Fourth Quarter and Full Year 2024 EARNINGS PRESENTATION February 27 | 2025

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance, growth, and future prospects, the Company’s strategy, business and economic trends and growth, technological leadership and differentiation, potential and completed acquisitions, anticipated operating efficiencies and synergies and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “develop,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “goal,” “guidance,” “in development,” “intend,” “likely,” “look,” “maintain,” “may,” “ongoing,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “probable,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following: • risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients; • demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties; • inflation and actions taken by central banks to counter inflation; • the Company’s ability to attract new clients and retain existing clients; • the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements; • financial failure of the Company’s clients; • the Company’s ability to retain and attract key employees; • the Company’s ability to compete in the markets in which it operates; • the Company’s ability to achieve its cost saving initiatives; • the Company’s implementation of strategic initiatives; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the Company’s ability to manage its growth effectively; • the Company’s ability to identify, complete and integrate acquisitions that complement and expand the Company’s business capabilities and realize cost savings, synergies or other anticipated benefits of newly acquired businesses, or that even if realized, such benefits may take longer to realize than expected; • the Company’s ability to identify and complete divestitures and to achieve the anticipated benefits therefrom; • the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products; • the Company’s use of artificial intelligence, including generative artificial intelligence; • adverse tax consequences for the Company, its operations and its stockholders, that may differ from the expectations of the Company, including that future changes in tax laws, potential increases to corporate tax rates in the United States and disagreements with tax authorities on the Company’s determinations that may result in increased tax costs; • adverse tax consequences in connection with the Transactions, including the incurrence of material Canadian federal income tax (including material “emigration tax”); • the Company’s ability to establish and maintain an effective system of internal control over financial reporting, including the risk that the Company’s internal controls will fail to detect misstatements in its financial statements • the Company’s ability to accurately forecast its future financial performance and provide accurate guidance; • the Company’s ability to protect client data from security incidents or cyberattacks; • economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflicts between Russia and Ukraine and in the Middle East), terrorist activities and natural disasters; • stock price volatility; and • foreign currency fluctuations. Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2024 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 5, 2025, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings. FORWARD LOOKING STATEMENTS & OTHER INFORMATION 2

DEFINITIONS OF NON-GAAP FINANCIAL MEASURES 3 In addition to its reported results, Stagwell Inc. has included in this earnings presentation certain financial results that the Securities and Exchange Commission (SEC) defines as "non-GAAP Financial Measures." Management believes that such non-GAAP financial measures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company's results. Such non-GAAP financial measures include the following: Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of Adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. 1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year. 2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period. 3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and nonrecurring items. 4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding (if dilutive). Other items includes restructuring costs, acquisition- related expenses, and non-recurring items, and subject to the anti-dilution rules. 5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments. 6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results. Included in this earnings presentation are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

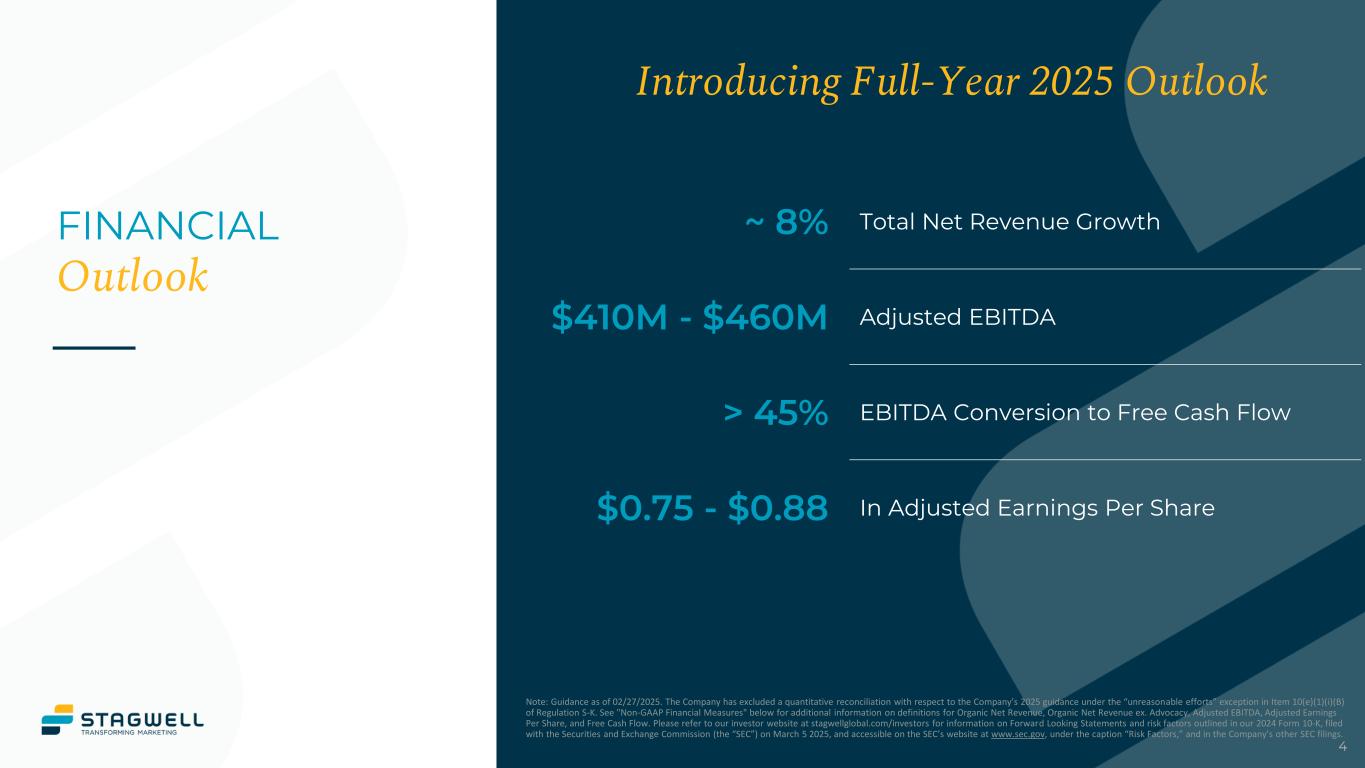

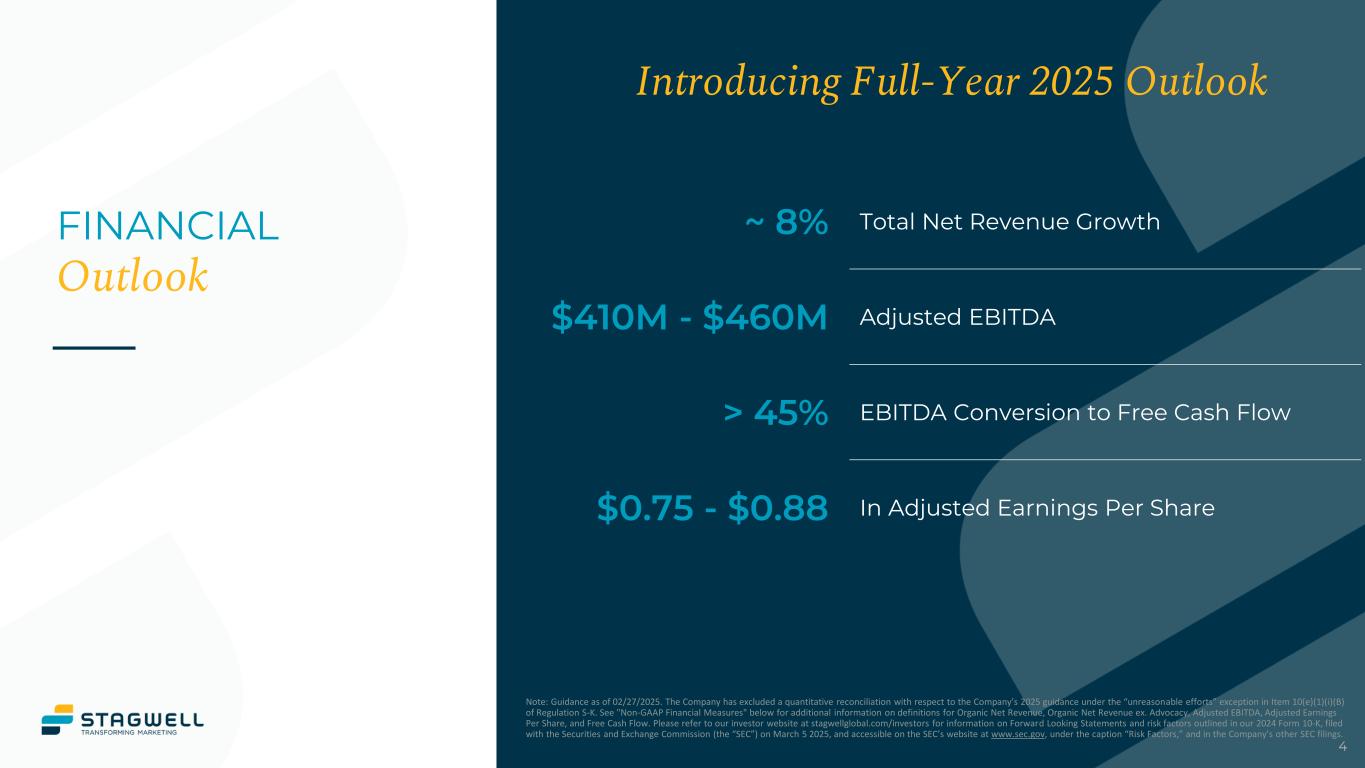

4 FINANCIAL Outlook Introducing Full-Year 2025 Outlook ~ 8% Total Net Revenue Growth $410M - $460M Adjusted EBITDA > 45% EBITDA Conversion to Free Cash Flow $0.75 - $0.88 In Adjusted Earnings Per Share Note: Guidance as of 02/27/2025. The Company has excluded a quantitative reconciliation with respect to the Company’s 2025 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See "Non-GAAP Financial Measures" below for additional information on definitions for Organic Net Revenue, Organic Net Revenue ex. Advocacy, Adjusted EBITDA, Adjusted Earnings Per Share, and Free Cash Flow. Please refer to our investor website at stagwellglobal.com/investors for information on Forward Looking Statements and risk factors outlined in our 2024 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 5 2025, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

F O U R T H Q U A R T E R H I G H L I G H T S NET REVENUE: $630M | NET LEVERAGE RATIO: 3.0x | ADJ. EBITDA: $123M Expanding CAPABILITIES & REACH Best-In-Class GROWTH Investing IN TECHNOLOGY Record-Breaking NEW BUSINESS Closed 2 acquisitions in 4Q to expand global reach and digital capabilities Acquired Consulum, a pan-MENA government advisory consultancy Added UNICEPTA, global media monitoring and analytics platform based in Germany Announced intent to acquire Create. Group, a leading digital strategic communications group in the Middle East, with anticipated close before end of 1Q25 Announced intent to acquire ADK Global, adding 10 new offices in APAC and bringing headcount in the region to more than 2,000 Record $102M of net new business wins in 4Q24, bringing LTM to $382M Secured multiple high profile new customer wins and expansions with leading companies including Starbucks, Target and Visa. The total number of wins increased 85% YoY; Count of our wins above $1 million increased 72% Revenue growth of 20% year-over-year to $789 million Digital Transformation grew 22% over the prior period US posted 21% growth year-over-year Advocacy revenue grew 80% year-over-year Stagwell Marketing Cloud grew 24% over the prior period Launched first-of-its-kind anticipatory AI tool ContextLens ahead of the election, built by Code and Theory for Real Clear Politics Deepened our relationship with Adobe, beta-testing Adobe Firefly and collaborating on The Machine, an AI-powered content development platform Continued to invest in our Stagwell Marketing Cloud solutions for marketers with updated AI-powered influencer pitch features to our PRophet tool Note: Net Leverage Ratio defined as Net Debt divided by LTM Adjusted EBITDA.

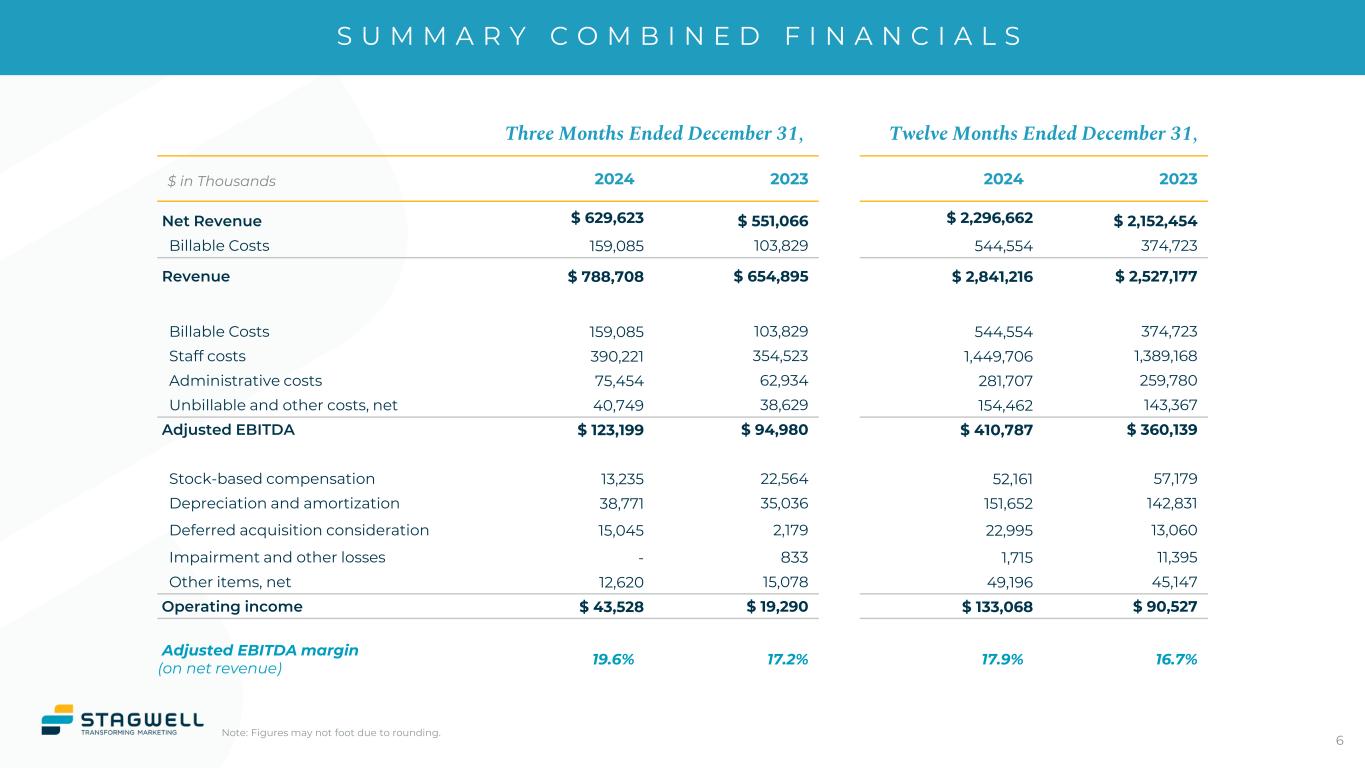

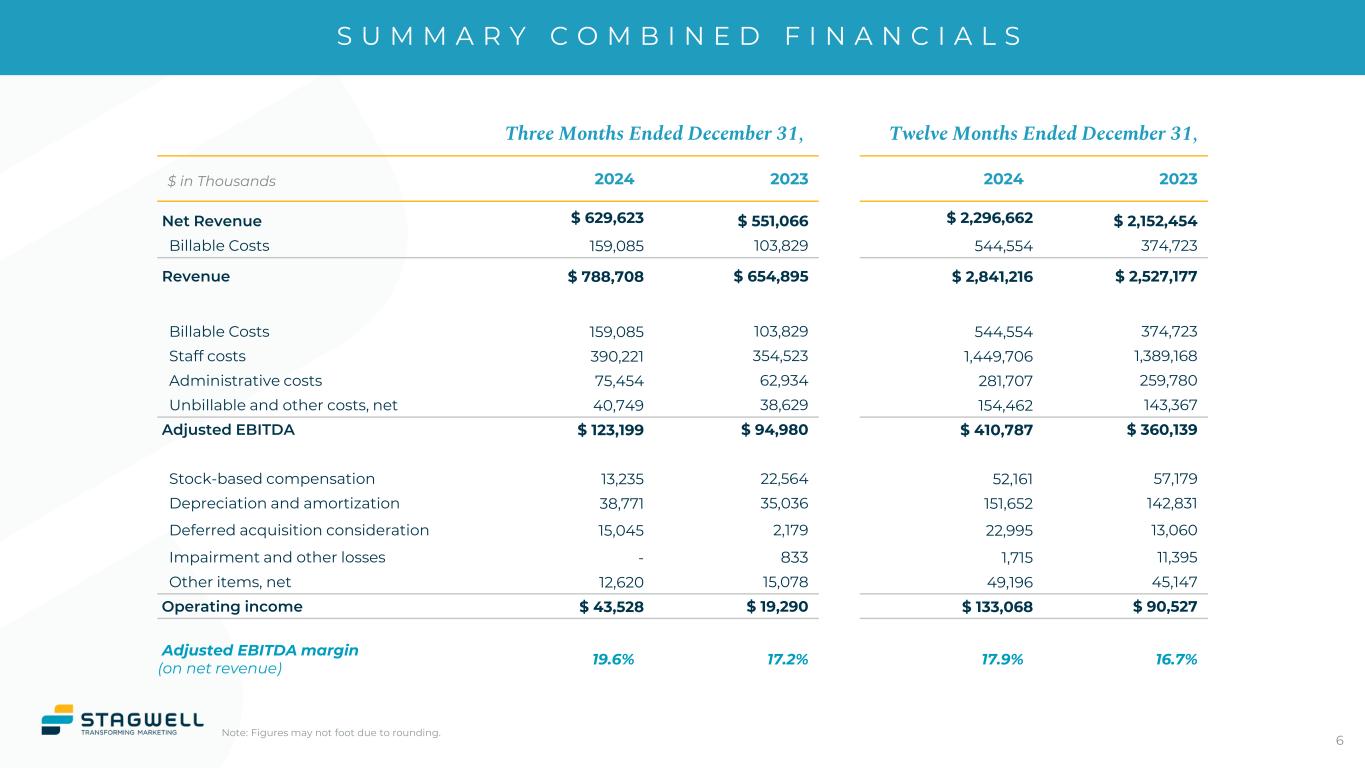

S U M M A R Y C O M B I N E D F I N A N C I A L S Note: Figures may not foot due to rounding. Three Months Ended December 31, Twelve Months Ended December 31, 2024 2023 2024 2023 Net Revenue $ 629,623 $ 551,066 $ 2,296,662 $ 2,152,454 Billable Costs 159,085 103,829 544,554 374,723 Revenue $ 788,708 $ 654,895 $ 2,841,216 $ 2,527,177 Billable Costs 159,085 103,829 544,554 374,723 Staff costs 390,221 354,523 1,449,706 1,389,168 Administrative costs 75,454 62,934 281,707 259,780 Unbillable and other costs, net 40,749 38,629 154,462 143,367 Adjusted EBITDA $ 123,199 $ 94,980 $ 410,787 $ 360,139 Stock-based compensation 13,235 22,564 52,161 57,179 Depreciation and amortization 38,771 35,036 151,652 142,831 Deferred acquisition consideration 15,045 2,179 22,995 13,060 Impairment and other losses - 833 1,715 11,395 Other items, net 12,620 15,078 49,196 45,147 Operating income $ 43,528 $ 19,290 $ 133,068 $ 90,527 Adjusted EBITDA margin (on net revenue) 19.6% 17.2% 17.9% 16.7% 6 $ in Thousands

4 Q 2 4 N E T R E V E N U E Note: Figures may not foot due to rounding. Three Months Ended December 31, 2024 Twelve Months Ended December 31, 2024 Net Revenue Change Net Revenue Change Dec 31, 2023 $ 551,066 $ 2,152,454 Organic revenue 55,069 10.0% 111,746 5.2% Acquisitions (divestitures), net 23,507 4.3% 31,028 1.4% Foreign currency (19) (0.0)% 1,434 0.0% Total Change $ 78,557 14.3% $ 144,208 6.7% Dec 31, 2024 $ 629,623 $ 2,296,662 7 $ in Thousands

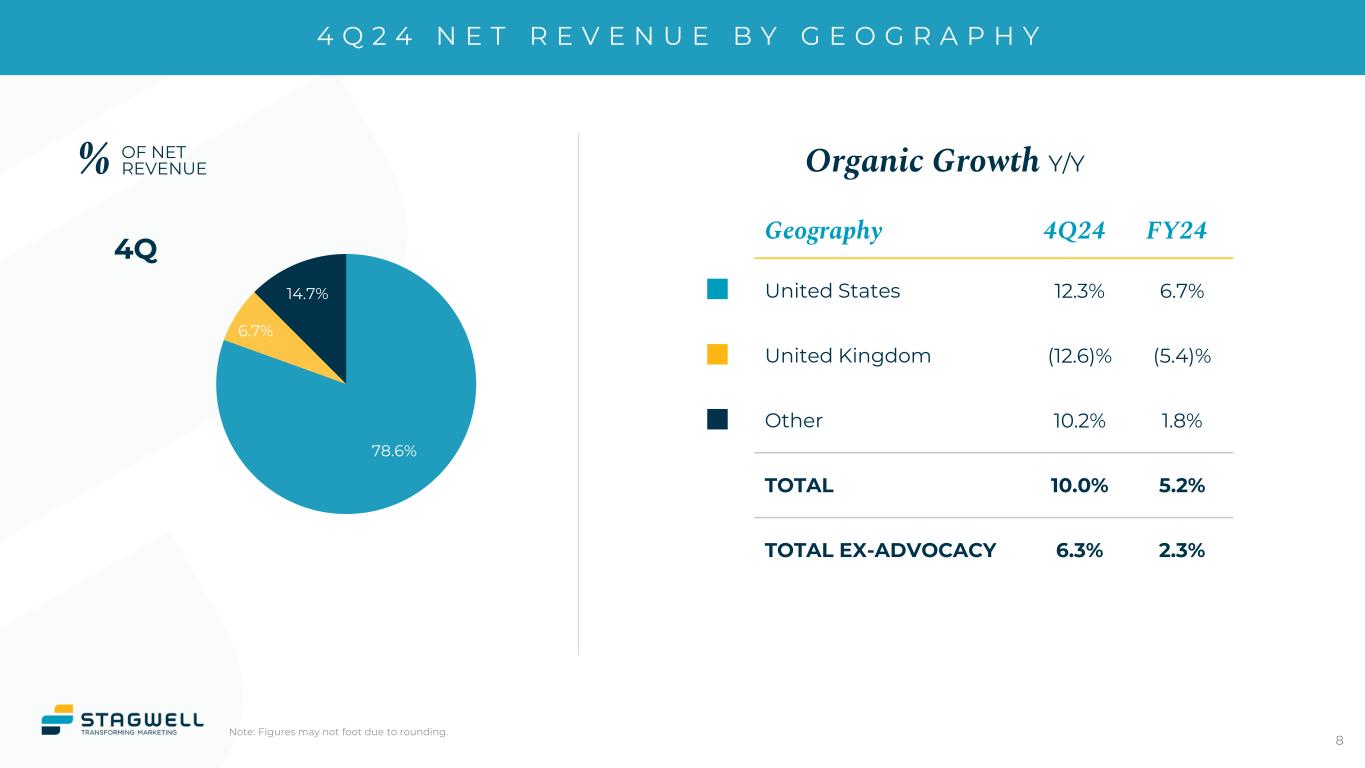

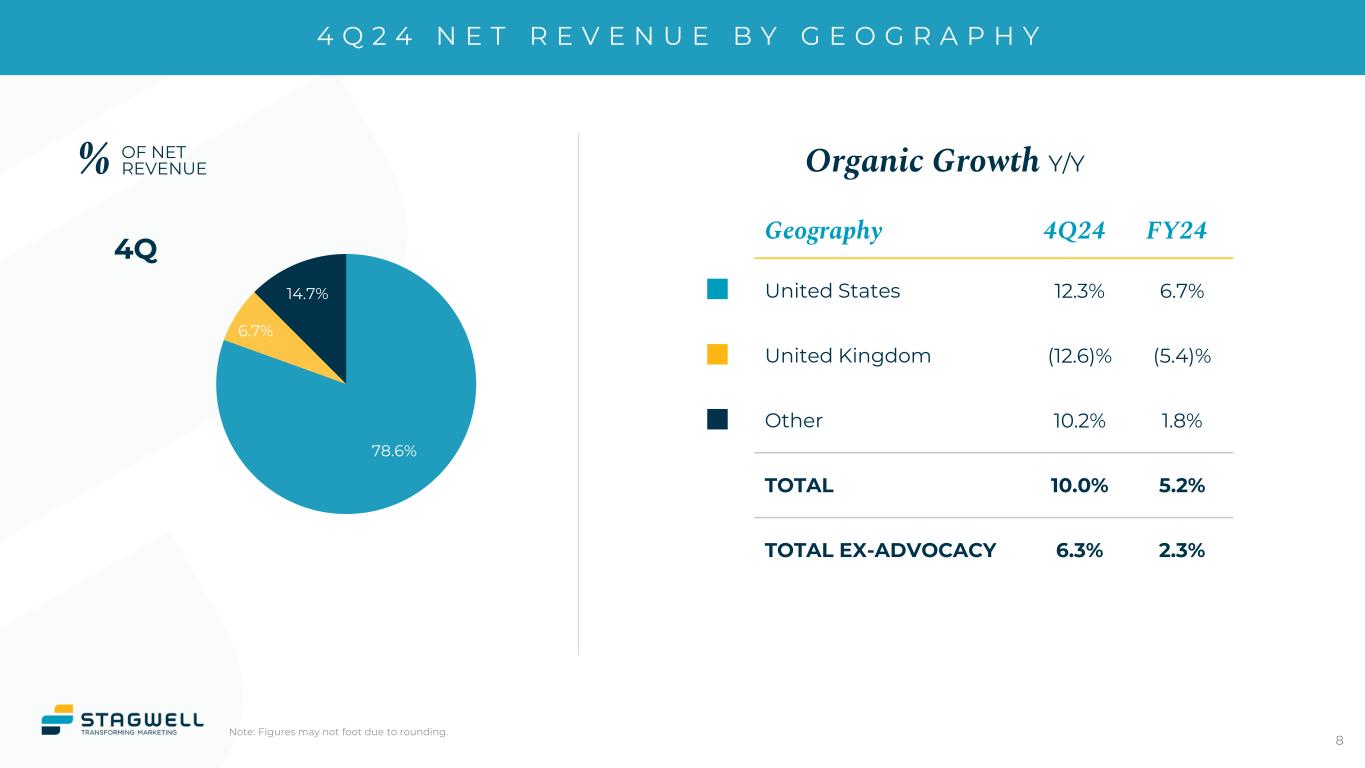

78.6% 6.7% 14.7% 4 Q 2 4 N E T R E V E N U E B Y G E O G R A P H Y Note: Figures may not foot due to rounding. 4Q Organic Growth Y/Y 8 % OF NET REVENUE Geography 4Q24 FY24 United States 12.3% 6.7% United Kingdom (12.6)% (5.4)% Other 10.2% 1.8% TOTAL 10.0% 5.2% TOTAL EX-ADVOCACY 6.3% 2.3%

G L O B A L N E T W O R K 9 North America Latin America Europe Asia Pacific • Australia • China • Hong Kong • India • Indonesia • Japan • Malaysia • Philippines • Taiwan • Thailand • Singapore • South Korea Middle East & Africa • Austria • Belgium • Bulgaria • Italy • Latvia • Romania • Slovak Republic • Slovenia • Switzerland • Turkey • Ukraine • France • Germany • Netherlands • Poland • Spain • Sweden • United Kingdom • Argentina • Aruba • Bolivia • Brazil • Curacao • Colombia • Costa Rica • Dominican • Ecuador • El Salvador • Guatemala • Honduras • Jamaica • Nicaragua • Panama • Peru • Republic • Uruguay • Venezuela • Algeria • Bahrain • Egypt • Jordan • Kuwait • Lebanon • Libya • Morocco • Nigeria • Oman • Saudi Arabia • South Africa • Tunisia • United Arab Emirates Stagwell Affiliates COUNTRIES 40+ 75+ EMPLOYEES 12K+ 21K+ Stagwell’s Affiliate Network Significantly Expands Our Global Footprint • Canada • USA • Mexico Note: As of December 31, 2024.

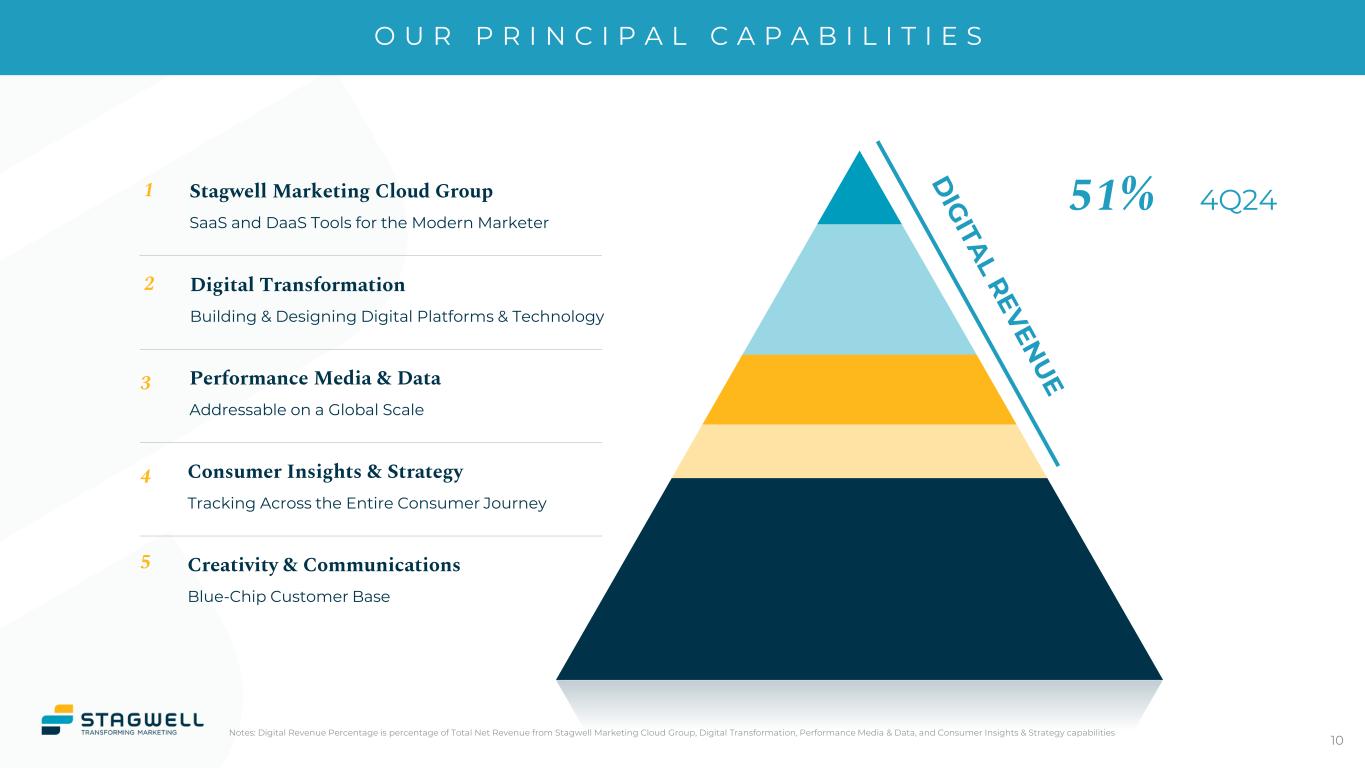

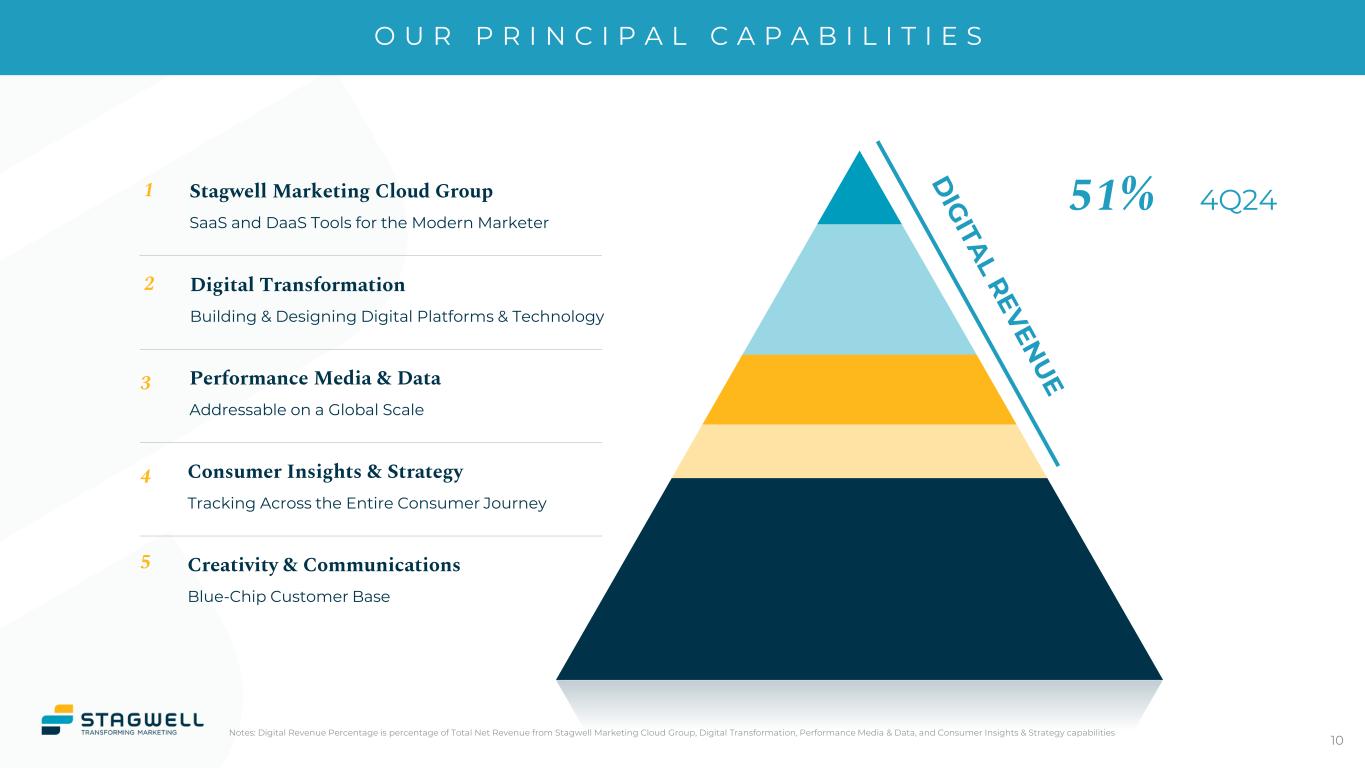

O U R P R I N C I P A L C A P A B I L I T I E S Creativity & Communications Blue-Chip Customer Base Performance Media & Data Addressable on a Global Scale Consumer Insights & Strategy Tracking Across the Entire Consumer Journey Digital Transformation Building & Designing Digital Platforms & Technology 2 3 4 5 10 51% 4Q24Stagwell Marketing Cloud Group SaaS and DaaS Tools for the Modern Marketer 1 Notes: Digital Revenue Percentage is percentage of Total Net Revenue from Stagwell Marketing Cloud Group, Digital Transformation, Performance Media & Data, and Consumer Insights & Strategy capabilities

R E V E N U E G R O W T H B Y C A P A B I L I T Y Notes: Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. EBITDA includes corporate expenses, notionally allocated ratably across each capability. 4Q24 FY24 Principal Capability Organic Revenue Growth Revenue Growth Organic Revenue Growth Revenue Growth Stagwell Marketing Cloud Group 15.8% 24.0% 16.1% 18.8% Digital Transformation 23.7% 22.0% 11.5% 12.8% Performance Media & Data 11.6% 11.9% 9.0% 9.7% Consumer Insights & Strategy (4.9)% (1.1)% (3.1)% (1.1)% Creativity & Communications 13.0% 24.6% 9.1% 13.8% TOTAL 14.1% 20.4% 9.4% 12.4% TOTAL EX-ADVOCACY 6.2% 13.3% 3.7% 7.0% % OF REVENUE 4Q 10% 23% 11% 6% 49%

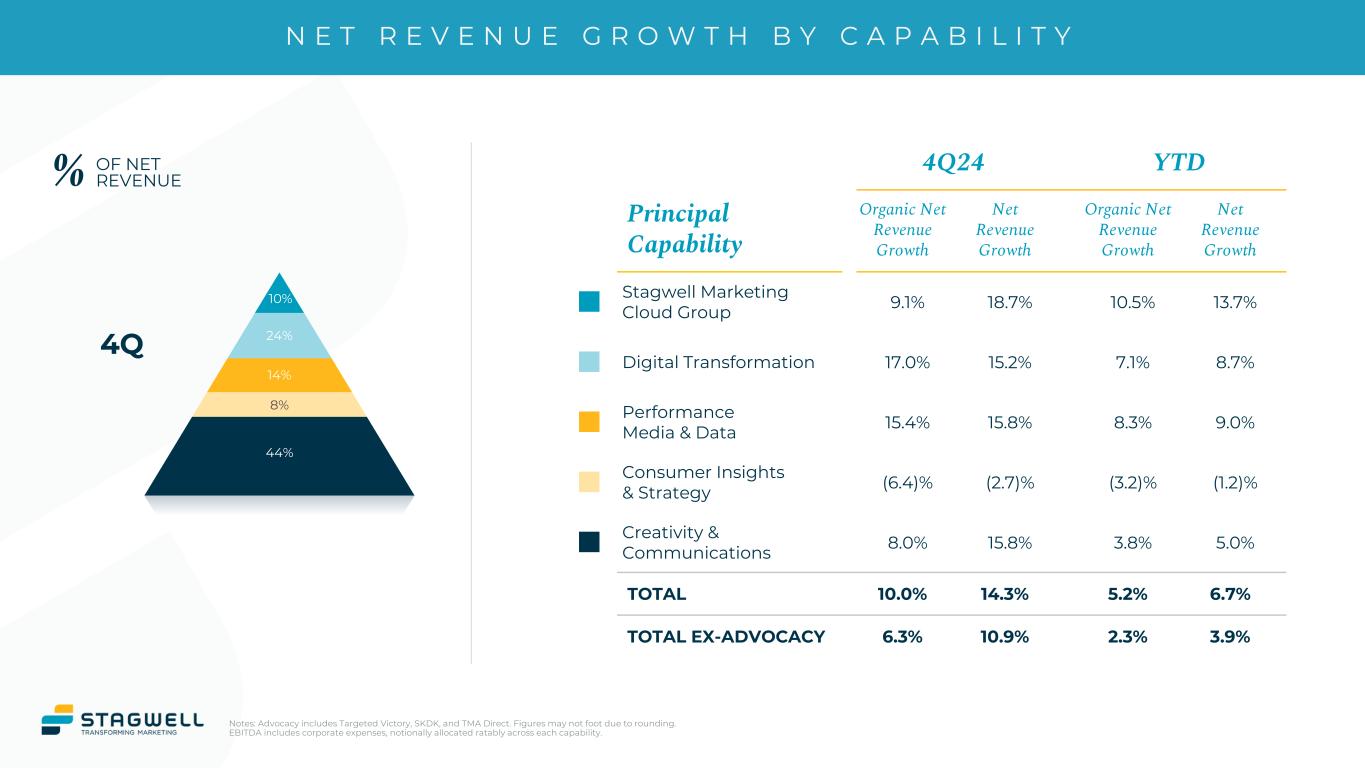

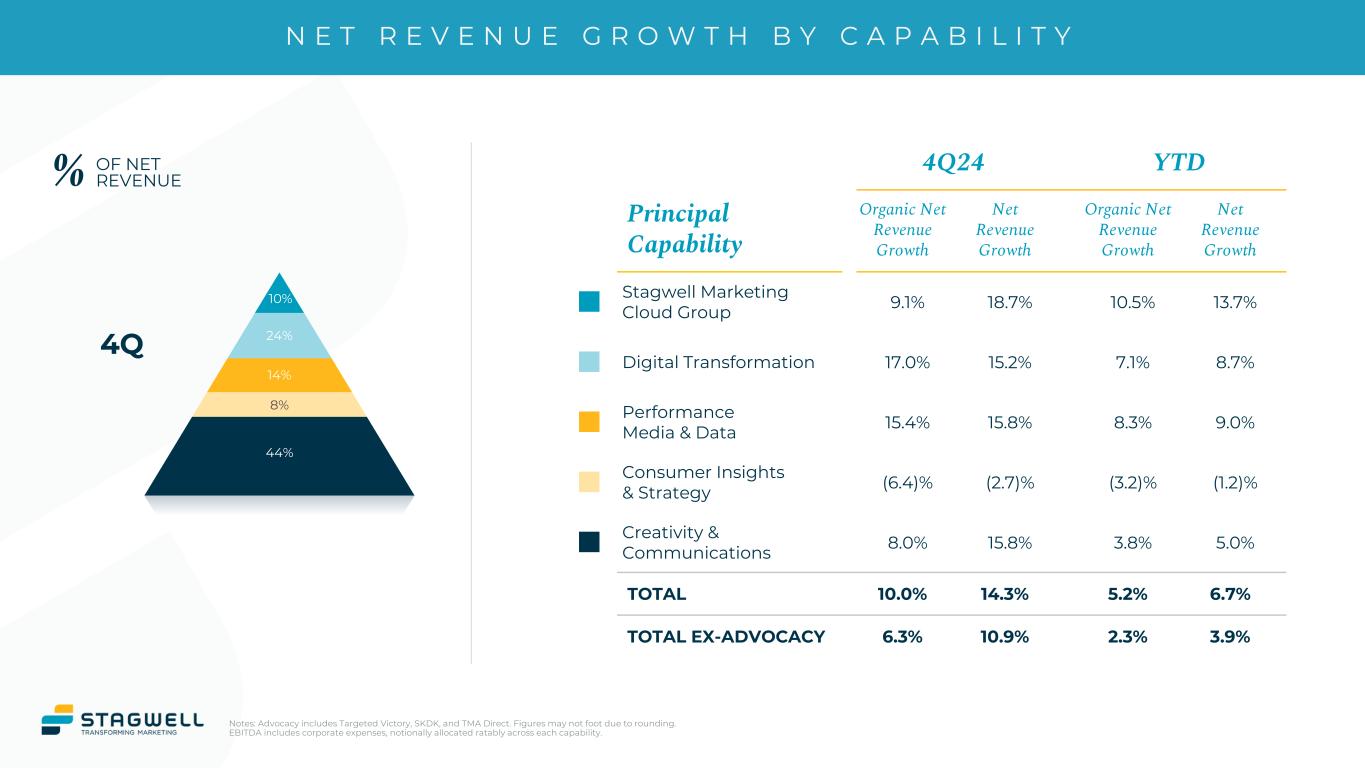

N E T R E V E N U E G R O W T H B Y C A P A B I L I T Y Notes: Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. EBITDA includes corporate expenses, notionally allocated ratably across each capability. 4Q24 YTD Principal Capability Organic Net Revenue Growth Net Revenue Growth Organic Net Revenue Growth Net Revenue Growth Stagwell Marketing Cloud Group 9.1% 18.7% 10.5% 13.7% Digital Transformation 17.0% 15.2% 7.1% 8.7% Performance Media & Data 15.4% 15.8% 8.3% 9.0% Consumer Insights & Strategy (6.4)% (2.7)% (3.2)% (1.2)% Creativity & Communications 8.0% 15.8% 3.8% 5.0% TOTAL 10.0% 14.3% 5.2% 6.7% TOTAL EX-ADVOCACY 6.3% 10.9% 2.3% 3.9% % OF NET REVENUE 4Q 10% 24% 14% 8% 44%

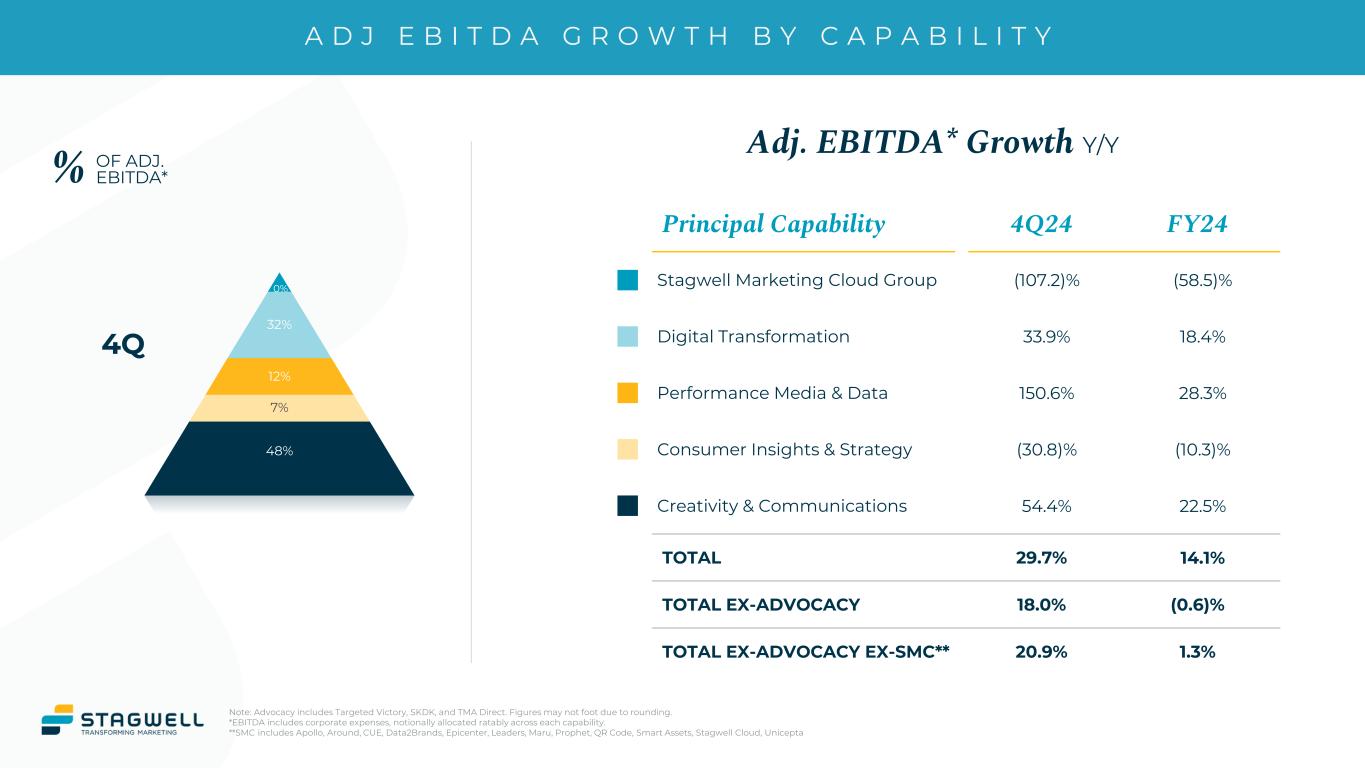

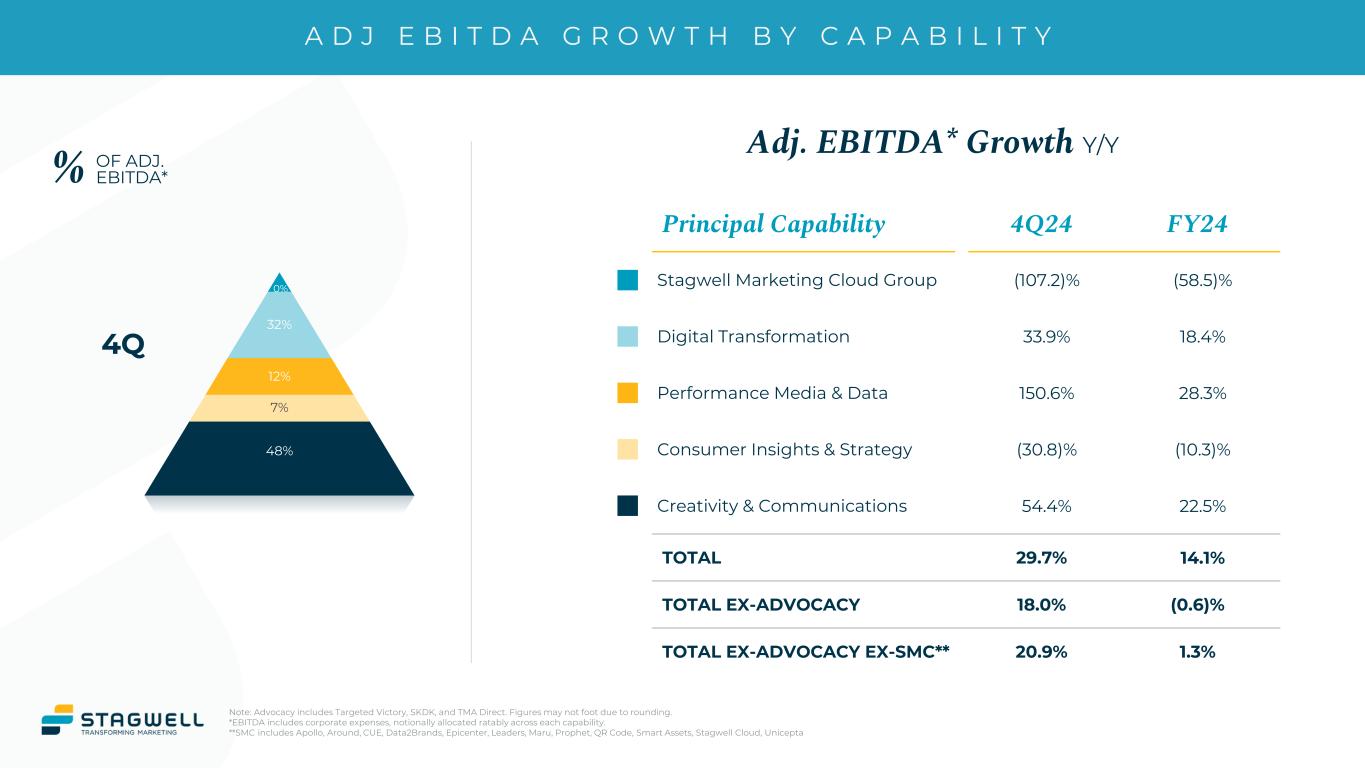

A D J E B I T D A G R O W T H B Y C A P A B I L I T Y Note: Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. *EBITDA includes corporate expenses, notionally allocated ratably across each capability. **SMC includes Apollo, Around, CUE, Data2Brands, Epicenter, Leaders, Maru, Prophet, QR Code, Smart Assets, Stagwell Cloud, Unicepta Principal Capability 4Q24 FY24 Stagwell Marketing Cloud Group (107.2)% (58.5)% Digital Transformation 33.9% 18.4% Performance Media & Data 150.6% 28.3% Consumer Insights & Strategy (30.8)% (10.3)% Creativity & Communications 54.4% 22.5% TOTAL 29.7% 14.1% TOTAL EX-ADVOCACY 18.0% (0.6)% TOTAL EX-ADVOCACY EX-SMC** 20.9% 1.3% % OF ADJ. EBITDA* 4Q Adj. EBITDA* Growth Y/Y 0% 32% 12% 7% 48%

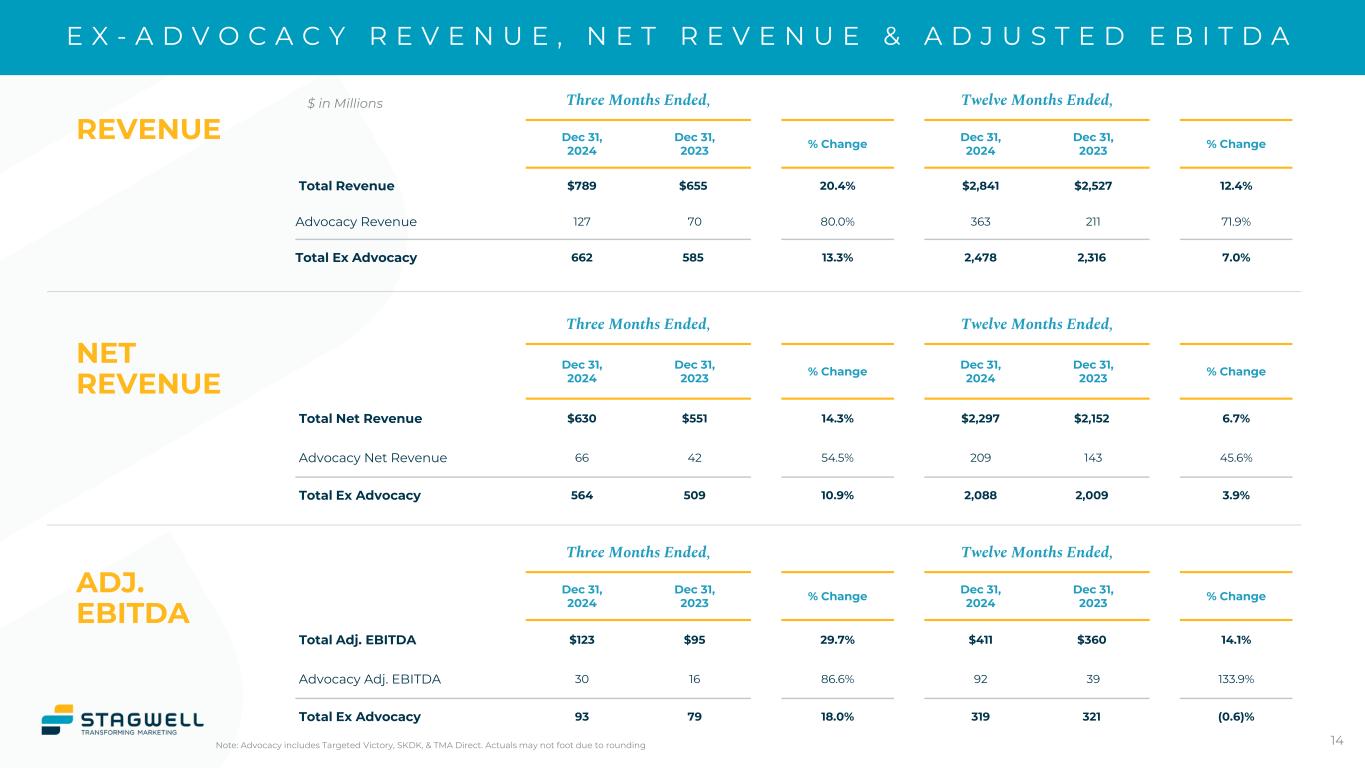

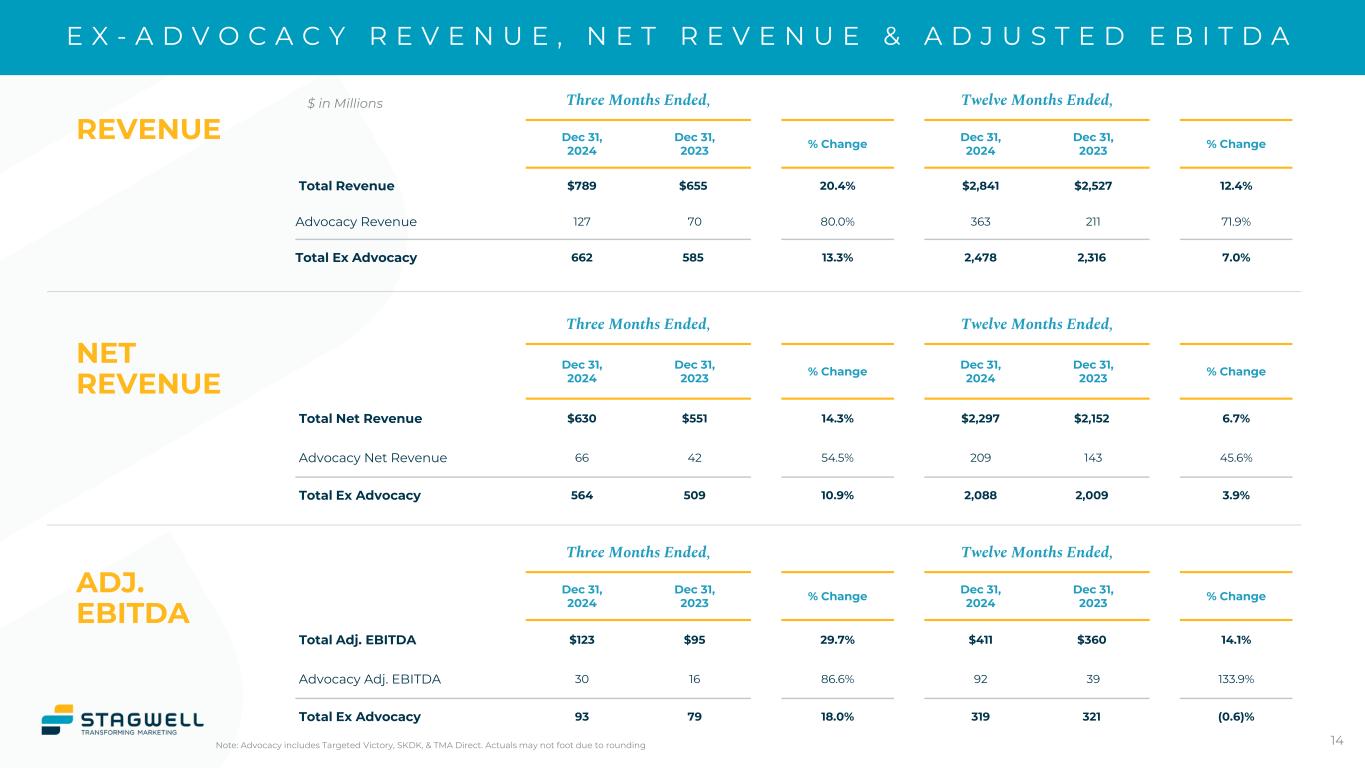

Three Months Ended, Twelve Months Ended, Dec 31, 2024 Dec 31, 2023 % Change Dec 31, 2024 Dec 31, 2023 % Change Total Revenue $789 $655 20.4% $2,841 $2,527 12.4% Advocacy Revenue 127 70 80.0% 363 211 71.9% Total Ex Advocacy 662 585 13.3% 2,478 2,316 7.0% Three Months Ended, Twelve Months Ended, Dec 31, 2024 Dec 31, 2023 % Change Dec 31, 2024 Dec 31, 2023 % Change Total Net Revenue $630 $551 14.3% $2,297 $2,152 6.7% Advocacy Net Revenue 66 42 54.5% 209 143 45.6% Total Ex Advocacy 564 509 10.9% 2,088 2,009 3.9% Three Months Ended, Twelve Months Ended, Dec 31, 2024 Dec 31, 2023 % Change Dec 31, 2024 Dec 31, 2023 % Change Total Adj. EBITDA $123 $95 29.7% $411 $360 14.1% Advocacy Adj. EBITDA 30 16 86.6% 92 39 133.9% Total Ex Advocacy 93 79 18.0% 319 321 (0.6)% E X - A D V O C A C Y R E V E N U E , N E T R E V E N U E & A D J U S T E D E B I T D A Note: Advocacy includes Targeted Victory, SKDK, & TMA Direct. Actuals may not foot due to rounding $ in Millions NET REVENUE ADJ. EBITDA 14 REVENUE

N E W B U S I N E S S U P D A T E 15 PER CLIENT AT TOP 25 Notable Business WINS & EXPANSIONSNet New Business 4Q24 $102M LTM $382M Avg. Net Revenue 4Q24 $6.9M

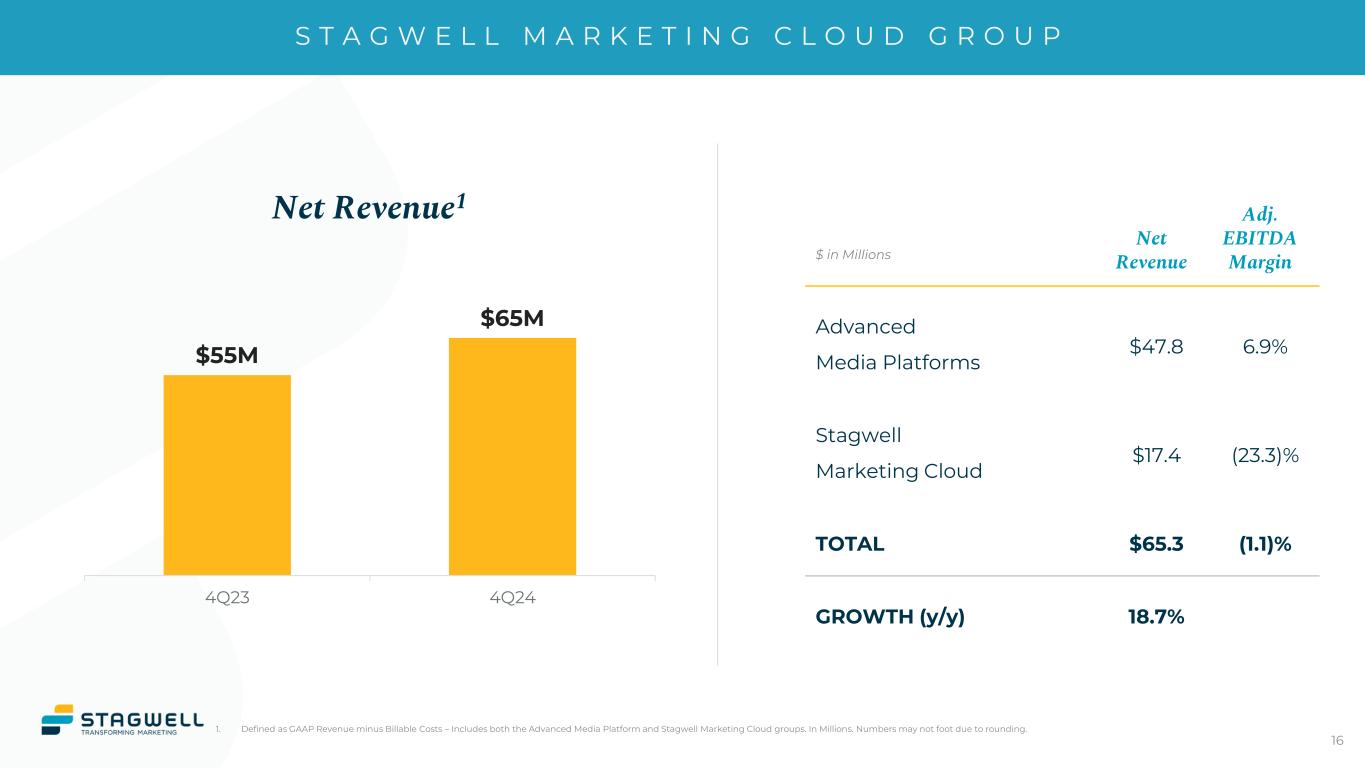

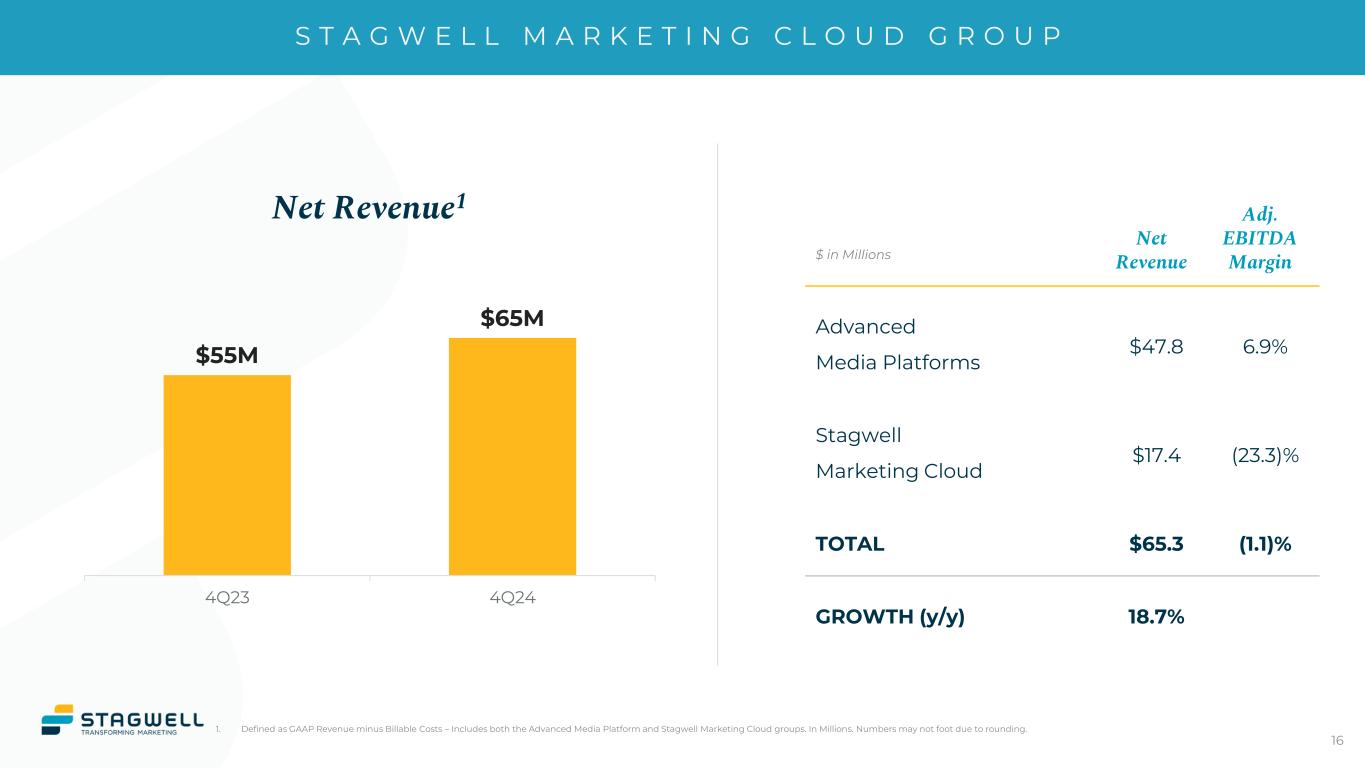

S T A G W E L L M A R K E T I N G C L O U D G R O U P 16 Net Revenue1 1. Defined as GAAP Revenue minus Billable Costs – Includes both the Advanced Media Platform and Stagwell Marketing Cloud groups. In Millions. Numbers may not foot due to rounding. Net Revenue Adj. EBITDA Margin Advanced Media Platforms $47.8 6.9% Stagwell Marketing Cloud $17.4 (23.3)% TOTAL $65.3 (1.1)% GROWTH (y/y) 18.7% $55M $65M 4Q23 4Q24 $ in Millions

17 LIQUIDITY Available Liquidity (as of 12/31/2024) Commitment Under Credit Facility $ 640 Drawn 264 Letters of Credit 15 Undrawn Commitments Under Facility $ 361 Total Cash & Cash Equivalents 131 Total Available Liquidity $ 492 $ in Millions Note: Numbers may not foot due to rounding.

18 MAINTAINING DISCIPLINE AROUND Deferred Acquisition Costs DAC INCREASED BY $1M FROM FY23 YEAR-END BALANCE AS STAGWELL CLOSED 10 ACQUISITIONS Numbers may not foot due to rounding. $101M $102M 4Q23 4Q24

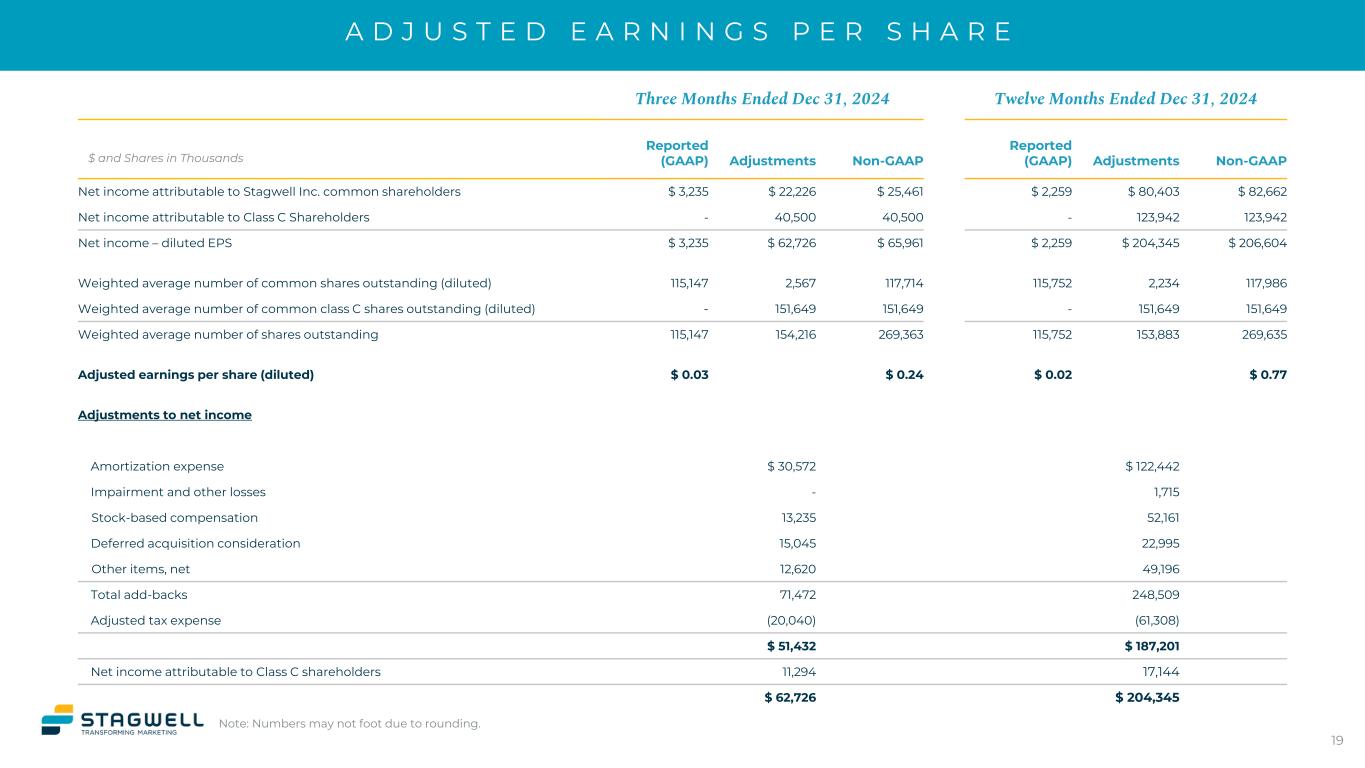

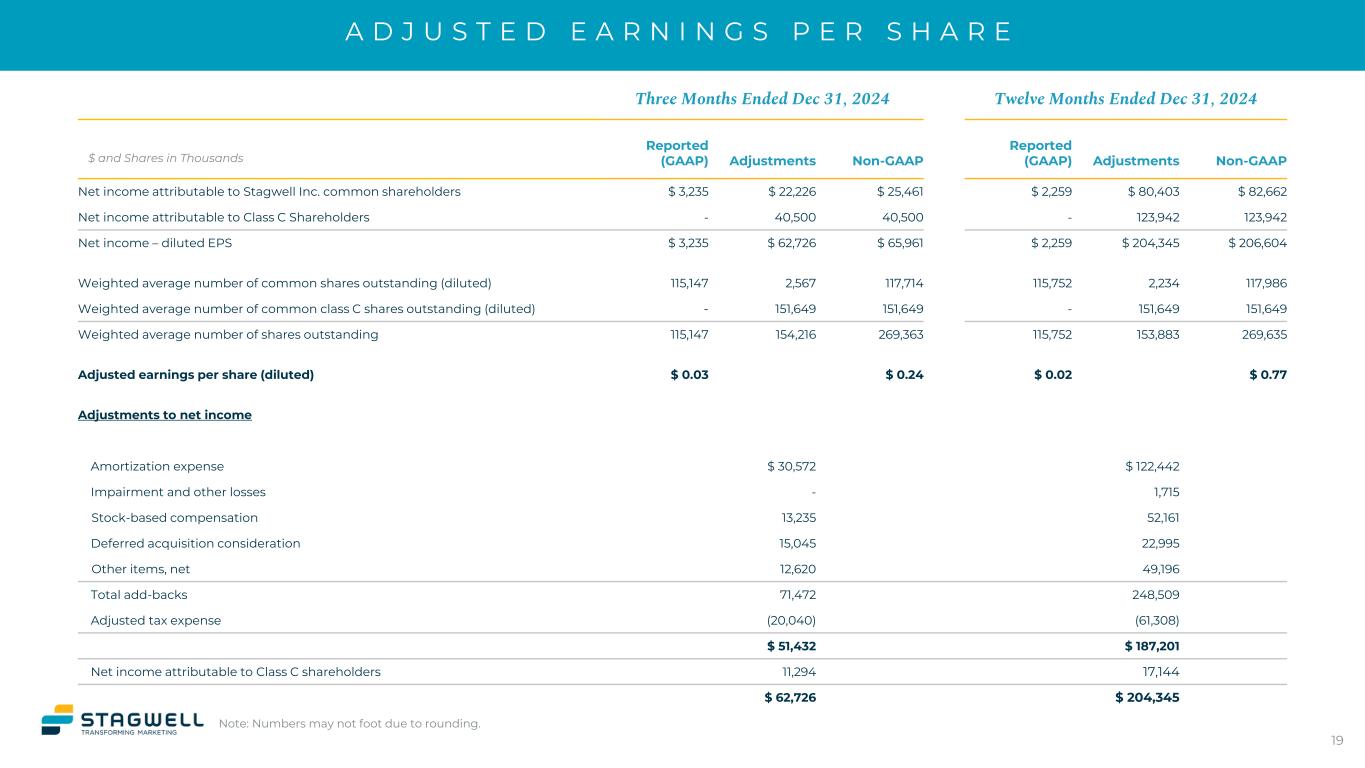

A D J U S T E D E A R N I N G S P E R S H A R E Three Months Ended Dec 31, 2024 Twelve Months Ended Dec 31, 2024 Reported (GAAP) Adjustments Non-GAAP Reported (GAAP) Adjustments Non-GAAP Net income attributable to Stagwell Inc. common shareholders $ 3,235 $ 22,226 $ 25,461 $ 2,259 $ 80,403 $ 82,662 Net income attributable to Class C Shareholders - 40,500 40,500 - 123,942 123,942 Net income – diluted EPS $ 3,235 $ 62,726 $ 65,961 $ 2,259 $ 204,345 $ 206,604 Weighted average number of common shares outstanding (diluted) 115,147 2,567 117,714 115,752 2,234 117,986 Weighted average number of common class C shares outstanding (diluted) - 151,649 151,649 - 151,649 151,649 Weighted average number of shares outstanding 115,147 154,216 269,363 115,752 153,883 269,635 Adjusted earnings per share (diluted) $ 0.03 $ 0.24 $ 0.02 $ 0.77 Adjustments to net income Amortization expense $ 30,572 $ 122,442 Impairment and other losses - 1,715 Stock-based compensation 13,235 52,161 Deferred acquisition consideration 15,045 22,995 Other items, net 12,620 49,196 Total add-backs 71,472 248,509 Adjusted tax expense (20,040) (61,308) $ 51,432 $ 187,201 Net income attributable to Class C shareholders 11,294 17,144 $ 62,726 $ 204,345 19 $ and Shares in Thousands Note: Numbers may not foot due to rounding.

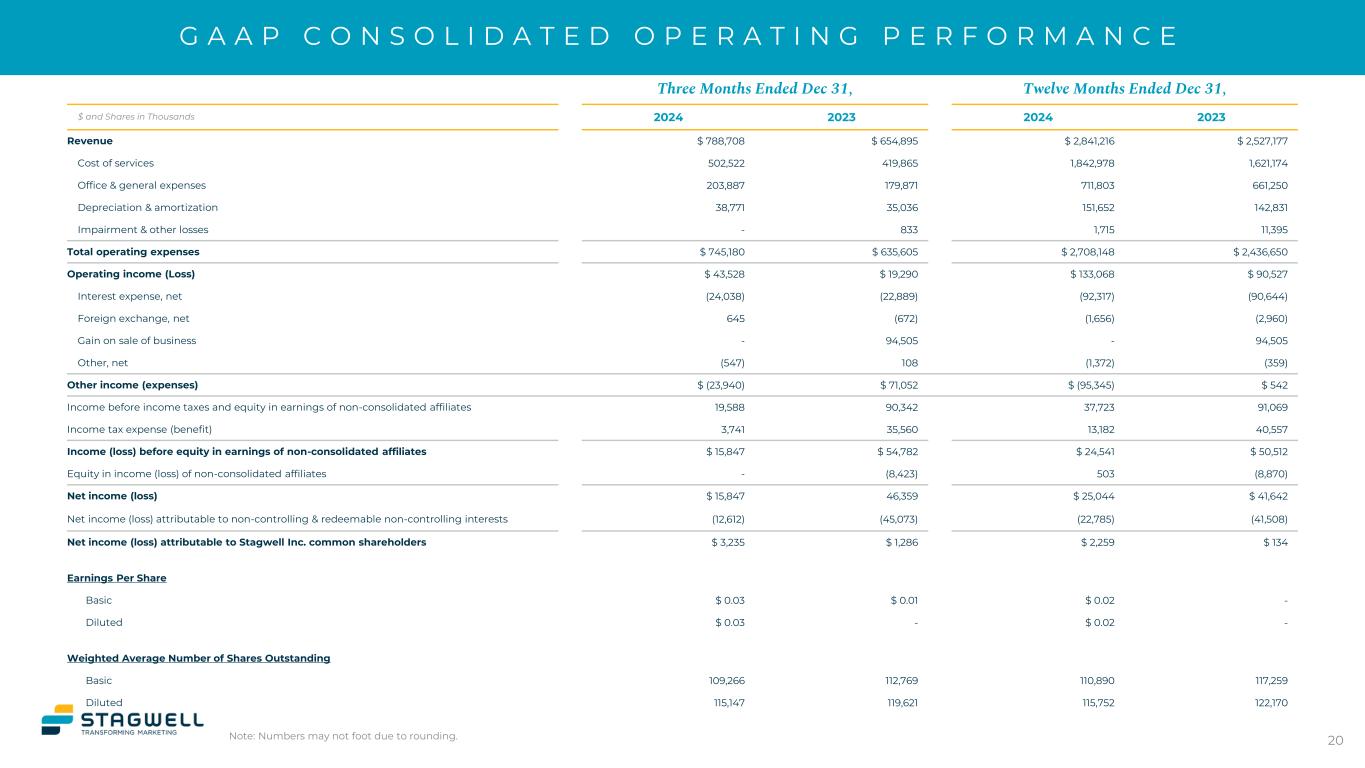

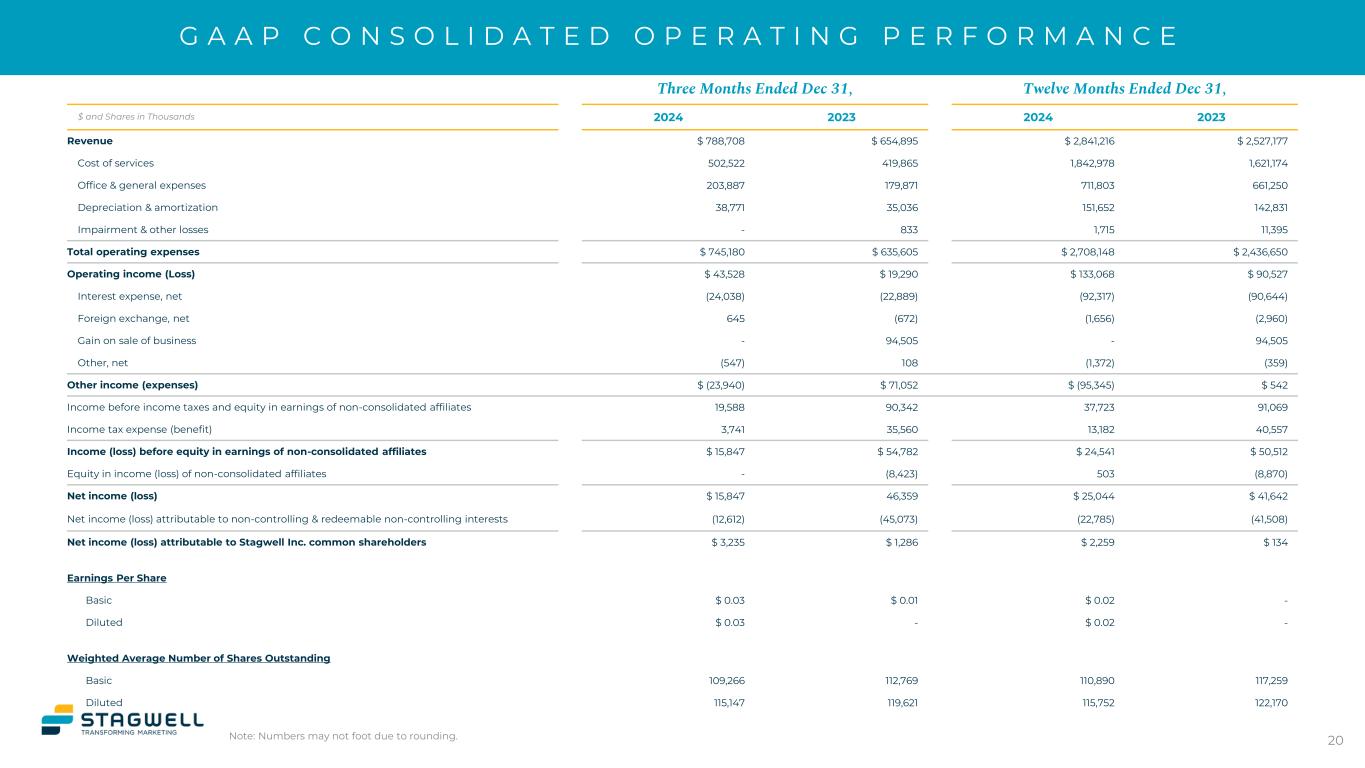

G A A P C O N S O L I D A T E D O P E R A T I N G P E R F O R M A N C E Note: Numbers may not foot due to rounding. 20 $ and Shares in Thousands Three Months Ended Dec 31, Twelve Months Ended Dec 31, 2024 2023 2024 2023 Revenue $ 788,708 $ 654,895 $ 2,841,216 $ 2,527,177 Cost of services 502,522 419,865 1,842,978 1,621,174 Office & general expenses 203,887 179,871 711,803 661,250 Depreciation & amortization 38,771 35,036 151,652 142,831 Impairment & other losses - 833 1,715 11,395 Total operating expenses $ 745,180 $ 635,605 $ 2,708,148 $ 2,436,650 Operating income (Loss) $ 43,528 $ 19,290 $ 133,068 $ 90,527 Interest expense, net (24,038) (22,889) (92,317) (90,644) Foreign exchange, net 645 (672) (1,656) (2,960) Gain on sale of business - 94,505 - 94,505 Other, net (547) 108 (1,372) (359) Other income (expenses) $ (23,940) $ 71,052 $ (95,345) $ 542 Income before income taxes and equity in earnings of non-consolidated affiliates 19,588 90,342 37,723 91,069 Income tax expense (benefit) 3,741 35,560 13,182 40,557 Income (loss) before equity in earnings of non-consolidated affiliates $ 15,847 $ 54,782 $ 24,541 $ 50,512 Equity in income (loss) of non-consolidated affiliates - (8,423) 503 (8,870) Net income (loss) $ 15,847 46,359 $ 25,044 $ 41,642 Net income (loss) attributable to non-controlling & redeemable non-controlling interests (12,612) (45,073) (22,785) (41,508) Net income (loss) attributable to Stagwell Inc. common shareholders $ 3,235 $ 1,286 $ 2,259 $ 134 Earnings Per Share Basic $ 0.03 $ 0.01 $ 0.02 - Diluted $ 0.03 - $ 0.02 - Weighted Average Number of Shares Outstanding Basic 109,266 112,769 110,890 117,259 Diluted 115,147 119,621 115,752 122,170

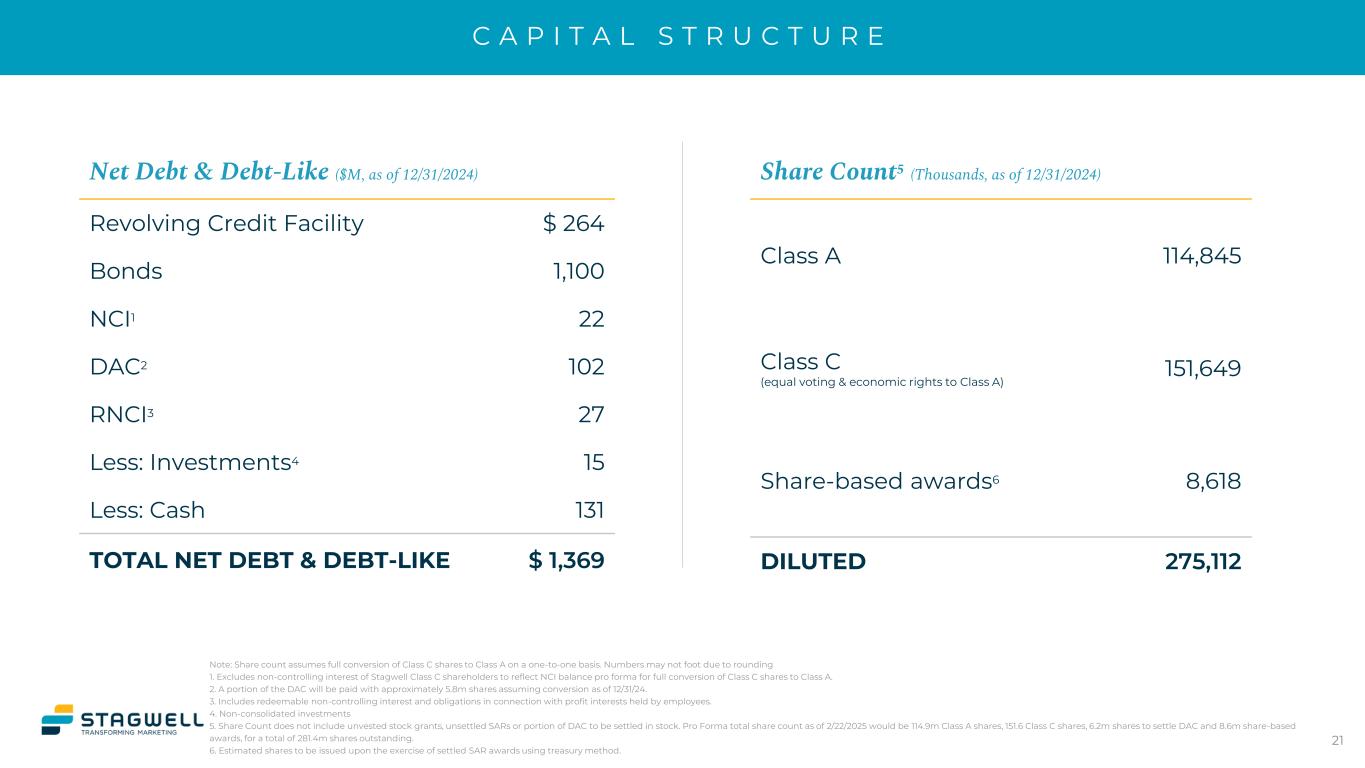

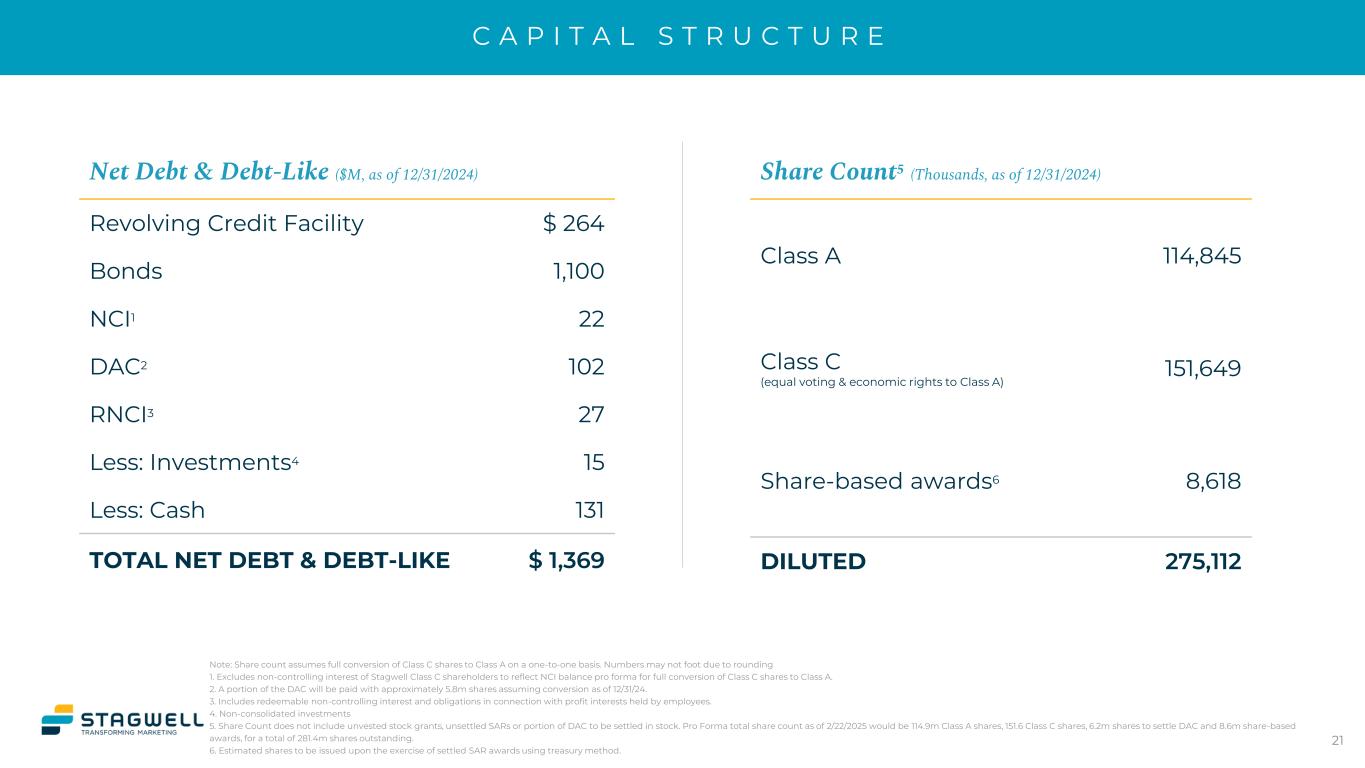

C A P I T A L S T R U C T U R E Note: Share count assumes full conversion of Class C shares to Class A on a one-to-one basis. Numbers may not foot due to rounding 1. Excludes non-controlling interest of Stagwell Class C shareholders to reflect NCI balance pro forma for full conversion of Class C shares to Class A. 2. A portion of the DAC will be paid with approximately 5.8m shares assuming conversion as of 12/31/24. 3. Includes redeemable non-controlling interest and obligations in connection with profit interests held by employees. 4. Non-consolidated investments 5. Share Count does not include unvested stock grants, unsettled SARs or portion of DAC to be settled in stock. Pro Forma total share count as of 2/22/2025 would be 114.9m Class A shares, 151.6 Class C shares, 6.2m shares to settle DAC and 8.6m share-based awards, for a total of 281.4m shares outstanding. 6. Estimated shares to be issued upon the exercise of settled SAR awards using treasury method. Net Debt & Debt-Like ($M, as of 12/31/2024) Revolving Credit Facility $ 264 Bonds 1,100 NCI1 22 DAC2 102 RNCI3 27 Less: Investments4 15 Less: Cash 131 TOTAL NET DEBT & DEBT-LIKE $ 1,369 Share Count5 (Thousands, as of 12/31/2024) Class A 114,845 Class C (equal voting & economic rights to Class A) 151,649 Share-based awards6 8,618 DILUTED 275,112 21

22 APPLYING A PROVEN PLAYBOOK to scale Stagwell Marketing Cloud Group Building complementary software solutions leveraging the domain expertise and distribution channels already in place at Stagwell Advanced Media Platforms Proprietary & Premium Owned Media Channels Media Studio Solution for Modern Media Planners and Buyers Harris Quest Research Market Research Products by The Harris Poll PRophet Comms Tech AI-Driven Platform for Modern Communicators Digital Services Technology Digital Transformation Building Digital Platforms & Consumer Experiences Performance Media & Data Integrated Omnichannel Media, Data & E-Commerce Consumer Insights & Strategy Tracking Across the Consumer Journey Creativity & Communications Blue-Chip Customer Base 1 2 3 4

23 We've developed a proven strategy to develop and incubate new technologies, making informed product roadmap decisions based off agency clients while leveraging our world-class tech team STAGWELL MARKETING CLOUD GROUP Product Incubation Playbook WE BUILD ADVANCED PRODUCTS MORE EFFICIENTLY than the rest Faster Shared infrastructure + tech expertise DEVELOP & ITERATE FAST Cheaper World's most ambitious clients + upselling opportunities LOWER GO-TO-MARKET COSTS Better Proprietary data + the best marketers in the world INTERNAL TESTING & INSIGHTS THAT DELIVER BETTER PRODUCTS

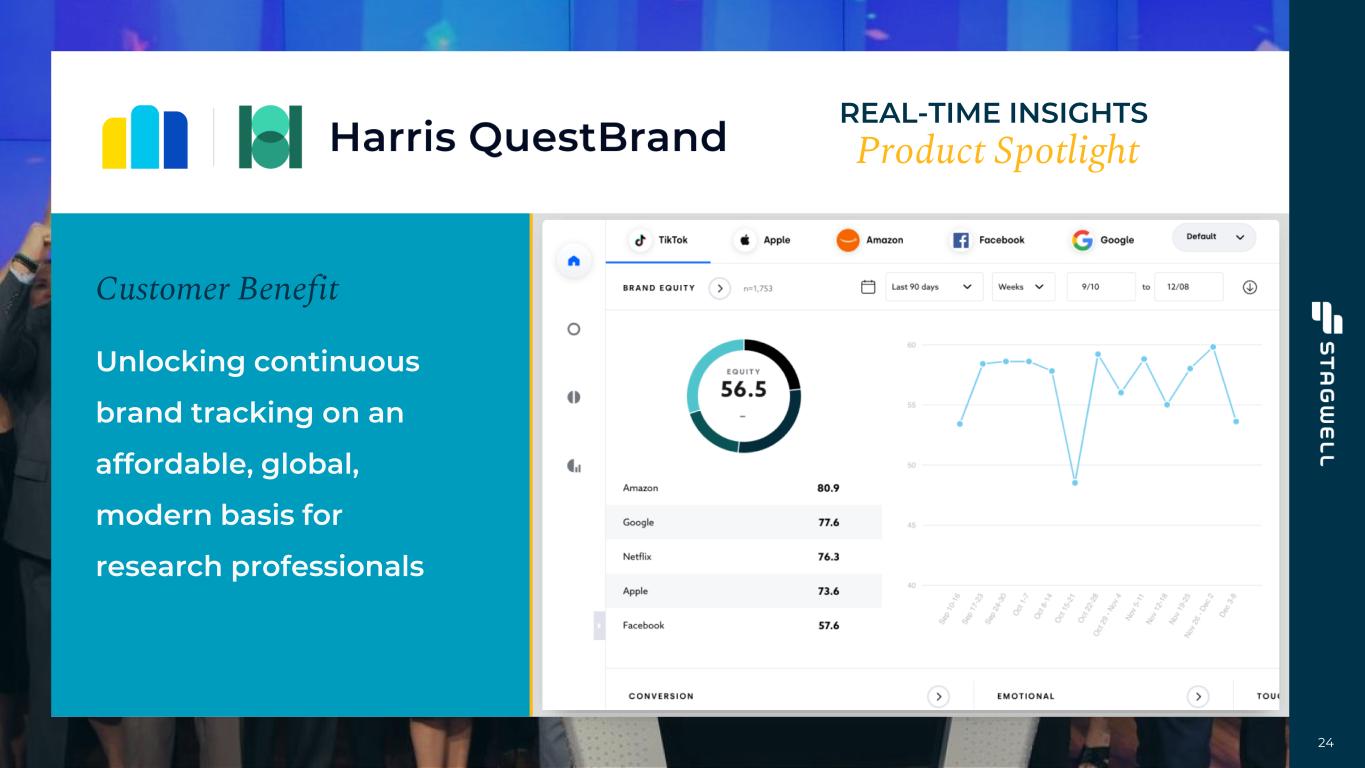

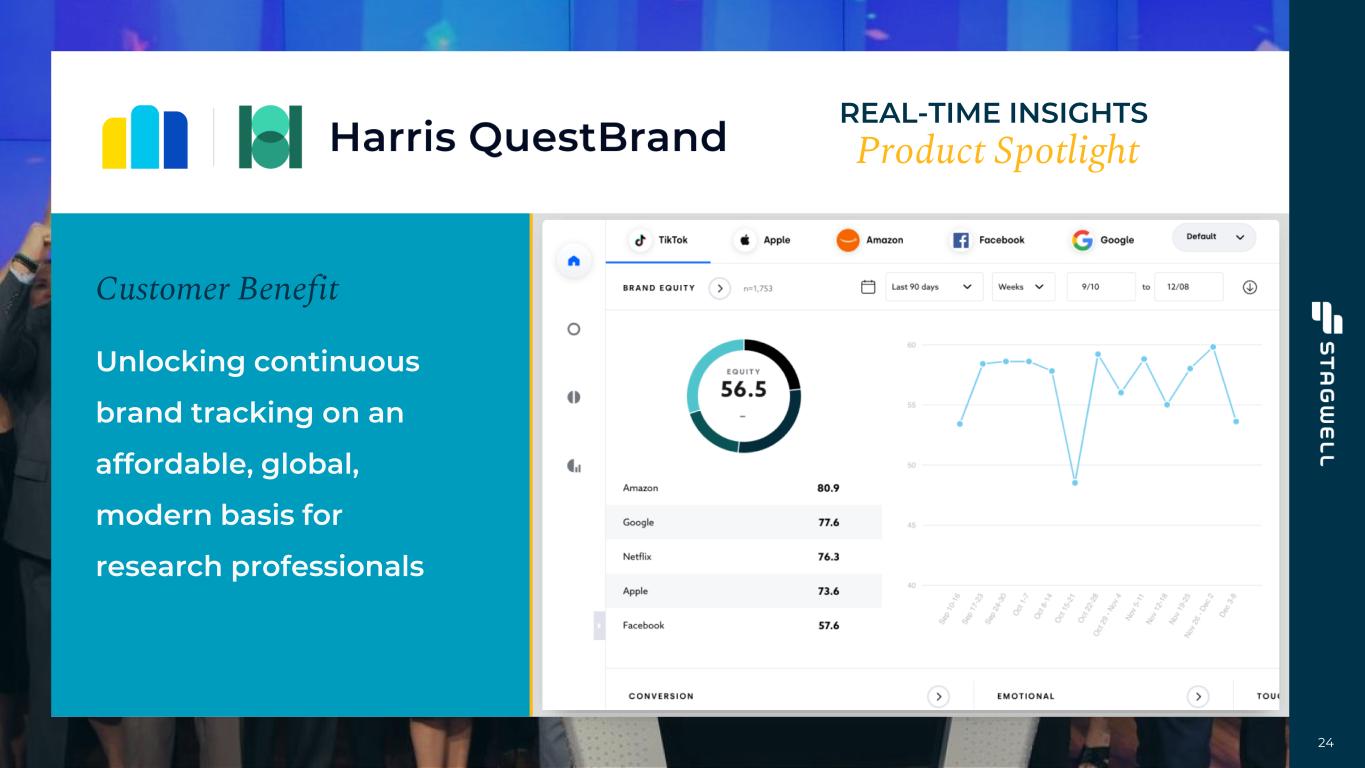

24 REAL-TIME INSIGHTS Product Spotlight Customer Benefit Unlocking continuous brand tracking on an affordable, global, modern basis for research professionals

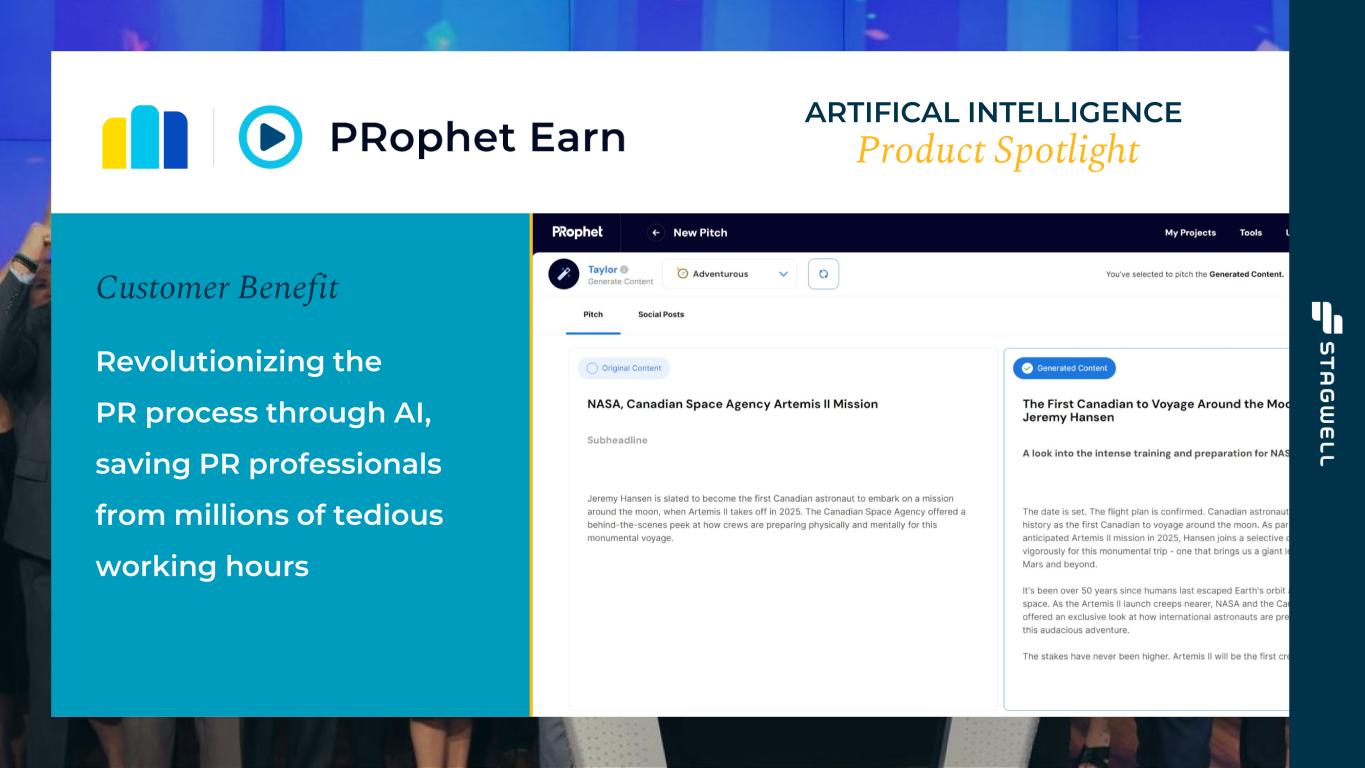

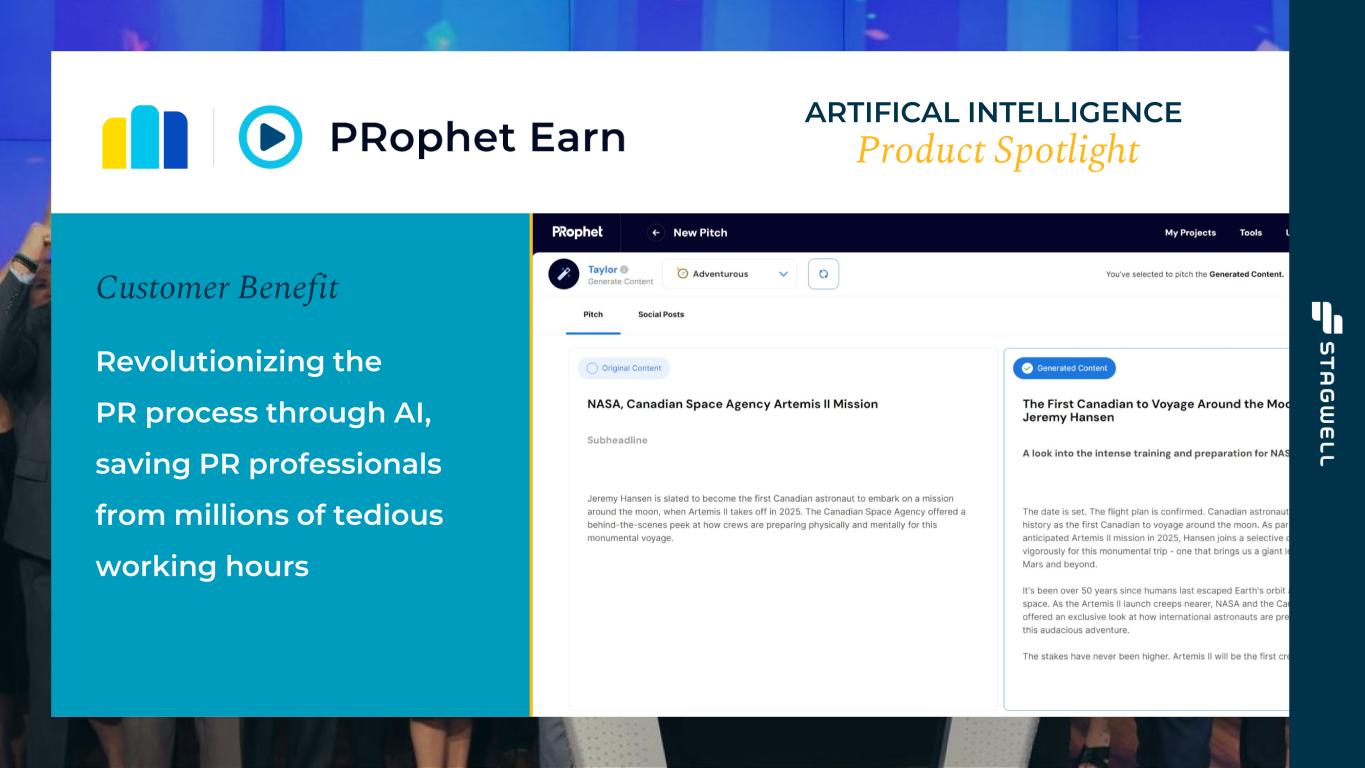

25 ARTIFICAL INTELLIGENCE Product Spotlight Customer Benefit Revolutionizing the PR process through AI, saving PR professionals from millions of tedious working hours

26 AUGMENTED REALITY Product Spotlight Customer Benefit Bringing a whole new level of stadium entertainment and fan engagement to sports and entertainment through shared AR

27 STAGWELL MARKETING CLOUD GROUP Pricing Model Modern, flexible pricing models that fit the needs and budgets for the modern marketer Subscription Pricing Annual SaaS contract Consumption Fee Data and media spend Advertising-Based Sponsorship fees

Thank You Contact Us: IR@StagwellGlobal.com