UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06338 |

|

Columbia Balanced Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq.

Columbia Management Advisors, LLC

One Financial Center

Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | August 31, 2006 | |

|

Date of reporting period: | February 28, 2006 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Funds

Semiannual Report

February 28, 2006

Columbia International Stock Fund

Columbia Mid Cap Growth Fund

Columbia Small Cap Growth Fund I

Columbia Real Estate Equity Fund

Columbia Technology Fund

Columbia Strategic Investor Fund

Columbia Balanced Fund

Columbia Oregon Intermediate Municipal Bond Fund

Columbia Conservative High Yield Fund

PRESIDENT'S MESSAGE

Columbia Funds

Table of Contents

| Columbia International Stock Fund | | | 1 | | |

|

| Columbia Mid Cap Growth Fund | | | 4 | | |

|

| Columbia Small Cap Growth Fund I | | | 7 | | |

|

| Columbia Real Estate Equity Fund | | | 10 | | |

|

| Columbia Technology Fund | | | 13 | | |

|

| Columbia Strategic Investor Fund | | | 16 | | |

|

| Columbia Balanced Fund | | | 19 | | |

|

Columbia Oregon Intermediate

Municipal Bond Fund | | | 22 | | |

|

| Columbia Conservative High Yield Fund | | | 25 | | |

|

| Financial Statements | | | 28 | | |

|

Board Consideration and Approval

of Investment Advisory Agreements | | | 151 | | |

|

Summary of Management Fee Evaluation

by Independent Fee Consultant | | | 154 | | |

|

| Columbia Funds | | | 158 | | |

|

Important Information

About This Report | | | 161 | | |

|

A message to our valued clients

In the mutual fund business, success can be measured a number of different ways. Performance is a key measure—the one that gains most attention. But fees and service are also important. In that regard, we are pleased to report that Columbia Management has experienced success on all three fronts over the past year. Even more important, our shareholders have benefited from this success.

Because performance ultimately determines investment success, we have devoted considerable energy to improving the performance of all Columbia funds. And we are happy to report that we have made considerable progress toward this important goal1.

Columbia has also taken great strides toward making fund operations more cost effective, which has translated into lower expense ratios on many Columbia funds. In this regard, we believe we still have more work to do, and we will continue to explore opportunities for reining in expenses to the benefit of all our shareholders.

On the service front, we have made it easy and convenient for shareholders to do business with us both on the web at www.columbiafunds.com or over the phone at 800.345.6611. In fact, we've recently upgraded our automated phone system with an advanced speech recognition system that allows callers to interact with the system using natural spoken commands.

After secure login, shareholders can buy, sell or exchange funds either online or over the phone. (Buying shares requires that a link has been established between the shareholder's bank account and Columbia.) Up-to-date performance and pricing information is available online and over the phone. At www.columbiafunds.com, shareholders can also update important personal information and get access to prospectuses and fund reports, which reduces paper clutter for shareholders and translates into a reduction of costs for the funds.

At Columbia Management, we think that you'll like what you see as you read the reports for the period ended February 28, 2006. We are committed to continued improvements in an effort to help our shareholders reach their long-term financial goals. And we look forward to continuing to work with you, our valued financial clients, in the years to come.

Sincerely,

Christopher L. Wilson

President, Columbia Funds

The views expressed in the President's Message reflect the current views of Columbia Funds. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and Columbia Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific company securities should not be construed as a recommendation or investment advice.

Not FDIC

Insured

May Lose Value

No Bank Guarantee

1Past performance is no guarantee of future results.

Performance Information – Columbia International Stock Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Growth of a $10,000 investment 03/01/96 – 02/28/06 ($)

| Share class | |

| Sales charge | | without | | with | |

| Class A | | | 21,709 | | | | 20,458 | | |

| Class B | | | 21,124 | | | | 21,124 | | |

| Class C | | | 21,208 | | | | 21,208 | | |

| Class D | | | 21,268 | | | | 21,061 | | |

| Class G | | | 21,122 | | | | 21,122 | | |

| Class Z | | | 22,052 | | | | n/a | | |

The table above shows the growth in value of a hypothetical $10,000 investment in each share class of Columbia International Stock Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Net asset value per share | |

| as of 02/28/06 ($) | | | | | |

| Class A | | | 17.72 | | |

| Class B | | | 17.36 | | |

| Class C | | | 17.43 | | |

| Class D | | | 17.48 | | |

| Class G | | | 17.35 | | |

| Class Z | | | 17.82 | | |

| Distributions declared per share | |

| 09/01/05 – 02/28/06 ($) | | | | | |

| Class A | | | 0.30 | | |

| Class B | | | 0.18 | | |

| Class C | | | 0.18 | | |

| Class D | | | 0.18 | | |

| Class G | | | 0.19 | | |

| Class Z | | | 0.34 | | |

Average annual total return as of 02/28/06 (%)

| Share class | | A | | B | | C | | D | | G | | Z | |

| Inception date | | 11/01/02 | | 11/01/02 | | 10/13/03 | | 11/01/02 | | 03/18/05 | | 10/01/92 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 14.43 | | | | 7.85 | | | | 14.19 | | | | 9.19 | | | | 14.20 | | | | 13.20 | | | | 14.16 | | | | 13.16 | | | | 14.18 | | | | 9.18 | | | | 14.66 | | |

| 1-year | | | 17.71 | | | | 10.94 | | | | 17.01 | | | | 12.01 | | | | 17.09 | | | | 16.09 | | | | 16.95 | | | | 15.95 | | | | 17.00 | | | | 12.00 | | | | 18.17 | | |

| 5-year | | | 5.46 | | | | 4.22 | | | | 4.88 | | | | 4.55 | | | | 4.97 | | | | 4.97 | | | | 5.03 | | | | 4.82 | | | | 4.88 | | | | 4.38 | | | | 5.79 | | |

| 10-year | | | 8.06 | | | | 7.42 | | | | 7.76 | | | | 7.76 | | | | 7.81 | | | | 7.81 | | | | 7.84 | | | | 7.73 | | | | 7.76 | | | | 7.76 | | | | 8.23 | | |

Average annual total return as of 12/31/05 (%)

| Share class | | A | | B | | C | | D | | G | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6- month (cumulative) | | | 15.72 | | | | 9.06 | | | | 15.43 | | | | 10.43 | | | | 15.51 | | | | 14.51 | | | | 15.46 | | | | 14.46 | | | | 15.41 | | | | 10.41 | | | | 15.96 | | |

| 1-year | | | 13.26 | | | | 6.75 | | | | 12.53 | | | | 7.53 | | | | 12.63 | | | | 11.63 | | | | 12.51 | | | | 11.51 | | | | 12.52 | | | | 7.52 | | | | 13.66 | | |

| 5-year | | | 3.03 | | | | 1.82 | | | | 2.50 | | | | 2.13 | | | | 2.58 | | | | 2.58 | | | | 2.64 | | | | 2.44 | | | | 2.49 | | | | 1.94 | | | | 3.35 | | |

| 10-year | | | 7.60 | | | | 6.96 | | | | 7.32 | | | | 7.32 | | | | 7.36 | | | | 7.36 | | | | 7.40 | | | | 7.29 | | | | 7.32 | | | | 7.32 | | | | 7.76 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for class A shares, maximum contingent deferred sales charge of 5.00% for class B and G shares and 1.00% for class C and D shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would have been lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the advisor or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. All results shown assume reinvestment of distributions. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Effective October 13, 2003, class D shares are closed to all new investors and new accounts. Existing class D shareholders will be able to make additional purchases at any time. In addition, the class D sales charge of 1.00% is waived after October 13, 2003.

Classes A, B and D (newer class shares) share performance information includes returns of the fund's class Z shares (the oldest existing fund class) for periods prior to the inception of the newer class shares. The returns for Class C include the returns of Class B prior to 10/13/03, the date on which class C was initially offered by the fund. The returns shown for Class C also include the performance of Class Z prior to the inception of Class B (11/01/02). Class G performance information includes returns of the fund's Class B shares for the period from 11/01/02 through 03/18/05 and for periods prior thereto, the fund's Class Z shares. Class Z share returns are not restated to reflect any expense differential (e.g., Rule 12b-1 fees) between class Z shares and the newer class shares. Had the expense differential been reflected, the returns for the periods prior to the inception of classes A, B, C, D and G would have been lower.

1

Fund Profile – Columbia International Stock Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

+14.43%

Class A Shares

Class A Shares

+15.14%

MSCI EAFE Index

MSCI EAFE Index

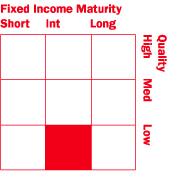

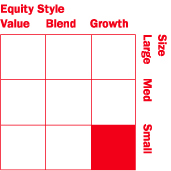

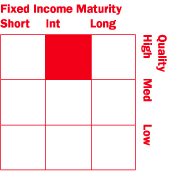

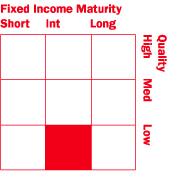

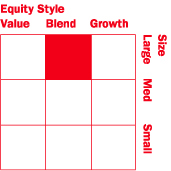

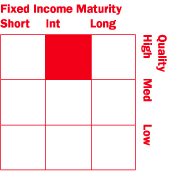

Management Style

Summary

n For the six-month period ended February 28, 2006, the Columbia International Stock Fund's Class A Shares returned 14.43% without sales charge. The fund's return was lower than its benchmarks, the MSCI EAFE Index, which returned 15.14%, and the MSCI All Country World ex US Index, which returned 17.09%.1 The fund fell just short of the average return of its peer group, the Morningstar Foreign Large Blend Fund Category, which was 14.95%.2

n The fund's out-of-benchmark weight in emerging markets and an above-average weight in Japan detracted from performance. Both markets aided performance in previous periods, and some of the fund's best performers came from emerging and Japanese stock markets during this reporting period. The fund has retained its exposure to both regions. Emerging markets, in particular, appear to offer some of the best opportunities for long-term growth despite intermittent volatility.

n A reduction in the fund's energy position was timely as it locked in gains for the fund before energy commodity prices began to decline – and energy stock prices along with them. A decision to underweight the United Kingdom (UK) also aided performance. A relatively tight monetary policy had a negative impact on UK stocks, and the UK was one of the worst-performing markets for the period.

1 The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US and Canada. The MSCI All Country World Ex US Index is also an index of global stock market performance that includes developed and emerging markets but excludes the US. Unlike the fund, indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2 ©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc. may not be copied or redistributed for any purpose and may only be used for non-commercial, personal purposes. The information contained herein is not represented or warranted to be accurate, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from use of this information. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933.

Portfolio Management

Fred Copper, CFA

n With the fund since 2005

n MBA, University of Chicago; BS, Boston College

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

International investing may involve certain risks, including foreign taxation, currency fluctuations, risks associated with possible differences in financial standards and other monetary and political risks.

Management style is determined by Columbia Management and is based on the investment strategy and process as outlined in the fund's prospectus.

2

UNDERSTANDING YOUR EXPENSES

Columbia International Stock Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

n For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

n For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number is in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the reporting period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and includes the fund's actual expense ratio. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

09/01/05 – 02/28/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,144.30 | | | | 1,018.94 | | | | 6.27 | | | | 5.91 | | | | 1.18 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,141.92 | | | | 1,015.22 | | | | 10.25 | | | | 9.64 | | | | 1.93 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,142.02 | | | | 1,015.22 | | | | 10.25 | | | | 9.64 | | | | 1.93 | | |

| Class D | | | 1,000.00 | | | | 1,000.00 | | | | 1,141.58 | | | | 1,015.22 | | | | 10.25 | | | | 9.64 | | | | 1.93 | | |

| Class G | | | 1,000.00 | | | | 1,000.00 | | | | 1,141.82 | | | | 1,015.47 | | | | 9.98 | | | | 9.39 | | | | 1.88 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,146.59 | | | | 1,020.18 | | | | 4.95 | | | | 4.66 | | | | 0.93 | | |

Expenses paid during the period are equal to the fund's respective class annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the transfer agent not waived a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided will not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the continuing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

3

Performance Information – Columbia Mid Cap Growth Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Growth of a $10,000 investment 03/01/96 – 02/28/06 ($)

| Share class | |

| Sales charge | | without | | with | |

| Class A | | | 22,969 | | | | 21,645 | | |

| Class B | | | 22,404 | | | | 22,404 | | |

| Class C | | | 22,449 | | | | 22,449 | | |

| Class D | | | 22,422 | | | | 22,202 | | |

| Class G | | | 22,350 | | | | 22,350 | | |

| Class R | | | 22,960 | | | | n/a | | |

| Class T | | | 23,005 | | | | 21,679 | | |

| Class Z | | | 23,256 | | | | n/a | | |

The table above shows the growth in value of a hypothetical $10,000 investment in each share class of Columbia Mid Cap Growth Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Net asset value per share | |

| as of 02/28/06 ($) | | | | | |

| Class A | | | 25.29 | | |

| Class B | | | 24.66 | | |

| Class C | | | 24.71 | | |

| Class D | | | 24.68 | | |

| Class G | | | 24.60 | | |

| Class R | | | 25.28 | | |

| Class T | | | 25.33 | | |

| Class Z | | | 25.61 | | |

| Distributions declared per share | |

| 09/01/05 – 02/28/06 ($) | | | | | |

| Class A | | | 0.31 | | |

| Class B | | | 0.31 | | |

| Class C | | | 0.31 | | |

| Class D | | | 0.31 | | |

| Class G | | | 0.31 | | |

| Class R | | | 0.00 | | |

| Class T | | | 0.31 | | |

| Class Z | | | 0.31 | | |

Average annual total return as of 02/28/06 (%)

| Share class | | A | | B | | C | | D | | G | | R | | T | | Z | |

| Inception | | 11/01/02 | | 11/01/02 | | 10/13/03 | | 11/01/02 | | 11/01/02 | | 01/23/06 | | 11/01/02 | | 11/20/85 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | | without | | with | | without | |

| 6-month (cumulative) | | | 15.61 | | | | 8.97 | | | | 15.21 | | | | 10.21 | | | | 15.18 | | | | 14.18 | | | | 15.20 | | | | 14.20 | | | | 15.25 | | | | 10.25 | | | | 15.57 | | | | 15.59 | | | | 8.96 | | | | 15.75 | | |

| 1-year | | | 24.43 | | | | 17.27 | | | | 23.53 | | | | 18.53 | | | | 23.53 | | | | 22.53 | | | | 23.50 | | | | 22.50 | | | | 23.60 | | | | 18.60 | | | | 24.38 | | | | 24.38 | | | | 17.22 | | | | 24.71 | | |

| 5-year | | | 3.44 | | | | 2.22 | | | | 2.92 | | | | 2.57 | | | | 2.97 | | | | 2.97 | | | | 2.94 | | | | 2.73 | | | | 2.88 | | | | 2.33 | | | | 3.43 | | | | 3.47 | | | | 2.26 | | | | 3.70 | | |

| 10-year | | | 8.67 | | | | 8.03 | | | | 8.40 | | | | 8.40 | | | | 8.42 | | | | 8.42 | | | | 8.41 | | | | 8.30 | | | | 8.69 | | | | 8.37 | | | | 8.67 | | | | 8.69 | | | | 8.04 | | | | 8.81 | | |

Average annual total return as of 12/31/05 (%)

| Share class | | A | | B | | C | | D | | G | | T | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 14.68 | | | | 8.09 | | | | 14.24 | | | | 9.24 | | | | 14.26 | | | | 13.26 | | | | 14.23 | | | | 13.23 | | | | 14.23 | | | | 9.23 | | | | 14.65 | | | | 8.05 | | | | 14.81 | | |

| 1- year | | | 16.08 | | | | 9.41 | | | | 15.20 | | | | 10.20 | | | | 15.22 | | | | 14.22 | | | | 15.19 | | | | 14.19 | | | | 15.25 | | | | 10.25 | | | | 16.05 | | | | 9.39 | | | | 16.36 | | |

| 5- year | | | -0.83 | | | | -2.00 | | | | -1.30 | | | | -1.67 | | | | -1.25 | | | | -1.25 | | | | -1.28 | | | | -1.48 | | | | -1.35 | | | | -1.91 | | | | -0.79 | | | | -1.96 | | | | -0.59 | | |

| 10-Year | | | 8.26 | | | | 7.62 | | | | 8.01 | | | | 8.01 | | | | 8.03 | | | | 8.03 | | | | 8.01 | | | | 7.90 | | | | 7.98 | | | | 7.98 | | | | 8.28 | | | | 7.64 | | | | 8.39 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for class A and T shares, maximum contingent deferred sales charge of 5.00% for class B and G shares and 1.00% for class C and D shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would have been lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the advisor or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

Class R and Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class R and Class Z shares have limited eligibility and the investment minimum requirement may vary. All results shown assume reinvestment of distributions. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Effective October 13, 2003, class D shares are closed to all new investors and new accounts. Existing class D shareholders will be able to make additional purchases at any time. In addition, the class D sales charge of 1.00% is waived after October 13, 2003.

Classes A, B, D, G and T (newer class shares) share performance information includes returns of the fund's class Z shares (the oldest existing fund class) for periods prior to the inception of the newer class shares. The returns for class C include the returns of class B prior to 10/13/03, the date on which class C was initially offered by the fund. The returns shown for class C also include the performance of class Z prior to the inception of class B (11/01/02). The returns for class R include the returns of class A prior to 01/23/06, the date on which class R was initially offered by the fund. The returns shown for class R also include the performance of class Z prior to the inception of class A (11/01/02). Class Z share returns are not restated to reflect any expense differential (e.g., Rule 12b-1 fees) between class Z shares and the newer class shares. Had the expense differential been reflected, the returns for the periods prior to the inception of classes A, B, C, D, G and T would have been lower.

4

Fund Profile – Columbia Mid Cap Growth Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

+15.61%

Class A Shares

Class A Shares

+8.90%

Russell Midcap Index

Russell Midcap Index

+9.69%

Russell Midcap Growth Index

Russell Midcap Growth Index

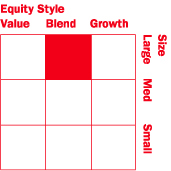

Management Style

Summary

n For the six-month period that ended February 28, 2006, the Columbia Mid Cap Growth Fund's Class A Shares returned 15.61% without sales charge. It outperformed both the Russell Midcap Index and the Russell Midcap Growth Index,1 which returned 8.90% and 9.69%, respectively, for the same period. Its return was also higher than the average return of the Morningstar Mid Cap Growth Funds Category, which was 10.66%.2 Strong stock selection across a variety of sectors accounted for the fund's strong performance.

n Stock selection within technology, industrials, health care, financials and telecommunications services made a significant contribution to the fund's return relative to its benchmarks and peer group. The fund's top contributor was Broadcom Corp. (3.0% of net assets), in the technology sector, which enjoyed strong profit growth as the result of higher-than-expected gross margins. Consumer staples stocks were the fund's weakest performers. Tyson Foods, Inc. (0.2% of net assets) was the fund's worst performer, as the company struggled to improve its profit margins.

n In an environment of healthy economic growth and relatively low inflation, the fund's managers maintain a bullish outlook for growth stocks, especially within the energy, materials and industrials sectors. However, decelerating growth could provoke a reassessment of the strength and duration of the current economic expansion. The fund's managers plan to continue to seek the stocks of growth companies with strong earnings prospects and attractive valuations.

1 The Russell Midcap Index is an index that measures the performance of the 800 smallest companies in the Russell 1000 Index, as ranked by total market capitalization. The Russell Midcap Growth Index is an index that measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Unlike the fund, indices are not investments, they do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2 ©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc. may not be copied or redistributed for any purpose and may only be used for non-commercial, personal purposes. The information contained herein is not represented or warranted to be accurate, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from use of this information. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933.

Portfolio Management

Kenneth A. Korngiebel, CFA

n With the fund since 2004

n MBA, Wharton School at University of Pennsylvania; BA, Stanford University

Wayne M. Collette, CFA

n With the fund since 2006

n MBA, Columbia University; BS, Brandeis University

J. Michael Kosicki, CFA

n With the fund since 2006

n BA, Hamilton College

George J. Myers, CFA

n With the fund since 2006

n MS, University of Wisconsin; BBA, University of Wisconsin

Theodore R. Wendell, CFA

n With the fund since 2006

n MBA, Columbia University; BA, Emory University

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investing in growth stocks incurs the possibility of losses because their prices are sensitive to changes in current or expected earnings.

Investing in mid-cap stocks may present special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Management style is determined by Columbia Management and is based on the investment strategy and process as outlined in the fund's prospectus.

5

UNDERSTANDING YOUR EXPENSES

Columbia Mid Cap Growth Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

n For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

n For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number is in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the reporting period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and includes the fund's actual expense ratio. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

09/01/05 – 02/28/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,156.11 | | | | 1,018.94 | | | | 6.31 | | | | 5.91 | | | | 1.18 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,152.09 | | | | 1,015.22 | | | | 10.30 | | | | 9.64 | | | | 1.93 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,151.79 | | | | 1,015.22 | | | | 10.30 | | | | 9.64 | | | | 1.93 | | |

| Class D | | | 1,000.00 | | | | 1,000.00 | | | | 1,151.99 | | | | 1,015.22 | | | | 10.30 | | | | 9.64 | | | | 1.93 | | |

| Class G | | | 1,000.00 | | | | 1,000.00 | | | | 1,152.49 | | | | 1,015.47 | | | | 10.03 | | | | 9.39 | | | | 1.88 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,155.70 | | | | 1,017.55 | | | | 1.72 | | | | 7.30 | | | | 1.46 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,155.91 | | | | 1,018.70 | | | | 6.57 | | | | 6.16 | | | | 1.23 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,157.49 | | | | 1,020.18 | | | | 4.97 | | | | 4.66 | | | | 0.93 | | |

Expenses paid during the period are equal to the fund's respective class annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the transfer agent not waived a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided will not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the continuing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

6

Performance Information – Columbia Small Cap Growth Fund I

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Growth of a $10,000 investment 10/01/96 – 02/28/06 ($)

| Share class | |

| Sales charge | | without | | with | |

| Class A | | | 31,990 | | | | 30,142 | | |

| Class B | | | 31,940 | | | | 31,940 | | |

| Class C | | | 31,940 | | | | 31,940 | | |

| Class Z | | | 32,009 | | | | n/a | | |

The table above shows the growth in value of a hypothetical $10,000 investment in each share class of Columbia Small Cap Growth Fund I during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Net asset value per share | |

| as of 02/28/06 ($) | | | | | |

| Class A | | | 31.51 | | |

| Class B | | | 31.46 | | |

| Class C | | | 31.46 | | |

| Class Z | | | 31.54 | | |

| Distributions declared per share | |

| 09/01/05 – 02/28/06 ($) | | | | | |

| Class A | | | 0.89 | | |

| Class B | | | 0.89 | | |

| Class C | | | 0.89 | | |

| Class Z | | | 0.89 | | |

Average annual total return as of 02/28/06 (%)

| Share class | | A | | B | | C | | Z | |

| Inception date | | 11/01/05 | | 11/01/05 | | 11/01/05 | | 10/01/96 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 16.95 | | | | 10.21 | | | | 16.76 | | | | 11.76 | | | | 16.76 | | | | 15.76 | | | | 17.02 | | |

| 1-year | | | 29.43 | | | | 22.00 | | | | 29.22 | | | | 24.22 | | | | 29.22 | | | | 28.22 | | | | 29.50 | | |

| 5-year | | | 6.84 | | | | 5.57 | | | | 6.80 | | | | 6.49 | | | | 6.80 | | | | 6.80 | | | | 6.85 | | |

| 10-year | | | 13.15 | | | | 12.44 | | | | 13.13 | | | | 13.13 | | | | 13.13 | | | | 13.13 | | | | 13.16 | | |

Average annual total return as of 12/31/05 (%)

| Share class | | A | | B | | C | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 10.91 | | | | 4.55 | | | | 10.87 | | | | 5.87 | | | | 10.87 | | | | 9.87 | | | | 10.91 | | |

| 1-year | | | 13.15 | | | | 6.65 | | | | 13.11 | | | | 8.11 | | | | 13.11 | | | | 12.11 | | | | 13.14 | | |

| 5-year | | | 2.43 | | | | 1.22 | | | | 2.42 | | | | 2.06 | | | | 2.42 | | | | 2.42 | | | | 2.43 | | |

| 10-year | | | 12.07 | | | | 11.36 | | | | 12.07 | | | | 12.07 | | | | 12.07 | | | | 12.07 | | | | 12.07 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for class A shares and maximum contingent deferred sales charge of 5.00% for class B shares and 1.00% for class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the advisor or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. All results shown assume reinvestment of distributions. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Classes A, B and C (newer class shares) share performance information includes returns of the fund's class Z shares (the oldest existing fund class) for periods prior to the inception of the newer class shares. Class Z share returns are not restated to reflect any expense differential (e.g., Rule 12b-1 fees) between class Z shares and the newer class shares. Had the expense differential been reflected, the returns for the periods prior to the inception of classes A, B and C would have been lower.

7

Fund Profile – Columbia Small Cap Growth Fund I

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

+16.95%

Class A Shares

Class A Shares

+10.24%

Russell 2000 Index

Russell 2000 Index

+11.69%

Russell 2000 Growth Index

Russell 2000 Growth Index

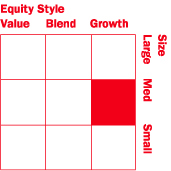

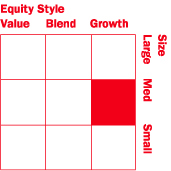

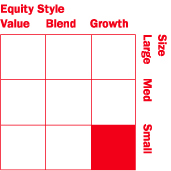

Management Style

Summary

n For the six-month period that ended February 28, 2006, Columbia Small Cap Growth Fund I's Class A Shares returned 16.95% without sales charge. It outperformed both the Russell 2000 Index and the Russell 2000 Growth Index, which returned 10.24% and 11.69%, respectively.1 The fund's return was also higher than the average return of the Morningstar Small Growth Funds Category, which was 11.06%.2 The management team's strong stock decisions helped the fund outperform its benchmark and peer group for the period.

n A decision to overweight industrials, one of the period's strongest sectors, aided performance. Ceradyne, Inc. (1.8% of net assets), an industrial company that develops ceramic products and components, was the fund's top contributor. The company benefited from a ramp up in military orders for body and vehicle armor. Information technology and energy sectors also had a positive impact on performance, as did the telecommunications and consumer discretionary sectors, which provided a standout performance from Millicom International Cellular SA (0.9% of net assets). The company, which provides cellular phone service to emerging markets, rose more than 117% during the period. Consumer staples stocks posted a slight decline and the fund's health care holdings underperformed.

n In an environment of healthy economic growth and relatively low inflation, the fund's managers maintain a bullish outlook for growth stocks, especially within the energy, materials and industrials sectors. However, decelerating growth could provoke a reassessment of the strength and duration of the current economic expansion. The fund's managers plan to continue to seek the stocks of growth companies with strong earnings prospects and attractive valuations.

1 The Russell 2000 Index is an index that tracks the performance of the 2,000 smallest of the 3,000 largest US companies based on market capitalization. The Russell 2000 Growth Index is an index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. Unlike the fund, indices are not investments, they do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2 ©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc. may not be copied or redistributed for any purpose and may only be used for non-commercial, personal purposes. The information contained herein is not represented or warranted to be accurate, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from use of this information. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933.

Portfolio Management

Kenneth A. Korngiebel, CFA

n With the fund since 2004

n MBA, Wharton School at University of Pennsylvania; BA, Stanford University

Wayne M. Collette, CFA

n With the fund since 2006

n MBA, Columbia University; BS, Brandeis University

J. Michael Kosicki, CFA

n With the fund since 2006

n BA, Hamilton College

George J. Myers, CFA

n With the fund since 2006

n MS, University of Wisconsin; BBA, University of Wisconsin

Theodore R. Wendell, CFA

n With the fund since 2006

n MBA, Columbia University; BA, Emory University

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investing in growth stocks incurs the possibility of losses because their prices are sensitive to changes in current or expected earnings.

Investments in small-cap stocks may be subject to greater volatility and price fluctuations because they may be thinly traded and less liquid than investments in larger companies.

Management style is determined by Columbia Management and is based on the investment strategy and process as outlined in the fund's prospectus.

8

UNDERSTANDING YOUR EXPENSES

Columbia Small Cap Growth Fund I

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

n For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

n For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number is in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the reporting period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and includes the fund's actual expense ratio. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

09/01/05 – 02/28/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,183.09 | | | | 1,017.85 | | | | 5.02 | | | | 7.00 | | | | 1.40 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,181.22 | | | | 1,014.13 | | | | 7.71 | | | | 10.74 | | | | 2.15 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,181.22 | | | | 1,014.13 | | | | 7.71 | | | | 10.74 | | | | 2.15 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,170.19 | | | | 1,019.19 | | | | 6.08 | | | | 5.66 | | | | 1.13 | | |

Expenses paid during the period are equal to the fund's respective class annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the transfer agent not waived a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided will not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the continuing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

9

Performance Information – Columbia Real Estate Equity Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Growth of a $10,000 investment 03/01/96 – 02/28/06 ($)

| Share class | |

| Sales charge | | without | | with | |

| Class A | | | 40,781 | | | | 38,427 | | |

| Class B | | | 39,825 | | | | 39,825 | | |

| Class C | | | 39,814 | | | | 39,814 | | |

| Class D | | | 39,853 | | | | 39,460 | | |

| Class Z | | | 41,234 | | | | n/a | | |

The table above shows the growth in value of a hypothetical $10,000 investment in each share class of Columbia Real Estate Equity Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Net asset value per share | |

| as of 02/28/06 ($) | | | | | |

| Class A | | | 26.44 | | |

| Class B | | | 26.46 | | |

| Class C | | | 26.44 | | |

| Class D | | | 26.46 | | |

| Class Z | | | 26.46 | | |

| Distributions declared per share | |

| 09/01/05 – 02/28/06 ($) | | | | | |

| Class A | | | 3.77 | | |

| Class B | | | 3.67 | | |

| Class C | | | 3.67 | | |

| Class D | | | 3.67 | | |

| Class Z | | | 3.80 | | |

Average annual total return as of 02/28/06 (%)

| | | A | | B | | C | | D | | Z | |

| Inception | | 11/01/02 | | 11/01/02 | | 10/13/03 | | 11/01/02 | | 04/01/94 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 9.51 | | | | 3.22 | | | | 9.12 | | | | 4.37 | | | | 9.13 | | | | 8.18 | | | | 9.16 | | | | 8.21 | | | | 9.65 | | |

| 1-year | | | 22.25 | | | | 15.22 | | | | 21.31 | | | | 16.31 | | | | 21.32 | | | | 20.32 | | | | 21.35 | | | | 20.35 | | | | 22.54 | | |

| 5-year | | | 17.69 | | | | 16.30 | | | | 17.13 | | | | 16.92 | | | | 17.12 | | | | 17.12 | | | | 17.15 | | | | 16.91 | | | | 17.95 | | |

| 10-year | | | 15.09 | | | | 14.41 | | | | 14.82 | | | | 14.82 | | | | 14.82 | | | | 14.82 | | | | 14.83 | | | | 14.71 | | | | 15.22 | | |

Average annual total return as of 12/31/05 (%)

| | | A | | B | | C | | D | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 3.97 | | | | -2.01 | | | | 3.53 | | | | -0.97 | | | | 3.57 | | | | 2.67 | | | | 3.57 | | | | 2.67 | | | | 4.06 | | |

| 1-year | | | 6.98 | | | | 0.83 | | | | 6.18 | | | | 1.59 | | | | 6.18 | | | | 5.27 | | | | 6.22 | | | | 5.30 | | | | 7.25 | | |

| 5-year | | | 15.42 | | | | 14.07 | | | | 14.90 | | | | 14.67 | | | | 14.89 | | | | 14.89 | | | | 14.91 | | | | 14.68 | | | | 15.66 | | |

| 10-year | | | 14.56 | | | | 13.88 | | | | 14.30 | | | | 14.30 | | | | 14.30 | | | | 14.30 | | | | 14.31 | | | | 14.19 | | | | 14.68 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for class A shares, maximum contingent deferred sales charge of 5.00% for class B shares and 1.00% for class C and D shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the advisor or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. All results shown assume reinvestment of distributions. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Effective October 13, 2003, class D shares are closed to all new investors and new accounts. Existing class D shareholders will be able to make additional purchases at any time. In addition, class D sales charge of 1.00% is waived after October 13, 2003.

Classes A, B and D (newer class shares) share performance information includes returns of the fund's class Z shares (the oldest existing fund class) for periods prior to the inception of the newer class shares. The returns for class C include the returns of class B prior to 10/13/03, the date on which class C was initially offered by the fund. The returns shown for class C also include the performance of class Z prior to the inception of class B (11/01/02). Class Z share returns are not restated to reflect any expense differential (e.g., Rule 12b-1 fees) between class Z shares and the newer class shares. Had the expense differential been reflected, the returns for the periods prior to the inception of classes A, B, C and D would have been lower.

10

Fund Profile – Columbia Real Estate Equity Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

+9.51%

Class A Shares

Class A Shares

+11.57%

NAREIT Index

NAREIT Index

Summary

n For the six-month period ended February 28, 2006, the Columbia Real Estate Equity Fund's Class A Shares returned 9.51% without sales charge. The fund underperformed its benchmark, the NAREIT Index, which returned 11.57%.1 Its return was also lower than the 11.73% average return of its peer group, the Morningstar Specialty-Real Estate Funds Category.2

n The fund's REIT holdings performed well in a market that was generally favorable for higher-quality REITs. In this environment, apartment REITs were exceptional performers. The rental market strengthened, especially at the high end, as some potential homebuyers were priced out of the market for single-family homes and condominiums. However, performance was dragged down by exposure to investments outside of the conventional REIT market, especially mortgage REITs and a high cash position. A position in hotel stocks also delivered disappointing returns. However, we have maintained the fund's position in hotel stocks in light of improved business prospects for hotels, particularly in higher-end urban markets.

n The fund was restructured when new managers took over in October 2005. Sector weights were brought more in line with its benchmark, and investments outside the real estate market were sold and replaced by securities that were more consistent with the fund's focus on real estate. The fund's new managers also positioned the fund more conservatively, with an emphasis on REITS with high-quality management and the potential for sustainable growth.

1 The National Association of Real Estate Investment Trusts (NAREIT) Index is an index that tracks performance of all publicly traded equity REIT. Unlike the fund, indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2 ©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc. may not be copied or redistributed for any purpose and may only be used for non-commercial, personal purposes. The information contained herein is not represented or warranted to be accurate, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from use of this information. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933.

Portfolio Management

Robert McConnaughey

n With the fund since 2005

n MIA, Columbia University; BA, Grinnell College

David I. Hoffman

n With the fund since 2005

n BS, Dartmouth College

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

The fund may be subject to the same types of risks associated with direct ownership of real estate including the decline of property value due to general, local and regional economic conditions. In addition, the fund's share price will likely be subject to more volatility than the overall stock market because it concentrates in real estate stocks.

11

UNDERSTANDING YOUR EXPENSES

Columbia Real Estate Equity Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

n For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

n For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number is in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the reporting period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and includes the fund's actual expense ratio. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

09/01/05 – 02/28/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,095.11 | | | | 1,018.99 | | | | 6.08 | | | | 5.86 | | | | 1.17 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,091.19 | | | | 1,015.27 | | | | 9.96 | | | | 9.59 | | | | 1.92 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,091.29 | | | | 1,015.27 | | | | 9.96 | | | | 9.59 | | | | 1.92 | | |

| Class D | | | 1,000.00 | | | | 1,000.00 | | | | 1,091.59 | | | | 1,015.27 | | | | 9.96 | | | | 9.59 | | | | 1.92 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,096.50 | | | | 1,020.23 | | | | 4.78 | | | | 4.61 | | | | 0.92 | | |

Expenses paid during the period are equal to the fund's respective class annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the transfer agent not waived a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided will not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the continuing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

12

Performance Information – Columbia Technology Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Growth of a $10,000 investment 11/09/00 – 02/28/06 ($)

| Share class | |

| Sales charge | | without | | with | |

| Class A | | | 10,940 | | | | 10,312 | | |

| Class B | | | 10,651 | | | | 10,551 | | |

| Class C | | | 10,671 | | | | 10,671 | | |

| Class D | | | 10,711 | | | | 10,605 | | |

| Class Z | | | 11,064 | | | | n/a | | |

The table above shows the growth in value of a hypothetical $10,000 investment in each share class of Columbia Technology Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Net asset value per share | |

| as of 02/28/06 ($) | | | | | |

| Class A | | | 10.33 | | |

| Class B | | | 10.11 | | |

| Class C | | | 10.13 | | |

| Class D | | | 10.17 | | |

| Class Z | | | 10.43 | | |

| Distributions declared per share | |

| 09/01/05 – 02/28/06 ($) | | | | | |

| Class A | | | 0.56 | | |

| Class B | | | 0.50 | | |

| Class C | | | 0.50 | | |

| Class D | | | 0.50 | | |

| Class Z | | | 0.58 | | |

Average annual total return as of 02/28/06 (%)

| | | A | | B | | C | | D | | Z | |

| Inception | | 11/01/02 | | 11/01/02 | | 10/13/03 | | 11/01/02 | | 11/09/00 | |

| | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 24.87 | | | | 17.69 | | | | 24.40 | | | | 19.40 | | | | 24.35 | | | | 23.35 | | | | 24.37 | | | | 24.37 | | | | 24.99 | | |

| 1-year | | | 39.86 | | | | 31.81 | | | | 39.00 | | | | 34.00 | | | | 38.90 | | | | 37.90 | | | | 38.87 | | | | 37.87 | | | | 40.36 | | |

| 5-year | | | 9.93 | | | | 8.63 | | | | 9.35 | | | | 9.07 | | | | 9.39 | | | | 9.39 | | | | 9.47 | | | | 9.25 | | | | 10.18 | | |

| Since inception | | | 1.71 | | | | 0.58 | | | | 1.20 | | | | 1.02 | | | | 1.23 | | | | 1.23 | | | | 1.30 | | | | 1.11 | | | | 1.92 | | |

Average annual total return as of 12/31/05 (%)

| Shares class | | A | | B | | C | | D | | Z | |

| | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 6-month (cumulative) | | | 23.39 | | | | 16.29 | | | | 23.01 | | | | 18.01 | | | | 22.95 | | | | 21.95 | | | | 22.99 | | | | 21.99 | | | | 23.57 | | |

| 1-year | | | 16.53 | | | | 9.83 | | | | 15.74 | | | | 10.74 | | | | 15.71 | | | | 14.71 | | | | 15.77 | | | | 14.77 | | | | 16.76 | | |

| 5-year | | | 2.70 | | | | 1.48 | | | | 2.17 | | | | 1.80 | | | | 2.21 | | | | 2.21 | | | | 2.30 | | | | 2.08 | | | | 2.91 | | |

| Since inception | | | -0.29 | | | | -1.43 | | | | -0.80 | | | | -0.98 | | | | -0.76 | | | | -0.76 | | | | -0.68 | | | | -0.87 | | | | -0.10 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for class A shares, maximum contingent deferred sales charge of 5.00% for class B shares and 1.00% for class C and D shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the advisor or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. All results shown assume reinvestment of distributions. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Effective October 13, 2003, class D shares are closed to all new investors and new accounts. Existing class D shareholders will be able to make additional purchases at any time. In addition, class D sales charge of 1.00% is waived after October 13, 2003.

Classes A, B and D (newer class shares) share performance information includes returns of the fund's class Z shares (the oldest existing fund class) for periods prior to the inception of the newer class shares. The returns for class C include the returns of class B prior to 10/13/03, the date on which class C was initially offered by the fund. The returns shown for class C also include the performance of class Z prior to the inception of class B (11/01/02). Class Z share returns are not restated to reflect any expense differential (e.g., Rule 12b-1 fees) between class Z shares and the newer class shares. Had the expense differential been reflected, the returns for the periods prior to the inception of classes A, B, C and D would have been lower.

13

Fund Profile – Columbia Technology Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

+24.87%

Class A Shares

Class A Shares

+12.85%

Merrill Lynch 100 Technology Index

Merrill Lynch 100 Technology Index

Summary

n For the six-month period ended February 28, 2006, the Columbia Technology Fund's Class A Shares returned 24.87% without sales charge. The fund outperformed its benchmark, the Merrill Lynch 100 Technology Index, which returned 12.85%.1 It also surpassed the average return of its peer group, the Morningstar Specialty – Technology Category, which was 11.62% for the same period.2 Semiconductor stocks made the greatest positive impact on fund performance. Wireless telecommunications services also made a strong contribution to the fund's return.

n Within the semiconductor industry, the fund's managers continued to look beyond mega-sized firms to identify growth potential among companies with specific product strengths. The fund had more exposure to wireless stocks than the index, because of positive trends that indicated growing demand and expanded usage for wireless technology. Holdings in systems software detracted from performance.

n The fund remained focused on companies positioned to potentially benefit from the adoption of new technologies, cost savings through outsourcing and key products – especially in the semiconductor industry. The fund's managers plan to continue to evaluate investments in wireless communications.

1 The Merrill Lynch 100 Technology Index is an equally weighted index of 100 leading technology stocks. Unlike the fund, indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2 ©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc. may not be copied or redistributed for any purpose and may only be used for non-commercial, personal purposes. The information contained herein is not represented or warranted to be accurate, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from use of this information. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933.

Portfolio Management

Wayne M. Collette, CFA

n With the fund since 2005

n MBA, Columbia University; BS, Brandeis University

Theodore R. Wendell, CFA

n With the fund since 2005

n MBA, Columbia University; BA, Emory University

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

The share price of a fund that invests primarily in one sector will likely be subject to more volatility than a fund that invests across many sectors. Technology stocks may be more volatile than stocks in other sectors. The fund should be considered part of an overall investment program, and not a complete investment program.

International investing may involve certain risks, including foreign taxation, currency fluctuations, risks associated with possible differences in financial standards and other monetary and political risks.

Some of the countries the fund invests in are considered emerging economies, which means there may be greater risks associated with investing there than in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

14

UNDERSTANDING YOUR EXPENSES

Columbia Technology Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

n For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

n For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number is in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the reporting period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and includes the fund's actual expense ratio. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

09/01/05 – 02/28/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,244.62 | | | | 1,017.80 | | | | 7.85 | | | | 7.05 | | | | 1.41 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,240.06 | | | | 1,014.08 | | | | 12.00 | | | | 10.79 | | | | 2.16 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,239.47 | | | | 1,014.08 | | | | 11.99 | | | | 10.79 | | | | 2.16 | | |

| Class D | | | 1,000.00 | | | | 1,000.00 | | | | 1,239.76 | | | | 1,014.08 | | | | 12.00 | | | | 10.79 | | | | 2.16 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,245.86 | | | | 1,019.04 | | | | 6.46 | | | | 5.81 | | | | 1.16 | | |

Expenses paid during the period are equal to the fund's respective class annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the transfer agent not waived a portion of expenses, total return would have been reduced.