Exhibit 10.41

EQUITY AND NOTE PURCHASE AGREEMENT

THIS AGREEMENT is entered into as of April 28, 2010 by and between (i) ES Cell Australia Limited, an Australian corporation, whose registered office is at R J Ryan Partners, 12 Langmore Lane, Berwick, Victoria 3806, Australia (“ESCA”); (ii) Pharmbio Growth Fund Pte Ltd, a Singapore private limited company, whose registered office is at 250 North Bridge Road #20-02 Raffles City Tower Singapore 179101 (“PGH”); (iii) Biomedical Sciences Investment Fund Pte Ltd, a Singapore private limited company, whose registered office is at 250 North Bridge Road #20-02 Raffles City Tower Singapore 179101(“BMSIF”) (collectively, the "Principal Vendors"); and (iv) BioTime, Inc., a California corporation, whose registered office is at 1301 Harbor Bay Parkway, Suite 100, Alameda, CA, 94502, United States of America ("Purchaser").

WHEREAS:

(A) ES Cell International Pte Ltd, a Singapore private limited company, whose registered office is at 60 Biopolis Street #01-03 Genome Singapore 138672 (“ESI”) has, as at the date of this Agreement, an issued and paid up share capital of S$18,646,208.08 divided into (i) 6,000,000 Series A1 ESI Preferred Shares (as defined below), 3,334,000 Series A2 ESI Preferred Shares (as defined below) and 3,885,076 Series A3 ESI Preferred Shares (as defined below) (collectively, the “ESI Preferred Shares”); and (ii) 6,300,000 ordinary shares (“ESI Ordinary Shares”).

(B) As at the date of this Agreement, each Principal Vendor is the legal and beneficial owner of the ESI Ordinary Shares and ESI Preferred Shares as set out against its name in Schedule 1 (collectively, the “Principal ESI Shares”). As at the date of this Agreement, BMSIF is the holder of the principal amount of the promissory notes as set out against its name in Schedule 1 (the “Notes”).

(D) The ESI Ordinary Shares owned by the Other Shareholders (as defined below), details of which are set out in Schedule 2 and the Principal ESI Shares comprise, together, the entire issued share capital of ESI. The Notes constitute all of the promissory notes issued by ESI.

(E) ESI has granted certain Options (as defined below) to the Option Holders (as defined below).

(F) The Purchaser has agreed:

(i) to purchase the Principal ESI Shares held by all the Principal Vendors in the aggregate, each fully paid up, on the terms and subject to the conditions, contained in this Agreement;

(ii) to purchase the ESI Ordinary Shares held by all the Other Shareholders in the aggregate, each fully paid up, on the terms and subject to the conditions contained in the Transfer Agreement (as defined below); and

(iii) for the Options to be terminated, on or prior to the Closing Date (as defined below) and for the Option Holders to be allotted and issued BioTime Shares (as defined below), set out against their respective names in Schedule 3, on the Closing Date.

IN CONSIDERATION of the representations, warranties, conditions and covenants contained in this Agreement, and for other valuable consideration, the receipt and adequacy of which is hereby acknowledged by the parties to this Agreement (the “Parties”), the Parties hereto agree as follows:

ARTICLE 1

SALE OF SHARES AND NOTES

1.1 Sale of Principal ESI Shares and Notes; Termination of Options. Each of the Principal Vendors agrees to sell, transfer, assign and convey, as the case may be, to Purchaser, and Purchaser agrees to purchase from the Principal Vendors, the number of Principal ESI Shares, and in the case of BMSIF, the principal amount of Notes, set out against the name of such Principal Vendor in column (1) of Schedule 1. The sale of the Principal ESI Shares shall be together with all rights and advantages attaching to them as at Closing (as defined below) (including the right to receive any and all accrued but unpaid divide nds on or after Closing). The sale of the Notes to Purchaser shall also include the right to receive all interest accrued on the Notes and all rights, title and interest of BMSIF in and to any collateral securing the Notes under the terms of the debenture entered into between BMSIF and ESI dated 20 June 2003, as supplemented by a first supplemental debenture dated 24 November 2005, a second supplemental debenture dated 17 November 2006 and a third supplemental debenture dated 15 January 2009 (collectively, the “ESI Debenture”) on or after Closing. The Parties acknowledge and agree that the Options shall be terminated on or prior to the Closing Date and for the Option Holders to be allotted and issued BioTime Shares, set out against their respective names in Schedule 3, on the Closing Date.

1.2 Waiver of Pre-Emption Rights. Each of the Principal Vendors hereby waives its pre-emption rights under the ESI articles of association (including Articles 22 and 22A thereunder) and the amended and restated shareholders agreement dated 15 January 2009 entered into between inter alia the Principal Vendors and ESI (the “Shareholders’ Agreement”) (including Clauses 7.2 and 7.3 of the Shareholders’ Agreement) or any other document or agreement in respect of the sale by each of the Principal Vendors and the Other Shareholders to the Purchaser of its respective portion of the ESI Preferred Shares and ESI Ordinary Shares, as the case may be, as contemplated by this Agreement and the Transfer Agreement.

1.3 Purchase Price. The purchase price of the Principal ESI Shares and Notes (the "Purchase Price") shall be satisfied by the allotment and issue by Purchaser to the Principal Vendors of common shares, no par value, of Purchaser (the "BioTime Shares"), subject to adjustment as provided in Section 1.7, and warrants to purchase up to 300,000 BioTime Shares (the "Warrant Share s"), at an exercise price of US $10.00 per BioTime Share (the "Warrant"). The number of BioTime Shares allocated to each Principal Vendor, being the Purchase Price attributable to such Principal Vendor, is set out against its name in column (2) of Schedule 1. The Parties agree that the Warrant shall expire four years after the Closing Date and shall be issued on the terms and conditions provided in the Warrant Agreement, in the form attached to this Agreement as Exhibit A. The Parties further agree that the BioTime Shares and the Warrant Shares shall rank pari passu with the issued and outstanding common shares, no par value, of Purchaser, including, in the case of the BioTime Shares, the right to receive all dividends declared and paid after Closing (as defined below) and, in the case of the Warrant Shares, the right to receive all dividends declared and paid after the allotment and issue of the Warrant Shares.

2

In connection with the termination of the Options, the Purchaser shall allot and issue BioTime Shares to the Option Holders. The number of BioTime Shares allocated to each Option Holder is set out against its name in Schedule 3.

1.4 Closing; Closing Date. Subject to Sections 1.10, 5.3, 5.4, and 5.5, the consummation of the purchase and sale of the Principal ESI Shares and Notes ("Closing") shall take place on May 3, 2010 at Allen & Gledhill LLP, One Marina Boulevard #30-00 Singapore 018989 or at such other place and on such other date as Purchaser and the Principal Vendors holding a majority of the ESI Preferred Shares and BMSIF shall mutually agree in writing (the "Closing Date"). At the Cl osing, each Principal Vendor shall transfer, assign, convey and deliver, as the case may be, to Purchaser legal and beneficial title to the Principal ESI Shares and Notes being sold by such Principal Vendor, free and clear of all mortgages, pledges, liens, security interests, conditional sales agreements, leases, indentures, encumbrances, levies, and attachments of third parties or charges of any kind or nature (the “Liens”), save for the security interests created in favor of BMSIF with respect to the Notes pursuant to the ESI Debenture which will be novated to the Purchaser on the Closing Date.

1.5 Escrow. Subject to adjustment under Section 1.7, 90% of the BioTime Shares issuable to the Principal Vendors as set out in column (3) of Schedule 1 shall be issued and delivered to them on the Closing Date as partial payment of the Purchase Price payable with respect to their Principal ESI Shares and Notes, as the case may be, and 10% of the BioTime Shares issuable to them as set out in column (4) of Schedule 1 (the "Escrow Shares") shall be issued and held in escrow by Wells Fargo Bank, National Association ("Escrow Holder") until the later of (i) the expiration of 180 days following the Closing Date (the “Escrow Termination Date”); and (ii) the date on which all claims for setoff under Section 1.7 made before the Escrow Termination Date (the “Escrow Claim”) have been resolved or terminated in accordance with the provisions of this Section 1.5. An Escrow Claim shall not be deemed to have been resolved until (A) the Purchaser and Principal Vendors have both notified the Escrow Holder in writing that the Escrow Claim has been resolved, or (B) the Escrow Claim has been resolved by a final court judgment or arbitration award Provided always that an Escrow Claim that is not the subject of pending litigation or arbitration, or that does not pertain to an unresolved claim by a third party, shall lapse unless the Purchaser commences arbitratio n or other legal proceedings in accordance with Section 7.4 (and in the case of an Escrow Claim against either or both of the BioOne Principal Vendors, by arbitration or legal proceedings being both issued and served) in respect of such Escrow Claim within three months after the Escrow Termination Date failing which such Escrow Claim shall be deemed to have terminated at the expiration of such three month period. No notice requirement under this Section 1.5 shall be deemed to affect the Purchaser's right to indemnification by the Principal Vendors under this Agreement. On or before the Closing Date, Purchaser and the Principal Vendors shall enter into an escrow agreement with Escrow Holder, in the form attached as Exhibit B (the "Escrow Agreement"). The Purchaser and the Principal Vendors agree that the Escrow Agreement shall provide for the delivery of Escrow Shares out of escrow in the manner provided in this Sec tion and in Sections 1.7 and 7.4 of this Agreement. The Parties agree and acknowledge that (i) 100% of the BioTime Shares issuable to the Other Shareholders pursuant to the Transfer Agreement shall be issued and delivered to the Other Shareholders on the Closing Date as full payment of the Purchase Price payable with respect to their ESI Ordinary Shares set out against their names in Schedule 2; and (ii) 100% of the BioTime Shares issuable to the Option Holders pursuant to this Agreement shall be issued and delivered to the Option Holders on the Closing Date in connection with the termination of the Option Holders’ respective Options. The Escrow Agreement shall contain a provision under which the Purchaser and the Principal Vendors agree that, where a resolution of any dispute between the Parties results in an award or judgment from arbitration or any other legal proceeding in accordance with the provisions of Section 7.4, the Escrow Holder shall release the Escrow Shares pursuant to, and following the receipt of, distribution instructions that are consistent with the award or judgment, delivered to the Escrow Holder by the prevailing Party or Parties. If this Agreement terminates without Closing, all Escrow Shares shall be returned to Purchaser.

3

1.6 Indemnification by Principal Vendors. It is expressly understood and agreed by and among Purchaser and the Principal Vendors that the Purchase Price to be paid by Purchaser is determined based on Purchaser's reliance upon the Warranties (as defined in Section 7.16 below). Subject to this Section 1.6, Section 1.7 and the provisions of Schedule 4, the Principal Vendors shall indemnify, defend and hold harmless Purchaser (“Indemnity”) from and against any liability, damage, loss, cost, or expense, including reasonable attor ney fees and expenses (“Losses”) which Purchaser may sustain as a result of a breach or breaches of the Warranties. For the purposes of this Section 1.6, as among BMSIF and PGH (collectively, the “BioOne Principal Vendors”) as Principal Vendors, the Indemnity is given jointly and severally but as among the BioOne Principal Vendors and ESCA, the Indemnity is given severally only and not jointly. The Parties agree that the provisions of Schedule 4 shall operate to limit the liability of each of the Principal Vendors under and in respect of the Indemnity.

1.7 Setoffs. To the extent that Purchaser incurs any Loss as a result of any breach of any Warranty, the portion of the Purchase Price attributable to the relevant Principal Vendors responsible for the breach of such Warranty (and not any other Principal Vendor) (the “Breaching Principal Vendor”) shall be reduced by the amount of such Loss, and each such reduction shall be applied to the portion of the Escrow Shares attributable to such Breaching Principal Vendor (the “R elevant Escrow Shares”) as set out in column (4) of Schedule 1, by return of such number of Relevant Escrow Shares by Escrow Holder to Purchaser, as may be computed in accordance with this Section 1.7. The number of the Relevant Escrow Shares to be returned to Purchaser from the escrow with respect to any Loss shall be the amount of the Loss divided by the volume weighted average closing price of the BioTime Shares on the NYSE Amex (or on such other exchange or over the counter market on which the BioTime Shares may trade if they are then no longer traded on the NYSE Amex) during the five trading days prior to the date of the written request signed by each of the Parties for release of such Relevant Escrow Shares from escrow. The Escrow Holder shall deliver the Relevant Escrow Shares to Purchaser on account of any Loss within 10 business days after receipt of a written request for delivery signed by each of the Parties stating the amount of the Loss and the number of Releva nt Escrow Shares.

4

1.8 Taxes. Purchaser shall pay any and all stamp duty or other taxes arising from the purchase of the Principal ESI Shares and Notes under this Agreement. Purchaser shall be responsible for arranging the payment of such stamp duty and all other such fees, taxes, and duties, including fulfilling any administrative or reporting obligation imposed by the jurisdiction in question in connection with the payment of such taxes and duties. Purchaser shall indemnify each of the Principal Vendors and/or its related corporations against any and all Losses suffered by such Pri ncipal Vendor and/or its related corporations as a result of the Purchaser failing to comply with its obligations under this Section 1.8.

1.9 Registration of BioTime Shares and Warrants. On the Closing Date, Purchaser and the Principal Vendors shall enter into a Registration Rights Agreement, in the form attached as Exhibit C (the "Registration Rights Agreement"), pursuant to which Purchaser shall agree to prepare and file with the United States Securities and Exchange Commission a registration statement registering the BioTime Shares, Warrants, and Warrant Shares for sale under the Securities Act of 1933, as amended (the " Securities Act"), in accordance with the terms and conditions of the Registration Rights Agreement. All costs and expenses incurred for the preparation, filing and/or registration of the BioTime Shares, Warrants and Warrant Shares with respect to this Agreement and to the transactions contemplated by this Agreement shall be borne by Purchaser as provided in the Registration Rights Agreement.

1.10 Minimum Number of ESI Shares and Notes to Be Sold. The Parties agree and acknowledge that the Transfer Agreement (as defined in Section 7.16) shall be executed contemporaneously with the execution of this Agreement. The Parties further agree and acknowledge that the Purchaser shall not be obligated to acquire less than 100% of the ESI Shares (as defined below), and 100% of the Notes, issued on the Closing Date; nor shall Purchaser be obligated to acquire any ESI Shares or Notes subject to any Lien, other than Liens created in favor of BMSIF with respect to the Notes pursuant to the ESI Debenture (the “Excepted Lien”). If any Principal Vendor or Other Shareholder (the “Excepted Holder”) is unable to deliver to Purchaser title and possession of any of the ESI Shares owned by it or Notes held by it free of all Liens (other than the Excepted Lien) (the “Excepted Shares/Notes”), Purchaser shall have the right to exclude from this Agreement the Excepted Shares/Notes and the Purchase Price attributable to such Excepted Holder shall be reduced by an amount equivalent to the Purchase Price attributable to the Excepted Shares/Notes held by such Excepted Holder based on the number of BioTime Shares per ESI Share or Note as set out in Schedule 1.

5

(a) If the total amounts of ESI Shares and Notes that the Principal Vendors and the Other Shareholders are ready, willing, and able to sell, assign, transfer, and convey, as the case may be, to Purchaser at the Closing free and clear of Liens are less than 100%, unless the Purchaser agrees, on Closing, to consummate the purchase of the remaining ESI Shares and Notes at the Purchase Price based on the number of BioTime Shares per ESI Share or Note as set out in Schedule 1, this Agreement shall ipso facto cease and terminate on the Closing Date, and none of the Parties shall have any claim against the other for costs, damages, compensation, or otherwise, save for any claim by the relevant Party arising from any antecedent breaches.

(b) If the Purchaser agrees to exclude the Excepted Shares/Notes or consummate the purchase of the remaining ESI Shares and Notes at the Purchase Price based on the number of BioTime Shares per ESI Share or Note as set out in Schedule 1 pursuant to this Section 1.10, the Purchaser shall not have any claim against those Principal Vendors and Other Shareholders who will sell, assign, transfer, and convey, as the case may be, their ESI Shares and Notes to Purchaser on Closing, in accordance with the provisions of this Agreement.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF PRINCIPAL VENDORS

The provisions of Schedule 4 shall operate to limit the liability of each of the Principal Vendors under and in respect of the Article 2 Warranties (as defined below).

The Principal Vendors make the Article 2 Warranties for the benefit and reliance of Purchaser. As among the BioOne Principal Vendors as Principal Vendors, the Article 2 Warranties are given jointly and severally but as among the BioOne Principal Vendors and ESCA, the Article 2 Warranties are given severally only and not jointly. The Article 2 Warranties shall be true and correct in all material respects on the date of this Agreement and on the Closing Date, as if made on both such dates. The Principal Vendors shall not cause or permit ESI to take any action, or to omit or fail to act, in any manner that would cause any of the Article 2 Warranties to be untrue in any material respect on the Closing Date. Except for Sections 2.1, 2.2, and 2.3, reference to ESI, as used in this Article 2, include ESI and all of its Subsidiaries (as defined below). Subject to this Article 2 and except as set forth in the Schedule of Exceptions attached hereto as Exhibit D (the “Schedule of Exceptions”) delivered to the Purchaser in connection with this Agreement (which Schedule of Exceptions and the statements set forth therein shall be deemed to be part of the Article 2 Warranties made hereunder) and the Disclosure Exceptions (as defined below), each Principal Vendor represents and warrants as follows:

2.1 Organization. ESI is a company duly incorporated and validly existing under the laws of Singapore and has all requisite power and authority to own its property and assets and carry on its business as now being conducted. ESI has lawfully carried on its business in the ordinary course of business so as to maintain the same as a going concern, and since December 31, 2009, there has been no material change in its business.

6

2.2 Capitalization.

(a) ESI has an issued and paid up capital of S$18,646,208.08 comprising 6,300,000 ESI Ordinary Shares and 13,219,076 ESI Preferred Shares consisting of the following series: Series A1, Series A2, and Series A3. There are no shares or other ownership interests of ESI of any other class issued. All of the issued Principal ESI Shares have been legally and validly issued and fully paid. All of the issued Principal ESI Shares are owned beneficially and of record as of the date hereof as set forth in Schedule 2.2(a).

(b) There are no outstanding subscriptions, options, warrants, rights, calls, convertible securities, or other agreements entitling any person or entity to purchase or otherwise acquire any Principal ESI Shares from ESI, nor are there any agreements, contracts, options, or commitments of any character relating to the issued Principal ESI Shares to which the Principal Vendors are parties to. All ESI Shares have been allotted and issued by ESI in compliance with all applicable laws and regulations.

(c) The Notes have been legally and validly issued and are the valid and binding obligations of ESI enforceable in accordance with their terms. The principal balance of each Note and interest accrued as of the last day of the calendar month preceding the date of this Agreement is shown on Schedule 2.2(c). The Notes are secured by the ESI Debenture set out in Schedule 2.2(c).

2.3 Subsidiaries.

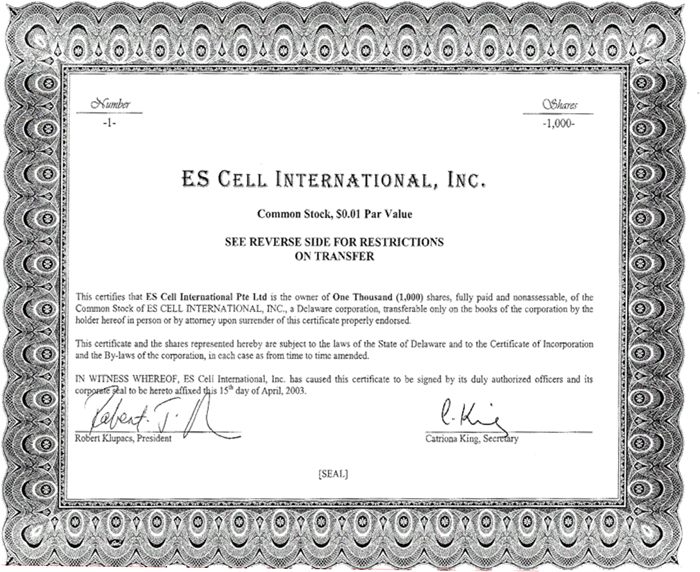

(a) Schedule 2.3(a) shows all of the wholly-owned subsidiaries of ESI (the "Subsidiaries"). Each of the Subsidiaries is a corporation, company, or other business entity duly organized, validly existing, and in good standing under the laws of the United States of America, and has all requisite power and authority to own its property and assets and carry on its business as now being conducted. ESI owns all of the outstanding capital stock or other equity or ownership interests in such Subsidiaries. All of the shares in the Subsidiaries (“Subsidiary Shares”) have been legally and validly issued, fully paid and non-assessab le, and are owned beneficially and of record by ESI, free and clear of Liens. There are no outstanding subscriptions, options, warrants, rights (including preemptive rights), calls, convertible securities, or other agreements entitling any person or entity to purchase or otherwise acquire any Subsidiary Shares from any Subsidiary; nor are there any agreements, contracts, options, or commitments of any character relating to the issued and outstanding Subsidiary Shares of any Subsidiary, except as disclosed in Schedule 2.3(a).

(b) Schedule 2.3(b) shows all of the companies (other than Subsidiaries) in which ESI or any of its Subsidiaries owns shares of capital stock or other equity interests (the "Portfolio Companies"), including the number of shares of capital stock or other equity or ownership interests of each class and series and the percentage of the outstanding shares or other interests represented by such shares or other ownership interests. All of the Portfolio Company shares of capital stock or other equity or ownership interests owned by ESI or the Subsidiaries have been legally and validly issued, fully paid and non-assessable, and are owned beneficially and of record by ESI or the Subsidiaries, free and clear of Liens. There are no outstanding subscriptions, options, warrants, rights (including preemptive rights), calls, convertible securities, other agreements or commitments of any character relating to the issued or unissued capital stock, or other equity or ownership interest of any of the Portfolio Companies, except as disclosed in Schedule 2.3(b).

7

2.4 No Conflict. The execution and delivery of this Agreement, and consummation of the transactions contemplated by this Agreement, do not and will not to the best knowledge of the Principal Vendors: (a) conflict with or result in a breach of any condition or provision, or constitute a default under or pursuant to the terms of any License set out in Schedule 2.12 or Material Contract set out in Schedule 2.17; or (b) result in the creation or imposition of any lien, charge, or encumbrance upon any of the assets or properties of ESI.

2.5 Assets. Other than the Intellectual Property, stem cells, and manufacturing documentation provided to Purchaser, the tangible and intangible assets shown in the Asset List in Schedule 2.5 constitute to the best knowledge of the Principal Vendors all of the relevant assets of ESI in the ordinary conduct of its business as now being conducted. As part of ESI’s business of stem cell distribution, ESI has distributed stem cells to numerous parties under various material transfer agreements, memorandums of understanding and simple letter agreements. Except in relation to the distributed stem cells, ESI has, and on the Closing Date ESI shall have, good and marketable title to such assets, free and clear of all Liens other than Liens securing the Notes.

2.6 Condition of Assets. All plant, machinery, equipment, and vehicles owned or used by ESI and its Subsidiaries are in good repair and condition having regard to their age and use, have been regularly and adequately maintained, and are in working order, and the plant, machinery, equipment, and vehicles owned or used by each of ESI and its Subsidiaries, which are required to be inspected and certified by an accredited body, have been so inspected and certified. Each of ESI and its Subsidiaries’ computer hardware and software has been adequately and appropriately maintained a nd supported and, where reasonable or prudent, has had the benefit of appropriate maintenance and support agreements. All other maintenance contracts are in full force and effect with respect to all assets of each of ESI and its Subsidiaries for which it is normal or prudent to have maintained by independent or specialist contractors and with respect to all assets for which each of ESI and its Subsidiaries is obliged to maintain or repair under any hire purchase, leasing, rental, insurance, or other agreement.

2.7 Patents. Schedule 2.7(a) shows the following information as to each patent; (a) the title; (b) the countries in which each patent owned by ESI was granted or applied for, whether by individual country or through the Patent Cooperation Treaty ("PCT"); (c) corresponding application/grant number; (d) priority date, for each such patent or Patent Application; and (e) the applicant or registered proprietor of the patent or Patent Application. For purposes of this Agreement, "Patent Applica tion" includes all applications, amendments to applications, continuations, divisionals, and continuations in part. Except as disclosed in Schedule 2.7(b), to the best knowledge of the Principal Vendors, none of the patents or Patent Applications listed in Schedule 2.7(a) is currently involved in any interference, inventorship dispute, reissue, reexamination, opposition proceeding, or cancellation proceeding, and ESI has not received any written notice regarding any such proceeding, and to the best knowledge of the Principal Vendors, there is no threatened proceeding of this nature. Except as disclosed in Schedule 2.7(c), ESI has not entered into any contract or agreement granting any person or entity the right to control the prosecution of any of the patents or Patent Applications. Except as disclosed in Schedule 2.7(d), ESI has not opposed any patents filed or owned by any third party.

8

2.8 Trademarks. ESI has not applied for or registered any trade marks.

2.9 Internet Domain Names. Schedule 2.9 shows the following information with respect to all internet domain names that have been filed, registered, or used by ESI: (a) the domain name; (b) the name of the registrar; (c) the date filed/registered; and (d) if not in the English language, the specific language.

2.10 Publications. Schedule 2.10 shows a list of publications which acknowledge ESI. No other warranty is made in relation to these publications.

2.11 Ownership of Intellectual Property. As used in this Agreement, "Intellectual Property" includes all patents, know-how, methods, formulae, trade secrets, compositions of matter, proprietary information, designs, copyrights, and moral rights. In relation to the patents listed in Schedule 2.7(a), ESI has obtained from the inventors, by means of employment contracts, other agreements or contracts of assignments from its current and former employees and consultants who are inventors, or through other means, the right to apply for and obtain the patent rights to the inventions that ESI d oes not already own by operation of law. To the best knowledge of the Principal Vendors, the patents listed in Schedule 2.7(a) are valid and subsisting (or in the case of applications, applied for).

2.12 Licenses. The Licenses referred to in this Agreement are limited to the Licenses shown on Schedule 2.12(a) and constitute all of the currently in force and key contracts, licenses, and agreements entitling ESI to use Intellectual Property owned or licensed by a third party, or entitling third parties to use ESI's Intellectual Property. ESI is not a party to any other currently in-force and key contract, agreement, understanding, or arrangement for the sale, transfer, assignment, sublicense, termination, amendment, or modification of any of the Licenses or any rights therein.&# 160; A current, complete, and accurate copy of each License (including, without limitation, all amendments, supplements, schedules, and exhibits thereto) has previously been delivered to Purchaser. To the best knowledge of the Principal Vendors, each of the Licenses has been duly authorized, executed and delivered by the parties thereto, and each License is the valid and binding agreement of the parties thereto, enforceable in accordance with its terms. Each of the Licenses is in full force and effect. Except as disclosed in Schedule 2.12(b), to the best knowledge of the Principal Vendors there exists no breach or default by ESI to any of the Licenses, and no act, omission, or other event has occurred, which with or without the passage of time or giving of notice, or both, would constitute a breach or default by ESI under any of the Licenses of sufficient materiality to entitle any party to a License to terminate the License or to recover monetary damages against ESI. Ex cept as disclosed in Schedule 2.12(b), to the best knowledge of the Principal Vendors, there are no existing disputes or disagreements of any kind whatsoever between ESI and any licensor or licensee under any of the Licenses.

9

2.13 Royalties and Other Payments. Except as provided in the Licenses the Material Contracts, and the Financial Statements, there are no royalties or other licence fees payable by ESI (other than payments due in the ordinary course of ESI’s business).

2.14 No Infringement. To the best knowledge of the Principal Vendors, there are no suits, proceedings, or claims pending or threatened against ESI which allege any infringement or misappropriation or unauthorized use of any Intellectual Property of any third party. Except as disclosed in Schedule 2.14, to the best knowledge of the Principal Vendors, ESI has not misappropriated or made any unauthorized or infringing use of any Intellectual Property belonging to any third party.

2.15 Unfair Competition. To the best knowledge of the Principal Vendors, ESI has no liability for, and has not engaged in, any practices constituting unfair competition or unfair trade practices, or that are unlawful, under any anti-trust law, or other law or regulation, under the laws of any jurisdiction.

2.16 Confidential Information. ESI has taken all commercially reasonable steps to protect and preserve the confidentiality of all Confidential Information. As used in this Agreement, Confidential Information (defined in Section 6.2) includes all non-public information of any kind (including, but not limited to, trade secrets) belonging to ESI, or belonging to a third party that was obtained by ESI under a License or other agreement with a third party that requires ESI to preserve and maintain the secrecy and confidentiality of the information. ESI's use, disclosure, or approp riation of Confidential Information belonging to a third party has been pursuant to the terms of a written agreement between ESI and such third party or otherwise in accordance with law. All current employees and Option Holders (as defined in Section 7.16) of ESI having access to Confidential Information have agreements with ESI protecting ESI’s Confidential Information or proprietary information. The Principal Vendors do not, to the best of their knowledge, know of any unauthorized or misappropriation of ESI’s Confidential Information by any third party in respect of which ESI has not taken any action.

2.17 Material Contracts. The Material Contracts referred to in this Agreement are limited to the Material Contracts shown on Schedule 2.17(a) and the Licenses. Except for the various agreements for distribution of stem cells made by ESI in the course of its business, legal and audit fees, the Material Contracts and the Licenses constitute all of the currently in-force and key contracts and agreements, to which ESI is a party, that (a) pertain to the purchase and sale of ESI’s stem cell products or ESI’s stem cell lines, (b) require or obligate ESI to pay to any th ird party more than S$25,000 during any calendar year, or (c) entitle ESI to receive from any third party more than S$25,000 during any calendar year. Other than the various agreements for distribution of stem cells made by ESI in the course of its business, ESI is not a party to any other currently in-force and key contract or agreement for the sale, transfer, or assignment of any of ESI’s stem cells or stem cell lines, or rights to use ESI’s stem cells or stem cell lines, except pursuant to the Material Contracts or Licenses. Except as disclosed in Schedule 2.17(b), a current, complete, and accurate copy of each Material Contract (including, without limitation, all amendments, supplements, schedules, and exhibits thereto) has previously been delivered to Purchaser. To the best knowledge of the Principal Vendors, each of the Material Contracts has been duly authorized, executed, and delivered by the parties thereto, and each Material Contract is the valid and bin ding agreement of the parties thereto, enforceable in accordance with its terms. Each of the Material Contracts is in full force and effect. Except as disclosed in Schedule 2.17(c) and 2.12(b), (i) to the best knowledge of the Principal Vendors there exists no breach or default by ESI under any of the Material Contracts, and no act, omission, or other event has occurred which, with or without the passage of time or giving of notice or both, would constitute a breach or default under any of the Material Contracts of sufficient materiality to entitle any party to a Material Contract to terminate such Material Contract or to recover monetary damages against ESI; and (ii) no contract, license, or agreement (a) that pertained to the purchase and sale of ESI’s stem cell products or ESI’s stem cell lines, (b) that required or obligated ESI to pay to any third party more than S$25,000 during any calendar year, or (c) that entitled ESI to receive from any third party more than S$25,000 during any calendar year, has been terminated by another party thereto due to an actual or alleged breach or default by ESI. Except as disclosed in Schedule 2.17(c) and 2.12(b), to the best knowledge of the Principal Vendors there are no existing disputes or disagreements of any kind whatsoever between ESI and any party to a Material Contract or Licence.

10

2.18 Customer Relations. There are no existing disputes or disagreements of any kind whatsoever between ESI and any of the customers for ESI's products, including, but not limited to, disputes or disagreements regarding payments made or owed, or the quality or performance of any product.

2.19 Permits. To the best knowledge of the Principal Vendors, the licenses, permits, certificates, and government authorizations described in Schedule 2.19 (the "Permits") constitute all of the business and industry related licenses, permits, certificates, and government authorizations necessary to legally conduct the business of ESI as now being conducted. Schedule 2.19 discloses as to ESI the Permits held and the jurisdictions that issued the Permits. All of the Permits held by ESI, as reflected on Schedule 2.19, have been legally and validly issued and are, as at Closing, in full force and effect. The consummation of the sale of the ESI Shares to Purchaser will not result in the cancellation or termination of any of the Permits.

2.20 Lease. The lease of ESI's office facility located at 60 Biopolis Street, #01-03 Genome, Singapore 138672 (the "Lease") and the sublease of ESI’s laboratory facility at 20 Biopolis Way #05-05/06 Centros, Singapore 138668 (the “Sublease”) are valid, binding, and enforceable in accordance with their terms, and are in full force and effect. The office and laboratory facilities leased or subleased under the Lease and Sublease respectively are referred to collectively as the “Facilities.” A current, complete, and accurate copy of the Lease and Sublease (including all amendments, supplements, schedules, and exhibits thereto) has previously been delivered to Purchaser. There exists no material subsisting breach or default by ESI and, to the best knowledge of the Principal Vendors, any other party to the Lease or Sublease. The consummation of the sale of the ESI Shares to Purchaser will not result in the cancellation or termination of the Lease or Sublease.

11

2.21 Financial Statements. ESI has provided Purchaser with financial statements and other financial information as follows: (a) audited balance sheets of ESI as at March 31, 2008 and 2009, and an unaudited balance sheet as at March 31, 2010; and (b) audited statements of income and cash flow of ESI for the fiscal years ended March 31, 2008 and 2009, and unaudited statements of income and cash flow for the fiscal year ended March 31, 2010. The financial statements described in (a) and (b) of the preceding sentence are referred to collectively as the "Financial Statements." The Financial Statements are true and fair for the periods presented, and, to the best knowledge of the Principal Vendors, the balance sheets, statements of income, and statements of cash flow were prepared in conformity with international generally accepted accounting principles, consistently applied, and all accounting rules and regulations applicable to such businesses, and in the case of quarterly data, subject only to ordinary and recurring year-end audit adjustments. The balance sheets and statements of income included in the Financial Statements fairly present the financial positions of the business and the results of operations at the dates presented and for the periods then ended. There has not been any material adverse change in the financial condition, assets, liabilities, revenues, or business of ESI, and ESI and its Subsidiaries have not sold or transferred any portion of their respective assets or property that would be material to ESI and its Subsidiaries taken as a whole, except for sales of inventory and transfers of cash in payment of trade payables and other expenses, all in the usual and ordinary course of business. As of March 31, 2010, ESI had no liabilities, indebtedness, or obligations that are not reflected on its March 31, 2010 unaudited balance sheet. None of ESI’s accounts payable or other obligations of payment have been outstanding for more than 90 days since the date payment was due.

2.22 Customers Revenues. Schedule 2.22 is a true and complete schedule showing the distribution of stem cells to each of ESI's customers during the nine months ended December 31, 2009.

2.23 Products; Services; Warrant Claims. To the best knowledge of the Principal Vendors, all products sold, licensed, leased, or delivered by ESI to customers and all services provided by ESI to customers on or prior to the Closing Date pursuant to any Material Contracts conform to applicable contractual commitments and express and implied warranties (to the extent not subject to legally effective express exclusions of warranties), and conform in all material respects to packaging, labeling, advertising, and marketing materials, and to applicable product or service specifications or documentation. ESI has no liability and, to the best knowledge of the Principal Vendors, there is no legitimate basis for any present or future action, suit, proceeding, hearing, investigation, charge, complaint, claim, or demand against ESI giving rise to any material liability relating to the sale of any product or performance of any service by ESI pursuant to any Material Contracts, or for replacement or repair of any product, or other damages in connection with the sale of any product or performance of any service by ESI pursuant to any Material Contracts, in excess of any reserves for such liabilities reflected on the balance sheets included in the Financial Statements.

12

2.24 Funding of ESI. No current government funding, or funding by or facilities of a university, college, other educational institution, or research center, is being used in the development of any ESI Intellectual Property or product. For the purpose of this Agreement, neither BMSIF nor PGH shall be considered to provide government funding.

2.25 Employees. Attached hereto as Schedule 2.25, and made a part of this Agreement, is a complete list of the current employees of ESI, the current salary, vacation, sick leave, bonuses, if any, and other benefits being paid or provided to each such employee (the "Employment Arrangements"). Except as disclosed in Schedule 2.25, ESI has no liability to such employees for any accrued wages, vacation, sick leave, bonuses, or other benefits. A current, complete, and accurate copy of each written employment contract or agree ment (including, without limitation, all amendments, supplements, schedules, and exhibits thereto) pertaining to the current employees engaged in the operation of ESI's business ("Employment Agreements") has previously been delivered to Purchaser. Each of the Employment Agreements has been duly authorized, executed, and delivered by the parties thereto, and each Employment Agreement is the valid and binding agreement of the parties thereto, enforceable in accordance with its terms. Each of the Employment Agreements is in full force and effect. There exists no breach or default by ESI (and, to the best knowledge of the Principal Vendors, any other party to any of the Employment Agreements). Except as disclosed in Schedule 2.25, since December 31, 2009, ESI has not granted any bonus or approved any increase in salary or other benefits to any of its current employees, or amended any Employment Agreements or Emplo yment Arrangements, or entered into any new Employment Agreements or Employment Arrangements. All current employees who require a valid employment pass or other required permit entitling such employee to work in Singapore or elsewhere in the world are in possession of such valid pass or permit.

2.26 Employee Benefit Plans. Except as disclosed in Schedule 2.25, there are no pension, profit sharing, retirement, health insurance, disability, life insurance, stock option, stock ownership, stock purchase, phantom stock, stock appreciation right, or similar compensation or benefit plan (collectively hereinafter referred to as "Employee Benefit Plans") in effect with respect to any of the current employees of ESI.

2.27 Employee Relations. There are no existing disputes or disagreements of any kind whatsoever between ESI and any party to an Employment Arrangement, including, but not limited to, disputes or disagreements regarding compensation or benefits paid or owed, the meaning of any term or provision of an Employment Agreement or other Employment Arrangement, the enforceability or validity of an Employment Agreement or other Employment Arrangement, or the sufficiency or quality of services provided or performed by any person under any of the Employment Agreements or other Employment Arrangements. &# 160;ESI has received no notification from any party to an Employment Agreement to the effect that such party intends to exercise any right to terminate, cancel, or decline to renew any Employment Agreement, and ESI has no reason to believe that any party to an Employment Agreement has any intention to take any such action. ESI has not, to the best knowledge of the Principal Vendors, having made due and careful inquiries, considered dismissing any current management or other current senior employee, and no current manager or current senior employee has given or received notice terminating his or her employment where termination will take effect on or after Closing.

13

2.28 Labor Difficulties. With respect to all current employees of ESI, (i) ESI is in compliance in all material respects with all applicable laws respecting employment and employment practices, terms and conditions of employment, and wages and hours, including, without limitation, any such laws respecting employment discrimination and occupational safety and health requirements, and has received no notice that it is engaged in any unfair labor practice; (ii) there is no unfair labor practice complaint against ESI pending or threatened before any government agency or authority; (iii) none of t he current employees is represented by any union and no negotiations regarding union representation are ongoing; and (iv) no arbitration proceeding arising out of or under any collective bargaining agreement is pending. There are no claims pending, or threatened or capable of arising, against ESI by any of its current or former employees or workmen or third parties, in respect of an accident or injury which is not fully covered by insurance.

2.29 Dividends and Distributions. Except for any dividends and distributions that have been paid in full prior to December 31, 2009, the board of directors of ESI has not (a) declared any dividend or distribution to its shareholders on account of ESI Shares of any class or series, or (b) set any record date for the determination of holders of ESI Shares of any class or series entitled to receive any dividend or distribution.

2.30 Taxes. ESI has filed when due all income tax returns and all other returns with respect to taxes which are required to be filed with the appropriate authorities of the jurisdictions where business is transacted by ESI or any of the Subsidiaries or where ESI or any of the Subsidiaries owns any property. All items and entries provided for or reflected in such returns are correct, are made on a proper basis, and are not subject to adjustment. All amounts, if any, required to be paid, as shown on such returns, and all assessments and all other taxes, governmental charges, pe nalties, interest, and fines due and payable on or before the date of this Agreement, have been paid. There are no suits, actions, claims, investigations, inquiries, or proceedings now pending against ESI in respect of taxes, governmental charges, or assessments; nor are there any matters under discussion with any governmental authority relating to taxes, governmental charges, or assessments asserted by any such authority. Where required under any applicable law, ESI has withheld from each payment made to each of its current and former employees the amount of all taxes required to be withheld therefrom and has paid the same to the proper tax receiving officers. ESI is not a party to or bound by any tax indemnity, tax sharing, or tax allocation agreement. All information furnished to the relevant tax authorities or other governmental authorities in any applicable jurisdictions, in connection with the application by each of ESI or any of the Subsidiaries for any cons ent or clearance, fully and accurately disclosed in all material respects all facts and circumstances material to the decision of each relevant tax authority or other authority. Each of ESI and its Subsidiaries has not taken any action which has had, or will have on Closing, the result of altering, prejudicing, or in any way disturbing any arrangement or agreement which it has previously had with the relevant tax authority. Each of ESI and its Subsidiaries has not engaged in, or been a party to, any transaction or series of transactions, or scheme or arrangement, of which the purpose or effect was or could be said to be the avoidance, or deferral, or a reduction in the liability to, taxation, except as may be permitted by applicable tax law and regulations. To the best knowledge of the Principal Vendors, all documents in the possession or under the control of each of ESI and its Subsidiaries, or the production of which any of ESI or its Subsidiaries is entitled, which (i) are necessary to establish the title of the relevant company to any asset or undertaking and (ii) are subject to stamp duty in Singapore or elsewhere, have been duly stamped.

14

2.31 Litigation; Investigations. There are no lawsuits, actions, claims; or, to the best knowledge of the Principal Vendors, any investigations or inquiries by an administrative agency or governmental body; or any legal, administrative, or arbitration proceedings pending or, to the best knowledge of the Principal Vendors, threatened against ESI or any of its properties, assets, or business; or, to the best knowledge of the Principal Vendors, to which ESI is, or in the case of threatened proceedings might become, a party; or any other lawsuit, action, claim, or proceeding pending, or to the be st of the knowledge of Principal Vendors, threatened against ESI, and which (a) if decided adversely to ESI could result in the loss of any License, Permit, Material Contract, or patent or (b) could lead to (i) the imposition of any adverse prohibitions, conditions, restrictions, limitations, or requirements on the right of ESI to conduct its business in the manner in which such business has been conducted by ESI, (ii) the imposition of any material fine, penalty, or sanction, (iii) the refusal or denial to issue or the cancellation, denial, or refusal to renew any Permit held by ESI or required for the conduct of any aspect of ESI's business, or (iv) to a judgment against ESI requiring ESI to pay damages or other amounts in excess of S$25,000 . The Principal Vendors do not know, and have no grounds to know, of any suit, action, claim, investigation, inquiry, or proceeding described in the preceding sentence; no fine, penalty, or other sanction has been imposed by any judicial, administrative, or regulatory body or government authority against ESI; and there is no outstanding order, writ, injunction, or decree of any court, administrative agency, governmental body, or arbitration tribunal against or affecting ESI or any of its properties, assets, Intellectual Property (owned or used under any License), business, or prospects. ESI and/or its current officers, agents, or employees has not, for the purposes of securing any contract for ESI, given or offered any (i) bribe, (ii) corrupt or unlawful payment or contribution, or (iii) any other corrupt or unlawful inducement.

2.32 Consents. No party has a right to terminate any License, Material Contract, the Lease, or any Permit, or to exercise any right of first refusal or otherwise to purchase, redeem, or otherwise acquire the shares of Cell Cure Neurosciences, Ltd. (Israel) owned by ESI as a result of the sale, transfer, and assignment to Purchaser of the ESI Shares and Notes.

15

2.33 Disclosure. The information furnished or to be furnished by ESI and the Principal Vendors to Purchaser in the Schedules in connection with the transactions contemplated hereby, is, to the best knowledge of the Principal Vendors, true and correct in all material respects.

2.34 Books and Records. The financial books and records of ESI have been prepared and maintained in accordance with generally accepted accounting principles, consistently applied, and give a true and fair view of the assets, liabilities, state of affairs, financial position, and results of operation of ESI.

2.35 Insurance. Schedule 2.35 contains a true and correct list of all material insurance policies (including without limitation, fire and casualty, general liability, theft, life, workers' compensation, managers and officers errors and omissions, and business interruption) that are maintained by ESI or that name ESI as an insured (or loss payee), including without limitation those that pertain to the assets or operations of ESI. All such policies are in full force and effect. No material claim is outstanding by ESI or any of its Subsidiaries under any policy of insurance and, to the best knowledge of the Principal Vendors, there are no circumstances likely to give rise to such a claim. To the best knowledge of the Principal Vendors, nothing has been done or omitted, or has occurred, which could make a policy of insurance taken out by ESI or any of its Subsidiaries void or voidable or is likely to result in an increase in premium.

2.36 Banking and Finance. ESI does not have any bank account (whether in credit or overdrawn) other than its bank accounts at the banks disclosed in Schedule 2.36 and its Financial Statements, and there have been no payments out of or drawings against the said accounts since December 31, 2009, except for payment in the ordinary and proper course of business. Each of ESI and its Subsidiaries does not have any liabilities in the nature of borrowings, or in respect of debentures or negotiable instruments, other than in relation to the Notes and cheques drawn in the ordinary course of busin ess on the aforementioned bank accounts, and other than as disclosed in the Financial Statements. Neither ESI nor any of its Subsidiaries is a party to any loan agreement, facility letter, or other agreement for the provision of credit or financing facilities or any agreement for the sale, factoring, or discounting of debts.

2.37 Insolvency. No order, nor any petition, other application, or resolution has been made, presented, or passed; nor has any meeting convened for the winding-up, judicial management, administration, or receivership of ESI been called or taken place; nor are there any grounds on which any person would be entitled to have ESI wound up or placed under judicial management, administration, or receivership; nor has any person threatened to present such a petition, or convened or threatened to convene a meeting of ESI to consider a resolution, to wind up ESI or any other resolutions; nor has any such s tep been taken in relation to ESI under the law relating to insolvency or the relief of debtors. No receiver, judicial manager, or any other person in similar capacity (including, where relevant, an administrative receiver and manager) has been appointed over the whole or any part of any of the property, assets, and/or undertaking of ESI; and the Principal Vendors are not aware of any grounds on which a petition or an application could be based for the appointment of such a receiver. No composition in satisfaction of the debts of ESI, scheme of arrangement of its affairs, or compromise or arrangement between ESI and its respective creditors and/or members, has been proposed, sanctioned, or approved. No distress, distraint, charging order, garnishee order, execution, or any other process has been levied or applied for in respect of the whole or any part of any of the property, assets, and/or undertaking of ESI. Save as disclosed in the Financial Statements, no mater ial event, or intervention or notice by any third party has occurred, that has or may cause, any floating charge created by ESI to crystallize or to become enforceable, nor has any such crystallization occurred or such enforcement been processed/pursued. To the best knowledge of the Principal Vendors, none of ESI or its Subsidiaries has been a party to any transaction with any third party which, in the event of any such third party going into liquidation, bankruptcy, or related process, would cause any such transaction to be set aside or be voidable at the option of any person.

16

2.38 Contracts, Commitments and Arrangements with Connected Person, etc. Except for the Notes, there are no existing contracts or arrangements to which ESI is a party or where any of the directors of, and/or any person connected with, ESI is interested, whether directly or indirectly. Except for the Notes, there shall not be outstanding, on Closing or during the financial year ended March 31, 2010, any material contracts, agreement, arrangements, or understandings (which are legally binding) between ESI and any person who is the beneficial owner of the ESI Equity, or any person con nected with any such person, relating to (a) the management of the business of ESI, (b) the ownership or transfer of ownership of the ESI Equity, or (c) the provision, supply, purchase, lease, license, or finance of goods, services, Intellectual Property, real property, or the Facilities, or any part thereof, to or by ESI.

2.39 Powers of Attorney. Except for the powers of attorney granted to patent agents for the conduct of patent matters, ESI has not given a power of attorney or any other authority (express, implied, or ostensible) which is still outstanding or effective to any person to enter into any contract, commitment, or obligation, or to do anything on ESI’s behalf, other than any authority to current employees to enter into routine trading contracts in the normal course of their duties.

2.40 Maintenance of Records. To the best knowledge of the Principal Vendors, the statutory books, books of account, and other records of whatsoever kind of ESI are in all material respects up-to-date and maintained in accordance with all applicable legal requirements, and contain in all material respects complete and accurate records of all matters required to be dealt with in such books; all such books and records, and all other documents (including documents of title and copies of all subsisting agreements to which ESI is a party), which are the property of ESI, or ought to be in its possession are in its possession or under its control; and no notice or allegation that any is incorrect or should be rectified has been received. All accounts, documents, and returns required by law to be delivered or made to the Registrar of Companies of Singapore or any other authority have been duly and correctly delivered or made, save for any omissions which are not material.

2.41 Filing of Charges. All charges, pledges, or security arrangements by or in favour of ESI have (if appropriate) been registered in accordance with the provisions of all applicable laws, comply with the necessary formalities as to registration, or otherwise have complied with the laws and formalities of any other relevant jurisdiction. The registered particulars of any charges over assets of ESI are complete and accurate in all respects.

17

2.42 Warranties and Indemnities. ESI has not, or at any time prior to Closing will not have, sold or otherwise disposed of any property, assets, and/or undertakings (other than inventory, trading stock, or other products including cell lines sold, or services provided in the ordinary course of business) in circumstances such that ESI is, or may be, still subject to any liability (whether contingent or otherwise) under any representation, warranty, or indemnity given or agreed to be given (other than representation, warranty, or indemnity given or agreed to be given in respect of inventory or tradi ng stock, cell lines sold, or services provided in the ordinary course of business) on or in connection with such sale or disposal.

2.43 Joint Ventures, Partnerships, etc. ESI is not, and has not agreed to become, a member of any joint venture, consortium, partnership, or other unincorporated association (other than a recognized trade association). ESI is not, and has not agreed to become, a party to any agreement or arrangement of participating with others in any business sharing commissions or other income.

ARTICLE 3

REPRESENTATIONS, WARRANTIES, AND COVENANTS OF PRINCIPAL VENDORS

The provisions of Schedule 4 shall operate to limit the liability of each of the Principal Vendors under and in respect of the Article 3 Warranties (as defined below). As among the BioOne Principal Vendors as Principal Vendors, the Article 3 Warranties are given jointly and severally, but as among the BioOne Principal Vendors and ESCA, the Article 3 Warranties are given severally only and not jointly. The Article 3 Warranties shall be true and correct in all material respects on the date of this Agreement and on the Closing Date, as if made on both such dates.

3.1 Certain Definitions.

(a) Accredited Investor. "Accredited Investor" has the meaning ascribed in Section 501 of Regulation D under the Securities Act.

(b) Regulation S. "Regulation S" means Rules 901 through 905 promulgated by the United States Securities and Exchange Commission under the Securities Act.

(c) United States. "United States" means the United States of America, its territories and possessions, any State of the United States, and the District of Columbia.

(d) U.S. Person. "U.S. Person" means: (i) Any natural person resident in the United States; (ii) any partnership or corporation organized or incorporated under the laws of the United States; (iii) any estate of which any executor or administrator is a U.S. Person; (iv) any trust of which any trustee is a U.S. Person; (v) any agency or branch of a foreign entity located in the United States; (vi) any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. person; (vii) any discretionary account or similar account (other than an estate or t rust) held by a dealer or other fiduciary organized, incorporated, or (if an individual) resident in the United States; and (viii) any partnership or corporation if: (A) organized or incorporated under the laws of any foreign jurisdiction; and (B) formed by a U.S. Person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by Accredited Investors (as defined in the Securities Act) who are not natural persons, estates, or trusts.

18

3.2 Investment Representations. Each Principal Vendor makes the following representations, as to itself, in connection with the acquisition of the BioTime Shares and Warrants:

(a) If the Principal Vendor is a U.S. Person, it is an Accredited Investor and has executed and is delivering to Purchaser an Accredited Investor Certification in the form of Exhibit 3.2(a).

(b) If the Principal Vendor is not a U.S. Person, it has executed and is delivering to Purchaser a Foreign Resident Certification in the form of Exhibit 3.2(b).

(c) The Principal Vendor and its attorneys, accountants, and financial advisors have made such investigation of Purchaser as they have deemed appropriate for determining to acquire (and thereby make an investment in) the BioTime Shares and Warrants; and in making such investigation, they have received copies of the following reports filed by Purchaser with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended (the "Disclosure Documents"): Annual Report on Form 10-K for the year ended December 31, 2009; definitive proxy statement for Purchaser's most recent annual meeting of shareholders; and each Current Report on Form 8-K filed by Purchaser after the filing of its most recent Ann ual Report on Form 10-K. Neither such inquiries nor any other diligence investigation conducted by such Principal Vendor or its attorneys, accountants, and financial advisors shall modify, amend, or affect such Principal Vendor’s right to rely upon the Purchaser’s representations and warranties and covenants contained herein and in the Disclosure Documents.

(d) The Principal Vendor and its attorneys, accountants, and financial advisors have made such investigation of ESI and its subsidiaries as they have deemed appropriate for evaluating their Principal ESI Shares and Notes and for determining to sell their Principal ESI Shares and Notes to Purchaser. In this regard, the Principal Vendor and its attorneys, accountants, and financial advisors have had access to and have received from ESI such financial statements and other information concerning the financial condition, assets, liabilities, revenues, contracts, patents, Patent Applications, business operations, and prospects of ESI and its subsidiaries as they may have requested.

(e) The Principal Vendor understands that the BioTime Shares and Warrants are being offered and sold without registration under the Securities Act or registration or qualification under the California Corporate Securities Law of 1968, the laws of other states of the United States, or under the laws of Singapore, or any other country, in reliance upon the exemptions from such registration and qualification requirements for non-public offerings to U.S. Persons and offerings made to non-U.S. Persons. The Principal Vendor acknowledges and understands that the availability of the aforesaid exemptions depends in part upon the accuracy of certain of the representations, declarations, and warranties contained herein, which the Principal Vendor makes with the intent that they may be relied upon by Purchaser. The Principal Vendor understands and acknowledges that no Singapore, Australian, Israeli, or United States federal, state, or other agency has reviewed or endorsed the offer or sale of the BioTime Shares, Warrants, or Warrant Shares or made any finding or determination as to the fairness of the offering or sale of the BioTime Shares, Warrants, or Warrant Shares.

19

(f) The Principal Vendor understands that each Warrant will bear a legend stating that the Warrant and Warrant Shares to be issued upon the exercise of the Warrant have not been registered under the Securities Act, and that the Warrant may not be exercised by or on behalf of any U.S. Person unless registered under the Securities Act or exempted from such registration.

(g) The Principal Vendor, either alone or together with its attorneys, accountants, and financial advisors, has such knowledge and experience in financial and business matters to enable it to evaluate the merits and risks of an investment in the BioTime Shares, Warrants, and Warrant Shares and to make an informed investment decision with respect thereto.

(h) The Principal Vendor is acquiring the BioTime Shares and Warrants solely for its own account and for investment purposes, and not with a view to, or for sale in connection with, any distribution of the BioTime Shares or Warrants, unless registered under the Securities Act.

(i) It has never been represented, guaranteed, or warranted to the Principal Vendors by Purchaser, or by any officer, director, employee, or agent of Purchaser, that the Principal Vendors will realize any specific value, sale price, or profit as a result of acquiring the BioTime Shares, Warrants, or Warrant Shares.

3.3 Resale Restrictions.

(a) Each Principal Vendor agrees that it will not sell, offer for sale, or transfer any of its BioTime Shares, Warrants, and Warrant Shares in any manner in the United States or to a U.S. Person, unless those BioTime Shares, Warrants, or Warrant Shares have been registered under the Securities Act, or unless there is an exemption from such registration and an opinion of counsel reasonably acceptable to Purchaser has been rendered, stating that such offer, sale, or transfer will not violate any United States federal or state securities laws, and, in the case of a sale by a person who is not a U.S. Person, was made in compliance with Regulation S. Notwithstanding anything herein to the contrary, no registration statement or opinion of counsel shall be required for the transfer of any BioTime Shares or Warrant Shares (i) in compliance with Rule 144 or Rule 144A under the Securities Act, (ii) by a Principal Vendor that is a partnership or a corporation to (A) a partner of such partnership or shareholder of such corporation, (B) a retired partner of such partnership who retires after the date hereof, (C) the estate of any such partner or shareholder, or (iii) by a Principal Vendor to an affiliated fund or entity of such Principal Vendor; provided, however, that in each of the foregoing cases, the transferee agrees in writing to be subject to the terms of this Article to the same extent as if the transferee were an original Principal Vendor hereunder.

20

(b) The certificates evidencing BioTime Shares, Warrants, and Warrant Shares sold to a Principal Vendor who is not a U.S. Person will contain a legend to the effect that transfer is prohibited except in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act, or pursuant to an available exemption from registration; and that hedging transactions involving those securities may not be conducted unless in compliance with the Securities Act.

(c) The certificates evidencing BioTime Shares, Warrants, and Warrant Shares sold to a Principal Vendor who is a U.S. Person will contain a legend to the effect that transfer is prohibited except pursuant to registration under the Securities Act, or pursuant to an available exemption from registration under the Securities Act.

(d) Purchaser will not permit the registration of the transfer of any Warrants, and Purchaser will issue instructions to the transfer agent and registrar of the BioTime Shares and Warrant Shares to refuse to register the transfer of any BioTime Shares or Warrant Shares, not made in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act, or pursuant to an available exemption from registration under the Securities Act.

3.4 Restrictions on Exercise of Warrants by anyone other than a Principal Vendor.

(a) The Warrants may not be exercised unless registered under the Securities Act or an exemption from such registration is available.

(b) Each person exercising a Warrant originally issued to a Principal Vendor who is not a U.S. Person will be required to give: (i) written certification that he or it is not a U.S. person and the Warrant is not being exercised on behalf of a U.S. Person; or (ii) a written opinion of counsel acceptable to the Purchaser to the effect that the Warrant and the Warrant Shares have been registered under the Securities Act or are exempt from registration thereunder.

(c) Unless the Warrant and Warrant Shares have been registered under the Securities Act, each person exercising a Warrant originally issued to a Principal Vendor who is a U.S. Person will be required to certify that such person is an "accredited investor" under the Securities Act or give a written opinion of counsel acceptable to the Purchaser to the effect that exercise of the Warrant and the issuance of the Warrant Shares are exempt from registration under the Securities Act.

3.5 Title to Principal ESI Shares and Notes. The Principal Vendor holds, and at Closing will deliver to Purchaser, legal and beneficial title to the Principal ESI Shares or Notes it is selling to Purchaser, free and clear of all Liens, save for (i) liens arising by operation of law in the normal course of business of ESI; and (ii) the security interests created in favor of BMSIF with respect to the Notes pursuant to the ESI Debenture, which will be assigned to the Purchaser on the Closing Date.

21

3.6 Authority. If the Principal Vendor is an entity rather than a natural person, it has the power and authority to execute and deliver, and to assume and perform all of its obligations under, this Agreement; and, the execution and delivery of this Agreement and the performance of the Principal Vendor's obligations under this Agreement have been duly authorized by Principal Vendor's board of directors, managers, partners, or persons holding comparable authority.

3.7 Enforceability. This Agreement is the valid and binding agreement of the Principal Vendor, enforceable in accordance with its terms, except to the extent limited by any bankruptcy, insolvency, or similar law affecting the rights of creditors generally.

3.8 No Conflict. The execution and delivery of this Agreement, and consummation of the transactions contemplated by this Agreement, including the sale of the Principal Vendor’s Principal ESI Shares or Notes to Purchaser, do not and will not: (a) violate any provisions of (i) any rule, regulation, statute, or law applicable to such Principal Vendor with respect to the sale of the Principal ESI Shares or Notes, or (ii) the terms of any order, writ or decree of any court or judicial or regulatory authority or body by which such Principal Vendor is bound; or (b) conflict with or result in a breach of any condition or provision or constitute a default under or pursuant to the terms of any contract, mortgage, lien, lease, agreement, debenture, bond, or instrument to which the Principal Vendor is a party, or which is binding upon it or him or upon any of its or his assets or property; or (c) result in the creation or imposition of any Lien on its or his Principal ESI Shares or Notes.

3.9 No Litigation. There are no pending or, to the best knowledge of such Principal Vendor, threatened lawsuits or other proceedings, or any basis therefore, challenging the right or authority of the Principal Vendor to enter into this Agreement and to consummate the transactions contemplated by this Agreement.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF PURCHASER

The Purchaser makes the representations and warranties contained in this Article 4 for the benefit and reliance of the Principal Vendors. The representations and warranties in this Article 4 shall be true and correct in all material respects on the date of this Agreement and on the Closing Date, as if made on both such dates. Purchaser hereby represents and warrants to each of the Principal Vendors the following:

4.1 Organization. Purchaser is a corporation duly organized, validly existing and in good standing under the laws of the state of its incorporation, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. Purchaser is not in violation of any of the provisions of its certificate or articles of incorporation, bylaws, or other organizational or charter documents. Purchaser is duly qualified to conduct its business and is in good standing as a foreign corporation or other entity in each jurisdictio n in which the nature of the business conducted or property owned by it makes such qualification necessary.

22

4.2 Authority; Enforceability. Purchaser has the corporate power and authority to execute and deliver, and to assume and perform all of its obligations under, this Agreement, the Registration Rights Agreement, the Warrants, and each of the other agreements entered into by the Parties hereto in connection with the transactions contemplated by this Agreement (together, the “Transaction Documents”). The execution and delivery of this Agreement and the Transaction Documents and the performance by Purchaser of its obli gations hereunder and thereunder have been duly authorized by all necessary action on the part of Purchaser and no further action is required by Purchaser, the Board of Directors of Purchaser, or the stockholders of Purchaser. This Agreement, and each of the Transaction Documents, is the valid and binding agreement of Purchaser, enforceable in accordance with its terms, except to the extent limited by any bankruptcy, insolvency, or similar law affecting the rights of creditors generally.

4.3 No Conflict. The execution and delivery of this Agreement and the Transaction Documents, and consummation of the transactions contemplated hereunder and thereunder, by Purchaser do not and will not (a) violate any provisions of (i) any United States federal or state rule, regulation, statute, or law applicable to Purchaser with respect to the purchase of the Principal ESI Shares and Notes, or (ii) the terms of any order, writ, or decree of any United States federal or state court or judicial or regulatory authority or body by which Purchaser is bound, or (iii) the Articles of Incorporati on or By-laws of Purchaser; and (b) will not conflict with or result in a breach of any condition or provision, or constitute a default under or pursuant to the terms, of any contract, mortgage, lien, lease, agreement, debenture, or instrument to which Purchaser is a party and which is binding upon Purchaser.

4.4 Validity of BioTime Shares and Warrants. The BioTime Shares, when delivered at Closing or from the Escrow, will be duly authorized and validly issued, fully paid and nonassessable, free and clear of all liens and encumbrances. The Warrants, when delivered at Closing, will be duly authorized and validly issued. When issued upon exercise of a Warrant in accordance with the terms of such Warrant, including payment in full of the exercise price, the Warrant Shares will be duly authorized and validly issued, fully paid and nonassessable, free and clear of all liens and e ncumbrances. Purchaser has reserved from its duly authorized capital stock the shares of its common stock issuable upon exercise of the Warrants in order to issue the Warrant Shares.

4.5 Litigation. There is no action, proceeding, or investigation pending, or any basis therefor or threat thereof, which challenges Purchaser’s right to enter into this Agreement, or challenges any action taken or to be taken, by Purchaser in connection with this Agreement.

23

4.6 Breaches. None of Purchaser nor Purchaser’s Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer is aware that, subject to the Schedule of Exceptions, any of the Warranties was untrue or inaccurate as of the date of this Agreement.