Exhibit 99.3

Building a Global Biopharmaceutical Leader

“Combining Strengths to Deliver Superior Value

through Innovation and Globalization”

Brussels, May 18, 2004

Disclaimer

• Unless otherwise determined by UCB and permitted by applicable law and regulation, the Offer will not be made, directly or indirectly, in or into, Australia, Belgium, Canada or Japan and the Offer will not be capable of acceptance from within Australia, Canada, Japan or Belgium. Accordingly, unless otherwise determined by UCB and permitted by applicable law and regulation, copies of this presentation or any other documents related to the Offer have not been and may not be mailed or otherwise forwarded, distributed or sent in or into Australia, Belgium, Canada or Japan and persons receiving such documents (including custodians, nominees and trustees) must not distribute or send them in, into or from any such jurisdictions.

• The Offer has not been notified to, and the offer documents have not been approved by, the Belgian Banking, Finance and Insurance Commission. The Offer is not available to persons resident in Belgium.

• This document does not constitute an offer or invitation to purchase any securities or a solicitation of an offer to buy any securities and no part of it shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. Celltech shareholders are advised to read the Offer Document and the Form of Acceptance and Celltech shareholders in the US are additionally advised to read the Tender Offer Statement and the Solicitation/Recommendation Statement where they become available because they will contain important information. The Tender Offer Document and the Solicitation/Recommendation Statement will be available on the SEC’s website from the date the Offer Document is mailed to Celltech Shareholders. The Offer Document and Form of Acceptance accompanying the Offer Document will be made available to all Celltech Shareholders at no charge to them.

• This communication has been prepared by and is the sole responsibility of UCB. Lazard is acting for UCB and for no one else in connection with the Offer and will not be responsible to anyone other than UCB for providing the protections afforded to customers of Lazard or for providing advice in relation to the Offer. JP Morgan and Morgan Stanley are acting for Celltech and for no one else in connection with the Offer and will not be responsible to anyone other than Celltech for providing the protection afforded to customers of JP Morgan and Morgan Stanley or for providing advice in relation to the Offer.

• This document has been prepared by UCB solely for use at the analysts’ presentation held in connection with the Offer.

• The analysts’ presentation includes “forward-looking statements” relating to the Offer, UCB and Celltech that are subject to known and unknown risks and uncertainties, many of which are outside of UCB’s and Celltech’s control and are difficult to predict, that may cause actual results to differ materially from any future results expressed or implied from such forward-looking statements. Important factors that could cause actual results to differ materially from such expectations include, without limitation: the inability to obtain necessary regulatory approvals in the context of the Offer or to obtain them on acceptable terms; the inability to integrate successfully Celltech within UCB or to realise synergies from such integration following the acquisition; costs related to the acquisition of Celltech; the economic environment of the industries in which UCB and Celltech operate; costs associated with research and development; changes in the prospects for products in the research and development pipeline of UCB or Celltech; dependence on existing management of UCB and Celltech; changes or uncertainties in UK or US federal or state tax laws or the administration of such laws; changes or uncertainties in the laws or regulations applicable to the markets in which UCB and Celltech operate, including those of the Federal Drug Administration in the United States; and other factors detailed in Celltech’s filings with the SEC.

• The information contained in this document has not been independently verified. No representation or warranty express or implied is made as to, and no reliance should be placed on the fairness, accuracy, completeness or correctness of the information or opinions contained herein. Neither UCB nor Celltech nor any of their respective affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document.

2

Today’s Agenda

• Introduction

G. Jacobs, Chairman of UCB Executive Committee

• Presentation of UCB and Celltech

R. Doliveux, Deputy Chairman of UCB Executive Committee, CEO of UCB Pharma Dr. Göran Ando, Chief Executive Officer of Celltech

• Transaction Rationale: Combining Strengths

R. Doliveux, Deputy Chairman of UCB Executive Committee, CEO of UCB Pharma

• Transaction Description

Marc Wiers, Adviser to UCB Executive Committee

• Conclusion

G. Jacobs, Chairman of UCB Executive Committee

3

UCB Makes Friendly Offer to

Acquire Celltech

G. Jacobs,

Chairman of UCB Executive Committee

UCB Group Strategy

• Acquiring innovative specialty business while divesting chemical commodities

• Quantum leap Pharma

• Celltech a unique opportunity

5

Building a Global Biopharmaceutical Leader

UCB Pharma | | Celltech |

• Innovative European-based Pharma company with global research and commercial platform delivering strong cash-flows | | • Leading European-based Biotech company with a strong Research platform and a pipeline with blockbuster potential |

• Expand leadership in specialist market segments

• Combine attractive pipelines and strong R&D capabilities

• Build potential blockbusters (Keppra, CDP-870,…) beyond Zyrtec

• Strengthen U.S. presence

• Realize synergies

Enhanced long-term top & bottom line performance

6

Attractive Transaction

• Full cash offer of 550p per share

• Implies share capital valuation of € 2.25bn

• Premium of 26.3% over three-month average

• Agreed-upon transaction

• Unanimously recommended by Celltech and UCB Boards

• Fully supported by management of both companies

• Simultaneous execution of licensing agreement on CDP 870

• Separate process

(1) Exchange rate (€/£): 1.4721

7

Combining Celltech with UCB will Drive Success

• Transaction fulfills UCB stated objectives

• Experienced management teams from both companies will lead the new group

• Best of both organizations will be combined

• Göran Ando will be nominated for UCB Board and join management team

• Corporate and Pharma headquarters to be based in Brussels

• R&D headquarters to be located in Slough (UK)

8

UCB: Global Leader in Targeted Specialist Areas

Roch Doliveux,

Deputy Chairman of UCB Executive Committee

CEO of UCB Pharma

Key Strengths of UCB Pharma

• Leader in Neurology and Allergy

• Global reach

• Track record of innovation (Zyrtec, Keppra, Xyzal,...)

• Experienced management team

• Strong in-market and financial performance

• Proven experience of successful acquisition and integration

10

UCB Pharma:

Leader in Allergy and Neurology

| |

| # 1 in allergy (Worldwide) |

| |

| |

| # 1 in epilepsy (US) |

Source: IMS

11

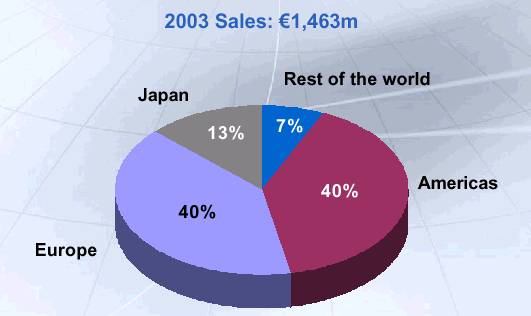

UCB Pharma: Global Reach

Source: UCB

12

UCB Pharma: Strong Historical Growth 14.5% CAGR over the Last Ten Years

Source: UCB

13

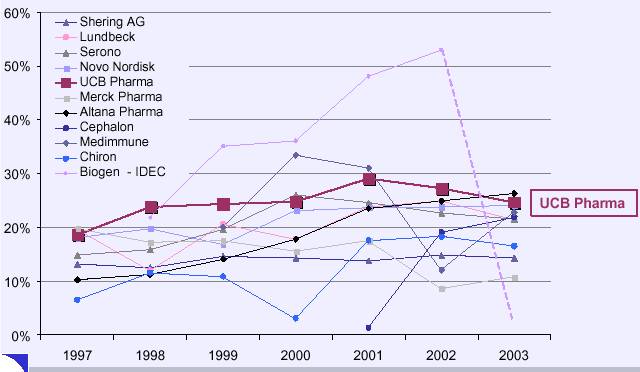

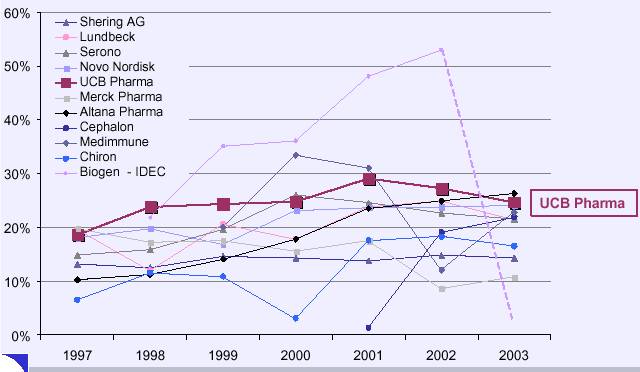

Comparative Evolution EBIT/Turnover 1997-2003 Mid-Cap Peer Group

Note: Negative EBIT Margin excluded

Source: Corporate Documents of Selected peer companies

14

UCB Pharma Vision and Strategy

Become the global “Specialist” company

to deliver sustained double-digit growth

• Innovate and acquire

• Lead in targeted specialist markets

• Expand lifecycles

• Maintain superior EBIT/Sales ratio

15

UCB Assessment of an Acquisition Opportunity

• Increase turnover base with external growth

• Complement our R&D activities

• Enlarge patent protected drug portfolio

• Enable us to sustain double digit growth

• Within 5 years, increase range of products in market

• Further enhance “specialist” profile

• Strengthen US presence

• Affordable

16

Celltech: World-class UK-based Biotechnology Company

Dr. Göran Ando,

Chief Executive Officer of Celltech

Celltech Overview

• Celltech is the leading UK-based biotech company

• R&D platform with capabilities in both

• Monoclonal antibodies

• Small molecules

• Cash-flows from existing portfolio of products with strong brands

• €511m revenues in 2003 (1)

• Manufacturing capabilities in Ashton and Rochester

• Sales and marketing organization in the US and Europe

• Tussionex life cycle

• Strong pipeline

• Potential blockbuster drug in Phase III (CDP 870)

• Promising early stage pipeline of specialist products

(1) Exchange rate (€/£): 1.4457

18

Celltech: Global Leading Antibody Technology Platform

| | | | Designing optimal therapeutic entity |

Antibody engineering | | | | • Valency |

| | | | • Conjugates |

| | | | • Novel entities (e.g triFab) |

| | | | |

| | Rapid selection of diverse and high affinity antibodies | | |

| | • SLAM | | |

| | | | |

Manufacturing systems | | | | Half-life prolongation |

• E.coli | | | | • PEG |

| | | | |

| | Target validation | | |

| | • Parallel reagents (SLAM) | | |

19

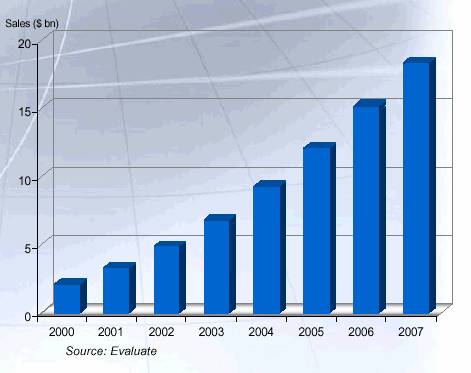

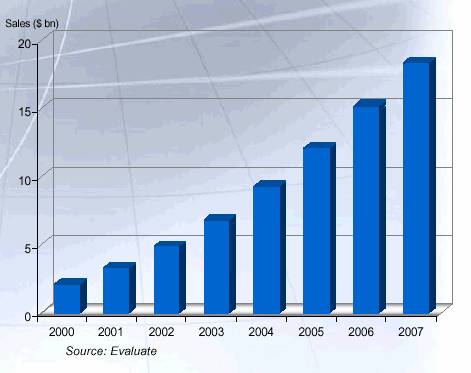

Large and Attractive Monoclonal Antibody (MAb) Market

• High success rate because of well-validated targets

• Many MAbs already approved by FDA

• Address specialty markets

• Several products have blockbuster potential

• Accelerated pathway to market

• Lower generic risk

Annual WW Sales MAbs

20

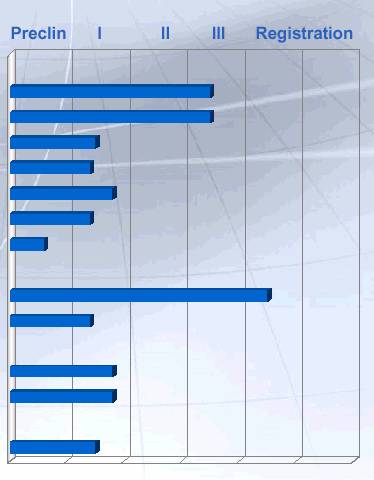

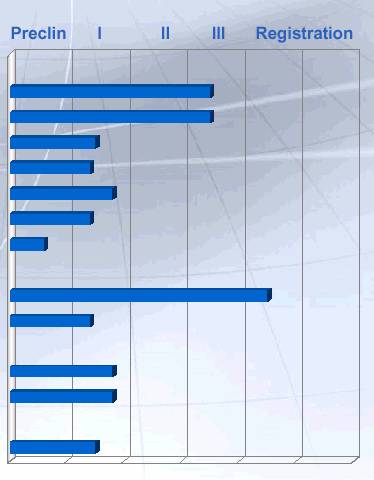

Celltech: Product Pipeline

Immune and inflammatory |

CDP-870 | | Rheumatoid arthritis |

| | Crohn’s disease |

| | Other indications: Psoriasis |

PDE4 | | COPD/Asthma |

CDP-484 | | Rheumatoid arthritis |

CDP-323 | | Inflammation |

CDP-146 | | Inflammation |

CNS | | |

Xyrem | | Narcolepsy |

CDP-323 | | Multiple Sclerosis |

Cancer | | |

CMC-544 | | NHL |

CDP-791 | | Cancer |

Other | | |

CDP-923 | | Inherited Storage Disorders |

Source : Celltech

21

CDP-870: Innovative New TNFa Inhibitor

• Celltech: full product rights from Feb 04

Crohn’s disease | | Rheumatoid arthritis |

(Phase III): | | (Phase III): |

• PRECISE-1 and 2 started Dec 03/Jan 04 | | • Positive MTX combination trial (014) |

• Incorporates CRP stratification | | • Monotherapy results Q304 |

| | • Further studies; start H204 |

• Life cycle management

• Delivery and process improvements

• New indications

22

Celltech Early Stage Pipeline

• CDP-323: oral a4-integrin inhibitor for inflammatory diseases (RA, IBD, MS)

• Encouraging natalizumab data in MS

• No safety issues identified

• Initial PK/PD data encouraging

• Phase II in RA starts H204; other indications to be determined

• CDP-484: anti-IL-1b Fab-PEG for inflammatory diseases (RA)

• Phase I/II study ongoing assess safety and efficacy in patients; due to complete end-04

• CDP-146: oral p38 MAP kinase inhibitor for inflammatory diseases (RA, COPD)

• Good preclinical efficacy; Phase I to start H204

• Oncology: building a 2nd strong area of focus

• Accelerated though OGS acquisition

• Pursuing multiple therapeutic approaches

• Strong fit with existing technologies

23

Transaction Rationale:

Combining Strengths

Roch Doliveux,

Deputy Chairman of UCB Executive Committee

CEO of UCB Pharma

UCB and Celltech Transaction Rationale

• Expanded leadership position in focused specialist-driven areas:

• CNS, inflammation, oncology

• Well-timed launches:

• CDP-870 by 2007

• UCB 44212, UCB 34714, CDP-484, CDP-323,... by 2010

• Complementary strengths in R&D enhance future prospects

• Existing global development, marketing and sales platform

• Complementary existing business (Respiratory, CNS)

• Stronger US presence

• Synergies to be realized rapidly

• Complementary organizational and management skills experienced in successful integrations

25

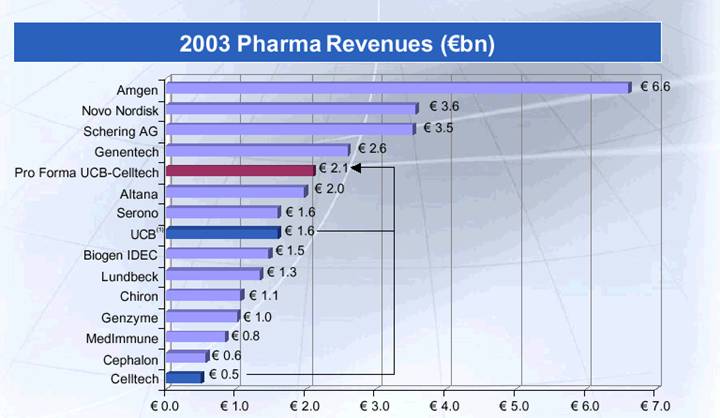

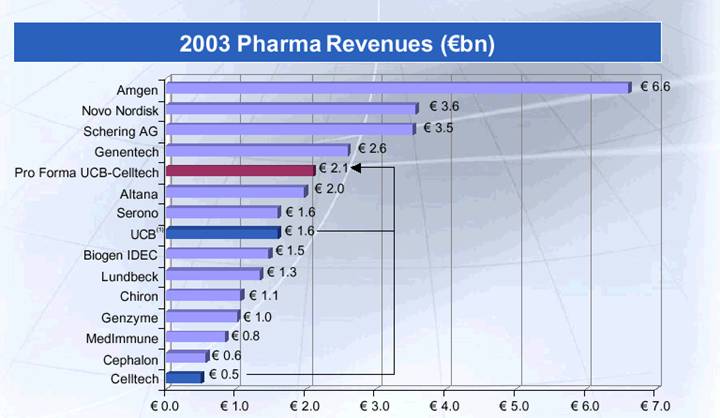

Building a Global Biopharmaceutical Leader

(1) Including Royalty Incomes

Source: Corporate Documents of Selected peer companies

26

Strong Specialist Focus of Combined Pipeline

| | | I | | II | | III | | Submission/Approval | |

| | | | | | | | | | |

CNS | Epilepsy | | UCB 44212 | | UCB 34714 | | Keppra | | | |

| | | | | | (IV, mono, PGS, ped) | | | |

| | | | | | | | | |

Multiple Sclerosis | | CDP-323 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Other | | | | Keppra | | | | | |

CNS | | | | UCB 34714 | | | | Xyrem | |

| | | | | | | | | | |

INFLAMMATION | Allergy / | | CDP 323 | | Dynavax | | Xyzal | | Xyzal (PER) | |

Respiratory | | Efletirizine (qd) | | UCB 35440 | | (EPAAC) | | Efletirizine (bid) | |

Rheumatoid Arthritis | | CDP-323

CDP-484 | | | | CDP-870 | | | |

| | | | | | | | | |

IBD / Crohn’s | | | | | | | | | |

Disease | | CDP-323 | | | | CDP-870 | | | |

| | | | | | | | | | |

ONCOLOGY | | | CMC-544 | | | | | | | |

| | CDP-791 | | | | | | | |

| | | | | | | | | | |

OTHER | | | CDP-923 | | | | | | Oxybutynin TDS | |

| | | | | | | | | | |

TOTAL | | | 8 / 2 | | 0 / 5 | | 2 / 2 | | 1 / 3 | |

UCB: blue

Celltech: red

27

UCB + Celltech: Enhanced Growth in Short, Medium and Long-Term

28

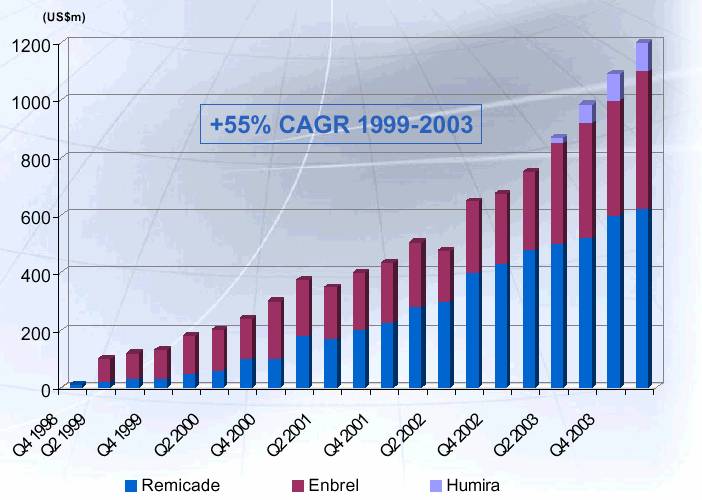

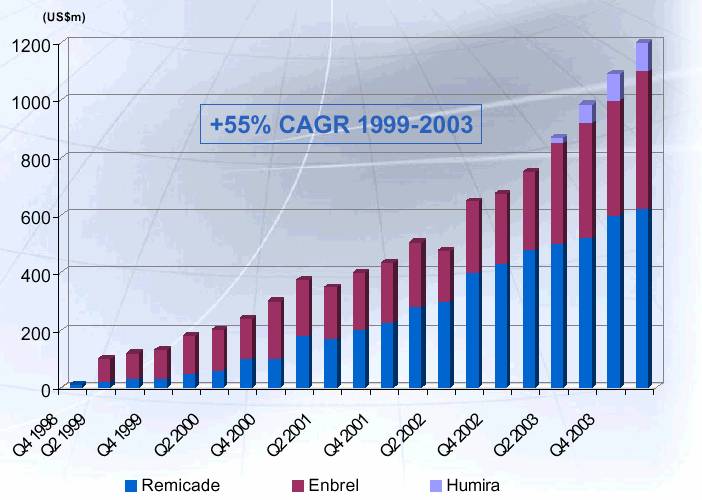

CDP 870: Attractive Market Quarterly Trend TNF-a Inhibitors

Source: Evaluate

29

Stronger US Presence

| | 2003 UCB

Pharmaceuticals | | 2003 Pro-forma

Celltech + UCB | |

| | | | | |

Pharmaceutical Product Sales (M€) | | 560 | | 803 | (1) |

| | | | | |

US Pharmaceutical sales vs. a % of Total Pharmaceutical sales | | 38 | % | 44 | % |

(1) Exchange rate of 1.4457 €/£

Source: UCB and Celltech company reports

30

Potential for Significant Synergies

Targets

• Total synergies: €100m

• Rapid phasing

• 65% in 2005

• 100% in 2006

• Conservative assumptions

• 5% of 03 combined pharma revenues

Sources

• Productivity, efficiency and simplification of supply chain

• Optimization of R&D organization and capacities

• Improved utilization of Sales and Marketing resources

• Rationalization of administrative costs

31

Combining Celltech with UCB Creates European-based Biopharmaceutical Leader

• Expanded leadership position in focused specialist-driven areas:

• CNS, inflammation, oncology

• Well-timed launches:

• CDP-870 by 2007

• UCB 44212, UCB 34714, CDP-484, CDP-323,... by 2010

• Complementary strengths

• Complementary existing business

• Complementary pipeline

• Stronger US presence

• Synergies to be realized rapidly

• Management of both companies is experienced in successful integrations and will lead new group

32

Transaction Description

Marc Wiers, Adviser to UCB Executive Committee

Offer Terms

• 100% cash offer

• Price of 550 pence per share

• Transaction value € 2.25bn

• Premiums

• 27.8% over May 17, 2004 close

• 26.3% over three-month average

• Recommended Offer

• Full board support: irrevocable undertakings to accept the Offer

• Full management support: key role in future organization

• Key offer conditions

• 90% acceptances

• Completion of review by anti-trust authorities

(1) Exchange rate (€/£): 1.4721

33

Key Offer Milestones

• May 18 : Offer Announcement

• Offer document to be posted and filed with the SEC this week

• Submission to anti-trust authorities: US and selected European countries

® Closing expected by Q3 2004

34

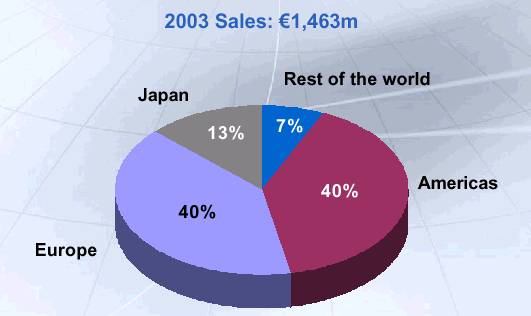

Highlights of 2003 Illustrative Combined P&L

| | UCB | | | | | |

€ Millions (1) | | Pharma | | Surf. Spec. | | Total | | Celltech | | Combined(4) | |

Revenues | | 1,463 | | 1,501 | | 2,966 | (3) | 511 | | 3,477 | |

EBITA | | 400 | | 96 | | 496 | | 72 | | 568 | |

% of Revenues | | 27 | % | 6 | % | 17 | % | 14 | % | 16 | % |

Adjusted Net Income(2) | | | | | | 350 | | 64 | | 349 | (5) |

Adjusted EPS (€/share) | | | | | | | €2.4 | | | | | €2.4 | |

| | | | | | | | | | | | | |

Note: no harmonization of accounting principles

• Transaction accounting using Fair Market Values (Belgian GAAP)

• UCB committed to IFRS for combined entity

• Transaction expected to be earnings accretive post synergies and before goodwill and intangibles, after second full year

(1) Exchange rate (€/£): 1.4457

(2) Pre Goodwill amortization and one-time integration/restructuring charges

(3) Includes other sales of €2m

(4) Assumes no synergies

(5) Includes financial charges for the acquisition

Source: UCB and Celltech company reports

35

Financing the Offer

• Total transaction value: €2.25bn

• Positive net cash position of Celltech (€218m)(1) and UCB (€24m) at December 31st, 2003

• High cash-flow generated from UCB’s existing portfolio and sustained growth of chemical activities to support rapid deleveraging

• Bank loans are in place

(1) Exchange rate (€/£): 1.4164 as of 31/12/2003

36

Conclusion

G. Jacobs,

Chairman of UCB Executive Committee

Combining Celltech with UCB Creates European-based Biopharmaceutical Leader

• Shared vision

• Leader today in Neurology and Respiratory, tomorrow in Inflammation, Oncology

• Well-timed launches of major new products

• Combined strengths to ensure success

• Strong management team experienced in successfully integrating acquisitions will lead the new company

• Unique opportunity for UCB’s shareholders

37