Exhibit 99.1

PAR pharmaceutical companies

Company Update January 2014

Cautionary Note Regarding Forward-Looking Statements

This presentation includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,”

“project,” and other words of similar meaning. These forward-looking statements address various matters including our estimate of financial results for the fiscal year ended December 31, 2013, including select pro forma financial results and pro forma leverage ratios based on our estimate of financial results for the fiscal year ended December 31, 2013, estimated financial results of JHP for the fiscal year ended December 31, 2013 and an estimate of JHP’s future manufacturing excess capacity. Each forward-looking statement contained in this presentation is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, finalizing the financial statements and completing the audits of the Company and JHP for the fiscal year ended December 31, 2013, and the risks identified under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended September 30, 2013, and filed with the Securities and Exchange Commission, as well as the other information we file with the SEC. We caution investors, potential investors, and others not to place considerable reliance on the forward-looking statements contained in this presentation. You are encouraged to read our filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of this document, and we undertake no obligation to update or revise any of these statements. Our business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Introduction

AGENDA Acquisition Rationale

Par Pharma

Financial Overview

2

Acquisition Rationale

Acquisition Rationale

Acquisition Rationale

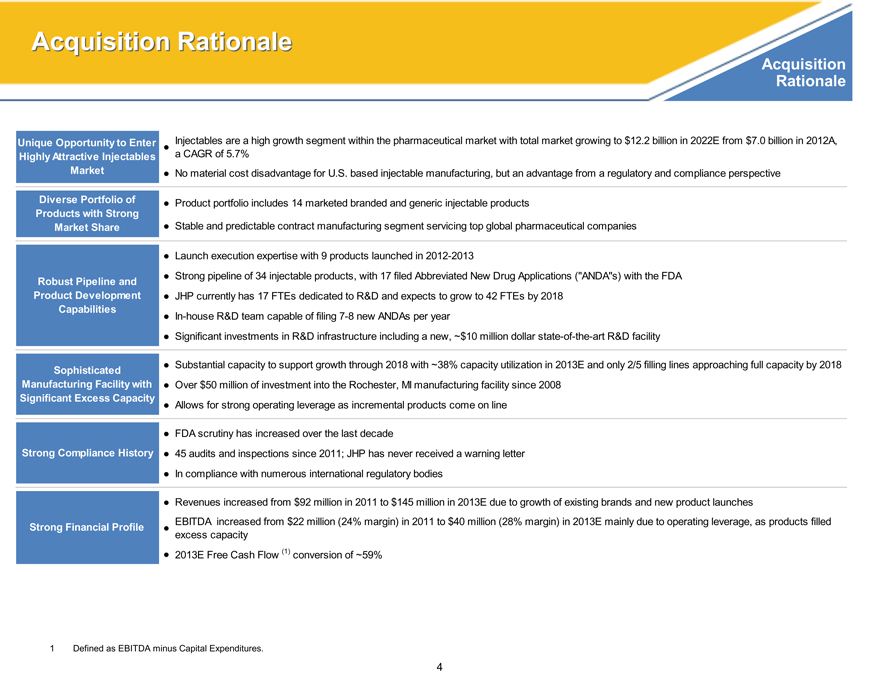

Unique Opportunity to Enter Injectables are a high growth segment within the pharmaceutical market with total market growing to $12.2 billion in 2022E from $7.0 billion in 2012A,

Highly Attractive Injectables a CAGR of 5.7%

Market No material cost disadvantage for U.S. based injectable manufacturing, but an advantage from a regulatory and compliance perspective

Diverse Portfolio of Product portfolio includes 14 marketed branded and generic injectable products

Products with Strong

Market Share Stable and predictable contract manufacturing segment servicing top global pharmaceutical companies

Launch execution expertise with 9 products launched in 2012-2013

Robust Pipeline and Strong pipeline of 34 injectable products, with 17 filed Abbreviated New Drug Applications (“ANDA“s) with the FDA

Product Development JHP currently has 17 FTEs dedicated to R&D and expects to grow to 42 FTEs by 2018

Capabilities

In-house R&D team capable of filing 7-8 new ANDAs per year

• Significant investments in R&D infrastructure including a new, ~$10 million dollar state-of-the-art R&D facility

Sophisticated • Substantial capacity to support growth through 2018 with ~38% capacity utilization in 2013E and only 2/5 filling lines approaching full capacity by 2018

Manufacturing Facility with • Over $50 million of investment into the Rochester, MI manufacturing facility since 2008

Significant Excess Capacity

• Allows for strong operating leverage as incremental products come on line

• FDA scrutiny has increased over the last decade

Strong Compliance History • 45 audits and inspections since 2011; JHP has never received a warning letter

• In compliance with numerous international regulatory bodies

• Revenues increased from $92 million in 2011 to $145 million in 2013E due to growth of existing brands and new product launches

Strong Financial Profile • EBITDA increased from $22 million (24% margin) in 2011 to $40 million (28% margin) in 2013E mainly due to operating leverage, as products filled

excess capacity

• 2013E Free Cash Flow (1) conversion of ~59%

1 Defined as EBITDA minus Capital Expenditures.

4

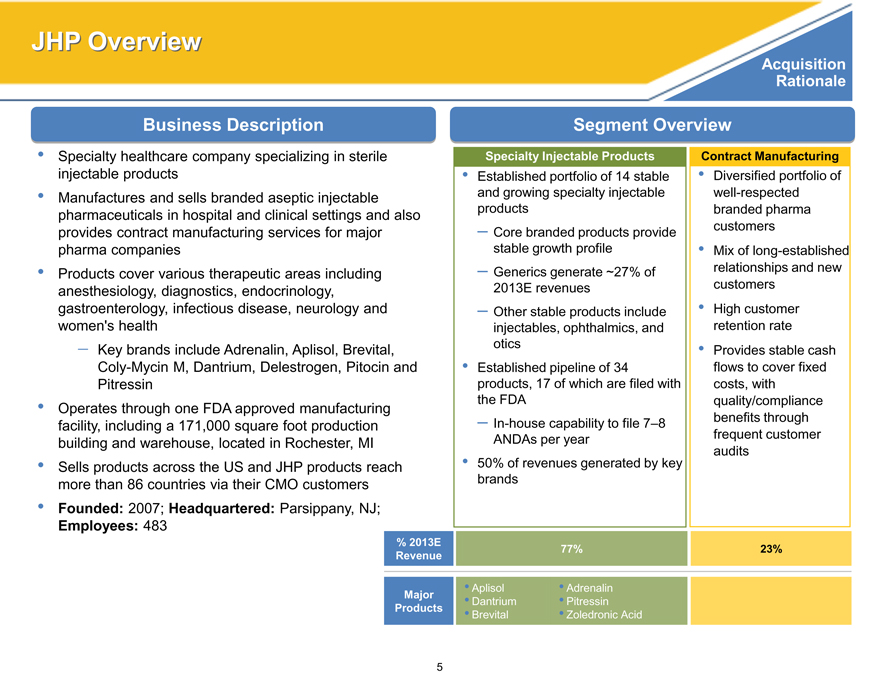

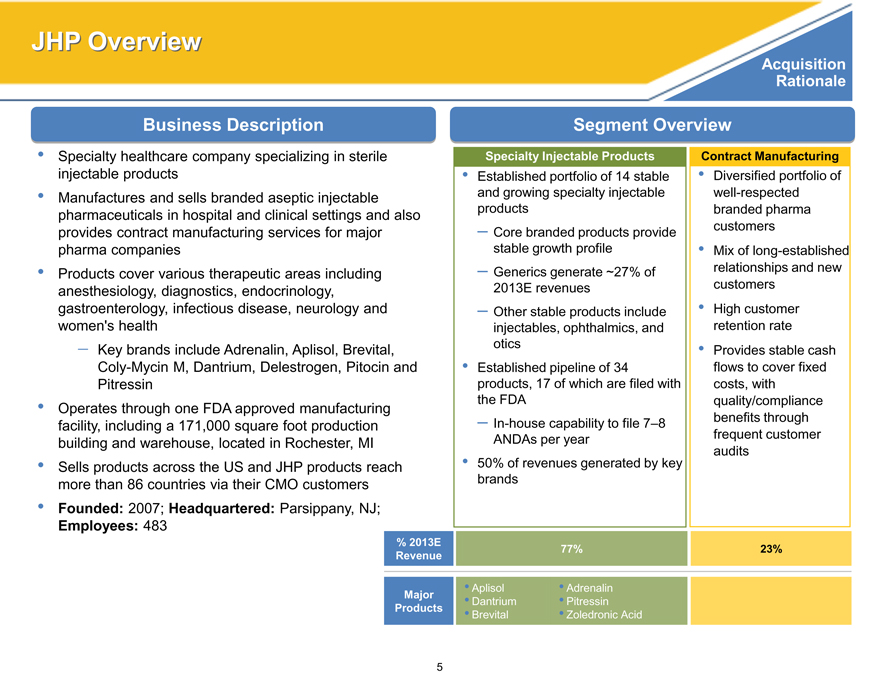

JHP Overview

Acquisition Rationale

Business Description Segment Overview

Specialty healthcare company specializing in sterile Specialty Injectable Products Contract Manufacturing

injectable products • Established portfolio of 14 stable • Diversified portfolio of

Manufactures and sells branded aseptic injectable and growing specialty injectable well-respected

pharmaceuticals in hospital and clinical settings and also products branded pharma

provides contract manufacturing services for major – Core branded products provide customers

pharma companies stable growth profile • Mix of long-established

Products cover various therapeutic areas including – Generics generate ~27% of relationships and new

anesthesiology, diagnostics, endocrinology, 2013E revenues customers

gastroenterology, infectious disease, neurology and – Other stable products include • High customer

women’s health injectables, ophthalmics, and retention rate

Key brands include Adrenalin, Aplisol, Brevital, otics • Provides stable cash

Coly-Mycin M, Dantrium, Delestrogen, Pitocin and • Established pipeline of 34 flows to cover fixed

Pitressin products, 17 of which are filed with costs, with

Operates through one FDA approved manufacturing the FDA quality/compliance

facility, including a 171,000 square foot production – In-house capability to file 7–8 benefits through

building and warehouse, located in Rochester, MI ANDAs per year frequent customer

audits

Sells products across the US and JHP products reach 50% of revenues generated by key

more than 86 countries via their CMO customers brands

• Founded: 2007; Headquartered: Parsippany, NJ;

Employees: 483

% 2013E 77% 23%

Revenue

• Aplisol • Adrenalin

Major • Dantrium • Pitressin

Products • Brevital • Zoledronic Acid

5

JHP’s Specialty Pharmaceuticals Platform

Acquisition Rationale

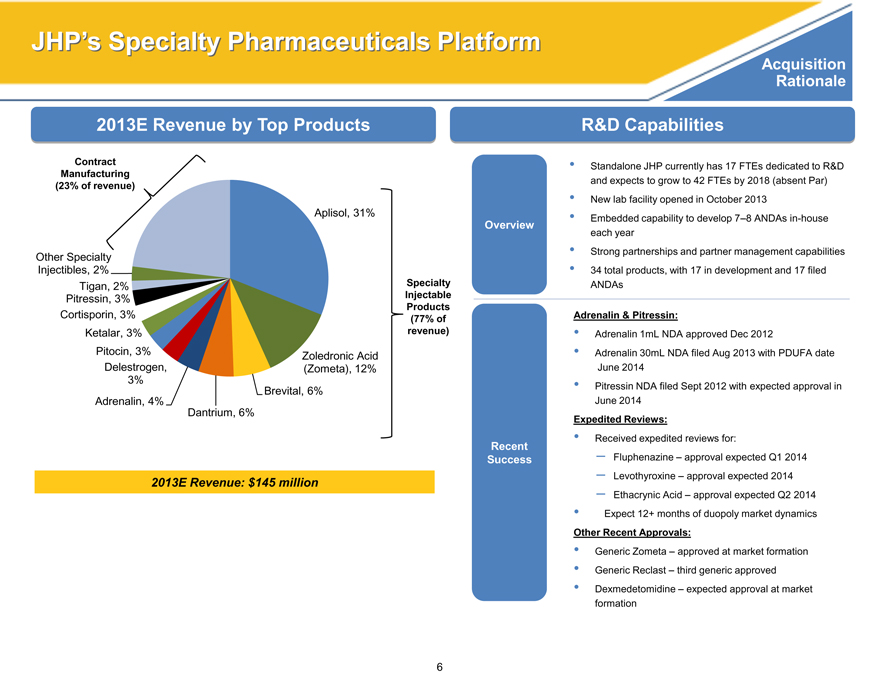

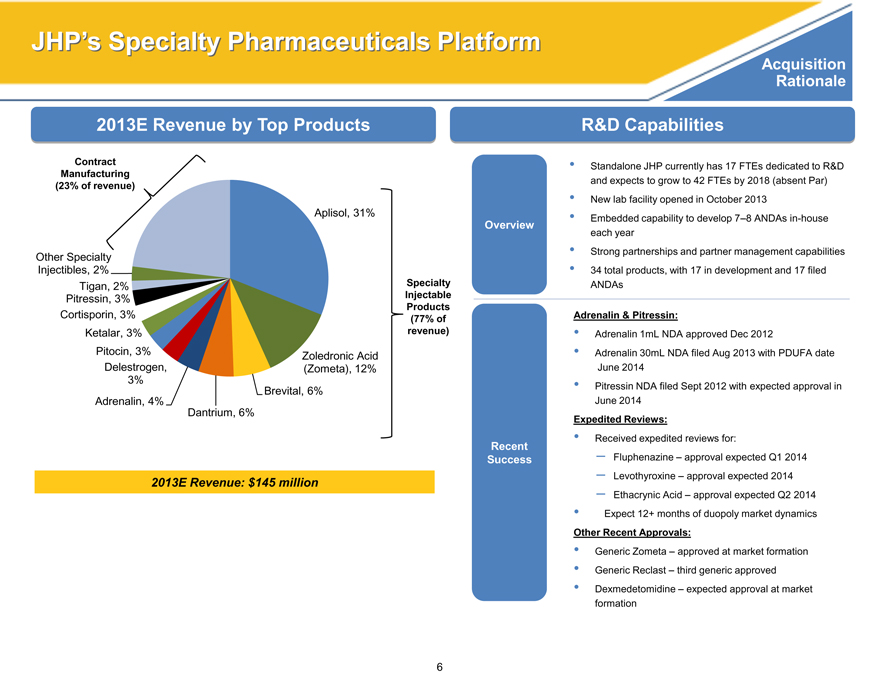

2013E Revenue by Top Products

Contract Manufacturing (23% of revenue)

Aplisol, 31%

Other Specialty Injectibles, 2%

Tigan, 2% Specialty Pitressin, 3% Injectable

Products

Cortisporin, 3% (77% of Ketalar, 3% revenue) Pitocin, 3% Zoledronic Acid Delestrogen, (Zometa), 12% 3% Brevital, 6% Adrenalin, 4% Dantrium, 6%

2013E Revenue: $145 million

R&D Capabilities

Standalone JHP currently has 17 FTEs dedicated to R&D

and expects to grow to 42 FTEs by 2018 (absent Par)

New lab facility opened in October 2013

Overview Embedded capability to develop 7–8 ANDAs in-house

each year

Strong partnerships and partner management capabilities

34 total products, with 17 in development and 17 filed

ANDAs

Adrenalin & Pitressin:

Adrenalin 1mL NDA approved Dec 2012

Adrenalin 30mL NDA filed Aug 2013 with PDUFA date

June 2014

Pitressin NDA filed Sept 2012 with expected approval in

June 2014

Expedited Reviews:

Received expedited reviews for:

Recent

Success – Fluphenazine – approval expected Q1 2014

– Levothyroxine – approval expected 2014

– Ethacrynic Acid – approval expected Q2 2014

Expect 12+ months of duopoly market dynamics

Other Recent Approvals:

Generic Zometa – approved at market formation

Generic Reclast – third generic approved

Dexmedetomidine – expected approval at market

formation

6

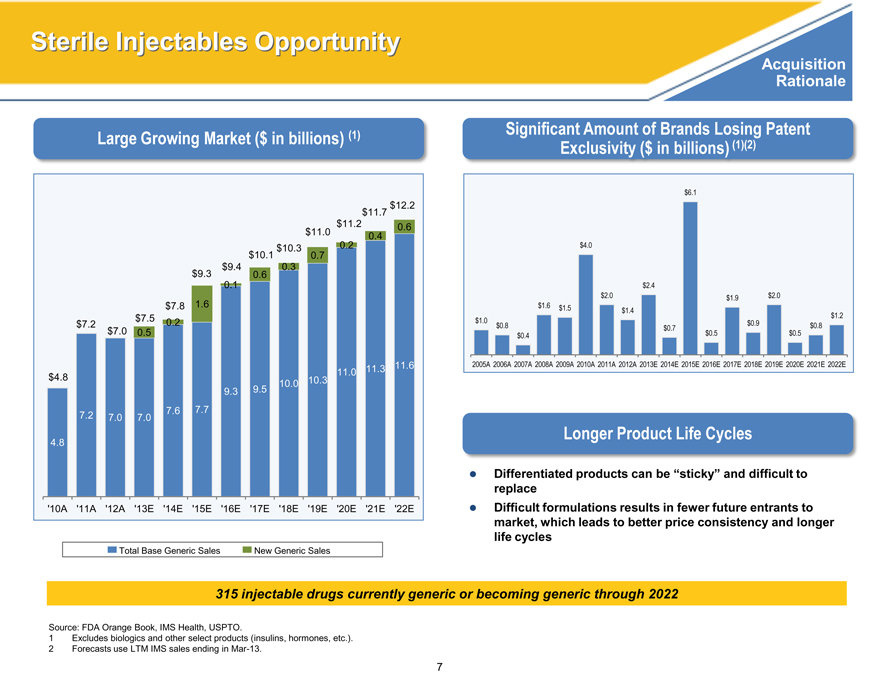

Sterile Injectables Opportunity

Acquisition Rationale

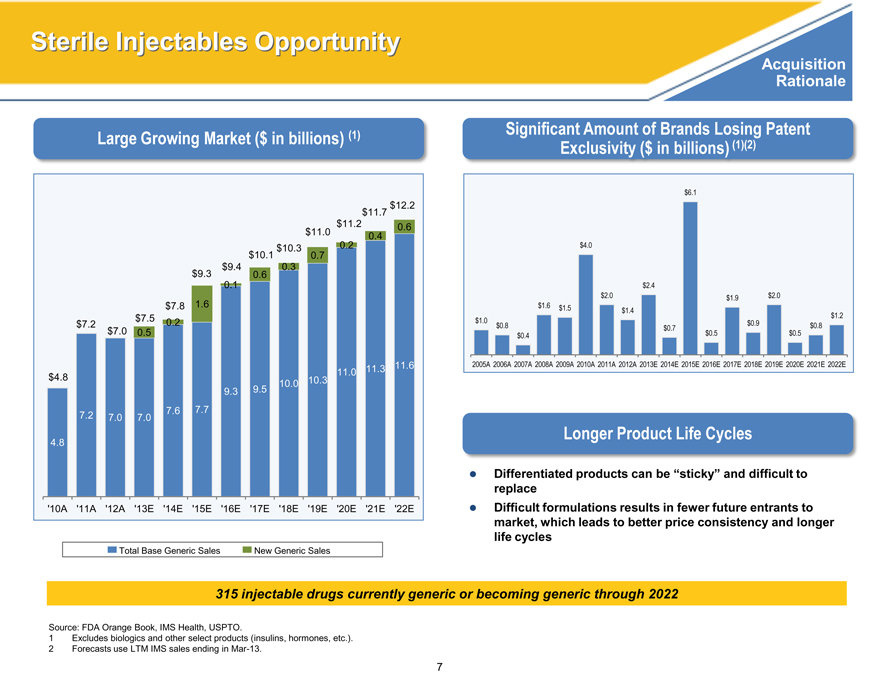

Large Growing Market ($ in billions) (1)

$12.2

$11.7

$11.2

0.6

$11.0

0.4

$10.3

0.2

$10.1

0.7

$9.4

0.3

$9.3

0.6

0.1

$7.8

1.6

$7.2

$7.5

0.2

$7.0

0.5

11.6

$4.8

10.3

11.0

11.3

9.3

9.5 10.0

7.2

7.0

7.0

7.6

7.7

4.8

‘10A

‘11A

‘12A

‘13E

‘14E

‘15E ‘16E ‘17E ‘18E ‘19E

‘20E

‘21E

‘22E

Total Base Generic Sales

New Generic Sales

Significant Amount of Brands Losing Patent

Exclusivity ($ in billions) (1)(2)

$6.1

$4.0

$2.4

$2.0 $1.9 $2.0

$1.6 $1.5

$1.4 $1.2

$1.0 $0.8 $0.9 $0.8

$0.7

$0.4 $0.5 $0.5

2005A 2006A 2007A 2008A 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E

Longer Product Life Cycles

Differentiated products can be “sticky” and difficult to

replace

Difficult formulations results in fewer future entrants to

market, which leads to better price consistency and longer

life cycles

315 injectable drugs currently generic or becoming generic through 2022

Source: FDA Orange Book, IMS Health, USPTO.

1 Excludes biologics and other select products (insulins, hormones, etc.).

2 Forecasts use LTM IMS sales ending in Mar-13.

7

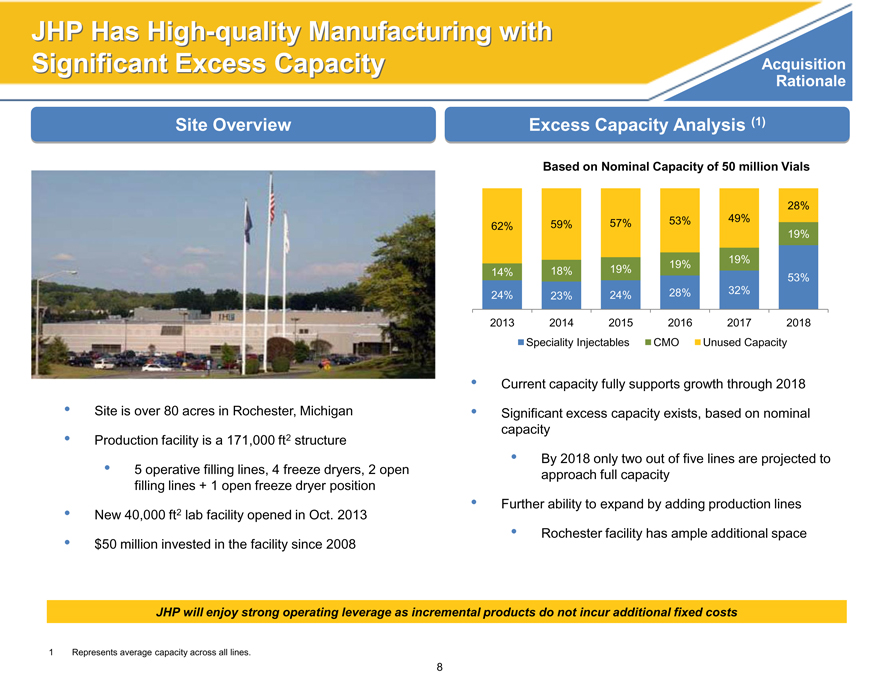

Acquisition

JHP has high-quality manufacturing with significant excess capacity

Rationale

Site overview

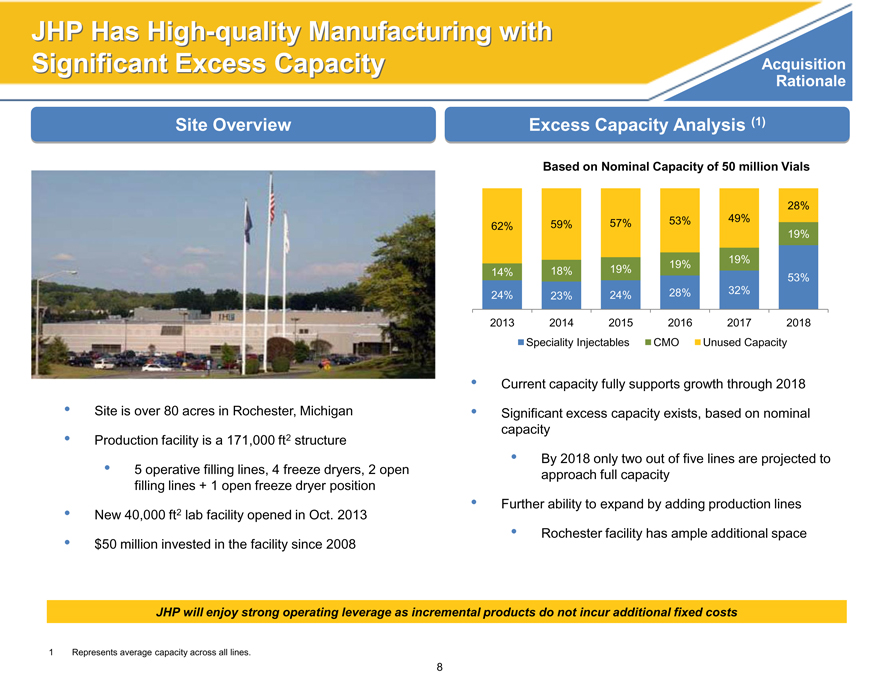

Excess Capacity Analysis (1)

Based on Nominal Capacity of 50 million Vials

28%

62% 59% 57% 53% 49%

19%

19% 19%

14% 18% 19% 53%

24% 23% 24% 28% 32%

2013 2014 2015 2016 2017 2018

Speciality Injectables CMO Unused Capacity

Current capacity fully supports growth through 2018

Significant excess capacity exists, based on nominal

capacity

By 2018 only two out of five lines are projected to

approach full capacity

Further ability to expand by adding production lines

Rochester facility has ample additional space

JHP will enjoy strong operating leverage as incremental products do not incur additional fixed costs

1 Represents average capacity across all lines.

8

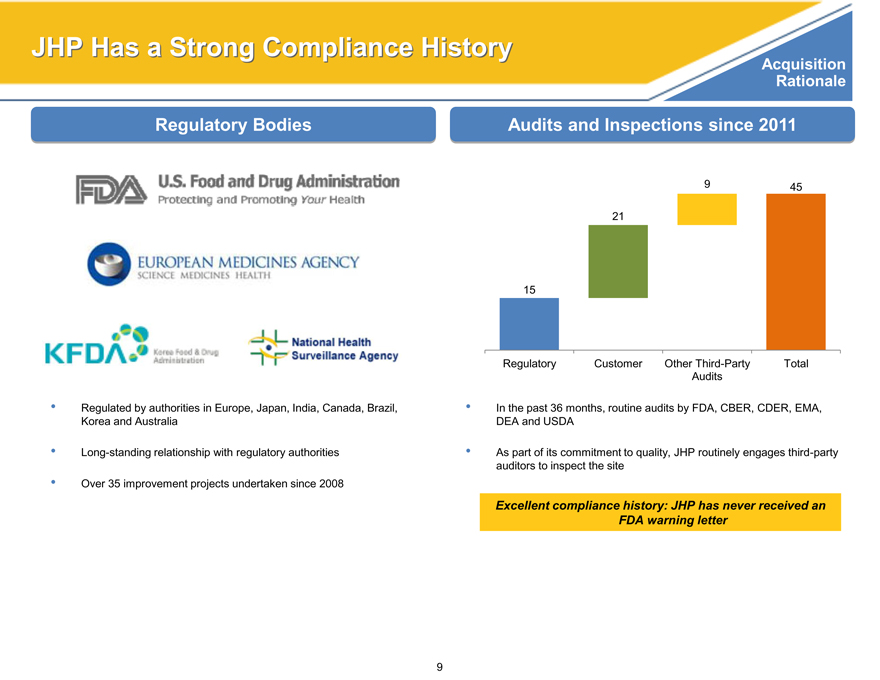

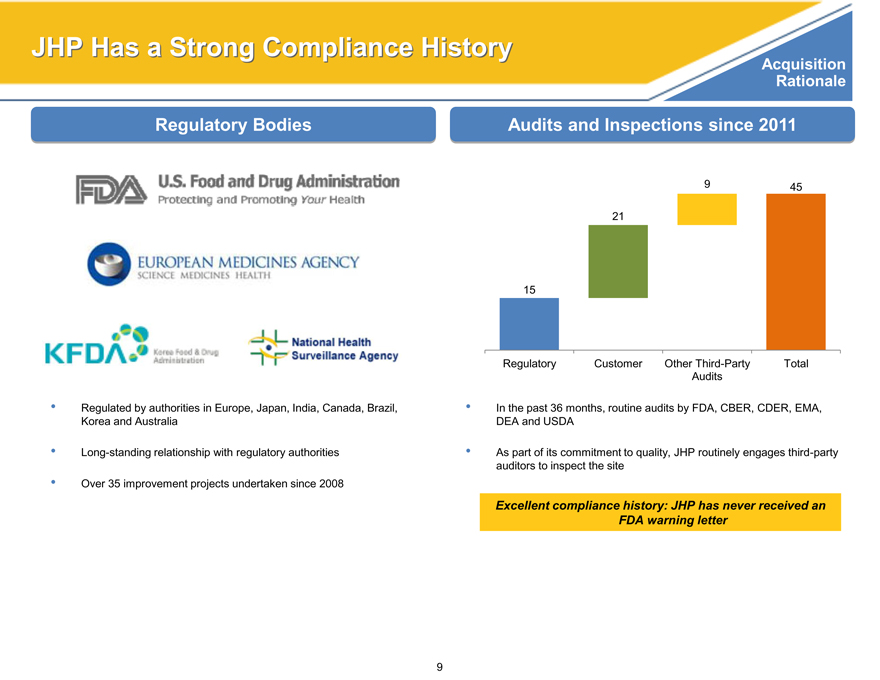

JHP Has a Strong Compliance History Acquisition

Rationale

Regulatory Bodies

Regulated by authorities in Europe, Japan, India, Canada, Brazil, Korea and Australia

Long-standing relationship with regulatory authorities

Audits and Inspections since 2011

9 45

21

15

Regulatory Customer Other Third-Party Total Audits

In the past 36 months, routine audits by FDA, CBER, CDER, EMA, DEA and USDA

As part of its commitment to quality, JHP routinely engages third-party auditors to inspect the site

Over 35 improvement projects undertaken since 2008

9

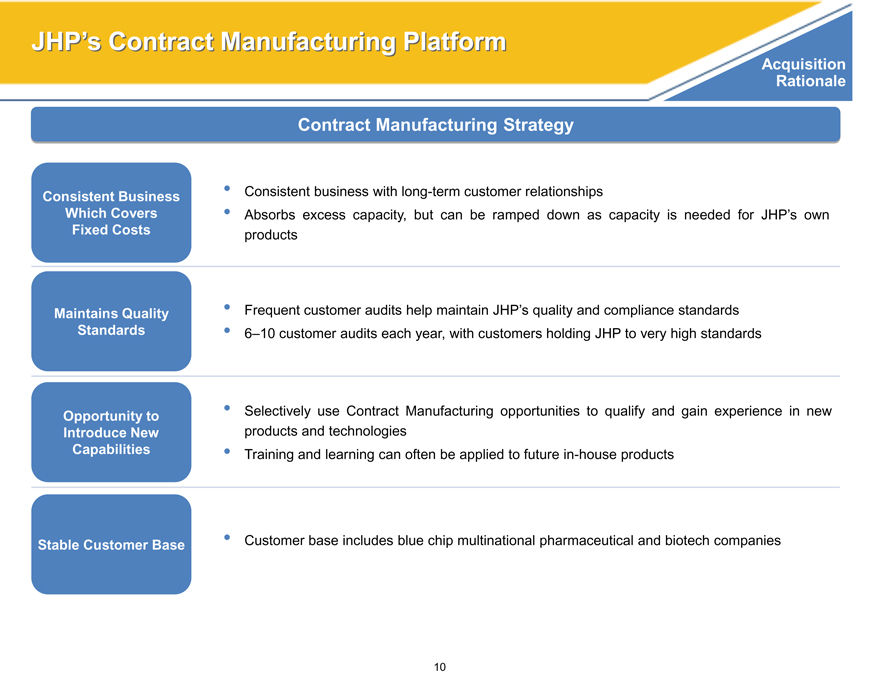

JHP’s Contract Manufacturing Platform

Acquisition Rationale

Contract Manufacturing Strategy

Consistent Business • Consistent business with long-term customer relationships

Which Covers • Absorbs excess capacity, but can be ramped down as capacity is needed for JHP’s own

Fixed Costs products

Maintains Quality • Frequent customer audits help maintain JHP’s quality and compliance standards

Standards • 6–10 customer audits each year, with customers holding JHP to very high standards

Opportunity to • Selectively use Contract Manufacturing opportunities to qualify and gain experience in new

Introduce New products and technologies

Capabilities • Training and learning can often be applied to future in-house products

Stable Customer Base • Customer base includes blue chip multinational pharmaceutical and biotech companies

10

Par Pharma

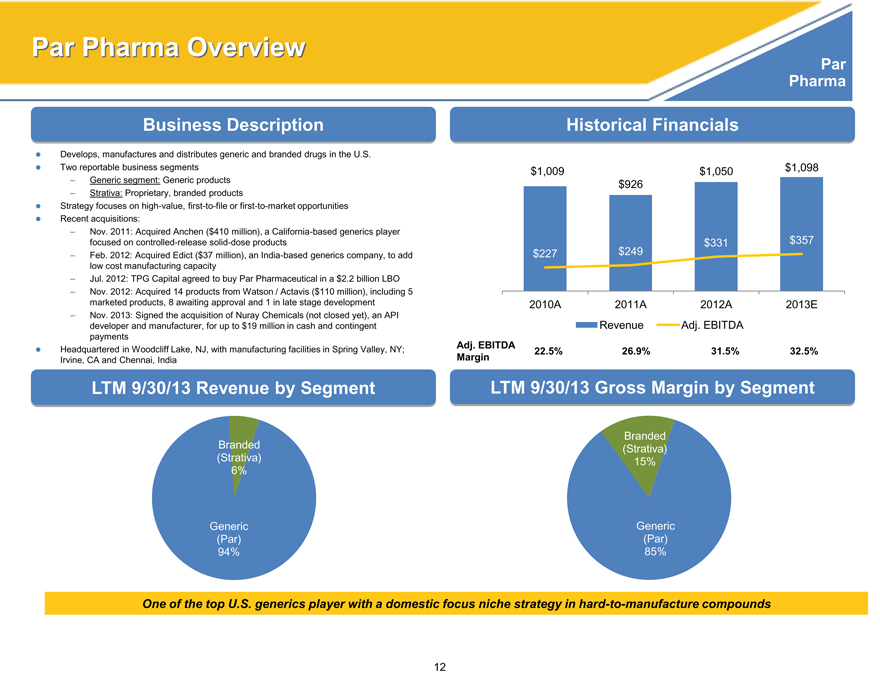

Par Pharma Overview

Par

Pharma

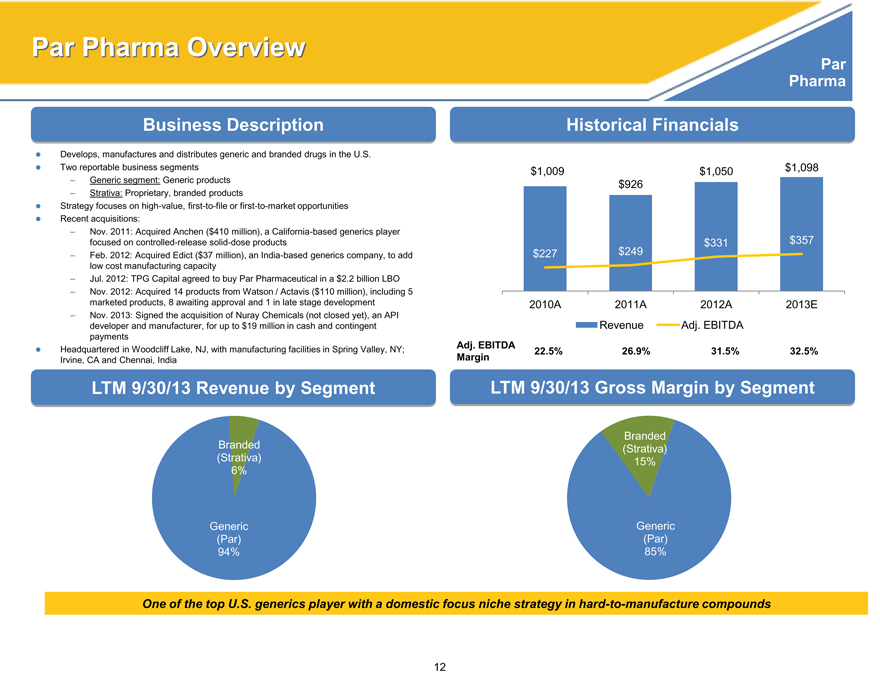

Business Description

Develops, manufactures and distributes generic and branded drugs in the U.S. Two reportable business segments

– Generic segment: Generic products

– Strativa: Proprietary, branded products

Strategy focuses on high-value, first-to-file or first-to-market opportunities Recent acquisitions:

– Nov. 2011: Acquired Anchen ($410 million), a California-based generics player focused on controlled-release solid-dose products

– Feb. 2012: Acquired Edict ($37 million), an India-based generics company, to add low cost manufacturing capacity

– Jul. 2012: TPG Capital agreed to buy Par Pharmaceutical in a $2.2 billion LBO

– Nov. 2012: Acquired 14 products from Watson / Actavis ($110 million), including 5 marketed products, 8 awaiting approval and 1 in late stage development

– Nov. 2013: Signed the acquisition of Nuray Chemicals (not closed yet), an API developer and manufacturer, for up to $19 million in cash and contingent payments Headquartered in Woodcliff Lake, NJ, with manufacturing facilities in Spring Valley, NY; Irvine, CA and Chennai, India

Historical Financials

$1,009 $1,050 $1,098

$ 926

$331 $357

$227 $ 249

2010A 2011A 2012A 2013E

Revenue Adj. EBITDA

Adj. EBITDA

Margin 22.5% 26.9% 31.5% 32.5%

LTM 9/30/13 Revenue by Segment

Branded

(Strativa)

6%

Generic

(Par)

94%

LTM 9/30/13 Gross Margin by Segment

Branded

(Strativa)

15%

Generic

(Par)

85%

One of the top U.S. generics player with a domestic focus niche strategy in hard-to-manufacture compounds

12

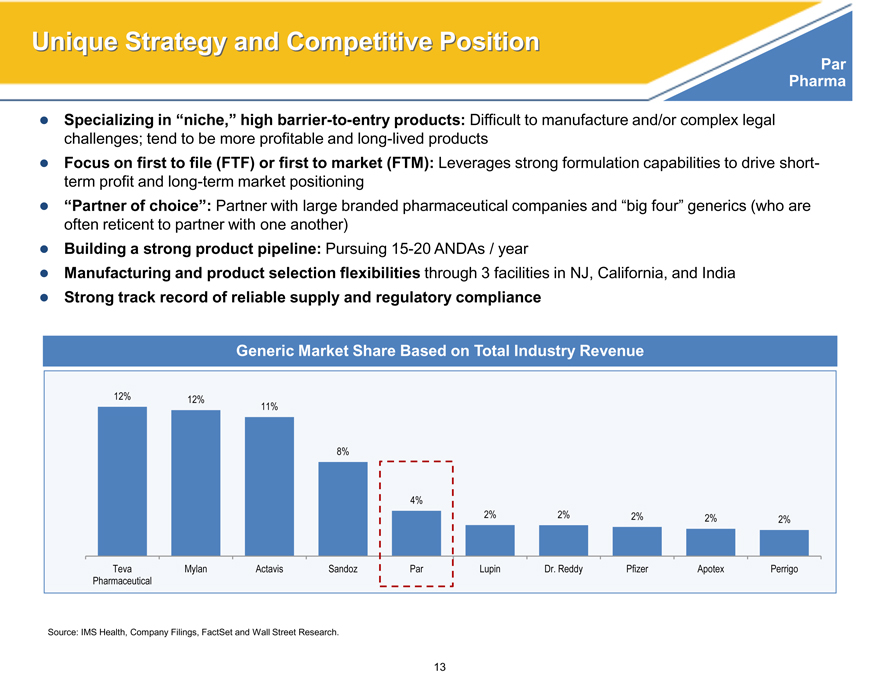

Unique Strategy and Competitive Position

Par

Pharma

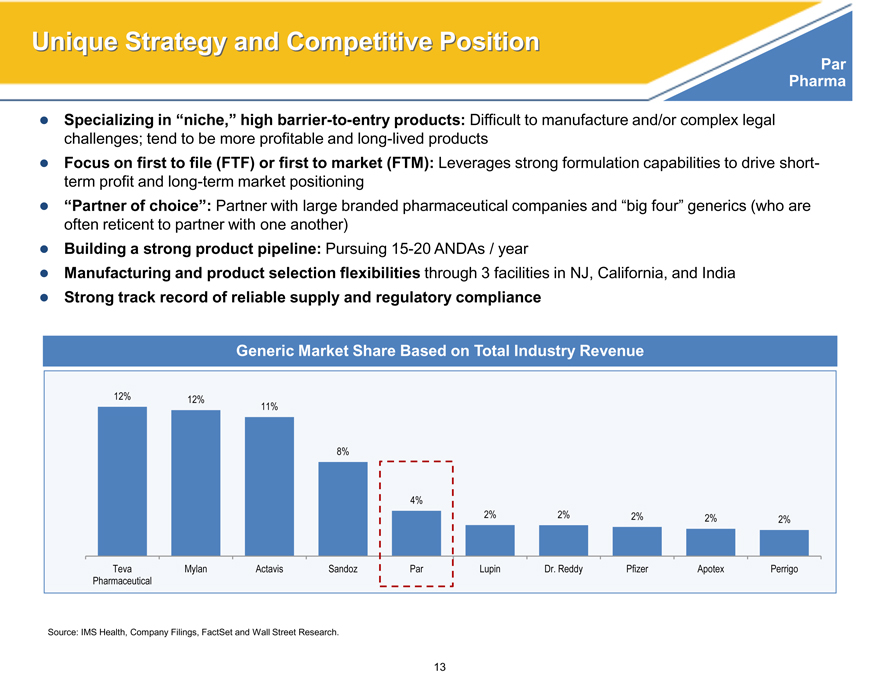

Specializing in “niche,” high barrier-to-entry products: Difficult to manufacture and/or complex legal challenges; tend to be more profitable and long-lived products

Focus on first to file (FTF) or first to market (FTM): Leverages strong formulation capabilities to drive short- term profit and long-term market positioning

“Partner of choice”: Partner with large branded pharmaceutical companies and “big four” generics (who are often reticent to partner with one another)

Building a strong product pipeline: Pursuing 15-20 ANDAs / year

Manufacturing and product selection flexibilities through 3 facilities in NJ, California, and India

Strong track record of reliable supply and regulatory compliance

Generic Market Share Based on Total Industry Revenue

12% 12% 11%

8%

4%

2% 2% 2% 2% 2%

Teva Mylan Actavis Sandoz Par Lupin Dr. Reddy Pfizer Apotex Perrigo

Pharmaceutical

Source: IMS Health, Company Filings, FactSet and Wall Street Research.

13

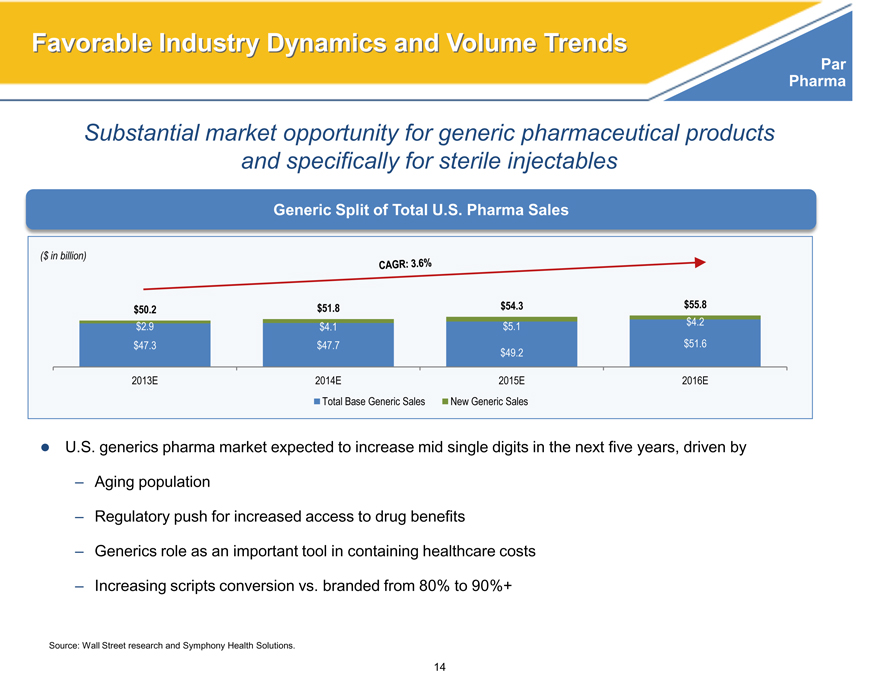

Favorable Industry Dynamics and Volume Trends

Par

Pharma

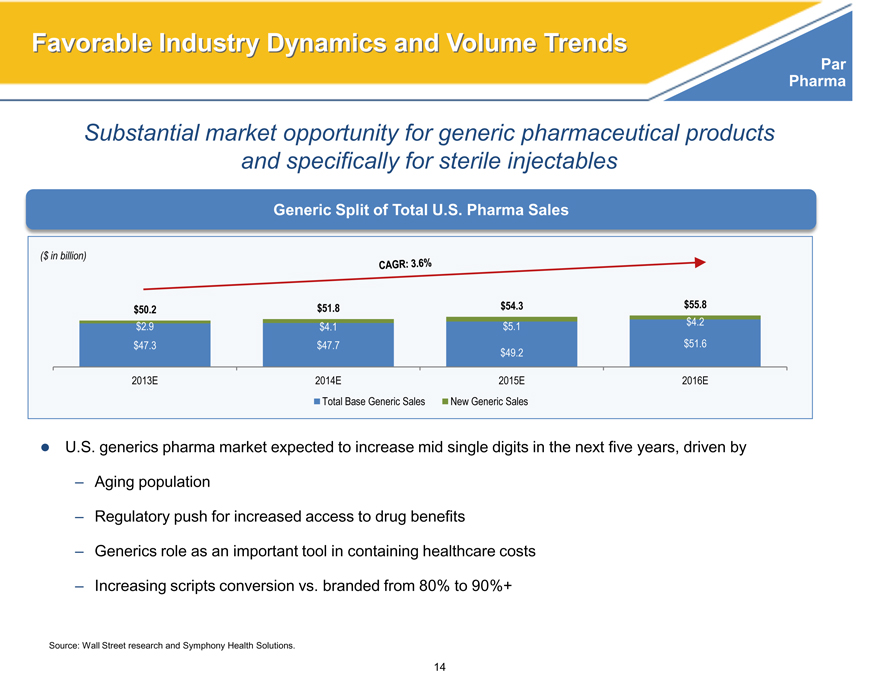

Substantial market opportunity for generic pharmaceutical products and specifically for sterile injectables

Generic Split of Total U.S. Pharma Sales

($ in billion)

$50.2 $51.8 $54.3 $55.8

$2.9 $4.1 $5.1 $4.2

$47.3 $47.7 $51.6

$49.2

2013E 2014E 2015E 2016E

Total Base Generic Sales New Generic Sales

U.S. generics pharma market expected to increase mid single digits in the next five years, driven by

– Aging population

– Regulatory push for increased access to drug benefits

– Generics role as an important tool in containing healthcare costs

– Increasing scripts conversion vs. branded from 80% to 90%+

Source: Wall Street research and Symphony Health Solutions.

14

Unique Strategy and Competitive Position

Par

Pharma

Operational Excellence: Highly Compliant and Reliable

Number of Warning Letters and

Consent Decrees for Manufacturing

22

21

19

15

8 8

4 4 4

3

1

0 0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Source: FDA gov.

FDA scrutiny has increased over the last

decade

Top Generics Companies Impacted by

Manufacturing Challenges (since 2007)

Rank Company Warning Letter

1 Teva 3/14/12, 1/31/11, 12/11/09

2 Mylan 10/13/11

3 Novartis 11/18/11, 8/12/08, 1/24/08

4 Watson –

5 Par1 –

6 Hosplra 5/28/13, 4/12/10, 8/12/09

7 Pfizer 4/9/10

8 BI –

9 Sun 8/25/10, 2/5/09, 10/31/08

10 Fresenius 7/1/13, 2/22/12, 4/6/11, 9/15/10, 4/22/09

11 Actavis 2/1/07

12 Perrigo 4/29/10

13 Impax 5/31/11

14 Rantbaxy 8/31/11, 9/16/08, 9/16/08

15 Lupin 5/7/09

16 Endo 2/1/08

17 Dr. Reddy’s 6/3/11

18 Mallinckrodt 8/12/08

19 Hikma –

20 Zydus 6/21/11

21 Glenmark –

22 Amneal –

23 Apotex 2/21/13, 3/29/10

24 CorePharma 6/21/10

25 Aurobindo 5/20/11

Source: FDA gov and 2014 IMS Health Data.

Par is only 1 of 3 scale players

without a warning letter since 2007

15

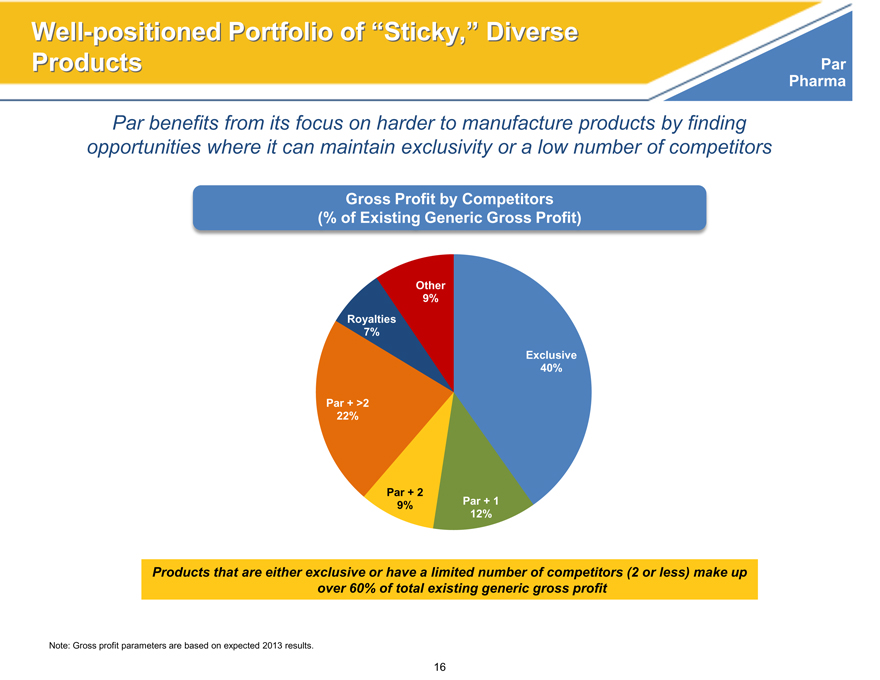

Well-positioned Portfolio of “Sticky,” Diverse

Products Par

Pharma

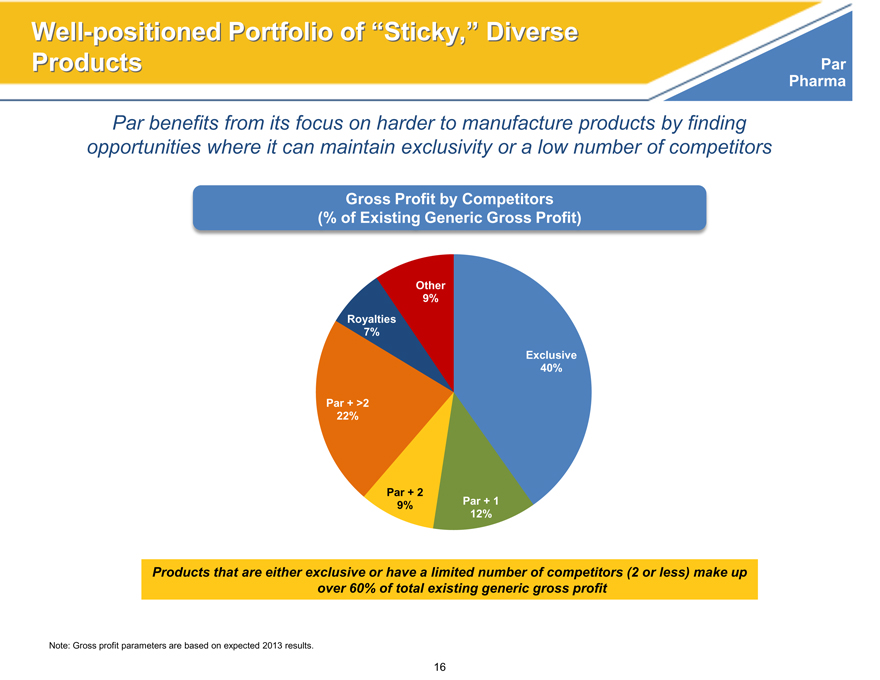

Par benefits from its focus on harder to manufacture products by finding opportunities where it can maintain exclusivity or a low number of competitors

Gross Profit by Competitors

(% of Existing Generic Gross Profit)

Other

9%

Royalties

7%

Exclusive

40%

Par + >2

22%

Par + 2

9%

Par + 1

12%

Products that are either exclusive or have a limited number of competitors (2 or less) make up over 60% of total existing generic gross profit

Note: Gross profit parameters are based on expected 2013 results.

16

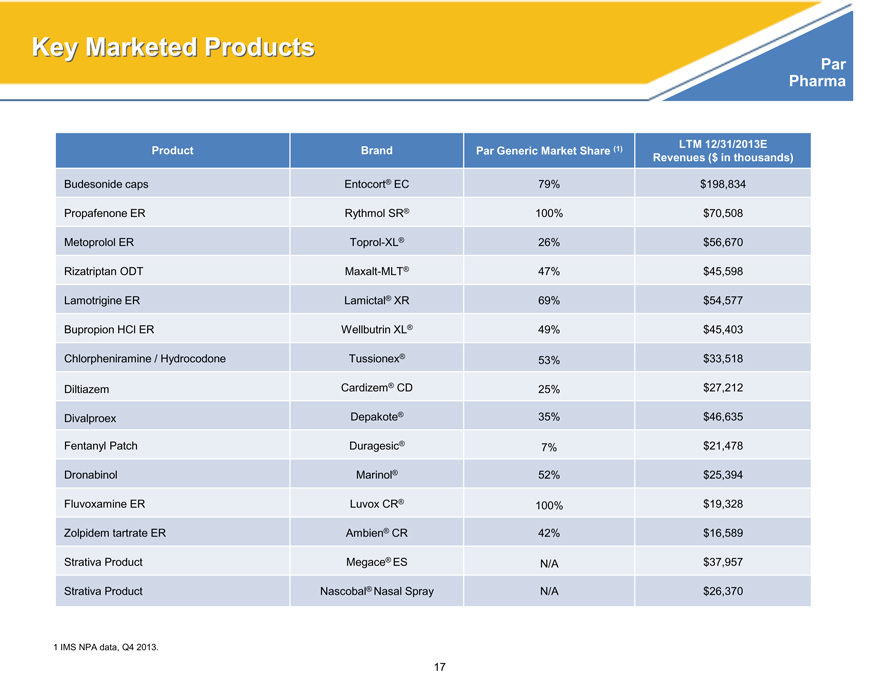

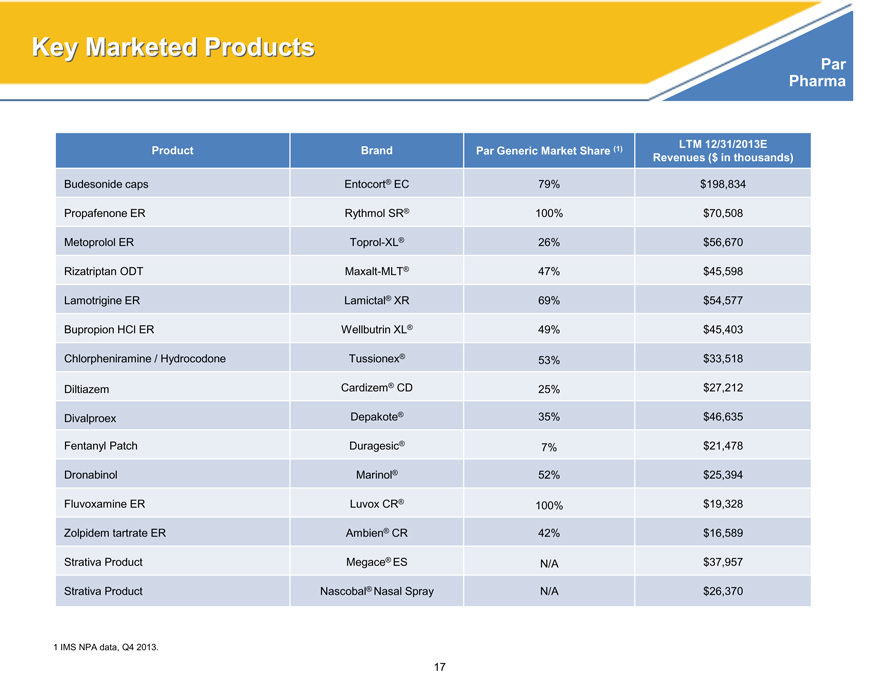

Key Marketed Products

Par

Pharma

Product Brand Par Generic Market Share (1) LTM 12/31/2013E

Revenues ($ in thousands)

Budesonide caps Entocort® EC 79% $198,834

Propafenone ER Rythmol SR® 100% $70,508

Metoprolol ER Toprol-XL® 26% $56,670

Rizatriptan ODT Maxalt-MLT® 47% $45,598

Lamotrigine ER Lamictal® XR 69% $54,577

Bupropion HCl ER Wellbutrin XL® 49% $45,403

Chlorpheniramine / Hydrocodone Tussionex® 53% $33,518

Diltiazem Cardizem® CD 25% $27,212

Divalproex Depakote® 35% $46,635

Fentanyl Patch Duragesic® 7% $21,478

Dronabinol Marinol® 52% $25,394

Fluvoxamine ER Luvox CR® 100% $19,328

Zolpidem tartrate ER Ambien® CR 42% $16,589

Strativa Product Megace® ES N/A $37,957

Strativa Product Nascobal® Nasal Spray N/A $26,370

1 IMS NPA data, Q4 2013.

17

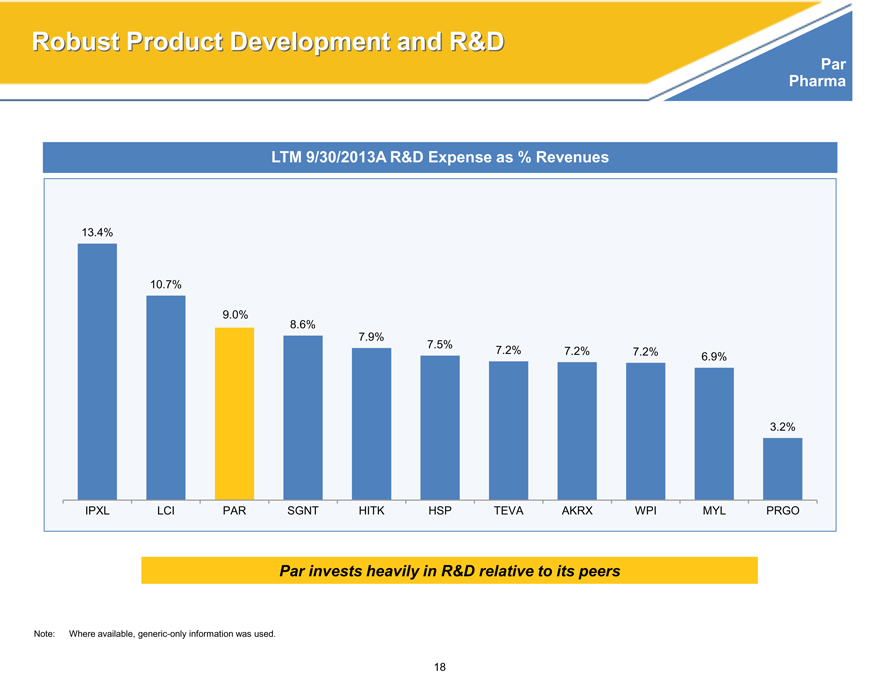

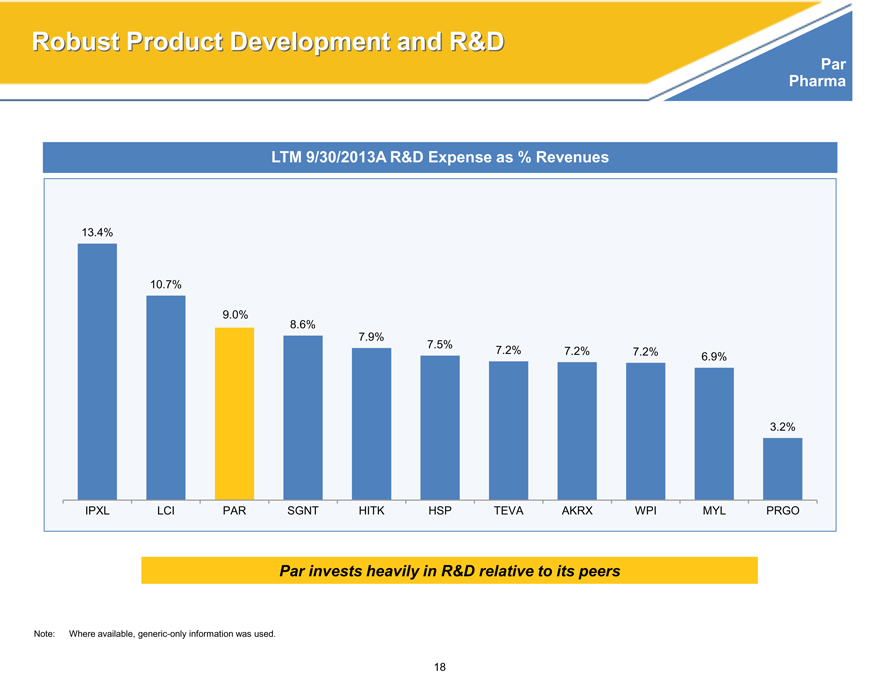

Robust Product Development and R&D

Par

Pharma

LTM 9/30/2013A R&D Expense as % Revenues

13.4%

10.7%

9.0%

8.6%

7.9%

7.5%

7.2% 7.2% 7.2% 6.9%

3.2%

IPXL LCI PAR SGNT HITK HSP TEVA AKRX WPI MYL PRGO

Par invests heavily in R&D relative to its peers

Note: Where available, generic-only information was used.

18

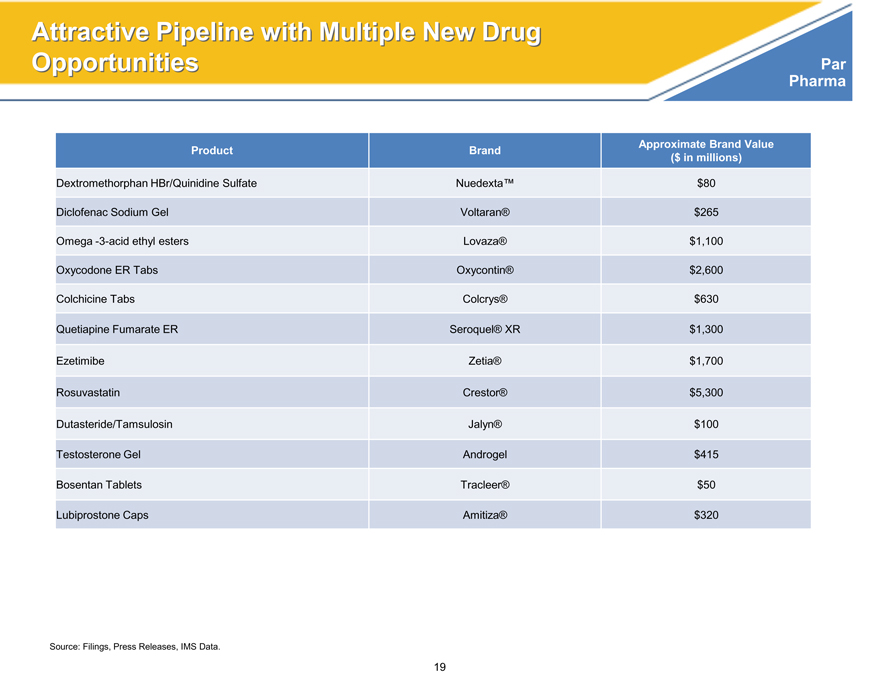

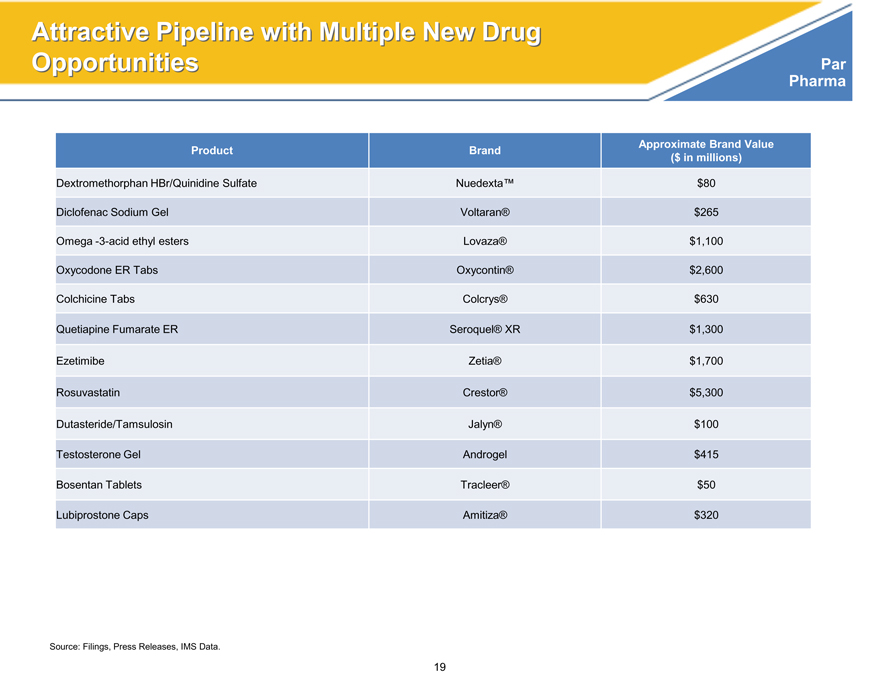

Attractive Pipeline with Multiple New Drug

Opportunities Par

Pharma

Product Brand Approximate Brand Value

($ in millions)

Dextromethorphan HBr/Quinidine Sulfate Nuedexta™ $80

Diclofenac Sodium Gel Voltaran® $265

Omega -3-acid ethyl esters Lovaza® $1,100

Oxycodone ER Tabs Oxycontin® $2,600

Colchicine Tabs Colcrys® $630

Quetiapine Fumarate ER Seroquel® XR $1,300

Ezetimibe Zetia® $1,700

Rosuvastatin Crestor® $5,300

Dutasteride/Tamsulosin Jalyn® $100

Testosterone Gel Androgel $415

Bosentan Tablets Tracleer® $50

Lubiprostone Caps Amitiza® $320

Source: Filings, Press Releases, IMS Data.

19

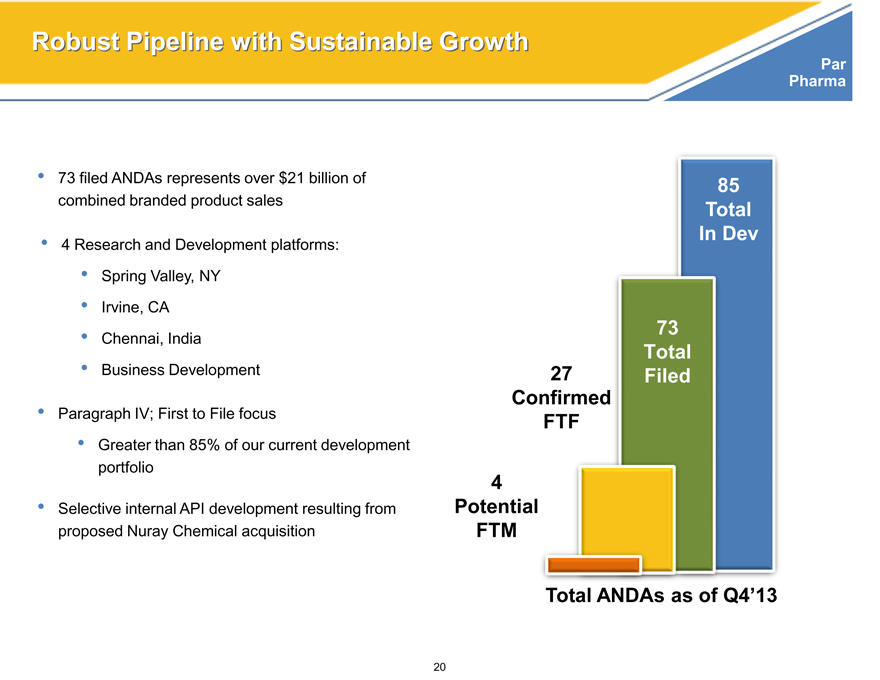

Robust Pipeline with Sustainable Growth

Par

Pharma

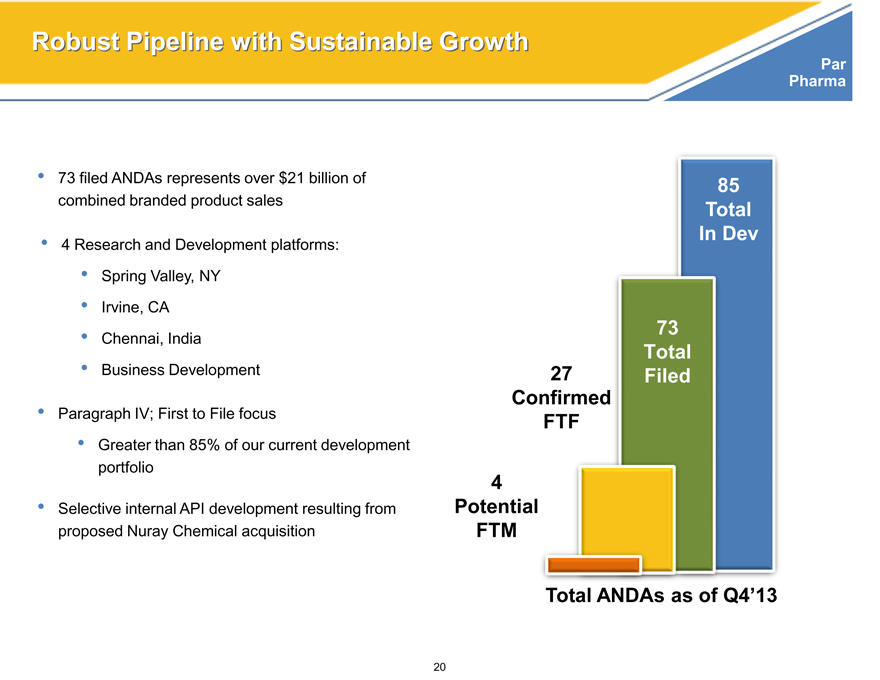

73 filed ANDAs represents over $21 billion of combined branded product sales

4 Research and Development platforms:

Spring Valley, NY

Irvine, CA

Chennai, India

Business Development

Paragraph IV; First to File focus

Greater than 85% of our current development portfolio

Selective internal API development resulting from proposed Nuray Chemical acquisition

85

Total

In Dev

73

Total

27 Filed

Confirmed

FTF

4

Potential

FTM

Total ANDAs as of Q4’13

20

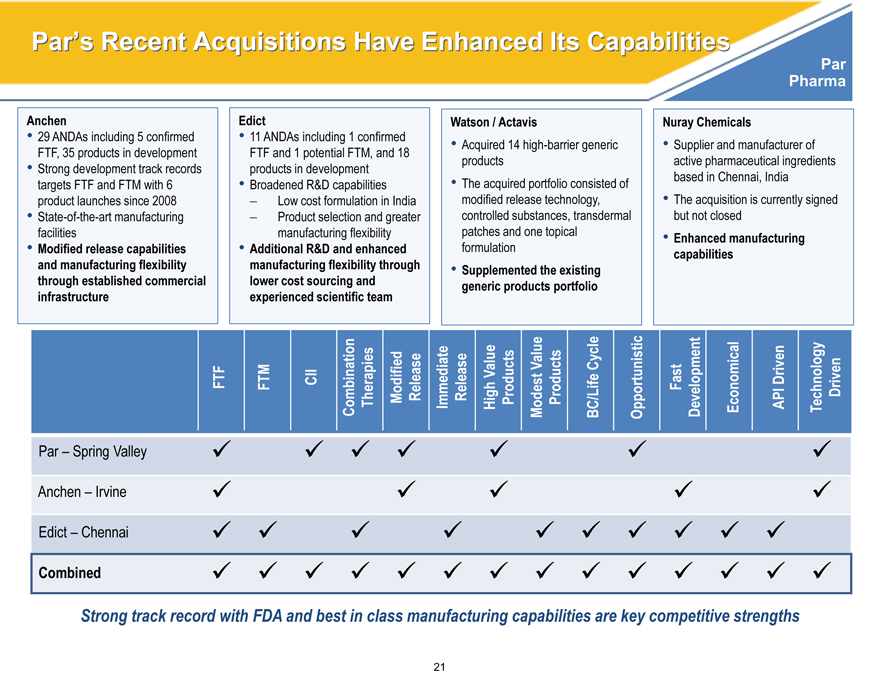

Par’s Recent Acquisitions Have Enhanced Its Capabilities

Par Pharma

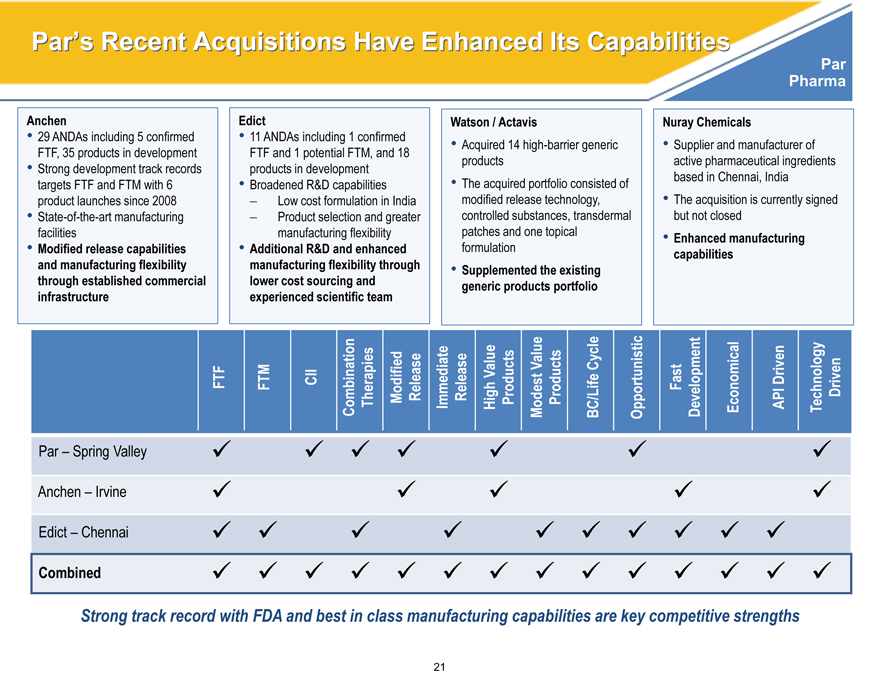

Anchen Edict Watson / Actavis Nuray Chemicals

29 ANDAs including 5 confirmed 11 ANDAs including 1 confirmed Acquired 14 high-barrier generic Supplier and manufacturer of

FTF, 35 products in development FTF and 1 potential FTM, and 18

• Strong development track records products in development products active pharmaceutical ingredients

targets FTF and FTM with 6 • Broadened R&D capabilities • The acquired portfolio consisted of based in Chennai, India

product launches since 2008 – Low cost formulation in India modified release technology, • The acquisition is currently signed

State-of-the-art manufacturing – Product selection and greater controlled substances, transdermal but not closed

facilities manufacturing flexibility patches and one topical • Enhanced manufacturing

Modified release capabilities Additional R&D and enhanced formulation capabilities

and manufacturing flexibility manufacturing flexibility through • Supplemented the existing

through established commercial lower cost sourcing and generic products portfolio

infrastructure experienced scientific team

Value Value Cycle Fast Driven Driven

FTF FTM CII Combination Therapies Modified Release Immediate Release High Products Modest Products BC/Life Opportunistic Development Economical API Technology

Par – Spring Valley

Anchen – Irvine

Edict – Chennai

Combined

Strong track record with FDA and best in class manufacturing capabilities are key competitive strengths

21

Financial Overview

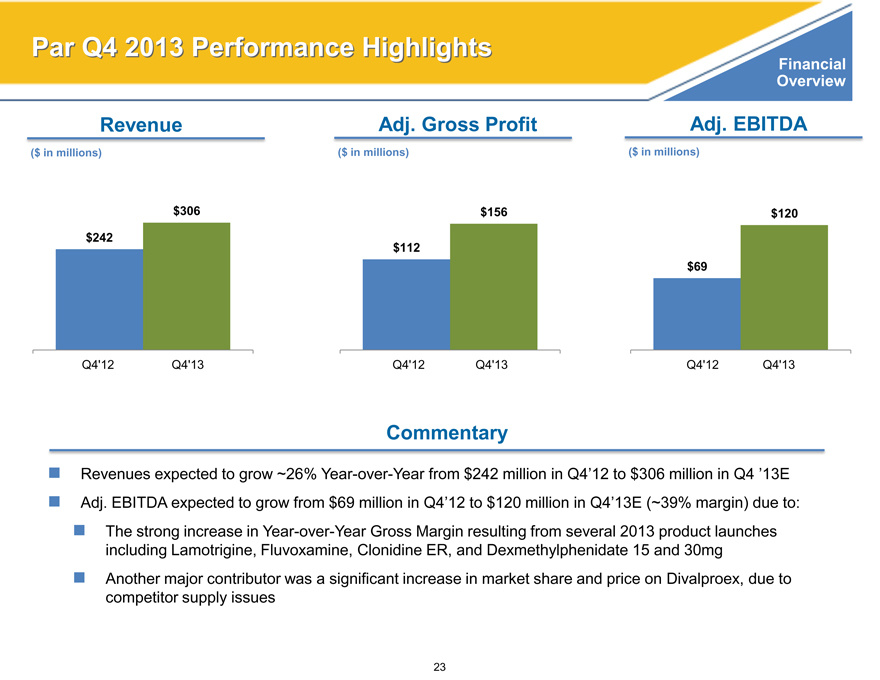

Par Q4 2013 Performance Highlights

Financial

Overview

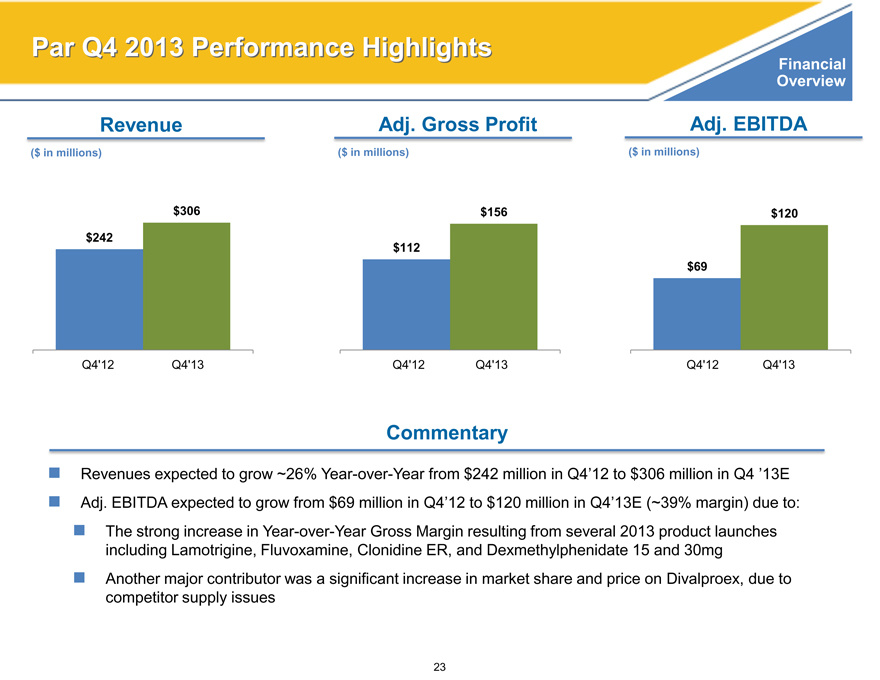

Revenue Adj. Gross Profit Adj. EBITDA

($ in millions)($ in millions)($ in millions)

$306 $156 $120

$242

$112

$69

Q4’12 Q4’13 Q4’12 Q4’13 Q4’12 Q4’13

Commentary

Revenues expected to grow ~26% Year-over-Year from $242 million in Q4’12 to $306 million in Q4 ’13E Adj. EBITDA expected to grow from $69 million in Q4’12 to $120 million in Q4’13E (~39% margin) due to:

The strong increase in Year-over-Year Gross Margin resulting from several 2013 product launches including Lamotrigine, Fluvoxamine, Clonidine ER, and Dexmethylphenidate 15 and 30mg Another major contributor was a significant increase in market share and price on Divalproex, due to competitor supply issues

23

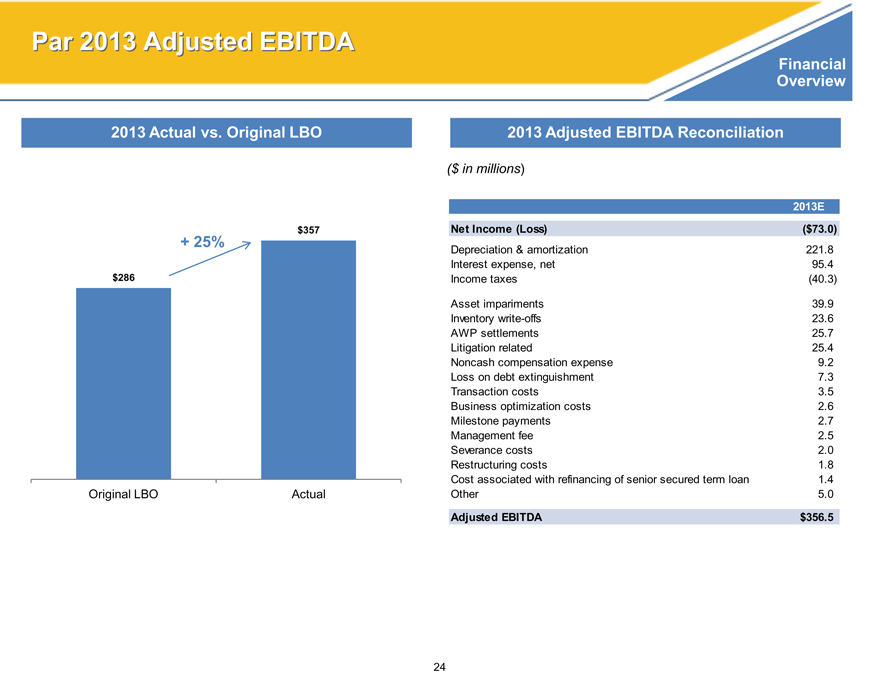

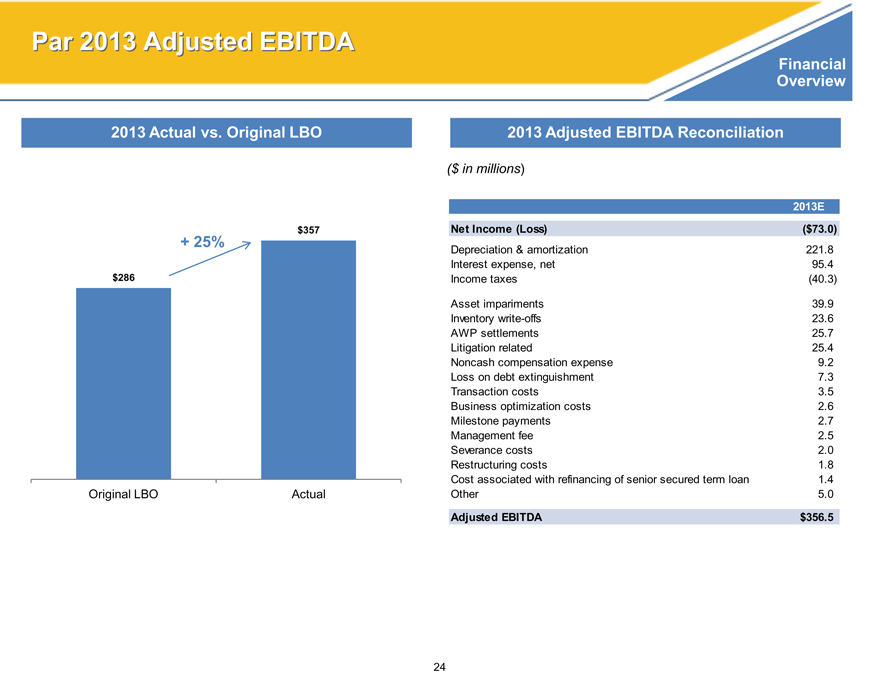

Par 2013 Adjusted EBITDA

Financial

Overview

2013 Actual vs. Original LBO

$357

+ 25%

$286

Original LBO Actual

2013 Adjusted EBITDA Reconciliation

($ in millions)

2013E

Net Income (Loss)($73.0)

Depreciation & amortization 221.8

Interest expense, net 95.4

Income taxes(40.3)

Asset impariments 39.9

Inventory write-offs 23.6

AWP settlements 25.7

Litigation related 25.4

Noncash compensation expense 9.2

Loss on debt extinguishment 7.3

Transaction costs 3.5

Business optimization costs 2.6

Milestone payments 2.7

Management fee 2.5

Severance costs 2.0

Restructuring costs 1.8

Cost associated with refinancing of senior secured term loan 1.4

Other 5.0

Adjusted EBITDA $356.5

24

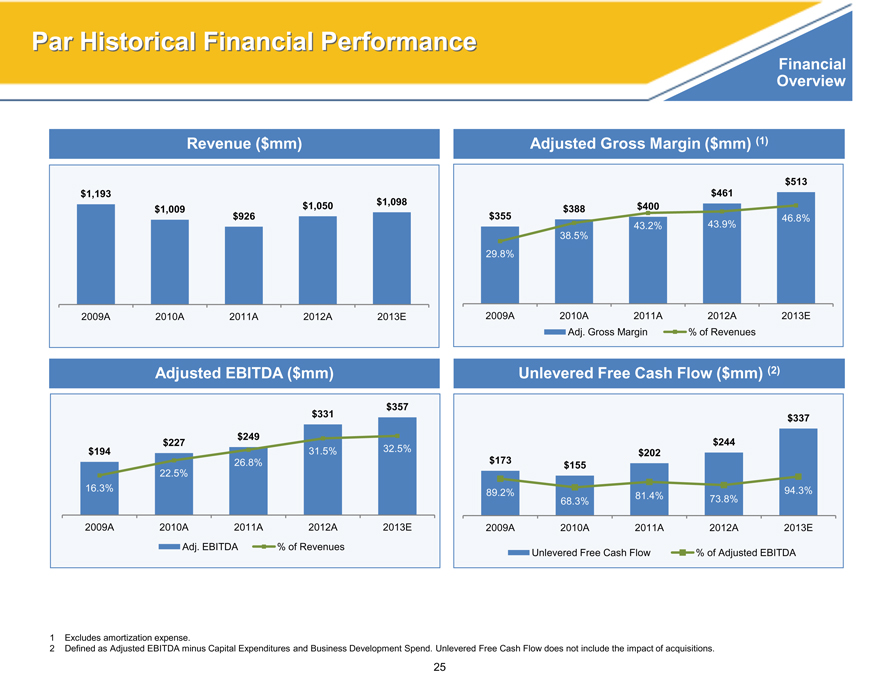

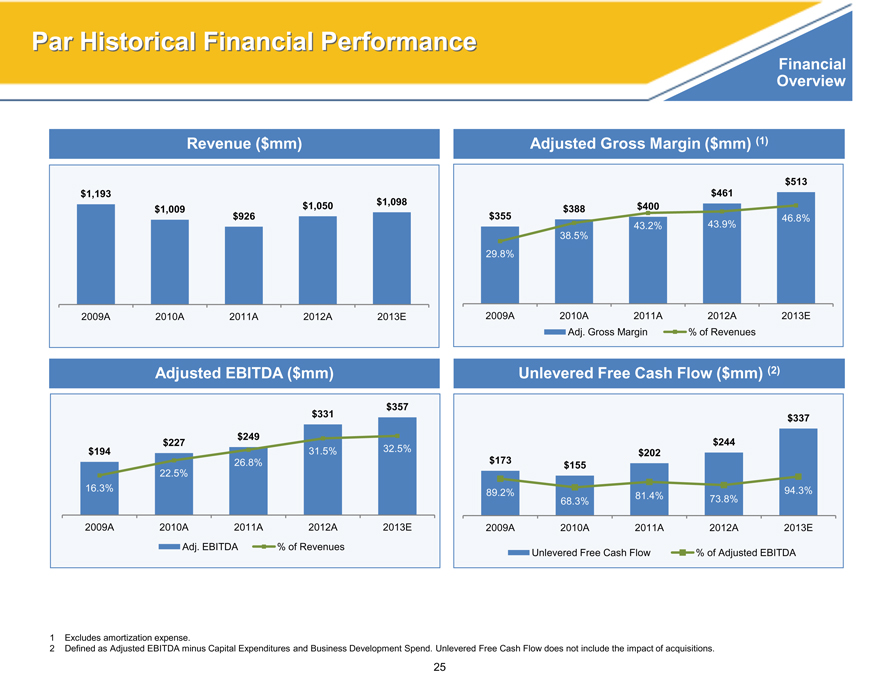

Par Historical Financial Performance

Financial

Overview

Revenue ($mm)

$1,193

$1,098

$1,009 $1,050

$926

2009A 2010A 2011A 2012A 2013E

Adjusted EBITDA ($mm)

$357

$331

$227 $249

$194 31.5% 32.5%

26.8%

22.5%

16.3%

2009A 2010A 2011A 2012A 2013E

Adj. EBITDA% of Revenues

Adjusted Gross Margin ($mm) (1)

$513

$461

$388 $400

$355 46.8%

43.2% 43.9%

38.5%

29.8%

2009A 2010A 2011A 2012A 2013E

Adj. Gross Margin% of Revenues

Unlevered Free Cash Flow ($mm) (2)

$337

$244

$202

$173 $155

89.2% 81.4% 94.3%

68.3% 73.8%

2009A 2010A 2011A 2012A 2013E

Unlevered Free Cash Flow% of Adjusted EBITDA

1 Excludes amortization expense.

2 Defined as Adjusted EBITDA minus Capital Expenditures and Business Development Spend. Unlevered Free Cash Flow does not include the impact of acquisitions.

25

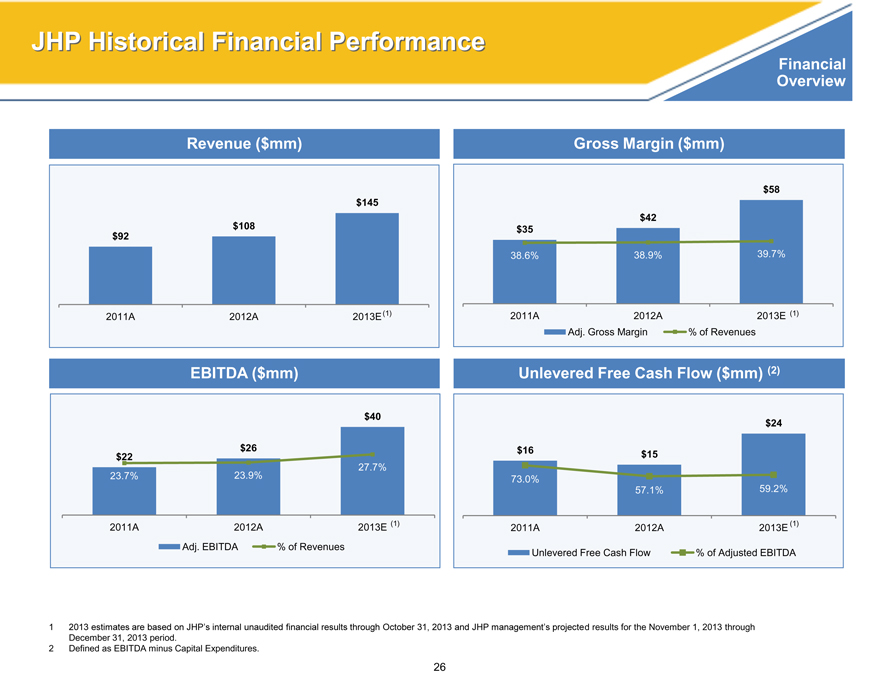

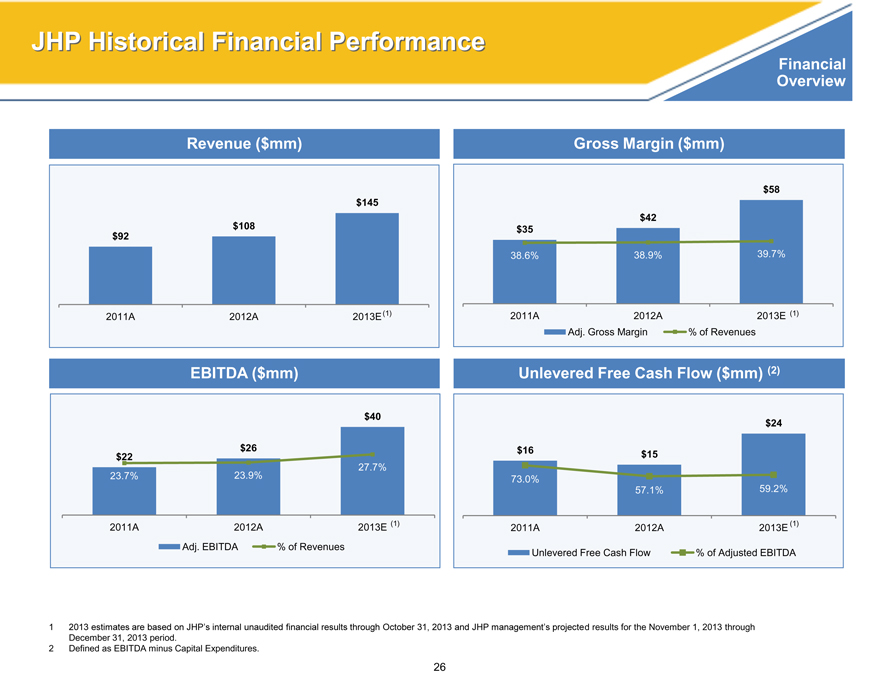

JHP Historical Financial Performance

Financial

Overview

Revenue ($mm)

$145

$108

$92

2011A 2012A 2013E (1)

EBITDA ($mm)

$40

$26

$22

27.7%

23.7% 23.9%

2011A 2012A 2013E (1)

Adj. EBITDA% of Revenues

Gross Margin ($mm)

$58

$42

$35

38.6% 38.9% 39.7%

2011A 2012A 2013E (1)

Adj. Gross Margin% of Revenues

Unlevered Free Cash Flow ($mm) (2)

$24

$16 $15

73.0%

57.1% 59.2%

2011A 2012A 2013E (1)

Unlevered Free Cash Flow% of Adjusted EBITDA

1 2013 estimates are based on JHP’s internal unaudited financial results through October 31, 2013 and JHP management’s projected results for the November 1, 2013 through

December 31, 2013 period.

2 Defined as EBITDA minus Capital Expenditures.

26

PAR pharmaceutical companies