April 4, 2012 Updated Guidance Investor Call

This presentation contains forward-looking statements. The Company’s representatives may also make forward-looking statements orally from time to time. Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, recent business and economic trends,potential acquisitions, estimates of amounts for deferred acquisition consideration and “put”option rights, constitute forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of newinformation or future events, if any. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following: •risks associated with severe effects of international, national, and regional economic downturn; •the Company’s ability to attract new clients and retain existing clients; •the spending patterns and financial success of the Company’s clients; •the Company’s ability to retain and attract key employees; •the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to “put”option rights and deferred acquisition consideration; •the successful completion and integration of acquisitions whichcomplement and expand the Company’s business capabilities; and •foreign currency fluctuations. The Company’s business strategy includes ongoing efforts to engage in material acquisitions of ownership interests in entities in the marketing communications services industry. The Company intends to financethese acquisitions by using available cash from operations, from borrowings under its current Financing Agreement and through incurrence of bridge or other debt financing, either of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on existing shareholders proportionate ownership. At any given time the Company may be engaged in a number of discussions that may result in one or more material acquisitions. These opportunities require confidentiality and may involve negotiations that require quick responses by the Company. Although there is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such transaction may lead to increased volatility in the trading price of the Company’s securities. Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10-K under the caption “Risk Factors”and in the Company’s other SEC filings. FORWARD LOOKING STATEMENT & OTHER INFORMATION

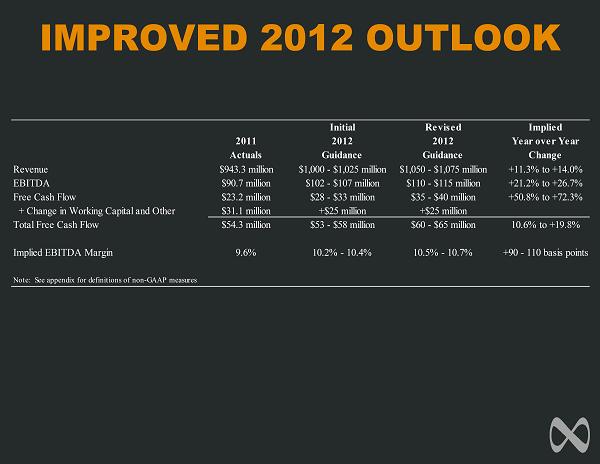

HIGHLIGHTS • Increasing financial guidance to reflect the enhanced financial performance of MDC Partners • Completed investments in integrated advertising agency Doner, leading media firm TargetCast and social commerce agency Dotbox, and formed joint venture in Brazil • Increasing 2012 financial guidance by $50 million of revenues to$1.050 billion to $1.075 billion, $8 million of EBITDA to $110 million to $115 million, and $7 million of Free Cash Flow to $35 million to $40 million • This implies revenue growth of +12.6% at the midpoint, EBITDA growth of +24.0%, and Free Cash Flow growth of +61.6% • Margin expansion revised to +90 to +110 basis points, an enhancement of +30 basis points from prior expectations • Net debt as of March 31 is below $340 million, including approximately $5-10 million of excess cash and zero net borrowings under our $150 million credit facility --Management reaffirms its target of net debt to EBITDA leverage of between 3.0x and 3.5x at year end 2012 and between 2.5x and 3.0x at year end 2013

WHAT IS THE SIGNIFICANCE In the first quarter of 2012, MDC invested in three key new growth vehicles: •Doner–Highly regarded, integrated creative agency with scaled network capabilities servicing 35 multi-national clients in North America and Europe •TargetCast–Leading independent integrated media buying and planning agency with strong digital capabilities adding significant scaleto the Maxxcom Global Media platform •Dotbox–Emerging Social Commerce agency with hybrid SAAS and agency model In total we expect these transactions to add $50 million of revenues and $8 million of EBITDA in 2012 –this brings expected margin expansion to +90 to +110 basis points versus 2011

One of the largest remaining still fully integrated creative agencies with 600 employees and offices in Detroit, Cleveland, London and Newport Beach •Young, entrepreneurial and experienced management team •Key clients include:Chrysler, Jeep, Dodge, Ram, Fiat, Autozone, Harman, The Coca-Cola Company, ADT, DuPont, The UPS Store, Perkins, Choice Hotels International and Avery Dennison, AutoTrader.com, Shell Lubricants, Sherwin-Williams, Coleman, Cox Communications, Chiquita •Capabilities include:Full service integrated agency with in-house digital and integrated production, media buying and planning services, analytics and optimization Well poised for significant incremental growth both in North America and abroad given MDC’s international capabilities

A NEW MEDIA MODEL MAXXCOM GLOBAL MEDIA • Integrated media platform with billings of over $3 billion Positioned to create a new media model based upon innovation, creativity and enhanced return on marketing investment by leveraging data and technology to drive measurable, superior performance

IMPROVED 2012 OUTLOOK Initial Revised Implied 2011 2012 2012 Year over Year Actuals Guidance Guidance Change Revenue $943.3 million $1,000 - $1,025 million $1,050 - $1,075 million +11.3% to +14.0% EBITDA $90.7 million $102 - $107 million $110 - $115 million +21.2% to +26.7% Free Cash Flow $23.2 million $28 - $33 million $35 - $40 million +50.8% to +72.3% + Change in Working Capital and Other $31.1 million +$25 million +$25 million Total Free Cash Flow $54.3 million $53 - $58 million $60 - $65 million 10.6% to +19.8% Implied EBITDA Margin 9.6% 10.2% - 10.4% 10.5% - 10.7% +90 - 110 basis points Note: See appendix for definitions of non-GAAP measures

APPENDIX

DEFINITION OF NON-GAAP MEASURES • EBITDA: EBITDA is a non-GAAP measure, that represents operating profit plus depreciationand amortization, stock- based compensation, acquisition deal costs, deferred acquisitionconsideration adjustments and profit distributions from affiliates. • Organic Growth: Organic revenue growth is a non-GAAP measure that refers to growth in revenues from sources other than acquisitions or foreign exchange impacts. • Free Cash Flow: Free cash flow is a non-GAAP measure that represents EBITDA less net income attributableto noncontrollinginterests, less capital expenditures net of landlord reimbursements, less net cash interest (including interest paid and to be paid on the 11% Senior Notes), less cash taxes plus realized cash foreign exchange gains. • Total Free Cash Flow:Total free cash flow is a non-GAAP measure that represents free cash flow plus changes in working capital plus other changes in cash. • Net Debt or Net Bank Debt: Debt due pertaining to the revolving credit facility plus debt pertaining to the Senior Notes less total cash and cash equivalents. Note: A reconciliation of Non-GAAP to US GAAP reported results has been provided by the Company in the tables included in the earnings release issued on February 27, 2012.

April 4, 2012 Updated Guidance Investor Call