Exhibit 99.2

February 18, 2016 Management Presentation Fourth Quarter & Full Year 2015 Results

2 FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation, including our “ 2016 Financial Outlook”, contains forward - looking statements . The Company’s representatives may also make forward - looking statements orally from time to time . Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, earnings guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward - looking statements . These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined below . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any . Forward - looking statements involve inherent risks and uncertainties . A number of important factors could cause actual results to differ materially from those contained in any forward - looking statements . Such risk factors include, but are not limited to, the following : • risks associated with the SEC’s ongoing investigation and the related class action litigation claims ; • risks associated with severe effects of international, national and regional economic downturn ; • the Company’s ability to attract new clients and retain existing clients; • the spending patterns and financial success of the Company’s clients; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent pa yme nt obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the successful completion and integration of acquisitions which compliment and expand the Company’s business capabilities; an d • foreign currency fluctuations. The Company’s business strategy includes ongoing efforts to engage in acquisitions of ownership interests in entities in the marketing communications services industry . The Company intends to finance these acquisitions by using available cash from operations and through incurrence of bridge or other debt financing, either of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on existing shareholders proportionate ownership . At any given time the Company may be engaged in a number of discussions that may result in one or more acquisitions . These opportunities require confidentiality and may involve negotiations that require quick responses by the Company . Although there is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such transaction may lead to increased volatility in the trading price of the Company’s securities . Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10 - K under the caption “Risk Factors” and in the Company’s other SEC filings .

3 FOURTH QUARTER 2015 SUMMARY » Industry leading topline growth » Strong Adjusted EBITDA growth and margin expansion, despite clean - up costs associated with leadership transition » Robust cash generation » Execution on growth initiatives such as International, Media Buying & Planning, and Data Science & Technology becoming key drivers of financial performance » Clear visibility for continued market share gains from strong new business results and pipeline » Continued focus on prudent capital allocation and achieving leverage target

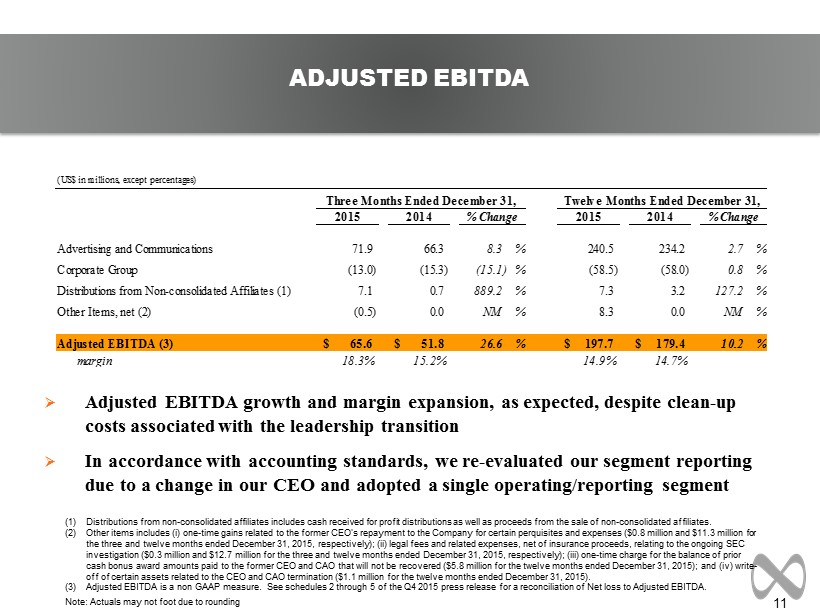

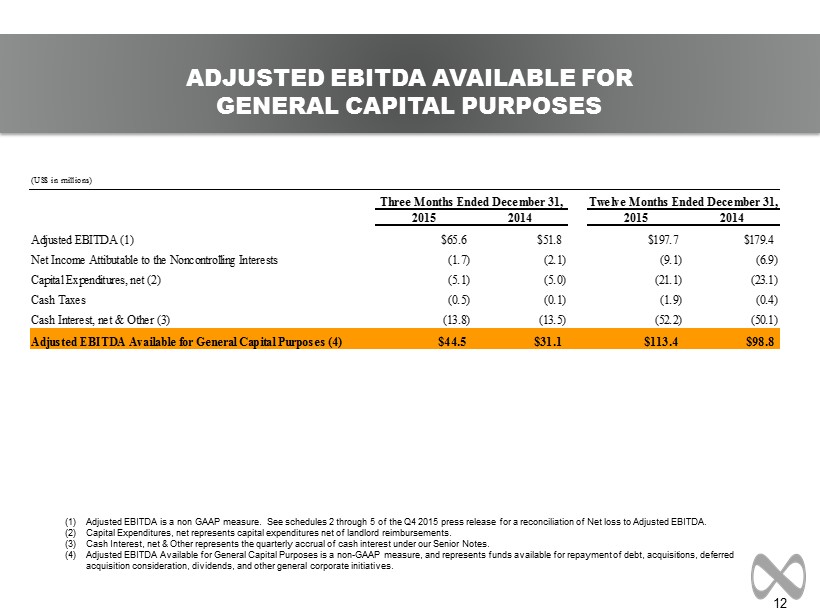

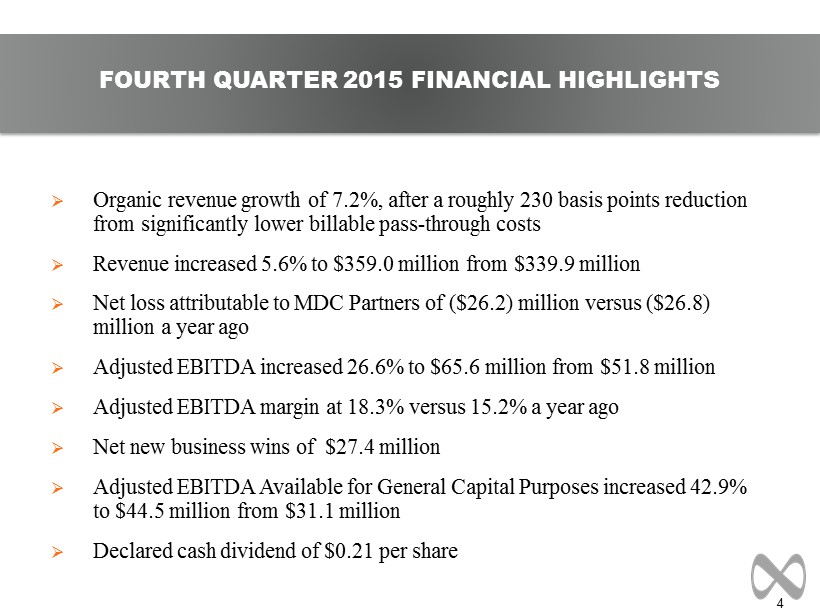

4 » Organic revenue growth of 7.2%, after a roughly 230 basis points reduction from significantly lower billable pass - through costs » Revenue increased 5.6% to $359.0 million from $339.9 million » Net loss attributable to MDC Partners of ($26.2) million versus ($26.8) million a year ago » Adjusted EBITDA increased 26.6% to $65.6 million from $51.8 million » Adjusted EBITDA margin at 18.3% versus 15.2% a year ago » Net new business wins of $27.4 million » Adjusted EBITDA Available for General Capital Purposes increased 42.9% to $44.5 million from $31.1 million » Declared cash dividend of $0.21 per share FOURTH QUARTER 2015 FINANCIAL HIGHLIGHTS

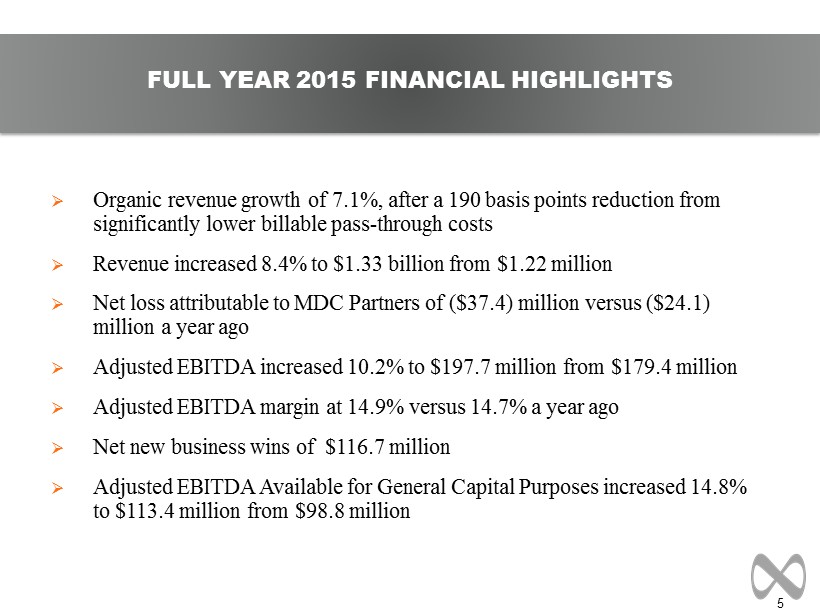

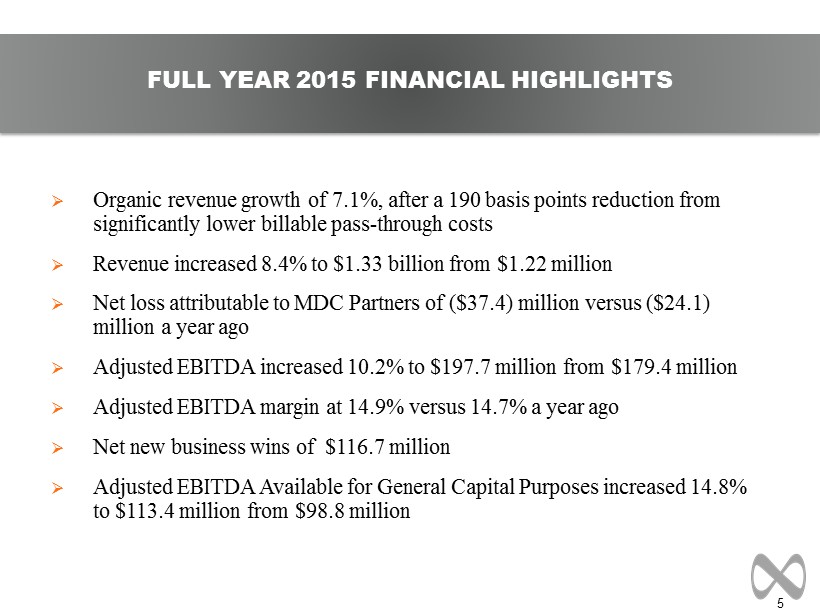

5 » Organic revenue growth of 7.1%, after a 190 basis points reduction from significantly lower billable pass - through costs » Revenue increased 8.4% to $1.33 billion from $1.22 million » Net loss attributable to MDC Partners of ($37.4) million versus ($24.1) million a year ago » Adjusted EBITDA increased 10.2% to $ 197.7 million from $179.4 million » Adjusted EBITDA margin at 14.9% versus 14.7% a year ago » Net new business wins of $116.7 million » Adjusted EBITDA Available for General Capital Purposes increased 14.8% to $113.4 million from $98.8 million FULL YEAR 2015 FINANCIAL HIGHLIGHTS

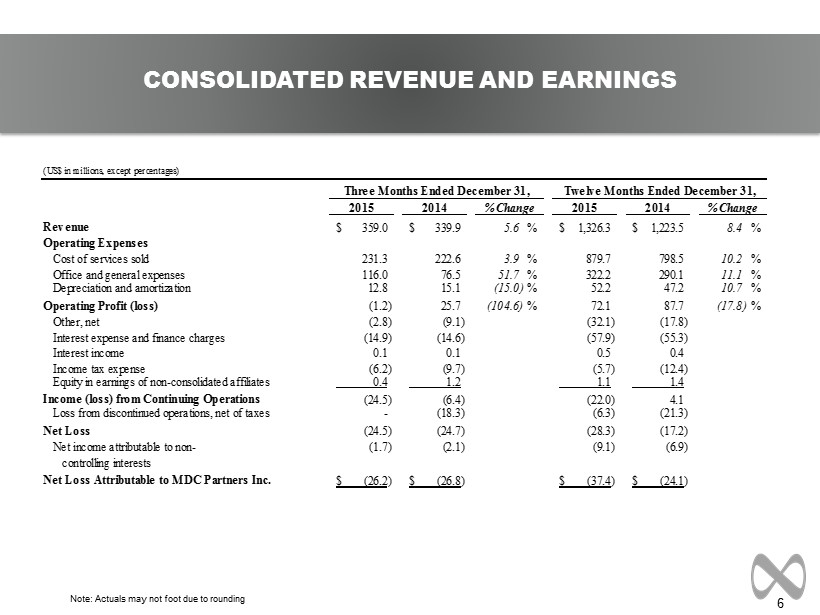

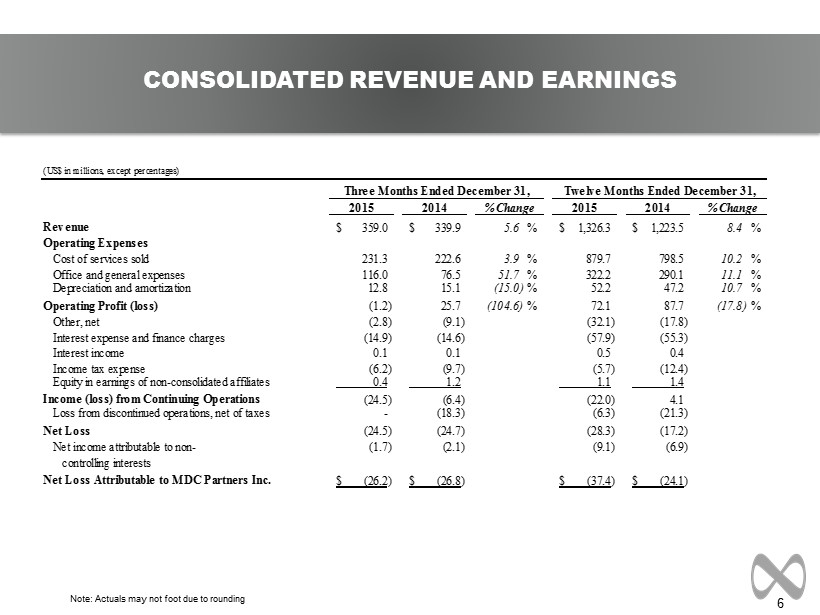

6 Note: Actuals may not foot due to rounding CONSOLIDATED REVENUE AND EARNINGS (US$ in millions, except percentages) 2015 2014 2015 2014 Revenue 359.0$ 339.9$ 5.6 % 1,326.3$ 1,223.5$ 8.4 % Operating Expenses Cost of services sold 231.3 222.6 3.9 % 879.7 798.5 10.2 % Office and general expenses 116.0 76.5 51.7 % 322.2 290.1 11.1 % Depreciation and amortization 12.8 15.1 (15.0) % 52.2 47.2 10.7 % Operating Profit (loss) (1.2) 25.7 (104.6) % 72.1 87.7 (17.8) % Other, net (2.8) (9.1) (32.1) (17.8) Interest expense and finance charges (14.9) (14.6) (57.9) (55.3) Interest income 0.1 0.1 0.5 0.4 Income tax expense (6.2) (9.7) (5.7) (12.4) Equity in earnings of non-consolidated affiliates 0.4 1.2 1.1 1.4 Income (loss) from Continuing Operations (24.5) (6.4) (22.0) 4.1 Loss from discontinued operations, net of taxes - (18.3) (6.3) (21.3) Net Loss (24.5) (24.7) (28.3) (17.2) Net income attributable to non- (1.7) (2.1) (9.1) (6.9) controlling interests Net Loss Attributable to MDC Partners Inc. (26.2)$ (26.8)$ (37.4)$ (24.1)$ % Change Three Months Ended December 31, Twelve Months Ended December 31, % Change

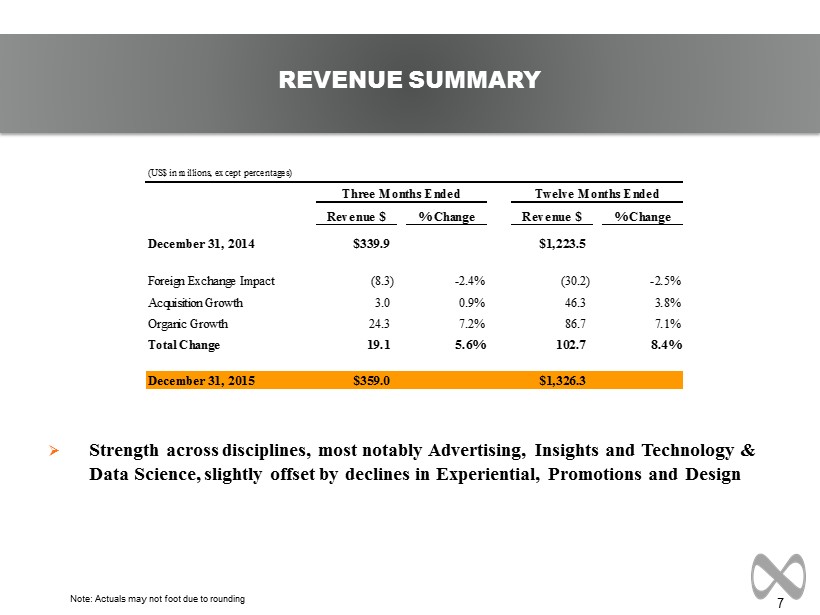

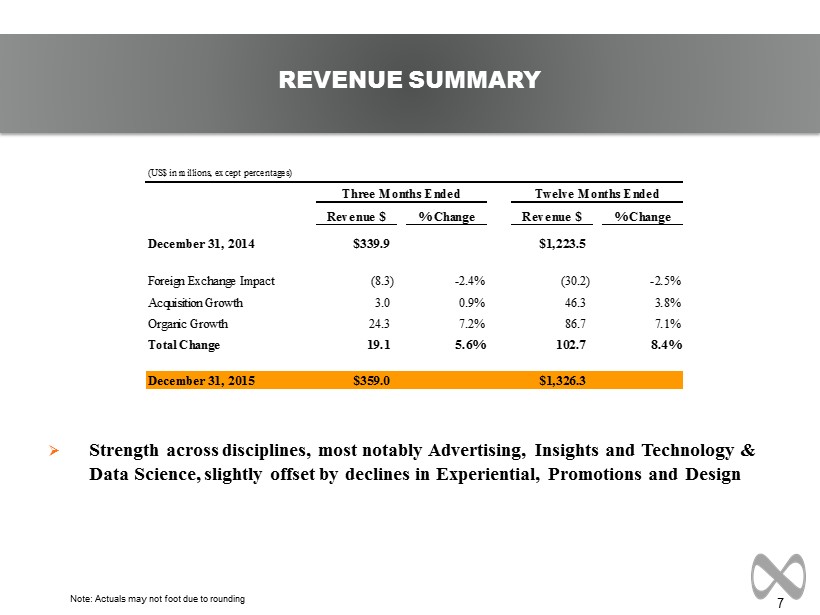

7 » Strength across disciplines, most notably Advertising, Insights and Technology & Data Science, slightly offset by declines in Experiential, Promotions and Design REVENUE SUMMARY Note: Actuals may not foot due to rounding (US$ in millions, except percentages) Revenue $ % Change Revenue $ % Change December 31, 2014 $339.9 $1,223.5 Foreign Exchange Impact (8.3) -2.4% (30.2) -2.5% Acquisition Growth 3.0 0.9% 46.3 3.8% Organic Growth 24.3 7.2% 86.7 7.1% Total Change 19.1 5.6% 102.7 8.4% December 31, 2015 $359.0 $1,326.3 Three Months Ended Twelve Months Ended

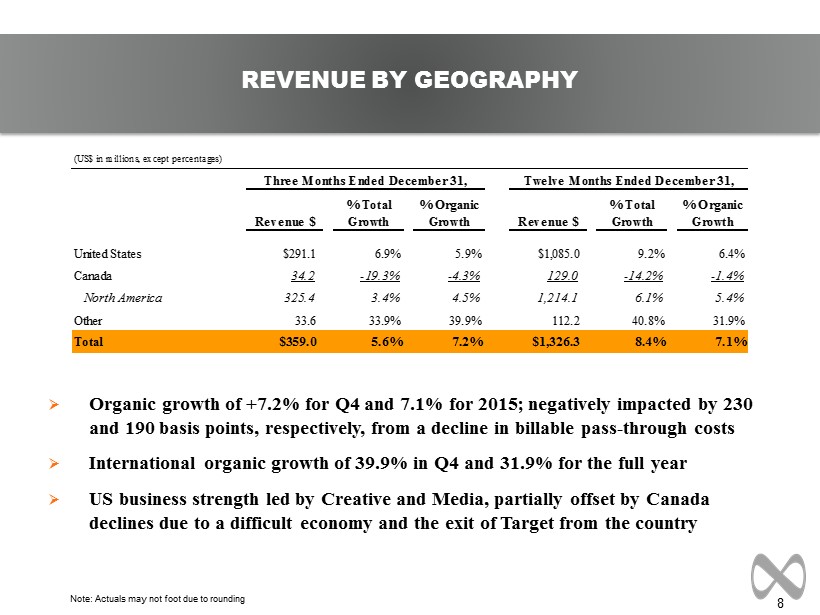

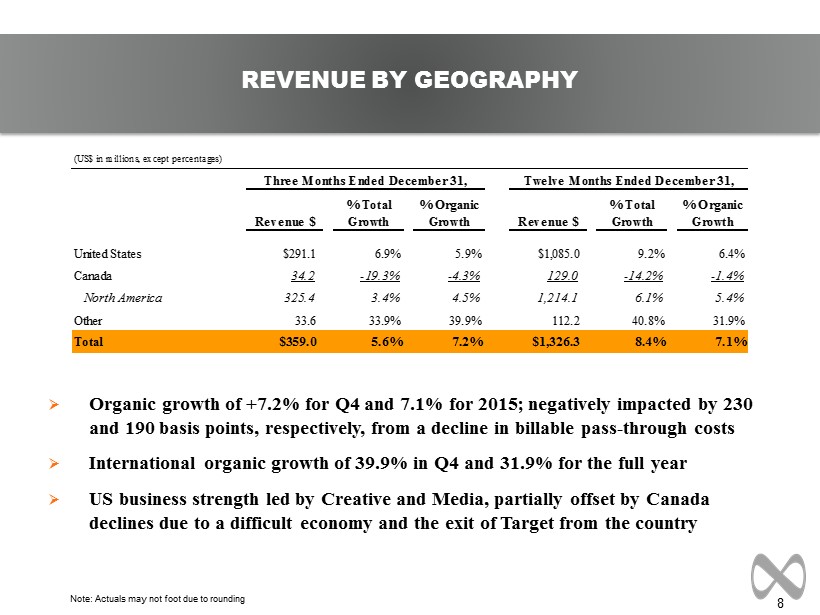

8 REVENUE BY GEOGRAPHY Note: Actuals may not foot due to rounding » Organic growth of +7.2% for Q4 and 7.1% for 2015; negatively impacted by 230 and 190 basis points, respectively, from a decline in billable pass - through costs » International organic growth of 39.9% in Q4 and 31.9% for the full year » US business strength led by Creative and Media, partially offset by Canada declines due to a difficult economy and the exit of Target from the country (US$ in millions, except percentages) % Total % Organic % Total % Organic Revenue $ Growth Growth Revenue $ Growth Growth United States $291.1 6.9% 5.9% $1,085.0 9.2% 6.4% Canada 34.2 -19.3% -4.3% 129.0 -14.2% -1.4% North America 325.4 3.4% 4.5% 1,214.1 6.1% 5.4% Other 33.6 33.9% 39.9% 112.2 40.8% 31.9% Total $359.0 5.6% 7.2% $1,326.3 8.4% 7.1% Three Months Ended December 31, Twelve Months Ended December 31,

9 Q4 2015 Mix Year - over - Year Growth by Category » Fastest growing client sectors: Healthcare, Technology, Communications, Consumer Products » Diversification continues: Top 10 clients declined to 24.1% of revenue in Q4 2015 from 24.3% a year ago (largest <4%) REVENUE BY CLIENT INDUSTRY * Excludes discontinued operations Note : Actuals may not foot due to rounding. Year - over - year category growth shown on a reported basis. Q4 2015 Full Year 2015 Above 10% Technology, Healthcare, Communications Healthcare, Technology, Consumer Products, Automotive, Food & Beverage 0% to 10% Food & Beverage, Automotive, Consumer Products Communications Below 0% Retail, Financials Retail, Financials

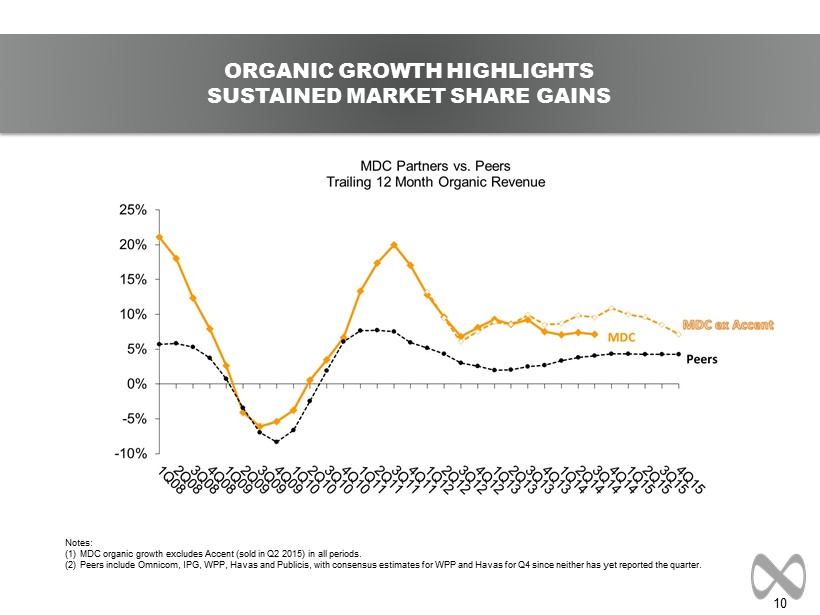

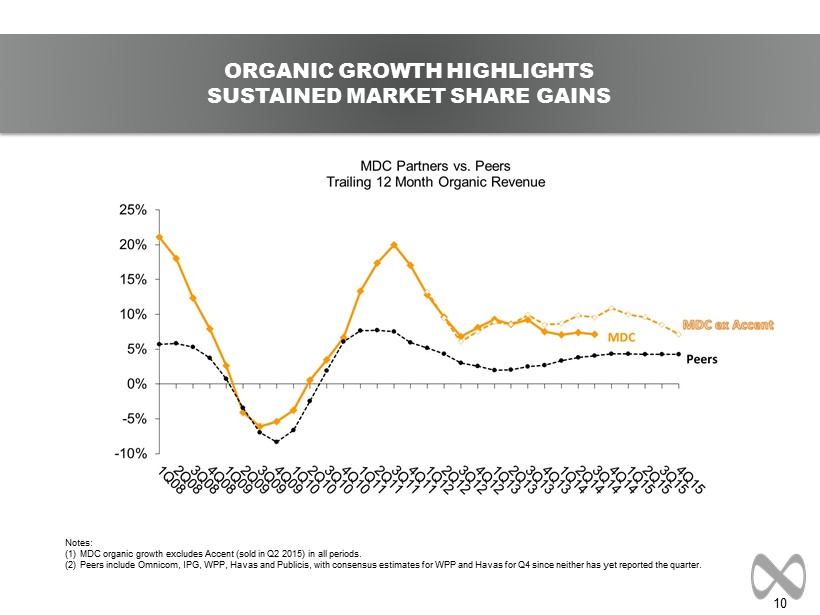

10 ORGANIC GROWTH HIGHLIGHTS SUSTAINED MARKET SHARE GAINS Notes: (1) MDC organic growth excludes Accent (sold in Q2 2015) in all periods. (2) Peers include Omnicom, IPG, WPP, Havas and Publicis , with consensus estimates for WPP and Havas for Q4 since neither has yet reported the quarter.

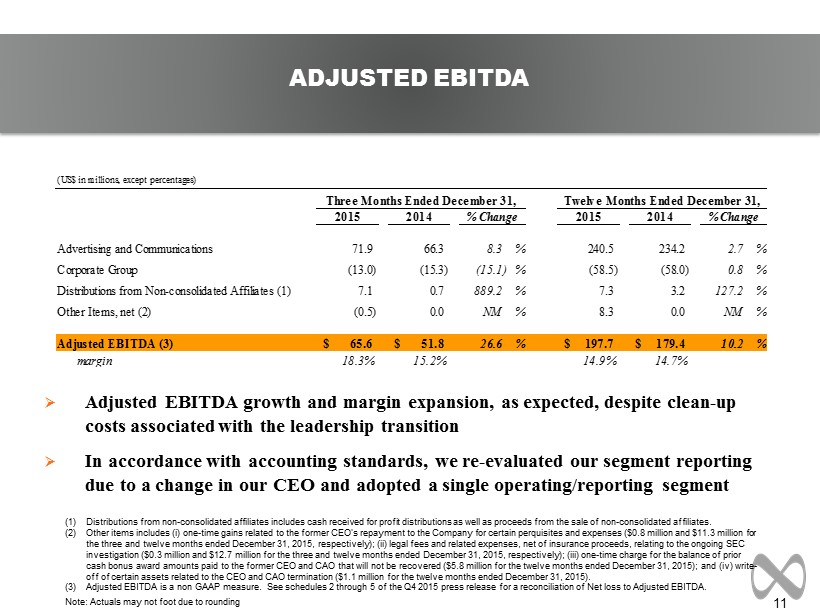

11 Note: Actuals may not foot due to rounding » Adjusted EBITDA growth and margin expansion, as expected, despite clean - up costs associated with the leadership transition » In accordance with accounting standards, we re - evaluated our segment reporting due to a change in our CEO and adopted a single operating/reporting segment ADJUSTED EBITDA (1) Distributions from non - consolidated affiliates includes cash received for profit distributions as well as proceeds from the sale of non - consolidated affiliates. (2) Other items includes ( i ) one - time gains related to the former CEO's repayment to the Company for certain perquisites and expenses ($0.8 million and $11 .3 million for the three and twelve months ended December 31, 2015, respectively); (ii) legal fees and related expenses, net of insurance proceeds, relating to the ongoing SEC investigation ($0.3 million and $12.7 million for the three and twelve months ended December 31, 2015, respectively); (iii) o ne - time charge for the balance of prior cash bonus award amounts paid to the former CEO and CAO that will not be recovered ($5.8 million for the twelve months ended Dec ember 31, 2015 ) ; and (iv) write - off of certain assets related to the CEO and CAO termination ($1.1 million for the twelve months ended December 31, 2015 ). (3) Adjusted EBITDA is a non GAAP measure. See schedules 2 through 5 of the Q4 2015 press release for a reconciliation of Net lo ss to Adjusted EBITDA . (US$ in millions, except percentages) 2015 2014 2015 2014 Advertising and Communications 71.9 66.3 8.3 % 240.5 234.2 2.7 % Corporate Group (13.0) (15.3) (15.1) % (58.5) (58.0) 0.8 % Distributions from Non-consolidated Affiliates (1) 7.1 0.7 889.2 % 7.3 3.2 127.2 % Other Items, net (2) (0.5) 0.0 NM % 8.3 0.0 NM % Adjusted EBITDA (3) 65.6$ 51.8$ 26.6 % 197.7$ 179.4$ 10.2 % margin 18.3% 15.2% 14.9% 14.7% % Change Three Months Ended December 31, Twelve Months Ended December 31, % Change

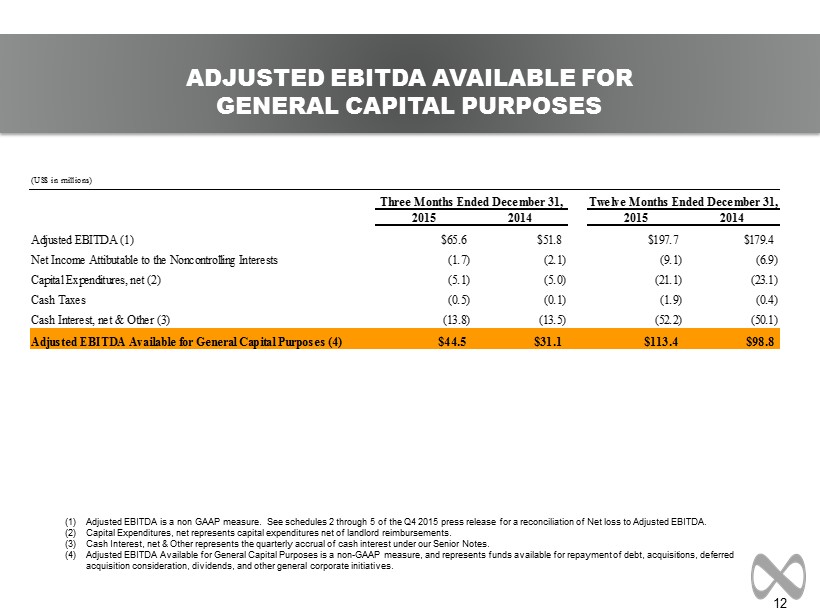

12 Note: Actuals may not foot due to rounding ADJUSTED EBITDA AVAILABLE FOR GENERAL CAPITAL PURPOSES (1) Adjusted EBITDA is a non GAAP measure. See schedules 2 through 5 of the Q4 2015 press release for a reconciliation of Net loss to Adjusted EBITDA. (2) Capital Expenditures, net represents capital expenditures net of landlord reimbursements . (3) Cash Interest, net & Other represents the quarterly accrual of cash interest under our Senior Notes . (4) Adjusted EBITDA Available for General Capital Purposes is a non - GAAP measure, and represents funds available for repayment of de bt, acquisitions, deferred acquisition consideration, dividends, and other general corporate initiatives. (US$ in millions) 2015 2014 2015 2014 Adjusted EBITDA (1) $65.6 $51.8 $197.7 $179.4 Net Income Attibutable to the Noncontrolling Interests (1.7) (2.1) (9.1) (6.9) Capital Expenditures, net (2) (5.1) (5.0) (21.1) (23.1) Cash Taxes (0.5) (0.1) (1.9) (0.4) Cash Interest, net & Other (3) (13.8) (13.5) (52.2) (50.1) Adjusted EBITDA Available for General Capital Purposes (4) $44.5 $31.1 $113.4 $98.8 Three Months Ended December 31, Twelve Months Ended December 31,

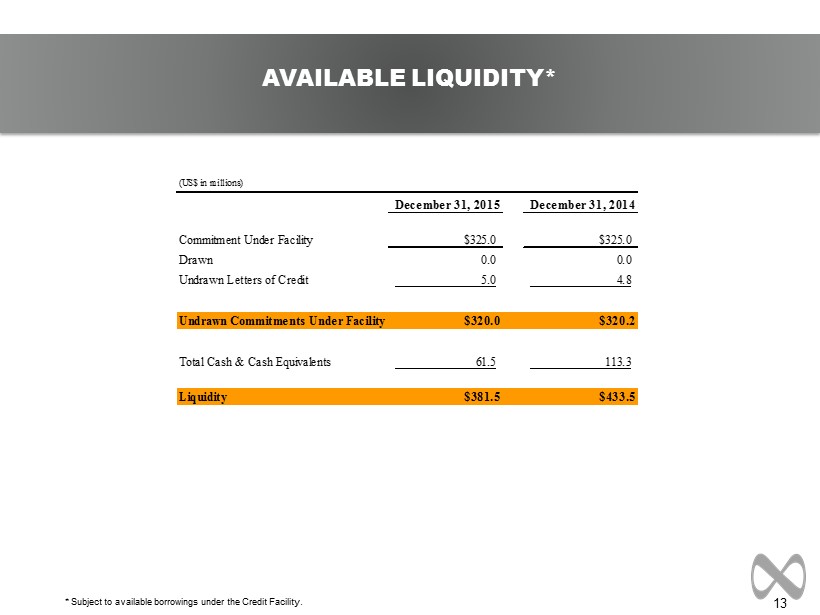

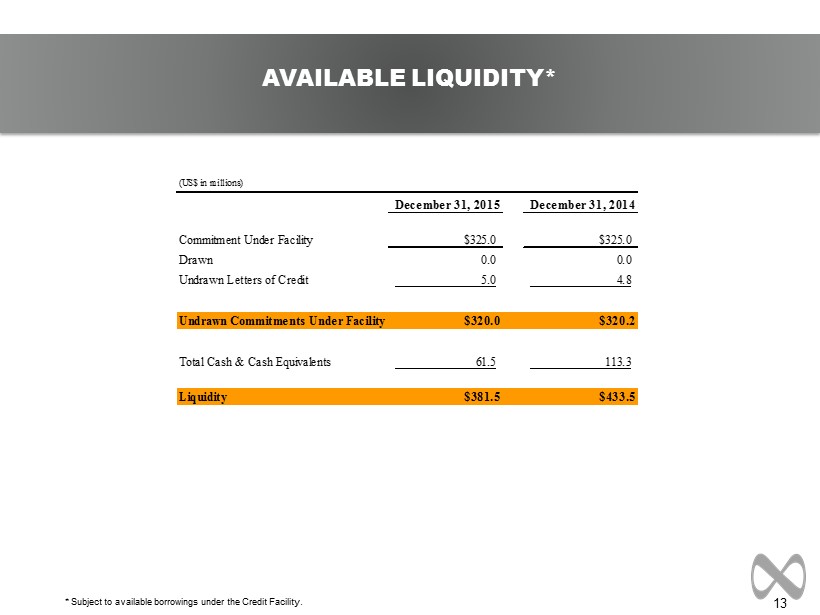

13 AVAILABLE LIQUIDITY* * Subject to available borrowings under the Credit Facility. (US$ in millions) December 31, 2015 December 31, 2014 Commitment Under Facility $325.0 $325.0 Drawn 0.0 0.0 Undrawn Letters of Credit 5.0 4.8 Undrawn Commitments Under Facility $320.0 $320.2 Total Cash & Cash Equivalents 61.5 113.3 Liquidity $381.5 $433.5

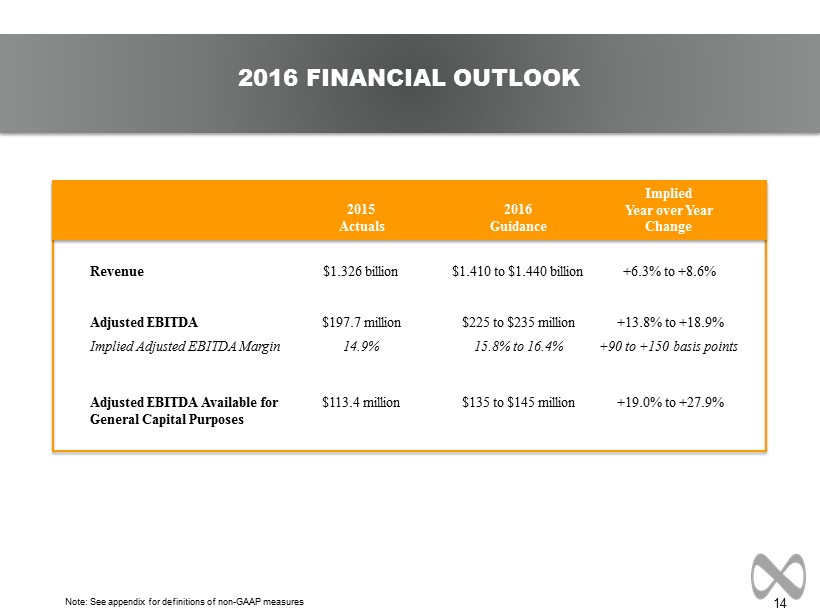

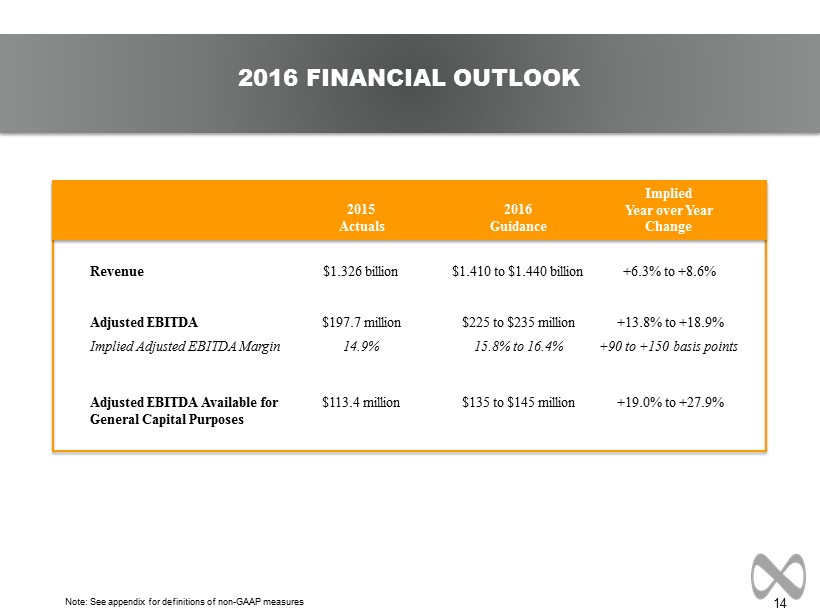

14 2016 FINANCIAL OUTLOOK Note: See appendix for definitions of non - GAAP measures Revenue Adjusted EBITDA Adjusted EBITDA Available for General Capital Purposes Implied Adjusted EBITDA Margin $1.326 billion $197.7 million $113.4 million 14.9% $1.410 to $1.440 billion $225 to $235 million $135 to $145 million 15.8% to 16.4% +6.3% to +8.6% +13.8% to +18.9% +19.0% to +27.9% +90 to +150 basis points 2015 Actuals Implied Year over Year Change 2016 Guidance

15 APPENDIX

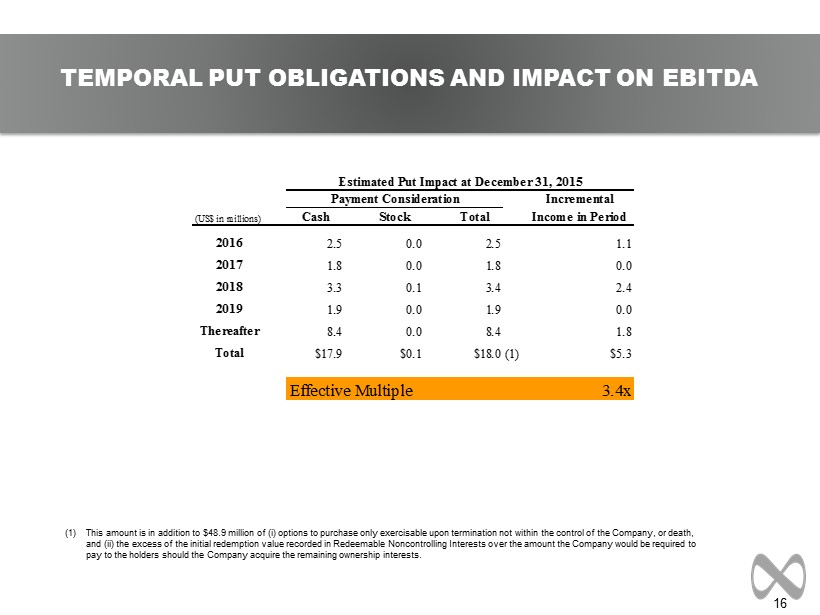

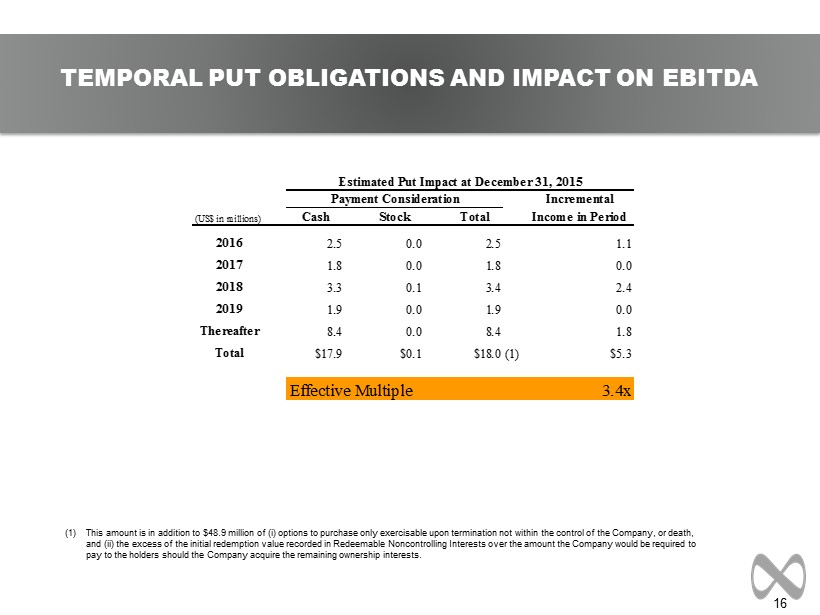

16 TEMPORAL PUT OBLIGATIONS AND IMPACT ON EBITDA (1) This amount is in addition to $48.9 million of ( i ) options to purchase only exercisable upon termination not within the control of the Company, or death, and (ii) the excess of the initial redemption value recorded in Redeemable Noncontrolling Interests over the amount the Company would be required to pay to the holders should the Company acquire the remaining ownership interests. Incremental (US$ in millions) Cash Stock Total Income in Period 2016 2.5 0.0 2.5 1.1 2017 1.8 0.0 1.8 0.0 2018 3.3 0.1 3.4 2.4 2019 1.9 0.0 1.9 0.0 Thereafter 8.4 0.0 8.4 1.8 Total $17.9 $0.1 $18.0(1) $5.3 Effective Multiple 3.4x Estimated Put Impact at December 31, 2015 Payment Consideration

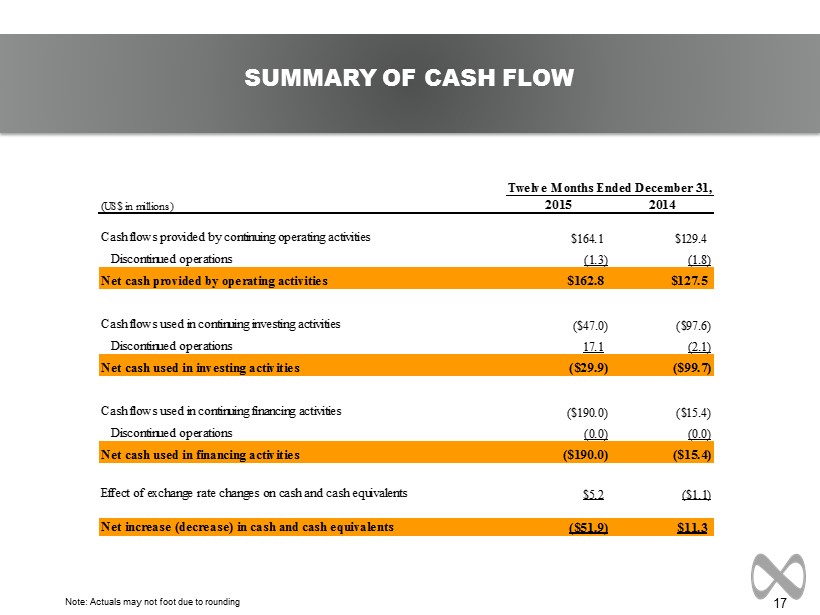

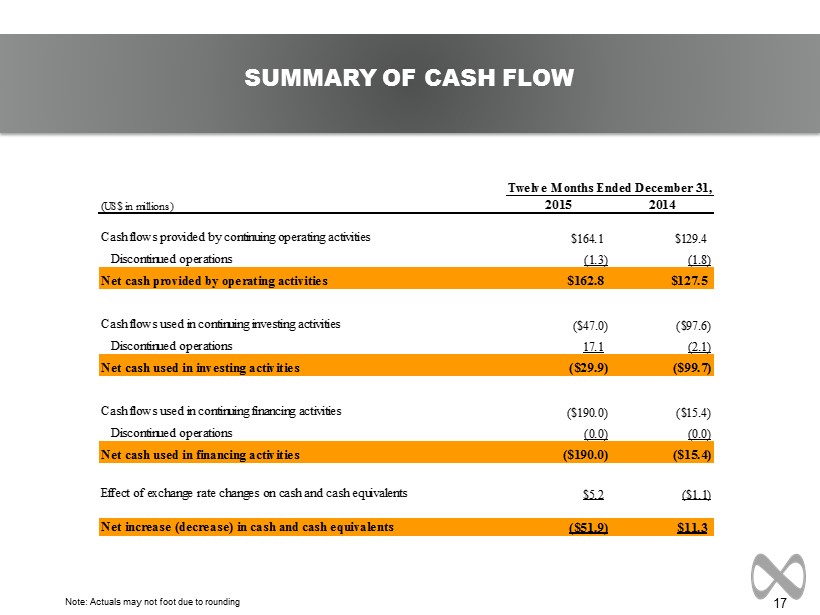

17 Note: Actuals may not foot due to rounding SUMMARY OF CASH FLOW Note: Actuals may not foot due to rounding (US$ in millions) 2015 2014 Cash flows provided by continuing operating activities $164.1 $129.4 Discontinued operations (1.3) (1.8) Net cash provided by operating activities $162.8 $127.5 Cash flows used in continuing investing activities ($47.0) ($97.6) Discontinued operations 17.1 (2.1) Net cash used in investing activities ($29.9) ($99.7) Cash flows used in continuing financing activities ($190.0) ($15.4) Discontinued operations (0.0) (0.0) Net cash used in financing activities ($190.0) ($15.4) Effect of exchange rate changes on cash and cash equivalents $5.2 ($1.1) Net increase (decrease) in cash and cash equivalents ($51.9) $11.3 Twelve Months Ended December 31,

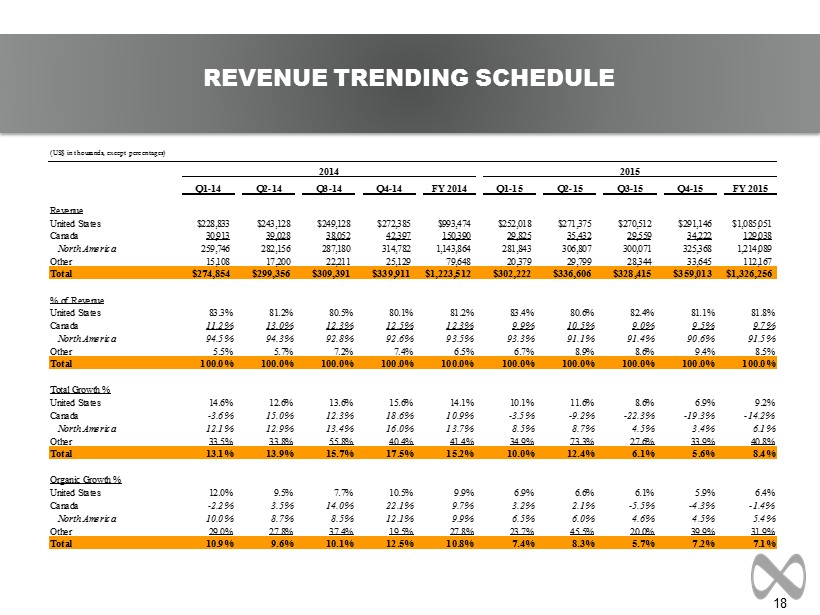

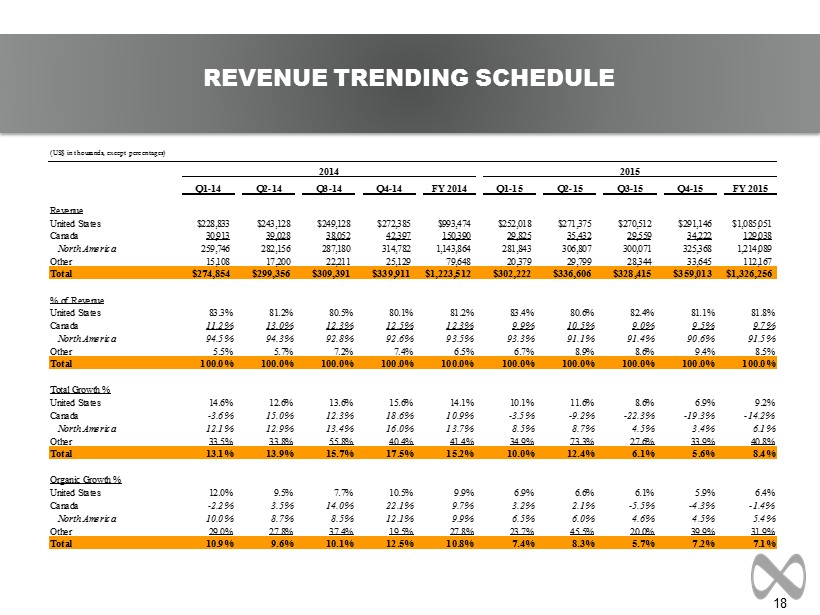

18 Note: Actuals may not foot due to rounding REVENUE TRENDING SCHEDULE (US$ in thousands, except percentages) Q1-14 Q2-14 Q3-14 Q4-14 FY 2014 Q1-15 Q2-15 Q3-15 Q4-15 FY 2015 Revenue United States $228,833 $243,128 $249,128 $272,385 $993,474 $252,018 $271,375 $270,512 $291,146 $1,085,051 Canada 30,913 39,028 38,052 42,397 150,390 29,825 35,432 29,559 34,222 129,038 North America 259,746 282,156 287,180 314,782 1,143,864 281,843 306,807 300,071 325,368 1,214,089 Other 15,108 17,200 22,211 25,129 79,648 20,379 29,799 28,344 33,645 112,167 Total $274,854 $299,356 $309,391 $339,911 $1,223,512 $302,222 $336,606 $328,415 $359,013 $1,326,256 % of Revenue United States 83.3% 81.2% 80.5% 80.1% 81.2% 83.4% 80.6% 82.4% 81.1% 81.8% Canada 11.2% 13.0% 12.3% 12.5% 12.3% 9.9% 10.5% 9.0% 9.5% 9.7% North America 94.5% 94.3% 92.8% 92.6% 93.5% 93.3% 91.1% 91.4% 90.6% 91.5% Other 5.5% 5.7% 7.2% 7.4% 6.5% 6.7% 8.9% 8.6% 9.4% 8.5% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Total Growth % United States 14.6% 12.6% 13.6% 15.6% 14.1% 10.1% 11.6% 8.6% 6.9% 9.2% Canada -3.6% 15.0% 12.3% 18.6% 10.9% -3.5% -9.2% -22.3% -19.3% -14.2% North America 12.1% 12.9% 13.4% 16.0% 13.7% 8.5% 8.7% 4.5% 3.4% 6.1% Other 33.5% 33.8% 55.8% 40.4% 41.4% 34.9% 73.3% 27.6% 33.9% 40.8% Total 13.1% 13.9% 15.7% 17.5% 15.2% 10.0% 12.4% 6.1% 5.6% 8.4% Organic Growth % United States 12.0% 9.5% 7.7% 10.5% 9.9% 6.9% 6.6% 6.1% 5.9% 6.4% Canada -2.2% 3.5% 14.0% 22.1% 9.7% 3.2% 2.1% -5.5% -4.3% -1.4% North America 10.0% 8.7% 8.5% 12.1% 9.9% 6.5% 6.0% 4.6% 4.5% 5.4% Other 29.0% 27.8% 37.4% 19.5% 27.8% 23.7% 45.5% 20.0% 39.9% 31.9% Total 10.9% 9.6% 10.1% 12.5% 10.8% 7.4% 8.3% 5.7% 7.2% 7.1% 2014 2015

19 Note: Actuals may not foot due to rounding DEFINITION OF NON - GAAP MEASURES Adjusted EBITDA: Adjusted EBITDA is a non - GAAP measure, that represents operating profit plus depreciation and amortization, stock - based compensation, acquisition deal costs, deferred acquisition consideration adjustments, distributions from non - consolidated affiliates and other non - recurring items. Organic Growth: Organic revenue growth is a non - GAAP measure that refers to growth in revenues from sources other than acquisitions or foreign exchange impacts. Adjusted EBITDA Available for General Capital Purposes: Adjusted EBITDA Available for General Capital Purposes is a non - GAAP measure, and represents funds available for repayment of debt, acquisitions, deferred acquisition consideration, dividends, and other general corporate initiatives . Net Bank Debt or Net Debt: Debt due pertaining to the revolving credit facility plus debt pertaining to the Senior Notes less total cash and cash equivalents. Note: A reconciliation of Non - GAAP to US GAAP reported results has been provided by the Company in the tables included in the earnings release issued on February 18, 2016.

MDC Partners Innovation Center 745 Fifth Avenue, Floor 19 New York, NY 10151 646 - 429 - 1800 www.mdc - partners.com