Third Quarter 2022 EARNINGS PRESENTATION NOVEMBER 3 | 2022

This press release contains forward-looking statements. Statements in this press release that are not historical facts, including without limitation the information under the heading "Financial Outlook" and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any. Some of the factors that could materially and adversely affect our business, financial condition, results of operations and cash flows include, but are not limited to, the following: • risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients; • the continued impact of the coronavirus pandemic (“COVID-19”), and evolving strains of COVID-19 on the economy and demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties; • an inability to realize expected benefits of the combination of the Company’s business with the business of MDC (the “Business Combination” and, together with the related transactions, the “Transactions”); • adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs; • the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions; • the Company’s ability to attract new clients and retain existing clients; • the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements; • financial failure of the Company’s clients; • the Company’s ability to retain and attract key employees; • the Company’s ability to compete in the markets in which it operates; • the Company’s ability to achieve its cost saving initiatives; • the Company’s implementation of strategic initiatives; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities; • the Company’smaterial weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting; • the Company’s ability to protect client data from security incidents or cyberattacks; • economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflict between Russia and Ukraine), terrorist activities and natural disasters; • stock price volatility; and • foreign currency fluctuations. Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings. FORWARD LOOKING STATEMENTS & OTHER INFORMATION 2

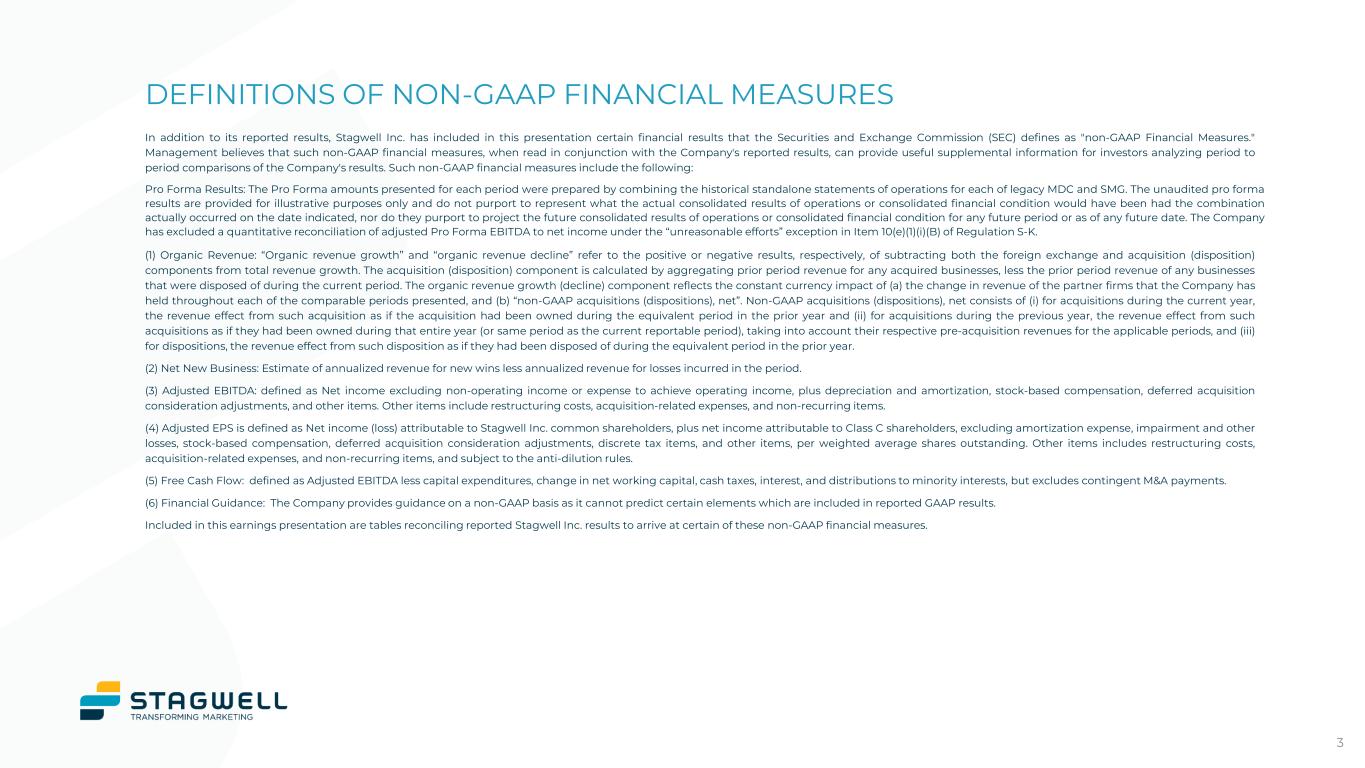

DEFINITIONS OF NON-GAAP FINANCIAL MEASURES 3 In addition to its reported results, Stagwell Inc. has included in this presentation certain financial results that the Securities and Exchange Commission (SEC) defines as "non-GAAP Financial Measures." Management believes that such non-GAAP financial measures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company's results. Such non-GAAP financial measures include the following: Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. (1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year. (2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period. (3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items. (4) Adjusted EPS is defined as Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, per weighted average shares outstanding. Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules. (5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments. (6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results. Included in this earnings presentation are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

FINANCIAL OUTLOOK Full-Year 2022 Organic Net Revenue Growth Organic Net Revenue Growth, Ex-Advocacy In Adjusted EBITDA 16% - 20% 13% - 17% $450M - $480M Note: Guidance as of 11/03/2022. All figures presented on a Pro Forma basis giving effect to the combination as if it was completed on January 1, 2020. The Company has excluded a quantitative reconciliation with respect to the Company’s 2022 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See "Non-GAAP Financial Measures" below for additional information on definitions for Organic Net Revenue, Organic Net Revenue Ex-Advocacy, Adjusted EBITDA, Adjusted Earnings Per Share, and Free Cash Flow. Please refer to our investor website at stagwellglobal.com/investors for information on Forward Looking Statements and risk factors outlined in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings. ~30% Free Cash Flow Growth 4 $0.86 - $0.94 In Adjusted Earnings Per Share

T H I R D Q U A R T E R H I G H L I G H T S Strategic INVESTMENT Leading GROWTH Strong FINANCIAL DISCIPLINE Record NEW BUSINESS In The Stagwell Marketing Cloud ~$5M in organic investments year-to-date Expanded sr. leadership team with CTO Mansoor Basha 4 Divisions: Data, CommsTech, Media Studio, Specialty Media $86M In Net New Business Driven by larger wins and client diversification into new services Top 25 clients averaged $6M in 3Q net revenue, up 20% y/y Awarded Bud Light’s North American Creative account 11.6% Net Revenue Growth, 11.3% Organic On top of 30% organic growth in 3Q21; 34% two-year stack +21% y/y digital net revenue growth; 17% organic growth 57% of 3Q net revenue from digital capabilities 20.7% adj. EBITDA margin on net revenue Reduced net debt by $125M bringing net leverage to 2.7x Returned $14M in capital through buybacks and $29M YTD $0.21 of adjusted earnings per share; $0.68 year-to-date NET DEBT: $1,180M | NET LEVERAGE RATIO: 2.7x | STOCK BUY BACKS: $14M Note: All figures presented on a Pro Forma basis giving effect to the combination as if it was completed on January 1, 2020. All growth rates are Pro Forma, year-over-year growth unless otherwise noted. Net Debt defined as bonds plus revolver balance less cash. Net Debt Ratio defined as Net Debt divided by LTM Adjusted EBITDA. 5

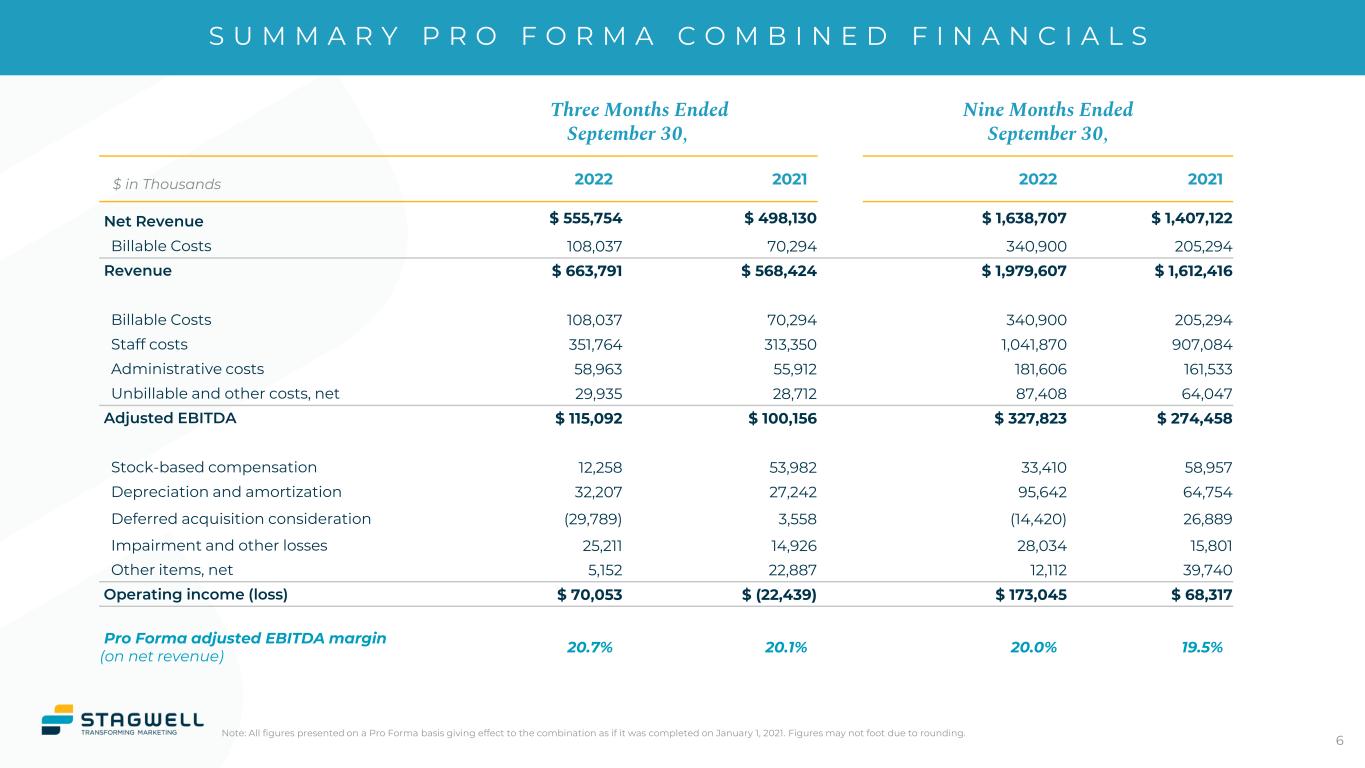

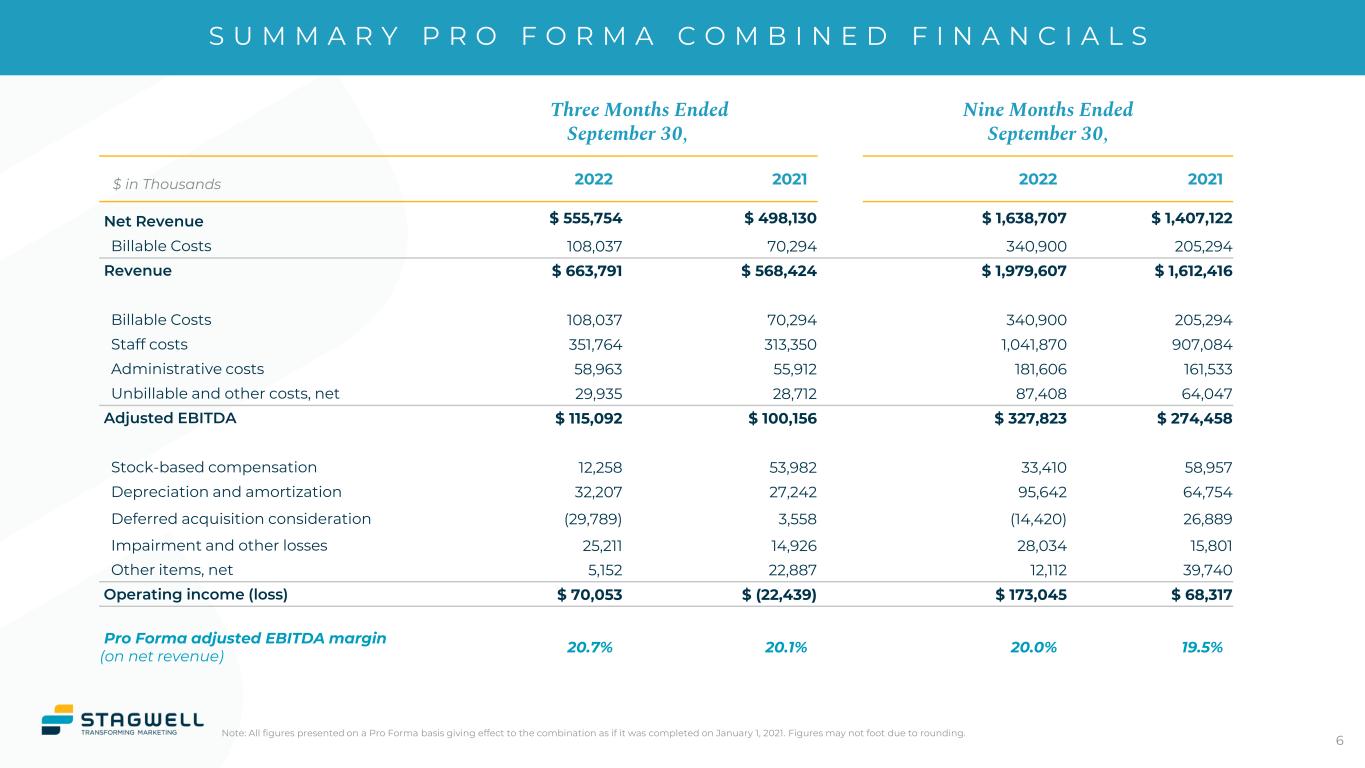

S U M M A R Y P R O F O R M A C O M B I N E D F I N A N C I A L S Note: All figures presented on a Pro Forma basis giving effect to the combination as if it was completed on January 1, 2021. Figures may not foot due to rounding. Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Net Revenue $ 555,754 $ 498,130 $ 1,638,707 $ 1,407,122 Billable Costs 108,037 70,294 340,900 205,294 Revenue $ 663,791 $ 568,424 $ 1,979,607 $ 1,612,416 Billable Costs 108,037 70,294 340,900 205,294 Staff costs 351,764 313,350 1,041,870 907,084 Administrative costs 58,963 55,912 181,606 161,533 Unbillable and other costs, net 29,935 28,712 87,408 64,047 Adjusted EBITDA $ 115,092 $ 100,156 $ 327,823 $ 274,458 Stock-based compensation 12,258 53,982 33,410 58,957 Depreciation and amortization 32,207 27,242 95,642 64,754 Deferred acquisition consideration (29,789) 3,558 (14,420) 26,889 Impairment and other losses 25,211 14,926 28,034 15,801 Other items, net 5,152 22,887 12,112 39,740 Operating income (loss) $ 70,053 $ (22,439) $ 173,045 $ 68,317 Pro Forma adjusted EBITDA margin (on net revenue) 20.7% 20.1% 20.0% 19.5% 6 $ in Thousands

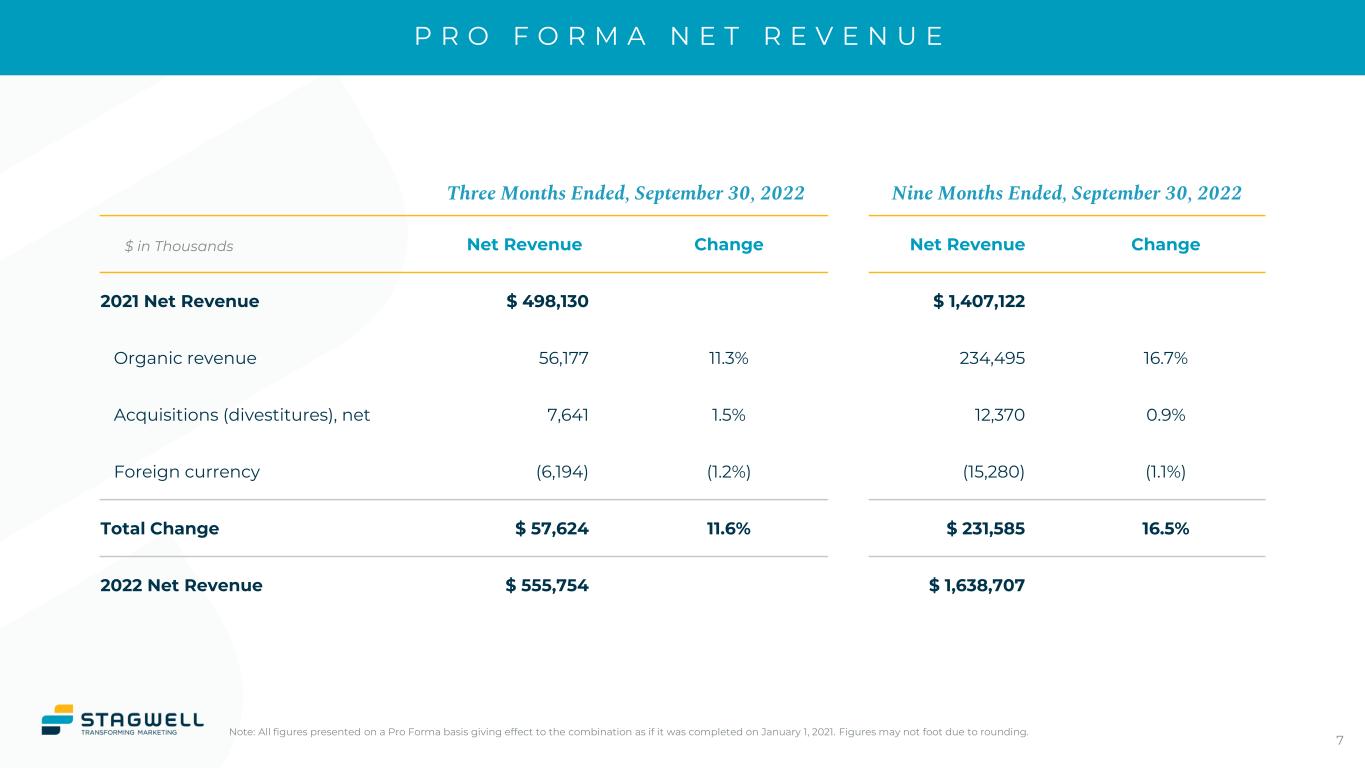

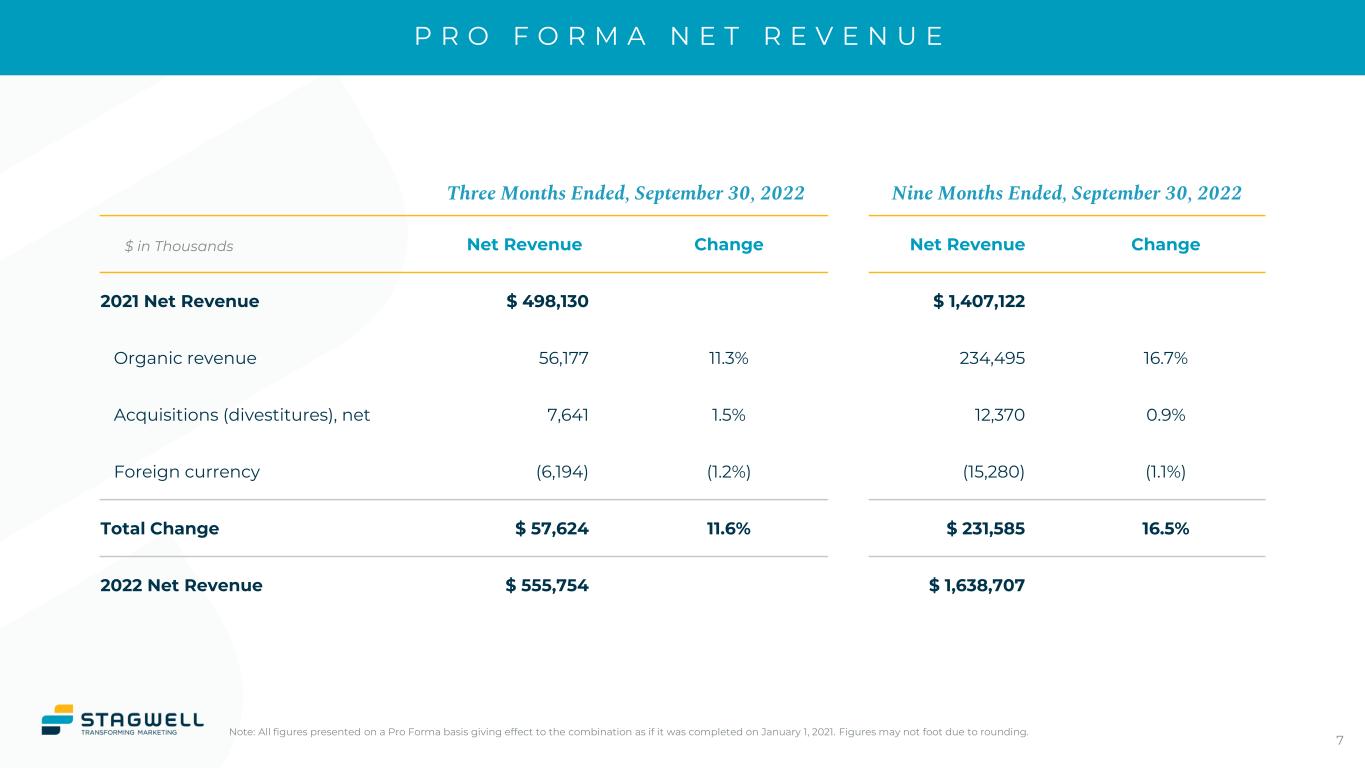

P R O F O R M A N E T R E V E N U E Note: All figures presented on a Pro Forma basis giving effect to the combination as if it was completed on January 1, 2021. Figures may not foot due to rounding. Three Months Ended, September 30, 2022 Nine Months Ended, September 30, 2022 Net Revenue Change Net Revenue Change 2021 Net Revenue $ 498,130 $ 1,407,122 Organic revenue 56,177 11.3% 234,495 16.7% Acquisitions (divestitures), net 7,641 1.5% 12,370 0.9% Foreign currency (6,194) (1.2%) (15,280) (1.1%) Total Change $ 57,624 11.6% $ 231,585 16.5% 2022 Net Revenue $ 555,754 $ 1,638,707 7 $ in Thousands

3 Q N E T R E V E N U E B Y G E O G R A P H Y Note: Figures presented on a Pro Forma basis giving effect to the combination as if completed on January 1, 2020. Figures may not foot due to rounding. 3Q Organic Growth Y/Y 81.5% 7.6% 10.8% Geography 3Q22 YTD United States 9.7% 15.4% United Kingdom 25.5% 33.9% Other 14.1% 16.5% TOTAL 11.3% 16.7% 8 % OF NET REVENUE 81.4% 7.5% 11.1% YTD

3 Q N E T R E V E N U E M I X B Y P R I N C I P A L C A P A B I L I T Y Note: Figures may not foot due to rounding. Creativity & Communications Blue-Chip Customer Base Performance Media & Data Addressable on a Global Scale Consumer Insights & Strategy Tracking Across the Entire Consumer Journey Digital Transformation Building & Designing Digital Platforms & Technology 1 2 3 4 29% 18% 9% 43% 9 57%

3 Q Y E A R - O V E R - Y E A R G R O W T H B Y C A P A B I L I T Y Note: Figures presented on a Pro Forma basis giving effect to the combination as if completed on January 1, 2021. Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. *EBITDA includes corporate expenses, notionally allocated ratably across each capability. Principal Capability Organic Net Revenue Growth Net Revenue Growth Adjusted EBITDA* Growth Digital Transformation 28.4% 30.5% 48.7% Performance Media & Data 4.8% 13.1% 4.1% Consumer Insights & Strategy 11.3% 12.7% (0.8%) Creativity & Communications 4.8% 0.9% (0.2%) TOTAL 11.3% 11.6% 14.9% TOTAL EX-ADVOCACY 7.3% 7.3% 0.2% % OF NET REVENUE 29% 18% 9% 43% 10 39% 11% 8% 43% % OF ADJ EBITDA*

Three Months Ended, SEPT 30, 2022 SEPT 30, 2021 % Change Total Net Revenue $556 $498 11.6% Advocacy Net Revenue 52 29 79.9% Ex Advocacy Net Revenue $504 $469 7.3% 3 Q E X - A D V O C A C Y N E T R E V E N U E & A D J U S T E D E B I T D A Note: All figures presented on a Pro Forma basis giving effect to the combination as if it was completed on January 1, 2020. Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. $ in Millions 11 Three Months Ended, SEPT 30, 2022 SEPT 30, 2021 % Change Total Adj. EBITDA $115 $100 14.9% Advocacy Adj. EBITDA 21 6 251.4% Ex Advocacy Adj. EBITDA $95 $94 0.2% NET REVENUE ADJ. EBITDA

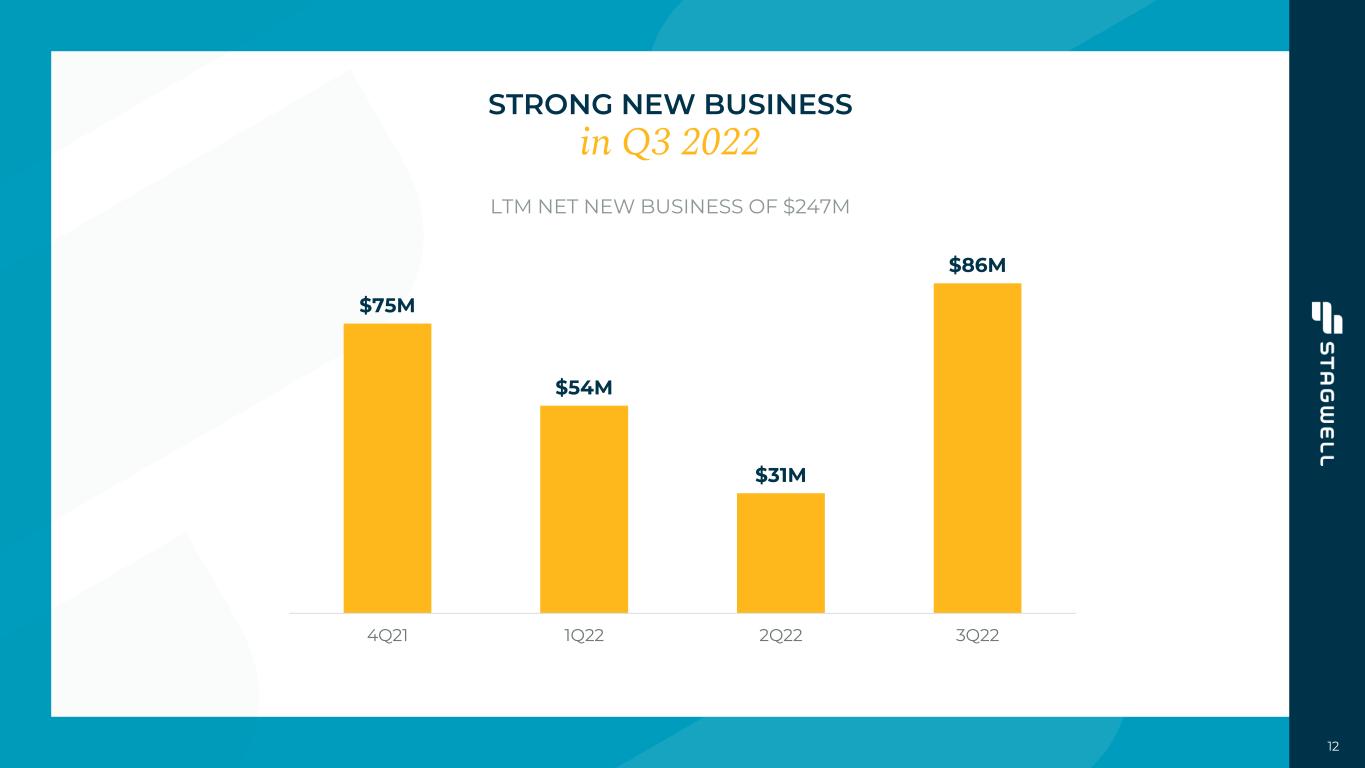

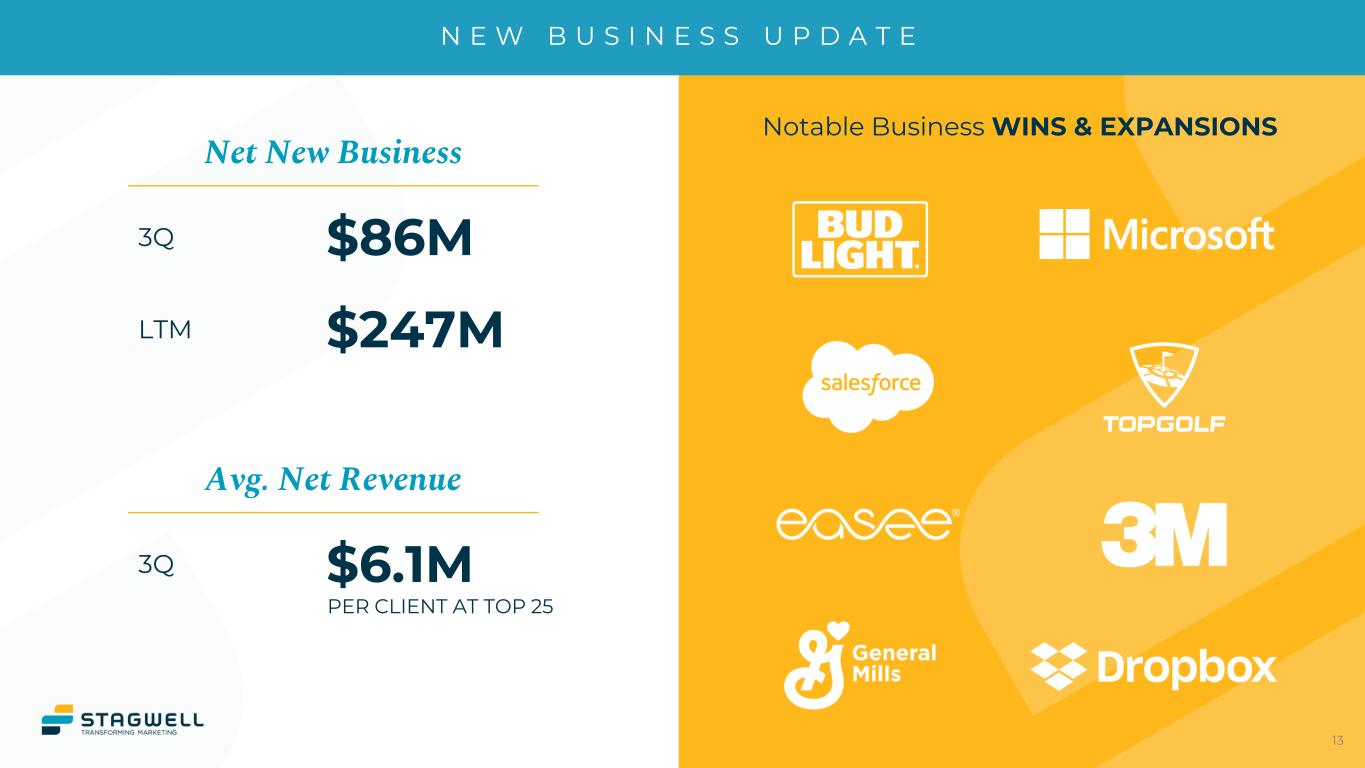

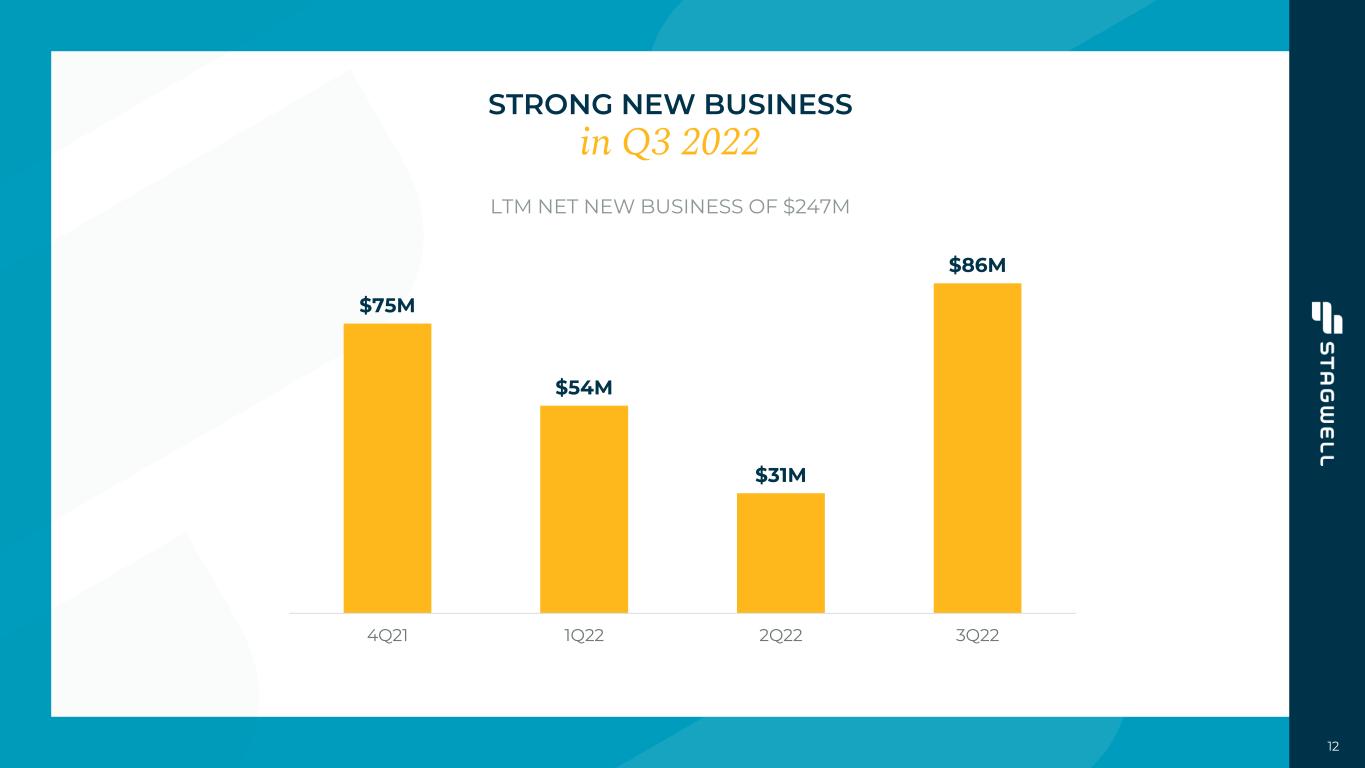

12 STRONG NEW BUSINESS in Q3 2022 LTM NET NEW BUSINESS OF $247M $75M $54M $31M $86M 4Q21 1Q22 2Q22 3Q22

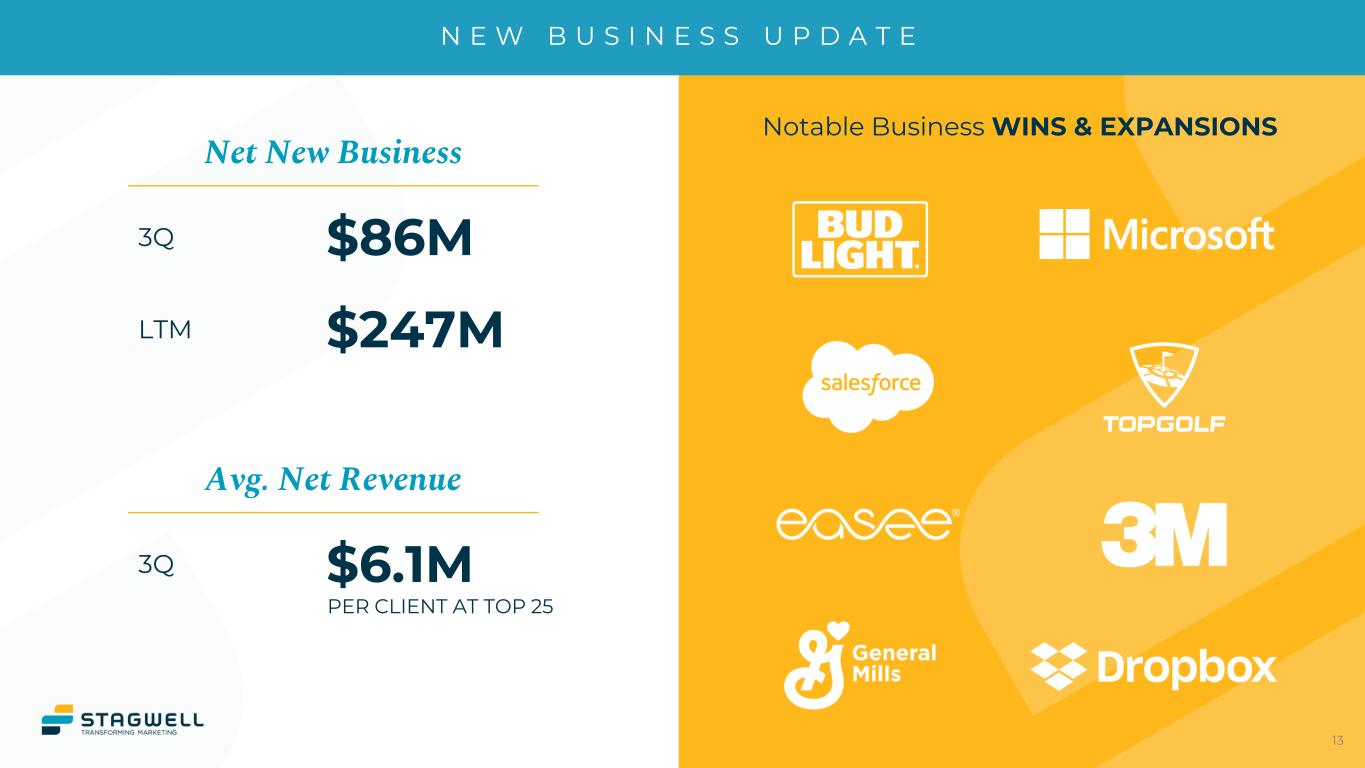

N E W B U S I N E S S U P D A T E 13 PER CLIENT AT TOP 25 Notable Business WINS & EXPANSIONS Net New Business 3Q $86M LTM $247M Avg. Net Revenue 3Q $6.1M

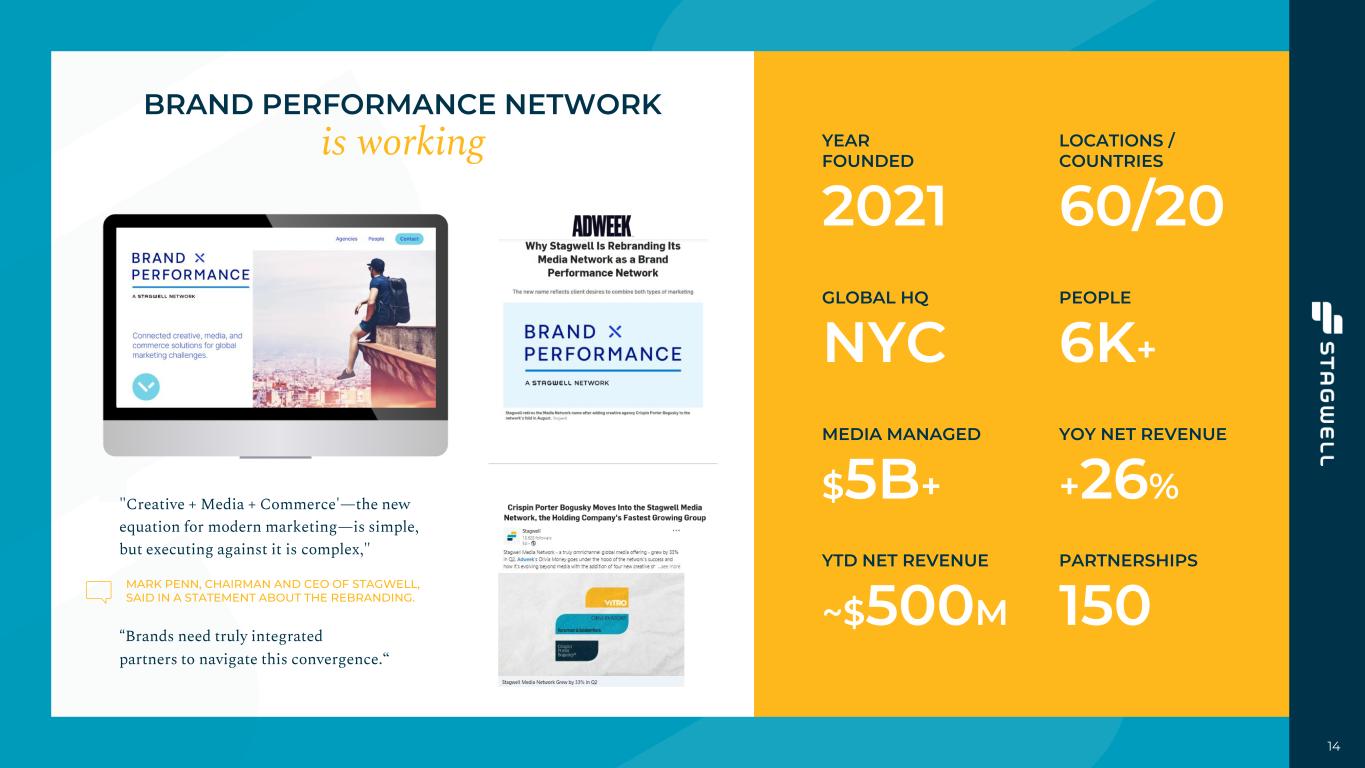

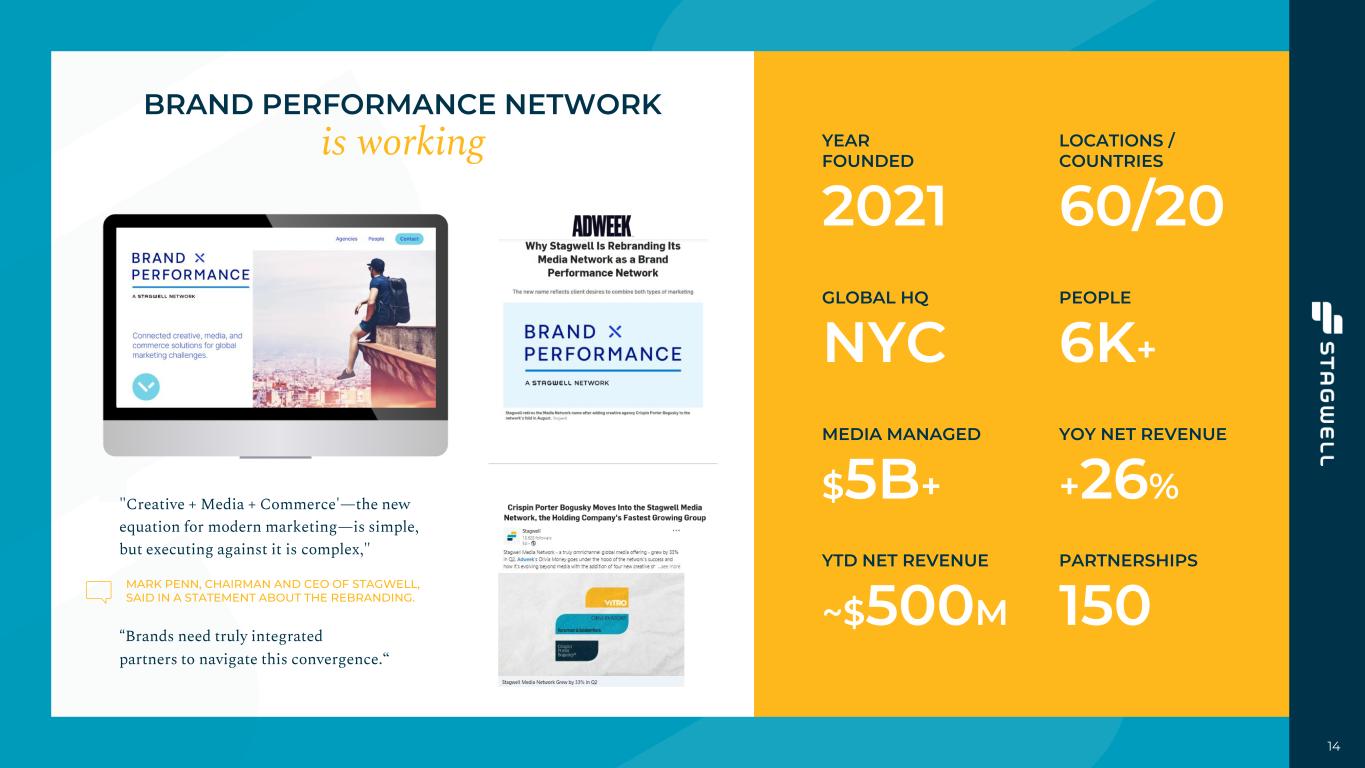

14 BRAND PERFORMANCE NETWORK is working YEAR FOUNDED 2021 GLOBAL HQ NYC MEDIA MANAGED $5B+ YTD NET REVENUE ~$500M LOCATIONS / COUNTRIES 60/20 PEOPLE 6K+ YOY NET REVENUE +26% PARTNERSHIPS 150 "Creative + Media + Commerce'—the new equation for modern marketing—is simple, but executing against it is complex," “Brands need truly integrated partners to navigate this convergence.“ MARK PENN, CHAIRMAN AND CEO OF STAGWELL, SAID IN A STATEMENT ABOUT THE REBRANDING.

S T R A T E G I C M & A I N Q 3 Transaction 80% ACQUISITION (remaining stake) Business Headquartered in Los Angeles, Wolfgang is a consultancy and creative agency, purposely built for the modern age. Wolfgang’s mission is to bridge the gap between management consulting and advertising by focusing on solving client problems with analytics and creativity, from the ground up. Wolfgang’s offerings include Consulting & Strategy, Creative and Production. Rationale Wolfgang will become part of the Doner Partner Network (“DPN”), with the three founders each taking up additional roles within the wider DPN. Colin Jeffery will take on the role of Chief Creative Officer of the combined operation, Mike Geiger will remain CEO of Wolfgang and will also lead production at Cahoots Studio, and Seema Miller will lead strategic and new business initiatives across Stagwell in addition to her Chief Strategy role at Wolfgang. The acquisition of Wolfgang further improves Stagwell’s foothold in California, while bringing it an enviable client roster including Gillette, Adidas, Uniqlo, Panda Express, UNICEF and Georgia Pacific.

DEVELOPMENT OF THE STAGWELL MARKETING CLOUD is a critical way to enhance the value of our company. Technology is not something that others do - it’s something we all need to participate in & get across the finish line. WE ARE MAKING INVESTMENTS & getting ready to market products that we believe can reach a $500 million revenue run-rate by 2027 and add billions to the value of the company.

17 SMC IS A PROPRIETARY SUITE of SaaS & DaaS tools built for the in-house marketer TARGETING Our Four Divisions HARRIS DATA COMMS TECH MEDIA STUDIO SPECIALTY MEDIA One-Stop Suite Of DaaS Tools For Market Researchers SaaS Platform For Modern Communication Professionals DIY Platform For In-House Media Buyers Proprietary & Premium Owned Media Channels$500M ~$140M OF REVENUE IN 2023 & A RUN-RATE BY 2027

18 ADDED SMC CHIEF TECHNOLOGY OFFICER ADDED & INTEGRATED NEW PRODUCTS INTO SUITE ORGANIZING SMC AROUND FOUR BUSINESS UNITS SMC Key Updates Previously with Accenture’s Applied Intelligence Practice, working on strategy & consulting, data led transformation, cloud analytics, AI & machine learning. HARRIS DATA COMMS TECH MEDIA STUDIO SPECIALTY MEDIA

19 LEADERSHIP team Mark J. Penn CHAIRMAN & CEO, STAGWELL GLOBAL • Founded, grew and sold Penn Schoen Berland to WPP • In WPP, served as CEO of Burson Marsteller and PSB • Executive Vice President and Chief Strategy Officer at Microsoft, running a $2 billion advertising budget • Author of Microtrends, a New York Times and Wall Street Journal best seller. EXPERIENCED SMC PRODUCT LEADERSHIP TEAM COMPRISED OF SUCCESSFUL SERIAL ENTREPRENEURS Mansoor Basha CTO Abe Geiger CPO Matthew Lochner MD Elspeth Rollert CMO Former CPO of Hudson MX, media buying & accounting systems provider, with clients including Dentsu, IPG, WPP, & Publicis media agencies Served in brand, performance & partnership marketing US & Global leadership roles at Uber & Microsoft Stagwell Group deal team member, working on over 20 private equity transactions Previously with Accenture’s Applied Intelligence Practice, working on strategy & consulting, data led transformation, cloud analytics, AI, & machine learning SMC CORPORATE LEADERSHIP TEAM SMC BOARD Dan Gardner BOARD MEMBER John Kahan BOARD MEMBER Former Chief Data & Analytics Officer, Microsoft Co-Founder of Code and Theory and business leader of Stagwell’s Code and Theory network Jim CarusoAaron Kwittken Ged Parton Josh Beatty Will Johnson Paul Krasinski Business Unit CEO, CommsTech Business Unit CEO, Harris Data Founder, ARound CEO, Harris Brand Platform CEO, Epicenter CEO, CUE

20

21

22 WE HAVE OUR FINANCIAL HOUSE in order Refinanced Bonds, Securing $1.1BN in financing › Fixed interest rate of 5.625% in rising interest rate environment › 8 years to maturity in 2029, providing financial flexibility Secured $500M Revolving Credit Facility with flexible terms, 5-year maturity Moody’s upgraded Stagwell’s corporate family rating (CFR) to B1 from B2 in July 2022

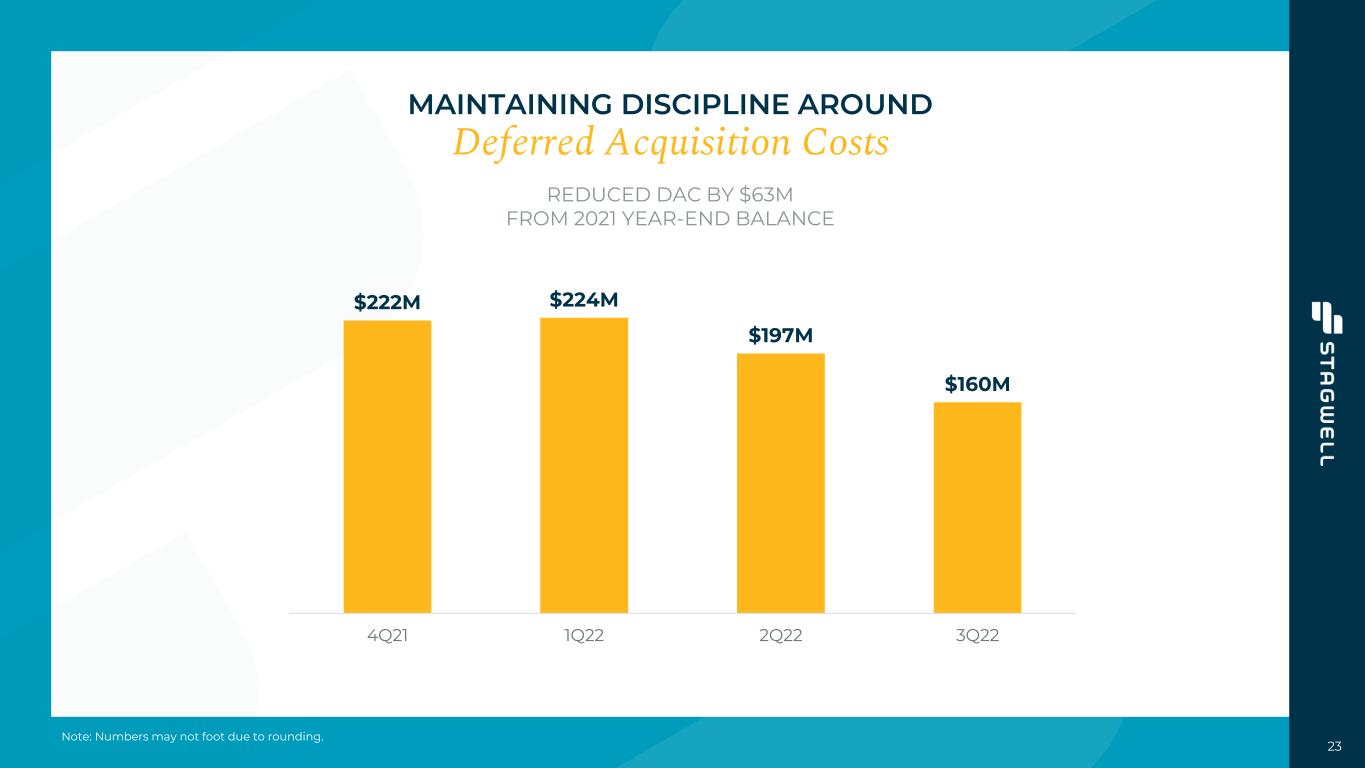

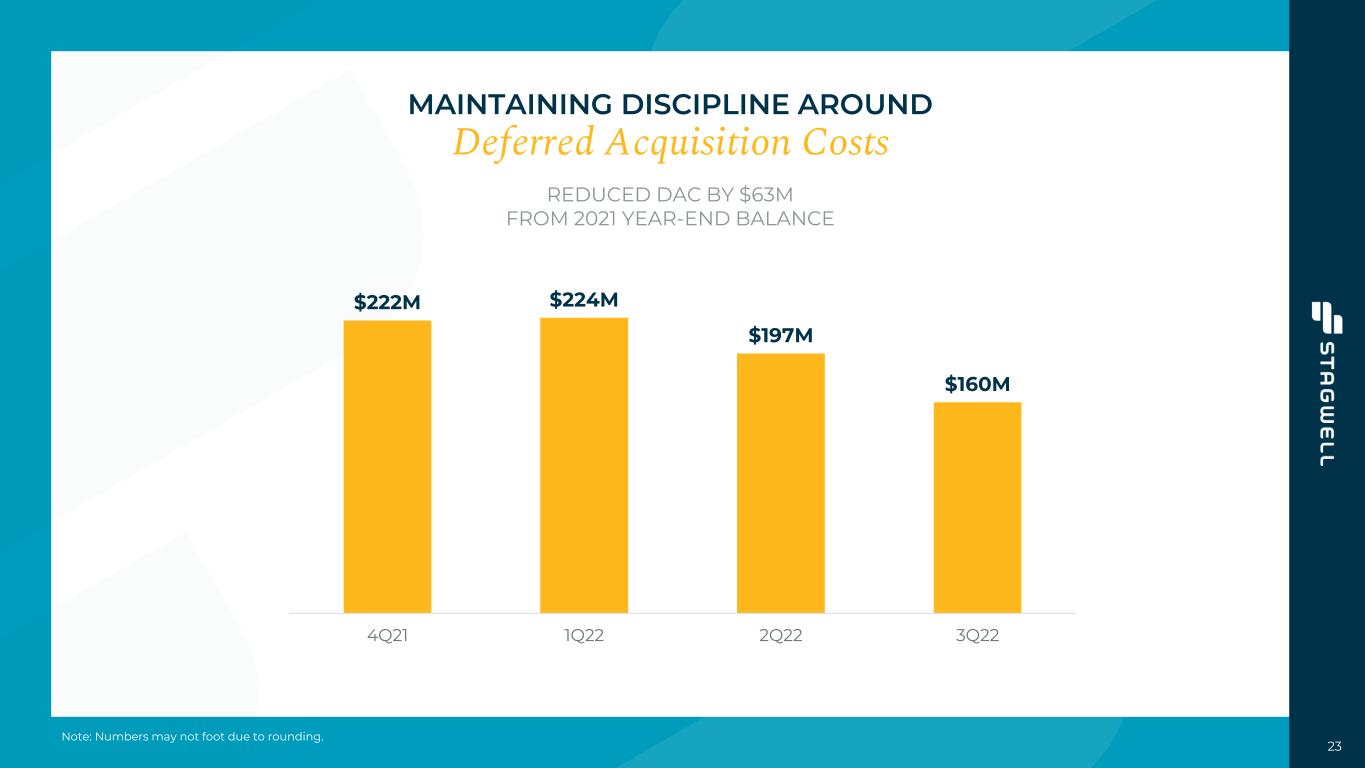

23 MAINTAINING DISCIPLINE AROUND Deferred Acquisition Costs REDUCED DAC BY $63M FROM 2021 YEAR-END BALANCE $222M $224M $197M $160M 4Q21 1Q22 2Q22 3Q22 Note: Numbers may not foot due to rounding.

G A A P C O N S O L I D A T E D O P E R A T I N G P E R F O R M A N C E Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Revenue $ 663,791 $ 466,634 $ 1,979,607 $ 857,436 Cost of services 417,134 324,782 1,253,765 558,856 Office & general expenses 119,186 121,770 429,121 226,720 Depreciation & amortization 32,207 24,790 95,642 46,122 Impairment & other losses 25,211 14,926 28,034 14,926 Total operating expenses $ 593,738 $ 486,268 $ 1,806,562 $ 846,624 Operating income (Loss) $ 70,053 $ (19,634) $ 173,045 $ 10,812 Interest expense, net (19,672) (11,912) (56,552) (15,197) Foreign exchange, net (3,927) (893) (4,163) (1,955) Other, net 147 45,621 182 46,806 Other income (expenses) $ (23,452) $ 32,816 $ (60,533) $ 29,654 Income tax expense 11,540 5,183 20,150 9,205 Income before equity in earnings of non-consolidated affiliates $ 35,061 $ 7,999 $ 92,362 $ 31,261 Equity in income (loss) of non-consolidated affiliates 213 (76) 1,053 (75) Net income $ 35,274 $ 7,923 $ 93,415 $ 31,186 Net (income) loss attributable to non-controlling & redeemable non-controlling interests (24,665) (9,994) (59,668) (10,987) Net income attributable to Stagwell Inc. common shareholders $ 10,609 $ (2,071) $ 33,747 $ 20,199 Earnings Per Share Basic $ 0.08 $ (0.06) $ 0.27 $ (0.06) Diluted $ 0.08 $ (0.06) $ 0.27 $ (0.06) Weighted Average Number of Shares Outstanding Basic 125,384 76,106 124,710 76,106 Diluted 125,384 76,106 124,710 76,106 Note: Conversion of Class C shares currently results in an anti-dilutive effect. Therefore, GAAP requires Diluted earnings per share and share count to reflect the lesser Basic figures. Pro forma Diluted earnings per share, as if the Class C converted, was $0.10 for the three months ended September 30, 2022 and $0.29 for the nine months ended September 30, 2022. Numbers may not foot due to rounding. 24 $ and Shares in Thousands

A D J U S T E D E A R N I N G S P E R S H A R E Three Months Ended September 30, 2022 Nine Months Ended September 30, 2022 Reported (GAAP) Adjustments Non-GAAP Reported (GAAP) Adjustments Non-GAAP Net income attributable to Stagwell Inc. common shareholders $ 10,609 $ 16,159 $ 26,768 $ 33,747 $ 50,815 $ 84,562 Weighted average number of common shares outstanding (basic and diluted) 125,384 125,384 125,384 124, 710 124,710 124,710 Adjusted earnings per share (basic and diluted) $ 0.08 $ 0.13 $ 0.21 $ 0.27 $ 0.41 $ 0.68 Adjustments to net income (loss) Pre-Tax Tax Net Pre-Tax Tax Net Amortization $ 23,814 $ (4,763) $ 19,051 $ 70,541 $ (14,108) $ 56,433 Impairment and other losses 25,211 (414) 24,797 28,034 (979) 27,055 Stock-based compensation 12,258 (2,452) 9,806 33,410 (6,682) 26,728 Deferred acquisition consideration (29,789) 5,958 (23,831) (14,420) 2,884 (11,536) Other items, net 5,152 (1,030) 4,122 12,112 (2,422) 9,690 Discrete tax items ̶ 2,680 2,680 ̶ 6,805 6,805 Total Adjustments $ 36,646 $ (21) $ 36,625 $ 129,677 $ (14,502) $ 115,175 Less: Net income attributable to Class C shareholders (20,466) (64,360) Net income attributable to Stagwell Inc. Common shareholders $ 16,159 $ 50,815 25 $ and Shares in Thousands Note: Conversion of Class C shares currently results in an anti-dilutive effect. Therefore, GAAP requires diluted earnings per share and share count to reflect the lesser Basic figures. Numbers may not foot due to rounding.

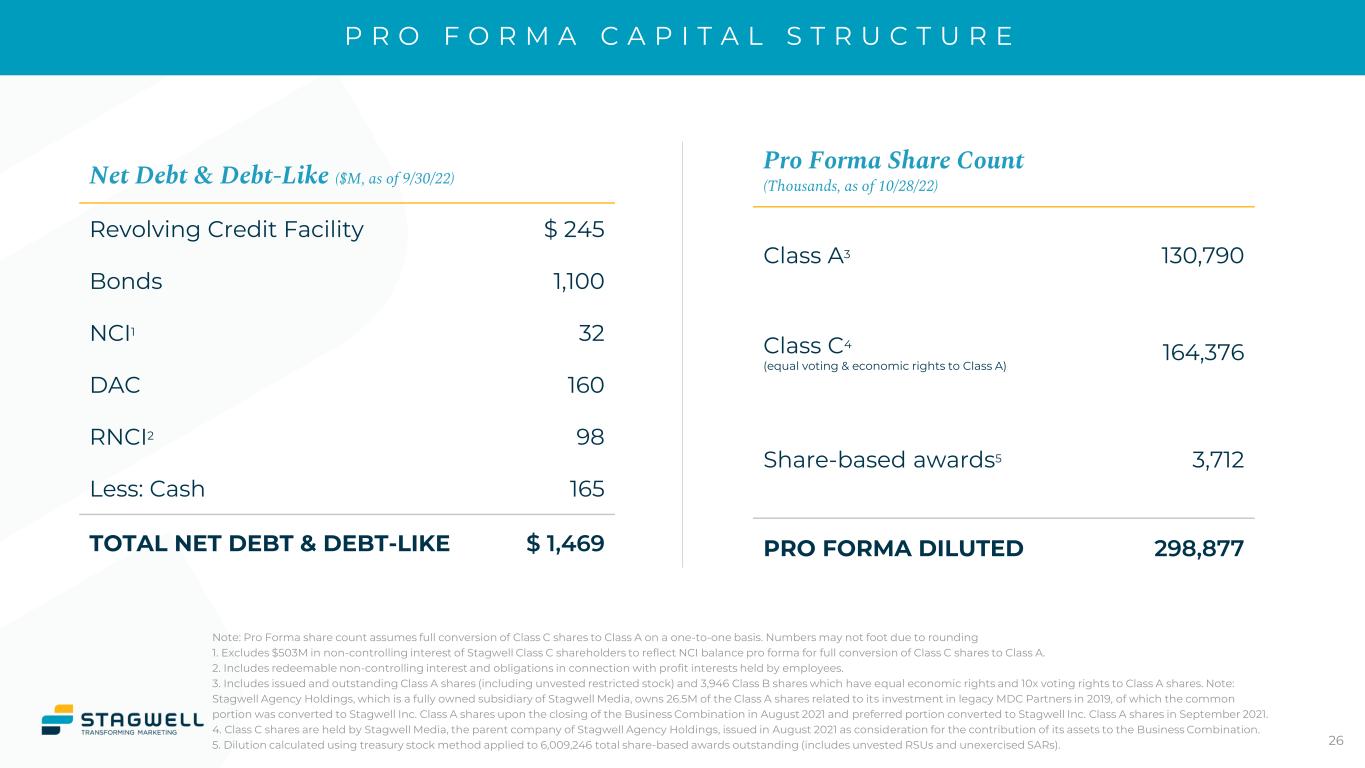

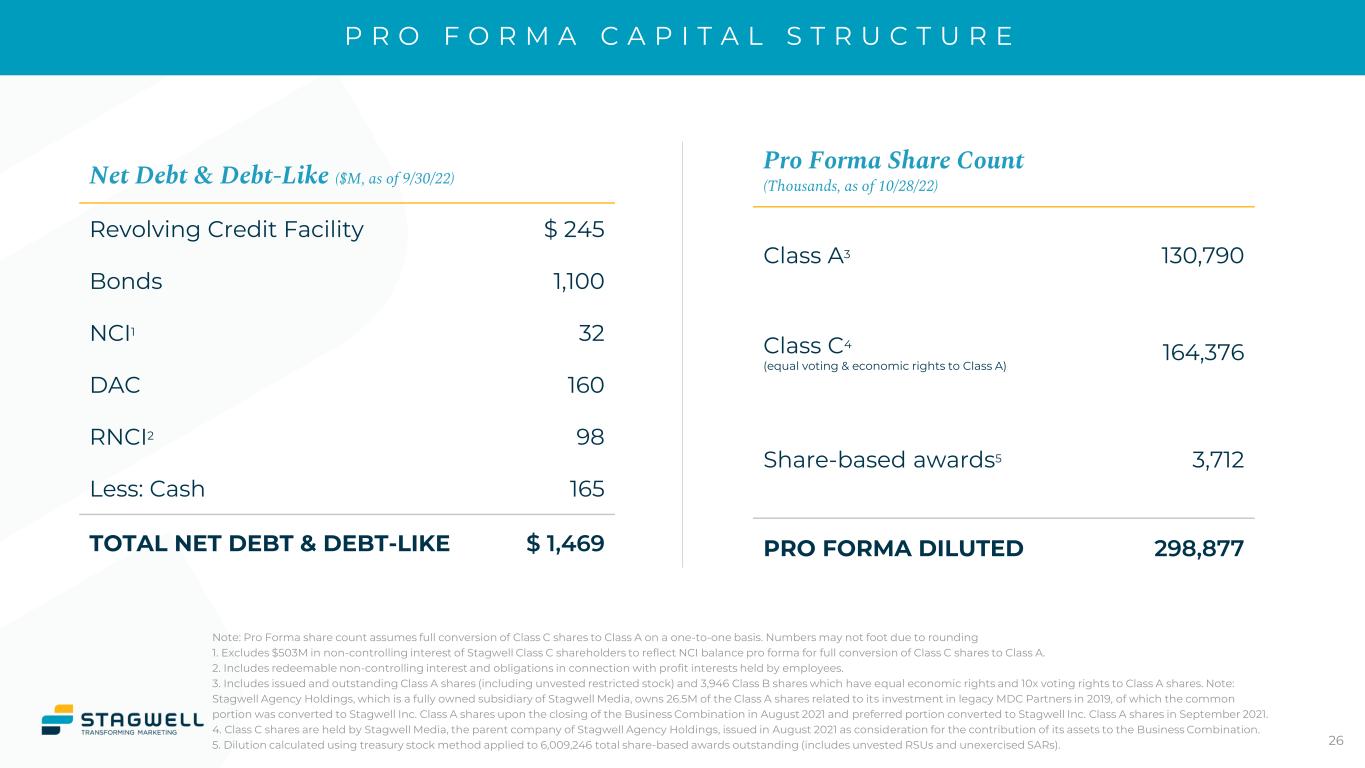

P R O F O R M A C A P I T A L S T R U C T U R E Note: Pro Forma share count assumes full conversion of Class C shares to Class A on a one-to-one basis. Numbers may not foot due to rounding 1. Excludes $503M in non-controlling interest of Stagwell Class C shareholders to reflect NCI balance pro forma for full conversion of Class C shares to Class A. 2. Includes redeemable non-controlling interest and obligations in connection with profit interests held by employees. 3. Includes issued and outstanding Class A shares (including unvested restricted stock) and 3,946 Class B shares which have equal economic rights and 10x voting rights to Class A shares. Note: Stagwell Agency Holdings, which is a fully owned subsidiary of Stagwell Media, owns 26.5M of the Class A shares related to its investment in legacy MDC Partners in 2019, of which the common portion was converted to Stagwell Inc. Class A shares upon the closing of the Business Combination in August 2021 and preferred portion converted to Stagwell Inc. Class A shares in September 2021. 4. Class C shares are held by Stagwell Media, the parent company of Stagwell Agency Holdings, issued in August 2021 as consideration for the contribution of its assets to the Business Combination. 5. Dilution calculated using treasury stock method applied to 6,009,246 total share-based awards outstanding (includes unvested RSUs and unexercised SARs). Net Debt & Debt-Like ($M, as of 9/30/22) Revolving Credit Facility $ 245 Bonds 1,100 NCI1 32 DAC 160 RNCI2 98 Less: Cash 165 TOTAL NET DEBT & DEBT-LIKE $ 1,469 Pro Forma Share Count (Thousands, as of 10/28/22) Class A3 130,790 Class C4 (equal voting & economic rights to Class A) 164,376 Share-based awards5 3,712 PRO FORMA DILUTED 298,877 26

Appendix

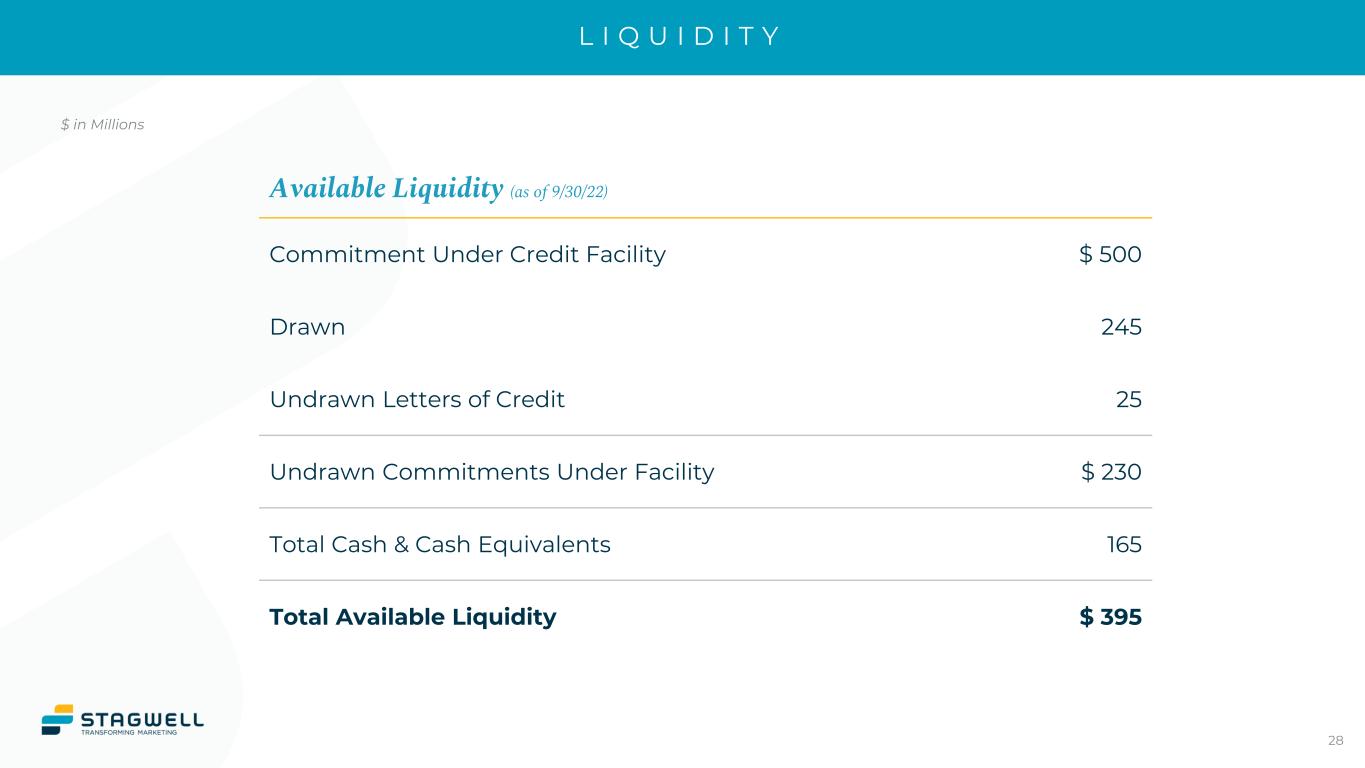

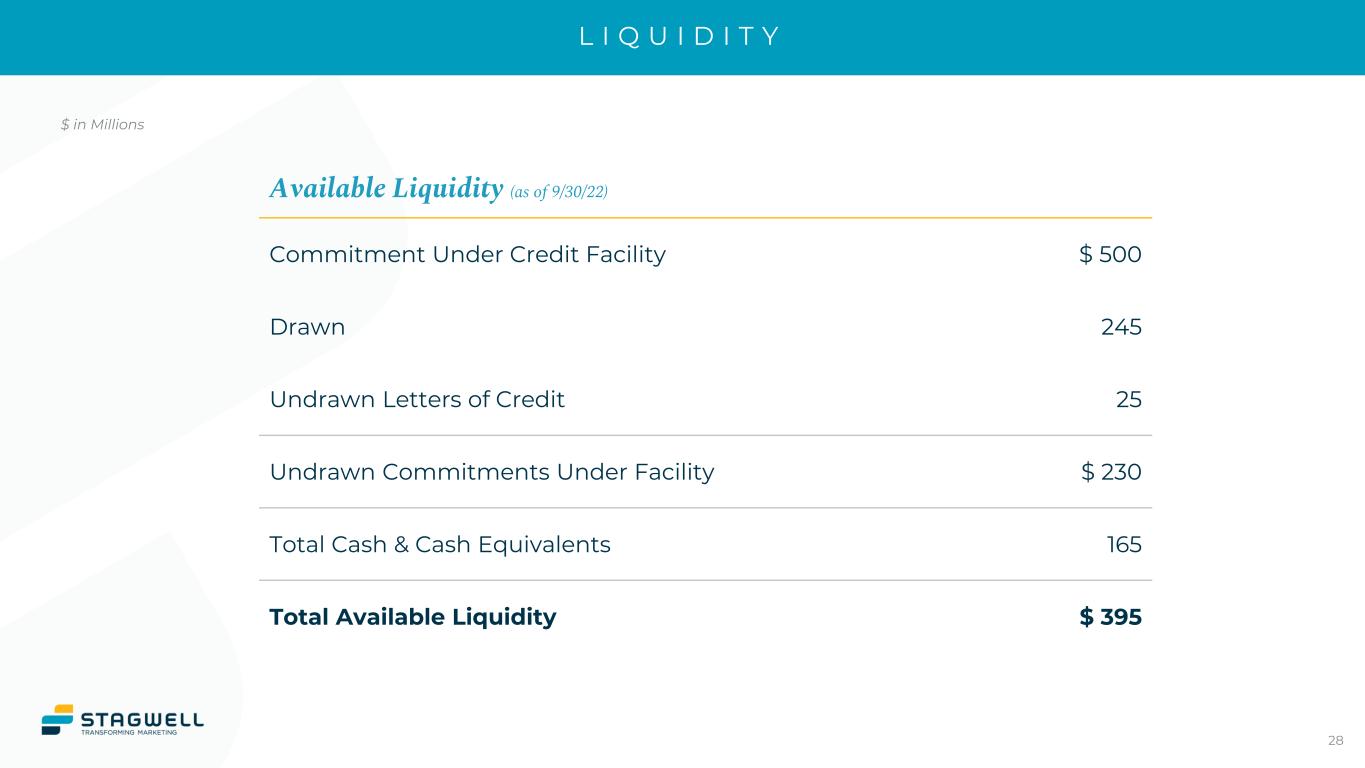

L I Q U I D I T Y Available Liquidity (as of 9/30/22) Commitment Under Credit Facility $ 500 Drawn 245 Undrawn Letters of Credit 25 Undrawn Commitments Under Facility $ 230 Total Cash & Cash Equivalents 165 Total Available Liquidity $ 395 28 $ in Millions

G L O B A L N E T W O R K 29 North America Latin America Europe Asia Pacific • Australia • China • Hong Kong • India • Indonesia • Japan • Malaysia • Philippines • Taiwan • Thailand • Singapore • South Korea Middle East & Africa • Austria • Belgium • Bulgaria • Italy • Latvia • Romania • Slovak Republic • Slovenia • Switzerland • Turkey • Ukraine • France • Germany • Netherlands • Poland • Spain • Sweden • United Kingdom • Argentina • Aruba • Bolivia • Brazil • Curacao • Colombia • Costa Rica • Dominican • Ecuador • El Salvador • Guatemala • Honduras • Jamaica • Nicaragua • Panama • Peru • Republic • Uruguay • Venezuela • Algeria • Bahrain • Egypt • Jordan • Kuwait • Lebanon • Libya • Morocco • Nigeria • Oman • Saudi Arabia • South Africa • Tunisia • United Arab Emirates Stagwell +Affiliates COUNTRIES 34 69 EMPLOYEES 13K+ 24K+ Stagwell’s Affiliate Network Significantly Expands Our Global Footprint • Canada • USA • Mexico Note: As of September 30, 2022.

Thank You Contact Us: IR@StagwellGlobal.com