Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

SCIENTIFIC-ATLANTA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No Fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ Fee | paid previously with preliminary materials. |

| ¨ Check | box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

September 27, 2004

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Scientific-Atlanta, Inc. to be held on Wednesday, November 3, 2004, at 9:00 a.m., local time, at our offices located at 5030 Sugarloaf Parkway, Lawrenceville, Georgia 30044. At this year’s meeting, the shareholders will consider the following:

| 1. | The election of three directors; |

| 2. | The ratification of selection of the independent accountant; and |

| 3. | Such other matters as may properly come before the meeting and at any adjournments thereof. |

This year we are including the Scientific-Atlanta Code of Conduct as an appendix to the proxy materials for the 2004 annual meeting. The Code of Conduct is our longstanding policy regarding ethics and business conduct and includes CORE VALUES based on INTEGRITY, HONESTY and RELIABILITY. We believe that adherence to these core values will help us to grow and expand the opportunities for both Scientific-Atlanta and our employees. This Code of Conduct applies to all our directors and employees because we believe that their cooperation and support are required to maintain our standards of conduct and integrity and are necessary for us to adhere to high ethical, moral, legal and business standards.

We look forward to seeing you at the annual meeting.

Sincerely,

Michael C. Veysey

Senior Vice President and Secretary

Scientific-Atlanta, Inc., 5030 Sugarloaf Parkway, Lawrenceville, Georgia 30044

Table of Contents

2004 ANNUAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

Table of Contents

SCIENTIFIC-ATLANTA, INC.

2004 ANNUAL MEETING OF SHAREHOLDERS

Time: | 9:00 a.m., Wednesday, November 3, 2004 | |

Place: | Scientific-Atlanta, Inc. 5030 Sugarloaf Parkway Lawrenceville, GA 30044 | |

Items of Business: | 1. Elect the following directors: | |

Ÿ James I. Cash, Jr. | ||

Ÿ James F. McDonald | ||

Ÿ Terence F. McGuirk | ||

2. Ratify the selection by the Audit Committee of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 1, 2005. | ||

3. Transact such other business as may properly come before the meeting and any adjournment. | ||

Who May Vote: | You can vote if you were a shareholder of record at the close of business on September 15, 2004. | |

Documents: | A proxy solicited by our Board, our Notice of 2004 Annual Meeting, our 2004 Proxy Statement and our 2004 Annual Report are included in this mailing. | |

Proxy Voting: | Your vote is important. Please vote in one of these ways: | |

1. Visit the web site listed on your proxy card; | ||

2. Use the toll-free telephone number listed on your proxy card; or | ||

3. Mark, sign, date and promptly return the enclosed proxy card in the postage-paid envelope. | ||

Electronic Delivery: | During this year’s voting process you may consent to receive future annual meeting materials on the Internet, instead of using the traditional paper-based delivery system. You may access electronic copies of the 2004 annual meeting materials on Scientific-Atlanta’s investor relations web site at www.scientificatlanta.com under the button labeled “Investor Relations.” | |

By Order of the Board of Directors, Michael C. Veysey, Secretary, September 27, 2004.

i

Table of Contents

SCIENTIFIC-ATLANTA, INC.

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 3, 2004

Why am I receiving these annual meeting materials?

The Board of Directors of Scientific-Atlanta is providing these materials to you in connection with our 2004 Annual Meeting of Shareholders. As a shareholder, you are invited to attend the meeting and are entitled to vote on the proposals described in this proxy statement.

The meeting will be held at 9:00 a.m., local time, on November 3, 2004 at our principal office located at 5030 Sugarloaf Parkway, Lawrenceville, Georgia 30044. These proxy materials are first being mailed to shareholders on or about September 27, 2004.

What is the purpose of the annual meeting?

At the annual meeting, the shareholders will act upon the matters outlined in the notice of meeting, including the election of three directors and ratification of the selection of independent accountant. Our Board recommends that you vote your shares:

| Ÿ | “FOR” each of the nominees to the Board; and |

| Ÿ | “FOR” the ratification of selection of independent accountant. |

In addition, on our proxy card you are being asked to consent to access future proxy material electronically on the Internet rather than receive paper copies in the mail. Our management will also report on the performance of Scientific-Atlanta during fiscal year 2004 and respond to questions from shareholders.

Where can I find out more about Scientific-Atlanta’s corporate governance initiatives?

The Board of Directors is responsible for establishing broad corporate policies and monitoring the overall performance of Scientific-Atlanta. The documents relating to the 2004 Annual Meeting of Shareholders, corporate governance policies established by the Board and other board governance information,including the following, can be found on Scientific-Atlanta’s investor relations web site at www.scientificatlanta.com under the button labeled “Investor Relations”:

| Ÿ | Our Code of Conduct which applies to our directors and all employees, including the senior financial officers (attached to these proxy materials as Appendix A); |

| Ÿ | Our Board Corporate Governance Guidelines (attached to these proxy materials as Appendix B); |

| Ÿ | The charters for our Audit Committee, Governance and Nominations Committee and the Human Resources and Compensation Committee (HRCC); |

| Ÿ | Information regarding Scientific-Atlanta’s Audit Committee hotline; |

| Ÿ | Section 16 filings of Scientific-Atlanta’s directors and executive officers in accordance with Section 403 of the Sarbanes-Oxley Act; and |

| Ÿ | Information regarding our compliance officer and internal audit function. |

Our Code of Conduct, Board Corporate Governance Guidelines and the charters for our Audit Committee, Governance and Nominations Committee and HRCC are available in print to any shareholder who requests such printed version in writing addressed to Office of General Counsel, Scientific-Atlanta, Inc., 5030 Sugarloaf Parkway, Lawrenceville, GA 30044.

All shareholders of record as of the close of business on the record date of September 15, 2004 may vote. As of September 15, 2004, we had 153,459,704 shares of common stock outstanding and entitled to vote.

How much does each share count?

Each share of Scientific-Atlanta common stock, $0.50 par value per share, is entitled to one vote. The

1

Table of Contents

presence at the meeting, in person or by proxy, of a majority of the shares of common stock outstanding on the record date will constitute a quorum at the meeting. Abstentions and broker non-votes will be counted to determine a quorum.

What does it mean if I receive more than one proxy card?

You will receive a proxy card for each account you have. Please vote proxies for all accounts to ensure that all your shares are voted.

How do I give voting instructions?

If your shares are registered directly in your name with Scientific-Atlanta’s transfer agent, The Bank of New York, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you. If you are the shareholder of record, you may attend the annual meeting and give instructions in person. You may also give voting instructions via the Internet, telephone or mail as described below. The proxy committee, named on the enclosed proxy card, will vote all properly executed proxies that are delivered pursuant to this solicitation and not subsequently revoked in accordance with the instructions given by you.

If your shares are held in a stock brokerage account or by a bank or other nominees, you are considered the beneficial owner of such shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee, which is considered the shareholder of record with respect to those shares. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee how to vote your shares. As the beneficial owner, you are invited to attend the meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meeting unless you have obtained a signed proxy from the record holder giving you the right to vote the shares.

How do I vote via the Internet?

If you are a shareholder of record, the web site for Internet voting is shown on your proxy card. Internet voting is available 24 hours a day, seven days a week. You will be given the opportunity to confirm that your instructions have been properly recorded, and you can consent to view future proxy statements and annual reports on the Internet instead ofreceiving them in the mail. If you vote on the Internet, you doNOT need to return your proxy card. The deadline for voting via the Internet is 5:00 p.m., Atlanta local time, on November 2, 2004. If you are a beneficial owner, or hold your shares in street name, please check your voting instruction card or contact your broker or nominee to determine whether you will be able to vote via the Internet.

If you are a shareholder of record, you can vote your shares by telephone by calling the toll-free telephone number shown on your proxy card. Telephone voting is available 24 hours a day, seven days a week. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. Our telephone voting procedures are designed to authenticate the shareholder by using individual control numbers. If you vote by telephone, you will also be given the opportunity to consent to view future proxy statements and annual reports on the Internet instead of receiving them in the mail. If you vote by telephone, you doNOT need to return your proxy card. The deadline for voting by telephone is 5:00 p.m., Atlanta local time, on November 2, 2004. If you are a beneficial owner, or hold your shares in street name, please check your voting instruction card or contact your broker or nominee to determine whether you will be able to vote by telephone.

If you are a shareholder of record, you may simply mark the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. If you wish to consent to view future proxy statements and annual reports on the Internet, check the box provided on the card.

If you hold your shares in street name, you must sign the voting instruction card provided by your broker or nominee and mail it in the accompanying postage-paid envelope. If you wish to view future proxy statements and annual reports electronically, please contact your broker or nominee.

Will my shares be voted if I do not provide my proxy?

Your shares may be voted under certain circumstances if they are held in the name of a brokerage firm. Brokerage firms have the authority

2

Table of Contents

under the New York Stock Exchange rules to vote customers’ unvoted shares, which are referred to as broker non-votes, on certain routine matters. At the meeting, shares represented by broker non-votes will be counted as voted by the brokerage firm in the election of directors and the ratification of selection of independent accountant, but will not be counted for any other matters to be voted on because these other matters are not considered routine. If you hold your shares directly in your name, they will not be voted if you do not provide a proxy.

What if I return my proxy card but do not provide voting instructions?

If you sign and return your proxy, but do not provide voting instructions, your shares will be voted “FOR” the election of the nominee directors named in this proxy statement and “FOR” the ratification of selection of independent accountant. In addition, the holders of the proxies will vote in their discretion on any other matters properly presented.

You may revoke a proxy by any one of the following three actions:

| 1. | delivering an instrument revoking the proxy to our Secretary, |

| 2. | delivering a later dated proxy to our Secretary, or |

| 3. | voting in person. |

Attendance at the annual meeting, in and of itself, will not constitute a revocation of a proxy.

Who will bear the cost of soliciting votes for the meeting?

We have engaged Morrow & Co., Inc. to assist in the solicitation of proxies from brokers, banks and their nominees which are shareholders of record, at a cost of approximately $8,000 plus reasonable expenses. We will pay the costs of this solicitation, including the cost of preparing and mailing this proxy statement. In addition to solicitations by mail, our directors and regular employees may solicit proxies in person or by telephone or other method. In such case, these directors or employees, as the case may be, would not receive any compensation in addition to their regular compensation as directors or employees for such solicitation.

Votes cast by proxy or in person at the annual meeting will be counted by the persons appointed by us to act as the inspectors of election for the meeting. All proxies and other voting materials are kept confidential and are not disclosed to us, subject to standard exceptions.

What are some of the considerations relating to electronic access of annual meeting materials?

The following are some things to note about electronic access of future annual meeting materials:

| Ÿ | Choosing online access of future annual meeting materials is voluntary. |

| Ÿ | Accessing your Scientific-Atlanta annual meeting materials online requires that you have access to the Internet, which may result in charges to you from your Internet service provider and/or telephone companies. |

| Ÿ | If you elect to access future annual reports and proxy material on the Internet, you will still receive a paper copy of the notice of annual meeting of shareholders and a proxy card in the mail to vote your shares. The proxy card will contain the Internet address for viewing the annual report and proxy statement, and instructions for electronic voting. |

| Ÿ | Your consent will be effective for accessing all future Scientific-Atlanta annual reports, notices of annual meeting and proxy statements, and will continue in effect unless it is revoked by you. |

| Ÿ | You may revoke your election if you change your mind after consenting by calling 1-800-524-4458. Also, even if you elect to view our annual meeting materials online, you will still be able to request printed copies of the annual report and proxy statement. |

| Ÿ | If you do not sign up for this service, you will continue receiving paper copies of these documents by U.S. mail. |

Whether you register for Internet access to the annual meeting documents or not, you will be able to choose how you want to vote your shares: via telephone, Internet or U.S. mail.

3

Table of Contents

ELECTION OF DIRECTORS

The Scientific-Atlanta articles of incorporation provide for the division of the Board into three classes, with the directors in each class serving for a term of three years. The nominees for director to be elected to serve until the annual meeting of shareholders in 2007 are: James I. Cash, Jr., James F. McDonald and Terence F. McGuirk. All of the nominees for election as directors at this meeting, and all directors whose term of office will continue after the annual meeting, are currently directors of Scientific-Atlanta.

Directors are elected by a plurality of the votes cast at the annual meeting in person or by proxy by the holders of shares entitled to vote in the election. Votes may be cast for or withheld from each nominee. Abstentions may not be specified with respect to the election of directors. The withholding of authority by a shareholder will not be counted in computing a plurality and thus will have no effect on the results of the election of such nominees.

The Board is informed that all of the nominees are willing to serve as directors, but if any of them should decline or be unable to act as a director, the persons designated as proxy holders in the accompanying proxy card(s) (or their substitutes) will vote for such substitute nominee or nominee(s) as may be designated by the Board unless the Board reduces the number of directors accordingly.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF THE NOMINEES.

NOMINEES FOR TERMS EXPIRING IN 2007 | ||

| JAMES I. CASH, JR. Director since 2001 Age 56

Dr. Cash served on the Harvard Business School faculty from 1976 to September 2003 and as chairman of the MBA program from 1992 to 1995. Dr. Cash is a director of The Chubb Corporation, General Electric Company, Microsoft Corporation and Phase Forward Incorporated. | |

| JAMES F. McDONALD Director since 1993 Age 64

Mr. McDonald has served as President and Chief Executive Officer of Scientific-Atlanta since July 1993 and Chairman of the Board of Scientific-Atlanta since November 2000. Mr. McDonald is a director of Burlington Resources, Inc., Mirant Corporation and NDCHealth Corporation. | |

4

Table of Contents

| TERENCE F. McGUIRK Director since 2001 Age 53

Mr. McGuirk has served as Vice Chairman of Turner Broadcasting System, Inc., a subsidiary of Time Warner Inc. and a producer of news and entertainment products and provider of programming for the basic cable industry, since April 2001. In addition, as Chairman and President of the Atlanta Braves, he has maintained executive oversight of all aspects of this baseball franchise, including player personnel, team operations and Turner Field, since April 2001. From 1996 to 2001, Mr. McGuirk was Chairman and Chief Executive Officer of Turner Broadcasting System, Inc. Mr. McGuirk is a director of Haverty Furniture Companies, Inc. |

DIRECTORS WHOSE TERMS WILL EXPIRE IN 2005

| DAVID W. DORMAN Director since 1998 Age 50

Mr. Dorman has been Chairman of the Board and Chief Executive Officer of AT&T Corp., a company that provides internet and transaction-based voice and data services, since November 2002. Mr. Dorman was President of AT&T from 2000 to 2002 and the Chief Executive Officer of Concert, a former global venture created by AT&T and British Telecommunications, from 1999 to 2000. Mr. Dorman was Chairman, President and Chief Executive Officer of PointCast, Inc., an internet software company, from 1997 to 1999. Mr. Dorman is a director of AT&T. | |

| WILLIAM E. KASSLING Director since 1990 Age 60

Mr. Kassling has served as Chairman of the Board of Westinghouse Air Brake Technologies Corporation, which is doing business as Wabtec Corporation and is a provider of equipment and services for the global rail industry, since 1990. Since May 2004, he has also served as Wabtec’s President and Chief Executive Officer. He previously served as Chief Executive Officer of Wabtec from March 1990 to February 2001. Mr. Kassling is a director of Aearo Corporation and Parker-Hannifin Corporation. | |

| MYLLE H. MANGUM Director since 1993 Age 56

Ms. Mangum has served as Chief Executive Officer of International Banking Technologies, a provider of branch banking solutions, since October 2003. From July 2002 to October 2003, Ms. Mangum served as Chief Executive Officer of True Marketing Services, LLC, a marketing services company. She was Chief Executive Officer of MMS Incentives, LLC, a private equity company concentrating on high-tech marketing solutions, from May 1999 to June 2002. Ms. Mangum is a director of Barnes Group, Inc., Haverty Furniture Companies, Inc., Payless ShoeSource, Inc., Respironics, Inc. and Emageon UV, Inc. | |

5

Table of Contents

DIRECTORS WHOSE TERMS WILL EXPIRE IN 2006 | ||

| MARION H. ANTONINI Director from 1990-2002 and since February 2003 Age 74

Mr. Antonini served as director of Scientific-Atlanta from 1990 until he retired in November 2002. In February 2003, the Board of Directors re-elected Mr. Antonini as a director. Mr. Antonini has been a Principal in Kohlberg & Company, a private merchant banking firm, since March 1998 and has served as a director and an executive for many companies in which Kohlberg & Co. held an interest. One of these, Printing Arts America, a private commercial printing company, filed a Chapter 11 bankruptcy petition in October 2001, within two years of Mr. Antonini’s resignation as its President. Mr. Antonini is a director of Engelhard Corporation, Orion Food Systems, L.L.C. and Redaelli Tecna S.p.A. | |

| DAVID J. McLAUGHLIN Director since 1987 Age 68

Mr. McLaughlin has been President and Chief Executive Officer of Pentacle Press LLC, a publishing and research company, since December 1999. He served as Vice Chairman of Troy Biosciences Incorporated, a company that develops and markets insect control products, from January 2000 to December 2002, and as President and Chief Executive Officer of Troy Biosciences Incorporated from July 1996 through 1999. He is a director of Smart & Final, Inc. and Troy Biosciences Incorporated. | |

| JAMES V. NAPIER Director since 1978 Age 67

Mr. Napier served as the Chairman of Scientific-Atlanta’s Board of Directors from November 1992 to November 2000. Mr. Napier is a director of Engelhard Corporation, Intelligent Systems, Inc., McKesson Corporation, Vulcan Materials Company and Wabtec Corporation. | |

| SAM NUNN Director since 1997 Age 66

Mr. Nunn has served as Co-Chairman and Chief Executive Officer of the Nuclear Threat Initiative, a charitable organization working to reduce the global threats from nuclear, biological and chemical weapons, since January 2001. Mr. Nunn also has served on the faculty at the School of International Affairs at Georgia Institute of Technology since 1997. From 1997 to December 2003, Mr. Nunn was a partner in the law firm of King & Spalding LLP, which represented us in certain legal matters during fiscal year 2004 and is expected to represent us on a variety of legal matters during fiscal year 2005. Mr. Nunn is a director of ChevronTexaco Corporation, The Coca-Cola Company, Dell Inc., General Electric Company, and Internet Security Systems, Inc. | |

6

Table of Contents

COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors engages in active, independent and informed oversight of Scientific-Atlanta’s business and affairs, including its senior management, and it has taken actions to set the overall corporate tone for ethical behavior, sound business practices and quality financial reporting.

The Board has adopted the Board Corporate Governance Guidelines attached to this Proxy Statement as Appendix B, which contains a process for shareholders to send communications to the Board and the non-management directors, and sets forth the policy with regard to board members’ attendance at annual meetings. The Board Corporate Governance Guidelines can also be found on the Company’s Internet website at www.scientificatlanta.com. Under these Board Corporate Governance Guidelines, the Board has adopted the categorical standards for independence set forth in the applicable New York Stock Exchange rules, and the Board has determined that each director, except for Mr. McDonald, is independent under these standards. In addition, under the Board Corporate Governance Guidelines, the non-management directors meet at least four times annually with the presiding director of these sessions rotating among the committee chairs.

The Board met five times during fiscal year 2004 to consider matters related to the business of Scientific-Atlanta. Each director attended 75 percent or more of the aggregate of the total number of meetings of the Board and the committees of which he or she was a member during the portion of fiscal year 2004 that he or she served as a director or committee member. All directors attended the Company’s 2003 annual meeting of shareholders.

The Board has a standing Audit Committee, Executive Committee, Governance and Nominations Committee, Human Resources and Compensation Committee (“HRCC”), and Pension Investment Committee. The table below provides membership information for each of the standing committees:

| Name | Audit | Executive | Governance & Nominations | HRCC | Pension | |||||

Marion H. Antonini | · | · | ||||||||

James I. Cash, Jr. | · | · | ||||||||

David W. Dorman | · | · | ||||||||

Mylle H. Mangum | · | n | · | |||||||

William E. Kassling | n | · | · | |||||||

James F. McDonald | · | |||||||||

Terence F. McGuirk | · | n | ||||||||

David J. McLaughlin | · | · | ||||||||

James V. Napier | · | n | · | |||||||

Sam Nunn | · | n | ||||||||

n Member and Committee Chair · Member

Audit Committee

The Audit Committee assists the Board in its oversight of Scientific-Atlanta’s accounting and financial reporting processes, including the following:

| Ÿ | The integrity of the financial statements and information, including the audited annual and the unaudited quarterly financial statements; |

| Ÿ | The independence, qualifications, performance and compensation of the independent accountant; |

| Ÿ | The performance of the internal audit function; and |

| Ÿ | The compliance with laws, regulations and internal company policies and the performance of the chief compliance officer. |

The Audit Committee met six times during fiscal year 2004. All of the members of the Audit Committee are independent under Section 301 of the Sarbanes-Oxley Act. In addition, all Audit Committee members meet the

7

Table of Contents

independence and financial literacy and related financial management expertise requirements under the New York Stock Exchange (“NYSE”) listed company rules. The Governance and Nominations Committee has determined that at least one Audit Committee member, Mr. Napier, satisfies the financial expert criteria adopted by the Securities and Exchange Commission (“SEC”) under Section 407 of the Sarbanes-Oxley Act. The Board has considered that Mr. Napier serves as a member of more than three audit committees of publicly-held companies and has determined that such service does not impair the ability of Mr. Napier to effectively serve on the Company’s Audit Committee. This Proxy Statement contains the Audit Committee Report, which starts on page 22, and the Audit Committee Charter as Appendix C.

Executive Committee

The Executive Committee acts for the Board between meetings, subject to certain limitations. The Executive Committee met twice during fiscal year 2004.

Governance and Nominations Committee

The purposes of the Governance and Nominations Committee include the following:

| Ÿ | providing oversight of Board governance; |

| Ÿ | developing and recommending to the Board a set of corporate governance principles applicable to Scientific-Atlanta; |

| Ÿ | making recommendations to the Board as a whole concerning its size, structure and compensation; |

| Ÿ | identifying individuals qualified to become board members; and |

| Ÿ | recommending to the whole Board nominees for the positions of Chairman of the Board, chairmen of the various committees of the Board, and members of the various committees of the Board. |

The Governance and Nominations Committee also considers nominations for directors (and will consider nominations by shareholders). The Governance and Nominations Committee considers director candidates recommended by shareholders in accordance with the Board Corporate Governance Guidelines, which is attached to this Proxy Statement as Appendix B, and its charter, which is attached to this Proxy Statement as Appendix D. The Company’s Board Corporate Governance Guidelines sets forth specific minimum qualifications for director nominees, specific qualities and skills that the committee believes are necessary for the Company’s board members to possess, and describes the committee’s process for identifying and evaluating nominees for director, including nominees recommended by shareholders.

During fiscal year 2004, the Governance and Nominations Committee met four times. All of the members of the Governance and Nominations Committee are independent under applicable rules of the NYSE.

Human Resources and Compensation Committee

The HRCC is responsible for determining whether Scientific-Atlanta’s officers and key management personnel are effectively compensated in terms of salaries, bonuses and supplemental compensation benefits, which properly recognize performance, are internally equitable and externally competitive. The HRCC makes determinations as to the compensation and benefits to be paid to Scientific-Atlanta’s officers and key employees. The members of the HRCC meet the independence criteria under applicable rules of the NYSE and the outside director qualifications of Section 162(m) of the Internal Revenue Code, and are deemed non-employee directors for purposes of Section 16 of the Securities Exchange Act of 1934. The HRCC met four times during fiscal year 2004. This Proxy Statement contains the Report of the HRCC, which starts on page 9.

Pension Investment Committee

The Pension Investment Committee monitors the Scientific-Atlanta qualified retirement plans to determine whether they are adequately funded and that funds are properly invested, reviews the performance of firms that provide investment advice and services to Scientific-Atlanta on pension investment matters, and reviews material changes to Scientific-Atlanta’s retirement plans. The Pension Investment Committee met three times during fiscal year 2004.

8

Table of Contents

HUMAN RESOURCES AND COMPENSATION COMMITTEE

Role of the Committee and the Board

The Human Resources and Compensation Committee (HRCC) sets compensation policies for Scientific-Atlanta’s senior management within guidelines set forth in the HRCC charter, which was approved by the Board of Directors. The HRCC evaluates individual and corporate performance from a short-term and long-term perspective, establishes base salaries and approves annual and long-term incentives for all officers, and administers Scientific-Atlanta’s option and incentive plans for executives. The HRCC’s recommendations regarding the compensation of Scientific-Atlanta’s chief executive officer are subject to the approval of the full board.

Compensation Philosophy

Scientific-Atlanta’s executive compensation program is designed to attract, motivate and retain highly qualified executives and to encourage the achievement of superior performance. The program is designed to:

| Ÿ | Foster a performance-oriented environment with a high level of variable compensation based on the short-term and long-term performance of the individual, team, business unit and Scientific-Atlanta against demanding goals and objectives. |

| Ÿ | Provide total compensation opportunities that exceed industry medians for superior financial results and outstanding personal performance. |

| Ÿ | Align the interests of Scientific-Atlanta’s executives and shareholders through the use of stock-based compensation plans. |

Base Salaries

Scientific-Atlanta positions its base salaries to be fully competitive with the range of compensation levels of high-technology companies and with Scientific-Atlanta’s direct business competitors that have similar market characteristics. National surveys and, periodically, outside compensation consultants are utilized by the HRCC when determining such salaries.

In determining whether the base salaries of executives, including the Chief Executive Officer, should be increased, the HRCC takes into account individual performance, performance of the operations directed by that executive, and the positioning of compensation within established salary ranges.

Incentive Compensation

Under Scientific-Atlanta’s compensation philosophy, the majority of variable compensation is intended to be payable under incentive plans. Payments and awards under these incentive plans are based on the achievement of annual and long-term goals and, accordingly, are “at risk.” Executives of Scientific-Atlanta are eligible to participate in the following incentive plans, as determined by the HRCC:

Senior Officer Annual Incentive Plan. This plan has been designed to qualify as “performance-based” compensation under Internal Revenue Code Section 162(m). Payments under the plan are based upon the achievement of annual goals. The award for Mr. McDonald under the Senior Officer Annual Incentive Plan was determined based on whether Mr. McDonald satisfied the quantitative objectives established by the HRCC earlier in the fiscal year. Mr. McDonald’s award under this plan and the basis for such award are discussed in the “Chief Executive Officer Compensation” section of this report.

9

Table of Contents

Annual Incentive Plan. Under the Annual Incentive Plan (AIP), awards are made based on company, business unit and/or region results and assessments of individual performance. Quantitative and qualitative objectives are weighted 60 percent and 40 percent, respectively, in setting “target” awards for staff participants and 75 percent and 25 percent, respectively, for business unit participants.

Quantitative objectives, consistent with annual business plans approved by the Board, are used in determining the amount of the award governed by the Company, business and/or business unit performance. Awards under the quantitative portion of the AIP are not made if the minimum thresholds are not met. The HRCC may also take into account non-recurring extraordinary circumstances unrelated to Scientific-Atlanta’s financial performance.

The award for Mr. McDonald under the AIP is discussed in the next section of this report. AIP awards for Messrs. Duke, Ecker, Haislip and Harney were based on the quantitative performance of Scientific-Atlanta, as measured by earnings per share, gross margin, sales (revenue) and working capital, and an assessment of their individual performance against personal qualitative objectives.

Senior Officer and AIP awards for the Chief Executive Officer and the four other most highly compensated executives of Scientific-Atlanta are included in the “Bonus” column of the Summary Compensation Table.

Long-Term Incentive Plan (LTIP). This plan permits the HRCC to use one or more long-term incentives to motivate excellent long-term performance. In fiscal year 2004, performance-based awards were granted in the form of cash and stock options to 17 key executives, including Messrs. McDonald, Duke, Ecker, Haislip and Harney. These awards will vest over a term of up to ten years, based on improvement in Scientific-Atlanta’s revenue and earnings per share. There was no earn-out in fiscal 2004. The number of options and cash granted are shown in the Summary Compensation Table.

Stock Option Plan. A larger group of executives and key employees, including the executives named in the Summary Compensation Table, receive grants of stock options under the provisions of the LTIP and the provisions of the 1996 Employee Stock Option Plan. The objective of the grants is to align the interests of executives and key employees with the interests of Scientific-Atlanta’s shareholders by affording the executives and key employees the opportunity of a potentially significant financial benefit if their efforts result in stock price appreciation. The HRCC takes into account the performance of the individual recipient, the number of options previously awarded to any individual participant and Scientific-Atlanta’s grant levels compared to competitive practices, targeting near a median grant posture. Grants made in fiscal year 2004 to Mr. McDonald and the other named executives are shown in the Summary Compensation Table and in the Option Grants in Last Fiscal Year Table. During fiscal year 2004, options for a total of 3,415,395 shares were granted to optionees including new hires.

Policy Relative to Internal Revenue Code Section 162(m)

The Omnibus Budget Reconciliation Act of 1993 (OBRA) limited deductible senior officer annual compensation to $1,000,000, unless the compensation qualifies as “performance-based” compensation under Section 162(m) of the Internal Revenue Code. In general, Scientific-Atlanta will seek to maximize the use of the “performance-based” exemption provided under Section 162(m). The HRCC also believes that inclusion of qualitative (non-quantitative) objectives plays an important role in incentive plans. The HRCC will continue to base a portion of incentive payments on such qualitative assessments, even though they may not meet the Section 162(m) requirements to qualify as “performance-based” compensation.

10

Table of Contents

Stock Ownership

The HRCC believes that significant ownership of Scientific-Atlanta common stock by officers and directors more closely aligns these individuals with Scientific-Atlanta’s other shareholders. As a result, Scientific-Atlanta’s officers and directors agreed during fiscal year 1994 to increase their ownership over time to a level of one times the annual salary for officers (three times in the case of the Chief Executive Officer) and three times the annual retainer for outside directors. As of the end of fiscal year 2004, officers’ holdings averaged 3.3 times base salaries, and outside director holdings averaged 33.4 times annual retainers (based on the closing price of Scientific-Atlanta’s common stock at the end of fiscal year 2004).

Chief Executive Officer Compensation

Effective September 2003, Mr. McDonald’s base salary was increased to $925,000 after having received no increase in base pay in fiscal year 2003.

During fiscal year 2004, Mr. McDonald was granted stock options of 320,000 shares. In combination with the grants of performance-based options and cash, discussed later in this section, the option grant was designed to be fully competitive with grants of long-term incentives to Chief Executive Officers by other comparable high technology companies.

Under the Senior Officer Annual Incentive Plan, Mr. McDonald had an opportunity to earn a maximum of $777,000 if Scientific-Atlanta achieved its maximum targeted performance as measured by earnings per share, gross margin percent, working capital percent and sales (revenue). The results for fiscal year 2004 resulted in the HRCC approving a payment of $761,900, according to the provisions of the plan.

Mr. McDonald also had an opportunity to earn additional incentive pay under the AIP, based on his performance against qualitative objectives. The HRCC approved payment of $500,100 based on his performance during the fiscal year. In reaching its decision, the HRCC noted the excellent performance by Scientific-Atlanta in growing revenue, continuing strong gross margins and generating strong cash flow in addition to increasing market share.

Other Compensation Plans

Scientific-Atlanta also has various broad-based employee benefit plans. Executives participate in these plans on the same terms as eligible, non-executive employees, subject to any legal limits on the amounts that may be contributed or paid to executives under the plans. Scientific-Atlanta offers an Employee Stock Purchase Plan under which employees may purchase Common Stock. Section 16(b) officers may not participate in the Employee Stock Purchase Plan. The Voluntary Employee Retirement and Investment Plan pursuant to the provisions of Section 401(k) of the Internal Revenue Code, permits employees to invest in a variety of funds on a pre-tax basis. Matching contributions under the plan are made in Scientific-Atlanta common stock.

Scientific-Atlanta also maintains pension, insurance and other benefit plans for its employees.

Submitted by the Human Resources and Compensation Committee:

Terence F. McGuirk, Chairman

James I. Cash, Jr.

Mylle H. Mangum

David J. McLaughlin

11

Table of Contents

COMPENSATION OF OFFICERS AND DIRECTORS

Summary Executive Compensation

The following table sets forth in the prescribed format the compensation paid to the Chief Executive Officer and the other four most highly compensated executive officers (“Named Executive Officers”) of Scientific-Atlanta for services rendered in all capacities during Scientific-Atlanta’s last three fiscal years:

Summary Compensation Table

| Long-Term Compensation | |||||||||||||||||||||

| Annual Compensation | Awards | Payouts | |||||||||||||||||||

Name and | Fiscal Year | Salary ($) | Bonus ($) | Other Annual Compensation ($) | Securities Underlying Options(#)(1) | LTIP Payouts ($) | All Other Compensation ($) | ||||||||||||||

James F. McDonald | 2004 | $ | 916,538 | $ | 1,262,000 | $ | — | 480,000 | $ | — | $ | 120,854 | (2) | ||||||||

Chairman of the Board, | 2003 | 870,000 | 865,700 | — | 600,000 | — | 147,801 | (2) | |||||||||||||

President and Chief Executive Officer | 2002 | 860,000 | 559,300 | — | 525,000 | — | 169,918 | (2) | |||||||||||||

H. Allen Ecker | 2004 | 397,692 | 391,400 | 10,755 | (3) | 61,500 | — | 50,626 | (2) | ||||||||||||

Executive Vice President | 2003 | 385,000 | 268,500 | 9,099 | (3) | 75,000 | — | 50,990 | (2) | ||||||||||||

| 2002 | 380,385 | 178,700 | 7,681 | (3) | 70,000 | — | 49,828 | (2) | |||||||||||||

Dwight B. Duke | 2004 | 372,692 | 366,900 | — | 70,500 | — | 44,597 | (2) | |||||||||||||

Senior Vice President; President, | 2003 | 360,000 | 241,500 | — | 82,000 | — | 33,224 | (2) | |||||||||||||

Transmission Network Systems | 2002 | 356,923 | 133,200 | — | 77,000 | — | 40,914 | (2) | |||||||||||||

Wallace G. Haislip | 2004 | 420,769 | 518,700 | — | 100,500 | — | 49,394 | (2) | |||||||||||||

Senior Vice President, | 2003 | 345,000 | 245,200 | — | 82,000 | — | 33,405 | (2) | |||||||||||||

Finance and Operations | 2002 | 341,154 | 31,050 | — | 77,000 | — | 44,766 | (2) | |||||||||||||

Michael P. Harney | 2004 | 368,846 | 368,400 | — | 70,500 | — | 24,546 | (2) | |||||||||||||

Senior Vice President; President, | 2003 | 331,539 | 238,100 | — | 82,000 | — | 14,256 | (2) | |||||||||||||

Subscriber Networks | 2002 | 310,673 | 157,200 | — | 80,000 | — | 15,343 | (2) | |||||||||||||

| (1) | For more information regarding the vesting criteria for these options, see the “Option Grants in Last Fiscal Year” table set forth on page 13. |

| (2) | Includes $41,591, $41,289, $16,734, $20,920 and $14,946 of life insurance premiums paid during fiscal year 2004 on behalf of Messrs. McDonald, Ecker, Duke, Haislip and Harney, respectively. Includes $83,183, $41,578, $10,468, $15,840 and $9,643 of life insurance premiums paid each year during fiscal years 2002 and 2003 on behalf of Messrs. McDonald, Ecker, Duke, Haislip and Harney, respectively. Also includes matching contributions paid during fiscal years 2002, 2003 and 2004 pursuant to the 401(k) plan and the Scientific-Atlanta Executive Deferred Compensation Plan. |

| (3) | Represents preferential earnings on deferred compensation under the 1985 Executive Deferred Compensation Plan. |

12

Table of Contents

Stock Options

The following tables set forth certain information in the prescribed formats with respect to options granted under Scientific-Atlanta’s various stock option plans and under stock option agreements during fiscal year 2004.

Option Grants in Last Fiscal Year

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | |||||||||||||||

Name | Number of Securities Underlying Options Granted(2) | % of Total Options Granted to Employees Fiscal Year 2004 | Exercise or Base Price ($/sh) | Expiration Date | 5%($) | 10%($) | ||||||||||

James F. McDonald | 320,000 | (3) | 9.4 | $ | 33.26 | 2/9/2014 | $ | 6,693,451 | $ | 16,962,520 | ||||||

| 160,000 | (4) | 4.7 | 33.26 | 2/9/2014 | 3,346,726 | 8,481,260 | ||||||||||

H. Allen Ecker | 41,000 | (3) | 1.2 | 33.26 | 2/9/2014 | 857,598 | 2,173,323 | |||||||||

| 20,500 | (4) | 0.6 | 33.26 | 2/9/2014 | 428,799 | 1,086,661 | ||||||||||

Dwight B. Duke | 47,000 | (3) | 1.4 | 33.26 | 2/9/2014 | 983,101 | 2,491,370 | |||||||||

| 23,500 | (4) | 0.7 | 33.26 | 2/9/2014 | 491,550 | 1,245,685 | ||||||||||

Wallace G. Haislip | 30,000 | (3) | 0.9 | 31.78 | 9/29/2013 | 599,588 | 1,519,474 | |||||||||

| 47,000 | (3) | 1.4 | 33.26 | 2/9/2014 | 983,101 | 2,491,370 | ||||||||||

| 23,500 | (4) | 0.7 | 33.26 | 2/9/2014 | 491,550 | 1,245,685 | ||||||||||

Michael P. Harney | 47,000 | (3) | 1.4 | 33.26 | 2/9/2014 | 983,101 | 2,491,370 | |||||||||

| 23,500 | (4) | 0.7 | 33.26 | 2/9/2014 | 491,550 | 1,245,685 | ||||||||||

| (1) | The dollar amounts in these columns were determined using assumed rates of appreciation set by the SEC and are not intended to forecast future appreciation, if any, in the market value of Scientific-Atlanta common stock. Such amounts are based on the assumption that the named persons hold the options for their full ten-year term. The actual value of the options will vary in accordance with the market price of Scientific-Atlanta common stock. |

| (2) | All of these stock options were awarded under the 1994 LTIP. If a change of control occurs (as defined in the 1994 LTIP), all options become exercisable immediately. These options may be exercised within a period of three years following a termination by reason of retirement, within one year following a termination by reason of death or disability, and within thirty days following a termination for other reasons, except for cause, in which case such options expire immediately upon the giving of the notice of such termination. |

| (3) | Vests in four equal installments beginning on the date of grant. |

| (4) | Options granted as part of the long-term incentive plan and vest 100 percent on the sixth anniversary of the date of grant, but may vest earlier based upon the compound annual percentage increase in net revenues over three years. |

13

Table of Contents

Aggregated Option Exercises in Last Fiscal Year and FY-End Option Values

| Number of Securities Underlying Unexercised Options/SARs at Fiscal Year-End (#) | Value of Unexercised In-The-Money Options/SARs at Fiscal Year-End ($)(1) | ||||||||||||||

Name | Shares Acquired on Exercise (#) | Valued Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

James F. McDonald | 225,000 | $ | 4,886,822 | 2,394,641 | 1,025,000 | $ | 7,563,125 | $ | 10,518,250 | ||||||

H. Allen Ecker | — | — | 354,245 | 133,750 | 1,779,932 | 1,361,725 | |||||||||

Dwight B. Duke | 55,250 | 659,915 | 254,652 | 146,500 | 746,167 | 1,451,412 | |||||||||

Wallace G. Haislip | — | — | 315,533 | 169,000 | 1,610,490 | 1,475,037 | |||||||||

Michael P. Harney | 115,000 | 2,249,459 | 216,752 | 147,250 | 941,850 | 1,453,835 | |||||||||

| (1) | The amounts in these columns are calculated using the difference between the closing sales price of Scientific-Atlanta common stock as reported on the New York Stock Exchange on July 2, 2004 of $32.83 and the option exercise prices. |

Long-Term Incentive Awards

The following table provides information concerning the right to receive long-term performance-based incentive cash awards granted during fiscal year 2004. Each contingent cash incentive award represents the right to receive cash on the date of payout. In addition to the right to receive the following cash awards, Scientific-Atlanta also granted options as part of the long-term incentive plan. There was no earn-out of long-term incentive performance awards in fiscal 2004.

Long-Term Incentive Plan—Awards in Fiscal Year 2004

Amount of Grant ($) | Performance or Other Period until Maturation or Payout(1) | Estimated Future Payouts under Non-Stock Price-Based Plans | ||||||||||||

Name | Threshold ($) | Target ($)(1) | Maximum ($) | |||||||||||

James F. McDonald | $ | 416,000 | 10 years | $ | 41,600 | $ | — | $ | 416,000 | |||||

H. Allen Ecker | 120,000 | 10 years | 12,000 | — | 120,000 | |||||||||

Dwight B. Duke | 113,000 | 10 years | 11,300 | — | 113,000 | |||||||||

Wallace G. Haislip | 132,000 | 10 years | 13,200 | — | 132,000 | |||||||||

Michael P. Harney | 113,000 | 10 years | 11,300 | — | 113,000 | |||||||||

| (1) | Vesting of the right to receive the cash performance awards is based generally upon the compound annual percentage increase in earnings per share over three years, subject to certain caps. Upon achieving the minimum level of increase, ten percent of the rights become vested, as shown in the “Threshold” column. Upon achievement of a specified maximum earnings per share increase, all such cash performance awards may become vested, as shown in the “Maximum” column. No “target,” as such, has been established, but partial vesting of the cash performance awards may be achieved upon certain specified increases of Scientific-Atlanta’s earnings per share between the “threshold” and the “maximum” levels. |

14

Table of Contents

Retirement Plans and Other Arrangements

Defined Benefit Retirement Plan. Scientific-Atlanta presently has in effect a non-contributory retirement plan for the benefit of its employees which provides for the payment of fixed benefits upon normal retirement or termination based on age, years of service and all cash compensation of each employee. Examples of annual retirement benefits payable under the retirement plan are set forth in the table below. These examples are based on the following: (i) retirement at the normal retirement age of 65, (ii) “average compensation” is the average compensation in the highest five consecutive of the last ten calendar years of service that immediately precede retirement, and (iii) the benefits are straight life annuities. Benefits under the retirement plan are not reduced by Social Security benefits. The approximate years of service, as of July 2, 2004, credited for retirement benefits for the persons named in the Summary Compensation Table are James F. McDonald, 11 years; H. Allen Ecker, 27 years; Dwight B. Duke, 26 years; Wallace G. Haislip, 15 years and Michael P. Harney, 24 years.

| Years of Service(1) | |||||||||||||||

Average Annual Compensation | 15 | 20 | 25 | 30 | 35 | ||||||||||

$125,000 | $ | 21,145 | $ | 25,160 | $ | 28,371 | $ | 30,780 | $ | 32,654 | |||||

150,000 | 25,374 | 30,191 | 34,046 | 36,936 | 39,185 | ||||||||||

175,000 | 29,603 | 35,223 | 39,720 | 43,092 | 45,715 | ||||||||||

200,000 | 33,832 | 40,255 | 45,394 | 49,248 | 52,256 | ||||||||||

225,000 | 33,832 | 40,255 | 45,394 | 49,248 | 52,256 | ||||||||||

250,000 | 33,832 | 40,255 | 45,394 | 49,248 | 52,256 | ||||||||||

500,000 | 33,832 | 40,255 | 45,394 | 49,248 | 52,256 | ||||||||||

| (1) | Scientific-Atlanta also maintains a Supplemental Executive Retirement Plan (SERP) for its executive officers, including Messrs. McDonald, Ecker, Duke, Haislip and Harney. Provisions of the SERP include a ten-year vesting requirement and a normal retirement age of 65. Benefits are based upon up to fifty percent of final average pay with offsets for the retirement plan, Social Security benefits and any retirement defined benefits payable from former employers. |

The Omnibus Budget Reconciliation Act of 1993 (OBRA) changed the Internal Revenue Code by placing an annual maximum limit of $150,000 on the compensation which may be considered in determining a participant’s benefits. Previous to this change in the statute, the Internal Revenue Code allowed a maximum limit of $235,840 (i.e., $200,000, indexed for a cost of living adjustment). Effective July 1, 1994, Scientific-Atlanta adopted a non-qualified Restoration Retirement Plan to replace the benefits to certain participants that had been eliminated by the changes made to the Internal Revenue Code by OBRA. Thus, effective July 1, 1994, participants’ compensation, as defined in the Restoration Retirement Plan, in excess of the newly prescribed limit and up to what the limit would have been had OBRA not been enacted, will be considered under the Restoration Retirement Plan. Participants under the SERP will continue to have all compensation, as defined in the SERP, in excess of the maximum limit prescribed by the Internal Revenue Code considered in determining their pension benefits. The above table does not include any benefits under the Restoration Retirement Plan.

Agreements and Transactions with Certain Related Persons. Scientific-Atlanta has letter agreements with Messrs. Ecker, Duke, Haislip and Harney which provide for the continuation of salary and certain benefits for a twelve-month period in the event of termination of employment without cause. Scientific-Atlanta also has agreements with Messrs. McDonald, Ecker, Duke, Haislip and Harney which provide for the payment of two times the executive’s compensation plus the continuation of the executive’s benefits for two years in the event the executive’s employment with Scientific-Atlanta is terminated within two years from the time of a change of control (as defined in the agreement) of Scientific-Atlanta, unless such termination is for cause.

Under our by-laws, we may indemnify our directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to Scientific-Atlanta. Scientific-Atlanta has also entered into indemnification agreements with our directors and executive

15

Table of Contents

officers that contractually obligates us to provide this indemnification to them. During fiscal year 2004, we advanced legal expenses to certain directors and officers in connection with a shareholder derivative suit and certain other legal proceedings described in our Form 10-K in an aggregate amount of approximately $257,000.

During fiscal year 2004, Jeffrey H. Taylor, a son-in-law of Mr. McDonald, was employed by Scientific-Atlanta as a Manager, Strategic Planning. Mr. Taylor was paid an aggregate salary and bonus of $95,615 for his services during the year. During fiscal year 2004, Robert B. Disney, a brother-in-law of Michael P. Harney, Senior Vice President; President, Subscriber Network Systems, was employed by Scientific-Atlanta as an Associate Staff Mechanical Engineer. Mr. Disney was paid an aggregate salary and bonus of $78,377. During fiscal year 2004, Terry Thomson, a son-in-law of Patrick M. Tylka, Senior Vice President; President, Worldwide Sales, was employed by Scientific-Atlanta as an account manager in the sales organization. Mr. Thomson was paid an aggregate salary, bonus and sales incentives of $121,517.

Director Compensation

Annual Fees. Each director who is not an employee receives a $50,000 annual cash retainer, paid quarterly, and $1,500 for each meeting of the board and each meeting of a committee he or she attends. Each committee chair receives an additional annual cash retainer of $5,000 paid quarterly, except that the chair of the Audit Committee receives $10,000. The Governance and Nominations Committee has the discretion to increase, based on anticipated time demands, the per meeting fee of certain special sub-committees of Board committees to $2,500. Non-employee directors may elect to defer all or a portion of their retainer and meeting fees under the Deferred Compensation Plan for Non-Employee Directors.

Non-Employee Director Stock Option Plan. Under this option plan, an initial option to purchase 40,000 shares of Scientific-Atlanta common stock is granted to each non-employee director upon joining the Scientific-Atlanta Board. An option to purchase an additional 5,000 shares is granted to each such director on the date of each annual meeting of shareholders. The exercise price for each option is the composite closing price of Scientific-Atlanta common stock on the New York Stock Exchange on the grant date. Each option is exercisable as to 25 percent of the shares covered thereby after the expiration of one year following the date of grant and for an additional 25 percent of the shares after the expiration of each succeeding year, except that if a change of control occurs (as defined in the plan), all options become exercisable immediately. Options granted under this option plan may be exercised within a period of one year following the last day of the director’s board membership, and within three years following termination by death or mandatory retirement. If board membership ceases on account of early retirement, all unexpired options held by the director on the last day of the director’s board membership, which are then exercisable or would have been exercisable had the director continued as a member of the board for one additional year shall be immediately exercisable and remain exercisable for one year following the last day of the director’s membership and shall expire if not exercised within such one year. The options granted under this option plan are exercisable only by the non-employee director, except in certain limited circumstances.

Non-Employee Director Stock Plan. This stock plan provides for the grant of a stock award of 500 shares of Scientific-Atlanta common stock and the grant of a retirement award of 1,500 shares of Scientific-Atlanta common stock to each non-employee director on the date of each annual meeting of shareholders. In addition, under this stock plan, each non-employee director may elect to receive up to 100 percent of his or her quarterly compensation, meeting fees and committee meeting fees from Scientific-Atlanta in the form of shares of Scientific-Atlanta common stock. Receipt of shares awarded as a stock award, retirement award or as an elective grant may be deferred under the Deferred Compensation Plan for Non-Employee Directors. Pursuant to the terms of this stock plan, each year non-employee directors must elect, as to his or her annual retirement award, either (a) to receive the 1,500 shares as restricted stock which cannot be sold or otherwise transferred for two years, or (b) to defer the 1,500 shares for at least two years under the Deferred Compensation Plan for Non-Employee Directors.

16

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the officers, directors, and shareholders of Scientific-Atlanta who own more than ten percent of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than ten-percent shareholders are required by SEC regulations to furnish Scientific-Atlanta with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to us and written representations submitted by the reporting persons, we believe that during the last fiscal year all Section 16(a) filing requirements applicable to its officers, directors and greater than ten-percent beneficial owners were complied with, except that Mr. Kassling reported one transaction late on Form 4.

17

Table of Contents

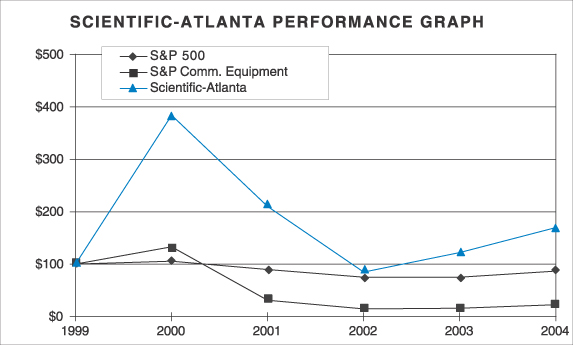

The following graph shows a comparison of total return to shareholders for Scientific-Atlanta, the Standard & Poor’s Communications Equipment Index and the Standard & Poor’s 500 for Scientific-Atlanta’s last five fiscal years. The graph assumes that the value of investment in the Scientific-Atlanta common stock and in each index was $100 on July 3, 1999 and that all dividends were reinvested. The points on the graph represent fiscal year end index levels based on the last trading day in each fiscal year. The values in the graph below have been adjusted to take into account the two-for-one stock split in March 2000.

18

Table of Contents

The following table sets forth information, as of September 1, 2004, as to shares of Scientific-Atlanta common stock held by persons known to us to be the beneficial owners of more than five percent of Scientific-Atlanta common stock based upon information publicly filed by such persons:

Name and Address of Beneficial Owner | Amount of Beneficial Ownership | Percent of Class | |||

Private Capital Management, L.P. | 20,289,930 | 13.4 | %(1) | ||

8889 Pelican Bay Blvd. Naples, Florida 34108 | |||||

Barclays Global Investors, NA. | 19,084,281 | 12.6 | %(2) | ||

45 Fremont Street San Francisco, California 94105 | |||||

FMR Corp. | 13,887,157 | 9.1 | %(3) | ||

82 Devonshire Street Boston, Massachusetts 02109 | |||||

| (1) | Based on a Schedule 13G Amendment No. 4 dated February 13, 2004 filed by Private Capital Management, L.P., Bruce S. Sherman and Gregg J. Powers. Private Capital Management and Messrs. Sherman and Powers have shared voting power over 20,289,930 shares and shared dispositive power over 19,715,930 shares. The percent of class was computed by the beneficial owner as of the date immediately preceding the filing of its Schedule 13G with the SEC. |

| (2) | Based on a Schedule 13G dated February 13, 2004 filed by Barclays Global Investors, NA., et al., Barclays Global Investors, NA. has sole voting and dispositive power over all of these shares. The percent of class was computed by the beneficial owner as of the date immediately preceding the filing of its Schedule 13G with the SEC. |

| (3) | Based on a Schedule 13G Amendment No. 1 dated February 16, 2004 filed by FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson. The percent of class was computed by the beneficial owner as of the date immediately preceding the filing of its Schedule 13G with the SEC. |

19

Table of Contents

The following table sets forth, as of September 1, 2004, unless otherwise indicated, information regarding the beneficial ownership of Scientific-Atlanta common stock held by each director, by each executive officer named in the Summary Compensation Table and by all directors and executive officers as a group:

Name of Beneficial Owner | Amount of Beneficial Ownership(1) | ||

Marion H. Antonini | 196,507 | (2) | |

James I. Cash, Jr. | 48,818 | (3) | |

David W. Dorman | 55,539 | (4) | |

William E. Kassling | 110,541 | (5) | |

Mylle H. Mangum | 76,613 | (6) | |

James F. McDonald | 2,530,955 | (7) | |

Terence F. McGuirk | 49,750 | (8) | |

David J. McLaughlin | 42,921 | (9) | |

James V. Napier | 96,598 | (10) | |

Sam Nunn | 66,531 | (11) | |

H. Allen Ecker | 401,547 | (12) | |

Dwight B. Duke | 267,032 | (13) | |

Wallace G. Haislip | 356,130 | (14) | |

Michael P. Harney | 242,555 | (15) | |

All Directors and Executive Officers as a Group (21 persons) | 5,727,670 | (16) | |

As of September 1, 2004, the total shares beneficially owned by each individual director and executive officer constituted less than 1.0% of the outstanding Scientific-Atlanta common stock, except that the shares beneficially owned by Mr. McDonald constituted 1.6% of the outstanding Scientific-Atlanta common stock. The aggregate shares beneficially owned by all directors and executive officers as a group represented approximately 3.7% of the outstanding common stock.

| (1) | Except as indicated below, each person has sole voting and dispositive power with respect to the shares shown in this column. The number of shares beneficially owned shown in this column: |

| Ÿ | Includes shares held in a dividend reinvestment plan with respect to which a beneficial owner has voting and dispositive power. |

| Ÿ | Includes restricted stock held by the beneficial owner. Directors and executive officers holding restricted stock have the right to vote the shares and to receive dividends on the shares, but do not have the right to dispose of such shares prior to vesting. |

| Ÿ | Includes shares held in the Scientific-Atlanta Voluntary Employee Retirement and Investment Plan (the 401(k) plan) by executive officers, who have voting and dispositive power over these shares. |

| Ÿ | Does not include stock awards deferred into an award sub-account and cash compensation deferred into a stock sub-account under the Deferred Compensation Plan for Non-Employee Directors by non-employee directors, who do not have the right to vote or dispose of these deferred shares. |

| (2) | Includes 50,000 shares of common stock that may be acquired by Mr. Antonini upon exercise of stock options exercisable as of October 31, 2004. Does not include 65,666 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

| (3) | Includes 3,000 shares of restricted stock, 5,500 shares of common stock held through a Keogh Plan and 33,750 shares of common stock that may be acquired by Dr. Cash upon exercise of stock options exercisable as of October 31, 2004. Does not include 1,500 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

| (4) | Includes 47,500 shares of common stock that may be acquired by Mr. Dorman upon exercise of stock options exercisable as of October 31, 2004. Does not include 12,000 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

20

Table of Contents

| (5) | Includes 72,500 shares of common stock that may be acquired by Mr. Kassling upon exercise of stock options exercisable as of October 31, 2004. Does not include 27,059 deferred shares of common stock held through the Deferred Compensation Plan for Non-Employee Directors. |

| (6) | Includes 57,500 shares of common stock that may be acquired by Ms. Mangum upon exercise of stock options exercisable as of October 31, 2004. Does not include 21,500 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

| (7) | Includes 2,394,641 shares of common stock that may be acquired by Mr. McDonald upon exercise of stock options exercisable as of October 31, 2004. |

| (8) | Includes 3,000 shares of restricted stock and 33,750 shares of common stock that may be acquired by Mr. McGuirk upon exercise of stock options exercisable as of October 31, 2004. |

| (9) | Includes 1,412 shares of common stock held by Mr. McLaughlin’s daughter, 400 shares of common stock held by Mr. McLaughlin’s spouse, 1,500 shares of restricted stock and 17,500 shares of common stock that may be acquired by Mr. McLaughlin upon exercise of stock options exercisable as of October 31, 2004. Does not include 62,861 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

| (10) | Includes 57,500 shares of common stock that may be acquired by Mr. Napier upon exercise of stock options exercisable as of October 31, 2004. Does not include 77,453 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

| (11) | Includes 57,500 shares of common stock that may be acquired by Mr. Nunn upon exercise of stock options exercisable as of October 31, 2004. Does not include 38,491 shares of common stock deferred under the Deferred Compensation Plan for Non-Employee Directors. |

| (12) | Includes 354,245 shares of common stock that may be acquired by Dr. Ecker upon exercise of stock options exercisable as of October 31, 2004. |

| (13) | Includes 254,652 shares of common stock that may be acquired by Mr. Duke upon exercise of stock options exercisable as of October 31, 2004. |

| (14) | Includes 323,033 shares of common stock that may be acquired by Mr. Haislip upon exercise of stock options exercisable as of October 31, 2004. |

| (15) | Includes 216,752 shares of common stock that may be acquired by Mr. Harney upon exercise of stock options exercisable as of October 31, 2004. |

| (16) | Includes 7,500 shares of restricted stock and 4,903,644 shares of common stock that may be acquired by directors and executive officers upon exercise of stock options exercisable as of October 31, 2004. Does not include 306,530 deferred shares of common stock held through the Deferred Compensation Plan for Non-Employee Directors. |

21

Table of Contents

RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANT

At the Annual Meeting, there will be presented to the shareholders a proposal to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm for our 2005 fiscal year. The Audit Committee unanimously selected Ernst & Young as the independent registered public accounting firm for our fiscal year ending July 1, 2005.

Representatives of Ernst & Young are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Ratification of the selection of Ernst & Young requires the affirmative vote of a majority of the shares voting on such proposal (i.e., shares voting for or against the proposal). Abstentions and broker non-votes are not counted for or against this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THIS PROPOSAL NO. 2. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED FOR THIS PROPOSAL UNLESS A VOTE AGAINST THE PROPOSAL OR AN ABSTENTION IS SPECIFICALLY INDICATED.

The Audit Committee is directly responsible for oversight of Scientific-Atlanta’s financial reporting and internal control. Management is responsible for the financial statements and the financial reporting process. The independent registered public accountants are responsible for expressing an opinion that Scientific-Atlanta’s audited financial statements are fairly stated in conformity with U.S. generally accepted accounting principles.

In the performance of our oversight function, we have reviewed and discussed the audited financial statements with management. We have discussed with Ernst & Young the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU §380), as amended.

We have received and reviewed the written disclosures and the letter from Ernst & Young required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as amended, and have discussed with Ernst & Young its independence. We have also considered whether the provision of non-audit services provided by Ernst & Young is compatible with maintaining Ernst & Young’s independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in Scientific-Atlanta’s Annual Report on Form 10-K for the year ended July 2, 2004 for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee:

William E. Kassling, Chairman

Marion H. Antonini

Mylle H. Mangum

David J. McLaughlin

James V. Napier

22

Table of Contents

Audit Fees

During fiscal years 2004 and 2003, the aggregate fees billed or expected to be billed by Ernst & Young for professional services rendered for the audit of Scientific-Atlanta’s annual consolidated financial statements, statutory audits of subsidiaries outside of the United States, work related to compliance with Section 404 of the Sarbanes-Oxley Act and the quarterly reviews of the financial statements included in Scientific-Atlanta’s quarterly reports on Form 10-Q were approximately $1,903,000 and $1,329,000, respectively.

Audit-Related Fees

During fiscal years 2004 and 2003, the aggregate fees billed or expected to be billed by Ernst & Young for professional services rendered for audit-related services which included audits of financial statements of certain employee benefit plans and due diligence related to acquisitions (in fiscal year 2003 only) were approximately $54,000 and $179,000, respectively.

Tax Fees

During fiscal years 2004 and 2003, the aggregate fees billed or expected to be billed by Ernst & Young for professional services rendered for tax services were approximately $535,000 and $590,000, respectively. These fees were primarily for tax return review and other compliance matters. The Audit Committee considers the provision of these tax services to be compatible with maintaining the independence of Ernst & Young.

All Other Fees

During fiscal years 2004 and 2003, Ernst & Young did not bill fees for professional services rendered other than as stated under the captions Audit Fees, Audit-Related Fees and Tax Fees above.

Audit Committee Pre-Approval Policy

The Audit Committee has adopted policies and procedures for pre-approving all services (audit and non-audit) performed by Ernst & Young for Scientific-Atlanta. In accordance with that policy, the Audit Committee has approved the provision of audit services by Ernst & Young for fiscal year 2004 and also has approved in advance the provision by Ernst & Young during fiscal year 2005 of particular categories or types of audit, audit-related and tax services, in each case subject to a specific budget. In cases where the provision of services by Ernst & Young has not been approved in advance by the Audit Committee, the chair of the Audit Committee has the delegated authority to pre-approve the provision of services, and such pre-approvals are then communicated to the full Audit Committee at the subsequent meeting.

23

Table of Contents

The Board knows of no other matters that are to be brought before the meeting. However, if any such other matters should be presented for consideration and voting, it is the intention of the persons named in the enclosed form of proxy to vote the proxy in accordance with their best judgment.

A copy of Scientific-Atlanta’s Annual Report on Form 10-K, including financial statements and schedule, filed with the SEC for the fiscal year ended July 2, 2004, is included in the annual report to shareholders that accompanies these proxy materials. Copies of any exhibit(s) to the Form 10-K will be furnished on request and upon the payment of Scientific-Atlanta’s expenses in furnishing such exhibit(s). Any request for exhibits should be in writing addressed to Michael C. Veysey, Senior Vice President and Secretary, Scientific-Atlanta, Inc., 5030 Sugarloaf Parkway, Lawrenceville, Georgia 30044.

SHAREHOLDER PROPOSALS AND NOMINATIONS FOR 2005 ANNUAL MEETING

For a shareholder’s proposal to be included in our Proxy Statement and form of proxy for the 2005 annual meeting of shareholders, the proposal must be submitted in writing to Michael C. Veysey, Senior Vice President and Secretary, Scientific-Atlanta, Inc., 5030 Sugarloaf Parkway, Lawrenceville, Georgia 30044, by no later than May 26, 2005.

In accordance with Scientific-Atlanta’s By-Laws, shareholders who do not submit a proposal for inclusion in the Proxy Statement, as described in the previous paragraph, but who intend to present a proposal, nomination for director or other business for consideration at the 2005 annual meeting, are required to notify the Secretary of Scientific-Atlanta of their proposal, nomination or other business by no later than sixty (60) days (expected to be September 4, 2005) and no earlier than ninety (90) days (expected to be August 5, 2005) prior to the 2005 annual meeting. Scientific-Atlanta’s By-Laws contain detailed requirements that the shareholder’s notice must satisfy. Any shareholder notice and any request for a copy of Scientific-Atlanta’s By-Laws should be in writing and addressed to Michael C. Veysey, Senior Vice President and Secretary, Scientific-Atlanta, Inc., 5030 Sugarloaf Parkway, Lawrenceville, Georgia 30044.