UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

Nuveen Ohio Quality Municipal Income Fund (NUO)

(Exact Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | |

Payment of Filing Fee (Check the appropriate box): |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| | Fee paid previously with preliminary materials: |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

Nuveen Ohio Quality Municipal Income Fund (NUO) November 15, 2019 Nuveen Fund Advisors, LLC Proxy Advisory Firm PresentationNuveen Ohio Quality Municipal Income Fund (NUO) November 15, 2019 Nuveen Fund Advisors, LLC Proxy Advisory Firm Presentation

Executive Summary § Under the Board’s active stewardship, NUO provides Ohio residents – the fund’s core, long-term shareholders – with the investment experience they want: attractive double tax-exempt income and competitive total returns ─ Superior 1-, 3-, 5- and 10-year total returns on both net asset value and market price vs the average of its Lipper closed-end peers ─ Distribution yields on market price in line with its Lipper closed-end peers and superior to lowest cost share class of funds inthe Morningstar Ohio tax-exempt open-end fund category ─ Superior market price returns vs average returns of the lowest cost share class of funds in the Morningstar Ohio tax-exempt open-end fund category ─ In line expense ratio on total assets (excluding leverage costs) compared to Lipper closed-end fund peers and lowest cost share class of funds in the Morningstar Ohio tax-exempt open-end fund category, in each case excluding Nuveen funds § Proactive, diverse, independent Board has demonstrated shareholder accountability. Board and CEF Committee oversight has resulted in: ─ Significant fee and expense savings for Ohio shareholders from fund mergers; ─ Meaningful net asset value increase in 2018 from ongoing share buyback program; ─ Additional ongoing fee savings from implementation of innovative, complex-wide management fee schedule; and ─ Ongoing, dedicated focus on performance and discounts Peer group comparisons exclude Nuveen funds. 2Executive Summary § Under the Board’s active stewardship, NUO provides Ohio residents – the fund’s core, long-term shareholders – with the investment experience they want: attractive double tax-exempt income and competitive total returns ─ Superior 1-, 3-, 5- and 10-year total returns on both net asset value and market price vs the average of its Lipper closed-end peers ─ Distribution yields on market price in line with its Lipper closed-end peers and superior to lowest cost share class of funds inthe Morningstar Ohio tax-exempt open-end fund category ─ Superior market price returns vs average returns of the lowest cost share class of funds in the Morningstar Ohio tax-exempt open-end fund category ─ In line expense ratio on total assets (excluding leverage costs) compared to Lipper closed-end fund peers and lowest cost share class of funds in the Morningstar Ohio tax-exempt open-end fund category, in each case excluding Nuveen funds § Proactive, diverse, independent Board has demonstrated shareholder accountability. Board and CEF Committee oversight has resulted in: ─ Significant fee and expense savings for Ohio shareholders from fund mergers; ─ Meaningful net asset value increase in 2018 from ongoing share buyback program; ─ Additional ongoing fee savings from implementation of innovative, complex-wide management fee schedule; and ─ Ongoing, dedicated focus on performance and discounts Peer group comparisons exclude Nuveen funds. 2

Executive Summary (continued) § Saba is a hedge fund activist out to make a quick profit for its investors at the expense of the long-term interests of Ohio residents ─ Saba has a track record of pushing for actions that, if successful, would leave NUO smaller with higher expenses and diminished income and return prospects ─ Saba’s nominees have no closed-end fund experience; one has been nominated (but never elected) in multiple 2019 proxy contests ─ Saba historically has withdrawn its nominees and exited its position whenever a fund acquiesces to its demands § A classified board structure is an important bulwark helping to defend the interests of long-term investors in closed-end funds like NUO ─ Closed-end funds are fundamentally different from public operating companies; they are subject to extensive regulation affording significant investor protections ─ Structure of listed closed-end funds makes them vulnerable to attacks from short-term investors seeking quick arbitrage profits at the expense of long-term retail shareholders; policies typical of most publicly-traded operating companies to elect directors annually exacerbate this vulnerability ─ Tactics like Saba’s have drawn increasing criticism from Congress and regulators, who fear that long-term retail investors are being put at risk We believe you should support the Board’s recommendation “FOR” the Board nominees and “AGAINST” Saba’s proposal to restructure the Board on the WHITE proxy card 3Executive Summary (continued) § Saba is a hedge fund activist out to make a quick profit for its investors at the expense of the long-term interests of Ohio residents ─ Saba has a track record of pushing for actions that, if successful, would leave NUO smaller with higher expenses and diminished income and return prospects ─ Saba’s nominees have no closed-end fund experience; one has been nominated (but never elected) in multiple 2019 proxy contests ─ Saba historically has withdrawn its nominees and exited its position whenever a fund acquiesces to its demands § A classified board structure is an important bulwark helping to defend the interests of long-term investors in closed-end funds like NUO ─ Closed-end funds are fundamentally different from public operating companies; they are subject to extensive regulation affording significant investor protections ─ Structure of listed closed-end funds makes them vulnerable to attacks from short-term investors seeking quick arbitrage profits at the expense of long-term retail shareholders; policies typical of most publicly-traded operating companies to elect directors annually exacerbate this vulnerability ─ Tactics like Saba’s have drawn increasing criticism from Congress and regulators, who fear that long-term retail investors are being put at risk We believe you should support the Board’s recommendation “FOR” the Board nominees and “AGAINST” Saba’s proposal to restructure the Board on the WHITE proxy card 3

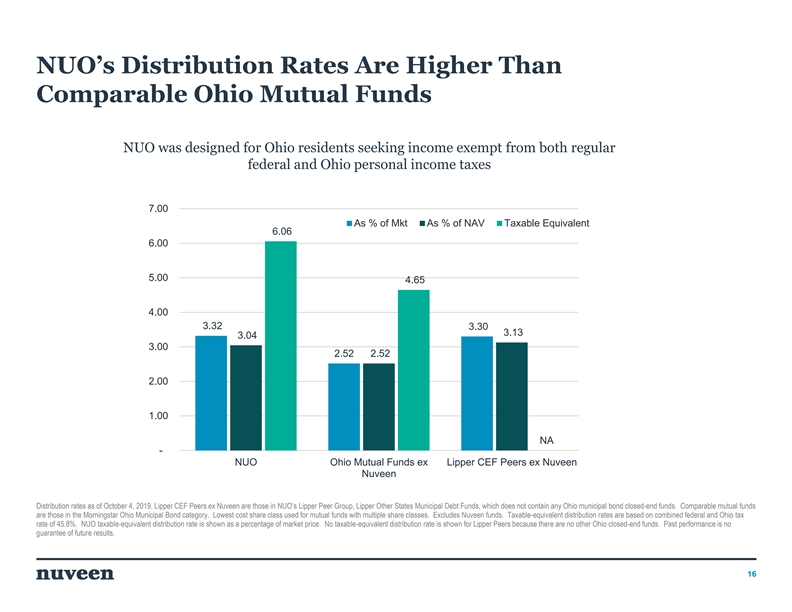

Snapshot: Ohio Quality Municipal Income Fund (NUO) NUO has delivered strong performance and met fundamental investment objectives Superior Total Unique Investor Attractive Current Competitive 1,2,3 2,3 4 Returns Exposure Income Expense Ratio • $463MM in total • In line with Lipper As % of Mkt NUO fund assets closed-end peers, all As % of NAV Lipper CEF ex Nuveen municipal closed- Taxable Equivalent • Only Ohio state- end funds and Ohio Ohio Mutual Funds ex Nuveen specific municipal municipal bond closed-end fund 3 mutual funds , using • Offers Ohio residents expense ratio on a leveraged Ohio total assets and municipal bond excluding leverage investment strategy costs, which can vary not available in other widely by fund products such as • Leverage costs mutual funds and account for 55% of ETFs overall fund NA expenses NUO Ohio Mutual Lipper CEF 1 Year 3 Years 5 Years 10 Years Funds ex Nuveen Peers ex Nuveen 20%+ Growth in Net Asset Value Since Fund Inception See Appendix A for more detailed information on fund performance and expenses. Total returns, annualized, as of 9/30/19 and are on market price for closed-end funds. 1. As of 10/4/2019. Taxable-equivalent distribution rate assumes a 45.8% combined federal and Ohio income tax rate. 2. Lipper Other States Municipal Debt category excluding other Nuveen closed-end funds. 3. Mutual funds are those in the Morningstar Ohio Municipal Bond category. Lowest cost share class used for funds with multiple share classes. Excludes Nuveen Ohio municipal bond fund 4. Lipper data as of 9/26/2019. Excluding costs of leverage. Lipper Other States Municipal Debt category and all leveraged municipal closed-end funds as tracked by Lipper. 4 3.32 3.04 6.06 2.52 2.52 4.65 3.30 3.13 21.5 10.0 7.9 2.9 1.2 2.8 5.2 4.5 3.4 5.9 5.7 3.7 Snapshot: Ohio Quality Municipal Income Fund (NUO) NUO has delivered strong performance and met fundamental investment objectives Superior Total Unique Investor Attractive Current Competitive 1,2,3 2,3 4 Returns Exposure Income Expense Ratio • $463MM in total • In line with Lipper As % of Mkt NUO fund assets closed-end peers, all As % of NAV Lipper CEF ex Nuveen municipal closed- Taxable Equivalent • Only Ohio state- end funds and Ohio Ohio Mutual Funds ex Nuveen specific municipal municipal bond closed-end fund 3 mutual funds , using • Offers Ohio residents expense ratio on a leveraged Ohio total assets and municipal bond excluding leverage investment strategy costs, which can vary not available in other widely by fund products such as • Leverage costs mutual funds and account for 55% of ETFs overall fund NA expenses NUO Ohio Mutual Lipper CEF 1 Year 3 Years 5 Years 10 Years Funds ex Nuveen Peers ex Nuveen 20%+ Growth in Net Asset Value Since Fund Inception See Appendix A for more detailed information on fund performance and expenses. Total returns, annualized, as of 9/30/19 and are on market price for closed-end funds. 1. As of 10/4/2019. Taxable-equivalent distribution rate assumes a 45.8% combined federal and Ohio income tax rate. 2. Lipper Other States Municipal Debt category excluding other Nuveen closed-end funds. 3. Mutual funds are those in the Morningstar Ohio Municipal Bond category. Lowest cost share class used for funds with multiple share classes. Excludes Nuveen Ohio municipal bond fund 4. Lipper data as of 9/26/2019. Excluding costs of leverage. Lipper Other States Municipal Debt category and all leveraged municipal closed-end funds as tracked by Lipper. 4 3.32 3.04 6.06 2.52 2.52 4.65 3.30 3.13 21.5 10.0 7.9 2.9 1.2 2.8 5.2 4.5 3.4 5.9 5.7 3.7

Snapshot: Ohio Quality Municipal Income Fund (NUO) NUO’s discount reflects broad market sentiment and municipal market fundamentals, not underlying poor performance or Board inattention or ineffectiveness Ø The relationship between market price and net Historical Closed-End Fund asset value can vary significantly over time 1 Premium/(Discount) Levels – Fluctuating market sentiment on underlying asset 10.0% class/investment strategy is often the primary driver of 9/30/19 large discounts All Municipals: -6.3 Lipper ex Nuveen: -5.2 – Yield and total return versus peers is often a secondary 5.0% NUO: -8.4 driver – Since 2013, leveraged municipal closed-end funds like 0.0% NUO have faced headwinds from the shifting outlook on interest rates, including the market’s 2013 “Taper Tantrum” and more recently the Fed’s 2017-2018 -5.0% tightening -10.0% Ø In the past 5 years, Ohio bond yields have fallen significantly more than the broader municipal -15.0% market and other major state markets – Ohio economic recovery has led to higher bond prices and lower yields which translates to lower fund net earnings -20.0% and distributions over time – These fundamentals have been the primary driver of NUO’s wider discount versus peers since 2015 – NUO has delivered superior total returns on market vs. All Munis Lipper ex Nuveen NUO Lipper peers and Ohio mutual funds despite wider discounts See Appendix A for more detailed information on fund performance and municipal bond yields. Municipal bond yields are represented by the relevant S&P Municipal Bond indices. 1. As of 9/30/2019. Figures based on month-end premium/(discount) as tracked by Morningstar. Chart illustrates the median month-end premium/(discount) to net asset value for the categories shown and the month-end premium/(discount) for NUO. Lipper ex Nuveen includes all funds, excluding Nuveen funds, that comprise the Lipper Other States Municipal Debt category. 5 12/31/2005 6/30/2006 12/31/2006 6/30/2007 12/31/2007 6/30/2008 12/31/2008 6/30/2009 12/31/2009 6/30/2010 12/31/2010 6/30/2011 12/31/2011 6/30/2012 12/31/2012 6/30/2013 12/31/2013 6/30/2014 12/31/2014 6/30/2015 12/31/2015 6/30/2016 12/31/2016 6/30/2017 12/31/2017 6/30/2018 12/31/2018 6/30/2019Snapshot: Ohio Quality Municipal Income Fund (NUO) NUO’s discount reflects broad market sentiment and municipal market fundamentals, not underlying poor performance or Board inattention or ineffectiveness Ø The relationship between market price and net Historical Closed-End Fund asset value can vary significantly over time 1 Premium/(Discount) Levels – Fluctuating market sentiment on underlying asset 10.0% class/investment strategy is often the primary driver of 9/30/19 large discounts All Municipals: -6.3 Lipper ex Nuveen: -5.2 – Yield and total return versus peers is often a secondary 5.0% NUO: -8.4 driver – Since 2013, leveraged municipal closed-end funds like 0.0% NUO have faced headwinds from the shifting outlook on interest rates, including the market’s 2013 “Taper Tantrum” and more recently the Fed’s 2017-2018 -5.0% tightening -10.0% Ø In the past 5 years, Ohio bond yields have fallen significantly more than the broader municipal -15.0% market and other major state markets – Ohio economic recovery has led to higher bond prices and lower yields which translates to lower fund net earnings -20.0% and distributions over time – These fundamentals have been the primary driver of NUO’s wider discount versus peers since 2015 – NUO has delivered superior total returns on market vs. All Munis Lipper ex Nuveen NUO Lipper peers and Ohio mutual funds despite wider discounts See Appendix A for more detailed information on fund performance and municipal bond yields. Municipal bond yields are represented by the relevant S&P Municipal Bond indices. 1. As of 9/30/2019. Figures based on month-end premium/(discount) as tracked by Morningstar. Chart illustrates the median month-end premium/(discount) to net asset value for the categories shown and the month-end premium/(discount) for NUO. Lipper ex Nuveen includes all funds, excluding Nuveen funds, that comprise the Lipper Other States Municipal Debt category. 5 12/31/2005 6/30/2006 12/31/2006 6/30/2007 12/31/2007 6/30/2008 12/31/2008 6/30/2009 12/31/2009 6/30/2010 12/31/2010 6/30/2011 12/31/2011 6/30/2012 12/31/2012 6/30/2013 12/31/2013 6/30/2014 12/31/2014 6/30/2015 12/31/2015 6/30/2016 12/31/2016 6/30/2017 12/31/2017 6/30/2018 12/31/2018 6/30/2019

Proposal 1: Trustee Nominees NUO’s Board of Trustees unanimously recommends that shareholders vote “FOR” the election of the Board-nominated Trustees on the WHITE proxy card Ø NUO Board is diverse, independent, with deep closed-end fund experience and has demonstrated shareholder accountability by adding fresh perspectives in line with its governing principles – Experience across asset classes and market cycles affords them invaluable insight and unique knowledge about closed-end funds – Management trustee as well as three of the nine current independent trustees, each of whom is up for re-election, are women – The Board has added three new independent trustees in the past three years – The election of Saba’s nominees would result in a less experienced and much less diverse Board Ø Board has exhibited accountability to NUO’s long-term shareholders by actively seeking to enhance long-term shareholder value and address discounts – Established Closed-End Fund Committee in 2012, which pursuant to its Board-approved charter is charged with closely monitoring the structure, operation and performance of Nuveen closed-end funds and working with management to identify potential actions that are in the long-term interests of fund shareholders – The Committee meets no less than four times each year and at these quarterly meeting reviews, and then reports to the full Board on: ü Overall market conditions as they relate to closed-end funds; ü Industry-wide closed-end fund distribution, total return and discount trends; ü Nuveen closed-end fund distributions, total returns and discounts in the context of industry-wide results and relative to peers, with a particular focus on outliers; ü Potential product actions, including but not limited to modification of investment guidelines, share buybacks, repositioning and mergers; and ü Detailed quarterly report on leverage management, which includes a review of leverage costs, contribution to performance, counterparty concentration and risk – (Continued on next slide) 6Proposal 1: Trustee Nominees NUO’s Board of Trustees unanimously recommends that shareholders vote “FOR” the election of the Board-nominated Trustees on the WHITE proxy card Ø NUO Board is diverse, independent, with deep closed-end fund experience and has demonstrated shareholder accountability by adding fresh perspectives in line with its governing principles – Experience across asset classes and market cycles affords them invaluable insight and unique knowledge about closed-end funds – Management trustee as well as three of the nine current independent trustees, each of whom is up for re-election, are women – The Board has added three new independent trustees in the past three years – The election of Saba’s nominees would result in a less experienced and much less diverse Board Ø Board has exhibited accountability to NUO’s long-term shareholders by actively seeking to enhance long-term shareholder value and address discounts – Established Closed-End Fund Committee in 2012, which pursuant to its Board-approved charter is charged with closely monitoring the structure, operation and performance of Nuveen closed-end funds and working with management to identify potential actions that are in the long-term interests of fund shareholders – The Committee meets no less than four times each year and at these quarterly meeting reviews, and then reports to the full Board on: ü Overall market conditions as they relate to closed-end funds; ü Industry-wide closed-end fund distribution, total return and discount trends; ü Nuveen closed-end fund distributions, total returns and discounts in the context of industry-wide results and relative to peers, with a particular focus on outliers; ü Potential product actions, including but not limited to modification of investment guidelines, share buybacks, repositioning and mergers; and ü Detailed quarterly report on leverage management, which includes a review of leverage costs, contribution to performance, counterparty concentration and risk – (Continued on next slide) 6

Proposal 1: Trustee Nominees (continued) Ø (continued) Board has exhibited accountability to NUO’s long-term shareholders by actively seeking to enhance long-term shareholder value and address discounts – The Committee is also actively engaged in monitoring Nuveen’s award-winning Closed-End Fund Investor Relations Program which seeks to ensure a robust and liquid secondary market for closed-end funds through education and outreach ® ü Includes Income Institute , an educational program for financial advisers ü Complements CEFConnect.com, sponsored by Nuveen closed-end funds, the leading website for comprehensive industry- wide closed-end fund information – The Audit Committee meets no less than 14 times per year and reviews and discusses the semi-annual and annual reports for every fund Ø Taken together, this oversight ensures close monitoring and timely action when warranted as evidenced by the fact that since 2012, the Board and Nuveen management have taken product actions involving over 100 closed-end funds, in each case delivering meaningful shareholder benefits Ø With respect to NUO, the Board has taken a number of actions designed to directly affect discounts and/or improve overall fund performance and return to shareholders: – In 2013, three other Nuveen Ohio funds were merged into NUO providing over $1.5 million in savings to date and improving returns to shareholders – In addition, an innovative, complex-wide fee structure – which is directly related to the funds’ unitary board for all Nuveen open-end and closed-end funds – saves NUO nearly $200,000 yearly and savings will grow as overall Nuveen fund assets grow – Leverage financing costs relative to base interest rates for NUO have been reduced by 25% since 2015 – In 2018, as discounts widened, the ongoing share buyback program generated over $500,000 in net asset value accretion from more than 200,000 shares repurchased 7Proposal 1: Trustee Nominees (continued) Ø (continued) Board has exhibited accountability to NUO’s long-term shareholders by actively seeking to enhance long-term shareholder value and address discounts – The Committee is also actively engaged in monitoring Nuveen’s award-winning Closed-End Fund Investor Relations Program which seeks to ensure a robust and liquid secondary market for closed-end funds through education and outreach ® ü Includes Income Institute , an educational program for financial advisers ü Complements CEFConnect.com, sponsored by Nuveen closed-end funds, the leading website for comprehensive industry- wide closed-end fund information – The Audit Committee meets no less than 14 times per year and reviews and discusses the semi-annual and annual reports for every fund Ø Taken together, this oversight ensures close monitoring and timely action when warranted as evidenced by the fact that since 2012, the Board and Nuveen management have taken product actions involving over 100 closed-end funds, in each case delivering meaningful shareholder benefits Ø With respect to NUO, the Board has taken a number of actions designed to directly affect discounts and/or improve overall fund performance and return to shareholders: – In 2013, three other Nuveen Ohio funds were merged into NUO providing over $1.5 million in savings to date and improving returns to shareholders – In addition, an innovative, complex-wide fee structure – which is directly related to the funds’ unitary board for all Nuveen open-end and closed-end funds – saves NUO nearly $200,000 yearly and savings will grow as overall Nuveen fund assets grow – Leverage financing costs relative to base interest rates for NUO have been reduced by 25% since 2015 – In 2018, as discounts widened, the ongoing share buyback program generated over $500,000 in net asset value accretion from more than 200,000 shares repurchased 7

Proposal 1: Trustee Nominees (continued) Saba has not made the case that change is warranted or that its nominees are more likely to enhance fund governance and achieve improved fund outcomes compared to Board-approved nominees Ø The Board’s record of actions refutes any claim that NUO’s 2018 discount is evidence of Board inattention and/or ineffectiveness – Rather, the primary driver of discounts in 2018 was rising short-term rates, creating negative market sentiment for leveraged municipal strategies – Over 80% of leveraged municipal strategies in 2018 traded on average at a discounts – over half of these at double digit discounts – And, in contrast to the claim that NUO’s expense ratio is high and uncompetitive, when appropriately calculated on total assets, NUO is in line with the median of both its Lipper closed-end fund peers and the lowest cost share class of Morningstar Ohio tax-exempt open-end funds Ø NUO has benefited from a board refreshment process that rests upon continuous, thoughtful trustee selection and development, guided by written, annually renewed governance principles and values driven by the needs of the fund’s core, long-term shareholders – Goal is to balance appropriate turnover against experience and perspective developed over time – Refreshment process relies upon an evergreen, active candidate pool, establishment of a search committee well in advance of need and an extensive interview process that strives to sustain trustee diversity of gender, ethnicity, opinion, perspective and experience – Board service on any other closed-end or open-end fund complex is not permitted; reinforces duty of loyalty to NUO’s core, long-term shareholders and avoids actual or appearance of conflicts of interest – Refreshment process would not have identified Saba’s nominees as potential candidates Peer group comparisons exclude Nuveen funds 8Proposal 1: Trustee Nominees (continued) Saba has not made the case that change is warranted or that its nominees are more likely to enhance fund governance and achieve improved fund outcomes compared to Board-approved nominees Ø The Board’s record of actions refutes any claim that NUO’s 2018 discount is evidence of Board inattention and/or ineffectiveness – Rather, the primary driver of discounts in 2018 was rising short-term rates, creating negative market sentiment for leveraged municipal strategies – Over 80% of leveraged municipal strategies in 2018 traded on average at a discounts – over half of these at double digit discounts – And, in contrast to the claim that NUO’s expense ratio is high and uncompetitive, when appropriately calculated on total assets, NUO is in line with the median of both its Lipper closed-end fund peers and the lowest cost share class of Morningstar Ohio tax-exempt open-end funds Ø NUO has benefited from a board refreshment process that rests upon continuous, thoughtful trustee selection and development, guided by written, annually renewed governance principles and values driven by the needs of the fund’s core, long-term shareholders – Goal is to balance appropriate turnover against experience and perspective developed over time – Refreshment process relies upon an evergreen, active candidate pool, establishment of a search committee well in advance of need and an extensive interview process that strives to sustain trustee diversity of gender, ethnicity, opinion, perspective and experience – Board service on any other closed-end or open-end fund complex is not permitted; reinforces duty of loyalty to NUO’s core, long-term shareholders and avoids actual or appearance of conflicts of interest – Refreshment process would not have identified Saba’s nominees as potential candidates Peer group comparisons exclude Nuveen funds 8

Proposal 1: Trustee Nominees (continued) Ø Saba has not demonstrated a bona fide interest in fund governance or stewardship in service to a fund’s core, long-term shareholders – Saba historically has withdrawn its nominees and sold out of its position whenever a fund acquiesces to its demands – Saba often nominates the same individuals for multiple proxy contests; one of Saba’s NUO nominees has also been nominated by Saba for proxy contests in 2019 involving Invesco, Western and BlackRock funds – Saba’s nominees have no experience with closed-end funds other than serving as a nominee in Saba’s activist campaigns. They in no way constitute a rounded slate that has NUO’s core, long-term shareholders in mind Ø Saba’s interests do not align with the long-term interests of Ohio residents who are NUO’s core, long-term shareholder – We believe Saba’s hedge fund investors seek capital appreciation, not income exempt from Federal and Ohio personal income taxes which is what NUO was designed to provide – Saba’s sole focus is on discount arbitrage, not on ways to enhance NUO’s ability to achieve its fundamental investment objective of double tax-exempt income, which we believe is the primary long-term driver of NUO’s market price relative to net asset value – In fact, if successful Saba would take actions that would actually impair rather than enhance NUO’s ability to achieve its fundamental investment objective We believe you should support the Board’s recommendation “FOR” the Board-approved nominees on the WHITE proxy card 9Proposal 1: Trustee Nominees (continued) Ø Saba has not demonstrated a bona fide interest in fund governance or stewardship in service to a fund’s core, long-term shareholders – Saba historically has withdrawn its nominees and sold out of its position whenever a fund acquiesces to its demands – Saba often nominates the same individuals for multiple proxy contests; one of Saba’s NUO nominees has also been nominated by Saba for proxy contests in 2019 involving Invesco, Western and BlackRock funds – Saba’s nominees have no experience with closed-end funds other than serving as a nominee in Saba’s activist campaigns. They in no way constitute a rounded slate that has NUO’s core, long-term shareholders in mind Ø Saba’s interests do not align with the long-term interests of Ohio residents who are NUO’s core, long-term shareholder – We believe Saba’s hedge fund investors seek capital appreciation, not income exempt from Federal and Ohio personal income taxes which is what NUO was designed to provide – Saba’s sole focus is on discount arbitrage, not on ways to enhance NUO’s ability to achieve its fundamental investment objective of double tax-exempt income, which we believe is the primary long-term driver of NUO’s market price relative to net asset value – In fact, if successful Saba would take actions that would actually impair rather than enhance NUO’s ability to achieve its fundamental investment objective We believe you should support the Board’s recommendation “FOR” the Board-approved nominees on the WHITE proxy card 9

Proposal 2: Board Declassification (Non-Binding) NUO’s Board of Trustees strongly supports a classified board structure and unanimously recommends that shareholders vote “AGAINST” the Saba Hedge Fund Proposal on the WHITE proxy card Ø Closed-end funds are fundamentally different from operating companies – They are subject to extensive regulation affording significant investor protections – For example, the 1940 Act requires, among other things, a majority of independent trustees, annual review of fund management, re-approval of the advisory contract and review of fund policies and procedures, all of which help to serve as a check on entrenchment of poorly performing managers – SEC views independent trustees as the “eyes and ears” of fund shareholders Ø Structure of listed closed-end funds makes them vulnerable to attacks from short-term investors seeking short- term arbitrage profits at the expense of a fund’s long-term shareholders – Closed-end funds typically trade at a discount to net asset value which creates an arbitrage opportunity for short-term investors like Saba – If able to take control of a fund board at an annual meeting, short-term investors will take actions to capture the discount as short-term gain for their own benefit at the expense of the fund’s long-term shareholders – Remaining long-term shareholders then bear the brunt of the costs of the proxy fight and resulting short-term actions of the activist who exits the fund: a higher expense ratio, unwanted tax liabilities and reduced income and return potential Ø Saba’s tactics have drawn scrutiny from Congress and regulators, who fear that long-term retail investors are being put at risk – “…[T]he growing practice of activist hedge funds attacking closed-end funds…[is]…not about improving governance, but rather about coercing closed-end funds that cannot adequately protect themselves.”- Rep. Gregory Meeks, D-NY, 9/25/19 – “[What]..is most troubling about this is that closed-end funds ordinarily are held by…‘buy-and-hold, mom-and-pop’ investors who bought the fund on the understanding that it wouldn’t be attacked in just this way.” – SEC Commissioner Robert Jackson Jr. 9/25/19 Statements cited from a September 25, 2019 meeting of the House Committee on Financial Services. 10Proposal 2: Board Declassification (Non-Binding) NUO’s Board of Trustees strongly supports a classified board structure and unanimously recommends that shareholders vote “AGAINST” the Saba Hedge Fund Proposal on the WHITE proxy card Ø Closed-end funds are fundamentally different from operating companies – They are subject to extensive regulation affording significant investor protections – For example, the 1940 Act requires, among other things, a majority of independent trustees, annual review of fund management, re-approval of the advisory contract and review of fund policies and procedures, all of which help to serve as a check on entrenchment of poorly performing managers – SEC views independent trustees as the “eyes and ears” of fund shareholders Ø Structure of listed closed-end funds makes them vulnerable to attacks from short-term investors seeking short- term arbitrage profits at the expense of a fund’s long-term shareholders – Closed-end funds typically trade at a discount to net asset value which creates an arbitrage opportunity for short-term investors like Saba – If able to take control of a fund board at an annual meeting, short-term investors will take actions to capture the discount as short-term gain for their own benefit at the expense of the fund’s long-term shareholders – Remaining long-term shareholders then bear the brunt of the costs of the proxy fight and resulting short-term actions of the activist who exits the fund: a higher expense ratio, unwanted tax liabilities and reduced income and return potential Ø Saba’s tactics have drawn scrutiny from Congress and regulators, who fear that long-term retail investors are being put at risk – “…[T]he growing practice of activist hedge funds attacking closed-end funds…[is]…not about improving governance, but rather about coercing closed-end funds that cannot adequately protect themselves.”- Rep. Gregory Meeks, D-NY, 9/25/19 – “[What]..is most troubling about this is that closed-end funds ordinarily are held by…‘buy-and-hold, mom-and-pop’ investors who bought the fund on the understanding that it wouldn’t be attacked in just this way.” – SEC Commissioner Robert Jackson Jr. 9/25/19 Statements cited from a September 25, 2019 meeting of the House Committee on Financial Services. 10

Proposal 2: Board Declassification (continued) Ø The current environment for closed-end funds is not dissimilar to ‘80s when arbitrageurs took large positions in public operating companies looking for greenmail – a tactic that was ultimately limited by law. – Until regulatory action protects investors in closed-end funds, a classified board is needed to protect core, long-term investors looking for the benefits of the fundamental investment mandate they expected Ø A classified board helps protect long-term closed-end fund investors from activist trustees uninterested in governance and unfamiliar with closed-end funds who can easily disrupt the board and its work, particularly if the activist trustees are not truly independent – In public operating companies, activist-appointed directors’ interests often coincide with common shareholder interests: operating improvement typically resulting in share price improvement for the benefit of all common shareholders – Unlike operating companies, closed-end funds have specific fundamental investment objectives (which cannot be changed without shareholder vote) which guide management and oversight of the fund – In closed-end funds like NUO, activists are seeking quick arbitrage profits at the expense of long-term shareholders whose investment goals align with the fund’s primary fundamental investment objective: attractive double tax-exempt income Ø Long-term shareholders incur significant expense from the short-term liquidity events forced on a fund by activist trustees – Liquidity events require sale of portfolio investments often generating a taxable event, which in the case of NUO is contrary toits fundamental investment objective of double tax-exempt income. – Liquidity events reduce fund size, resulting in a higher expense ratio and reduced income and return potential – A staggered board protects NUO’s core, long-term shareholders from the financial costs imposed by a short-term liquidity event that is not in their best interest 11Proposal 2: Board Declassification (continued) Ø The current environment for closed-end funds is not dissimilar to ‘80s when arbitrageurs took large positions in public operating companies looking for greenmail – a tactic that was ultimately limited by law. – Until regulatory action protects investors in closed-end funds, a classified board is needed to protect core, long-term investors looking for the benefits of the fundamental investment mandate they expected Ø A classified board helps protect long-term closed-end fund investors from activist trustees uninterested in governance and unfamiliar with closed-end funds who can easily disrupt the board and its work, particularly if the activist trustees are not truly independent – In public operating companies, activist-appointed directors’ interests often coincide with common shareholder interests: operating improvement typically resulting in share price improvement for the benefit of all common shareholders – Unlike operating companies, closed-end funds have specific fundamental investment objectives (which cannot be changed without shareholder vote) which guide management and oversight of the fund – In closed-end funds like NUO, activists are seeking quick arbitrage profits at the expense of long-term shareholders whose investment goals align with the fund’s primary fundamental investment objective: attractive double tax-exempt income Ø Long-term shareholders incur significant expense from the short-term liquidity events forced on a fund by activist trustees – Liquidity events require sale of portfolio investments often generating a taxable event, which in the case of NUO is contrary toits fundamental investment objective of double tax-exempt income. – Liquidity events reduce fund size, resulting in a higher expense ratio and reduced income and return potential – A staggered board protects NUO’s core, long-term shareholders from the financial costs imposed by a short-term liquidity event that is not in their best interest 11

Proposal 2: Board Declassification (continued) Ø A classified board is an important bulwark helping to defend the interests of NUO’s core, long-term shareholders: an activist like Saba should not be allowed to disrupt NUO’s board in order to serve its own short-term interests and jeopardize the fund’s ability to meet its fundamental investment objectives We believe you should support the Board’s recommendation “AGAINST” Saba’s proposal to restructure the Board on the WHITE proxy card 12Proposal 2: Board Declassification (continued) Ø A classified board is an important bulwark helping to defend the interests of NUO’s core, long-term shareholders: an activist like Saba should not be allowed to disrupt NUO’s board in order to serve its own short-term interests and jeopardize the fund’s ability to meet its fundamental investment objectives We believe you should support the Board’s recommendation “AGAINST” Saba’s proposal to restructure the Board on the WHITE proxy card 12

Conclusion § Under Board’s active stewardship, NUO has been providing Ohio residents – the fund’s core, long-term shareholders – with the experience they want by achieving the fund’s fundamental investment objectives. NUO has generated attractive double tax-exempt income and competitive total returns over the long-term. § A proactive, diverse and independent Board has demonstrated shareholder accountability. The Board’s and the Closed-End Fund Committee’s efforts have resulted in a variety of actions to enhance long-term shareholder value and address discounts. These actions include fund mergers, share buy backs, reduced leverage costs relative to base rates and fee savings through complex-wide fee reductions. § The Board has taken similar fund-specific actions across the Nuveen family of closed-end funds, and has also developed broader, complex-wide programs to support the closed-end fund secondary market by promoting greater awareness, understanding and usage of closed-end funds – earning extensive external recognition. § Discounts are common in the closed-end fund market; we believe they are primarily driven by market sentiment and municipal market fundamentals and secondarily by fund income and total returns. NUO’s discount reflects underlying Ohio municipal market fundamentals, not Board inattention or ineffectiveness. § Saba has not made the case that change is needed or that its nominees would be better able than the Board nominees to oversee NUO as it seeks to continue to provide the attractive investment outcomes that will attract core, long-term shareholders to the fund. 13Conclusion § Under Board’s active stewardship, NUO has been providing Ohio residents – the fund’s core, long-term shareholders – with the experience they want by achieving the fund’s fundamental investment objectives. NUO has generated attractive double tax-exempt income and competitive total returns over the long-term. § A proactive, diverse and independent Board has demonstrated shareholder accountability. The Board’s and the Closed-End Fund Committee’s efforts have resulted in a variety of actions to enhance long-term shareholder value and address discounts. These actions include fund mergers, share buy backs, reduced leverage costs relative to base rates and fee savings through complex-wide fee reductions. § The Board has taken similar fund-specific actions across the Nuveen family of closed-end funds, and has also developed broader, complex-wide programs to support the closed-end fund secondary market by promoting greater awareness, understanding and usage of closed-end funds – earning extensive external recognition. § Discounts are common in the closed-end fund market; we believe they are primarily driven by market sentiment and municipal market fundamentals and secondarily by fund income and total returns. NUO’s discount reflects underlying Ohio municipal market fundamentals, not Board inattention or ineffectiveness. § Saba has not made the case that change is needed or that its nominees would be better able than the Board nominees to oversee NUO as it seeks to continue to provide the attractive investment outcomes that will attract core, long-term shareholders to the fund. 13

Conclusion (continued) § Saba does not have a bona fide interest in fund governance, but instead would seek to coerce NUO into taking actions that would generate short-term trading profits for Saba’s hedge fund investors at the expense of NUO’s core, long-term shareholders. § We strongly feel the Board-nominated trustees along with a classified Board structure will provide the best protection for NUO shareholders against coercive action by short-term hedge fund investors like Saba, in-line with the investor protections afforded by the 1940 Act. We believe you should support the Board’s recommendation “FOR” the Board nominees (including those elected by Preferred shareholders) and “AGAINST” Saba’s proposal to restructure the Board on the WHITE proxy card 14Conclusion (continued) § Saba does not have a bona fide interest in fund governance, but instead would seek to coerce NUO into taking actions that would generate short-term trading profits for Saba’s hedge fund investors at the expense of NUO’s core, long-term shareholders. § We strongly feel the Board-nominated trustees along with a classified Board structure will provide the best protection for NUO shareholders against coercive action by short-term hedge fund investors like Saba, in-line with the investor protections afforded by the 1940 Act. We believe you should support the Board’s recommendation “FOR” the Board nominees (including those elected by Preferred shareholders) and “AGAINST” Saba’s proposal to restructure the Board on the WHITE proxy card 14

Appendix A Supplemental Fund Performance Information 15Appendix A Supplemental Fund Performance Information 15

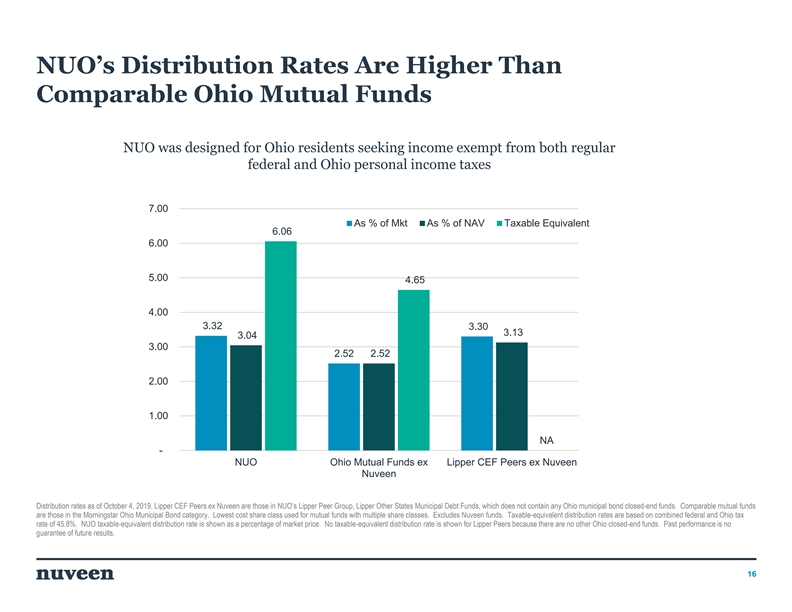

NUO’s Distribution Rates Are Higher Than Comparable Ohio Mutual Funds NUO was designed for Ohio residents seeking income exempt from both regular federal and Ohio personal income taxes 7.00 As % of Mkt As % of NAV Taxable Equivalent 6.06 6.00 5.00 4.65 4.00 3.32 3.30 3.13 3.04 3.00 2.52 2.52 2.00 1.00 NA - NUO Ohio Mutual Funds ex Lipper CEF Peers ex Nuveen Nuveen Distribution rates as of October 4, 2019. Lipper CEF Peers ex Nuveen are those in NUO’s Lipper Peer Group, Lipper Other States Municipal Debt Funds, which does not contain any Ohio municipal bond closed-end funds. Comparable mutual funds are those in the Morningstar Ohio Municipal Bond category. Lowest cost share class used for mutual funds with multiple share classes. Excludes Nuveen funds. Taxable-equivalent distribution rates are based on combined federal and Ohio tax rate of 45.8%. NUO taxable-equivalent distribution rate is shown as a percentage of market price. No taxable-equivalent distribution rate is shown for Lipper Peers because there are no other Ohio closed-end funds. Past performance is no guarantee of future results. 16NUO’s Distribution Rates Are Higher Than Comparable Ohio Mutual Funds NUO was designed for Ohio residents seeking income exempt from both regular federal and Ohio personal income taxes 7.00 As % of Mkt As % of NAV Taxable Equivalent 6.06 6.00 5.00 4.65 4.00 3.32 3.30 3.13 3.04 3.00 2.52 2.52 2.00 1.00 NA - NUO Ohio Mutual Funds ex Lipper CEF Peers ex Nuveen Nuveen Distribution rates as of October 4, 2019. Lipper CEF Peers ex Nuveen are those in NUO’s Lipper Peer Group, Lipper Other States Municipal Debt Funds, which does not contain any Ohio municipal bond closed-end funds. Comparable mutual funds are those in the Morningstar Ohio Municipal Bond category. Lowest cost share class used for mutual funds with multiple share classes. Excludes Nuveen funds. Taxable-equivalent distribution rates are based on combined federal and Ohio tax rate of 45.8%. NUO taxable-equivalent distribution rate is shown as a percentage of market price. No taxable-equivalent distribution rate is shown for Lipper Peers because there are no other Ohio closed-end funds. Past performance is no guarantee of future results. 16

NUO Has Outperformed Comparable Closed-End Funds NUO has outperformed the total returns of its Lipper peer group (both including and excluding other Nuveen funds) on market price as well as on NAV for the 1-, 3-, 5- and 10-year trailing periods 25.0 15.0 NUO NUO 22.5 21.5 Lipper Lipper 12.1 12.5 Lipper ex Nuveen Lipper ex Nuveen 20.0 10.6 17.5 10.0 15.4 9.1 15.0 12.5 7.5 10.0 5.6 10.0 5.3 5.2 4.9 5.0 4.3 7.5 3.9 5.9 3.5 5.7 5.3 5.2 3.2 4.9 2.8 4.5 5.0 2.5 2.9 2.5 1.2 1.2 - - 1 Year 3 Years 5 Years 10 Years 1 Year 3 Years 5 Years 10 Years Returns on Market Price Returns on Net Asset Value (NAV) Morningstar returns as of September 30 2019. Comparable closed-end funds are those in the Fund’s Lipper Peer Group: Lipper Other States Municipal Debt Funds. Past performance is no guarantee of future results. 17NUO Has Outperformed Comparable Closed-End Funds NUO has outperformed the total returns of its Lipper peer group (both including and excluding other Nuveen funds) on market price as well as on NAV for the 1-, 3-, 5- and 10-year trailing periods 25.0 15.0 NUO NUO 22.5 21.5 Lipper Lipper 12.1 12.5 Lipper ex Nuveen Lipper ex Nuveen 20.0 10.6 17.5 10.0 15.4 9.1 15.0 12.5 7.5 10.0 5.6 10.0 5.3 5.2 4.9 5.0 4.3 7.5 3.9 5.9 3.5 5.7 5.3 5.2 3.2 4.9 2.8 4.5 5.0 2.5 2.9 2.5 1.2 1.2 - - 1 Year 3 Years 5 Years 10 Years 1 Year 3 Years 5 Years 10 Years Returns on Market Price Returns on Net Asset Value (NAV) Morningstar returns as of September 30 2019. Comparable closed-end funds are those in the Fund’s Lipper Peer Group: Lipper Other States Municipal Debt Funds. Past performance is no guarantee of future results. 17

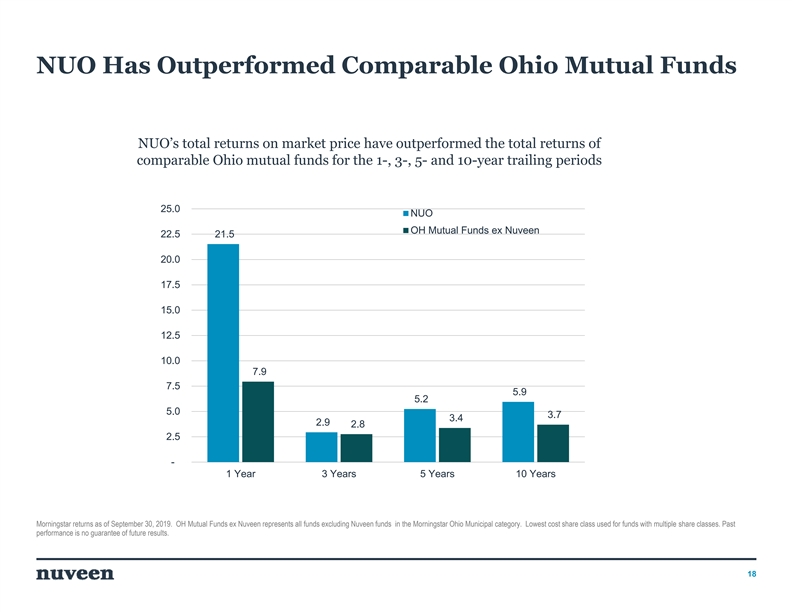

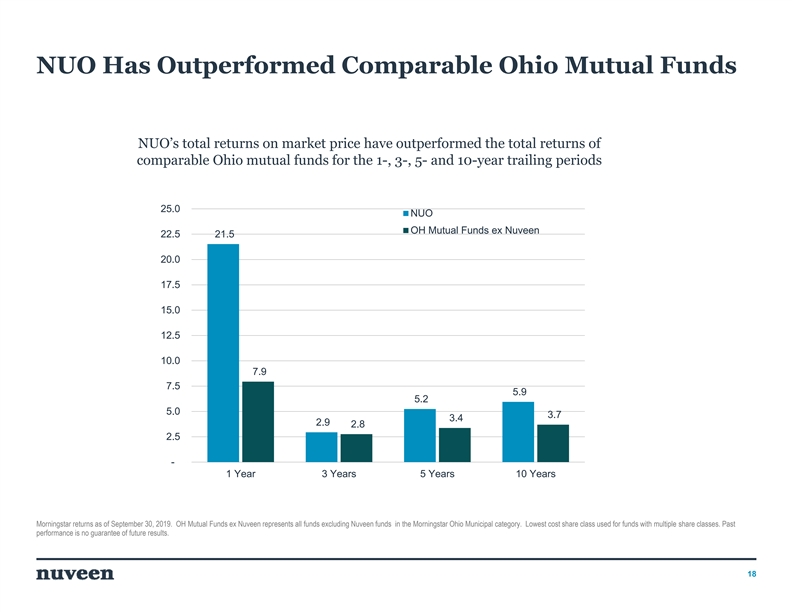

NUO Has Outperformed Comparable Ohio Mutual Funds NUO’s total returns on market price have outperformed the total returns of comparable Ohio mutual funds for the 1-, 3-, 5- and 10-year trailing periods 25.0 NUO OH Mutual Funds ex Nuveen 22.5 21.5 20.0 17.5 15.0 12.5 10.0 7.9 7.5 5.9 5.2 5.0 3.7 3.4 2.9 2.8 2.5 - 1 Year 3 Years 5 Years 10 Years Morningstar returns as of September 30, 2019. OH Mutual Funds ex Nuveen represents all funds excluding Nuveen funds in the Morningstar Ohio Municipal category. Lowest cost share class used for funds with multiple share classes. Past performance is no guarantee of future results. 18NUO Has Outperformed Comparable Ohio Mutual Funds NUO’s total returns on market price have outperformed the total returns of comparable Ohio mutual funds for the 1-, 3-, 5- and 10-year trailing periods 25.0 NUO OH Mutual Funds ex Nuveen 22.5 21.5 20.0 17.5 15.0 12.5 10.0 7.9 7.5 5.9 5.2 5.0 3.7 3.4 2.9 2.8 2.5 - 1 Year 3 Years 5 Years 10 Years Morningstar returns as of September 30, 2019. OH Mutual Funds ex Nuveen represents all funds excluding Nuveen funds in the Morningstar Ohio Municipal category. Lowest cost share class used for funds with multiple share classes. Past performance is no guarantee of future results. 18

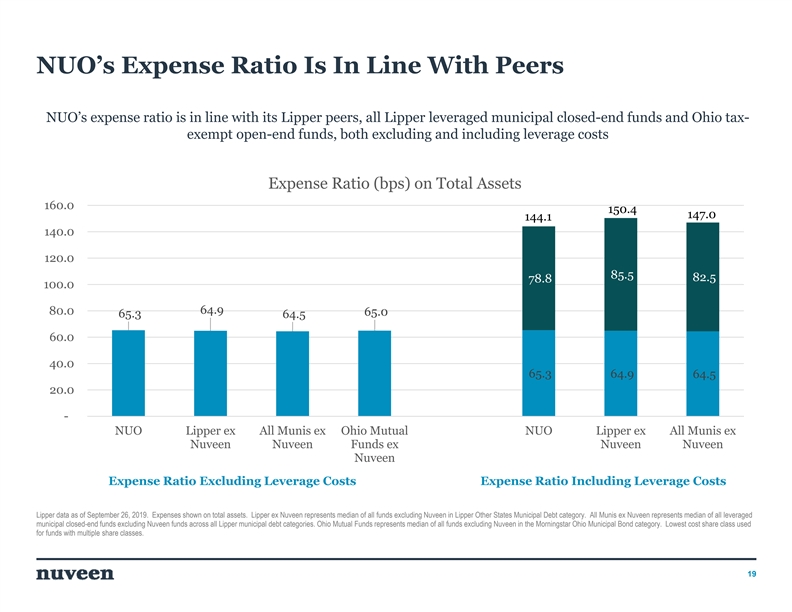

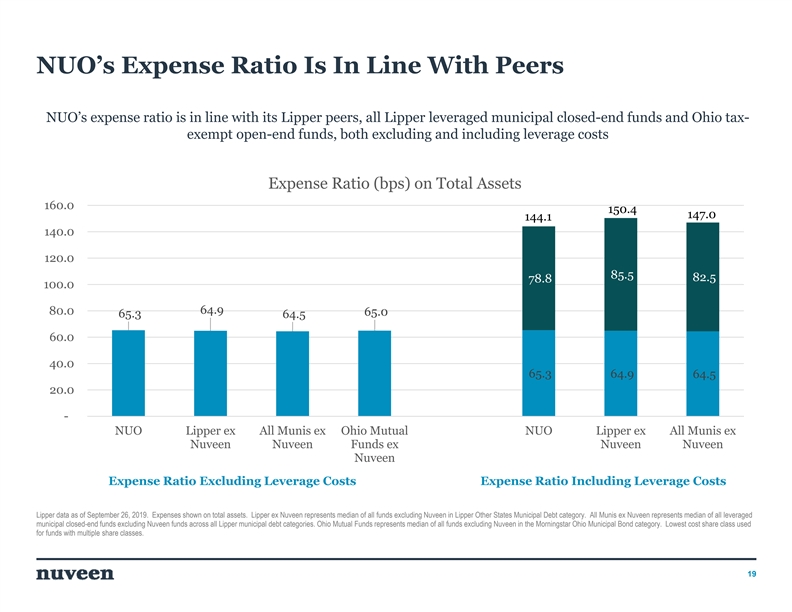

NUO’s Expense Ratio Is In Line With Peers NUO’s expense ratio is in line with its Lipper peers, all Lipper leveraged municipal closed-end funds and Ohio tax- exempt open-end funds, both excluding and including leverage costs Expense Ratio (bps) on Total Assets 160.0 150.4 147.0 144.1 140.0 120.0 85.5 82.5 78.8 100.0 64.9 80.0 65.0 65.3 64.5 60.0 40.0 65.3 64.9 64.5 20.0 - NUO Lipper ex All Munis ex Ohio Mutual NUO Lipper ex All Munis ex Nuveen Nuveen Funds ex Nuveen Nuveen Nuveen Expense Ratio Excluding Leverage Costs Expense Ratio Including Leverage Costs Lipper data as of September 26, 2019. Expenses shown on total assets. Lipper ex Nuveen represents median of all funds excluding Nuveen in Lipper Other States Municipal Debt category. All Munis ex Nuveen represents median of all leveraged municipal closed-end funds excluding Nuveen funds across all Lipper municipal debt categories. Ohio Mutual Funds represents median of all funds excluding Nuveen in the Morningstar Ohio Municipal Bond category. Lowest cost share class used for funds with multiple share classes. 19NUO’s Expense Ratio Is In Line With Peers NUO’s expense ratio is in line with its Lipper peers, all Lipper leveraged municipal closed-end funds and Ohio tax- exempt open-end funds, both excluding and including leverage costs Expense Ratio (bps) on Total Assets 160.0 150.4 147.0 144.1 140.0 120.0 85.5 82.5 78.8 100.0 64.9 80.0 65.0 65.3 64.5 60.0 40.0 65.3 64.9 64.5 20.0 - NUO Lipper ex All Munis ex Ohio Mutual NUO Lipper ex All Munis ex Nuveen Nuveen Funds ex Nuveen Nuveen Nuveen Expense Ratio Excluding Leverage Costs Expense Ratio Including Leverage Costs Lipper data as of September 26, 2019. Expenses shown on total assets. Lipper ex Nuveen represents median of all funds excluding Nuveen in Lipper Other States Municipal Debt category. All Munis ex Nuveen represents median of all leveraged municipal closed-end funds excluding Nuveen funds across all Lipper municipal debt categories. Ohio Mutual Funds represents median of all funds excluding Nuveen in the Morningstar Ohio Municipal Bond category. Lowest cost share class used for funds with multiple share classes. 19

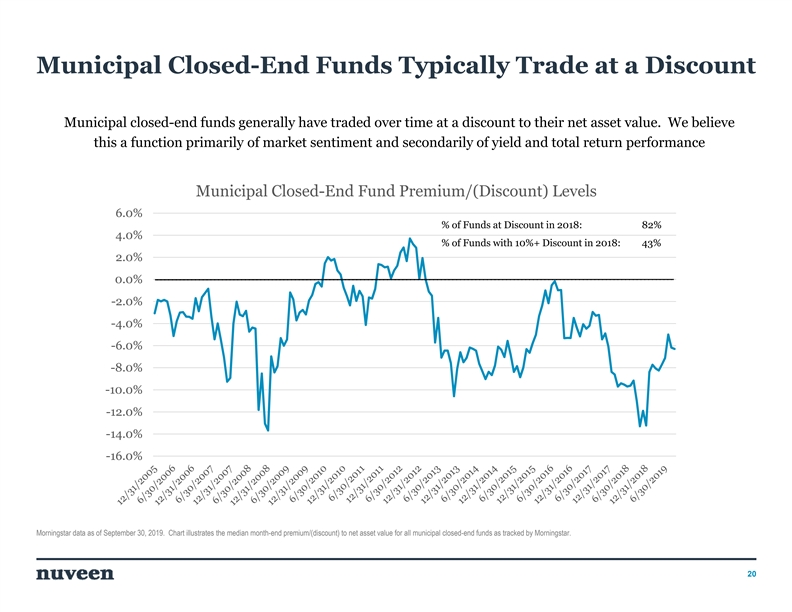

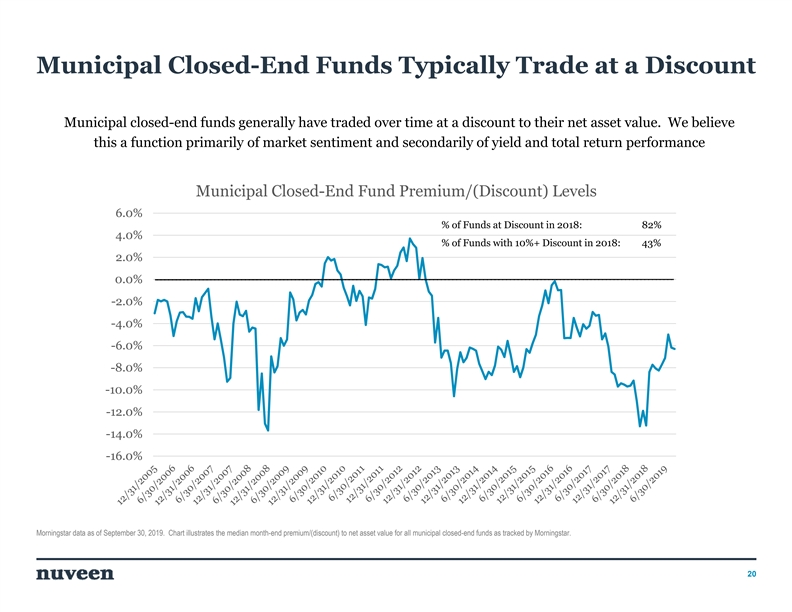

Municipal Closed-End Funds Typically Trade at a Discount Municipal closed-end funds generally have traded over time at a discount to their net asset value. We believe this a function primarily of market sentiment and secondarily of yield and total return performance Municipal Closed-End Fund Premium/(Discount) Levels 6.0% % of Funds at Discount in 2018: 82% 4.0% % of Funds with 10%+ Discount in 2018: 43% 2.0% 0.0% -2.0% -4.0% -6.0% -8.0% -10.0% -12.0% -14.0% -16.0% Morningstar data as of September 30, 2019. Chart illustrates the median month-end premium/(discount) to net asset value for all municipal closed-end funds as tracked by Morningstar. 20Municipal Closed-End Funds Typically Trade at a Discount Municipal closed-end funds generally have traded over time at a discount to their net asset value. We believe this a function primarily of market sentiment and secondarily of yield and total return performance Municipal Closed-End Fund Premium/(Discount) Levels 6.0% % of Funds at Discount in 2018: 82% 4.0% % of Funds with 10%+ Discount in 2018: 43% 2.0% 0.0% -2.0% -4.0% -6.0% -8.0% -10.0% -12.0% -14.0% -16.0% Morningstar data as of September 30, 2019. Chart illustrates the median month-end premium/(discount) to net asset value for all municipal closed-end funds as tracked by Morningstar. 20

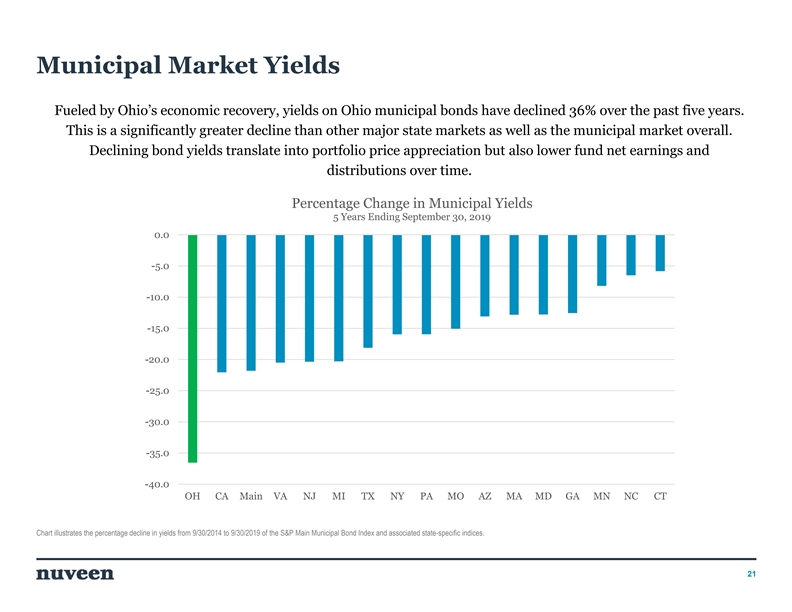

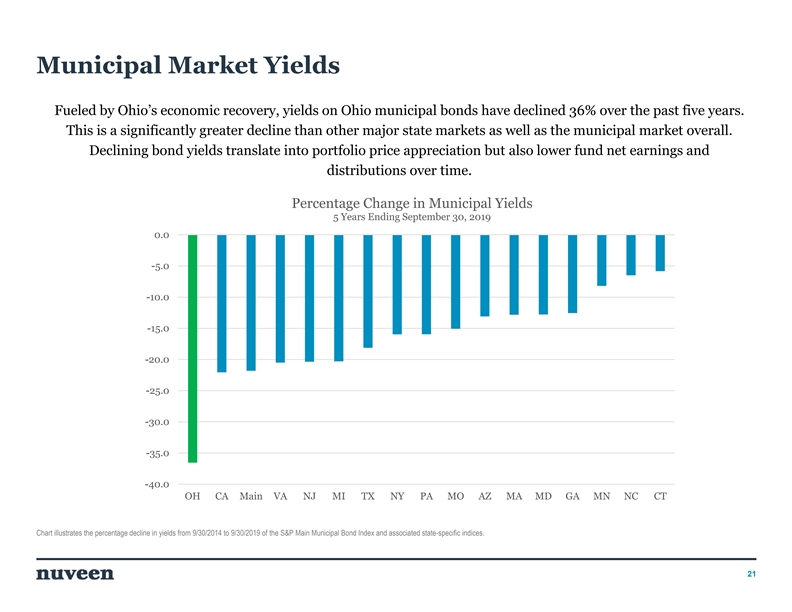

Municipal Market Yields Fueled by Ohio’s economic recovery, yields on Ohio municipal bonds have declined 36% over the past five years. This is a significantly greater decline than other major state markets as well as the municipal market overall. Declining bond yields translate into portfolio price appreciation but also lower fund net earnings and distributions over time. Percentage Change in Municipal Yields 5 Years Ending September 30, 2019 0.0 -5.0 -10.0 -15.0 -20.0 -25.0 -30.0 -35.0 -40.0 OH CA Main VA NJ MI TX NY PA MO AZ MA MD GA MN NC CT Chart illustrates the percentage decline in yields from 9/30/2014 to 9/30/2019 of the S&P Main Municipal Bond Index and associated state-specific indices. 21Municipal Market Yields Fueled by Ohio’s economic recovery, yields on Ohio municipal bonds have declined 36% over the past five years. This is a significantly greater decline than other major state markets as well as the municipal market overall. Declining bond yields translate into portfolio price appreciation but also lower fund net earnings and distributions over time. Percentage Change in Municipal Yields 5 Years Ending September 30, 2019 0.0 -5.0 -10.0 -15.0 -20.0 -25.0 -30.0 -35.0 -40.0 OH CA Main VA NJ MI TX NY PA MO AZ MA MD GA MN NC CT Chart illustrates the percentage decline in yields from 9/30/2014 to 9/30/2019 of the S&P Main Municipal Bond Index and associated state-specific indices. 21

Appendix B Board Trustee Biographies 22Appendix B Board Trustee Biographies 22

Board Nominees for Election by All Shareholders Ms. Stockdale retired at the end of 2012 as Executive Director of the Gaylord and Dorothy Donnelley Foundation, a private foundation supporting land conservation and artistic vitality. In 2013, she joined the board of the U.S. Endowment for Forestry and Communities and rejoined the board of the Land Trust Alliance. Her previous positions include the Executive Directorship of the Great Lakes Protection Fund, Senior Staff Associate at the Chicago Community Trust and Executive Director of Openlands. She has served on the board of the Brushwood Center at Ryerson Woods, as a member of the Advisory Council of the National Zoological Park and the Governor’s Science Advisory Council (Illinois), a board member of the Forefront (formerly the Donors Forum), and a Commissioner of the Illinois and Michigan Canal National Heritage Corridor. Ms. Stockdale, a native of the United Kingdom, has a Bachelor of Science degree in geography JUDITH M. from Durham University (UK) and a Master of Forest Science degree from Yale University. Ms. Stockdale has been a director of the funds STOCKDALE since 1997. She serves as a member of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (since 2002) and was its Chair (2011-2014); and she previously served on the Dividend Committee (2007-2016). Ms. Stone retired from the New York State Division of the Budget in 2004, having served as its Director for nearly five years and as Deputy Director from 1995 through 1999. She is currently on the Board of Directors of CBOE Global Markets. She has also served as the Chair of the New York Racing Association Oversight Board, as a Commissioner on the New York State Commission on Public Authority Reform and as a member of the Boards of Directors of several New York State public authorities. Ms. Stone has a B.A. from Skidmore College in Business Administration. Ms. Stone was elected to the Board in December, 2006, she serves on the Board’s Audit Committee (since 2011); Chair (since 2019); and the Closed-End Fund Committee (since 2012); Chair (2013-2018). She previously served as a member of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (2007-2010). CAROLE E. STONE Ms. Wolff retired from Skadden, Arps, Slate, Meagher & Flom LLP in 2014 after more than 30 years of providing client service in the Mergers & Acquisitions Group where she advised boards and senior management on U.S. and international corporate, securities, regulatory andstrategic matters,including governance,shareholder,fiduciary, operational and management issues. Since 2005 she has been a Trustee of New-York Presbyterian Hospital, serving as Chair of the Patient Safety & Quality Committee since 2019 and has served as a Trustee since 2004 of The John A. Hartford Foundation where she currently is the Chair. From 2013-2017, she was a Board member of Travelers Insurance Company of Canada and The Dominion of Canada General Insurance Company. From 2005-2015 she was trustee of Mt. Holyoke College and served as Vice Chair of the Board from 2011. Ms. Wolff received her Bachelor of Arts from Mt. Holyoke College MARGARET L. and her Juris Doctor from Case Western Reserve University School of Law. Ms. Wolff was elected to the Board in 2016 and she is a member WOLFF of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (since 2016); and serves on the Dividend Committee (since 2017). 23Board Nominees for Election by All Shareholders Ms. Stockdale retired at the end of 2012 as Executive Director of the Gaylord and Dorothy Donnelley Foundation, a private foundation supporting land conservation and artistic vitality. In 2013, she joined the board of the U.S. Endowment for Forestry and Communities and rejoined the board of the Land Trust Alliance. Her previous positions include the Executive Directorship of the Great Lakes Protection Fund, Senior Staff Associate at the Chicago Community Trust and Executive Director of Openlands. She has served on the board of the Brushwood Center at Ryerson Woods, as a member of the Advisory Council of the National Zoological Park and the Governor’s Science Advisory Council (Illinois), a board member of the Forefront (formerly the Donors Forum), and a Commissioner of the Illinois and Michigan Canal National Heritage Corridor. Ms. Stockdale, a native of the United Kingdom, has a Bachelor of Science degree in geography JUDITH M. from Durham University (UK) and a Master of Forest Science degree from Yale University. Ms. Stockdale has been a director of the funds STOCKDALE since 1997. She serves as a member of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (since 2002) and was its Chair (2011-2014); and she previously served on the Dividend Committee (2007-2016). Ms. Stone retired from the New York State Division of the Budget in 2004, having served as its Director for nearly five years and as Deputy Director from 1995 through 1999. She is currently on the Board of Directors of CBOE Global Markets. She has also served as the Chair of the New York Racing Association Oversight Board, as a Commissioner on the New York State Commission on Public Authority Reform and as a member of the Boards of Directors of several New York State public authorities. Ms. Stone has a B.A. from Skidmore College in Business Administration. Ms. Stone was elected to the Board in December, 2006, she serves on the Board’s Audit Committee (since 2011); Chair (since 2019); and the Closed-End Fund Committee (since 2012); Chair (2013-2018). She previously served as a member of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (2007-2010). CAROLE E. STONE Ms. Wolff retired from Skadden, Arps, Slate, Meagher & Flom LLP in 2014 after more than 30 years of providing client service in the Mergers & Acquisitions Group where she advised boards and senior management on U.S. and international corporate, securities, regulatory andstrategic matters,including governance,shareholder,fiduciary, operational and management issues. Since 2005 she has been a Trustee of New-York Presbyterian Hospital, serving as Chair of the Patient Safety & Quality Committee since 2019 and has served as a Trustee since 2004 of The John A. Hartford Foundation where she currently is the Chair. From 2013-2017, she was a Board member of Travelers Insurance Company of Canada and The Dominion of Canada General Insurance Company. From 2005-2015 she was trustee of Mt. Holyoke College and served as Vice Chair of the Board from 2011. Ms. Wolff received her Bachelor of Arts from Mt. Holyoke College MARGARET L. and her Juris Doctor from Case Western Reserve University School of Law. Ms. Wolff was elected to the Board in 2016 and she is a member WOLFF of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (since 2016); and serves on the Dividend Committee (since 2017). 23

Board Nominees for Election by Preferred Shareholders Dr.Hunter isDean Emeritusofthe HenryB. TippieCollege of Business at the University of Iowa. He served as dean of the College from July 2006 until his retirement on June 30, 2012. He had been Dean and Distinguished Professor of Finance at the University of Connecticut School of Business since June 2003. From 1995 to 2003, he was the Senior Vice President and Director of Research at the Federal Reserve Bank of Chicago. While there he served as the Bank’s Chief Economist and was an Associate Economist on the Federal Reserve System’s Federal Open Market Committee (FOMC). In addition to serving as a Vice President in charge of financial markets and basic research at the Federal Reserve Bank in Atlanta, he held faculty positions at Emory University, Atlanta University, the University of Georgia and Northwestern University. A past Director of the Credit Research Center at Georgetown University, past President of the Financial Management Association International, and past President of Beta Gamma Sigma, The International Business Honor Society, Dr. WILLIAM C. Hunter has consulted with numerous foreign central banks and official agencies in Western, Central and Eastern Europe, Asia, Central HUNTER America and South America. From 1990 to 1995, he was a U.S. Treasury Advisor to Central and Eastern Europe. He has been a Director of Wellmark, Inc. since 2009 and was a Director of the Xerox Corporation from 2004 to 2018 and SS&C Technologies, Inc. from 2004 to 2005. Dr. Hunter was elected to the Board in 2003 and he currently serves as a member of the Board’s Audit Committee (since 2018); and Dividend Committee (since 2014); Chair (since 2015). He previously served on the Compliance, Risk Management & Regulatory Oversight Committee (2004-2017); and Closed-End Fund Committee (2012-2015). Mr. Moschner is a consultant in the wireless industry and, in July 2012, founded Northcroft Partners, LLC, a management consulting firm that provides operational, management and governance solutions. Prior to founding Northcroft Partners, LLC, Mr. Moschner held various positions at Leap Wireless International, Inc., a provider of wireless services, where he was as a consultant from February 2011 to July 2012, Chief Operating Officer from July 2008 to February 2011, and Chief Marketing Officer from August 2004 to June 2008. Before he joined Leap Wireless International, Inc., Mr. Moschner was President of the Verizon Card Services division of Verizon Communications, Inc. from 2000 to 2003, and President of One Point Services at One Point Communications from 1999 to 2000. Mr. Moschner also served at Zenith Electronics Corporation as Director, President and Chief Executive Officer from 1995 to 1996, and as Director, President and Chief Operating Officer from 1994 to 1995. From 1996 until 2016, he was a member of the Board of Directors of Wintrust Financial ALBIN F. MOSCHNER Corporation. Since 2019, Mr. Moschner has been the Chairman of the Board of Directors of USA Technologies, Inc. (Director since 2012). He is a board member emeritus of the Advisory Boards of the Kellogg School of Management (since 1995) and previously served as a board member of the Archdiocese of Chicago Financial Council (2012-2018). Mr. Moschner received a Bachelor of Engineering degree in Electrical Engineering from The City College of New York in 1974 and a Master of Science degree in Electrical Engineering from Syracuse University in 1979. Mr. Moschner joined the Fund Board in July, 2016, he currently serves as a member of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (since 2016); Closed-End Fund Committee (since 2016); and Dividend Committee (since 2018). 24Board Nominees for Election by Preferred Shareholders Dr.Hunter isDean Emeritusofthe HenryB. TippieCollege of Business at the University of Iowa. He served as dean of the College from July 2006 until his retirement on June 30, 2012. He had been Dean and Distinguished Professor of Finance at the University of Connecticut School of Business since June 2003. From 1995 to 2003, he was the Senior Vice President and Director of Research at the Federal Reserve Bank of Chicago. While there he served as the Bank’s Chief Economist and was an Associate Economist on the Federal Reserve System’s Federal Open Market Committee (FOMC). In addition to serving as a Vice President in charge of financial markets and basic research at the Federal Reserve Bank in Atlanta, he held faculty positions at Emory University, Atlanta University, the University of Georgia and Northwestern University. A past Director of the Credit Research Center at Georgetown University, past President of the Financial Management Association International, and past President of Beta Gamma Sigma, The International Business Honor Society, Dr. WILLIAM C. Hunter has consulted with numerous foreign central banks and official agencies in Western, Central and Eastern Europe, Asia, Central HUNTER America and South America. From 1990 to 1995, he was a U.S. Treasury Advisor to Central and Eastern Europe. He has been a Director of Wellmark, Inc. since 2009 and was a Director of the Xerox Corporation from 2004 to 2018 and SS&C Technologies, Inc. from 2004 to 2005. Dr. Hunter was elected to the Board in 2003 and he currently serves as a member of the Board’s Audit Committee (since 2018); and Dividend Committee (since 2014); Chair (since 2015). He previously served on the Compliance, Risk Management & Regulatory Oversight Committee (2004-2017); and Closed-End Fund Committee (2012-2015). Mr. Moschner is a consultant in the wireless industry and, in July 2012, founded Northcroft Partners, LLC, a management consulting firm that provides operational, management and governance solutions. Prior to founding Northcroft Partners, LLC, Mr. Moschner held various positions at Leap Wireless International, Inc., a provider of wireless services, where he was as a consultant from February 2011 to July 2012, Chief Operating Officer from July 2008 to February 2011, and Chief Marketing Officer from August 2004 to June 2008. Before he joined Leap Wireless International, Inc., Mr. Moschner was President of the Verizon Card Services division of Verizon Communications, Inc. from 2000 to 2003, and President of One Point Services at One Point Communications from 1999 to 2000. Mr. Moschner also served at Zenith Electronics Corporation as Director, President and Chief Executive Officer from 1995 to 1996, and as Director, President and Chief Operating Officer from 1994 to 1995. From 1996 until 2016, he was a member of the Board of Directors of Wintrust Financial ALBIN F. MOSCHNER Corporation. Since 2019, Mr. Moschner has been the Chairman of the Board of Directors of USA Technologies, Inc. (Director since 2012). He is a board member emeritus of the Advisory Boards of the Kellogg School of Management (since 1995) and previously served as a board member of the Archdiocese of Chicago Financial Council (2012-2018). Mr. Moschner received a Bachelor of Engineering degree in Electrical Engineering from The City College of New York in 1974 and a Master of Science degree in Electrical Engineering from Syracuse University in 1979. Mr. Moschner joined the Fund Board in July, 2016, he currently serves as a member of the Board’s Compliance, Risk Management & Regulatory Oversight Committee (since 2016); Closed-End Fund Committee (since 2016); and Dividend Committee (since 2018). 24

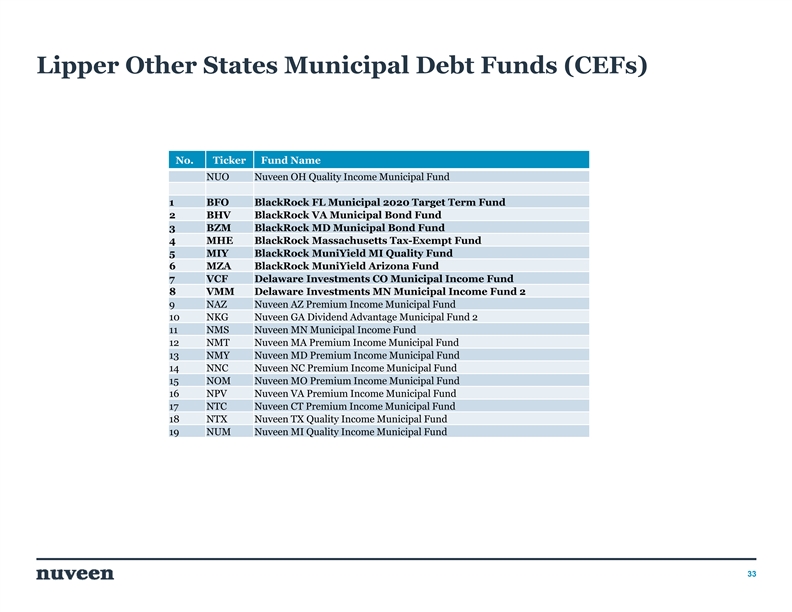

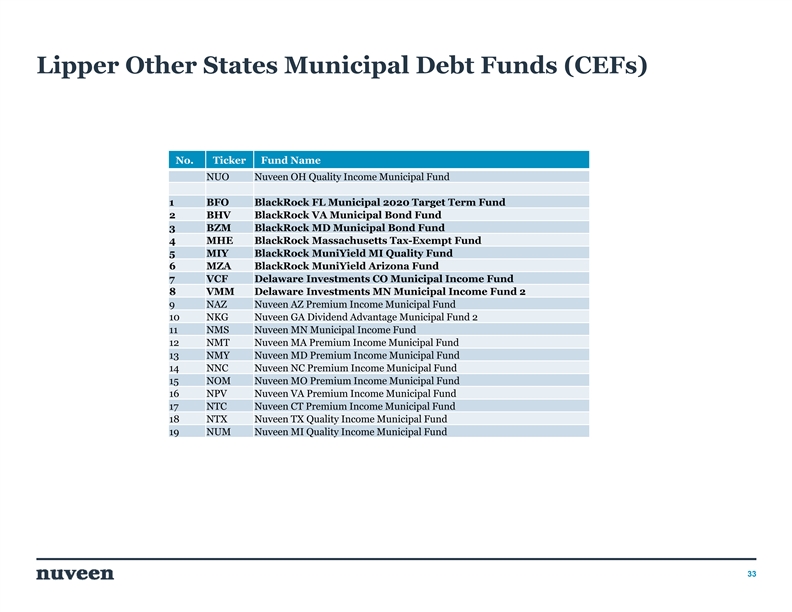

Trustees Not Up for Election Ms. Cook serves as an interested trustee on the Nuveen Fund Board and leads Nuveen’s global client organization, overseeing product, marketing, distribution and solutions for the firm, which has over $1 trillion in assets under management. She leads Nuveen’s strategy to deliver consultative, outcome-focused advice and investment solutions to clients worldwide. Prior to the integration of the TIAA and Nuveen Investments asset management organizations, Margo was Co-President of Nuveen Investments. Margo joined the firm in 2008. Before joining the firm, she led the global institutional investment organization at Bear Stearns Asset Management, responsible for the equity and fixed income investment teams, product management and institutional clients. Prior to that, Margo held various senior investment leadership roles at BNY Mellon for over 20 years, including CIO, Institutional Investments and Head of Fixed Income. Margo serves as a trustee on the Nuveen Fund Board and Executive Sponsor of LEAD, a women’s professional organization with the mission of adding and retaining women in MARGO COOK, CFA asset management. She is the Chair of the All Stars Project of Chicago Board and is on the Executive Committee of The University of Rhode Island Foundation Board of Trustees. She graduated with a bachelor’s degree in Finance from the University of Rhode Island and an Executive M.B.A. from Columbia University. She holds the CFA designation. Ms. Cook joined the Board in 2016. Chairman of the Hall-Perrine Foundation, a private philanthropic corporation, since 2019 (Board member since 1996), Mr. Evans was formerly President and Chief Operating Officer of the SCI Financial Group, Inc., a regional financial services firm headquartered in Cedar Rapids, Iowa. Formerly, he was a member of the Board of the Federal Reserve Bank of Chicago, a Director of Alliant Energy, and Member and President Pro Tem of the Board of Regents for the State of Iowa University System. Mr. Evans is Chairman of the Board of United Fire Group, sits on the Board of Source Media Group, is a public member of the American Board of Orthopedic Surgery, and is a Life Trustee of Coe College. He has a Bachelor of Arts degree from Coe College and an MBA from the University of Iowa. Mr. Evans has been a director since 1999. Heservesasamemberofthe Closed-End Fund Committee(since2012); Chair (since 2019); Audit Committee (1999-2010; since 2014); Chair (2004-2007; 2014-2018); and previously serving as a member of the Dividend Committee (2003-2015); Chair (2008-2014). JACK EVANS 25Trustees Not Up for Election Ms. Cook serves as an interested trustee on the Nuveen Fund Board and leads Nuveen’s global client organization, overseeing product, marketing, distribution and solutions for the firm, which has over $1 trillion in assets under management. She leads Nuveen’s strategy to deliver consultative, outcome-focused advice and investment solutions to clients worldwide. Prior to the integration of the TIAA and Nuveen Investments asset management organizations, Margo was Co-President of Nuveen Investments. Margo joined the firm in 2008. Before joining the firm, she led the global institutional investment organization at Bear Stearns Asset Management, responsible for the equity and fixed income investment teams, product management and institutional clients. Prior to that, Margo held various senior investment leadership roles at BNY Mellon for over 20 years, including CIO, Institutional Investments and Head of Fixed Income. Margo serves as a trustee on the Nuveen Fund Board and Executive Sponsor of LEAD, a women’s professional organization with the mission of adding and retaining women in MARGO COOK, CFA asset management. She is the Chair of the All Stars Project of Chicago Board and is on the Executive Committee of The University of Rhode Island Foundation Board of Trustees. She graduated with a bachelor’s degree in Finance from the University of Rhode Island and an Executive M.B.A. from Columbia University. She holds the CFA designation. Ms. Cook joined the Board in 2016. Chairman of the Hall-Perrine Foundation, a private philanthropic corporation, since 2019 (Board member since 1996), Mr. Evans was formerly President and Chief Operating Officer of the SCI Financial Group, Inc., a regional financial services firm headquartered in Cedar Rapids, Iowa. Formerly, he was a member of the Board of the Federal Reserve Bank of Chicago, a Director of Alliant Energy, and Member and President Pro Tem of the Board of Regents for the State of Iowa University System. Mr. Evans is Chairman of the Board of United Fire Group, sits on the Board of Source Media Group, is a public member of the American Board of Orthopedic Surgery, and is a Life Trustee of Coe College. He has a Bachelor of Arts degree from Coe College and an MBA from the University of Iowa. Mr. Evans has been a director since 1999. Heservesasamemberofthe Closed-End Fund Committee(since2012); Chair (since 2019); Audit Committee (1999-2010; since 2014); Chair (2004-2007; 2014-2018); and previously serving as a member of the Dividend Committee (2003-2015); Chair (2008-2014). JACK EVANS 25