UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1 to Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number 1-10816

MGIC INVESTMENT CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

| WISCONSIN | | 39-1486475 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

| MGIC PLAZA, 250 EAST KILBOURN AVENUE, | | |

| MILWAUKEE, WISCONSIN | | 53202 |

| (Address of principal executive offices) | | (Zip Code) |

(414) 347-6480

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class: | | Common Stock, Par Value $1 Per Share |

| | | Common Share Purchase Rights |

| Name of Each Exchange on Which | | |

| Registered: | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒Yes ☐No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).☒Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| |

| Large accelerated filer ☒ | Accelerated filer ☐ |

| | |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| | |

| Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒No

State the aggregate market value of the voting common stock held by non-affiliates of the Registrant as of June 30, 2017: Approximately $4.1 billion*

* Solely for purposes of computing such value and without thereby admitting that such persons are affiliates of the Registrant, shares held by directors and executive officers of the Registrant are deemed to be held by affiliates of the Registrant. Shares held are those shares beneficially owned for purposes of Rule 13d-3 under the Securities Exchange Act of 1934 but excluding shares subject to stock options.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock as of April 16, 2018: 371,347,632.

EXPLANATORY NOTE

On February 23, 2018, we filed our Annual Report on Form 10-K for the year ended December 31, 2017 (the “Original Filing”), with the Securities and Exchange Commission (the “SEC”). The Original Filing indicated that the information required by Part III of Form 10-K would be incorporated by reference to the Company’s definitive Proxy Statement for the 2018 Annual Meeting of Shareholders, provided such Proxy Statement was filed within 120 days after December 31, 2017. Such Proxy Statement will not be filed within 120 days after December 31, 2017; therefore, this Amendment No. 1 (this “Amendment”) on Form 10-K/A, which amends and restates items identified below with respect to the Original Filing, is being filed to provide the disclosure required by Part III of Form 10-K.

This Form 10-K/A only amends information in Part III, Item 10 (Directors, Executive Officers and Corporate Governance), Item 11 (Executive Compensation), Item 12 (Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters), Item 13 (Certain Relationships and Related Transactions, and Director Independence) and Item 14 (Principal Accounting Fees and Services). In addition, as required by Rule 12b-15 of the Securities Exchange Act of 1934, this Form 10-K/A contains new certifications by our chief executive officer and our chief financial officer, filed as exhibits hereto. Because this Form 10-K/A includes no financial statements, we are not including certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

This Amendment on Form 10-K/A is not intended to revise any other information presented in the Original Filing, which remains unchanged, and has not been updated to reflect events occurring subsequent to the original filing date.

|

| | | |

| TABLE OF CONTENTS |

| | | Page No. |

| PART III | | |

| | Item 10. | | |

| | Item 11. | | |

| | Item 12. | | |

| | Item 13. | | |

| | Item 14. | | |

| PART IV | | |

| | Item 15. | | |

| | |

| | | |

| | |

| | |

Part III

| |

| Item 10. | Directors, Executive Officers and Corporate Governance. |

DIRECTORS

Each nominee listed below is a director of the Company who, with the exception of Ms. Lora, was previously elected by our shareholders. Historically, the Board has consisted of 11 directors. In October 2016, an independent director left the Board to reduce his outside time commitments, which reduced the number of directors to 10. Ms. Lora was brought to the attention of the Board by an independent director. In addition to her qualifications discussed in her biography below, she further enhances the Board's gender diversity. In evaluating incumbent directors for renomination to the Board, the Management Development, Nominating and Governance Committee has considered a variety of factors. These include the Board membership criteria described in our Corporate Governance Guidelines (found on our website (http://mtg.mgic.com) under the “Leadership & Governance; Documents” links) and past performance on the Board based on any feedback from other Board members.

Information about our directors who are standing for election at our 2018 Annual Meeting of Shareholders appears below. The biographical information about our directors is as of April 20, 2018, and for each director includes a discussion about the skills and qualifications that the Board has determined support the director’s continued service on the Board.

Daniel A. Arrigoni, age 67, has been a director since 2013 and serves on the Audit Committee and the Risk Management Committee. Mr. Arrigoni was President and Chief Executive Officer of U.S. Bank Home Mortgage Corp., one of the largest originators and servicers of home loans in the U.S., until his retirement in 2013. Prior to his retirement, Mr. Arrigoni also served as an Executive Vice President of U.S. Bank, N.A. Mr. Arrigoni led the mortgage company for U.S. Bank and its predecessor companies since 1996. Mr. Arrigoni has over 40 years of experience in the home mortgage and banking industries.

Mr. Arrigoni brings to the Board a broad understanding of the mortgage business and its regulatory environment, skill in assessing and managing credit risk, and significant finance experience, each gained from his many years of executive management in the home mortgage and banking industries.

Cassandra C. Carr, age 73, has been a director since 2013 and serves on the Management Development, Nominating & Governance Committee and the Risk Management Committee. Ms. Carr is a consultant. She was Global Vice Chair of Talent at Hill+Knowlton Strategies before leaving in 2012, and spent nine years as a Senior Advisor for Public Strategies, Inc., both of which firms provide public relations services. Prior to joining Public Strategies, Ms. Carr held various senior-level positions, including Senior Executive Vice President – External Affairs, Senior Vice President – Human Resources, and Senior Vice President – Finance and Treasurer, with SBC Communications, Inc., which during her tenure became one of the world’s largest telecommunications companies.

Ms. Carr brings to the Board significant strategic planning, regulatory and public relations consulting and executive management experience, as well as financial management experience with a public company.

C. Edward Chaplin, age 61, has been a director since 2014 and serves on the Risk Management Committee and the Securities Investment Committee. Mr. Chaplin was President and Chief Financial Officer at MBIA Inc., a provider of financial guarantee insurance and the largest municipal bond-only insurer, from 2008 until March 2016, and remained with MBIA as Executive Vice President until his January 1, 2017 retirement. He served as a member of MBIA’s Board of Directors from 2003 until 2006, when he left to become Chief Financial Officer of that company. Prior to joining MBIA, Mr. Chaplin was Senior Vice President and Treasurer of Prudential Financial Inc., a firm he joined in 1983 and for which he held various senior management positions, including Regional Vice President of Prudential Mortgage Capital Company. Mr. Chaplin also serves on the Board of Brighthouse Financial, Inc., a provider of life insurance and annuity products in the U.S.

Mr. Chaplin brings to the Board a deep understanding of the insurance and real estate industries, management and leadership skills, and financial expertise.

Curt S. Culver, age 65, has been a director since 1999 and serves on the Executive Committee. Mr. Culver was our Chairman of the Board from 2005 until his retirement as our Chief Executive Officer in 2015. He is currently our non-executive Chairman of the Board. He was our Chief Executive Officer from 2000 and was the Chief Executive Officer of Mortgage Guaranty Insurance Corporation (“MGIC”)

from 1999, in both cases until his retirement, and he held senior executive positions with us and MGIC for more than five years before he became Chief Executive Officer. He is also a director of Wisconsin Energy Corporation and its subsidiary Wisconsin Electric Power Company.

Mr. Culver brings to the Board extensive knowledge of our business and operations and a long-term perspective on our strategy.

Timothy A. Holt, age 65, has been a director since 2012 and serves on the Audit Committee and the Securities Investment Committee (as its Chairman). Mr. Holt was an executive committee member and Senior Vice President and Chief Investment Officer of Aetna, Inc., a diversified health care benefits company, when he retired in 2008 after 30 years of service. From 2004 through 2007, he also served as Chief Enterprise Risk Officer of Aetna. Prior to being named Chief Investment Officer in 1997, Mr. Holt held various senior management positions with Aetna, including Chief Financial Officer of Aetna Retirement Services and Vice President, Finance and Treasurer of Aetna. Mr. Holt also serves as a director of Virtus Investment Partners, Inc. From January 2014 to February 2017, he served as a director of StanCorp Financial Group, Inc., which was a publicly-traded insurance products company until it was acquired in March 2016.

Mr. Holt brings to the Board investment expertise, skill in assessing and managing investment and credit risk, broad-based experience in a number of areas relevant to our business, including insurance, and senior executive experience gained at a major public insurance company.

Kenneth M. Jastrow, II, age 71, has been a director since 1994. He serves as our Lead Director and he serves on the Executive Committee and the Management Development, Nominating & Governance Committee. He is a corporate director and private investor. During 2007-2015, Mr. Jastrow served as a non-executive Chairman of the Board of Forestar Group Inc., which engaged in various real estate and natural resource businesses. During 2000-2007, Mr. Jastrow served as Chairman and Chief Executive Officer of Temple-Inland Inc., a paper and forest products company, which during Mr. Jastrow’s tenure also had interests in real estate and financial services. Mr. Jastrow is also a director of KB Home and Genesis Energy, LLC, the general partner of Genesis Energy, LP, a publicly-traded master limited partnership.

Mr. Jastrow brings to the Board senior executive and leadership experience gained through his service as chairman and chief executive officer at a public company with diversified business operations in sectors relevant to our operations, experience in the real estate, mortgage banking and financial services industries, and knowledge of corporate governance matters gained through his service as a non-executive chairman and on public company boards.

Michael E. Lehman, age 67, has been a director since 2001 and serves on the Audit Committee (as its Chairman) and the Management Development, Nominating & Governance Committee. Mr. Lehman has served the University of Wisconsin in various capacities since March 2016, most recently as Interim Vice Provost for Information Technology and Chief Information Officer and Special Advisor to the Chancellor, and previously as Interim Vice Chancellor for Finance and Administration. He was the Interim Chief Financial Officer at Ciber Inc., a global information technology company (2013-2014); Chief Financial Officer of Arista Networks, a cloud networking firm (2012-2013); and Chief Financial Officer of Palo Alto Networks, a network security firm (2010-2012). Earlier in his career, he was the Executive Vice President and Chief Financial Officer of Sun Microsystems, Inc., a provider of computer systems and professional support services. During the past five years, Mr. Lehman also served as a director of Solera Holdings, Inc., until it was acquired by a private company.

Mr. Lehman brings to the Board financial and accounting knowledge gained through his service as chief financial officer of a large, multinational public company, skills in addressing the range of financial issues facing a large company with complex operations, senior executive and operational experience, and leadership skills.

Melissa B. Lora, age 55, has been a director since 2017 and serves on the Audit Committee and the Risk Management Committee. Ms. Lora, since 2013, has been President of Taco Bell International, a segment of Taco Bell Corp., which is a division of Yum! Brands, Inc., one of the world’s largest restaurant companies. Ms. Lora will be retiring from Taco Bell Corp. in the summer of 2018. Ms. Lora served in various roles at Taco Bell Corp., including Global Chief Financial and Development Officer (2012-2013), Chief Financial and Development Officer (2006-2012) and Chief Financial Officer (2001-2006). Ms. Lora also serves as Lead Independent Director for KB Home.

Ms. Lora brings to the Board substantial executive management experience, including in financial and marketing matters.

Gary A. Poliner, age 64, has been a director since 2013 and serves on the Risk Management Committee (as its Chairman), the Audit Committee and the Securities Investment Committee. Mr. Poliner was President of The Northwestern Mutual Life Insurance Company (“Northwestern Mutual”), the nation’s largest direct provider of individual life insurance, and a member of its Board of Trustees, until his retirement from that company in June 2013, after more than 35 years of service. He was named President of Northwestern Mutual in

2010. Mr. Poliner also held various other senior-level positions at Northwestern Mutual, including Chief Financial Officer (2001-2008) and Chief Risk Officer (2009-2012). During a portion of 2016, Mr. Poliner served as a consultant for the Janus Funds and since June 2016, he has served as an Independent Trustee of the Janus Funds (58 funds).

Mr. Poliner brings to the Board a breadth of executive management experience in the insurance business, including risk management, and financial and insurance regulatory expertise.

Patrick Sinks, age 61, has been a director since 2014 and serves on the Executive Committee (as its Chairman). Mr. Sinks has been our Chief Executive Officer since 2015. He has served as our President and Chief Operating Officer since 2006, and held senior executive positions with MGIC for more than five years before then.

Mr. Sinks brings to the Board extensive knowledge of our industry, business and operations, a long-term perspective on our strategy and the ability to lead our Company as the mortgage finance system and the mortgage insurance industry evolve.

Mark M. Zandi, age 58, has been a director since 2010 and serves on the Risk Management Committee. Dr. Zandi, since 2007, has been Chief Economist of Moody’s Analytics, Inc., where he directs economic research. Moody’s Analytics is a leading provider of economic research, data and analytical tools. It is a subsidiary of Moody’s Corporation that is separately managed from Moody’s Investors Service, the rating agency subsidiary of Moody’s Corporation. Dr. Zandi is a trusted adviser to policymakers and an influential source of economic analysis for businesses, journalists and the public and he frequently testifies before Congress on economic matters.

Dr. Zandi, with his economics and residential real estate industry expertise, brings to the Board a deep understanding of the economic factors that shape our industry. In addition, Dr. Zandi has expertise in the legislative and regulatory processes relevant to our business.

EXECUTIVE OFFICERS

Information required by this Item regarding Executive Officers was included in Part I to our Annual Report on Form 10-K filed with the SEC on February 23, 2018.

CORPORATE GOVERNANCE AND BOARD MATTERS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers and directors to file reports of their beneficial ownership of our stock and changes in stock ownership with the SEC. Based in part on statements by the directors and executive officers, we believe that all Section 16(a) forms were timely filed by our directors and executive officers in 2017.

Code of Business Conduct

We have a Code of Business Conduct emphasizing our commitment to conducting our business in accordance with legal requirements and high ethical standards. The Code applies to all employees, including our executive officers, and specified portions are applicable to our directors. Certain portions of the Code that apply to transactions with our executive officers, directors, and their immediate family members are described in Item 13. These descriptions are subject to the actual terms of the Code.

Our Code of Business Conduct is available on our website (http://mtg.mgic.com) under the “Leadership & Governance; Documents” links. Written copies of this document are available to any shareholder who submits a written request to our Secretary. We intend to disclose on our website any waivers from, or amendments to, our Code of Business Conduct that are subject to disclosure under applicable rules and regulations.

Audit Committee

Our Board has an Audit Committee, all of whose members meet the heightened independence criteria that apply to Audit Committee members under SEC and NYSE rules. The Board has determined that Messrs. Holt and Lehman and Ms. Lora are “audit committee financial experts” as defined in SEC rules.

Item 11. Executive Compensation.

COMPENSATION DISCUSSION AND ANALYSIS

In this Compensation Discussion and Analysis (“CD&A”), we describe the components of our executive compensation program for our chief executive officer, our chief financial officer and our three other most highly compensated executive officers (our “named executive officers” or “NEOs”). We also provide other information about our executive compensation program, including the role of the Management Development, Nominating and Governance Committee of our Board (the “Committee”).

EXECUTIVE SUMMARY

thxKey Takeaways

Our 2017 financial and business performance was outstanding

|

| | |

| • | Adjusted net operating income per diluted share for 2017 was $1.36, up 37% from 2016 ($0.99), with adjusted net operating income of $517.7 million, up 31% from 2016 ($396.3 million).(1) |

Adjusted Net Operating Income

per Diluted Share(1)

|

| |

| | (1) Adjusted net operating income and adjusted net operating income per diluted share are non-GAAP measures of performance. For a description of how we calculate these measures and for a reconciliation of these measures to their nearest comparable GAAP measures, see Appendix B. |

| | (2) New insurance written refers to direct new insurance written (before the effects of reinsurance). |

|

| | |

| • | Our book of flow insurance in force, the principal source of our future revenue, grew by more than 8% in 2017. |

| • | Capital transactions contributed to the decrease in our long-term debt to shareholders' equity ratio, to 26.5% as of December 31, 2017, from 46.7% as of December 31, 2016. |

The 2017 incentive compensation we awarded is aligned with the interests of shareholders

|

| | |

| • | Our NEOs' 2017 bonuses depended on performance against ten performance metrics, with over 40% dependent on the extent to which we achieved EPS and ROE goals. |

| | ° | As noted above, our 2017 adjusted net operating income per diluted share was 37% more than 2016 ($1.36 vs. $0.99). The Tax Act resulted in a $133 million charge to earnings in 2017 due to our remeasuring our deferred tax assets to reflect the lower rates. Adjusted net operating income excludes the effect of the remeasurement as do the EPS and ROE metrics for our bonus plan. We present these comparisons on an adjusted net operating income per diluted share basis to highlight the increase in our core financial performance. |

| | ° | Our 2017 ROE of 12.5%, as calculated by Bloomberg, was at the 81st percentile of our Benchmarking Peer Group. (Bloomberg calculates ROE by dividing GAAP net income by average equity outstanding). Our 2017 ROE, calculated using our definition of adjusted net operating income for us and each company in our Benchmarking Peer Group, was at the 92nd percentile. |

| • | Full vesting for all of the 2017 long-term equity awards to our CEO and EVPs requires 13.5% compound annual growth in adjusted book value per share. Adjusted book value per share will be computed as if the Tax Act had not reduced the corporate tax rate from 35% to 21%. Adjusted book value per share is a non-GAAP financial measure. For a description of how we calculate this measure and for a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this CD&A. |

In 2017 and 2018, we further aligned compensation with the interests of shareholders

|

| | |

| • | Our 2017 equity awards to our CEO and EVPs were changed to: |

| | ° | Establish three-year cliff vesting, |

| | ° | Reduce by 12% the number of annual equity award shares due to a sustained increase in our stock price, and |

| | ° | Tie vesting solely to achievement of a performance goal relating to increased book value per share. |

| | For more information about these changes, see "— Components of our Executive Compensation Program — 2017 Long-Term Equity Awards," page 14. |

| • | We increased our stock ownership guidelines in 2017. See "— Other Aspects of our Executive Compensation Program — Stock Ownership Guidelines," page 22. |

| • | We reduced the number of metrics to determine the 2018 bonuses, to five from the ten used in 2017. Feedback from an advisor to several of our shareholders suggested that ten metrics was a relatively large number that added complexity to the program and had the possibility of insulating pay from poor performance in any single metric. |

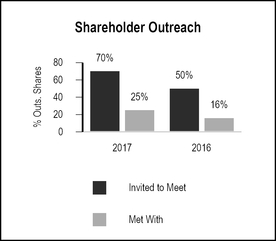

Shareholder Outreach and Consideration of Last Year’s “Say on Pay” Vote

During 2017, we continued our shareholder outreach efforts, as shown in the chart to the right. We value the views of our shareholders and intend to continue to engage and solicit their feedback.

At the 2016 and 2017 Annual Meetings, 99% of the Say on Pay votes cast were in support of the compensation of our NEOs. The Committee views this voting result as confirmation of overwhelming shareholder support of our executive compensation program.

Compensation-Related Corporate Governance Policies and Best Practices

We have many compensation-related governance policies and best practices that we believe align our executive compensation with long-term shareholder interests:

Stock Ownership. In early 2017, the Committee changed the stock ownership guidelines for NEOs to be stock valued at six times base salary for our CEO and three times base salary for the other NEOs. At the time the Committee changed our stock ownership guidelines, our Benchmarking Peers had guidelines for their CEOs ranging from five to seven times base salary.

Equity Holding Post-Vesting. Our NEOs and other executive officers are required to hold, for one year after vesting, the lower of 25% of shares that vest under equity awards and 50% of the shares that were received by the officer after taking account of shares withheld to cover taxes. Apart from what is required, we have had a culture of stock retention by senior executives. Excluding shares withheld from equity awards for income tax withholding, the last time any of our current or past NEOs sold our stock while an NEO was more than 12 years ago.

No Hedging, Pledging or 10b5-1 Plans. Our policies prohibit directors, NEOs and other executive officers from entering into hedging transactions referencing the Company’s equity securities, holding Company securities in a margin account, or pledging Company securities as collateral for a loan. They also prohibit the use by those individuals of plans created pursuant to Rule 10b5-1 of the Securities Exchange Act which may otherwise have allowed such persons to transact in our securities while in possession of material undisclosed information.

High Percentage of Performance-Based Compensation. 85% of our CEO’s 2017 TDC is tied to achievement of pre‑set performance goals.

Limited Perquisites. Our NEO perks are very modest, ranging between approximately $800 and $4,800 in 2017.

Effective Use of Equity Compensation with Low Burn Rate and Dilution. The total equity awards granted to all participants under our 2015 Omnibus Incentive Plan in each of January 2017 and January 2018 were less than 0.5% of our outstanding shares at the prior December 31. In October 2017, the Compensation Consultant provided a report indicating that the Company had the lowest dilution from outstanding awards among all companies in the Benchmarking Peer Group (calculated as average of 2014-2016 shares granted as a percentage of weighted average total shares outstanding). Based on a “burn rate” methodology that uses the average of the total awards granted (adjusted depending on the volatility of the price of the underlying stock, which for us increases the calculated "burn rate") during each of the last three completed years and the weighted average number of shares outstanding during each such year, our three-year average annual “burn rate” for 2015-2017 would be approximately 1.2%.

Limited Change in Control Benefits:

| |

| • | “Double trigger” is required for any benefits to be paid (equity awards will not vest upon a change in control if the Committee determines that the awards will be assumed or replaced); |

| |

| • | Cash severance does not exceed 2 times base salary plus bonus plus retirement plan accrual; and |

| |

| • | There is no excise tax gross-up provision. |

Employment Agreements. None; only the limited provisions referred to above that are effective after a change in control.

“Clawback” Policy. Our “clawback” policy applies to cash incentive compensation as well as equity award compensation received by our NEOs and other executive officers.

Compensation Consultant Performs No Services for Us. The Compensation Consultant is retained by the Committee and performs no services for the Company.

Compensation Risk Evaluation. Annually, the Committee reviews an executive compensation risk evaluation by management designed to ensure that our compensation programs do not motivate excessive risk-taking and are not reasonably likely to have a material adverse effect on the Company.

Omnibus Incentive Plan. Our 2015 Omnibus Incentive Plan, approved by shareholders, contains the following provisions:

| |

| • | No granting of stock options with an exercise price less than the fair market value of the Company’s common stock on the date of grant; |

| |

| • | No re-pricing (reduction in exercise price) of stock options; |

| |

| • | No cash buy-outs of underwater stock options; |

| |

| • | No inclusion of reload provisions in any stock option grant; |

| |

| • | No payment of dividends on performance shares before they are vested; |

| |

| • | No single trigger vesting of awards upon a change in control in which the awards are assumed or replaced; |

| |

| • | No recycling of shares withheld for tax purposes upon vesting; |

| |

| • | No granting of more than 5% of the awards under the plan with a vesting period of less than one year; and |

| |

| • | No Committee discretion to accelerate vesting of awards, except under certain limited instances like death and disability. |

OBJECTIVES OF OUR EXECUTIVE COMPENSATION PROGRAM

In setting compensation, the Committee focuses on TDC. The objectives of our executive compensation program are to:

| |

| • | Attract and retain high-quality executives. We want a competitive pay opportunity in the sense that: |

| |

| ◦ | our base salaries are on average around the median of our Benchmarking Peers over a several year time horizon, and |

| |

| ◦ | our bonus and long-term equity awards, when performance is strong, move TDC above the market median to reflect that strong performance. |

| |

| • | Align executive compensation with long-term shareholder interests. We aim to achieve a close alignment between compensation and long-term shareholder interests by: |

| |

| ◦ | linking compensation to Company and executive performance; and |

| |

| ◦ | paying a substantial portion of TDC in: |

| |

| ▪ | bonuses based on specific goals that align payouts with Company performance, and |

| |

| ▪ | long-term equity awards whose vesting is based on three-year goals that align payouts with Company performance and whose value directly reflects our stock price. |

| |

| • | Limit perquisites. We provide only minimal perks for our executive officers. |

HOW WE MAKE COMPENSATION DECISIONS

Role of the Management Development, Nominating and Governance Committee

The Committee, which consists solely of independent directors, is responsible for overseeing the development and administration of our executive compensation program. The Committee approves the compensation of our CEO and our other senior executives, and performs other tasks including:

| |

| • | Review and approval of bonus and equity compensation goals and objectives; |

| |

| • | Evaluation of performance in light of these goals and objectives; and |

| |

| • | Evaluation of the competitiveness of the CEO’s total compensation package. |

The Committee also supports the Board’s role in overseeing the risks facing the Company, as described in more detail above under “Committee Membership and Meetings — Board Oversight of Risk.”

The Committee is supported in its work by our Chief Executive Officer, our Chief Human Resources Officer, our General Counsel and the Committee’s Compensation Consultant, as described below. Our Chairman of the Board, who was previously our CEO but now is not a member of our management, regularly participates in meetings of the Committee.

Role of the Compensation Consultant

The Committee has retained FW Cook & Co., a nationally recognized executive compensation consulting firm, to advise it. While our Chief Human Resources Officer coordinates its assignments, the Compensation Consultant reports directly to the Committee; the Committee retains authority to approve the compensation of the Compensation Consultant, determine the nature and scope of its services and evaluate its performance. The Compensation Consultant provides no services to the Company. The Committee may replace the Compensation Consultant or hire additional consultants at any time. A representative of the Compensation Consultant attends meetings of the Committee, as requested.

The Committee retains the Compensation Consultant to help it evaluate and oversee our executive compensation program and to periodically review the compensation of our directors. In connection with our executive compensation program, the Compensation Consultant provides various services to the Committee, including advising the Committee on the principal aspects of our executive compensation program and evolving industry practices and providing market information and analysis regarding the competitiveness of our program, including its relationship to performance.

The Compensation Consultant's work for the Committee during 2017 and early 2018 included:

| |

| • | Providing an evaluation of NEO compensation compared to Benchmarking Peers; |

| |

| • | Providing advice about the annual bonus plan, including the goals and target performance incorporated into the formula that is used to determine payouts; |

| |

| • | Providing advice about the long-term equity incentive program, including the level of awards granted under the program and the vesting provisions; |

| |

| • | Providing advice regarding “best practice” compensation practices, such as stock retention guidelines; |

| |

| • | Reviewing the 2016 Peer Group and provided advice regarding the addition of four peers to the group in 2017; |

| |

| • | Performing simulations of the concern level output of the quantitative pay-for-performance model of a leading proxy governance firm using our CEO’s compensation and our TSR as inputs; |

| |

| • | Reviewing drafts and commenting on the CD&A and related compensation tables for the Proxy Statement; and |

| |

| • | Providing an evaluation of compensation for the non-employee directors compared to market, and providing advice about possible revisions to the director compensation program. |

The Committee has assessed the independence of the Compensation Consultant pursuant to SEC and New York Stock Exchange rules and concluded that its work for the Committee does not raise any conflict of interest.

Role of Officers

While the Committee is ultimately responsible for making all compensation decisions affecting our NEOs, our CEO participates in the process because the Committee views his input as necessary given his close day-to-day association with the other NEOs and his knowledge of our operations. Among other things, our CEO makes recommendations on the components of compensation for the NEOs, other than himself. Our CEO does not participate in the portions of Committee meetings regarding the review of his own performance or the determination of the amounts of his compensation or when the Committee members meet among themselves.

Our Chief Human Resources Officer and our General Counsel also participate in the Committee’s compensation process. Our Chief Human Resources Officer is responsible for coordinating the work of the Compensation Consultant for the Committee and the annual preparation of an executive compensation risk evaluation. He maintains knowledge of executive compensation trends, practices, rules and regulations and works with our General Counsel on related legal and tax compliance matters as well as on other matters related to executive compensation. The Committee receives information from management that includes: detailed breakdowns of the compensation of the NEOs; the amount, if any, that our NEOs realized during the period they were NEOs from sales of stock received upon vesting of equity awards; the total amount of stock and RSUs held by each NEO; and the other compensation information disclosed in the Proxy Statement.

BENCHMARKING

To provide the Committee with a framework for evaluating compensation levels for our NEOs against market practices, the Compensation Consultant periodically prepares reports analyzing compensation data for our Benchmarking Peers. In addition, each year we provide the Committee with information regarding market trends and expected executive base salary changes for the coming year. The compensation surveys that we reviewed and, with the concurrence of the Compensation Consultant, summarized in the aggregate for the Committee in connection with establishing base salaries for 2017 were published by AON Hewitt, Mercer Consulting, Willis Towers Watson and World at Work.

We added companies to our Peer Group in 2017

The U.S. mortgage insurance industry has only six public companies. Therefore, the Committee has found it necessary to include companies from outside the mortgage insurance industry when constructing our group of Benchmarking Peers. Historically, surety and title insurers have been included because, like mortgage insurers, they have significant exposure to the residential real estate market.

While shareholders have not expressed concern with our Benchmarking Peer Group during our engagements, the Committee periodically reviews the composition of the group. In March 2017, the Committee added four companies to the group for several reasons, including the following:

| |

| • | Size of the Group. Due to the limited number of public companies in the mortgage, surety and title insurance industries, our 2016 Peer Group of ten companies has been smaller than the peer groups of most other companies. In addition, the number was expected to decrease as one of the Benchmarking Peers had agreed to be acquired by a non-public company, and two of the other Benchmarking Peers have significantly decreased in size since 2008 as a result of the financial crisis. Because of the relatively small peer group size and the prospect of it becoming smaller, the Committee chose to increase the size of our peer group. |

| |

| • | Composition of the Group. As noted above, our 2016 Peer Group has previously been composed of companies in the mortgage, surety and title insurance industries. However, recent talent acquisition has been from outside those industries; one of our NEOs and several of the officers we have most recently hired joined us from banking and mortgage finance companies. Therefore, the Committee determined that those industries should be represented in our peer group. In determining the companies to be added to our peer group, the Committee also considered which companies chose us as a peer; three of the four companies added chose us as a peer. |

Why the selected peers are appropriate for benchmarking purposes

Our Benchmarking Peer Group, including an identification of the companies added for 2017, is shown below. We believe these companies are appropriate for benchmarking our executive compensation for the reasons shown in the table below.

|

| | | | | | | |

| | | | Mortgage Insurer - Direct Competitor(1) | Significant Exposure to Residential Real Estate Market | Industry in which we Compete for Talent | Chose us as a Peer | Business |

| | MGIC 2017 Peer Group | | | | | | |

| | MGIC 2016 Peer Group | | | | | | |

| | Ambac Financial Group, Inc. | | | X | X | X | Financial Guaranty Insurer |

| | Arch Capital Group Ltd. | | X | X | X | | Includes Mortgage Insurer |

| | Assured Guaranty Ltd. | | | X | X | X | Financial Guaranty Insurer |

| | Essent Group Ltd. | | X | X | X | X | Mortgage Insurer |

| | Fidelity National Financial Inc. | | | X | X | | Title Ins & Other R.E. Services |

| | First American Fin'l Corp. | | | X | X | | Title Ins & Other R.E. Services |

| | Genworth Financial Inc. | | X | X | X | X | Includes Mortgage Insurer |

| | MBIA Inc. | | | X | X | X | Financial Guaranty Insurer |

| | NMI Holdings Inc. | | X | X | X | X | Mortgage Insurer |

| | Radian Group Inc. | | X | X | X | X | Mortgage Insurer |

| | Flagstar Bancorp Inc. | | | X | X | | Mortgage Orig & Svg; Banking |

| | Ocwen Financial Corp. | | | X | X | X | Mortgage Svg & Lending |

| | PennyMac Fin'l Services Inc. | | | X | X | X | Mortgage Svg & Lending |

| | PHH Corporation | | | X | X | X | Mortgage Svg & Lending |

| |

| (1) | Parent companies of direct competitors whose overall results are principally or significantly impacted by these competitors. |

As shown in the table below, we are reasonably comparable in terms of revenues, market capitalization and CEO compensation to the companies in our Benchmarking Peer Group.

|

| |

| MGIC Percentile Rank Versus Peer Group | |

| 2017 Revenue | 41st |

| 12/31/17 Market Capitalization | 80th |

| 2017 CEO TDC | 44th |

| 1-Year TSR (Period ended 12/31/17) | 76th |

| 3-Year TSR (Period ended 12/31/17) | 61st |

| 5-Year TSR (Period ended 12/31/17) | 100th |

COMPONENTS OF OUR EXECUTIVE COMPENSATION PROGRAM

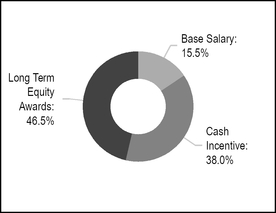

Each of the components of our executive compensation is discussed below. To meet our objective of aligning compensation and shareholder interests, our executive compensation program includes an annual bonus program that is tied to Company performance, and long-term equity awards whose vesting is based on Company performance and whose ultimate value reflects our stock price. As shown in the charts below, a large percentage of our CEO's TDC is at-risk through the annual bonus and long-term equity awards.

CEO 2017 Pay Mix (% of TDC)

At-Risk Performance-Based Pay: 84.5%

Base Salary

Our general philosophy is to target base salary range midpoints for our executive officers near the median levels of their Benchmarking Peer Group counterparts. In addition to reviewing market competitiveness, in considering any change to our CEO’s compensation, including base salary, the Committee takes into account its evaluation of his performance, based in part on a CEO evaluation survey completed by each non-management director. Subjects covered by the evaluation include financial results, leadership, strategic planning, succession planning, external relationships and communications and relations with the Board. Base salary changes for our other NEOs are recommended to the Committee by the CEO based on his evaluation of each NEO’s performance and the base salary surveys referred to under “Benchmarking” above. The Committee approves changes in salaries for NEOs after taking into account the CEO’s recommendations and the Committee's independent judgment regarding the officer gained through the Committee’s and the Board’s general contact with them.

In early April 2017, each NEO received a merit salary increase of approximately 3%. (The portion of Mr. Lane's base salary attributable to a 2010 retention arrangement is not considered in determining his increase.)

Annual Bonus

Background Considerations. In each of 2017 and 2016, we experienced large one-time expenses, including an additional $133 million tax provision in 2017 as a result of the enactment of the Tax Act. Because of the non-recurring nature of these items, we believe a benchmark of net operating income (including per diluted share) should be used to analyze our 2017 and 2016 actual results. Net operating income excludes this additional tax provision and other items that are generally viewed by securities analysts that follow us as not relevant to their analysis of our performance. Our adjusted net operating income per diluted share was $1.36 in 2017, compared to $0.99 in 2016, a 37% increase; our net operating income was $517.7 million in 2017, compared to $396.3 million in 2016, a 31% increase. Net operating income (including per diluted share) is a non-GAAP measure of performance. For a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this CD&A.

The structure of our current bonus program, which has financial goals and business objectives, was initially adopted for our 2015 fiscal year and was in effect for 2016 and 2017.

Maximum Bonus Opportunity. Unchanged from 2016, the NEOs’ maximum bonus opportunities for 2017 are 3 times base salary for the CEO and 2.25 times base salary for the other NEOs. (The portion of Mr. Lane's base salary attributable to a 2010 retention arrangement is not considered as part of his base salary for these purposes.) Bonus opportunity represents a multiple of the base salary amount approved by the Committee that becomes effective in March or April of the year for which the bonuses are awarded. Such base salary amounts will not be the same as the base salary amounts disclosed in the SCT due to the effects of the March or April pay increases and

variability in the number of pay periods in each calendar year. Based on our periodic assessment of our Benchmarking Peer Group, we have determined that these maximum bonus opportunities are appropriate to meet our objective that, when performance is strong, our bonus and long-term equity awards should move TDC above the market median to reflect that higher performance. In addition, in determining the TDC opportunity, the Committee has weighted bonus potentials more heavily than base salaries because bonuses are more directly linked to Company performance.

Our CEO's maximum bonus opportunity is in line with our Benchmarking Peers' practices. In January 2018, the Compensation Consultant provided a report including the following comparative data showing how our CEO’s 2016 maximum bonus opportunity, as a percentage of base salary, compares to those of the CEOs in our Benchmarking Peer Group. Comparisons for 2016 are shown because this compensation data was the latest available when the report was provided by the Compensation Consultant.

MGIC Percentile Rank Among Benchmarking Peer Group

CEO Disclosed Maximum Bonus Opportunity for 2016 as a Percent of Base Salary

|

| | | | |

| | | 2016 Peer Group |

| | MGIC | 25th percentile | Median | 75th percentile |

Bonus Opportunity(1) (% of Base Salary) | 300% | 240% | 306% | 438% |

| |

| (1) | Of the fourteen peer companies, twelve disclose a maximum bonus opportunity. For the two companies that do not disclose a maximum bonus opportunity, we used the highest percentage paid for 2014, 2015 or 2016 as the maximum opportunity. |

Determination of 2017 Bonus. Payment of bonuses for NEOs is conditioned on meeting one or more of the goals listed in our shareholder-approved 2015 Omnibus Incentive Plan. Prior to the Tax Act, compensation paid under a bonus plan of this type was intended to qualify as deductible compensation, as discussed in more detail under “Other Aspects of Our Executive Compensation Program – Tax Deductibility Limit” in this CD&A. Under the 2017 bonus plan, if the Combined Ratio is less than 40%, then the maximum bonus may be paid, unless the bonus formula described below results in a lower amount. For 2017, our Combined Ratio was 20.5%, which is the sum of our Expense Ratio of 16.0% and our Loss Ratio of 4.5%. For more information about these metrics, see the table titled "Calculation of 2017 Preliminary Bonus Percentage" below.

As shown in the table below, the bonus formula for 2017 had five financial performance goals (with a total weight of 75%) and five business objectives (with a total weight of 25%). Threshold, target and maximum performance levels were established for each financial performance goal. Actual performance at such levels would result in 0%, 50% and 100% achievement, respectively, for that goal, with actual achievement between these levels calculated by interpolation. The percentages determined by the Company’s actual 2017 performance for each financial performance goal were multiplied by assigned weights to determine a weighted score for that goal. For each business objective, the Committee reviewed management’s written report of the Company’s activities with respect to each objective and the related score, which was accepted by the Committee.

|

| | | | | | | | | | | | | | |

| Calculation of 2017 Preliminary Bonus Percentage | | | Maximum | | |

| | | | | | Possible | | |

| | 2017 Performance Levels | Actual | Score | | Weighted |

| | Threshold | Target | Maximum | 2017 | (Weight) | Score | Score |

| Financial Performance Goals: | | | | | | | |

| Diluted EPS, before effects of tax law changes | $0.43 | $0.86 | $1.08 | $1.28 | 30 | % | 30.0 |

| |

| Return on Equity, before effects of tax law changes | 6.0 | % | 12.4 | % | 15.0 | % | 19.2 | % | 25 |

| 25.0 |

| |

| Flow New Insurance Written (billions) | $40.0 | $48.0 | $56.0 | $49.1 | 15 |

| 8.5 |

| |

| Expense Ratio | 20.4 | % | 17.4 | % | 15.0 | % | 16.0 | % | 15 |

| 11.9 |

| |

| Loss Ratio | 6.2 | % | 3.1 | % | 2.1 | % | 4.5 | % | 15 |

| 4.1 |

| |

| Total | | | | | 100 | % | 79.5 |

| |

| Times: Total Weight of Financial Performance Goals | | | | | X 75% |

| 59.6 | % |

| | | | | | | | |

| Business Objectives: | | | | | | | |

| Capital Position | | For a discussion of performance against these business objectives, see "Performance Against Business Objectives" below | 20 | % | 20.0 |

| |

| Grow Insurance in Force | | 20 |

| 20.0 |

| |

| Manage Role of MI in Hosing Policy | | 20 |

| 18.0 |

| |

| Pursue Business Opportunities | | 20 |

| 10.0 |

| |

| Develop Co-Workers | | 20 |

| 20.0 |

| |

| Total | | | | | 100 | % | 88.0 |

| |

| Times: Total Weight of Business Objectives | | | | | X 25% |

| 22.0 | % |

| 2017 Preliminary Bonus Percentage | | | 81.6 | % |

The aggregate weighted financial and business performance scores resulted in a preliminary bonus percentage of 81.6%. The Committee has discretion to adjust the preliminary bonus percentage down by as much as 20 percentage points or up by as much as 10 percentage points, but did not do so. The adjusted percentage was multiplied by the aggregate maximum bonuses of the NEOs to determine the amount of the total bonus pool, which the Committee is not required to allocate in full; it allocated the pool such that the CEO received 81% of his maximum bonus and the other NEOs received an average of 80.5% of their maximum bonuses. The CEO recommends to the Committee a bonus for each of the other NEOs, which takes account of the bonus formula and the CEO’s evaluation of the NEO’s performance. The Committee, which generally has regular contact with the NEOs through their interaction with the Board, accepted the CEO’s recommendation and approved bonuses for the other NEOs.

The following table shows the percentage of the maximum possible bonus received by our CEO for the past three years.

|

| | | |

| | 2015 | 2016 | 2017 |

| CEO Bonus Received as a Percentage of Maximum Possible Bonus | 92% | 89% | 81% |

Performance Against Business Objectives. As shown in the table below, in 2017, the Company achieved favorable results against the business objectives used to determine the 2017 bonuses of our NEOs.

|

| | |

| Business Objective | | Results |

| | | |

Capital Position - Manage capital with consideration of compliance requirements, access to capital, levels of capital, the mix of sources of capital, and financial flexibility. | » | • Capital transactions contributed to the decrease in our long-term debt to shareholders' equity ratio, to 26.5% as of December 31, 2017, from 46.7% as of December 31, 2016. • Increased dividends from our principal subsidiary, MGIC, to our holding company. • Received upgraded ratings for MGIC from Moody's and Standard and Poor's.

|

| | | |

Prudently Grow Insurance in Force - Manage the 2017 book of business by product, geography and customer to produce a desirable volume and mix. | » | • Grew flow insurance in force by more than 8%. • Wrote $49.1 billion of NIW consistent with return goals and at levels of risk within risk appetite. • Increased market share from 17.8% in 2016 to 18.3% in 2017, despite significant pressure from tax-advantaged mortgage insurers. |

| | | |

Manage Role of Mortgage Insurance in Housing Policy - Manage the Company's business franchise through dealings with federal and state regulatory agencies, as well as the GSEs. | » | • Held leadership positions in trade associations. • Continued to enhance the reputation of the Company and the mortgage insurance industry relative to changing housing policy and a broader role for private mortgage insurance. |

| | | |

Pursue Business Opportunities - Advance core business within and outside GSE framework. Seek new opportunities to utilize core strengths. | » | • Positioned a credit insurance subsidiary to participate in future GSE credit risk transfer deals if acceptable returns can be achieved, considering strategic benefits. |

| | | |

Develop Co-Workers - Develop and nurture a respected organization with a clear path of succession throughout using best practice talent management efforts. | » | • Continued to build a robust talent review and succession mechanism for all management and key contributor positions. |

Rigor of Our Financial Performance Goals. The 2017 target performance levels (for 50% payout level) and maximum performance levels (for 100% payout) for each financial performance goal compared to actual performance in 2016 are presented below.

Diluted Earnings per Share Before Effects of Tax Law Changes

|

| | | |

| | Actual | 2017 Performance Levels |

| | 2016 | Target | Maximum |

| Diluted Earnings Per Share Before Effects of Tax Law Changes | $0.86 | $0.86 | $1.08 |

Our 2017 diluted EPS target performance level was set equal to our 2016 actual results, and the maximum performance level was set 26% higher than our 2016 actual results.

Return on Equity before Effects of Tax Law Changes

|

| | | |

| | Actual | 2017 Performance Levels |

| | 2016 | Target | Maximum |

| Return on Equity Before Effects of Tax Law Changes | 15.3% | 12.4% | 15.0% |

Our 2017 return on equity target performance level was set equal to our 2017 forecasted level. Our ROE calculation reflects GAAP net income, before effects of tax law changes, divided by beginning shareholders' equity. As shareholders' equity increases, all things equal, ROE will decrease. The decrease in the 2017 forecasted performance level compared to the 2016 actual ROE reflects, in part, the 14% increase in beginning shareholders' equity. Our target net income would have put us in the 52nd percentile of the Benchmark Peer Group’s ROEs for 2016 shown by Bloomberg and confirms our January 2017 view that our ROE target was set at a reasonably rigorous level.

New Insurance Written ("NIW")

|

| | | |

| | Actual | 2017 Performance Levels |

| | 2016 | Target | Maximum |

| New Insurance Written (billions) | $47.9 | $48.0 | $56.0 |

Our 2017 NIW target performance level of $48.0 billion was set equal to our 2016 actual NIW (rounded up), while the maximum performance level required a 17% increase over our 2016 NIW. The target performance level reflected that we remained subject to significant challenges, including intense price and other competition within our industry, and continued strong competition from the Federal Housing Administration and the Veterans Administration. In addition, at the time the bonus metrics were established, the 2017 mortgage origination market was expected to decline from 2016 levels due to declines in refinancing originations more than offsetting a small increase in purchase originations. Our actual NIW in 2017 was at the highest level since 2007 and increased by $1.2 billion over 2016 (a 2.5% increase).

Expense Ratio

|

| | | |

| | Actual | 2017 Performance Levels |

| | 2016 | Target | Maximum |

| Expense Ratio | 15.3% | 17.4% | 15.0% |

Our 2017 expense ratio target performance level was set equal to our 2017 forecasted level. Our expense ratio, while the lowest in the industry, was forecasted to increase in 2017 over our 2016 level due to an expected increase in expenses, largely due to the upgrading of our technology and building, and an expected decrease in net premiums written, due to expected changes in NIW, our mix of business, our premium rates, and the percentage of our insurance in force being ceded to reinsurers. Our maximum performance goal would have required a 9% decrease in expenses from 2016, or an 8% increase in net premiums written from 2016 (or some combination of the two).

Loss Ratio

|

| | | |

| | Actual | 2017 Performance Levels |

| | 2016 | Target | Maximum |

Loss Ratio(1) | 3.1% | 3.1% | 2.1% |

| |

| (1) | Our 2015 Omnibus Incentive Plan provides for performance to be calculated by excluding items determined to be extraordinary, unusual or non-recurring, which for 2017 were losses incurred associated with hurricane activity in Florida, Puerto Rico and Texas. |

A declining loss ratio indicates improving performance. Our 2017 loss ratio target performance level of 3.1% was set equal to the actual level in 2016, while the maximum performance level would have required a 32% improvement over 2016.

CEO Bonus Alignment. The following chart illustrates how our CEO bonuses have aligned with the Company’s year-end stock price and with our adjusted net operating income (loss) for the past five years. Adjusted net operating income (loss) is a non-GAAP financial measure. For a description of how we calculate this measure and for a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this CD&A.

Long-Term Equity Awards

Background Considerations. Consistent with our belief that there should be a strong link between compensation and performance, long-term equity awards provide one of our most significant TDC opportunities. We emphasize this component of our executive compensation program because it aligns executives’ interests with those of shareholders by linking compensation to both company performance and stock price, while fostering a long-term planning horizon and supporting the retention of our leadership team. Long-term equity awards at their grant date value represented 47% of the 2017 TDC of our CEO and 38% of the 2017 TDC of our other NEOs.

The following table shows how the Company's grant date value of long-term equity awards to our CEO compares to the awards to the CEOs of our Benchmarking Peer Group.

MGIC's CEO Long-Term Equity Awards - Percentile Rank Among our Benchmarking Peers |

| | |

| | MGIC Grant Date Stock Price | MGIC Percentile Rank |

| 2016 Long-Term Equity Awards | $5.66 | 30th |

| 2017 Long-Term Equity Awards | $10.41 | 44th |

| 2018 Long-Term Equity Awards (2017 awards for peers) | $15.81 | 60th |

Below is a discussion of our 2017 long-term equity awards and a discussion of our 2016 and 2015 long-term equity awards, which is provided for comparison purposes and because a portion of the long-term equity awards granted in 2016 and 2015 vested in 2017.

2017 Long-Term Equity Awards. To further align our long-term equity awards with the interests of shareholders, the 2017 long-term equity awards granted to our NEOs reflect the following changes compared to the 2016 awards.

|

| | |

| Change | | Explanation |

| 100% Cliff Vesting | » | The 2016 Book Value (BV) Awards, discussed below, were subject to partial vesting each year, while the 2017 Book Value (BV) Awards only cliff vest after three years based on compound achievement of an adjusted book value per share growth goal. |

| | | |

| 100% BV Awards | » | While 2016 BV Awards represented 80% of the equity awards granted to our CEO and EVPs in 2016, BV Awards represent 100% of the equity awards to these officers in 2017. |

| | | |

| Reduced Number of Units Awarded | » | We awarded approximately the same number of RSUs to our CEO and other NEOs each year during 2012-2016. The price of our stock was extremely volatile during this period; its closing price on the award dates in each of those years was $3.95, $2.75, $8.43, $8.98, and $5.66. Given the bounds of this price range, the Committee believed that reducing the number of shares when the price went up and increasing it when the price went down would not foster proper alignment with shareholders. Given the increase in our stock price from the 2016 grant date, a general sustained increase in its price since mid-2012, and our return to sustained profitability, the Committee reduced the number of shares awarded in 2017 by 12% compared to the number granted in 2016. |

100% of the long-term equity awards granted to the NEOs in 2017 were BV Awards. These awards cliff vest after three years based on cumulative achievement of a three-year cumulative adjusted book value ("ABV") per share growth goal that represents a 13.5% compound annual growth in ABV. Book value growth was chosen as the vesting goal in part because of its simplicity and relevance to management and investors. Book value growth measures cumulative build-up of equity in the Company; we believe its use as a metric aligns executive compensation with the financial strength of the Company.

ABV per share is a non-GAAP financial measure. For a description of how we calculate this measure and for a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this CD&A. For the 2017 BV Awards, one adjustment to book value is the elimination of the effects of the Tax Act. Therefore, the 2017 ABV is increased by adding back the additional tax expense related to the remeasurement of our net deferred tax assets to reflect the lower corporate income tax rate under the Tax Act. In 2018 and 2019, ABV will be decreased by reflecting income taxes at a 35% tax rate, instead of the 21% tax rate provided for under the Tax Act.

The table below shows:

| |

| • | the three-year cumulative goal for vesting of the 2017 BV Awards, and |

| |

| • | the 2017 growth in ABV per share as calculated for the awards; no shares will vest until the end of the three-year performance period |

Growth in Adjusted Book Value per Share for 2017 Equity Awards |

| |

| 3-year Cumulative Goal | 2017 Actual Growth |

| $3.56 | $1.34 |

2016 and 2015 Performance-Based Long-Term Equity Awards – BV (Book Value) Awards. BV Awards represented 80% of the long-term equity awards granted in each of January 2016 and 2015 to the CEO and NEOs who were Executive Vice Presidents ("EVPs"), and 60% of the awards to NEOs who were Senior Vice Presidents ("SVPs"). Vesting for these awards will occur over a three-year period, based on achievement of a three-year cumulative goal for growth in ABV per share. Partial vesting may occur annually (up to a maximum of 1/3 for the first year and 2/3 for the first and second years combined) based on progress against the three-year cumulative goal. ABV per share is a non-GAAP financial measure. For a description of how we calculate this measure and for a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this CD&A.

The tables below show:

| |

| • | the three-year cumulative goal for vesting of the 2016 and 2015 BV Awards, |

| |

| • | the 2017, 2016 and 2015 growth in adjusted book value per share as calculated for each of the awards, and |

| |

| • | the resulting vesting percentages. |

The three-year cumulative goal for 2016 and 2015 equity awards represented a compound annual growth in ABV of 14.9% and 26.5%, respectively.

Growth in Adjusted Book Value per Share for 2016 Equity Awards |

| | | | |

| 3-year Cumulative Goal | 2016 Actual Growth | 2016 Vesting % | 2017 Actual Growth | 2017 Vesting % |

| $3.49 | $0.94 | 26.9% | $1.44 | 39.8% |

Growth in Adjusted Book Value per Share for 2015 Equity Awards |

| | | | | | |

| 3-year Cumulative Goal | 2015 Actual Growth | 2015 Vesting % | 2016 Actual Growth | 2016 Vesting % | 2017 Actual Growth | 2017 Vesting % |

| $3.39 | $1.21 | 33.3% | $1.40 | 33.4% | $2.05 | 33.3% |

2016 and 2015 Other Long-Term Equity Awards - CR (Combined Ratio) Awards. The remaining 20% of the long-term equity awards granted in January 2016 and January 2015 to the CEO and NEOs who were EVPs, and 40% of the awards to NEOs who were SVPs, vest through continued service during a three-year performance period, if the Combined Ratio is less than 40%. The Committee adopted a performance goal for these awards to further align the interests of our NEOs with shareholders and to qualify the awards for the performance-based compensation exception under Section 162(m) of the Internal Revenue Code. See “Other Aspects of Our Executive Compensation Program – Tax Deductibility Limit” in this CD&A. One-third of the CR Awards are scheduled to vest in each of the three years after they are granted. If the performance goal is not met for a particular year, the awards that were scheduled to vest that year will be forfeited.

For 2017, the Combined Ratio was 20.5% (Expense Ratio of 16.0% and Loss Ratio of 4.5%). As a result, the portions of the 2016 and 2015 awards that were scheduled to vest in February 2017 did vest.

With respect to all of these awards, dividends are not paid currently, but when awards vest, a payment is made equal to the dividends that would have been paid had those vested awards been entitled to receive current dividends. We have not paid dividends since 2008 and do not anticipate paying dividends in the foreseeable future.

Pension Plan

Our executive compensation program includes a qualified pension plan and a supplemental executive retirement plan. We believe retirement plans are an important element of a competitive compensation program. These plans compute retirement benefits based only on current cash compensation (salary and annual bonus) and therefore do not include longer-term incentives that can result in substantial increases in pension value. We also offer a broad-based 401(k) plan to which we make contributions in cash. A description of our pension plan can be found following the table titled “Pension Benefits at 2017 Fiscal Year-End” in “Compensation and Related Tables” below.

Perquisites

To avoid an entitlement mentality, the perks we provide to our NEOs are minimal, ranging from $800 to $4,800. The 2017 perks included club dues and expenses, a parking space at our headquarters and spouse travel in connection with conferences attended by our CEO.

OTHER ASPECTS OF OUR EXECUTIVE COMPENSATION PROGRAM

No Employment Agreements

Our CEO and other NEOs do not have employment agreements other than those discussed below that become effective upon a change in control.

Stock Ownership by Named Executive Officers

Stock Ownership Guidelines. We have stock ownership guidelines for our executive officers to encourage them to maintain an ownership interest in the Company and to mitigate potential risks from incentive arrangements. Stock considered owned consists of shares owned outright by the executive (including shares in the executive's account in our 401(k) plan), and unvested restricted stock and RSUs scheduled to vest within one year (assuming ratable vesting over the performance period).

As noted above, in January 2017, the Committee changed the stock ownership guidelines to be stock valued at six times base salary for our CEO and stock valued at three times base salary for the other NEOs. Until the guideline is met, an NEO must not dispose of the portion of shares received upon vesting of equity awards equal to the lower of 25% of the shares that vested and 50% of the shares that were received by the NEO after taking account of shares withheld to cover taxes.

Each of our NEOs is in compliance with our stock ownership policy. The table below shows the revised guidelines, shares considered owned as of December 31, 2017 for purposes of the revised guidelines, and the multiple of base salary represented by that ownership for our CEO and all other NEOs.

|

| | | |

| | Guideline

(value of shares) | Actual Ownership

(value at 12/31/16) | Actual Ownership as a Multiple of Base Salary |

| CEO | $5,100,000 | $17,125,632 | 20.1 x |

| Total Other NEOs | $6,650,700 | $16,511,889 | 7.4 x |

Equity Holding Post-Vesting Requirement. A portion of equity awards granted to our NEOs and other executive officers must not be sold for one year after vesting. The number of shares that must not be sold is the lower of 25% of the shares that vested and 50% of the shares that were received by the officer after taking account of shares withheld to cover taxes. The holding period may end before one year if the officer is no longer required to report their equity transactions to the SEC. The holding period does not apply to involuntary transactions, such as would occur in a merger, and for certain other dispositions.

Excluding shares withheld from equity awards for income tax withholding, the last time any of our current or past NEOs sold our stock while an NEO was more than 12 years ago.

Hedging, Pledging and 10b5-1 Plan Prohibitions

Under our hedging policy, our directors, NEOs and other executive officers may not enter into hedging transactions referencing the Company’s equity securities, which for these purposes include, but are not limited to, vested and unvested RSUs and company stock held directly or indirectly. Under our pledging policy, those same individuals may not hold Company securities in a margin account or pledge Company securities as collateral for a loan. Our insider trading policy prohibits the use by those individuals of plans created pursuant to Rule 10b5-1 of the Securities Exchange Act which may otherwise have allowed such persons to transact in our securities while in possession of material undisclosed information.

“Clawback” Policy

Under our “clawback” policy, the Company will seek to recover from any NEO or other executive officer, to the extent the Committee deems appropriate, amounts associated with cash incentive compensation that was earned and equity awards that vested based on achievement of a performance goal if a subsequent financial restatement shows that such compensation should not have been paid.

Change in Control Provisions

Each of our NEOs is a party to a Key Executive Employment and Severance Agreement with us (a “KEESA”), as described in the section titled “Potential Payments Upon Termination or Change-in-Control – Change in Control Agreements” below. No executive officer has an employment or severance agreement, other than a KEESA. The period for which our KEESAs provide employment protection ends on the third anniversary of the date of a change in control. Our KEESAs provide for a cash termination payment in two lump sums (or one lump sum if neither the Company nor any affiliate’s stock is publicly traded) only after both a change in control and a specified employment termination (a “double trigger”). Our KEESAs provide for "double trigger" vesting of equity awards: there must be a change in control and an employment termination. The agreements for our outstanding equity awards provide that the equity will not vest upon a change in control if the Committee reasonably determines in good faith prior to the occurrence of the change in control that the awards will be assumed or replaced by the employee’s employer immediately following the change in control with an alternative award meeting specified requirements.

Our KEESAs do not contain a gross-up by the Company for any excise tax payments resulting from payments upon a change in control. For participants with KEESAs effective on or after October 23, 2014, and/or who have reached age 62, payments under the KEESAs or under any other agreement with or plan of the Company are capped by reducing such payments to an amount that will not trigger payment

of federal excise taxes on such payment. For participants with KEESAs effective before October 23, 2014, and who are younger than age 62, payments under the KEESAs or under any other agreement with or plan of the Company are similarly reduced only if the resulting after-tax value to the participant of the total payments upon a change in control is greater than the after-tax value to the participant if the cash payments were not so reduced with the participant responsible for the excise taxes.

No Stock Option Repricing

Our 2011 Omnibus Incentive Plan and our 2015 Omnibus Incentive Plan both prohibit the repricing of stock options, either by amending existing options to lower the exercise price, by granting new options having a lower exercise price in exchange for outstanding options having a higher exercise price or replacing underwater options with cash or other securities, unless such re-pricing is approved by shareholders.

Tax Deductibility Limit

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation in excess of $1 million paid during a year to certain covered executives. For 2017, our covered executives were Messrs. Sinks, Hughes, Lane and Mackey. For 2017, Section 162(m) generally exempted qualifying performance-based compensation from the $1 million annual deduction limit. Although the rules allowing this exemption are complex, we believe all of our compensation for 2017 qualifies as tax-deductible, with the exception of approximately 13% of our NEOs' 2017 bonuses. However, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and related regulations, and the fact that such regulations and interpretations may change from time to time (with potentially retroactive effect), there is no certainty that compensation intended by the Committee to satisfy the requirements for deductibility under Section 162(m) will be deductible.

Beginning in 2018, as a result of the changes made to Code Section 162(m) by the Tax Act, our number of covered executives will increase to include the four executives listed above, plus any executive who serves as our Chief Executive Officer or Chief Financial Officer at any time on or after January 1, 2018, or who is among our three most highly compensated officers other than the Chief Executive Officer and Chief Financial Officer for any year beginning with 2018. Also beginning in 2018, only qualifying performance-based compensation that is paid pursuant to a binding contract in effect on November 2, 2017 will be exempt from the deduction limit. Accordingly, any compensation paid in the future pursuant to new compensation arrangements entered into after November 2, 2017, even if performance-based, will count toward the $1 million deduction limit if paid to a covered executive. As a result of the changes made to Code Section 162(m) by the Tax Act, we expect some of the 2018 compensation we provide to our executive officers will not be deductible.

In making decisions about executive compensation, we also consider the impact of other regulatory provisions, including the provisions of Section 409A of the Internal Revenue Code regarding non-qualified deferred compensation and the change in control provisions of Section 280G of the Internal Revenue Code.

Process for Approving Compensation Components

The Committee's practice for many years has been to make equity awards and approve new salaries and bonuses, if any, at its meeting in late January, which normally follows our announcement of earnings for the prior year. The Committee also may approve changes in compensation at other times throughout the year.

The Committee has not adjusted executive officers' future compensation based upon amounts realized or forfeited pursuant to previous equity awards.

COMPENSATION COMMITTEE REPORT

Among its other duties, the Committee assists the oversight by the Board of Directors of MGIC Investment Corporation’s executive compensation program, including approving corporate goals relating to compensation for the CEO and senior officers, evaluating the performance of the CEO and determining the CEO’s annual compensation and approving compensation for MGIC Investment Corporation’s other senior executives.

The Committee reviewed and discussed with management the foregoing Compensation Discussion and Analysis. Based upon this review and discussion, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in MGIC Investment Corporation’s Annual Report on Form 10-K for the year ending December 31, 2017.

Members of the Management Development, Nominating and Governance Committee: