- STGW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Stagwell (STGW) CORRESPCorrespondence with SEC

Filed: 15 Jun 16, 12:00am

June 15, 2016

Via Edgar

Mr. Larry Spirgel

Mr. Robert Littlepage

Division of Corporation Finance

Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

| RE: | MDC Partners Inc. |

Form 10-K for Fiscal Year Ended December 31, 2015

Filed February 26, 2016

SEC Correspondence Dated May 18, 2016

File No. 001-13718

Dear Mr. Spirgel and Mr. Littlepage:

Set forth below is the response of MDC Partners Inc. (the “Company”) to the correspondence of the Staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Staff,” “Commission,” or “SEC”), which was set forth in your letter dated May 18, 2016 regarding the Company’s above-referenced filing.

* * * * *

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 16

Advertising and Communications Segment, page 20 and 24

Organic revenue growth is calculated by subtracting the impact of both foreign exchange and the aggregation of prior year revenue of acquired businesses from the change in total revenue year over year.

We will clarify the definition of our non-GAAP measure for “organic revenue” and replace such term with the terms “organic revenue growth” or “organic revenue decline”, as applicable, in all future filings as follows:

Two such terms are “organic revenue growth” or “organic revenue decline” that refer to the positive or negative results, respectively, of the following calculation: (i) the change in revenue during the relevant time period, less (ii) for each business acquired in the current calendar year, the incremental impact on revenue for the comparable period prior to the Company’s ownership of such acquired business, less (iii) revenue from each business acquired by the Company in the previous fiscal year through the twelve month anniversary of the Company’s ownership, less (iv) foreign exchange impacts.

The descriptor in all future filings will be revised for the “organic growth” column to identify it as “organic revenue growth (decline).”

| 2 |

14. Segment Information, page 75

| 2. | We note in the fourth quarter of 2015 the Company determined that the Partner Firm network represents an operating segment and as a result you now report operating results in one reportable segment identified as Advertising and Communications along with the Corporate Group. To help us understand how you applied the guidance in FASB ASC 280 in identifying your operating segment, please provide us with the following information: |

| a. | Provide your organization chart which identifies the positions, roles or functions that report directly to your chief operating decision maker (“CODM”) and senior management team; |

| b. | Tell us the title and describe the role of your CODM and each of the individuals who report to the CODM; |

| c. | Identify and describe the role of your segment manager; |

| d. | Tell us how often the CODM meets with his/her direct reports, the financial information the CODM reviews to prepare for those meetings, the financial information discussed in those meetings, and who attends those meetings; |

| e. | Describe the information regularly provided to the CODM and tell us how frequently it is prepared; |

| f. | Describe the information regularly provided to the Board of Directors and tell us how frequently it is prepared; |

| g. | Describe the information about the Advertising, Experiential marketing, Communications and Digital service offerings that are provided to the CODM, tell us whether there are managers accountable for the service offerings, and if so, tell us to whom they are accountable; |

| h. | Explain how budgets are prepared, who approves the budget at each stop of the process, the level of detail discussed at each step, and the level at which the CODM makes changes to the budget; |

| i. | Describe the level of detail communicated to the CODM when actual results differ from budgets and who is involved in meetings with the CODM to discuss budget-to-actual variances; and, |

| j. | Describe the basis for determining the compensation of the individuals that report to the CODM. |

| 3 |

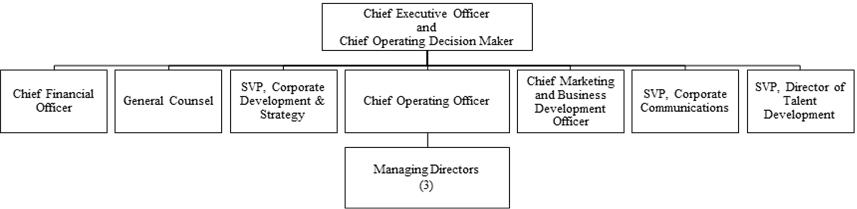

Attached is an organization chart that identifies the roles/positions that reported directly to MDC’s chief operating decision maker (“CODM”) at December 31, 2015, including MDC’s senior management team.

As shown in the organization chart, MDC’s CODM is Scott Kauffman, Chairman of the Board and CEO. Mr. Kauffman makes the key operating decisions within MDC, evaluates the operating performance of the Partner Firm network[1], and allocates resources to the Partner Firm network.

MDC’s senior management team reports directly to the CODM.

Members of MDC’s senior management team at December 31, 2015 included Andre Coste, Executive VP and COO.[2] Mr. Coste was accountable for the operating performance of the Partner Firms and was MDC’s segment manager.

MDC’s Managing Directors reported to Mr. Coste. The Managing Directors are responsible for designated Partner Firms, which may change over time. The Managing Directors provide financial, strategic, and operational support to the Partner Firms and monitor the operating performance of the Partner Firms. In that regard, each Managing Director works closely with senior management of the Partner Firms and leads monthly performance update calls with senior management of the Partner Firms. Mr. Coste and other members of MDC’s senior management team also participate in these calls.

The Partner Firms within the Partner Firm network have a range of service offerings and these service offerings are further supplemented by collaboration between and among the Partner Firms within the Partner Firm network. Because the Managing Directors are responsible for designated Partner Firms, they are not necessarily responsible for discrete service offerings to clients, such as advertising, experiential marketing, and digital service offerings.

_____________________________________

| [1] | The Partner Firm network is the aggregation of all of MDC’s Partner Firms and differs from the consolidated Company as corporate results are not included. The Company’s segment disclosures include actual corporate results for each year presented. |

| [2] | MDC’s Form 8-K filed June 1, 2016 disclosed that in connection with a limited restructuring of the Company’s corporate department, the Company and Andre Coste entered into a Separation and Release Agreement, with an effective employment termination date of June 15, 2016. While management is in the process of evaluating, this change is not expected to result in a change to MDC’s segment disclosures. |

| 4 |

Other members of MDC’s senior management team at December 31, 2015 were:

| · | David Doft, Chief Financial Officer. |

| · | David Ross, Senior VP, Corporate Development & Strategy. |

| · | Bob Kantor, Chief Marketing and Business Development Officer. |

| · | Alexandra Delanghe, Senior VP, Corporate Communications. |

| · | Amie Miller, Senior VP, Talent Development. |

| · | Mitchell Gendel, General Counsel |

Compensation arrangements for MDC’s senior management team provide for (i) a base salary intended to be competitive with the marketplace, (ii) annual short-term, performance-based cash incentive awards provided that the Company achieves consolidated Adjusted EBIDA-based financial performance goals and the individual achieves key performance indicators designed to motivate and reward achievement of annual corporate and personal objectives, and (iii) long-term performance-based incentive awards in the form of restricted stock with a three-year vesting term based on the Company’s consolidated Adjusted EBITDA financial performance as compared to Board-approved annual budgets. The primary financial target for annual incentive awards and LTIP incentive awards is consolidated Adjusted EBITDA performance.

The CODM receives monthly financial information detailing the operating performance of the Partner Firm network. This information includes actual operating results and variances to the current year budget. This information is presented for each Partner Firm individually and/or in total at the Partner Firm network level. This information is also presented at varying levels of aggregation to provide the CODM additional insight into what is driving the operating performance of the Partner Firm network and inform resource allocation decisions. This information includes, but is not limited to, Partner Firms aggregated by geography, discipline (distinguishing integrated advertising agencies from other Partner Firms), size, and market position.

The CODM, segment manager, and members of the senior management team meet regularly (generally weekly) to discuss this financial information, as well as key strategic initiatives and other matters relative to the operating performance of the Partner Firm network. These discussions often focus on key performance metrics (including revenue, margins, and Adjusted EBITDA), how the performance is tracking relative to budget and investor expectations, and the reasons for any variances.

The annual budgets are prepared on a bottom-up basis. The process starts at the Partner Firm level and is coordinated through the Managing Directors. The Managing Directors review the budgets for each Partner Firm and provide them to the segment manager for review. Changes to the budgets are coordinated with the Partner Firms through the Managing Directors and reviewed by the segment manager. The segment manager discusses the results of his review with the Managing Directors, the CFO, and other members of MDC’s senior management team, and presents the budget information to the CODM for his review at the Partner Firm network level. Changes, if any, resulting from the CODM’s review generally focus on the initiatives supporting revenue and Adjusted EBITDA targets and opportunities for collaboration across the Partner Firm network.

| 5 |

On a quarterly basis, the Partner Firms prepare re-forecasts to address variances to the current year budget. The re-forecasting process is similar to the annual budget process.

The Company’s Board of Directors approves the annual budgets and strategic plans for the Partner Firm network. The budget and strategic planning information is discussed with the Board at the Partner Firm network level. Generally, these discussions focus on the initiatives supporting revenue and Adjusted EBITDA targets and opportunities for collaboration across the Partner Firm network. During the intervening period, the Board receives MDC’s quarterly and annual financial reporting packages and discusses updates to the budgets through the re-forecasting process as well as key strategic initiatives and other matters relative to the operating performance of the Partner Firm network.

| 3. | Please explain to us your consideration of the disclosure requirements of ASC 280-10-50-40. |

ASC 280-10-50-40 states:

“A public entity shall report the revenues from external customers for each product and service or each group of similar products and services unless it is impracticable to do so. The amounts of revenues reported shall be based on the financial information used to produce the public entity's general-purpose financial statements. If providing the information is impracticable, that fact shall be disclosed.”

MDC recognizes the need for the enterprise-wide disclosures required by ASC 280 and historically MDC has provided the enterprise-wide disclosures about geography. However, MDC has not provided similar enterprise-wide disclosures about each of its service offerings.

Some Partner Firms have discrete or specialized disciplines and related service offerings. However, other Partner Firms have different service offerings, including the integrated advertising Partner Firms. Further, these service offerings are supplemented by collaboration with other Partner Firms within the Partner Firm network. The integrated advertising Partner Firms comprise a significant portion of MDC’s revenues and MDC does not separately monitor or otherwise track the revenue related to each of the service offerings within these Partner Firms.

There are differences between and among these service offerings. However, they represent a range of essentially similar marketing communications service offerings and MDC has disclosed its total marketing communications services revenue. In management’s judgment, MDC’s disclosure of its total marketing communications service revenue complies with the disclosure requirements of ASC 280-10-5-40.

| 6 |

However, as MDC implements initiatives to enhance the operating performance of its Partner Firm network, management will continue to reassess this disclosure and the need to disaggregate its marketing communications services revenue to provide users of its financial statements with the information they need to understand MDC’s performance, assess MDC’s prospects for future cash flows, and make more informed judgments about MDC as a whole.

As requested, The Company acknowledges the following:

| · | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

* * * * *

| 7 |

Please direct any questions concerning the above responses to the undersigned (telephone: (646) 429-1818; fax: (212) 937-4365).

Very truly yours,

/s/ David Doft

David Doft

Chief Financial Officer

| cc: | Kathryn Jacobson, Senior Staff Accountant |

Robert S. Littlepage, Accounting Branch Chief

William Mastrianna, Attorney-Advisor

Securities and Exchange Commission

Scott Kauffman, Chairman and Chief Executive Officer

Mitchell Gendel, General Counsel & Corporate Secretary

Christine LaPlaca, SVP Accounting and Financial Reporting

Members of the Audit Committee of Board of Directors of MDC Partners Inc.

Paul Curnin and Cheryl Scarboro (Simpson Thacher & Bartlett LLP)

Robert Trinchetto, BDO USA, LLP

| 8 |

Attachment I

Organization Chart

Below is an organization chart that identifies the roles/positions that reported directly to MDC’s chief operating decision maker at December 31, 2015, including MDC’s senior management team.

| 9 |