Exhibit 99.2

Exhibit 99.2

The BOK Financial Corporation Story

Forward-Looking Statement

This presentation contains forward-looking statements that are based on management’s beliefs, assumptions, current expectations, estimates, and projections about BOK Financial Corporation, the financial services industry, and the economy generally. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of such words, and similar expressions are intended to identify such forward-looking statements. Management judgements relating to, and discussion of the provision and allowance for credit losses involve judgements as to future events and are inherently forward-looking statements. Assessments that BOKF’s acquisitions and other growth endeavors will be profitable are necessary statements of belief as to the outcome of future events, based in part on information provided by others which BOKF has not independently verified. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expressed, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to, (1) the ability to fully realize expected cost savings from mergers within the expected time frames, (2) the ability of other companies on which BOKF relies to provide goods and services in a timely and accurate manner, (3) changes in interest rates and interest rate relationships, (4) demand for products and services, (5) the degree of competition by traditional and non-traditional competitors, (6) changes in banking regulations, tax laws, prices, levies, and assessments, (7) the impact of technological advances, and (8) trends in customer behavior as well as their ability to repay loans. BOK Financial

Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise.

BOK Financial Corporation

2

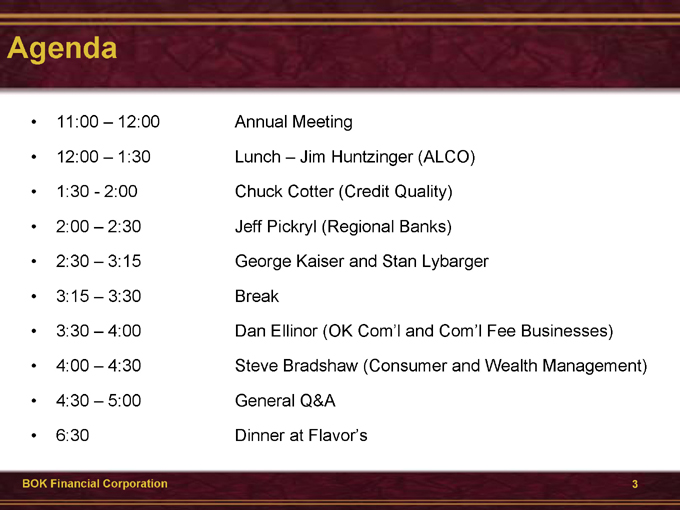

Agenda

11:00 – 12:00 Annual Meeting

12:00 – 1:30 Lunch – Jim Huntzinger (ALCO) 1:30 - 2:00 Chuck Cotter (Credit Quality) 2:00 – 2:30 Jeff Pickryl (Regional Banks) 2:30 – 3:15 George Kaiser and Stan Lybarger 3:15 – 3:30 Break

3:30 – 4:00 Dan Ellinor (OK Com’l and Com’l Fee Businesses) 4:00 – 4:30 Steve Bradshaw (Consumer and Wealth Management) 4:30 – 5:00 General Q&A

6:30 Dinner at Flavor’s

BOK Financial Corporation

3

Investment Portfolio Management

Jim Huntzinger Senior Vice President Chief Investment Officer

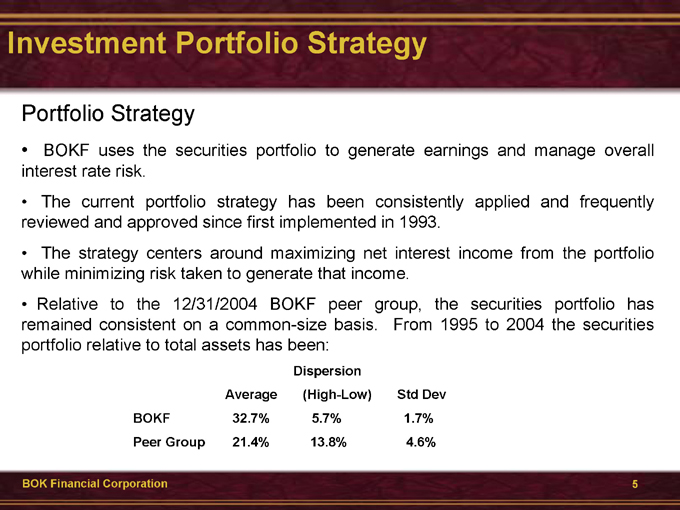

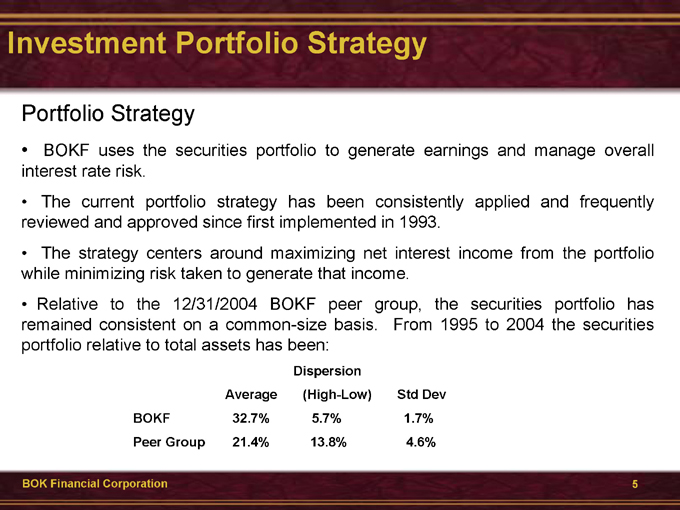

Investment Portfolio Strategy

Portfolio Strategy

BOKF uses the securities portfolio to generate earnings and manage overall interest rate risk.

The current portfolio strategy has been consistently applied and frequently reviewed and approved since first implemented in 1993.

The strategy centers around maximizing net interest income from the portfolio while minimizing risk taken to generate that income.

Relative to the 12/31/2004 BOKF peer group, the securities portfolio has remained consistent on a common-size basis. From 1995 to 2004 the securities portfolio relative to total assets has been:

Dispersion

Average (High-Low) Std Dev BOKF 32.7% 5.7% 1.7% Peer Group 21.4% 13.8% 4.6%

BOK Financial Corporation

5

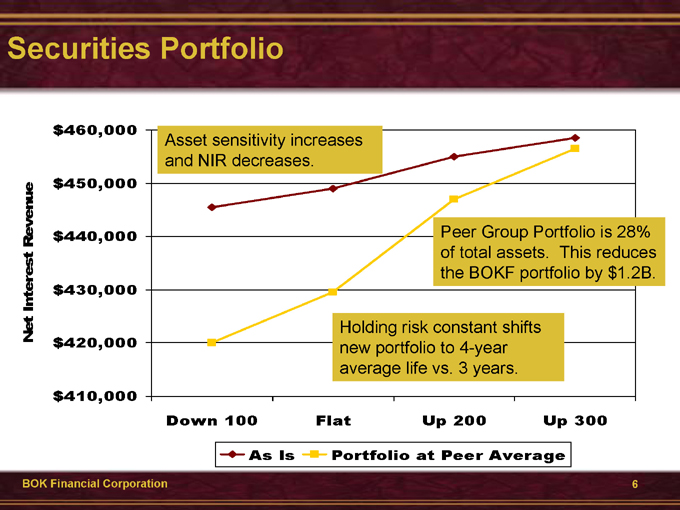

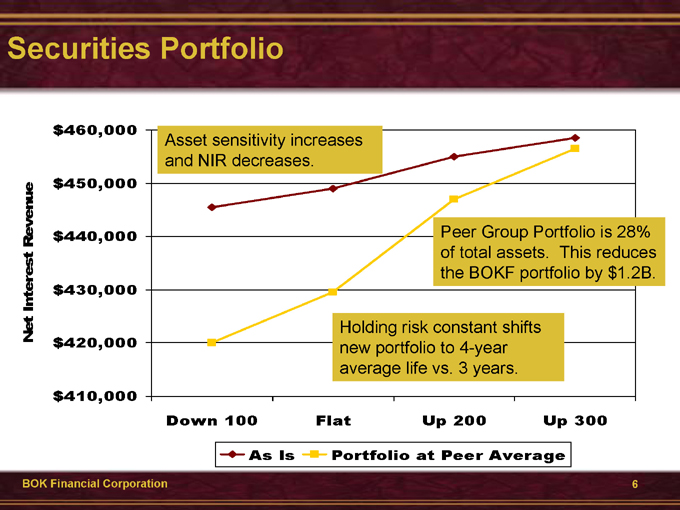

Securities Portfolio $460,000 $450,000 $440,000 $430,000 $420,000 $410,000

Asset sensitivity increases and NIR decreases.

Peer Group Portfolio is 28% of total assets. This reduces the BOKF portfolio by $1.2B.

Holding risk constant shifts new portfolio to 4-year average life vs. 3 years.

Down 100 Flat Up 200 Up 300

As Is

Portfolio at Peer Average

BOK Financial Corporation

Net Interest Revenue

6

Credit Quality

Chuck Cotter Executive Vice President Chief Credit Officer

Credit Quality

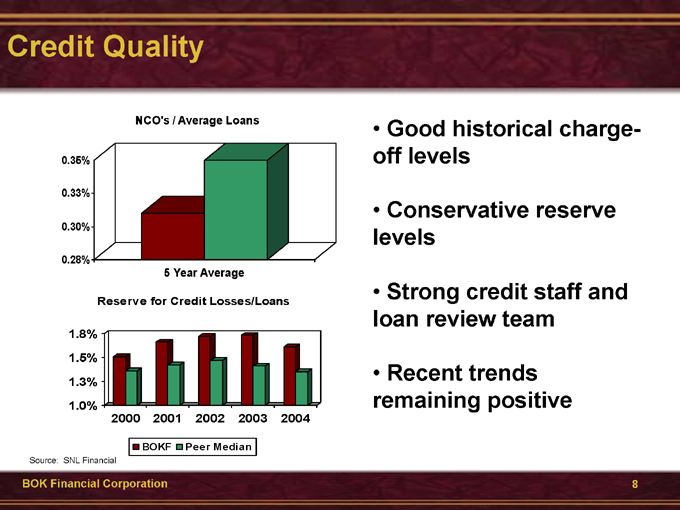

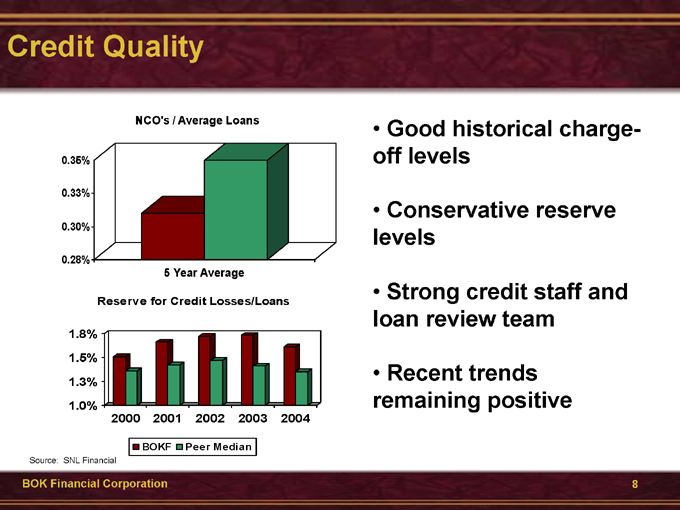

NCO’s / Average Loans

0.35% 0.33% 0.30%

0.28%

5 Year Average

Reserve for Credit Losses/Loans

1.8% 1.5% 1.3% 1.0%

2000 2001 2002 2003 2004

BOKF Peer Median

Source: SNL Financial

Good historical charge-off levels

Conservative reserve levels

Strong credit staff and loan review team

Recent trends remaining positive

BOK Financial Corporation

8

Regional Banks

Jeff Pickryl

Senior Executive Vice President

Regional Bank Growth Strategy

Recent trend in regional banking has been to increase the brick-and-mortar branch network to gain “retail” market share.

Our strategy is to focus primarily on gaining commercial banking market share by having an adequate branch network, while investing in recruitment of the highest caliber commercial banking sales staff.

BOK Financial Corporation

10

Regional Expansion

Logical “step-outs” from Oklahoma

Texas

Seven bank acquisitions in Dallas and Houston since 1997

Built de-novo branches in Katy, Plano, Fort Worth – Coppell to open in late 2005 Eight supermarket branches acquired or built, primarily Kroger Continuous recruitment of top commercial lending talent

New Mexico

Opened commercial real estate LPO in August of 1997

Acquired branch network from Bank of America; Opened December 4, 1998 Opened commercial banking office in Santa Fe July 31, 2000 Continuous recruitment of top commercial lending talent

Colorado

Opened energy lending LPO in April 2002

Acquired Colorado State Bank & Trust September 10, 2003 Constructing de-novo branch to open in late 2005 Continuous recruitment of top commercial lending talent

Arizona

Started commercial real estate LPO in July of 2004 Acquired Valley Commerce Bank April 6, 2005 Considering locations for de-novo branches Continuous recruitment of top commercial lending talent

BOK Financial Corporation

11

Loan Growth

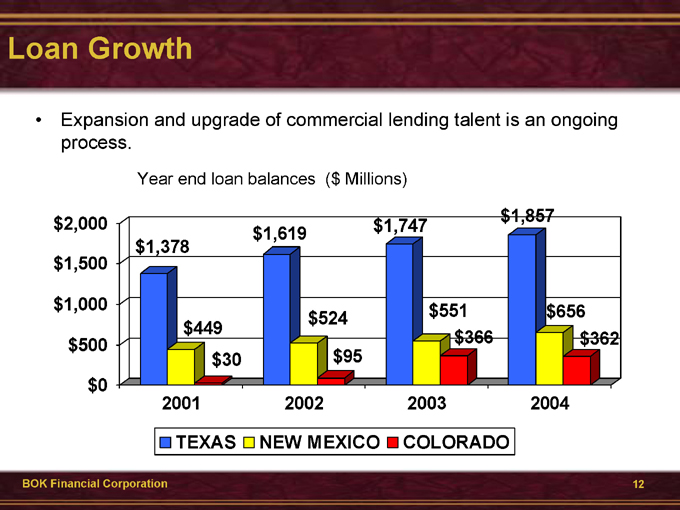

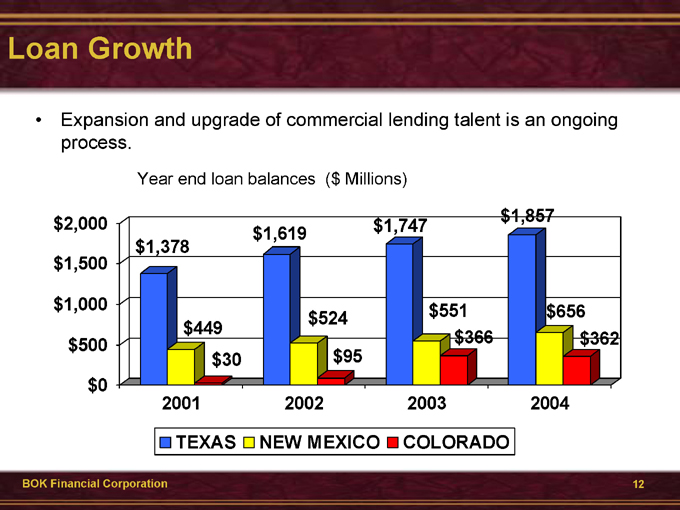

Expansion and upgrade of commercial lending talent is an ongoing process.

Year end loan balances ($Millions) $2,000 $1,500 $1,000 $500 $0

2001 2002 2003 2004

TEXAS NEW MEXICO COLORADO

$1,857 $1,619 $1,747 $1,378

$524 $551 $656 $449 $366 $362

$30 $95

BOK Financial Corporation

12

Operating Revenue

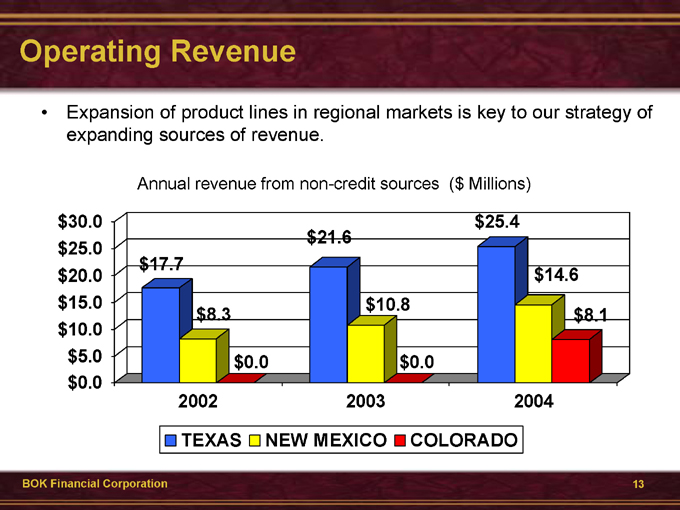

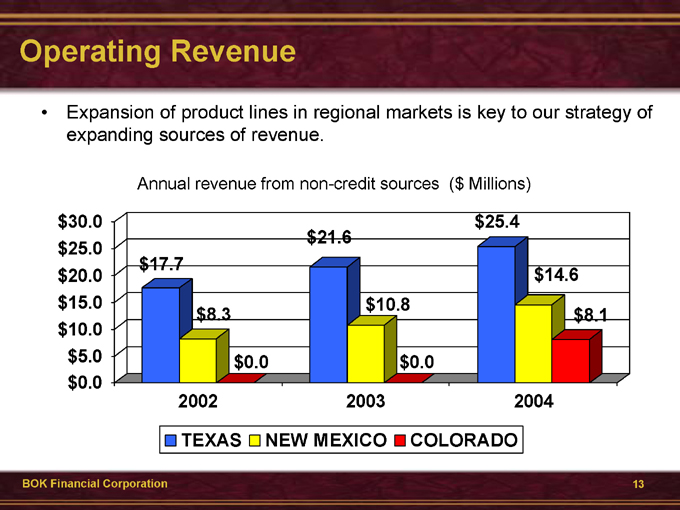

Expansion of product lines in regional markets is key to our strategy of expanding sources of revenue.

Annual revenue from non-credit sources ($Millions) $30.0 $25.0 $20.0 $15.0 $10.0 $5.0 $0.0 $25.4 $21.6 $17.7 $14.6 $10.8 $8.3 $8.1

$0.0 $0.0

2002 2003 2004

TEXAS NEW MEXICO COLORADO

BOK Financial Corporation

13

Operating Efficiency

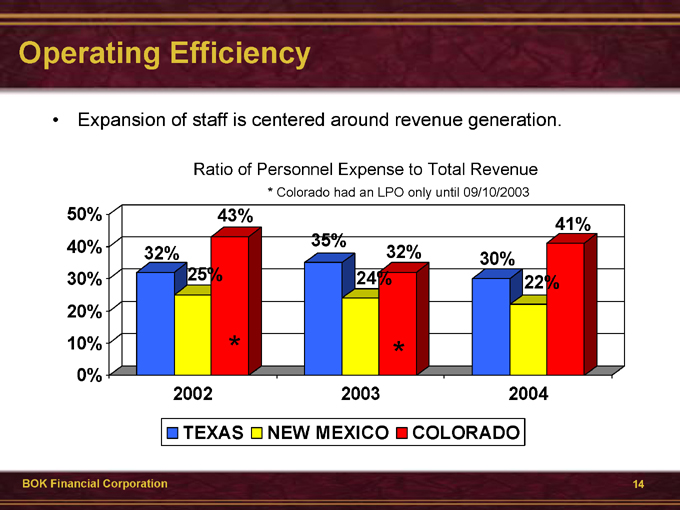

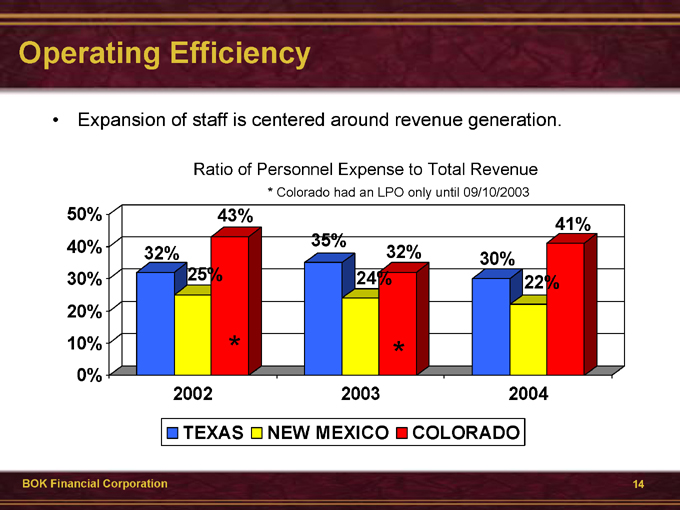

Expansion of staff is centered around revenue generation.

Ratio of Personnel Expense to Total Revenue

* Colorado had an LPO only until 09/10/2003

50% 40% 30% 20% 10% 0%

43%

41% 35% 32% 32% 30% 25% 24% 22%

* *

2002 2003 2004

TEXAS NEW MEXICO COLORADO

BOK Financial Corporation

14

Net Income

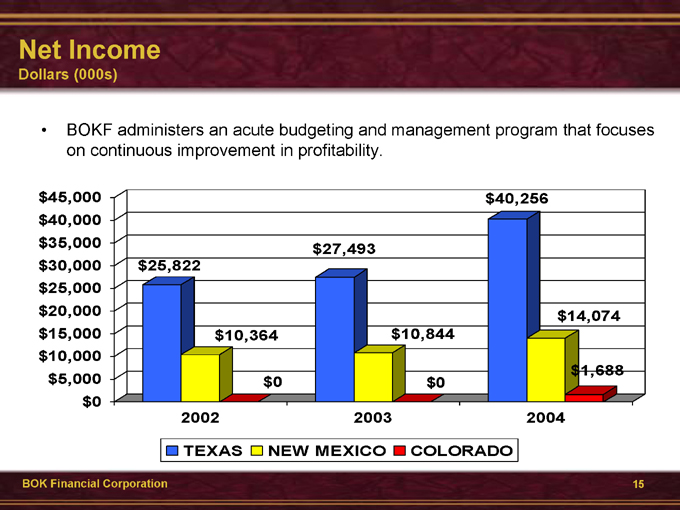

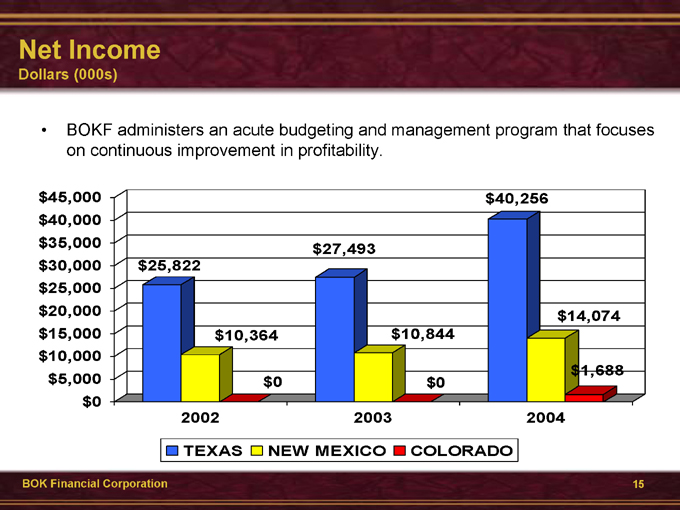

Dollars (000s)

BOKF administers an acute budgeting and management program that focuses on continuous improvement in profitability.

$45,000 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $0 $40,256

$27,493 $25,822

$14,074 $10,364 $10,844

$1,688

$0 $0

2002 2003 2004

TEXAS NEW MEXICO COLORADO

BOK Financial Corporation

15

General Discussion

George Kaiser Chairman BOK Financial Corporation

Stan Lybarger President and CEO

BOK Financial Corporation

Oklahoma Commercial and Fee Businesses

Dan Ellinor

Senior Executive Vice President

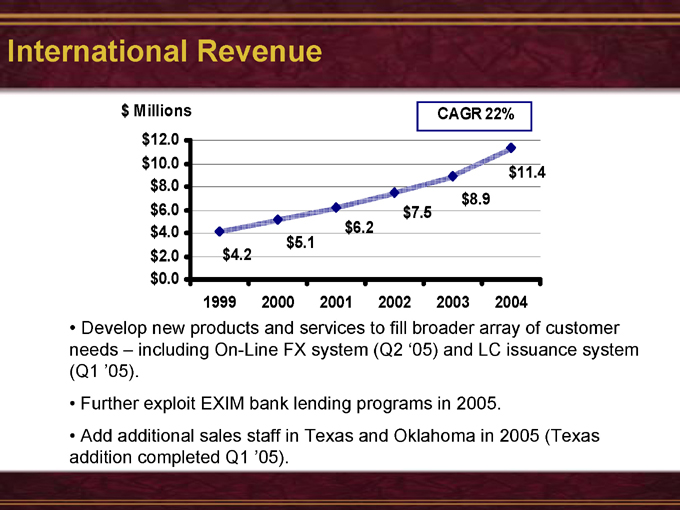

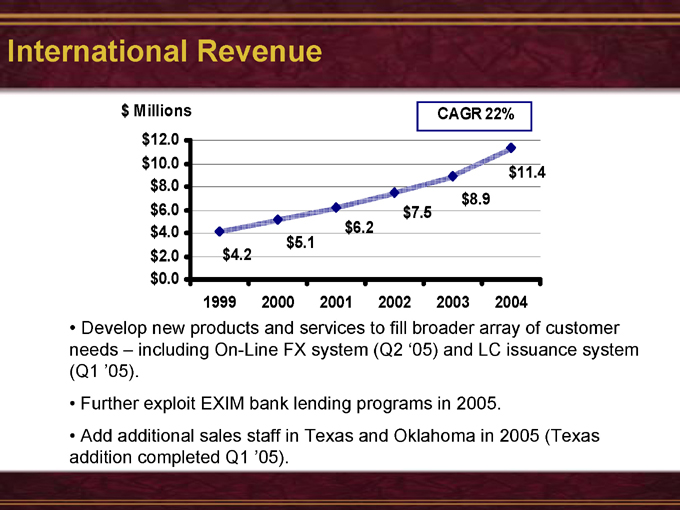

International Revenue $Millions CAGR 22% $12.0 $10.0 $11.4 $8.0 $8.9 $6.0 $7.5 $4.0 $6.2 $5.1 $2.0 $4.2 $0.0 1999 2000 2001 2002 2003 2004

Develop new products and services to fill broader array of customer needs – including On-Line FX system (Q2 ‘05) and LC issuance system (Q1 ‘05).

Further exploit EXIM bank lending programs in 2005.

Add additional sales staff in Texas and Oklahoma in 2005 (Texas addition completed Q1 ‘05).

BOk Commercial Lending

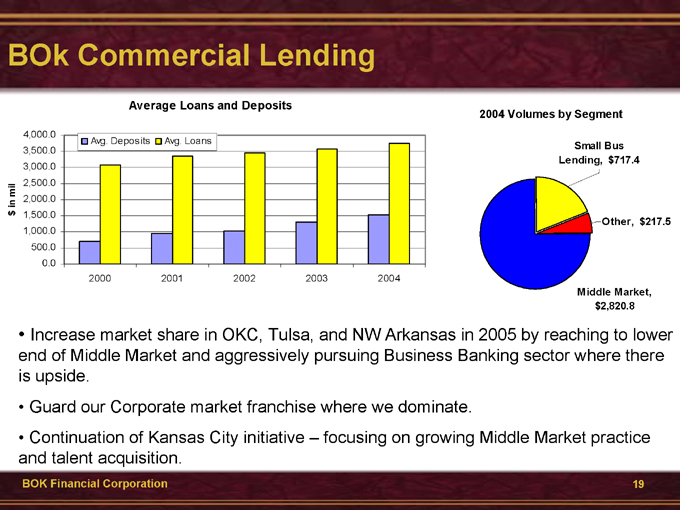

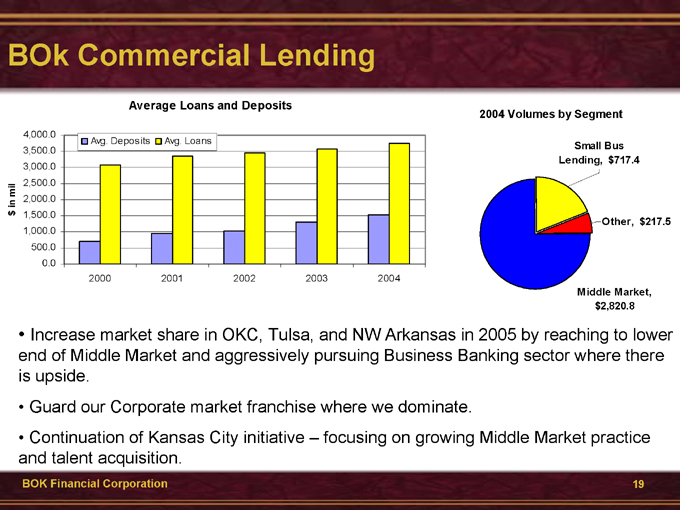

Average Loans and Deposits

$ in mil

4,000.0

Avg. Deposits Avg. Loans 3,500.0 3,000.0 2,500.0 2,000.0 1,500.0 1,000.0 500.0 0.0

2000 2001 2002 2003 2004

2004 Volumes by Segment

Small Bus Lending, $717.4

Other, $217.5

Middle Market, $2,820.8

Increase market share in OKC, Tulsa, and NW Arkansas in 2005 by reaching to lower end of Middle Market and aggressively pursuing Business Banking sector where there is upside.

Guard our Corporate market franchise where we dominate.

Continuation of Kansas City initiative – focusing on growing Middle Market practice and talent acquisition.

BOK Financial Corporation

19

TransFund

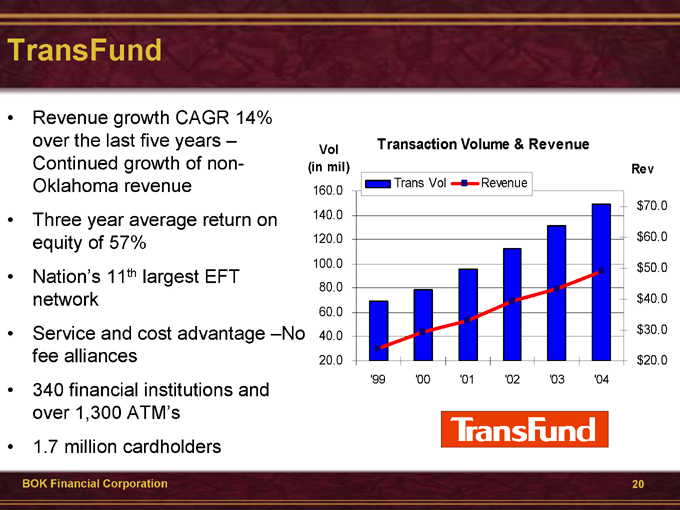

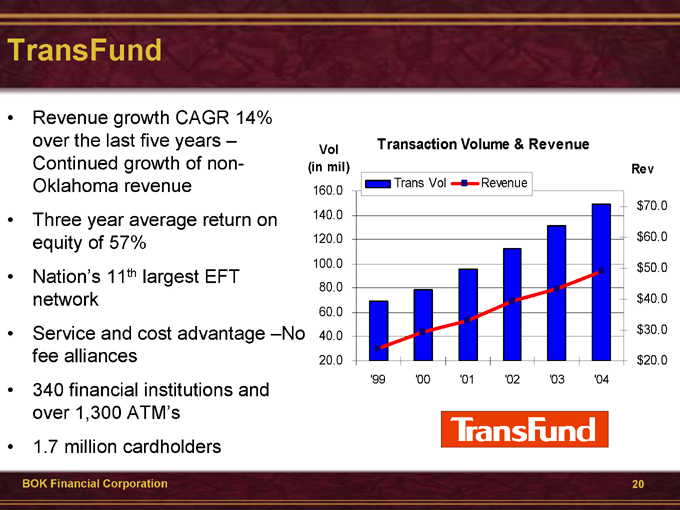

Vol Transaction Volume & Revenue

(in mil) Rev

Trans Vol Revenue 160.0 $70.0 140.0 120.0 $60.0 100.0 $50.0 80.0 $40.0 60.0 $30.0 40.0 20.0 $20.0

‘99 ‘00 ‘01 ‘02 ‘03 ‘04

Revenue growth CAGR 14% over the last five years – Continued growth of non-Oklahoma revenue Three year average return on equity of 57% Nation’s 11th largest EFT network Service and cost advantage –No fee alliances 340 financial institutions and over 1,300 ATM’s 1.7 million cardholders

BOK Financial Corporation

20

Treasury Services

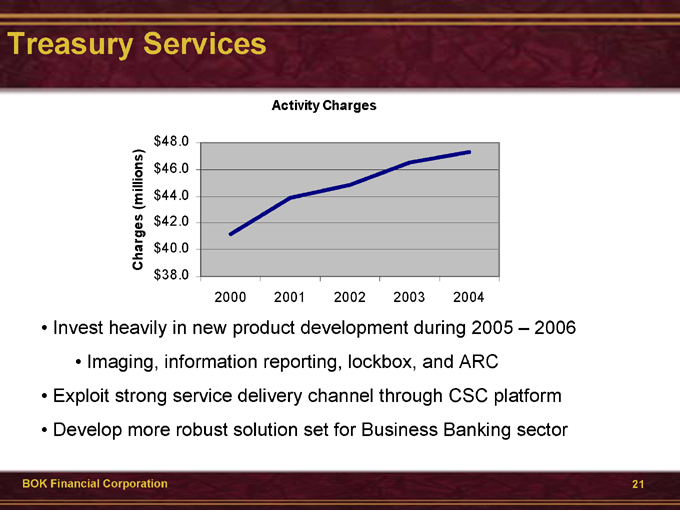

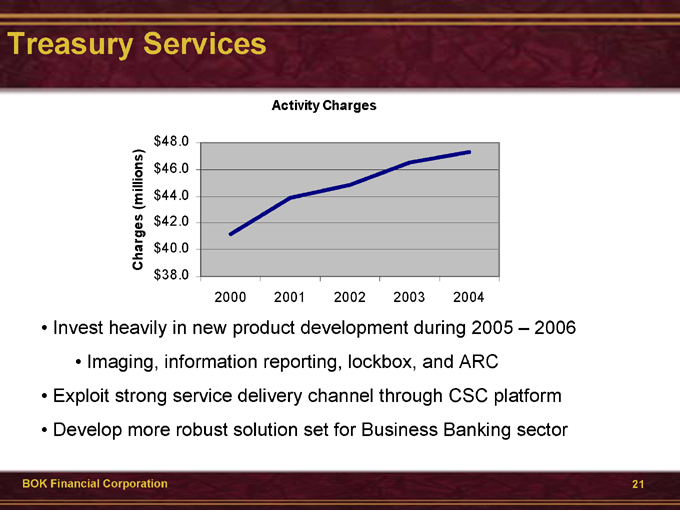

Charges (millions)

Activity Charges $48.0 $46.0 $44.0 $42.0 $40.0 $38.0

2000 2001 2002 2003 2004

Invest heavily in new product development during 2005— 2006

Imaging, information reporting, lockbox, and ARC

Exploit strong service delivery channel through CSC platform Develop more robust solution set for Business Banking sector

BOK Financial Corporation

21

Consumer Banking and Wealth Management

Steve Bradshaw Senior Executive Vice President

Consumer Banking

140 branches, 92 traditional and 48 in-store in 6 states Primary focus:

Fee income lift Core deposit growth

Perfect Banking sales & service mission Strategic branch expansion

BOK Financial Corporation

23

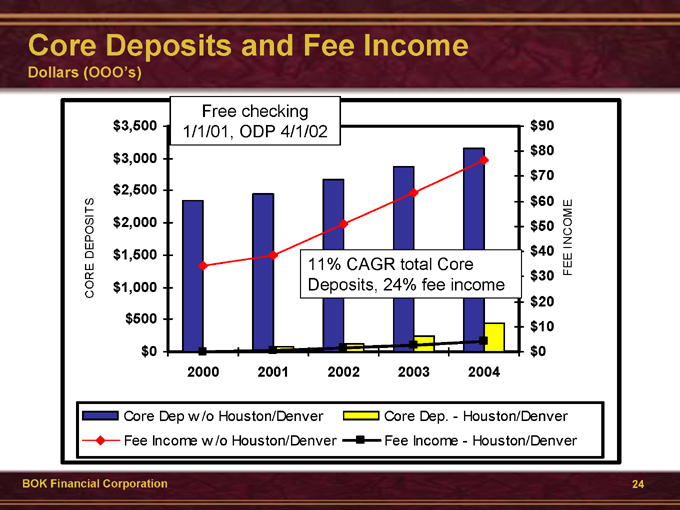

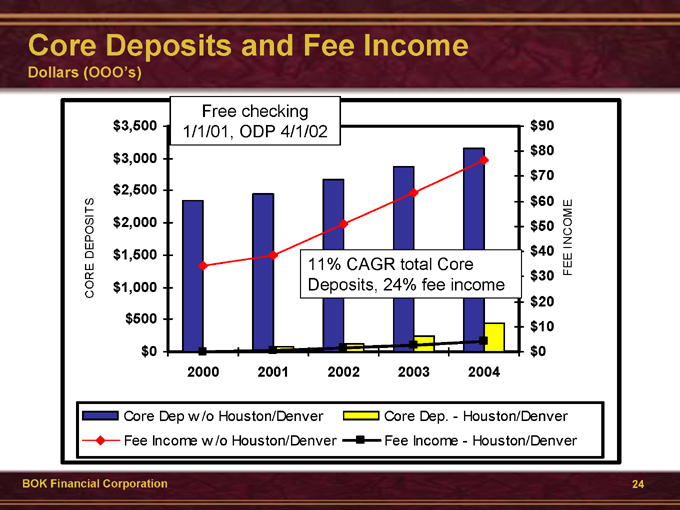

Core Deposits and Fee Income

Dollars (OOO’s)

CORE DEPOSITS

FEE INCOME

Free checking 1/1/01, ODP 4/1/02 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0

11% CAGR total Core Deposits, 24% fee income $90 $80 $70 $60 $50 $40 $30 $20 $10 $0

2000 2001 2002 2003 2004

Core Dep w /o Houston/Denver Fee Income w /o Houston/Denver

Core Dep.—Houston/Denver Fee Income—Houston/Denver

BOK Financial Corporation

24

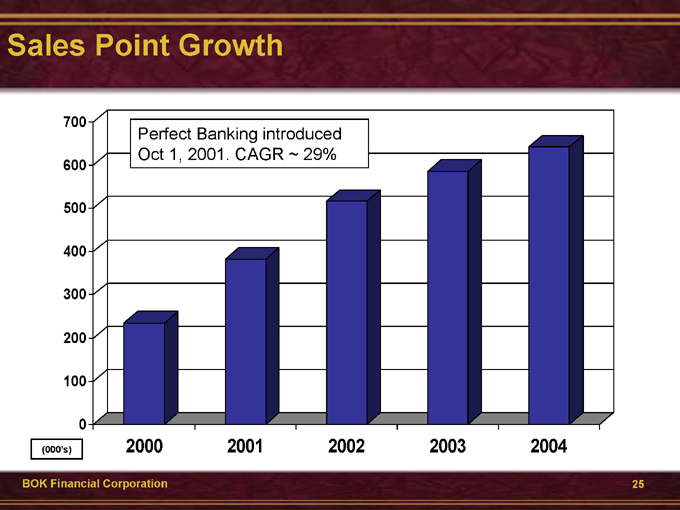

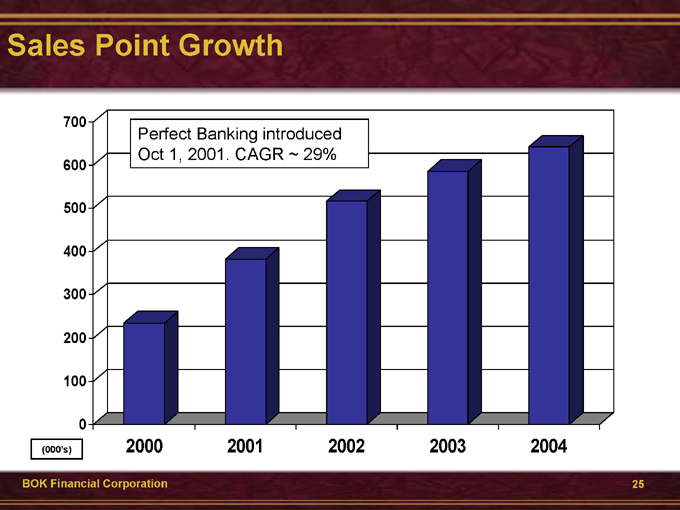

Sales Point Growth

Perfect Banking introduced Oct 1, 2001. CAGR ~ 29%

700 600 500 400 300 200 100 0

2000 2001 2002 2003 2004

(000’s)

BOK Financial Corporation

25

Wealth Management $25 billion in assets, $9 billion managed Primary focus:

Nationally competitive products Extraordinary client experience

Team investment delivery

Open architecture & improved equity performance Trusted advisor sales & service mission

BOK Financial Corporation

26

BOKF Investment Management

Performance Highlights

AP Short-Term Income Fund: The #1 Short Investment Grade Debt fund for 4 of the last 7 years*. (Achieved highest average annual total return for 5 year periods ending December ‘98, ‘01, ‘02, ‘03)

AP Bond Fund: Top quartile performance for the 10 years ending March 31, 2005*.

AP Equity Fund: Outperformed 88% of the 419 similarly managed Large Cap Value funds in calendar year 2004 with an annual total return of 14.95%*; also beat the S&P 500 Index by over 400 basis points for the same period.

*Source: Lipper Analytical Services

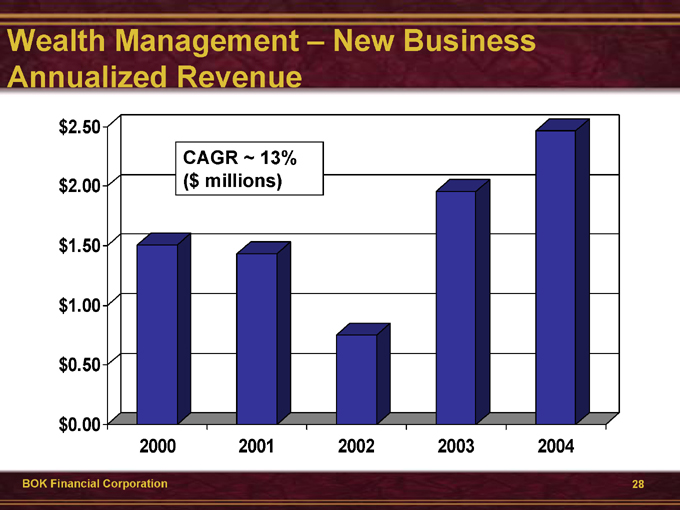

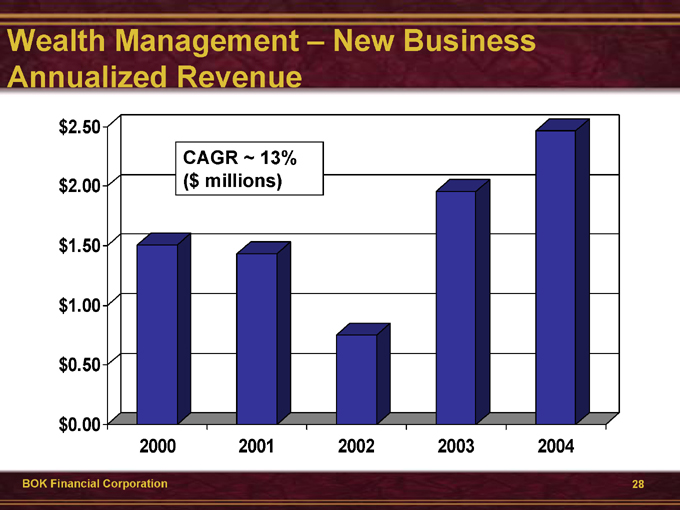

Wealth Management — New Business Annualized Revenue

CAGR ~ 13% ($ millions) $2.50 $2.00 $1.50 $1.00 $0.50 $0.00

2000 2001 2002 2003 2004

BOK Financial Corporation

28

BOSC

Full service securities firm

Retail Institutional

Investment Banking Risk Management

90 brokers in 10 states Distribution-focused

Revenue per million dollars of retail deposits 4 times industry average

BOK Financial Corporation

29

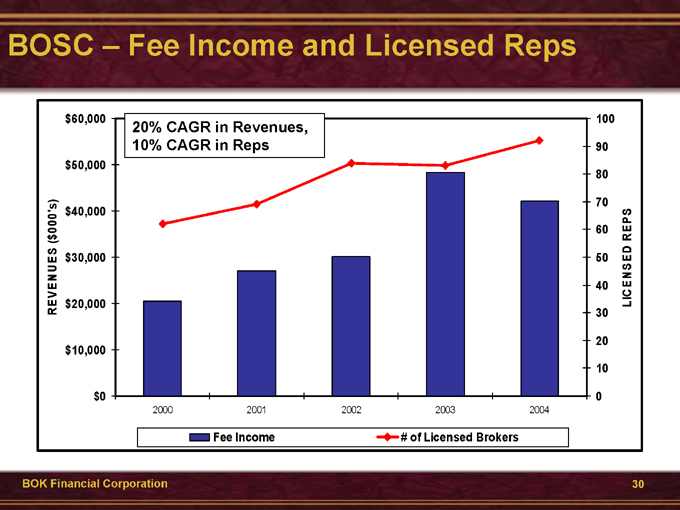

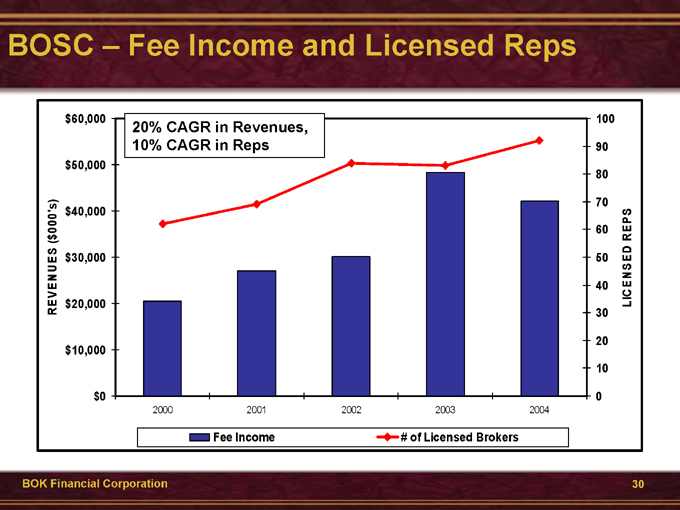

BOSC — Fee Income and Licensed Reps $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0

20% CAGR in Revenues, 10% CAGR in Reps REVENUES ($000’S)

LICENSED REPS

100 90 80 70 60 50 40 30 20 10 0

2000 2001 2002 2003 2004

Fee Income # of Licensed Brokers

BOK Financial Corporation

30

The BOK Financial Corporation Story