UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| x | Definitive Additional Materials | |||

| ¨ | Soliciting Material Under Rule 14a-12 | |||

PAR PHARMACEUTICAL COMPANIES, INC. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ¨ | No fee required | |||

| x | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

Par Pharmaceutical Companies, Inc. common stock, par value 0.01 (“common stock”).

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

36,833,149 shares of common stock (including restricted shares); 2,013,888 shares of common stock underlying outstanding options of the Company with an exercise price of $50.00 or less; 50,876 shares of common stock underlying Performance Share Units of the Company; 335,057 shares of common stock underlying outstanding Restricted Share Units of the Company; 217,906 shares of common stock underlying outstanding Director Stock Units of the Company; and 1,992 shares of common stock to be issued pursuant to the Company’s Employee Stock Purchase Program.

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

The proposed maximum aggregate value of the transaction for purposes of calculating the filing fee is $1,918,832,313. The maximum aggregate value of the transaction was calculated based upon the sum of (A) (1) 36,833,149 shares of common stock (including restricted shares) issued and outstanding and owned by persons other than the Company and Merger Sub on July 18, 2012, multiplied by (2) $50.00 per share (the “per share merger consideration”); (B) (1) 2,013,888 shares of common stock underlying outstanding options of the Company with an exercise price of $50.00 or less, as of July 18, 2012, multiplied by (2) the excess of the per share merger consideration over the weighted average exercise price of $26.72 at July 18, 2012; (C) (1) 50,876 shares of common stock underlying outstanding Performance Share Units of the Company on July 18, 2012, multiplied by (2) the per share merger consideration; (D) (1) 335,057 shares of common stock underlying outstanding Restricted Share Units of the Company on July 18, 2012, multiplied by (2) the per share merger consideration; (E) (1) 217,906 shares of common stock underlying outstanding Director Stock Units of the Company on July 18, 2012, multiplied by (2) the per share merger consideration; and (F) 1,992 shares of common stock to be issued pursuant to the Company’s Employee Stock Purchase Program on or prior to September 28, 2012, multiplied by (2) the per share merger consideration. The filing fee equals the product of 0.0001146 multiplied by the maximum aggregate value of the transaction.

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

$1,918,832,313

| |||

| ||||

| (5) | Total fee paid:

$219,898.18 | |||

| ||||

| x | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

The information provided set forth in Annex A hereto is being furnished to disclose certain information (the “Selected Information”) that Par Pharmaceutical Companies, Inc., a Delaware corporation (the “Company” or “Par”), will furnish to prospective debt financing sources that are expected to provide a portion of the financing for the transactions contemplated by the previously announced Agreement and Plan of Merger, dated as of July 14, 2012 (the “Merger Agreement”), by and among the Company, Sky Growth Holdings Corporation, a Delaware corporation (“Parent”), and Sky Growth Acquisition Corporation, a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”).

The Selected Information is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in Annex A, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure. By furnishing the information herein and in Annex A, the Company makes no admission as to the materiality of any information contained herein or therein.

Forward-Looking Statements

Certain statements made in the Selected Information reflect the Company’s expectations regarding future events and, accordingly, are subject to risks and uncertainties. These statements are based on the Company’s opinions, expectations, beliefs, plans, objectives, assumptions and projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “foresees,” “predicts,” “forecasts,” “continuing,” “ongoing,” “maintains,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout the Selected Information and include statements regarding the Company’s intentions, beliefs or current expectations concerning, among other things, the ability of third parties to fulfill their obligations relating to the proposed transactions, including providing financing under current financial market conditions; the closing of the transactions described in the Merger Agreement; future operations; future financial performance, trends and future events, particularly relating to sales of current products and the development, approval and introduction of new products; Food and Drug Administration (“FDA”) and other regulatory applications and approvals; market position and expenditures; the continuation of historical trends; the Company’s ability to operate its business under its new capital and operating structure; and the sufficiency of the Company’s cash balances and cash generated from operating and financing activities for future liquidity and capital resource needs.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. The Company believes that these risks and uncertainties include, but are not limited to, those described in the Company’s periodic and current reports filed with the SEC.

Although the Company bases these forward-looking statements on assumptions that it believes are reasonable when made, the Company cautions you that forward-looking statements are not guarantees of future performance and that the Company’s actual results of operations, financial condition and liquidity, and the development of the industry in which the Company operates may differ materially from those made in or suggested by the forward-looking statements contained in the Selected Information. In addition, even if the Company’s results of operations, financial condition and liquidity, and the development of the industry in which the Company operates are consistent with the forward-looking statements contained in the Selected Information, those results or developments may not be indicative of results or developments in subsequent periods.

Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements that the Company makes in the Selected Information speak only as of the date of those statements, and the Company undertakes no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

Important Notice and Additional Information

This communication may be deemed to be solicitation material in respect of the proposed acquisition of the Company by an affiliate of TPG. In connection with the proposed transaction, the Company has filed with the SEC and mailed to its security holders a definitive proxy statement and filed other related documents with the SEC. Investors and stockholders of the Company are advised to read the definitive proxy statement and these other materials because they contain important information about Par and the proposed transaction. Investors and stockholders may obtain a free copy of the definitive proxy statement and other documents filed by the Company with the SEC at the SEC web site atwww.sec.gov. Copies of the definitive proxy statement and other filings made by Par with the SEC can also be obtained, free of charge, by directing a request to Par Pharmaceutical Companies, Inc., 300 Tice Boulevard, Woodcliff Lake, NJ 07677, Attn: Investor Relations. The definitive proxy statement and such other documents are also available for free on the Company’s web site at www.parpharm.com as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC.

Participants in the Solicitation

The Company and its directors and officers and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed acquisition transaction. Information regarding the directors and executive officers of the Company is set forth in the proxy statement for the Company’s 2012 Annual Meeting of Stockholders, which was filed with the SEC on March 30, 2012, and in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, which was filed with the SEC on February 28, 2012. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive proxy statement relating to the proposed acquisition and other relevant materials filed with the SEC. Investors should read the definitive proxy statement carefully before making any voting or investment decisions.

ANNEX A

Information for Potential Financing Sources

The Transactions

On July 14, 2012, we entered into an Agreement and Plan of Merger (the “Agreement”) with Sky Growth Holdings Corporation, a Delaware corporation (“Parent”), and Sky Growth Acquisition Corporation, a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”). The Agreement provides for the merger of Merger Sub with and into the Company, with the Company surviving the Merger as a wholly-owned subsidiary of Parent (the “Merger”).

Parent and Merger Sub are beneficially owned by affiliates of TPG Capital, L.P. (the “Sponsor”) and were formed solely for the purposes of executing the Agreement and facilitating the Merger. The Agreement provides for a purchase price of approximately $1.9 billion for our fully diluted equity. We expect this transaction to close, subject to customary conditions, before the end of 2012.

For more information about the Merger, the Agreement and our modification of the Rights Agreement, please see our Current Report on Form 8-K, filed July 16, 2012 and our Definitive Proxy Statement on Schedule 14A, filed on August 27, 2012. Please also see our Current Report on Form 8-K, filed on September 6, 2012 and our Definitive Additional Materials on Schedule 14A, filed on September 6, 2012, for information regarding certain information that we have previously furnished to prospective debt financing sources that are expected to provide a portion of the financing for the transactions contemplated by the Agreement.

At the effective time of the Merger, each share of Company common stock issued and outstanding immediately prior to the effective time of the Merger (other than shares owned by (i) the Company, Merger Sub or any direct or indirect subsidiary of any of them immediately prior to the effective time of the Merger or (ii) stockholders who have properly exercised, perfected and not withdrawn a demand for, or lost the right to, appraisal rights under Delaware law) will be converted automatically into the right to receive $50.00 in cash (“Per Share Acquisition Consideration”), without interest. After that time, we will continue our current operations, except that we will cease to be a public company, and our common stock will cease to be traded on The New York Stock Exchange.

Company stock options, restricted shares, restricted stock units, performance share units and director stock units will generally be cancelled upon completion of the Merger in exchange for the Per Share Acquisition Consideration or, in the case of stock options, the excess, if any, of the Per Share Acquisition Consideration over the exercise price of the option. All performance-based vesting criteria in respect of performance share units will be deemed satisfied at target for purposes of calculating the amounts payable.

Parent expects to pay the purchase price for the shares of common stock of the Company with borrowings under a new $980.0 million senior secured term loan facility, the proceeds from the sale of $490.0 million in Senior Notes, a $738.8 million equity contribution from the Sponsor and one or more potential co-investors and the Company’s cash on hand. Parent is also expected to enter into a new $150.0 million senior secured revolving credit facility, which is currently expected to be undrawn at closing of the Merger (although we may further draw on the senior secured revolving credit facility at closing to (i) pay fees and expenses related to the Merger, including any original issue discount or upfront fees, if any, related to the issuance of the notes offered and/or the senior secured term loan facility, (ii) to replace, backstop or cash-collateralize letters of credit, if any, and (iii) to fund working capital needs). Certain managers of the Company will be given the opportunity to roll over shares of common stock and stock options in connection with the Merger. The amount of the cash equity investment and/or borrowings needed to finance the Merger will be reduced by the value of the rolled shares and stock options.

Attractive Pipeline with Multiple New Drug Opportunities and High Visibility of Future Earnings

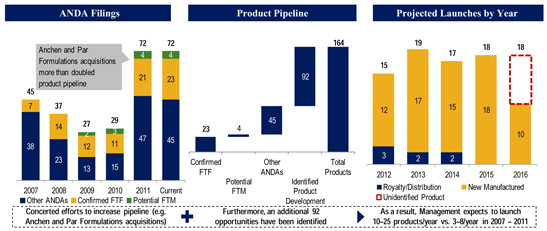

The Company has a robust pipeline and a large number of products pending regulatory approval. As of June 30, 2012, the Company had approximately 72 ANDAs pending with the FDA, including 23 first-to-file and four first-to-market opportunities, representing over $20 billion of combined branded product sales. Many of these products have been developed internally, which generally contribute higher gross margins than products that the Company sells under supply and distribution agreements. Moreover, of those pending product applications, 10 are date-certain product launches, representing over $15 billion in annual branded sales, which provides the Company with long-term cash flow visibility.

The Company expects to submit between 13 and 17 new ANDA filings during each of 2012, 2013 and 2014. Additionally, the Company foresees that its investments in generic product development will yield approximately 10 to 25 new product launches during

each of the same periods. These ANDA filings would be significant mileposts for the Company, as it expects many of these potential products to be first-to-file or first-to-market opportunities with gross margins in excess of the average of its current portfolio. Being an ANDA applicant that is the first to file a substantially complete ANDA with a Paragraph IV certification is particularly important in the Company’s industry as it provides the potential to receive a 180-day period of marketing exclusivity of its generic product.

Likewise, the Company intends to continue to pursue and execute on opportunistic and commercially compelling business development opportunities that could further diversify its pipeline. Given the Company’s strong track record of success in carrying out similar transactions in the past in an effective and efficient manner, the Company believes that it is well positioned to compete for these potential opportunities.

Extensive Product Pipeline with 10 Date-Certain Product Launches, Representing $15bn of Brand Value | ||||||||

Products | FTF/ FTM | Brand | Brand Value ($mm) | Timing | ||||

Dutasteride | Avodart® | $527 | Settlement Pending. Launch 11/15 | |||||

Oxaliplatin | ü | Eloxatin® | $1,400 | Settled. Launch 11/12 | ||||

Dexmethyl- phenidate XR | Focalin® XR | $501 | Settled. Launch 10/12 | |||||

Duloxetine | ü | Cymbalta® | $3,900 | Settled. Launch 6/13 | ||||

Testosterone Gel | Androgel® | $969 | Settled. Launch 9/15 | |||||

Rosuvastatin | ü | Crestor® | $4,500 | Launch patent expiry 7/16 | ||||

Ezetimibe | ü | Zetia® | $1,300 | Settled. Launch 12/16 | ||||

Travaprost Z | ü | Travatan® Z | $470 | Settled. Date certain launch | ||||

Fenofibric Acid DR | Trilipix® | $547 | Settled. Launch 7/13 | |||||

Quetiapine Fumarate ER | Seroquel® XR | $1,100 | Settled. Launch 12/16 | |||||

Note: Based on publicly available information as of June 30, 2012.

Additional Disclosed Pipeline Opportunities Another ~$2bn of Brand Value | ||||

Product | Brand Name | Brand Value ($mm) | ||

Dextromethorphan HBr/Quinidine Sulfate | Nuedexta™ | $20 | ||

Diclofenac K | Cambia® | $8 | ||

Omega -3-acid ethyl esters | Lovaza® | $998 | ||

Omeprazole/ Sodium Bicarb | Zegerid® OS/OTC | $30 | ||

Sumatriptan succinate/ Naproxen Na | Treximet® | $116 | ||

Zolpidem tartrate | Edluar® | $5 | ||

Carvedilol Phosphate ER Caps | Coreg® CR | $283 | ||

Clonidine HCI ER | Kapvay™ | $13 | ||

Dexlansoprazole DR Caps | Dexilant® | $518 | ||

Doxercalciferol | Hectorol® | $26 | ||

Dutasteride/ Tamsulosin | Jalyn® | $52 | ||

Naproxen Esomeprazole Mg Tabs | Vimovo® | $37 | ||

Pramipexole DiHCl ER Tabs | Mirapex ER® | $28 | ||

Tramadol HCl ER Tabs | Ryzolt® | $14 | ||

Source: Filings, Press Releases, Analyst Day Presentation dated January 6, 2012 and IMS Data.

Robust Product Development Capabilities

A substantial portion of the Company’s development effort is focused on technically difficult-to-formulate products and products that require advanced manufacturing technology. The Company expends resources on research and development primarily to enable it to manufacture and market FDA-approved generic pharmaceuticals in accordance with FDA regulations. Typically, research expenses related to the development of innovative compounds and the filing of NDAs are significantly greater than those expenses associated with ANDAs. The success of the Company’s approach to R&D in its generic products division is reflected in the substantial revenues generated by products developed in-house such as propafenone. The Company’s R&D efforts benefit from an experienced team of scientists, clinicians and regulatory professionals with proven product development expertise.

Furthermore, the Company’s recent additions of Anchen Incorporated and its subsidiary Anchen Pharmaceuticals, Inc. (collectively referred to as “Anchen”) and Par Formulations Private Limited (“Par Formulations”) have enhanced its strategic positioning by providing broader R&D capabilities for both immediate-release and extended-release products, as well as additional manufacturing capacity. Through the Anchen acquisition in late 2011, the Company added development expertise in extended-release formulations along with a manufacturing facility in California, four in-market products including generic versions of Wellbutrin XL® and Ambien CR®, and a disclosed pipeline of 29 products. Similarly, with the addition of Par Formulations in early 2012, the Company gained access to a low-cost manufacturing facility, R&D capabilities in immediate- and extended-release oral products, and several pipeline projects currently in development. As a result of these transactions, the Company has enhanced both its R&D and manufacturing capabilities.