| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM N-CSR

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number | 811-6325 |

Dreyfus Midcap Index Fund, Inc.

| c/o The Dreyfus Corporation | ||

| 200 Park Avenue | ||

| New York, New York 10166 | ||

| (Address of principal executive offices) | (Zip code) | |

| Michael A. Rosenberg, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (212) 922-6000 |

| Date of fiscal year end: | 10/31 |

| Date of reporting period: | 4/30 /08 |

1

FORM N-CSR

| Item 1. | Reports to Stockholders. |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents | ||

| THE FUND | ||

| 2 | A Letter from the CEO | |

| 3 | Discussion of Fund Performance | |

| 6 | Understanding Your Fund’s Expenses | |

| 6 | Comparing Your Fund’s Expenses | |

| With Those of Other Funds | ||

| 7 | Statement of Investments | |

| 20 | Statement of Financial Futures | |

| 21 | Statement of Assets and Liabilities | |

| 22 | Statement of Operations | |

| 23 | Statement of Changes in Net Assets | |

| 24 | Financial Highlights | |

| 25 | Notes to Financial Statements | |

| 32 | Information About the Review | |

| and Approval of the Fund’s | ||

| Management Agreement | ||

| FOR MORE INFORMATION | ||

| Back Cover | ||

| Dreyfus |

| Midcap Index Fund, Inc. |

| The | Fund |

A LETTER FROM THE CEO

Dear Shareholder:

We are pleased to present this semiannual report for Dreyfus Midcap Index Fund, Inc., covering the six-month period from November 1, 2007, through April 30, 2008.

Although the U.S. economy has teetered on the brink of recession and the financial markets encountered heightened volatility due to an ongoing credit crisis during the reporting period, we recently have seen signs of potential improvement.The Federal Reserve Board’s aggressive easing of monetary policy and innovative measures to inject liquidity into the banking system appear to have reassured many investors. At Dreyfus, we believe that the current economic downturn is likely to be relatively brief by historical standards, but the ensuing recovery may be gradual and prolonged as financial deleveraging and housing price deflation continue to weigh on economic activity.

The implications of our economic outlook for the U.S. stock market generally are positive. Selling pressure among overleveraged investors has created attractive values in a number of areas, including among many of the market’s largest and well-established companies. Your financial advisor can help you assess current risks and take advantage of these longer-term opportunities within the context of your overall investment portfolio.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Manager.

Thank you for your continued confidence and support.

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2007, through April 30, 2008, as provided by Thomas Durante, CFA, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended April 30, 2008, Dreyfus Midcap Index Fund produced a total return of –7.04% .1 The Standard & Poor’s MidCap 400 Index (“S&P 400 Index”), the fund’s benchmark, produced a total return of –6.95% for the same period.2,3

Midcap stocks produced disappointing results in a challenging investment environment during the reporting period, as investors grew concerned regarding an intensifying housing contraction, tighter credit conditions, mounting job losses and higher food and energy prices. However, midcap stocks generally produced higher returns than their large- and small-cap counterparts. The difference in returns between the fund and the benchmark was primarily the result of transaction costs and operating expenses.

The Fund’s Investment Approach

The fund seeks to match the total return of the S&P 400 Index by generally investing in all 400 stocks in the S&P 400 Index, in proportion to their respective weightings.The fund may also use stock index futures whose performance is tied to the S&P 400 Index as a substitute for the sale or purchase of stocks.The S&P 400 Index is composed of 400 stocks of midsize domestic companies across 10 economic sectors. Each stock is weighted by its market capitalization; that is, larger companies have greater representation in the S&P 400 Index than smaller ones.

Consumers Struggled in a Slowing Economy

U.S. stocks generally produced disappointing results during the reporting period due to a “perfect storm” of negative economic news. The most prominent of these factors was the continued deterioration of the U.S. housing market. As housing values declined during the reporting period, mortgage defaults and foreclosures rose sharply, fueling ongoing

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

turmoil in the sub-prime mortgage market. Stock prices in the financials sector plummeted when major commercial banks, investment banks and bond insurers reported massive sub-prime related losses. While lower home prices and aggressive interest-rate reductions by the Federal Reserve Board created a more favorable environment for home buyers, increasingly stringent lending criteria and a tighter job market limited the number of potential new homeowners, further contributing to the housing market’s slump.

Meanwhile, escalating commodity prices not only have resulted in higher energy costs for consumers, but they also have burdened families with higher food prices.The increasing use of corn for the production of ethanol as an alternative energy source has resulted in higher feed costs for farmers and, in turn, rising milk, dairy, cereal and meat costs for consumers. Higher gasoline prices also increased transportation costs for food producers. These factors caused consumers to cut back on spending in other, more discretionary areas.

Stocks with Significant Overseas Exposure Advanced

While the U.S. economy slowed, the global economy remained relatively robust, boosting the fortunes of midcap companies serving overseas markets.For example,within the energy sector,a number of independent drillers, exploration-and-production companies and developers of U.S. oil and natural gas resources benefited from growing demand from China and India,which helped drive commodity prices higher and spurred new exploration and production activity.

Exporters also fared relatively well, including sellers of commodities such as steel, as demand remained strong for construction materials in the world’s emerging markets, such as China and India. Agricultural producers benefited from robust global export activity as well as higher food prices around the world. Mid-size U.S. industrial companies serving international markets also gained value, including machinery and farm equipment manufacturers that focus on global infrastructure development, as well as drilling-equipment providers that sell the meters, valves, pumps and pipes used in building clean water supplies for growing global economies.

4

On the other hand, the S&P 400 Index saw more disappointing results in the technology, consumer discretionary, health care and financials sectors.Within the technology area, wireless communications equipment makers and semiconductor manufacturers were hurt by slumping cellular phone sales. In the consumer discretionary sector, specialty retailers and casinos were adversely affected by the U.S. economic downturn, while for-profit education companies suffered from tighter lending standards for student loans. Within the health care sector, medical equipment manufacturers encountered a more difficult sales environment due to hospitals’ inability to obtain the credit needed to increase capital spending. Finally, banks, thrifts, and mortgage companies generally faltered due to the troubled housing and mortgage markets.

Index Funds Offer Diversification Benefits

As an index fund, we attempt to replicate the returns of the S&P 400 Index by closely approximating its composition. In our view, an investment in a broadly diversified midcap index fund, such as Dreyfus Midcap Index Fund, may help investors in their efforts to manage the risks associated with midcap investing by limiting the impact on the overall portfolio of unexpected losses in any single industry group or holding.

May 15, 2008

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no | |

| guarantee of future results. Share price and investment return fluctuate such that upon redemption, | ||

| fund shares may be worth more or less than their original cost. Return figure provided reflects the | ||

| absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in | ||

| effect that may be extended, terminated or modified. Had these expenses not been absorbed, the | ||

| fund’s return would have been lower. | ||

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital | |

| gain distributions.The Standard & Poor’s MidCap 400 Index is a widely accepted, unmanaged | ||

| total return index measuring the performance of the midsize company segment of the U.S. market. | ||

| 3 | “Standard & Poor’s®,”“S&P®” and “Standard & Poor’s MidCap 400 Index” are trademarks | |

| of The McGraw-Hill Companies, Inc., and have been licensed for use by the fund.The fund is | ||

| not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no | ||

| representation regarding the advisability of investing in the fund. |

The Fund 5

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Midcap Index Fund, Inc. from November 1, 2007 to April 30, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | ||

| assuming actual returns for the six months ended April 30, 2008 | ||

| Expenses paid per $1,000 † | $ 2.40 | |

| Ending value (after expenses) | $929.60 | |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | ||

| assuming a hypothetical 5% annualized return for the six months ended April 30, 2008 | ||

| Expenses paid per $1,000 † | $ 2.51 | |

| Ending value (after expenses) | $1,022.38 | |

† Expenses are equal to the fund’s annualized expense ratio of .50%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

6

| STATEMENT OF INVESTMENTS |

| April 30, 2008 (Unaudited) |

| Common Stocks—96.9% | Shares | Value ($) | ||

| Consumer Discretionary—12.4% | ||||

| 99 Cents Only Stores | 92,295 a | 877,726 | ||

| Advance Auto Parts | 186,550 | 6,469,554 | ||

| Aeropostale | 132,127 a,b | 4,200,317 | ||

| American Eagle Outfitters | 422,250 | 7,756,732 | ||

| American Greetings, Cl. A | 102,995 b | 1,843,610 | ||

| AnnTaylor Stores | 121,140 a | 3,064,842 | ||

| ArvinMeritor | 143,738 b | 2,147,446 | ||

| Barnes & Noble | 89,490 b | 2,888,737 | ||

| Belo, Cl. A | 173,539 | 1,752,744 | ||

| Blyth | 47,650 b | 802,426 | ||

| Bob Evans Farms | 61,194 b | 1,717,716 | ||

| Borders Group | 115,945 b | 730,453 | ||

| BorgWarner | 229,670 b | 11,288,280 | ||

| Boyd Gaming | 110,850 b | 2,078,437 | ||

| Brinker International | 199,749 | 4,532,305 | ||

| Callaway Golf | 130,795 b | 1,797,123 | ||

| Career Education | 178,500 a,b | 3,596,775 | ||

| Carmax | 430,930 a,b | 8,941,797 | ||

| CBRL Group | 43,725 b | 1,615,201 | ||

| Charming Shoppes | 230,300 a,b | 1,188,348 | ||

| Cheesecake Factory | 136,525 a,b | 3,089,561 | ||

| Chico’s FAS | 347,610 a,b | 2,457,603 | ||

| Chipotle Mexican Grill, Cl. A | 65,100 a,b | 6,388,263 | ||

| Coldwater Creek | 118,300 a,b | 631,722 | ||

| Collective Brands | 129,290 a,b | 1,599,317 | ||

| Corinthian Colleges | 167,900 a,b | 1,905,665 | ||

| Corrections Corp. of America | 246,600 a | 6,288,300 | ||

| DeVry | 118,295 b | 6,742,815 | ||

| Dick’s Sporting Goods | 164,300 a,b | 4,698,980 | ||

| Dollar Tree | 181,450 a | 5,733,820 | ||

| Entercom Communications, Cl. A | 51,785 b | 548,921 | ||

| Foot Locker | 304,890 | 3,856,859 | ||

| Furniture Brands International | 95,685 b | 1,296,532 | ||

| Gentex | 284,300 b | 5,310,724 | ||

| Getty Images | 94,100 a | 3,072,365 | ||

| Guess? | 107,900 b | 4,130,412 |

The Fund 7

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | Shares | Value ($) | ||||

| Consumer Discretionary (continued) | ||||||

| Hanesbrands | 187,900 a,b | 6,580,258 | ||||

| Harte-Hanks | 89,580 b | 1,223,663 | ||||

| Hovnanian Enterprises, Cl. A | 72,840 a,b | 860,969 | ||||

| International Speedway, Cl. A | 60,050 | 2,547,321 | ||||

| ITT Educational Services | 58,000 a,b | 4,446,280 | ||||

| John Wiley & Sons, Cl. A | 88,800 b | 4,089,240 | ||||

| Lamar Advertising, Cl. A | 155,400 a,b | 6,144,516 | ||||

| Lear | 152,345 a,b | 4,352,497 | ||||

| Lee Enterprises | 79,150 b | 611,830 | ||||

| Life Time Fitness | 66,500 a,b | 2,417,275 | ||||

| Matthews International, Cl. A | 61,200 b | 3,025,728 | ||||

| MDC Holdings | 69,100 b | 3,011,378 | ||||

| Media General, Cl. A | 45,000 b | 660,600 | ||||

| Modine Manufacturing | 64,470 b | 1,132,738 | ||||

| Mohawk Industries | 109,340 a,b | 8,330,615 | ||||

| NetFlix | 88,200 a,b | 2,820,636 | ||||

| NVR | 10,350 a,b | 6,349,725 | ||||

| O’Reilly Automotive | 227,700 a,b | 6,573,699 | ||||

| Pacific Sunwear of California | 139,600 a,b | 1,872,036 | ||||

| PetSmart | 253,900 b | 5,682,282 | ||||

| Phillips-Van Heusen | 101,300 b | 4,275,873 | ||||

| Regis | 87,000 | 2,540,400 | ||||

| Rent-A-Center | 131,700 a,b | 2,835,501 | ||||

| Ross Stores | 267,400 | 8,955,226 | ||||

| Ruby Tuesday | 102,095 b | 868,828 | ||||

| Ryland Group | 83,400 b | 2,667,132 | ||||

| Saks | 279,770 a,b | 3,639,808 | ||||

| Scholastic | 51,650 a,b | 1,453,948 | ||||

| Scientific Games, Cl. A | 129,100 a,b | 3,635,456 | ||||

| Service Corporation International | 516,700 b | 5,740,537 | ||||

| Sotheby’s | 133,127 b | 3,687,618 | ||||

| Strayer Education | 28,500 b | 5,292,165 | ||||

| Thor Industries | 67,885 b | 2,058,273 | ||||

| Timberland, Cl. A | 96,050 a,b | 1,402,330 | ||||

| Toll Brothers | 253,390 a,b | 5,736,750 | ||||

| Tupperware Brands | 121,640 b | 4,792,616 |

| Common Stocks (continued) | Shares | Value ($) | ||

| Consumer Discretionary (continued) | ||||

| Urban Outfitters | 222,800 a,b | 7,630,900 | ||

| Valassis Communications | 94,830 a,b | 1,346,586 | ||

| Warnaco Group | 89,100 a,b | 4,111,074 | ||

| Williams-Sonoma | 173,725 b | 4,586,340 | ||

| 277,033,075 | ||||

| Consumer Staples—3.1% | ||||

| Alberto-Culver | 167,600 | 4,218,492 | ||

| BJ’s Wholesale Club | 117,754 a | 4,488,782 | ||

| Church & Dwight | 131,014 b | 7,444,215 | ||

| Corn Products International | 145,800 b | 6,762,204 | ||

| Energizer Holdings | 113,450 a,b | 8,969,357 | ||

| Hansen Natural | 119,700 a,b | 4,236,183 | ||

| Hormel Foods | 141,835 b | 5,589,717 | ||

| J.M. Smucker | 109,688 | 5,471,237 | ||

| Lancaster Colony | 41,549 b | 1,586,756 | ||

| NBTY | 110,800 a | 3,119,020 | ||

| PepsiAmericas | 116,835 | 3,002,660 | ||

| Ruddick | 73,380 b | 2,839,806 | ||

| Smithfield Foods | 230,720 a,b | 6,617,050 | ||

| Tootsie Roll Industries | 53,868 b | 1,310,608 | ||

| Universal | 53,666 b | 3,444,821 | ||

| 69,100,908 | ||||

| Energy—10.0% | ||||

| Arch Coal | 284,100 | 16,295,976 | ||

| Bill Barrett | 66,300 a,b | 3,409,809 | ||

| Cimarex Energy | 163,400 b | 10,179,820 | ||

| Denbury Resources | 483,900 a,b | 14,787,984 | ||

| Encore Acquisition | 105,400 a,b | 4,809,402 | ||

| Exterran Holdings | 128,877 a,b | 8,607,695 | ||

| FMC Technologies | 256,502 a,b | 17,236,934 | ||

| Forest Oil | 174,435 a,b | 10,279,455 | ||

| Frontier Oil | 204,300 b | 5,076,855 | ||

| Helmerich & Payne | 204,570 b | 10,995,638 | ||

| Newfield Exploration | 259,470 a | 15,765,397 | ||

| Overseas Shipholding Group | 53,545 b | 4,029,797 | ||

| Patterson-UTI Energy | 304,000 b | 8,493,760 |

The Fund 9

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | Shares | Value ($) | ||||

| Energy (continued) | ||||||

| Pioneer Natural Resources | 235,625 b | 13,602,631 | ||||

| Plains Exploration & Production | 222,651 a | 13,866,704 | ||||

| Pride International | 329,835 a,b | 14,001,496 | ||||

| Quicksilver Resources | 202,800 a,b | 8,414,172 | ||||

| Southwestern Energy | 674,800 a | 28,550,788 | ||||

| Superior Energy Services | 159,400 a,b | 7,074,172 | ||||

| Tidewater | 108,290 b | 7,062,674 | ||||

| 222,541,159 | ||||||

| Financial—15.6% | ||||||

| Affiliated Managers Group | 71,900 a,b | 7,142,546 | ||||

| Alexandria Real Estate Equities | 63,200 b | 6,637,896 | ||||

| AMB Property | 193,250 b | 11,160,187 | ||||

| American Financial Group | 141,281 | 3,873,925 | ||||

| AmeriCredit | 226,145 a,b | 3,156,984 | ||||

| Apollo Investment | 235,400 | 3,808,772 | ||||

| Arthur J. Gallagher & Co. | 181,655 b | 4,463,263 | ||||

| Associated Banc-Corp | 251,293 b | 7,104,053 | ||||

| Astoria Financial | 161,175 | 3,819,847 | ||||

| Bank of Hawaii | 95,155 b | 5,217,349 | ||||

| BRE Properties, Cl. A | 100,600 b | 4,823,770 | ||||

| Brown & Brown | 224,980 b | 4,319,616 | ||||

| Camden Property Trust | 104,000 b | 5,502,640 | ||||

| Cathay General Bancorp | 97,500 b | 1,662,375 | ||||

| City National | 79,687 b | 3,866,413 | ||||

| Colonial BancGroup | 386,875 b | 3,149,163 | ||||

| Commerce Group | 85,600 b | 3,119,264 | ||||

| Cousins Properties | 72,900 b | 1,852,389 | ||||

| Cullen/Frost Bankers | 115,830 b | 6,465,631 | ||||

| Duke Realty | 288,700 b | 7,050,054 | ||||

| Eaton Vance | 228,190 b | 8,351,754 | ||||

| Equity One | 72,900 b | 1,800,630 | ||||

| Everest Re Group | 124,085 | 11,211,080 | ||||

| Federal Realty Investment Trust | 116,000 b | 9,529,400 | ||||

| Fidelity National Financial, Cl. A | 420,670 b | 6,726,513 | ||||

| First American | 181,605 b | 5,956,644 | ||||

| First Community Bancorp | 48,100 b | 1,033,669 | ||||

| First Niagara Financial Group | 206,100 b | 2,974,023 |

10

| Common Stocks (continued) | Shares | Value ($) | ||

| Financial (continued) | ||||

| FirstMerit | 158,850 b | 3,259,602 | ||

| Hanover Insurance Group | 102,485 | 4,599,527 | ||

| HCC Insurance Holdings | 227,510 | 5,614,947 | ||

| Health Care REIT | 175,200 b | 8,488,440 | ||

| Highwoods Properties | 112,830 b | 3,953,563 | ||

| Horace Mann Educators | 80,200 | 1,356,984 | ||

| Hospitality Properties Trust | 185,340 b | 5,954,974 | ||

| IndyMac Bancorp | 159,690 b | 518,993 | ||

| Jefferies Group | 222,660 b | 4,186,008 | ||

| Jones Lang LaSalle | 62,700 b | 4,866,147 | ||

| Liberty Property Trust | 181,650 | 6,363,200 | ||

| Macerich | 142,800 b | 10,442,964 | ||

| Mack-Cali Realty | 129,585 | 5,056,407 | ||

| Mercury General | 70,200 b | 3,502,278 | ||

| Nationwide Health Properties | 188,000 b | 6,771,760 | ||

| New York Community Bancorp | 641,119 | 11,969,692 | ||

| Old Republic International | 454,812 b | 6,526,552 | ||

| PMI Group | 159,560 b | 898,323 | ||

| Potlatch | 77,383 b | 3,467,532 | ||

| Protective Life | 138,645 | 5,909,050 | ||

| Radian Group | 158,205 b | 854,307 | ||

| Raymond James Financial | 189,492 b | 5,451,685 | ||

| Rayonier | 154,773 b | 6,505,109 | ||

| Realty Income | 199,900 b | 5,259,369 | ||

| Regency Centers | 137,300 | 9,826,561 | ||

| SEI Investments | 249,400 b | 5,803,538 | ||

| StanCorp Financial Group | 96,700 | 4,954,908 | ||

| SVB Financial Group | 63,825 a,b | 3,105,725 | ||

| Synovus Financial | 651,400 b | 7,712,576 | ||

| TCF Financial | 214,390 b | 3,730,386 | ||

| UDR | 263,220 b | 6,654,202 | ||

| Unitrin | 102,290 | 3,880,883 | ||

| W.R. Berkley | 307,250 | 7,893,252 | ||

| Waddell & Reed Financial, Cl. A | 170,150 b | 5,761,279 | ||

| Washington Federal | 172,618 b | 4,110,035 | ||

| Webster Financial | 103,530 | 2,696,957 | ||

| Weingarten Realty Investors | 147,200 b | 5,430,208 |

The Fund 11

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | Shares | Value ($) | ||

| Financial (continued) | ||||

| Westamerica Bancorporation | 56,900 b | 3,325,236 | ||

| Wilmington Trust | 133,640 b | 4,394,083 | ||

| 346,837,092 | ||||

| Health Care—11.6% | ||||

| Advanced Medical Optics | 119,776 a,b | 2,515,296 | ||

| Affymetrix | 136,800 a,b | 1,492,488 | ||

| Apria Healthcare Group | 86,400 a,b | 1,522,368 | ||

| Beckman Coulter | 123,764 | 8,453,081 | ||

| Cephalon | 133,500 a,b | 8,331,735 | ||

| Cerner | 131,800 a,b | 6,098,386 | ||

| Charles River Laboratories International | 134,600 a,b | 7,813,530 | ||

| Community Health Systems | 190,715 a | 7,157,534 | ||

| Covance | 126,590 a,b | 10,606,976 | ||

| Dentsply International | 297,900 | 11,579,373 | ||

| Edwards Lifesciences | 111,885 a,b | 6,200,667 | ||

| Endo Pharmaceuticals Holdings | 264,700 a | 6,572,501 | ||

| Gen-Probe | 106,500 a | 6,002,340 | ||

| Health Management Associates, Cl. A | 479,900 b | 3,421,687 | ||

| Health Net | 217,740 a | 6,377,605 | ||

| Henry Schein | 176,900 a,b | 9,794,953 | ||

| Hill-Rom Holdings | 122,800 b | 3,085,964 | ||

| Hologic | 504,284 a,b | 14,720,050 | ||

| Intuitive Surgical | 76,200 a,b | 22,041,612 | ||

| Invitrogen | 91,200 a,b | 8,533,584 | ||

| Kindred Healthcare | 59,000 a,b | 1,400,070 | ||

| Kinetic Concepts | 106,800 a,b | 4,235,688 | ||

| LifePoint Hospitals | 112,000 a,b | 3,373,440 | ||

| Lincare Holdings | 144,450 a | 3,515,913 | ||

| Medicis Pharmaceutical, Cl. A | 111,200 b | 2,290,720 | ||

| Millennium Pharmaceuticals | 641,162 a | 15,945,699 | ||

| Omnicare | 240,365 b | 4,891,428 | ||

| Par Pharmaceutical Cos. | 68,200 a,b | 1,162,810 | ||

| PDL BioPharma | 230,550 a,b | 3,057,093 | ||

| Perrigo | 153,200 b | 6,279,668 | ||

| Pharmaceutical Product Development | 207,300 | 8,586,366 | ||

| Psychiatric Solutions | 108,800 a,b | 3,776,448 | ||

| Resmed | 153,300 a,b | 6,610,296 |

12

| Common Stocks (continued) | Shares | Value ($) | ||

| Health Care (continued) | ||||

| Sepracor | 221,100 a,b | 4,764,705 | ||

| STERIS | 122,445 b | 3,392,951 | ||

| Techne | 77,000 a | 5,584,040 | ||

| Universal Health Services, Cl. B | 102,135 | 6,397,736 | ||

| Valeant Pharmaceuticals International | 179,550 a,b | 2,384,424 | ||

| Varian | 59,800 a,b | 3,045,614 | ||

| VCA Antech | 167,200 a,b | 5,412,264 | ||

| Vertex Pharmaceuticals | 262,450 a,b | 6,697,724 | ||

| WellCare Health Plans | 82,300 a | 3,603,094 | ||

| 258,729,921 | ||||

| Industrial—16.1% | ||||

| AGCO | 180,805 a,b | 10,871,805 | ||

| AirTran Holdings | 180,750 a,b | 616,357 | ||

| Alaska Air Group | 75,137 a,b | 1,613,943 | ||

| Alexander & Baldwin | 81,537 | 4,095,603 | ||

| Alliant Techsystems | 64,700 a,b | 7,115,706 | ||

| AMETEK | 211,476 | 10,260,815 | ||

| Avis Budget Group | 204,410 a | 2,714,565 | ||

| BE Aerospace | 183,700 a | 7,414,132 | ||

| Brink’s | 94,835 | 6,899,246 | ||

| Carlisle Cos. | 118,664 b | 3,427,016 | ||

| CF Industries Holdings | 95,500 | 12,768,350 | ||

| ChoicePoint | 133,971 a | 6,477,498 | ||

| Con-way | 89,485 | 4,138,681 | ||

| Copart | 137,500 a,b | 5,619,625 | ||

| Corporate Executive Board | 68,600 b | 2,988,902 | ||

| Crane | 101,400 | 4,151,316 | ||

| Deluxe | 101,400 b | 2,155,764 | ||

| Donaldson | 139,066 b | 6,054,934 | ||

| DRS Technologies | 81,600 b | 5,095,104 | ||

| Dun & Bradstreet | 111,740 | 9,419,682 | ||

| Fastenal | 247,200 b | 12,065,832 | ||

| Federal Signal | 94,363 b | 1,309,758 | ||

| Flowserve | 113,150 | 14,040,784 | ||

| GATX | 94,496 b | 4,157,824 | ||

| Graco | 120,645 b | 4,995,909 | ||

| Granite Construction | 64,587 b | 2,215,334 |

The Fund 13

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | Shares | Value ($) | ||

| Industrial (continued) | ||||

| Harsco | 166,792 | 9,895,769 | ||

| Herman Miller | 111,750 b | 2,607,128 | ||

| HNI | 87,752 b | 1,910,361 | ||

| Hubbell, Cl. B | 112,365 | 5,026,086 | ||

| IDEX | 161,000 | 5,907,090 | ||

| JB Hunt Transport Services | 169,800 b | 5,768,106 | ||

| JetBlue Airways | 358,425 a,b | 1,806,462 | ||

| Joy Global | 213,000 | 15,815,250 | ||

| Kansas City Southern | 152,200 a,b | 6,861,176 | ||

| KBR | 335,000 | 9,661,400 | ||

| Kelly Services, Cl. A | 44,085 b | 980,891 | ||

| Kennametal | 152,200 | 5,291,994 | ||

| Korn/Ferry International | 91,600 a,b | 1,709,256 | ||

| Lincoln Electric Holdings | 84,800 b | 6,470,240 | ||

| Manpower | 157,255 | 10,556,528 | ||

| Mine Safety Appliances | 57,700 b | 2,144,709 | ||

| MSC Industrial Direct, Cl. A | 93,900 b | 4,578,564 | ||

| Navigant Consulting | 90,200 a,b | 1,814,824 | ||

| Nordson | 66,386 b | 3,918,766 | ||

| Oshkosh | 146,500 b | 5,947,900 | ||

| Pentair | 195,940 b | 7,216,470 | ||

| Quanta Services | 337,580 a,b | 8,959,373 | ||

| Republic Services | 311,467 | 9,901,536 | ||

| Rollins | 83,634 b | 1,332,290 | ||

| Roper Industries | 176,300 b | 10,951,756 | ||

| SPX | 105,195 | 12,938,985 | ||

| Stericycle | 172,700 a,b | 9,218,726 | ||

| Teleflex | 77,175 | 4,251,571 | ||

| Thomas & Betts | 100,940 a | 3,781,212 | ||

| Timken | 189,100 | 6,835,965 | ||

| Trinity Industries | 160,651 b | 4,883,790 | ||

| United Rentals | 149,895 a,b | 2,824,022 | ||

| URS | 164,700 a | 6,643,998 | ||

| Wabtec | 96,100 b | 4,120,768 | ||

| Werner Enterprises | 87,850 b | 1,708,683 | ||

| YRC Worldwide | 112,100 a,b | 1,821,625 | ||

| 358,747,755 |

14

| Common Stocks (continued) | Shares | Value ($) | ||

| Information Technology—12.9% | ||||

| 3Com | 793,800 a,b | 1,897,182 | ||

| ACI Worldwide | 70,950 a,b | 1,567,995 | ||

| Activision | 580,054 a | 15,690,461 | ||

| Acxiom | 133,800 | 1,582,854 | ||

| ADC Telecommunications | 232,300 a,b | 3,256,846 | ||

| ADTRAN | 111,600 b | 2,640,456 | ||

| Advent Software | 35,350 a,b | 1,409,051 | ||

| Alliance Data Systems | 156,150 a,b | 8,964,571 | ||

| Amphenol, Cl. A | 349,400 b | 16,135,292 | ||

| Arrow Electronics | 242,682 a | 6,603,377 | ||

| Atmel | 876,100 a,b | 3,259,092 | ||

| Avnet | 296,783 a | 7,772,747 | ||

| Avocent | 90,150 a,b | 1,758,826 | ||

| Broadridge Financial Solutions | 276,300 | 5,144,706 | ||

| Cadence Design Systems | 549,090 a,b | 6,111,372 | ||

| CommScope | 132,794 a,b | 6,314,355 | ||

| Cree | 172,600 a,b | 4,487,600 | ||

| CSG Systems International | 68,950 a | 834,295 | ||

| Cypress Semiconductor | 301,343 a,b | 8,473,765 | ||

| Diebold | 129,896 | 5,091,923 | ||

| Digital River | 80,100 a,b | 2,631,285 | ||

| DST Systems | 99,650 a,b | 5,963,056 | ||

| Dycom Industries | 80,100 a | 1,151,838 | ||

| F5 Networks | 167,600 a | 3,792,788 | ||

| Fair Isaac | 96,495 b | 2,390,181 | ||

| Fairchild Semiconductor International | 245,775 a | 3,204,906 | ||

| Foundry Networks | 296,100 a,b | 3,769,353 | ||

| Gartner | 128,330 a,b | 2,941,324 | ||

| Global Payments | 156,900 b | 6,944,394 | ||

| Harris | 269,380 | 14,554,601 | ||

| Imation | 61,900 b | 1,450,936 | ||

| Ingram Micro, Cl. A | 293,100 a | 4,985,631 | ||

| Integrated Device Technology | 375,260 a | 4,011,529 | ||

| International Rectifier | 143,090 a,b | 3,256,728 | ||

| Intersil, Cl. A | 250,100 | 6,682,672 | ||

| Jack Henry & Associates | 151,550 b | 3,982,734 | ||

| Kemet | 165,250 a,b | 672,568 |

The Fund 15

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | Shares | Value ($) | ||

| Information Technology (continued) | ||||

| Lam Research | 245,750 a,b | 10,036,430 | ||

| Macrovision | 106,700 a,b | 1,683,726 | ||

| McAfee | 320,305 a | 10,650,141 | ||

| Mentor Graphics | 177,059 a,b | 1,782,984 | ||

| Metavante Technologies | 176,300 a | 4,155,391 | ||

| MPS Group | 188,315 a,b | 2,020,620 | ||

| National Instruments | 113,400 | 3,336,228 | ||

| NCR | 344,800 a | 8,492,424 | ||

| Palm | 210,900 b | 1,214,784 | ||

| Parametric Technology | 228,900 a,b | 3,989,727 | ||

| Plantronics | 96,450 b | 2,402,570 | ||

| Polycom | 173,900 a,b | 3,895,360 | ||

| RF Micro Devices | 575,400 a,b | 1,939,098 | ||

| Semtech | 126,800 a,b | 2,059,232 | ||

| Silicon Laboratories | 104,000 a,b | 3,512,080 | ||

| SRA International, Cl. A | 84,800 a,b | 2,227,696 | ||

| Sybase | 154,860 a,b | 4,555,981 | ||

| Synopsys | 280,000 a | 6,470,800 | ||

| Tech Data | 107,100 a | 3,599,631 | ||

| Triquint Semiconductor | 282,238 a | 1,859,948 | ||

| ValueClick | 193,300 a,b | 3,856,335 | ||

| Vishay Intertechnology | 367,749 a,b | 3,475,228 | ||

| Western Digital | 438,100 a | 12,700,519 | ||

| Wind River Systems | 151,650 a,b | 1,249,596 | ||

| Zebra Technologies, Cl. A | 130,995 a,b | 4,814,066 | ||

| 287,363,885 | ||||

| Materials—6.8% | ||||

| Airgas | 162,795 | 7,835,323 | ||

| Albemarle | 149,700 | 5,600,277 | ||

| AptarGroup | 134,800 | 5,951,420 | ||

| Cabot | 128,440 b | 3,745,310 | ||

| Carpenter Technology | 97,200 | 4,984,416 | ||

| Chemtura | 477,503 | 3,304,321 | ||

| Cleveland-Cliffs | 89,100 b | 14,291,640 | ||

| Commercial Metals | 230,100 | 7,165,314 | ||

| Cytec Industries | 82,800 | 4,886,028 | ||

| Ferro | 86,049 | 1,512,741 |

16

| Common Stocks (continued) | Shares | Value ($) | ||

| Materials (continued) | ||||

| FMC | 148,300 | 9,310,274 | ||

| Louisiana-Pacific | 203,400 b | 2,341,134 | ||

| Lubrizol | 134,988 | 7,872,500 | ||

| Martin Marietta Materials | 81,380 b | 8,901,344 | ||

| Minerals Technologies | 37,650 b | 2,550,411 | ||

| Olin | 147,285 b | 2,970,738 | ||

| Packaging Corp. of America | 181,415 | 3,987,502 | ||

| Reliance Steel & Aluminum | 124,500 | 7,567,110 | ||

| RPM International | 240,383 | 5,360,541 | ||

| Scotts Miracle-Gro, Cl. A | 87,600 b | 2,903,064 | ||

| Sensient Technologies | 94,378 b | 2,809,633 | ||

| Sonoco Products | 196,383 | 6,470,820 | ||

| Steel Dynamics | 372,100 | 12,967,685 | ||

| Temple-Inland | 209,700 b | 2,447,199 | ||

| Terra Industries | 179,100 a,b | 6,780,726 | ||

| Valspar | 197,760 b | 4,346,765 | ||

| Worthington Industries | 130,400 b | 2,348,504 | ||

| 151,212,740 | ||||

| Telecommunication Services—.7% | ||||

| Cincinnati Bell | 490,150 a | 2,274,296 | ||

| NeuStar, Cl. A | 152,700 a,b | 4,200,777 | ||

| Telephone & Data Systems | 210,035 | 8,044,341 | ||

| 14,519,414 | ||||

| Utilities—7.7% | ||||

| AGL Resources | 150,902 | 5,130,668 | ||

| Alliant Energy | 224,249 | 8,447,460 | ||

| Aqua America | 263,323 b | 4,853,043 | ||

| Aquila | 741,920 a | 2,670,912 | ||

| Black Hills | 74,592 b | 2,909,834 | ||

| DPL | 224,230 b | 6,240,321 | ||

| Energen | 141,500 | 9,655,960 | ||

| Energy East | 312,466 b | 7,124,225 | ||

| Equitable Resources | 241,080 b | 16,000,480 | ||

| Great Plains Energy | 170,275 b | 4,365,851 | ||

| Hawaiian Electric Industries | 164,953 b | 4,066,091 | ||

| IDACORP | 88,933 b | 2,884,987 | ||

| MDU Resources Group | 360,062 b | 10,394,990 |

The Fund 17

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Common Stocks (continued) | Shares | Value ($) | ||

| Utilities (continued) | ||||

| National Fuel Gas | 164,824 b | 8,435,692 | ||

| Northeast Utilities | 306,240 | 8,060,237 | ||

| NSTAR | 210,770 b | 6,788,902 | ||

| OGE Energy | 181,151 | 5,921,826 | ||

| ONEOK | 205,415 | 9,884,570 | ||

| PNM Resources | 151,631 b | 2,197,133 | ||

| Puget Energy | 255,900 | 6,963,039 | ||

| SCANA | 230,279 | 9,079,901 | ||

| Sierra Pacific Resources | 461,636 | 6,292,099 | ||

| Vectren | 150,675 b | 4,261,089 | ||

| Westar Energy | 192,905 b | 4,473,467 | ||

| WGL Holdings | 97,640 b | 3,202,592 | ||

| Wisconsin Energy | 230,812 | 10,954,338 | ||

| 171,259,707 | ||||

| Total Common Stocks | ||||

| (cost $1,718,277,562) | 2,157,345,656 | |||

| Principal | ||||

| Short-Term Investments—.2% | Amount ($) | Value ($) | ||

| U.S. Treasury Bills: | ||||

| 1.29%, 7/3/08 | 1,000,000 c | 997,812 | ||

| 2.01%, 5/29/08 | 1,600,000 c | 1,598,594 | ||

| 2.13%, 5/8/08 | 900,000 c | 899,875 | ||

| Total Short-Term Investments | ||||

| (cost $3,494,868) | 3,496,281 | |||

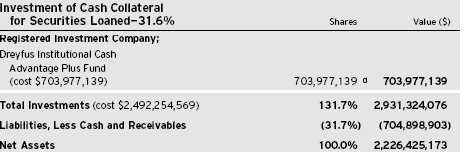

| Other Investment—3.0% | Shares | Value ($) | ||

| Registered Investment Company; | ||||

| Dreyfus Institutional Preferred | ||||

| Plus Money Market Fund | ||||

| (cost $66,505,000) | 66,505,000 d | 66,505,000 | ||

18

| The Fund | 19 |

| STATEMENT OF FINANCIAL FUTURES |

| April 30, 2008 (Unaudited) |

| Market Value | Unrealized | |||||||

| Covered by | Appreciation | |||||||

| Contracts | Contracts ($) | Expiration | at 4/30/2008 ($) | |||||

| Financial Futures Long | ||||||||

| Standard & Poor’s | ||||||||

| Midcap 400 E-mini | 836 | 70,232,360 | June 2008 | 2,930,623 |

See notes to financial statements.

20

| STATEMENT OF ASSETS AND LIABILITIES |

| April 30, 2008 (Unaudited) |

| Cost | Value | |||

| Assets ($): | ||||

| Investments in securities—See Statement of | ||||

| Investments (including securities on loan, | ||||

| valued at $698,087,894)—Note 1(b): | ||||

| Unaffiliated issuers | 1,721,772,430 | 2,160,841,937 | ||

| Affiliated issuers | 770,482,139 | 770,482,139 | ||

| Cash | 1,629,261 | |||

| Dividends and interest receivable | 1,744,324 | |||

| Receivable for shares of Common Stock subscribed | 1,577,064 | |||

| 2,936,274,725 | ||||

| Liabilities ($): | ||||

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | 893,552 | |||

| Liability for securities on loan—Note 1(b) | 703,977,139 | |||

| Payable for shares of Common Stock redeemed | 4,818,282 | |||

| Payable for futures variation margin—Note 4 | 102,314 | |||

| Payable for investment securities purchased | 58,265 | |||

| 709,849,552 | ||||

| Net Assets ($) | 2,226,425,173 | |||

| Composition of Net Assets ($): | ||||

| Paid-in capital | 1,798,470,485 | |||

| Accumulated undistributed investment income—net | 8,362,682 | |||

| Accumulated net realized gain (loss) on investments | (22,408,124) | |||

| Accumulated net unrealized appreciation (depreciation) | ||||

| on investments (including $2,930,623 net | ||||

| unrealized appreciation on financial futures) | 442,000,130 | |||

| Net Assets ($) | 2,226,425,173 | |||

| Shares Outstanding | ||||

| (200 million shares of $.001 par value Common Stock authorized) | 80,080,455 | |||

| Net Asset Value, offering and redemption price per share—Note 3(c) ($) | 27.80 | |||

See notes to financial statements.

The Fund 21

| STATEMENT OF OPERATIONS |

| Six Months Ended April 30, 2008 (Unaudited) |

| Investment Income ($): | ||

| Income: | ||

| Cash dividends: | ||

| Unaffiliated issuers | 14,960,321 | |

| Affiliated issuers | 815,527 | |

| Income from securities lending | 1,916,888 | |

| Interest | 38,255 | |

| Total Income | 17,730,991 | |

| Expenses: | ||

| Management fee—Note 3(a) | 2,749,151 | |

| Shareholder servicing costs—Note 3(b) | 2,749,151 | |

| Directors’ fee—Note 3(a) | 63,863 | |

| Loan commitment fees—Note 2 | 4,277 | |

| Total Expenses | 5,566,442 | |

| Less—Director fees reimbursed | ||

| by the Manager—Note 3(a) | (63,863) | |

| Net Expenses | 5,502,579 | |

| Investment Income—Net | 12,228,412 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | ||

| Net realized gain (loss) on investments | 42,253,770 | |

| Net realized gain (loss) on financial futures | (4,883,004) | |

| Net Realized Gain (Loss) | 37,370,766 | |

| Net unrealized appreciation (depreciation) on investments (including | ||

| $2,429,211 net unrealized appreciation on financial futures) | (228,525,029) | |

| Net Realized and Unrealized Gain (Loss) on Investments | (191,154,263) | |

| Net (Decrease) in Net Assets Resulting from Operations | (178,925,851) | |

See notes to financial statements.

22

STATEMENT OF CHANGES IN NET ASSETS

| Six Months Ended | ||||

| April 30, 2008 | Year Ended | |||

| (Unaudited) | October 31, 2007 | |||

| Operations ($): | ||||

| Investment income—net | 12,228,412 | 28,994,689 | ||

| Net realized gain (loss) on investments | 37,370,766 | 193,108,441 | ||

| Net unrealized appreciation | ||||

| (depreciation) on investments | (228,525,029) | 140,059,922 | ||

| Net Increase (Decrease) in Net Assets | ||||

| Resulting from Operations | (178,925,851) | 362,163,052 | ||

| Dividends to Shareholders from ($): | ||||

| Investment income—net | (26,033,448) | (20,998,329) | ||

| Net realized gain on investments | (207,596,229) | (88,327,491) | ||

| Total Dividends | (233,629,677) | (109,325,820) | ||

| Capital Stock Transactions ($): | ||||

| Net proceeds from shares sold | 272,490,449 | 576,117,327 | ||

| Dividends reinvested | 222,298,819 | 103,680,432 | ||

| Cost of shares redeemed | (347,223,599) | (712,189,070) | ||

| Increase (Decrease) in Net Assets | ||||

| from Capital Stock Transactions | 147,565,669 | (32,391,311) | ||

| Total Increase (Decrease) in Net Assets | (264,989,859) | 220,445,921 | ||

| Net Assets ($): | ||||

| Beginning of Period | 2,491,415,032 | 2,270,969,111 | ||

| End of Period | 2,226,425,173 | 2,491,415,032 | ||

| Undistributed investment income—net | 8,362,682 | 22,167,718 | ||

| Capital Share Transactions (Shares): | ||||

| Shares sold | 9,916,607 | 18,393,370 | ||

| Shares issued for dividends reinvested | 7,791,794 | 3,504,973 | ||

| Shares redeemed | (12,682,075) | (22,774,821) | ||

| Net Increase (Decrease) in Shares Outstanding | 5,026,326 | (876,478) |

See notes to financial statements.

The Fund 23

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| Six Months Ended | ||||||||||||

| April 30, 2008 | Year Ended October 31, | |||||||||||

| (Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||

| Per Share Data ($): | ||||||||||||

| Net asset value, | ||||||||||||

| beginning of period | 33.19 | 29.91 | 27.81 | 24.55 | 22.42 | 17.66 | ||||||

| Investment Operations: | ||||||||||||

| Investment income—net a | .15 | .38 | .28 | .28 | .16 | .13 | ||||||

| Net realized and | ||||||||||||

| unrealized gain (loss) | ||||||||||||

| on investments | (2.41) | 4.36 | 3.23 | 3.87 | 2.18 | 5.07 | ||||||

| Total from Investment | ||||||||||||

| Operations | (2.26) | 4.74 | 3.51 | 4.15 | 2.34 | 5.20 | ||||||

| Distributions: | ||||||||||||

| Dividends from | ||||||||||||

| investment income—net | (.35) | (.28) | (.26) | (.16) | (.12) | (.12) | ||||||

| Dividends from net | ||||||||||||

| realized gain | ||||||||||||

| on investments | (2.78) | (1.18) | (1.15) | (.73) | (.09) | (.32) | ||||||

| Total Distributions | (3.13) | (1.46) | (1.41) | (.89) | (.21) | (.44) | ||||||

| Net asset value, | ||||||||||||

| end of period | 27.80 | 33.19 | 29.91 | 27.81 | 24.55 | 22.42 | ||||||

| Total Return (%) | (7.04)b | 16.45 | 12.95 | 17.14 | 10.50 | 30.05 | ||||||

| Ratios/Supplemental | ||||||||||||

| Data (%): | ||||||||||||

| Ratio of total expenses | ||||||||||||

| to average net assets | .51c | .51 | .50 | .50 | .50 | .51 | ||||||

| Ratio of net expenses | ||||||||||||

| to average net assets | .50c | .50 | .50 | .50 | .50 | .51 | ||||||

| Ratio of net investment | ||||||||||||

| income to average | ||||||||||||

| net assets | 1.11c | 1.20 | .95 | 1.04 | .68 | .69 | ||||||

| Portfolio | ||||||||||||

| Turnover Rate | 8.80b | 22.53 | 16.05 | 19.54 | 14.13 | 12.12 | ||||||

| Net Assets, | ||||||||||||

| end of period | ||||||||||||

| ($ x 1,000) 2,226,425 | 2,491,415 | 2,270,969 | 2,059,222 | 1,526,260 | 1,119,730 | |||||||

| a | Based on average shares outstanding at each month end. | |

| b | Not annualized. | |

| c | Annualized. | |

| See notes to financial statements. | ||

24

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

Dreyfus Midcap Index Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a non-diversified open-end management investment company. The fund’s investment objective is to match the performance of the Standard & Poor’s Midcap 400 Index. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as investment adviser. MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the Distributor of the fund’s shares, which are sold to the public without a sales charge.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered open-end investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a

The Fund 25

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. For other securities that are fair valued by the Board of Directors, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

The Financial Accounting Standards Board (“FASB”) released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements.The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments is recognized on the accrual basis.

Pursuant to a securities lending agreement with Mellon Bank, N.A. (“Mellon Bank”), a subsidiary of BNY Mellon and a Dreyfus affiliate, the fund may lend securities to qualified institutions. It is the fund’s policy, that at origination, all loans are secured by collateral of at least

26

102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or Letters of Credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction.Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended April 30, 2008, Mellon Bank earned $821,523 from lending fund portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

During the current year, the fund adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recog-

The Fund 27

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

nized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority.Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax expense in the current year.The adoption of FIN 48 had no impact on the operations of the fund for the period ended April 30, 2008.

Each of the tax years in the three-year period ended October 31, 2007, remains subject to examination by the Internal Revenue Service and state taxing authorities.

The tax characters of distributions paid to shareholders during the fiscal year ended October 31, 2007 was as follows: ordinary income $22,941,235 and long-term capital gains $86,384,585.The tax character of current year distributions will be determined at the end of the current fiscal year.

NOTE 2—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowing. During the period ended April 30, 2008, the fund did not borrow under the Facility.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a Management Agreement (“Agreement”) with the Manager, the management fee is computed at the annual rate of .25% of the value of the fund’s average daily net assets, and is payable monthly. Under the terms of the Agreement, the Manager has agreed to pay all

28

of the fund’s expenses, except management fees, brokerage commissions, taxes, commitment fees, interest fees and expenses of non-interested Board members (including counsel fees), Shareholder Services Plan fees and extraordinary expenses. In addition, the Manager is required to reduce its fee in an amount equal to the fees and expenses of the non-interested Board members (including counsel fees). Each Board member also serves as a Board member of other funds within the Dreyfus complex (collectively, the “Fund Group”). Currently, the Fund and 13 other funds (comprised of 40 portfolios) in the Dreyfus Family of Funds pay each Board member their respective allocated portion of an annual retainer of $85,000 and an attendance fee of $10,000 for each regularly scheduled Board meeting, an attendance fee of $2,000 for each separate in-person committee meeting that is not held in conjunction with a regularly scheduled Board meeting and an attendance fee of $1,000 for each Board meeting and separate committee meeting attended that are conducted by telephone.The Chairman of the Board receives an additional 25% of such compensation and the Audit Committee Chairman receives an additional $15,000 per annum. The fund also reimburses each Board member for travel and out of pocket expenses in connection with attending Board or committee meetings. Subject to the fund’s Emeritus Program Guidelines, Emeritus Board members, if any, receive 50% of the fund’s annual retainer fee and per meeting fee paid at the time the Board member achieves emeritus status.

(b) Under the Shareholder Services Plan, the fund pays the Distributor for the provision of certain services at the annual rate of .25% of the value of the fund’s average daily net assets.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor deter-

The Fund 29

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

mines the amounts to be paid to Service Agents. During the period ended April 30, 2008, the fund was charged $2,749,151 pursuant to the Shareholder Services Plan.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $446,776 and shareholders services fee $446,776.

(c) Prior to December 1, 2007, 2% redemption fee was charged and retained by the fund on certain shares redeemed within sixty days following the date of issuance, including redemptions made through the use of the fund’s exchange privilege. Effective December 1, 2007, the fund discontinued the redemption fee on shares.The fund reserves the right to reimpose a redemption fee in the future.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and financial futures, during the period ended April 30, 2008, amounted to $193,953,493 and $300,898,275, respectively.

The fund may invest in financial futures contracts in order to gain exposure to or protect against changes in the market. The fund is exposed to market risk as a result of changes in the value of the underlying financial instruments. Investments in financial futures require the fund to “mark to market” on a daily basis, which reflects the change in the market value of the contract at the close of each day’s trading. Accordingly, variation margin payments are received or made to reflect daily unrealized gains or losses.When the contracts are closed, the fund recognizes a realized gain or loss.These investments require initial margin deposits with a broker, which consist of cash or cash equivalents. The amount of these deposits is determined by the exchange or Board of Trade on which the contract is traded and is subject to change. Contracts open at April 30, 2008, are set forth in the Statement of Financial Futures.

30

At April 30, 2008, accumulated net unrealized appreciation on investments was $439,069,507, consisting of $633,022,682 gross unrealized appreciation and $193,953,175 gross unrealized depreciation.

At April 30, 2008, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

In March 2008, the FASB released Statement of Financial Accounting Standards No. 161 “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements.The application of FAS 161 is required for fiscal years beginning after November 15, 2008 and interim periods within those fiscal years. At this time, management is evaluating the implications of FAS 161 and its impact on the financial statements and the accompanying notes has not yet been determined.

The Fund 31

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF |

| THE FUND’S MANAGEMENT AGREEMENT (Unaudited) |

At a meeting of the fund’s Board held on March 4 and 5, 2008, the Board unanimously approved the continuation of the fund’s Management Agreement with Dreyfus for a one-year term ending March 30, 2009.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus. In approving the continuance of the Management Agreement, the Board members considered all factors that they believed to be relevant, including, among other things, the factors discussed below.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members received a presentation from representatives of Dreyfus regarding services provided to the fund and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the fund pursuant to its Management Agreement. Dreyfus’s representatives reviewed the fund’s distribution of accounts and the relationships Dreyfus has with various intermediaries and the different needs of each. Dreyfus’s representatives noted the various distribution channels for the fund as well as the diverse methods of distribution among other funds in the Dreyfus fund complex, and Dreyfus’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including those of the fund. Dreyfus also provided the number of accounts investing in the fund, as well as the fund’s asset size.

The Board members also considered Dreyfus’s research and portfolio management capabilities and Dreyfus’s oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board members also considered Dreyfus’s extensive administrative, accounting and compliance infrastructure.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board members reviewed the fund’s performance and placed significant emphasis on comparisons to a group of

32

mid-cap core funds that are benchmarked against the S&P 400 Index (the “Performance Group”) and to a larger universe of funds, consisting of all retail and institutional mid-cap core funds (the “Performance Universe”) selected and provided by Lipper, Inc., an independent provider of investment company data.The Board was provided with a description of the methodology Lipper used to select the Performance Group and Performance Universe, as well as the Expense Group and Expense Universe (discussed below).The Board members discussed the results of the comparisons and noted that the fund’s total return performance ranked in the second quartile of the Performance Group for the one-, three- and five- year periods, in the second quartile of the Performance Universe for the one- and three- year periods and in the third quartile of the Performance Universe for the two- year period. The Manager also provided a comparison of the fund’s total return to the returns of the fund’s benchmark index for the past ten years noting that the fund’s performance closely tracked the index, with the difference mainly attributable to fund expenses and tracking errors.

The Board members also discussed the fund’s management fee and expense ratio and reviewed the range of management fees and expense ratios as compared to a comparable group of funds (the “Expense Group”) and a broader group of funds (the “Expense Universe”), each selected and provided by Lipper. The Board members noted that the fund’s expense ratio was lower than the Expense Group and slightly higher than the Expense Universe medians for the past three years. Representatives of the Manager noted that the Manager has agreed to pay all of the fund’s direct expenses, except management fees, brokerage commissions, taxes, interest, fees and expenses of non-interested Board members, fees and expenses of independent counsel to the fund and to the non-interested Board members, Shareholder Services Plan fees, and extraordinary expenses. The Manager has also agreed to reduce its management fee in an amount equal to the fund’s allocable portion of the accrued fees and expenses of non-interested Board members and fees and expenses of independent counsel to the fund and to the non-interested Board member.

The Fund 33

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF |

| THE FUND’S MANAGEMENT AGREEMENT (Unaudited) (continued) |

Representatives of Dreyfus reviewed with the Board members the fees paid to Dreyfus or its affiliates by mutual funds and/or separate accounts managed by Dreyfus with similar investment objectives, policies and strategies as the fund (the “Similar Accounts”), and explained the nature of the Similar Accounts and the differences, from Dreyfus’s perspective, as applicable, in providing services to the Similar Accounts as compared to the fund. Dreyfus’s representatives also reviewed the costs associated with distribution through intermediaries. The Board analyzed differences in fees paid to Dreyfus and discussed the relationship of the advisory fees paid in light of Dreyfus’s performance, and the services provided. The Board members considered the relevance of the fee information provided for the Similar Accounts managed by Dreyfus, to evaluate the appropriateness and reasonableness of the fund’s management fees. The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services provided.

Analysis of Profitability and Economies of Scale. Dreyfus’s representatives reviewed the dollar amount of expenses allocated and profit received by Dreyfus and the method used to determine such expenses and profit. The Board members evaluated the profitability analysis in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund investors. The Board members also considered potential benefits to Dreyfus from acting as investment adviser and noted that there were no soft dollar arrangements with respect to trading the fund’s investments.

It was noted that the Board members should consider Dreyfus’s profitability with respect to the fund as part of their evaluation of whether the fees under the Management Agreement bear a reasonable relationship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services and that a discussion of economies of scale is predicated on assets increasing significantly. It also was noted that the profitability percentage for managing the fund was within ranges determined by appropriate court cases to be reasonable given the ser-

34

vices rendered and generally superior service levels provided.The Board also noted the fee waiver and expense reimbursement arrangements in place for the fund and their effect on Dreyfus’s profitability.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to continuation of the fund’s Management Agreement. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by Dreyfus are adequate and appropriate.

- The Board was satisfied with the fund’s total return.

- The Board concluded that the fee paid by the fund to Dreyfus was reasonable in light of the services provided, comparative perfor- mance, expense and advisory fee information, costs of the services provided and profits to be realized and benefits derived or to be derived by Dreyfus from its relationship with the fund.

- The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the manage- ment of the fund had been adequately considered by Dreyfus in connection with the management fee rate charged to the fund and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board members considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that continuation of the fund’s Management Agreement was in the best interests of the fund and its shareholders.

The Fund 35

NOTES

| Item 2. | Code of Ethics. | |

| Not applicable. | ||

| Item 3. | Audit Committee Financial Expert. | |

| Not applicable. | ||

| Item 4. | Principal Accountant Fees and Services. | |

| Not applicable. | ||

| Item 5. | Audit Committee of Listed Registrants. | |

| Not applicable. | ||

| Item 6. | Investments. | |

| (a) | Not applicable. | |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management | |

| Investment Companies. | ||

| Not applicable. | ||

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. | |

| Not applicable. | ||

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Companies and | |

| Affiliated Purchasers. | ||

| Not applicable. [CLOSED END FUNDS ONLY] | ||

| Item 10. | Submission of Matters to a Vote of Security Holders. |

The Registrant has a Nominating Committee (the "Committee"), which is responsible for selecting and nominating persons for election or appointment by the Registrant's Board as Board members. The Committee has adopted a Nominating Committee Charter (the "Charter"). Pursuant to the Charter, the Committee will consider recommendations for nominees from shareholders submitted to the Secretary of the Registrant, c/o The Dreyfus Corporation Legal Department, 200 Park Avenue, 8th Floor East, New York, New York 10166. A nomination submission must include information regarding the recommended nominee as specified in the Charter. This information includes all information relating to a recommended nominee that is required to be disclosed in solicitations or proxy statements for the election of Board members, as well as information sufficient to evaluate the factors to be considered by the Committee, including character and integrity, business and professional experience, and whether the person has the ability to apply sound and

2

independent business judgment and would act in the interests of the Registrant and its shareholders. Nomination submissions are required to be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders, and such additional information must be provided regarding the recommended nominee as reasonably requested by the Committee.

| Item 11. | Controls and Procedures. |

(a) The Registrant's principal executive and principal financial officers have concluded, based on their evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes to the Registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

| Item 12. | Exhibits. |

(a)(1) Not applicable.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dreyfus Midcap Index Funds, Inc.

| By: | /s/ J. David Officer | |

| J. David Officer, | ||

| President | ||

| Date: | June 18, 2008 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ J. David Officer | |

| J. David Officer, | ||

| President | ||

| Date: | June 18, 2008 | |

| By: | /s/ James Windels | |

| James Windels, | ||

| Treasurer | ||

| Date: | June 18, 2008 | |

4

EXHIBIT INDEX

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940. (EX-99.CERT)

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940. (EX-99.906CERT)

5