Exhibit 99.1

INVESTOR PRESENTATION SEPTEMBER | 2021

Cautionary Statement Regarding Forward - Looking Statements This presentation contains forward - looking statements. Statements in this presentation that are not historical facts, including without limitatio n the information under the heading "Financial Outlook" and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions , a nd estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward - looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates ”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward - looking statements. These statements are based on current plans, estimat es and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward - looking statements speak only as of the date they are made, and the Company undertakes no obli gation to update publicly any of them in light of new information or future events, if any. Forward - looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward - looking statements. Such risk factors include, but are not limited to, the following: • risks associated with international, national and regional unfavorable economic conditions that could affect the Company or i ts clients, including as a result of the novel coronavirus pandemic (“COVID - 19”); the effects of the outbreak of COVID - 19, including the measures to reduce its spread, and the impact on the economy and demand f or our services, which may precipitate or exacerbate other risks and uncertainties; • an inability to realize expected benefits of the redomiciliation of the Company from the federal jurisdiction of Canada to the State of Delaware (the “ Redomiciliation ”) and the subsequent combination of the Company’s business with the business of the subsidiaries of Stagwell Media LP (“Stagwell”) that own and operate a portfolio of marketin g s ervices companies (the “Business Combination” and, together with the Redomiciliation , the “Transactions”) or the occurrence of difficulties in connection with the Transactions; • adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may d iff er from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s d ete rmination of value and computations of its attributes may result in increased tax costs; • the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions; • the impact of uncertainty associated with the Transactions on the Company’s businesses; • direct or indirect costs associated with the Transactions, which could be greater than expected; • risks associated with severe effects of international, national and regional economic conditions; • the risk of parties challenging the Transactions or the impact of the Transactions on the Company’s debt arrangements; • the Company’s ability to attract new clients and retain existing clients; • reduction in client spending and changes in client advertising, marketing and corporate communications requirements; • financial failure of the Company’s clients; • The Company’s ability to retain and attract key employees; • the Company’s ability to achieve the full amount of its stated cost saving initiatives; • the Company’s implementation of strategic initiatives; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent pa yme nt obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities; an d • foreign currency fluctuations. Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors out lined in more detail in the Company’s filings with the Securities and Exchange Commission (the “SEC”) and accessible on the SEC’s website at www.sec.gov., under the caption “Risk Factors,” and in the Company’s other SEC filings . s tatement. FORWARD LOOKING INFORMATION & OTHER INFORMATION 2

Pro Forma Financial Information: The unaudited summary pro forma financial information contained in this presentation has been prepared for illustrative purpo ses only and is not necessarily indicative of the operating results or financial position that would have been achieved if the Transaction or other pro forma adjustments had been completed on the dates or for the pe rio ds presented, nor does the summary pro forma financial information purport to project the results of operations or financial position for any future period or as of any future date. The summary pro forma fi nancial information is based upon currently available information and the estimates and assumptions of the Company’s management as described herein. In addition, the summary pro forma financial information present ed in this presentation does not comply with the requirements of the SEC. You should refer to the pro forma information and notes related thereto contained in the Company’s SEC filings . Industry and Market Data: This presentation includes information and statistics regarding market participants in the sectors in which the Company compe tes and other industry data which was obtained from third - party sources, including reports by market research firms and company filings. Trademarks: This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the propert y o f their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM© or ®, but the Company wi ll assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, of these trademarks, service marks, trade names and copyrights. FORWARD LOOKING INFORMATION & OTHER INFORMATION (CONT’D) 3

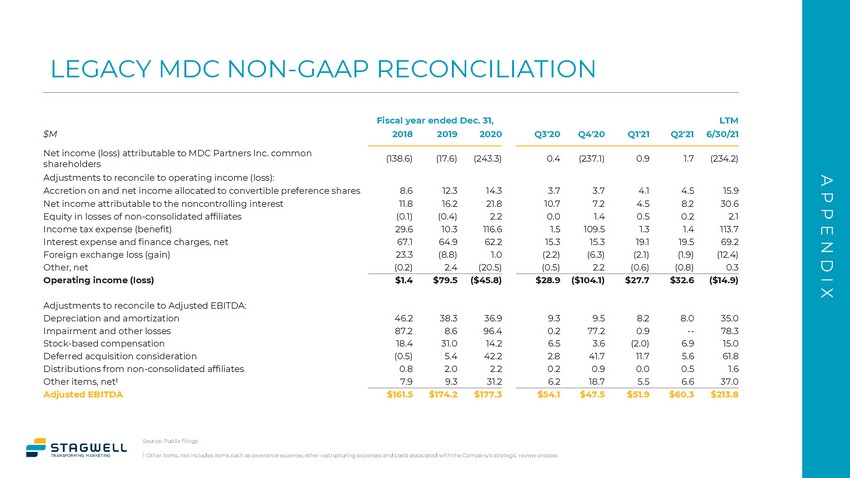

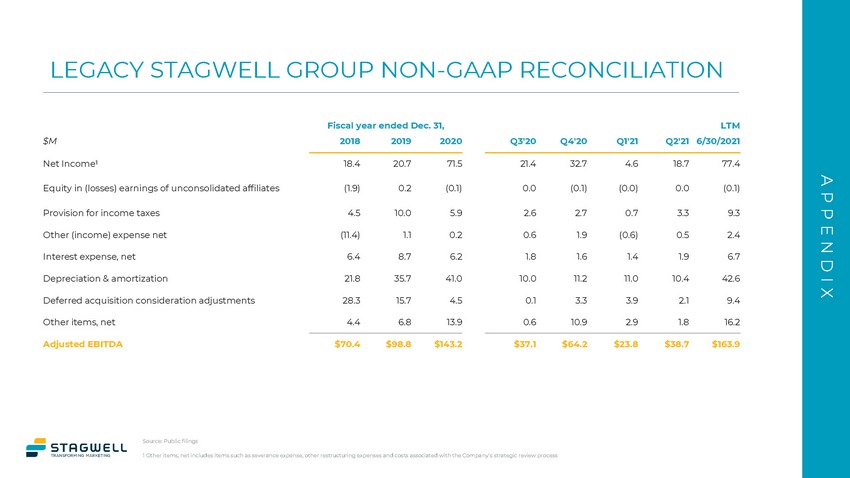

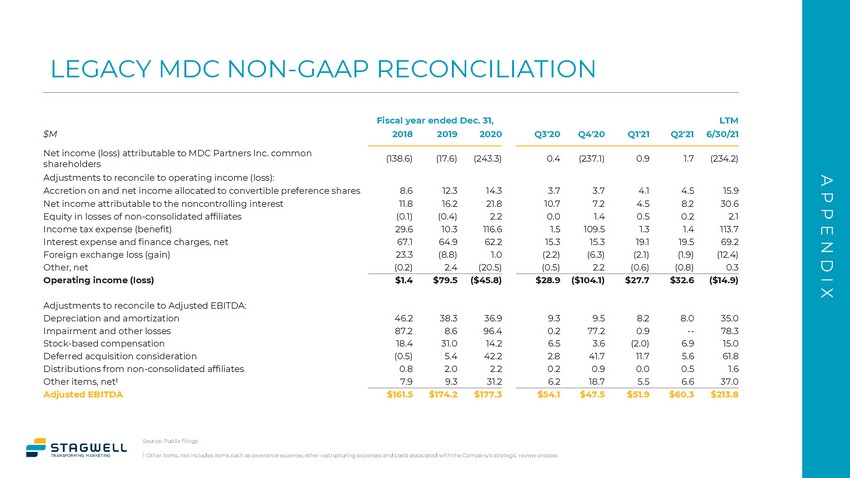

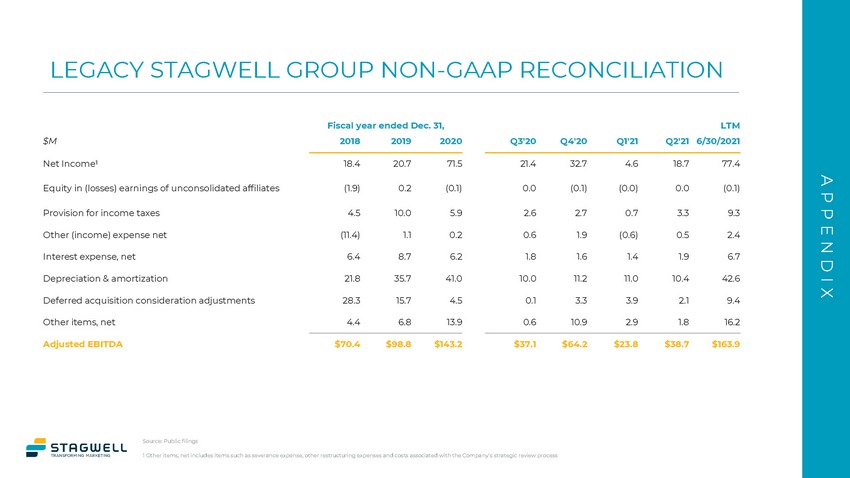

Non - GAAP Financial Measures The presentation includes certain financial measures that the SEC defines as “non - GAAP financial measures.” The Company’s manage ment believes that such non - GAAP financial measures, when read in conjunction with the results reported in accordance with generally accepted accounting princ ipl es (“GAAP”), can provide useful supplemental information for investors analyzing period - to - period comparisons of MDC’s and Stagwell Group’s results. Such non - GAAP financial measures include the following: Adjusted EBITDA (MDC): Adjusted EBITDA is a non - GAAP financial measure that represents net income (loss) attributable to MDC com mon shareholders, plus or minus adjustments to operating income (loss) plus depreciation and amortization, stock - based compensation, deferred acquisition consideration adjustments, distributions from non - consolidated affiliates, and other items, net which includes items such as severance expense and other restructuring expenses, including costs for leases that will either be terminated or sublet in connection w ith the centralization of MDC’s New York real estate portfolio. Adjusted EBITDA ( Stagwell Group): Adjusted EBITDA is a non - GAAP financial measure that represents Stagwell Group’s net income plus (minus) interest, taxes, depreciation and amortization, transaction costs and normalized purchase price accounting adjustments, DAC, the fair market value adjustments of financial instruments and real es tat e restructuring costs for certain brands, and other non - recurring items. Adjusted EBITDA ( Stagwell Group) is based on Stagwell Group's financials and other adjustments based on reports by MDC third party accounting advisors. Free Cash Flow: Free Cash Flow is a measure that represents Adjusted EBITDA less capital expenditures, interest, cash taxes, min ority interest distributions, and changes in working capital. Free Cash Flow Conversion: Free Cash Flow Conversion is a measure that represents Free Cash Flow divided by Adjusted EBITDA. Pro Forma Cash Generation: Pro Forma Cash Generation is a non - GAAP measure defined as Adjusted EBITDA with run rate synergies le ss capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excluding contingent M&A payments. Net Revenue: Net Revenue is a measure defined as the amount of our gross billings excluding billable expenses charged to a cl ien t, primarily consisting of fees, commissions and performance incentives. These non-GAAP financial measures have important limitations and should not be considered in isolation or as a substitute for me asures of MDC’s and Stagwell Group's financial performances prepared in accordance with GAAP. In addition, these metrics, as presented by MDC and Stagwell Group may not be comparable to similarly titled measures of other companies due to varying methods of calculations. Please refer to the Appendix of this presentation for a reconciliation of the non - GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP. Included in the presentation are tables reconciling MDC’s and Stagwell Group’s reported results to these non - GAAP financial meas ures. Actuals may not foot due to rounding FORWARD LOOKING INFORMATION & OTHER INFORMATION (CONT’D) 4

Company Overview 5

A technology - based marketing services company that can transform marketing through its unique combination of creativity & high - growth digital services. “An investment in Stagwell is an investment in the future of marketing” Mark Penn, Chairman & CEO 6

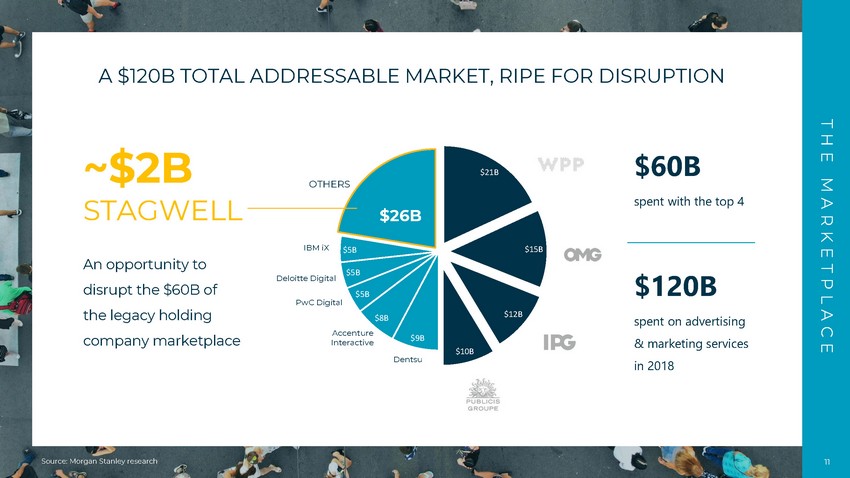

We provide clients with everything they need today to get the right ad to the right person at the right time. This means we develop integrated marketing strategies and campaigns that include: → CREATIVE SERVICES → DIGITAL TRANSFORMATION → E - COMMERCE ENGINEERING → RESEARCH & INSIGHTS, & → ADVANCED TARGETING & MEDIA PLACEMENT ACROSS ONLINE & OFFLINE CHANNELS STAGWELL AT A GLANCE ~$ 2.2 B LTM Revenue ~$ 400 M LTM EBITDA* 68 10,000 24 ~ 4,000 Employees Countries Blue - Chip Customers Cities 1,000 Engineers $ 120+ B Addressable Market KEY STATS 7 *LTM EBITDA of $408M, including $30M of targeted synergies $ 2 00 M+ PF Free Cash Flow

We started with a big idea 6 years ago and with a record of organic growth as the network has been built from the ground up. Led by Mark Penn, former Chief Strategy Officer of Microsoft, CEO of Burston - Marsteller , and founder of Penn and Schoen, with more than 45 years of successful operating and industry experience. We are backed by experienced technology & financial investors, including Steve Ballmer, co - founder of the Ballmer Group & former CEO of Microsoft. OUR HISTORY 2015 2021 8

Investment highlights Industry - Leading Growth for a marketing services company Unlimited Opportunity to grow and expand globally Strong Margins fueled by high - growth digital services & SaaS products Prudent Cost Management proven by past execution Growing Free Cash Flow for reducing debt and investing in growth Optimized Capital Structure that is stable and cost - effective Proven Leadership Team with deep industry experience 1 2 3 4 5 6 7 INVESTMENT HIGHLIGHTS 9

The Marketplace 10

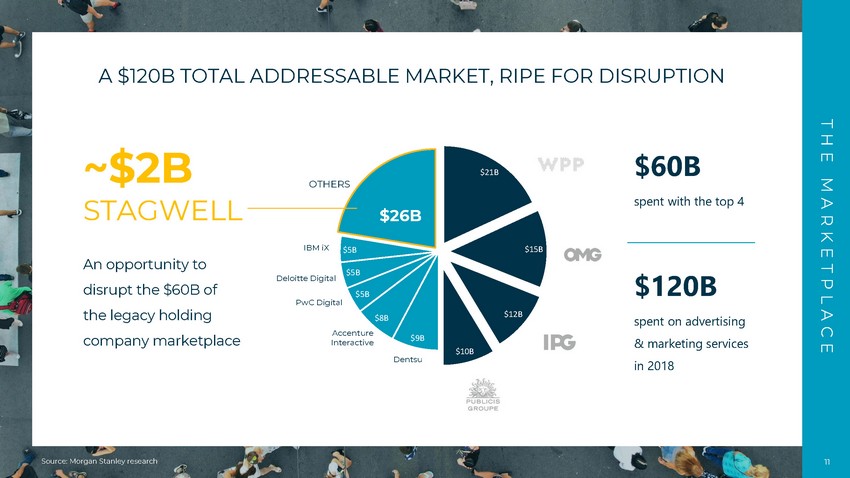

Source: Morgan Stanley research An opportunity to disrupt the $60B of the legacy holding company marketplace ~$2B STAGWELL A $120B TOTAL ADDRESSABLE MARKET, RIPE FOR DISRUPTION THE MARKETPLACE $21B $15B $12B $10B $9B $8B $5B $5B $5B $26B Dentsu Accenture Interactive PwC Digital Deloitte Digital IBM iX OTHERS $120B spent on advertising & marketing services in 2018 $60B spent with the top 4 11

7% 5% 31% 6% 1% 6% 44% 33% 15% 35% 9% 6% 2% Source: Zenith research DIGITAL MEDIA IS DISRUPTING MARKETING GLOBAL AD SPENDING 2000 (Total $329B) GLOBAL AD SPENDING 2020 (Total $613B) The new marketplace creates new opportunities THE MARKETPLACE Newspapers Magazines Television Radio Cinema Outdoor Internet 12

Source: US Census Bureau, Targeted Victory, eMarketer Research Political & advocacy consulting, digital strategy, & online fundraising Political funds raised online ($ in billions) $0.4 $1.3 $2.2 $7.0 2014 2016 2018 2020 Online Advocacy Services enabling influencers & global performance marketing $132 $142 $171 $197 $221 $243 2019 2020 2021E 2022E 2023E 2024E US digital ad spend ($ in billions) Digital Marketing Services Designing, creating, implementing & managing consumer e - commerce platforms $337 $382 $442 $505 $577 $759 2015 2016 2017 2018 2019 2020 US E - Commerce sales ($ billions) E - Commerce DIGITAL MARKETING IS GROWING RAPIDLY 10% - 15% target annual growth driven by e - commerce, online advocacy & digital marketing services THE STAGWELL APPROACH 13

The Stagwell Approach 14

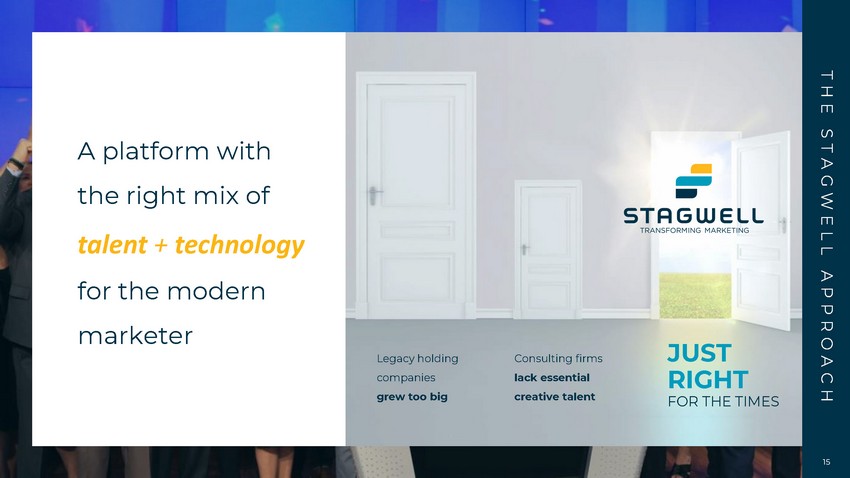

A platform with the right mix of talent + technology for the modern marketer Consulting firms lack essential creative talent JUST RIGHT FOR THE TIMES Legacy holding companies grew too big THE STAGWELL APPROACH 15

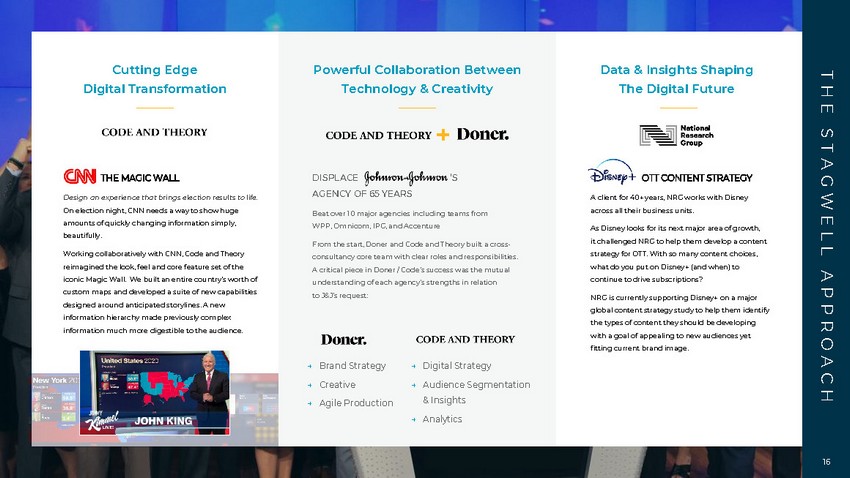

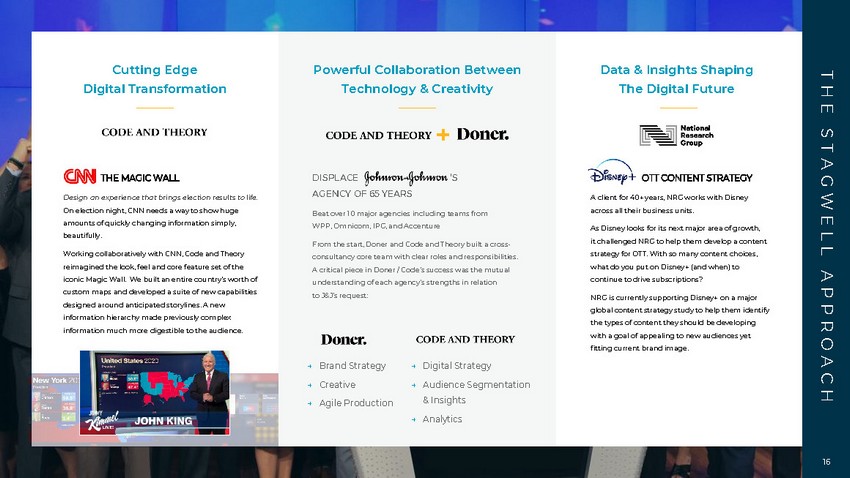

THE STAGWELL APPROACH Cutting Edge Digital Transformation Data & Insights Shaping The Digital Future THE MAGIC WALL Design an experience that brings election results to life. On election night, CNN needs a way to show huge amounts of quickly changing information simply, beautifully. Working collaboratively with CNN, Code and Theory reimagined the look, feel and core feature set of the iconic Magic Wall. We built an entire country’s worth of custom maps and developed a suite of new capabilities designed around anticipated storylines. A new information hierarchy made previously complex information much more digestible to the audience. OTT CONTENT STRATEGY A client for 40+ years, NRG works with Disney across all their business units. As Disney looks for its next major area of growth, it challenged NRG to help them develop a content strategy for OTT. With so many content choices, what do you put on Disney+ (and when) to continue to drive subscriptions? NRG is currently supporting Disney+ on a major global content strategy study to help them identify the types of content they should be developing with a goal of appealing to new audiences yet fitting current brand image. Powerful Collaboration Between Technology & Creativity DISPLACE ‘S AGENCY OF 65 YEARS Beat over 10 major agencies including teams from WPP, Omnicom, IPG, and Accenture From the start, Doner and Code and Theory built a cross - consultancy core team with clear roles and responsibilities. A critical piece in Doner / Code’s success was the mutual understanding of each agency’s strengths in relation to J&J’s request: → Digital Strategy → Audience Segmentation & Insights → Analytics → Brand Strategy → Creative → Agile Production 16

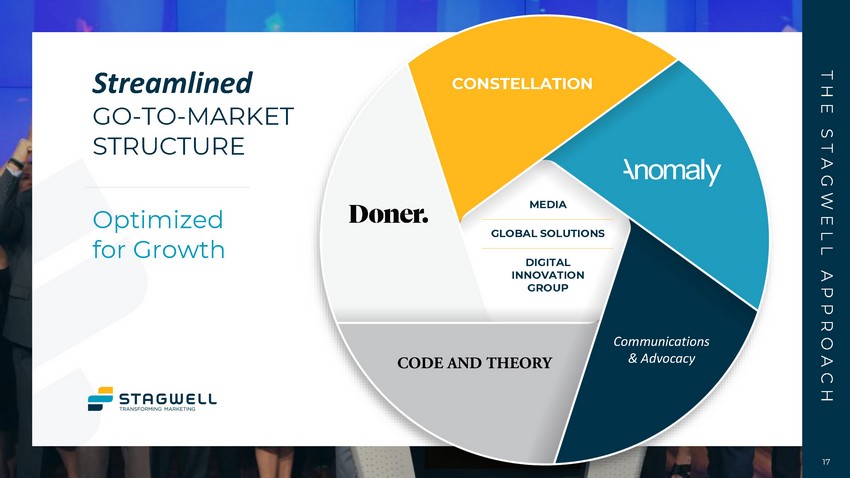

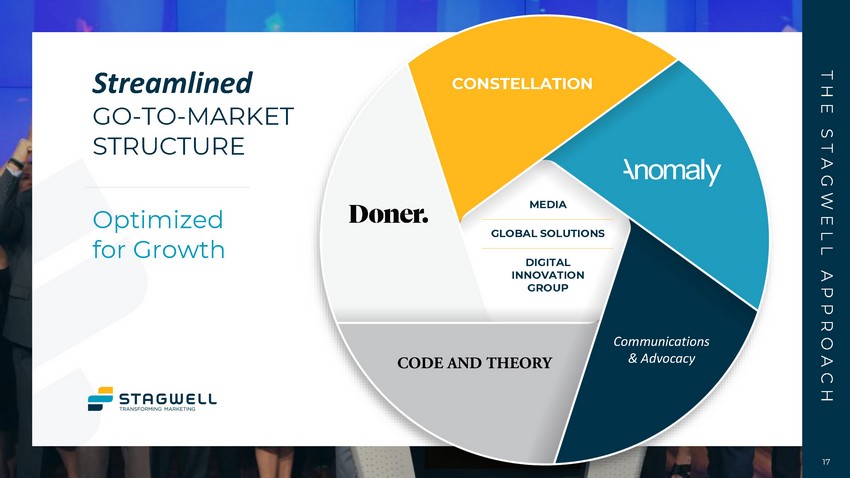

THE STAGWELL APPROACH 17 Communications & Advocacy MEDIA DIGITAL INNOVATION GROUP GLOBAL SOLUTIONS CONSTELLATION Streamlined GO - TO - MARKET STRUCTURE Optimized for Growth

Access Points FOR GROWTH Blue - Chip Customer Base Provides Significant Expansion Opportunity Communications Media & Entertainment Retail Food & Beverage Consumer Products Technology Automotive Financial Services Healthcare THE STAGWELL APPROACH 18

Stagwell +Affiliates CITIES 68 80 COUNTRIES 24 32 EMPLOYEES 10,000 +12,000 STAGWELL AFFILIATES Our Global NETWORK 10,000+ Employees Across 24 Countries & 68 Cities In Addition To Vast Affiliate Network THE STAGWELL APPROACH 19

Growing Unique DIGITAL REVENUE STREAMS Suite Of Digital Marketing Products Based On AI, Proprietary Data & Insights Audience Identification & Activation I nfluencer Management Platform AI For Public Relations Pros Mobile Device Usage & Behavior Modern Brand Management Transformational Media Execution Traveler Targeting Across Channels Augmented Reality Creation Platform Personalized Text Messaging, At Scale Targeted to drive $75M of incremental, primarily recurring revenue over time THE STAGWELL APPROACH 20

Disciplined INVESTMENT APPROACH THE STAGWELL APPROACH TARGET TO ACQUIRE >$325 MILLION OF REVENUE EXPANDING REACH & CAPABILITIES Lower Multiples (5 - 7x) Higher Multiples (9 - 12x) Expand Global Footprint Expand Digital Platforms Invest Emerging Technologies 21

* Targeted by 2025 OPPORTUNITY TO GROW TO $3 BILLION+ AND BEYOND OF TARGET GAAP REVENUE IN 2025 THROUGH COMBINATION OF ORGANIC, NEW REVENUE STREAMS & ACQUISITIONS Potential Equation for Success * ($M) Combined Revenue + Organic Growth $2,600 + New Digital Revenue Streams $75 + M&A Growth $325 = TARGET GOAL Adding IT ALL UP $3,000+ THE STAGWELL APPROACH 22

Financial Highlights 23

Enhanced Market Position LTM (6/30/21 Pro Forma Actual) GAAP REVENUE $2,197 M ADJ. EBITDA $ 378 M

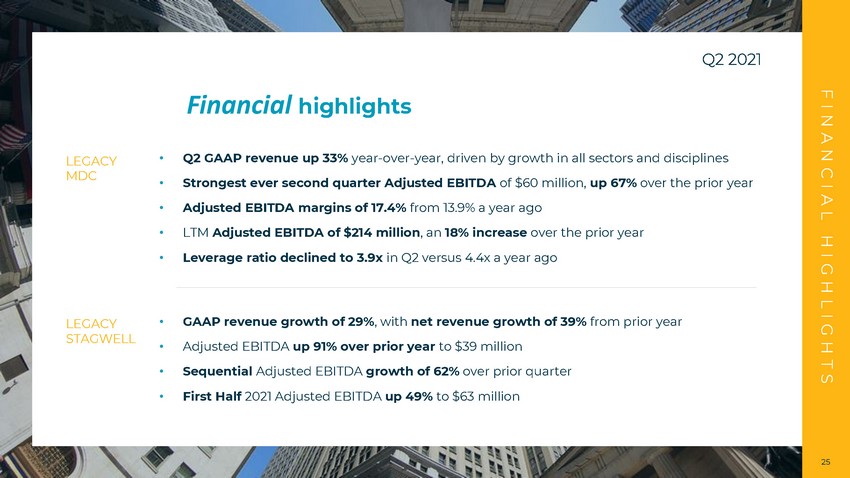

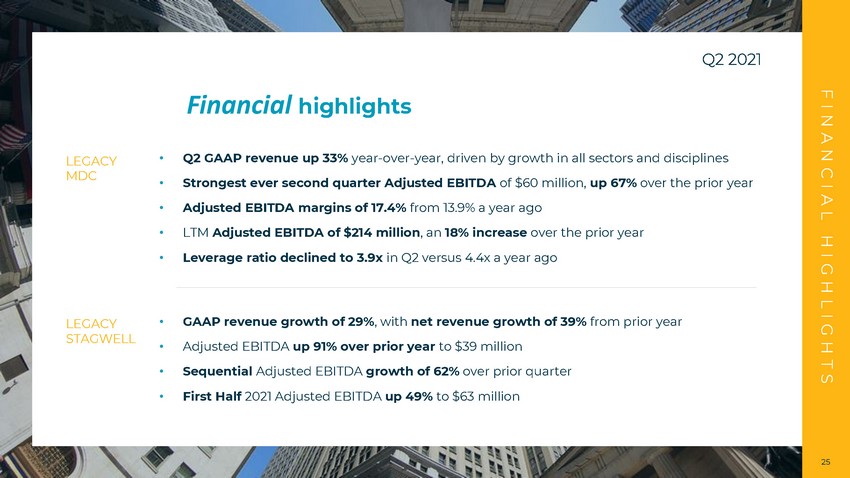

Financial highlights FINANCIAL HIGHLIGHTS Q2 2021 • Q2 GAAP revenue up 33% year - over - year, driven by growth in all sectors and disciplines • Strongest ever second quarter Adjusted EBITDA of $60 million, up 67% over the prior year • Adjusted EBITDA margins of 17.4% from 13.9% a year ago • LTM Adjusted EBITDA of $214 million , an 18% increase over the prior year • Leverage ratio declined to 3.9x in Q2 versus 4.4x a year ago • GAAP revenue growth of 29% , with net revenue growth of 39% from prior year • Adjusted EBITDA up 91% over prior year to $39 million • Sequential Adjusted EBITDA growth of 62% over prior quarter • First Half 2021 Adjusted EBITDA up 49% to $63 million LEGACY MDC LEGACY STAGWELL 25

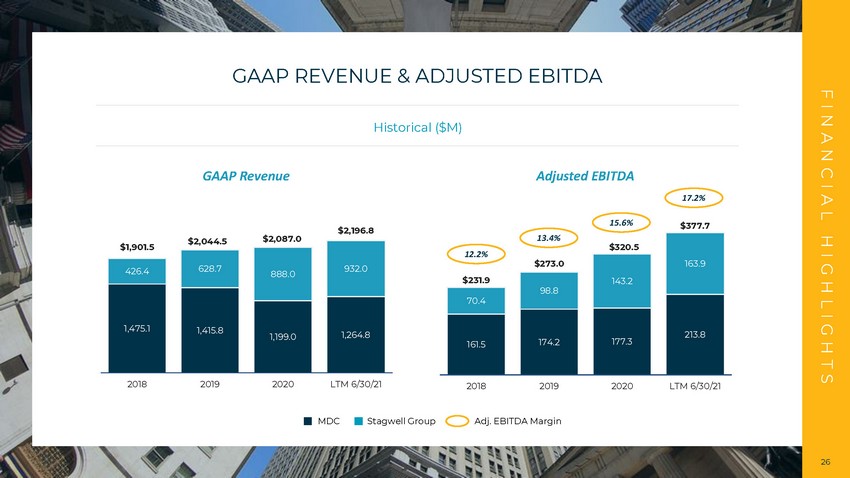

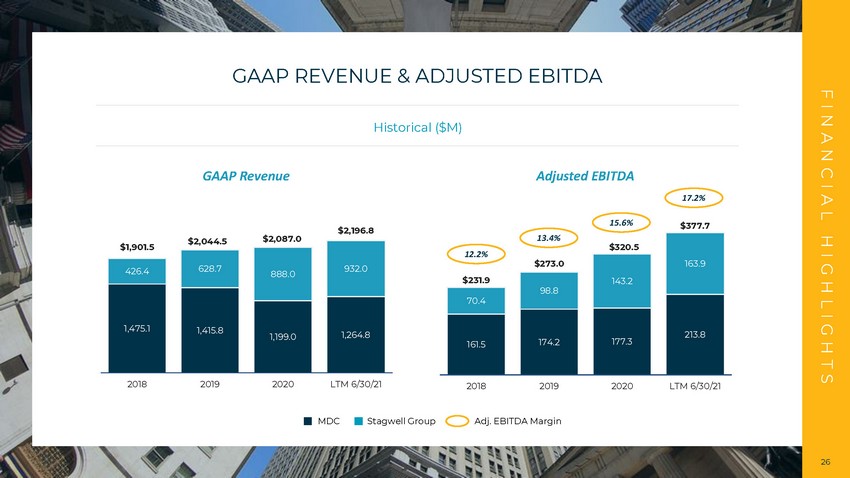

GAAP REVENUE & ADJUSTED EBITDA FINANCIAL HIGHLIGHTS GAAP Revenue Adjusted EBITDA $1,901.5 $2,044.5 $2,087.0 $2,196.8 1,475.1 1,415.8 1,199.0 1,264.8 426.4 628.7 888.0 932.0 2018 2019 2020 LTM 6/30/21 $231.9 $273.0 $320.5 $377.7 161.5 174.2 177.3 213.8 70.4 98.8 143.2 163.9 2018 2019 2020 LTM 6/30/21 12.2% Adj. EBITDA Margin 13.4% 15.6% 17.2% Historical ($M) MDC Stagwell Group 26

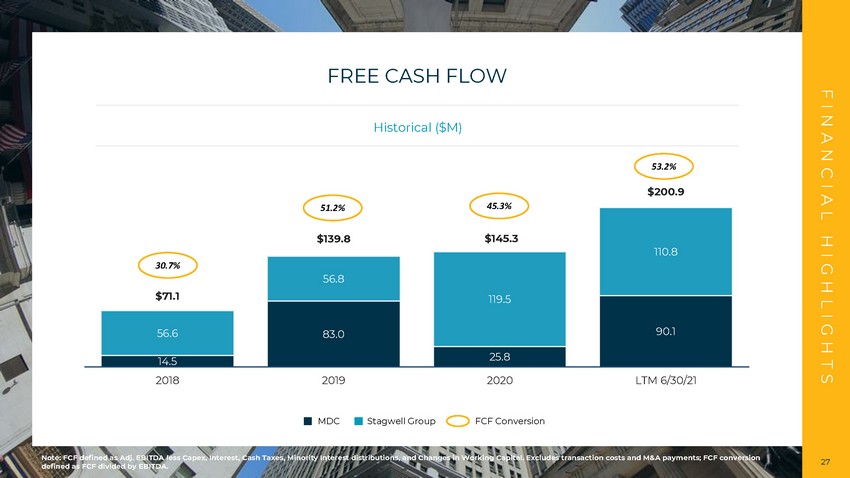

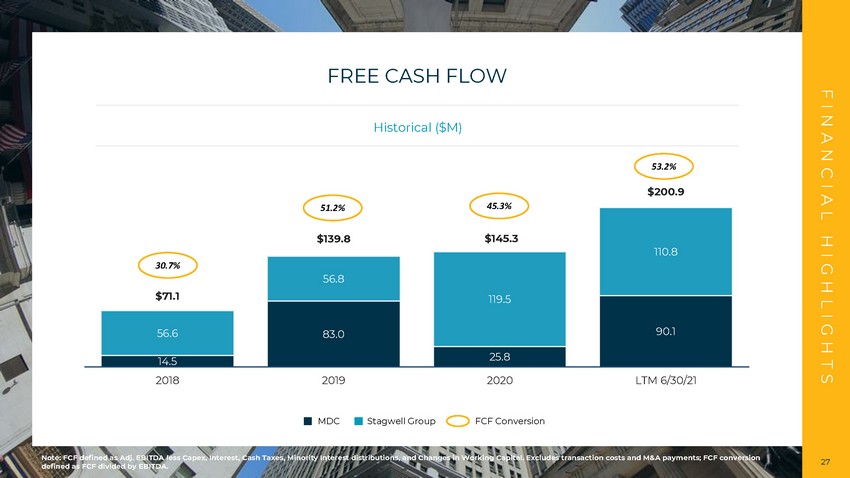

FREE CASH FLOW FINANCIAL HIGHLIGHTS FCF Conversion Historical ($M) MDC Stagwell Group Note: FCF defined as Adj. EBITDA less Capex, Interest, Cash Taxes, Minority Interest distributions, and Changes in Working Ca pit al. Excludes transaction costs and M&A payments; FCF conversion defined as FCF divided by EBITDA. $71.1 $139.8 $145.3 $200.9 14.5 83.0 25.8 90.1 56.6 56.8 119.5 110.8 2018 2019 2020 LTM 6/30/21 30.7% 51.2% 45.3% 53.2% 27

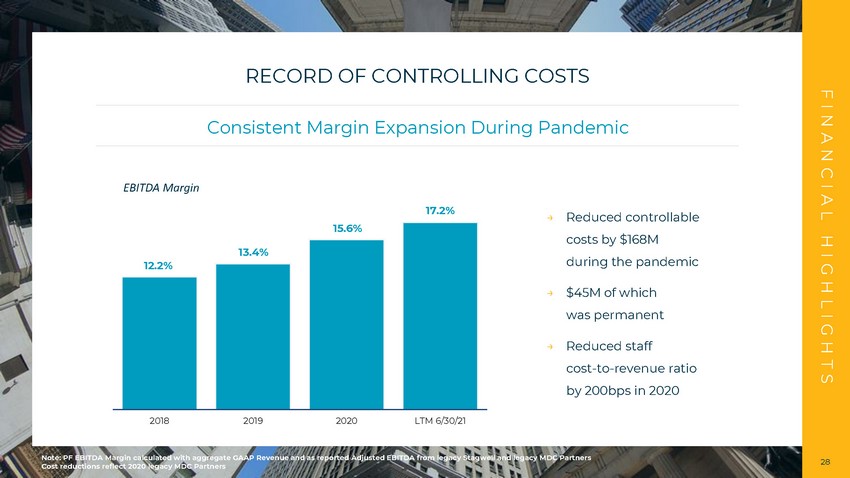

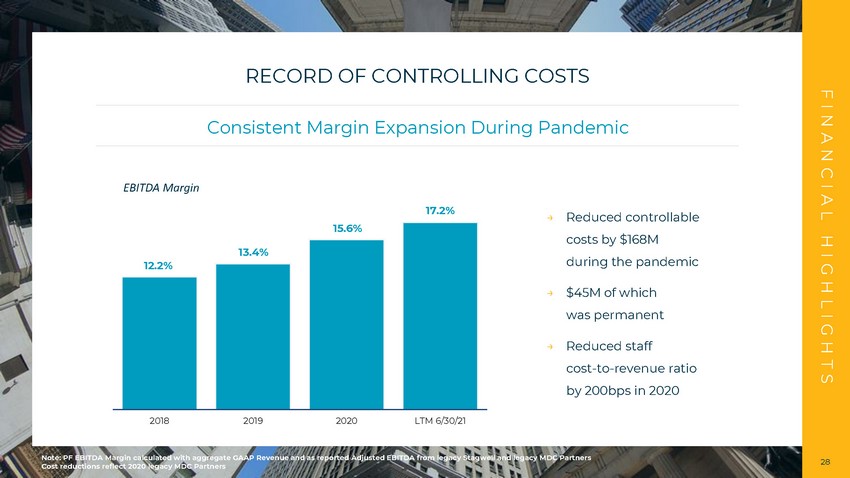

RECORD OF CONTROLLING COSTS FINANCIAL HIGHLIGHTS Consistent Margin Expansion During Pandemic Note: PF EBITDA Margin calculated with aggregate GAAP Revenue and as reported Adjusted EBITDA from legacy Stagwell and legacy MD C Partners Cost reductions reflect 2020 legacy MDC Partners 12.2% 13.4% 15.6% 17.2% 2018 2019 2020 LTM 6/30/21 → Reduced controllable costs by $168M during the pandemic → $45M of which was permanent → Reduced staff cost - to - revenue ratio by 200bps in 2020 EBITDA Margin 28

FURTHER COST SYNERGIES TO ACHIEVE FINANCIAL HIGHLIGHTS Targeting $30 Million Note: Estimates do not include cost to achieve of $24 million. 1 Includes consolidation of IT staff, decrease in third party spend on employee benefits and consolidation of translation ser vic es 29 Corporate 9% T&E 5% Shared Services 16% Media 32% Production 10% Research 12% Real Estate 9% Other 1 7% Targeted Annualized Cost Synergies ~ 55% Targeted To Be Realized by Year 1 ~ 90% Targeted To Be Realized by Year 2 100% Targeted To Be Realized by Year 3 $30M ~

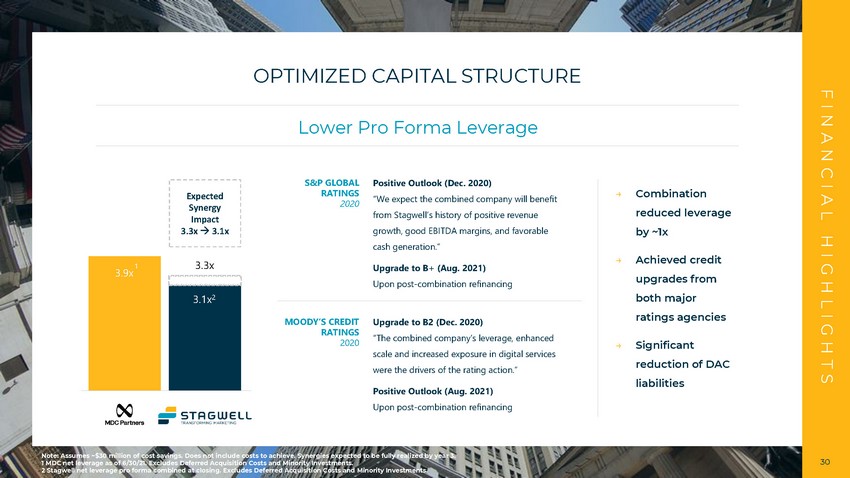

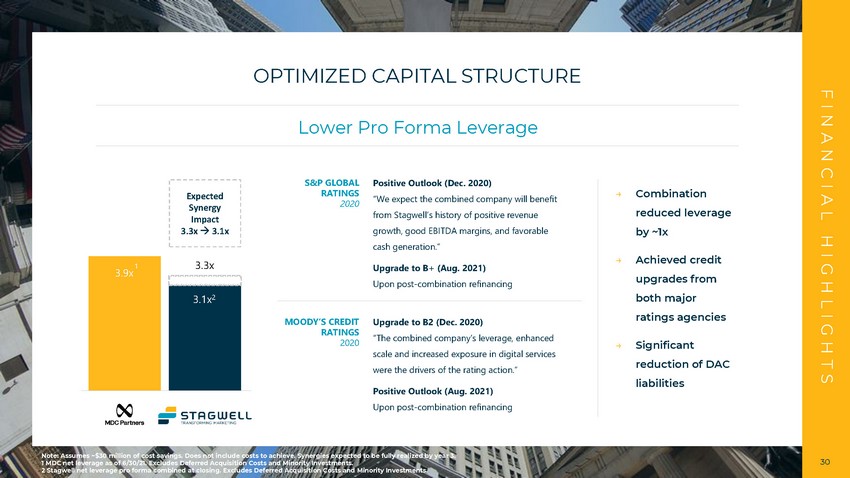

OPTIMIZED CAPITAL STRUCTURE FINANCIAL HIGHLIGHTS Lower Pro Forma Leverage Note: Assumes ~$30 million of cost savings. Does not include costs to achieve. Synergies expected to be fully realized by yea r 3 . 1 MDC net leverage as of 6/30/21. E xcludes Deferred Acquisition Costs and Minority Investments. 2 Stagwell net leverage pro forma combined at closing. Excludes Deferred Acquisition Costs and Minority Investments. 30 Expected Synergy Impact 3.3x 3.1x 3.9x 1 3.1x 2 3.3x Positive Outlook (Dec. 2020) “We expect the combined company will benefit from Stagwell’s history of positive revenue growth, good EBITDA margins, and favorable cash generation.” Upgrade to B+ (Aug. 2021) Upon post - combination refinancing Upgrade to B2 (Dec. 2020) “The combined company’s leverage, enhanced scale and increased exposure in digital services were the drivers of the rating action.” Positive Outlook (Aug. 2021) Upon post - combination refinancing → Combination reduced leverage by ~1x → Achieved credit upgrades from both major ratings agencies → Significant reduction of DAC liabilities S&P GLOBAL RATINGS 2020 MOODY’S CREDIT RATINGS 2020

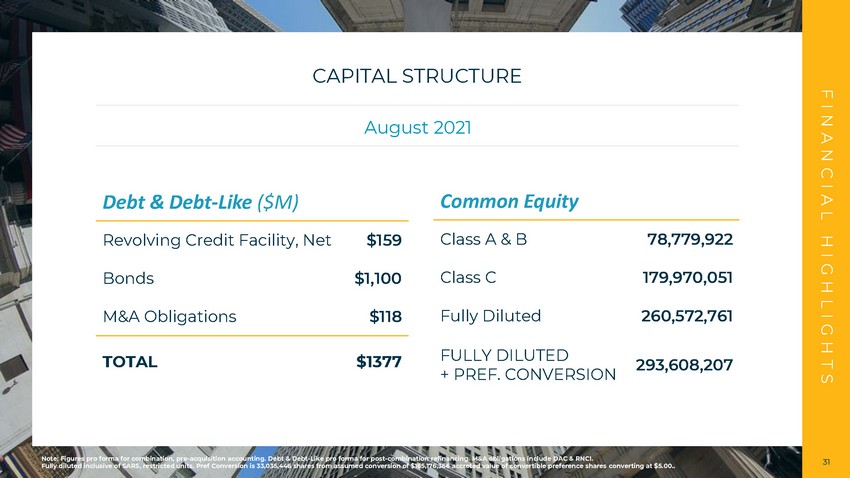

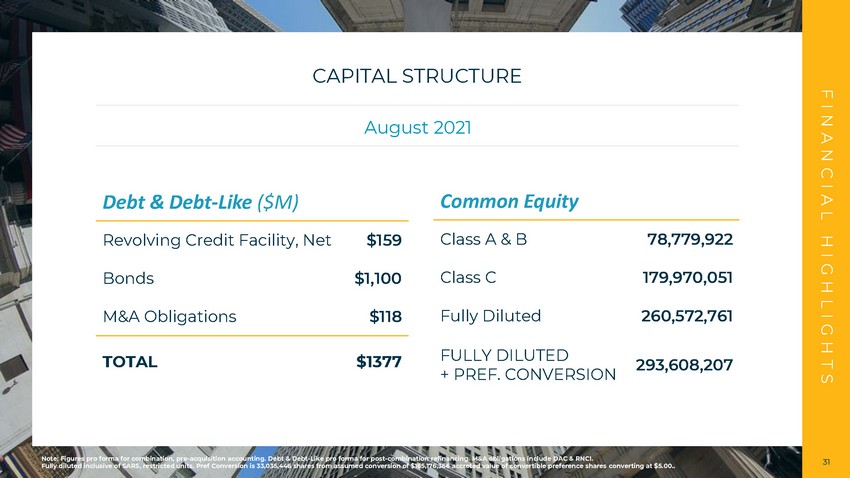

FINANCIAL HIGHLIGHTS 31 Debt & Debt - Like ($M) Revolving Credit Facility, Net $159 Bonds $1,100 M&A Obligations $118 TOTAL $1377 Common Equity Class A & B 78,779,922 Class C 179,970,051 Fully Diluted 260,572,761 FULLY DILUTED + PREF. CONVERSION 293,608,207 Note: Figures pro forma for combination, pre - acquisition accounting. Debt & Debt - Like pro forma for post - combination refinancing . M&A obligations include DAC & RNCI. Fully diluted inclusive of SARS, restricted units. Pref Conversion is 33,035,446 shares from assumed conversion of $165,176,366 accreted value of convertible preference shares con verting at $5.00.. CAPITAL STRUCTURE August 2021

FINANCIAL HIGHLIGHTS 32 -50% 0% 50% 100% 150% 200% 250% 300% STGW SFOR IPG WPP PUB OMC Performance YTD Rising Above Traditional Holding Companies Compelling INVESTMENT + ~ 230% VS. 38% PEER A VERAGE Note: market data as of 9/14/2021

Investment recap Industry - Leading Growth for a marketing services company Unlimited Opportunity to grow and expand globally Strong Margins fueled by high - growth digital services & SaaS products Prudent Cost Management proven by past execution Growing Free Cash Flow for reducing debt and investing in growth Optimized Capital Structure that is stable and cost - effective Proven Leadership Team with deep industry experience 1 2 3 4 5 6 7 FINANCIAL HIGHLIGHTS 33

Appendix 34 These materials are not to be printed, downloaded or distributed. These materials are only available to QIBs and non - US persons.

Source: Public filings 1 Other items, net includes items such as severance expense, other restructuring expenses and costs associated with the Compa ny' s strategic review process LEGACY MDC NON - GAAP RECONCILIATION APPENDIX Fiscal year ended Dec. 31, LTM $M 2018 2019 2020 Q3'20 Q4'20 Q1'21 Q2'21 6/30/21 Net income (loss) attributable to MDC Partners Inc. common shareholders (138.6) (17.6) (243.3) 0.4 (237.1) 0.9 1.7 (234.2) Adjustments to reconcile to operating income (loss): Accretion on and net income allocated to convertible preference shares 8.6 12.3 14.3 3.7 3.7 4.1 4.5 15.9 Net income attributable to the noncontrolling interest 11.8 16.2 21.8 10.7 7.2 4.5 8.2 30.6 Equity in losses of non - consolidated affiliates (0.1) (0.4) 2.2 0.0 1.4 0.5 0.2 2.1 Income tax expense (benefit) 29.6 10.3 116.6 1.5 109.5 1.3 1.4 113.7 Interest expense and finance charges, net 67.1 64.9 62.2 15.3 15.3 19.1 19.5 69.2 Foreign exchange loss (gain) 23.3 (8.8) 1.0 (2.2) (6.3) (2.1) (1.9) (12.4) Other, net (0.2) 2.4 (20.5) (0.5) 2.2 (0.6) (0.8) 0.3 Operating income (loss) $1.4 $79.5 ($45.8) $28.9 ($104.1) $27.7 $32.6 ($14.9) Adjustments to reconcile to Adjusted EBITDA: Depreciation and amortization 46.2 38.3 36.9 9.3 9.5 8.2 8.0 35.0 Impairment and other losses 87.2 8.6 96.4 0.2 77.2 0.9 -- 78.3 Stock - based compensation 18.4 31.0 14.2 6.5 3.6 (2.0) 6.9 15.0 Deferred acquisition consideration (0.5) 5.4 42.2 2.8 41.7 11.7 5.6 61.8 Distributions from non - consolidated affiliates 0.8 2.0 2.2 0.2 0.9 0.0 0.5 1.6 Other items, net 1 7.9 9.3 31.2 6.2 18.7 5.5 6.6 37.0 Adjusted EBITDA $161.5 $174.2 $177.3 $54.1 $47.5 $51.9 $60.3 $213.8

Source: Public filings 1 Other items, net includes items such as severance expense, other restructuring expenses and costs associated with the Compa ny' s strategic review process LEGACY STAGWELL GROUP NON - GAAP RECONCILIATION APPENDIX Fiscal year ended Dec. 31, LTM $M 2018 2019 2020 Q3'20 Q4'20 Q1'21 Q2'21 6/30/2021 Net Income 1 18.4 20.7 71.5 21.4 32.7 4.6 18.7 77.4 Equity in (losses) earnings of unconsolidated affiliates (1.9) 0.2 (0.1) 0.0 (0.1) (0.0) 0.0 (0.1) Provision for income taxes 4.5 10.0 5.9 2.6 2.7 0.7 3.3 9.3 Other (income) expense net (11.4) 1.1 0.2 0.6 1.9 (0.6) 0.5 2.4 Interest expense, net 6.4 8.7 6.2 1.8 1.6 1.4 1.9 6.7 Depreciation & amortization 21.8 35.7 41.0 10.0 11.2 11.0 10.4 42.6 Deferred acquisition consideration adjustments 28.3 15.7 4.5 0.1 3.3 3.9 2.1 9.4 Other items, net 4.4 6.8 13.9 0.6 10.9 2.9 1.8 16.2 Adjusted EBITDA $70.4 $98.8 $143.2 $37.1 $64.2 $23.8 $38.7 $163.9

Thank You Contact Us IR@stagwellglobal.com