UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from___________ to __________

Commission file number 1-12830

BioTime, Inc.

(Exact name of registrant as specified in its charter)

| California | | 94-3127919 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1010 Atlantic Avenue, Suite 102

Alameda, California 94501

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code(510) 521-3390

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | | Name of exchange on which registered |

| Common shares, no par value | | NYSE American |

| Common share purchase warrants expiring October 1, 2018 | | NYSE American |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☐No☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☒No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer☐ | Accelerated filer☒ |

| Non-accelerated filer☐ (Do not check if a smaller reporting company) | Smaller reporting company☐ |

| | Emerging growth company☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes☐ No☒

The approximate aggregate market value of voting common shares held by non-affiliates computed by reference to the price at which common shares were last sold as of June 30, 2017 was $223,153,000. Shares held by each executive officer and director and by each person who beneficially owns more than 5% of the outstanding common shares have been excluded in that such persons may under certain circumstances be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of common shares outstanding as of March 13, 2018 was 126,869,152.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for 2018 Annual Meeting of Shareholders are incorporated by reference in Part III

BioTime, Inc.

Table of Contents

PART I

Statements made in this Form 10-K that are not historical facts may constitute forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those discussed. Words such as “expects,” “may,” “will,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions identify forward-looking statements. See “Risk Factors.”

References to “BioTime”, “we” and “our” means BioTime, Inc. and its subsidiaries and affiliates unless the context otherwise indicates.

The description or discussion, in this Form 10-K, of any contract or agreement is a summary only and is qualified in all respects by reference to the full text of the applicable contract or agreement.

INDUSTRY AND MARKET DATA

This Annual Report (“Report”) on Form 10-K contains market data and industry forecasts that were obtained from industry publications, third party market research and publicly available information. These publications generally state that the information contained therein has been obtained from sources believed to be reliable. While we believe that the information from these publications is reliable, we have not independently verified such information.

This Annual Report on Form 10-K also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this Report from our own research as well as from industry and general publications, surveys and studies conducted by third parties, some of which may not be publicly available. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

Deconsolidation of OncoCyte Corporation Effective February 17, 2017

Effective February 17, 2017, BioTime deconsolidated OncoCyte Corporation (“OncoCyte”) financial statements and results of operations from those of BioTime under applicable generally accepted accounting principles due to the decrease in BioTime’s percentage ownership in OncoCytebelow 50%as a result of the issuance of 625,000 shares of OncoCyte common stock to certain investors who exercised OncoCyte warrants. Prior to that date, OncoCyte was a majority-owned and consolidated subsidiary of BioTime. Since February 17, 2017, BioTime has accounted for OncoCyte using the equity method of accounting, electing the fair value option, with all subsequent changes in fair value included in BioTime’s consolidated statements of operations in other income and expenses, net. As of, and for each reporting period after February 17, 2017, the fair value of BioTime’s interest in OncoCyte is determined by the number of shares of OncoCyte held by BioTime and the closing price of the OncoCyte common stock as quoted on NYSE American: OCX.

OncoCyte’s assets and liabilities are not included in BioTime’s audited consolidated balance sheet at December 31, 2017 due to the deconsolidation. The fair value of OncoCyte shares owned by BioTime is shown on BioTime’s audited consolidated balance sheet as of December 31, 2017. BioTime’s audited consolidated balance sheet at December 31, 2016 includes OncoCyte’s assets and liabilities, after intercompany eliminations. BioTime’s audited consolidated statements of operations for the year ended December 31, 2017 include OncoCyte’s results from January 1, 2017 through February 16, 2017, the day immediately preceding the deconsolidation.

The deconsolidation of OncoCyte is sometimes referred to as the “OncoCyte Deconsolidation” in this Report.

Audited financial statements of OncoCyte for the year ended December 31, 2017 will be included as financial statement schedules in Part IV, Item 15 and will be filed as an exhibit by an amendment to this Report.

Deconsolidation of Asterias Biotherapeutics, Inc. Effective May 13, 2016

Effective May 13, 2016, BioTime deconsolidated Asterias Biotherapeutics, Inc. (“Asterias”) financial statements and results of operations from those of BioTime under applicable generally accepted accounting principles due to the decrease in BioTime’s percentage ownership in Asterias from 57.1% to 48.7% as a result of a sale of common stock by Asterias in a public offering. Prior to that date, Asterias was a majority-owned and consolidated subsidiary of BioTime. Since May 13, 2016, BioTime has accounted for Asterias using the equity method of accounting, electing the fair value option, with all subsequent changes in fair value included in BioTime’s consolidated statements of operations in other income and expenses, net. As of, and for each reporting period after May 13, 2016, the fair value of BioTime’s interest in Asterias is determined by the number of shares of Asterias held by BioTime and the closing price of the Asterias common stock as quoted on NYSE American: AST. Asterias’ assets and liabilities are not included in BioTime’s audited consolidated balance sheet at December 31, 2016 due to the deconsolidation. The fair value of Asterias shares owned by BioTime is shown on BioTime’s consolidated balance sheets as of December 31, 2017 and 2016. BioTime’s audited consolidated statements of operations for the year ended December 31, 2016 include Asterias’ results from January 1, 2016 through May 12, 2016, the day immediately preceding the deconsolidation.Asterias’ results are not included in BioTime’saudited consolidated statements of operations for the year ended December 31, 2017.

The deconsolidation of Asterias is sometimes referred to as the “Asterias Deconsolidation” in this Report.

Audited financial statements of Asterias for the years ended December 31, 2017 and 2016 are included as financial statement schedules in Part IV, Item 15, and are filed as an exhibit to this Report.

For further discussion see the Notes to Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in this Report.

Overview

Overview of Business

BioTime is a clinical-stage biotechnology company targeting degenerative diseases. Our programs are based on two core proprietary technology platforms:cell replacement andcell/drug delivery. With our cell replacement platform, we are creating new cells and tissues with our pluripotent and progenitor cell technologies. These cells and tissues are developed to replace those that are either rendered dysfunctional or lost due to degenerative diseases. Our cell/drug delivery programs are based upon our proprietaryHyStem®cell and drug delivery matrix technology.HyStem®was designed to provide for the transfer, retention, engraftment and metabolic support of cellular replacement therapy.

Our lead cell replacement clinical program isOpRegen®, a retinal pigment epithelium cell replacement therapy, is in a Phase I/IIa, multicenter trial for the treatment of late-stage, dry age-related macular degeneration (dry-AMD). There are currently no FDA-approved therapies for dry-AMD, which accounts for approximately 90% of all age-related macular degeneration cases, and is the leading cause of blindness in people over the age of 60.

Our lead cell delivery clinical program isRenevia®, which met its primary endpoint in a European pivotal clinical trial in patients with HIV-associated facial lipoatrophy. On March 13, 2018 we submitted a design dossier for EU market clearance (CE Mark) for the use ofRenevia®as a device to aid in transferring a patient’s own adipose tissue to treat certain forms of facial lipoatrophy, or fat loss. We believe this European CE Mark submission is a gateway to the much larger, multi-billion dollar market opportunity of cosmetic facial aesthetics.

BioTime's research has created numerous promising technologies. We are creating value for shareholders by developing some of these technologies ourselves through our clinical development programs, while also unlocking the value of others through partnering and strategic transactions. As a result, we have significant equity holdings in two publicly-traded companies, Asterias Biotherapeutics, Inc. (“Asterias”) and OncoCyte Corporation (“OncoCyte”), which we founded and which, until recently, were our majority-owned, consolidated subsidiaries. Asterias (NYSE American: AST) is presently focused on advancing three clinical-stage programs that have the potential to address areas of very high, unmet medical need in the fields of neurology (spinal cord injury) and oncology (acute myeloid leukemia and lung cancer). OncoCyte (NYSE American: OCX) is developing confirmatory diagnostic tests for lung cancer, breast cancer, and bladder cancer utilizing novel liquid biopsy technology. The combined market value of BioTime’s holdings in Asterias and OncoCyte was approximately $95.2 million as of February 28, 2018.

We also have a new majority-owned subsidiary, AgeX Therapeutics, Inc. (“AgeX”), which we formed in 2017 to continue development of early-stage programs focusing on the development of technology relating to cell immortality, regenerative biology, and aging and age-related diseases. AgeX’s initial programs focus on utilizing brown adipose tissue in targeting diabetes, obesity, and heart disease; and induced tissue regeneration (“iTR”) in utilizing the human body’s own abilities to scarlessly regenerate tissues damaged from age or trauma. AgeX has raised more than $10.7 million in equity funding from institutional and private investors, which has allowed BioTime to focus its resources on its clinical programs in its core therapeutic sectors. On August 2, 2017, AgeX initially raised approximately $10.0 million from the sale of its common stock at a price of $2.00 per share. BioTime continues to hold 28.8 million shares of AgeX. Our management and Board of Directors are exploring a number of options for having AgeX become a publicly-traded company, including a potential tax-free pro rata distribution of all AgeX shares to BioTime shareholders.

The technologies being developed by BioTime, our affiliates and our subsidiaries have the potential to significantly improve the treatment of degenerative diseases, which affect large numbers of people. We and our affiliates currently have multiple product candidates in human clinical trials: one met its primary endpoint in a pivotal study in Europe and could be approved by the end of this year, one is a blood test to help diagnose lung cancer, one may be helping spinal cord injury victims regain full or partial use of their hands and one may be the first treatment for the leading cause of blindness in people over 60. We also have several other promising programs that may help to address some of the biggest unmet medical needs faced by the world's aging population.

BioTime is incorporated in the State of California. Our common shares trade on the NYSE American and the Tel Aviv Stock Exchange under the symbol “BTX.” Our principal executive offices are located at 1010 Atlantic Avenue, Suite 102, Alameda, CA 94501, and our phone number at that address is (510) 521-3390. Our website address is www.biotime.com. The information on, or that can be accessed through our website is not part of this Report. We also make available, free of charge through our website, our most recent annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after the reports are electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”).

Overview of Product Candidates Being Developed by BioTime

Pipeline

Our clinical programs are based on two proprietary, core technology platforms:cell/drug deliveryandcell replacement.

The near-term clinical development focus for our two lead clinical programs is in two therapeutic fields:Aesthetics andOphthalmology.

Cell Replacement:

Ophthalmology:

OpRegen®

OpRegen®is our lead ophthalmic product for the treatment of the dry form of age-related macular degeneration. It is a suspension of terminally differentiated retinal pigment epithelial (RPE) cells that are derived from pluripotent cells. RPE cells form the back lining of the retina and support the function of photoreceptors (rods and cones). RPE cells can be damaged and lost in various forms of retinal degeneration. TheOpRegen® therapeutic approach is to replace damaged or lost RPE cells with the goals of slowing disease progression in order to preserve vision, and/or restore visual function.OpRegen®is currently in a Phase I/IIa clinical trial for the treatment of late-stage dry-AMD. Age-related macular degeneration (AMD) affects more than 30 million people worldwide and is the leading cause of blindness in people over the age of 60. Approximately 90 percent of AMD patients suffer from the dry form, also referred to as dry-AMD, for which there is no therapy approved by the United States Food and Drug Administration (FDA). This program is currently being conducted by our 98.8% owned subsidiary Cell Cure Neurosciences, Ltd. (“Cell Cure”). Further references to this program may be described as being conducted by BioTime. More detail onOpRegen® and the trial data to date can be found below under THERAPEUTIC PRODUCT CANDIDATES BEING DEVELOPED BY BIOTIME – Cell Replacement – Ophthalmology—”OpRegen®.”

Retinal restoration

In 2017, we expanded our ophthalmology portfolio through the acquisition of exclusive global rights to technology that allows the generation of three-dimensional human retinal tissue derived from human pluripotent cells. This tissue contains all the cell types and layers of the human retina and has shown evidence of functional integration in proof of concept animal models for advanced retinal degeneration. The technology is being developed to potentially treat or prevent a variety of retinal degenerative diseases and injuries. In 2017, the National Institutes of Health (NIH) awarded us a grant of up to $1.56 million to further develop this innovative, next generation vision restoration program for retinal diseases and injuries, which severely impact the quality of life for millions of people who have limited treatment options.

Cell/Drug Delivery:

Aesthetics:

Renevia®

Renevia®, our lead facial aesthetics product, is being developed as a potential treatment for facial lipoatrophy. “Lipoatrophy” means the loss of fat tissue which may be caused by several factors, including trauma, aging or drug side effects such as those that cause HIV-associated lipoatrophy.Renevia®consists of our proprietary cell and drug delivery matrix (HyStem®) combined with the patient’s own fat or adipose progenitor cells. As a potential alternative to traditional fat transfer procedures,Renevia®is designed to mimic the naturally-occurring extracellular matrix in the body and provide a 3-D scaffold that supports effective cell transplant, retention, engraftment and metabolic support.Renevia® is being developed with the goal of providing a natural looking and feeling, long-lasting option for facial volume restoration. Additional information aboutHyStem® can be found below under TECHNOLOGY PLATFORMS —HyStem® Delivery Technology.

In 2017Renevia®met the primary endpoint of implanted volume retention in a pivotal clinical trial in Europe to assess its safety and efficacy in restoring facial volume in patients whose subcutaneous fat, or adipose tissue, has been lost due to a side effect of certain drugs used to treat some patients with HIV. Based on these clinical trial results, on March 13, 2018 we filed for marketing authorization in the European Union (EU) for certain forms of facial lipoatrophy. We anticipate approval later this year. For more detail onRenevia® and the trial data to date, please see THERAPEUTIC PRODUCT CANDIDATES BEING DEVELOPED BY BIOTIME — Cell/Drug Delivery – Aesthetics – “Renevia®”, below.

We view our European clinical trials ofRenevia® as being supportive of the U.S. development ofRenevia®, for treating facial lipoatrophy, whether from drugs, trauma or aging. A U.S. investigator-led trial ofPremvia™ began in late 2017 for use in the treatment of age-related facial lipoatrophy.Premvia™ has the same composition asRenevia®. Results of this investigator-led trial are expected later this year. A company sponsored exploratory study ofRenevia®for use in treating age-related facial atrophy is expected to commence in Europe later this year.Premvia™, is aHyStem® hydrogel formulation that has already received FDA 510(k) clearance for the management of wounds, including partial and full-thickness wounds, ulcers, tunneled/undermined wounds, surgical wounds, and burns.

Other Cell/Drug Delivery:

We are also developingHyStem® for the delivery of therapeutic drugs and cells to localized areas of the body, including for sustained drug release in the targeted area.

ReGlyde™

ReGlyde™ is anotherHyStem® product in preclinical development as a device for viscosupplementation and as a platform for intraarticular drug delivery in osteoarthritis (OA). The viscosupplementation device program aims to administerReGlyde™ directly into OA affected joints to provide joint lubrication to reduce pain and improve quality of life. The drug delivery program seeks to enable the sustained release of therapeutics in affected OA joints to help slow or reverse disease progression, in addition to alleviating pain and improving joint function.

Products for Orthopedic Indications

We are developing a bone grafting product under a research and development agreement and a licensing agreement with Heraeus Medical GmbH. The goal of this program is to develop innovative bone grafting products that could potentially address difficult to heal or compromised bone fractures based on the use of our proprietaryPureStem® progenitor cell technology. This program is currently being conducted by our 99.8% owned subsidiary OrthoCyte Corporation (“OrthoCyte”), as such, further herein, references to this project may be described as being conducted by BioTime.

Products Enhancements

As part of our therapeutic and delivery program, we are also developingHyStem® product enhancements, including a frozen liquid product format, which, if successful, will makeHyStem® products significantly easier for physicians to administer.

Overview of Product Candidates of Public Affiliates

Asterias is a clinical-stage biotechnology company dedicated to developing cell-based therapeutics to treat neurological conditions associated with demyelination and cellular immunotherapies to treat cancer. OncoCyte is developing confirmatory diagnostic tests for lung cancer, breast cancer, and bladder cancer utilizing novel liquid biopsy technology. The combined market value of BioTime’s holdings in Asterias and OncoCyte was approximately $95.2 million as of February 28, 2018.

Therapeutic Products in Neurology and Oncology

Asterias currently has three clinical programs:

| | ● | AST-OPC1 is an oligodendrocyte progenitor cell population derived from pluripotent stem cells that is currently in a Phase I/IIa clinical trial for spinal cord injuries (“SCI”) that has been partially funded by the California Institute for Regenerative Medicine; |

| | ● | AST-VAC2 is a non-patient-specific (“off-the-shelf”) cancer immunotherapy derived from pluripotent stem cells for which a clinical trial in non-small cell lung cancer is being funded and sponsored by Cancer Research UK, the world’s largest independent cancer research charity; and |

| | ● | AST-VAC1 is a patient-specific cancer immunotherapy which has generated positive Phase 2 data in the treatment of Acute Myeloid Leukemia (“AML”). |

Liquid Biopsies for Diagnosis of Cancer

Our affiliate OncoCyte is focused on the discovery, development, and commercialization of innovative, biopsy tests that improve diagnosis and reduce healthcare costs for some of the most common and deadly cancers. They are developing confirmatory diagnostic tests for areas of high unmet need including lung cancer, breast cancer, and bladder cancer utilizing novel liquid biopsy technology. While current biopsy tests use invasive surgical procedures to provide tissue samples to determine if a tumor is benign or malignant, OncoCyte is developing a next generation of diagnostic tests that will be based on liquid biopsies using blood or urine samples.

Overview of AgeX Product Candidates

AgeX is applying technology relating to cellular immortality and regenerative biology to aging and age-related diseases. AgeX has three initial areas of product development:

| | ● | AGEX-BAT1 consists of pluripotent stem cell-derived brown adipocytes is initially planned to be developed as a potential treatment for type 2 diabetes; |

| | | |

| | ● | AGEX-VASC1 consists of vascular progenitors that will be targeting cardiac ischemia; and |

| | | |

| | ● | iTR (induced Tissue Regeneration), which is being designed as a systemic therapy for inducing the scarless regeneration of tissues. |

Strategy

As we transition into a clinical and commercial-ready company, our near-term focus continues to be on three primary objectives: Clinical Progress, Simplification and Unlocking Value.

Clinical Progress

Our efforts are focused on progressing our therapeutic products through clinical development. Our organizational capabilities are being aligned to execute on this objective to better position us to design, execute and oversee trials, with the goal of generating significant value-creating data in the near-term, and enabling future commercialization of our product candidates. Clinical progress success will allow the company to create greater value for our shareholders, as well as allow us to better resource several other programs that are based on our core technologies.

Simplification

Because our research created numerous promising technologies that we developed in part through a range of subsidiaries and partnership relationships, BioTime's structure became complex over time. Over the last two years we have focused on simplification.We will continue to work on simplifying our corporate, financial and organizational structure to allow us to execute our objectives more efficiently, while also making it much easier for shareholders and potential investors to better understand our company.

Unlocking Value

Our purpose is to deliver therapies to patients with significant unmet, or under-met, needs, while creating value for our investors. BioTime’s research has created numerous valuable technologies. We are creating value for shareholders by developing some of these technologies ourselves through our clinical development programs while unlocking the value of others through the execution of various strategies, including partnering, sale of non-core assets, creation of companies, spinoffs, and the implementation of our simplification plans. We expect to continue to do so when we deem it in the best interest of our shareholders.

Technology Platforms

Cell Replacement Technology:

BioTime believes that it and its subsidiaries and affiliates have the world’s premier collection of pluripotent cell assets. Pluripotent cells, which we believe are capable of becoming any of the cell types of the human body, have potential applications in many areas of medicine with large unmet patient needs, including various age-related degenerative diseases and degenerative conditions for which there are presently no cures. Unlike pharmaceuticals that require a molecular target, therapeutic strategies based on the use of pluripotent cells are generally aimed at regenerating or replacing affected cells and tissues, and therefore, may have broader applicability than many pharmaceutical products. Pharmaceuticals and therapies that require systemic delivery into the body often have unexpected results, or side effects, that can limit the usefulness on the particular therapy. Many times, the side effects are so detrimental that the therapy cannot be approved. Cell replacement, on the other hand, is locally administered, so systemic side effects are not a primary concern in therapeutic development. The risk profile more closely resembles that of transplant medicine, focused more on whether the transplanted cells are rejected by the body and whether the cells do what they are expected to do. | |  |

BioTime has two proprietary cell therapy platforms,PureStem® progenitor cells and pluripotent cell lines.PureStem®cells address significant challenges in regenerative medicine through their purity, proliferative capacity and ability to better predictably acquire tissue specificity or “differentiate,” into a broad spectrum of cell types in a simplified and controlled fashion. These advantages may allow the production, on a commercial scale, of pure cultures of potentially therapeutic cell types that do not contain uncharacterized “undifferentiated” cell types. The pluripotent cell lines derived under current Good Manufacturing Practice (cGMP) conditions, are NIH-registered and are among the best-characterized and documented human stem cell lines available today, with donor medical history, adventitious agents testing, complete genome sequence, STR-fingerprint and HLA-type data available.

HyStem®Delivery Technology:

| HyStem®is a patented biomaterial that mimics the extracellular matrix, the structural network of molecules surrounding cells in organs and tissues that is essential to cellular function and tissue integrity. Many tissue engineering and regenerative cell-based therapies will require the delivery of therapeutic cells in a matrix or scaffold for accurate anatomical delivery, cell retention and engraftment, guided tissue remodeling and proper function.HyStem® is a unique hydrogel that has been shown to support cellular attachment and proliferationin vivo. Current research at leading medical institutions has shown thatHyStem®is compatible with a wide variety of cells and tissue types including brain, bone, skin, cartilage, vascular and heart tissues. |

| | The patented technology underlying ourHyStem® hydrogel products in development, such asRenevia®, Premvia® andReGlyde™, was developed at the University of Utah and has been exclusively licensed to BioTime for human therapeutic uses. TheHyStem® technology is based on a unique thiol cross-linking chemistry to prepare hyaluronan-based hydrogels. Since the first published report in 2002, there have been over 200 academic scientific publications supporting the biocompatibility of thiol cross-linked hyaluronan-based hydrogels and their applications as medical devices and in cell culture, tissue engineering, and animal models of cell-based therapies. |

| | Due to the unique cross-linking chemistry,HyStem® hydrogels have the ability to mix cells and can be injected or applied as a gel which allows the hydrogel to conform to a cavity or space. This property ofHyStem®hydrogels offers several distinct advantages over other hydrogels, including the possibility of combining bioactive materials with the hydrogel at the point of use. Building upon this platform, we are developing theHyStem®family of unique, biocompatible resorbable hydrogel products. |

Therapeutic Product Candidates Being Developed By BioTime

Cell Replacement

Ophthalmology

OpRegen®

| | |  |

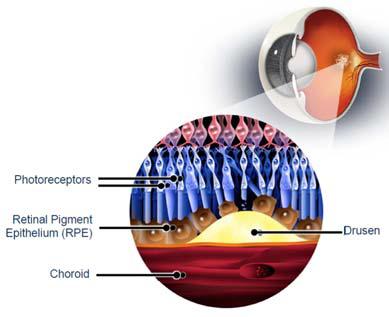

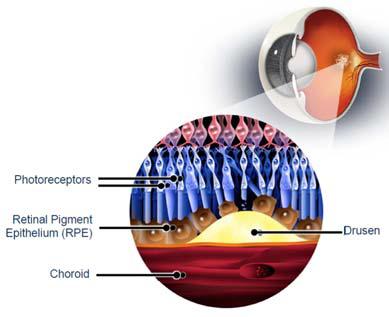

| Age-related macular degeneration, also known as “AMD”, is a gradual, progressive, deterioration of the macula, the small sensitive area in the center of the retina that provides clear central vision. Damage to the macula makes facial recognition, reading and driving difficult or impossible. There are two forms of AMD, the dry form and the wet form. The dry form, or “dry-AMD”, advances slowly toward geographic atrophy (GA) in which RPE cells and photoreceptors degenerate, or are lost. Once the atrophy involves the fovea (the center of the macula), patients lose their central vision and may develop into legal blindness. Its cause is unknown. It tends to progress more slowly than the wet type, and there is not an approved treatment or cure, other than nutritional supplements, which have shown limited efficacy in longer-term studies. | |

| | |

AMD affects more than 30 million people worldwide and approximately 1.6 million people are newly diagnosed annually in the U.S. It is the leading cause of vision loss in people over the age of 60. Approximately 90 percent of AMD patients suffer from the dry form, for which there are no FDA approved medical therapies.

We believe one of the most promising future therapies for dry-AMD is the replacement of the layer of damaged RPE cells that support and nourish the retina.

| | Our lead ophthalmology product,OpRegen®, is a cell replacement therapy derived from our pluripotent cell technology. It is currently in a Phase I/IIa clinical trial for the treatment of dry-AMD.OpRegen® is a proprietary formulation of RPE cells developed to be transplanted into the patient’s eye, where the patient’s own RPE cells are missing or compromised.OpRegen® consists of animal-free RPE cells with high purity and potency using a proprietary directed differentiated method.OpRegen® is formulated as a suspension of RPE cells and it was developed to address the significant unmet medical need of people suffering from dry aged-related macular degeneration. |

| | | |

Preclinical studies in rats have shown that following a single subretinal injection ofOpRegen® as a suspension of cells, the cells rapidly organized into their natural monolayer structure and survive throughout the lifetime of the rat, which we believe is critical to the potential success ofOpRegen®in humans.

OpRegen®is intended to be an allogeneic, “off-the-shelf,” product provided to retinal surgeons in an “easy-to-use” form for transplantation. Unlike other investigational treatments for dry-AMD, and currently-marketed treatments for wet-AMD (Ranibizumab (Lucentis®) and Aflibercept (Eylea®)), that require multiple, frequent injections into the eye, we expectOpRegen® would potentially be administered in a single procedure, or once every several years.

The patients in our current Phase I/IIa study are or will be 50 years of age or older, whose dry-AMD has advanced to the GA stage, with absence of additional concomitant ocular disorders. The eye in which the disease has progressed the most will be treated, while the other eye will serve as a control. Following injection, the patients will be followed for 12 months at specified intervals, to evaluate the safety and tolerability ofOpRegen®. Currently there are four study sites in Israel and two sites in the U.S. Enrollment in the third cohort was completed in January 2018. Cohort 4 enrollment is expected to begin in the second quarter of 2018. The fourth cohort will also include patients with better vision and a wide range of preliminary functional assessments, such as best corrected visual acuity.

Following the initial 12-month period, patients will continue to be evaluated at longer intervals for up to an additional five years following injection. A secondary objective of the clinical trial will be to examine the ability of transplantedOpRegen® to engraft, survive, and modulate disease progression in the patients. In addition to thorough characterization of visual function, several vision tests will be used to quantify improvements in reducing the progression of the disease.

Interim data from the nine subjects, with large areas of GA treated in Cohorts 1-3, represent an initial review of this ongoing Phase I/IIa open-label study and suggest that RPE cells are generally well-tolerated when administered by subretinal injection. Findings using a variety of imaging modalities suggest presence of cells in the subretinal space, an observation that is consistent with, and supported by, the data from the preclinical studies ofOpRegen®. The surgical procedures were generally well-tolerated, with spectral domain optical coherence tomography (SD-OCT) images showing absorption of the subretinal fluid in the bleb within less than 48 hours after surgery and healing of the site of retinal penetration by the cannula within a few weeks. Fundus findings on clinical examination and by different imaging modalities evolved over the first few weeks and months, then largely stabilized. Best corrected visual acuity (BCVA) has remained stable in both the treated and fellow eyes of these advanced AMD patients. Subretinal pigmentation that correlates with irregular subretinal hyperreflectance on SD-OCT have been observed, suggesting the presence of cells in the subretinal space. Though it is not definitively known at this time whether these changes represent engraftment and survival of the transplanted cells, data from the preclinical studies suggest this is the most likely scenario.

Importantly, in this safety-focused study, no unexpected ocular AEs have been observed and those events expected to occur based on the procedures involved inOpRegen® administration, such as vitrectomy, have been mild in severity. The majority of these subjects had pre-existing epiretinal membranes (ERMs) at the time of study enrollment and several have experienced new or worsening ERM following the surgical procedure andOpRegen® injection. These subjects are being monitored during study follow-up, however, none have required surgical intervention to date. The independent data safety monitoring board (DSMB) has approved moving to the 4th Cohort based on the safety data from the first 3 cohorts. Cohort 4 will incorporate an additional variety of objective and subjective assessments to look for signs of potential efficacy as well as potential anatomical changes indicative ofOpRegen® cell function following implantation.

We are currently actively enrolling additional subjects at a number of clinical trial sites in the United States and Israel. We currently have two active clinical trial sites the U.S. Both sites are headed by well-renowned physicians, David S. Boyer, MD of Retina-Vitreous Associates in Los Angeles and Dr. H. Richard McDonald of West Coast Retina Medical Group in San Francisco. We expect to open additional clinical trial sites in the U.S. later this year.

We have established an innovative cell therapy manufacturing facility located in the Jerusalem Bio Park on the campus of Hadassah University Hospital in Jerusalem, Israel. Our facility is equipped to produceOpRegen® and a range of other cell therapy products for human use in clinical trials as well as at a grade suitable for commercial use.

Retinal Restoration

We have acquired exclusive global rights to ophthalmology-related technology that was developed, in part, in collaboration with BioTime scientists, and includes composition and methodologies to develop 3-D retinal tissue constructs from pluripotent cells for implantation in patients with advanced stages of retinal degeneration.

This technology may allow generation of three-dimensional laminated human retinal tissue in a controlled manufacturing process. This could lead to retinal restoration treatments for a variety of advanced retinal degenerative diseases and ocular injuries, such as retinitis pigmentosa, macular degeneration, and diabetic retinopathy.

In September 2017, BioTime was awarded a grant of up to $1.56 million from the Small Business Innovation Research program of the National Institutes of Health. The grant provides funding to further develop BioTime’s innovative, next generation vision restoration program for more advanced retinal diseases and injuries, which severely impact the quality of life for millions of people with no treatment option. This initiative aims at improving vision in people affected by blindness, whether caused by retinal injuries, age-related macular degeneration, retinitis pigmentosa or other causes.

Cell/Drug Delivery

Aesthetics

Renevia®

Renevia®consists of our proprietary cell-transplantation delivery matrix (HyStem®) combined with the patient’s own adipose progenitor cells from their own fat. We are developingRenevia® as an injectable product to address needs in facial aesthetic procedures, and potentially certain reconstructive surgeries, such as breast reconstruction after cystectomy or lumpectomy. Our goal is to improve the process of transplanting a patient’s own fat cells to potentially provide longer lasting volume, while maintaining a natural look and feel. | |  |

Lipoatrophy is the loss of fat tissue which can be caused by several factors, including trauma, aging or drug side effects such as in HIV-associated lipoatrophy. Cells obtained from a patient, such as adipose progenitor cells obtained through liposuction, can be transplanted back into the same patient at another location in the body without the risk of potential rejection or transmission of diseases associated with the transplant of allogenic donor tissues. However, the transplantation of cells alone, without the molecular matrix in which cells normally reside, often leads to widespread cell death, or the failure of the transplanted cells to remain at the transplant site. The transfer of cells inRenevia®may resolve this issue by maintaining the transplanted cells at the intended site and by providing a three-dimensional scaffold upon which cells can attach and rebuild normal tissue. | |

We conducted a multi-site pivotal clinical study in Europe to assess the efficacy ofRenevia® as a delivery matrix for fat progenitor cells to restore skin volume in HIV patients whose subcutaneous adipose tissue has been lost as a side effect of their use of certain anti-retroviral drugs, like Stavudine and Zidovudine. The resulting facial wasting ages the individual’s appearance prematurely and, along with a thinning of the skin, allows musculature and vasculature to be easily seen. Treatment of the condition improves the individual’s self-esteem and quality of life.

Renevia®has met the primary endpoint of implanted volume retention in its pivotal European clinical trial. Based on these clinical trial results, we have filed for marketing authorization in the EU for certain forms of facial lipoatrophy. We anticipate approval later this year.

In the EU pivotal clinical trial,Renevia® treated patients retained approximately 100% of transplanted volume at six months (p<0.001), based on 3-D volume measurement of the implanted area, achieving the primary endpoint of the study (see Chart below). In addition to meeting the primary endpoint, treated patients retained an average 70% of the transplanted volume at 12 months and those patients that were observed after 18 months retained 64% of the transplanted volume. The data from additional patients at this time point are expected later this year. AllRenevia® transplants were shown to be generally well tolerated and there were no device-related serious adverse events noted during this trial.

3-D Volume Measurement of the EU Pivotal Renevia Trial - Primary Endpoint (p<0.001)

In addition to serving as the basis for our European filing for marketing authorization, we also plan to use this trial to support initial safety findings for U.S. development ofRenevia® for multiple forms of facial lipoatrophy.

The rapidly-growing global facial aesthetics market is estimated to be over $5 billion. Execution of our label expansion plans into this broader market has already begun with an investigator-led trial in the United States. In 2017, a U.S. investigator-led trial of ourPremvia™ HyStem® product, which has 510 (k) clearance in the U.S. for wound management and is the same composition asRenevia®, was initiated to study the utility ofPremvia™ for facial volume deficit in non-HIV patients. Although BioTime does not control execution of this trial, we expect preliminary data later this year. A company sponsored, exploratory study ofRenevia® for cosmetic use is expected to commence in Europe later this year to study more broadly the utility ofRenevia® for volume deficit in non-HIV patients.

BioTime plans to build upon this investigator-led trial and the EU pivotal trial data with additional studies, including an additional company-sponsored study in Europe and a pivotal trial in the U.S. We will continue our discussions with the FDA regarding a potential development pathway forRenevia® in the U.S.Renevia® is manufactured in the U.S. in compliance with cGMP requirements and has been tested pursuant to ISO 10993 standards for implantable medical devices.

Other Cell/Drug Delivery

ReGlyde™

ReGlyde™is a proprietary formulation of theHyStem® hydrogel platform and is currently in preclinical development for viscosupplementation and drug delivery in osteoarthritis. Pre-clinical results are encouraging and have shown biocompatibility and preclinical efficacy signals in animal models.

Research and Development and License Agreements with Heraeus Medical GmbH

We are developing cellular therapeutics for orthopedic disorders with Heraeus Medical GmbH (“Heraeus”). The initial goal of this project is to develop innovative bone grafting therapies based on the use of our proprietaryPureStem®human embryonic progenitor cell technology. Pursuant to the terms of our research and development agreement with Heraeus, BioTime is responsible for research and development of a cell-based bone grafting product usingPureStem® technology and eitherHyStem® scaffold technology for delivery of bio-active components or scaffold technology owned by Heraeus or licensed to Heraeus from third parties.

AgeX Product Candidates

Brown Fat Technology for Treatment of Metabolic Disorders

Brown adipose tissue (BAT) cells, or as they are sometimes called “brown fat cells,” have only recently become the subject of intense study by medical researchers. Unlike normal white adipose tissue which is the fat we normally associate with obesity and disorders correlated with obesity such as Type II Diabetes (T2D), BAT cells don’t simply store calories. BAT cells burn calories in the process of generating body heat. In addition, the cells secrete biologically-active molecules that are believed to play an important role in maintaining the body in a state of metabolic health. Recently it has also been reported that humans lose BAT as a function of age and the loss of these cells are implicated in unhealthy age-related changes in metabolism such as obesity, T2D, and metabolic syndrome. This recent discovery may have important consequences for regenerative medicine, since pluripotent cells provide a means of manufacturing all human cell types on an industrial scale, including BAT cells. AgeX’s research team has invented a technology to manufacture BAT cells and filed certain patent applications that it believes provides it with a path to develop BAT cells for the potentially large and growing markets associated with obesity, T2D, and cardiovascular disease. Prior to initiating human clinical trials, AgeX will be required to successfully perform extensive preclinical testing of the cells to determine their safety and efficacy in non-human model systems.

Treatment of Vascular Disorders

AgeX is using vascular cells derived from pluripotent stem cells, and other technologies, to develop treatments for vascular disorders. The therapeutic indications AgeX is targeting include age-related cardiovascular diseases such as coronary artery disease, heart failure, and peripheral artery disease. Therapeutics for age-related vascular disease represent some of the largest, fastest-growing actual and potential markets in the U.S. due to the aging baby boom generation. Cardiovascular disease is among the leading causes of death and disability in the U.S., and consumes a major and ever-increasing proportion of health care costs. The National Academy of Sciences has estimated that a potential 58 million Americans are currently afflicted with cardiovascular disease. AgeX is using technology for the differentiation of pluripotent stem cells into vascular endothelial cells in combination with thePureStem®technology to produce highly purified monoclonal embryonic vascular endothelial progenitor stem cells.

iTR

When tissues in the human body are damaged as a result of degenerative disease, injury, or surgery, there is generally a very limited capacity of the body to regenerate the tissue back to its original state. Exceptions to this rule are blood and the liver, both of which both show a remarkable capacity to restore equilibrium after the loss of cells. Other exceptions are tissues in the human body when it is first being formed. Early in development tissues such as the skin can repair itself scarlessly, but this ability is lost even before we are born. Another example in the animal kingdom is the Mexican salamander which shows a profound capacity to regenerate damaged tissues, even restoring severed limbs. However, in the adult human, most tissues simply scar rather than regenerate. AgeX’s scientists have been performing certain research to understand the molecular mechanisms regulating this loss of regenerative potential after the human body is formed based on its expertise in pluripotent stem cell technology. As a result, these scientists have invented a novel technology called “induced Tissue Regeneration” or “iTR.” iTR is designed to eventually facilitate the identification of therapies to induce scarless regeneration of tissues in the body that currently cannot naturally repair themselves. Examples of potential applications are numerous, but AgeX plans to initially focus on the regeneration of the heart following infection or heart failure, and scarless skin regeneration. iTR is a revolutionary new approach to medicine.

Product Candidates of Public Affiliates Asterias Biotherapeutics and OncoCyte

Therapeutic Products in Neurology and Oncology

Asterias currently has three clinical-stage programs which have the potential to address areas of very high unmet medical need in the fields of neurology and oncology.

AST-OPC1 Oligodendrocyte Progenitor Cells for Spinal Cord Injury and Other Neurodegenerative Diseases

AST-OPC1 is an oligodendrocyte progenitor cell population. Oligodendrocyte progenitor cells are cells that become oligodendrocytes after injection. It has been shown preclinically to have three potentially reparative functions that address the complex pathologies observed at the injury site of a spinal cord injury. These activities of AST-OPC1 include production of neurotrophic factors, stimulation of vascularization, and induction of remyelination of denuded axons, all of which are critical for survival, regrowth and conduction of nerve impulses through axons at the injury site.

AST-OPC1 was tested in patients with acute spinal cord injury in a Phase I trial and is being tested in a Phase I/IIa dose escalation (“SCIStar study”) trial. Asterias completed enrollment of the entire SCiStar study in December 2017. Asterias has enrolled a total of 25 subjects in the SCiStar study, plus five subjects from the previous Phase 1 safety trial. In October 2017, Asterias reported 12-month data from the SCiStar study’s Cohort 2 (AIS-A 10 million-cell cohort), which included six subjects. At 12 months, 67% (4 out of 6) of Cohort two subjects recovered two or more motor levels on at least one side, exceeding the company’s 12-month target of 45-50% of subjects achieving this level of improvement. In February 2018, Asterias provided a clinical trial update that highlighted the following:

| | ● | Positive Safety Profile - Asterias has dosed 25 subjects with AST-OPC1 in the SCiStar study and a total of 30 subjects including the five subjects from the previous Phase 1 safety trial who have been followed for as long as seven years. As of the update, there have been no serious adverse events (SAEs) related to the AST-OPC1 cells. |

| | | |

| | ● | Cell Engraftment - Together with the previously reported results from Cohort 2, the MRI results-to-date for 94% (17/18) of the Cohort 2-4 subjects provide supportive evidence that AST-OPC1 cells have durably engrafted at the injury site and helped to prevent cavitation. Cohort 3 consists of subjects with AIS-A injuries that were administered 20 million AST-OPC1 cells and Cohort 4 consists of subjects with AIS-B injuries that were administered 10 million AST-OPC1 cells. |

| | | |

| | ● | Improved Motor Function - At six months, 83% (15/18) of Cohort 2-4 subjects recovered at least 1 motor level on at least one side and 22% (4/18) of Cohort 2-4 subjects recovered two or more motor levels on at least one side. |

Asterias will have various SCiStar study data readouts in 2018.

There are approximately 17,000 new spinal cord injuries annually (NSCIC SCI Facts and Figures at a Glance (2016)). There are currently no drugs approved by the United States Food and Drug Administration (“FDA”) specifically for the treatment of spinal cord injury. As of 2016, the National Spinal Cord Injury Statistical Center reported that approximately 4,500 of these new spinal cord injuries annually in the U. S. are AIS-A, AIS-B, or AIS-C patients with C-4 to C-7 spinal cord injuries (https://www.nscisc.uab.edu/).

The FDA has granted Orphan Drug Designation of AST-OPC1 and designated AST-OPC1 a Regenerative Medicine Advanced Therapy for the treatment of acute SCI.

AST-VAC1: Autologous Telomerase-loaded Dendritic Cells

AST-VAC1 is an Asterias autologous (patient-specific) cancer vaccine designed to stimulate a patient’s immune system to attack telomerase. Asterias is developing AST-VAC1 for the treatment of Acute Myeloid Leukemia (“AML”), the most common form of acute leukemia in adults. A Phase II clinical trial of AST-VAC1 was conducted and demonstrated that AST-VAC1 was successfully manufactured and released in 24 out of the 33 patients enrolled in the study. Twenty-one patients received AST-VAC1 in the study, including 19 in clinical remission and two in early relapse. AST-VAC1 was found to have a favorable safety and tolerability profile. Asterias has performed follow-up data collection on the 19 patients who were treated while in complete remission to determine the long-term effects of the AST-VAC1 administration on remission duration and disease-free survival. The results of this data collection were reported in an oral presentation in May 2015. Eleven of 19 patients (58%) remained in complete remission at a median follow-up of 52 months. These results compare to historical data suggesting that between 20-40% of patients would be expected to be relapse free at 3-4 years. Additionally, of the 7 patients in the higher risk over 60-year-old group, 4 (57%) remained relapse free at a median follow up of 54 months. Historically, relapse free survival rates in this population have been 10-20% at 3-4 years. Asterias has conducted an End of Phase II meeting with the FDA with the goal of reviewing the proposed clinical development plan for AST-VAC1.

The next major step in clinical development for AST-VAC1 would be to conduct a confirmatory Phase 2b study in higher risk patients over 60 years old.

AST-VAC2: hES Cell-Derived Allogeneic Dendritic Cells

AST-VAC2 is being developed by Asterias as an allogeneic, or non-patient specific, cancer vaccine candidate designed to stimulate patient immune responses to telomerase. AST-VAC2 is produced from human embryonic stem (“hES’) cells that can be modified with any antigen. In September 2014, Asterias entered into a Clinical Trial and Option Agreement (the “CRUK Agreement”) with Cancer Research UK (“CRUK”) and Cancer Research Technology Limited, (“CRT”), a wholly-owned subsidiary of CRUK, pursuant to which CRUK has agreed to fund Phase I/II clinical development of AST-VAC2 loaded with the same LAMP-telomerase construct used in AST-VAC1. Under the terms of the CRUK Agreement, Asterias is responsible, at their own cost, for completing process development and manufacturing scale-up of the AST-VAC2 manufacturing process and transferring the resulting cGMP-compatible process to CRUK. CRUK is responsible, at its own cost, for manufacturing clinical grade AST-VAC2 and for carrying out the Phase I/II clinical trial of AST-VAC2. The Asterias technology transfer to CRUK has been completed and CRUK has received the necessary regulatory approvals to initiate the first-in-human (FIH) clinical trial of AST-VAC2 in the United Kingdom. Patient enrollment for this study is expected to begin in 2018.

Liquid Biopsies for Cancer Diagnostics

OncoCyte is developing diagnostic tests for lung cancer, breast cancer, and bladder cancer utilizing novel liquid biopsy technology. While current biopsy tests use invasive surgical procedures to provide tissue samples to determine if a tumor is benign or malignant, OncoCyte is developing highly accurate, easy to administer, non-invasive molecular diagnostic tests that will be based on liquid biopsies using blood or urine samples.

Clinical Trials-Lung Cancer Diagnostic

OncoCyte collaborated with the Wistar Institute of Anatomy and Biology (“Wistar”) to develop one of the components of the confirmatory lung cancer diagnostic test in a large, multi-site clinical study. This collaboration involved a clinical study with over 2,000 blood samples obtained from patients with a high-risk profile for development of lung cancer, which led to the discovery of biomarkers that differentially express in lung cancer patients.

Confirmatory diagnostics are used in conjunction with a current standard of care screening procedure. A lung confirmatory diagnostic would be used in conjunction with Low Dose CAT Scan (LDCT) to confirm a suspicious nodule by yielding a secondary suspicious versus benign result. In the case of a benign result, the patient would not need additional invasive procedures to determine the presence of cancer. In the case of a suspicious result, additional procedures would be highly warranted.

Both Wistar and OncoCyte have presented data at several international and regional medical conferences including: American Thoracic Society in 2016 (Wistar proof of concept study); CHEST in 2016 (Wistar larger proof of concept study, which validated the results of the ATS study); American Thoracic Society in 2017 (OncoCyte research and validation study of 299 patients that resulted in a 95% sensitivity and 73% specificity and was an independent validation); and IASLC Chicago Multidisciplinary Symposium in Thoracic Oncology in 2017 (OncoCyte analytical validation).

Based on these study results, OncoCyte announced that it will initiate a clinical validation phase as well as start to ramp up its commercial capabilities in anticipation of the potential commercial launch of the test. When the CLIA lab was certified OncoCyte successfully conduced a small CLIA lab validation study to demonstrate that the full assay system utilized in the CLIA lab provides the same results on clinical samples as those obtained in the R&D lab. OncoCyte began a clinical validation study on a new set of approximately 300 blinded prospectively collected blood samples to confirm whether the sensitivity and specificity of the test remain within commercial parameters in a CLIA operational setting. In November of 2017, OncoCyte announced that during the process of running initial samples for the Clinical Validation Study, inconsistent analytic results were observed by OncoCyte’s technical team. OncoCyte believes this was caused by a variance in a recently received lot of consumables used in the processing system that analyzes blood samples for the genetic markers that indicate whether lung nodules found in patients are benign or suspicious. To address this issue, OncoCyte has worked to resolve the causes of the inconsistent analytic results. In addition to seeking a solution to the problems it has encountered with the current analytic system, OncoCyte has announced that it is actively evaluating alternative analytic platforms that might be used to runDetermaVu™ diagnostic tests. At the conclusion of this process, data will be available to determine which platform delivers the most accurate, consistent and robust test results and acceptable cost. OncoCyte has announced that once it makes a final decision regarding analytic platforms, it plans to complete product development by carrying out a research and development verification study followed by an analytical validation study, and if those studies are successfully completed, a clinical validation study will be conducted, with a target of completing clinical validation for commercialization in 2018. OncoCyte has collected all the samples necessary for carrying out all these studies.

Clinical Trials—Breast Cancer Diagnostic

OncoCyte completed a strong proof of concept study for its breast cancer confirmatory test, and presented data at the San Antonio Breast Cancer Symposium (SABCS) in December of 2016. The study looked at serum from 100 women who had a mammogram with a result of BIRADs 3 or 4. The results of this analysis were promising, with a 15-marker model producing a sensitivity of 90% and a specificity of 76%.

OncoCyte is continuing development of a breast cancer confirmatory diagnostic by conducting a larger study that it expects will analyze blood samples from approximately 300 patients with benign or malignant nodules.

Clinical Trials—Bladder Cancer Diagnostic

As part of the clinical development of a urine-based bladder cancer diagnostic test, OncoCyte initiated a clinical trial in January 2014 and in May of 2015, they presented preliminary findings of their bladder research, which showed a sensitivity of 90% and a specificity of 83%. Sensitivity is the probability of detecting the presence of the disease accurately. A sensitivity of 90% means that 9 out of 10 cancers were detected. Specificity is the probability of accurately predicting not having the disease. OncoCyte has decided to pursue a co-development partner for its bladder cancer test.

2017 Highlights

BioTime achieved numerous strategic accomplishments during 2017, including advancing clinical trials and product development in several key programs.

Clinical Progress

| | ● | Renevia®met its primary endpoint in a European pivotal trial of HIV-associated lipoatrophy, which is a severe form of facial lipoatrophy. The primary endpoint was the change in hemifacial volume at six months in the treated patients compared to patients in the delayed treatment arm as measured by 3-D photographic volumetric assessment. On average, 5.1cc of hemifacial volume was measured after six months, which represents an approximate 100% retention of transplanted volume. There were no device-related serious adverse events noted during the trial. |

| | | |

| | ● | We presented positive data from theOpRegen®trial in dry-AMD. The interim data were presented on May 8, 2017 at the Annual Meeting of the Association for Research in Vision and Ophthalmology (ARVO) in Baltimore, Maryland by Eyal Banin, MD, PhD. Imaging analysis suggested the transplantedOpRegen® cells remained in place (engrafted) in an area of the scar that was completely depleted of retinal pigment epithelium. There was also possible evidence of a biological response with some areas appearing to show structural improvement (a thickening of the thinned area of retina above the scar) without any signs of retinal edema, a fluid build-up that can further compromise vision. |

| | | |

| | ● | We expanded theOpRegen®trial in dry-AMD to the U.S. with the opening of sites in Los Angeles and San Francisco headed by two well-renowned physicians, David S. Boyer, MD of Retina-Vitreous Associates and Dr. H. Richard McDonald of West Coast Retina Medical Group. |

| | | |

| | ● | We established an innovative cell therapy manufacturing facility in Jerusalem, Israel. This new 800 square meter (8,600 square feet), state-of-the-art, cGMP manufacturing facility is located in the Jerusalem Bio Park on the campus of Hadassah University Hospital. It is equipped to produceOpRegen®and a range of cell therapy products for human use in clinical trials as well as at a grade suitable for commercial use. |

| | | |

| | ● | We expanded our ophthalmology portfolio with technology for next generation retinal disease therapies that includes composition and methodologies to develop 3-D retinal tissue derived from human pluripotent stem cells for implantation in patients with advanced stages of retinal degeneration. |

| | | |

| | ● | We hosted a Key Opinion Leader event on the topic of dry-AMD. The meeting featured a presentation by a key opinion leader, David S. Boyer, MD, Retina-Vitreous Associates, who discussed the clinical perspective and cell therapy treatment options for patients with dry-AMD. BioTime’s management team also provided an overview of the Company’s ongoing clinical development work withOpRegen®, being studied for patients with dry-AMD, including recently presented clinical trial data from the 2017 Annual ARVO meeting. |

Simplification

| | ● | We consolidated our ownership ofOpRegen®through an equity swap that allowed us to increase our share ownership of our Israeli subsidiary, Cell Cure, which leads theOpRegen®development program. By acquiring the Cell Cure shares held by other shareholders, we now own nearly 99% of Cell Cure. |

| | | |

| | ● | BioTime formed a new subsidiary, AgeX to develop its programs focused on aging. AgeX consolidated certain BioTime subsidiaries and programs in the field of interventional gerontology. The formation of AgeX continues the implementation of BioTime’s strategy to simplify its corporate structure and operations as well as focus resources on the continued clinical development of its two lead programs:Renevia®andOpRegen®. The formation of AgeX provides greater flexibility to explore external financing alternatives as well as strategic options to grow its technology platform. |

Unlocking Value

| | ● | AgeX raised net proceeds of $10 million, valuing AgeX at approximately $68 million post-money. BioTime now owns approximately 85% of the outstanding shares of AgeX. The financing is expected to fund AgeX’s general operations and product development well into 2019. BioTime had previously planned to spend more than $5 million annually on these programs and associated operational expenses. |

| | | |

| | ● | In September 2017, theBioTime Board of Directors agreed in principle to distribute some or all of the AgeX shares to BioTime shareholders. We are working with investment banks and other financial institutions, the Internal Revenue Service and the Securities and Exchange Commission to finalize and implement the strategy for taking AgeX public, which may include a tax-free distribution. |

Patent Portfolio

| | ● | During 2017,BioTime was issued 41 new patentsto expand and bolster its patent estate, including the patent estate coveringOpRegen®through 2031. These new patents add to the over 800 issued patents or pending patent applications that BioTime and its subsidiaries have invented or licensed worldwide and address many of BioTime’s key programs, includingOpRegen®, which is in a Phase I/IIa trial for dry-AMD; stroke and orthopedics, which are in early stages of development; and cell culture methods that are applicable across the pluripotent cell platform that enables robust manufacturing processes for many of the products. |

| | | |

| | ● | Successful defense of two key patents related toOpRegen®. The European Patent Office (EPO), in an opposition proceeding, ruled that two patents related toOpRegen® are valid and remain in force as granted. |

Non-dilutive Funding

| | ● | BioTime was awarded a new grant for 2017 of up to 7.2 million Israeli New Shekels(approximately $2 million) from the Israel Innovation Authority (IIA). The grant provides funding for the continued development ofOpRegen®, and to date the IIA has provided annual grants totaling approximately $12 million. |

| | | |

| | ● | BioTime was awarded a grant of up to $1.56 million from the Small Business Innovation Researchprogram of the National Institutes of Health. The grant provides funding to further develop BioTime’s innovative, next generation vision restoration program for more advanced retinal diseases and injuries, which severely impact the quality of life for millions of people with no treatment option |

Other Company News

| | ● | During 2017,BioTime successfully raised $49 millionin gross proceeds from new and previous investors in two underwritten public offering of our common shares. |

Additional Information

HyStem®,Hextend®,PureStem® andRenevia® are registered trademarks of BioTime, Inc., andReGlyde™ andPremvia™ are trademarks of BioTime, Inc.ReCyte™ is a trademark of ReCyte Therapeutics, Inc.OpRegen® is a registered trademark of Cell Cure Neurosciences, Ltd., andGeneCards®is a registered trademark of Yeda Research and Development Co. Ltd.

In 2017, BioTime was led by the Co-CEO leadership team of Adi Mohanty, who is responsible for human clinical development, product commercialization, corporate and administrative functions and Dr. Michael D. West, one of the world’s foremost experts on therapies derived from stem cells, who is responsible for research, product discovery, and preclinical product development.

To efficiently advance product candidates through the clinical trial process, we have historically created operating subsidiaries for each program and product line. Management believes this approach has fostered efficient use of resources and reduced shareholder dilution as compared to strategies commonly deployed by the biotechnology industry in advancing various programs and product lines through development. However, operating our business through multiple subsidiaries and affiliated companies results in certain administrative expenses that we would not incur if all our operations were conducted within BioTime itself. On the other hand, this organizational structure has facilitated our fundraising efforts and has allowed BioTime to develop multiple clinical-stage products, rather than being dependent on a single product program. We, and some of the other members of BioTime, have also received substantial amounts of non-dilutive financial support from government and nonprofit organizations that are seeking, based on rigorous scientific review processes, to identify and accelerate the development of potential breakthroughs in the treatment of various major diseases.

Affiliate & Subsidiary Ownership

The following table shows the companies within BioTime, their respective principal fields of business, our percentage ownership, directly and through subsidiaries, including unconsolidated affiliates as of December 31, 2017, and the country where their principal business is located:

| | | Field of Business | | BioTime

Ownership | | Country |

| Public Affiliates(1): | | | | | | | | |

| OncoCyte Corporation(2) | | Cancer diagnostics | | | 46.7% | | | USA |

| Asterias Biotherapeutics, Inc.(3) | | Therapeutic products derived from pluripotent stem cells, and immunotherapy products. Clinical programs include: AST-OPC1 for spinal cord injury, AST-VAC1 for acute myelogenous leukemia, and AST-VAC2 for non-small cell lung cancer | | | 40.2% | | | USA |

| | | | | | | | | |

| AgeX and its Subsidiaries: | | | | | | | | |

| AgeX Therapeutics, Inc. | | PureStem®progenitor cell lines, brown adipose fat, induced tissue regeneration (“iTR”) technology | | | 85.4% | | | USA |

| ReCyte Therapeutics, Inc.(4) | | Research and development involved in stem cell-derived endothelial and cardiovascular related progenitor cells for the treatment of vascular disorders and ischemic conditions | | | 94.8% | | | USA |

| LifeMap Sciences, Inc.(4) | | Biomedical, gene, disease, and stem cell databases and tools | | | 81.7% | | | USA |

| | | | | | | | | |

| Other BioTime Subsidiaries: | | | | | | | | |

| Cell Cure Neurosciences Ltd. | | R&D and manufacturing of BioTime’s cell replacement platform technology | | | 98.8%(5) | | | Israel |

| ES Cell International Pte. Ltd(6) | | Research and clinical grade cell lines | | | 100% | | | Singapore |

| OrthoCyte Corporation(6) | | Research in orthopedic diseases and injuries | | | 99.8% | | | USA |

| | (1) | The term “Public Affiliates” or “Affiliates” used in this Report refers to OncoCyte and Asterias, which are unconsolidated companies of which we are the largest shareholder and are able to exercise significant influence based on our share ownership, including influence over the operating and financial policies of those companies. |

| | | |

| | (2) | See Notes 3 and 4 to our consolidated financial statements included elsewhere in this Report. Beginning February 17, 2017, BioTime deconsolidated OncoCyte and OncoCyte is no longer a subsidiary of BioTime as of that date, but remains an affiliate of BioTime. |

| | | |

| | (3) | Since the deconsolidation of Asterias on May 13, 2016, Asterias is no longer a subsidiary of BioTime but remains an affiliate. |

| | | |

| | (4) | ReCyte Therapeutics and LifeMap Sciences are subsidiaries of AgeX. |

| | | |

| | (5) | Includes shares owned by BioTime and ES Cell International Pte. Ltd. |

| | | |

| | (6) | The operating activities and fields of business listed under these subsidiaries are conducted primarily by BioTime as the parent company. |

Our Ownership of Cell Cure

During June and July of 2017 we increased our ownership of Cell Cure by acquiring all of the Cell Cure ordinary shares and Cell Cure convertible promissory notes held by its second largest shareholder, Hadasit Bio-Holdings Ltd., and all of the Cell Cure ordinary shares held by its third largest shareholder,Teva Pharmaceutical Industries, Ltd.As a result of this acquisition, we now own, directly and through a wholly-owned subsidiary, approximately 99% of the outstanding Cell Cure ordinary shares.

Cell Cure has adopted stock option plans under which it may issue up to 125,363 of its ordinary shares to officers, directors, employees, and consultants. As of December 31, 2017, options to purchase 80,792 ordinary shares of common stock were granted and outstanding.

Our Ownership of Asterias – Affiliate

As of February 7, 2018, we owned 40.2% of the outstanding Asterias common stock. Asterias common stock is listed for trading on the NYSE American under the symbol AST. Asterias has adopted an Equity Incentive Plan under which Asterias has reserved 13,500,000 shares of common stock for the grant of stock options, and other equity-based awards to officers, directors, employees, and consultants. As of December 31, 2017, Asterias had outstanding warrants to purchase 2,813,159 shares of Asterias common stock, options to purchase a total of 6,375,828 shares of Asterias common stock and 690,000 restricted stock units. Since the deconsolidation of Asterias on May 13, 2016, Asterias ceased being a consolidated subsidiary but has remained a significant affiliate of BioTime.

Our Ownership of OncoCyte – Affiliate

Beginning February 17, 2017, BioTime deconsolidated OncoCyte and OncoCyte is no longer a consolidated subsidiary of BioTime as of that date, but remains a significant affiliate of BioTime. As of February 7, 2018, we owned 46.7% of the OncoCyte common stock outstanding. OncoCyte common stock is listed for trading on the NYSE American under the symbol OCX. OncoCyte has adopted a stock option plan under which it may issue up to 5,200,000 shares of its common stock to its officers, directors, employees, and consultants. As of December 31, 2017, options to purchase 3,390,287 shares of OncoCyte common stock had been granted.

Our Ownership of OrthoCyte

As of February 22, 2018, we owned 99.8% of the outstanding common stock of OrthoCyte. OrthoCyte has adopted a stock option plan under which it may issue up to 4,000,000 shares of its common stock to officers, directors, employees, and consultants of OrthoCyte and BioTime employees, including officers. As of December 31, 2017, options to purchase 1,249,000 shares of OrthoCyte common stock had been granted.

Our Ownership of AgeX

As of February 22, 2018, we owned 85.4% of the outstanding common stock of AgeX. AgeX has adopted a stock option plan under which it may issue up to 4,000,000 shares of its common stock to officers, directors, employees, and consultants of AgeX and BioTime employees, including officers. As of December 31, 2017, options to purchase 1,239,000 shares of AgeX common stock had been granted.

AgeX has issued warrants to purchase 1,473,600 shares of its common stock that expire the earlier to occur of (i) the third anniversary from the date of issuance, (ii) on or after January 31, 2019, after notice from AgeX, if the AgeX shares are publicly traded and the price of AgeX common stock exceeds $3.75 per share for 20 trading days (on a volume weighted average price basis, as defined), and (iii) a change of control, as defined in warrant agreement.

Our Ownership of ReCyte Therapeutics

As of February 22, 2018, AgeX owned 94.8% of the outstanding common stock of ReCyte Therapeutics, Inc. (“ReCyte Therapeutics”). ReCyte Therapeutics has adopted a stock option plan under which it may issue up to 4,000,000 shares of its common stock to officers, directors, employees, and consultants of ReCyte Therapeutics and BioTime employees, including officers. As of December 31, 2017, options to purchase 1,199,975 shares of ReCyte Therapeutics common stock had been granted.

Our Ownership of LifeMap Sciences

As of February 22, 2018, AgeX owned approximately 82% of the outstanding common stock of LifeMap Sciences, Inc. (“LifeMap Sciences”). LifeMap Sciences has adopted a stock option plan under which it may issue up to 2,342,269 shares of its common stock to officers, directors, employees, and consultants of LifeMap Sciences and BioTime employees, including officers. As of December 31, 2017, options to purchase 904,571 shares of LifeMap Sciences common stock had been granted.

Patents and Trade Secrets