BOK Financial Corporation

Analyst Day

April 29, 2009

Forward-Looking Statements

This presentation contains forward-looking statements that are based on management’s beliefs, assumptions, current expectations, estimates, and projections about BOK Financial Corporation, the financial services industry, and the economy generally. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of such words, and similar expressions are intended to identify such forward-looking statements. Management judgments relating to, and discussion of the provision and allowance for credit losses involve judgments as to future events and are inherently forward-looking statements. Assessments that BOKF’s acquisitions and other growth endeavors will be profitable are necessary statements of belief as to the outcome of future events, based in part on information provided by others which BOKF has not independently verified. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expressed, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to, (1) the ability to fully realize expected cost savings from mergers within the expected time frames, (2) the ability of other companies on which BOKF relies to provide goods and services in a timely and accurate manner, (3) changes in interest rates and interest rate relationships, (4) demand for products and services, (5) the degree of competition by traditional and non-traditional competitors, (6) changes in banking regulations, tax laws, prices, levies, and assessments, (7) the impact of technological advances, and (8) trends in customer behavior as well as their ability to repay loans. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise.

2

Agenda

7:30-8:00 a.m. Continental Breakfast – Doubletree Hotel at Warren Place

Tulsa Learning Center

8:00-8:15 a.m. Welcome – Stan Lybarger, President & CEO

8:15-9:00 a.m. Review of 1st Quarter Earnings – Steven Nell,

Chief Financial Officer

9:00-9:45 a.m. Loan Portfolio & Asset Quality – Chuck Cotter, Chief Credit Officer

9:45-10:00 a.m. Break

10:00-10:45 a.m. Oklahoma, Arizona, New Mexico, Arkansas, Commercial &

TransFund – Dan Ellinor, Sr. Executive Vice President

10:45-11:30 a.m. Colorado, Kansas City, Consumer & Wealth Management –

Steve Bradshaw, Sr. Executive Vice President

11:30-12:00 p.m. Texas – Norm Bagwell, Chairman & CEO, Bank of Texas

12:00 Lunch

3

Review of 1st Quarter Earnings

4

Steven Nell

Chief Financial Officer

Executive Vice President

12/31/08 3/31/09 Change*

BOK Financial Today

5

*annualized

Total assets

22,734,648

$

23,333,442

$

10.54

%

Average loans

12,826,696

$

12,784,765

$

(1.31)

%

Combined Reserve for Loan

Losses/Pd End Loans

1.93%

2.07%

14

bps

Average deposits

14,093,936

$

14,850,184

$

21.46

%

Shareholder's equity

1,846,257

$

1,931,300

$

18.42

%

Tangible Common Equity

6.64%

6.84%

20

bps

Market Cap

$ 2.7 billion

2.4 billion

(11.11)

%

-$0.20

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

1Q08

2Q08

3Q08

4Q08

1Q09

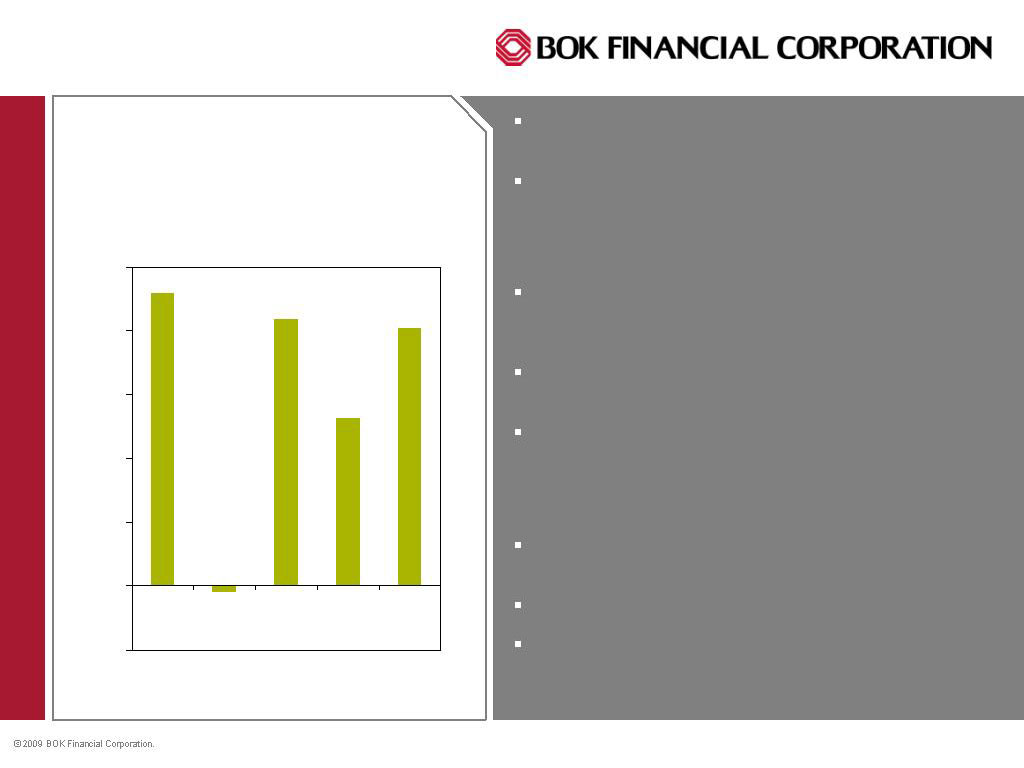

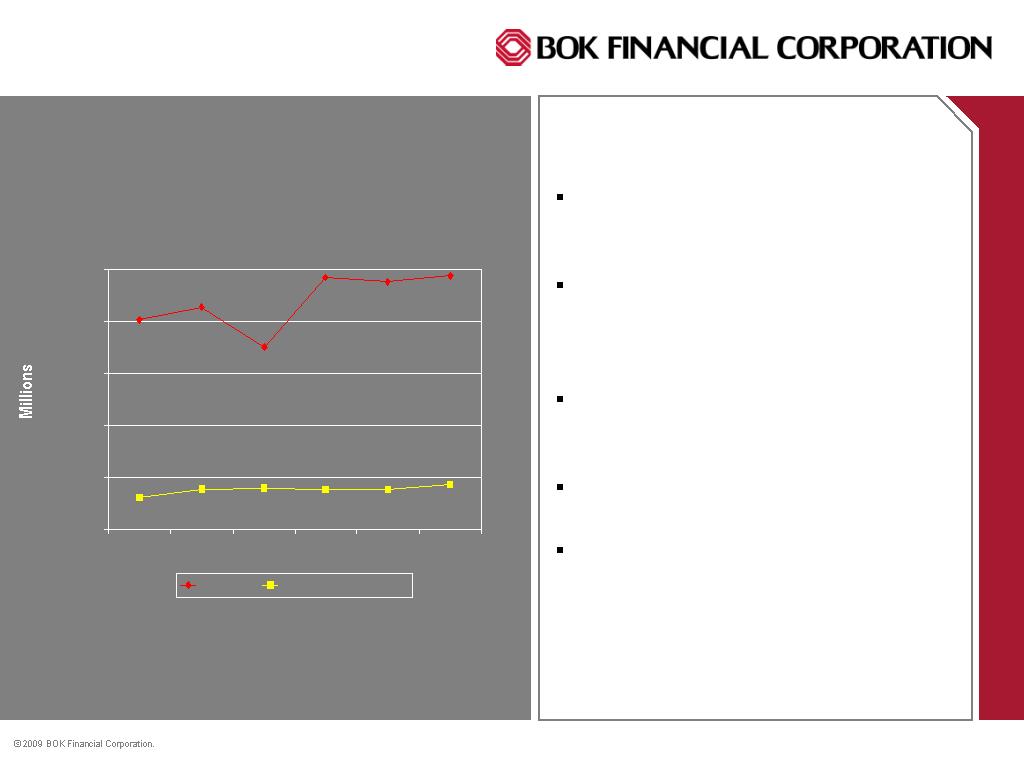

Earnings of $55 million or $0.81 per diluted

share

The net interest margin of 3.47%, down 10

basis points from 4Q08 due primarily to the

spread between LIBOR and federal funds

returning to a historically normal level

Fees and commissions revenue totaled

$121.5 million, an increase of nearly $11

million or 9.8% over 4Q08

Recognized OTTI charges of $15 million for

certain preferred stocks and private label MBS

Planned provision of $45 million less net

charge offs of $31.9 million increased

combined reserve for credit losses to 2.07% of

outstanding loans

Average deposits up $756 million or 21%

annualized since 4Q08

Tangible common equity increased to 6.84%

Increased the cash dividend from $0.225 to

$0.24 per common share

Diluted Earnings Per Share

First Quarter Results

6

Quarterly Results ($ In 000s)

7

3/31/2008

6/30/2008

9/30/2008

12/31/2008

3/31/2009

Net interest revenue

147,128

$

158,939

$

164,348

$

176,447

$

169,845

$

Net interest margin

3.31%

3.44%

3.48%

3.57%

3.47%

Other operating revenue

113,857

124,449

119,958

110,930

121,507

Other operating expense

151,642

158,501

158,736

159,010

167,749

Efficiency Ratio

57.60%

55.55%

55.46%

54.94%

57.10%

Net operating income

109,343

124,887

125,570

128,367

123,603

Provision for credit losses

17,571

59,310

52,711

73,001

45,040

Net change re: mortgage

servicing rights and related hedge

(1,571)

(6,285)

(4,368)

(11,343)

(163)

Gain (loss) on securities,

derivatives and asset sales

11,852

(3,834)

4,442

(4,572)

20,705

Net impairment losses

5,306

15,002

Non-recurring (losses) recoveries

-

(60,700)

6,700

-

-

Federal and state income taxes

34,450

(2,862)

22,958

10,363

28,838

Non-controlling interest income (expense), net

(32)

1,219

10

6,355

(233)

Net income

62,265

$

(1,161)

$

56,685

$

35,443

$

55,032

$

Quarter Ended

Net interest revenue was

down $6.6 million

compared to 4Q08 due

primarily to the spread

between LIBOR and the

federal funds rate

returning to a historically

normal level

Average earning assets

increased $477 million

from the previous quarter

Average interest bearing

deposits increased $604

million while average

funds purchased, repos

and other borrowed funds

decreased $361 million

from 4Q08

Net Interest Margin

8

12/31/08

3/31/09

TAX-EQUIVALENT ASSETS YIELDS

Trading securities

6.55%

3.69%

Funds sold and resell agreements

0.76%

0.24%

Total securities

5.17%

4.96%

Total loans

5.27%

4.56%

Less Allowance for loan losses

-

-

Total loans, net

5.35%

4.65%

Total tax-equivalent yield on earning assets

5.28%

4.75%

COST OF INTEREST-BEARING LIABILITIES

Interest-bearing deposits:

Interest-bearing transaction

1.51%

0.95%

Savings

0.37%

0.28%

Time

3.28%

2.83%

Total interest-bearing deposits

2.29%

1.76%

Funds purchased and repurchase agreements

0.94%

0.45%

Other borrowings

1.51%

0.58%

Subordinated debt

5.48%

5.67%

Total cost of interest-bearing liabilities

2.02%

1.50%

Tax-equivalent net interest revenue spread

3.26%

3.25%

Effect of noninterest-bearing funding sources

and other

0.31%

0.22%

Tax-equivalent net interest margin

3.57%

3.47%

Quarter Ended

0%

20%

40%

60%

80%

100%

Net Interest Revenue, 58.2%

Brokerage & Trading, 8.5%

Transaction Card, 8.7

Trust fees, 5.7%

Deposit service charges, 9.4%

Mortgage Banking, 6.3%

Other, 3.2%

Components of Revenue

FYE 12/31/08

9

Fee Revenue in Millions

4Q08 1Q09

Brokerage & Trading $23.50 $24.70

Transaction Card

25.18

25.43

Trust Fees

17.14

16.51

Deposit Svc Charges

29.24

27.40

Mortgage Banking

7.22

18.50

Margin Asset Fees

.19

.06

Other

8.46

8.90

Total

$110.93

$121.50

The 156% increase in mortgage banking

revenue was primarily driven by increased

volume in refinancing due to government

initiatives to lower mortgage interest rates

Expense Management

Higher FDIC insurance premiums

resulted in a $2.2 million increase

over 4Q08

Personnel expense increased in

1Q09 primarily due to seasonal

increases in payroll taxes and other

employee benefit costs

Added 61 employees during 1Q09,

hired high quality talent for BOSC,

Mortgage, Treasury and RITS,

New initiatives include capping merit

increases for 2009

Recently began a review of non-

personnel operating expenses to

identify opportunities to decrease

cost without impacting service quality

10

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

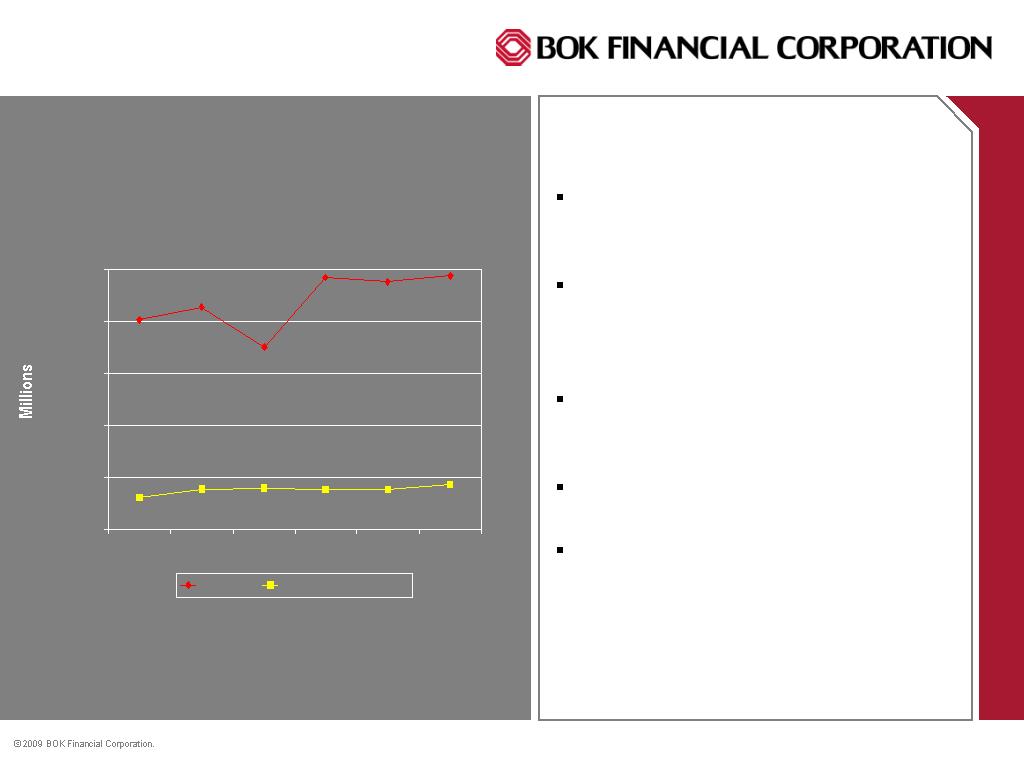

Revenue

Personnel Expense

Revenue & Personnel Expense Trends

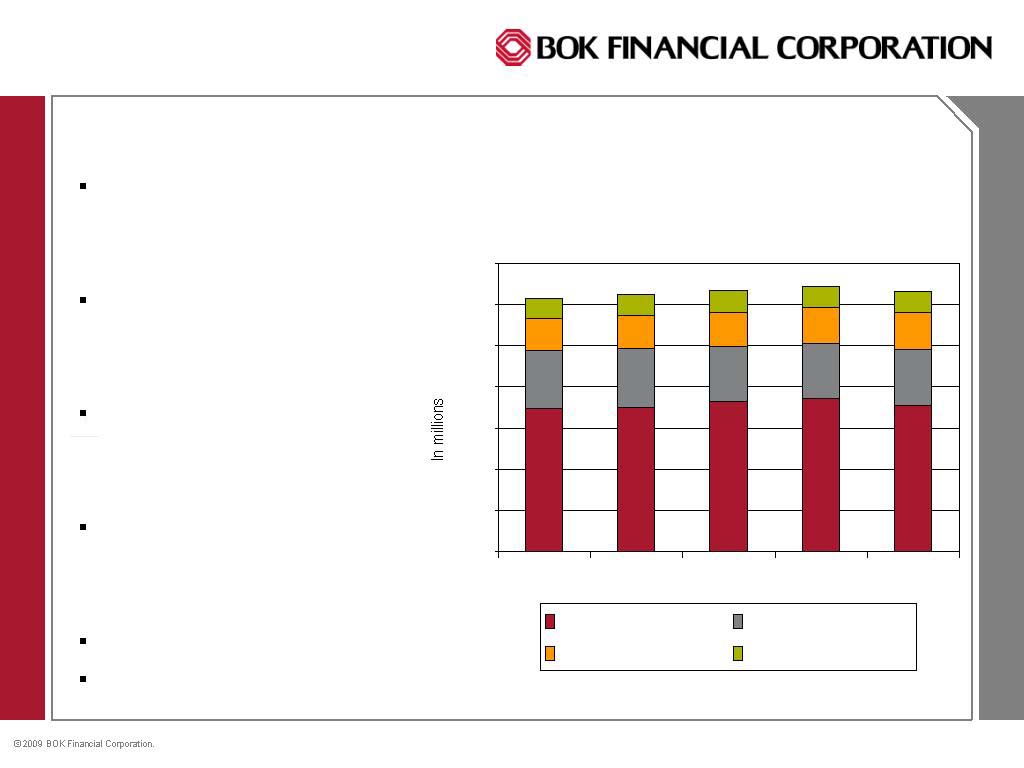

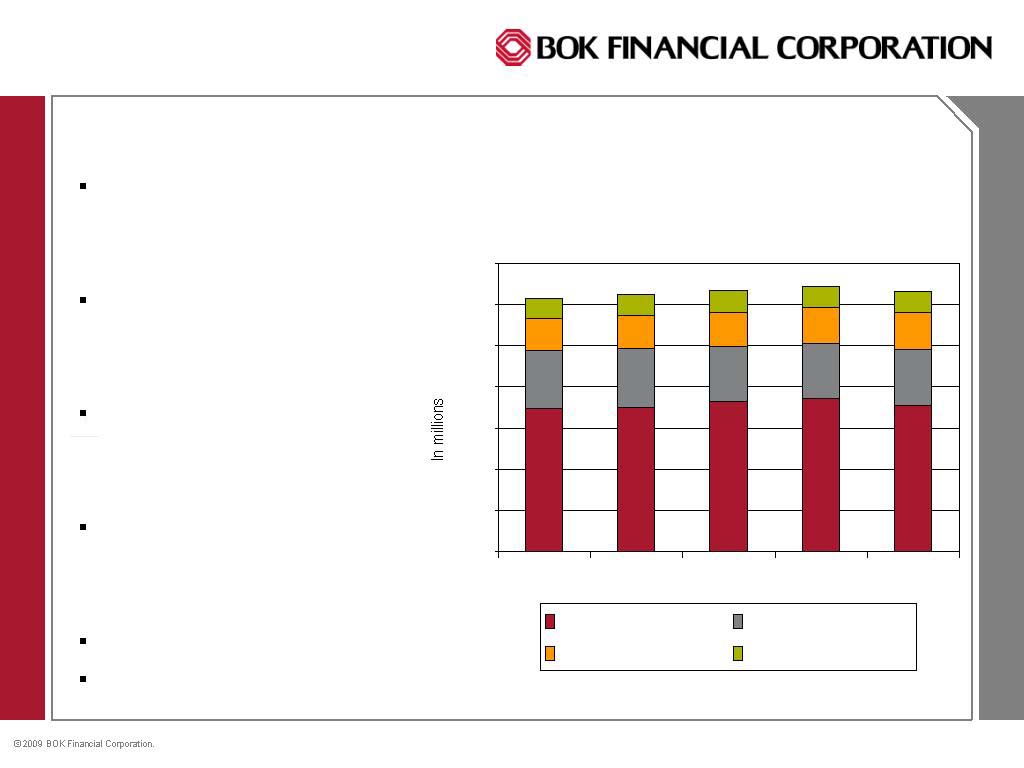

Loans

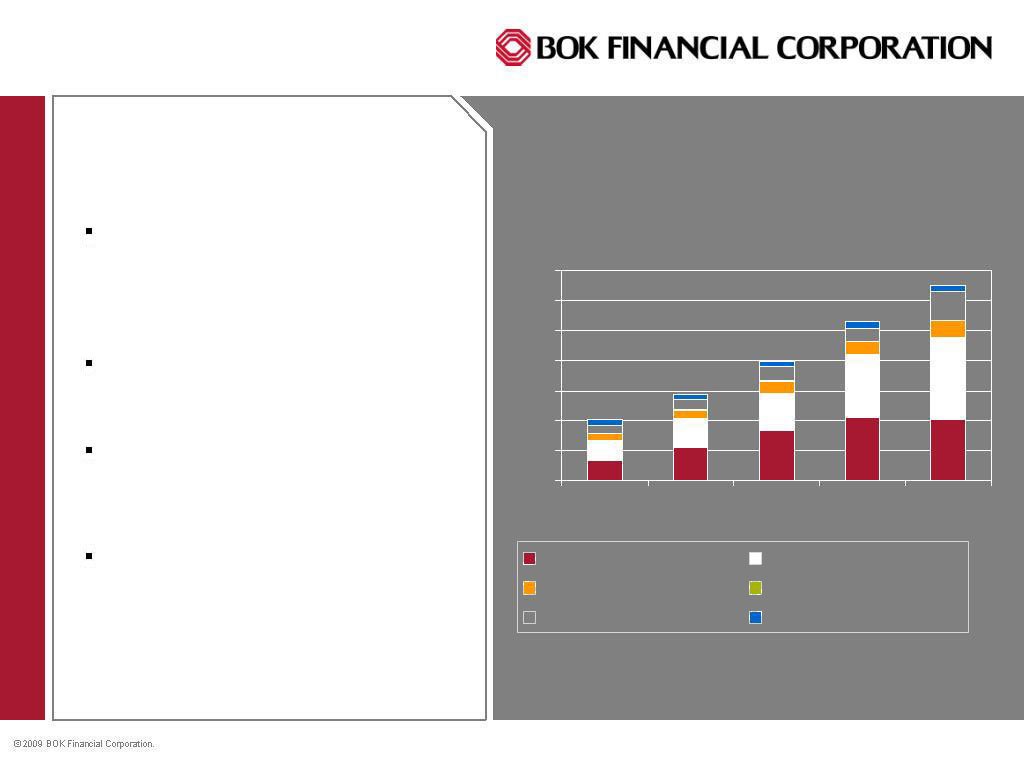

Loan Trends

Commercial loans decreased

$310 million in 1Q09; decrease

was generally consistent across

nearly all sectors

CRE increased $31 million;

increases in retail, office and

multifamily offset the decrease in

construction & land development

Residential mortgages increased

$67 million due to higher

originations driven by lower

interest rates

Consumer loans decreased as

BOKF exited the dealer financial

services in favor of a customer-

focused direct lending approach

Loan pricing is improving

Approximately 25% of CRE is

owner-occupied property

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

1Q08

2Q08

3Q08

4Q08

1Q09

Commercial

Commercial Real Estate

Residential Mortgage

Consumer

57%

23%

12%

8%

8%

11

56%

22%

14%

58%

21%

13%

57%

22%

13%

56%

22%

13%

8%

8%

8%

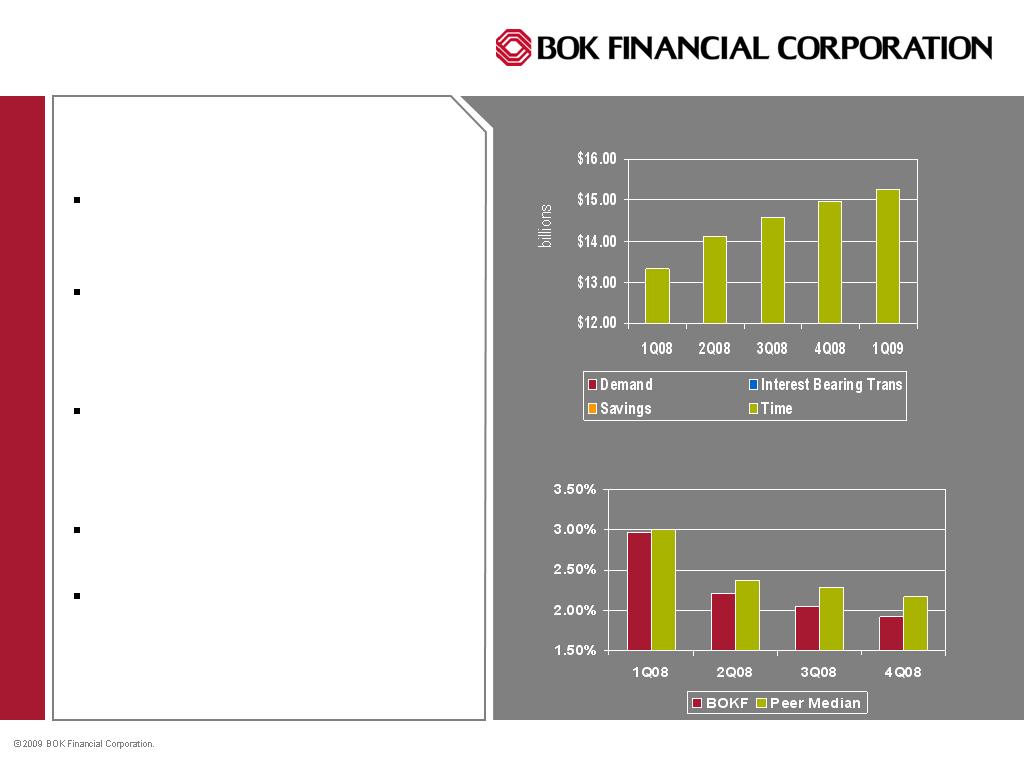

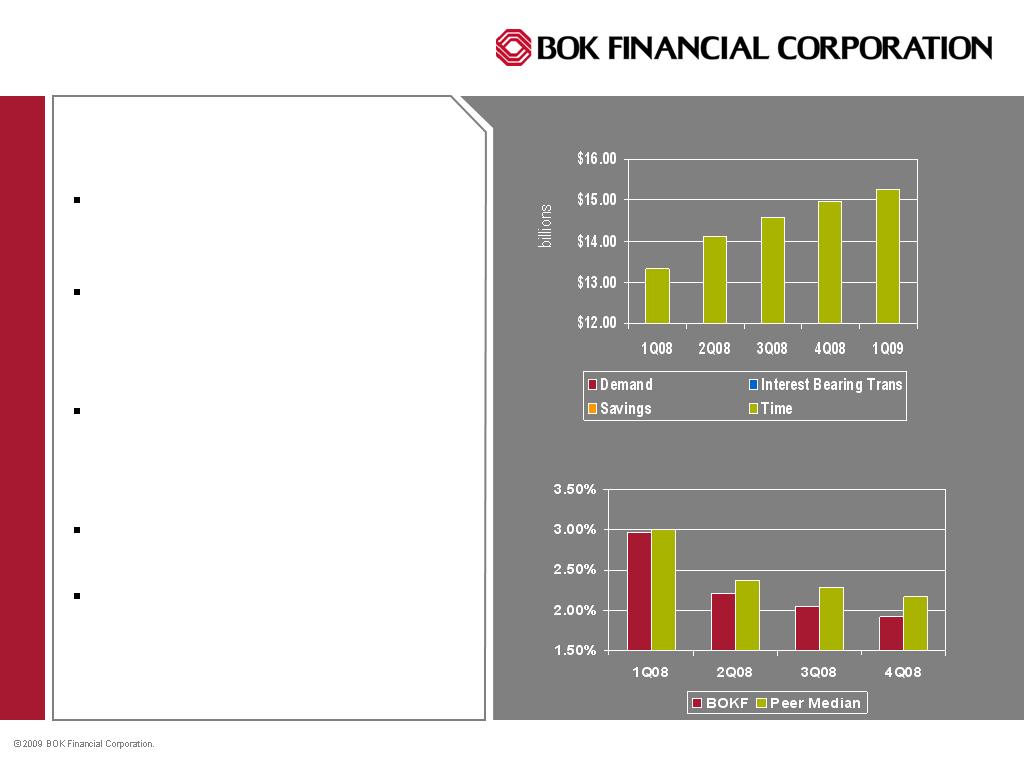

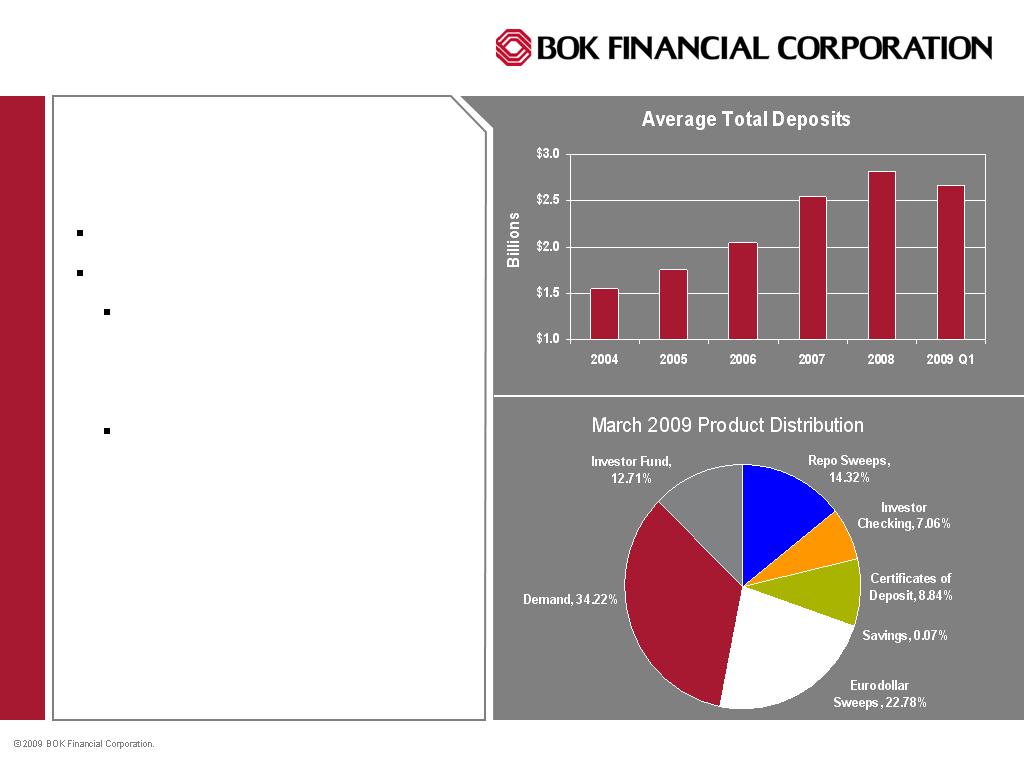

Deposits

Deposits

Cost of Deposits

BOKF has placed a special focus on

growing deposits and maximizing

liquidity

Deposits increased $288 million

during 1Q09 primarily due to growth

in Consumer and Wealth

Management accounts

Texas and Arkansas experienced

the largest deposit growth, though

deposits in nearly all markets

increased

Loan to deposit ratio was 83% at

3/31/09

Over the last year, demand and

interest bearing transaction deposits

have increased as a percent of total

deposits; the mix stayed consistent

from 4Q08 to 1Q09

12

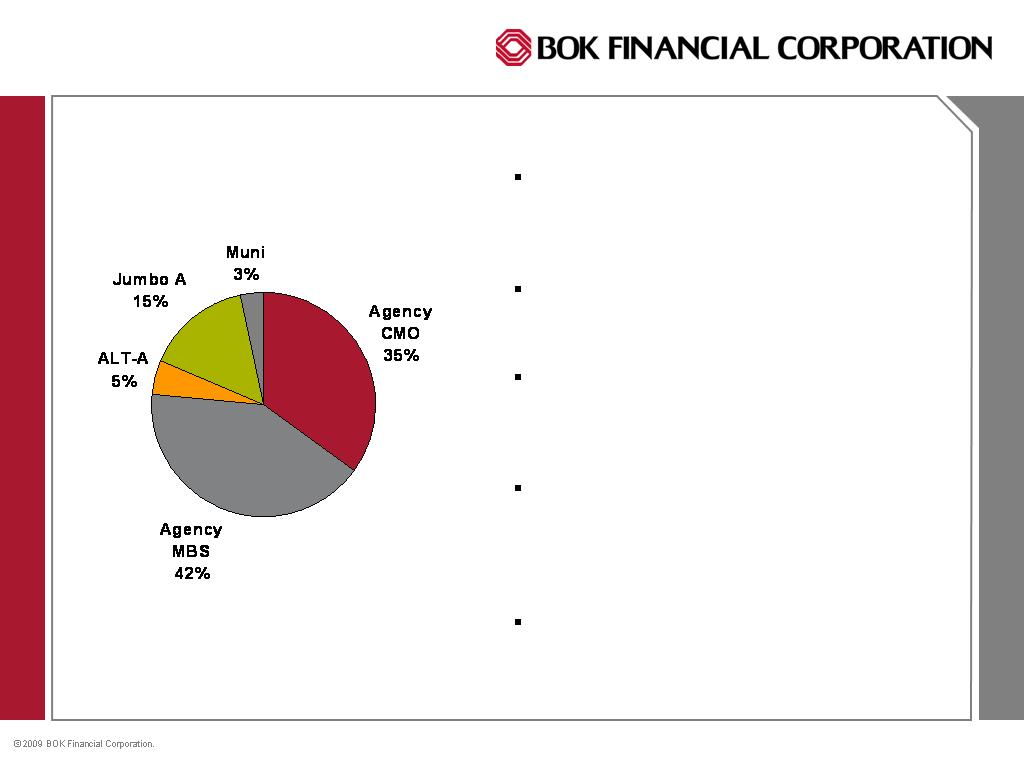

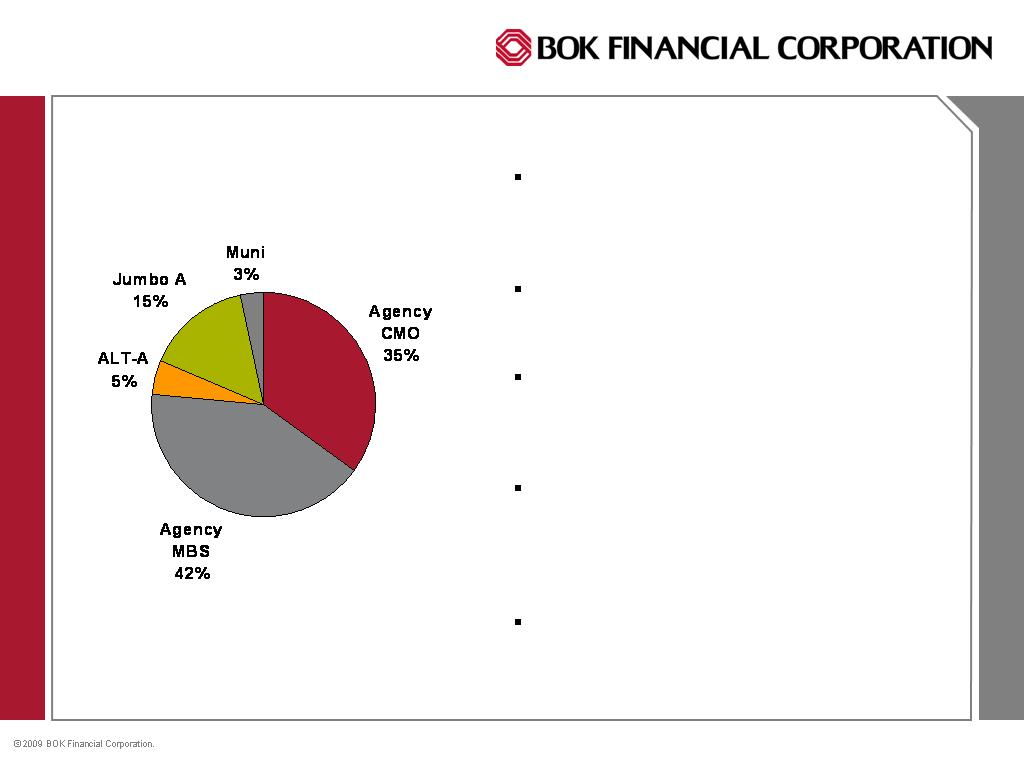

$7.7B Investment Portfolio

Current portfolio has an effective duration

of approximately 1.9 years and would

extend less than one year if rates increase

300bp

The $665 million increase in the portfolio in

1Q09 included purchases and a $69 million

increase in the fair value of AFS securities

At 3/31, our AFS portfolio included $5.5

billion MBS, fully backed by U.S.

government agencies and $1.6 billion

privately issued MBS

Approximately $381 million of the privately

issued MBS consisted of Alt-A mortgage

loans; all Alt-A MBS originated in 2007 and

2006 are credit enhanced with additional

collateral support

BOKF does not hold any CLOs, CDOs,

payment option ARMs or subprime

mortgage loans

13

As of 3/31/09

OTTI Evaluation of Debt

Securities

Debt securities rated below investment grade

were evaluated for other-than-temporary

impairment

The evaluation was based on projections of

estimated cash flows using current and

anticipated unemployment and default rates,

decreasing housing prices and increasing

default rates

14 MBS totaling approx. $444 million were

rated below investment grade by at least one

nationally-recognized rating agency; six of

these were still rated investment grade by

another rating agency

Four of the 14 MBS analyzed were identified

as having other-than-temporary impairment;

the aggregate unrealized loss on these

securities totaled $46 million and estimated

credit losses totaled $7 million

Summary ($ in millions)

Amortized cost of private issue MBS $1,556

Aggregate cost of securities

rated < investment grade by at

least one rating agency 444

Fair value of securities

rated < investment grade by at

least one rating agency 277

Other Than Temporary Impairment 46

Credit component 7

14

OTTI Evaluation of Equities

BOKF owns preferred stocks issued by six

financial institutions

Preferred stocks have a current carrying

value of $24 million including $22 million in

cumulative other-than-temporary

impairment charges

In 1Q09, we recognized an $8 million other-

than temporary impairment on the preferred

stock of one issuer whose preferred stock,

though not in default, was downgraded to

below investment grade

These preferred stocks have certain debt-

like features such as a quarterly dividend

based on LIBOR

Summary ($ in 000s)

Original cost at purchase $46,419

Previously written down value 32,464

Fair value at 3/31/09 16,341

OTTI recognized 1Q09 8,000

Aggregate tax equivalent yield is 12.05%

15

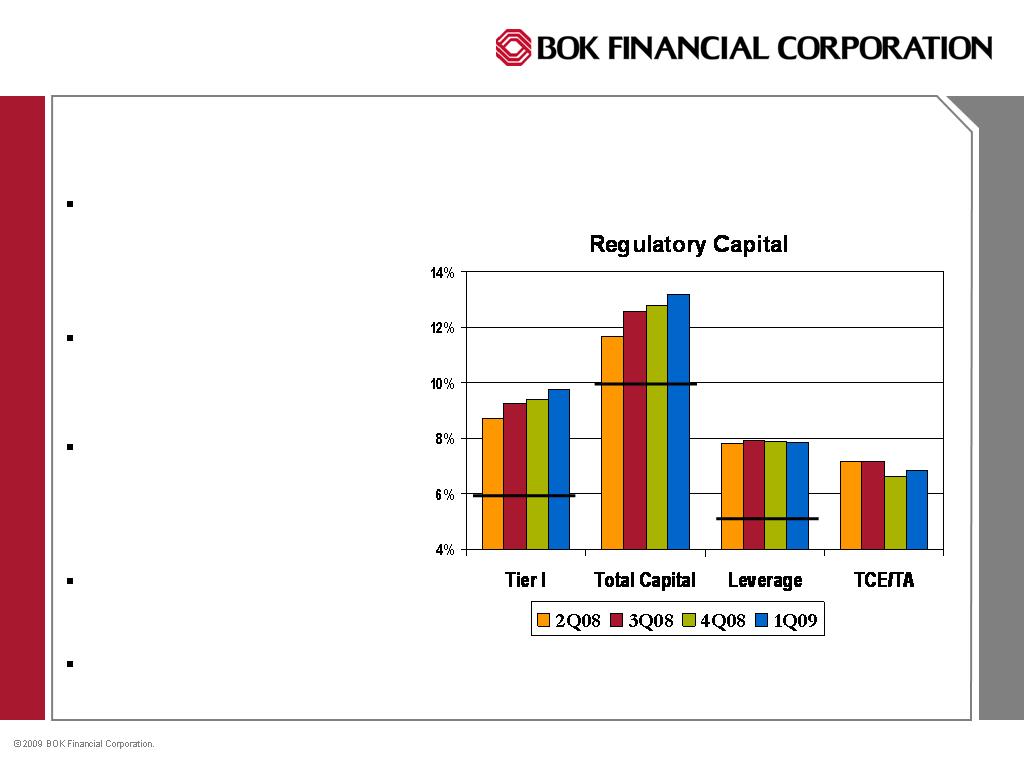

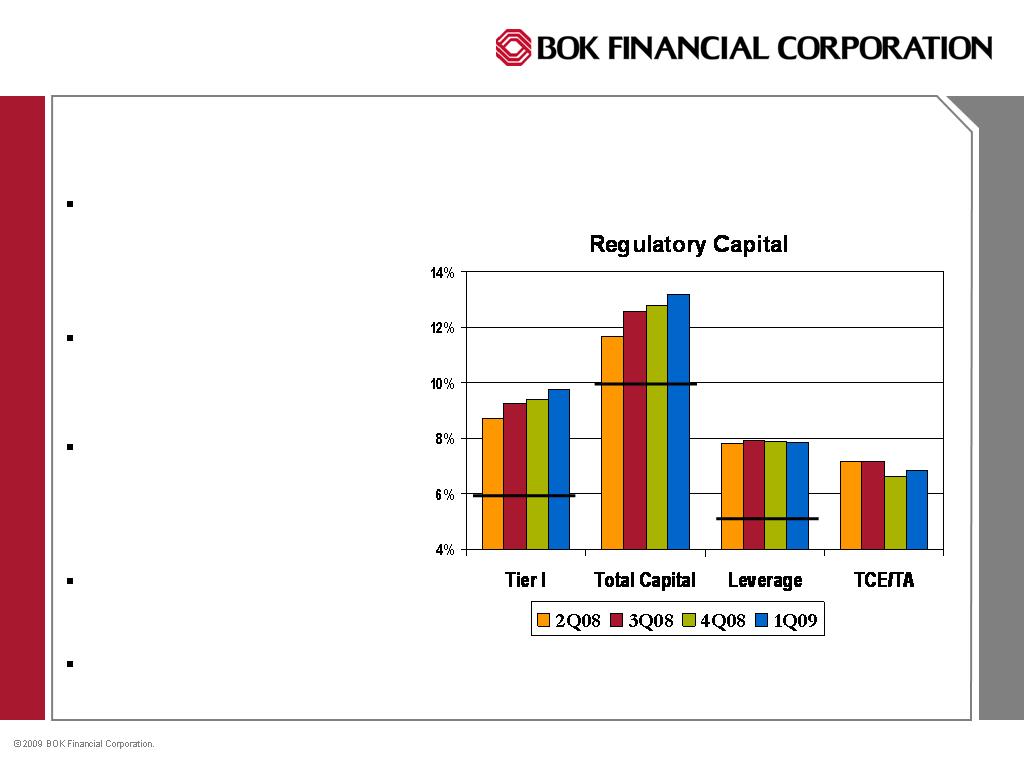

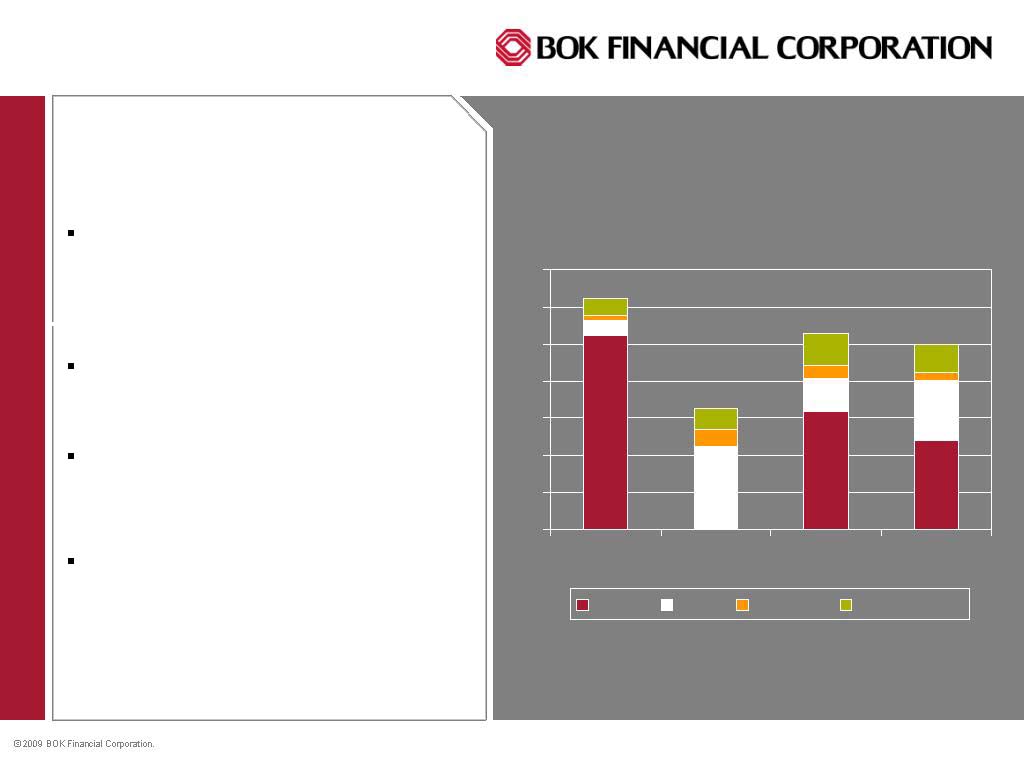

Solid Capital

16

BOKF elected not to participate

in the Capital Purchase

Program (an element of TARP)

as current capital sufficient to

support planned growth

Current uses of capital include

organic growth, dividends,

acquisitions within our footprint

and periodic stock buyback

BOKF’s capital levels far

exceed “well capitalized” as

defined by the federal banking

agencies as indicated by the

solid black lines

Tangible common equity ratio

increased to 6.84% from 6.64%

at 12/31/08

TCE/RWA increased to 8.65%

from 8.07% at 12/31/08

First Quarter Results

7

17

LOB’s performance includes allocation of

funds, direct and indirect expenses, taxes

and net charge-offs

Funds Management unit manages overall

liquidity and interest rate risk, and contains

impairment charges and excess provision

over net charge-offs

62,265

$

55,032

$

Total

3,429

23,381

Funds management and other

58,836

31,651

Subtotal

10,053

5,502

Wealth management

12,033

9,628

Consumer banking

36,750

$

16,521

$

Commercial banking

8

200

9

200

March 31,

Three Months ended

(In Thousands)

Net Income by Line of Business

Net Income by Geographic

Region

(In Thousands)

Three Months ended March 31,

200

9

200

8

Oklahoma

$

25,051

$

36,335

Texas

6,808

12,180

New Mexico

2,610

4,592

Arkansas

3,707

2,239

Colorado

(1,873)

2,981

Arizona

(

6,455

)

554

Kansas City

1,739

489

Subtotal

31,587

59,370

F

unds management and other

23,445

2,895

Total

$

55,032

$

62,265

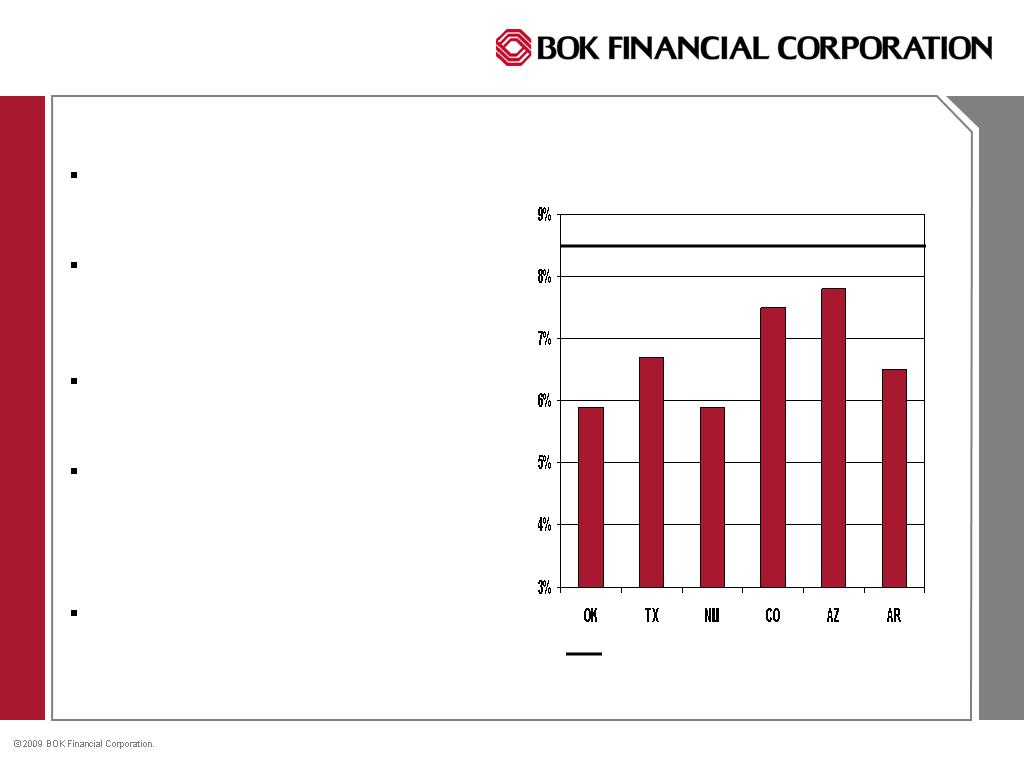

Market Update

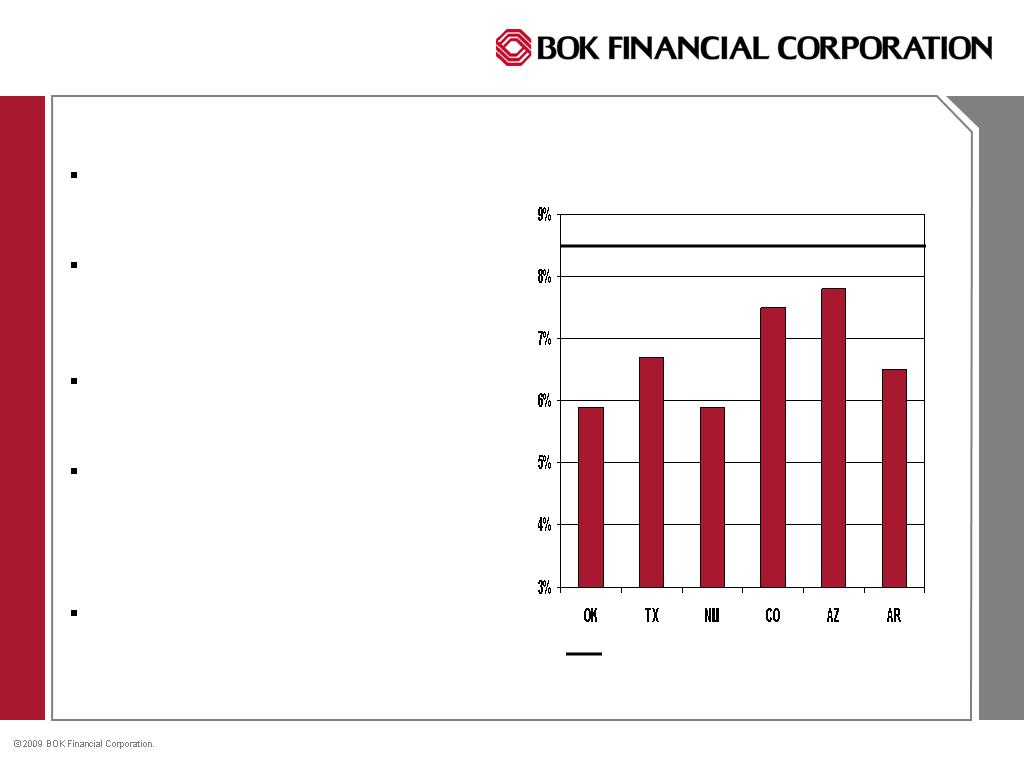

March Unemployment Rates

US unemployment rate (8.5%)

In OK, loan demand has slowed, but

spreads and fees are improving; record

syndication fees and solid deposit growth

In the regional markets we have seen an

increase in employees and customers in

play due to competitors downsizing or

exiting fee business

In Texas, we have successfully grown

low cost deposits and enhanced deposit

margin

In Albuquerque, northwest AR, KC and

Denver, account officers are working

through exit credits; recent growth in

pipeline reflects progress in re-focusing

on new business

In AZ, loan demand is slow and CRE

values are still declining; we closed the

Tucson office and opened three new

branches in Phoenix

18

Source: US Dept of Labor

Current Focus

Aggressively address credit quality, including continuous evaluation

of the loan portfolio

Continue to focus on growing loans at higher spreads

Increase fee revenue in regional markets

Grow deposits at the lowest cost possible and actively manage

liquidity

Control expense growth in relation to revenue growth

Continue expansion efforts through modest branching and

opportunistic acquisitions within our footprint

Focus on providing exceptional delivery of our products and service

while laying the groundwork for our long term growth objectives

19

Loan Portfolio and

Asset Quality

20

Chuck Cotter

Chief Credit Officer

Executive Vice President

Credit Administration

Re-examined our loan and risk management policies in 2008, adding some

additional controls to limit and identify risk

Expanded the list of unacceptable loan types

Added required approvals to new loans, renewals and extensions for CRE

loans

Revised the hedging policies, adding cash margin requirements

Exited Indirect Auto Lending and certain agriculture portfolios

Senior Loan Committee approves loans beginning at $7.5 million depending on

risk grade

Credit Committee of the Board of Directors approves loans $25 million to $40

million

Board of Directors approves all loans over $40 million

21

Asset Quality –

Net Charge-Offs

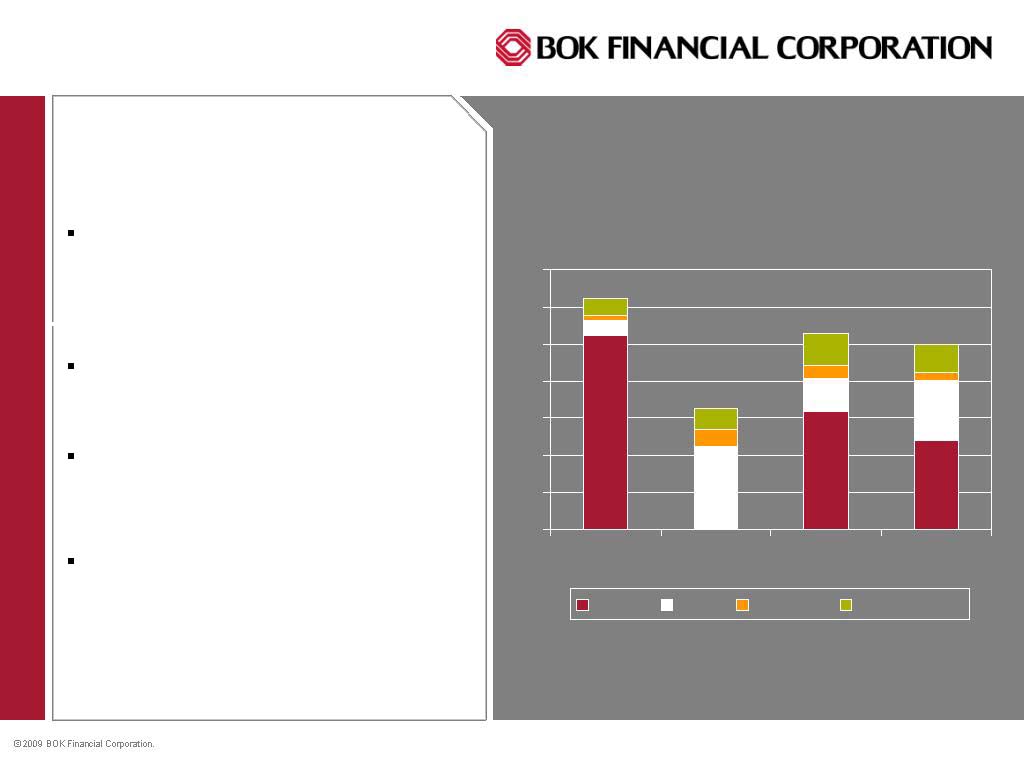

Net Charge-Offs Basis Points

Subsidiary banks are governed by

the same credit policies and a

strong centralized credit

administration staff and loan

review team

2Q08 included a $26 million write-

off related to midstream company

loan exposure

3Q08 included nearly $12 million

in non-recurring commercial loan

recoveries from loans charged off

several years ago

Net losses charges against the

allowance for loan losses in 1Q09

totaled $31.9 million or 1.00%

annualized of average

outstanding loans

0

20

40

60

80

100

120

140

2Q08

3Q08

4Q08

1Q09

Coml

CRE

Res RE

Consumer

22

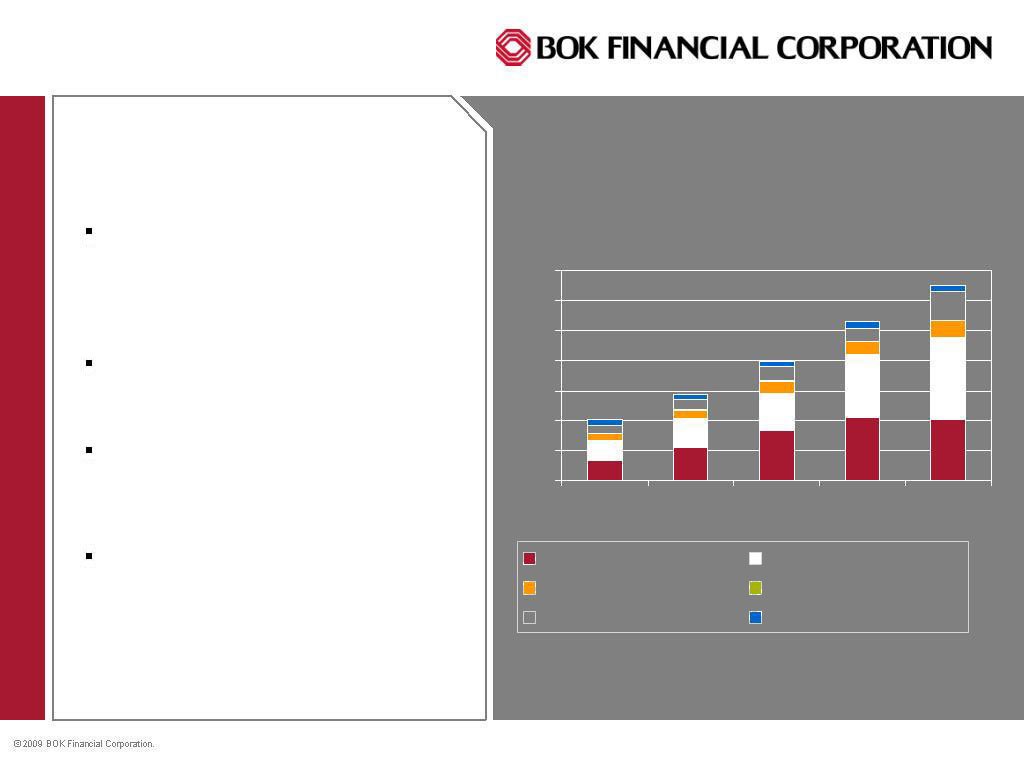

Asset Quality –

Nonperforming Assets

Nonperforming Assets

Beginning in 2Q08, NPAs include

approx $47 million related to a

midstream company - this

represents 1/3 of the original

exposure

NPAs totaled $414 million or

3.26% of outstanding loans and

repossessed assets

BOKF’s approach is to maximize

collection of loans rather than to

sell problem loans at distressed

priced

Growth in nonaccruing assets

during 1Q09 was concentrated

primarily in the AZ market; BOKF

exited the Tucson market earlier

this year

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

1Q08

2Q08

3Q08

4Q08

1Q09

Coml

CRE

Res RE

Consumer

OREO

Renegotiated Loans

23

Non-Accruing Loans

Office CRE

7%

Construction &

Land Dev

29%

Healthcare

4%

Residential RE

10%

Other CRE

7%

All Others

3%

Multifamily CRE

8%

Energy*

15%

Services

9%

Wholesale/ Retail

3%

Manufacturing

5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

OK

TX

NM

AR

CO

AZ^

KS

By Loan Sector

As A Percent of Loans

in the Market

24

* Loan to a midstream company accounts for 94%

of Energy non-accruals

indicates OK non-accruals excluding

the midstream company

indicates CO non-accruals excluding

loans acquired with First United Bank

As of 3/31/09

^ Non-accruals in AZ represent 19% of outstanding loans

in that market

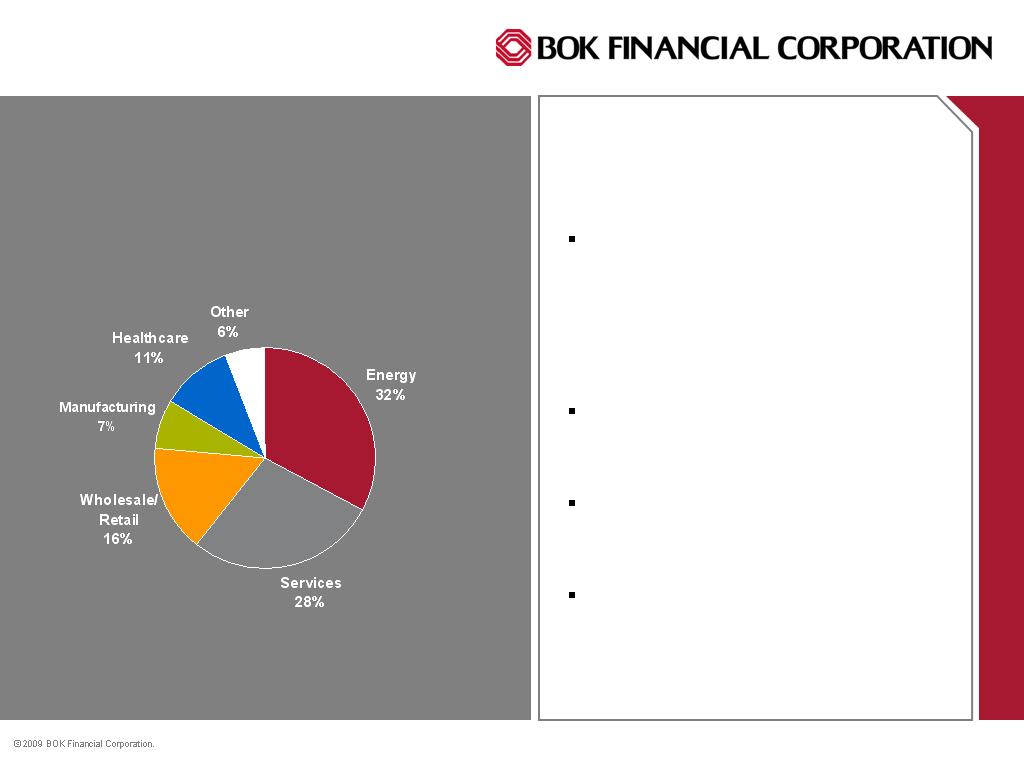

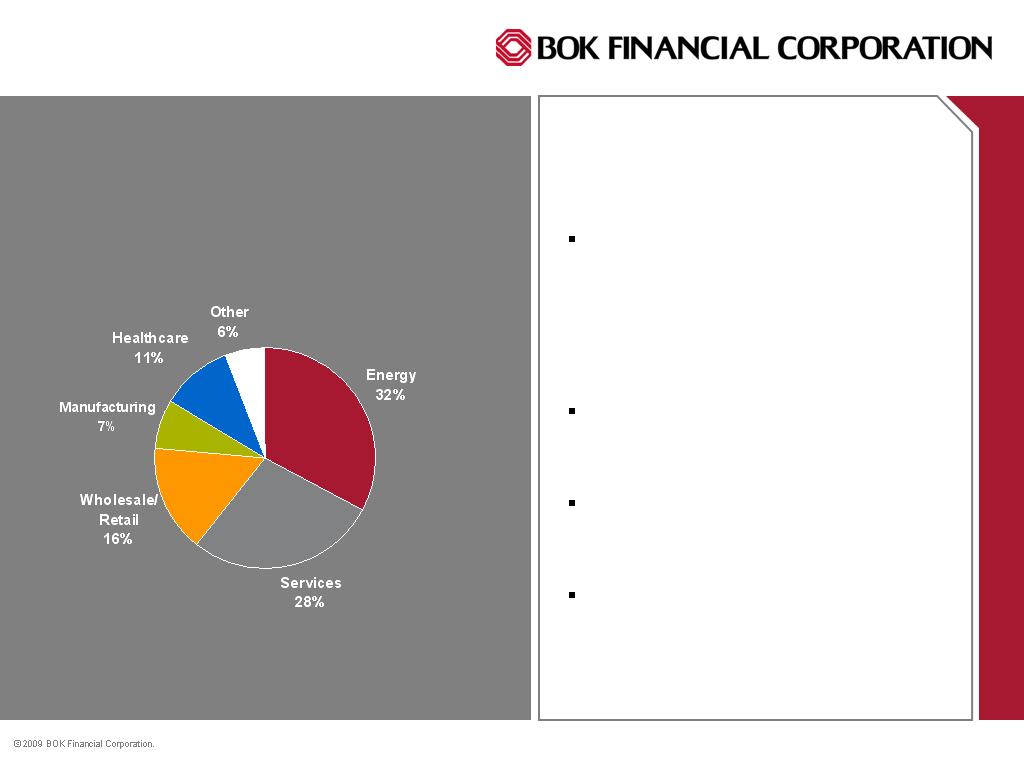

Commercial & Industrial

Loans

The services sector includes a

large number of loans to a

variety of businesses including

communications, gaming and

recreation, transportation and

financial services

Outstanding loans in the

services sector decreased $76

million during 1Q09

Over 60% of the loans in the

services sector have individual

balances less than $10 million

$690 million of the services

sector portfolio is attributed to TX

and $587 million to OK

C&I Portfolio By Industry

25

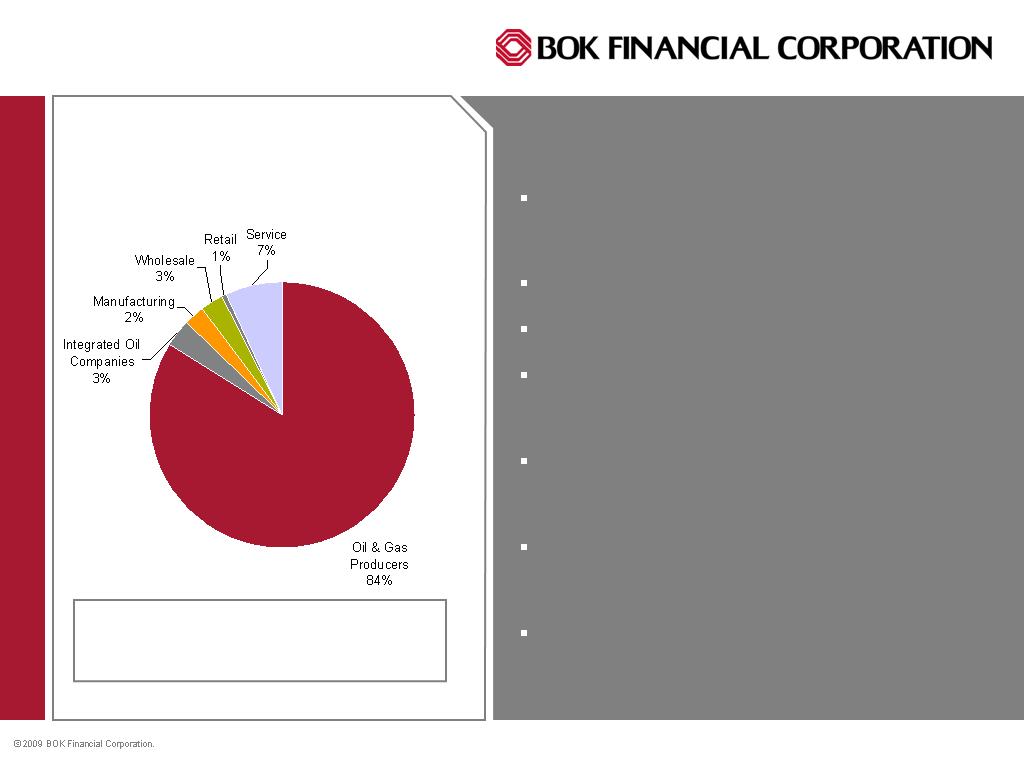

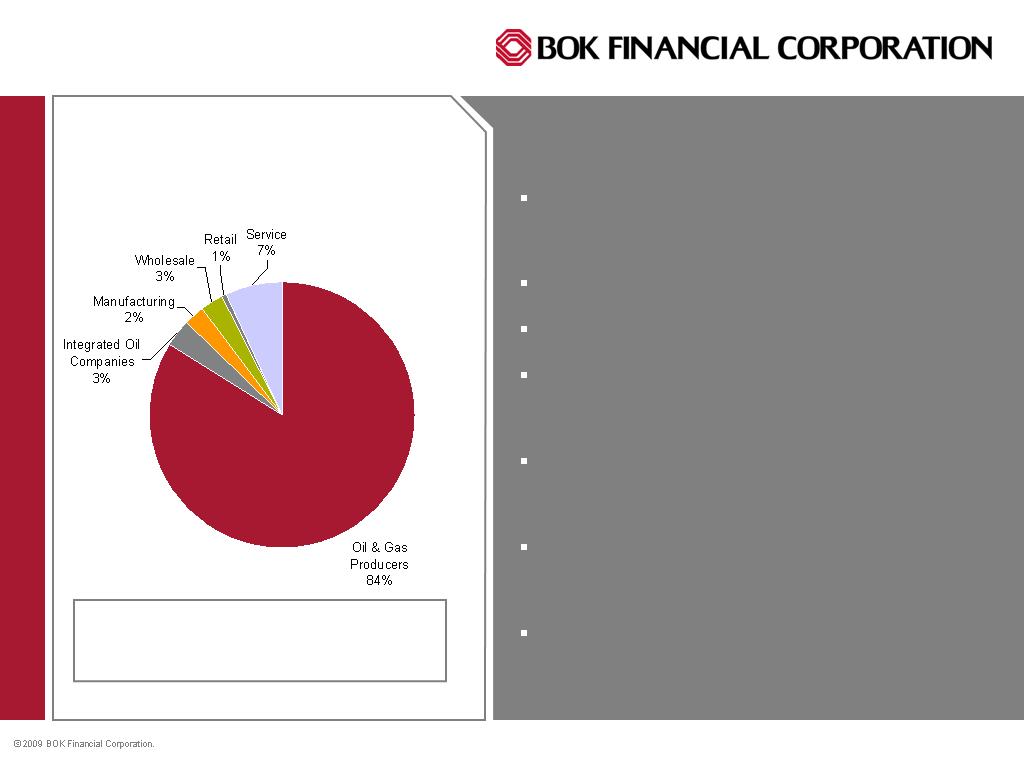

Energy Portfolio

Approximately $1.1 billion of the energy

portfolio is attributed to OK, $761 million

to TX and $426 million to CO

50-60% loan to value

54% gas concentration

Energy production portfolio has been

one of the best performing portfolios for

the last 20+ years

Sensitivity analysis is performed for

each credit – currently using a base of

$40/bbl for oil and $5/mcf for gas

Petroleum engineers on staff perform

engineering reviews of properties

pledged as collateral

Limited exposure to oil field service

companies (drilling contractors, etc.)

26

84% of the $2.3 billion energy

portfolio is collateralized by

production

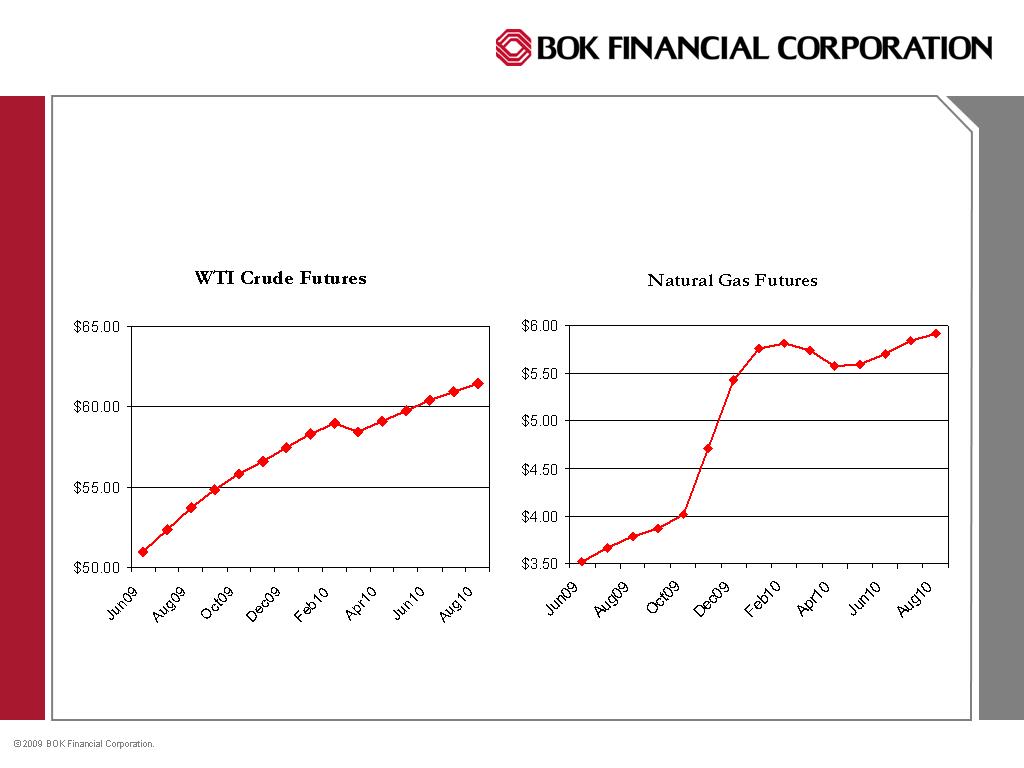

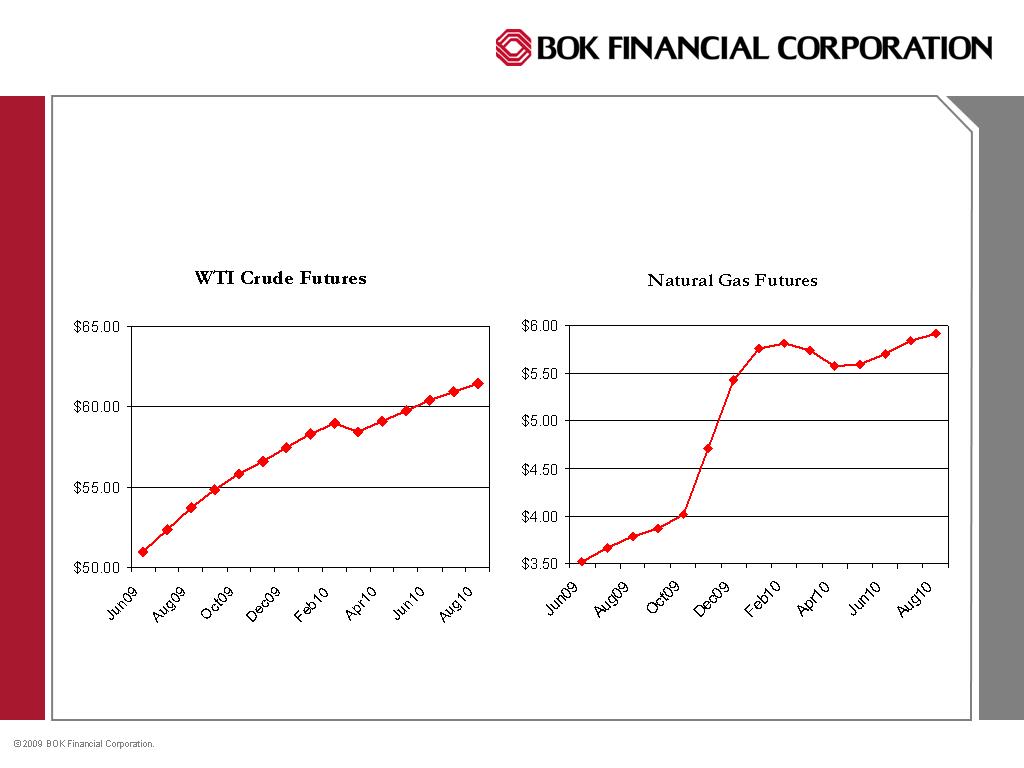

Energy Futures

Source: Bloomberg/pricing date of 4/24/09

27

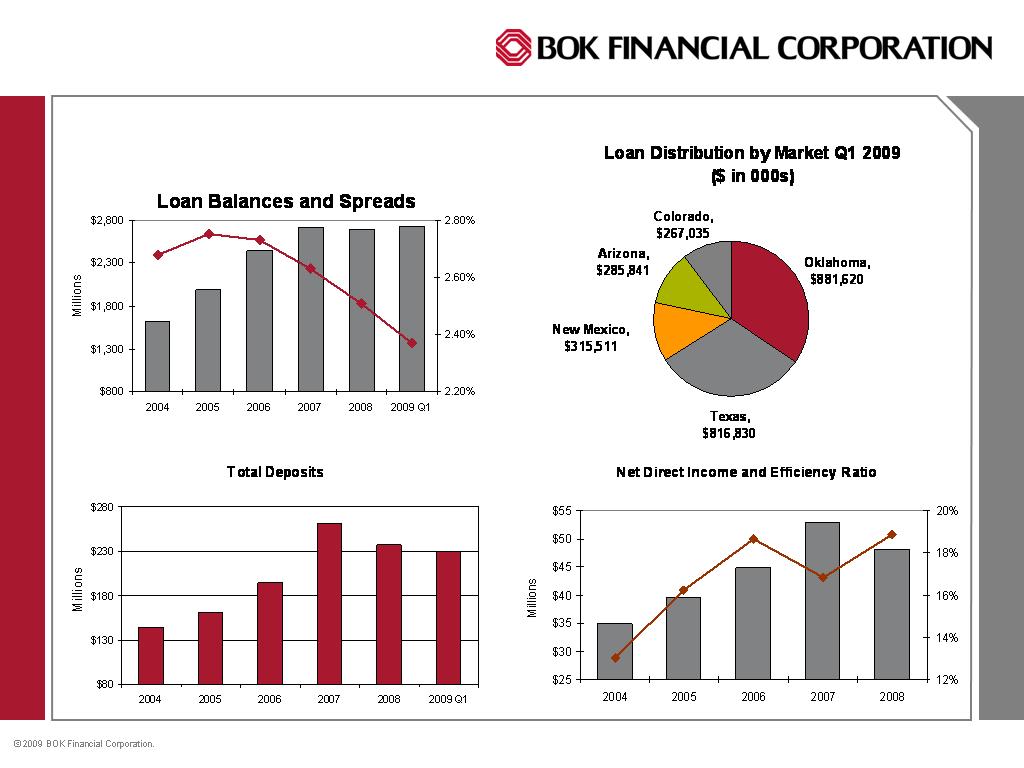

CRE by Market

Commercial Real Estate

Of the $879 million in

construction and development

loans, approximately $246

million are attributed to the OK

market, $223 million to TX,

$165 million to CO, $131 million

to AZ and $87 million to NM

Initial underwriting of many

construction loans includes

mini-perm options

In stressed markets, appraisals

are updated every 6 months

28

Market $ in 000s % of Total

Oklahoma 881,620 32%

Texas 816,830 30

New Mexico 315,511 12

Arkansas 133,227 5

Colorado 267,035 10

Arizona 285,841 10

Kansas 32,017 1

Shared National Credits

Shared National Credits ($ in millions):

December

2008

March 2009

Nu

mber of Relationships

1

7

6

17

6

Commt ($)

O/S ($)

Commt ($)

O/S ($)

Shared Natio

nal Credit Volume

3,479

2,250

3,

4

49

2,

1

36

Agented by BOKF

825

527

781

488

Percent of Total

23.73

%

23.42

%

22.

66

%

22.8

6

%

Relationships in Local Markets

3,097

1,976

3,0

74

1,8

60

Percent of Total

89.03

%

87.78

%

89.1

4

%

87.

05

%

SNCs are held to the same standard of analysis and level of review as

internally originated credits

At 3/31, there were 5 SNC’s on non-accrual with outstanding balances

totaling $48 million

29

Additional Loan Detail

30

Residential Mortgage Loans, excluding loans held for sale totaled $1.8B

$1.6 billion or 86% of the residential mortgage loan portfolio is attributed to

Oklahoma and Texas where home values have been more stable

BOKF has no concentration in sub-prime residential mortgage loans and BOKF

ARMS do not include below-market rates

Indirect auto loans totaled $650 million

Approximately $404 million were purchased from dealers in OK and $162

million were purchased from dealers in AR with the remaining loans purchased

from dealers in TX

Indirect auto loans decreased $42 million in 1Q09 primarily due to BOKF’s

decision to exit the business in favor or a more customer-focused direct lending

approach

Commercial Banking

Oklahoma, Arkansas, Arizona, New Mexico

Energy and Real Estate Banking

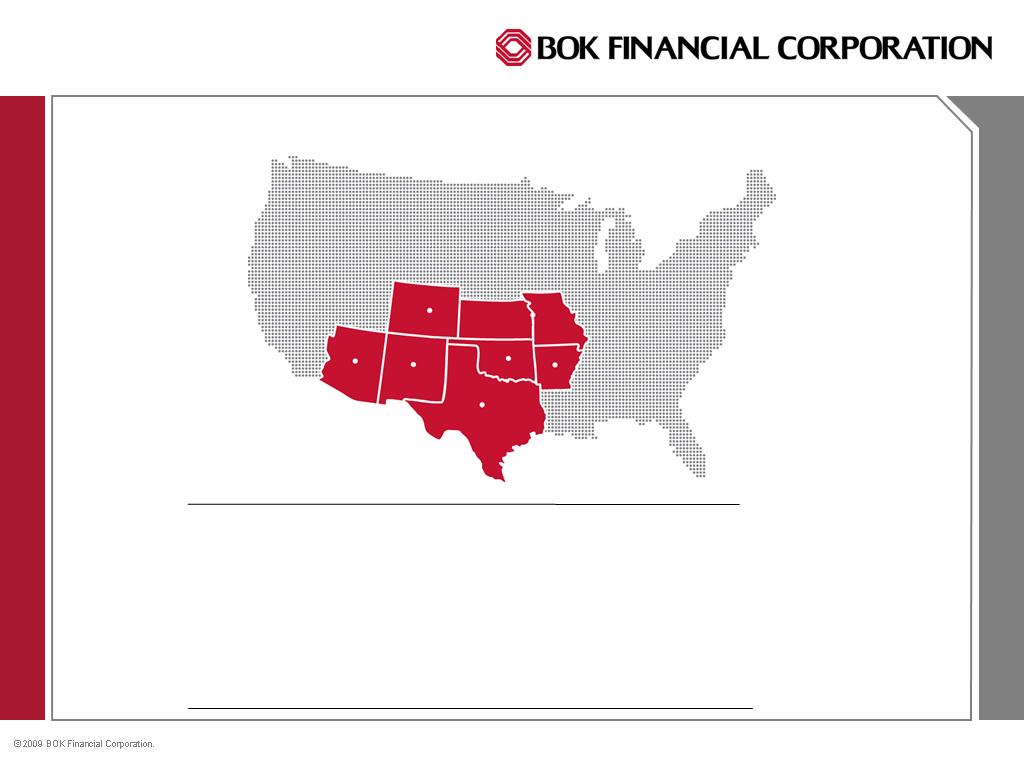

BOKF Footprint

31

Dan Ellinor

Senior Executive Vice President

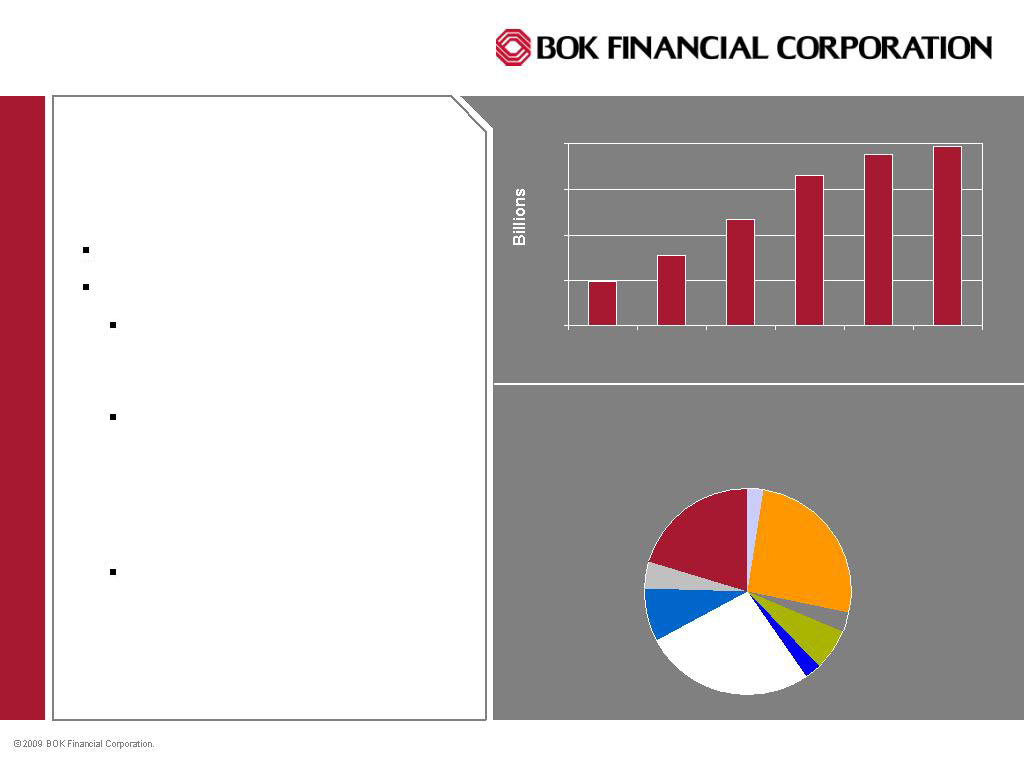

Loan Growth & Distribution

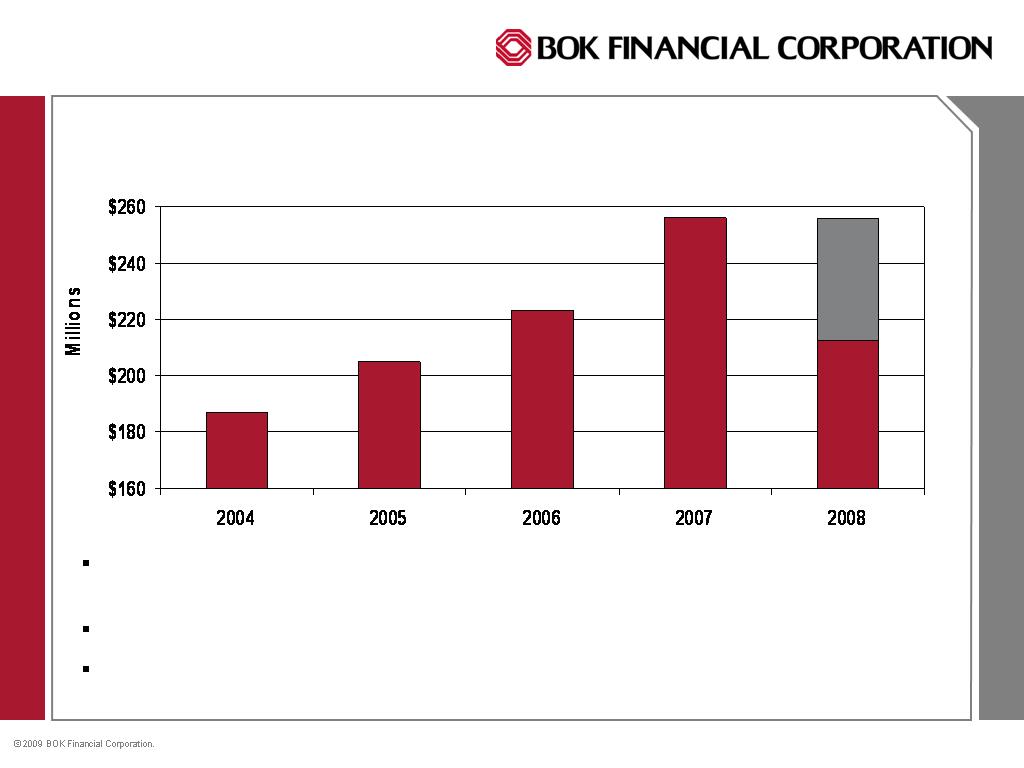

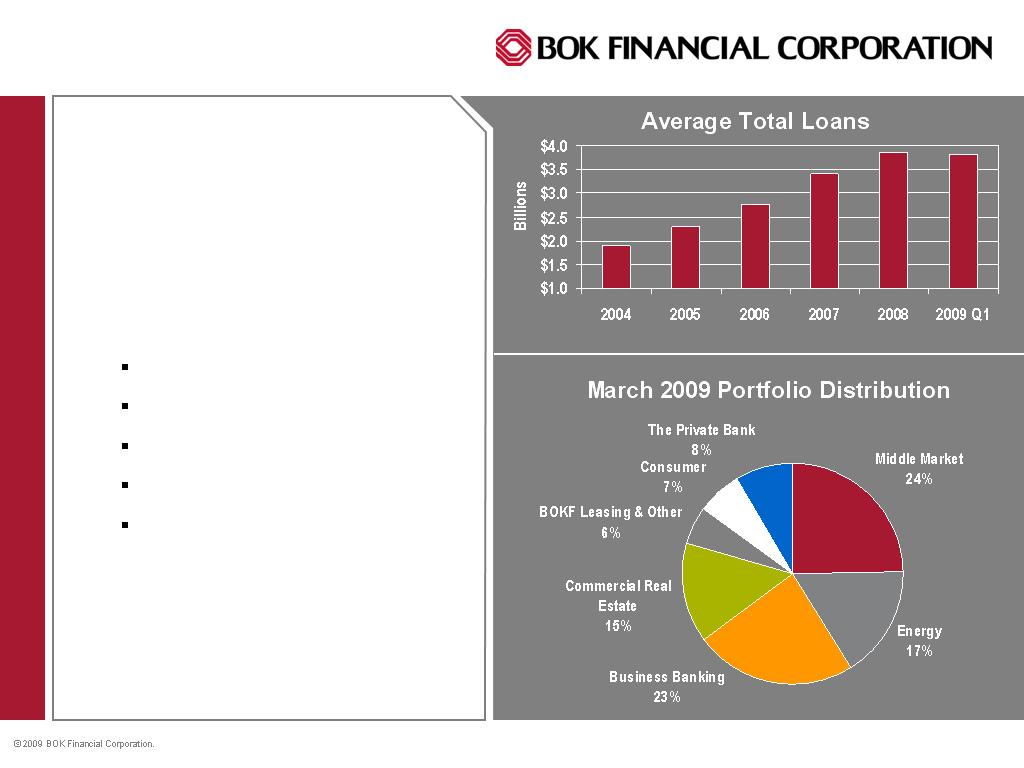

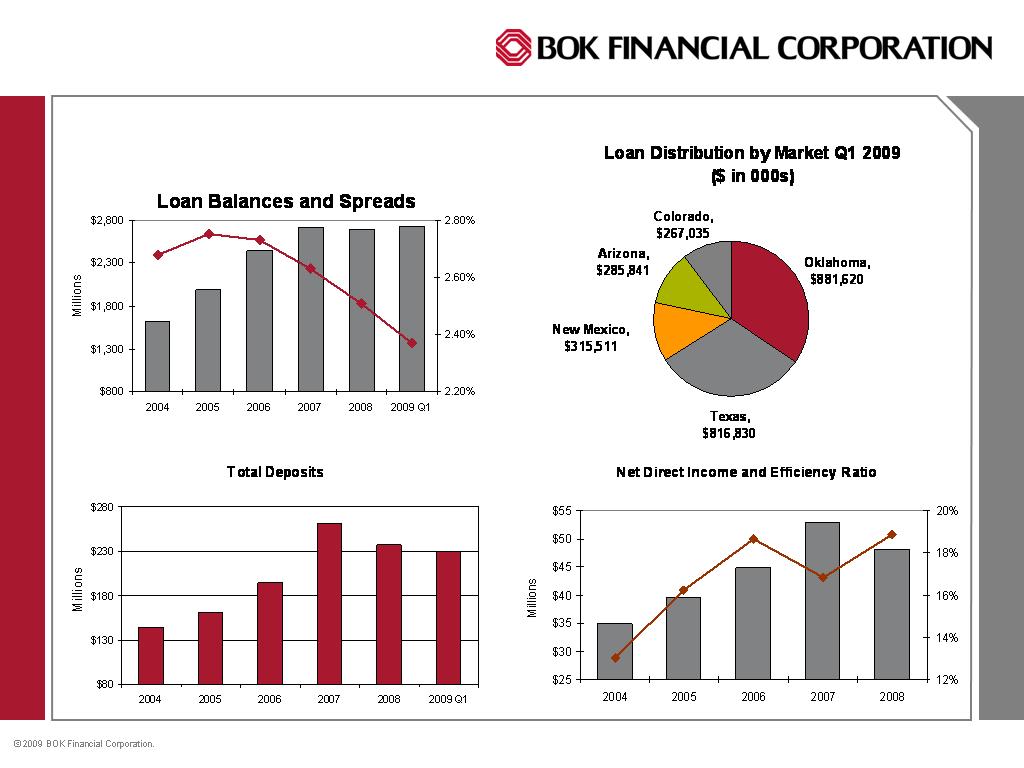

5 Year CAGR 11.36%

3 Year CAGR 11.83%

Largest Segments are

Energy, Real Estate, and

Middle Market

Niche Businesses:

Agribusiness growth slowed

as portfolio mix was cleaned

up, and Dealer Financial

Services originations have

been discontinued

Affiliate Banking Markets in

Arkansas, Arizona, and New

Mexico provide strong

growth rates

Average Total Loans

$4.0

$5.0

$6.0

$7.0

$8.0

2004

2005

2006

2007

2008

2009 Q1

March 2009 Portfolio Distribution

Middle Market,

20.23%

Commercial RE

BOKF, 26.64%

Agribusiness,

2.46%

Arkansas, 3.14%

Business Banking

OK, 6.40%

Energy BOKF,

25.59%

Arizona

Commercial &

BBG, 2.63%

Dealer Financial,

8.41%

New Mexico

Commercial &

BBG, 4.50%

32

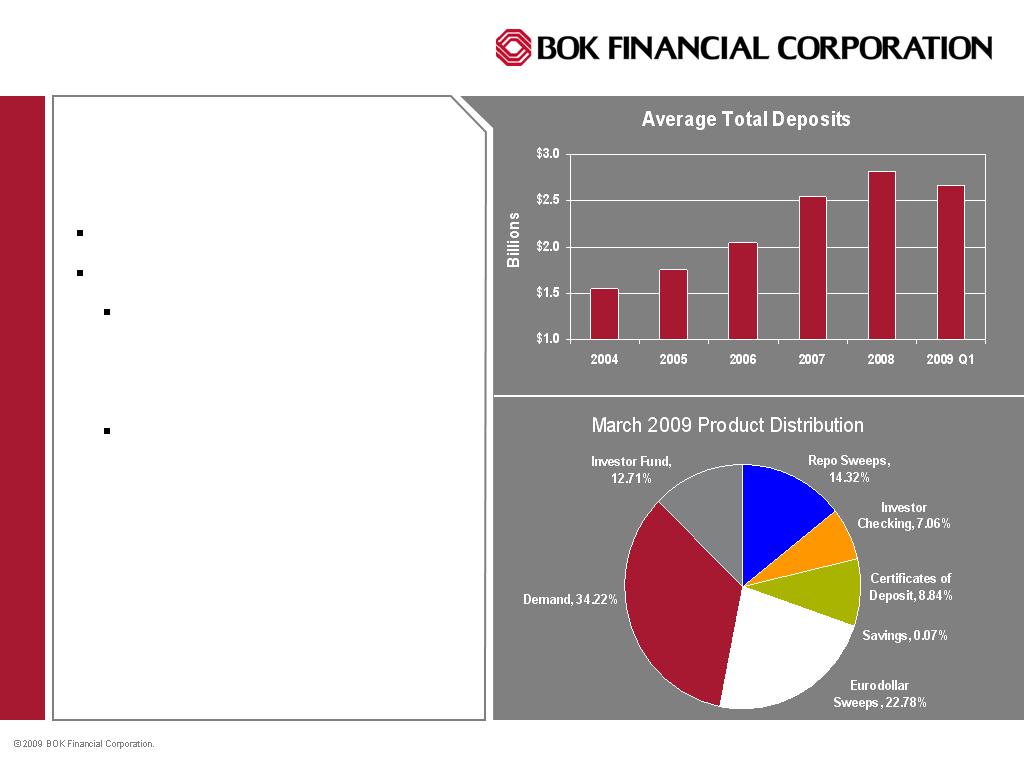

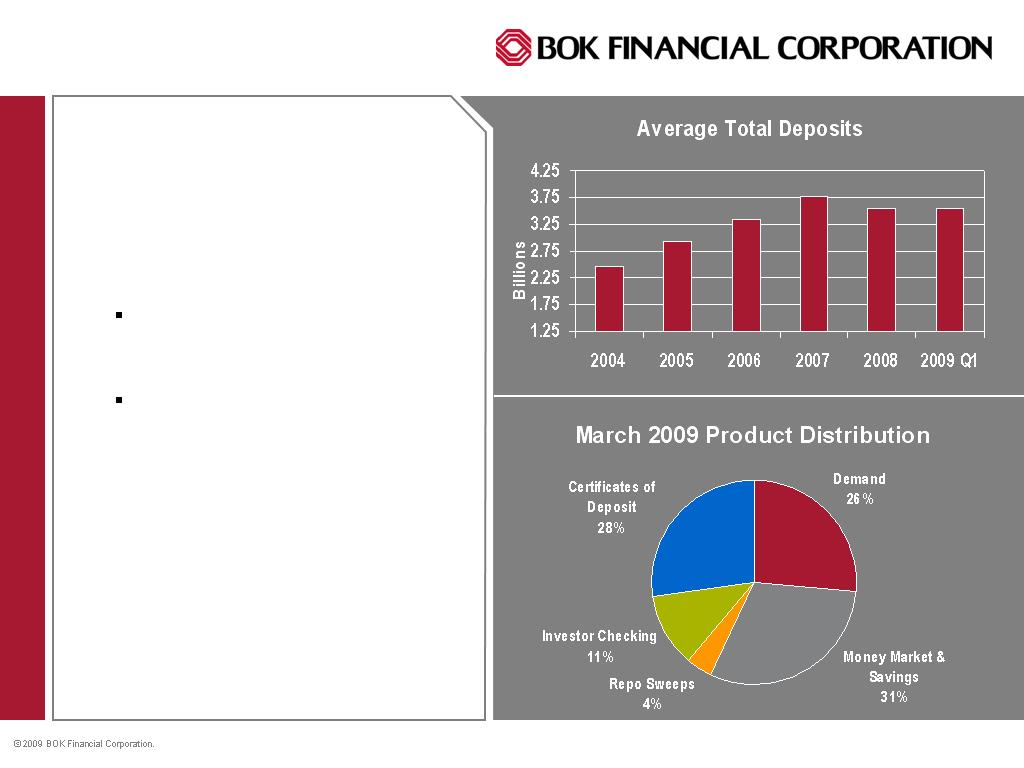

Deposit Growth &

Distribution

5 Year CAGR of 8.44%

3 Year CAGR of 5.70%

The higher growth rate

products continue to be the

higher rate investor fund and

sweep products

Demand Deposits continue to

grow at a nice pace 6.42%

over the last 3 years. New

tiered pricing for analyzed

balances has move dollars

from sweep products back to

deposits.

33

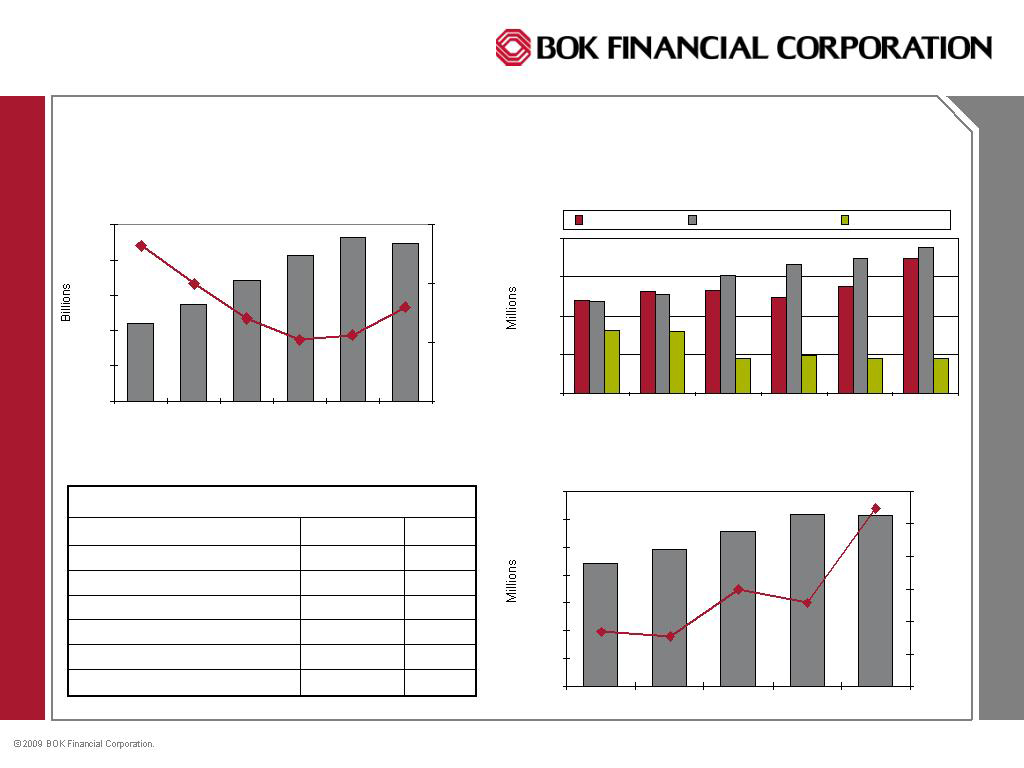

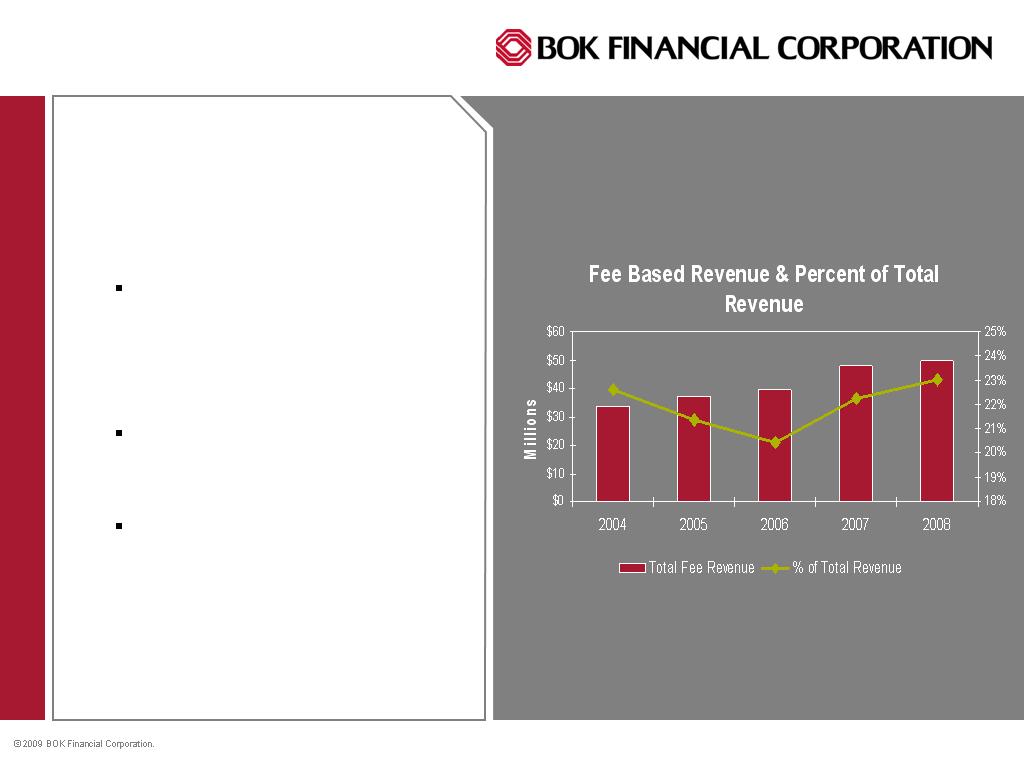

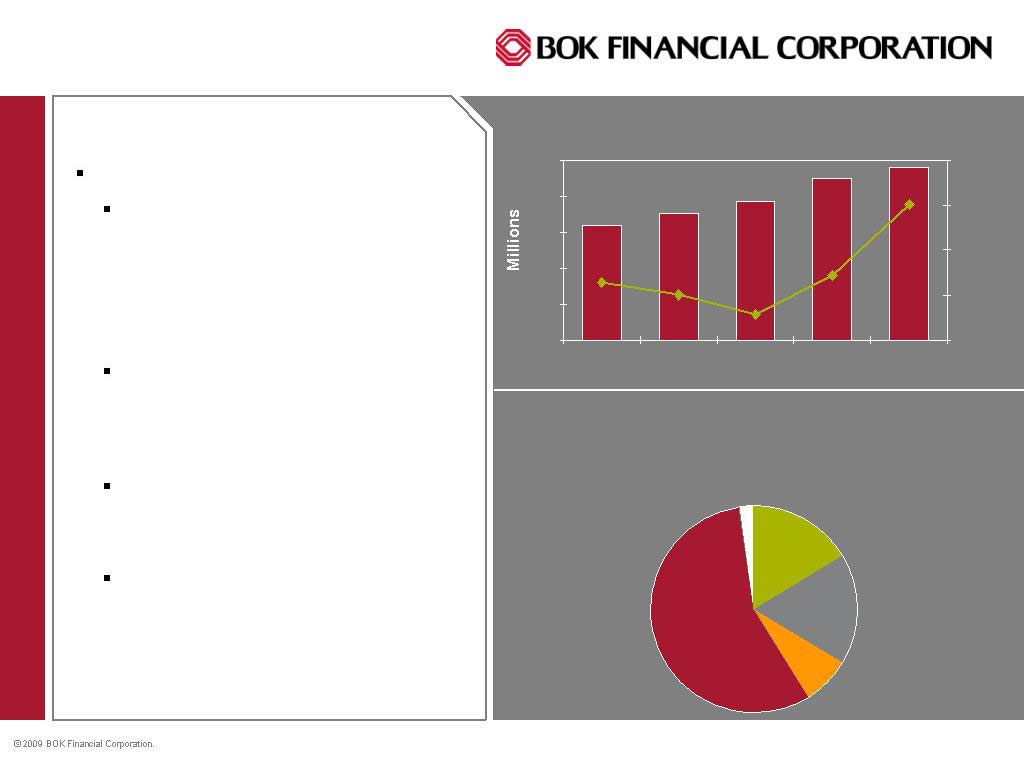

Fee Based Revenue

5 year CAGR of 2.05%

Results were hurt by $45 million

loss with SemGroup in 2008.

Excluding the volatility of trading

revenue, other fee based

revenue items have a 5 yr CAGR

of 8.39%

Transaction card revenue from

the TransFund Network

continues to produce double digit

growth rates

Revenue recognized from

Merchant Banking activities

totaled $1.5 million in 2008

Service charge revenue results

have been enhanced by the

lower rate environment, reducing

ECR credit given analyzed

balances

Service Fee Revenue & Percent of Total Revenue

w/o $43.2MM SemGroup Loss 2008

$0

$25

$50

$75

$100

$125

2004

2005

2006

2007

2008

30%

31%

32%

33%

34%

Fee Based Revenue Distribution 2008

excludes Derivative Credit Quality Losses

International,

7.54%

Other, 2.09%

Transaction

Card, 56.80%

Service

Charges,

17.13%

Derivatives,

16.44%

34

Net Direct Income Results

Adding Back SemGroup Loss

Net direct income from the operation of this business group has produced a CAGR of

4.99% over the last 5 years (8.95% without the impact of the SemGroup loss in 2008)

Fee based revenue contributes around 30% of total revenue

Expenses were held in check, although the SemGroup derivative loss caused the

efficiency ratio to jump to 33.83%

35

Oklahoma Commercial Banking

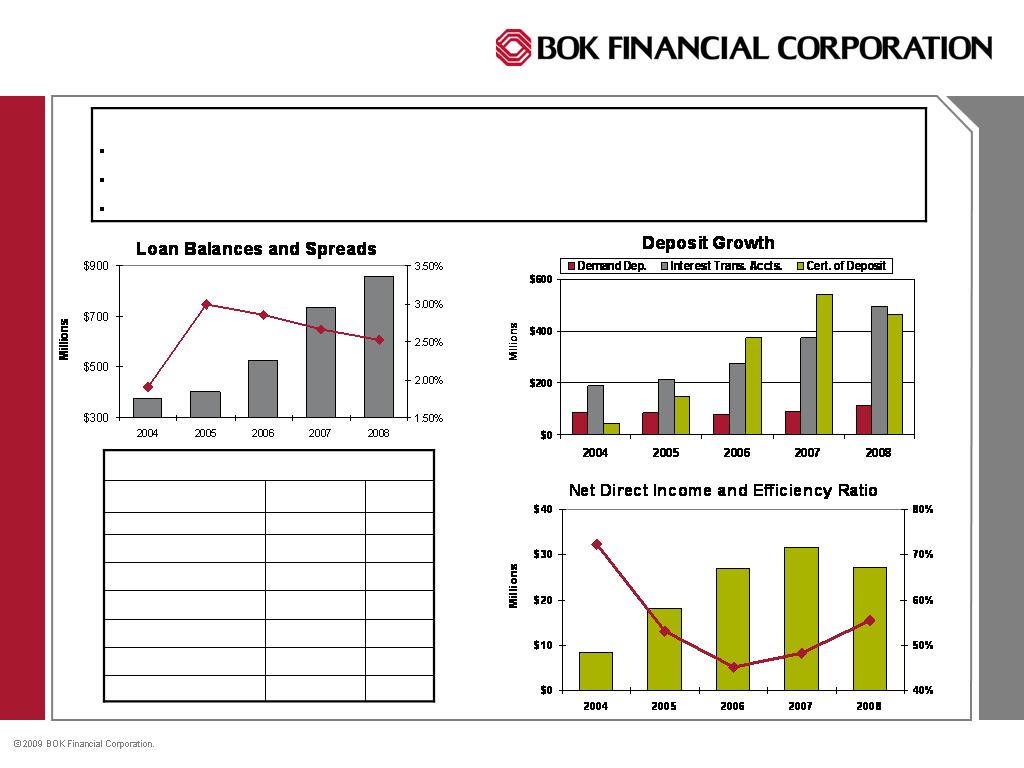

Loan Balances and Spreads

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

2004

2005

2006

2007

2008

2009 Q1

2.00%

2.25%

2.50%

2.75%

Net Direct Income & Efficiency Ratio

w/o $43.2MM SemGroup Loss 2008

$50

$70

$90

$110

$130

$150

$170

$190

2004

2005

2006

2007

2008

14.00%

14.50%

15.00%

15.50%

16.00%

16.50%

17.00%

Deposit Growth

$50

$250

$450

$650

$850

2004

2005

2006

2007

2008

2009 Q1

Demand Dep.

Interest Trans. Accts.

Cert. of Deposit

0.4%

829,079

Other Revenue

0.3%

721,526

Syndication Fees

11.2%

23,146,802

Service Charge Revenue

7.1%

14,625,331

Derivative Revenue w/o SemGroup

100.0%

$207,410,026

Total Revenue

4.0%

8,317,406

International Revenue

77.0%

$159,769,882

Net Interest Revenue

Revenue Distribution (2008)

$ Amt

% of Total

36

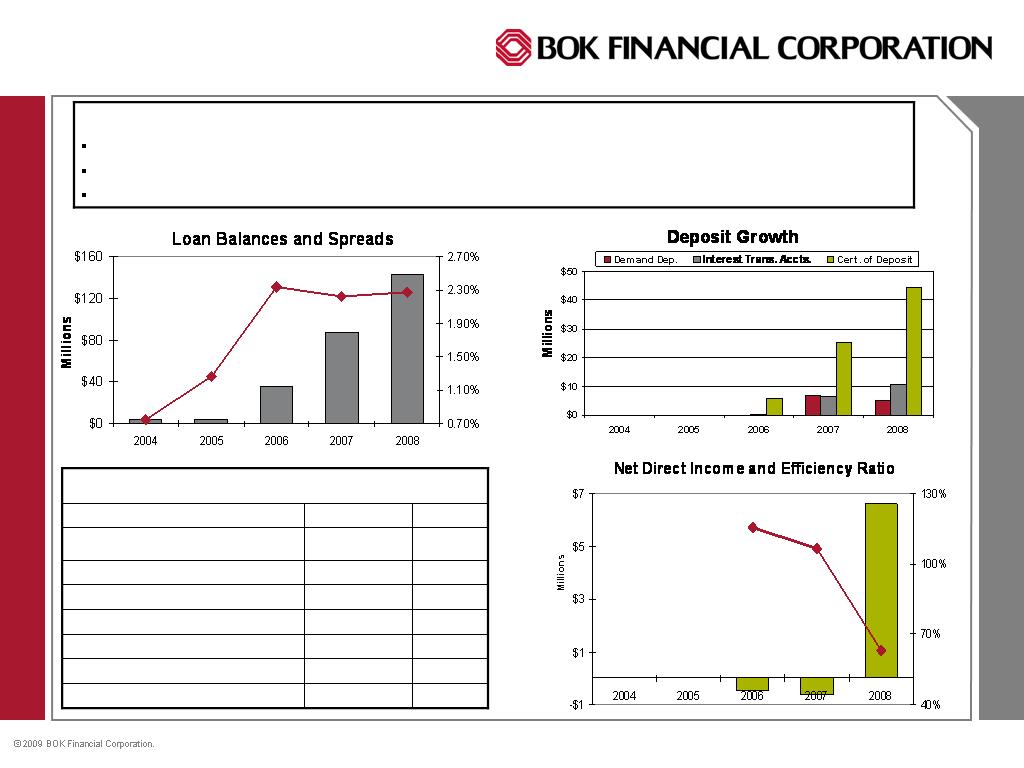

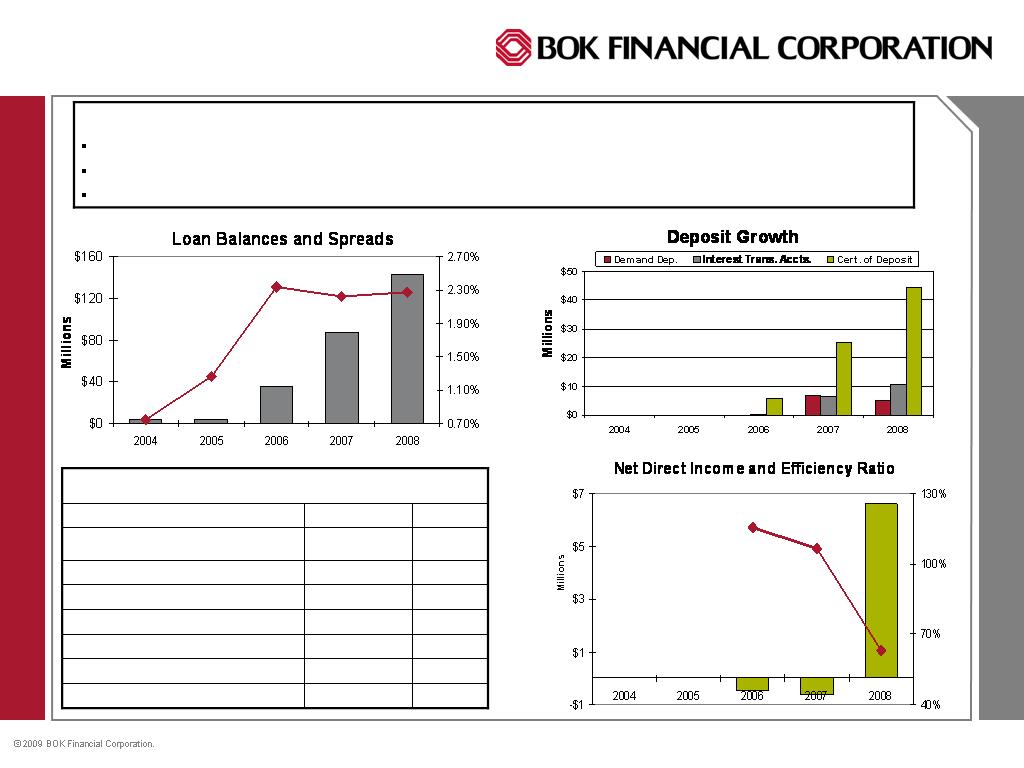

Bank of Arizona

Deposit Growth

$0

$20

$40

$60

$80

2004

2005

2006

2007

2008

2009 Q1

Demand Dep.

Interest Trans. Accts.

Cert. of Deposit

Loan Balances and Spreads

$0

$150

$300

$450

$600

2004

2005

2006

2007

2008

2009 Q1

1.50%

1.75%

2.00%

2.25%

2.50%

2.75%

Net Direct Income and Efficiency Ratio

-$1

$0

$1

$2

$3

$4

$5

$6

2004

2005

2006

2007

2008

0%

30%

60%

90%

0.5%

100,175

International Revenue

1.5%

320,976

Other Revenue

0.8%

162,503

Trading Revenue

3.5%

718,921

Service Charge Revenue

2.1%

441,168

Trust Revenue

100.0%

$20,771,001

Total Revenue

-1.4%

-291,523

Mortgage Revenue

93.0%

$19,318,781

Net Interest Revenue

Revenue Distribution (2008)

$ Amt

% of Total

37

Bank of Albuquerque

Loan Balances and Spreads

$50

$250

$450

$650

$850

2004

2005

2006

2007

2008

2009 Q1

2.35%

2.55%

2.75%

2.95%

Net Direct Income & Efficiency Ratio

$15

$25

$35

$45

$55

2004

2005

2006

2007

2008

32%

34%

36%

38%

40%

42%

Deposit Growth

$50

$150

$250

$350

$450

$550

$650

2004

2005

2006

2007

2008

2009 Q1

Demand Dep.

Interest Trans. Accts.

Cert. of Deposit

0.7%

552,139

International Revenue

5.4%

4,151,851

Other Revenue (check card rev)

2.1%

1,624,406

Trading Revenue

17.0%

13,097,577

Service Charge Revenue

5.4%

4,135,534

Trust Revenue

100.0%

$76,954,722

Total Revenue

0.4%

296,322

Mortgage Revenue

69.0%

$53,096,893

Net Interest Revenue

Revenue Distribution (2008) $ Amt % of Total

38

Bank of Arkansas

Loan Balances and Spreads

$100

$200

$300

$400

$500

2004

2005

2006

2007

2008

2009 Q1

2.00%

2.20%

2.40%

2.60%

2.80%

Net Direct Income and Efficiency Ratio

$0

$3

$6

$9

$12

$15

2004

2005

2006

2007

2008

0%

10%

20%

30%

Deposit Growth

$0

$30

$60

$90

$120

2004

2005

2006

2007

2008

2009 Q1

Demand Dep.

Interest Trans. Accts.

Cert. of Deposit

0.7%

114,090

International Revenue

1.5%

222,280

Other Revenue

0.2%

31,266

Trading Revenue

6.0%

966,368

Service Charge Revenue

5.8%

933,770

Trust Revenue

100.0%

$16,040,442

Total Revenue

0.7%

119,143

Mortgage Revenue

85.1%

$13,653,525

Net Interest Revenue

Revenue Distribution (2008) $ Amt % of Total

39

Energy Lending - BOKF

40

Real Estate Banking - BOKF

41

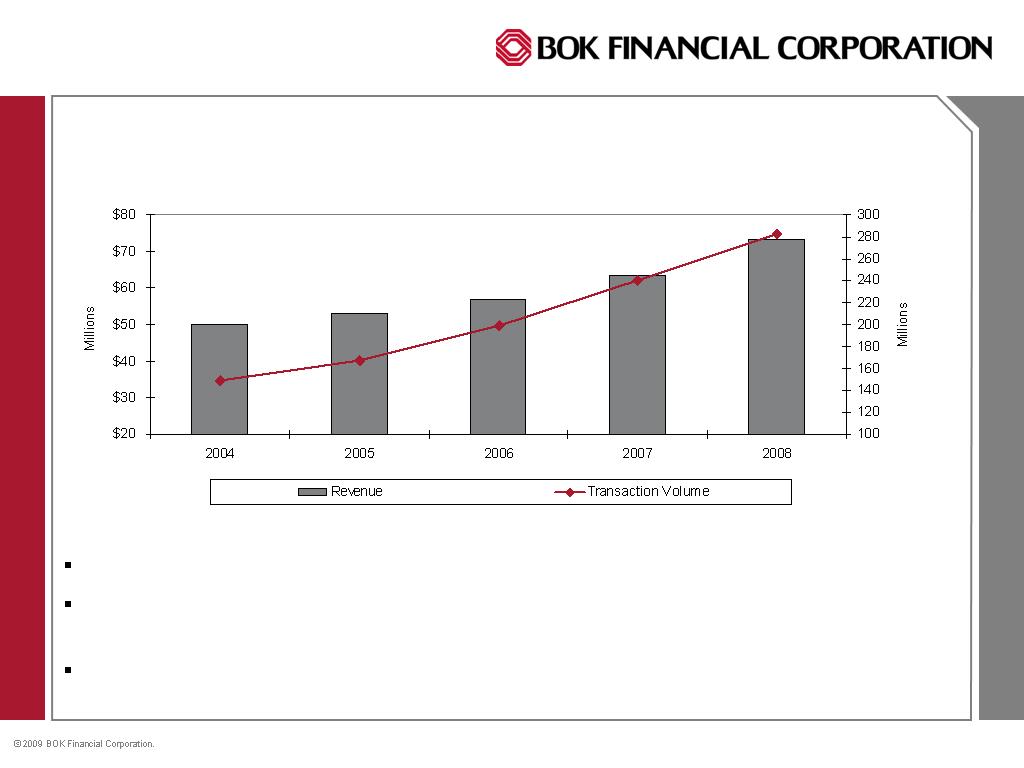

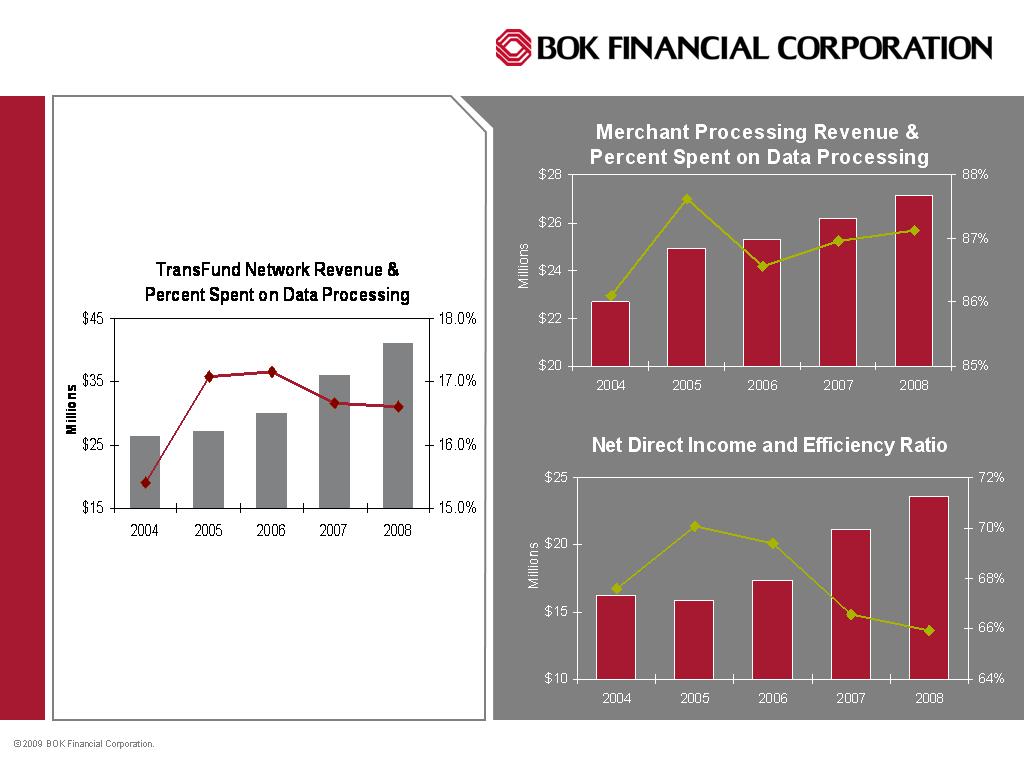

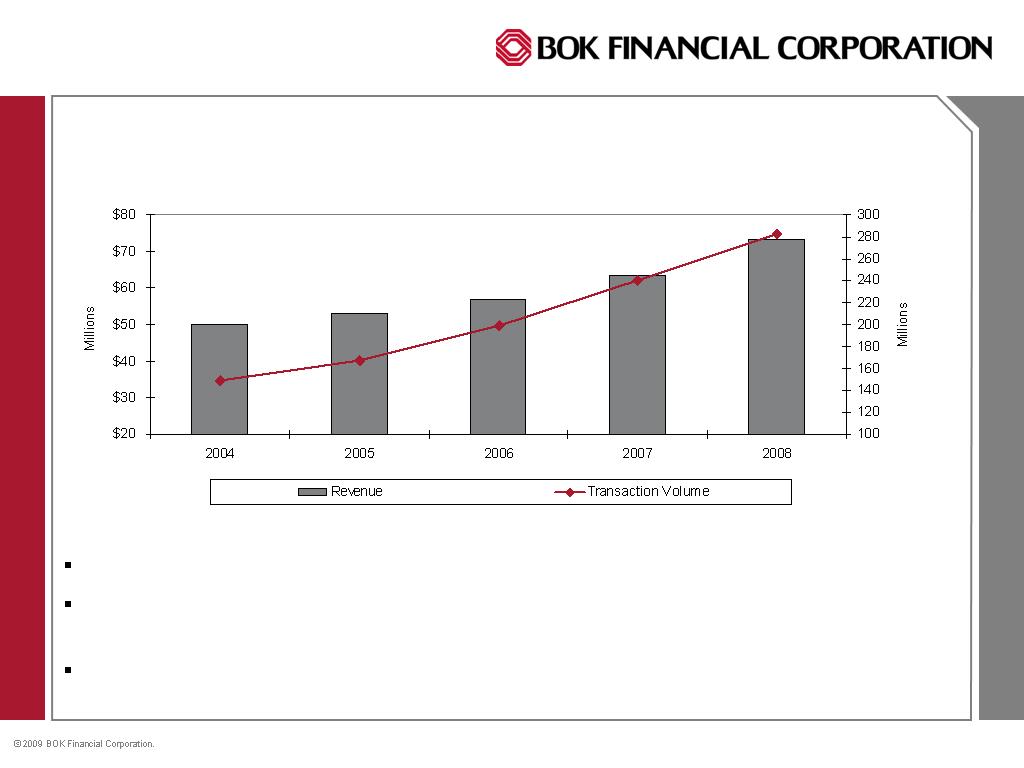

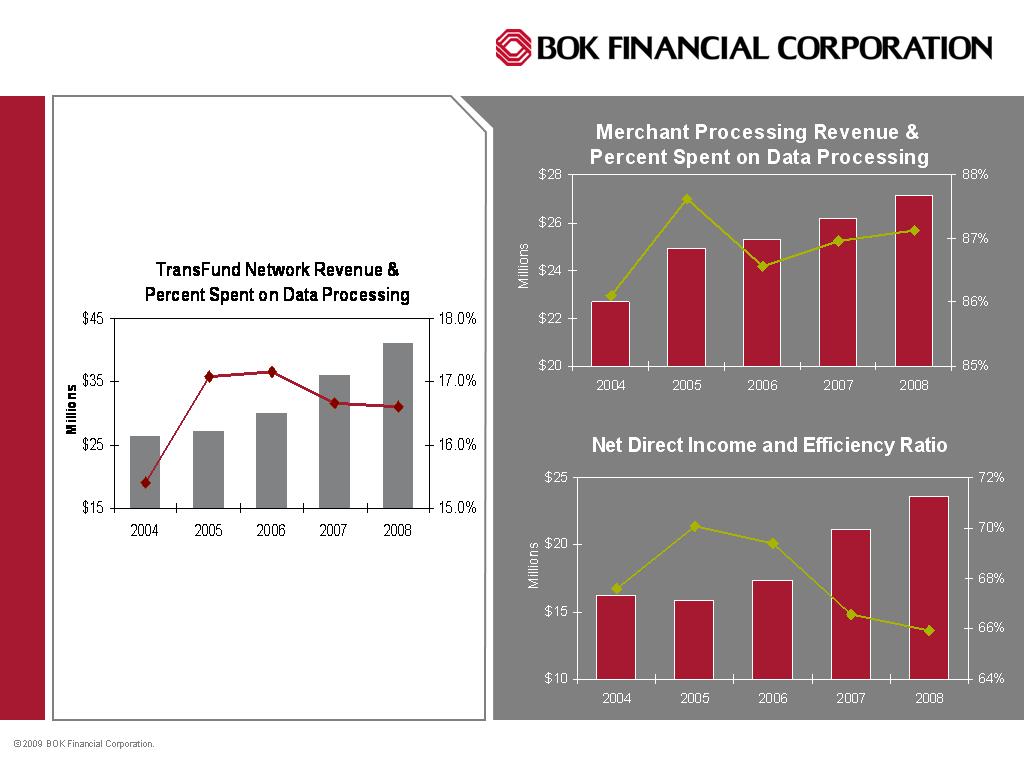

TransFund Revenue and Transaction Volume

TransFund is the 9th largest ATM network in the nation.

Transaction volumes have produced a 17.4% CAGR over the last five years, resulting

in an 10.4% CAGR for revenue recognized.

Customer base consists of 385 financial institutions, 1,933 ATMs, and 2.2 million

cardholders located in a 13 state area.

42

TransFund Expansion to New Markets

In the past year, 97% of all new business sold was outside the state of Oklahoma.

TransFund now has relationships with major convenience store chains in a 6 state

area (QuikTrip, 7-Eleven, Kum & Go, etc.), offering convenient, surcharge-free

access to TransFund cardholders.

43

TransFund

44

Consumer Banking & Corporate

Marketing, Wealth Management, Treasury

Services, International, Mortgage

Banking, Colorado and Kansas City

Steve Bradshaw

Senior Executive Vice President

45

Consumer Banking

2008 Highlights:

Branch Expansion – Organic & Acquisition

ExpressBank Relocation to the Business Technology Center

Deposit Growth During Market Unrest

CAGR 6.3%

46

Consumer Banking

2009 Strategies:

Optimization Projects – SmarterPay & Deposit Pricing

Financial Needs Analysis Profile Certification Program

Deposit Account Acquisition Initiatives – QuickSave & Online

Deposit Application

Enhanced Brand Marketing Initiatives

47

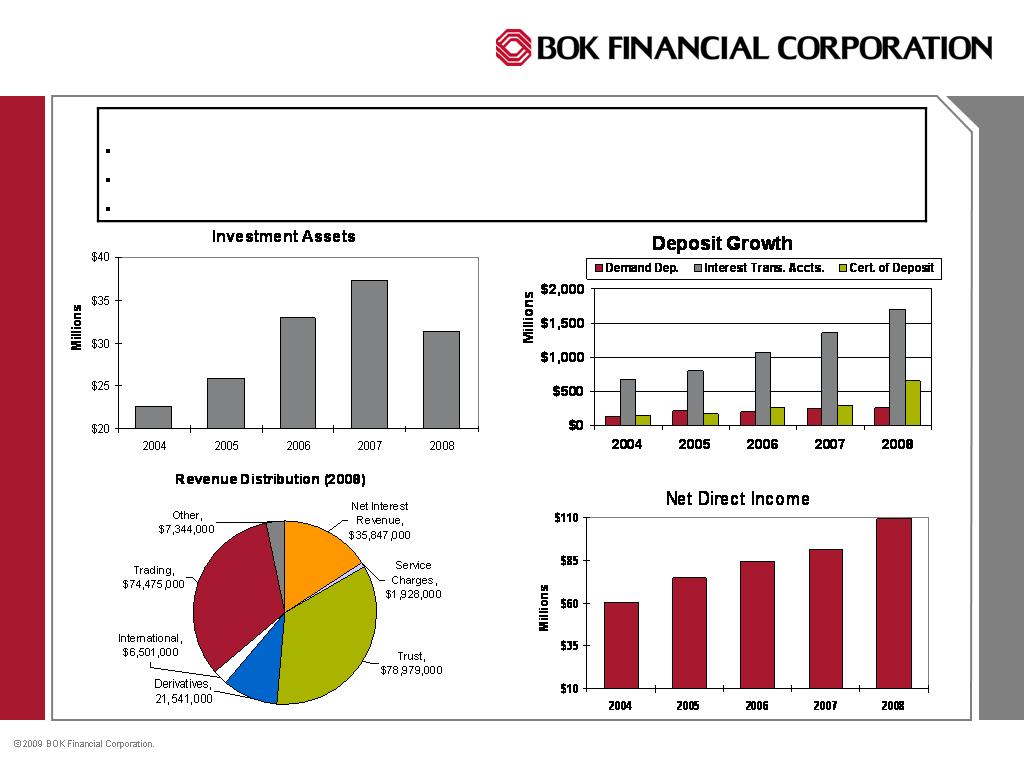

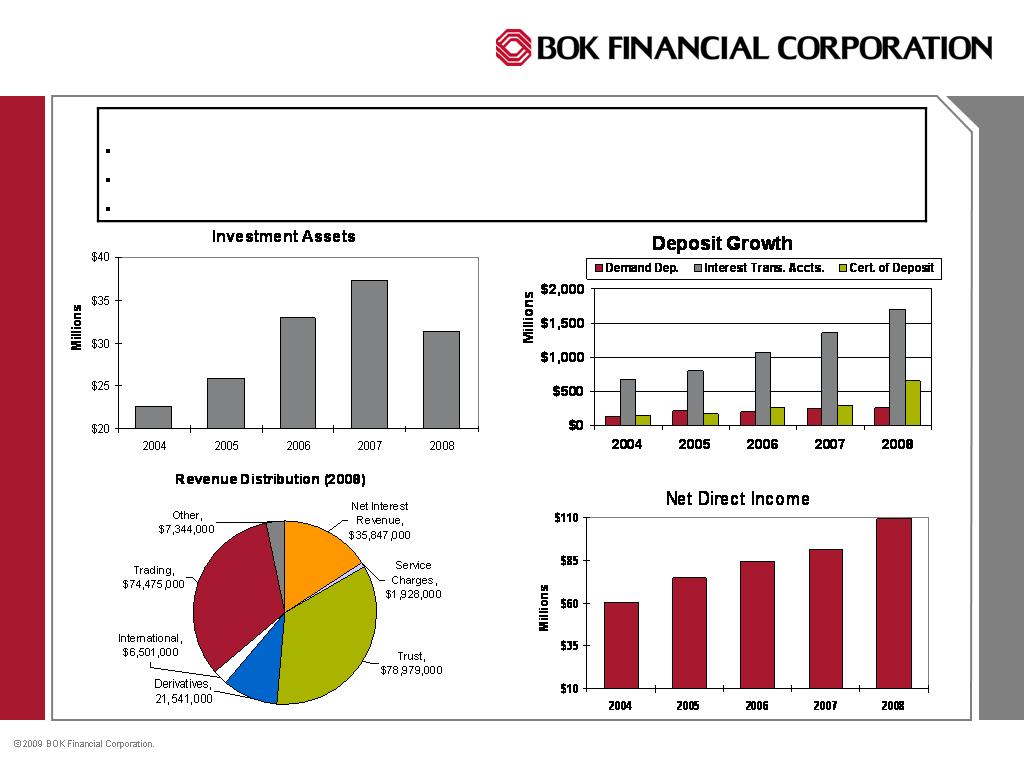

Wealth Management

2008 Highlights:

Added Record Volume of New Assets Under Management

Maximized Fixed Income Trading Opportunities

Completed Comprehensive Rebranding Initiatives

CAGR: 6.8%

48

Wealth Management

2009 Strategies:

Successfully complete Texas Private Bank Expansion Project

Maximize Municipal Finance Financial Advisory and Underwriting

Opportunities

Significantly grow Cavanal Hill Assets Under Management

49

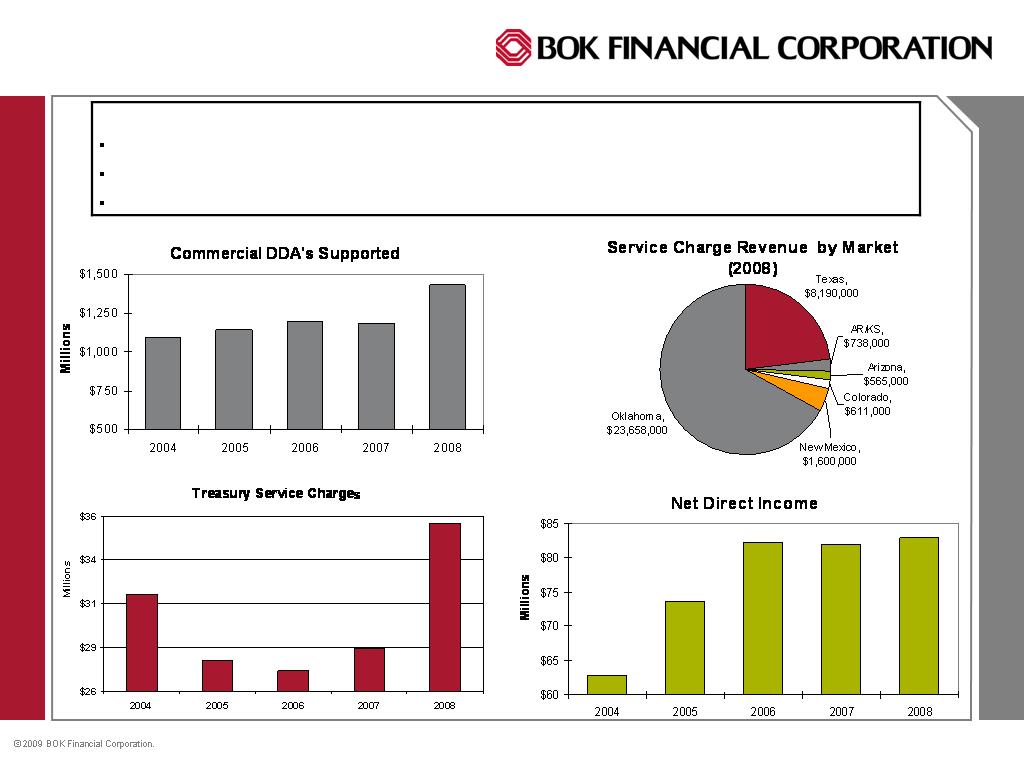

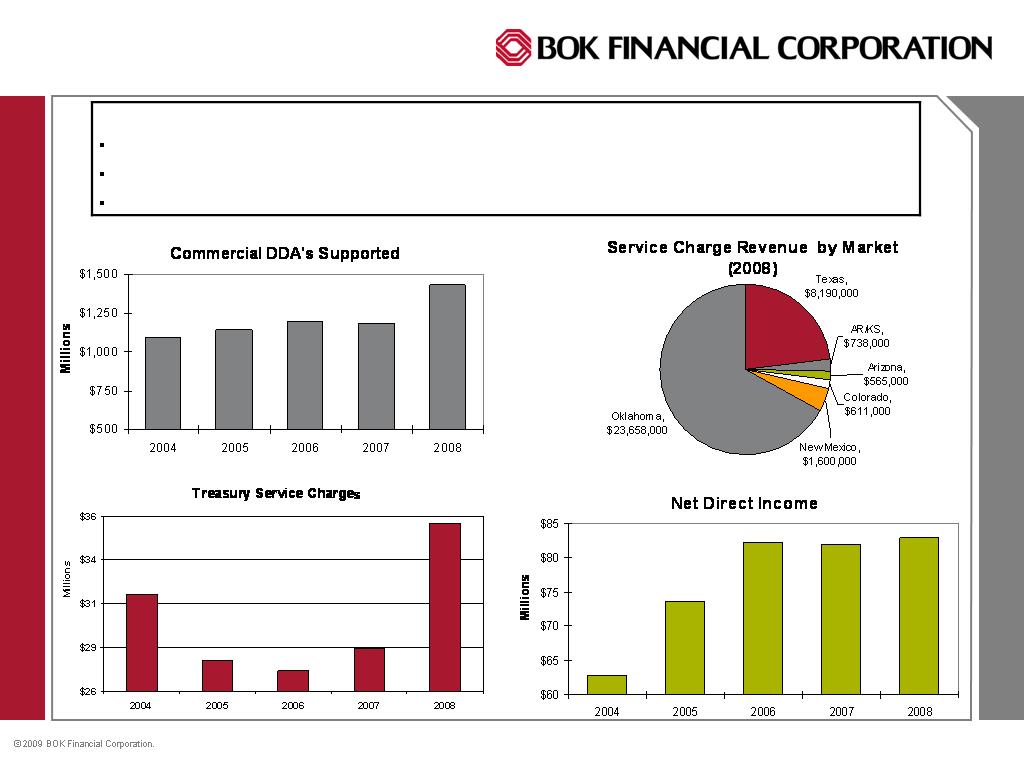

Treasury Services

2008 Highlights:

Received “A” Rating in 2008 Phoenix-Hecht Middle Market Monitor

Launched Treasury Services Healthcare Vertical

Achieved modest (3%) Growth in Low Rate Turbulent Market

50

Treasury Services

2009 Strategies:

Targeted effort to grow Commercial DDA 10% across footprint

Increase top line revenue growth at least 4%

Launch Targeted Commercial Credit Card Sales Effort

Strong regional growth goal alignment

51

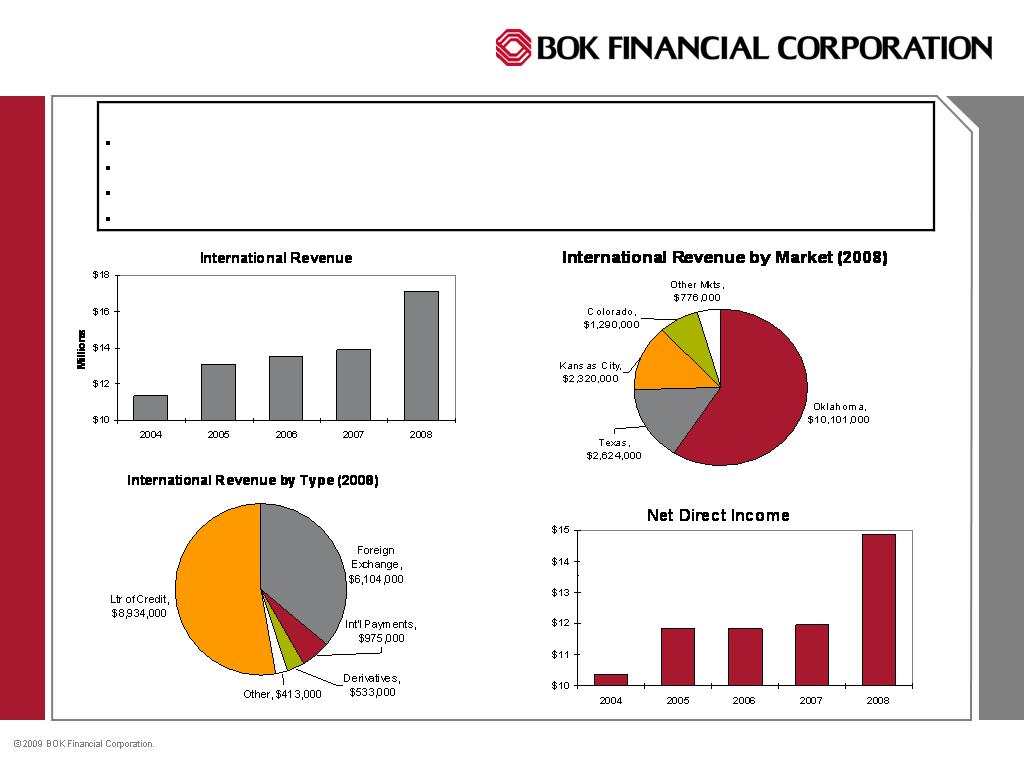

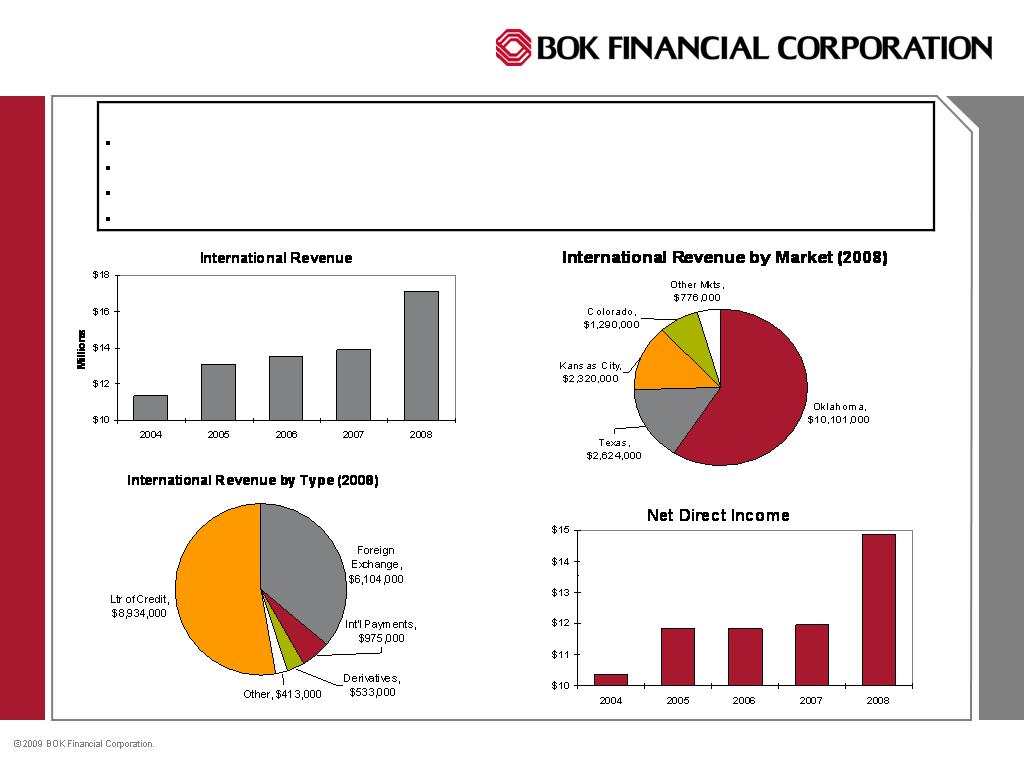

International Services

2008 Highlights:

Focused on supporting the International Services & Trade Finance needs of BOKF Clients

Continued to enhance product and technology platforms

Bolstered Management and Sales Teams

Increased Revenue to $17.1M, 24% growth

52

International Revenues

2009 Strategies:

Strategically expand and enhance Correspondent Bank network

Product & Sales training initiative

Enhance International Branding

53

Mortgage Banking

2008 Highlights:

Continued Sales Force Growth

Continued increase in Mortgage Referrals from Consumer Branches

Mortgage Servicing Delinquencies Remain Well Below National Average

54

Mortgage Banking

2009 Strategies:

Maintain and grow Servicing Portfolio during period of low

interest rates

Continue to build sales force and sales leadership outside of

Oklahoma

Streamline processes end to end to cut costs and create

scalability

55

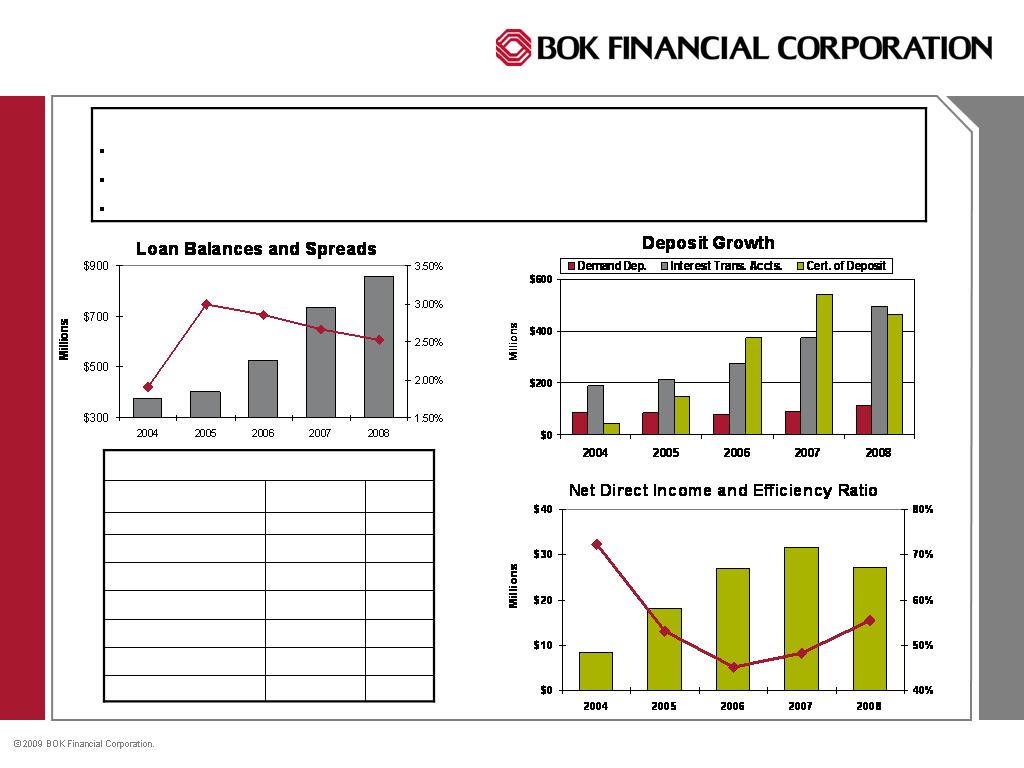

Colorado Market

2008 Highlights:

Loans Grew 18% and Operating Revenue Grew 5%; Exceeded NDO Plan

Added Key Talent

Achieved Integration of First United Bank Acquisition

2.1%

1,290,266

International Revenue

.8%

459,567

Other Revenue

4.1%

2,483,625

Trading Revenue

3.8%

2,339,357

Service Charge Revenue

16.3%

9,965,779

Trust Revenue

100.0%

61,056,958

Total Revenue

-.4%

-247,323

Mortgage Revenue

73.3%

$44,765,687

Net Interest Revenue

Revenue Distribution (2008) $ Amt % of Total

56

Colorado Market

2009 Strategies:

Intensify focus on growth areas

Enhance credit quality

Develop Market Wide Performance System

57

Kansas City Market

2008 Highlights:

Exceptional Growth in Fee based Lines of Business due in part to Strong Cross Sale/Team Selling Culture

Expansion through Talent Acquisition

Identified and Managed Asset Quality Issues

11.8%

2,118,290

International Revenue

1.3%

232,823

Other Revenue

51.1%

9,208,133

Trading Revenue

3.4%

621,034

Service Charge Revenue

2.4%

429,915

Trust Revenue

100.0%

$18,012,185

Total Revenue

2.6%

465,255

Mortgage Revenue

27.4%

$4,936,735

Net Interest Revenue

Revenue Distribution (2008) $ Amt % of Total

58

Kansas City Market

2009 Strategies:

Targeted Market Expansion

Talent Acquisition and Board Development

Bank of Kansas City Brand Identification

Long Term Strategic Planning Initiative

59

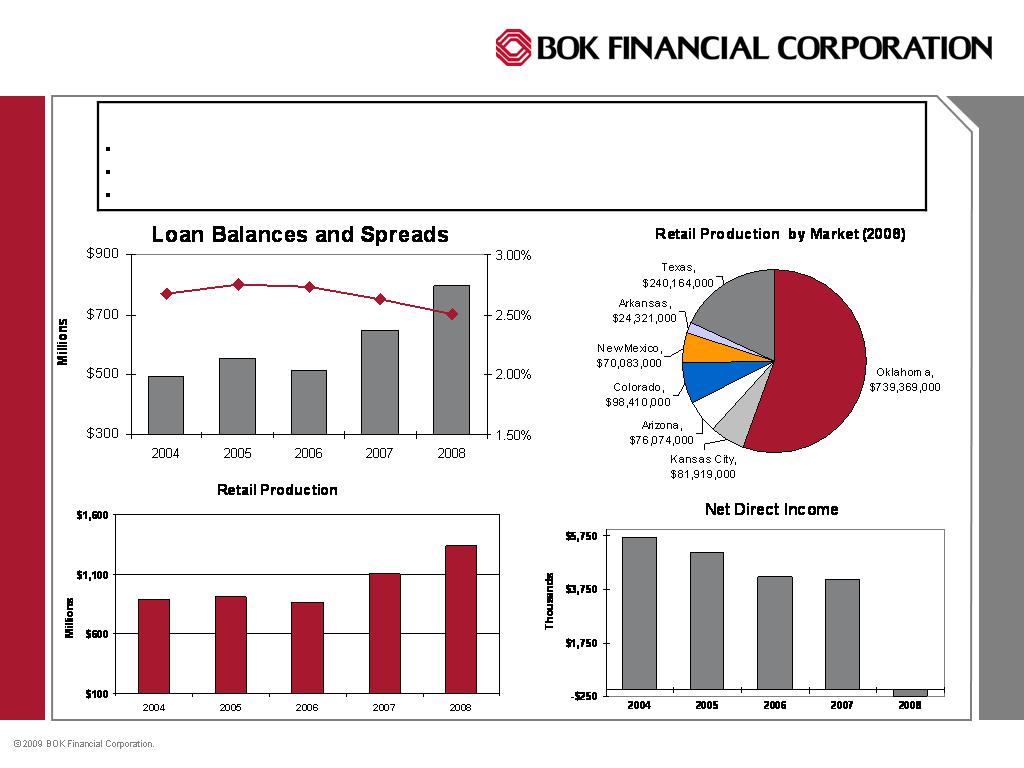

Bank of Texas

60

Norm Bagwell

Chairman & CEO

Bank of Texas

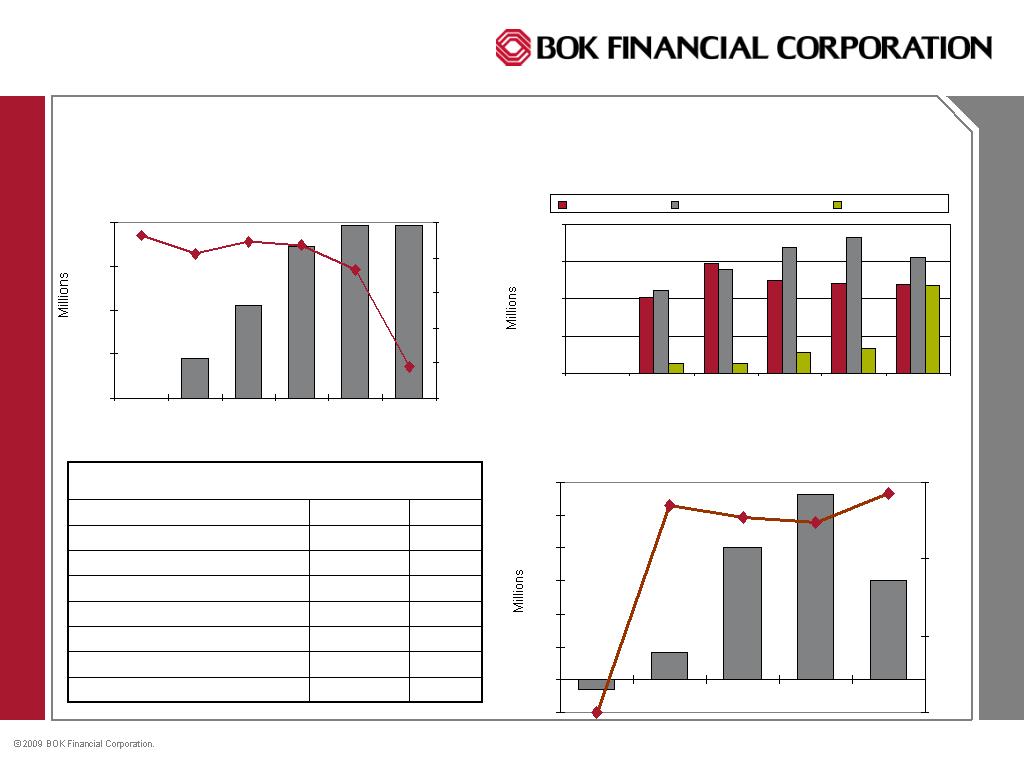

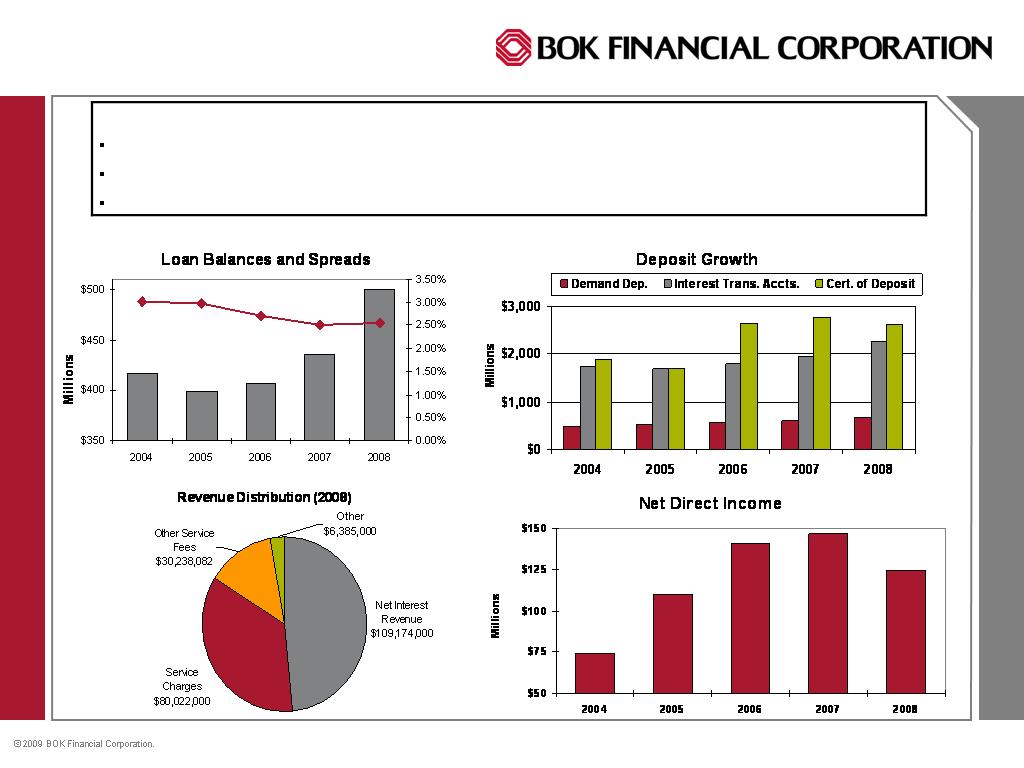

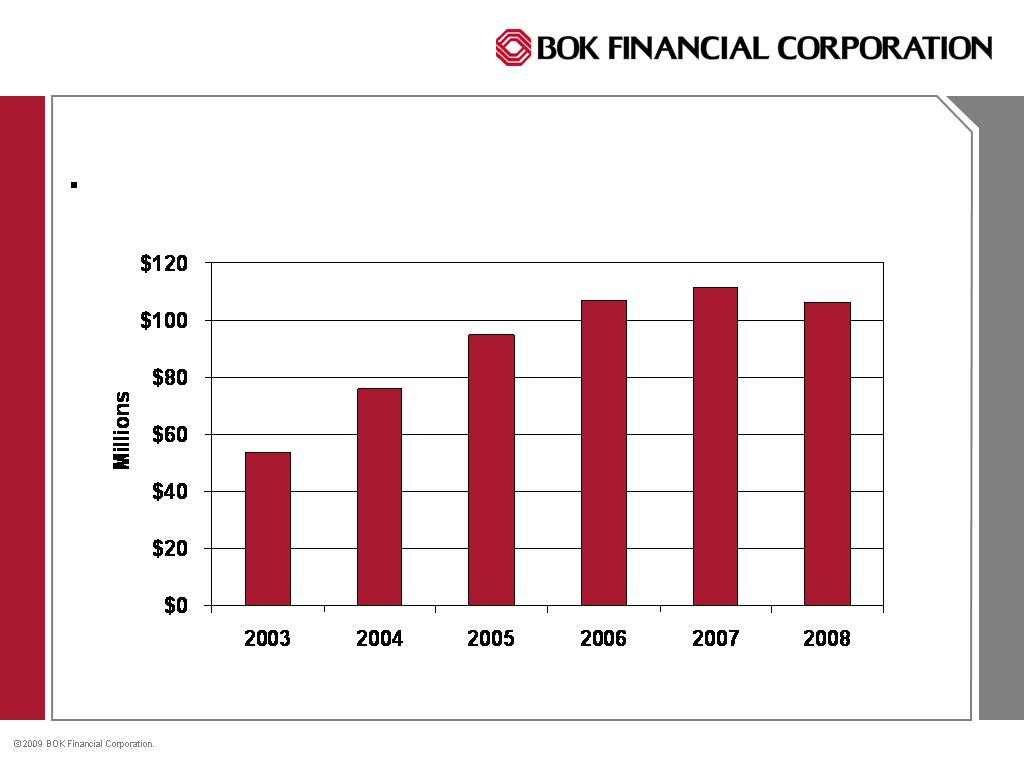

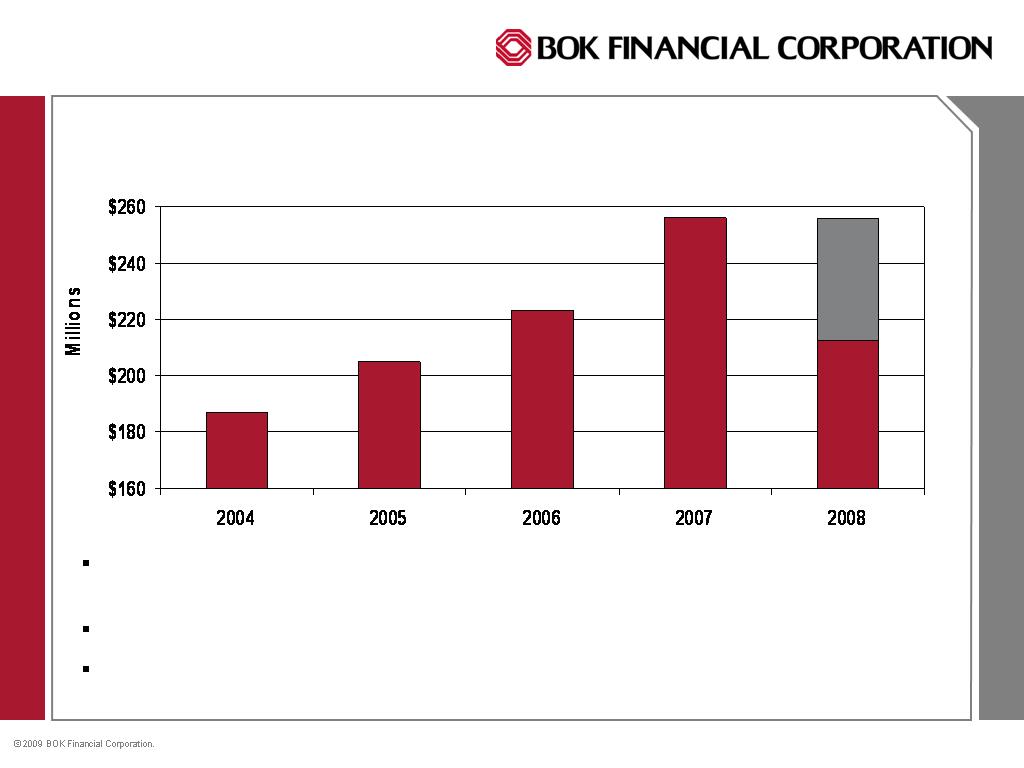

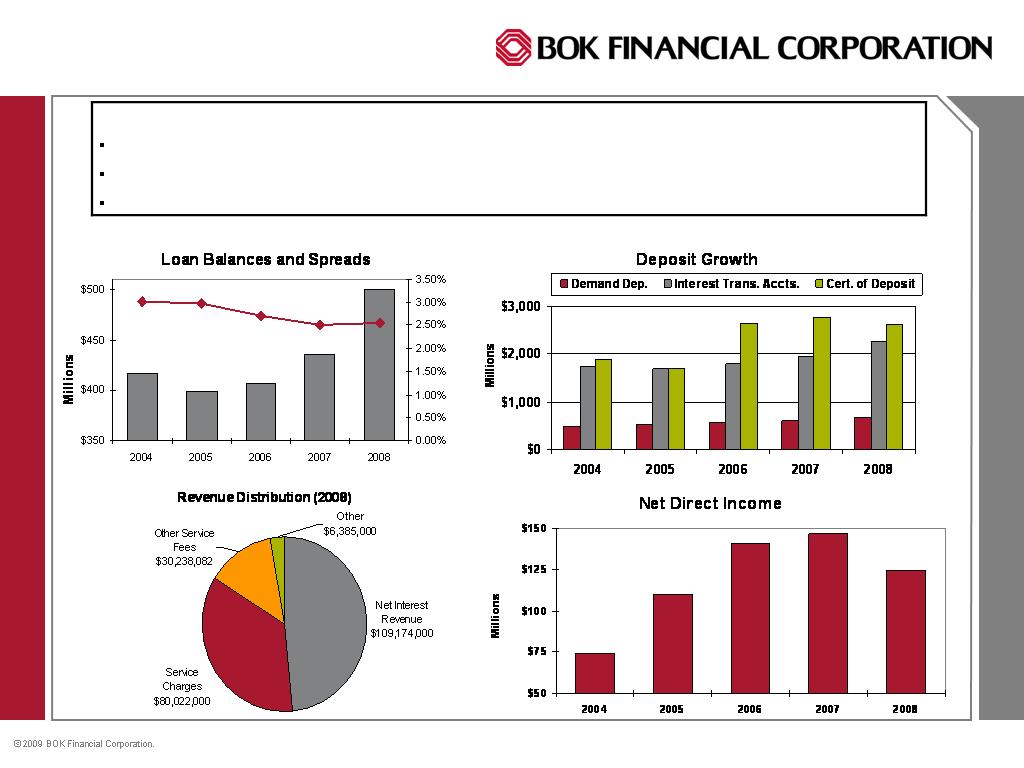

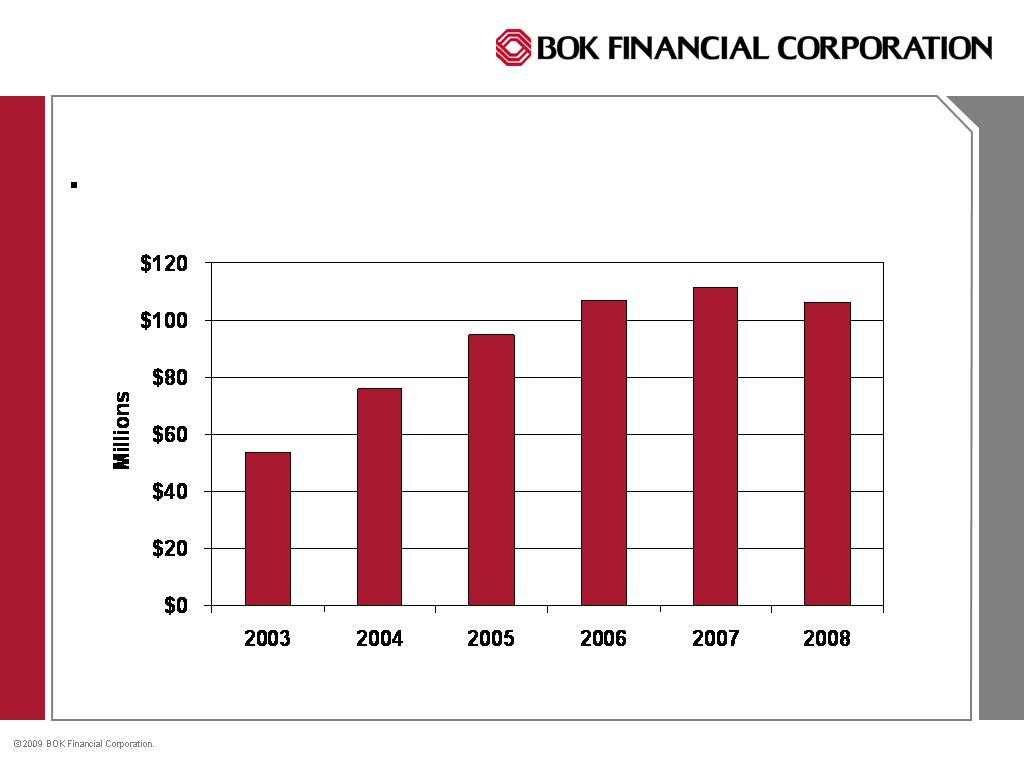

Net Direct Operating Income

5 year CAGR of 14.8%

61

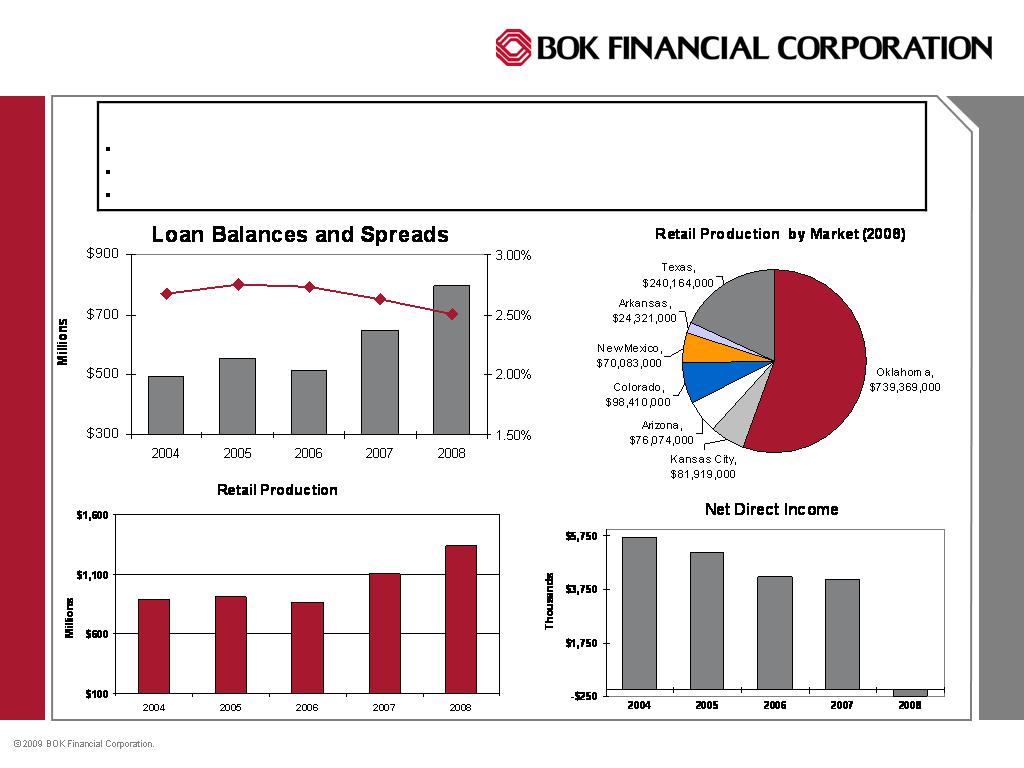

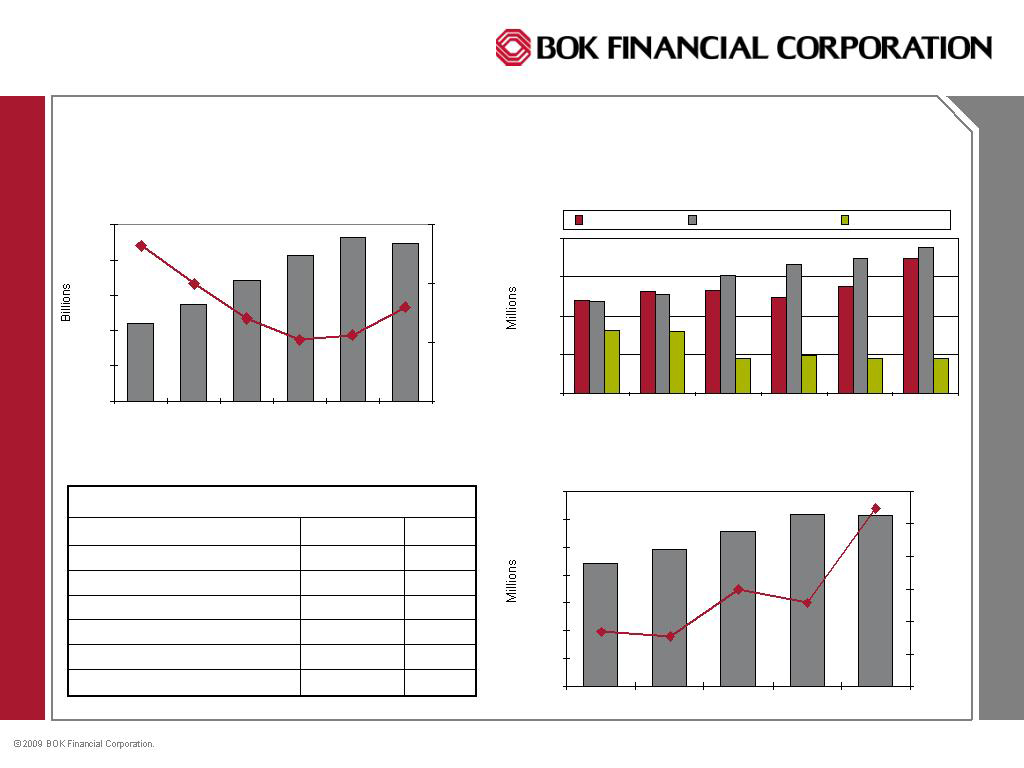

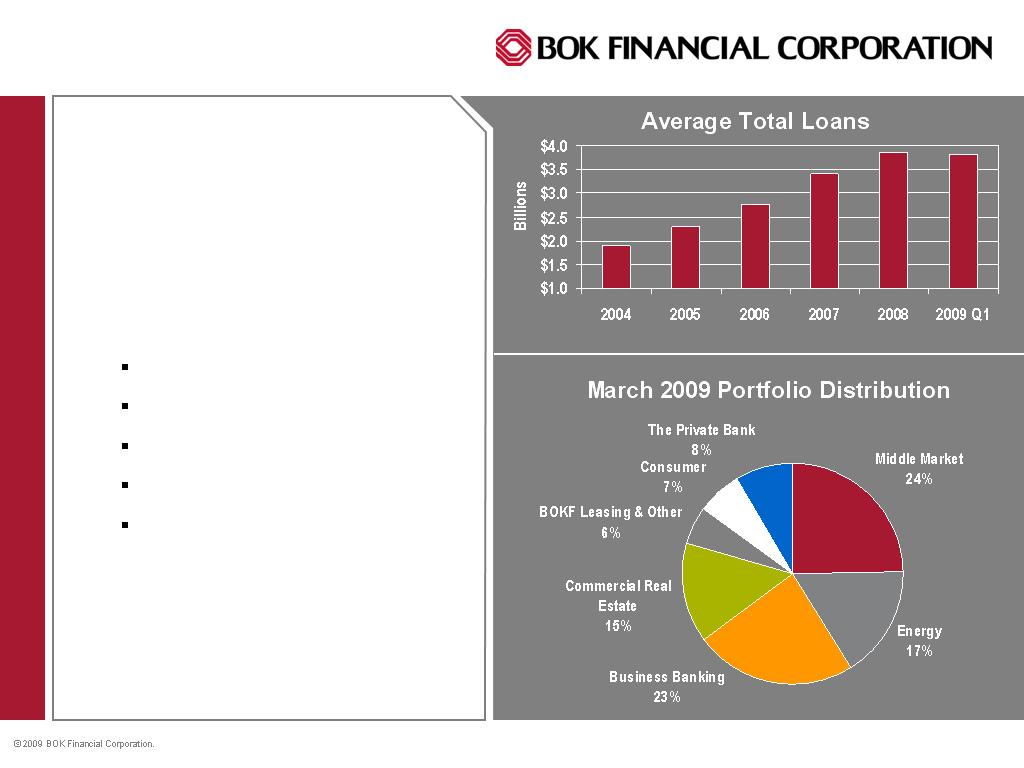

Loan Growth & Distribution

5 Year CAGR 16.7%

Largest Segments are

Middle Market - 25%

Business Banking - 24%

Energy - 17%

Real Estate - 15%

Consumer/Wealth - 14%

62

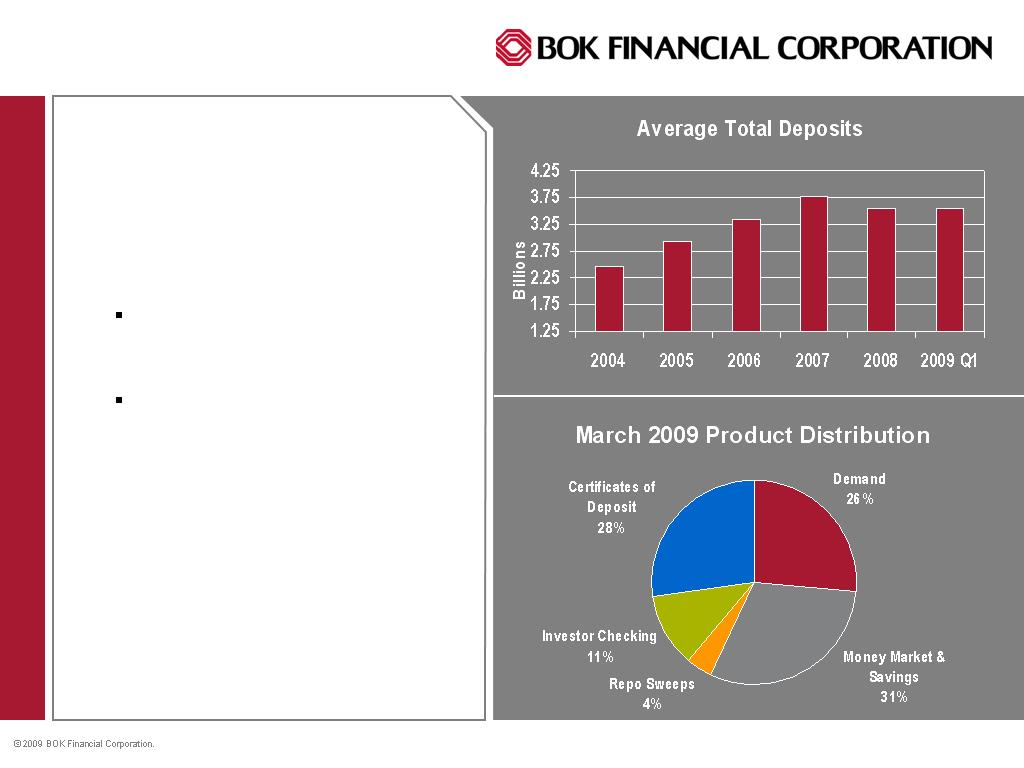

Deposit Growth &

Product Type

5 Year CAGR 9.3%

Heavy focus on deposit

generation and migration of

book to high margin products

Demand Deposits have

grown at a CAGR of 10.5%

over the last 5 years, from

$610M in 2003 to ~$1 Billion

today.

63

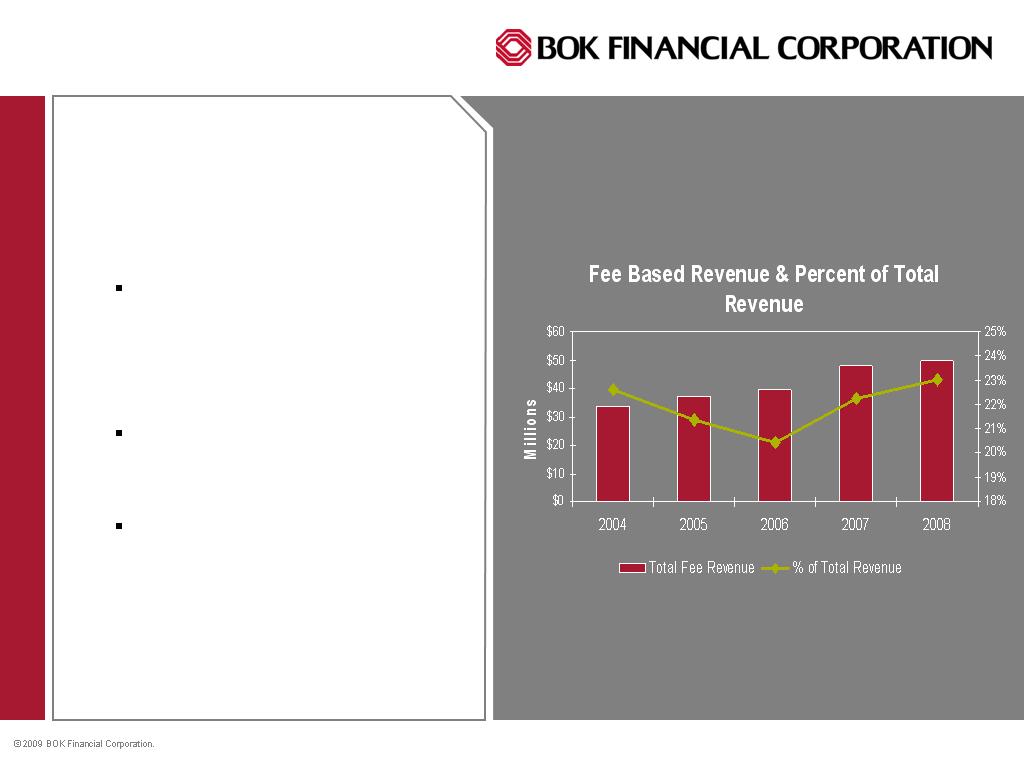

Fee Based Revenue

5 year CAGR of 11.0%

Service Charge Revenues

from Consumer NSF fees

and Treasury have been a

strong driver and account for

42% of the mix

Trust Fees & Commissions

have a five-year CAGR of

8.3%

Trading & Brokerage has a

five-year CAGR of 53%

64

Components of Fee Based Revenue

5 year CAGR of 11.0%

65

Qualitative Outcomes for Texas 2008

Common Business Model

Evolution of Eight Banking Charters into One

Commercial, Consumer, and Wealth Segments

Dallas, Ft. Worth, and Houston Markets

Launched Wealth Management Initiative

Rapid build enabled by market conditions

Significant investment and opportunity

Building a Disciplined, Consistent, and Holistic Sales Effort

Identified Target Markets (industry, sales size, specialization)

Delivery of the entire BOKF platform

Teamwork Across All Markets, Products, and LOB’s

Diversification of Revenue

66

Areas of Focus in Texas 2009

Portfolio Management

Diversification of revenue with focus on fee generating businesses

Build of core deposits

Improved margin on loans and deposits

Expense discipline balancing investment with expense leverage

Talent acquisition across all lines

67