- STGW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Stagwell (STGW) CORRESPCorrespondence with SEC

Filed: 19 Apr 21, 12:00am

April 19, 2021

Mr. Donald Field

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Trade & Services

100 F. Street N.E.

Washington, D.C. 20549

| Re: | MDC Partners Inc. | |

| Amendment No. 1 to Registration Statement on Form S-4 | ||

| Filed March 29, 2021 | ||

| File No. 333-252829 |

Dear Mr. Field:

On behalf of MDC Partners Inc. (the “Company”), reference is made to the letter dated April 13, 2021 (the “Comment Letter”) from the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) regarding the Company’s Amendment No. 1 (“Amendment No. 1”) to Registration Statement on Form S-4 filed with the Commission on March 29, 2021 (the “Registration Statement”).

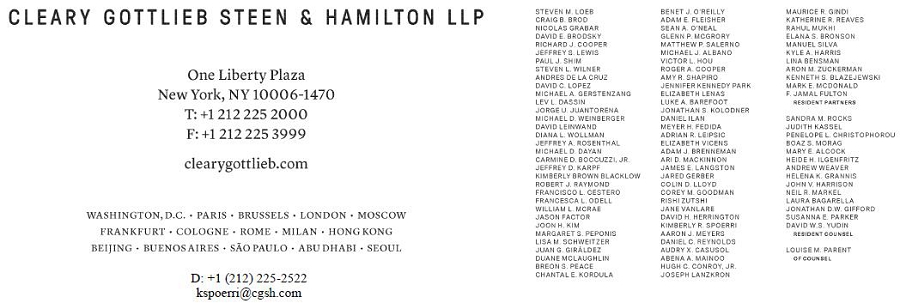

In response to our telephonic conversation with the Staff on April 16, 2021, and to preview with the Staff the Company’s proposed responses to comments #9 to #13 of the Comment Letter, please see enclosed the following: (i) attached as Annex A are the Company’s proposed revisions to “Material U.S. Federal Income Tax Considerations for MDC Canada Shareholders” and “Certain Canadian Federal Income Tax Considerations for MDC Canada Shareholders” to be made pursuant to a second amendment to the Registration Statement (“Amendment No. 2”), including a blackline showing the changes made compared to Amendment No. 1, (ii) attached as Annex B is the revised form of opinion of Cleary Gottlieb Steen & Hamilton LLP, which will be attached as Exhibit 8.2 to Amendment No. 2, and (iii) attached as Annex C is the revised form of opinion of Fasken Martineau DuMoulin LLP, which will be attached as Exhibit 8.1 to Amendment No. 2.

We thank you for your attention to this letter responding to the Comment Letter and look forward to hearing from you at your earliest convenience. If you have any questions or comments regarding the foregoing, please do not hesitate to contact me at (212) 225-2522 or by email at kspoerri@cgsh.com.

Sincerely,

| /s/ Kimberly R. Spoerri |

Kimberly R. Spoerri

| cc: | Mara Ransom, Securities and Exchange Commission |

| David Ross, MDC Partners Inc. | |

| Mark Penn, Stagwell Media LP | |

| Christopher Giordano, DLA Piper LLP |

Annex A

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR MDC CANADA SHAREHOLDERS

This discussion describes the material U.S. federal income tax consequences of various aspects of the Proposed Transactions that may be relevant to an MDC Canada Common Shareholder that holds its MDC Canada Common Shares as capital assets. This summary does not, however, purport to be a comprehensive description of all of the tax consequences of the Proposed Transactions, including tax considerations that are generally assumed to be known by taxpayers or that may be relevant to particular holders in light of their particular circumstances or to certain categories of taxpayers subject to special rules, such as banks, dealers, traders who elect to mark-to-market, tax-exempt entities, insurance companies, controlled foreign corporations or passive foreign investment companies, expatriates, shareholders who hold MDC Canada Shares as part of a hedge, straddle, conversion or integrated transaction, 10% U.S. Shareholders (as defined below) or U.S. Holders (as defined below) who have a “functional currency” other than the U.S. dollar. This discussion does not address any U.S. federal income tax consequences applicable to holders of the Company’s incentive awards or holders of the Company’s debt.

For purposes of this discussion, the term “U.S. Holder” means a beneficial owner of MDC Canada Common Shares that is, for U.S. federal income tax purposes, (i) an individual citizen or resident of the United States; (ii) a corporation created or organized in the United States or in any state thereof; (iii) an estate the income of which is subject to United States federal income tax regardless of its source; or (iv) a trust if (a) a court within the United States can exercise primary supervision over the administration of the trust or (b) it has a valid election in place to be treated as a United States person and one or more United States persons has authority to control all substantial decisions of the trust. A “Non-U.S. Holder” means a beneficial owner of MDC Canada Common Shares that is not a U.S. Holder.

If an MDC Canada Shareholder is a partnership or other entity treated as a partnership for U.S. federal income tax purposes (or a partner therein), the tax treatment of the partnership and each partner in such partnership generally will depend on the activities of the partnership and the status of the partner. Partnerships that hold MDC Canada Shares, and partners in such partnerships, should consult their own tax advisors.

The discussion below does not address special rules that may apply to a “10% U.S. Shareholder,” which is a U.S. person that owns directly, indirectly or constructively (under specified attribution rules), 10% or more of the total combined voting power or of the total value of all classes of the Company’s equity.

10% U.S. Shareholders should consult their own tax advisors regarding the U.S. federal and other applicable tax consequences of the Proposed Transactions to them in light of their particular circumstances.

This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), its legislative history, existing and proposed regulations promulgated thereunder, published rulings and court decisions, all as currently in effect. These laws are subject to change, possibly on a retroactive basis. This summary is not binding on the IRS or the courts. MDC Canada Shareholders should note that no rulings have been or are expected to be sought from the IRS with respect to any of these issues and no assurance can be given that the IRS will not take contrary positions to those described herein.

MDC Canada Shareholders should consult their own tax advisors with respect to the United States federal tax consequences of the Proposed Transactions and the tax consequences that may arise under the laws of any state, municipality, non-U.S. country or other taxing jurisdiction.

Reorganizations

In the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., the Redomiciliation should qualify as a “reorganization” (under section 368(a) of the Code), and accordingly the taxation of the Company’s U.S. shareholders is subject to the rules in section 367(b) of the Code and Treasury Regulations section 1.367(b)-3 as described below under “U.S. Tax Consequences of the Proposed Transaction to U.S. Holders.” Accordingly, the Redomiciliation should be treated, for U.S. federal income tax purposes, as if MDC Canada (i) transferred all of its assets and liabilities to a new U.S. corporation (MDC Delaware) in exchange for all of the outstanding stock of MDC Delaware and (ii) then distributed the stock of MDC Delaware that MDC Canada received in the transaction to the MDC Canada Shareholders in liquidation of MDC Canada.

1

In the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., the MDC Reorganization should qualify as a “reorganization” (under section 368(a) of the Code), but unlike the Redomiciliation, the rules in section 367(b) of the Code should not apply to the Company’s U.S. shareholders in connection with the MDC Reorganization. Accordingly, subject to the discussion below regarding the U.S. tax consequences of the Redomiciliation, U.S. Holders should not be required to recognize additional gain or loss for U.S. federal income tax purposes in connection with the MDC Reorganization.

We do not intend to request a ruling from the IRS regarding the U.S. federal income tax treatment of the Redomiciliation or the MDC Reorganization. Consequently, no assurance can be given that the IRS will not challenge the qualification of either the Redomiciliation or the MDC Reorganization as a reorganization under section 368(a) of the Code, or that a court would not sustain such challenge.

U.S. Tax Consequences of the Proposed Transactions to U.S. Holders

In accordance with the treatment of the Proposed Transactions as described above under “Reorganizations,” it is the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., that the Proposed Transactions should result in the U.S. federal income tax consequences for U.S. Holders described below in this section “U.S. Tax Consequences of the Proposed Transaction to U.S. Holders.”

U.S. Holders That Own MDC Canada Shares with a Fair Market Value of $50,000 or More

A U.S. Holder who, at the time of the Redomiciliation, beneficially owns MDC Canada Shares with a fair market value of $50,000 or more as of the Redomiciliation Effective Time, will, subject to the discussion below under “Passive Foreign Investment Company Status,” be subject to U.S. federal income tax on the amount of gain (but cannot recognize any loss) in such U.S. Holder’s MDC Canada Shares. For this purpose, a U.S. Holder’s gain equals the excess (if any) of the fair market value of its MDC Canada Shares over the U.S. Holder’s tax basis in such shares as of the date of the Redomiciliation. In lieu of such treatment, such a U.S. Holder could elect to include in income as a deemed dividend the “all earnings and profits amount” (as described below in this section and under “All Earnings and Profits Amount”). U.S. Holders should consult their own tax advisors to determine whether they have gain in their MDC Canada Shares.

A U.S. Holder’s basis in the MDC Delaware Shares it receives in the Redomiciliation should be equal to its basis in the MDC Canada Shares exchanged therefor, increased by any gain recognized by the U.S. Holder in connection with the Redomiciliation. A U.S. Holder’s holding period in the MDC Delaware Shares received pursuant to the Redomiciliation should include the U.S. Holder’s holding period in the MDC Canada Shares exchanged therefor.

Instead of being taxed in respect of any gain in its MDC Canada Shares, such a U.S. Holder may elect to include in its income as a deemed dividend the “all earnings and profits amount” attributable to such U.S. Holder’s MDC Canada Shares (as described under “All Earnings and Profits Amount,” below). If a U.S. Holder makes the “all earnings and profits” election, the election must comply with strict conditions for making this election under applicable Treasury Regulations and generally must include, among other things (i) a statement that the Redomiciliation is a section 367(b) exchange, (ii) a complete description of the Redomiciliation, (iii) a description of any stock, securities or other consideration transferred or received in the Redomiciliation, (iv) a statement describing the amounts required to be taken into account for U.S. federal income tax purposes, (v) a statement that the U.S. Holder is making the election that includes (A) a copy of the information that the U.S. Holder received from MDC Delaware (or the Combined Company) establishing and substantiating the U.S. Holder’s all earnings and profits amount with respect to the U.S. Holder’s MDC Canada Shares, and (B) a representation that the U.S. Holder has notified MDC Delaware (or the Combined Company) that the U.S. Holder is making the election, and (vi) certain other information required to be furnished with the U.S. Holder’s tax return or otherwise furnished pursuant to the Code or the Treasury Regulations thereunder. In addition, the election must be attached by the U.S. Holder to its timely filed U.S. federal income tax return for the year of the Redomiciliation, and the U.S. Holder must send notice to the Combined Company of the election no later than the date such tax return is filed. U.S. Holders seeking information from the Combined Company are encouraged to visit the “Investor Relations” portal on the Company’s website at mdc-partners.com. The Company, MDC Delaware and the Combined Company make no representation that they will be able to respond to any requests received after such date.

2

Such a U.S. Holder that elects to include the “all earnings and profits amount” will have an aggregate adjusted tax basis in the MDC Delaware Shares received in the Redomiciliation equal to the aggregate adjusted tax basis of the MDC Canada Shares surrendered in exchange therefor, increased by such U.S. Holder’s “all earnings and profits amount” included in its taxable income as a deemed dividend. Such U.S. Holder’s holding period in the MDC Delaware Shares received pursuant to the Redomiciliation should include the U.S. Holder’s holding period in the MDC Canada Shares exchanged therefor.

U.S. Holders who acquired different blocks of MDC Canada Shares at different times or different prices should consult their own tax advisors as to the determination of capital gains, the availability of the “all earnings and profits” election, and the tax bases and holding periods of the MDC Delaware Shares received in the Redomiciliation.

U.S. HOLDERS ARE STRONGLY URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE U.S. FEDERAL INCOME TAX TREATMENT OF THE PROPOSED TRANSACTIONS, AND IN PARTICULAR THE REDOMICILIATION, WHERE APPLICABLE, WHETHER TO MAKE THE “ALL EARNINGS AND PROFITS” ELECTION DESCRIBED ABOVE AND, IF THE ELECTION IS DETERMINED TO BE ADVISABLE, THE APPROPRIATE FILING REQUIREMENTS WITH RESPECT TO THIS ELECTION.

U.S. Holders That Own MDC Canada Shares with a Fair Market Value of Less than $50,000

Subject to the discussion below under “Passive Foreign Investment Company Status,” a U.S. Holder who, at the time of the Redomiciliation, beneficially owns MDC Canada Shares with a fair market value of less than $50,000, should not be required to recognize any gain or loss in connection with the Redomiciliation, and generally should not be required to include any part of the “all earnings and profits amount” (described under “All Earnings and Profits Amount” below) in income. Such U.S. Holder generally: will not recognize gain or loss with respect to its MDC Canada Shares exchanged for MDC Delaware Shares; will have an aggregate tax basis in the MDC Delaware Shares received pursuant to the Redomiciliation equal to such U.S. Holder’s aggregate tax basis in the MDC Canada Shares surrendered in exchange therefor; and will have a holding period for the MDC Delaware Shares received pursuant to the Redomiciliation that includes such Holder’s holding period for the MDC Canada Shares surrendered in exchange pursuant to the Redomiciliation.

All Earnings and Profits Amount

As described in greater detail above, in general, certain U.S. Holders may elect to include in income as a deemed dividend the “all earnings and profits amount” in lieu of recognizing gain in their MDC Canada Shares (see “U.S. Holders That Own MDC Canada Shares with a Fair Market Value of $50,000 or More” above). The “all earnings and profits amount” is generally equal to the net positive amount of earnings and profits, if any, accumulated by the Company during an MDC Canada Shareholder’s ownership period and that are attributable to such Shareholder’s MDC Canada Shares. The Company is currently in the process of determining its historical earnings and profits and also expects to determine its earnings and profits for the taxable year of the Redomiciliation ending with the Redomiciliation Effective Date. Although the Company will not complete this determination until after completion of the Redomiciliation, the Company currently expects to have a significant amount of earnings and profits for the taxable year of MDC Canada that ends on the Redomiciliation Effective Date. The calculation of “all earnings and profits” depends on the applicable MDC Canada Shareholder’s period of ownership and the outcome may differ based on the particular MDC Canada Shareholder. At this stage, there can be no assurances regarding the “all earnings and profits amount.”

3

U.S. Holders Exercising Dissent Rights

A U.S. Holder of MDC Canada Shares that validly exercises Dissent Rights and receives the fair value for such U.S. Holder’s MDC Canada Shares generally will recognize gain or loss in an amount equal to the difference, if any, between (i) the amount received by such U.S. Holder in exchange for its MDC Canada Shares (other than amounts, if any, that are or are deemed to be interest for U.S. federal income tax purposes, which amounts will be taxed as ordinary income), and (ii) the U.S. Holder’s adjusted tax basis in such MDC Canada Shares surrendered. Such gain or loss would be long-term capital gain or loss if the U.S. Holder’s holding period for such MDC Canada Shares was more than one year at the Redomiciliation Effective Date. Preferential tax rates for long-term capital gains are generally applicable to a U.S. Holder that is an individual, estate or trust. Deductions for capital losses are subject to significant limitations.

It is possible that the IRS may take the position that some portion of the amounts received by a U.S. Holder exercising Dissent Rights should be treated as interest or as otherwise being subject to taxation as ordinary income. U.S. Holders that intend to exercise Dissent Rights are urged to consult their own tax advisors regarding the U.S. federal income tax consequences to such holder of exercising such rights prior to exercising such rights and having due regard to such U.S. Holder’s particular circumstances.

Passive Foreign Investment Company Status

Special U.S. tax rules apply to U.S. shareholders of companies that are considered to be passive foreign investment companies (“PFICs”). Generally, a company will be classified as a PFIC in a particular taxable year if, taking into account its proportionate share of the income and assets of its subsidiaries under applicable “look-through” rules, either:

| • | 75 percent or more of its gross income for the taxable year is passive income; or |

| • | the average percentage of the value of its assets that produce or are held for the production of passive income is at least 50 percent. |

For this purpose, passive income generally includes dividends, interest, gains from certain commodities transactions, rents, royalties and the excess of gains over losses from the disposition of assets that produce passive income. If a foreign corporation is classified as a PFIC for any taxable year during which a U.S. shareholder owns stock in the foreign corporation, the foreign corporation generally remains thereafter classified as a PFIC with respect to that U.S. shareholder.

The Company believes that it has not been classified as a PFIC for any prior taxable year and, based on the present composition of its income and assets and the manner in which the Company conducts its business, that the Company will not be a PFIC in the portion of the 2021 taxable year that ends on the Redomiciliation Effective Date. However, this conclusion depends on complex factual determinations that are made annually and thus there can be no assurance in this regard. If the Company were a PFIC for any taxable year during which a U.S. Holder held MDC Canada Shares, certain adverse tax consequences, including recognition of gain and application of an interest charge, could apply to such U.S. Holder as a result of the Redomiciliation, unless an exception under the relevant U.S. Treasury Regulations can be relied upon.

The discussion above under “Material U.S. Federal Income Tax Considerations for MDC Canada Shareholders” assumes that the Company is not, and has never been, considered a PFIC. If this assumption is incorrect, the U.S. federal income tax consequences of the Redomiciliation may be materially different from those described above. Holders are encouraged to consult their own tax advisors regarding the Company’s status as a PFIC and the tax consequences to them of such status in light of their particular circumstances.

U.S. Tax Consequences of the Proposed Transactions to Non-U.S. Holders

In accordance with the treatment of the Proposed Transactions as described above under “Reorganizations,” it is the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., that the Proposed Transactions should result in the U.S. federal income tax consequences to Non-U.S. Holders described in the remainder of this section. A Non-U.S. Holder generally should not be subject to U.S. federal income tax in respect of the Proposed Transactions, provided that (a) the gain (if any) in its MDC Canada Shares is not effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States and (b) if the Non-U.S. Holder is an individual, such Non-U.S. Holder is present in the United States for less than 183 days in the taxable year of the sale and certain other conditions are met. Non-U.S. Holders are urged to consult their own tax advisors regarding the U.S. federal income tax consequences that may apply to them as a result of the Proposed Transactions.

4

U.S. Tax Considerations Relevant to the Ownership and Disposition of Combined Company Shares After the Proposed Transactions

Tax Consequences to U.S. Holders

Dividends

A distribution of cash or property to a U.S. Holder with respect to its Combined Company Shares generally will be treated as a dividend to the extent paid out of the Combined Company’s current or accumulated earnings and profits and will be includible in income by the U.S. Holder and taxable as ordinary income when received. If such a distribution exceeds the Combined Company’s current and accumulated earnings and profits, the excess will be first treated as a tax-free return of the U.S. Holder’s investment, up to the U.S. Holder’s tax basis in its Combined Company Shares, and thereafter as a capital gain. Dividends received by a non-corporate U.S. Holder will be eligible to be taxed at reduced rates if the U.S. Holder meets certain holding period and other applicable requirements. Dividends received by a corporate U.S. Holder will be eligible for the dividends-received deduction if the U.S. Holder meets certain holding period and other applicable requirements.

Sale, Exchange or Other Taxable Disposition of Combined Company Shares

For U.S. federal income tax purposes, gain or loss a U.S. Holder realizes on the sale or other disposition of its Combined Company Shares will be capital gain or loss, and will be long-term capital gain or loss if the U.S. Holder’s holding period (as described under “U.S. Tax Consequences of the Redomiciliation to U.S. Holders” above) in the Combined Company Shares is greater than one year. The amount of the U.S. Holder’s gain or loss will be equal to the difference between the amount realized on the disposition and the U.S. Holder’s tax basis in the Combined Company Shares (as described under “U.S. Tax Consequences of the Redomiciliation to U.S. Holders” above) that were sold. Long-term capital gains recognized by non-corporate U.S. Holders will be subject to tax at reduced rates. The deductibility of capital losses may be subject to limitations.

Tax Consequences to Non-U.S. Holders

Dividends

A distribution of cash or property to a Non-U.S. Holder with respect to its Combined Company Shares generally will be treated as a dividend to the extent paid out of the Combined Company’s current or accumulated earnings and profits. If such a distribution exceeds the Combined Company’s current and accumulated earnings and profits, the excess will be first treated as a tax-free return of the Non-U.S. Holder’s investment, up to the Non-U.S. Holder’s tax basis in the Combined Company Shares, and thereafter as a capital gain subject to the tax treatment described below in “—Sale, Exchange or Other Taxable Disposition of Combined Company Shares.”

Dividends paid to a Non-U.S. Holder generally will be subject to withholding of U.S. federal income tax at a 30 percent rate, or such lower rate as may be specified by an applicable tax treaty. Even if a Non-U.S. Holder is eligible for a lower treaty rate, a withholding agent generally will be required to withhold at a 30 percent rate (rather than the lower treaty rate) unless the Non-U.S. Holder has furnished a valid IRS Form W-8BEN or W-8BEN-E, or other documentary evidence establishing the Non-U.S. Holder’s entitlement to the lower treaty rate with respect to such dividend payments, and the withholding agent does not have actual knowledge or reason to know to the contrary.

However, if the dividends are effectively connected with the conduct by a Non-U.S. Holder of a trade or business within the United States, then the dividends will be exempt from the withholding tax described above and instead will be subject to U.S. federal income tax on a net income basis.

5

However, if the dividends are effectively connected with the conduct by a Non-U.S. Holder of a trade or business within the United States, then the dividends will be exempt from the withholding tax described above and instead will be subject to U.S. federal income tax on a net income basis.

In addition, under the U.S. tax rules known as the Foreign Account Tax Compliance Act (“FATCA”), a Non-U.S. Holder of Combined Company Shares will generally be subject to a 30 percent U.S. withholding tax on dividends in respect of such Combined Company Shares if the Non-U.S. Holder is not FATCA compliant, or holds its Combined Company Shares through a foreign financial institution that is not FATCA compliant. In order to be treated as FATCA compliant, a Non-U.S. Holder must provide certain documentation (usually an IRS Form W-8BEN or W-8BEN-E) containing information about its identity, its FATCA status, and if required, its direct and indirect U.S. owners. These requirements may be modified by the adoption or implementation of a particular intergovernmental agreement between the United States and another country or by future U.S. Treasury Regulations. Documentation that Non-U.S. Holders provide in order to be treated as FATCA compliant may be reported to the IRS and other tax authorities, including information about a Non-U.S. Holder’s identity, its FATCA status, and if applicable, its direct and indirect U.S. owners.

Sale, Exchange or Other Taxable Disposition of Combined Company Shares.

Non-U.S. Holders generally will not be subject to U.S. federal income tax with respect to gain recognized on a sale, exchange or other taxable disposition of Combined Company Shares, provided that (a) the gain is not effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States and (b) if the Non-U.S. Holder is an individual, such Holder is present in the United States for less than 183 days in the taxable year of the sale and other conditions are met.

Information Reporting and Backup Withholding

Information returns are required to be filed with the IRS with respect to payments made to certain U.S. Holders. In addition, certain U.S. Holders may be subject to backup withholding tax in respect of such payments if they do not provide their taxpayer identification numbers to the paying agent, fail to certify that they are not subject to backup withholding tax, or otherwise fail to comply with applicable backup withholding tax rules. Non-U.S. Holders may be required to comply with applicable certification procedures to establish that they are Non-U.S. Holders in order to avoid the application of such information reporting requirements and backup withholding tax. Any amount paid as backup withholding may be creditable against the holder’s U.S. federal income tax liability, provided that the required information is timely furnished to the IRS.

U.S. AND NON-U.S. HOLDERS ARE STRONGLY URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX CONSEQUENCES OF THE PROPOSED TRANSACTIONS TO THEM IN THEIR PARTICULAR CIRCUMSTANCES.

6

MATERIAL CANADIAN FEDERAL INCOME TAX CONSIDERATIONS FOR MDC CANADA SHAREHOLDERS

In the opinion of Fasken Martineau DuMoulin LLP, the following summary describes, as of the date hereof, the material Canadian federal income tax considerations of the Proposed Transactions generally applicable to an MDC Canada Common Shareholder who, immediately prior to the Redomiciliation Effective Date, owns MDC Canada Common Shares. This summary is generally applicable to a beneficial owner of MDC Canada Common Shares who, for purposes of the Canadian Tax Act and at all relevant times, holds the MDC Canada Common Shares, and after the Proposed Transactions will hold Combined Company Shares, as capital property, deals at arm’s length with the Company and the Combined Company and is not affiliated with the Company or the Combined Company (a “Holder”). Generally, MDC Canada Common Shares and Combined Company Shares will be considered capital property to a Holder provided the Holder does not hold such shares in the course of carrying on a business of trading or dealing in securities and has not acquired them in one or more transactions considered to be an adventure or concern in the nature of trade.

This summary is based on the facts set out in this Proxy Statement/Prospectus, the current provisions of the Canadian Tax Act in force as of the date hereof and the current administrative policies and assessing practices of the Canada Revenue Agency (“CRA”) published in writing and publicly available prior to the date hereof. This summary takes into account all specific proposals to amend the Canadian Tax Act that have been publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Proposed Amendments”) and assumes that the Proposed Amendments will be enacted in the form proposed. No assurance can be given that the Proposed Amendments will be enacted in the form proposed, or at all. Except for the Proposed Amendments, this summary does not take into account or anticipate any changes in law, whether by judicial, governmental or legislative decision or action or changes in the administrative policies or assessing practices of the CRA, nor does it take into account other federal or any provincial, territorial or foreign tax legislation or considerations, which may differ materially from those described in this summary.

This summary is based on the Company ceasing to be resident in Canada for purposes of the Canadian Tax Act at the Redomiciliation Effective Time, and assumes that from the time of the Redomiciliation and at all relevant times thereafter, the Company and the Combined Company will not be resident in Canada for purposes of the Canadian Tax Act, will be resident in the United States for purposes of the Canada-U.S. Tax Convention (the “Treaty”) and will be entitled to all of the benefits of the Treaty.

This summary is not applicable to a Holder: (i) that is a “financial institution” for purposes of certain rules in the Canadian Tax Act (referred to as the mark-to-market rules); (ii) an interest in which is a “tax shelter investment”; (iii) that is a “specified financial institution”; (iv) that reports its “Canadian tax results” in a currency other than the Canadian currency; (v) that is a partnership for Canadian federal income tax purposes or is exempt from tax under Part I of the Canadian Tax Act; (vi) that has entered, or will enter, into a “derivative forward agreement” with respect to their MDC Canada Common Shares or Combined Company Shares; (vii) who acquired MDC Canada Common Shares under or in connection with an MDC Canada Incentive Plan or any other equity based compensation arrangement; or (viii) in respect of which the Company or the Combined Company will be a “foreign affiliate” at any time after the Redomiciliation (all such terms as defined in the Canadian Tax Act). Additional considerations not discussed herein may be applicable to a Holder that is a corporation resident in Canada and is, or becomes, controlled by a non- resident person or group of persons not dealing at arm’s length for purposes of the “foreign affiliate dumping” rules in section 212.3 of the Canadian Tax Act. Such Holders should consult with and rely on their own tax advisors.

This summary does not discuss the Canadian income tax consequences of the Proposed Transactions to holders of stock options, stock appreciation rights, performance share units, restricted share units, deferred share units, restricted stock or other share-based awards granted by the Company or the Combined Company. Any such holders should consult with and rely on their own tax advisors.

7

This summary does not purport to be a comprehensive description of all of the Canadian federal income tax consequences of the Proposed Transactions, including tax considerations that are generally assumed to be known by taxpayers or that may be relevant to particular holders in light of their particular circumstances. Accordingly, Holders are urged to consult their own legal and tax advisors with respect to the tax consequences to them of the Proposed Transactions, having regard to their particular circumstances.

8

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR MDC CANADA SHAREHOLDERS

This discussion describes the material U.S. federal income tax consequences of various aspects of the Proposed Transactions that may be relevant to an MDC Canada Common Shareholder that holds its MDC Canada Common Shares as capital assets. This summary does not, however, purport to be a comprehensive description of all of the tax consequences of the Proposed Transactions, including tax considerations that are generally assumed to be known by taxpayers or that may be relevant to particular holders in light of their particular circumstances or to certain categories of taxpayers subject to special rules, such as banks, dealers, traders who elect to mark-to-market, tax-exempt entities, insurance companies, controlled foreign corporations or passive foreign investment companies, expatriates, shareholders who hold MDC Canada Shares as part of a hedge, straddle, conversion or integrated transaction, 10% U.S. Shareholders (as defined below) or U.S. Holders (as defined below) who have a “functional currency” other than the U.S. dollar. This discussion does not address any U.S. federal income tax consequences applicable to holders of the Company’s incentive awards or holders of the Company’s debt.

For purposes of this discussion, the term “U.S. Holder” means a beneficial owner of MDC Canada Common Shares that is, for U.S. federal income tax purposes, (i) an individual citizen or resident of the United States; (ii) a corporation created or organized in the United States or in any state thereof; (iii) an estate the income of which is subject to United States federal income tax regardless of its source; or (iv) a trust if (a) a court within the United States can exercise primary supervision over the administration of the trust or (b) it has a valid election in place to be treated as a United States person and one or more United States persons has authority to control all substantial decisions of the trust. A “Non-U.S. Holder” means a beneficial owner of MDC Canada Common Shares that is not a U.S. Holder.

If an MDC Canada Shareholder is a partnership or other entity treated as a partnership for U.S. federal income tax purposes (or a partner therein), the tax treatment of the partnership and each partner in such partnership generally will depend on the activities of the partnership and the status of the partner. Partnerships that hold MDC Canada Shares, and partners in such partnerships, should consult their own tax advisors.

The discussion below does not address special rules that may apply to a “10% U.S. Shareholder,” which is a U.S. person that owns directly, indirectly or constructively (under specified attribution rules), 10% or more of the total combined voting power or of the total value of all classes of the Company’s equity.

10% U.S. Shareholders should consult their own tax advisors regarding the U.S. federal and other applicable tax consequences of the Proposed Transactions to them in light of their particular circumstances.

This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), its legislative history, existing and proposed regulations promulgated thereunder, published rulings and court decisions, all as currently in effect. These laws are subject to change, possibly on a retroactive basis. This summary is not binding on the IRS or the courts. MDC Canada Shareholders should note that no rulings have been or are expected to be sought from the IRS with respect to any of these issues and no assurance can be given that the IRS will not take contrary positions to those described herein.

MDC Canada Shareholders should consult their own tax advisors with respect to the United States federal tax consequences of the Proposed Transactions and the tax consequences that may arise under the laws of any state, municipality, non-U.S. country or other taxing jurisdiction.

Reorganizations

TheIn the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., the Redomiciliation should qualify as a tax-free“reorganization” (under section 368(a) of the Code), and accordingly the taxation of the Company’s U.S. shareholders is subject to the rules in section 367(b) of the Code and Treasury Regulations section 1.367(b)-3.as described below under “U.S. Tax Consequences of the Proposed Transaction to U.S. Holders.” Accordingly, the Redomiciliation should be treated, for U.S. federal income tax purposes, as if MDC Canada (i) transferred all of its assets and liabilities to a new U.S. corporation (MDC Delaware) in exchange for all of the outstanding stock of MDC Delaware and (ii) then distributed the stock of MDC Delaware that MDC Canada received in the transaction to the MDC Canada Shareholders in liquidation of MDC Canada.

The In the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., the MDC Reorganization should qualify as a tax-free“reorganization” (under section 368(a) of the Code), but unlike the Redomiciliation, the rules in section 367(b) of the Code should not apply to the Company’s U.S. shareholders in connection with the MDC Reorganization. Accordingly, subject to the discussion below regarding the U.S. tax consequences of the Redomiciliation, U.S. Holders should not be required to recognize additional gain or loss for U.S. federal income tax purposes in connection with the MDC Reorganization.

We do not intend to request a ruling from the IRS regarding the U.S. federal income tax treatment of the Redomiciliation or the MDC Reorganization. Consequently, no assurance can be given that the IRS will not challenge the qualification of either the Redomiciliation or the MDC Reorganization as a reorganization under section 368(a) of the Code, or that a court would not sustain such challenge.

U.S. Tax Consequences of the Proposed Transactions to U.S. Holders

The Proposed Transactions may trigger U.S. federal income tax for certain U.S. Holders.

In accordance with the treatment of the Proposed Transactions as described above under “Reorganizations,” it is the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., that the Proposed Transactions should result in the U.S. federal income tax consequences for U.S. Holders described below in this section “U.S. Tax Consequences of the Proposed Transaction to U.S. Holders.”

U.S. Holders That Own MDC Canada Shares with a Fair Market Value of $50,000 or More

A U.S. Holder who, at the time of the Redomiciliation, beneficially owns MDC Canada Shares with a fair market value of $50,000 or more as of the Redomiciliation Effective Time, will, subject to the discussion below under “Passive Foreign Investment Company Status,” be subject to U.S. federal income tax on the amount of gain (but cannot recognize any loss) in such U.S. Holder’s MDC Canada Shares. For this purpose, a U.S. Holder’s gain equals the excess (if any) of the fair market value of its MDC Canada Shares over the U.S. Holder’s tax basis in such shares as of the date of the Redomiciliation. In lieu of such treatment, such a U.S. Holder could elect to include in income as a deemed dividend the “all earnings and profits amount” (as described below in this section and under “All Earnings and Profits Amount”). U.S. Holders should consult their own tax advisors to determine whether they have gain in their MDC Canada Shares.

A U.S. Holder’s basis in the MDC Delaware Shares it receives in the Redomiciliation should be equal to its basis in the MDC Canada Shares exchanged therefor, increased by any gain recognized by the U.S. Holder in connection with the Redomiciliation. A U.S. Holder’s holding period in the MDC Delaware Shares received pursuant to the Redomiciliation should include the U.S. Holder’s holding period in the MDC Canada Shares exchanged therefor.

Instead of being taxed in respect of any gain in its MDC Canada Shares, such a U.S. Holder may elect to include in its income as a deemed dividend the “all earnings and profits amount” attributable to such U.S. Holder’s MDC Canada Shares (as described under “All Earnings and Profits Amount,” below). If a U.S. Holder makes the “all earnings and profits” election, the election must comply with strict conditions for making this election under applicable Treasury Regulations and generally must include, among other things (i) a statement that the Redomiciliation is a section 367(b) exchange, (ii) a complete description of the Redomiciliation, (iii) a description of any stock, securities or other consideration transferred or received in the Redomiciliation, (iv) a statement describing the amounts required to be taken into account for U.S. federal income tax purposes, (v) a statement that the U.S. Holder is making the election that includes (A) a copy of the information that the U.S. Holder received from MDC Delaware (or the Combined Company) establishing and substantiating the U.S. Holder’s all earnings and profits amount with respect to the U.S. Holder’s MDC Canada Shares, and (B) a representation that the U.S. Holder has notified MDC Delaware (or the Combined Company) that the U.S. Holder is making the election, and (vi) certain other information required to be furnished with the U.S. Holder’s tax return or otherwise furnished pursuant to the Code or the Treasury Regulations thereunder. In addition, the election must be attached by the U.S. Holder to its timely filed U.S. federal income tax return for the year of the Redomiciliation, and the U.S. Holder must send notice to the Combined Company of the election no later than the date such tax return is filed. U.S. Holders seeking information from the Combined Company are encouraged to visit the “Investor Relations” portal on the Company’s website at mdc-partners.com. The Company, MDC Delaware and the Combined Company make no representation that they will be able to respond to any requests received after such date.

2

Such a U.S. Holder that elects to include the “all earnings and profits amount” will have an aggregate adjusted tax basis in the MDC Delaware Shares received in the Redomiciliation equal to the aggregate adjusted tax basis of the MDC Canada Shares surrendered in exchange therefor, increased by such U.S. Holder’s “all earnings and profits amount” included in its taxable income as a deemed dividend. Such U.S. Holder’s holding period in the MDC Delaware Shares received pursuant to the Redomiciliation should include the U.S. Holder’s holding period in the MDC Canada Shares exchanged therefor.

U.S. Holders who acquired different blocks of MDC Canada Shares at different times or different prices should consult their own tax advisors as to the determination of capital gains, the availability of the “all earnings and profits” election, and the tax bases and holding periods of the MDC Delaware Shares received in the Redomiciliation.

U.S. HOLDERS ARE STRONGLY URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE U.S. FEDERAL INCOME TAX TREATMENT OF THE PROPOSED TRANSACTIONS, AND IN PARTICULAR THE REDOMICILIATION, WHERE APPLICABLE, WHETHER TO MAKE THE “ALL EARNINGS AND PROFITS” ELECTION DESCRIBED ABOVE AND, IF THE ELECTION IS DETERMINED TO BE ADVISABLE, THE APPROPRIATE FILING REQUIREMENTS WITH RESPECT TO THIS ELECTION.

U.S. Holders That Own MDC Canada Shares with a Fair Market Value of Less than $50,000

Subject to the discussion below under “Passive Foreign Investment Company Status,” a U.S. Holder who, at the time of the Redomiciliation, beneficially owns MDC Canada Shares with a fair market value of less than $50,000, should not be required to recognize any gain or loss in connection with the Redomiciliation, and generally should not be required to include any part of the “all earnings and profits amount” (described under “—All Earnings and Profits Amount” below) in income. Such U.S. Holder generally: will not recognize gain or loss with respect to its MDC Canada Shares exchanged for MDC Delaware Shares; will have an aggregate tax basis in the MDC Delaware Shares received pursuant to the Redomiciliation equal to such U.S. Holder’s aggregate tax basis in the MDC Canada Shares surrendered in exchange therefor; and will have a holding period for the MDC Delaware Shares received pursuant to the Redomiciliation that includes such Holder’s holding period for the MDC Canada Shares surrendered in exchange pursuant to the Redomiciliation.

All Earnings and Profits Amount

As described in greater detail above, in general, certain U.S. Holders may elect to include in income as a deemed dividend the “all earnings and profits amount” in lieu of recognizing gain in their MDC Canada Shares (see “U.S. Holders That Own MDC Canada Shares with a Fair Market Value of $50,000 or More” above). The “all earnings and profits amount” is generally equal to the net positive amount of earnings and profits, if any, accumulated by the Company during an MDC Canada Shareholder’s ownership period and that are attributable to such Shareholder’s MDC Canada Shares. The Company is currently in the process of determining its historical earnings and profits and also expects to determine its earnings and profits for the taxable year of the Redomiciliation ending with the Redomiciliation Effective Date. Although the Company will not complete this determination until after completion of the Redomiciliation, the Company currently expects to have a significant amount of earnings and profits for the taxable year of MDC Canada that ends on the Redomiciliation Effective Date. The calculation of “all earnings and profits” depends on the applicable MDC Canada Shareholder’s period of ownership and the outcome may differ based on the particular MDC Canada Shareholder. At this stage, there can be no assurances regarding the “all earnings and profits amount.”

U.S. Holders Exercising Dissent Rights

A U.S. Holder of MDC Canada Shares that validly exercises Dissent Rights and receives the fair value for such U.S. Holder’s MDC Canada Shares generally will recognize gain or loss in an amount equal to the difference, if any, between (i) the amount received by such U.S. Holder in exchange for its MDC Canada Shares (other than amounts, if any, that are or are deemed to be interest for U.S. federal income tax purposes, which amounts will be taxed as ordinary income), and (ii) the U.S. Holder’s adjusted tax basis in such MDC Canada Shares surrendered. Such gain or loss would be long-term capital gain or loss if the U.S. Holder’s holding period for such MDC Canada Shares was more than one year at the Redomiciliation Effective Date. Preferential tax rates for long-term capital gains are generally applicable to a U.S. Holder that is an individual, estate or trust. Deductions for capital losses are subject to significant limitations.

3

It is possible that the IRS may take the position that some portion of the amounts received by a U.S. Holder exercising Dissent Rights should be treated as interest or as otherwise being subject to taxation as ordinary income. U.S. Holders that intend to exercise Dissent Rights are urged to consult their own tax advisors regarding the U.S. federal income tax consequences to such holder of exercising such rights prior to exercising such rights and having due regard to such U.S. Holder’s particular circumstances.

Passive Foreign Investment Company Status

Special U.S. tax rules apply to U.S. shareholders of companies that are considered to be passive foreign investment companies (“PFICs”). Generally, a company will be classified as a PFIC in a particular taxable year if, taking into account its proportionate share of the income and assets of its subsidiaries under applicable “look-through” rules, either:

| • | 75 percent or more of its gross income for the taxable year is passive income; or |

| • | the average percentage of the value of its assets that produce or are held for the production of passive income is at least 50 percent. |

For this purpose, passive income generally includes dividends, interest, gains from certain commodities transactions, rents, royalties and the excess of gains over losses from the disposition of assets that produce passive income. If a foreign corporation is classified as a PFIC for any taxable year during which a U.S. shareholder owns stock in the foreign corporation, the foreign corporation generally remains thereafter classified as a PFIC with respect to that U.S. shareholder.

The Company believes that it has not been classified as a PFIC for any prior taxable year and, based on the present composition of its income and assets and the manner in which the Company conducts its business, that the Company will not be a PFIC in the portion of the 2021 taxable year that ends on the Redomiciliation Effective Date. However, this conclusion depends on complex factual determinations that are made annually and thus there can be no assurance in this regard. If the Company were a PFIC for any taxable year during which a U.S. Holder held MDC Canada Shares, certain adverse tax consequences, including recognition of gain and application of an interest charge, could apply to such U.S. Holder as a result of the Redomiciliation, unless an exception under the relevant U.S. Treasury Regulations can be relied upon.

The discussion above under “Material U.S. Federal Income Tax Considerations for MDC Canada Shareholders” assumes that the Company is not, and has never been, considered a PFIC. If this assumption is incorrect, the U.S. federal income tax consequences of the Redomiciliation may be materially different from those described above. Holders are encouraged to consult their own tax advisors regarding the Company’s status as a PFIC and the tax consequences to them of such status in light of their particular circumstances.

U.S. Tax Consequences of the Proposed Transactions to Non-U.S. Holders

In accordance with the treatment of the Proposed Transactions as described above under “Reorganizations,” it is the opinion of Cleary Gottlieb Steen & Hamilton LLP, counsel to MDC Partners, Inc., that the Proposed Transactions should result in the U.S. federal income tax consequences to Non-U.S. Holders described in the remainder of this section. A Non-U.S. Holder generally should not be subject to U.S. federal income tax in respect of the Proposed Transactions, provided that (a) the gain (if any) in its MDC Canada Shares is not effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States and (b) if the Non-U.S. Holder is an individual, such Non-U.S. Holder is present in the United States for less than 183 days in the taxable year of the sale and certain other conditions are met. Non-U.S. Holders are urged to consult their own tax advisors regarding the U.S. federal income tax consequences that may apply to them as a result of the Proposed Transactions.

4

U.S. Tax Considerations Relevant to the Ownership and Disposition of Combined Company Shares After the Proposed Transactions

Tax Consequences to U.S. Holders

Dividends

A distribution of cash or property to a U.S. Holder with respect to its Combined Company Shares generally will be treated as a dividend to the extent paid out of the Combined Company’s current or accumulated earnings and profits and will be includible in income by the U.S. Holder and taxable as ordinary income when received. If such a distribution exceeds the Combined Company’s current and accumulated earnings and profits, the excess will be first treated as a tax-free return of the U.S. Holder’s investment, up to the U.S. Holder’s tax basis in its Combined Company Shares, and thereafter as a capital gain. Dividends received by a non-corporate U.S. Holder will be eligible to be taxed at reduced rates if the U.S. Holder meets certain holding period and other applicable requirements. Dividends received by a corporate U.S. Holder will be eligible for the dividends-received deduction if the U.S. Holder meets certain holding period and other applicable requirements.

Sale, Exchange or Other Taxable Disposition of Combined Company Shares

For U.S. federal income tax purposes, gain or loss a U.S. Holder realizes on the sale or other disposition of its Combined Company Shares will be capital gain or loss, and will be long-term capital gain or loss if the U.S. Holder’s holding period (as described under “U.S. Tax Consequences of the Redomiciliation to U.S. Holders” above) in the Combined Company Shares is greater than one year. The amount of the U.S. Holder’s gain or loss will be equal to the difference between the amount realized on the disposition and the U.S. Holder’s tax basis in the Combined Company Shares (as described under “U.S. Tax Consequences of the Redomiciliation to U.S. Holders” above) that were sold. Long-term capital gains recognized by non-corporate U.S. Holders will be subject to tax at reduced rates. The deductibility of capital losses may be subject to limitations.

Tax Consequences to Non-U.S. Holders

Dividends

A distribution of cash or property to a Non-U.S. Holder with respect to its Combined Company Shares generally will be treated as a dividend to the extent paid out of the Combined Company’s current or accumulated earnings and profits. If such a distribution exceeds the Combined Company’s current and accumulated earnings and profits, the excess will be first treated as a tax-free return of the Non-U.S. Holder’s investment, up to the Non-U.S. Holder’s tax basis in the Combined Company Shares, and thereafter as a capital gain subject to the tax treatment described below in “—Sale, Exchange or Other Taxable Disposition of Combined Company Shares.”

Dividends paid to a Non-U.S. Holder generally will be subject to withholding of U.S. federal income tax at a 30 percent rate, or such lower rate as may be specified by an applicable tax treaty. Even if a Non-U.S. Holder is eligible for a lower treaty rate, a withholding agent generally will be required to withhold at a 30 percent rate (rather than the lower treaty rate) unless the Non-U.S. Holder has furnished a valid IRS Form W-8BEN or W-8BEN-E, or other documentary evidence establishing the Non-U.S. Holder’s entitlement to the lower treaty rate with respect to such dividend payments, and the withholding agent does not have actual knowledge or reason to know to the contrary.

However, if the dividends are effectively connected with the conduct by a Non-U.S. Holder of a trade or business within the United States, then the dividends will be exempt from the withholding tax described above and instead will be subject to U.S. federal income tax on a net income basis.

5

However, if the dividends are effectively connected with the conduct by a Non-U.S. Holder of a trade or business within the United States, then the dividends will be exempt from the withholding tax described above and instead will be subject to U.S. federal income tax on a net income basis.

In addition, under the U.S. tax rules known as the Foreign Account Tax Compliance Act (“FATCA”), a Non-U.S. Holder of Combined Company Shares will generally be subject to a 30 percent U.S. withholding tax on dividends in respect of such Combined Company Shares if the Non-U.S. Holder is not FATCA compliant, or holds its Combined Company Shares through a foreign financial institution that is not FATCA compliant. In order to be treated as FATCA compliant, a Non-U.S. Holder must provide certain documentation (usually an IRS Form W-8BEN or W-8BEN-E) containing information about its identity, its FATCA status, and if required, its direct and indirect U.S. owners. These requirements may be modified by the adoption or implementation of a particular intergovernmental agreement between the United States and another country or by future U.S. Treasury Regulations. Documentation that Non-U.S. Holders provide in order to be treated as FATCA compliant may be reported to the IRS and other tax authorities, including information about a Non-U.S. Holder’s identity, its FATCA status, and if applicable, its direct and indirect U.S. owners.

Sale, Exchange or Other Taxable Disposition of Combined Company Shares.

Non-U.S. Holders generally will not be subject to U.S. federal income tax with respect to gain recognized on a sale, exchange or other taxable disposition of Combined Company Shares, provided that (a) the gain is not effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States and (b) if the Non-U.S. Holder is an individual, such Holder is present in the United States for less than 183 days in the taxable year of the sale and other conditions are met.

Information Reporting and Backup Withholding

Information returns are required to be filed with the IRS with respect to payments made to certain U.S. Holders. In addition, certain U.S. Holders may be subject to backup withholding tax in respect of such payments if they do not provide their taxpayer identification numbers to the paying agent, fail to certify that they are not subject to backup withholding tax, or otherwise fail to comply with applicable backup withholding tax rules. Non-U.S. Holders may be required to comply with applicable certification procedures to establish that they are Non-U.S. Holders in order to avoid the application of such information reporting requirements and backup withholding tax. Any amount paid as backup withholding may be creditable against the holder’s U.S. federal income tax liability, provided that the required information is timely furnished to the IRS.

U.S. AND NON-U.S. HOLDERS ARE STRONGLY URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX CONSEQUENCES OF THE PROPOSED TRANSACTIONS TO THEM IN THEIR PARTICULAR CIRCUMSTANCES.

6

CERTAINMATERIAL CANADIAN FEDERAL INCOME TAX CONSIDERATIONS FOR MDC CANADA SHAREHOLDERS

TheIn the opinion of Fasken Martineau DuMoulin LLP, the following summary describes, as of the date hereof, the principalmaterial Canadian federal income tax considerations of the Proposed Transactions generally applicable to an MDC Canada Common Shareholder who, immediately prior to the Redomiciliation Effective Date, owns MDC Canada Common Shares. This summary is generally applicable to a beneficial owner of MDC Canada Common Shares who, for purposes of the Canadian Tax Act and at all relevant times, holds the MDC Canada Common Shares, and after the Proposed Transactions will hold Combined Company Shares, as capital property, deals at arm’s length with the Company and the Combined Company and is not affiliated with the Company or the Combined Company (a “Holder”). Generally, MDC Canada Common Shares and Combined Company Shares will be considered capital property to a Holder provided the Holder does not hold such shares in the course of carrying on a business of trading or dealing in securities and has not acquired them in one or more transactions considered to be an adventure or concern in the nature of trade.

This summary is based on the facts set out in this Proxy Statement/Prospectus, the current provisions of the Canadian Tax Act in force as of the date hereof and the current administrative policies and assessing practices of the Canada Revenue Agency (“CRA”) published in writing and publicly available prior to the date hereof. This summary takes into account all specific proposals to amend the Canadian Tax Act that have been publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Proposed Amendments”) and assumes that the Proposed Amendments will be enacted in the form proposed. No assurance can be given that the Proposed Amendments will be enacted in the form proposed, or at all. Except for the Proposed Amendments, this summary does not take into account or anticipate any changes in law, whether by judicial, governmental or legislative decision or action or changes in the administrative policies or assessing practices of the CRA, nor does it take into account other federal or any provincial, territorial or foreign tax legislation or considerations, which may differ materially from those described in this summary.

This summary is based on the Company ceasing to be resident in Canada for purposes of the Canadian Tax Act at the Redomiciliation Effective Time, and assumes that from the time of the Redomiciliation and at all relevant times thereafter, the Company and the Combined Company will not be resident in Canada for purposes of the Canadian Tax Act, will be resident in the United States for purposes of the Canada-U.S. Tax Convention (the “Treaty”) and will be entitled to all of the benefits of the Treaty.

This summary is not applicable to a Holder: (i) that is a “financial institution” for purposes of certain rules in the Canadian Tax Act (referred to as the mark-to-market rules); (ii) an interest in which is a “tax shelter investment”; (iii) that is a “specified financial institution”; (iv) that reports its “Canadian tax results” in a currency other than the Canadian currency; (v) that is a partnership for Canadian federal income tax purposes or is exempt from tax under Part I of the Canadian Tax Act; (vi) that has entered, or will enter, into a “derivative forward agreement” with respect to their MDC Canada Common Shares or Combined Company Shares; (vii) who acquired MDC Canada Common Shares under or in connection with an MDC Canada Incentive Plan or any other equity based compensation arrangement; or (viii) in respect of which the Company or the Combined Company will be a “foreign affiliate” at any time after the Redomiciliation (all such terms as defined in the Canadian Tax Act). Additional considerations not discussed herein may be applicable to a Holder that is a corporation resident in Canada and is, or becomes, controlled by a non- resident person or group of persons not dealing at arm’s length for purposes of the “foreign affiliate dumping” rules in section 212.3 of the Canadian Tax Act. Such Holders should consult with and rely on their own tax advisors.

This summary does not discuss the Canadian income tax consequences of the Proposed Transactions to holders of stock options, stock appreciation rights, performance share units, restricted share units, deferred share units, restricted stock or other share-based awards granted by the Company or the Combined Company. Any such holders should consult with and rely on their own tax advisors.

This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular Holder. This summary is not exhaustive of alldoes not purport to be a comprehensive description of all of the Canadian federal income tax consequences of the Proposed Transactions, including tax considerations that are generally assumed to be known by taxpayers or that may be relevant to particular holders in light of their particular circumstances. Accordingly, Holders are urged to consult their own legal and tax advisors with respect to the tax consequences to them of the Proposed Transactions, having regard to their particular circumstances.

7

Annex B

| D: +1 (212) 225-2812 | |

| cgoodman@cgsh.com |

April [ ], 2021

MDC Partners, Inc.

330 Hudson Street,

10th Floor,

New York, New York 10013

Ladies and Gentlemen:

We have acted as counsel to MDC Partners, Inc., a Canadian corporation (the “Company” or “MDC Canada”), in connection with the Proposed Transactions, including the Redomiciliation of MDC Canada into a new corporation organized under the laws of the State of Delaware in the United States of America (“MDC Delaware”) and the MDC Reorganization. All capitalized terms used but not otherwise defined herein have the meaning ascribed to them in the Proxy Statement/Prospectus dated April [●], 2021 (the “Proxy Statement/Prospectus”).

At your request, and in connection with the filing of the Proxy Statement/Prospectus, we are rendering our opinion regarding certain U.S. federal income tax consequences of the Redomiciliation and MDC Reorganization.

For purposes of the opinion set forth below, we have relied, with your consent, upon the accuracy and completeness of the factual statements and representations (which statements and representations we have neither investigated nor verified) contained in the certificate of the officer of MDC Canada dated the date hereof (the “Officer’s Certificate”), and have assumed that such factual statements and representations will be accurate and complete as of the Effective Time (as if made as of such time) and that all such factual statements and representations made to the knowledge of any person or entity or with similar qualification are and will be true and correct as if made without such qualification. Furthermore, we have relied, with their consent, upon the accuracy and completeness of the factual statements and representations (which statements and representations we have neither investigated nor verified) contained in the certificate of the officer of Stagwell Media LP (“Stagwell”) dated the date hereof (the “Stagwell Officer’s Certificate”), and have assumed that such factual statements and representations will be accurate and complete as of the Effective Time (as if made as of such time) and that all such factual statements and representations made to the knowledge of any person or entity or with similar qualifications are and will be true and correct as if made without such qualification. We have also relied upon the accuracy of the Proxy Statement/Prospectus and the documents referenced therein and such other documents, information and materials as we have deemed necessary or appropriate.

In rendering this opinion, we have assumed, with your permission, that: (1) the description of the Proposed Transactions set forth in the Proxy Statement/Prospectus represents the entire understanding of the Company and Stagwell with respect to the Proposed Transactions and there are no other written or oral agreements regarding the Proposed Transactions other than those expressly referred to in the Proxy Statement/Prospectus; (2) each agreement referenced in the Proxy Statement/Prospectus to effect the Proposed Transactions will be consummated in accordance therewith and as described therein (and no transaction or condition described therein and affecting this opinion will be waived or modified); (3) neither the Company, Stagwell, nor any of their respective affiliates is or will be a party to any oral or written agreement relating to the Proposed Transactions that may cause any of the statements and representations set forth in the Officer’s Certificate or the Stagwell Officer’s Certificate to be untrue, incorrect, or incomplete in any respect; and (4) MDC Canada, MDC Delaware, New MDC, OpCo, Stagwell and their respective subsidiaries will treat the Redomiciliation and MDC Reorganization, for U.S. federal income tax purposes, in a manner consistent with the opinion set forth below. If any of the above described assumptions are untrue for any reason or if the transaction is consummated in a manner that is different from the manner described in the Proxy Statement/Prospectus or the documents referenced herein, our opinion as expressed below may be adversely affected.

MDC Partners, Inc., p. 2

Our opinion relates solely to the specific matters set forth below, and no opinion is expressed, or should be inferred, as to any other U.S. federal, state, local or non-U.S. income, estate, gift, transfer, sales, use or other tax consequences that may result from the Proposed Transactions. Our opinion is based on the Internal Revenue Code of 1986, as amended (the “Code”), the U.S. Treasury Regulations, case law and published rulings and other pronouncements of the Internal Revenue Service, as in effect on the date hereof. No assurances can be given that such authorities will not be amended or otherwise changed at any time, possibly with retroactive effect. Future legislative, judicial or administrative changes, on either a prospective or retroactive basis, could affect our opinion. Further, our opinion is limited to legal rather than factual matters and has no official status or binding effect of any kind, including upon the Internal Revenue Service or the courts. Accordingly, there is no assurance that the Internal Revenue Service or a court will not take a contrary position to those expressed in this opinion. We undertake no responsibility to advise you of any future change in the matters stated herein or in the federal income tax laws or the application or interpretation thereof, including if such change applies retroactively.

Based upon the foregoing and subject to the assumptions, exceptions, limitations and qualifications set forth herein and in the Proxy Statement/Prospectus under the heading “Material U.S. Federal Income Tax Considerations for MDC Canada Shareholders” we are of the opinion that, under current U.S. federal income tax law:

| (1) | the Redomiciliation should qualify as an “F reorganization” within the meaning of Section 368(a)(1)(F) of the Code and consequently the taxation of the Company’s U.S. shareholders is subject to the rules in Section 367(b) of the Code and Treasury Regulations Section 1.367(b)-3, as described under the heading “Material U.S. Federal Income Tax Considerations for MDC Canada Shareholders—U.S. Tax Consequences of the Proposed Transactions to U.S. Holders.” The Redomiciliation should be treated, for U.S. federal income tax purposes, as if MDC Canada (i) transferred all of its assets and liabilities to a new U.S. corporation (MDC Delaware) in exchange for all of the outstanding stock of MDC Delaware and then distributed the stock of MDC Delaware that MDC Canada received in the transaction to the MDC Canada Shareholders in liquidation of MDC Canada; |

| (2) | the MDC Reorganization should qualify as an “F reorganization” within the meaning of Section 368(a)(1)(F) of the Code and the Company’s U.S. shareholders should not be required to recognize additional gain or loss for U.S. federal income tax purposes in connection with the MDC Reorganization; and |

| (3) | in accordance with the conclusions expressed above in (1) and (2), the discussion under the headings “Material U.S. Federal Income Tax Considerations for MDC Canada Shareholders—U.S. Tax Consequences of the Proposed Transactions to U.S. Holders” and “—U.S. Tax Consequences of the Proposed Transactions to Non-U.S. Holders” in the Proxy Statement/Prospectus, insofar as such sections express conclusions as to the application of U.S. federal income tax law to the MDC Canada Shareholders addressed therein, should be the U.S. federal income tax consequences to such MDC Canada Shareholders resulting from the Proposed Transactions, provided, that, we express no opinion regarding the discussion under the headings “—All Earnings and Profits Amount” and “—Passive Foreign Investment Company Status” contained therein. |

The opinion expressed herein is being furnished in connection with the filing of the Proxy Statement/Prospectus and the description of U.S. federal income tax consequences of the Proposed Transactions to MDC Canada Shareholders as described therein, and may not be used or relied upon for any other purpose. We hereby consent to the filing of this opinion with the Securities and Exchange Commission as Exhibit 8.2 to the Proxy Statement/Prospectus and to the references to this opinion in the Proxy Statement/Prospectus. In giving this consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules or regulations of the Securities and Exchange Commission promulgated thereunder.

MDC Partners, Inc., p. 3

| Very truly yours, | ||

| CLEARY GOTTLIEB STEEN & HAMILTON LLP | ||

| By: | ||

| Corey M. Goodman, a Partner | ||

Annex C

April [ ], 2021

MDC Partners, Inc.

One World Trade Center,

Floor 65,

New York, New York 10007

Ladies and Gentlemen:

We have acted as counsel to MDC Partners, Inc., a Canadian corporation (the “Company” or “MDC Canada”), in connection with the Proposed Transactions, including the Redomiciliation of MDC Canada into a new corporation organized under the laws of the State of Delaware in the United States of America (“MDC Delaware”) and the MDC Reorganization. All capitalized terms used but not otherwise defined herein have the meaning ascribed to them in the Proxy Statement/Prospectus dated February 8, 2021 (the “Proxy Statement/Prospectus”).

At your request, and in connection with the filing of the Proxy Statement/Prospectus, we are rendering our opinion regarding certain Canadian federal income tax consequences of the Redomiciliation and MDC Reorganization.

For purposes of the opinion set forth below, we have relied, with your consent, upon the accuracy and completeness of the factual statements and representations (which statements and representations we have neither investigated nor verified) contained in the certificate of the officer of MDC Canada dated the date hereof (the “Officer’s Certificate”), and have assumed that such factual statements and representations will be accurate and complete as of the Effective Time (as if made as of such time) and that all such factual statements and representations made to the knowledge of any person or entity or with similar qualification are and will be true and correct as if made without such qualification. We have also relied upon the accuracy of the Proxy Statement/Prospectus and the documents referenced therein and such other documents, information and materials as we have deemed necessary or appropriate.

In rendering this opinion, we have assumed, with your permission, that: (1) the description of the Proposed Transactions set forth in the Proxy Statement/Prospectus represents the entire understanding of the Company with respect to the Proposed Transactions, and there are no other written or oral agreements regarding the Proposed Transactions other than those expressly referred to in the Proxy Statement/Prospectus; (2) each agreement referenced in the Proxy Statement/Prospectus to effect the Proposed Transactions will be consummated in accordance therewith and as described therein (and no transaction or condition described therein and affecting this opinion will be waived or modified); (3) neither the Company nor any of its affiliates is or will be a party to any oral or written agreement relating to the Proposed Transactions that may cause any of the statements and representations set forth in the Officer’s Certificate to be untrue, incorrect, or incomplete in any respect; and (4) MDC Canada, MDC Delaware, New MDC, OpCo and their subsidiaries will treat the Proposed Transactions, for Canadian federal income tax purposes, in a manner consistent with the opinion set forth below. If any of the above described assumptions are untrue for any reason or if the transaction is consummated in a manner that is different from the manner described in the Proxy Statement/Prospectus or the documents referenced herein, our opinion as expressed below may be adversely affected.

Our opinion relates solely to the specific matters set forth below, and no opinion is expressed, or should be inferred, as to any other Canadian federal, provincial, local or non- Canadian income, estate, gift, transfer, sales, use or other tax consequences that may result from the Proposed Transactions. Our opinion is based on the facts set out in this Proxy Statement/Prospectus, the current provisions of the Income Tax Act (Canada) as amended, including the regulations promulgated thereunder (the “Canadian Tax Act”) in force as of the date hereof and the current administrative policies and assessing practices of the Canada Revenue Agency (“CRA”) published in writing and publicly available prior to the date hereof. Our opinion takes into account all specific proposals to amend the Canadian Tax Act that have been publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Proposed Amendments”) and assumes that the Proposed Amendments will be enacted in the form proposed. No assurance can be given that the Proposed Amendments will be enacted in the form proposed, or at all. Except for the Proposed Amendments, our opinion does not take into account or anticipate any changes in law, whether by judicial, governmental or legislative decision or action or changes in the administrative policies or assessing practices of the CRA, nor does it take into account other federal or any provincial, territorial or foreign tax legislation or considerations, which may differ materially from those described in the Proxy Statement/Prospectus. Further, our opinion is limited to legal rather than factual matters and has no official status or binding effect of any kind, including upon the CRA or the courts. Accordingly, there is no assurance that the CRA or a court will not take a contrary position to those expressed in this opinion. We undertake no responsibility to advise you of any future change in the matters stated herein or in the Canadian federal income tax laws or the application or interpretation thereof, including if such change applies retroactively.

Based upon the foregoing and subject to the assumptions, exceptions, limitations and qualifications set forth herein and in the Proxy Statement/Prospectus under the heading “Material Canadian Federal Income Tax Considerations for MDC Canada Shareholders” we are of the opinion that, under current Canadian federal income tax law: