Management Presentation

May 8, 2007

First Quarter 2007 Results

Exhibit

99.2

Forward Looking Statements and Other Information

This presentation contains forward-looking statements. The Company’s representatives may also make forward-looking statements orally from time to time.

Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, recent business and economic

trends, potential acquisitions, estimates of amounts for deferred acquisition consideration and “put” option rights, constitute forward-looking statements.

These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in

this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them

in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those

contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

risks associated with effects of national and regional economic conditions;

the Company’s ability to attract new clients and retain existing clients;

the financial success of the Company’s clients;

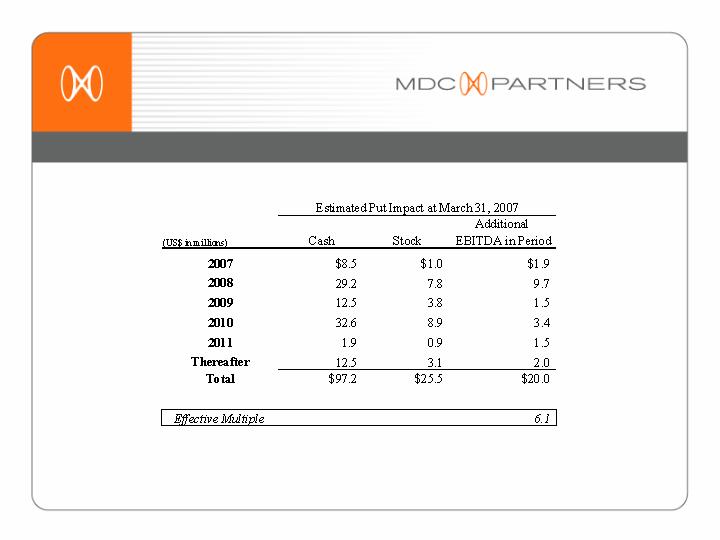

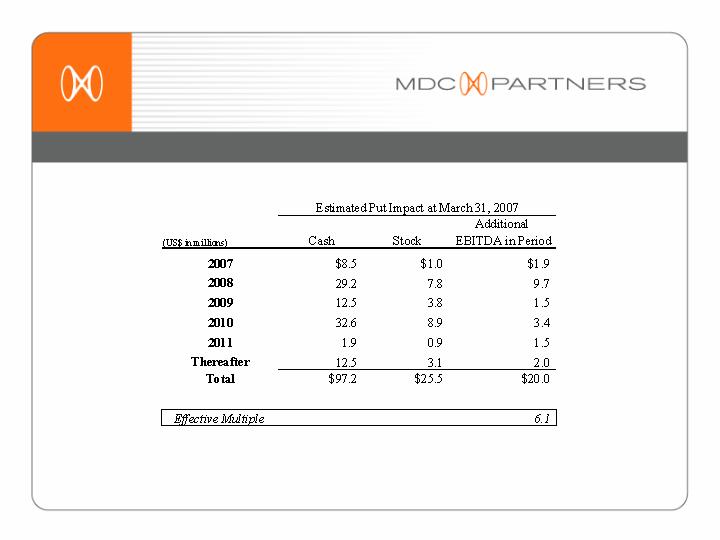

the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations

when due and payable, including but not limited to those relating to “put” option rights;

the Company’s ability to refinance its debt facilities prior to September 21, 2007;

the Company’s ability to retain and attract key employees;

the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities;

foreign currency fluctuations; and

risks arising from the Company’s historical option grant practices.

The Company’s business strategy includes ongoing efforts to engage in material acquisitions of ownership interests in entities in the marketing

communications services industry. The Company intends to finance these acquisitions by using available cash from operations and through incurrence of

bridge or other debt financing, either of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on

existing shareholders proportionate ownership. At any given time the Company may be engaged in a number of discussions that may result in one or more

material acquisitions. These opportunities require confidentiality and may involve negotiations that require quick responses by the Company. Although there

is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such

transaction may lead to increased volatility in the trading price of the Company’s securities.

Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10-K under the

caption “Risk Factors” and in the Company’s other SEC filings.

1

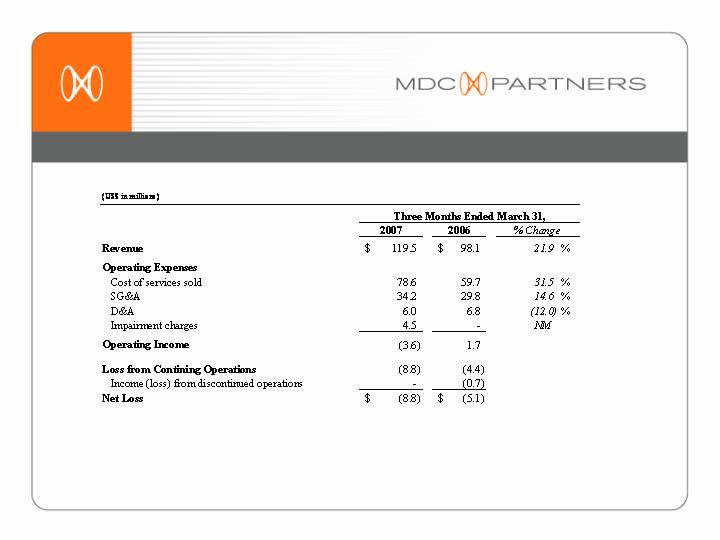

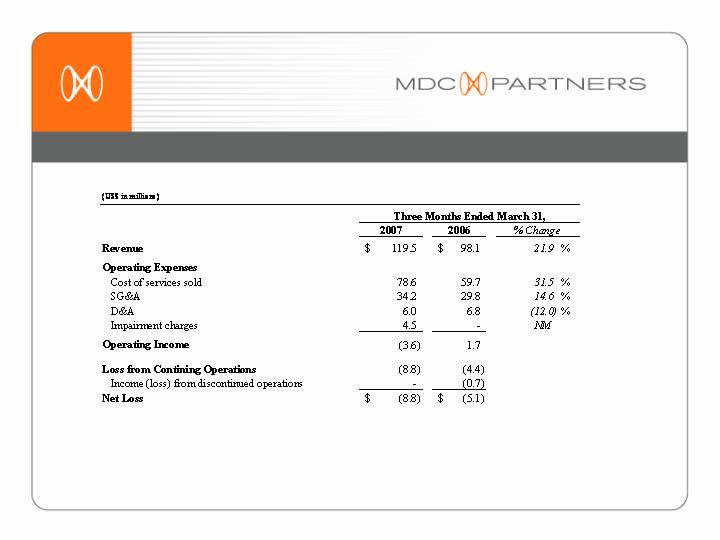

Summary of Consolidated Results

Amounts and percentages may not foot due to rounding.

2

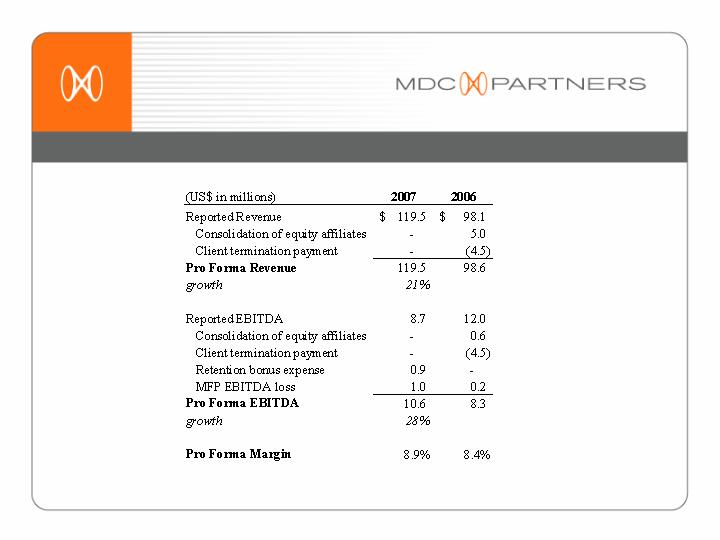

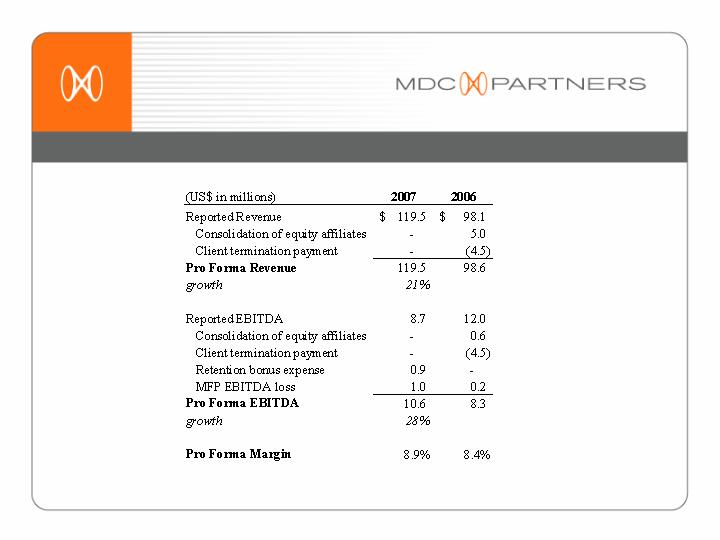

Normalized Results

3

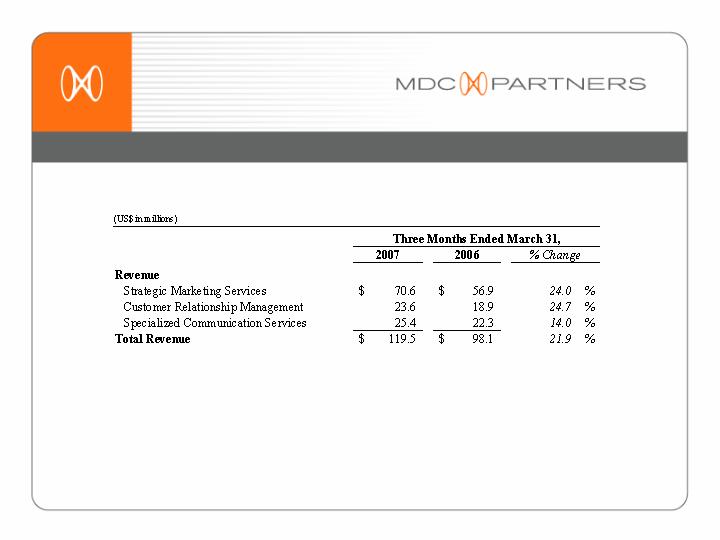

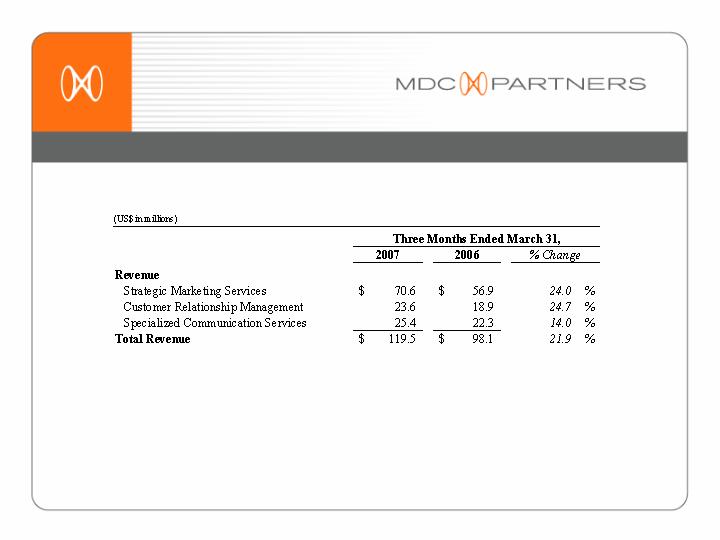

Summary of Segment Results – Revenue

Amounts and percentages may not foot due to rounding.

4

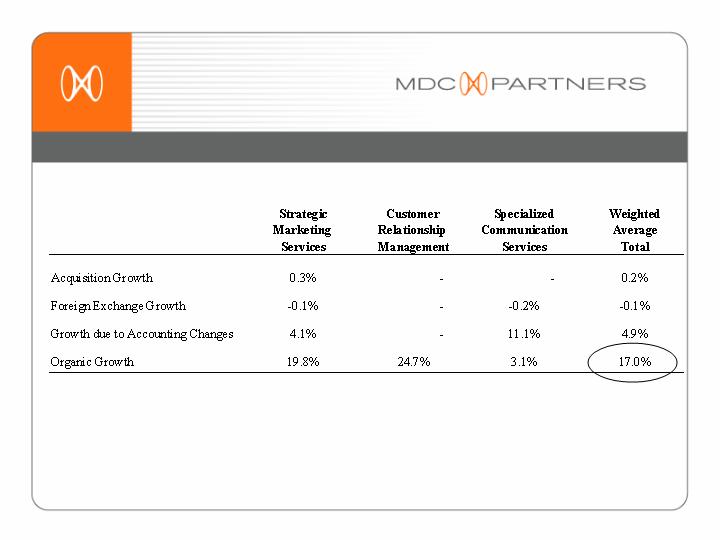

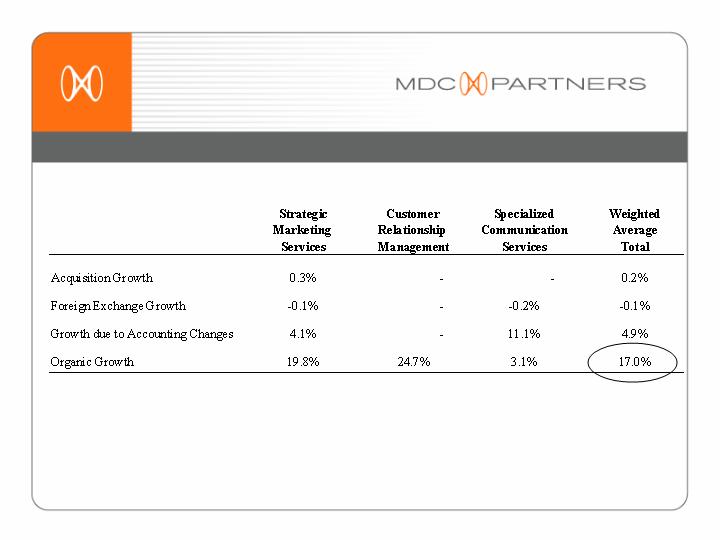

Q1 2007 Marketing Communications Revenue Growth by Segment

5

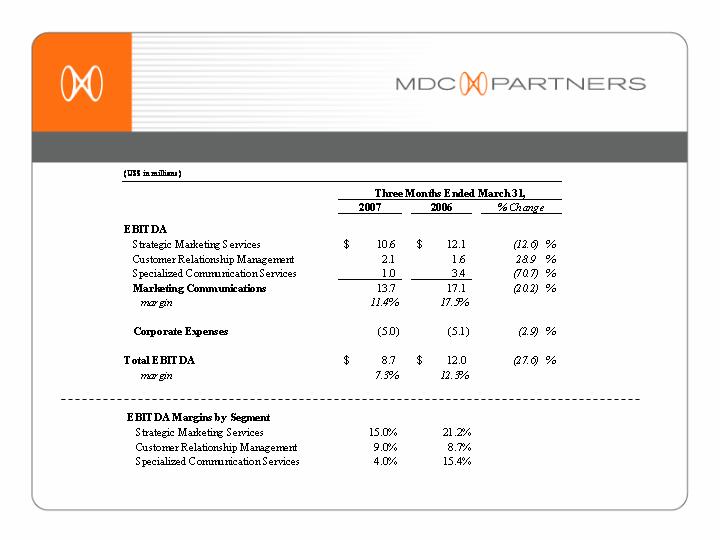

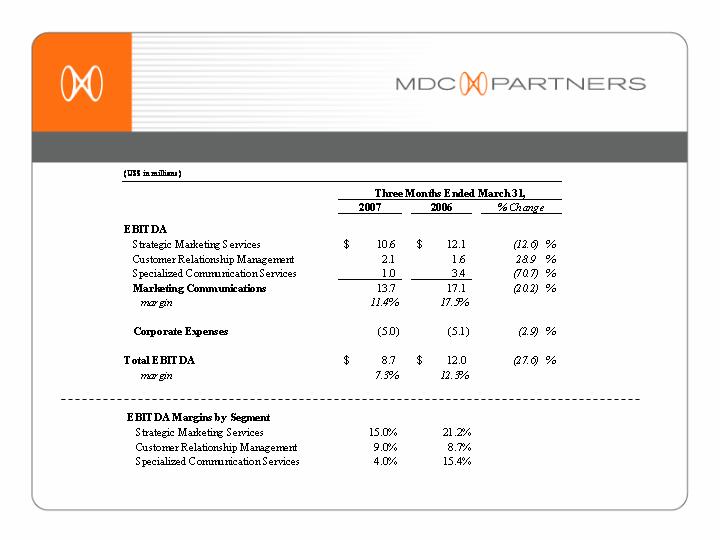

Summary of Segment Results – EBITDA

Amounts and percentages may not foot due to rounding.

6

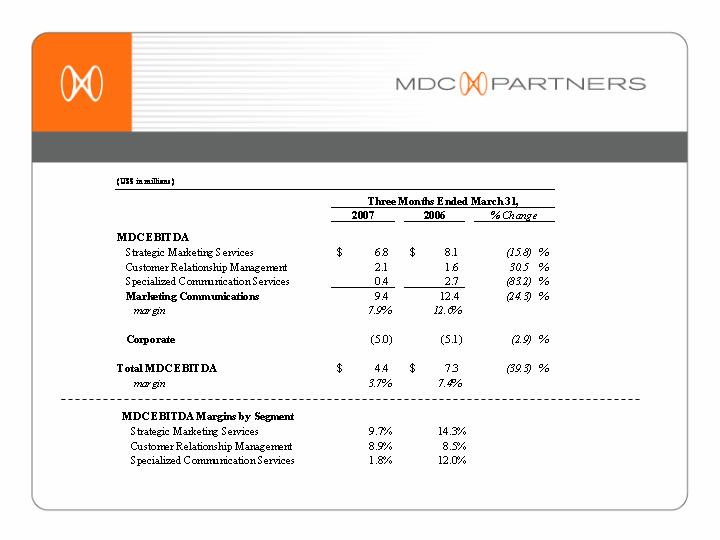

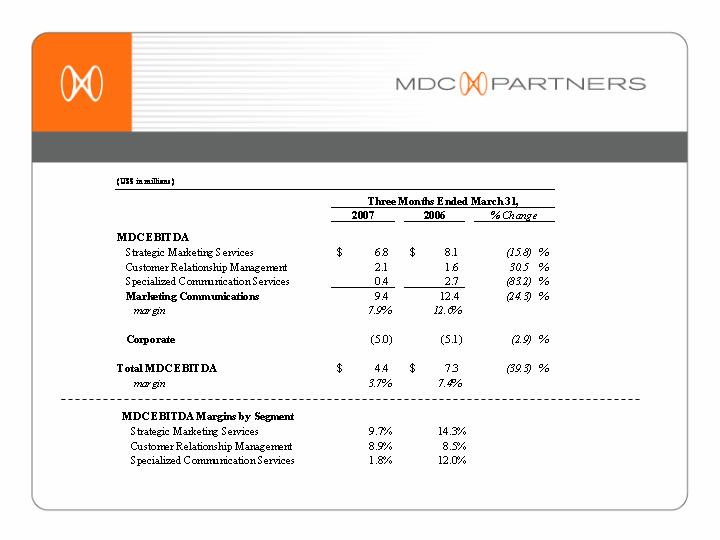

Summary of Segment Results – MDC’s Share of EBITDA

Amounts and percentages may not foot due to rounding.

7

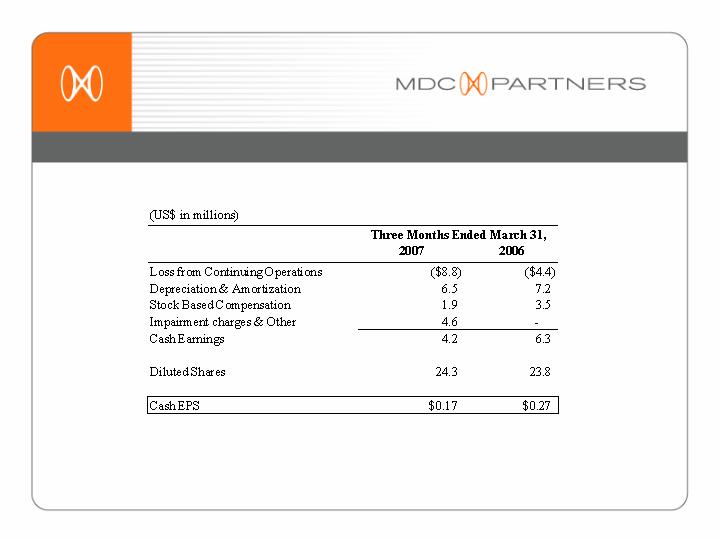

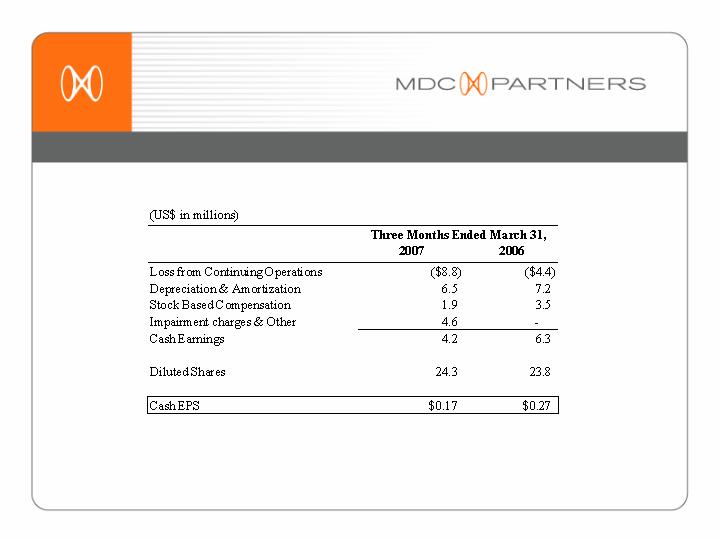

Cash EPS Reconciliation

8

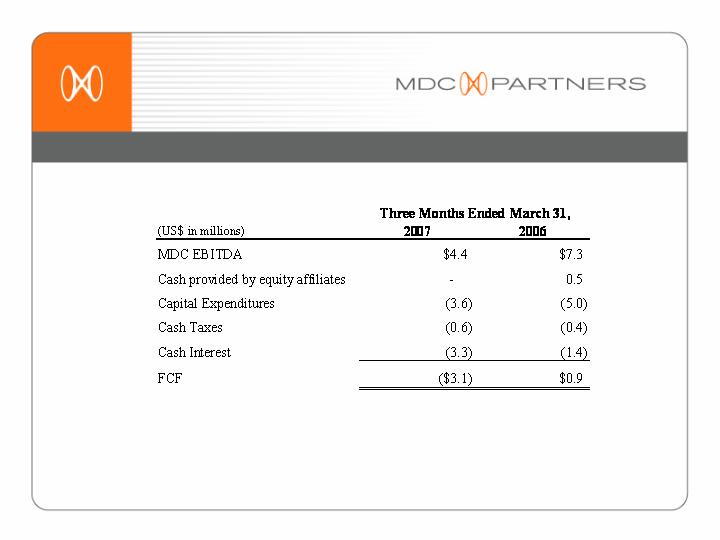

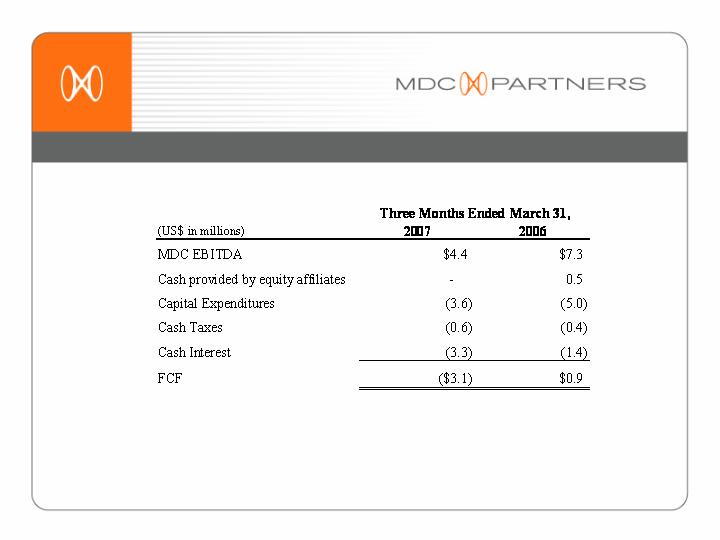

Free Cash Flow

9

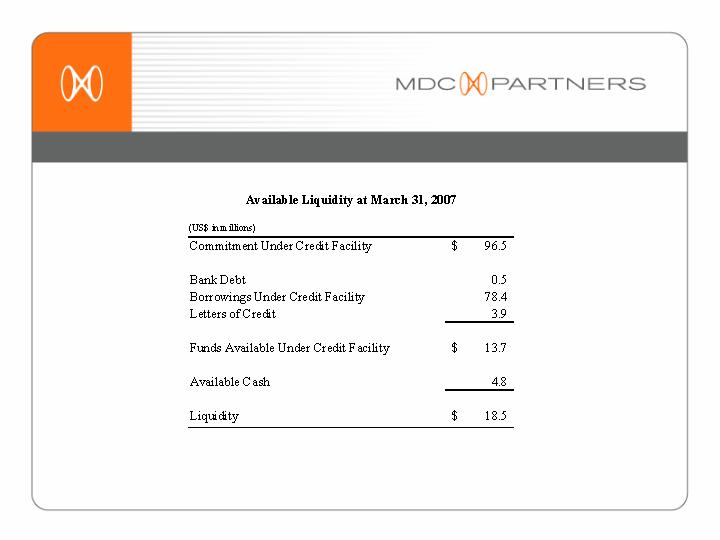

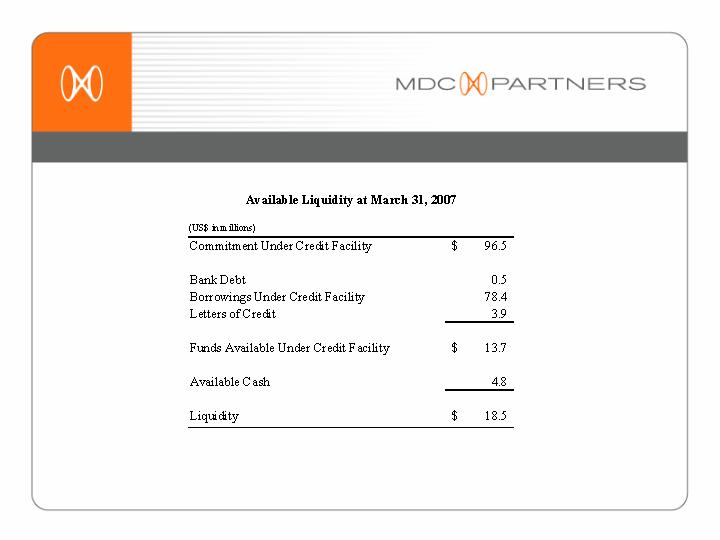

Liquidity Profile

10

Potential Contractual Put Obligations and Impact on EBITDA

11

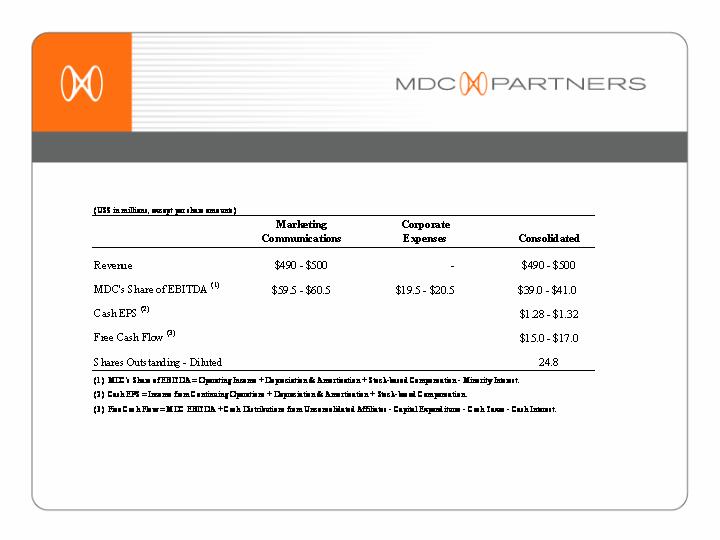

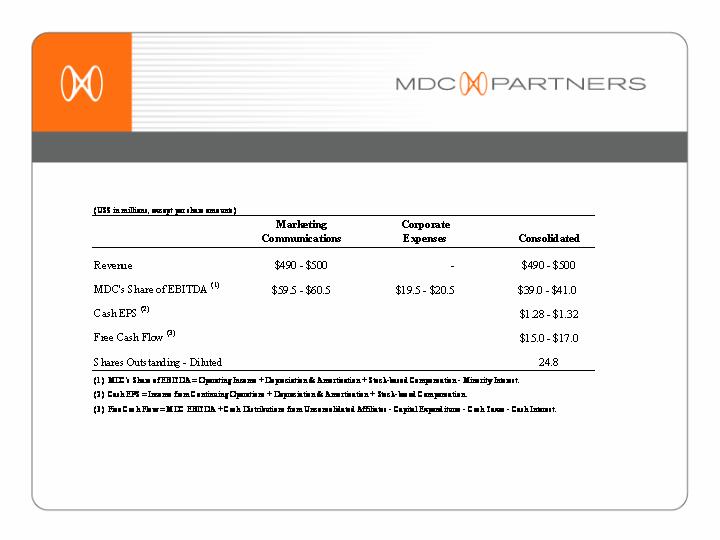

2007 Financial Outlook

12

2007 Organic Growth Outlook

13

Definition of Non-GAAP Measures

EBITDA: EBITDA is a non-GAAP measure, that represents operating profit plus depreciation and amortization, stock-based compensation and impairment charges. A reconciliation of “EBITDA” to the US GAAP reported results of operations has been provided by the Company in the tables included in the earnings release issued on May 8, 2007.

Organic Growth: Organic revenue growth is a non-GAAP measure that refers to growth in revenues from sources other than acquisitions or foreign exchange impacts.

Cash Earnings: Cash earnings is a non-GAAP measure that represents loss from continuing operations plus depreciation and amortization, stock based compensation and other non-cash charges.

Free Cash Flow: Free cash flow is a non-GAAP measure that represents EBTIDA less minority interest plus cash distributions from unconsolidated affiliates less capital expenditures, less cash interest, less cash taxes.

14