MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

A Major Enterprise Fund of the Municipality of Anchorage

Financial Statements,

Required Supplementary Information

and

Other Information

December 31, 2018 and 2017

(With Independent Auditor’s Report Thereon)

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Table of Contents

| |

Financial Section: | |

Independent Auditor’s Report | 1-3 |

Management’s Discussion and Analysis | 4-15 |

Statements of Net Position | 16-17 |

Statements of Revenues, Expenses and Changes in Net Position | 18 |

Statements of Cash Flows | 20-21 |

Notes to Financial Statements | 23-73 |

Required Supplementary Information: | |

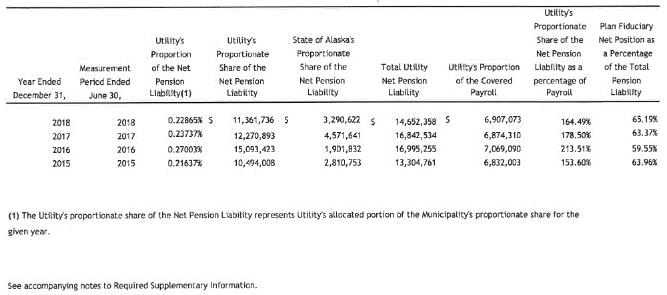

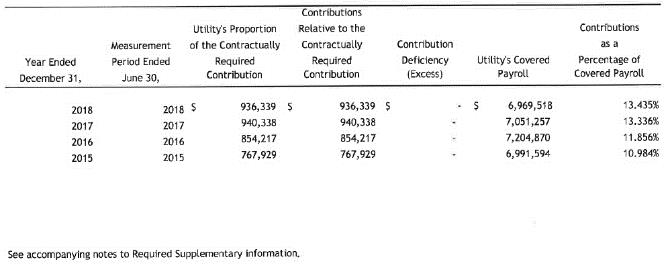

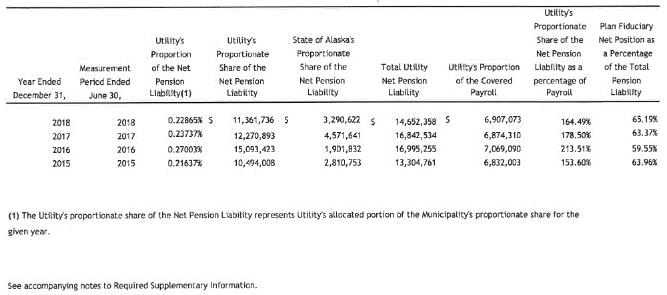

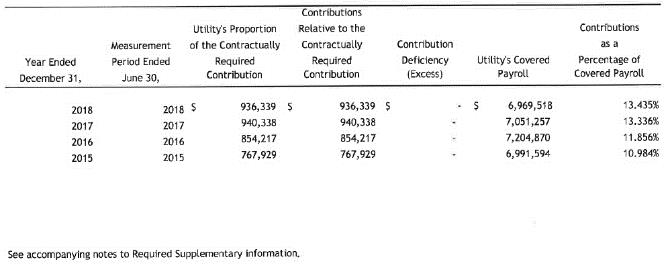

Public Employees Retirement System – Defined Benefit Pension Plan: | |

Schedule of the Utility’s Information on the Net Pension Liability | 77 |

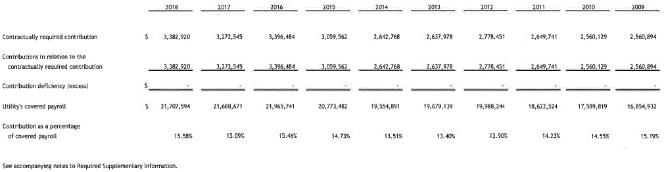

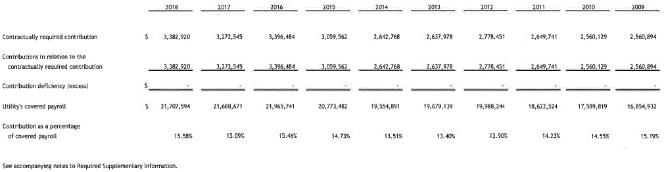

Schedule of Utility Contributions | 78 |

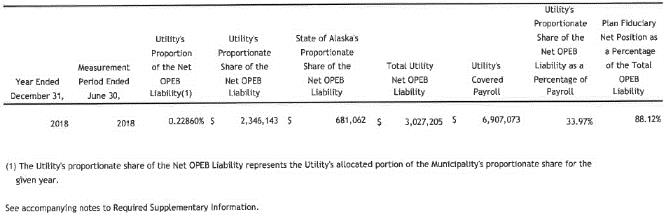

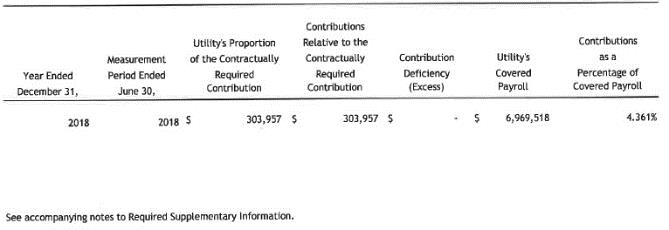

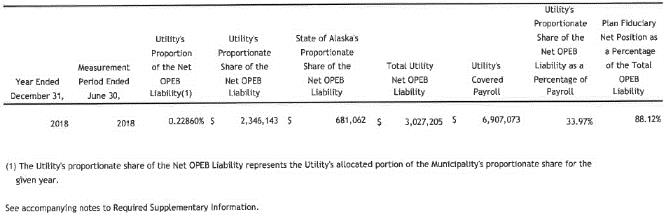

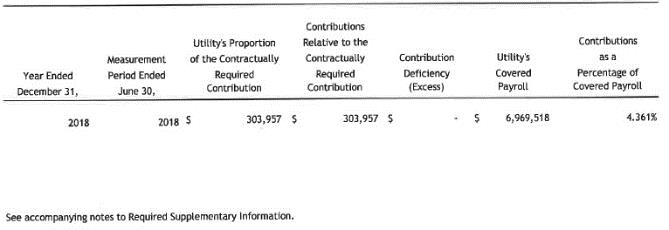

Public Employees Retirement System – Other Postemployment Benefit Plans: | |

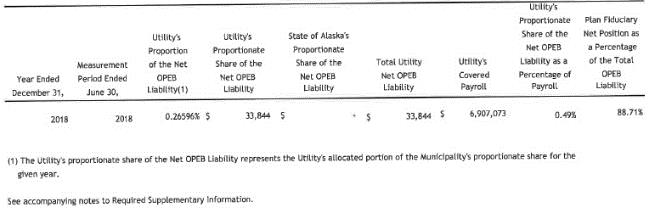

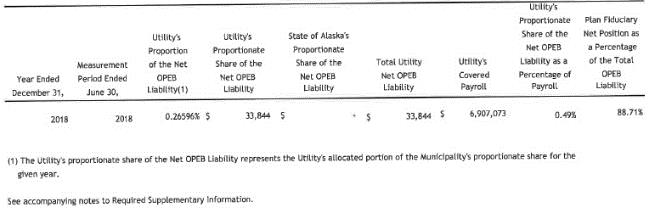

Schedule of the Utility’s Information on the Net OPEB Liability - ARHCT | 79 |

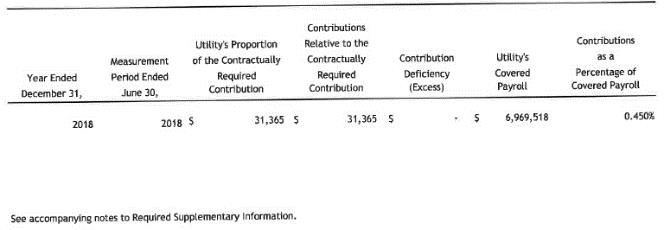

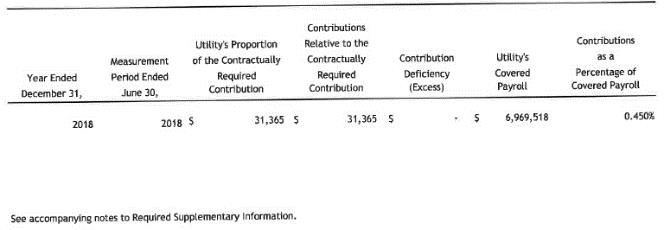

Schedule of Utility Contributions - ARHCT | 80 |

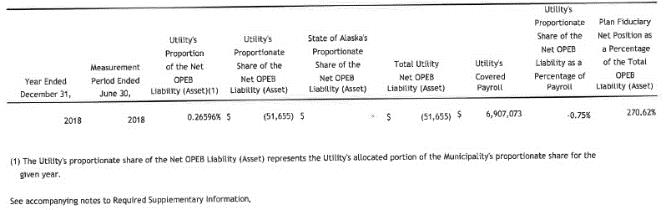

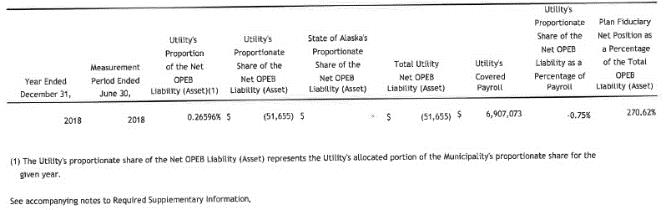

Schedule of the Utility’s Information on the Net OPEB Liability - RMP | 81 |

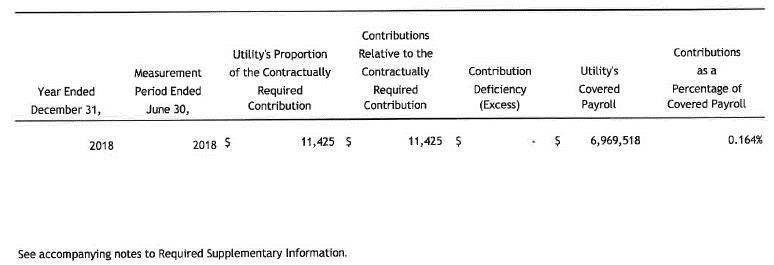

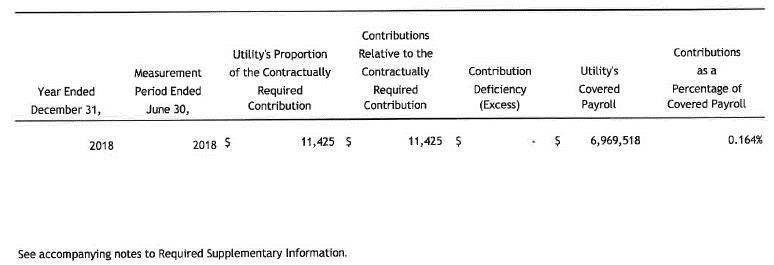

Schedule of Utility Contributions - RMP | 82 |

Schedule of the Utility’s Information on the Net OPEB Liability - ODD | 83 |

Schedule of Utility Contributions - ODD | 84 |

International Brotherhood of Electrical Workers (IBEW) – Defined Benefit Pension Plan - Schedule of Utility Contributions | 85 |

Notes to Required Supplementary Information | 86-87 |

Statistical Section: | |

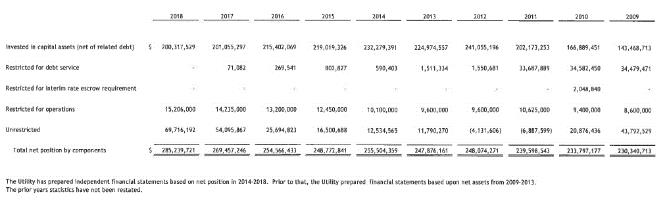

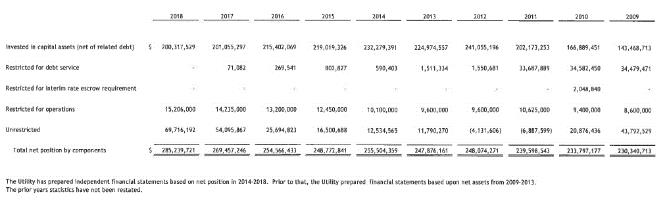

Net Position by Components | 90 |

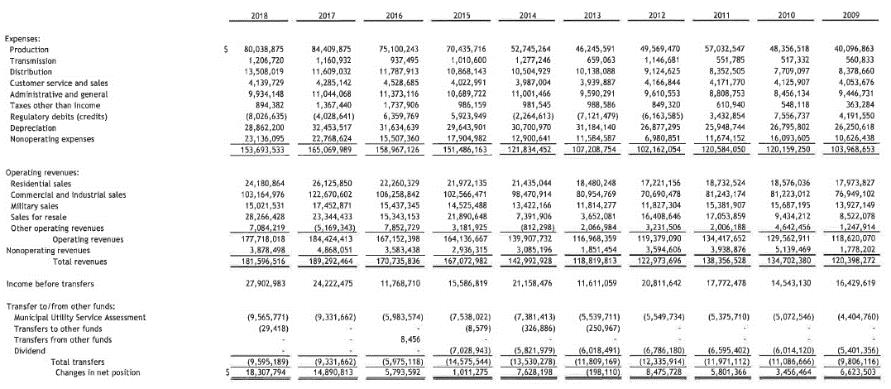

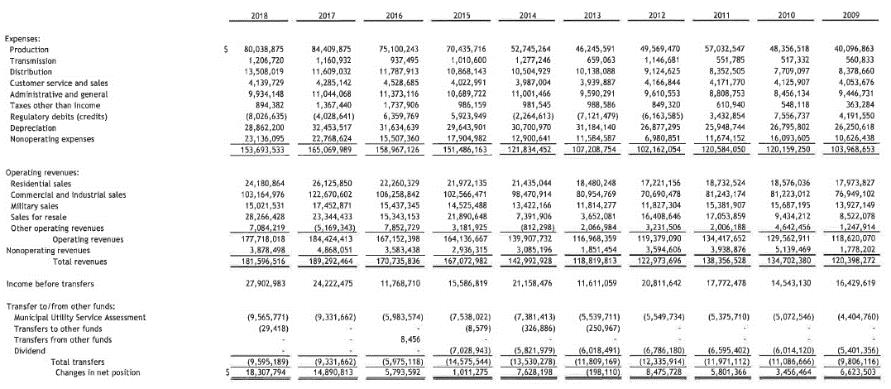

Change in Net Position | 91 |

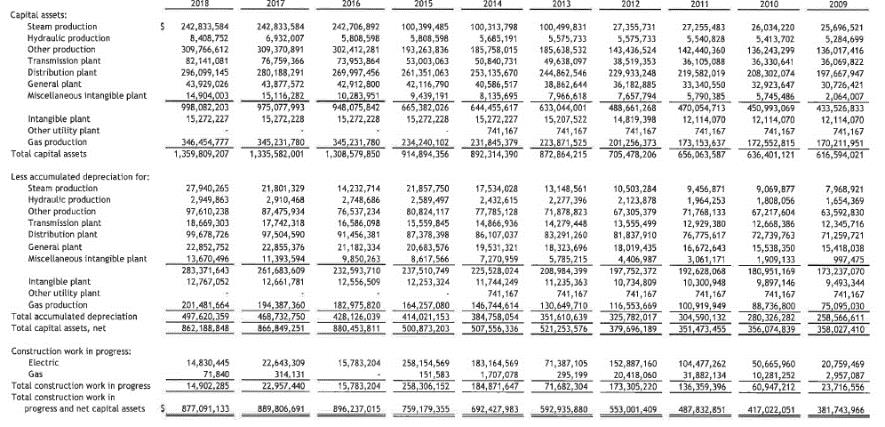

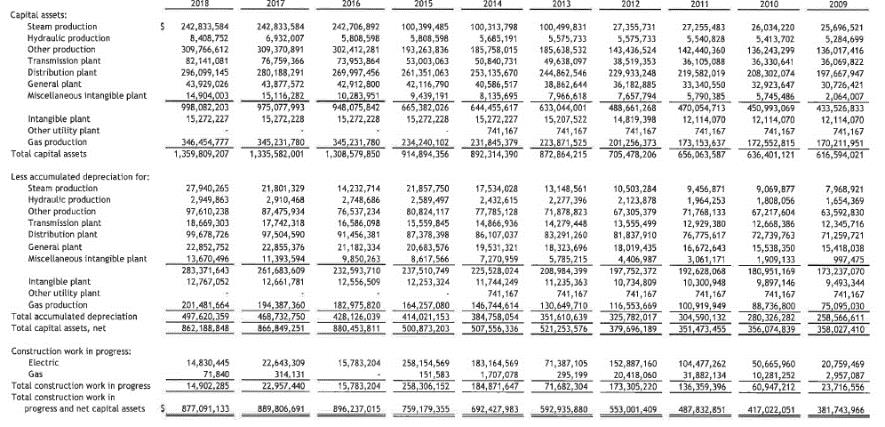

Capital Assets | 92 |

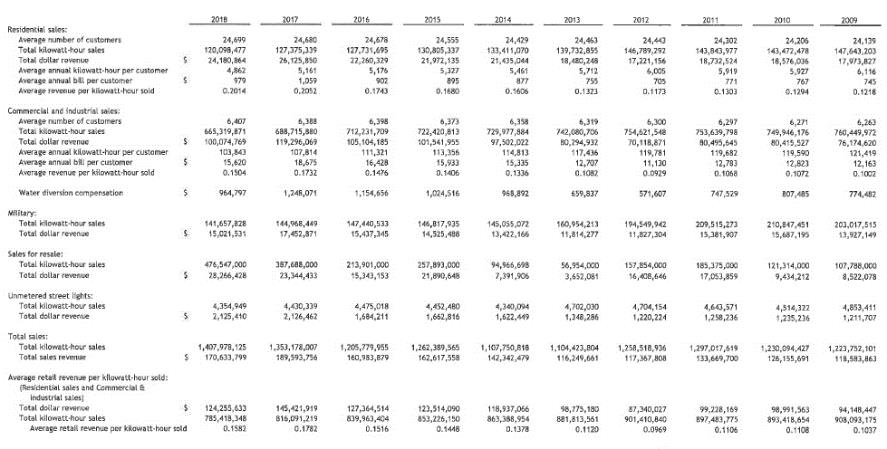

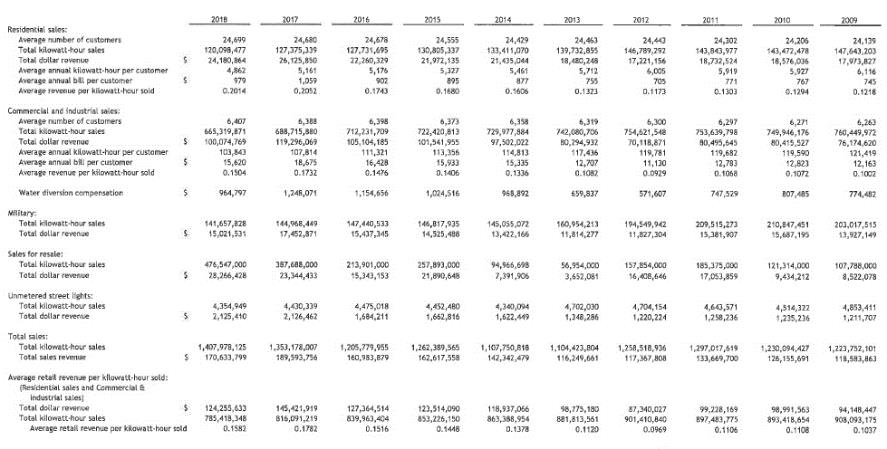

Comparative Operating Revenue Relationships | 93 |

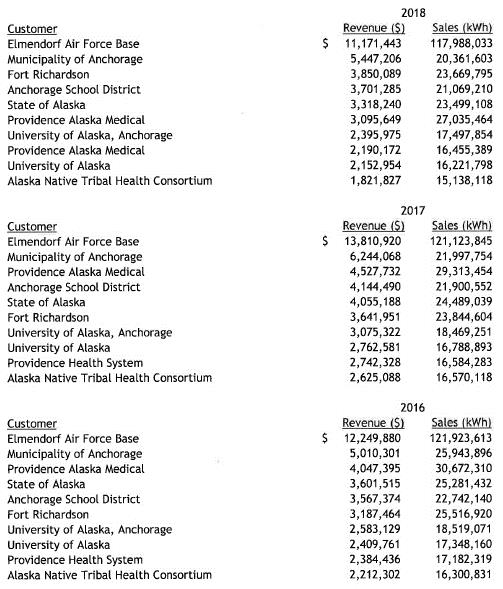

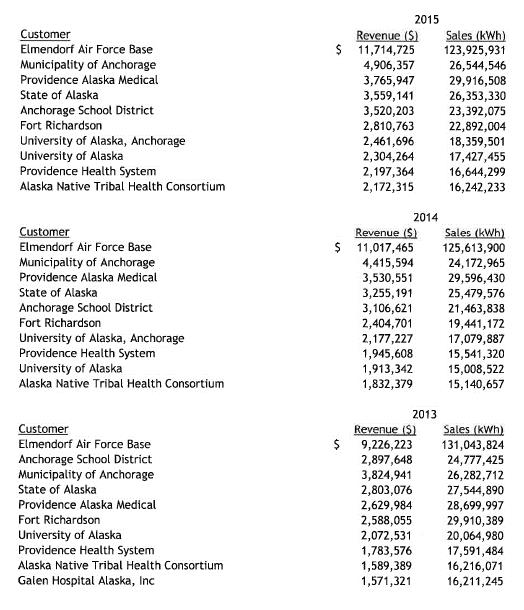

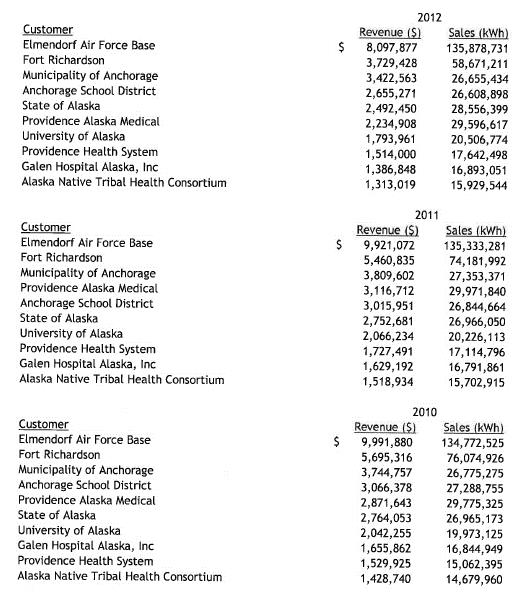

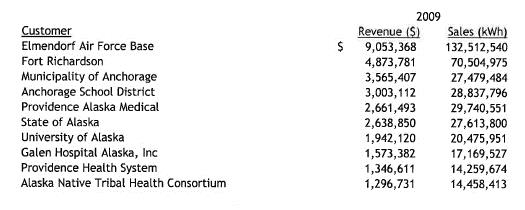

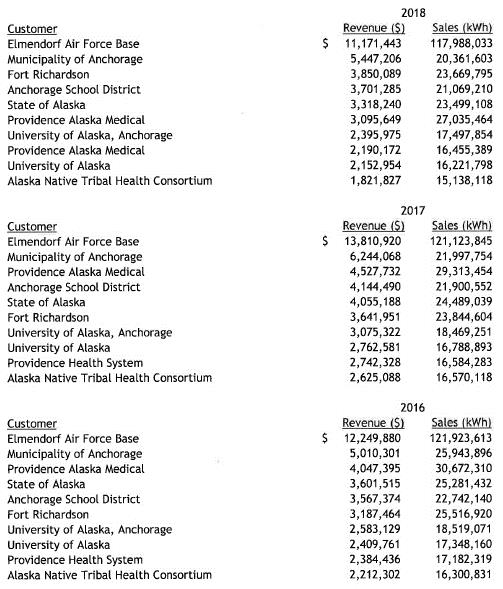

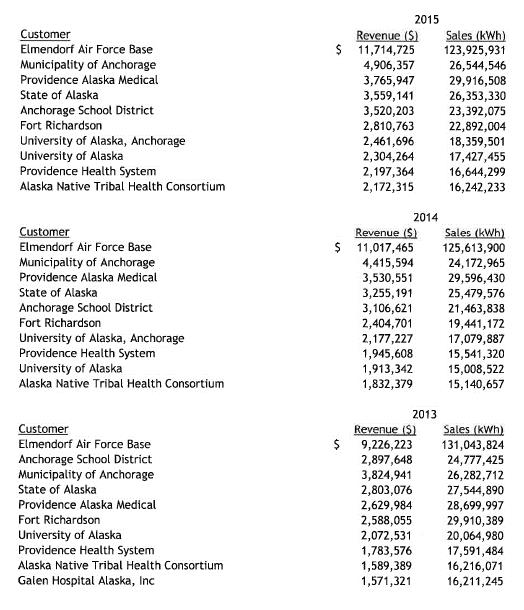

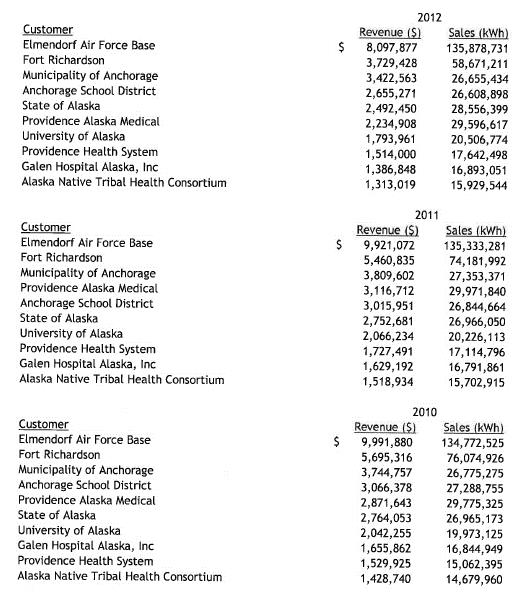

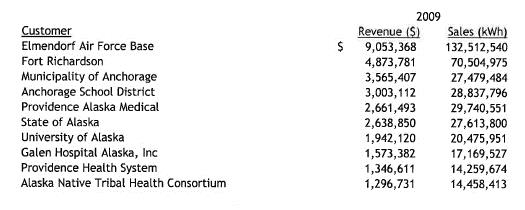

Top Ten Customers by Revenue | 94-97 |

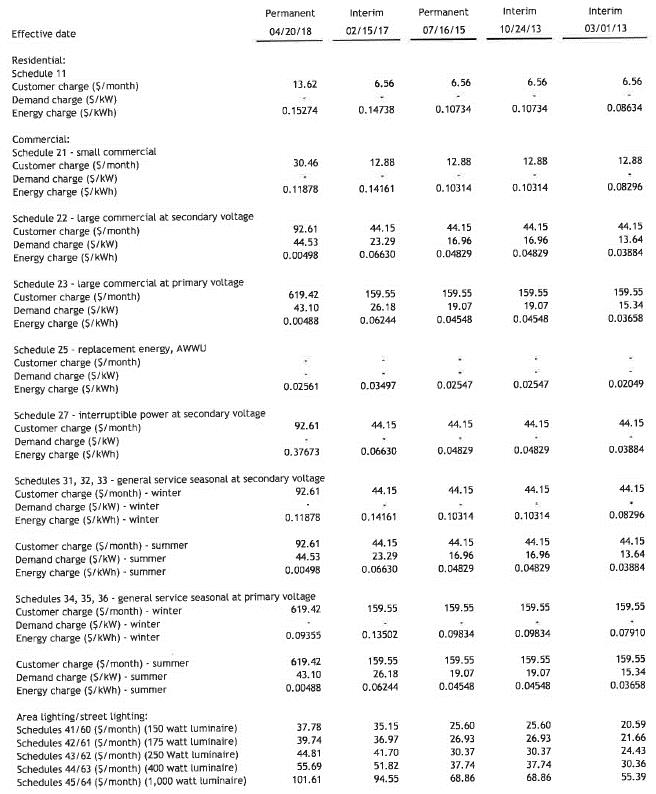

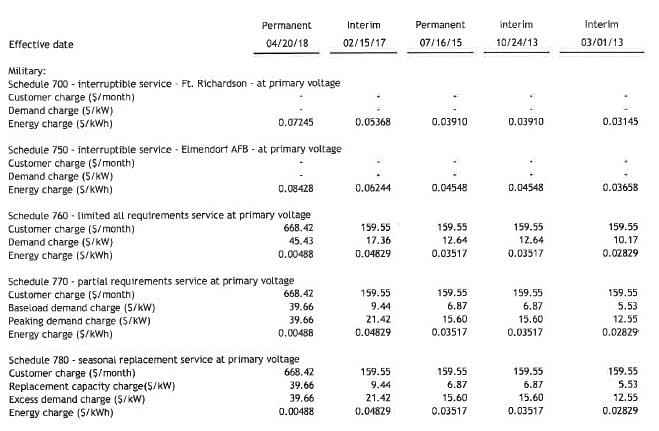

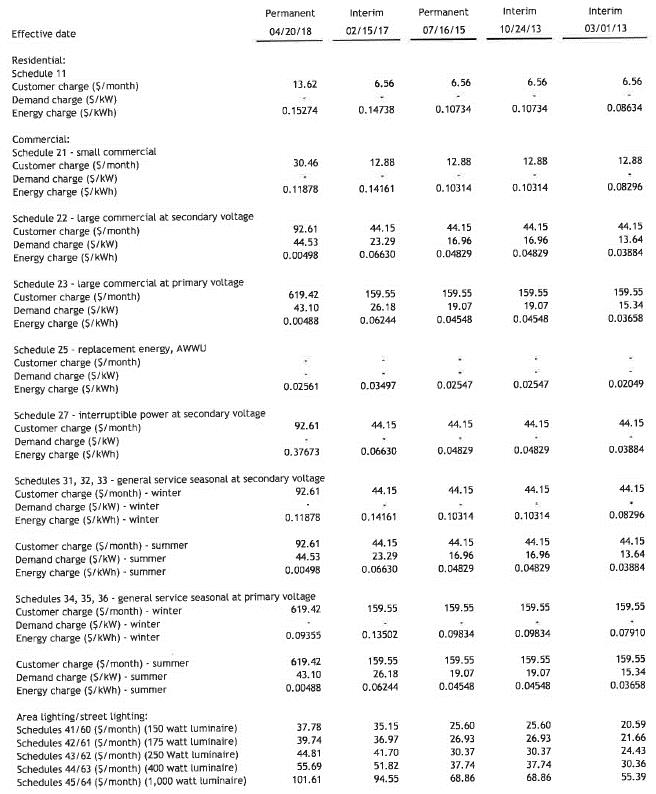

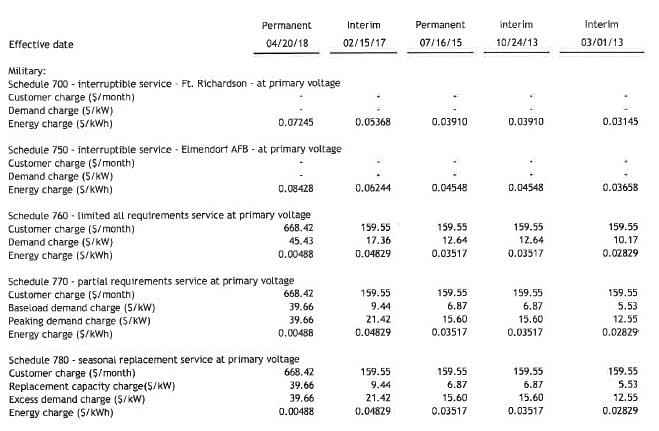

Rate Summary | 98-99 |

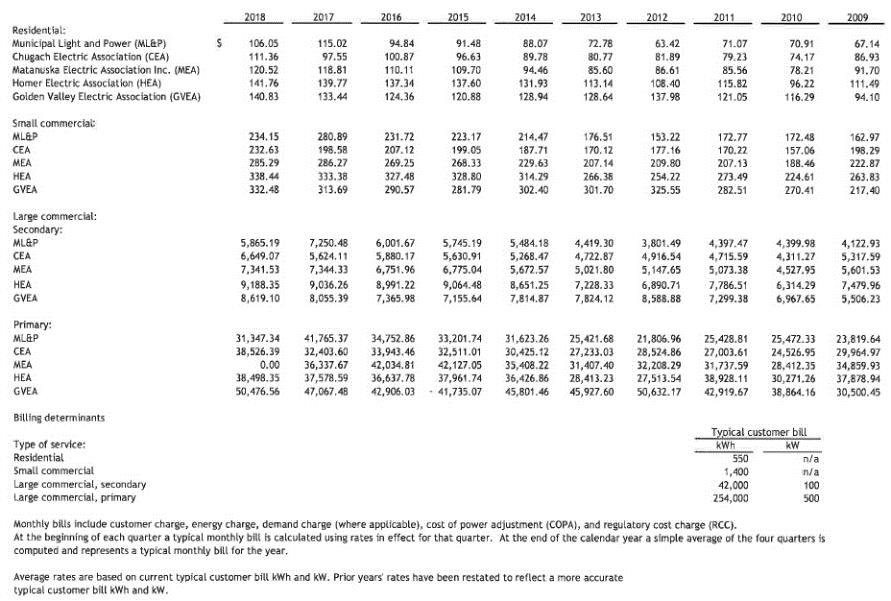

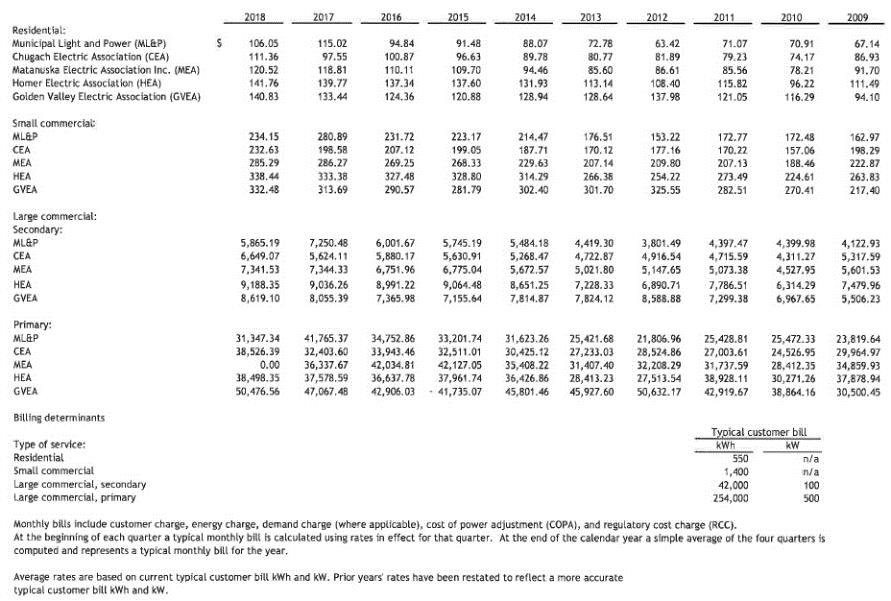

Typical Monthly Bill Comparison | 100 |

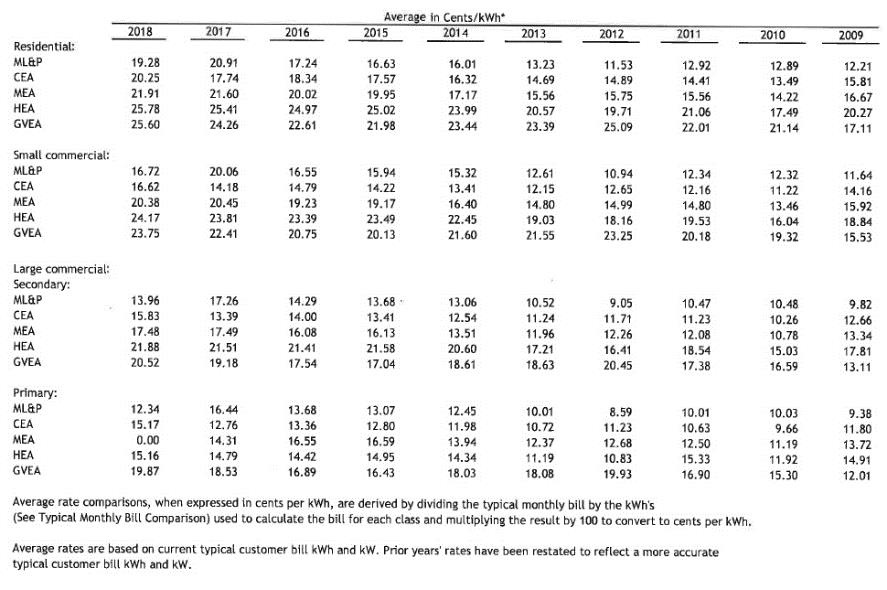

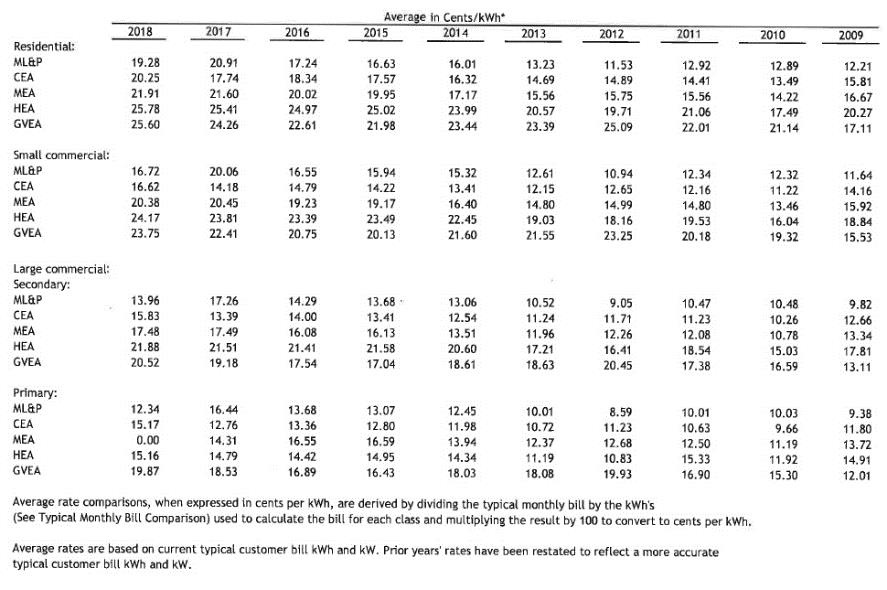

Rate Comparison | 101 |

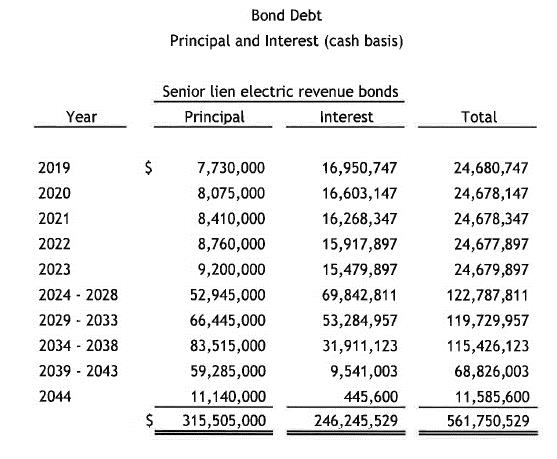

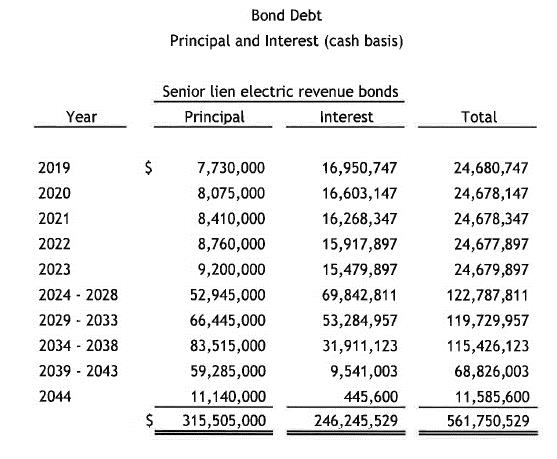

Bond Debt | 102 |

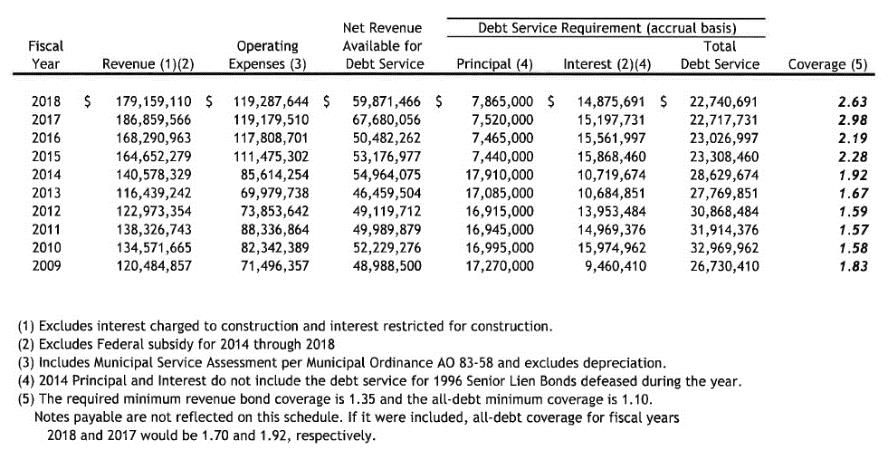

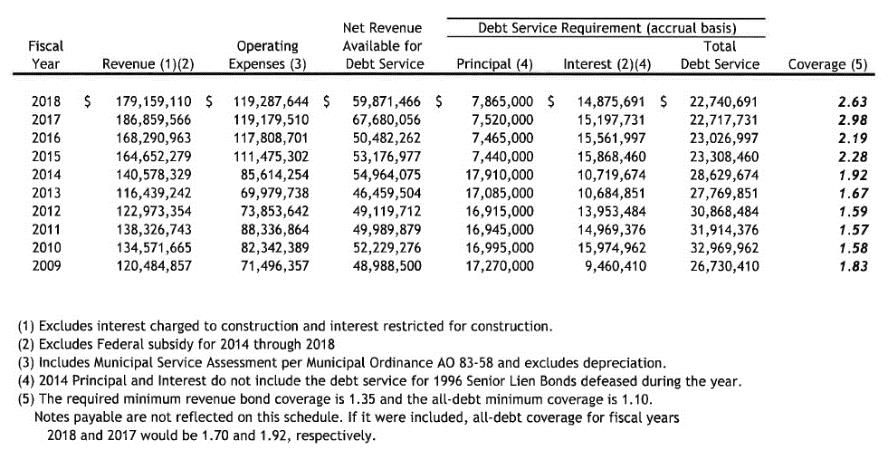

Schedule of Revenue Bond Coverage | 103 |

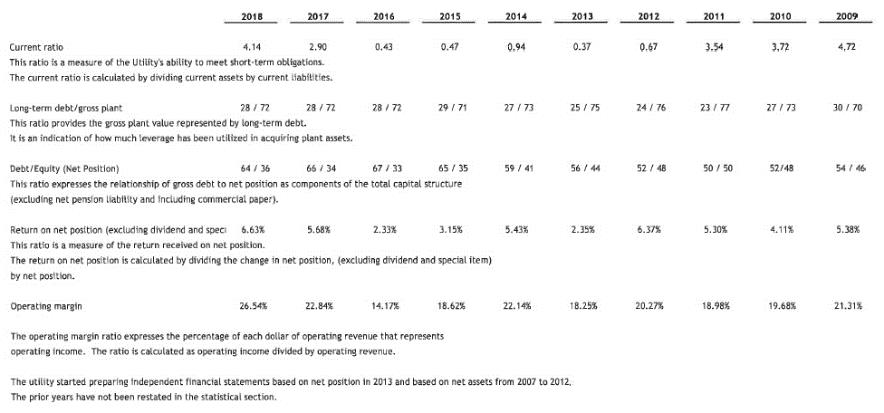

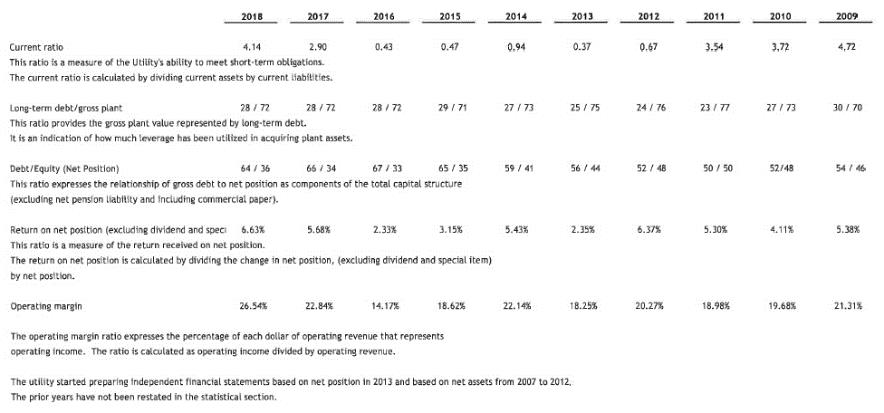

Statement of Net Position Ratios | 104 |

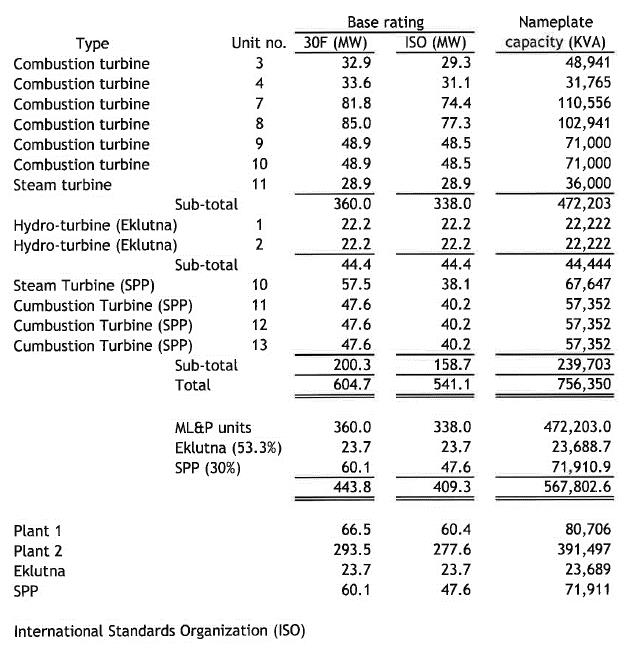

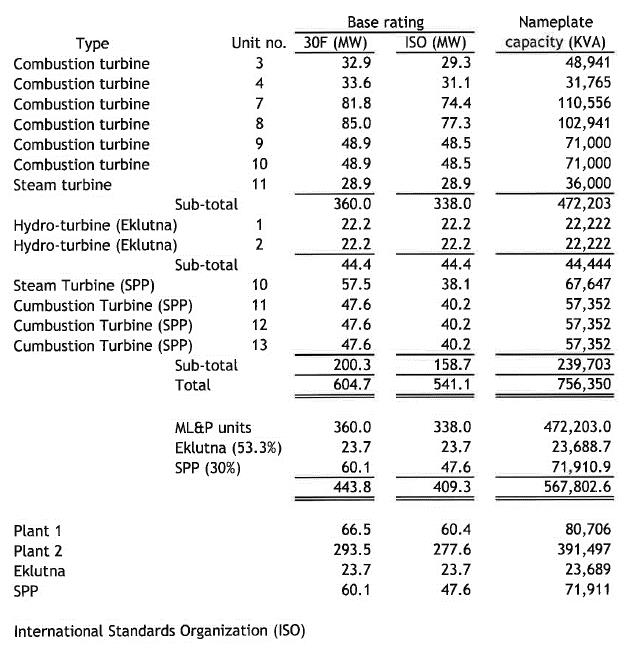

Base Ratings by Generation Units | 105 |

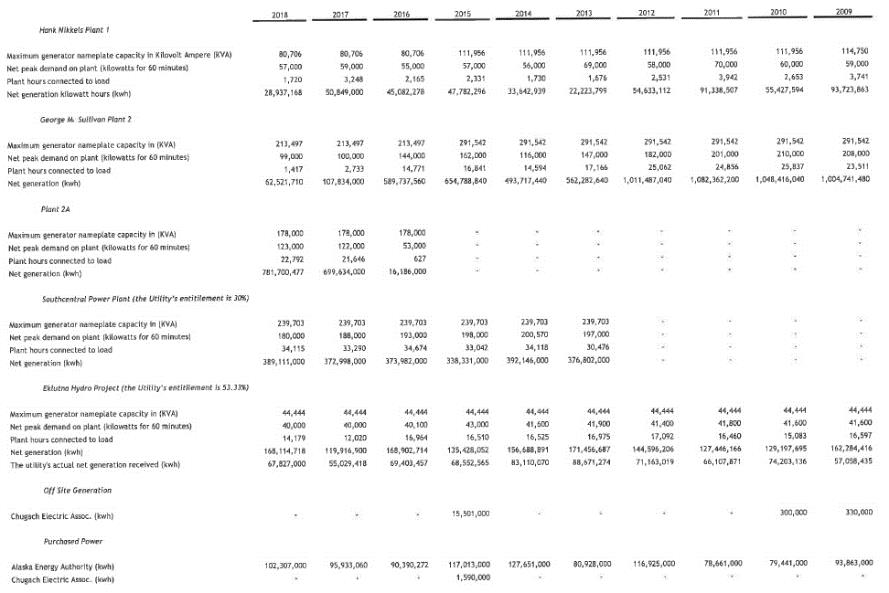

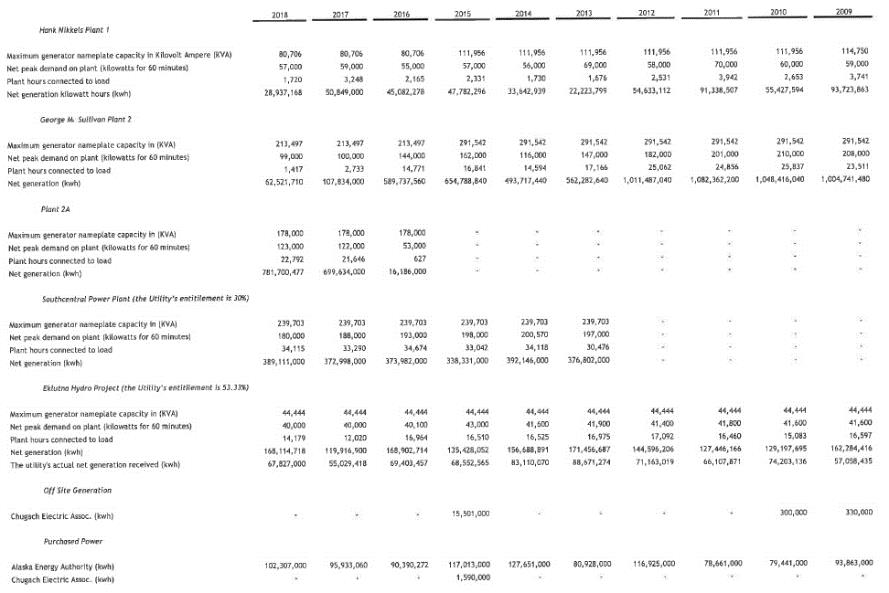

Generated and Purchased Power | 106 |

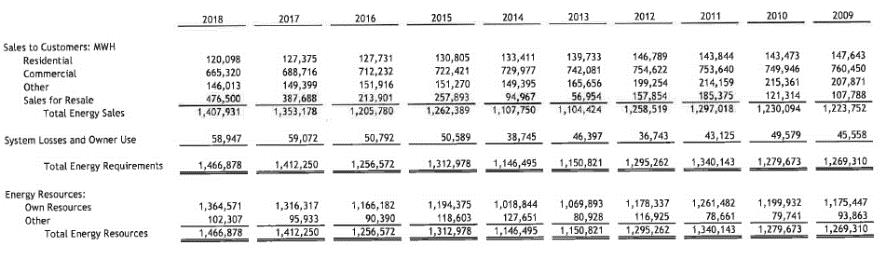

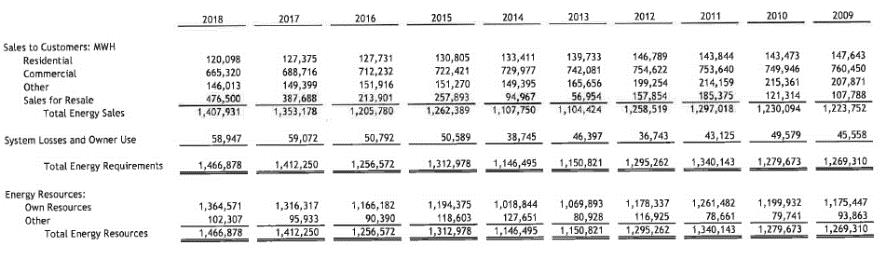

Energy Loads and Resources | 107 |

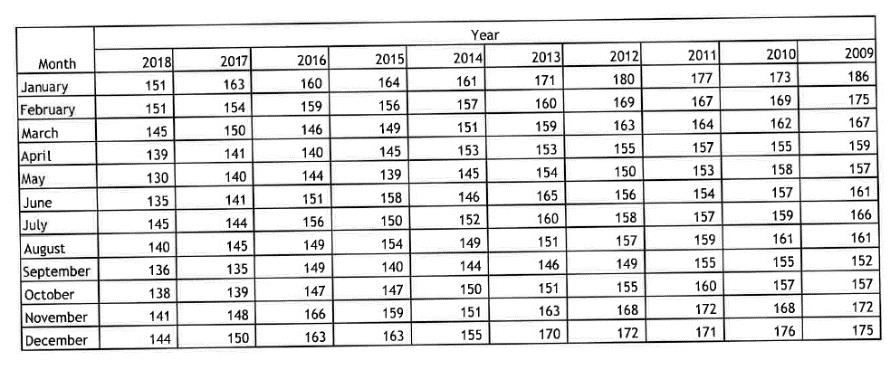

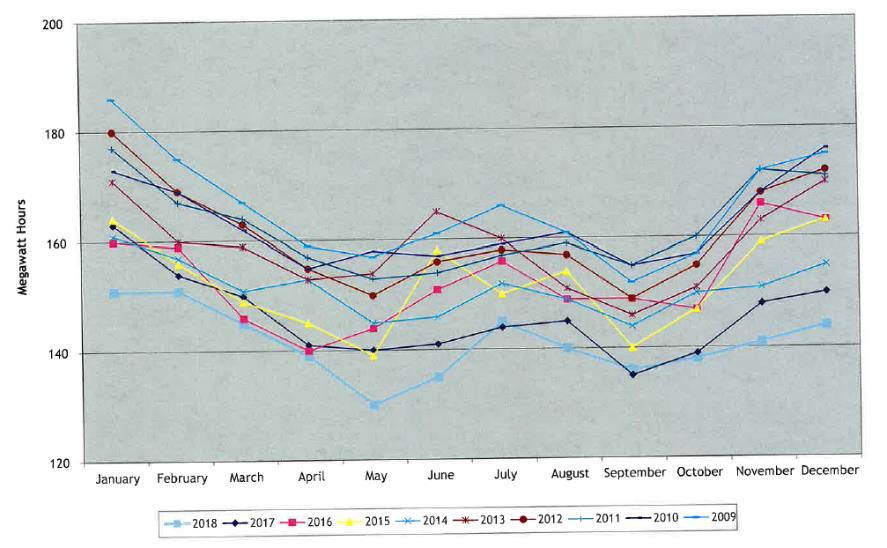

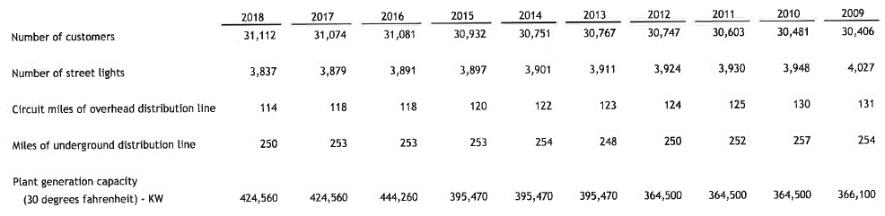

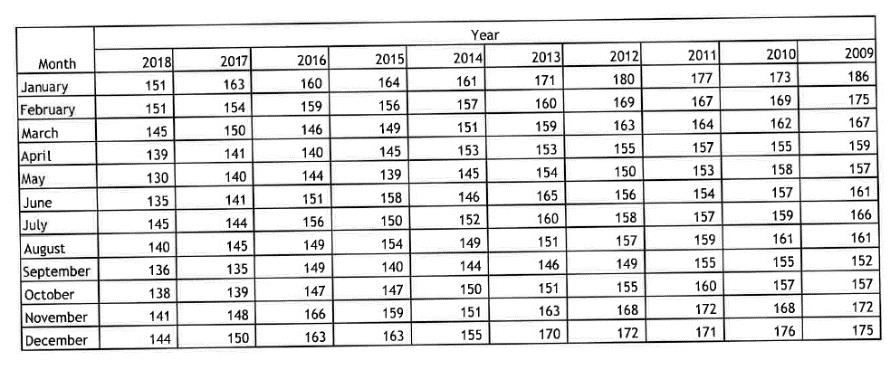

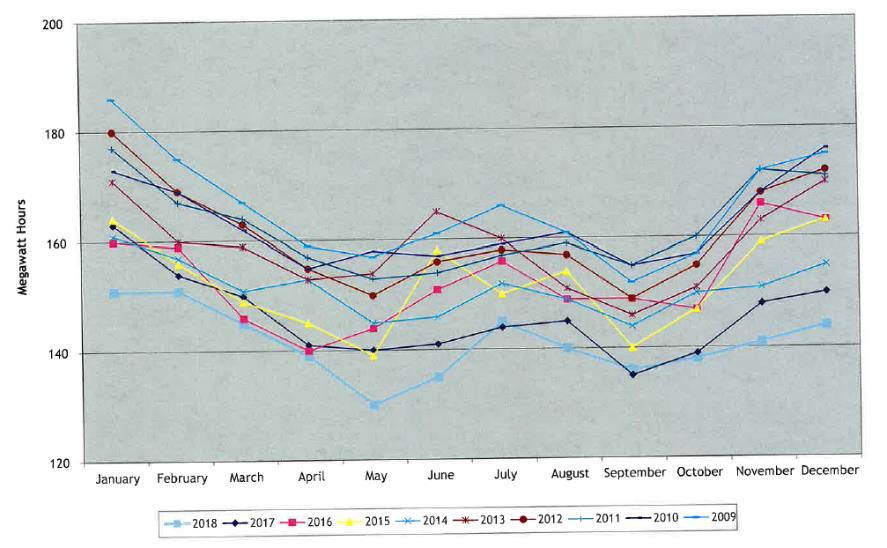

Monthly Peak (Megawatt Hours) | 108-109 |

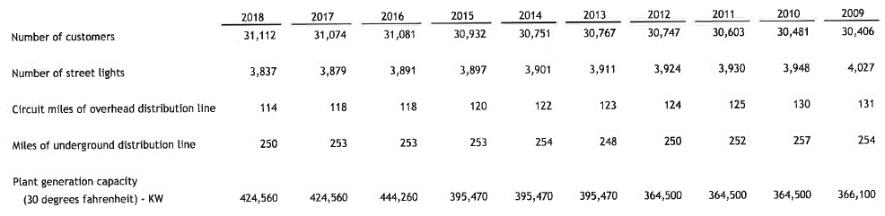

Miscellaneous Statistical Information | 110 |

Independent Auditor’s Report on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards | 111-112 |

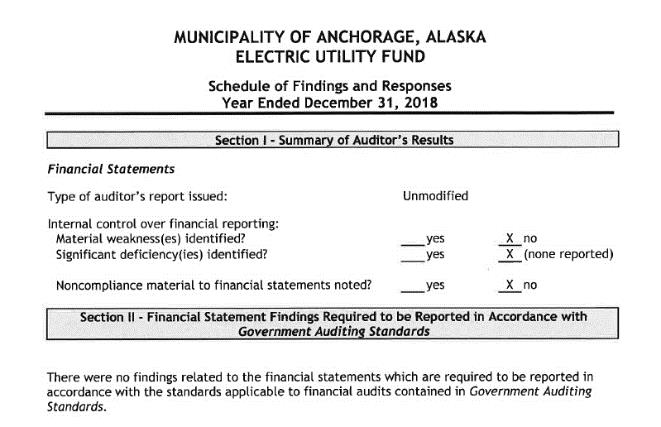

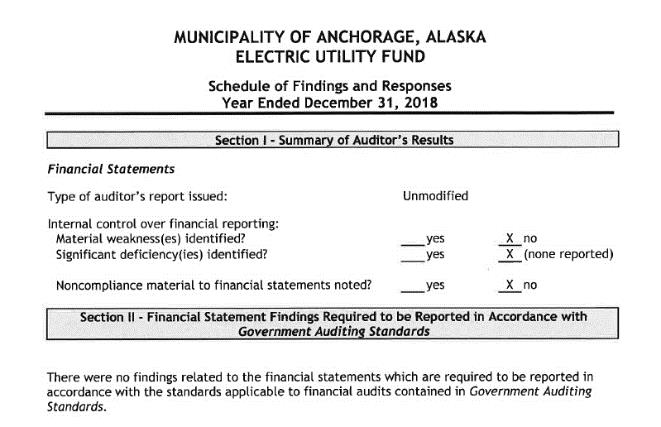

Schedule of Findings and Responses | 113 |

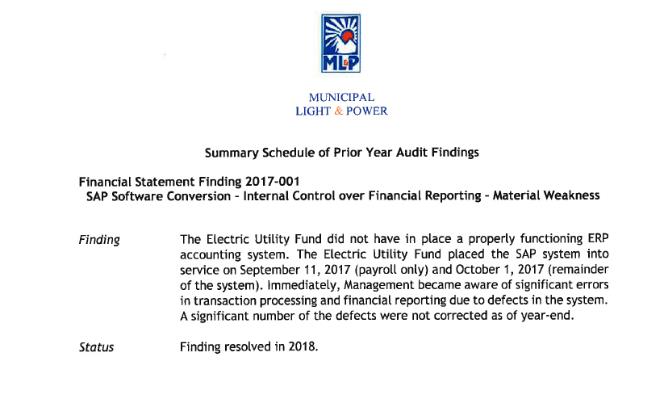

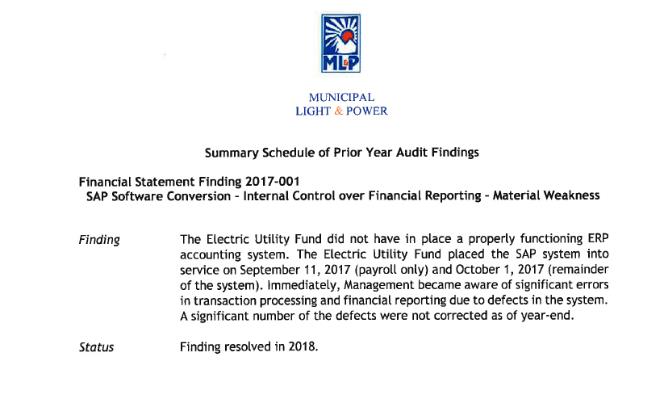

Summary Schedule of Prior Audit Findings | 114 |

THIS PAGE INTENTIONALLY LEFT BLANK

Independent Auditor’s Report

Independent Auditor’s Report

Honorable Mayor and Members of the Assembly

Municipality of Anchorage, Alaska

Report on the Financial Statements

We have audited the accompanying financial statements of the Electric Utility Fund, an enterprise fund of the Municipality of Anchorage, Alaska, as of and for the years ended December 31, 2018 and 2017, and the related notes to the financial statements, which collectively comprise the Electric Utility Fund’s basic financial statements as listed in the table of contents.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United State. Those standards required that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgement, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of the accounting policies used and the reasonableness of significant accounting estimates made by management, as we as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Electric Utility Fund as of December 31, 2018 and 2017, and the changes in financial position and its cash flows for the year ended in accordance with accounting principles generally accepted in the United States of America.

BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms.

BDO is the brand name for the BDO network and for each of the BDO Member Firms.

1

Emphasis of Matters

As discussed in Note 1, the financial statements present only the Electric Utility Fund, and do not purport to, and do not present fairly the financial position of the Municipality of Anchorage, Alaska as of December 31, 2018 and 2017, the changes in its financial position, or where applicable, its cash flows for the years ended in accordance with accounting principles generally accepted in the United States. Our opinion is not modified with respect to this matter.

Change in Accounting Principle

As discussed in Note 2 to the accompanying financial statements, in 2018 the Electric Utility Fund adopted the provisions of Governmental Accounting Standards Board (GASB) Statement No. 75, Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions. Our opinion was not modified with respect to this matter.

Other Matters

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that Management’s Discussion and Analysis on pages 4 through 15 and other required supplementary information on pages 77 through 87 be presented to supplement the basic financial statements. Such information, although not a part of the basic financial statements, is required by the Governmental Accounting Standards Board who considers it to be an essential part of financial reporting for placing the basic financial statements in an appropriate operational, economic, or historical context. We have applied certain limited procedures to the required supplementary information in accordance with auditing standards generally accepted in the United States of America, which consisted of inquiries of management about the methods of preparing the information and comparing the information for consistency with management’s responses to our inquiries, the basic financial statements, and other knowledge we obtained during our audit of the basic financial statements. We do not express an opinion or provide any assurance on the information because the limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

Other Information

Our audit was conducted for the purpose of forming an opinion on the financial statements that collectively comprise the Electric Utility Fund’s basic financial statements. The statistical section is presented for purposes of additional analysis and is not a required part of the basic financial statements. The statistical section has not been subject to the auditing procedures applied in the audit of the basic financial statements, and accordingly, we do not express an opinion or provide any assurance on it.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated June 30, 2019 on our consideration of the Electric Utility Fund’s internal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of that report is to describe the scope of our testing of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinion on the internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards in considering the Electric Utility Fund’s internal control over financial reporting and compliance.

/s/ BDO USA, LLP

Anchorage, Alaska

June 30, 2019

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

The Electric Utility Fund (Utility) is a public utility of the Municipality of Anchorage (Municipality or Anchorage). The following is a discussion and analysis of the Utility’s financial performance, providing an overview of the financial activities for the years ended December 31, 2018 and 2017. This discussion and analysis is designed to assist the reader in focusing on the significant financial issues, provide an overview of the Utility’s financial activities and identify changes in the Utility’s financial position. We encourage readers to consider the information presented here in conjunction with the Utility’s financial statements and accompanying notes, taken as a whole.

Financial Highlights

| · | | The Utility’s total plant decreased $12.7 million or 1.4% in 2018 while decreasing $6.4 million or 0.7% in 2017. The decrease in 2018 and 2017 was due to depreciation exceeding additions. |

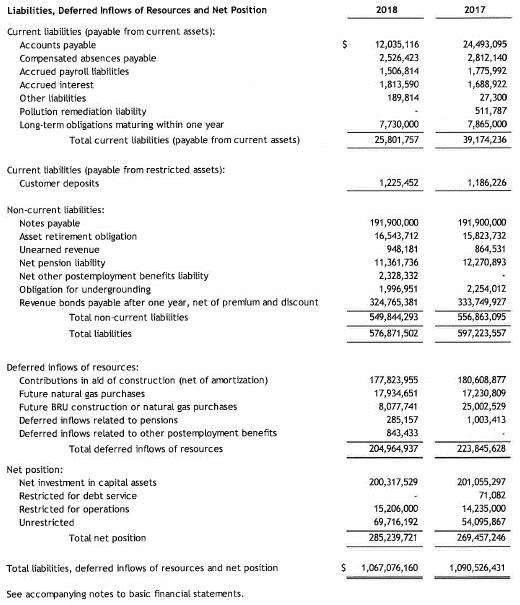

| · | | Total assets and deferred outflows of resources exceeded total liabilities and deferred inflows of resources by $285.2 million at December 31, 2018 and by $269.5 million at December 31, 2017. Of these amounts, $69.7 million in 2018 and $54.1 million in 2017 were unrestricted and available to meet the Utility’s ongoing obligations to customers and creditors. |

| · | | The Utility’s total net position increased $15.8 million or 5.86% in 2018, compared to an increase of $14.9 million or 5.85% in 2017. The increase in net position in 2018 was primarily due to lower fuel costs and a lower gas transfer price for internally produced gas. Depreciation also decreased significantly in 2018. Beginning net position was reduced by $2.5 million due to adoption of a new accounting standard in 2018. The increase in net position in 2017 was primarily due to a full year of a new rate structure as well as a full year of operating Generation Plant 2A. |

Overview of the Financial Statements

The Utility is a business type activity of the Municipality that provides electrical services to a specific area of the Municipality. The Utility’s activities are recorded in an enterprise fund of the Municipality.

Required Financial Statements

The Utility’s financial statements offer short and long-term information about the activities of the Utility and collectively provide an indication of the Utility’s financial health. The basic financial statements are prepared using the economic resources measurement focus and accrual basis of accounting.

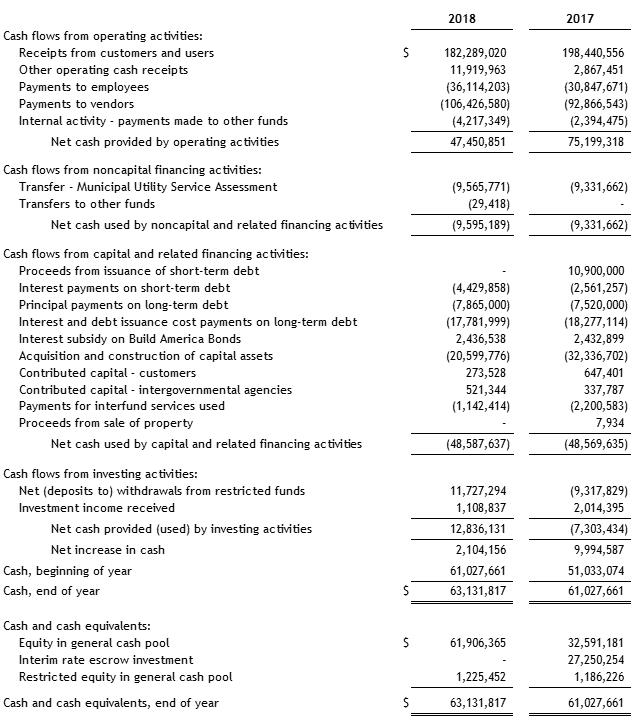

The basic financial statements, presented on a comparative basis for the years ended December 31, 2018 and 2017, include Statements of Net Position, Statements of Revenues, Expenses, and Changes in Net Position and Statements of Cash Flows.

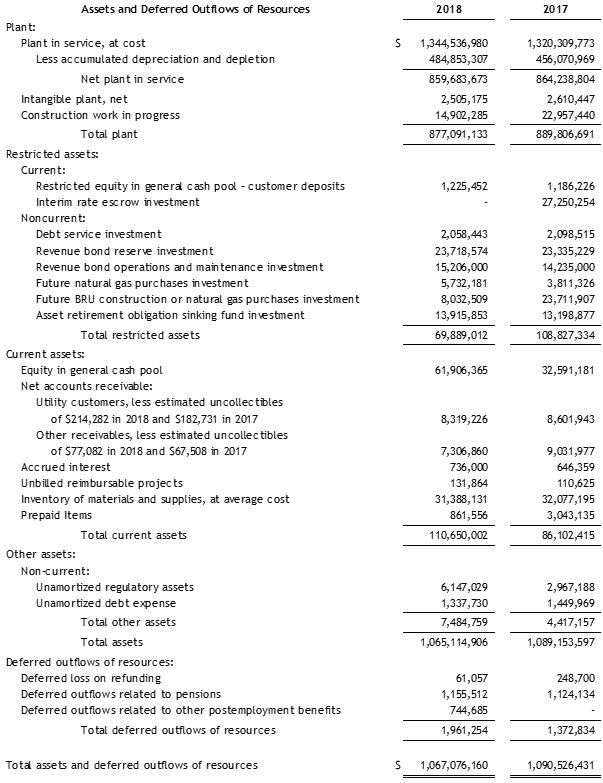

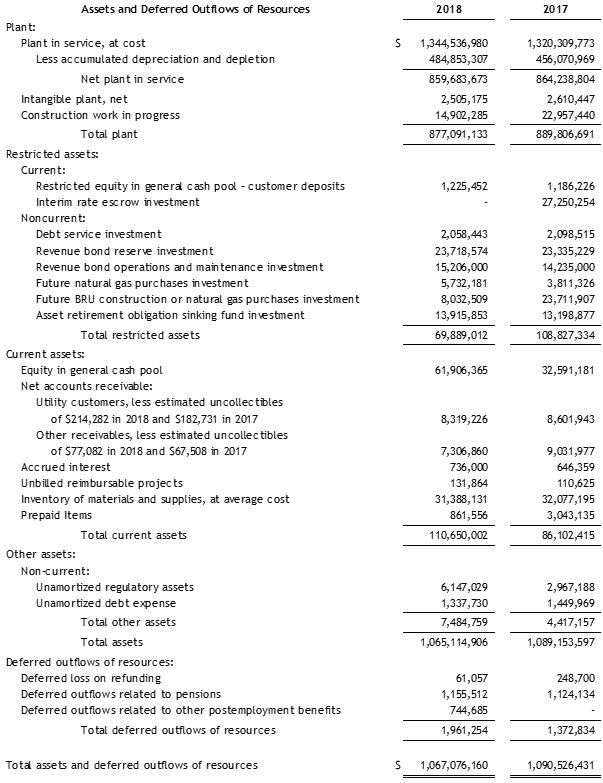

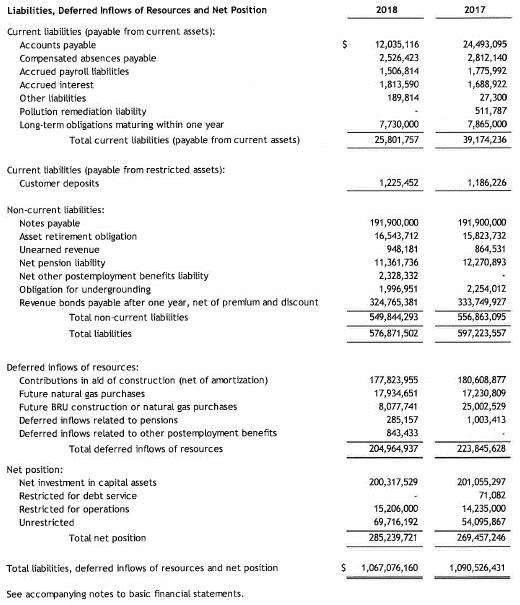

The Statements of Net Position present information on all of the Utility’s assets, liabilities, deferred outflows of resources and deferred inflows of resources, with the difference reported as net position, and provides information about the nature and amounts of investments in resources and obligations to creditors.

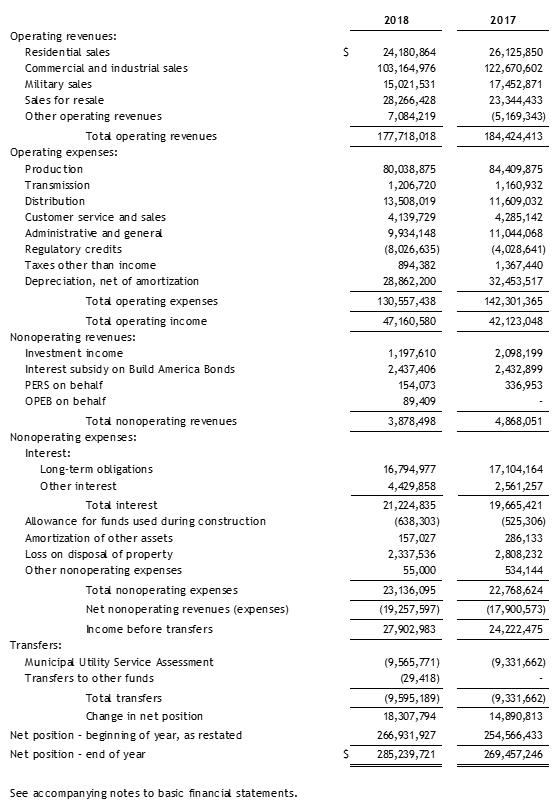

The Statements of Revenues, Expenses, and Changes in Net Position report operating and non-operating revenues and expenses, and the change in net position of the Utility for the years presented.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

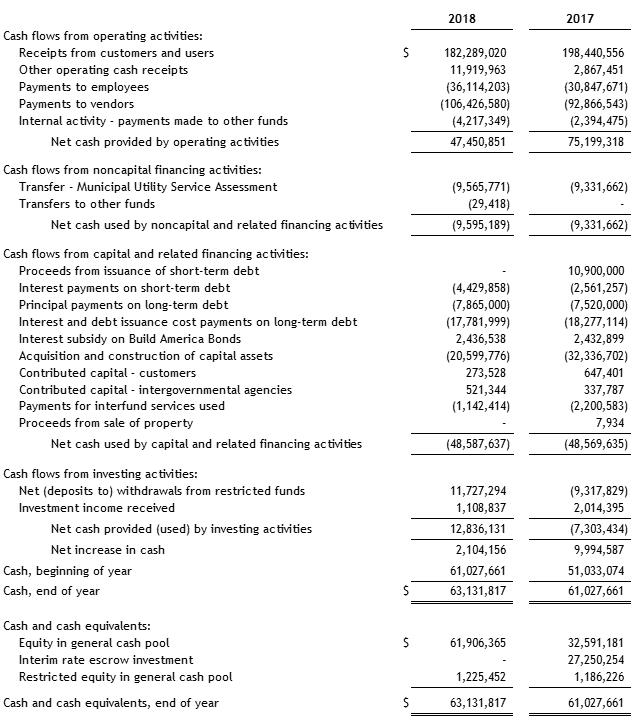

The Statements of Cash Flows, using the direct method of presentation, provide information about the Utility’s cash receipts and cash payments during the years presented. These statements report cash and cash‑equivalent activities for each fiscal year resulting from operating activities, noncapital financing activities, capital and related financing activities, and investing activities. These statements also provide answers to such questions as, where did cash come from, what was cash used for, and what was the change in cash balance during the reporting period.

The Notes to Financial Statements provide the reader with additional information that is essential to a full understanding of the data provided in the basic financial statements.

The Required Supplementary Information presents certain information concerning the progress in funding the Utility’s obligation to provide pension and other postemployment benefits.

Financial Analysis of the Utility

One of the most important questions asked about the Utility’s finances is whether the Utility, as a whole, is better or worse off as a result of the year’s activities. The Statements of Net Position and the Statements of Revenues, Expenses, and Changes in Net Position report information about the Utility’s activities in ways that will help answer this question. These two statements report the net position of the Utility and changes in net position for each of the years presented. You can think of the Utility’s net position, the difference between assets, deferred outflows of resources, liabilities, and deferred inflows of resources as one way to, over time, provide a measure of the Utility’s financial health or financial position. Over time, increases or decreases in the Utility’s net position can indicate whether its financial health is improving or deteriorating. However, you will need to also consider other non-financial factors such as changes in economic conditions and customer growth, as well as legislative and regulatory mandates.

The Utility’s total net position increased $18.3 million from beginning net position, as restated, during 2018 compared to an increase in net position of $14.9 million during 2017. The following analysis focuses on the Utility’s net position and changes in net position during the year.

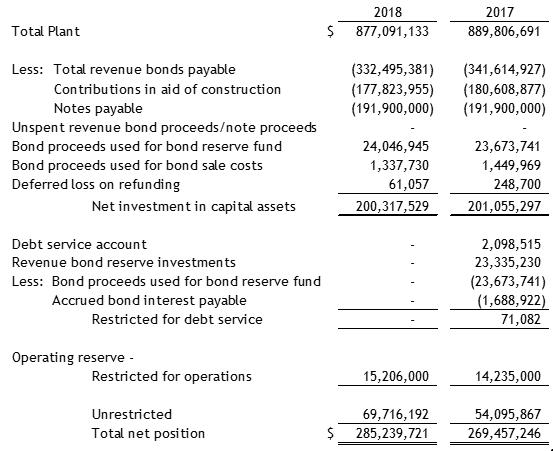

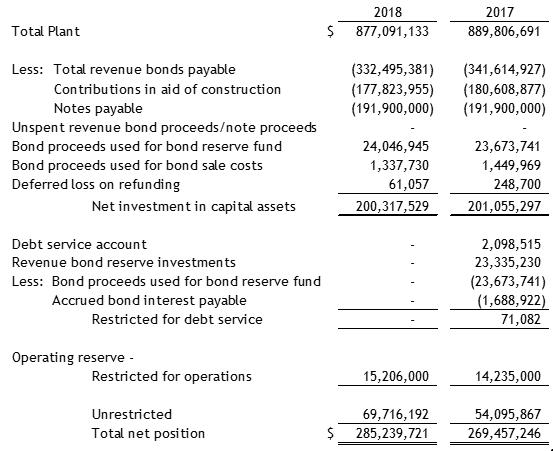

A portion of the Utility’s net position (70.3% and 74.7% as of December 31, 2018 and 2017, respectively) reflects its net investment in capital assets, such as gas and electric production, transmission and distribution facilities, less any related outstanding debt used to acquire those assets. Those capital assets are used to provide services to customers; consequently those assets are not available for future spending or to be used to liquidate any outstanding debt.

An additional portion of the Utility’s net position (5.3% and 5.3% as of December 31, 2018 and 2017 respectively) represent resources that are subject to external restriction for debt repayment and future operations.

The unrestricted portion of the Utility’s net position (24.4% and 20.0% as of December 31, 2018 and 2017, respectively) are available to be used to meet the Utility’s obligations to creditors and customers.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

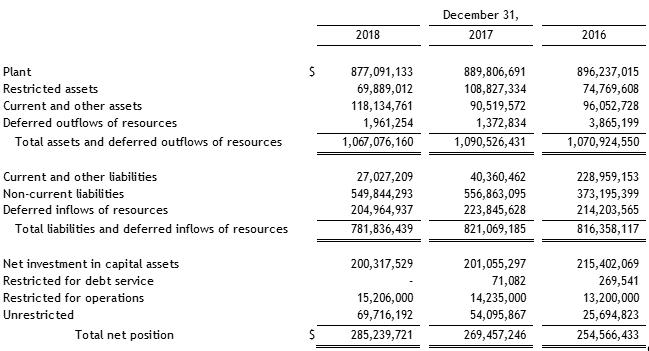

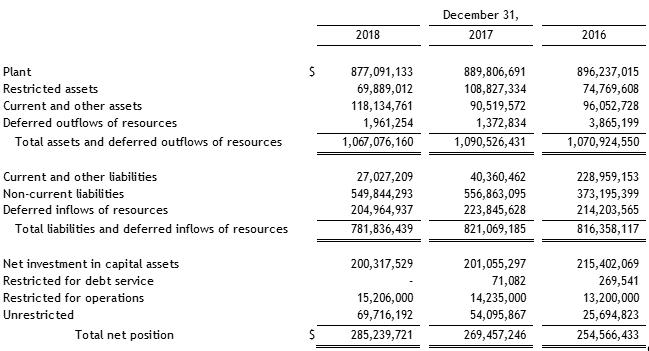

Net Position

Notable components of changes in assets, liabilities, and deferred inflows and outflows of resources are discussed below.

Plant decreased $12.7 million during 2018 compared to a decrease of $6.4 million during 2017.

During 2018 construction work in progress decreased by $8.1 million, compared to an increase of $7.2 million in 2017 as a result of capital projects started in prior years, completed in 2018.

During 2017 construction work in progress increased by $7.2 million, compared to a decrease of $242.5 million in 2016. Due to the completion of major capital projects in 2016, change in construction work in progress in 2017 is representative of a more typical year.

Restricted assets decreased $38.9 million during 2018 compared to an increase of $34.0 million during 2017.

During 2018 the Regulatory Commission of Alaska (RCA) allowed the Utility to remove the restriction on $40.6 million in cash collected due to the rate increase and the Utility repaid $9.1 million in tax credits received in prior years from the State of Alaska.

In February 2017, the RCA granted the Utility an interim and refundable rate increase of 37.30%. An interim rate escrow was established for the purpose of restricting the refundable rate increase collected from customers.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

Current and other assets increased $27.6 million during 2018 compared to a decrease of $5.5 million during 2017.

During 2018 the Utility’s equity in general cash pool increased by $29.3 million due to lifting of the restriction of funds collected from customers pursuant to the refundable rate increase granted by the RCA. Other receivables decreased by $1.7 million due to timing of payment of receivables. Prepaid items decreased $2.2 million due to accelerated payments in 2017 for purchased power.

During 2017 the Utility’s equity in general cash pool decreased by $14.7 million primarily due to the restriction of funds collected from customers pursuant to the refundable rate increase granted by the RCA. Other receivables increased by $5.8 million primarily due to end of the year economy energy sales of electricity. Inventories of materials and supplies increased by $1.8 million primarily due to an increase in gas stored at Cook Inlet Natural Gas Storage and additional materials purchased for Generation Plant 2A.

Deferred outflows of resources increased $0.6 million during 2018 and decreased $2.5 million in 2017 as a result of changes in pension related items and accounting for other postemployment benefits.

Current and other liabilities decreased $13.3 million during 2018 compared to a decrease of $188.6 million during 2017.

During 2018 accounts payable from current assets decreased $12.5 million primarily due to repaying prior year over-recovery of cost of power expenses from customers.

During 2017 short-term debt decreased $181.0 million due to reclassification of notes payable to long-term debt. Accounts payable from restricted assets decreased $6.1 million because the Utility expended all of its proceeds from short-term debt completing Generation Plant 2A.

Non-current liabilities decreased $7.0 million during 2018 compared to a decrease of $183.7 million in 2017.

During 2018 the primary driver of the change was a $0.9 million reduction in pension liability, the addition of $2.3 million in other postemployment benefits (OPEB) liability due to adoption of new accounting standards, and $7.9 million redemption of bonds.

During 2017 the primary driver of the change was the reclassification of $191.9 million in notes payable from short-term to long-term, offset by a decrease of $2.8 million in the net pension liability and $7.5 million redemption of bonds.

Deferred inflows of resources decreased $18.9 million in 2018 compared to an increase of $9.6 million in 2017.

During 2018 contributions in aid of construction decreased by $2.8 million due to amortization in 2018 exceeding additions. Deferred inflows of resources related to pensions decreased $0.7 million while deferred inflows of resources related to other postemployment benefits of $0.8 million were recorded due to the adoption of a new accounting standard. The future natural gas purchases account increased by $0.7 million in investment earnings and redemption of intercompany debt. Future BRU construction or natural gas purchases account decreased by $16.9 million primarily due to refunding tax credits offset by $2.2 million in gas sales and $0.1 million in investment earnings (see Note 9 (c)).

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

During 2017 contributions in aid of construction increased by $3.3 million due to the transfer of $9.0 million from non-contributed to contributed plant as a result of an RCA order, offset by amortization. Deferred inflows of resources related to pensions changed $0.8 million. The future natural gas purchases account increased by $0.8 million in investment earnings and redemption of intercompany debt. Future BRU construction or natural gas purchases account increased by $4.8 million. There were $16.3 million in gas sales and $0.2 million in investment earnings (see Note 9 (c)).

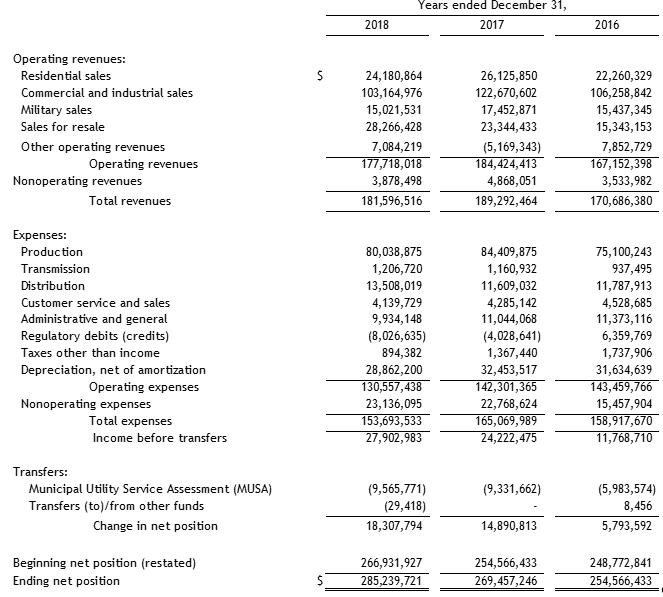

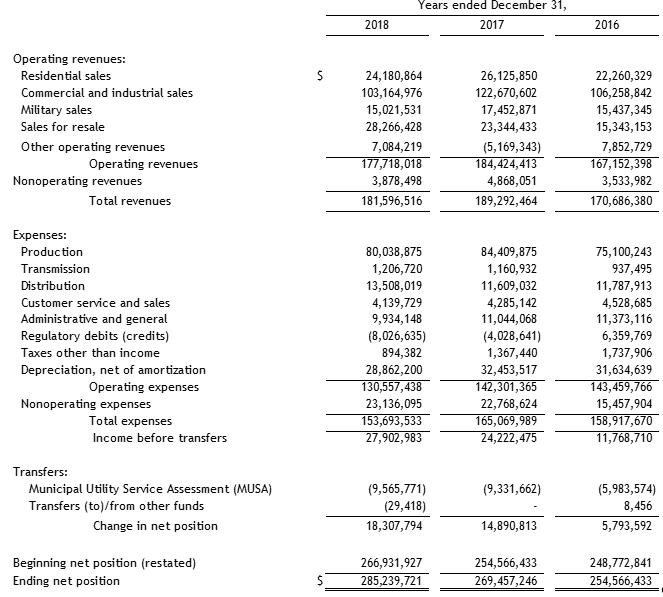

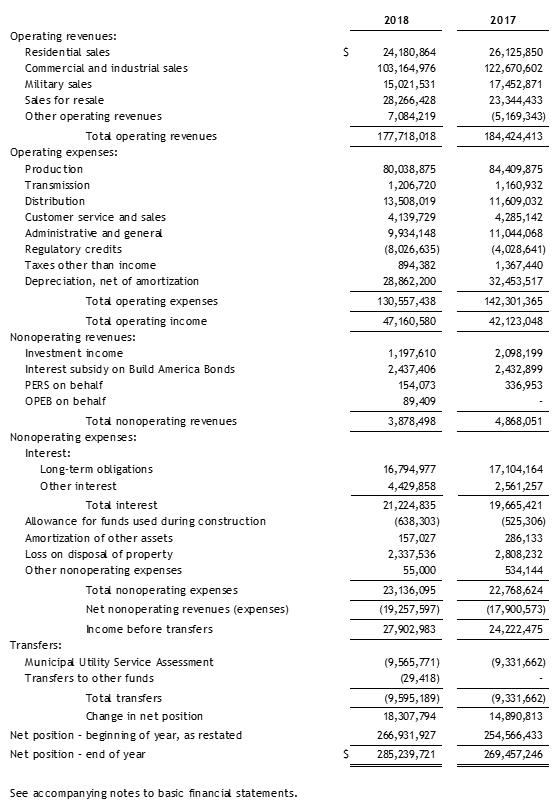

Revenues, Expenses, and Changes in Net Position

Changes in the Utility’s net position can be determined by reviewing the following condensed schedule of revenues, expenses, and changes in net position for the years ended December 2018, 2017, and 2016:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

Revenues by Source:

Total revenues decreased $7.7 million during 2018 compared to an increase of $18.6 million during 2017. Total kilowatt hours (kWh) sold increased by 54.8 million in 2018 compared to an increase of 147.3 million in 2017. Components of the changes in revenues were:

During 2018 total operating revenues were $177.7 million, a decrease of $6.7 million from 2017. Military sales revenue decreased by $2.4 million. Commercial and industrial sales decreased by $19.5 million while sales for resale increased by $4.9 million during the year. Retail sales decreases were primarily due to lower Cost of Power Adjustment (COPA.) revenues as a result of lower fuel costs for the year and more efficient generation assets. Other operating revenues increased by $12.3 million due to under-recovery of COPA. Non-operating revenues decreased by just under $1 million due to lower investment income as a result of fewer assets invested.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

During 2017 total operating revenues were $184.4 million, an increase of $17.3 million from 2016 primarily due to rate increases implemented in February 2017. The largest growth was in commercial and industrial sales, which increased $16.4 million. Increases of $3.9 million in residential sales, $2 million in military sales, and $8 million in sales for resale were offset by a decrease of $13 million in other operating revenues. Other operating revenues decreased $13 million due to over-recovery of COPA. Non-operating revenues increased by $1.3 million primarily due to investment gains.

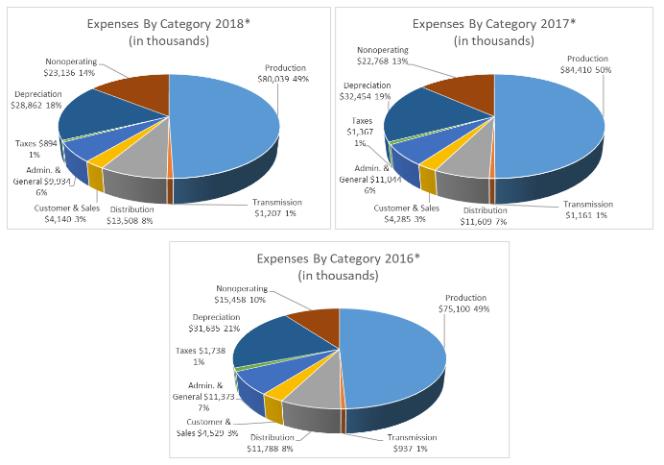

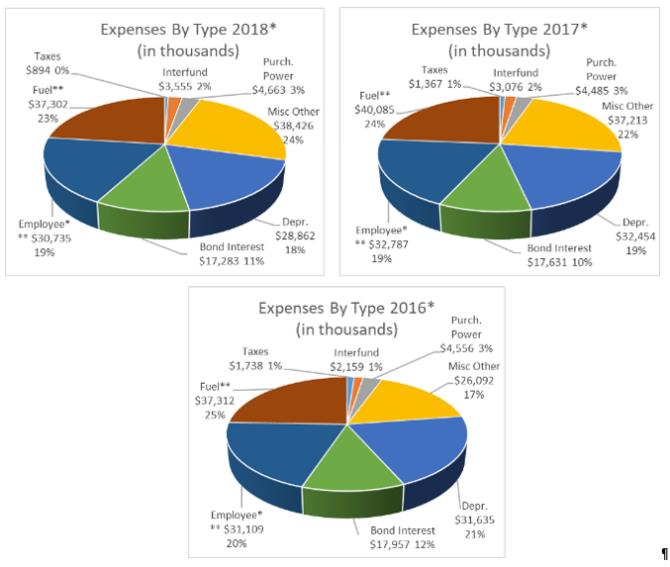

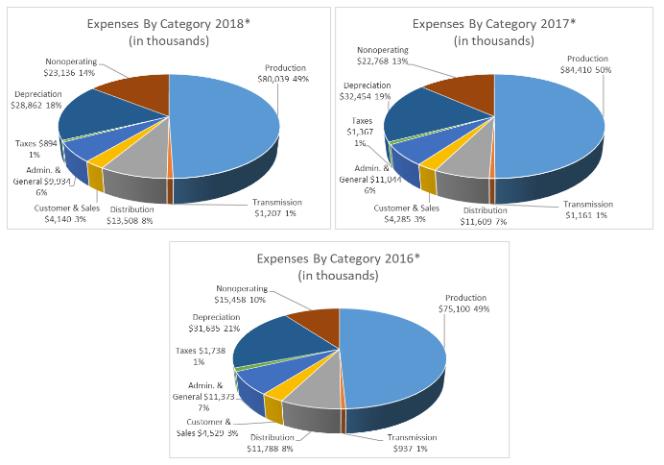

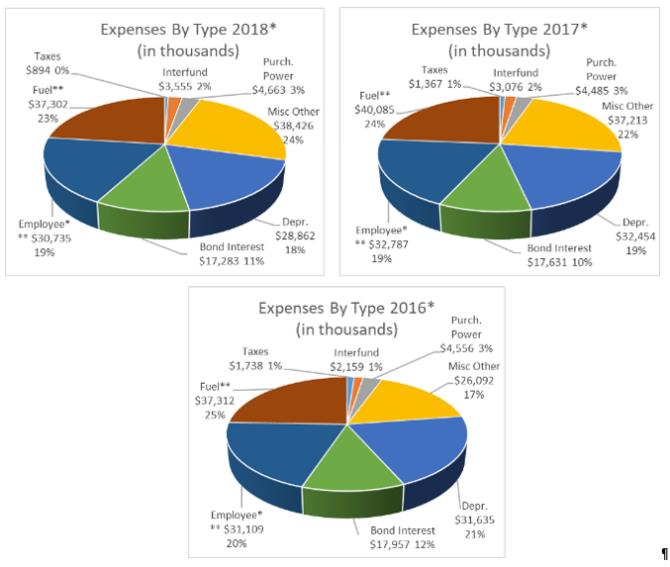

Expenses by Category

Total expenses by category decreased $11.4 million during 2018 compared to an increase of $6.2 million during 2017. Components of the changes were:

During 2018 operating expenses decreased $11.7 million from 2017 due to a $4.4 million decrease in production expenses (primarily fuel),and a $4 million increase in regulatory credits due to repayment of over-collection of COPA from customers. Distribution expenses increased by $1.9 million, administrative and general expenses decreased $1.1 million; depreciation expenses decreased $3.6 million primarily due to retirement of assets. Non-operating expenses increased just $0.4 million primarily due to increased short-term borrowing costs offset by decreases in other miscellaneous, interest expenses and loss on disposal of property.

MUSA, which represents payments to the municipal government in lieu of property taxes, remained consistent with 2017, increasing just $0.2 million due to a decrease in plant assets and an increase in mill rates.

During 2017 operating expenses decreased $1.1 million from 2016, mainly due to a $9.3 million increase in production expenses offset by a $10.4 million increase in regulatory credits. Production increased mainly because more fuel was used by the Utility for increased sales of electricity for resale, and regulatory credits reflect an over-collection of COPA from customers during the year. Non-operating expenses increased $7.3 million primarily due to a $12 million decrease in allowance for funds used during construction (AFUDC), a $0.2 million increase in interest expense on long-term obligations, and a $0.6 million increase in other interest due to an increase in interest rates, offset by a $6 million decrease in loss on disposal of property.

MUSA increased $3.3 million over 2016, due to the increase in plant value when Generation Plant 2A was placed in service in late 2016.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

* Expenses by category excluding regulatory debits (credits)

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

*Expenses by type excluding regulatory debits (credits)

**Fuel expense includes purchased natural gas, transportation costs, diesel fuel used, and CINGSA.

***Employee expense includes general liability and workers compensation insurance.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

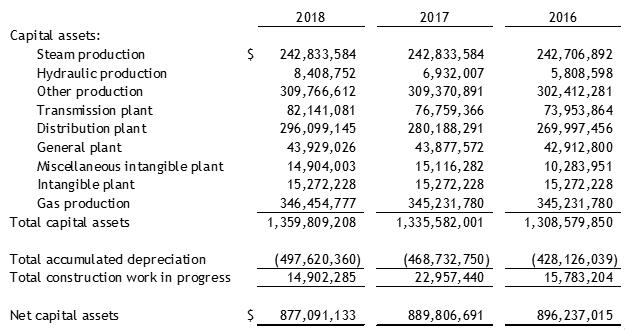

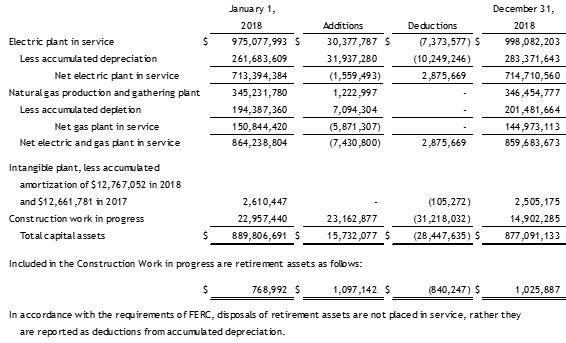

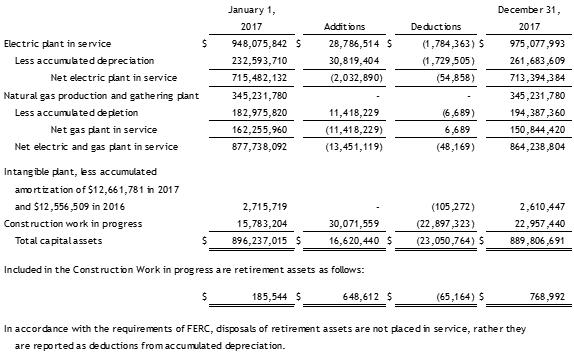

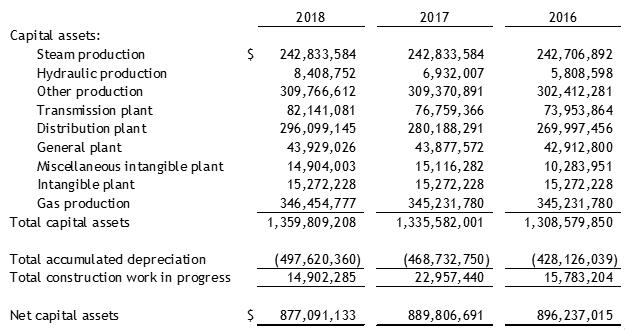

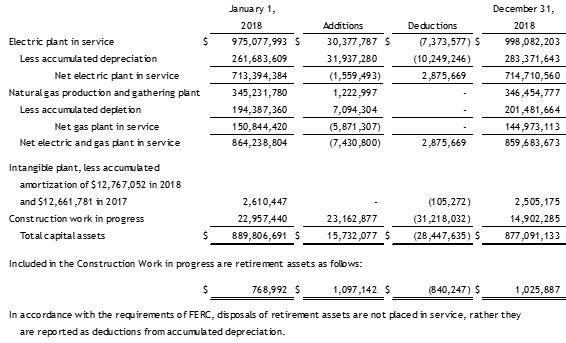

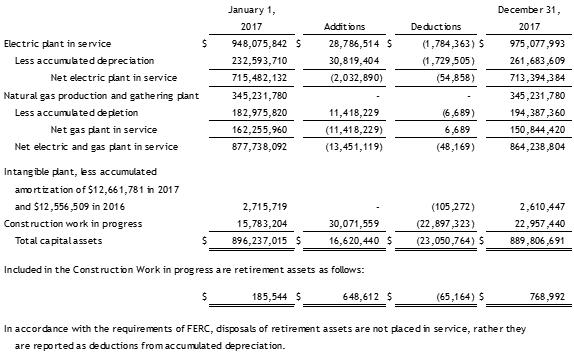

Capital Assets - Plant

The Utility’s investment in capital assets as of December 31, 2018 and 2017 was $877.1 million and $889.8 million, respectively (net of accumulated depreciation and depletion.) This included investments in gas and electric production, transmission and distribution related facilities, as well as general items such as buildings and vehicles. Plant decreased 1.43% and 0.72% over the prior year for 2018 and 2017, respectively.

The Utility’s capital assets as of December 31, 2018, 2017, and 2016 were as follows:

For further information regarding the Utility’s capital assets, see Note 4.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

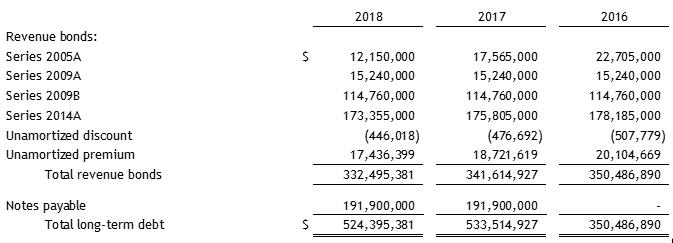

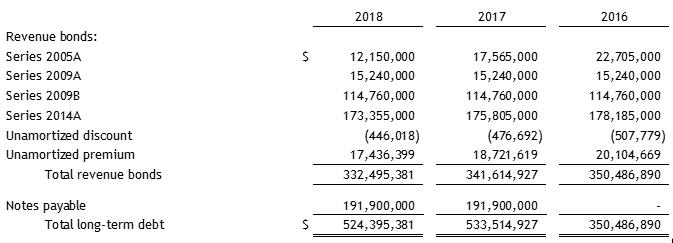

Long Term Debt – Revenue Bonds and Notes Payable

As of December 31, 2018 and 2017, the Utility had outstanding long-term debt of $524 and $534 million, respectively.

The Utility’s long term-debt as of December 31, 2018, 2017, and 2016, were as follows:

Notes payable were reclassified from short-term to long-term in 2017. Notes payable increased $10.9 million during 2017 as Generation Plant 2A construction was concluded.

Bond Rating

At December 31, 2018, the Utility maintains the following underlying credit ratings:

| |

Standard & Poor’s | A+ |

Fitch | A+ |

In May 2018, Standard & Poor’s reaffirmed the A+ rating of the Utility’s Senior Debt. In September 2018, Fitch reaffirmed the A+ rating of the Utility’s Senior Debt.

Budgetary Highlights

On November 21, 2017, an ordinance adopting and appropriating funds for the 2018 Municipal Utilities’ Operating and Capital Budgets for the Municipality was approved. The Utility’s operating budget was $169,464,144 and the capital budget was $57,105,000, which includes $11 million for the BRU. The Utility’s 2018 actual appropriated expenses of $134,490,309 were $35.0 million or 20.6% under the budget. Capital expenditures for plant improvements totaled $23 million.

On October 9, 2018, an ordinance adopting and appropriating funds for the 2019 Municipal Utilities’ Operating and Capital Budgets for the Municipality was approved. The Utility’s operating budget was $159,217,263 and the capital budget was $42,020,000, which includes $9.6 million for the BRU.

On April 9, 2019 a resolution amending the Utility’s 2019 operating budget by $0.8 million was approved by the Municipal Assembly; the Utility’s total revised operating budget for 2019 increased to $160 million.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Management’s Discussion and Analysis

December 31, 2018 and 2017

Economic Factors and Rates

Sale of the Utility

On April 3, 2018, Anchorage voters approved an amendment to the Anchorage Municipal Charter authorizing the Municipality to sell the Utility to Chugach Electric Association (CEA) by Municipal ordinance. An asset purchase and sale agreement has been approved by the Anchorage Municipal Assembly and CEA’s board of directors. The Utility and CEA have both filed petitions with the RCA to approve the acquisition. A successful acquisition of most of the assets of the Utility by CEA would have a significant effect on the financial position and results of operations of the Utility. The petitions, as filed, request that the Utility retain only the generation assets of Eklutna and sell power to CEA from those assets. (See Note 9(i) and Note 11).

Contacting the Utility’s Financial Management

This financial report is designed to provide our customers, citizens, and creditors with a general overview of the Utility’s finances and to demonstrate the Utility’s accountability for the money it receives. If you have any questions about this report or need additional financial information, contact the Utility’s Chief Financial Officer, Mollie C. Morrison, at (907) 263‑5205.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Statements of Net Position

December 31, 2018 and 2017

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Statements of Net Position, continued

December 31, 2018 and 2017

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Statements of Revenues, Expenses and Changes in Net Position

For the Years Ended

December 31, 2018 and 2017

THIS PAGE INTENTIONALLY LEFT BLANK

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Statements of Cash Flows

For the Years Ended

December 31, 2018 and 2017

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Statements of Cash Flows, continued

For the Years Ended

December 31, 2018 and 2017

THIS PAGE INTENTIONALLY LEFT BLANK

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(1)Description of Business and Summary of Significant Accounting Policies

The first electric system serving Anchorage was installed in 1916 by the Alaska Engineering Commission, the agency of the United States Department of the Interior which constructed the Alaska Railroad. A small steam plant and several diesel power generators supplied Anchorage with electricity until 1929 when the private Anchorage Power and Light Company began supplying the community with electricity from a hydroelectric power plant on the Eklutna River located 15 miles northeast of downtown Anchorage. The Alaska Engineering Commission distribution system was purchased by Anchorage in 1932. Anchorage then acquired the Eklutna plant from the Anchorage Power and Light Company in 1943. This is what is now Anchorage Municipal Light and Power or the Electric Utility Fund, a public utility of the Municipality of Anchorage. The Utility now has six turbine generating units fired by natural gas and one heat recovery steam turbine generating unit. The Utility also has a thirty percent ownership in Southcentral Power Project and fifty-three and one-third percent ownership interest in the Eklutna Hydroelectric Project and is entitled to twenty-five and nine-tenths percent of the output of the Bradley Lake Hydroelectric Project. The Utility meets the majority of its natural gas requirements from its ownership interest in the Beluga River Gas Field, including the initial one-third interest acquired in December 1996. The Utility’s goal in acquiring the working interest in the BRU was to lock in a critical resource for the long-term and provide a hedge against anticipated future increases in natural gas prices. During 2016 the Utility acquired 70% of a one-third working interest in the field from ConocoPhillips Alaska, Inc.(CPAI), increasing its working interest to 56.67%.

The accompanying financial statements include the activities of the Utility. The Utility is a major enterprise fund of the Municipality and not the Municipality as a whole. The Utility is subject to the regulatory authority of the RCA.

The Utility applies all applicable provisions of the Governmental Accounting Standards Board (GASB) which has authority for setting accounting standards for governmental entities. The accounting records of the Utility conform to the Uniform System of Accounts prescribed by the Federal Energy Regulatory Commission (FERC).

Accounting and reporting treatment applied to the Utility is accounted for on a flow of economic resources measurement focus using the accrual basis of accounting. Revenues are recognized when they are earned and expenses are recognized at the time liabilities are incurred. Operating revenues and expenses generally result from providing services and producing and delivering goods in connection with the Utility’s principal ongoing operations. All other revenues and expenses are reported as non-operating.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

The Utility meets the criteria, and accordingly follows the accounting and reporting requirements applicable to regulated operations. The Utility’s rates are regulated by the RCA and as a result, revenues intended to recover certain costs are provided either before or after the costs are incurred, resulting in regulatory assets or liabilities. The following regulatory assets and liabilities are reflected in the accompanying financial statements:

| · | | The Utility receives contributions in aid of construction, which it records as contributed plant in service and a deferred inflow of resources. The Utility amortizes contributed plant and the deferred inflow of resources over the useful life of the utility plant. |

| · | | The Utility accepted a monetary settlement in 2015 from its BRU partners for its 2014 underlift. The Utility used these funds to reduce its Gas Transfer Price (GTP) from July 1, 2016 through June 30, 2017. See Note 9(a). |

| · | | The Utility has a regulatory asset or liability account to capture the difference in the cost of power and revenue received through the Cost of Power Adjustment (COPA). See Note 9(b). |

| · | | The Utility has a regulatory asset or liability account to capture the difference in the amount of the Gas Fund revenue requirement and the actual amount of revenue collected from the Electric Fund. See Note 9(b). |

| · | | The Utility records proceeds from the sales of gas, net of royalties, taxes and an Asset Retirement Obligation (ARO) surcharge, as a deferred regulatory liability, reported as deferred inflows of resources on the statements of net position. See Note 9(c). |

| · | | The Utility funds ARO expenses associated with future abandonment of the BRU through a surcharge to the Utility’s GTP, which is deposited into a sinking fund. See Note 9(c) and (d). |

Management believes that the recorded amounts of all regulatory assets are fully recoverable from ratepayers in the future.

(b)Management Estimates

In preparing the financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and deferred outflows of resources, liabilities and deferred inflows of resources and the reporting of contingent assets and liabilities as of the date of the statement of net position and revenues and expenses for the period. Actual results could differ from those estimates. The more significant accounting and reporting policies and estimates applied in the preparation of the accompanying financial statements are discussed below.

(c)Cash Pools and Investments

The Municipality uses a central treasury to account for all cash and investments to maximize interest. Interest income on cash pool investments is distributed based on the average daily balance in the general cash pool. The Utility’s investments are reported at fair value in the financial statements.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(d) Statements of Cash Flows

For purposes of the statements of cash flows, the Utility has defined cash as the demand deposits and all investments maintained in the general cash pool, regardless of maturity period, since the Utility uses the cash pools essentially as demand deposit accounts. Restricted assets in the general cash pool, except for customer deposits, have not been included in the definition of cash.

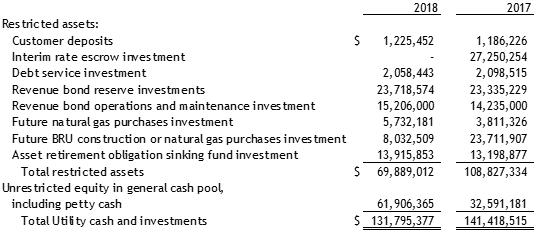

(e) Restricted Assets

Certain proceeds of the Utility’s revenue bonds, as well as resources set aside for their repayment, are classified as restricted assets on the statements of net position because their use is limited by applicable bond covenants. The revenue bond reserve investment account is used to report resources set aside to augment potential deficiencies from Utility operations that could adversely affect debt service payments. The debt service account is used to segregate resources accumulated for debt service payments over the next twelve months. The revenue bond operations and maintenance account represents funds set aside to comply with bond covenants requiring a reserve equal to one‑eighth of the preceding year’s operating expenses (as defined in the bond covenants).

The restricted equity in general cash pool-customer deposits account represents deposits provided by electric service customers as security for bill payment. Future natural gas purchases or BRU construction and ARO sinking funds are funds for which the RCA has specified the use.

Interim revenue escrow investments are funds collected from customer sales arising from interim and refundable rates granted by the RCA. The restriction on those funds was lifted on June 1, 2018 by the RCA following the submittal of tariff sheets in compliance with RCA Order No. 13 in U-17-008. (See Note 9(e).)

(f)Inventories

Inventories are valued at weighted average cost. The cost of inventories are recorded as expenditures when consumed rather than when purchased. Inventories consist of parts and materials used to maintain or build new transmission, distribution, and generation facilities. Scrap and nonusable materials in inventory are carried at net estimated realizable value until sold or otherwise disposed of.

The Utility also stores natural gas in a depleted field on the Kenai Peninsula. Cook Inlet Natural Gas Storage Alaska (CINGSA) started in 2012 and as of December 31, 2018 the Utility has stored 6.74 billion cubic feet of gas.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

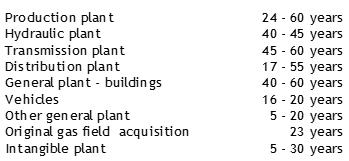

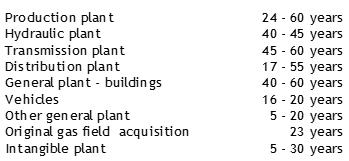

(g)Property, Plant and Equipment

Electric

Capital assets are stated at cost. Depreciation is computed by use of the straight‑line method over the estimated economic life of the asset. Additions to electric plant in service are at original cost of items such as contracted services, direct labor and materials, indirect overhead charges and AFUDC. The Utility capitalizes general plant assets valued at more than $25,000 that have an expected life in excess of one year. Contributed assets are recorded at the cost incurred by the Utility for the addition of such assets. Donated assets are recorded at acquisition value. Acquisition value is the price that would be paid to acquire an asset with equivalent service potential in an orderly market transaction at the acquisition date. For property replaced or retired, the cost of the property unit, plus removal costs less salvage, is charged to accumulated depreciation. Gain or loss is not recognized unless the Utility determines that such costs could not be recovered in rates. Costs for maintenance and repairs are expensed as incurred, except for major maintenance on generation assets, for which costs are collected into a regulatory asset and amortized over the period of utility, generally three to five years.

Estimated lives of major plant and equipment categories follow:

Gas

Acquisition costs, the costs of wells, related equipment and facilities initially acquired as part of the 1996 acquisition of a one-third working interest in the BRU were, as a result of a regulatory proceeding and subsequent order by the RCA, being depleted at 125% of the principal payments on the debt used to finance the acquisition of this asset. Those assets were fully depleted at December 31, 2018, as related debt was fully redeemed at December 1, 2018.

The acquisition of assets purchased with designated underlift settlement funds are being amortized using the units of production method, based upon proven reserves in accordance with the amortization method used for regulatory purposes. The acquisition of assets purchased with gas sale proceeds, and assets acquired from CPAI in the 2016 purchase, are being recorded as contributed plant and are being amortized using the units of production method, based on proven reserves in accordance with the amortization method used for regulatory purposes.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(h)Unbilled Revenues and Accounts Receivable

Electric revenues are based on cycle billings rendered to customers monthly. As a result of this cycle billing method, the Utility does not accrue revenue at the end of any fiscal period for services sold but not billed at such date. The unbilled revenues for the Utility are immaterial. An allowance for doubtful accounts is provided for receivables where there is a question of collectability. Utility receivables are presented in the statements of net position net of estimated uncollectible amounts. Gas sales are calculated based upon volumes delivered and recorded as a regulatory liability, which is reported as deferred inflows of resources on the statements of net position (see Note 9(c)).

The Utility has elected to account for underlifted gas from its ownership interest in the BRU according to the sales method. Therefore, the financial statements do not include a receivable or revenue for underlifted volumes for which the Utility did not elect to receive cash settlement. As of December 31, 2018 and 2017, the underlift balance was 23,106 and 172 Mcf, respectively. The Utility also has the option per the Gas Balancing Agreement to take cash settlements for any underlifted gas.

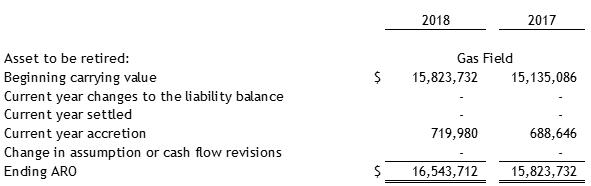

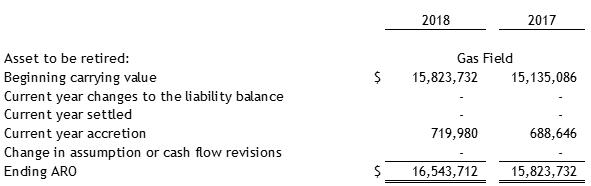

(j)Asset Retirement Obligation (ARO)

The Utility accounts for its ARO for its interest in the BRU in accordance with Accounting Standards Codification (ASC) Topic #410-20, formerly Statement of Financial Accounting Standards No 143, “Accounting for Asset Retirement Obligations” (SFAS No 143) and 18 CFR 101 General Instruction No 25, Accounting for Asset Retirement Obligations (Regulations of the Federal Energy Regulatory Commission, Department of Energy, or FERC). ASC 410-20 and FERC General Instruction No 25 applies to the fair value of a liability for an ARO that is recorded when there is a legal obligation associated with the retirement of a tangible long-lived asset and the liability can be reasonably estimated. Obligations associated with the retirement of these assets require recognition of: (1) the present value of a liability and offsetting asset for an ARO, (2) the subsequent accretion of that liability and depreciation of the asset, and (3) the periodic review of the ARO liability estimates and discount rates.

In 2012 the Utility made its initial recording of the ARO asset and ARO liability with a beginning balance of $1,461,335 representing the fair value of the obligation at 1996 – the period when the obligation was incurred. The Utility recorded in 2012 $4,185,549 to the ARO liability representing total accretion expense that would have been incurred if the liability was accreted from the time the obligation was incurred through December 31, 2012. During 2013, the Utility commissioned a study of the costs associated with abandoning the BRU field and as a result of the findings of that study, adjusted the ARO liability and accretion as of December 2013. On April 22, 2016, the Utility purchased 70% of CPAI’s one-third interest in the BRU. At that time a revised estimate was made of the life of the gas field. The Utility’s obligation for an ARO was adjusted for the increased liability and changes in estimated life and discount rate. As of December 31, 2016, the Utility entered into an agreement with the State of Alaska Department of Natural Resources (DNR) to establish an ARO investment fund to meet its obligations for dismantling, removing and restoring the land and property to a condition acceptable to the commissioner of the DNR in accordance with the terms and conditions of assigned leases and applicable statutes and regulations.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

A schedule of changes in the ARO balance for the years ending December 31, 2018 and 2017 is as follows:

(k)Discount or Premium on Revenue Bonds Payable

The discount or premium on revenue bonds payable is amortized over the life of the related bond issues using the effective interest method.

(l) Compensated Absences

The Utility records employee leave, which includes sick leave, when earned.

(m) Deferred Outflows and Inflows of Resources

The Utility enters into transactions that result in the consumption or acquisition of resources in one period that are applicable to future periods. These consumptions and acquisitions of resources are reported in the statements of net position as deferred outflows and inflows of resources, respectively. The Utility records deferred outflows of resources related to pensions and other postemployment benefits, and deferred loss on refunding of bonds, and deferred inflows of resources related to pensions and other postemployment benefits, contributions in aid of construction and certain items related to the operation of the BRU.

(n)Net Position

The Utility’s net position is categorized as net investment in capital assets, restricted or unrestricted. The Utility’s restricted net position represents assets restricted for payment of debt service, or restricted for operations, in accordance with covenants of the related revenue bond indentures. It is the Utility’s policy to evaluate whether to use restricted or unrestricted resources to make certain payments, on a case by case basis, when both restricted and unrestricted assets are available for the same purposes.

(o)Intragovernmental Charges

Certain functions of the Municipality of a general and administrative nature are centralized and the related costs are allocated to the various funds of the Municipality, including the Utility. Such costs allocated to the Utility totaled $4,214,954 and $3,580,714 for the years ended December 31, 2018 and 2017, respectively, including general liability and workers compensation of $660,414 for 2018 and $504,452 for 2017.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(p) Utility Revenue Distribution/Municipal Service Assessment (MUSA)

Prior to 2006, the RCA restricted the Utility from making a revenue distribution or paying the gross receipts portion of the MUSA. That restriction was removed in December 2005. The Utility made an annual revenue distribution to the Municipality for the years 2006 - 2015, which by Ordinance, was up to a maximum of 5% of the Utility’s gross revenues, excluding restricted revenues. During those years the Utility also included the gross receipts portion, considered supplemental MUSA, at 1.25% times the actual gross operating revenues in its payment of MUSA. During 2017, the Municipality eliminated the gross receipts portion of the MUSA and revised the methodology for calculating the Utility Revenue Distribution.

Beginning January 1, 2016, the Utility is restricted by the RCA from making revenue distributions to the Municipality, with the exception of MUSA. The Utility’s distribution for MUSA in 2018 and 2017 was $9,565,771 and $9,331,662, respectively.

(q) Environmental

The Utility has adopted an aggressive policy designed to identify and mitigate the potential effects of past, present, and future operational activities that may result in environmental impact. It is the Utility’s accounting policy to record a liability when the likelihood of responsibility for an environmental impact is probable and the cost of mitigating the impact is estimable within reasonable limits. Such costs are capitalized if they result in an extension of the assets’ life, increase the capacity, or improve the safety or efficiency of property owned by the Utility; or mitigate or prevent environmental contamination that has yet to occur and that otherwise may result from future operations or activities. At December 31, 2016, the Utility recorded a liability of $760,000 for environmental cleanup responsibilities related to a capital project at Hank Nikkels Power Plant 1. At December 31, 2018 and 2017, the liability balance was $0.00 and $511,787, respectively. See Note 8(a). There were no other environmental issues that met the Utility’s accounting policy and accordingly, no provision has been made in the accompanying financial statements for any potential liability.

(r)Net Pension Liability

For purposes of measuring net pension liability, deferred outflows and inflows of resources related to pensions and pension expenses, information about the fiduciary net position of the Public Employees’ Retirement System (PERS) and additions to/from PERS’ fiduciary net position have been determined on the same basis as they are reported by PERS. For this purpose, benefit payments (including refunds of employee contributions) are recognized when due and payable in accordance with the benefit terms. Investments are reported at fair value. Details regarding the net pension liability are discussed in Note 7.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(s)Net Other Postemployment Benefits (OPEB) Liability

For purposes of measuring net OPEB liability, deferred outflows and inflows of resources related to OPEB and OPEB expenses, information about the fiduciary net position of PERS and additions to/from PERS’ fiduciary net position have been determined on the same basis as they are reported by PERS. For this purpose, benefit payments (including refunds of employee contributions) are recognized when due and payable in accordance with the benefit terms. Investments are reported at fair value. Details regarding the net OPEB liability are discussed in Note 7.

(t)Reclassifications

Certain amounts previously reported may have been reclassified to conform to current presentations. The reclassifications had no effect on the previously reported change in net position.

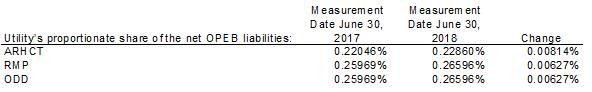

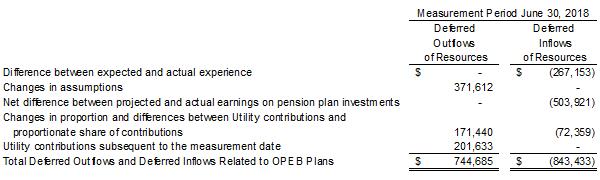

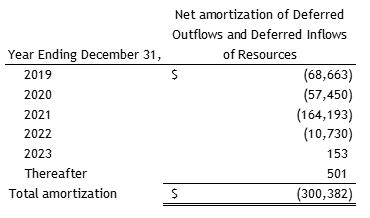

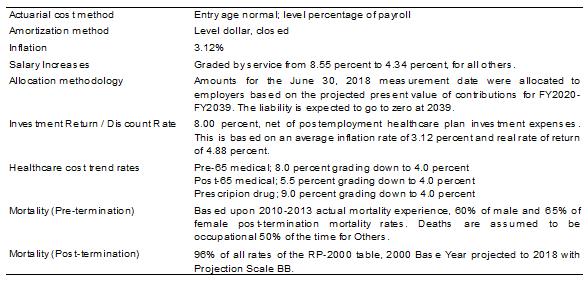

(2) Change in Accounting Principle

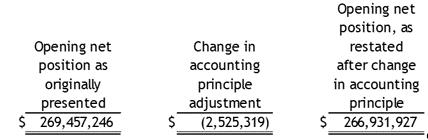

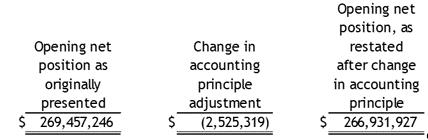

As discussed in Note 7 to the financial statements, the Utility participates in the PERS plans. In 2018, the Utility adopted the provisions of GASB Statement No. 75 Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions, which, among other accounting and reporting criteria, requires the Utility to recognize its proportional share of the net OPEB liability (and related deferred inflows and outflows of resources), as of the beginning of the Utility’s fiscal year. The prior period presented in the financial statements was not restated as it was not practical to do. As a result of the implementation of this statement, the Utility has recorded an opening balance adjustment to reflect opening balance OPEB liabilities and related accounts and to decrease opening net position as follows:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

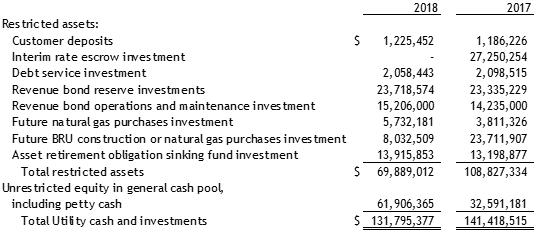

(3) Cash and Investments

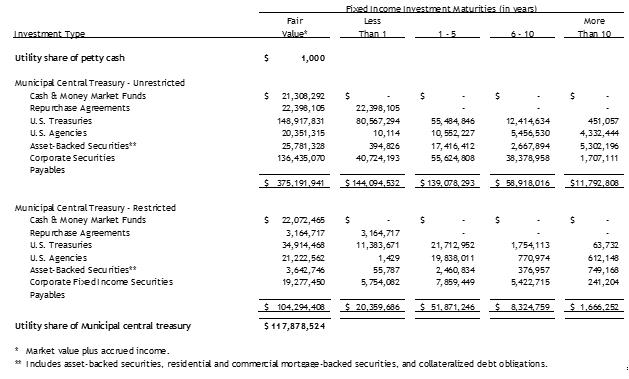

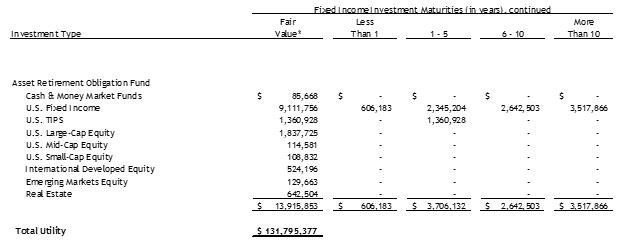

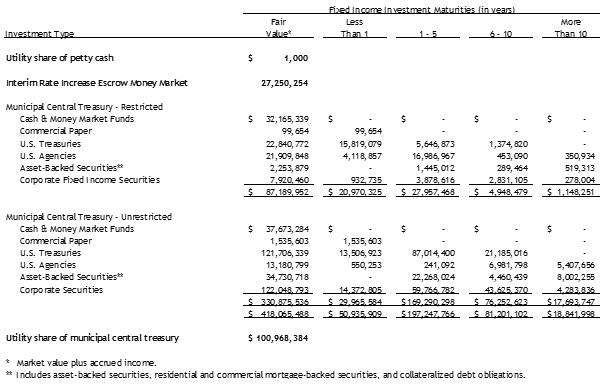

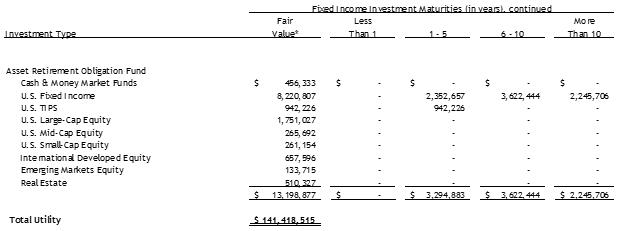

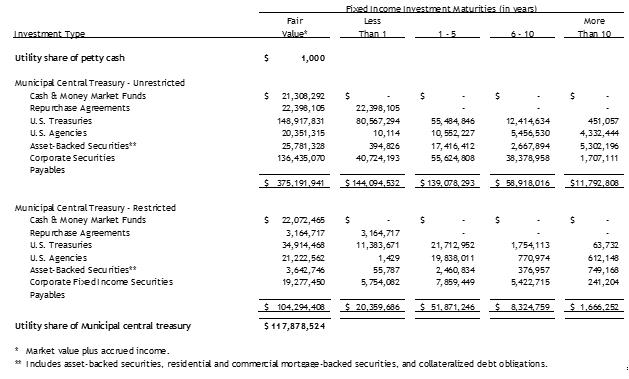

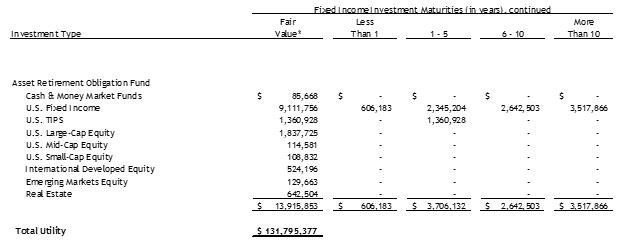

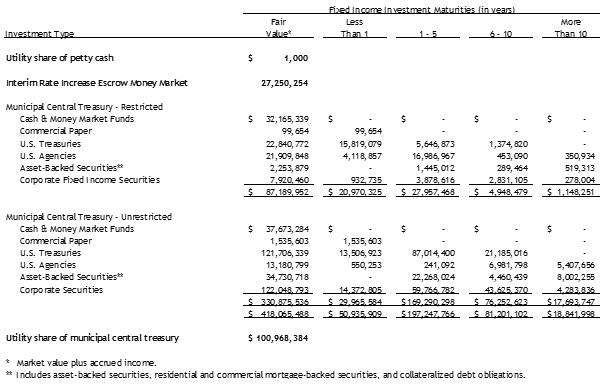

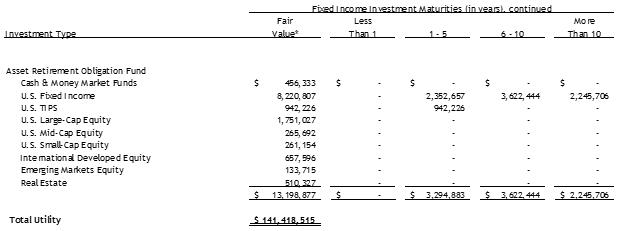

At December 31, 2018 and 2017, the Municipality had cash and investments in a general cash pool (Central Treasury). The Utility also carries certain balances for the Utility, beginning in 2017, in separate accounts for Interim Rate Increase Escrow and Asset Retirement Obligations. Fixed income maturities for these accounts are as follows:

December 31, 2018

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

December 31, 2018, continued:

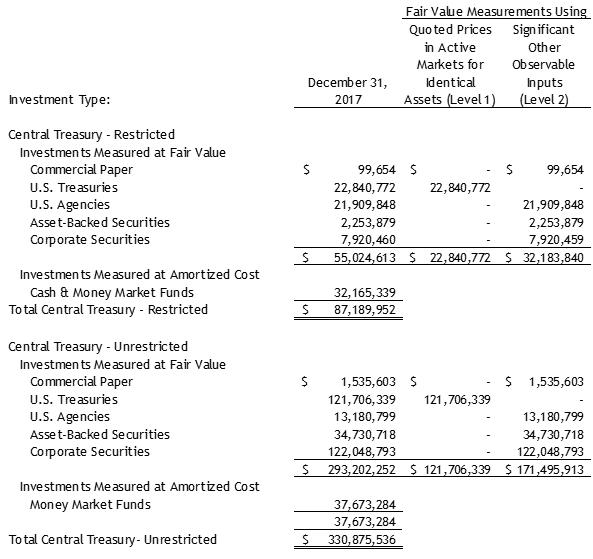

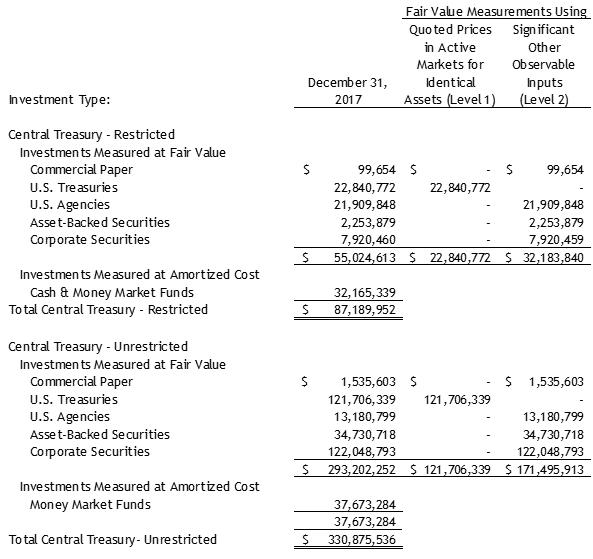

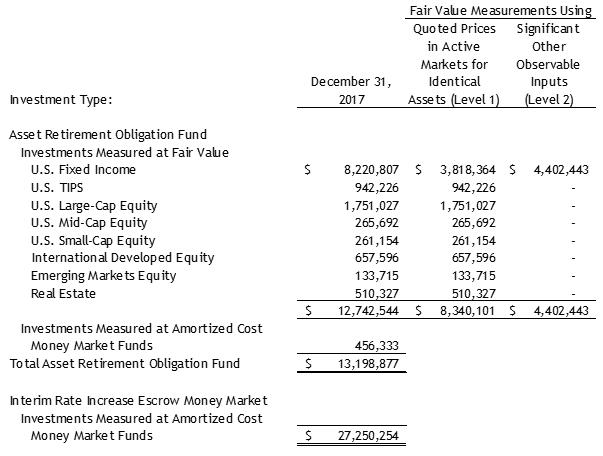

December 31, 2017

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

December 31, 2017, continued

Reported in the Statement of Net Position:

| (a) | | Municipal Central Treasury |

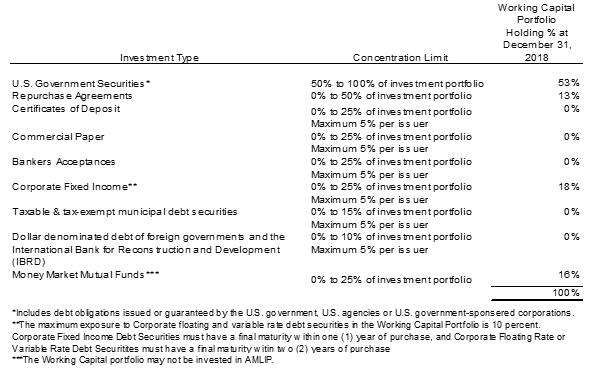

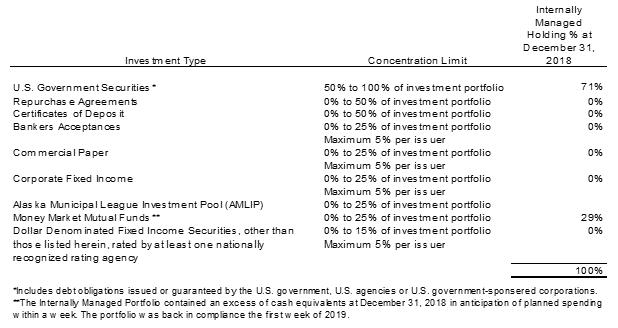

The Municipality manages its Central Treasury in four portfolios; one internally managed portfolio and three externally managed duration portfolios based on liability duration and cash needs: working capital, contingency reserve and strategic reserve.

The Municipality maintains a comprehensive policy over cash and investments that is designed to mitigate risks while maximizing investment return and providing for operating liquidity. Pursuant to Anchorage Municipal Code (AMC) 6.50.030, the Municipality requires investments to meet specific rating and issuer requirements.

Both externally and internally managed investments are subject to the primary investment objectives outlined in AMC 6.50.030, in priority order as follows: safety of principal, liquidity, return on investment and duration matching. Consistent with these objectives, AMC 6.50.030 authorizes investments that meet the following rating and issuer requirements:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

| · | | Obligations issued or guaranteed by the U.S. government, U.S. agencies or U.S. government sponsored corporations and agencies. |

| · | | Corporate debt securities that are guaranteed by the U.S. government or the Federal Deposit Insurance Corporation (FDIC) as to principal and interest. |

| · | | Taxable and tax-exempt municipal securities having a long-term rating of at least A- by a nationally recognized rating agency or taxable or tax-exempt municipal securities having a short-term rating of at least A-1 by Standard & Poor’s, P-1 by Moody’s, or F-1 by Fitch. |

| · | | Debt securities issued and guaranteed by the International Bank for Reconstruction and Development (IBRD) and rated AAA by a nationally recognized rating agency. |

| · | | Commercial paper, excluding asset-backed commercial paper, rated at least A-1 by Standard & Poor’s, P-1 by Moody’s, or F-1 by Fitch. |

| · | | Bank debt obligations, including unsecured certificates of deposit, notes, time deposits, and bankers’ acceptances (with maturities of not more than 365 days), and deposits with any bank, the short-term obligations of which are rated at least A-1 by Standard & Poor’s, P-1 by Moody’s, or F-1 by Fitch and which is either: |

| a) | | Incorporated under the laws of the United States of America, or any state thereof, and subject to supervision and examination by federal or state banking authorities; or |

| b) | | Issued through a foreign bank with a branch or agency licensed under the laws of the United States of America, or any state thereof, or under the laws of a country with a Standard & Poor’s sovereign rating of AAA, or a Moody’s sovereign rating for bank deposits of Aaa, or a Fitch national rating of AAA, and subject to supervision and examination by federal or state banking authorities. |

| · | | Repurchase agreements secured by obligations of the U.S. government, U.S. agencies, or U.S. government-sponsored corporations and agencies. |

| · | | Dollar denominated corporate debt instruments rated BBB- or better (investment grade) by Standard & Poor’s or the equivalent by another nationally recognized rating agency. |

| · | | Dollar denominated corporate debt instruments rated lower than BBB- (non-investment grade) by Standard & Poor’s or the equivalent by another nationally recognized rating agency, including emerging markets. |

| · | | Dollar denominated debt instruments of foreign governments rated BBB- or better (investment grade) by Standard & Poor’s or the equivalent by another nationally recognized rating agency. |

| · | | Asset Backed Securities (ABS), excluding commercial paper, collateralized by: credit cards, automobile loans, leases and other receivables which must have a credit rating of AA- or above by Standard & Poor’s or the equivalent by another nationally recognized rating agency. |

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

| · | | Mortgage Backed Securities, including generic mortgage-backed pass-through securities issued by Ginnie Mae, Freddie Mac, and Fannie Mae, as well as non-agency mortgage-backed securities, Collateralized Mortgage Obligations (CMOs), or Commercial Mortgage-Backed Securities (CMBS), which must have a credit rating of AA- or better by Standard & Poor’s or the equivalent by another nationally recognized rating agency. |

| · | | Debt issued by the Tennessee Valley Authority |

| · | | Money Market Mutual Funds rated Am or better by Standard & Poor’s, or the equivalent by another nationally recognized rating agency, as long as they consist of allowable securities as outlined above. |

| · | | The Alaska Municipal League Investment Pool (AMLIP). |

| · | | Mutual Funds consisting of allowable securities as outlined above. |

| · | | Interfund Loans from a Municipal Cash Pool to a Municipal Fund. |

In addition to providing a list of authorized investments, AMC 06.50.030 specifically prohibits investment in the following:

| · | | Structured Investment Vehicles. |

| · | | Asset Backed Commercial Paper. |

| · | | Securities not denominated in U.S. Dollars. |

| · | | Real Estate Investments. |

| · | | Derivatives, except “to be announced” forward mortgage-backed securities (TBAs) and derivatives for which payment is guaranteed by the U.S. government or an agency thereof. |

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

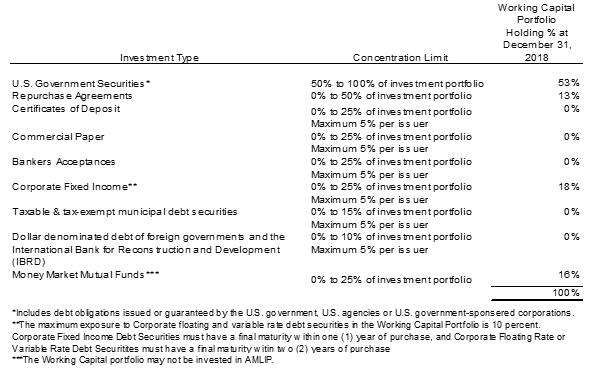

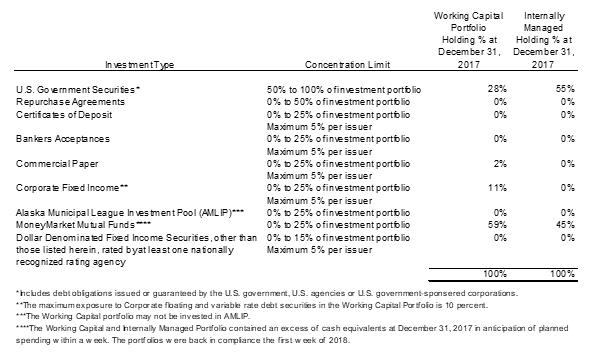

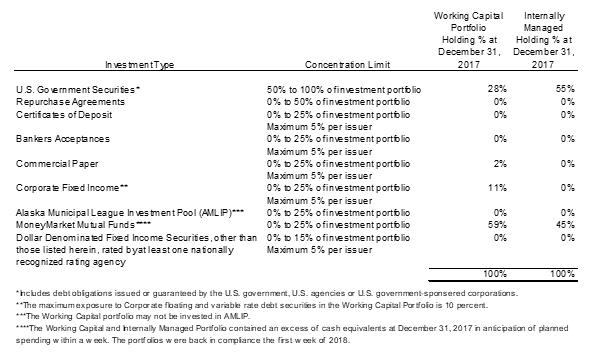

The Investment Management Agreement (IMA) for each external manager and the policy and procedures (P&P) applicable to the internally managed investments provide additional guidelines for each portfolio’s investment mandate. The IMA and P&P limit the concentration of investments for the working capital portfolio at the time new investments are purchased as follows for 2018:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

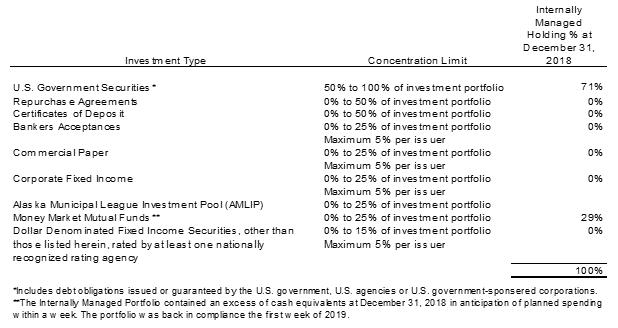

The IMA and P&P limit the concentration of investments for the internally managed portfolio at the time new investments are purchased as follows for 2018:

The IMA and P&P limit the concentration of investments for the working capital portfolio and the internally managed portfolio at the time new investments are purchased as follows for 2017:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

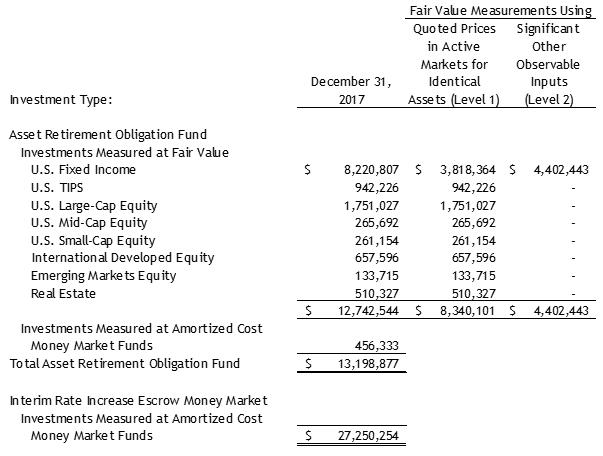

| (b) | | Beluga River Asset Retirement Obligation Fund |

Funds set aside to pay for dismantling, removing, and restoring assets of the Beluga River Unit gas field were transferred from the MOA Central Treasury to a separate investment portfolio in 2017, per assembly ordinance.

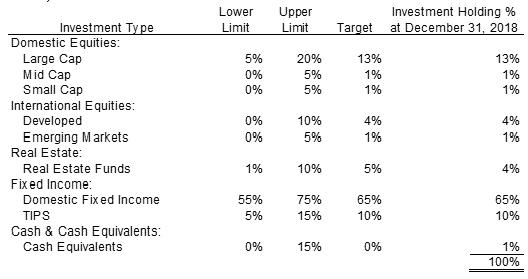

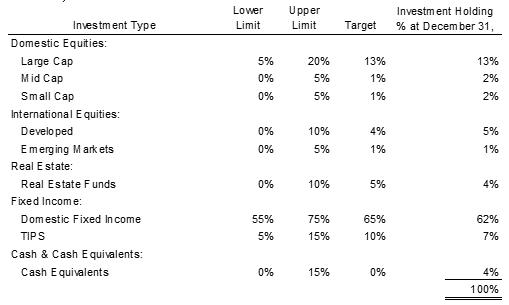

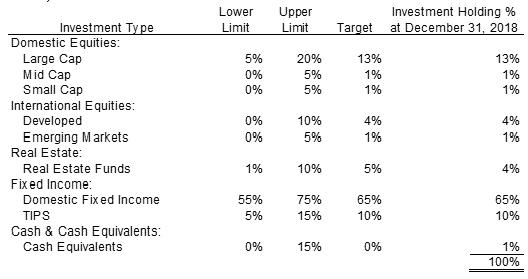

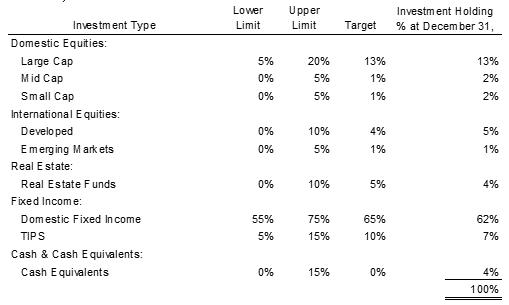

The Beluga River Asset Retirement Obligation Fund is managed to maximize capital appreciation with a long-term rate of return. The Fund is authorized to invest in the following assets:

| · | | Domestic equities and International equities, including real estate investment trusts. |

| · | | Investment grade dollar-denominated fixed income securities. |

| · | | Cash and money market instruments. |

The Beluga River Asset Retirement Obligation Fund limits the concentration of its investments as follows:

December 31, 2018

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

December 31, 2017

(c)Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will adversely affect the fair value of an investment. The externally managed portfolios of the Municipal Central Treasury utilize the duration method to measure exposure to interest rate risk.

Duration is a measure of an investment’s sensitivity to interest rate changes, and represents the sensitivity of an investment’s market price to a one percent change in interest rates. The effective duration of an investment is determined by its expected future cash flows, factoring in uncertainties introduced through options, prepayments, and variable rates. The effective duration of a pool is the average fair value weighted effective duration of each security in the pool.

AMC 6.50.030 requires the Working Capital Portfolio have a duration of zero to 270 days. At December 31, 2018, the Working Capital Portfolio had a duration of 1.37 years, or approximately 500 days, and was not within the targeted duration. At December 31, 2017, the Working Capital Portfolio had a duration of 0.14 years, or approximately 51 days. AMC 6.50.030 also requires that the Contingency Reserve Portfolio have an average duration within half a year of its benchmark. At December 31, 2018, the Contingency Reserve Portfolio had a duration of 1.83 years as compared to its benchmark, Barclays 1-3 Year Government Index, which had a duration of 1.90 years. At December 31, 2017, the Contingency Reserve Portfolio had a duration of 1.94 years as compared to its benchmark, Barclays 1-3 Year Government Index, which had a duration of 1.91 years. AMC 6.50.030 requires the Strategic Reserve Portfolio have a maximum duration no greater than one year in excess of its benchmark. At December 31, 2018, the Strategic Reserve Portfolio had a duration of 3.12 years as compared to its benchmark, Barclays Intermediate Government/Corporate Index, which had a duration of 2.91 years. At December 31, 2017, the Strategic Reserve Portfolio had a duration of 3.70 years as compared to its benchmark, Barclays Intermediate Government/Corporate Index, which had a duration of 3.73 years.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

The effective duration of the externally managed portfolio of the Municipal Central Treasury working capital portfolio at December 31, 2018, was 1.37 years, which is not within the targeted duration of +/-.25 years of the Merrill Lynch 90-day Treasury Bill Index, as required per Alaska Permanent Capital Management Investment Manager Agreement. The effective duration of the contingency reserve and strategic reserve portfolios at December 31, 2018, were 1.83 years, and 3.12 years, respectively, which are within the required durations per the policy.

The effective durations of the externally managed portfolios of the Municipal Central Treasury (working capital, contingency reserve and strategic reserve) at December 31, 2017, were 0.14 years, 1.94 years, and 3.70 years, respectively, which are within the required durations per the policy

The Beluga River Asset Retirement Obligation Fund does not have Investment Policies addressing interest rate risk.

(d)Credit Risk

Credit risk is the risk that an issuer or other counterparty to an investment will not fulfill its obligations. For fixed income securities, this risk is generally expressed as a credit rating.

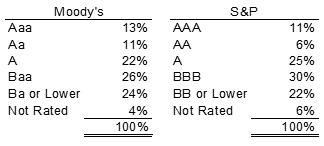

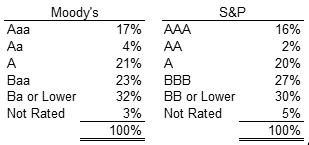

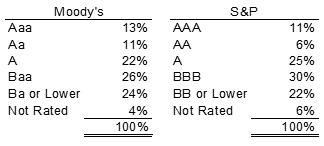

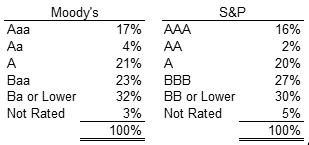

At December 31, 2018, the Municipal Central Treasury’s investment in marketable debt securities, excluding U.S. Treasury and Agency securities, totaled $185,136,594. The distribution of ratings on these securities was as follows:

At December 31, 2017, the Municipal Central Treasury’s investment in marketable debt securities, excluding U.S. Treasury and Agency securities, totaled $167,959,335. The distribution of ratings on these securities was as follows:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

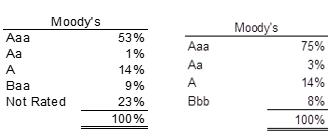

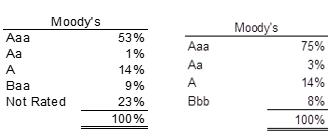

At December 31, 2018 and 2017, the Beluga River Asset Retirement Obligation Fund investment in fixed income securities, including U.S. TIPS, totaled $10,472,684 and $9,163,033, respectively. The distribution of ratings on these securities was as follows:

(e)Concentration of Credit Risk

Concentration of credit risk is the risk of loss attributed to the magnitude of an entity’s investment in a single issuer. GASB Statement No. 40 requires disclosure when the amount invested in a single issuer exceeds 5 percent or more of total investments. Investments issued or explicitly guaranteed by the U.S. Government, as well as mutual funds and other pooled investments, are exempted from this requirement.

At December 31, 2018 and 2017, the Municipal Central Treasury and the Beluga River Asset Retirement Obligation Fund, had no investments in any single issuer exceeding 5 percent of total investments.

(f)Custodial Credit Risk

Custodial credit risk is the risk, in event of the failure of a depository institution, that an entity will not be able to recover deposits or collateral securities in the possession of an outside party. For investments, custodial credit risk is the risk, in event of the failure of the counterparty to a transaction, that an entity will not be able to recover the value of the investment or collateral securities in the possession of an outside party. All collateral consists of obligations issued, or fully insured or guaranteed as to payment of principal and interest, by the United States of America, an agency thereof or a United States government sponsored corporation, with market value not less than the collateralized deposit balances.

AMC 6.50.030 requires that repurchase agreements be secured by obligations of the U.S. government, U.S. agencies, or U.S. government-sponsored corporations and agencies. As of December 31, 2018 and 2017 cash deposits and investments were not exposed to custodial credit risk.

(g) Foreign Currency Risk

Foreign currency risk is the risk that changes in exchange rates will adversely impact the fair value of an investment. The Municipality has no specific policy addressing foreign currency risk; however foreign currency risk is managed through the requirements of AMC 6.50.030 and the asset allocation policies of each portfolio.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

The Municipal Central Treasury is not exposed to foreign currency risk because AMC 6.50.030 explicitly prohibits the purchase of securities not denominated in U.S. Dollars. At December 31, 2018 and 2017, all debt obligations held in the Municipal Central Treasury were payable in U.S. Dollars.

(h) Fair Value Measurements

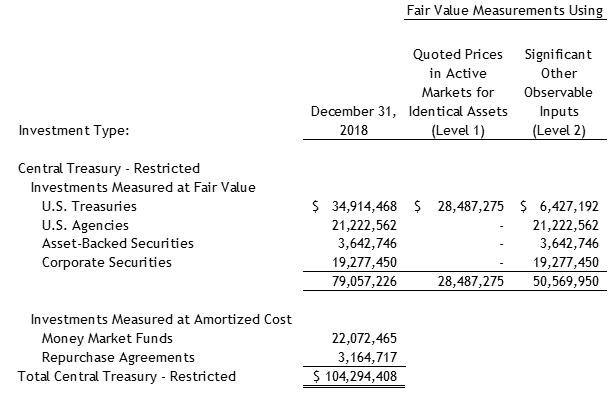

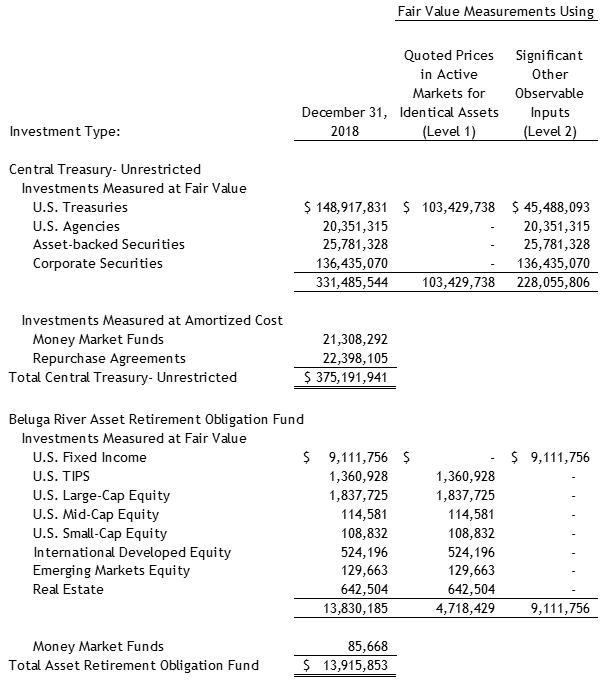

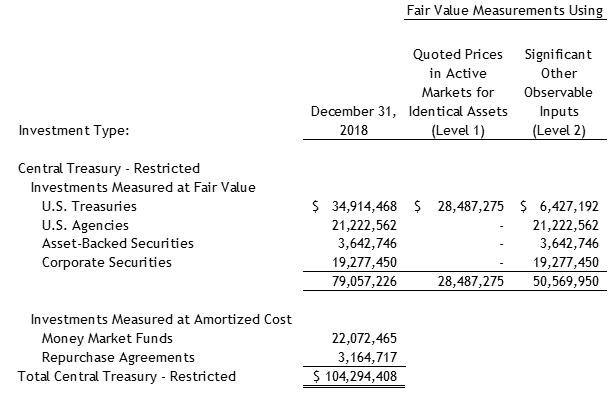

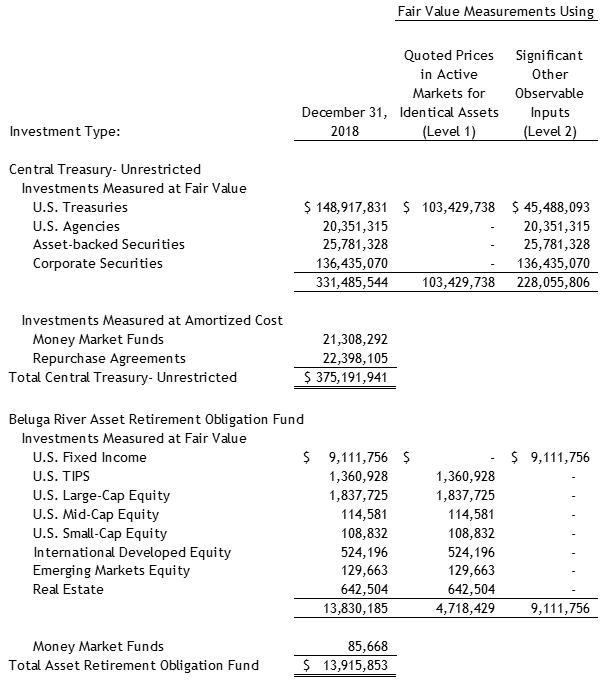

At December 31, 2018 and 2017, the Municipality had the following cash and investments, valued as follows:

| · | | Asset-backed securities are valued using pricing models maximizing the use of observable inputs for similar securities. This includes basing value on yields currently available on comparable securities of issuers with similar credit ratings. |

| · | | Short-term collective investments such as money market funds are valued at amortized cost. |

| · | | Commercial paper is valued using pricing models maximizing the use of observable inputs for similar securities. This includes basing value on yields currently available on comparable securities of issuers with similar credit ratings. |

| · | | Corporate securities are valued using pricing models maximizing the use of observable inputs for similar securities. This includes basing value on yields currently available on comparable securities of issuers with similar credit ratings. |

| · | | Domestic equity funds are valued at the closing price reported on the active market on which the individual funds traded. |

| · | | Real estate funds are valued at the closing price reported on the active market on which the individual funds are traded. |

| · | | International equity funds are valued at the closing price reported on the active market on which the individual funds traded. |

| · | | Repurchase agreements are valued at the daily closing price as reported using the daily price quoted by the financial institution holding the investment for the Municipality. |

| · | | U.S Treasuries are valued at the closing price reported on the active market on which the individual securities traded. |

| · | | U.S Agencies are valued using pricing models maximizing the use of observable inputs for similar securities. |

| · | | U.S TIPs are valued at the closing price reported on the active market on which the individual securities traded. |

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

The Municipality utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible. The Municipality determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principle or most advantageous market. When considering market participant assumptions in fair value measurements, the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following levels:

•Level 1 Inputs: quoted prices for identical assets or liabilities in active markets

•Level 2 Inputs: quoted prices for similar assets or liabilities in active or inactive markets; or inputs other than quoted prices that are observable

•Level 3 Inputs: significant unobservable inputs for assets or liabilities

The Municipality categorizes its fair value measurements within the fair value hierarchy established by generally accepted accounting principles. The Municipality as a whole has the following recurring fair value measurements as of December 31, 2018 and 2017:

December 31, 2018:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

December 31, 2018, continued

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

December 31, 2017

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

December 31, 2017, continued

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(4) Capital Assets

A summary of capital assets at December 31, 2018 follows:

A summary of capital assets at December 31, 2017 follows:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(5)Long‑Term Liabilities

(a) Revenue Bonds Payable

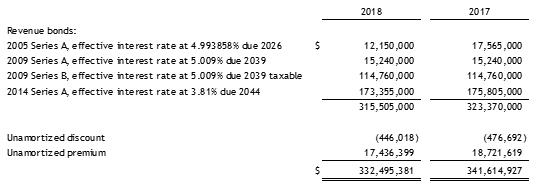

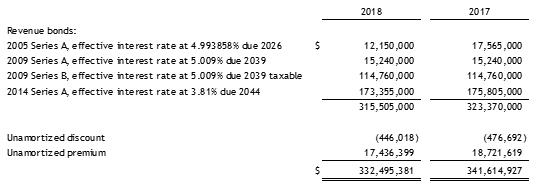

A summary of revenue bonds payable consist of the following at December 31:

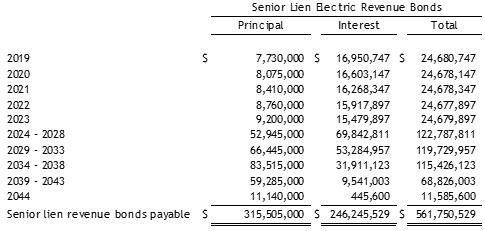

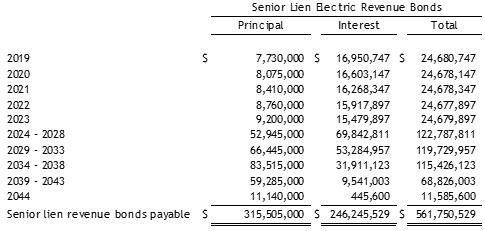

Debt service requirements to maturity at December 31, 2018 are as follows:

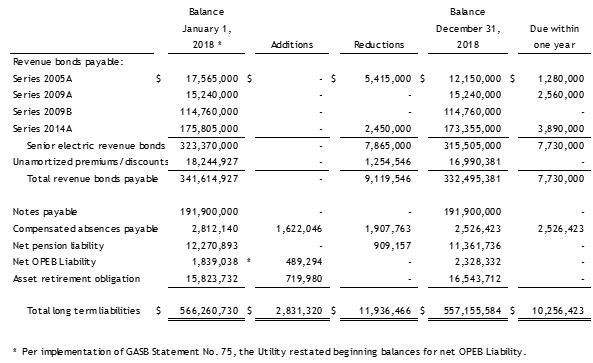

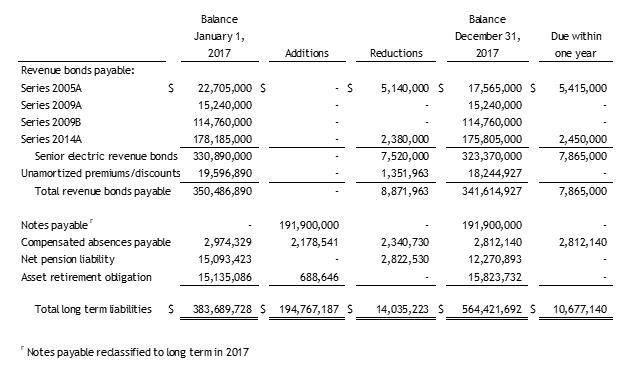

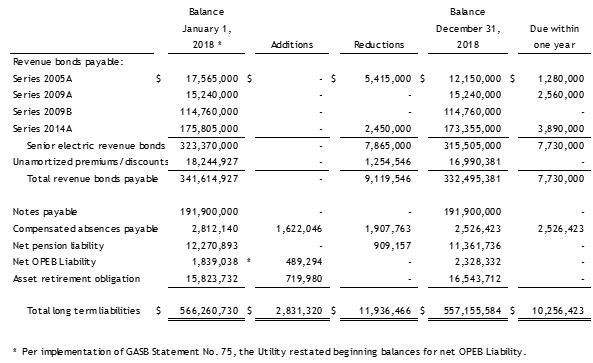

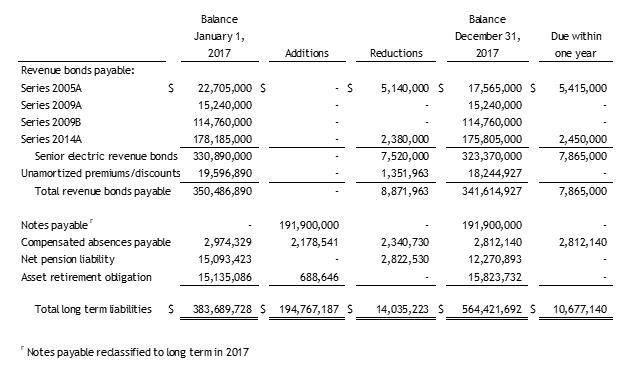

The Utility’s revenue bonds bear interest at effective rates of 3.75% to 6.5% and require the establishment of reserves over a five‑year period at least equal to the maximum annual debt service on all outstanding senior lien bonds. The senior lien revenue bond covenants further stipulate that net revenue before depreciation and amortization for each year will be equal to at least 1.35 times the debt service requirements for that year. At December 31, 2018 and 2017, the Utility had satisfied the reserve requirements and debt service covenants. The Utility has pledged future customer revenues, net of specified operating expenses, to repay revenue bonds. Proceeds from the bonds provided financing for construction and other capital improvements. The bonds are payable solely from customer net revenues and are payable through 2044. The total principal remaining to be paid on the bonds for the years ended December 31, 2018 and 2017 was $315,505,000 and $323,370,000, respectively. Principal and interest paid for the years ended December 31, 2018 and 2017 were $25,178,097 and $25,179,497, respectively. Total customer net revenues for the years ended December 31, 2018 and 2017 were $59,871,466 and $67,680,056, respectively.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

In February 2012, the Assembly authorized the issuance of commercial paper in one or more series in the aggregate principal amount not to exceed three hundred million dollars ($300,000,000).

In April 2015, the Utility redeemed all outstanding commercial paper and entered into a short-term borrowing agreement with Wells Fargo Municipal Capital Strategies, LLC, herein referred to as the Direct Drawdown Purchase Program (DDPP). This borrowing program continued to fulfill the purpose of the Commercial Paper program, but at a lower aggregate fee and interest cost to the Utility over the life of the program. The DDPP was used by the Utility to complete construction of Generation Plant 2A. At December 31, 2016 the outstanding balance of DDPP notes payable was $181,000,000. During 2017, $10,900,000 was drawn down for completion of Generation Plant 2A. On November 30, 2017 the loan term was extended to November 29, 2019. No further drawdowns are anticipated. The Utility intends to extend the loan under the same terms until December 31, 2020.

At December 31, 2018 and 2017 the balance was $191,900,000. The notes are reflected as long-term notes payable on the Utility’s Statement of Net Position, as the principal is not expected to be paid within one year.

The following is a summary of long-term liability activity as of December 31, 2018 and 2017:

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

(6) Net Position

Net position is composed of the following at December 31:

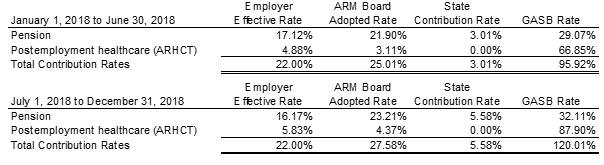

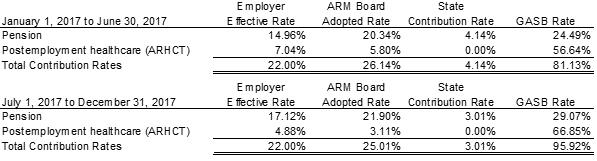

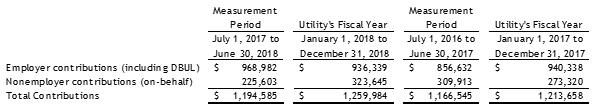

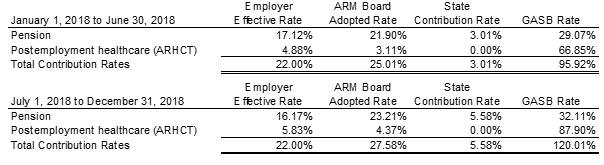

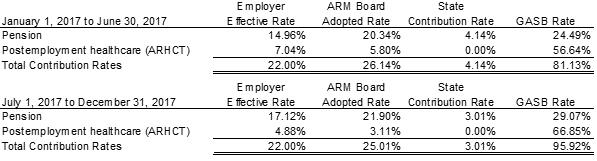

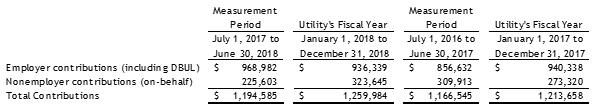

(7)Retirement Plans

Substantially all regular employees of the Utility are covered by one of the following plans:

(a)IBEW Plans

Defined Benefit Plan

The Utility’s IBEW members participate in a cost‑sharing defined benefit plan, the Alaska Electrical Pension Plan of the Alaska Electrical Pension Fund (IBEW Plan). The Alaska Electrical Trust Funds (AETF) Board of Trustees administers the IBEW Plan and has the authority to establish and amend benefit terms and approve changes in employer required contributions. Each year, AETF issues annual financial reports that can be obtained by writing the plan administrator, Alaska Electrical Pension Trust, 2600 Denali Street, Suite 200, Anchorage, Alaska, 99503. The Utility had 166 and 176 employees covered by the Plan as of December 31, 2018 and 2017, respectively.

MUNICIPALITY OF ANCHORAGE, ALASKA

ELECTRIC UTILITY FUND

Notes to Financial Statements

December 31, 2018 and 2017

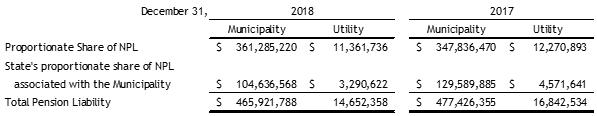

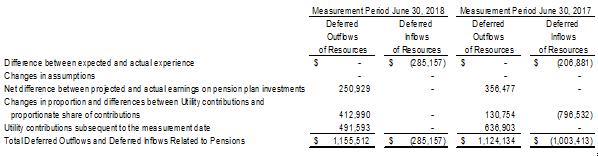

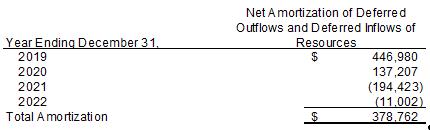

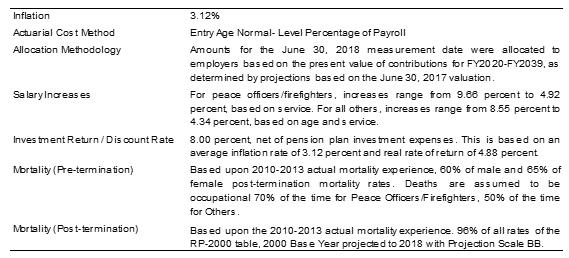

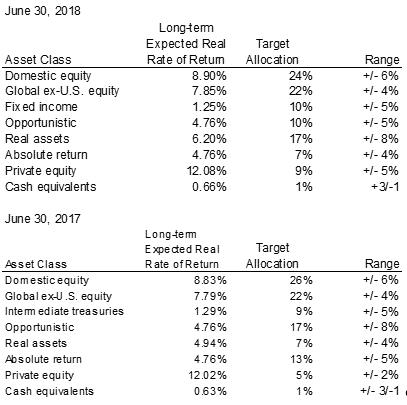

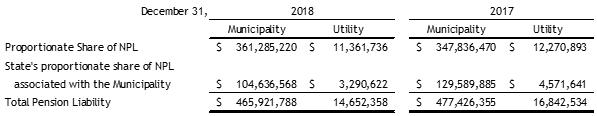

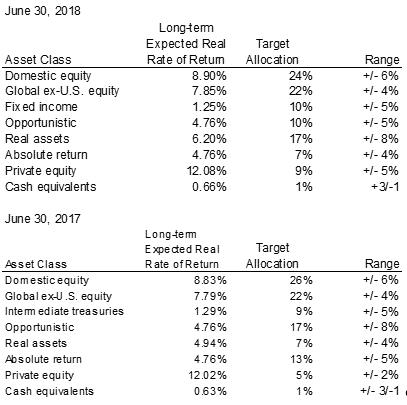

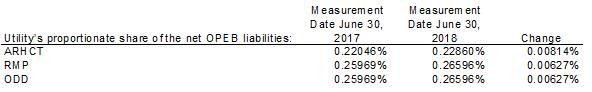

The IBEW Plan provides several levels of retirement benefits, including early retirement, normal retirement, late retirement, and disability retirement and includes several options for spouse participation and death benefits. The Utility contributes to the IBEW Plan for its covered employees according to the terms of its Agreement Covering Terms and Conditions of Employment (Agreement) with the IBEW Local 1547. The Agreement in effect during January and February 2017 expired on December 31, 2016. A new agreement was approved subsequent to year end and is effective from February 28, 2017 to December 31, 2019. The Agreement automatically renews for a period of one year from its expiration date and for successive periods of one year each thereafter for so long as there is no proper notification of an intent to negotiate a successor Agreement.