PURE NICKEL INC.

ANNUAL AND SPECIAL

MEETING OF SHAREHOLDERS

TO BE HELD ON

MARCH 31, 2009

PURE NICKEL INC.

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual and Special Meeting of the shareholders of Pure Nickel Inc. (the “Corporation”) will be held at the offices of Heenan Blaikie LLP, 200 Bay Street, South Tower, Royal Bank Plaza, Suite 2600, Toronto, Ontario, Canada, on Tuesday, March 31, 2009 at 10:00 a.m. (Toronto time) for the following purposes:

(a)

to receive the Annual Report of the Corporation which contains the financial statements of the Corporation for the year ended November 30, 2008 and the auditors’ report thereon;

(b)

to elect directors;

(c)

to reappoint auditors and to authorize the directors to fix their remuneration;

(d)

to consider and, if deemed advisable, approve the continuance of the Corporation, from theBusiness Corporations Act(Yukon) to theCanada Business Corporations Act, all as described in the attached Management Information Circular; and

(e)

to transact any other business which may properly come before the Meeting, or any adjournment thereof.

The directors of the Corporation have fixed the close of business on February 27, 2009 as the record date for the determination of the Shareholders entitled to receive notice of the Meeting.

DATED at Toronto, Ontario, February 9, 2009.

BY ORDER OF THE BOARD

/s/ ROBERT ANGRISANO

Robert Angrisano

Chairman of the Board of Directors

Shareholders who are unable to attend the Meeting in person and who wish to ensure that their shares are voted at the Meeting, are requested to date, sign and return in the envelope provided for that purpose, the enclosed form of proxy.

All instruments appointing proxies to be used at the Meeting or at any adjournment thereof must be deposited with the Corporation’s registrar and transfer agent, Computershare Trust Company of Canada, not less than 48 hours, excluding Saturdays, Sundays, and holidays, before the time of the Meeting or any adjournment thereof or with the Chairman of the Meeting prior to the commencement of the Meeting or any adjournment thereof.

PURE NICKEL INC.

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES

This Management Information Circular is furnished in connection with the solicitation of proxies by management of Pure Nickel Inc. (the “Corporation”) for use at the Annual and Special Meeting (the “Meeting”) of the shareholders of the Corporation (“Shareholders”) to be held on March 31, 2009 at the time and place and for the purposes set forth in the accompanying Notice of Meeting. The information contained herein is given as of the date hereof, except as otherwise noted herein. It is expected that the solicitation of proxies will be primarily by mail. However, proxies may also be solicited by telephone, facsimile or in person by employees of the Corporation. The total cost of the solicitation will be borne by the Corporation.

The Corporation will pay the reasonable costs incurred by persons who are the registered but not beneficial owners of shares (such as brokers, dealers and other registrants under applicable securities law and nominees and custodians) in sending or delivering copies of the Notice of Meeting, Management Information Circular and form of proxy to the beneficial owners of shares which are registered in the names of such persons. Payments will be made upon receipt of an appropriate invoice. The Corporation will furnish to such persons, upon request to the Secretary of the Corporation, 95 Wellington Street West, Suite 900, Toronto, ON, M5J 2N7 (Tel. (416) 644.0066) and without additional cost, additional copies of the Notice of Meeting, Management Information Circular, form of proxy and financial statement request form required for this purpose.

PROXIES AND VOTING

Shareholders who are unable to attend the Meeting in person and who wish to have their shares voted at the Meeting are requested to date, sign and return, in the envelope provided for that purpose, the enclosed form of proxy. Proxies must be deposited (i) with the Corporation’s transfer agent, Computershare Trust Company of Canada, 100 University Avenue, 9th floor, North Tower, Toronto, Ontario M5J 2Y1, not less than 48 hours, excluding Saturdays, Sundays, and holidays, before the time of the Meeting or any adjournment or postponement thereof, or (ii) with the Chairman of the Meeting prior to the commencement of the Meeting or any adjournment or postponement thereof, in order for the shares represented thereby to be voted at the Meeting or any adjournment or postponement thereof.

The shares represented by any proxy in favour of the nominees of management named therein will be voted for, against or withheld from voting with respect to the matters described herein in accordance with the instructions provided in any such proxy. In the absence of any specification, such proxies will be voted FOR the election of directors, FOR the appointment of auditors and FOR the continuance of the Corporation under theCanada Business Corporations Act (as set out below).

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments to matters identified in the Notice of Meeting or other matters that may properly come before the Meeting. Management knows of no other matters to come before the Meeting other than matters referred to in the Notice of Meeting. If any matters which are not now known should properly come before the Meeting or if any amendments or variations to the matters referred to in the Notice of Meeting are presented for consideration at the Meeting, the forms of proxy will be voted on such matters, amendments and variations in accordance with the best judgment of the person voting the proxy.

A Shareholder has the right to appoint a person (who need not be a Shareholder) as proxy holder to attend and act on his, her or its behalf at the Meeting other than the representatives of management designated in the enclosed form of proxy. The Shareholder may exercise this right by inserting the name of the nominee in the space provided in the enclosed form of proxy or may complete another appropriate form of proxy, and in each case delivering the completed proxy in the manner set forth above.

NON-REGISTERED HOLDERS

Only registered Shareholders of common shares of the Corporation or the person(s) they appoint as their proxyholder(s) are permitted to vote at the Meeting. However, in many cases, common shares beneficially owned by a holder (a “Non-Registered Holder”) are not registered in the name of the holder but are rather registered either (a) in the name of an Intermediary that the Non-Registered Holder deals with in respect of the Common Shares; or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (CDS)) of which the Intermediary is a participant. Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans. In accordance with the requirements of National Instrument 54-101 –Communica tion with Beneficial Securities of a Reporting Issuer, the Corporation has distributed copies of the Notice of Meeting, this Management Information Circular, a form of proxy, the Corporation’s Annual Report and a financial statement request form (collectively the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Holders. Generally Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

(a)

be given a form of proxy which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form” or a “proxy authorization form”) which the Intermediary must follow. Typically, the Non-Registered Holder will also be given a page of instructions which contains a removable label containing a bar code and other information. In order for the form of proxy to be validly constituted, the Non-Registered Holder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the Intermediary or its service company in accordance with the in structions of the Intermediary or its service company; or

(b)

less typically, be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deliver it to Computershare Trust Company of Canada as provided under “Proxies and Voting” above.

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the Common Shares which they beneficially own. Should a Non-Registered Holder who receives either form of proxy wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the proxy and insert the Non-Registered Holder’s (or such other persons’) name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the form of proxy is to be delivered.

REVOCATION OF PROXIES

Any Shareholder who has given a proxy may revoke it by depositing an instrument in writing executed by him or her or by his or her attorney authorized in writing at the principal office of the Corporation, 95 Wellington Street West, Suite 900, Toronto, Ontario, M5J 2N7 (telephone (416) 644-0066) to the attention of the Secretary, on or before the last business day preceding the day of the Meeting or any adjournment thereof or, as to any matter upon which a vote has not already been cast pursuant to the authority conferred by such proxy, with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof, or by any other manner permitted by law.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS THEREOF

As at the close of business on February 27, 2009 (the “Record Date”), 67,765,559 Common Shares were issued and outstanding. Each Shareholder is entitled to one vote for each Common Share registered in such holder’s name as at the close of business on the Record Date. All dollar amounts are herein Canadian dollars unless otherwise stated.

The board directors of the Corporation (the “Board”) and the senior officers of the Corporation do not know of any person or company who at the date hereof beneficially owns, directly or indirectly, or exercises control or direction over, more than 10% of the outstanding Common Shares of the Corporation.

MATTERS TO BE ACTED ON AT THE MEETING

1.

Election of Directors

The number of directors on the board of directors of the Corporation (the “Board”) was set at seven at the Annual and Special Meeting of the Shareholders held on May 30, 2007. Management proposes to nominate the six persons listed below for election as directors at the Meeting. Each director will hold office until the next annual general meeting of the Shareholders, unless his office is earlier vacated. Management does not contemplate that any of the nominees will be unable to serve as a director. In the event that prior to the meeting any vacancies occur in the slate of nominees herein listed, it is intended that discretionary authority shall be exercised by the person named in the proxy as nominee to vote the Common Shares represented by proxy for the election of any other person or persons as directors.

The following table, the notes thereto and the professional biographies immediately following such table set out the names of the Management nominees; their positions and offices in the Corporation; principal occupations; the period of time that they have been directors of the Corporation; and the number of Common Shares which each beneficially owns or over which control or direction is exercised. All of the nominees for directors are residents of Canada except for Robert Angrisano and R. David Russell who are residents of the United States.

Name and Municipality of Residence | Director Since | Principal Occupation | Number of Common Shares beneficially owned or controlled(3) |

| | | | |

Robert Angrisano Seattle, Washington | 1999 | Chairman of the Corporation since December 2007; President of the Corporation from 2005 to March 2007; CEO of the Corporation from May 2006 to March 2007; various positions with Microsoft from 1993 to 2004. | 2,416,479 |

| | | | |

Harry Blum(2) Thornhill, Ontario | 2007 | Managing partner with Collins Barrow Toronto LLP, Chartered Accountants; Managing Partner of DMCT Transaction Services Inc. (which merged with Collins Barrow in 2008) since January 1, 2005. | 101,200 |

| | | | |

David McPherson(1) St. Catharines, Ontario | 2007 | President & CEO of the Corporation since December 2007; independent consultant from 2006 to December 2007; Vice-President of First Ontario Credit Union from 2001 to 2006. | 125,000 |

| | | | |

R. David Russell(2) Centennial, Colorado | 2006 | President & CEO of Apollo Gold Corporation from 2002 to present. | 50,000 |

| | | | |

Constantine Salamis Morin Heights, Québec | 2007 | Mining engineer from 1976 to 1991; founder and currently a director of Manicouagan Minerals. | Nil |

| | | | |

W.S. (Steve) Vaughan Toronto, Ontario | 2007 | Partner with the law firm McMillan Binch Mendelson LLP from February 2002 to 2007 and Partner with the law firm Heenan Blaikie LLP from February 2007 to present. | Nil |

_________

Notes:

(1)

Mr. McPherson served on the Audit, Corporate Governance and Nominating and Compensation Committees until he was appointed CEO of the Corporation in December 2007.

(2)

Member of Audit, Corporate Governance and Nominating and Compensation Committees.

(3)

Information with respect to the number of Common Shares held by the directors has been provided by such directors.

Robert Angrisano:

Mr. Angrisano graduated from the University of Oregon with a degree in Business Administration. He retired from Microsoft Corp. in July 2004 after spending more than 11 years in a variety of positions, including Director of Technology, Director of Business Windows and Senior Principal Technologist. Mr. Angrisano was the President, a director and a principal shareholder of M.A.N. Resources, Inc., which Nevada Star Resource Corp. acquired in February 2002. Mr. Angrisano has spent 28 years in consulting and management in the high technology industry and has been involved in the mining industry since 1995. His principal responsibilities have been guiding companies’ directions and strategies as well as operational management.

Harry Blum:

Mr. Blum, managing partner of Collins Barrow Toronto LLP, Chartered Accountants, has over 20 years of audit, tax and advisory experience. Formerly a senior professional with one of the big four accounting firms, Mr. Blum joined DMCT, LLP in 1992, was admitted to the Partnership in 1995, and that firm merged with Collins Barrow in 2008. He has serviced both public and private companies and his scope of expertise ranges from financial due diligence, structuring purchase and sale transactions, restructurings, initial public offerings, acquisitions, divestitures, carve-outs and spin-offs. In addition, he has lead teams in the area of income trust conversions, complex tax based transactions and other strategic advisory assignments. Mr. Blum’s clients include major financial institutions, large private and public companies, and private equity funds in both Canada and the United States. Mr. Blum previously served as President and director of Whitmore Resource Corp. from July 13, 2000 to November 22, 2004. Mr. Blum graduated with a Bachelor of Commerce from the University of Toronto and obtained his designation as a Chartered Accountant in 1989.

David McPherson:

Mr. McPherson has over 25 years of financial institution experience with a major chartered bank, a number of those years being at the executive level. He has had responsibility for large regional retail and small business banking operations. He has served in an advisory capacity to a number of community based economic development groups including Niagara Growth Fund, a regional venture capital fund based in Niagara. From 2001 to 2006 Mr. McPherson was a Vice-President with First Ontario Credit Union and led strategy development, product and marketing groups. Since the fall of 2006 he has been self-employed as a management consultant and in December 2007 was appointed President and CEO of the Corporation.

R. David Russell:

Mr. Russell graduated from the Montana School of Mineral, Science and Technology with a Bachelor of Science Degree in Mining Engineering. With over 27 years in the mining industry, Mr. Russell is currently President and CEO and a director of Apollo Gold. Apollo Gold is a gold mining company with operations and exploration projects in Canada, USA and Mexico. Mr. Russell is responsible for all mine operations, exploration and development and for general financial accounting and recording. Mr. Russell’s past positions include the following: Vice-President and Chief Operating Officer of Getchell Gold Company/Placer Dome Gold, General Manager, US Operations, LAC Minerals Ltd. (now Barrick Gold Corporation), Manager, Underground Mining, Independence Mining Company, Project Manager, Hecla Mining Company, Manager, Lincoln Project FMC/Meridian Gold.

Constantine Salamis:

Mr. Salamis, a mining engineer, has been involved in numerous mineral exploration and production companies throughout his 50 year career including Falconbridge Nickel, Inco Ltd., SOQUEM and Manicouagan Minerals, a public company he founded in 2004. In addition to Mr. Salamis’ North American experience, overseas he has completed geological evaluation assignments for international agencies including the World Bank and the United Nations.

W.S. (Steve) Vaughan:

Mr. Vaughan is a Partner at the law firm Heenan Blaikie LLP. Mr. Vaughan has participated in natural resource transactions in more than 50 countries over the past five years. Mr. Vaughan has a Master of Science Degree in Geology as well as a law degree and has worked in, or been closely associated with all facets of the mineral exploration, mine finance and securities industries since 1955. He served as a director of Atomic Energy of Canada Limited from 1992 to 1998 and was Chair of its Environmental Committee. Mr. Vaughan has also served on various committees advising Canadian governments, the Ontario Securities Commission and Toronto Stock Exchange on issues such as mineral policy, mineral strategy, mining finance, mining taxation, seed capital, junior resource policies, over-the-counter trading and nuclear issues. Mr. Vaughan is a director and member of the Securities C ommittee of the Prospectors and Developers Association of Canada. He is a former director of the Toronto Branch of the Canadian Institute of Mining, Metallurgy and Petroleum and a past member of the Joint Toronto Stock Exchange Ontario Securities Commission Mining Standards Task Force.

No proposed director is being elected under any arrangement or understanding between the proposed director and any other person or company except the directors and executive officers of the Corporation acting solely in such capacity.

Corporate Cease Trade Orders and Bankruptcies

To the knowledge of the Corporation, none of the proposed directors is, or has been within the last ten years, a director or officer of any other issuer that, while that person was acting in that capacity, was the subject of a cease trade or similar order or an order that denied the issuer access to any statutory exemptions for a period of more than thirty consecutive days or became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of that issuer.

Penalties and Sanctions

None of the proposed directors has been the subject of any penalties or sanctions imposed by a court or securities regulatory authority relating to trading in securities, the promotion, formation or management of a publicly traded company or involving theft or fraud.

Individual Bankruptcies

None of the proposed directors of the Corporation has, within the ten years prior to the date of this Management Information Circular, been declared bankrupt or made a voluntary assignment in bankruptcy, made a proposal under any legislation relating to bankruptcy or proceedings, arrangement or compromise with creditors or had a receiver, receiver-manager or trustee appointed to hold the assets of that individual.

2.

Reappointment of Auditors

SF Partnership LLP, Chartered Accountants, 4950 Yonge Street, Suite 400, Toronto, Ontario, Canada, M2N 6K1 is the current auditor of the Corporation. At the Meeting, Shareholders will be requested to reappoint SF Partnership as the independent auditor of the Corporation to hold office until the next annual meeting of Shareholders and to authorize the Board to fix the auditors’ remuneration. SF Partnership LLP has been the Corporation’s auditor since April 30, 2007.

The Board recommends a vote “for” the re-appointment of SF Partnership LLP as independent auditor for the Corporation until the next annual meeting of Shareholders or until a successor is appointed and the authorization of the Board to fix the auditors’ remuneration. In the absence of a contrary instruction, the persons designated by Management of the Corporation in the enclosed form of proxy intend to vote FOR the reappointment of SF Partnership LLP as auditor of the Corporation to hold office until the next annual meeting of Shareholders or until a successor is appointed and the authorization of the Board to fix the remuneration of the auditor.

3.

Continuance by the Corporation Under theCanada Business Corporations Act

Background and Reasons for Continuance

The Board of Directors of the Corporation has determined that it would be in the best interests of the Corporation to continue the Corporation under theCanada Business Corporations Act (“CBCA”).

The Corporation is currently governed, as to matters of corporate law, by theBusiness Corporations Act (Yukon)(“Yukon Act”). A corporation subject to the Yukon Act may, if authorized by special resolution, apply to the Director appointed under the CBCA for a certificate of continuance under the CBCA. Upon the issuance of a certificate of continuance in respect of the Corporation, the Yukon Act will cease to apply to the Corporation and the CBCA will become applicable to the Corporation as if the Corporation had been incorporated under the CBCA.

The Corporation is seeking the approval and authorization of its shareholders to apply to the Director appointed under the CBCA for a certificate of continuance continuing the Corporation as if it had been incorporated under the CBCA. The Corporation believes that the continuance of the Corporation will permit the Corporation to take advantage of more modern corporate law procedures provided by the CBCA. It will also permit the Corporation to amalgamate with its wholly-owned subsidiary, PNI Corp. (also incorporated under the CBCA), which, should the Corporation decide to proceed with the amalgamation, will reduce costs.

At the Meeting, the shareholders of the Corporation will be asked to approve a special resolution authorizing the continuance, the full text of which is attached to this Circular as Schedule “A”. A special resolution means a resolution passed by a majority of not less than two-thirds of the votes cast by those shareholders who, being entitled to do so, vote in person or by proxy at a meeting of shareholders. The special resolution:

1

contemplates the continuance of the Corporation to the jurisdiction of Canada under the CBCA;

2

authorizes the making of an application to the Director appointed under the CBCA for a certificate of continuance continuing the Corporation from the Yukon Territory to Canada;

3

authorizes the making of an application to the registrar appointed under the Yukon Act for consent to the continuance of the Corporation from the Yukon Territory to Canada;

4

approves the adoption of CBCA articles of continuance and by-laws, the text of which is attached as Exhibits I and II, respectively, to Schedule “A” to this Circular, to supersede and replace the Corporation’s existing articles and by-laws; and

5

authorizes the abandonment of the Corporation’s application to the Director appointed under the CBCA for the continuance of the Corporation under the CBCA in the absolute discretion of the directors of the Corporation, at any time without further approval, ratification or confirmation by the shareholders of the Corporation.

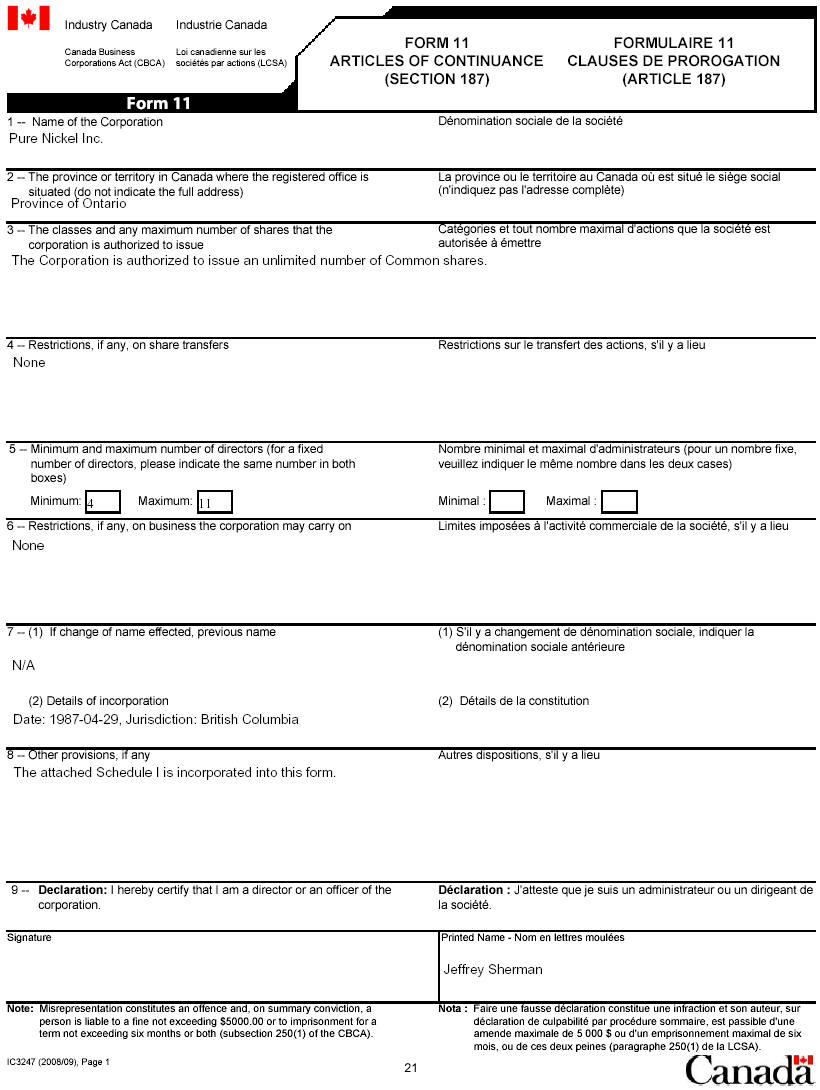

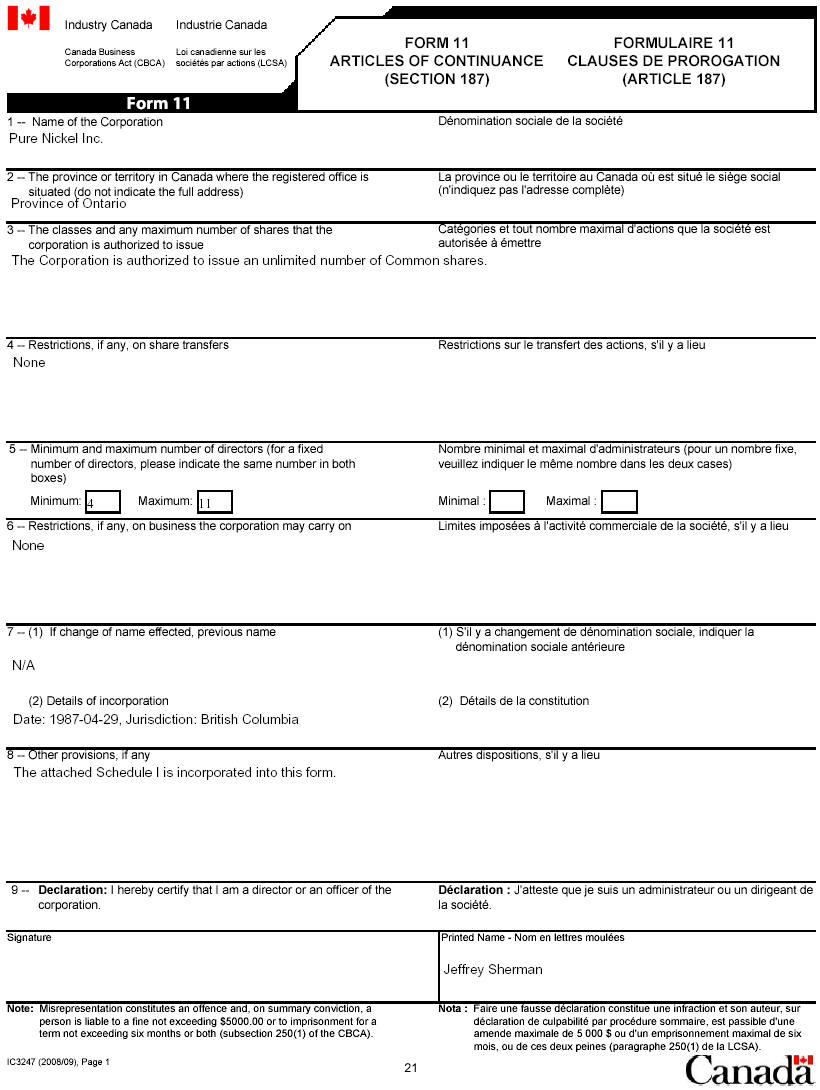

Articles of Continuance and By-Laws

Upon the continuance becoming effective, the current articles of the Corporation will be replaced with the Articles of Continuance filed pursuant to the CBCA and the current by-laws of the Corporation will be replaced with a new set of by-laws (“New By-Laws”). The forms of the Articles of Continuance and the New By-Laws are attached to Schedule “A” to this Circular as Exhibits I and II, respectively. The principal features of the Articles of Continuance and the New By-Laws are set forth below – please refer to their full text.

Authorized Capital. The Articles of Continuance provide that the Corporation will be authorized to issue an unlimited number of common shares.

Common Shares. Holders of common shares will be entitled to receive notice of and to attend all annual and special meetings of shareholders of the Corporation and to one vote in respect of each common share held at all such meetings. Holders of common shares will be entitled to receive dividends if, as and when declared by the Board of Directors of the Corporation in such amounts and payable in such manner as the Board of Directors of the Corporation may from time to time determine. In the event of the liquidation, dissolution or winding up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding up its affairs, holders of common shares shall, subject to the rights of the holders of any other class of shares of the Corporation entitled to receive assets of the Corporation upon such a distribution i n priority to or concurrently with the holders of the common shares, be entitled to participate rateably in the distribution.

Number of Directors. The Corporation will be entitled to have a minimum of 4 and a maximum of 11 directors elected to the board under the Articles of Continuance.

Registered Office. The registered office will be established in the Articles of Continuance as Suite 900, 95 Wellington St. West, Toronto, Ontario M5J 2N7.

Restrictions on Business of the Corporation. The Articles of Continuance will not place any restrictions on the business that the Corporation may carry on.

Shareholders’ Meeting Quorum. Pursuant to the New By-Laws, a quorum at any meeting of shareholders shall be two persons present in person and each entitled to vote thereat and holding or representing by proxy not less than ten per cent of the votes entitled to be cast thereat.

Electronic Meetings and Delivery of Documents. The New By-Laws will permit the holding of electronic meetings of the Board of Directors and shareholders of the Corporation and contemplate delivery of documents in electronic format, subject to compliance with applicable law.

Shareholder Protection under the CBCA

The CBCA provides to shareholders substantially the same rights as under the Yukon Act, including rights of dissent and appraisal and rights to bring derivative and oppressive actions. The following is a comparison of some of the principal provisions of the Yukon Act and the CBCA that are relevant to shareholders. This summary is not intended to be exhaustive and shareholders should consult their legal advisors with respect to the detailed provisions of the CBCA and their rights under it. Reference should be made to the full text of both statutes for particulars of the differences.

Sale of Corporation’s Undertaking. Under the CBCA, a sale of all or substantially all the property of a corporation other than in the ordinary course of business of the corporation requires approval by a majority of not less than two-thirds of the votes cast by shareholders who voted in respect of the proposed sale. The provisions of the Yukon Act are substantially the same.

Amendments to Articles of the Corporation. Under the CBCA, any substantive change to the articles of a corporation, such as a change in the name of the corporation, a change in the province in which the corporation’s registered office is situated and certain changes to the share capital of a corporation, require approval by a majority of not less than two-thirds of the votes cast by shareholders who voted at a meeting in respect of the change. Where holders of a class of shares are adversely affected by certain proposed amendments, holders of shares of that class (whether or not such shares carry a right to vote) are entitled to vote separately as a class on the proposed amendments. The provisions of the Yukon Act are substantially the same.

By-law Amendments. The CBCA provides that unless the articles, by-laws or a unanimous shareholder agreement otherwise provide, the directors may, by resolution, make, amend, or repeal any by-laws that regulate the business or affairs of a corporation. However, the directors must submit a by-law, or an amendment or a repeal of a by-law, to the shareholders of the corporation, and the shareholders may, with approval of a simple majority, confirm, reject or amend the by-law, amendment or repeal. The provisions of the Yukon Act are substantially the same.

Authorization of Unlimited Number of Shares. The CBCA permits a corporation to have an unlimited number of shares without par value. The provisions of the Yukon Act are substantially the same.

Rights of Dissent and Appraisal. The CBCA provides that shareholders who dissent to certain actions being taken by a corporation may exercise a right of dissent and require the corporation to purchase the shares held by such shareholder at the fair value of such shares. The dissent right is applicable where the corporation proposes to (a) amend the articles to add, change or remove provisions restricting or constraining the issue, transfer or ownership of shares of that class, (b) amend its articles to add, change or remove any restriction on the business that the corporation may carry on, (c) enter into a long form amalgamation, (d) continue out of the jurisdiction, (e) sell, lease or exchange all or substantially all its property, or (f) carry out a going-private transaction or a squeeze-out transaction. The dissenting shareholder is required to strictly comply with the provisions of the CBCA in order to exercise this remedy. The Yukon Act provides similar rights to shareholders but is not available to shareholders in the context of a going-private or a squeeze-out transaction. SeeRight of Dissent under the Yukon Act, below.

Oppression Remedies. Under the CBCA, a shareholder has the right to apply to a court for an order where an act or omission of the corporation or an affiliate effects a result, or the business or affairs of which are conducted in a manner, or the exercise of the directors’ of the corporation’s or any of its affiliates powers, would be oppressive or unfairly prejudicial to or would unfairly disregard the interests of any security holder, creditor, director or officer of the corporation. On such an application, the court may make any interim or final order it thinks fit, including an order restraining the conduct complained of. Under the Yukon Act, the oppression remedy is substantially the same as that in the CBCA.

Shareholder Derivative Actions. Pursuant to the CBCA, a complainant, which includes a shareholder, may apply to the court for leave to bring an action in the name of and on behalf of a corporation or any subsidiary, or to intervene in an existing action to which the corporation is a party for the purpose of prosecuting, defending or discontinuing the action on behalf of the corporation. On such an application, the court may make any order it thinks fit, including an order authorizing the complainant or any other person to control the conduct of the action. Pursuant to the Yukon Act, derivative actions are dealt with in substantially the same manner as the CBCA.

Financial Assistance. The CBCA does not restrict a corporation from giving financial assistance to shareholders or directors of the corporation or an affiliated corporation. The Yukon Act contains provisions that restrict the corporation from doing so except in specified circumstances.

Record Date for Voting. The CBCA provides for the setting of a fixed record date for voting purposes. Transfers of shares after the record date are not recognized for voting entitlement purposes. The Yukon Act does not permit the setting of a fixed record date for voting purposes and a transferee of shares requesting to have its name included in the relevant shareholder list at least ten days (or such shorter time as is provided in the by-laws) prior to the meeting is entitled to vote, provided that the transferee can establish that the transferee owns the shares.

Requisition of Meetings. The CBCA provides that holders of not less than five per cent of the issued shares of a corporation that carry the right to vote at a meeting sought to be held may requisition the directors to call a meeting of shareholders for the purposes stated in the requisition. The provisions of the Yukon Act are substantially the same.

Shareholder Communication. The CBCA contains exemptions from the restrictions on proxy solicitation that permit a shareholder to make a public announcement concerning the shareholder’s voting intentions (whether by way of a speech in a public forum or the issuance of a press release, opinion, statement or advertisement). In addition, the CBCA enables shareholders to communicate with each other, (i) for the purpose of obtaining support for shareholder proposals, (ii) if such communications relate to the business and affairs of the corporation, (iii) to organize a dissident’s proxy solicitation, (iv) if 15 or fewer shareholders are solicited, (v) as clients, by a person engaged in the business of providing proxy voting advice, and (vi) other communications as may be prescribed from time to time. The Yukon Act does not contain such broad exemption s to the proxy solicitation rules and, accordingly, shareholder communication is more limited.

Form of Proxy and Information Circular. The CBCA requires that management of a distributing corporation, concurrently with giving notice of a meeting of shareholders, send a form of proxy in prescribed form to each shareholder who is entitled to receive notice of the meeting. Where management of a corporation solicits proxies, a management proxy circular in prescribed form must also accompany the notice of the meeting. The Yukon Act contains similar provisions.

Electronic Documents. The CBCA contains innovative provisions dealing with electronic communication with shareholders. The Yukon Act contains no such provisions.

Place of Meetings. The CBCA provides that meetings of shareholders of a corporation must be held at the place within Canada provided in the by-laws or, in the absence of such provision, at the place within Canada that the directors determine. A meeting of shareholders of a corporation may be held at a place outside of Canada if the place is specified in the articles or all the shareholders entitled to vote at the meeting agree that the meeting is to be held at that place. Under the Yukon Act, meetings of shareholders of a corporation must be held at the place within the Yukon provided in the by-laws or, in the absence of such a provision, at the place within the Yukon that the directors determine. If the articles of the Corporation so provide, meetings of the shareholders may be held outside the Yukon at one or more places specified in the articles.

Electronic meetings. The CBCA permits any person entitled to attend a meeting of shareholders to participate by means of telephonic, electronic or other communication facilities that permit all participants to adequately communicate with each other. The CBCA also provides that a meeting may be held entirely electronically if authorized by the by-laws of the corporation. The Yukon Act does not contain similar provisions.

Quorum of Shareholders. The CBCA states that, unless the by-laws of a corporation otherwise provide, a quorum of shareholders is present at a meeting of shareholders (irrespective of the number of persons actually present at the meeting) if holders of a majority of the shares entitled to vote at the meeting are present in person or represented by proxy. The Yukon Act provides for substantially the same quorum requirements.

Shareholder Consent in Lieu of Meeting. The CBCA provides that a resolution in writing signed by all the shareholders entitled to vote on that resolution at a meeting of shareholders is as valid as if it had been passed at a meeting of the shareholders. The Yukon Act contains substantially the same provisions.

Shareholder Proposals. The CBCA contains eligibility requirements for shareholders that wish to submit proposals for inclusion in a corporation’s proxy materials, including a requirement that a shareholder have had a continuous minimum level of investment in the corporation for a specified period of time. No similar requirements are imposed by the Yukon Act.

Duties of Directors. The CBCA provides that, subject to any unanimous shareholder agreement, the directors manage, or supervise the management of, the business and affairs of the Corporation. The Yukon Act simply provides that the directors manage the business and affairs of the Corporation and does not explicitly contemplate supervision.

Directors’ Residency. The CBCA states that a distributing corporation shall have not fewer than three directors, at least two of whom are not officers or employees of the corporation or its affiliates. At least twenty-five per cent of the directors of a corporation must be resident Canadians. However, if a corporation has less than four directors, at least one director must be a resident Canadian. Furthermore, at least twenty-five percent of the directors present at a meeting of directors must be resident Canadians to properly transact business. The Yukon Act does not contain any residency requirements for directors.

Removal of Directors. The CBCA permits the removal of directors by holders of a majority of the shares being voted. Unless otherwise provided in the articles of a corporation, a quorum of directors may fill a vacancy among the directors, except for a vacancy resulting from an increase in the number or the minimum or maximum number of directors or the failure to elect the number or minimum number of directors provided for in the articles. The Yukon Act contains substantially the same provisions.

The continuance does not create a new legal entity, nor will it prejudice or affect the continuity of the Corporation. The continuance will not result in any change in the business of the Corporation nor in the persons who constitute the Corporation’s Board of Directors and its officers.

In order to authorize the continuance, shareholders of the Corporation will be asked to consider and, if deemed advisable, pass the special resolution authorizing the continuance as set out in Schedule “A” to this Circular (the “Continuance Resolution”). This special resolution requires the affirmative vote of not less than two-thirds of the votes cast by the shareholders who vote in respect thereof. The Board of Directors recommends that shareholders vote in favour of the Continuance Resolution. In the absence of contrary instructions, the persons named in the accompanying form of proxy intend to vote any Common Shares represented by proxies held by them FOR the Continuance Resolution.

Right of Dissent under the Yukon Act

The following description of the rights of shareholders of the Corporation who dissent (“Dissenting Shareholders”) to the Continuance Resolution is not a comprehensive statement of the procedures to be followed by a Dissenting Shareholder who seeks payment of the fair value of such Dissenting Shareholder's Common Shares and is qualified in its entirety by the reference to the full text of Section 193 of the Yukon Act, which is attached to this Circular as Schedule “B”. A shareholder who intends to exercise the right of dissent and appraisal should carefully consider and comply with the provisions of Section 193 of the Yukon Act and retain a legal advisor for such purposes. Failure to comply with the provisions of Section 193 of the Yukon Act and to adhere to the procedures established therein may result in the loss of all rights thereunder.

Shareholders are entitled to the dissent rights set out in Section 193 of the Yukon Act and to be paid the fair value of their Common Shares if such shareholder dissents to the Continuance Resolution and the Continuance Resolution becomes effective. Neither a vote against the Continuance Resolution, nor an abstention or the execution or exercise of a proxy vote against such resolution will constitute notice of dissent, but a shareholder need not vote against such resolution in order to object. A shareholder must dissent with respect to all Common Shares either held personally by him or her or on behalf of any one beneficial owner and which are registered in one name. A brief summary of the provisions of Section 193 of the Yukon Act is set out below.

Persons who are beneficial owners of Common Shares registered in the name of a broker, custodian, nominee or other intermediary who wish to dissent should be aware that only a registered shareholder is entitled to dissent. A shareholder, who beneficially owns Common Shares but is not the registered holder thereof, should contact the registered holder for assistance. In order to dissent, a shareholder must send to the Corporation in the manner set forth below, a written notice of objection (the “Objection Notice”) to the Continuance Resolution. On the action approved by the Continuance Resolution becoming effective, the making of an agreement between the Corporation and the Dissenting Shareholder as to the payment to be made for the Dissenting Shareholder’s Common Shares or the pronouncement of an order by the Court, whichever first occurs, the shareholder ce ases to have any rights as a shareholder other than the right to be paid the fair value of his Common Shares in an amount agreed to by the Corporation and the shareholder or in the amount of the judgement, as the case may be, which fair value shall be determined as of the close of business on the last business day before the day on which the resolution from which the dissent was adopted. Until any one of such events occurs, the shareholder may withdraw his or her dissent or the Corporation may rescind the resolution and in either event, the proceedings shall be discontinued.

If the Continuance Resolution is approved, the Dissenting Shareholder who sent an Objection Notice, or the Corporation, may apply to the court to fix the fair value of the Common Shares held by the Dissenting Shareholder and the court shall make an order fixing the fair value of such Common Shares, giving judgement in that amount against the Corporation in favour of the Dissenting Shareholders and fixing the time by which the Corporation must pay that amount to the Dissenting Shareholder. If such an application is made by a Dissenting Shareholder, the Corporation shall, unless the court otherwise orders, send to each Dissenting Shareholder a written offer (the "Offer to Purchase") to pay to the Dissenting Shareholder, an amount considered by the directors of the Corporation to be the fair value of the subject Common Shares, together with a statement showing how t he fair value of the subject Common Shares was determined.

Every Offer to Purchase shall be on the same terms. At any time before the Court pronounces an order fixing the fair value of the Dissenting Shareholder’s Common Shares, a Dissenting Shareholder may make an agreement with the Corporation for the purchase of his or her Common Shares, in the amount of the Offer to Purchase, or otherwise. The Offer to Purchase shall be sent to each Dissenting Shareholder within 10 days of the Corporation being served with a copy of the originating notice. Any order of the Court may also contain directions in relation to the payment to the shareholder of all or part of the sum offered by the Corporation for the Common Shares, the deposit of the share certificates representing the Common Shares, and other matters. If the Corporation is not permitted to make a payment to a Dissenting Shareholder due to there being reasonable grounds for bel ieving that the Corporation is or would after the payment be unable to pay its liabilities as they become due, or the realizable value of the Corporation’s assets would thereby be less than the aggregate of its liabilities, then the Corporation shall, within ten days after the pronouncement of an order, or the making of an agreement between the shareholder and the Corporation as to the payment to be made for his Common Shares, notify each Dissenting Shareholder that it is unable lawfully to pay such Dissenting Shareholders for their shares.

Notwithstanding that a judgement has been given in favour of a Dissenting Shareholder by the court, if the Corporation is not permitted to make a payment to a Dissenting Shareholder for the reasons stated in the previous paragraph, the Dissenting Shareholder by written notice delivered to the Corporation within 30 days after receiving the notice, as set forth in the previous paragraph, may withdraw his or her notice of objection in which case the Corporation is deemed to consent to the withdrawal and the shareholder is reinstated to his or her full rights as a shareholder, failing which he or she retains his or her status as a claimant against the Corporation to be paid as soon as it is lawfully able to do so or, in a liquidation, to be ranked subordinate to the rights of creditors of the Corporation but in priority to its shareholders.

In order to be effective, a written Objection Notice must be received by the Corporation’s Registered and Records Office in the Yukon Territory, Lackowicz, Shier & Hoffman, Suite 300, 204 Black Street, Whitehorse, Yukon Territory Y1A 2M9, or by the Chairman of the meeting, prior to the commencement or recommencement thereof.

4.

Other Matters

Management of the Corporation knows of no matters to come before the Meeting other than as set forth in the Notice of Meeting. HOWEVER, IF OTHER MATTERS WHICH ARE NOT KNOWN TO MANAGEMENT OF THE CORPORATION SHOULD PROPERLY COME BEFORE THE MEETING, THE ACCOMPANYING PROXY WILL BE VOTED ON SUCH MATTERS IN ACCORDANCE WITH THE BEST JUDGMENT OF THE PERSONS VOTING THE PROXY.

COMPENSATION OF DIRECTORS AND OFFICERS

There were four Named Executive Officers of the Corporation during the year ended November 30, 2008: David McPherson, President and CEO, J. Jay Jaski, former Chairman and CEO until he passed away on December 19, 2007, Jeffrey Sherman, CFO, and Jay Richardson, former CFO until his resignation on February 6, 2008. “Named Executive Officer” or “NEO” means (a) each Chief Executive Officer; (b) each Chief Financial Officer; (c) each of the Corporation’s three most highly compensated executive officers, other than the Chief Executive Officer and the Chief Financial Officer, who were serving as executive officers at the end of the most recently completed financial year and whose total salary and bonus exceeds $150,000; and (d) any additional individual for whom disclosure would have been provided under (c) except that t he individual was not serving as an officer of the Corporation at the end of the most recently completed financial year-end.

SUMMARY COMPENSATION TABLE

NEO Name and Principal Position (a) | Annual Compensation | Long Term Compensation |

Year (b) | Salary ($) (c) | Bonus ($) (d) | Other Annual Compensation ($) (e) | Awards | Payouts | All other Compen- sation (S) (i) |

Securities Under Options/ SARs Granted (#) (1) | Common Shares or Units Subject to Resale Restrictions ($) (g) | LTIP Payouts (S) (h) |

David McPherson(1) | 2008 | 220,000 | 120,000 | Nil | 250,000 | Nil | Nil | Nil |

Jeffrey D. Sherman(2) | 2008 | 59,250 | 12,500 | Nil | 100,000 | Nil | Nil | Nil |

J. Jay Jaski(3)

former Chairman and CEO | 2008 | 28,000 | Nil | Nil | Nil | Nil | Nil | Nil |

2007 | 205,000 | 9,000 | Nil | 1,500,000 | Nil | Nil | Nil |

2006 | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Robert Angrisano(4)

former President and CEO | 2007 | 72,170 | Nil | Nil | 100,000 | Nil | Nil | Nil |

2006 | 80,000 | Nil | Nil | Nil | Nil | Nil | Nil |

Jay Richardson(5)

former CFO | 2008 | 36,000 | Nil | Nil | Nil | Nil | Nil | Nil |

2007 | 48,000 | Nil | Nil | 250,000 | Nil | Nil | Nil |

2006 | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

___________

Notes:

(1)

Mr. McPherson became President and CEO of the Corporation on December 20, 2007. Of the salary amount shown, $60,000 was paid as consulting fees for the period January 1, 2008 to March 31, 2008. He had previously been granted options as a director of the Corporation on 100,000 common shares with an exercise price of $0.90 each on March 27, 2007. Subsequent to the year-end, on December 17, 2008, he was granted options on 400,000 common shares with an exercise price of $0.06 each.

(2)

Mr. Sherman became CFO of the Corporation on February 6, 2008. Subsequent to the year-end, on December 17, 2008, he was granted options on 25,000 common shares with an exercise price of $0.06 each.

(3)

Mr. Jaski was Chairman and CEO of the Corporation until he passed away on December 19, 2007.

(4)

Robert Angrisano resigned as President and CEO of the Corporation on March 27, 2007, and remained an employee of the Corporation until November 30, 2007.

(5)

Mr. Richardson resigned as CFO on February 6, 2008.

Long-Term Incentive Plan Awards

No Long-Term Incentive Plan awards were made to Named Executive Officers during the year ended November 30, 2008.

Option/SAR Grants during the Most Recently Completed Financial Year

The following table sets forth stock options granted to the Named Executive Officers during the year ended November 30, 2008:

NEO Name | Year | Securities Under Options/SARs Granted(#) | % of Total Options/SARs Granted to Employees in Financial Year | Exercise or Base Price ($/Security) | Market Value of Securities Underlying Options/SARs on the ($/Security) Date of Grant | Expiration Date |

David McPherson(1) President and CEO | 2008 | 250,000 | 23.3% | 0.26 | 0.26 | April, 21, 2011 |

Jeffrey D. Sherman(2) CFO | 2008 | 100,000 | 9.3% | 0.31 | 0.31 | February 5, 2011 |

______________

Notes:

(1)

Mr. McPherson became President and CEO of the Corporation on December 20, 2007. Subsequent to the year-end, on December 17, 2008, he was granted options on 400,000 common shares with an exercise price of $0.06 each.

(2)

Mr. Sherman became CFO of the Corporation on February 6, 2008. Subsequent to the year-end, on December 17, 2008, he was granted options on 25,000 common shares with an exercise price of $0.06 each.

Aggregated Option/SAR Exercises during the Most Recently Completed Financial Year and Year-End Option/SAR Values

The following table sets forth incentive stock options exercised by the Named Executive Officers during the year ended November 30, 2008 as well as the value of stock options held by the Named Executive Officers on November 30, 2008.

NEO Name | Securities Acquired on Exercise (#) | Aggregate Value Realized ($) | Unexercised Options/SARs at the Financial Year End (#) Exercisable / Unexercisable | Value of Unexercised in-the-money Options/SARs at Financial Year End ($) Exercisable/ Unexercisable |

David McPherson | Nil | Nil | 200,000/150,000 | Nil/Nil |

Jeffrey D. Sherman | Nil | Nil | 50,000/50,000 | Nil/Nil |

Option and SAR Repricings

There were no option/SAR repricings during the year ended November 30, 2008.

Defined Benefit or Actuarial Plan Disclosure

The Corporation does not provide retirement benefits for directors and executive officers.

Termination of Employment, Change in Responsibilities and Employment Contracts

Mr. McPherson became President and CEO on December 20, 2007. Under an employment contract that was effective April 1, 2008, Mr. McPherson is paid an annual salary of $240,000, payable monthly. Under the contract, he also receives a monthly car allowance of $1,500, and premiums for life and disability insurance paid for by the Corporation. In the event of termination without cause or if a terminating event occurs because of a change in control of the Corporation (or similar event, as defined in the contract), Mr. McPherson receives a minimum of 24 months’ salary plus $100,000.

Under the terms of an employment agreement, dated February 1, 2008, as amended, Mr. Sherman is paid an annual salary of $67,000, and received 100,000 share options exercisable at $0.31, half vesting February 5, 2008, the balance vesting one year later.

Under the terms of an employment agreement dated August 1, 2007 with the Corporation, Mr. Jaski was employed as Chairman and CEO until he passed away on December 19, 2007. Mr. Jaski received an annual salary of $300,000 payable monthly, with the salary payable either in cash or Common Shares at the average closing market price for the five trading days prior to the date of the payment of the salary. That agreement terminated upon the untimely death of Mr. Jaski on December 19, 2007.

Pursuant to a consultant agreement dated September 1, 2006, as amended, with Manaca Inc., a corporation controlled by Mr. Richardson, he was retained as CFO and received an annual consulting fee of $72,000, payable monthly. On February 6, 2008 Mr. Richardson resigned as CFO, and remained as a consultant for the same fee until June 30, 2008.

Composition of the Compensation Committee

The members of the Compensation Committee are Harry Blum (Chair) and R. David Russell. David McPherson resigned from the committee on December 20, 2007 when he became CEO and President of the Corporation. The Board expects to appoint a third member of to the Compensation Committee in due course.

Report on Executive Compensation

Each executive officer receives a base salary, which constitutes the largest share of the officer’s compensation package. Base salary is recognition for discharging job responsibilities and reflects the officer’s performance over time, as well as that individual’s particular experience and qualifications. An officer’s base salary is reviewed by the Compensation Committee on an annual basis and may be adjusted to take into account performance contributions for the year and to reflect sustained performance contributions over a number of years. See the section entitled “Termination of Employment, Change in Responsibilities and Employment Contracts”. Officers are also eligible to receive discretionary performance bonuses as determined by the Board, based on each officer’s responsibilities and performance, his or her ac hievement of corporate objectives and the Corporation’s financial performance.

In addition, officers are eligible under the Existing Plan and will be eligible under the New Plan to receive grants of stock options. The Existing Plan and the New Plan (collectively, the “Plans”) are an important part of the Corporation’s long-term incentive strategy for its officers, permitting them to participate in any appreciation of the market value of the Common Shares over a stated period of time. The Plans are intended to reinforce commitment to long-term growth in profitability and shareholder value. The size of stock option grants to officers is dependent on each officer’s level of responsibility, authority and importance to the Corporation and the degree to which such officer’s long-term contribution to the Corporation will be key to its long-term success.

The composition and role of the Compensation Committee is discussed below under the heading “Compensation”.

Compensation of the Chief Executive Officer

In late 2007, the Compensation Committee engaged Akcessia Consulting Inc. to undertake a broad-based compensation study of junior exploration companies. Akcessia reviewed the compensation plans for 70 comparable companies and considered base salaries, bonuses, other compensation, and options of the CEOs of such companies. The Compensation Committee reviewed the study in detail and structured a recommendation as a result of its review. The Board is of the view that the compensation of the Chief Executive Officer reflects market compensation practices.

Submitted by:

Harry Blum (Chair);

R. David Russell.

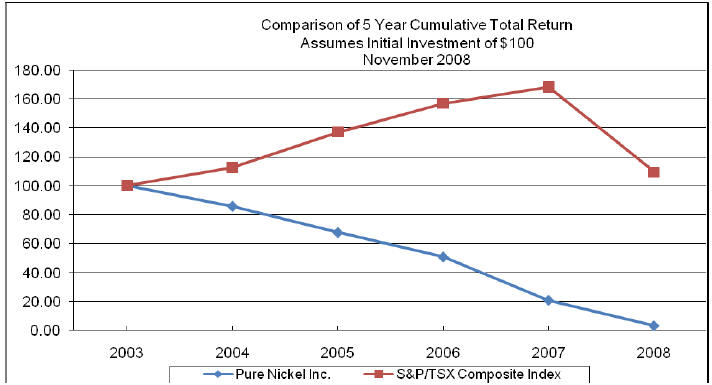

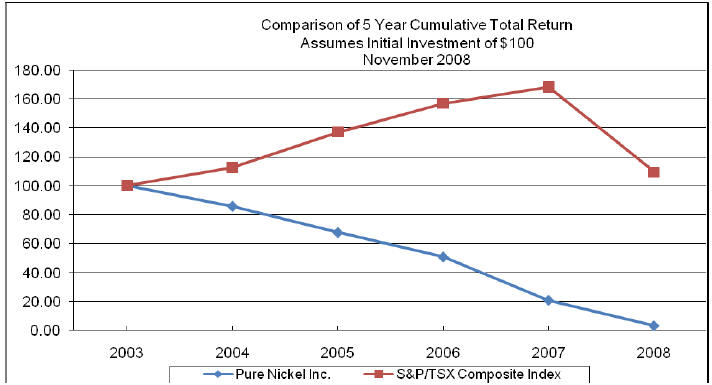

Performance Graph

As at November 30, 2008, the following graph shows the total cumulative return on a $100 investment on November 30, 2003 in common shares of Pure Nickel Inc, compared to the S&P/TSX 300 Composite Index (assuming reinvestment of dividends) over the five year period ended November 30, 2008. Note that the data points only record the value at November 30 each year, so that fluctuations during the years are not shown.

Compensation of Directors

Compensation for outside directors is set at $600 per director for each meeting, and $750 for the Chairman of any committee. In addition each director was granted options for 100,000 common shares exercisable at $0.26 each, on April 21, 2008. During the year, the Corporation incurred legal expenses with a firm of which a director, Mr. W. S. Vaughan was a principal, of $255,666, and paid David McPherson $60,000 and Robert Angrisano $19,037 for consulting services.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER

EQUITY COMPENSATION PLANS

As of November 30, 2008, the securities authorized for issuance under the equity compensation plan of the Corporation, being the Existing Plan, were as follows:

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (b) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (c) |

Equity compensation plans approved by security holders | 4,175,000 | $0.83 | 2,601,555 |

Equity compensation plans not approved by security holders | nil | n/a | n/a |

Totals | 4,175,000 | $0.83 | 2,601,555 |

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIORS OFFICERS

None of the directors, executive officers or senior officers of the Corporation, and none of the associates or affiliates of any of the foregoing, is currently indebted to the Corporation or was indebted to the Corporation at any time since the beginning of the Corporation’s most recently completed fiscal year.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

Except as otherwise set out herein, there have been no material transactions entered into since the beginning of the Corporation’s last completed fiscal year, or proposed to be entered into by the Corporation that have or will materially affect the Corporation or any of the affiliates of the Corporation involving an officer or director of the Corporation, a proposed nominee for election as a director of the Corporation, the principal shareholder of the Corporation or any associate or affiliate of any of such persons.

MANAGEMENT CONTRACTS

No management functions of the Corporation or its subsidiaries are to any substantial degree performed by a person or company other than the directors or executive officers of the Corporation or its subsidiaries.

INTERESTS OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No person who has been a director or officer of the Corporation at any time since the beginning of its last completed fiscal year, no proposed nominee for election as a director, and no associate of any of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the meeting, except as disclosed in this Management Information Circular.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Board and the management of the Corporation consider good corporate governance to be central to effective and efficient operations. Through the Corporate Governance and Nominating Committee, the Board reviews, evaluates and modifies its governance program to ensure it is of the highest standard. The Board is satisfied that the Corporation’s governance plan is consistent with legal and stock exchange requirements. In recent years, there have been several changes to the corporate governance disclosure requirements applicable to the Corporation. Specifically, the Canadian Securities Administrators introduced in final form National Instrument 58-101 –Disclosure of Corporate Governance Practices and National Policy 58-201 –Corporate Governance Guidelines, both of which came into force on June 30, 2005 and effectively replaced the c orporate governance guidelines and disclosure policies of the TSX. Under NI 58-101, the Corporation is required to disclose certain information relating to its corporate governance practices. This information is set out in Schedule “C” to this Circular. In addition, the Corporation’s Corporate Mandate is attached hereto as Schedule “D”.

Audit Committee

The members of the Audit Committee are Harry Blum (Chair) and R. David Russell. David McPherson resigned from the committee on December 20, 2007 when he became President and CEO of the Corporation. The Board will appoint a third member of the Audit Committee in due course. All current members of the Audit Committee meet the independence criteria set out in Multilateral Instrument 52-110 –Audit Committees, and the Corporate Governance Guidelines. The responsibilities and operation of the Audit Committee are set out in the charter of the Audit Committee, the text of which is available on SEDAR at www.sedar.com and on the Corporation’s web site at www.purenickel.com. A description of the relevant education and experience of each Audit Committee member, the Audit Committee’s policy regarding pre-approval of audit and non-audit services, and the fees paid by the Corporation to its auditors for audit, audit-related and non-audit services can be found in the AIF under the section entitled “Audit, Governance and Compensation Committee”.

ADDITIONAL INFORMATION

Additional information relating to the Corporation is available on SEDAR at www.sedar.com. Copies of the Corporation’s comparative financial statements and accompanying Management’s Discussion and Analysis for the fiscal year ended November 30, 2008 are available on SEDAR or shareholders may request copies to be sent to them without charge by contacting the Corporate Secretary of the Corporation at (416) 644-0066. Financial information with respect to the Corporation is provided in the Corporation’s comparative financial statements and accompanying Management’s Discussion and Analysis for the most recently completed financial year.

APPROVAL

The contents and the sending of this Management Information Circular have been approved by the Board.

DATED as of February 9, 2009

BY ORDER OF THE BOARD

/s/ ROBERT ANGRISANO

Robert Angrisano

Chairman of the Board of Directors

SCHEDULE “A”

SPECIAL RESOLUTION OF THE SHAREHOLDERS OF PURE NICKEL INC.

CONTINUANCE UNDER THE CANADA BUSINESS CORPORATIONS ACT

BE IT RESOLVED AS A SPECIAL RESOLUTION THAT:

1

the continuance of the Corporation under the Canada Business Corporations Act on substantially the terms and conditions set out in the Management Information Circular of the Corporation dated February 9, 2009 is hereby authorized and approved;

2

any director or officer of the Corporation is hereby authorized and directed to make application pursuant to Section 187 of the Canada Business Corporations Act to the Director thereunder and to the registrar under the Business Corporations Act (Yukon) to continue the Corporation as if it had been incorporated under the Canada Business Corporations Act;

3

the articles of the Corporation are hereby amended by substituting all of the provisions thereof with the provisions set out in the Articles of Continuance a copy of which is annexed hereto as Exhibit I, with any amendments, deletions or alterations as may be considered necessary or advisable by any officer of the Corporation in order to ensure compliance with the Canada Business Corporations Act and the requirements of the Director thereunder, and that such Articles of Continuance are hereby approved;

4

any one director or officer of the Corporation is hereby authorized and instructed to take all such acts and proceedings and to execute and deliver all such applications, authorizations, certificates, documents, and instruments, including, without limitation, the instrument of continuance, articles of continuance, by-laws and any forms prescribed by the Canada Business Corporations Act or the Business Corporations Act (Yukon) as in his or her opinion may be necessary or desirable for the implementation of this resolution;

5

effective upon the issuance of such certificate of continuance, the General By-Law of the Corporation attached hereto as Exhibit II is hereby adopted and approved; and

6

the directors of the Corporation may, in their absolute discretion, abandon the application for the continuance of the Corporation under the Canada Business Corporations Act at any time without further approval, ratification or confirmation by the shareholders of the Corporation.

EXHIBIT I TO SCHEDULE “A”

ARTICLES OF CONTINUANCE

SCHEDULE 1 TO THE ARTICLES OF CONTINUANCE

OF PURE NICKEL INC.

1

The actual number of directors within the minimum and maximum number set out in paragraph 5 may be determined from time to time by resolution of the board of directors. Any vacancy among the directors resulting from an increase in the number of directors as so determined may be filled by resolution of the directors.

2

The directors are authorized to appoint one or more directors, who shall hold office for a term expiring not later than the close of the next annual meeting of shareholders, but the total number of directors so appointed may not exceed one-third the number of directors elected or appointed at the last annual meeting of shareholders.

EXHIBIT II TO SCHEDULE “A”

GENERAL BY-LAW

A by-law relating generally to the transaction of the business and affairs of

PURE NICKEL INC.

DIRECTORS

1.

Calling of and notice of meetings

Meetings of the board will be held on such day and at such time and place as the Chairman, President, Secretary of the Corporation or any two directors may determine. Notice of meetings of the board will be given to each director not less than 48 hours before the time when the meeting is to be held. Each newly elected board may without notice hold its first meeting for the purposes of organization and the appointment of officers immediately following the meeting of shareholders at which such board was elected.

2.

Place of meetings

Meetings of the board may be held at any place within or outside Canada and in any financial year of the Corporation it shall not be necessary for a majority of the meetings of the board to be held at a place within Canada.

3.

Quorum of directors

At any meeting of directors, a quorum shall be a majority of the directors then in office.

4.

Votes to govern

At all meetings of the board every question will be decided by a majority of the votes cast on the question; and in case of an equality of votes the chair of the meeting will not be entitled to a second or casting vote.

5.

Interest of directors and officers generally in contracts

No director or officer will be disqualified by his or her office from contracting with the Corporation nor will any contract or arrangement entered into by or on behalf of the Corporation with any director or officer or in which any director or officer is in any way interested be liable to be voided nor will any director or officer so contracting or being so interested be liable to account to the Corporation for any profit realized by any such contract or arrangement by reason of such director or officer holding that office or of the fiduciary relationship thereby established provided that, in each case, the director or officer has complied with the provisions of the Canada Business Corporations Act.

SHAREHOLDERS’ MEETINGS

6.

Quorum

A quorum of shareholders is present at a meeting of shareholders, irrespective of the number of persons actually present at the meeting, if the holder or holders of 5% of the shares entitled to vote at the meeting are present in person or represented by proxy.

7.

Meetings by telephonic or electronic means

A meeting of the shareholders may be held by means of a telephonic, electronic, web-based or other communication facility that permits all participants to communicate adequately with each other during the meeting.

8.

Proxies

To the extent permitted by theCanada Business Corporations Act, the directors may from time to time pass resolutions regarding the lodging of instruments appointing a proxyholder at some place or places other than the place at which a meeting or adjourned or postponed meeting of shareholders is to be held and for particulars of such instruments to be sent in writing or otherwise communicated by such electronic means that is capable of producing a written copy or report before the meeting or adjourned meeting to the Corporation or any agent of the Corporation appointed for the purpose of receiving such particulars, recognizing any electronic method of indicating assent to such an instrument as proper execution or authorization by the maker thereof, and providing that instruments appointing a proxy so lodge d may be voted upon as though the instruments themselves were produced at the meeting or adjourned meeting and votes given in accordance with such resolutions shall be valid and shall be counted. The chairman of any meeting of shareholders may, subject to any resolutions made as aforesaid and applicable law, in his or her discretion accept written or electronic communication that is capable of producing a written copy or report, as to the authority of anyone claiming to vote on behalf of and to represent a shareholder notwithstanding that no instrument of proxy conferring such authority has been lodged with the Corporation, and any votes given in accordance with such written or electronic communication accepted by the chairman of the meeting shall be valid and shall be counted.

9.

Postponement or cancellation of meetings

A meeting of shareholders may be postponed or cancelled by the board at any time prior to the date of the meeting.

10.

Procedures at meetings

The board may determine the procedures to be followed at any meeting of shareholders including, without limitation, the rules of order. Subject to the foregoing, the chair of a meeting may determine the procedures of the meeting in all respects.

INDEMNIFICATION

11.

Indemnification of directors and officers

The Corporation will indemnify a director or officer of the Corporation, a former director or officer of the Corporation or another individual who acts or acted at the Corporation’s request as a director or officer, or in a similar capacity, of another entity, and his or her heirs and legal representatives to the extent permitted by the Canada Business Corporations Act.

12.

Indemnity of others

Except as otherwise required by theCanada Business Corporations Actand subject to paragraph 11, the Corporation may from time to time indemnify and save harmless any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that he or she is or was an employee or agent of the Corporation, or is or was serving at the request of the Corporation as an employee, agent of or participant in another entity against expenses (including legal fees), judgements, fines and any amount actually and reasonably incurred by him or her in connection with such action, suit or proceeding if he or she acted honest ly and in good faith with a view to the best interests of the Corporation or, as the case may be, to the best interests of the other entity for which he or she served at the Corporation’s request and, with respect to any criminal or administrative action or proceeding that is enforced by a monetary penalty, had reasonable grounds for believing that his or her conduct was lawful. The termination of any action, suit or proceeding by judgement, order, settlement or conviction will not, of itself, create a presumption that the person did not act honestly and in good faith with a view to the best interests of the Corporation or other entity and, with respect to any criminal or administrative action or proceeding that is enforced by a monetary penalty, had no reasonable grounds for believing that his or her conduct was lawful.

13.

Right of indemnity not exclusive

The provisions for indemnification contained in the by-laws of the Corporation will not be deemed exclusive of any other rights to which any person seeking indemnification may be entitled under any agreement, vote of shareholders or directors or otherwise, both as to action in his or her official capacity and as to action in another capacity, and will continue as to a person who has ceased to be a director, officer, employee or agent and will inure to the benefit of that person’s heirs and legal representatives.

14.

No liability of directors or officers for certain matters

To the extent permitted by law, no director or officer for the time being of the Corporation will be liable for the acts, receipts, neglects or defaults of any other director or officer or employee or for joining in any receipt or act for conformity or for any loss, damage or expense happening to the Corporation through the insufficiency or deficiency of title to any property acquired by the Corporation or for or on behalf of the Corporation or for the insufficiency or deficiency of any security in or upon which any of the moneys of or belonging to the Corporation will be placed out or invested or for any loss or damage arising from the bankruptcy, insolvency or tortious act of any person, firm or body corporate with whom or which any moneys, securities or other assets belonging to the Corporation will be lodged or deposited or for any loss, conversion, misapplication or misappropriation of or any damage resulting from any dealings with any moneys, securities or other assets belonging to the Corporation or for any other loss, damage or misfortune whatever which may happen in the execution of the duties of his or her respective office or trust or in relation thereto unless the same will happen by or through his or her failure to act honestly and in good faith with a view to the best interests of the Corporation and in connection therewith to exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances. If any director or officer of the Corporation is employed by or performs services for the Corporation otherwise than as a director or officer or is a member of a firm or a shareholder, director or officer of a body corporate which is employed by or performs services for the Corporation, the fact that the person is a director or officer of the Corporation will not disentitle such director or officer or such firm or body corporate, as the case may be, from receiving proper remuneration for such services.

BANKING ARRANGEMENTS, CONTRACTS, ETC.

15.

Banking arrangements

The banking business of the Corporation, or any part thereof, will be transacted with such banks, trust companies or other financial institutions as the board may designate, appoint or authorize from time to time and all such banking business, or any part thereof, will be transacted on the Corporation’s behalf by one or more officers or other persons as the board may designate, direct or authorize from time to time.

16.

Execution of instruments

Contracts, documents or instruments in writing requiring execution by the Corporation will be signed by hand by any two persons each of whom is an officer or director of the Corporation (whether under the corporate seal of the Corporation, if any, or otherwise) and all contracts, documents or instruments in writing so signed will be binding upon the Corporation without any further authorization or formality. The board is authorized from time to time by resolution:

(a)