed $1.00 per share (adjusted for stock dividends or distributions, recapitalizations, merger, consolidation, exchange of shares, stock splits or the like), the named executive shall forfeit all the service-based restricted stock granted to him in such Service-Based Performance Year on or before March 15 of the year following the Service-Based Performance Year. To the extent the Company’s earnings per share for the year following the grant of service-based restricted stock equal or exceed $1.00 per share (adjusted for stock dividends or distributions, recapitalizations, merger, consolidation, exchange of shares, stock splits or the like), the named executive retains all the service-based restricted stock granted to him or her the previous year and such shares shall be earned and vest three years following the second Friday in January of the year in which such shares were granted. |

Executive Name and Principal Position | Year | Salary | Bonus | Stock Awards(1) | Option Award | Non-Equity Incentive Plan Compensation(2) | Change in Pension Value & Nonqualified Deferred Compensation Earnings(3) | All Other Compensation(4) | Total | ||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | ||||||||||||||||

Steven G. Bradshaw President & Chief Executive Officer | 2019 | $ | 1,000,000 | $ | — | $ | 1,999,965 | $ | — | $ | 743,400 | $ | 29,712 | $ | 45,294 | $ | 3,818,371 | ||||||||

| 2018 | $ | 991,000 | $ | — | $ | 2,000,026 | $ | — | $ | 1,800,000 | $ | (18,341 | ) | $ | 40,784 | $ | 4,813,469 | ||||||||

| 2017 | $ | 935,667 | $ | — | $ | 1,892,027 | $ | — | $ | 189,200 | $ | 21,124 | $ | 44,305 | $ | 3,082,323 | |||||||||

Steven E. Nell Executive Vice President Chief Financial Officer | 2019 | $ | 538,375 | $ | — | $ | 621,008 | $ | — | $ | 334,854 | $ | 4,906 | $ | 37,987 | $ | 1,537,130 | ||||||||

| 2018 | $ | 529,375 | $ | — | $ | 583,213 | $ | — | $ | 639,275 | $ | 4,399 | $ | 34,800 | $ | 1,791,062 | |||||||||

| 2017 | $ | 523,333 | $ | — | $ | 577,486 | $ | — | $ | 153,174 | $ | 4,103 | $ | 34,200 | $ | 1,292,296 | |||||||||

Stacy C. Kymes Executive Vice President- Corporate Banking | 2019 | $ | 493,058 | $ | — | $ | 575,050 | $ | — | $ | 414,930 | $ | 1,854 | $ | 42,737 | $ | 1,527,629 | ||||||||

| 2018 | $ | 456,125 | $ | — | $ | 527,008 | $ | — | $ | 628,145 | $ | 1,664 | $ | 41,866 | $ | 1,654,808 | |||||||||

| 2017 | $ | 441,667 | $ | — | $ | 511,772 | $ | — | $ | 281,439 | $ | 1,551 | $ | 180,550 | $ | 1,416,979 | |||||||||

Scott B. Grauer Executive Vice President-Wealth Management; Chief Executive Officer of BOK Financial Securities, Inc. | 2019 | $ | 531,723 | $ | — | $ | 567,610 | $ | — | $ | 332,562 | $ | 4,793 | $ | 46,056 | $ | 1,482,744 | ||||||||

| 2018 | $ | 509,847 | $ | — | $ | 555,159 | $ | — | $ | 597,086 | $ | 4,298 | $ | 44,715 | $ | 1,711,105 | |||||||||

| 2017 | $ | 487,252 | $ | — | $ | 539,076 | $ | — | $ | 267,614 | $ | 4,009 | $ | 51,829 | $ | 1,349,780 | |||||||||

Norman P. Bagwell Executive Vice President- Regional Banks; Chief Executive Officer of Bank of Texas | 2019 | $ | 467,715 | $ | — | $ | 493,443 | $ | — | $ | 342,940 | $ | — | $ | 32,781 | $ | 1,336,879 | ||||||||

| 2018 | $ | 454,075 | $ | — | $ | 479,133 | $ | — | $ | 613,528 | $ | — | $ | 29,393 | $ | 1,576,129 | |||||||||

| 2017 | $ | 443,000 | $ | — | $ | 465,095 | $ | — | $ | 312,900 | $ | — | $ | 24,431 | $ | 1,245,426 | |||||||||

| (1) | The amounts in column (e) are the grant date fair value of the non-vested stock. Messrs. Bradshaw and Nell were issued restricted stock units in 2019 and restrict stock awards in 2018 and 2017; Messers. Kymes, Grauer, and Bagwell were issued restricted stock awards all years. |

| (2) | The amounts in column (g) reflect the annual cash awards made pursuant to the Executive Incentive Plan, which is discussed in further detail on page 36 under the heading “Components of Executive Compensation.” Incentive amounts are paid at a targeted percentile of our Peers. |

| (3) | The amounts in column (h) include (i) the actuarial increase in the present value of the named executive officer’s benefits under the Company pension plan using a discount rate defined in the Pension Plan and (ii) Nonqualified Deferred Compensation Earnings further described in column (d) of the Nonqualified Deferred Compensation Table on page 49. Executives who did not have the ability to defer income or who chose not to defer income are not required to disclose investment income on the Summary Compensation Table. |

| (4) | The amounts in column (i) for 2018 are derived from Company matching contributions to the 401(k) Thrift Plan as follows: Bradshaw, $33,000; Nell, $33,000; Grauer, $33,000; Kymes, $33,000; and Bagwell, $25,200. Amounts also include trip earnings (personal portion of a trip such as an accompanying spouse) as follows: Bradshaw, $5,351; Grauer, $7,520; Kymes, $5,116, and Bagwell $4,995; and a Champion Health corporate members wellness benefit for named executive officers and spouses as follows: Bradshaw, $2,775; Nell, $1,800; Grauer, $2,775; and Kymes, $2,775. |

| Option Awards | Stock Awards | |||||||||

| (a) | (b) | (c) | (d) | (e) | ||||||

| Executive Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) | ||||||

| Steven G. Bradshaw | 5,232 | $ | 135,683 | — | $ | — | ||||

| Steven E. Nell | — | $ | — | 3,070 | $ | 238,416 | ||||

| Stacy C. Kymes | 903 | $ | 23,180 | 2,649 | $ | 205,721 | ||||

| Scott B. Grauer | 2,609 | $ | 80,603 | 2,488 | $ | 193,218 | ||||

| Norman P. Bagwell | — | $ | — | 2,521 | $ | 195,781 | ||||

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | ||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | (k) | (l) | ||||||||||||

| Executive Name | Grant Date (m/dd/yy) | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | All Other Stock Awards: Number of Shares of Stock or Units (#) | All Other Option Awards: Number of Securities Under-lying Options (#) | Exercise or Base Price of Option Award ($/sh) | Grant Date Fair Value of Stock and Option Awards(8) ($) | ||||||||||||

| Steven G. Bradshaw | (1) | $ | 264,000 | $ | 800,000 | $ | 1,600,000 | ||||||||||||||||

(2) | $ | 200,000 | $ | 240,000 | |||||||||||||||||||

2/26/2019(6) | 8,516 | 25,806 | 51,612 | $ | 1,999,965 | ||||||||||||||||||

| Steven E. Nell | (1) | $ | 80,190 | $ | 243,000 | $ | 486,000 | ||||||||||||||||

(2) | $ | 81,000 | $ | 97,200 | |||||||||||||||||||

(3) | $ | 26,730 | $ | 81,000 | $ | 162,000 | |||||||||||||||||

2/26/2019(4) | 1,851 | 5,609 | 11,218 | $ | 434,698 | ||||||||||||||||||

2/26/2019(6) | 2,404 | $ | 186,310 | ||||||||||||||||||||

| Stacy C. Kymes | (1) | $ | 59,400 | $ | 180,000 | $ | 360,000 | ||||||||||||||||

(2) | $ | 90,000 | $ | 108,000 | |||||||||||||||||||

(3) | $ | 59,400 | $ | 180,000 | $ | 360,000 | |||||||||||||||||

2/26/2019(5) | 1,714 | 5,194 | 10,388 | $ | 402,535 | ||||||||||||||||||

2/26/2019(7) | 2,226 | $ | 172,515 | ||||||||||||||||||||

| Scott B. Grauer | (1) | $ | 51,084 | $ | 154,800 | $ | 309,600 | ||||||||||||||||

(2) | $ | 77,400 | $ | 92,880 | |||||||||||||||||||

(3) | $ | 51,084 | $ | 154,800 | $ | 309,600 | |||||||||||||||||

2/26/2019(5) | 1,692 | 5,127 | 10,254 | $ | 397,343 | ||||||||||||||||||

2/26/2019(7) | 2,197 | $ | 170,268 | ||||||||||||||||||||

| Norman P. Bagwell | (1) | $ | 55,836 | $ | 169,200 | $ | 338,400 | ||||||||||||||||

(2) | $ | 84,600 | $ | 101,520 | |||||||||||||||||||

(3) | $ | 55,836 | $ | 169,200 | $ | 338,400 | |||||||||||||||||

2/26/2019(5) | 1,471 | 4,457 | 8,914 | $ | 345,418 | ||||||||||||||||||

2/26/2019(7) | 1,910 | $ | 148,025 | ||||||||||||||||||||

| (1) | Bradshaw receives 80%, Nell receives 60%, and Grauer, Kymes, and Bagwell receive 40% of their annual incentive based on EPS Growth. Annual incentive cash awards were finalized and approved by the Committee on February 25, 2020 and are provided in column (g) of the “Summary Compensation Table” on page 44 herein. For final target achievement and payout, see the Annual Incentive Bonus Factors chart on page 37. The total annual incentive cannot exceed $2,000,000 for any participant per the Executive Incentive Plan. |

| (2) | Represents annual incentive targets for achievement of Strategic Objectives established by the Committee on February 26, 2019 for service performed in 2019. The named executives were eligible to receive 20% of their annual incentive based on Strategic Objective goal achievement which may range from zero to 120%. |

| (3) | Represents annual incentive targets for Business Performance Bonus established by the Committee on February 26, 2019 for service performed in 2019. Nell receives 20% of his annual incentive based on overall Company performance. Kymes, Grauer, and Bagwell each receive 40% of their annual incentive based on business unit performance. |

| (4) | Represents performance units granted as long-term incentive pursuant to the Executive Incentive Plan. Performance units vest when earned and are subject to a two year hold requirement, followed by stock ownership guidelines as further described in “Compensation Discussion and Analysis” on page 32 herein. |

| (5) | Represents performance shares granted as long-term incentive pursuant to the Executive Incentive Plan. Performance shares vest when earned and are subject to a two year hold requirement, followed by stock ownership guidelines as further described in “Compensation Discussion and Analysis” on page 32 herein. |

| (6) | Represents service units granted as long-term incentive pursuant to the Executive Incentive Plan. Service units vest on the third anniversary of the second Friday in January of the year in which the service shares were issued and are subject to a two year hold requirement, followed by stock ownership guidelines as further described in “Compensation Discussion and Analysis” on page 32 herein. |

| (7) | Represents service shares granted as long-term incentive pursuant to the Executive Incentive Plan. Service shares vest on the third anniversary of the second Friday in January of the year in which the service shares were issued and are subject to a two year hold requirement, followed by stock ownership guidelines as further described in “Compensation Discussion and Analysis” on page 32 herein. |

| (8) | Amounts reported in column (l) represent the grant-date fair value of non-vested stock awarded. The Company’s policy regarding the valuation of stock compensation is included in footnote 1 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 27, 2020. |

| Option Awards | Stock Awards | ||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | ||||||||||

| Executive Name | Number of Securities Underlying Unexercised Options Exercisable (#)(1) | Number of Securities Underlying Unexercised Options Unexercisable (#)(1) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date (m/dd/yy) | Number of Shares or Units of Stock That Have Not Vested (#)(2) | Market Value of Shares or Units of Stock That Have Not Vested ($)(3) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)(4) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(3) | ||||||||||

| Steven G. Bradshaw | 3,384 | $ | 55.74 | 1/10/23 | |||||||||||||||

| 69,353 | $ | 6,061,452 | |||||||||||||||||

| Total | — | 3,384 | — | $ | — | 69,353 | $ | 6,061,452 | |||||||||||

| Steven E. Nell | 1,418 | $ | 58.76 | 1/12/22 | |||||||||||||||

| 3,678 | $ | 55.74 | 1/10/22 | ||||||||||||||||

| 3,678 | $ | 55.74 | 1/10/23 | ||||||||||||||||

| 6,306 | $ | 551,144 | |||||||||||||||||

| 14,714 | $ | 1,286,004 | |||||||||||||||||

| Total | 5,096 | 3,678 | 6,306 | $ | 551,144 | 14,714 | $ | 1,286,004 | |||||||||||

| Scott B. Grauer | 512 | $ | 55.94 | 1/31/21 | |||||||||||||||

| 1,556 | $ | 58.76 | 1/12/21 | ||||||||||||||||

| 1,556 | $ | 58.76 | 1/12/22 | ||||||||||||||||

| 5,873 | $ | 513,300 | |||||||||||||||||

| 13,705 | $ | 1,197,817 | |||||||||||||||||

| Total | 3,624 | — | 5,873 | $ | 513,300 | 13,705 | $ | 1,197,817 | |||||||||||

| Stacy C. Kymes | |||||||||||||||||||

| 5,716 | $ | 499,578 | |||||||||||||||||

| 13,337 | $ | 1,165,654 | |||||||||||||||||

| Total | — | — | 5,716 | $ | 499,578 | 13,337 | $ | 1,165,654 | |||||||||||

| Norman P. Bagwell | 5,082 | $ | 444,167 | ||||||||||||||||

| 11,859 | $ | 1,036,477 | |||||||||||||||||

| Total | — | — | 5,082 | $ | 444,167 | 11,859 | $ | 1,036,477 | |||||||||||

| (1) | Columns (b) and (c) represent stock options which vest 1/7 each year in accordance with the BOK Financial 2003 Stock Option Plan (as amended) and the BOK Financial 2009 Omnibus Incentive Plan and terminate three years after vesting. |

| (2) | Column (g) represents performance shares which are not subject to adjustment based upon the three year performance period, but which have not yet completed the vesting period. Performance shares vest pursuant to the Executive Incentive Plan. Shares may not be sold unless certain stock ownership guidelines are met as described in “Compensation Discussion and Analysis” on page 32. |

| (3) | Market value of performance shares is based on the closing price of BOK Financial common stock of $87.40 (as reported on NASDAQ as of December 31, 2019). |

| (4) | Column (i) represents performance shares granted as long-term incentive pursuant to the Executive Incentive Plan the amount of which remains subject to adjustment based on EPS Growth over a three year performance period as further described in Compensation Discussion and Analysis on page 32. Performance shares vest pursuant to the Executive Incentive Plan. Shares may not be sold unless certain stock ownership guidelines are met as described in “Compensation Discussion and Analysis.” |

| (a) | (b) | (c) | (d) | (e) | ||||

Executive Name(1) | Plan Name | Number of Years Credited Service(2) | Present Value of Accumulated Benefit | Payments During Last Fiscal Year | ||||

| Steven G. Bradshaw | BOKF Pension Plan | 15 | $ | 190,726 | $ | — | ||

| Steven E. Nell | BOKF Pension Plan | 14 | $ | 148,321 | $ | — | ||

| Stacy C. Kymes | BOKF Pension Plan | 9 | $ | 56,075 | $ | — | ||

| Scott B. Grauer | BOKF Pension Plan | 15 | $ | 144,904 | $ | — | ||

| (1) | Bagwell is a named executive but is not listed, as he does not participate in the BOKF Pension Plan. |

| (2) | Named executives are credited with the number of years employed by the Company since the Pension Plan’s inception in 1987 (through December 31, 2005 when the number of years of credited service was frozen). |

Executive Name(1) | Executive Contributions in Last FY ($) | Registrant Contributions in Last FY ($) | Aggregate Earnings in Last FY(2) ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last FYE ($) | ||

| (a) | (b) | (c) | (d) | (e) | (f) | ||

| Steven G. Bradshaw | $23,403 | $— | $ | 338,365 | |||

| (1) | Bradshaw is the only named executive to have a deferral account balance. |

| (2) | Earnings include gains or losses reported on investments in distressed asset and venture capital funds, and interest earned on uninvested cash accrued at BOKF’s money market deposit rates as well as dividends paid and changes in fair value of the Company's common stock. |

Executive Name(1) | Compensation Component | Termination without Cause(2) | Termination without Cause Following a Change of Control(3) | Termination for Cause(4) | ||||||

| Steven G. Bradshaw | Salary/Severance | $ | 1,499,803 | $ | 2,000,000 | |||||

| Unvested Stock Options | $ | 107,137 | $ | 107,137 | ||||||

| Unvested Restricted Stock | $ | 6,061,452 | $ | 6,061,452 | ||||||

Other (5) | $ | 3,000 | $ | 3,000 | $ | 3,000 | ||||

| TOTAL | $ | 7,671,392 | $ | 8,171,589 | $ | 3,000 | ||||

| Steven E. Nell | Salary/Severance | $ | 809,702 | $ | 1,080,000 | |||||

| Unvested Stock Options | $ | 116,445 | $ | 116,445 | ||||||

| Unvested Restricted Stock | $ | 1,837,149 | $ | 1,837,149 | ||||||

Other (5) | $ | 3,000 | $ | 3,000 | $ | 3,000 | ||||

| TOTAL | $ | 2,766,296 | $ | 3,036,594 | $ | 3,000 | ||||

| Stacy C. Kymes | Salary/Severance | $ | 749,902 | $ | 1,000,000 | |||||

| Unvested Stock Options | $ | — | $ | — | ||||||

| Unvested Restricted Stock | $ | 1,665,232 | $ | 1,665,232 | ||||||

| Other (5) | $ | 3,000 | $ | 3,000 | $ | 3,000 | ||||

| TOTAL | $ | 2,418,134 | $ | 2,668,232 | $ | 3,000 | ||||

| Scott B. Grauer | Salary/Severance | $ | 773,899 | $ | 1,032,000 | |||||

| Unvested Stock Options | $ | — | $ | — | ||||||

| Unvested Restricted Stock | $ | 1,711,117 | $ | 1,711,117 | ||||||

| Other (5) | $ | 3,000 | $ | 3,000 | $ | 3,000 | ||||

| TOTAL | Total | $ | 2,488,016 | $ | 2,746,117 | $ | 3,000 | |||

| Norman P. Bagwell | Salary/Severance | $ | 704,905 | $ | 940,000 | |||||

| Unvested Stock Options | $ | — | $ | — | ||||||

| Unvested Restricted Stock | $ | 1,480,644 | $ | 1,480,644 | ||||||

Other (5) | $ | 3,000 | $ | 3,000 | $ | 3,000 | ||||

| TOTAL | $ | 2,188,549 | $ | 2,423,644 | $ | 3,000 | ||||

| (1) | Executive payments upon termination do not include payments of deferred compensation which, if applicable, are described on page 49. The table assumes (i) that the executive has been paid all amounts owed through the date of termination, (ii) the closing price of BOK Financial common stock of $87.40 (as reported on NASDAQ as of December 31, 2019); and (iii) salary, stock option and performance share information as of December 31, 2019. Except as expressly provided herein or amounts owed up through the date of termination, Executive does not receive any additional payments in the event of voluntary termination, early retirement (prior to age 65), retirement (age 65 or older), involuntary for cause termination, change in control, or upon death or disability. |

| (2) | When the executive’s employment is terminated without cause, he shall receive standard severance pay for senior executives in effect at the time of termination, and in addition, an amount equal to the executive’s then annual salary payable in one lump sum payment. The executive shall be entitled to receive pension, thrift, medical insurance, disability insurance plans benefits and other fringe benefits accrued through, but not beyond the date of termination, and shall be entitled to receive pay for vacation in accordance with the Company’s existing policy. Options held by the executive shall vest and shall be exercisable for ninety days following termination and restricted stock held by the executive shall continue to be owned by the executive but shall remain subject to all applicable restrictions. |

| (3) | When the executive’s employment is terminated without cause following a change of control, he shall receive a lump sum payment in an amount equal to two times executive’s then Annual Salary at the time of termination in lieu of standard and enhanced severance amounts. “Change of Control” occurs when either (i) George B. Kaiser, affiliates of George B. Kaiser, George B. Kaiser Foundation, George Kaiser Family Foundation, and/or members of the family of George B. Kaiser collectively cease to own more shares of the voting capital stock of BOK Financial than any other shareholder (or group of shareholders acting in concert to control BOK Financial to the exclusion of George B. Kaiser, affiliates of George B. Kaiser, George B. Kaiser Foundation, George Kaiser Family Foundation, and/or members of the family of George B. Kaiser), or (ii) BOK Financial shall cease to own directly and indirectly more than fifty percent (50%) of the voting capital stock of BOKF, NA. |

| (4) | Termination of executive for cause would generally be termination for (i) failure to substantially perform his duties, (ii) committing any act which is intended to injure BOK Financial or its affiliates, (iii) charged, indicted or convicted of any criminal act or act involving moral turpitude, (iv) committing any dishonest or fraudulent act which is material to BOKF or its affiliates, including reputation or (v) refusing to obey orders of the CEO unless such instructions would require executive to commit an illegal act, could subject executive to personal liability, would require executive to violate the terms of his agreement or are inconsistent with recognized ethical standards or inconsistent with the duties of an officer of the bank. |

| (5) | For a period of two years following any termination for cause, and for a period of one year following any termination for any reason other than cause, the executive is prohibited from directly or indirectly contacting or soliciting, in any manner, individuals or entities who were at any time during the term of the executive’s employment agreement clients of BOKF, NA or any of its affiliates, for the purpose of providing banking, trust, investment, or other services provided by BOKF, NA or any of its affiliates, or contacting or soliciting employees of BOKF, NA or any affiliates of BOK, NA to seek employment with any person or entity except BOKF, NA and its affiliates. In exchange, the executive shall receive $3,000 in arrears for each year the non-solicitation agreement is in effect. |