Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic January 21, 2025 Q4 Earnings Conference Call

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic This presentation contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, and the economy generally. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” "outlook," “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward-looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at bokf.com. All data is presented as of December 31, 2024 unless otherwise noted. Legal Disclaimers 2

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Stacy Kymes Chief Executive Officer 3

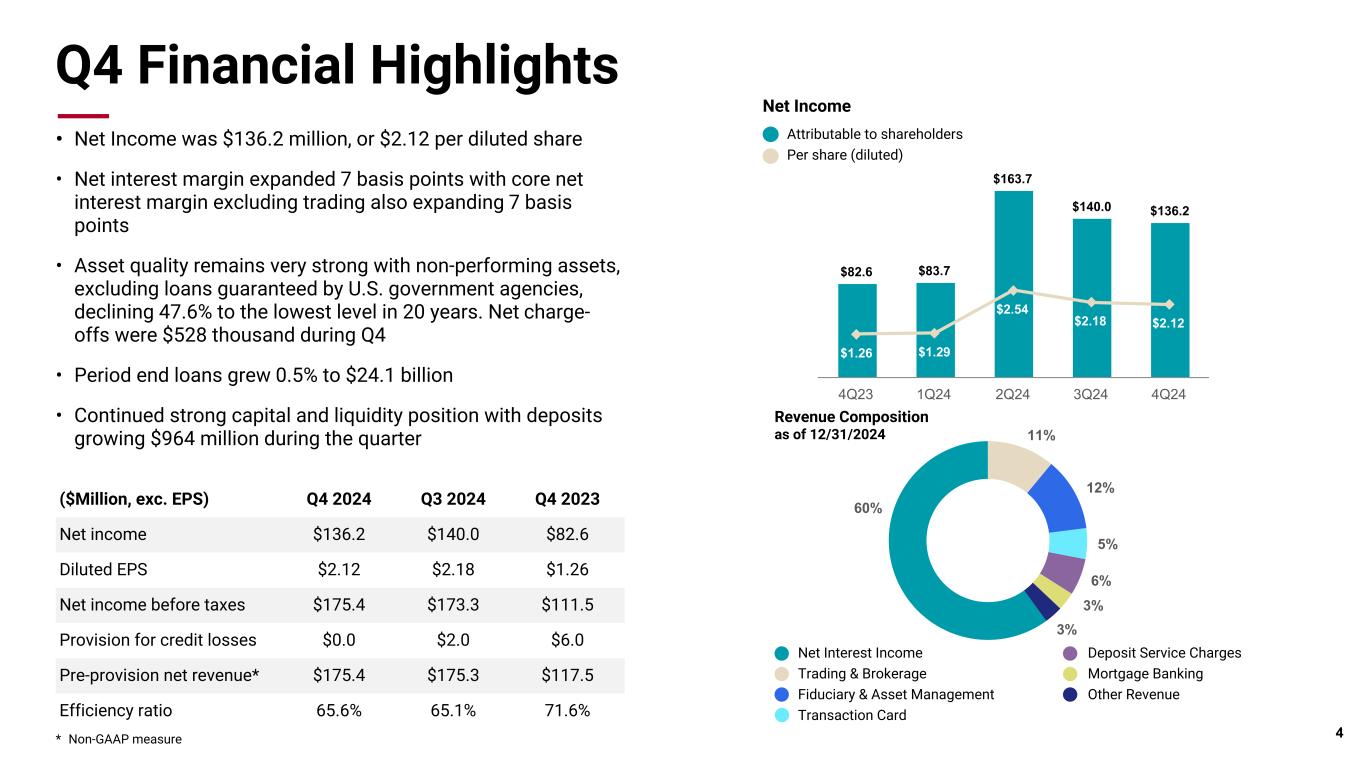

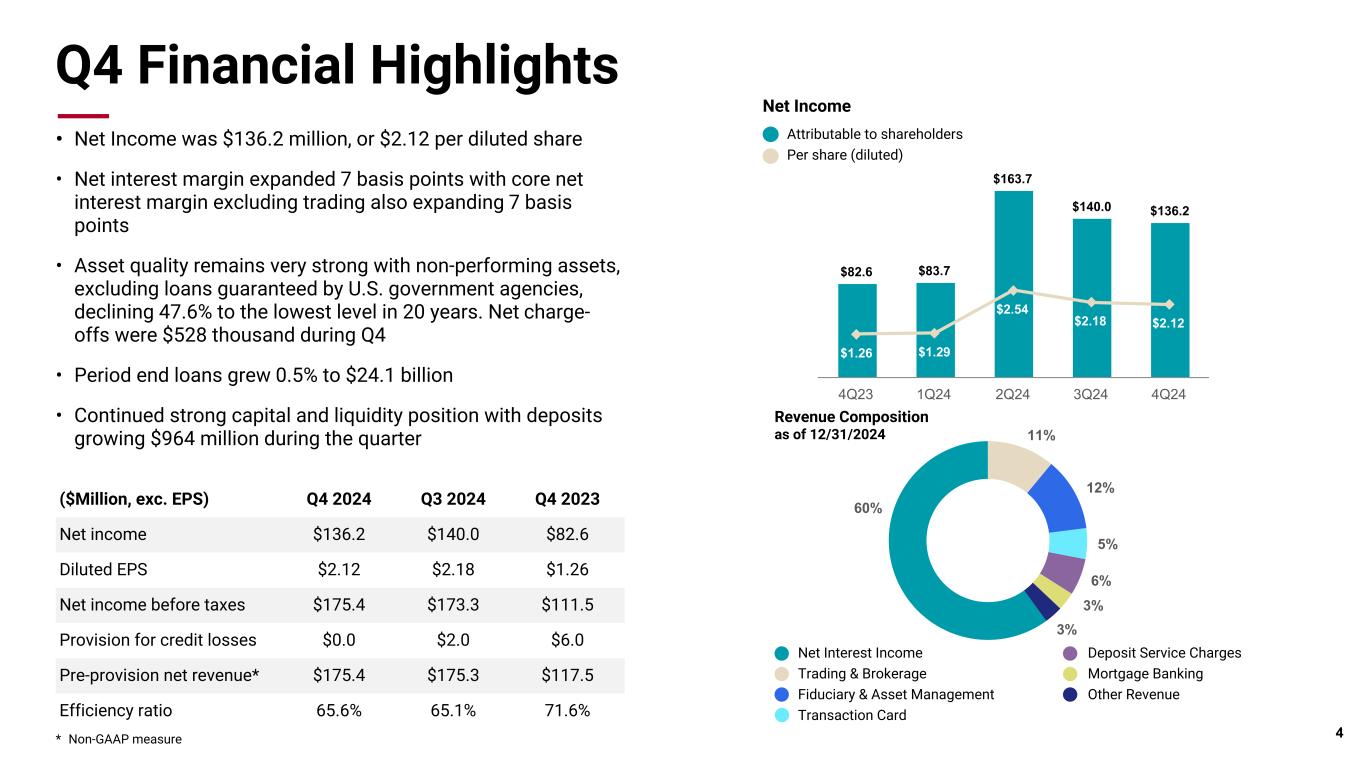

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Q4 Financial Highlights * Non-GAAP measure Attributable to shareholders Per share (diluted) Net Income • Net Income was $136.2 million, or $2.12 per diluted share • Net interest margin expanded 7 basis points with core net interest margin excluding trading also expanding 7 basis points • Asset quality remains very strong with non-performing assets, excluding loans guaranteed by U.S. government agencies, declining 47.6% to the lowest level in 20 years. Net charge- offs were $528 thousand during Q4 • Period end loans grew 0.5% to $24.1 billion • Continued strong capital and liquidity position with deposits growing $964 million during the quarter 4 $82.6 $83.7 $163.7 $140.0 $136.2 $1.26 $1.29 $2.54 $2.18 $2.12 4Q23 1Q24 2Q24 3Q24 4Q24 ($Million, exc. EPS) Q4 2024 Q3 2024 Q4 2023 Net income $136.2 $140.0 $82.6 Diluted EPS $2.12 $2.18 $1.26 Net income before taxes $175.4 $173.3 $111.5 Provision for credit losses $0.0 $2.0 $6.0 Pre-provision net revenue* $175.4 $175.3 $117.5 Efficiency ratio 65.6% 65.1% 71.6% Revenue Composition as of 12/31/2024 60% 11% 12% 5% 6% 3% 3% Net Interest Income Trading & Brokerage Fiduciary & Asset Management Transaction Card Deposit Service Charges Mortgage Banking Other Revenue

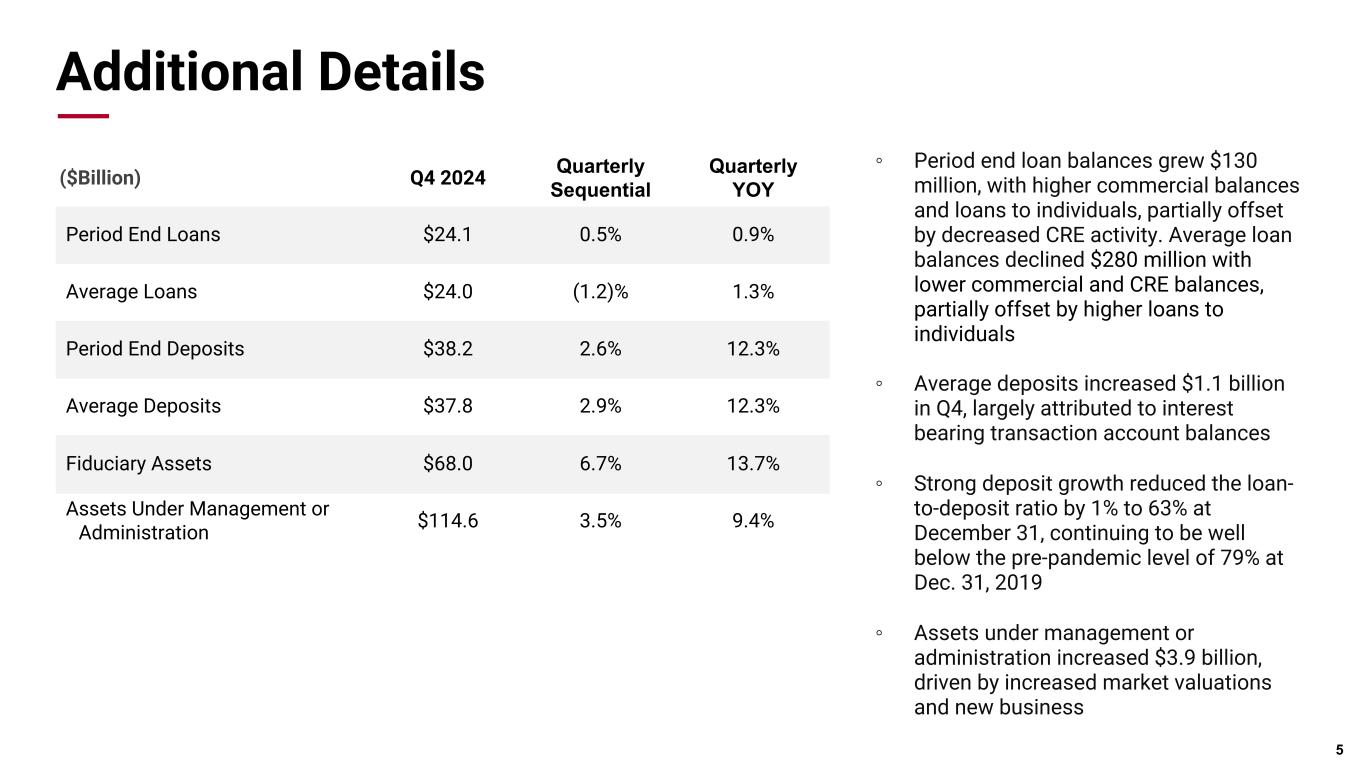

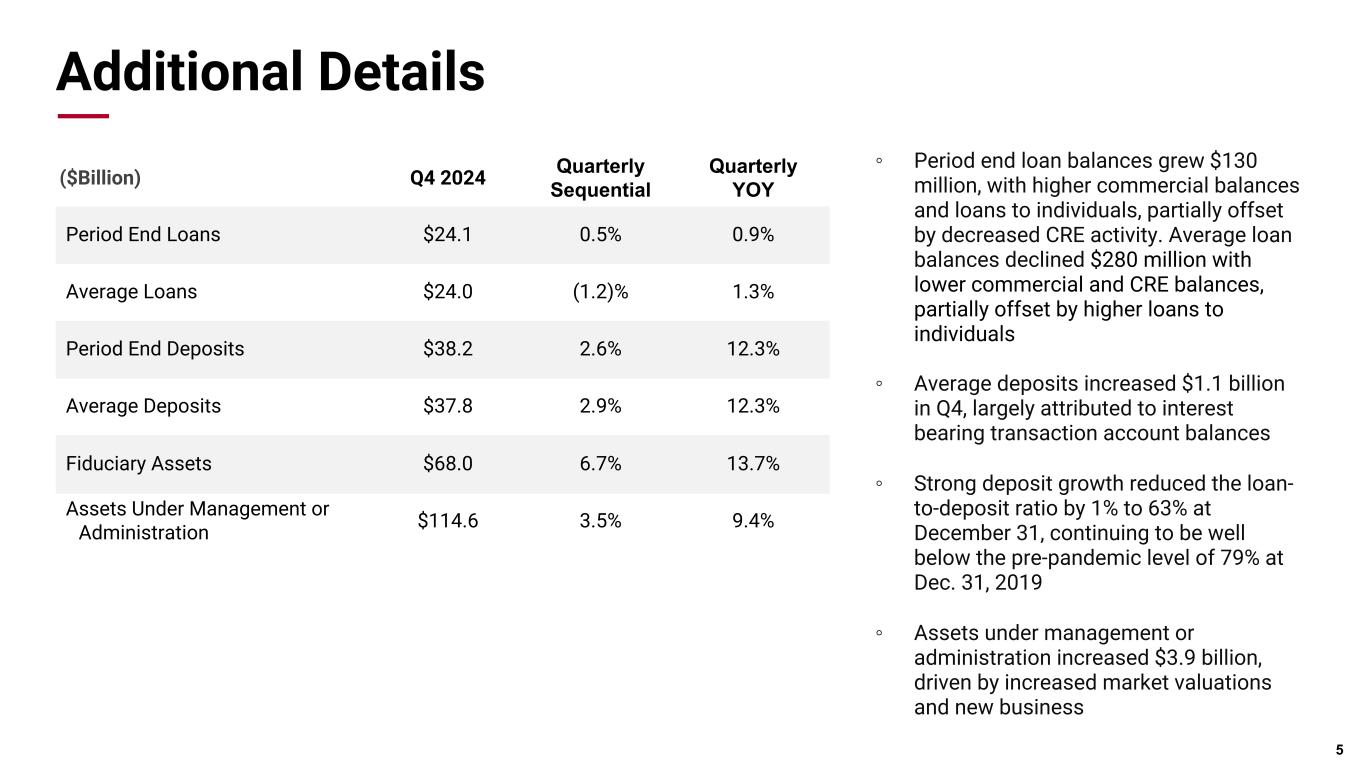

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Additional Details 5 ◦ Period end loan balances grew $130 million, with higher commercial balances and loans to individuals, partially offset by decreased CRE activity. Average loan balances declined $280 million with lower commercial and CRE balances, partially offset by higher loans to individuals ◦ Average deposits increased $1.1 billion in Q4, largely attributed to interest bearing transaction account balances ◦ Strong deposit growth reduced the loan- to-deposit ratio by 1% to 63% at December 31, continuing to be well below the pre-pandemic level of 79% at Dec. 31, 2019 ◦ Assets under management or administration increased $3.9 billion, driven by increased market valuations and new business ($Billion) Q4 2024 Quarterly Sequential Quarterly YOY Period End Loans $24.1 0.5% 0.9% Average Loans $24.0 (1.2)% 1.3% Period End Deposits $38.2 2.6% 12.3% Average Deposits $37.8 2.9% 12.3% Fiduciary Assets $68.0 6.7% 13.7% Assets Under Management or Administration $114.6 3.5% 9.4%

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Marc Maun EVP, Regional Banking Executive 6

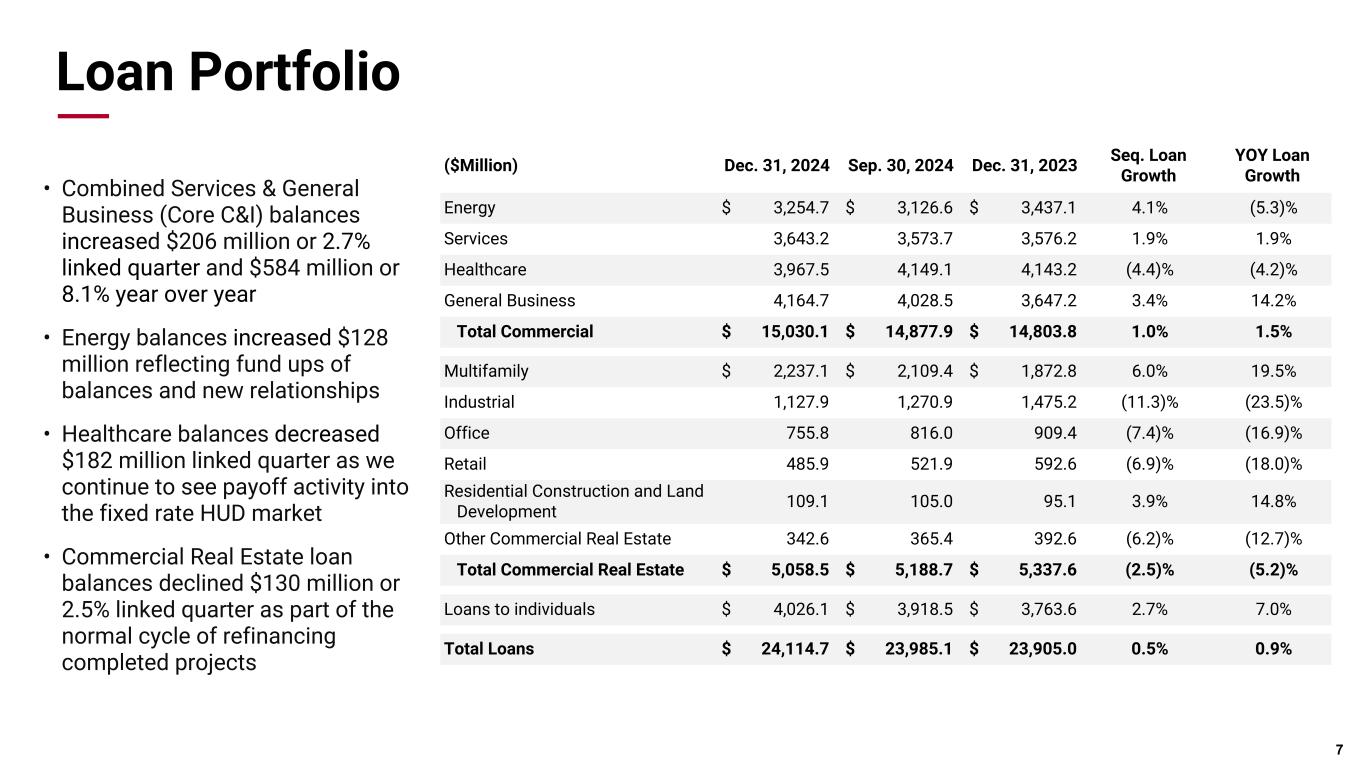

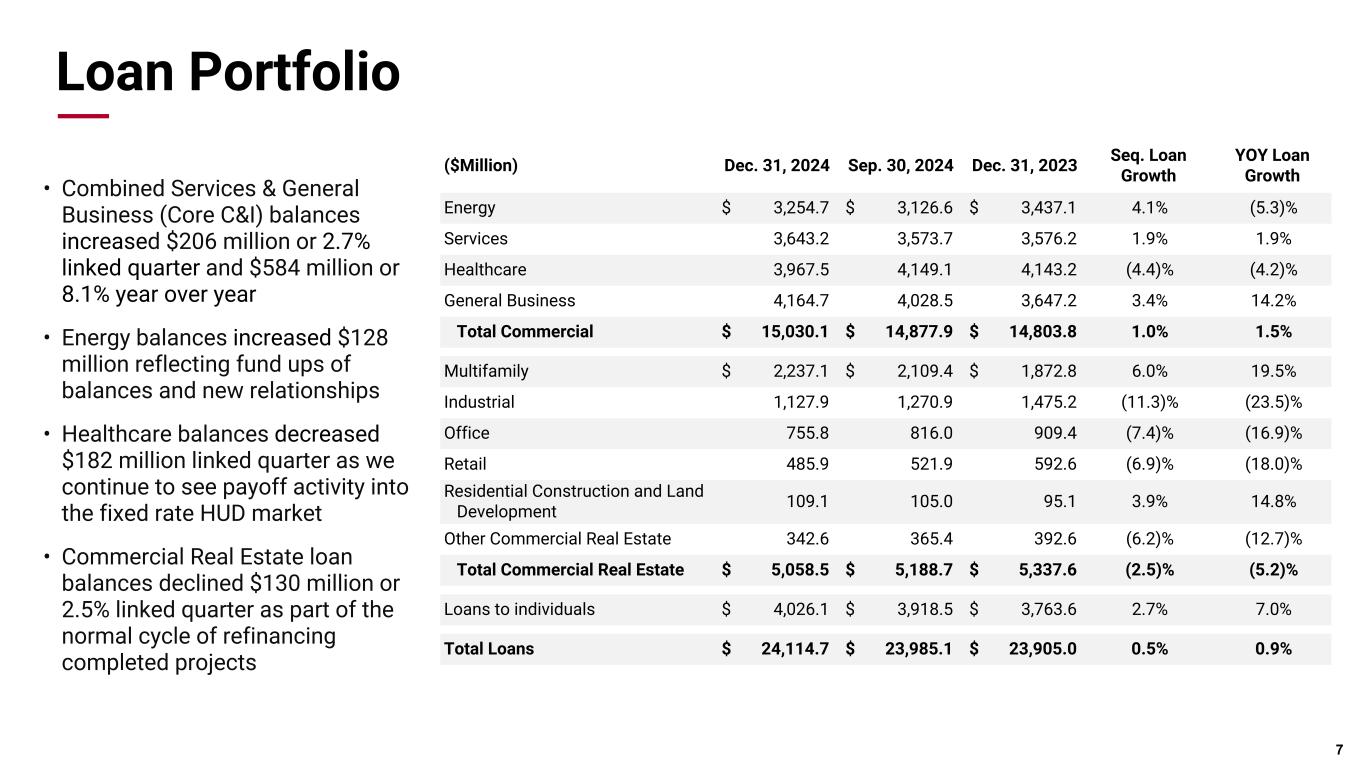

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Loan Portfolio • Combined Services & General Business (Core C&I) balances increased $206 million or 2.7% linked quarter and $584 million or 8.1% year over year • Energy balances increased $128 million reflecting fund ups of balances and new relationships • Healthcare balances decreased $182 million linked quarter as we continue to see payoff activity into the fixed rate HUD market • Commercial Real Estate loan balances declined $130 million or 2.5% linked quarter as part of the normal cycle of refinancing completed projects 7 ($Million) Dec. 31, 2024 Sep. 30, 2024 Dec. 31, 2023 Seq. Loan Growth YOY Loan Growth Energy $ 3,254.7 $ 3,126.6 $ 3,437.1 4.1% (5.3)% Services 3,643.2 3,573.7 3,576.2 1.9% 1.9% Healthcare 3,967.5 4,149.1 4,143.2 (4.4)% (4.2)% General Business 4,164.7 4,028.5 3,647.2 3.4% 14.2% Total Commercial $ 15,030.1 $ 14,877.9 $ 14,803.8 1.0% 1.5% Multifamily $ 2,237.1 $ 2,109.4 $ 1,872.8 6.0% 19.5% Industrial 1,127.9 1,270.9 1,475.2 (11.3)% (23.5)% Office 755.8 816.0 909.4 (7.4)% (16.9)% Retail 485.9 521.9 592.6 (6.9)% (18.0)% Residential Construction and Land Development 109.1 105.0 95.1 3.9% 14.8% Other Commercial Real Estate 342.6 365.4 392.6 (6.2)% (12.7)% Total Commercial Real Estate $ 5,058.5 $ 5,188.7 $ 5,337.6 (2.5)% (5.2)% Loans to individuals $ 4,026.1 $ 3,918.5 $ 3,763.6 2.7% 7.0% Total Loans $ 24,114.7 $ 23,985.1 $ 23,905.0 0.5% 0.9%

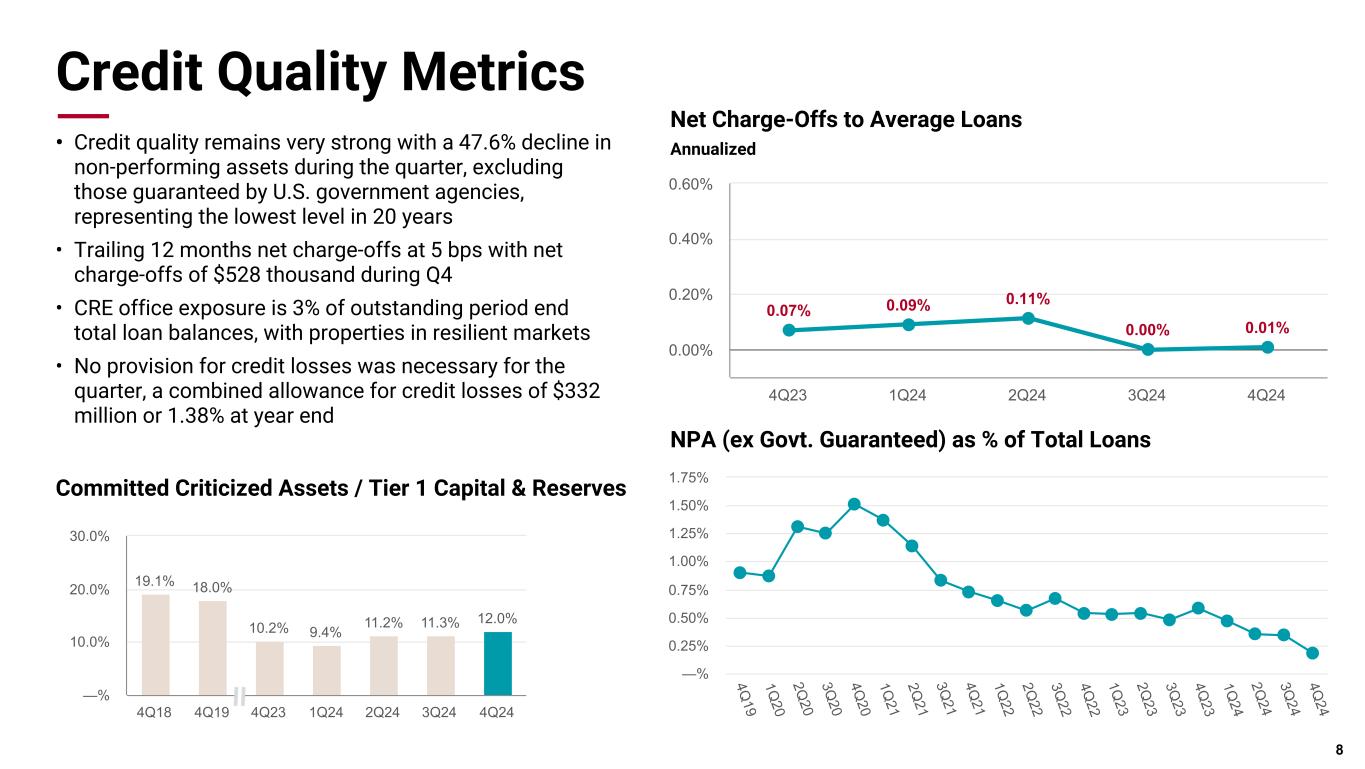

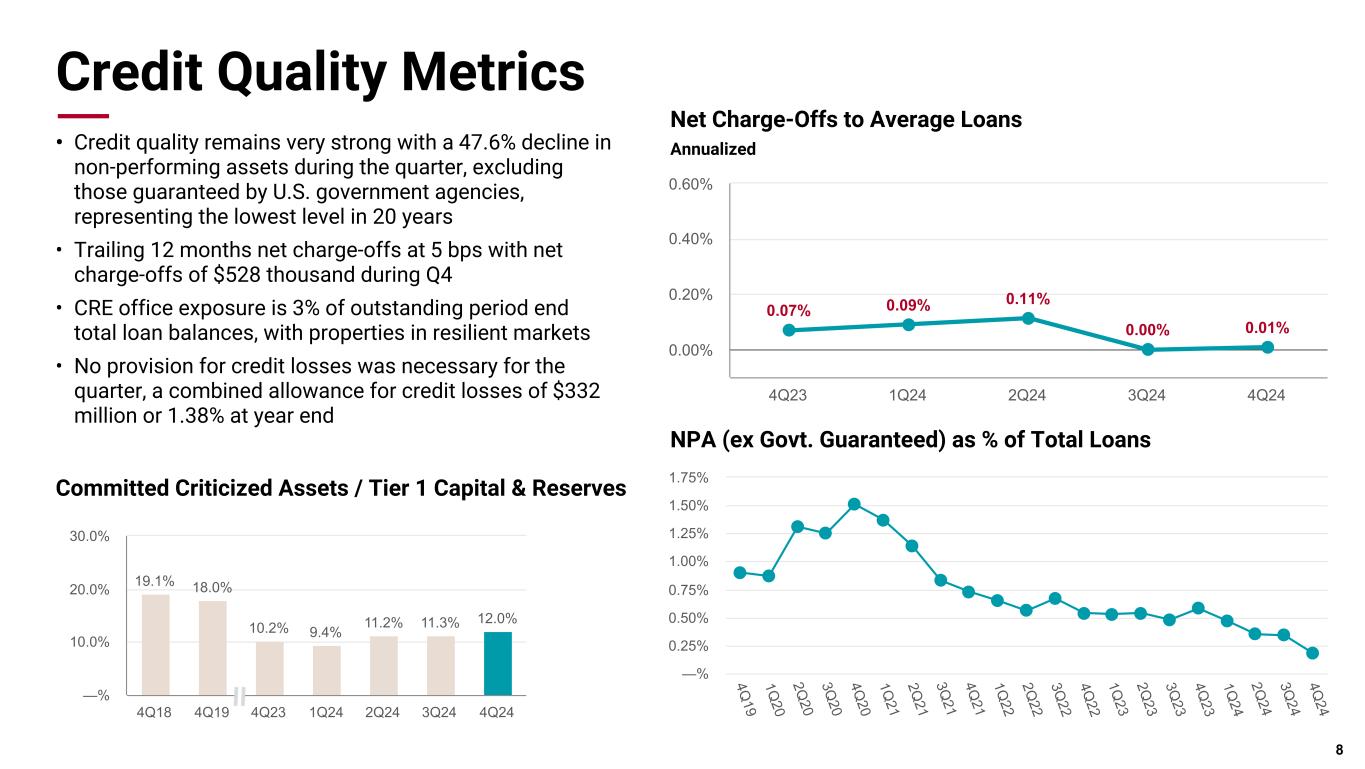

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Credit Quality Metrics • Credit quality remains very strong with a 47.6% decline in non-performing assets during the quarter, excluding those guaranteed by U.S. government agencies, representing the lowest level in 20 years • Trailing 12 months net charge-offs at 5 bps with net charge-offs of $528 thousand during Q4 • CRE office exposure is 3% of outstanding period end total loan balances, with properties in resilient markets • No provision for credit losses was necessary for the quarter, a combined allowance for credit losses of $332 million or 1.38% at year end Net Charge-Offs to Average Loans NPA (ex Govt. Guaranteed) as % of Total Loans Annualized 8 0.07% 0.09% 0.11% 0.00% 0.01% 4Q23 1Q24 2Q24 3Q24 4Q24 0.00% 0.20% 0.40% 0.60% 19.1% 18.0% 10.2% 9.4% 11.2% 11.3% 12.0% 4Q18 4Q19 4Q23 1Q24 2Q24 3Q24 4Q24 —% 10.0% 20.0% 30.0% Committed Criticized Assets / Tier 1 Capital & Reserves 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 —% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75%

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Scott Grauer EVP, Wealth Management Executive 9

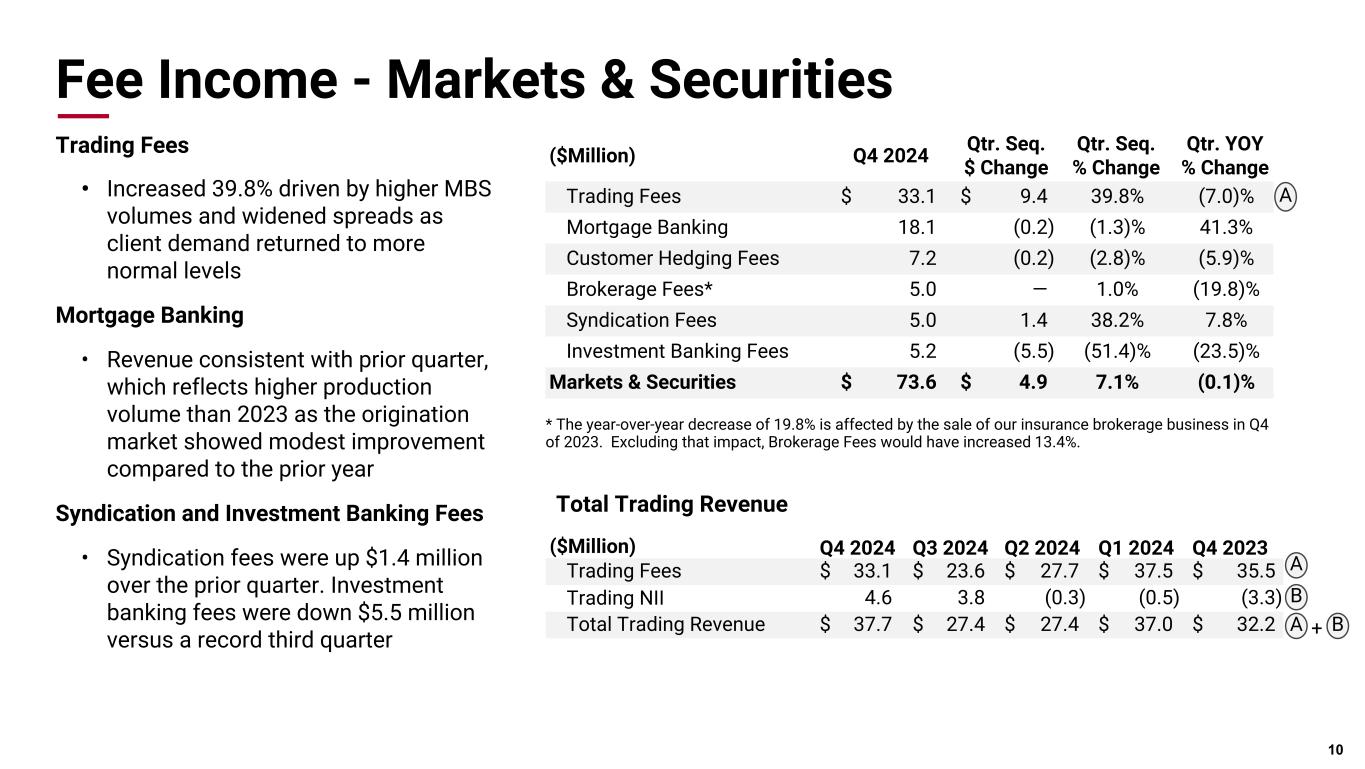

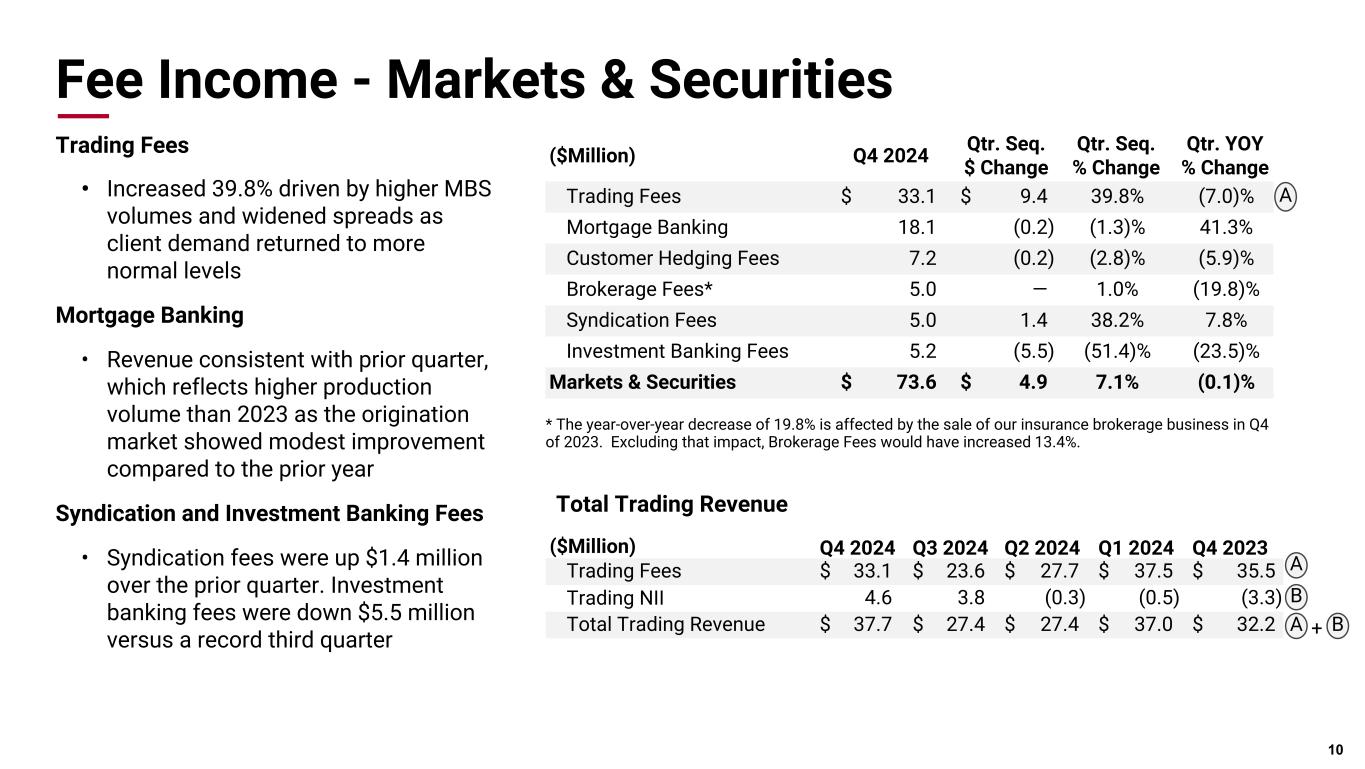

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Fee Income - Markets & Securities Trading Fees • Increased 39.8% driven by higher MBS volumes and widened spreads as client demand returned to more normal levels Mortgage Banking • Revenue consistent with prior quarter, which reflects higher production volume than 2023 as the origination market showed modest improvement compared to the prior year Syndication and Investment Banking Fees • Syndication fees were up $1.4 million over the prior quarter. Investment banking fees were down $5.5 million versus a record third quarter 10 ($Million) Q4 2024 Qtr. Seq. $ Change Qtr. Seq. % Change Qtr. YOY % Change Trading Fees $ 33.1 $ 9.4 39.8% (7.0)% Mortgage Banking 18.1 (0.2) (1.3)% 41.3% Customer Hedging Fees 7.2 (0.2) (2.8)% (5.9)% Brokerage Fees* 5.0 — 1.0% (19.8)% Syndication Fees 5.0 1.4 38.2% 7.8% Investment Banking Fees 5.2 (5.5) (51.4)% (23.5)% Markets & Securities $ 73.6 $ 4.9 7.1% (0.1)% * The year-over-year decrease of 19.8% is affected by the sale of our insurance brokerage business in Q4 of 2023. Excluding that impact, Brokerage Fees would have increased 13.4%. ($Million) Q4 2024 Q3 2024 Q2 2024 Q1 2024 Q4 2023 Trading Fees $ 33.1 $ 23.6 $ 27.7 $ 37.5 $ 35.5 Trading NII 4.6 3.8 (0.3) (0.5) (3.3) Total Trading Revenue $ 37.7 $ 27.4 $ 27.4 $ 37.0 $ 32.2 A A Total Trading Revenue A + B B

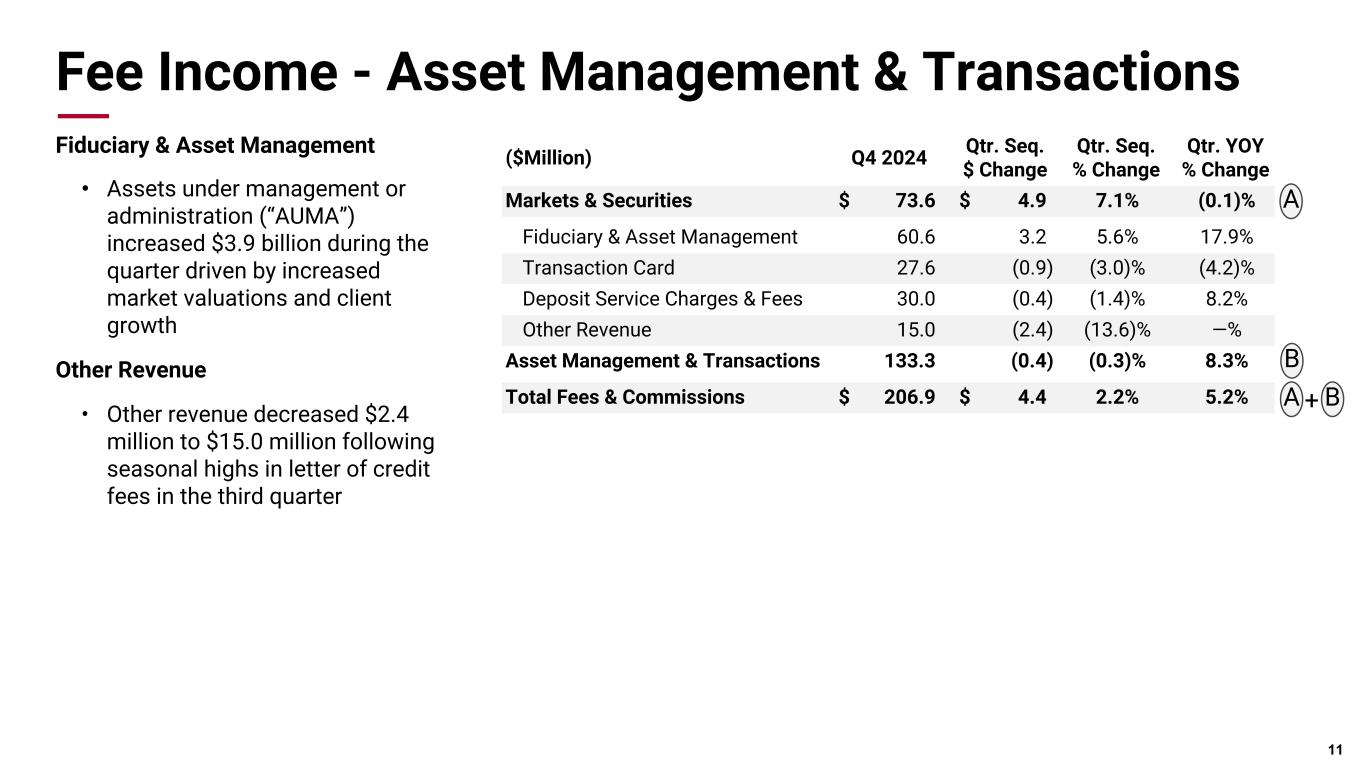

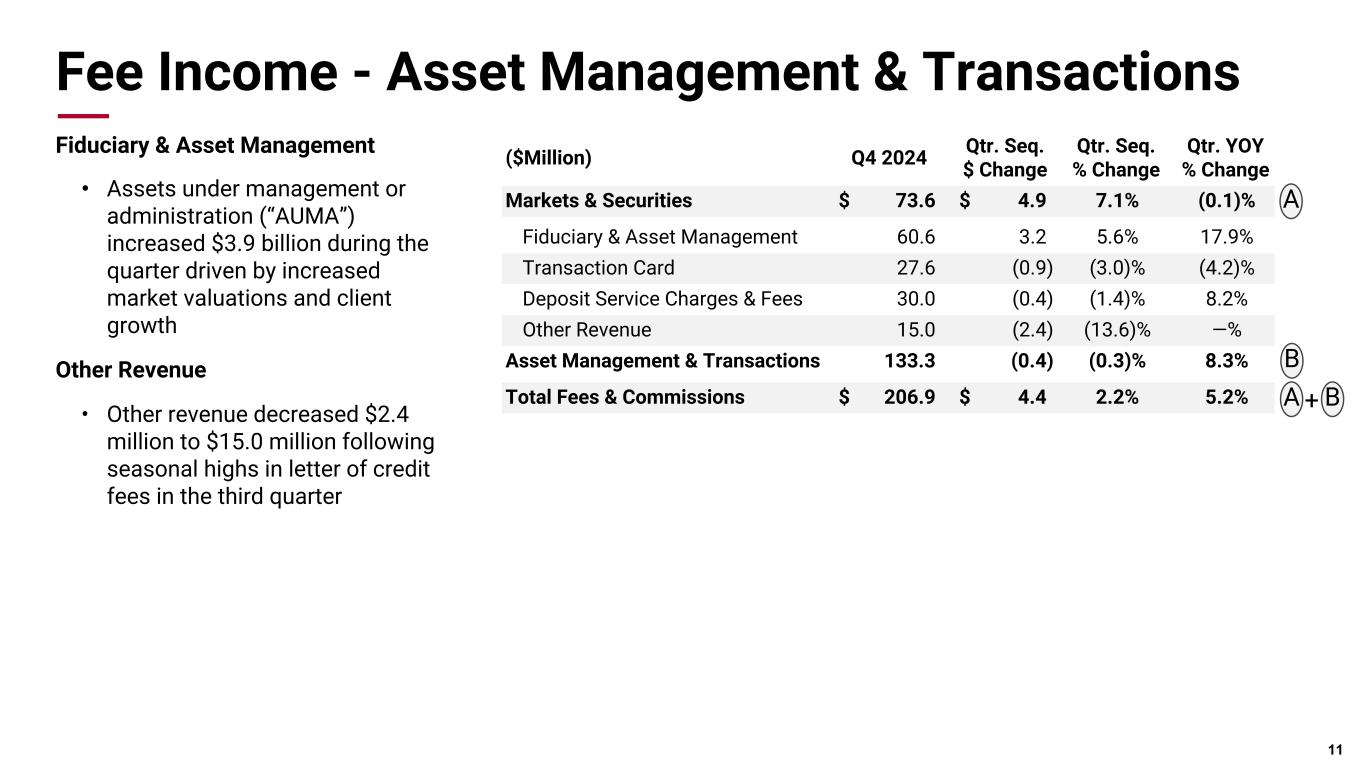

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Fee Income - Asset Management & Transactions Fiduciary & Asset Management • Assets under management or administration (“AUMA”) increased $3.9 billion during the quarter driven by increased market valuations and client growth Other Revenue • Other revenue decreased $2.4 million to $15.0 million following seasonal highs in letter of credit fees in the third quarter 11 ($Million) Q4 2024 Qtr. Seq. $ Change Qtr. Seq. % Change Qtr. YOY % Change Markets & Securities $ 73.6 $ 4.9 7.1% (0.1)% Fiduciary & Asset Management 60.6 3.2 5.6% 17.9% Transaction Card 27.6 (0.9) (3.0)% (4.2)% Deposit Service Charges & Fees 30.0 (0.4) (1.4)% 8.2% Other Revenue 15.0 (2.4) (13.6)% —% Asset Management & Transactions 133.3 (0.4) (0.3)% 8.3% Total Fees & Commissions $ 206.9 $ 4.4 2.2% 5.2% B+A A B

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Marty Grunst EVP, Chief Financial Officer 12

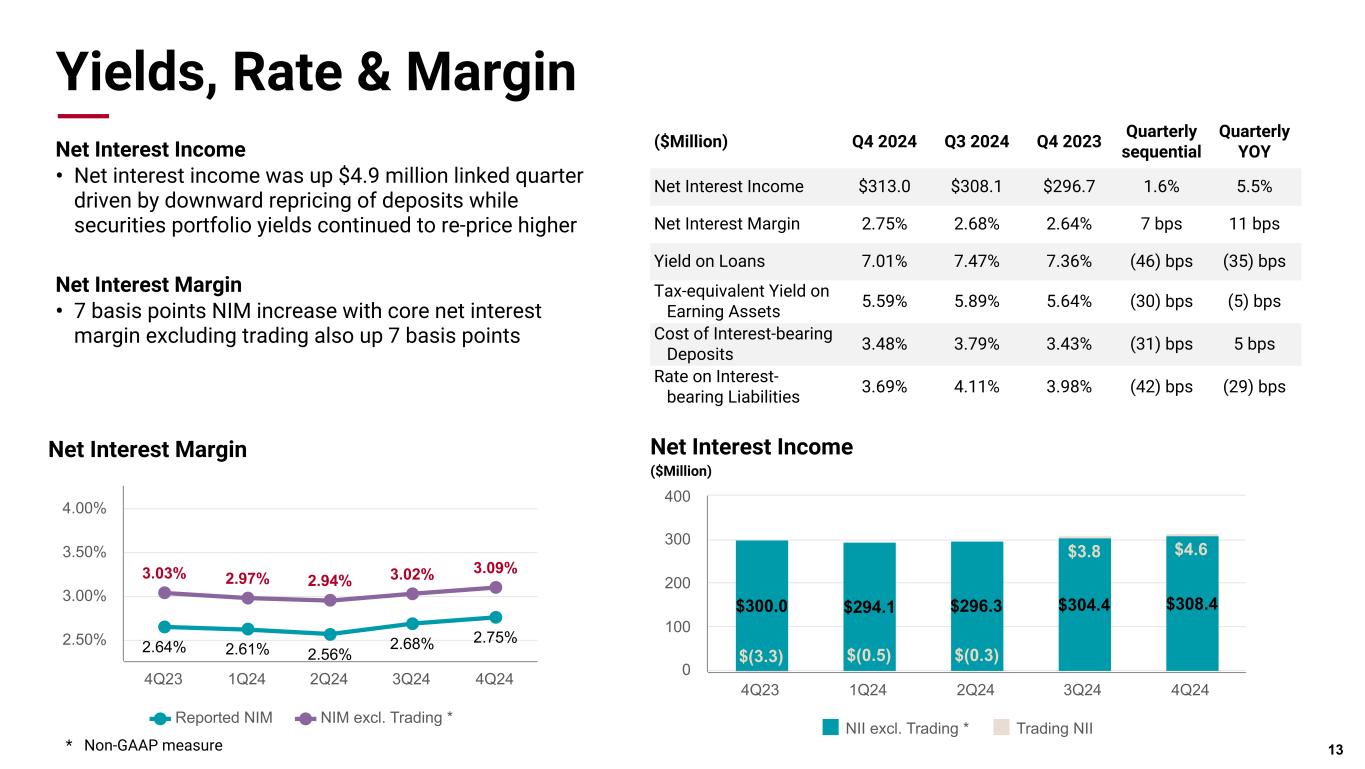

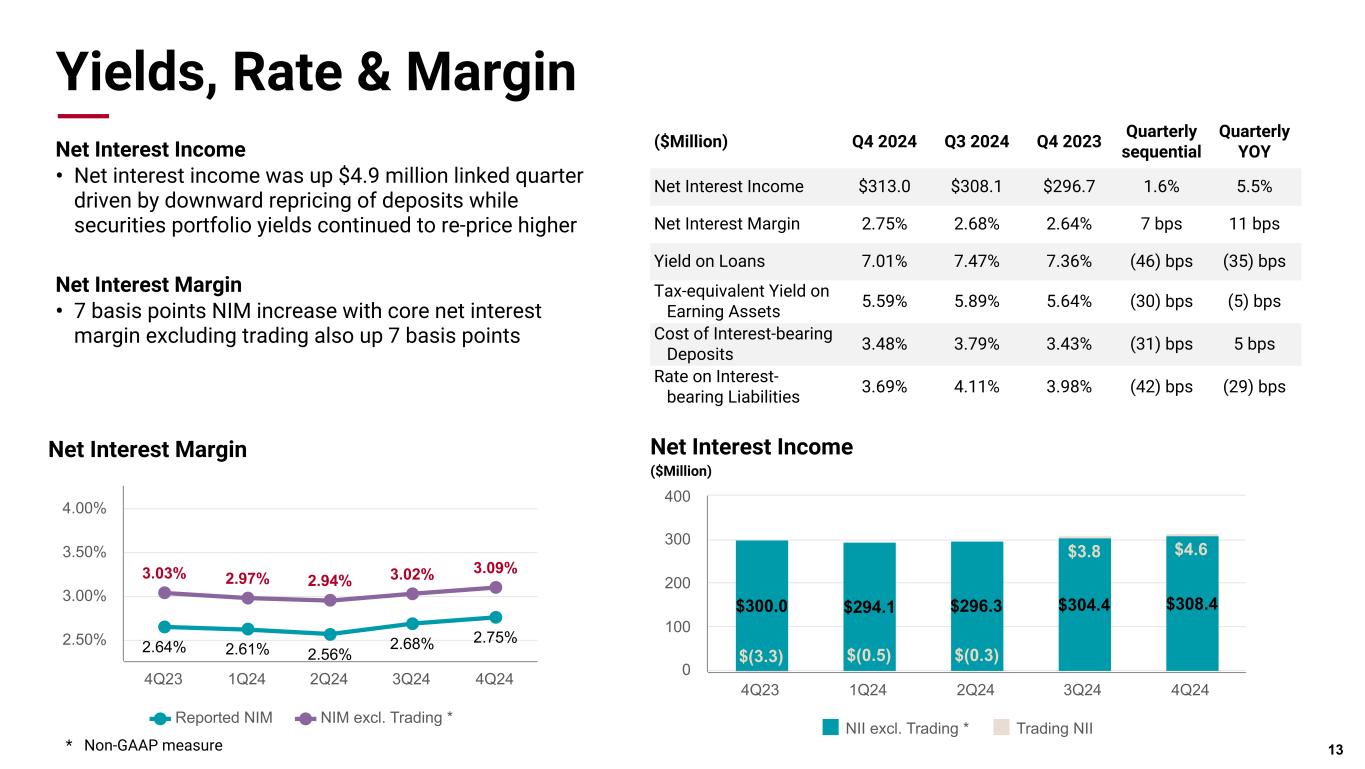

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Yields, Rate & Margin Net Interest Income • Net interest income was up $4.9 million linked quarter driven by downward repricing of deposits while securities portfolio yields continued to re-price higher Net Interest Margin • 7 basis points NIM increase with core net interest margin excluding trading also up 7 basis points 13 ($Million) Q4 2024 Q3 2024 Q4 2023 Quarterly sequential Quarterly YOY Net Interest Income $313.0 $308.1 $296.7 1.6% 5.5% Net Interest Margin 2.75% 2.68% 2.64% 7 bps 11 bps Yield on Loans 7.01% 7.47% 7.36% (46) bps (35) bps Tax-equivalent Yield on Earning Assets 5.59% 5.89% 5.64% (30) bps (5) bps Cost of Interest-bearing Deposits 3.48% 3.79% 3.43% (31) bps 5 bps Rate on Interest- bearing Liabilities 3.69% 4.11% 3.98% (42) bps (29) bps Net Interest Income ($Million) $300.0 $294.1 $296.3 $304.4 $308.4 $(3.3) $(0.5) $(0.3) $3.8 $4.6 NII excl. Trading * Trading NII 4Q23 1Q24 2Q24 3Q24 4Q24 0 100 200 300 400 2.64% 2.61% 2.56% 2.68% 2.75% 3.03% 2.97% 2.94% 3.02% 3.09% Reported NIM NIM excl. Trading * 4Q23 1Q24 2Q24 3Q24 4Q24 2.50% 3.00% 3.50% 4.00% Net Interest Margin * Non-GAAP measure

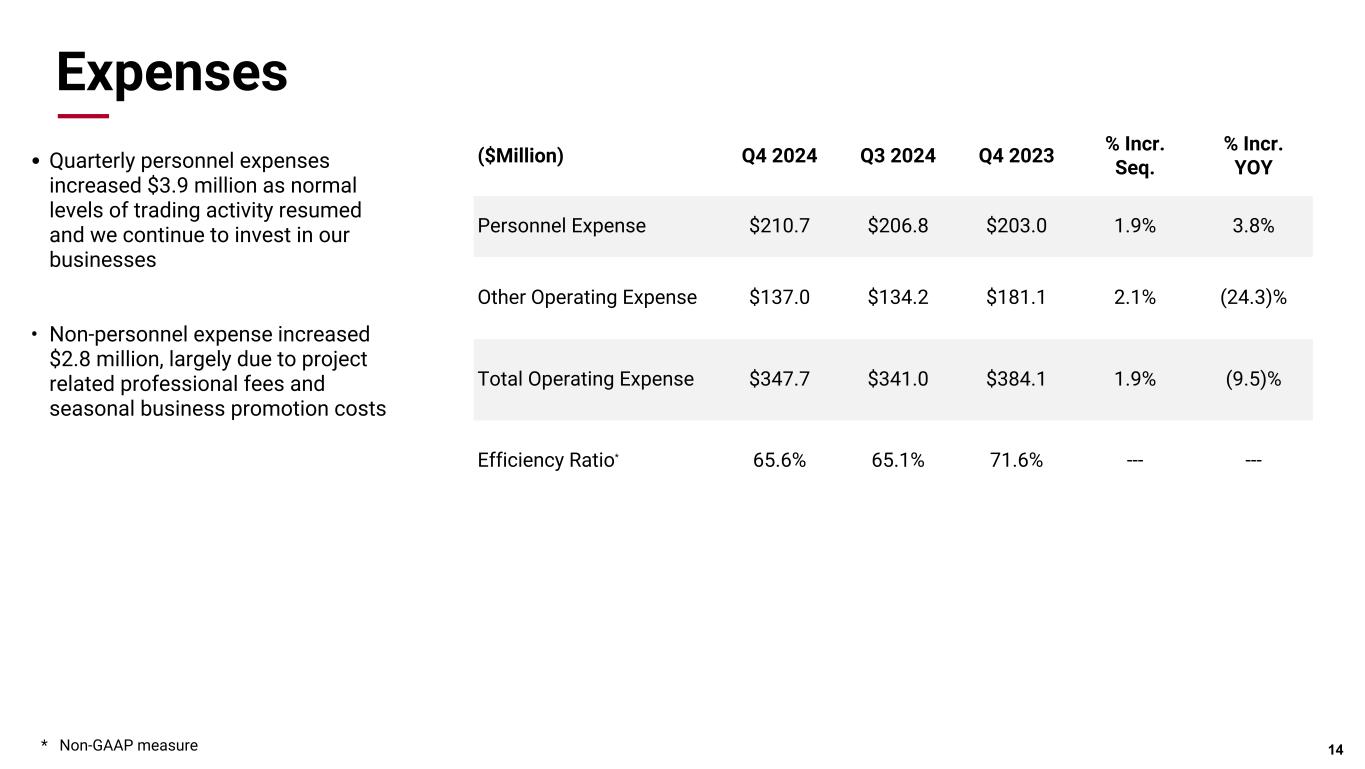

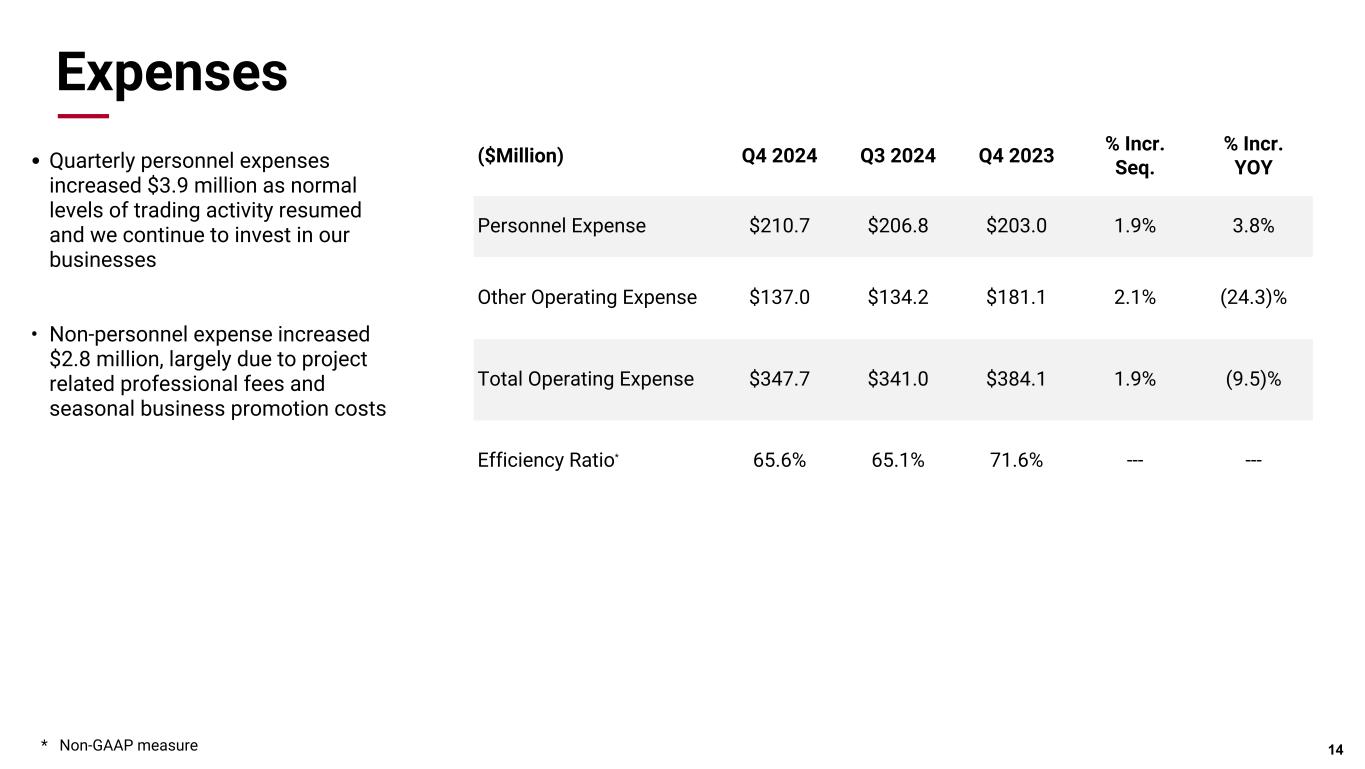

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Expenses • Quarterly personnel expenses increased $3.9 million as normal levels of trading activity resumed and we continue to invest in our businesses • Non-personnel expense increased $2.8 million, largely due to project related professional fees and seasonal business promotion costs 14 ($Million) Q4 2024 Q3 2024 Q4 2023 % Incr. Seq. % Incr. YOY Personnel Expense $210.7 $206.8 $203.0 1.9% 3.8% Other Operating Expense $137.0 $134.2 $181.1 2.1% (24.3)% Total Operating Expense $347.7 $341.0 $384.1 1.9% (9.5)% Efficiency Ratio* 65.6% 65.1% 71.6% --- --- * Non-GAAP measure

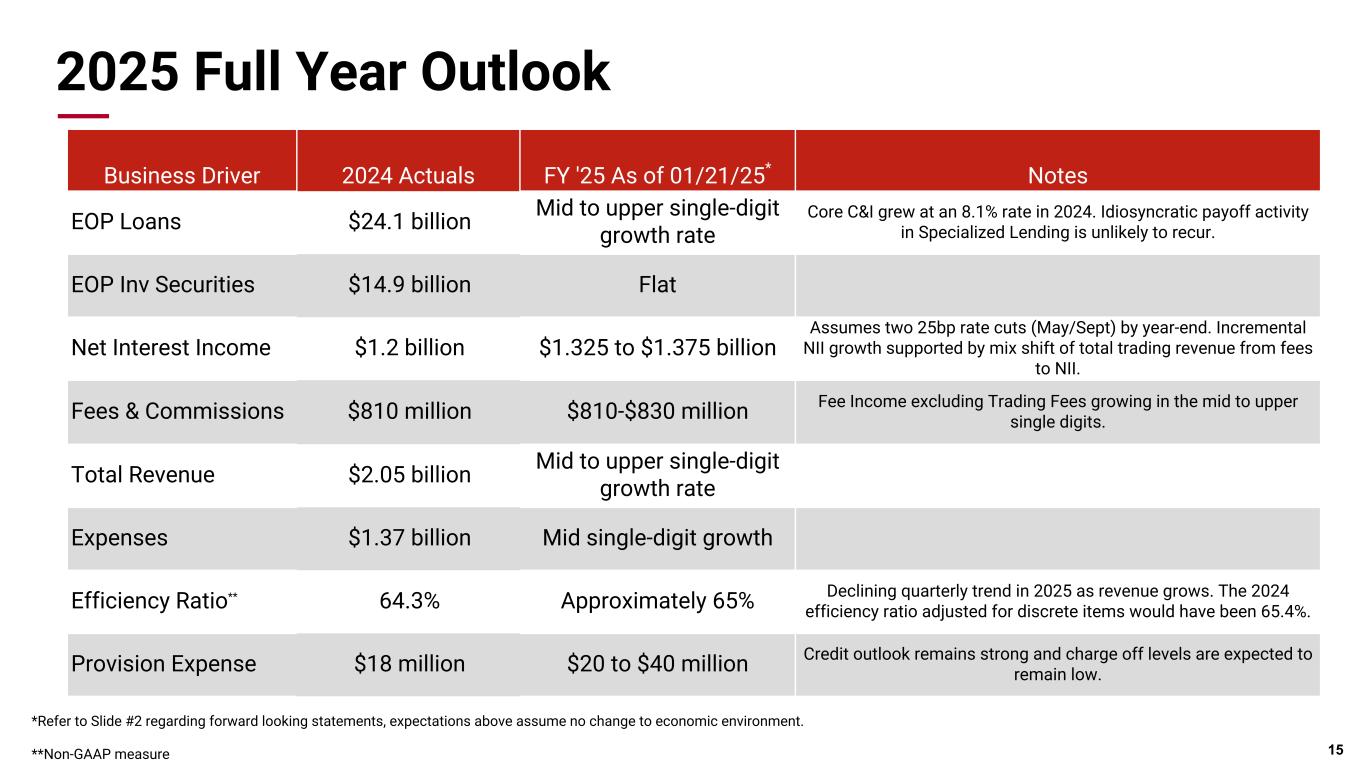

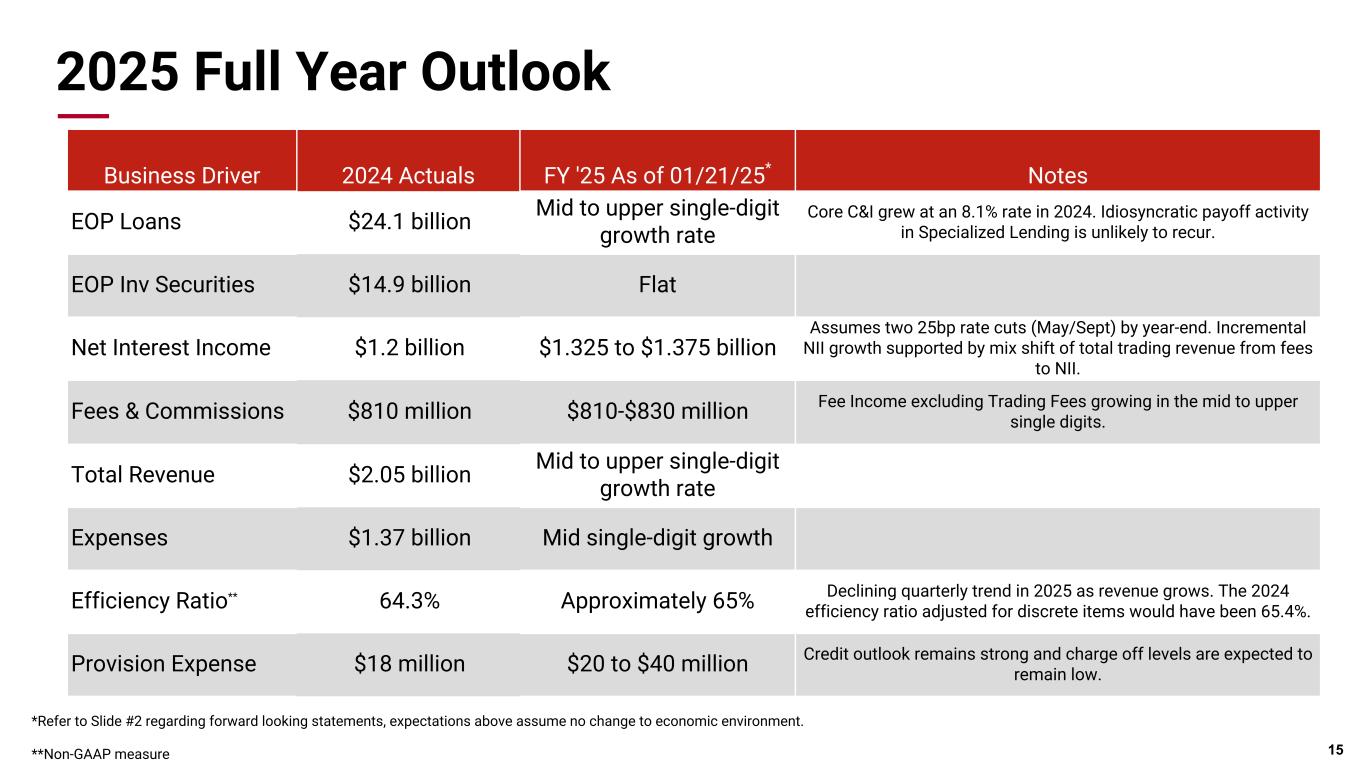

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic 2025 Full Year Outlook 15 *Refer to Slide #2 regarding forward looking statements, expectations above assume no change to economic environment. **Non-GAAP measure Business Driver 2024 Actuals FY '25 As of 01/21/25* Notes EOP Loans $24.1 billion Mid to upper single-digit growth rate Core C&I grew at an 8.1% rate in 2024. Idiosyncratic payoff activity in Specialized Lending is unlikely to recur. EOP Inv Securities $14.9 billion Flat Net Interest Income $1.2 billion $1.325 to $1.375 billion Assumes two 25bp rate cuts (May/Sept) by year-end. Incremental NII growth supported by mix shift of total trading revenue from fees to NII. Fees & Commissions $810 million $810-$830 million Fee Income excluding Trading Fees growing in the mid to upper single digits. Total Revenue $2.05 billion Mid to upper single-digit growth rate Expenses $1.37 billion Mid single-digit growth Efficiency Ratio** 64.3% Approximately 65% Declining quarterly trend in 2025 as revenue grows. The 2024 efficiency ratio adjusted for discrete items would have been 65.4%. Provision Expense $18 million $20 to $40 million Credit outlook remains strong and charge off levels are expected to remain low.

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Question & Answer Session 16

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Stacy Kymes Chief Executive Officer 17

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Appendix 18

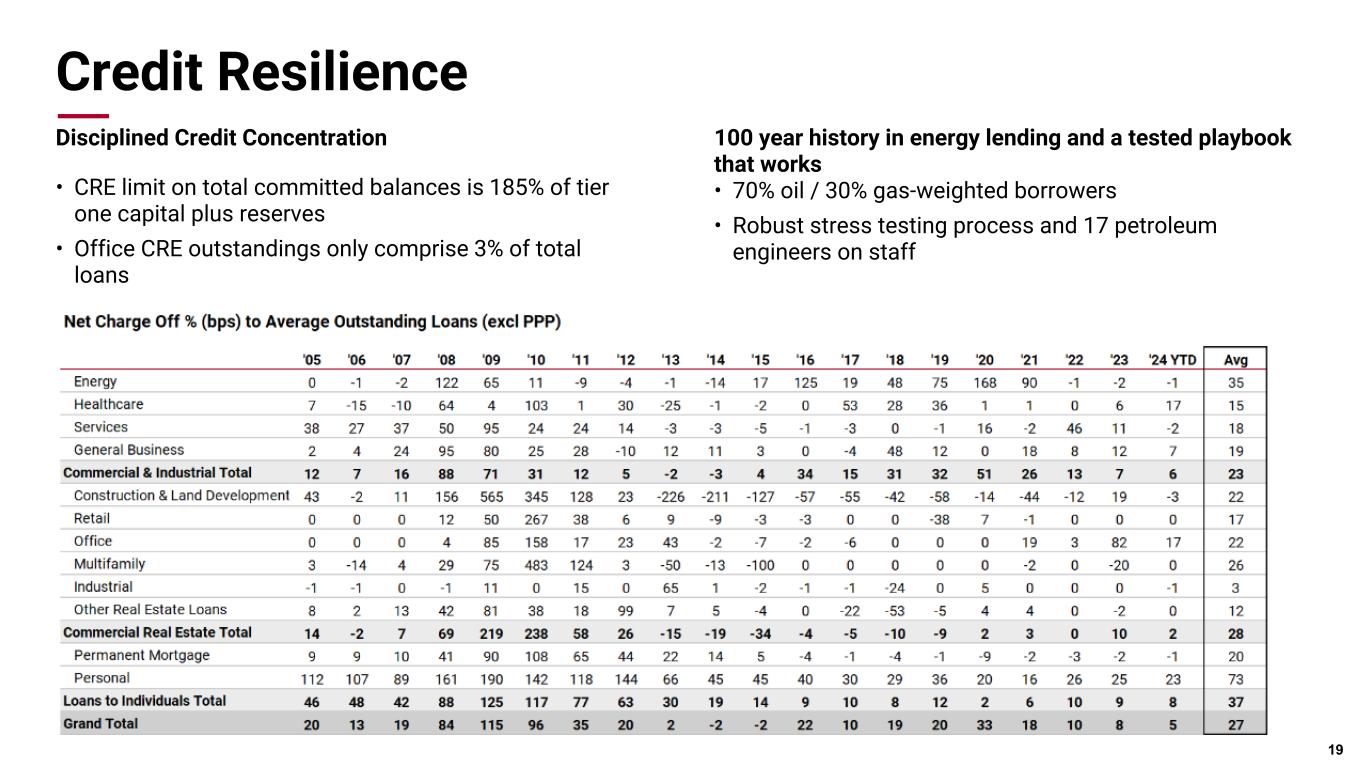

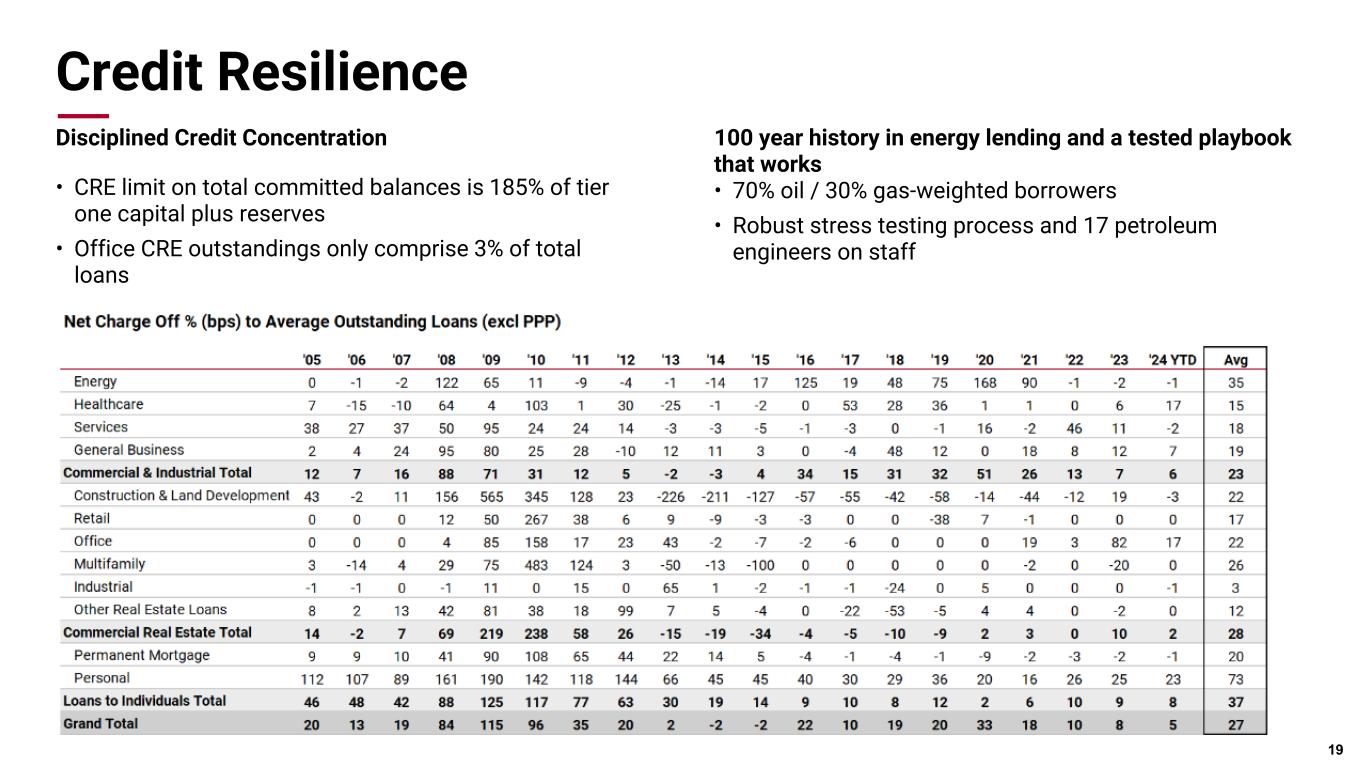

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Credit Resilience Disciplined Credit Concentration • CRE limit on total committed balances is 185% of tier one capital plus reserves • Office CRE outstandings only comprise 3% of total loans 19 100 year history in energy lending and a tested playbook that works • 70% oil / 30% gas-weighted borrowers • Robust stress testing process and 17 petroleum engineers on staff

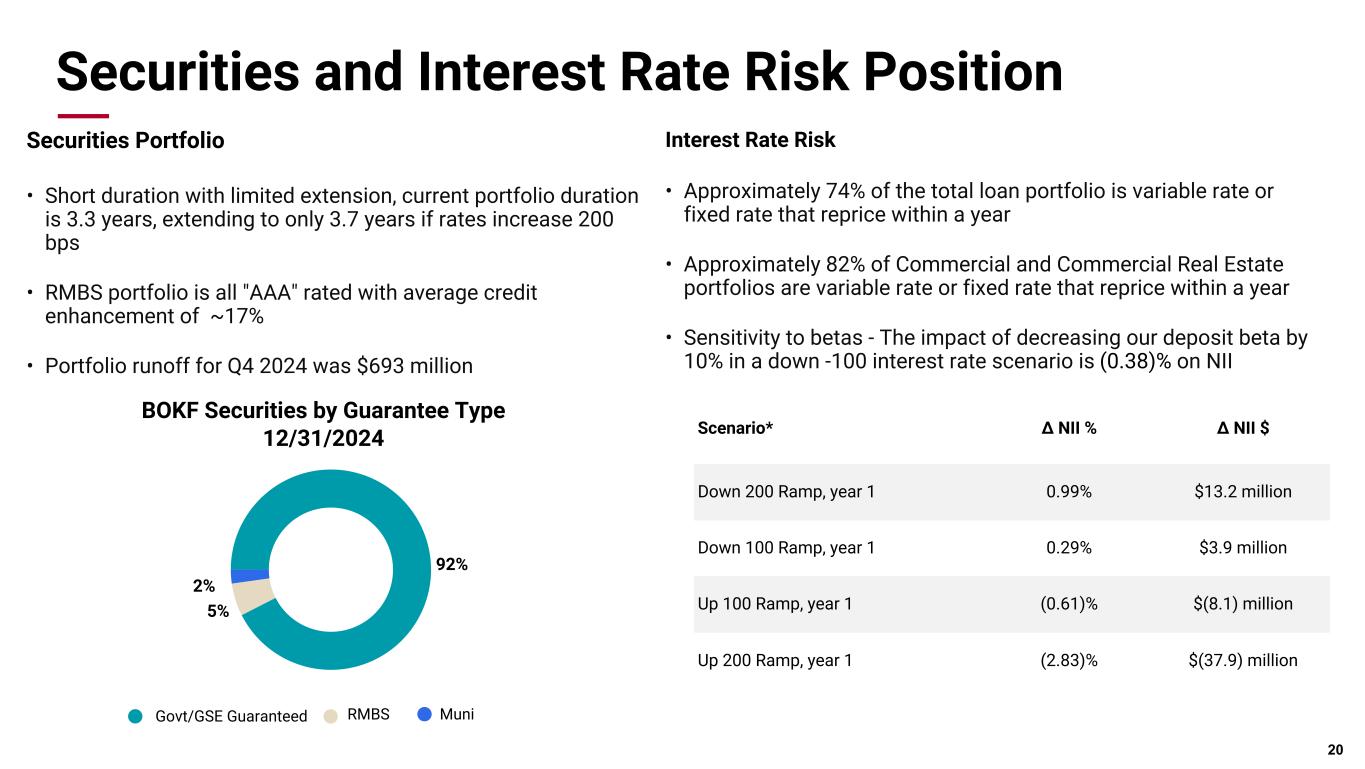

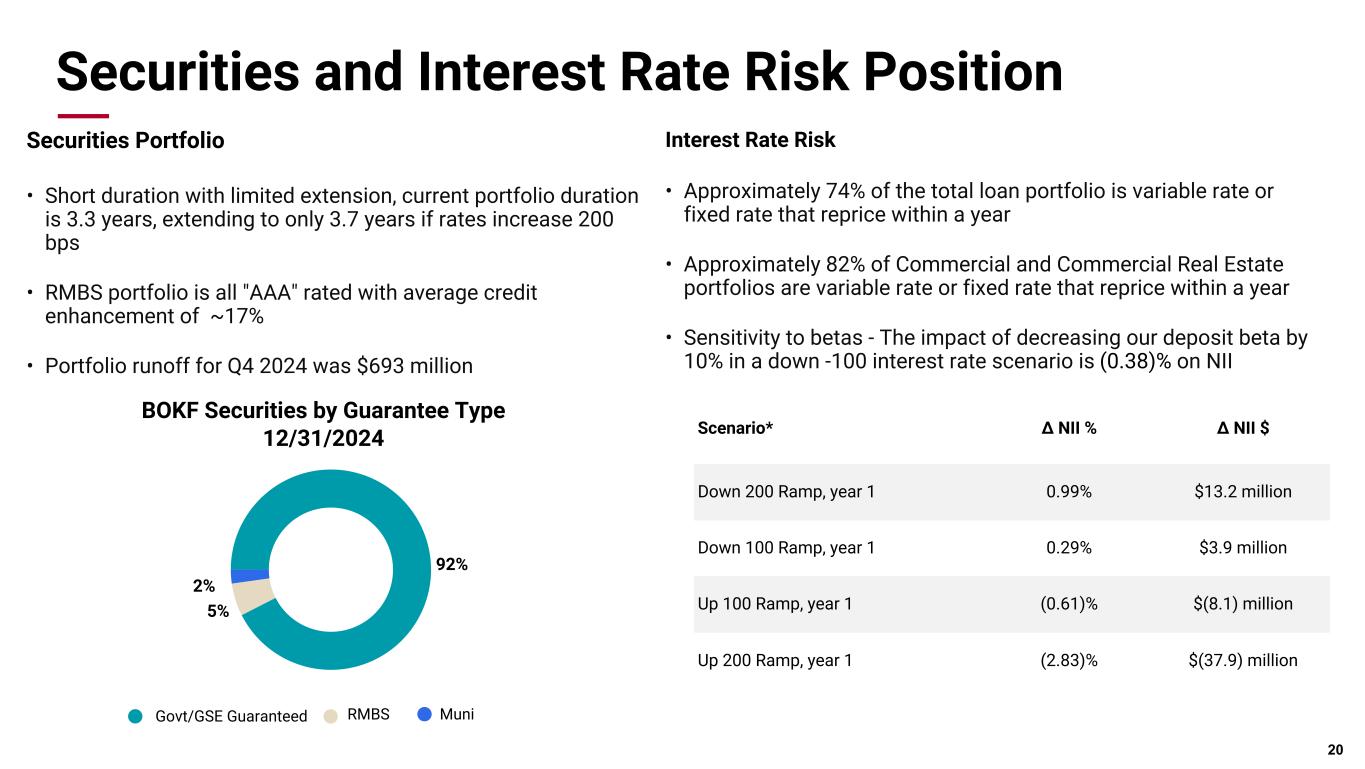

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Securities and Interest Rate Risk Position Interest Rate Risk • Approximately 74% of the total loan portfolio is variable rate or fixed rate that reprice within a year • Approximately 82% of Commercial and Commercial Real Estate portfolios are variable rate or fixed rate that reprice within a year • Sensitivity to betas - The impact of decreasing our deposit beta by 10% in a down -100 interest rate scenario is (0.38)% on NII 20 Scenario* Δ NII % Δ NII $ Down 200 Ramp, year 1 0.99% $13.2 million Down 100 Ramp, year 1 0.29% $3.9 million Up 100 Ramp, year 1 (0.61)% $(8.1) million Up 200 Ramp, year 1 (2.83)% $(37.9) million Securities Portfolio • Short duration with limited extension, current portfolio duration is 3.3 years, extending to only 3.7 years if rates increase 200 bps • RMBS portfolio is all "AAA" rated with average credit enhancement of ~17% • Portfolio runoff for Q4 2024 was $693 million 92% 5% 2% Govt/GSE Guaranteed RMBS Muni BOKF Securities by Guarantee Type 12/31/2024

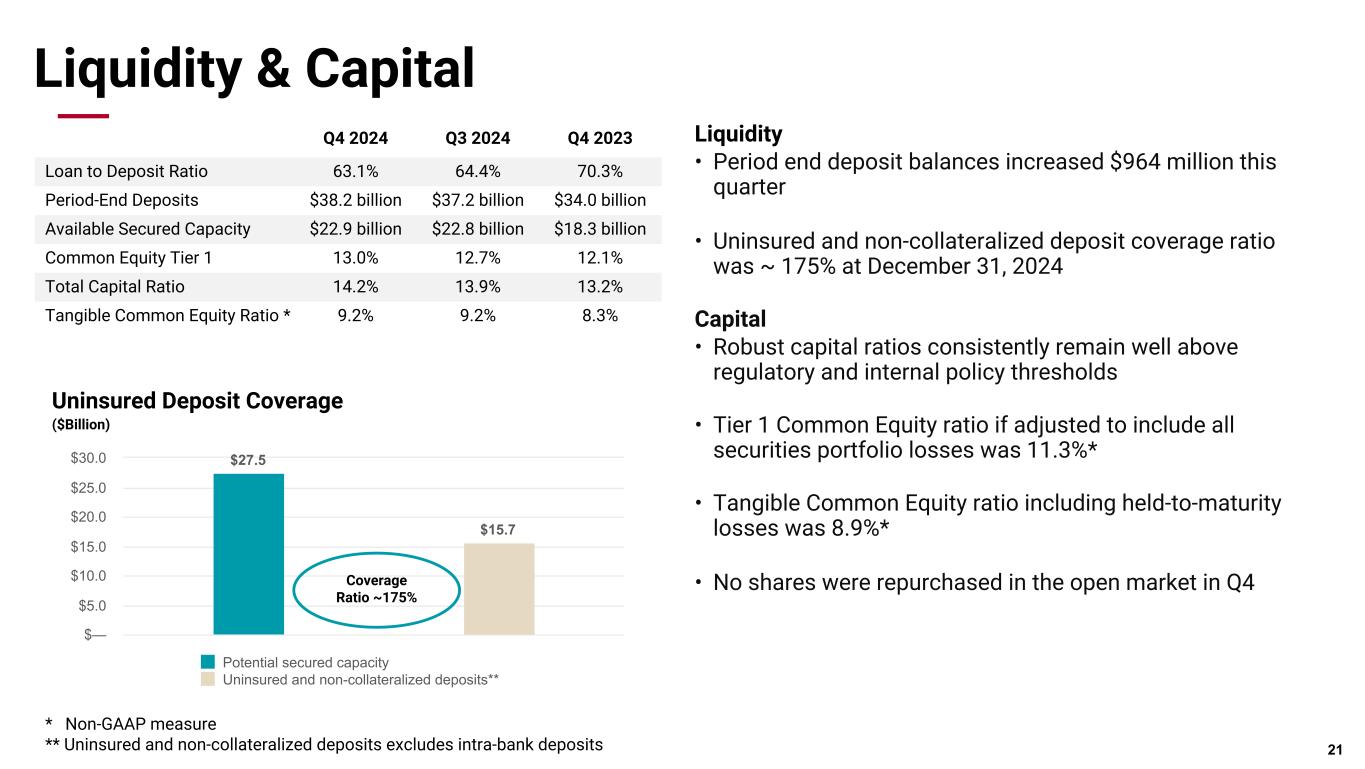

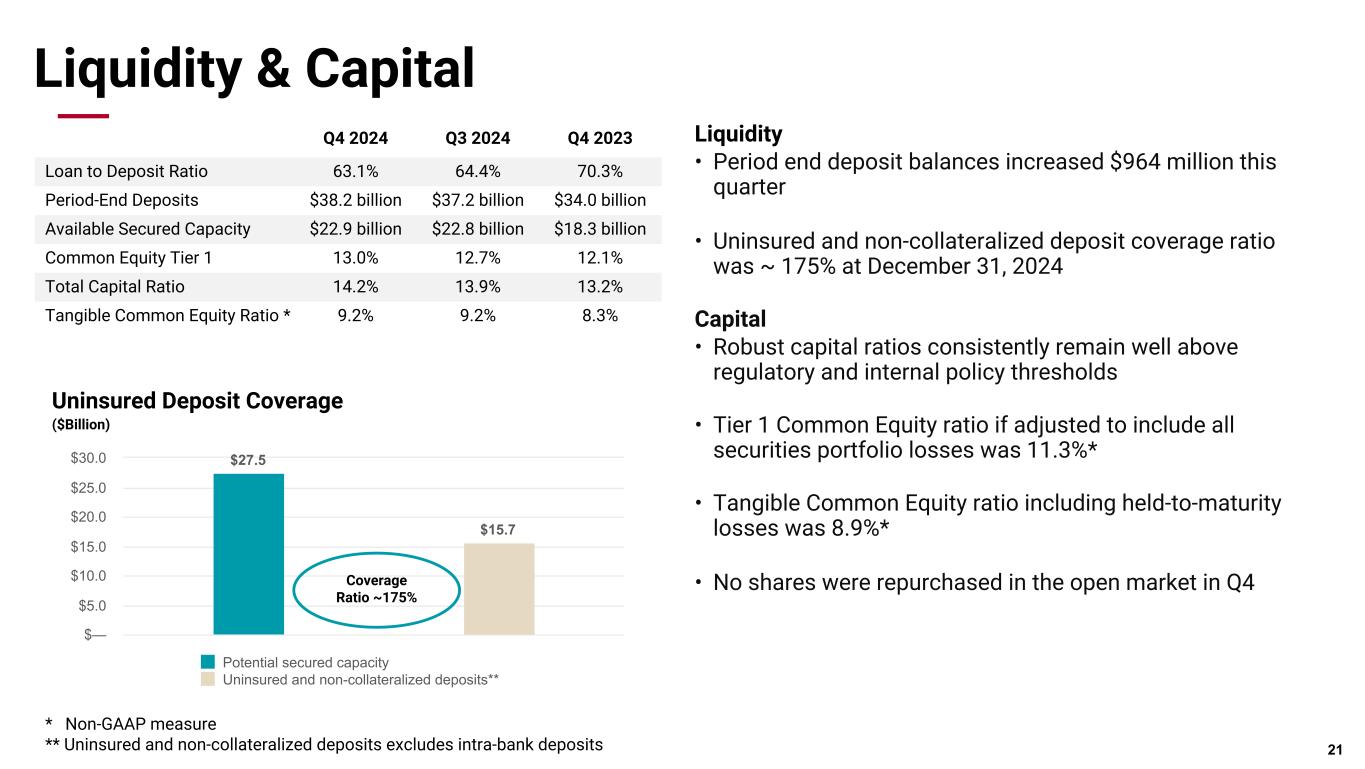

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic Liquidity & Capital * Non-GAAP measure ** Uninsured and non-collateralized deposits excludes intra-bank deposits Liquidity • Period end deposit balances increased $964 million this quarter • Uninsured and non-collateralized deposit coverage ratio was ~ 175% at December 31, 2024 Capital • Robust capital ratios consistently remain well above regulatory and internal policy thresholds • Tier 1 Common Equity ratio if adjusted to include all securities portfolio losses was 11.3%* • Tangible Common Equity ratio including held-to-maturity losses was 8.9%* • No shares were repurchased in the open market in Q4 21 Q4 2024 Q3 2024 Q4 2023 Loan to Deposit Ratio 63.1% 64.4% 70.3% Period-End Deposits $38.2 billion $37.2 billion $34.0 billion Available Secured Capacity $22.9 billion $22.8 billion $18.3 billion Common Equity Tier 1 13.0% 12.7% 12.1% Total Capital Ratio 14.2% 13.9% 13.2% Tangible Common Equity Ratio * 9.2% 9.2% 8.3% $27.5 $15.7 Potential secured capacity Uninsured and non-collateralized deposits** $— $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Coverage Ratio ~175% Uninsured Deposit Coverage ($Billion)

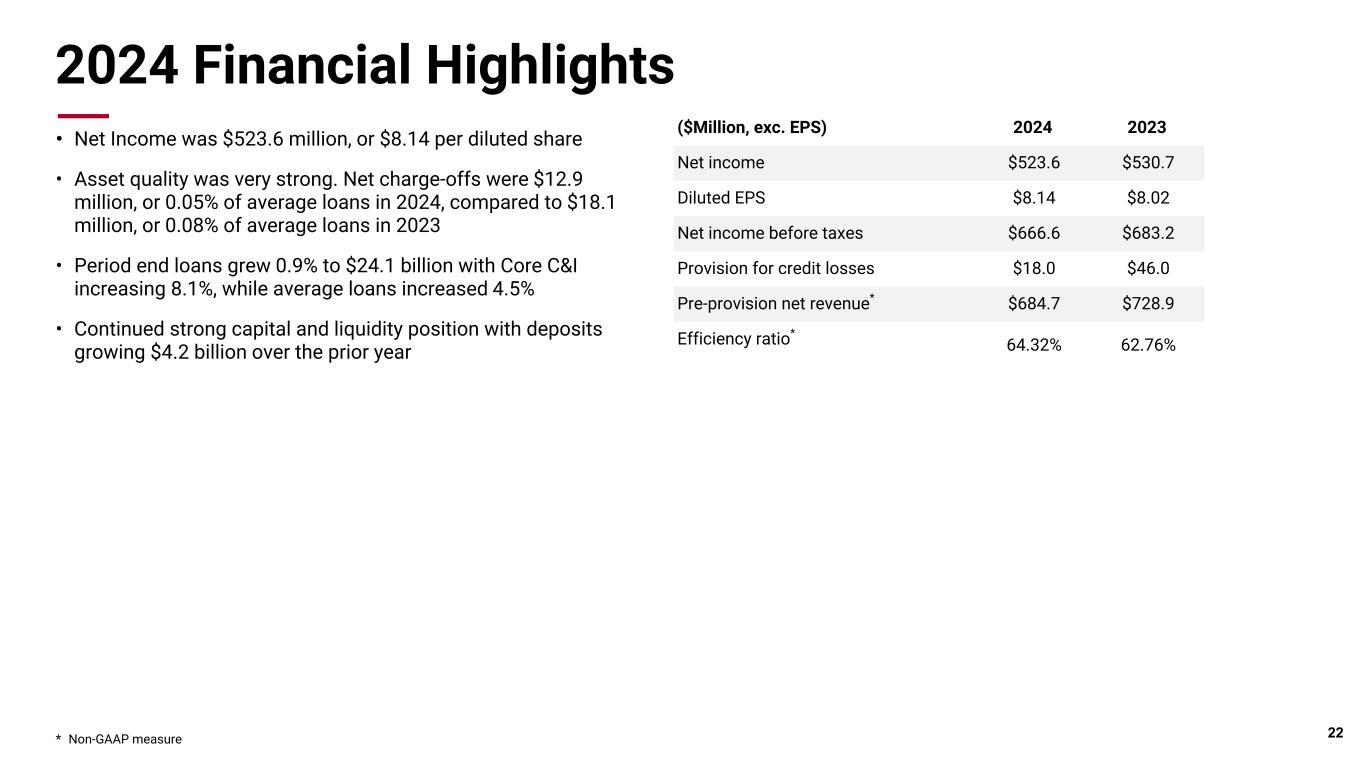

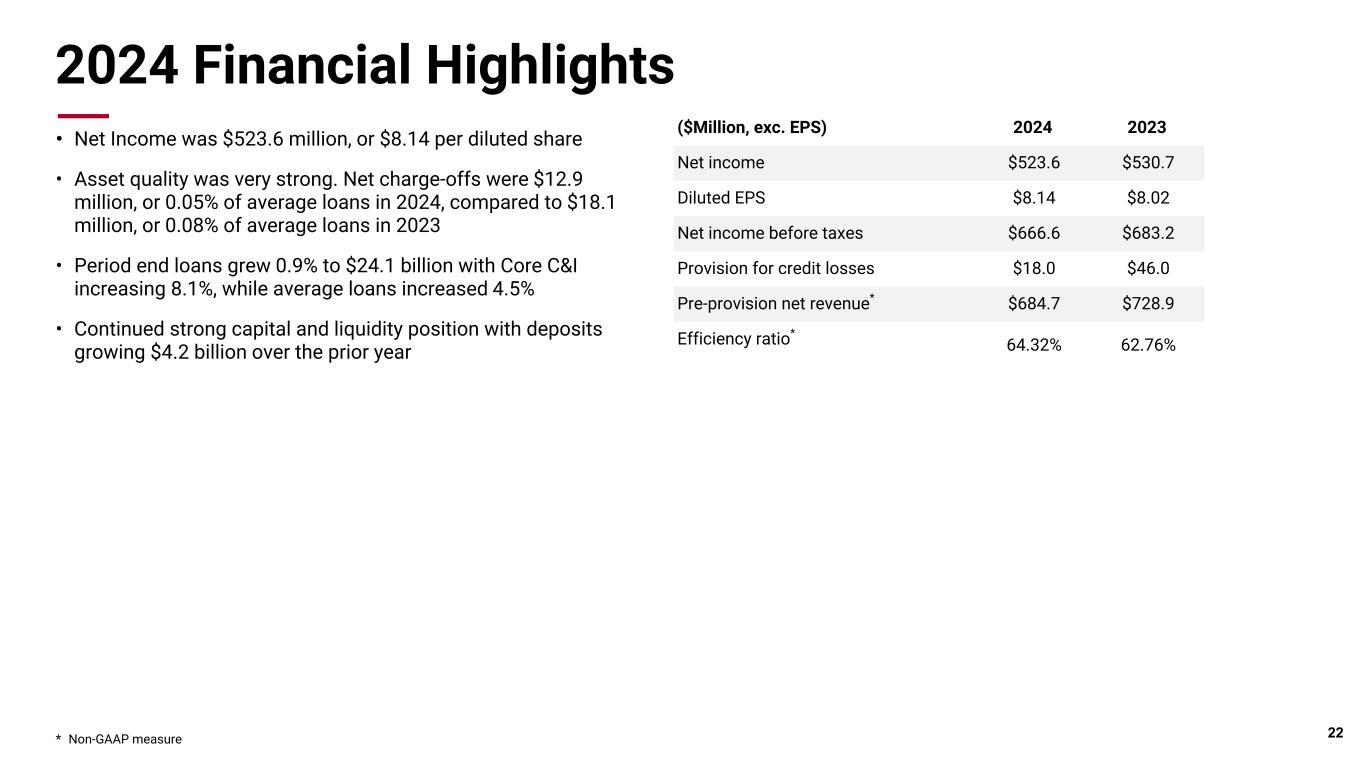

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic 2024 Financial Highlights * Non-GAAP measure • Net Income was $523.6 million, or $8.14 per diluted share • Asset quality was very strong. Net charge-offs were $12.9 million, or 0.05% of average loans in 2024, compared to $18.1 million, or 0.08% of average loans in 2023 • Period end loans grew 0.9% to $24.1 billion with Core C&I increasing 8.1%, while average loans increased 4.5% • Continued strong capital and liquidity position with deposits growing $4.2 billion over the prior year 22 ($Million, exc. EPS) 2024 2023 Net income $523.6 $530.7 Diluted EPS $8.14 $8.02 Net income before taxes $666.6 $683.2 Provision for credit losses $18.0 $46.0 Pre-provision net revenue* $684.7 $728.9 Efficiency ratio* 64.32% 62.76%

Pri m ar y & se co nd ar y br an d co lor s Data viz colors Data viz monochromatic