Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party Other Than the Registrant ☐

Check the Appropriate Box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Monro, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

☒ | No fee required | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed |

Table of Contents

Notice of 2021 Annual Meeting of

Shareholders and Proxy Statement

August 17, 2021

Rochester, NY 14615

Table of Contents

| Dear Fellow Shareholders,

Since I joined Monro in April, I have spent much of my time traveling to our stores, getting to know our Teammates and understanding our customers’ vehicle needs. I can unequivocally say that this is a tremendous time to be part of Monro. The depth of talent across the organization and the guidance of our strong senior leadership team were instrumental in driving the business forward in fiscal 2021. As a leading front-line service organization, our go-forward plan will be grounded in our commitment to our customers and teammates with a renewed focus on in-store execution. With a scalable platform, Monro is also uniquely positioned to continue to grow through strategic acquisitions and investments in greenfield locations. Importantly, we remain steadfast on driving strong cash flow to fuel future growth. |

Keeping Customers on the Road During an Unprecedented Year

While we experienced an unprecedented year, as an essential business, Monro continued to operate throughout the COVID-19 pandemic to keep America’s frontline workers on the road. Our team quickly adjusted our operations to ensure the health and safety of our customers and teammates across all facets of our business. Although many aspects of the pandemic were beyond our control, we never lost sight of our key strategic priorities and accelerated our Monro.Forward initiatives so that we could emerge from the pandemic stronger than before.

Accelerating Monro.Forward Initiatives and Enhancing Financial Position

We continued to advance our Monro.Forward initiatives, centered around our commitment to operational excellence as a best-in-class service organization. Throughout fiscal 2021, we successfully transformed approximately 150 stores through our rebranding and reimaging initiative, as well as completed the rollout of our digital phone system and other in-store technological improvements. With the full support of our Board of Directors, we will continue Monro’s growth and transformation strategy and focus on bringing our Monro.Forward initiatives to life in every store for every customer and for every teammate.

As part of our growth strategy, we continue to capitalize on attractive acquisition opportunities in our fragmented industry. Over the past year, we expanded our geographic presence in the dynamic Western region, with the acquisition of 17 stores in Southern California, and most recently 30 Mountain View Tire & Service stores in the Los Angeles area. Combined, these acquisitions represent approximately $65 million in expected annualized sales. In addition, we plan on strategically opening greenfield locations to accelerate our growth in attractive markets.

During fiscal 2021, we also focused on strengthening our financial position and bolstering our liquidity. The remarkable efforts of our team to drive variable margin improvement and targeted fixed cost reductions led to record operating cash flow of $185 million. Our steadfast commitment to driving strong cash flow gives us ample flexibility to continue implementing our strategic growth initiatives as well as pursuing attractive acquisition opportunities to deliver long-term value for our shareholders.

Advancing Monro.Forward Responsibly

Over the past year, Monro’s leadership team has made significant progress in formalizing and advancing our corporate responsibility initiatives and transparency. Under the leadership of our Executive Vice President — Chief Legal Officer, Maureen Mulholland, Monro recently published our inaugural Corporate Responsibility Report on the https://corporate.monro.com/corporateresponsibility section of our corporate website. In alignment with our Company core values, our corporate responsibility strategy focuses on integrating Environmental, Social and Governance (ESG) factors into long-term decision making and strategy. This includes fostering diversity, equity, and inclusion; enhancing teammate engagement; making a positive impact within the communities where we live and operate and being good stewards of the environment. I recognize that our ESG journey is ongoing and am committed and excited to work with our senior leaders to build on the great work that has already been done to continue to drive Monro.Forward responsibly.

Table of Contents

Driving Long-term Shareholder Value

In closing, fiscal 2021 was an unprecedented year for Monro. The Company continued to accelerate its strategic growth initiatives, strengthened its financial position, and returned $30 million to shareholders. I am confident in our path forward and believe our strong focus on operational execution will drive long-term value for our shareholders.

Looking Ahead

Monro has made remarkable progress in our transformation journey during fiscal 2021, and I believe these accomplishments will be instrumental to our success in the coming year and beyond. As we head into fiscal 2022, we are encouraged by the pace of the economic recovery and are seeing more customers take to the road. We have a strong foundation to build upon and an exceptional team in place ensuring that we capitalize on the opportunities ahead. The continued dedication of our valued teammates and our strong commitment to providing a five-star customer experience will remain critical to our success.

On behalf of the Board of Directors and the Senior Leadership Team, I would like to thank you for your continued support of Monro. I look forward to speaking with you at our annual meeting on August 17, 2021.

Sincerely,

Michael T. Broderick

President and Chief Executive Officer

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Date: | Tuesday, August 17, 2021 | |

| Time: | 10:00 a.m. (Eastern Daylight Time) | |

| Location: | Virtual meeting to be held via the Internet at www.virtualshareholdermeeting.com/MNRO2021 | |

| Record Date: | Monday, June 28, 2021 | |

Items of Business

| 1. | Elect four directors to Class 2 of the Board of Directors to serve a two-year term and until their successors are duly elected and qualified at the 2023 annual meeting of shareholders; |

| 2. | Elect Michael T. Broderick to Class 1 of the Board of Directors to serve the remainder of that term and until his respective successor has been duly elected and qualified at the 2022 annual meeting of shareholders; |

| 3. | Approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers; |

| 4. | Ratify the re-appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending March 26, 2022; |

| 5. | Shareholder Proposal — Proposal for Board to adopt a recapitalization plan; |

| 6. | Consider any other business as may properly be brought before the meeting or any adjournment or postponement thereof. |

The Board of Directors recommends that you vote “FOR” each of the director nominees included in Proposals No. 1 and No. 2 and “FOR” both Proposals No. 3 and No. 4. The Board of Directors is not making any recommendation with regard to Proposal No. 5.

How to Vote

Using the control number that appears on the Notice of Internet Availability (the “Notice”), you may vote your shares:

|  |  |  | |||

By Telephone: You may vote by calling |

By Internet: Prior to the Annual Meeting, you may vote at Proxyvote.com |

By Mail: Mark, sign and date your proxy paid envelope we have provided |

During the Meeting: Go to www.virtualshareholdermeeting.com/ |

Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholders’ Meeting to be Held on August 17, 2021: We are following the Securities and Exchange Commission’s “e-proxy” rules that allow public companies to furnish proxy materials to shareholders over the Internet. Instead of a physical copy, you have received a Notice of Internet Availability of Proxy Materials, which provides instructions on how to view our proxy materials for the Annual Meeting over the Internet, how to vote, and how to request a printed copy of the proxy materials.

Table of Contents

Below are the highlights of the important information you will find in this Proxy Statement. As this is only a summary, we request that you please review the full Proxy Statement before casting your vote.

General Meeting Information

| ||

2021 Annual Meeting Date and Time |

Tuesday, August 17, 2021 10:00 a.m. (Eastern Daylight Time)

| |

Record Date |

Monday, June 28, 2021 | |

Voting |

Shareholders of record as of the record date are entitled to vote personally or by proxy at the Annual Meeting. Each share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting.

| |

Voting Matters and Board of Directors’ Recommendations

| ||||||||

Proposal

| Voting Options

| Vote Required for

| Broker

| Board of

| ||||

1 and 2. Election of Directors |

“FOR” all nominees or “WITHHOLD” your vote for all or any of the nominees

|

Each nominee for director must receive a majority of the votes cast

|

No |

FOR EACH NOMINEE | ||||

3. Advisory Vote to Approve Executive Compensation

|

“FOR,” “AGAINST” or “ABSTAIN” from voting

|

Majority of votes cast must vote in favor of this proposal |

No |

FOR | ||||

4. Ratification of Appointment of Independent Registered Public Accounting Firm

|

“FOR,” “AGAINST” or “ABSTAIN” from voting |

Majority of votes cast must vote in favor of this proposal |

Yes |

FOR | ||||

5. Shareholder Proposal – Proposal for Board to adopt a recapitalization plan |

“FOR,” “AGAINST” or “ABSTAIN” from voting |

Majority of votes cast must vote in favor of this proposal |

No |

NO RECOMMENDATION | ||||

| i |

Table of Contents

Governance Highlights

We are committed to applying sound corporate governance principles. We believe these governance practices are in the best interests of our shareholders and strengthen accountability within our organization.

Annual Elections

|

Yes

|

|

Stock Ownership Guidelines for Directors and Executives

|

Yes

| ||||

Independent Board Chair

|

Yes

|

Anti-Hedging and Pledging Policy

|

Yes

| |||||

Board Independence

|

89%

|

Code of Ethics

|

Yes

| |||||

Audit, Compensation and Nominating Committee Independence

|

100%

|

Board Member Recruiting Guidelines

|

Yes

| |||||

Number of Financial Experts

|

One

|

Regular Executive Sessions of the Independent Board Members

|

Yes

| |||||

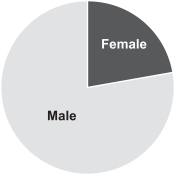

Board Gender Diversity

|

22% Female

|

Anonymous Reporting

|

Yes

| |||||

Comprehensive Annual Board and Committee Evaluations

|

Yes

|

Executive Compensation

|

Yes

| |||||

Director Overboarding

|

No

|

Strategy and Risk Oversight by Board and Committees

|

Yes

| |||||

Four New (Three Independent) Directors since 2017

|

Yes

|

Corporate Responsibility (ESG) Reporting

|

Yes

|

Our commitment to sound corporate governance practices has been illustrated through a number of actions taken in this past year, including:

| • | Compensation Committee retained Exequity, LLP as its compensation advisor; |

| • | Conducted executive benchmarking, analyzing the Company’s peer group and survey data; |

| • | Issued inaugural Corporate Responsibility Report for Fiscal 2021; and |

| • | Strengthened Board oversight of Environmental, Social and Governance (ESG) matters, through delegation of primary oversight to Nominating and Corporate Responsibility Committee. |

Director Nominees

You are being asked to vote to elect the following four director nominees to Class 2 of our Board of Directors. Detailed information about each of these nominees begins on page 6 of the Proxy Statement.

Name

|

Age

|

Director

|

Independent

|

Occupation

| |||||||||||||

Frederick M. Danziger

|

81

|

1984

|

Yes

|

Retired. Director of Indus Realty Trust (Nasdaq: GRIF)

| |||||||||||||

Stephen C. McCluski

|

69

|

2013

|

Yes

|

Retired. Former Senior Vice President and Chief Financial Officer of Bausch & Lomb Incorporated

| |||||||||||||

Robert E. Mellor

|

77

|

2010

|

Yes

|

Chairman of the Board of Monro, Inc. (Nasdaq: MNRO)

| |||||||||||||

Peter J. Solomon

|

82

|

1984

|

Yes

|

Chairman of PJ Solomon, L.P.

| |||||||||||||

You are also being asked to vote to elect the following director nominee to Class 1 of our Board of Directors. Detailed information about this nominee begins on page 8 of the Proxy Statement.

Name

|

Age

|

Director

| Independent

|

Occupation

| ||||

Michael T. Broderick

|

52

|

2021

|

No

|

President and Chief Executive Officer of Monro, Inc.

|

| ii |  |

Table of Contents

Board of Directors Overview

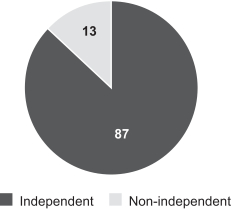

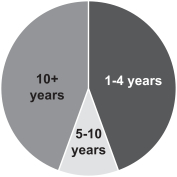

Our Board of Directors is currently composed of nine directors, eight of whom are independent. The charts below highlight the Board’s composition and experience:

Director Independence

| Tenure on the Board of Directors

| ||

Gender Diversity

| |||

Executive Compensation Overview

What We Do

|

What We Don’t Do

| |

Pay for Performance – majority of compensation “at risk”

|

Permit Short Sales by Directors, Officers or Employees

| |

Reasonable Post-Employment and Change in Control Provisions

|

Allow Hedging or Pledging of Company Stock

| |

Stock Ownership Guidelines

|

Offer Change in Control Tax Gross-Ups

| |

Utilize Independent Compensation Advisor

|

Permit Repricing of Underwater Options without Shareholder Approval

| |

Clawback Policy

|

Offer Unreasonable Perquisites

| |

Annual shareholder “say on pay” vote

|

No single trigger cash severance based solely upon a change-in-control of the Company.

| |

Executive benchmarking

| ||

Modest perquisites

|

| iii |

Table of Contents

Elements of Compensation for Fiscal 2021

Our executive compensation program, set forth by the Compensation Committee, is designed to implement our executive pay philosophy to:

| • | Attract, reward and retain talented and experienced executives and other key employees |

| • | Motivate our executive officers to achieve short-term and long-term corporate goals that will enhance shareholder value |

| • | Support our core values and culture by promoting internal equity and external competitiveness |

The objectives and key characteristics of each element of our executive compensation are summarized in the table on page 19 of this Proxy Statement. Our executive compensation determinations for Fiscal 2021 were significantly influenced by the outbreak of COVID-19, the evolving impact of the pandemic on our business and operations and the Company’s response to the resulting challenges and opportunities. For Fiscal 2021, as a result of COVID-19 and, in particular, the difficulty in establishing annual and long-term performance goals, in May 2020, the Compensation Committee determined to:

| • | Delay base salary increases for executives. |

| • | Divide the annual performance period for the incentive bonus into two equal, six-month halves, each with different goals and metrics. |

| • | Set performance metrics for the first half performance period for the Fiscal 2021 incentive bonus that were based 100% on individual initiatives focused on navigating through the COVID-19 pandemic by: (i) concentrating on employee and customer safety & protocols; (ii) strengthening employee resources and support; and (iii) driving cost management and business resiliency. |

| • | Shift the mix and weighting of long-term incentives to 50% restricted stock units and 50% stock options. |

Changes in the Company’s Fiscal 2021 executive compensation program were made by the Compensation Committee to provide an appropriate balance between accounting for the uncertainty of the impact of COVID-19 on the Company’s business and operations, while motivating our executives to provide leadership and strategic oversight through the fiscal year. For fiscal 2022, the Compensation Committee expects to return to a more normalized executive compensation program, including annual performance goals and metrics and the grant of performance stock units as a part of our long-term incentive compensation program.

| iv |  |

Table of Contents

| v |

Table of Contents

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

The Monro, Inc. Board of Directors (the “Board” or the “Board of Directors”) is using this Proxy Statement to solicit proxies from the holders of its common stock for use at the Monro, Inc. 2021 annual meeting of shareholders and any adjournment or postponement thereof (the “Annual Meeting” or the “meeting”). The Notice of Internet Availability of Proxy Materials (the “Notice”), which provides instructions on how to view our proxy materials for the Annual Meeting over the Internet, how to vote and how to request a printed copy of the proxy materials and the Proxy Card are first being mailed to our shareholders on or about July 8, 2021. In this Proxy Statement, we may also refer to Monro, Inc. and its subsidiaries as “Monro,” the “Company,” “we,” “our” or “us.”

| Meeting Time and Applicable Dates | This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Monro, Inc., a New York corporation, of the proxy to be voted at the Annual Meeting to be held on Tuesday, August 17, 2021, at 10:00 A.M. (Eastern Daylight Time), and at any adjournment or postponement thereof. The close of business on Monday, June 28, 2021 has been fixed as the record date for the determination of the shareholders entitled to notice of and to vote at the meeting.

| |

| Attending the Annual Meeting | Monro will host the Annual Meeting solely by means of electronic communication via a virtual meeting at www.virtualshareholdermeeting.com/MNRO2021, commencing at 10:00 A.M. (Eastern Daylight Time) on August 17, 2021. There will not be an option for shareholders to attend the Annual Meeting in person. A summary overview of the information you need to attend the Annual Meeting over the Internet is provided below:

• All shareholders can attend the Annual Meeting over the Internet at the website provided above;

• Only shareholders as of the record date of June 28, 2021 may vote or submit questions electronically while attending the Annual Meeting (by using the control number provided in your Notice);

• Instructions on how to attend the Annual Meeting are posted at the website provided above; and

• A replay of the Annual Meeting will be available over the Internet for approximately 12 months following the date of the Annual Meeting at the website provided above.

| |

| Matters to be Voted Upon at the Annual Meeting | At the Annual Meeting, holders of record of our common stock as of June 28, 2021 will consider and vote upon the following proposals:

1. To elect four directors to Class 2 of the Board of Directors to serve a two-year term and until their successors are duly elected and qualified at the 2023 annual meeting of shareholders;

2. To elect Michael T. Broderick to Class 1 of the Board of Directors to serve the remainder of that term and until his respective successor has been duly elected and qualified at the 2022 annual meeting of shareholders;

3. To approve, on a non-binding, advisory basis, the compensation paid to our named executive officers;

4. To ratify the re-appointment of PricewaterhouseCoopers LLP (“PWC”) as our independent registered public accounting firm for the fiscal year ending March 26, 2022;

5. Shareholder proposal – Proposal for Board to adopt a recapitalization plan; and

6. To consider any other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.

As of the date of this Proxy Statement, these are the only matters that the Board of Directors intends to present at the Annual Meeting. The Board does not know of any other business to be presented at the Annual Meeting. The Board of Directors recommends that you vote “FOR” proposal Nos. 1 – 4 and makes no recommendation for your vote on Proposal No. 5.

| |

| 1 |

Table of Contents

| Voting Rights of Holders of Common Stock | Shareholders of record as the record date are entitled to vote personally or by proxy at the Annual Meeting. On the record date, there were 33,505,287 shares of our common stock, par value $0.01 per share (“common stock”) outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting. Our shareholders do not have cumulative voting rights.

The voting rights of common shareholders are subject to the voting rights of the holders of the shares of our Class C Convertible Preferred Stock, par value $1.50 per share (“Class C Preferred Stock”).

| |

| Rights of Holders of Class C Preferred Stock | At least 60% of the shares of Class C Preferred Stock must vote as a separate class or unanimously consent to effect or validate any action taken by our common shareholders. Therefore, the Class C Preferred Stock holders have an effective veto over all matters put to a vote of our common shareholders, and could use that veto power to block any matter that our common shareholders may approve at the Annual Meeting.

On the record date, there were 19,664 shares of Class C Preferred Stock outstanding. We expect that the holders of the Class C Preferred Stock will approve, by unanimous written consent, Proposal Nos. 1 – 4 being put to a vote of our common shareholders at the Annual Meeting.

| |

| Voting Instructions for Record Holders | If your shares are registered directly in your name with our transfer agent, then you are a shareholder of record with respect to those shares and you may vote by:

• Calling 1-800-690-6903;

• Visiting proxyvote.com before the meeting and inputting the control number shown on your Notice and proxy card;

• completing and returning your proxy card by mail; or

• attending the Annual Meeting via the Internet at www.virtualshareholdermeeting.com/MNRO2021 and using the electronic voting options.

Whether or not you plan to attend the Annual Meeting, you should vote as soon as possible. If you plan to vote before the Annual Meeting, your vote must be received by 11:59 p.m. Eastern Daylight Time on August 16, 2021.

| |

| Voting Instructions for Beneficial Owners | If your shares are held in a brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name” and you must instruct the broker, bank or other nominee to vote on your behalf. Please refer to the voting instruction card provided by your broker, bank or other nominee.

| |

| Broker Non-Votes | Broker non-votes occur when beneficial owners do not give voting instructions to their brokers and the brokers lack the discretionary authority to vote on the proposal. If you are a beneficial owner and do not give instructions to your broker, the broker will determine if it has the discretionary authority to vote on the particular matter.

Under the rules of the New York Stock Exchange, which are also applicable to companies listed on the Nasdaq Stock Market (“Nasdaq”), brokers have the discretion to vote on routine matters such as ratifying the appointment of external auditors, but do not have discretion to vote on non-routine matters such as electing directors and approving, on an advisory basis, the compensation of our named executive officers.

Broker non-votes, if any, will be counted for purposes of calculating whether a quorum is present at the meeting, but will not be counted for purposes of determining the number of votes cast with respect to a particular proposal.

| |

| 2 |  |

Table of Contents

| Quorum | A quorum must be present in person or by proxy to hold the Annual Meeting and will exist if a majority of the issued and outstanding shares of our common stock are present in person or by proxy and are entitled to vote at the Annual Meeting.

We will include abstentions and broker non-votes to determine whether a quorum is present at the Annual Meeting. John A. Heisman and Michael L. Boehme, our inspectors of election for the meeting, will determine whether a quorum is present and will tabulate votes cast by proxy or in person. If we do not have a quorum at the Annual Meeting, we expect to adjourn the meeting until we obtain a quorum.

| |

| Vote Required to Elect Directors | You may either vote for or withhold authority to vote for all or any of the nominees named in this Proxy Statement.

To be elected, each nominee for director must receive a majority of the votes cast at the Annual Meeting.

Votes that are withheld from any nominee count as a vote cast against that nominee. Abstentions and broker non-votes are not deemed to be votes cast and will therefore not affect this proposal.

| |

| Vote Required to Approve Compensation of Named Executive Officers | You may cast your vote in favor of, against, or abstain from voting to approve, on a non-binding, advisory basis, the compensation paid to our named executive officers.

To be approved, a majority of the votes cast at the Annual Meeting must vote in favor of this proposal. Abstentions and broker non-votes are not deemed to be votes cast and will therefore not affect this proposal.

| |

| Vote Required to Ratify Appointment of PWC | You may cast your vote in favor of, against, or abstain from voting to ratify the re-appointment of PWC as our independent registered accounting firm for the year ending March 26, 2022.

To be approved, a majority of the votes cast at the Annual Meeting must vote in favor of this proposal. Abstentions are not deemed to be votes cast and will therefore not affect this proposal.

There will be no broker non-votes on this proposal because brokers have discretion to vote shares held in street name on this proposal without specific instructions from the beneficial owner of those shares.

| |

Vote Required to Approve Shareholder Proposal | You may cast your vote in favor of, against, or abstain from voting to approve the shareholder proposal requesting the Board to adopt a recapitalization plan.

To be approved, a majority of the votes cast at the Annual Meeting must vote in favor of this proposal. Abstentions and broker non-votes are not deemed to be votes cast and will therefore not affect this proposal.

| |

| Revoking a Proxy | A shareholder who has given a proxy may revoke it at any time prior to its exercise by:

• executing and delivering a later-dated proxy;

• submitting a new vote by telephone or via the Internet prior to the Annual Meeting;

• providing written notice of the revocation to the Secretary of the Company at the address above; or

• attending the virtual Annual Meeting and voting electronically during the meeting.

Please note that attending the Annual Meeting alone is not enough to revoke a proxy.

If you have instructed a broker, bank or other nominee to vote your shares, you may submit a new, later-dated voting instruction form or contact your bank, broker or other nominee.

| |

| 3 |

Table of Contents

| Proxy Instructions | All shares of common stock represented by properly executed proxies returned and not revoked will be voted in accordance with instructions you give in the proxy.

If you return a signed proxy but do not indicate voting instructions, your proxy will be voted as recommended by the Board of Directors, or “FOR” the following proposals:

• the election of the director nominees named in the Proxy Statement;

• approving the compensation paid to the Company’s named executive officers;

• ratifying the appointment of PWC as our independent registered public accounting firm for the fiscal year ending March 26, 2022; and

• in the proxy holder’s best judgment as to any other matters properly brought before the Annual Meeting or any adjournment or postponement thereof.

If you return a signed proxy but do not indicate a voting instruction for Proposal No. 5, your proxy will be voted as abstaining from voting on that proposal.

| |

| Participants in the Proxy Solicitation | This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Monro in connection with the Annual Meeting. The Company will bear the cost of soliciting proxies. In addition, our directors, officers and employees may solicit proxies by telephone or otherwise.

We will reimburse brokers, banks or other nominees for their expenses in forwarding proxies and proxy materials to the beneficial owners of shares held in street name.

| |

| Results of the Annual Meeting | We will report the voting results in a filing with the U.S. Securities and Exchange Commission (“SEC”) on a Current Report on Form 8-K within four business days following the conclusion of the Annual Meeting.

If the official results are not available at that time, we will provide preliminary voting results and will provide the final results in an amendment to the Form 8-K as soon as practicable after they become available.

| |

| Availability of Proxy Materials | We are following the SEC’s “e-proxy” rules that allow public companies to furnish proxy materials to shareholders via the Internet. The “e-proxy” rules allow us to send you a Notice of Internet Availability of Proxy Materials while providing online access to the documents instead of sending full, printed copies of the proxy materials. We first released the Notice to our shareholders of record on or about July 8, 2021. The Notice provides instructions on how to: (1) view our proxy materials for the Annual Meeting via the Internet; (2) vote your shares; and (3) request a printed copy of the proxy materials, free of charge.

Our proxy materials, including the Notice, this proxy statement, your proxy card, and our 2021 Annual Report are available, free of charge, at www.proxyvote.com. You can also request paper or e-mailed copies by calling 1-800-579-1639 or emailing sendmaterials@proxyvote.com with your control number in the subject line of the email.

Copies of this proxy statement and our 2021 Annual Report are also available in the Investor Information section of our website at https://corporate.monro.com/investors/financial-information. Information available on our website is not a part of, and is not incorporated into, this proxy statement. You may also request these materials by calling 1-800-876-6676 or emailing krudd@monro.com.

In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis. Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the environmental impact of the printed materials.

| |

| Multiple Copies of Proxy Materials | You may receive more than one Notice and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. To ensure that all of your shares are voted, please vote using each proxy card or voting instruction form that you receive.

For more information, see the section entitled, “Notice Regarding Delivery of Shareholder Documents” below.

| |

| 4 |  |

Table of Contents

| Contact for Questions | If you have any questions or need assistance in voting your shares, please contact us at the address and phone number below.

Secretary Monro, Inc. 200 Holleder Parkway Rochester, NY 14615 (585) 647-6400

| |

| 5 |

Table of Contents

PROPOSAL NO. 1 — ELECTION OF CLASS 2 DIRECTORS

Our Board of Directors consists of nine directors, divided into two classes: five directors in Class 1 and four directors in Class 2. The Class 2 directors will serve until the Annual Meeting and the Class 1 directors will serve until the 2022 annual meeting of shareholders, or until their respective successors have been duly elected and qualified. Five directors are nominated for election at the Annual Meeting – one in Class 1 and four in Class 2. The Nominating and Corporate Responsibility Committee has assessed and recommended each nominee for election to our Board of Directors.

Set forth below for each nominee for election as a director is a brief statement about the nominee’s age, principal occupation and business experience, including any directorships with any other public companies, describing the specific individual qualities and skills of each nominee that contribute to the overall effectiveness of the Board of Directors and its committees. Each nominee has consented to being named as a nominee and to serve as a director if elected. Although we do not anticipate that any of the nominees named will be unable to serve if elected, the votes will be cast for a substitute nominee selected by the Board of Directors unless the number of directors to be elected has been reduced to the number of nominees willing and able to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF THESE NOMINEES TO CLASS 2:

Name

| Age

| Director

| Independent

| Occupation

| ||||||||||

Frederick M. Danziger | 81 | 1984 | Yes | Retired. Director of Indus Realty Trust (Nasdaq: GRIF) and Bloomingdale Properties, Inc.

| ||||||||||

Stephen C. McCluski | 69 | 2013 | Yes | Retired. Former Senior Vice President and Chief Financial Officer of Bausch & Lomb Incorporated

| ||||||||||

Robert E. Mellor

| 77 | 2010 | Yes | Chairman of the Board of Monro, Inc. (Nasdaq: MNRO) | ||||||||||

Peter J. Solomon

| 82 | 1984 | Yes | Chairman of PJ Solomon, L.P. | ||||||||||

Set forth below is a summary of the biographical information for each of the Class 2 director nominees:

Frederick M. Danziger

Age: 81

Director since: 1984

Committees: Compensation (Chair) Audit Nominating and Corporate Responsibility | Principal Occupation:

Retired. Director of Indus Realty Trust, Inc. (Nasdaq: GRIF), a publicly traded real estate firm and Bloomingdale Properties, Inc.

Business Experience:

• Former chief executive officer of Griffin Industrial Realty, Inc.

• Formerly held Of Counsel position with Latham & Watkins LLP

Current Directorships:

• Current director of Bloomingdale Properties, Inc.

• Current director of Indus Realty Trust, Inc. | |||||

Skills and Expertise:

• Knowledge of legal and regulatory matters, risk management, strategic development and execution, accounting and finance

• Leadership skills

• Experience in corporate governance best practices of other major corporations |

| 6 |  |

Table of Contents

Stephen C. McCluski

Age: 69

Director since: 2013

Committees: Audit (Chair) Compensation Finance Nominating and Corporate Responsibility

| Principal Occupation:

Former senior vice president and chief financial officer of Bausch & Lomb Incorporated (Retired)

Business Experience:

• Former senior vice president and chief financial officer of Bausch & Lomb Incorporated

• Former vice president and controller of Bausch & Lomb Incorporated

Current and Former Directorships:

• Current chairman of the Board of Directors and member of the audit committee of ImmunoGen, Inc. (Nasdaq: IMGN)

• Former director of Standard Microsytems Corporation | |||||

Skills and Expertise:

• Knowledge in finance, risk management, mergers and acquisitions, strategic planning, and financial reporting, accounting and controls |

Robert E. Mellor

Age: 77

Director since: 2010

Committees: Nominating and Corporate Responsibility (Chair) Audit Compensation Executive | Principal Occupation:

Chairman of the Board of Directors

Business Experience:

• Interim chief executive officer of Monro, Inc. from August 2020 to April 2021

• Former director of Ryland Group, Inc.

• Former lead independent director of Board of Monro, Inc.

• Former chairman of the Board of Directors and chief executive officer of Building Materials Holding Corporation (“BMHC”), provider of the distribution, manufacturing and sale of building materials and component products

Current and Former Directorships:

• Former Director of CalAtlantic Group, Inc.

• Former Chairman of the Board of Directors of BMHC Stock Holdings, Inc.

• Current Non-Executive Chairman of the Board of Directors of Coeur Mining, Inc. (NYSE: CDE) | |||||

Skills and Expertise:

• Knowledge in legal and regulatory matters, mergers and acquisitions, risk management, real estate, strategic development and execution, accounting and finance

• Experience in corporate governance best practices of other major corporations |

Peter J. Solomon

Age: 82

Director since: 1984

Committees: Finance Executive | Principal Occupation:

Chairman of PJ Solomon, L.P., an investment banking firm, and independently operated affiliate of Natixis, part of Groupe BPCE, a top 10 European and a top 20 global bank

Business Experience:

• Chairman of PJ Solomon, L.P., an investment banking firm

Current and Former Directorships:

• Former member of Boards of Director of Associate Dry Goods Corporation, Culbro Corporation, Edison Brothers Stores, Inc., Esquire, Inc., Handyman Corporation, Lawfin International Limited, LIN Broadcasting Corporation (now known as LIN Media, LLC (NYSE: LIN)), Office Depot, Inc. (Nasdaq: ODP), Phillips-Van Heusen Corporation (now known as PVH Corp. (NYSE: PVH)), The Miller-Wohl Company and The Stop & Shop Supermarket Company. | |||||

Skills and Expertise:

• Knowledge in banking and financial services, capital markets, government regulations, mergers and acquisitions, strategic development and execution and risk management

• Leadership skills shown throughout business career and government service

• Experience in corporate governance best practices of other major corporations |

The Board of Directors recommends that you vote “FOR” each of the director nominees listed above.

| 7 |

Table of Contents

PROPOSAL NO. 2 — ELECTION OF CLASS 1 DIRECTOR

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF THIS NOMINEE TO CLASS 1:

Name

| Age

| Director

| Independent

| Occupation

| ||||||||||

Michael T. Broderick | 52 | 2021 | No | President and Chief Executive Officer of Monro, Inc. | ||||||||||

Set forth below is a summary of the biographical information for the Class 1 director nominee:

Michael T. Broderick

Age: 52

Director since: 2021

Committees: Executive | Principal Occupation:

President and Chief Executive Officer of Monro, Inc. (Nasdaq: MNRO)

Business Experience:

• Former executive vice president of merchandising and store operations support at Advance Auto Parts (NYSE: AAP)

• Former senior vice president of the automotive division of Canadian Tire Corporation (CTC-A.TO)

• Former chief executive officer of Federal Mogul Corporation (Nasdaq: FDML)

Current and Former Directorships:

• Former board member of Federal Mogul Corporation | |||||

Skills and Expertise:

• Knowledge in store operations, category management, mergers and acquisitions, strategic development and execution and risk management

• Leadership skills as a senior officer of several different companies

• Experience in corporate governance best practices of other major corporations |

The Board of Directors recommends that you vote “FOR” the director nominee listed above.

Set forth below is a summary of the biographical information for each of the continuing Class 1 directors:

John L. Auerbach

Age: 43

Director since: 2017

Committees: Compensation | Principal Occupation:

Partner of Auerbach Advisers

Business Experience:

• Founder of LiveArt Holdings, Inc., a collector to collector digital marketplace for fine art and objects

• Founder of Eloquii Design, Inc., a digitally native direct-to-consumer women’s fashion brand sold to Walmart

• Former executive vice president of Art & Objects and Digital Businesses at Sotheby’s, Inc.

• Former senior vice president of Digital & Global eCommerce at Kate Spade & Company

• Former international managing director of Digital & eCommerce Initiatives at Christie’s Inc.

Current and Former Directorships:

• Co-chairman, LiveArt Holdings, Inc. • Former chairman, Eloquii Design, Inc. | |||||

Skills and Expertise:

• Knowledge and extensive operational experience in retail, eCommerce deployment and strategy, brand building, digital marketing and artificial intelligence |

| 8 |  |

Table of Contents

Donald Glickman

Age: 88

Director since: 1984

Committees: Finance (Chair) Executive

| Principal Occupation:

Member of J.F. Lehman & Company

Business Experience:

• Member of J.F. Lehman & Company, a private equity investment firm that focuses on acquiring middle market companies in the defense and aerospace industries

• Private investor

• Former trustee of Babson Corporate Investors and Babson Participation Investors

Current and Former Directorships:

• Former lead director of MSC Software Corporation | |||||

Skills and Expertise:

• Knowledge in banking and financial services, accounting and finance, capital markets, government regulations, mergers and acquisitions, risk management and strategy development and execution

• Leadership skills as a senior officer in various investment banking firms

• Experience in corporate governance best practices of other major corporations |

Lindsay N. Hyde

Age: 39

Director since: 2017

Committees: Audit Nominating and Corporate Responsibility

| Principal Occupation:

Entrepreneur in residence, Moderne Ventures, a venture capital fund focused on technology companies innovating within real estate, mortgage, finance, insurance, hospitality and home services

Business Experience:

• Founder and former chief executive officer of Baroo, a provider of pet-related amenities in multifamily communities in large urban markets across the U.S.

• Founder and former executive director of Strong Women, Strong Girls, a nationally recognized mentoring organization

Current and Former Directorships:

• Former elected director of the Harvard Alumni Association

• Former director of Coca-Cola Scholars Alumni Foundation | |||||

Skills and Expertise:

• Experience in service delivery, marketing, strategic development and execution

• Knowledge in risk management and human resources

• Entrepreneurial leadership and approach

• Community engagement and culture |

| 9 |

Table of Contents

Leah C. Johnson

Age: 57

Director since: 2020

Committees: None

| Principal Occupation:

Executive Vice President, Chief Communications, Marketing & Advocacy Officer of Lincoln Center for the Performing Arts, an internationally renowned performing arts institution

Business Experience:

• Founder and former chief executive officer of LCJ Solutions, LLC, a strategic communications consulting firm

• Former senior vice president, Global Corporate Affairs at Citigroup, Inc.

• Former vice president of corporate communications at S&P Global Ratings (previously, Standard & Poor’s)

Current and Former Directorships:

• Former director of Pluralsight, Inc.

• Current trustee of The Trust for Cultural Resources of the City of New York

• Current trustee of the Museum of the City of New York

• Current vice chair of the Board of Trustees at New York Public Radio | |||||

Skills and Expertise:

• Knowledge and operational experience in corporate strategy and communications, public affairs, marketing, change management, and diversity and inclusion

• Entrepreneurial leadership and approach

• Community engagement and culture |

| 10 |  |

Table of Contents

CORPORATE GOVERNANCE PRACTICES AND POLICIES

Corporate Responsibility

Monro’s Corporate Responsibility (CR) efforts are an important lens through which we identify Environmental, Social and Governance (ESG) risks and opportunities that could meaningfully impact our business over the long term.

As part of our commitment to transparency and accountability, formalizing our CR strategy and objectives is a top priority for senior management and the Board. In furtherance of these objectives, we have published an inaugural Corporate Responsibility Report located at https://corporate.monro.com/corporateresponsibility. Information available in the report and on our website is not a part of, and is not incorporated into, this proxy statement. The report highlights key areas of focus and progress during Fiscal 2021 within our priority ESG topic areas: Teammates, customers, communities and the environment.

Included in the report is a mapping to certain metrics of the Sustainability Accounting Standards Board’s (SASB) Multiline & Specialty Retailers and Auto Parts industries. We will continue to enhance our disclosures in order to better inform stakeholders on Monro’s ESG-related risks, opportunities, management strategies and performance throughout Fiscal 2022 and beyond.

Fiscal 2021 Highlights

ESG Oversight. In Fiscal 2021, Monro increased its executive oversight of the Company’s priority ESG factors. The Company’s Executive Vice President — Chief Legal Officer leads management’s efforts to increase our focus and transparency in this area, with input from, and collaboration with, other members of the Senior Leadership Team. The Board of Directors delegated primary oversight of ESG matters to the re-named Nominating and Corporate Responsibility Committee.

Teammate Development and Safety. We continued to enhance Teammate engagement and prioritize safety by conducting more robust and structured training. Through the Company’s Monro University online learning management system, in Fiscal 2021, employees logged nearly 60,000 hours of professional development and technical training. Our safety efforts have reduced workers’ compensation claims by an average of 32 percent.

Diversity, Equity and Inclusion. We continued to foster diversity, equity and inclusion at all levels of the company through our Teammate Resource Group (TRG) and our training and recruiting initiatives. We have added diverse resources to our recruitment team to help launch new hiring initiatives and are working with a Diversity, Equity & Inclusion (DE&I) consultant to assist in the formulation of an official DE&I strategy.

Communities. The Company continued to make a positive impact in the communities where our Teammates work and live through volunteer work and investments in social programs that align with our mission and vision. Our charitable efforts include a long-time philanthropic commitment to the United Way to which we donated $157,000 in Fiscal 2021. We also have a partnership with Feeding America, to which, with the help of customers, we were able to donate $160,000 that provided 1.6 million meals to those in need.

Environment. Being good stewards of the environment is important to Monro. The Company has implemented energy saving initiatives such as LED lighting and energy efficient signage as part of our store refresh plan. Approximately 60% of our stores are now fitted with energy efficient lighting. In Fiscal 2021, we recycled 2.5 million gallons of oil, 3.3 million tires, 73,000 vehicle batteries and 316 tons of cardboard. One hundred percent of used oil and anti-freeze is collected and recycled.

We have a Code of Ethics that applies to all of our directors and executive officers, including our principal executive officer, principal financial officer and principal accounting officer or controller. The Code of Ethics is publicly available on our website at https://corporate.monro.com/investors/corporate-governance. We intend to post any amendments to or waivers from the Code of Ethics that apply to our principal executive officer, principal financial officer and principal accounting officer on our website.

Board Meetings

The Board of Directors held five meetings during the year ended March 27, 2021 (“Fiscal 2021”). During the fiscal year, each director attended at least 75% of the aggregate number of all meetings of the Board of Directors and committees on which he or she served. All attended last year’s annual meeting of shareholders and we expect all directors and nominees to attend the Annual Meeting, as is our stated policy in our Corporate Governance Guidelines.

| 11 |

Table of Contents

At least annually, the Board of Directors meets to review management succession planning, as well as our overall executive resources. In addition, our independent directors meet regularly in executive sessions, over which our Chairman, Robert E. Mellor, presides. During the eight months of Fiscal 2021 during which Mr. Mellor served as the Company’s interim Chief Executive Officer, Stephen C. McCluski served as Lead Independent Director of the Board and presided over executive sessions of the Board in accordance with our Charter of the Lead Independent Director, which is available on the Investor Information — Corporate Governance page of our website.

The Board of Directors determines whether each of our directors is considered independent. For a director to be considered independent, the director must meet the bright-line independence standards under the Nasdaq listing standards. The Board of Directors must also affirmatively determine that the director has no relationship with the Company that would interfere with the director’s exercise of independent judgment in carrying out the director’s responsibilities. In addition to the Nasdaq listing standards, the Board of Directors will consider all relevant facts and circumstances in determining whether a director is independent. The Board of Directors also considers all commercial, industrial, banking, consulting, legal, accounting, charitable, familial or other business relationships any director may have with the Company. There are no family relationships among any of our directors and executive officers. The Board has determined that the following nominees and directors satisfy the independence requirements of Nasdaq: John L. Auerbach, Frederick M. Danziger, Donald Glickman, Lindsay N. Hyde, Leah C. Johnson, Stephen C. McCluski, Robert E. Mellor, and Peter J. Solomon.

Committees of the Board of Directors

Each of the following Board committees, except for the Executive Committee, functions under a written charter adopted by the Board, copies of which are available on the Investor Information — Corporate Governance page of our website, currently https://corporate.monro.com/investors/corporate-governance, and to any shareholder who requests them. As a matter of routine corporate governance, each committee, except the Executive Committee, reviews its charter and practices on an annual basis. In Fiscal 2021, each committee determined that its charter and practices were consistent with listing standards of Nasdaq.

The current members, responsibilities and the number of meetings held in Fiscal 2021 of each of these committees are shown below:

Audit Committee

Committee Members

Stephen C. McCluski* (Chair) Frederick M. Danziger Lindsay N. Hyde Robert E. Mellor

Number of meetings in 2021: 7

* Audit Committee Financial Expert |

Key Responsibilities

• Monitoring, and assisting the Board in its oversight of, the integrity of our financial accounting and reporting processes;

• Selecting, retaining, determining the compensation for, and monitoring the independence, qualification and performance of our independent registered public accounting firm;

• Monitor the independence, qualification and performance of the independent auditors;

• Reviewing the performance of our internal auditors;

• Monitoring our systems of internal controls regarding finance, accounting, legal and regulatory compliance and compliance with our Code of Ethics; and

• Providing an avenue of communication among the independent registered public accounting firm, management, internal auditors and the Board.

Independence and Financial Literacy

• The Board has determined that each member of the Audit Committee is independent as defined by the Nasdaq listing standards and SEC rules applicable to Audit Committee members.

• All members of the Audit Committee satisfy the Nasdaq’s financial literacy requirement.

• The Board has determined that Mr. McCluski is an audit committee financial expert (as defined by SEC rules) and qualifies as financially sophisticated under the Nasdaq rules as a result of his knowledge, abilities, education and experience. |

| 12 |  |

Table of Contents

Compensation Committee

Committee Members

Frederick M. Danziger (Chair) John L. Auerbach Stephen C. McCluski Robert E. Mellor

Number of meetings in 2021: 2 |

Key Responsibilities

• Reviewing and approving, together with the other independent members of the Board, the annual compensation for our CEO and non-CEO executive officers;

• Reviewing and approving the overall compensation strategy and program structure for employees;

• Reviewing and making recommendations to the Board with respect to the total compensation of the non-employee directors, our incentive compensation plans and equity-based plans; and

• Overseeing risk management of our compensation programs.

Independence and Authority

• The Board has determined that each member of the Compensation Committee is independent as defined by the Nasdaq listing standards and the SEC rules.

• The Compensation Committee has the power and authority to form, and delegate authority to, subcommittees. |

Nominating and Corporate Responsibility Committee

Committee Members

Robert E. Mellor (Chair) Frederick M. Danziger Lindsay N. Hyde Stephen C. McCluski

Number of meetings in 2021:1 | Key Responsibilities

• Identifying and recommending to the Board candidates for election and to serve on the Board;

• Board and Key management succession planning;

• Providing oversight with respect to corporate governance matters; and

• Primary oversight of the Company’s corporate responsibility (ESG) programs and initiatives.

Independence

• The Board has determined that each member of the Nominating and Corporate Responsibility Committee is independent as defined by the Nasdaq listing standards and SEC rules. |

Finance Committee

Committee Members

Donald Glickman (Chair) Stephen C. McCluski Peter J. Solomon

Number of meetings in 2021: 3 | Key Responsibilities

• Reviewing and making recommendations to the Board regarding our short- and long-term financing plans and the financing of transactions that may have a material impact on our financial profile;

• Reviewing management’s process for assessing the financial returns from acquisitions;

• Considering and making recommendations to the Board on our dividend policy and practices and the issuance and repurchase of shares, if any;

• Reviewing our use of financial instruments, hedging arrangements and strategies to manage and mitigate exposure to financial and market risks; and

• Reviewing the financial performance and funding requirements of the defined benefit pension plan. |

Executive Committee

Committee Members

Michael T. Broderick (Chair) Donald Glickman Robert E. Mellor Peter J. Solomon

Number of meetings in 2021: 6

| Key Responsibilities

• Acting in place of the Board on limited matters that require action between Board meetings. However, without the approval of the full Board of Directors or the shareholders, the Executive Committee may not:

• approve any action requiring shareholder approval;

• fill vacancies on the Board of Directors;

• fix compensation of directors or executive officers;

• engage our independent registered public accounting firm; or

• repeal, amend or adopt new bylaws. |

| 13 |

Table of Contents

Lead Independent Director

The Board of Directors does not have a policy on whether or not the roles of Chief Executive Officer and Chairman of the Board should be separate and, if they are to be separate, whether the Chairman of the Board should be a non-employee director or an employee. The Board of Directors believes that it should be free to make a choice regarding its leadership structure from time to time in any manner that is in the best interests of the Company and its shareholders. Under the Company’s bylaws, the Board of Directors may elect a Chairperson of the Board to preside at all meetings of the shareholders and directors and to perform other duties as the Board may elect. Pursuant to our Corporate Governance Guidelines, if the Chairperson is not an independent director, the independent members of the Board of Directors will designate a lead independent director, responsible for conducting executive sessions of the independent directors. For eight months of Fiscal 2021, Robert E. Mellor served as Monro’s interim Chief Executive Officer. During this time, the Board appointed Stephen C. McCluski to serve as Lead Independent Director. With Michael Broderick’s onboarding in April 2021, Mr. Mellor returned to his position as Independent Chairman of the Board. As such, the roles of Chief Executive Officer and Chairman are again separated and Mr. McCluski is no longer serving as Lead Independent Director.

| 14 |  |

Table of Contents

Board of Directors’ Role in Risk Oversight

One of the most important functions of the Board is oversight of risks inherent in the operation of the Company’s business. Senior management is responsible for the day-to-day management of risks facing the Company. The Board implements its risk oversight function both as a whole and through delegation to Board committees. The Board is responsible for ensuring an appropriate culture of risk management exists within the Company, overseeing the Company’s aggregate risk profile and monitoring how the Company addresses specific risks. The Board receives regular reports from officers on particular risks to the Company, reviews the Company’s strategic plan, and regularly communicates with its committees. Each committee meets with key management personnel and representatives of outside advisors to oversee and manage these risks. For example, the Manager of Internal Audit and the General Counsel meet with the Audit Committee to discuss financial, legal and regulatory risks. Management has designed reporting processes to provide visibility to the Board of Directors about identifying, assessing and managing critical risks to the Company and management’s risk mitigation strategies.

During Fiscal 2021, Company management, along with the Compensation Committee, considered whether any of the Company’s compensation policies and practices has the potential to create risks that are reasonably likely to have a material adverse effect on the Company. Management considered the risk profile of the Company’s business and the design and structure of its compensation policies and practices. The results of Management’s review were reported to the Compensation Committee. For Fiscal 2021, management concluded, and the Compensation Committee agreed, that the risks arising from its compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Board or Committee | Primary Areas of Risk Oversight | |

Full Board of Directors | • Strategic, financial and execution risks and exposures associated with the annual operating plan

• Major litigation and regulatory exposures and other current matters that may present material risks to the Company’s operations, plans, prospects or reputation

• Acquisitions and divestitures (including through post-closing reviews)

• Senior management succession planning

• Employee pension and retirement savings plans, including relative investment performance and funded status

• Cybersecurity risks, including reviewing measures based on presentations from the head of the Company’s Information Technology Department, which occur at least annually, and reports from the Audit Committee

| |

Audit | • Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting and assets, financial policies, credit and liquidity matters and related-party transactions

• Cybersecurity matters, including reviewing measures implemented by the Company to protect data and reviewing the Company’s plans to respond to any cyber breaches, and receiving regular reports from the head of the Company’s Information Technology Department

• Legal, regulatory and compliance risks

| |

Compensation | • Risks and exposures associated with performance management of officers and executive compensation programs and arrangements, including incentive plans

| |

Finance | • Risks and exposures associated with financial position and financing activities, including cost of capital

• Use of financial instruments and other hedging arrangements and strategies to manage exposure to financial and market risks

• Financial status of the Company’s defined benefit pension plan

| |

Nominating and Corporate Responsibility | • Risks and exposures relating to director and key management succession planning and director independence

• Compliance with corporate governance structure and processes, including succession planning and corporate responsibility (ESG) initiatives and processes

| |

| 15 |

Table of Contents

Certain Relationships and Related Party Transactions

Review and Approval of Related Person Transactions

We review all relationships and transactions in which we and any of our directors, executive officers or their immediate family members are participants to determine whether those persons have a direct or indirect material interest in the relevant transaction. Our finance and legal staff are primarily responsible for developing and implementing processes and controls to gather information about potential related party transactions from our directors and executive officers. This includes the utilization of a robust questionnaire process for all Board members and executive officers. Then, based on the facts and circumstances, that group determines whether the Company or a related person has a direct or indirect material interest in the transaction. If our finance and legal staff determine that the Company or a related person has a direct or indirect material interest in a transaction, then the Audit Committee, or other board committee comprised solely of independent directors, must approve or ratify the transaction. There were no reportable related person transactions during Fiscal 2021.

The Nominating and Corporate Responsibility Committee is responsible for identifying, screening and recommending candidates for membership on the Board of Directors pursuant to the Company’s Corporate Governance Guidelines, as approved by the Board of Directors. The Nominating and Corporate Responsibility Committee’s Charter includes an affirmative statement that the Committee’s will endeavor to include diverse candidates, including women and minorities, in each pool of Board candidates. The Committee’s goal is to nominate candidates from a broad range of experiences and backgrounds who can contribute to the Board of Directors’ overall effectiveness in meeting its responsibilities. In assessing potential new directors, the committee considers individuals from various disciplines and diverse backgrounds, taking into account gender, age and ethnicity. The Nominating and Corporate Responsibility Committee, at the direction of the Board of Directors, has taken meaningful steps to seek to identify one or more potential female nominees for director who, like any other nominee, satisfy the Company’s director qualification standards, including the appropriate experience and demonstrated commitment to the Company. The selection of qualified directors is complex and crucial to our long-term success. Candidates for nomination to the Board of Directors are considered based upon various criteria, such as their broad-based business skills and experiences, a global business perspective, concern for the long-term interests of our shareholders, and personal integrity and judgment. In addition, directors must have time available to devote to Board activities and to enhance their knowledge of Monro and the automotive service industry.

The Nominating and Corporate Responsibility Committee will consider recommendations from shareholders of potential candidates for the Board of Directors and will evaluate candidates recommended by shareholders in the same manner as it evaluates candidates recommended by Board members, senior officers or search firms. A shareholder wishing to recommend a potential candidate must submit the recommendation in writing, addressed to the Secretary, Monro, Inc., 200 Holleder Parkway, Rochester, NY 14615, Attention: Nominating and Corporate Responsibility Committee, so that the Secretary receives the recommendation not less than 120 days and not more than 180 days prior to the next annual meeting of shareholders. Each recommendation must include the information required by the Certificate of Incorporation for shareholders submitting a nomination. You may obtain additional information and a copy of the Certificate of Incorporation by submitting a written request to the Secretary of the Company at the address above.

Shareholders wishing to communicate with our non-management directors may send a letter to: Secretary, Monro, Inc., 200 Holleder Parkway, Rochester, NY 14615, Attention: Non-Management Directors. All correspondence sent to that address will be delivered to the appropriate directors on a quarterly basis, unless the Secretary otherwise determines that it should be delivered more promptly. The Secretary will promptly direct any concerns relating to accounting, internal controls, auditing or officer conduct to the Chair of the Audit Committee. All correspondence to non-management directors will be acknowledged by the Secretary and may also be forwarded within Monro to a subject matter expert for investigation. Alternatively, communication with non-management directors may occur as outlined in the section entitled “Administration — Reporting Violations” in our Code of Ethics, which is publicly available on our website at https://corporate.monro.com/investors/corporate-governance.

| 16 |  |

Table of Contents

The Company does not pay any director who is also an employee of Monro or its subsidiaries for his or her service as director.

In Fiscal 2021, non-employee directors received the following compensation:

| • | $40,000 annual retainer; a $30,000 annual retainer for the chairman of the Board of Directors1, as well as Audit Committee and the Finance Committee chairmen; a $15,000 retainer for the Compensation Committee chairman and a $10,000 annual retainer for the Nominating and Corporate Responsibility Committee chairman; |

| • | a grant of 2,575 shares of restricted stock on the date of the 2020 annual meeting of shareholders, determined by dividing $130,000 by $50.48, the closing price of a share of our common stock on the date of the 2020 annual meeting of shareholders; |

| • | $3,000 for each meeting of the Board of Directors and $1,000 for each committee meeting attended; and |

| • | reasonable travel expenses to attend meetings, if applicable. |

Director Stock Ownership Guidelines

The Board of Directors adopted the Monro, Inc. Stock Ownership Guidelines to, among other things, further engage certain senior executives and the members of the Board in the long-term success of the Company. The Company’s stock guidelines for its non-employee directors are as follows:

Stock Ownership Guideline | Common stock or equivalents with an aggregate value equal to at least three times the annual cash retainer payable to each director

| |

Target Date | Within a four-year period of joining the Board of Directors | |

As of March 27, 2021, all of the Company’s non-employee directors are in full compliance with the stock ownership guidelines.

The following table summarizes the compensation that the Company’s non-employee directors earned for services as members of the Board of Directors and any committee of the Board of Directors during Fiscal 2021:

Director Compensation Table

Name | Fees Earned or Paid in Cash ($) | Stock ($) | Total ($) | ||||||||||||

John L. Auerbach |

| 50,000 |

| 129,986 |

| 179,986 | |||||||||

Frederick M. Danziger |

| 70,000 |

| 129,986 |

| 199,986 | |||||||||

Donald Glickman |

| 87,000 |

| 129,986 |

| 216,986 | |||||||||

Lindsay N. Hyde |

| 54,000 |

| 129,986 |

| 183,986 | |||||||||

Leah C. Johnson |

| 23,000 |

| 129,986 |

| 152,986 | |||||||||

Stephen C. McCluski |

| 107,000 |

| 129,986 |

| 236,986 | |||||||||

Robert E. Mellor(3) |

| — |

| — |

| — | |||||||||

Peter J. Solomon |

| 57,000 |

| 129,986 |

| 186,986 | |||||||||

| (1) | For Fiscal 2021, Mr. Mellor only received director compensation during the time in which he was an independent, non-employee director, from March 29, 2020 through August 19, 2020. |

| (2) | Beginning in fiscal 2018, the Company began awarding non-employee directors restricted stock in lieu of stock options. Each non-employee director was awarded 2,575 shares of the Company’s restricted stock on August 18, 2020 (the “Award Date”). This column represents the aggregate award date value of the restricted stock awarded during Fiscal 2021 under FASB ASC 718. The value of the restricted stock is derived by multiplying number of shares awarded by the closing price per share on the Award Date of $50.48. For additional information on the valuation assumptions with respect to the Fiscal 2021 awards, refer to Note 11 of the Company’s financial statements in the Form 10-K for the year-ended March 27, 2021, as filed with the SEC. |

| 17 |

Table of Contents

| (3) | Mr. Mellor’s compensation is all reflected in the Named Executive Officer Summary Compensation tables as a result of his appointment as interim CEO in August 2020. Mr. Mellor did not receive the non-employee director grant of restricted stock on August 18, 2020 because he was serving as our interim CEO, nor did he receive retainer fees or meeting fees for attending Board meetings while he served as our interim CEO. |

The restricted stock awarded to directors vests over a three-year period. Stock options granted prior to Fiscal 2018 were fully vested at the time of the grant. The following table shows the number of equity awards outstanding for each non-management director as of March 27, 2021.

Name | Restricted Stock Outstanding (Shares) | Stock Options Outstanding (Shares) | ||||||||

John L. Auerbach |

| 4,291 |

| — | ||||||

Frederick M. Danziger |

| 4,291 |

| — | ||||||

Donald Glickman |

| 4,291 |

| 10,000 | ||||||

Lindsay N. Hyde |

| 4,291 |

| — | ||||||

Leah C. Johnson |

| 2,575 |

| — | ||||||

Stephen C. McCluski |

| 4,291 |

| 10,000 | ||||||

Robert E. Mellor(1) |

| — |

| — | ||||||

Peter J. Solomon |

| 4,291 |

| — | ||||||

TOTAL |

| 28,321 |

| 20,000 | ||||||

| (1) | Mr. Mellor’s outstanding equity awards are reflected in the Outstanding Equity Awards table for the Named Executive Officers as a result of his appointment as interim CEO in August 2020. |

Anti-Hedging and Pledging Policy

We prohibit our directors from engaging in transactions in our securities involving publicly traded options, short sales and hedging transactions because they may create the appearance of unlawful insider trading and, in certain circumstances, present a conflict of interest. In addition, our insider trading policy prohibits directors from pledging our securities as collateral for a loan or holding our securities in a margin account unless the margin feature is not utilized or our securities are otherwise excluded from being pledged.

| 18 |  |

Table of Contents

Elements of Compensation for Fiscal 2021

The objectives and key characteristics of direct elements of our Fiscal 2021 executive compensation are summarized below:

Our executive compensation determinations for Fiscal 2021 were significantly influenced by the outbreak of COVID-19, the evolving impact of the pandemic on our business and operations, and our response to the resulting challenges and opportunities, as described in more detail below.

Compensation Element |

Period | Objectives | ||||

Fixed |

Base Salary (Cash) |

Annual |

• Fixed annual cash provided for performing day-to-day job responsibilities • Generally determined based on an individual’s time in the position, experience, performance, future potential and market data • Reviewed annually for potential adjustment based on factors such as changes in the executive’s responsibilities, individual performance and market data • For Fiscal 2021, due to the uncertainty created by the COVID-19 pandemic, salary increases, typically given in May each year, were delayed | |||

At-Risk | Annual Incentive Bonus (Cash) | Annual | • Variable cash compensation tied to the achievement of annual corporate financial and operational goals established by the Committee each fiscal year • Aligns interests of executives with shareholders, with amount earned dependent on Company performance objectives designed to enhance shareholder value • For Fiscal 2021, the year was equally divided into two halves with different goals. First half goals for Fiscal 2021, set in May 2020, were based 100% on individual objectives focused primarily on the execution of a successful COVID-19 recovery strategy. Second half goals were tied to the achievement of more traditional corporate financial and operational goals, set in October 2020 | |||