ANNUAL INFORMATION FORM

FOR THE FISCAL PERIOD (15 MONTHS)

ENDED DECEMBER 31, 2008

AS AT MARCH 31, 2009

ITEM 2. TABLE OF CONTENTS

- 2 -

Preliminary Notes

Documents Incorporate by Reference

This discussion includes certain statements that may be deemed “forward-looking statements”. All statements in this discussion, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements are discussed herein and include market prices, exploitation and exploration successes, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. |

Incorporated by reference into this annual information form (the “Annual Information Form” or “AIF”) are the audited consolidated financial statements and Management Discussion and Analysis for Taseko Mines Limited (the “Company” or “Taseko”) for the fiscal year (fifteen months) ended December 31, 2008 and the fiscal year ended September 30, 2007 together with the auditor’s report thereon. The financial statements are available for review on the SEDAR website located atwww.sedar.com. All financial information in this Annual Information Form is prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) using Canadian dollars.

Also incorporated by reference is the technical report “Technical Report on the 105 Million Ton Increase in Mineral Reserves at the Gibraltar Mine” dated January 23, 2009, prepared by Scott Jones, P. Eng., and the technical report “Technical Report, Executive Summary Feasibility Study of the Prosperity Gold – Copper Project” dated October 15, 2007, prepared by Scott Jones, P. Eng. Both technical reports have been filed on Taseko’s profile on SEDAR atwww.sedar.com.

Currency and Metric Equivalents

The Company’s accounts are maintained in Canadian dollars and all dollar amounts herein are expressed in Canadian dollars unless otherwise indicated. .

The following factors for converting Imperial measurements into metric equivalents are provided:

| To convert from Imperial | To metric | Multiply by |

| | | |

| acres | hectares | 0.405 |

| feet | metres | 0.305 |

| miles | kilometres | 1.609 |

| tons (2000 pounds) | tonnes | 0.907 |

| ounces (troy)/ton | grams/tonne | 34.286 |

- 3 -

In this AIF the following defined terms have the meanings set forth below:

| NYSE Amex | The New York Stock Exchange which has incorporated the former American Stock exchange, being one of the two stock exchanges (together with the TSX) on which the Common Shares are listed. |

| | |

| Common Shares | The Company’s common shares without par value, being the only class or kind of the Company’s authorized capital. |

| | |

| Company | Taseko Mines Limited, including its subsidiaries, unless the context requires otherwise. |

| | |

| Carbonatite deposit | Carbonatites deposits are igneous rocks largely consisting of the carbonate minerals calcite and dolomite which contain the niobium mineral pyrochlore, rare earth minerals or copper sulphide minerals. |

| | |

| Epithermal deposit | A mineral deposit formed at low temperature (50-200°C), usually within one kilometer of the earth’s surface, often as structurally controlled veins. |

| | |

| Flotation | Flotation is a method of mineral separation whereby after crushing and grinding ore, froth created in a slurry by a variety of reagents, causes some finely crushed minerals to float to the surface where they are skimmed off. |

| | |

| HQ | A letter name specifying the dimensions of bits, core barrels, and drill rods in the H-size and Q-group wireline diamond drilling system having a core diameter of 63.5 mm and a hole diameter of 96 mm. |

| | |

Induced Polarization

(“IP”) Survey | A geophysical survey used to identify a feature that appears to be different from the typical or background survey results when tested for levels of electro- conductivity. IP detects both chargeable, pyrite-bearing rock and non- conductive rock that has high content of quartz. |

| | |

| Mineral Deposit | A deposit of mineralization, which may or may not be ore. |

| | |

| Mineral Symbols | Ag – silver; Au – gold; Cu – copper; Pb – lead; Zn – Zinc; Mo – molybdenum; Nb - niobium. |

| | |

| NQ | A letter name specifying the dimensions of bits, core barrels, and drill rods in the N-size and Q-group wireline diamond drilling system having a core diameter of 47.6 mm and a hole diameter of 75.7 mm |

| | |

| Porphyry deposit | A type of mineral deposit in which ore minerals are widely disseminated, generally of low grade but large tonnage. |

- 4 -

Solvent Extraction/

Electrowinning

(“SX/EW”) | Solvent extraction is the technique of transferring a solute from one solution to another; for example when copper oxide is dissolved into solution, copper becomes the solute. Electrowinning is the process in which an electric current flows between a pair of electrodes (anode & cathode) in a solution containing metal ions (electrolyte). Metal is deposited on the cathode in accordance with the metal’s ability to gain or lose electrons. Since ion deposition is selective, the cathode product is generally high grade and requires little further refining. |

| | |

| TSX | The Toronto Stock Exchange, one of the two stock exchanges on which the Common Shares are listed, along with NYSE Amex. |

Resource Category (Classifications) Used in this AIF

The discussion of mineral deposit classifications in this AIF adheres to the resource/reserve definitions and classification criteria developed by the Canadian Institute of Mining and Metallurgy in 2005. Estimated mineral resources fall into two broad categories dependent on whether the economic viability of them has been established and these are namely “resources” (economic viability not established) and ore “reserves” (viable economic production is feasible). Resources are sub-divided into categories depending on the confidence level of the estimate based on level of detail of sampling and geological understanding of the deposit. The categories, from lowest confidence to highest confidence, are inferred resource, indicated resource and measured resource. Reserves are similarly sub-divided by order of confidence into probable (lowest) and proven (highest). These classifications can be more particularly described as follows:

A “Mineral Resource” is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

An “Inferred Mineral Resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

An “Indicated Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

A “Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate

- 5 -

techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

A “Mineral Reserve” is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

A “Probable Mineral Reserve” is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

A “Proven Mineral Reserve” is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. The US Securities and Exchange Commission require permits in hand or imminent to classify mineralized material as reserves.

For United States reporting purposes, SEC Industry Guide 7 (under the United States Securities Exchange Act of 1934 (the “Exchange Act”), as interpreted by Staff of the United States Securities and Exchange Commission (the “SEC”), applies different standards in order to classify mineralization as a reserve. As a result, the definitions of proven and probable reserved used in National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) differ from the definitions in the SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards.

ITEM 3. CORPORATE STRUCTURE

Taseko Mines Limited was incorporated on April 15, 1966, pursuant to theCompany Actof the Province of British Columbia. This corporate legislation was superseded in 2004 by theBritish Columbia CorporationsAct which is now the corporate law statute that governs Taseko.

Taseko has one material active wholly owned subsidiary, Gibraltar Mines Ltd. (“Gibraltar”), a second active but not material subsidiary Aley Corporation (“Aley”), and three non-material, inactive subsidiaries, Cuisson Lake Mines Ltd. (which is 70% owned and holds certain Gibraltar Mine mineral interests), 688888 BC Ltd. (which is wholly owned) and Taseko Acquisitionsub Ltd. (which is wholly owned). Taseko owns 100% of the common shares of Gibraltar but none of Gibraltar’s issued preferred shares.

The head office of Taseko is located at Suite 300, 905 West Pender Street, Vancouver, British Columbia, Canada V6C 1L6, telephone (604) 778 373-4533, facsimile (778) 373-4534. The Company’s legal registered office is in care of its Canadian attorneys Lang Michener LLP, Barristers & Solicitors, at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada V6E 4N7, telephone (604) 689-9111, facsimile (604) 685-7084.

- 6 -

In this Annual Information Form, the terms “Company” or “Taseko” refer to Taseko Mines Limited and all its subsidiaries together unless the context otherwise clearly requires. Certain terms used herein are defined in the glossary of this Annual Information Form or in the disclosure to which the term relates.

ITEM 4. GENERAL DEVELOPMENT OF THE BUSINESS

The principal business activity of Taseko for the past three years has been the operation and capacity expansion of its Gibraltar Mine which constitutes the majority of the activity disclosed by Taseko’s consolidated financial statements summarized below.

The consolidated financial statements below have been prepared in accordance with Canadian generally accepted accounting principles (“GAAP”), and are expressed in thousands of Canadian dollars except for per share and share amounts.

| | | As at December | | | As at September 30 | |

| | | 31 | | | | | | | |

| Balance Sheets | | 2008 | | | 2007 | | | 2006 | |

| Current assets | $ | 41,283 | | $ | 94,619 | | $ | 149,447 | |

| Mineral properties | | 32,610 | | | 18,407 | | | 2,628 | |

| Property, plant and equipment | | 292,390 | | | 158,492 | | | 43,817 | |

| Other assets | | 111,962 | | | 105,745 | | | 101,569 | |

| Total assets | $ | 478,245 | | $ | 377,263 | | | 297,461 | |

| | | | | | | | | | |

| Current liabilities | | 112,053 | | | 44,589 | | | 47,863 | |

| Other liabilities | | 131,285 | | | 169,014 | | | 148,664 | |

| Shareholders’ equity | | 234,907 | | | 163,660 | | | 100,934 | |

| Total liabilities & shareholders’ equity | $ | 478,245 | | $ | 377,263 | | $ | 297,461 | |

| | | | | | | | | | |

| | | Fifteen months | | | | | | | |

| | | ended December | | | | | | | |

| | | 31 | | | Year ended September 30 | |

| Statements of Operations | | 2008 | | | 2007 | | | 2006 | |

| Revenue | $ | 231,678 | | $ | 218,426 | | $ | 161,900 | |

| Cost of sales | | (196,261 | ) | | (109,533 | ) | | (103,628 | ) |

| Amortization | | (7,363 | ) | | (3,155 | ) | | (3,412 | ) |

| Operating profit | | 28,054 | | $ | 105,738 | | $ | 54,860 | |

| Accretion of reclamation obligation | | 1,451 | | | 1,777 | | | 1,732 | |

| Exploration | | 11,864 | | | 8,967 | | | 3,544 | |

| Foreign exchange loss (gain) | | 4,032 | | | 233 | | | (289 | ) |

| Gain on asset retirement obligation change of estimates | | (6,917 | ) | | (4,570 | ) | | – | |

| Loss on advances on equipment | | 862 | | | – | | | – | |

| Loss on extinguishment of capital leases | | – | | | – | | | 240 | |

| General and administration | | 11,034 | | | 6,501 | | | 5,286 | |

| Ledcor termination fee | | – | | | – | | | 3,500 | |

| Gain on sale of marketable securities | | (1,034 | ) | | (1,508 | ) | | – | |

| Interest and other income | | (9,701 | ) | | (11,093 | ) | | (7,170 | ) |

| Interest expense | | 8,284 | | | 5,947 | | | 4,594 | |

| Interest accretion on convertible debt | | 2,938 | | | 2,922 | | | 1,280 | |

| Stock-based compensation | | 6,442 | | | 6,771 | | | 3,182 | |

| Change in fair market value of financial instruments | | 886 | | | 1,925 | | | – | |

| Earnings (loss) before income taxes | $ | (30,141 | ) | $ | 87,866 | | $ | 38,961 | |

| Current income tax recovery (expense) | | 2,151 | | | (3,959 | ) | | (4,397 | ) |

| Future income tax recovery (expense) | | 3,446 | | | (35,645 | ) | | (1,648 | ) |

| Earnings (loss) for the year | $ | 3,510 | | $ | 48,262 | | $ | 32,916 | |

| | | | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | | |

| Unrealized gain (loss) on reclamation deposits | | 1,859 | | | (419 | ) | | – | |

| Unrealized gain (loss) on marketable securities/investments | | (11,295 | ) | | 4,710 | | | – | |

| Reclassification of realized gain on sale of marketable securities | | (1,152 | ) | | (1,508 | ) | | – | |

| Tax effect | | 1,570 | | | (445 | ) | | – | |

| Other comprehensive income (loss) | $ | (9,018 | ) | $ | 2,338 | | $ | – | |

| Total comprehensive income (loss) | $ | (5,508 | ) | $ | 50,600 | | $ | 32,916 | |

| Basic earnings (loss) per share | $ | 0.02 | | $ | 0.37 | | $ | 0.29 | |

| Diluted earnings (loss) per share | $ | 0.02 | | $ | 0.36 | | $ | 0.26 | |

- 8 -

| | | Fifteen months | | | | | | | |

| | | ended December | | | | | | | |

| | | 31 | | | Year ended September 30 | |

| Statements of Operations | | 2008 | | | 2007 | | | 2006 | |

| Basic weighted average number of common shares outstanding | | 142,062 | | | 129,218 | | | 113,554 | |

| Diluted weighted average number of common shares outstanding | | 156,928 | | | 142,278 | | | 126,462 | |

Taseko’s business is focused on, firstly, enhancing the production of copper and molybdenum from its producing Gibraltar mine (the “Gibraltar Mine”) and, secondly, on demonstrating the economic feasibility and social acceptability of its Prosperity gold and copper property (the “Prosperity Project”). A feasibility study has been completed for Prosperity Project, demonstrating mineral reserves as defined under Canadian Securities regulations under NI 43-101. As no permits are in place, the Prosperity Project does not have reserves under US SEC Guide 7 Standards. Both the Gibraltar Mine and the Prosperity Project are located in central British Columbia, Canada.

The Company also has two non material properties located in British Columbia, including the advanced exploration stage property known as the Harmony project, and the mid stage exploration niobium project known as the Aley project. Mineralization at the Harmony project has not at this time been determined to constitute a proven or probable reserve, and there are no mineral resources currently estimated at the Aley project. Taseko and its subsidiaries owns all its projects outright.

After focusing on the recommencement of copper production at the Gibraltar Mine over fiscal 2005 through 2007, the Company reactivated environmental and economic assessments of the Prosperity Project. A $2 million feasibility study on the Prosperity Project was completed in September 2007, projecting the technical and economic feasibility of the project.

In fiscal 2008, Taseko expanded the ore concentrator and other production improvements at the Gibraltar Mine. Taseko also continued to advance the Prosperity Project through the environmental assessment process. Work on the Harmony and Aley projects was curtailed in 2008 and 2009 because of deterioration of economic conditions and commodity prices. Project assessment work will resume once prevailing commodity prices suggest new opportunities for these projects. Taseko believes that there will continue to be demand for copper, molybdenum and gold for the foreseeable future and there will be a continuing need to replace depleted reserves from existing mines hence it sees value in projects which may not yet seem economic.

During the past three years, the Company’s two material projects have developed as follows:

| | a) | The Gibraltar Mine obtained government permitting and re-started the operation in early October 2004 following several years on care and maintenance as a result of low metal prices. Commercial production started on January 1, 2005 and has continued to the present. Total production between restart and up to December 31, 2008 was 15.7 million tons milled, producing 225.8 million lb. of copper in concentrate, 6.9 million lb. cathode copper and 2.6 million lb. of molybdenum. Construction of the Phase 1 mill expansion was completed in February 2008. The ramp up to the rated processing capacity of 46,000 tons per day (“tpd”) has been ongoing since the completion of construction. The construction schedule of a Phase 2 expansion program, designed to increase concentrator from 46,000 tpd to 55,000 tpd, has been modified as a result of management’s review of capital spending in the face of the global credit market crisis. The regrind and cleaner flotation circuits will be complete in the summer of 2009 as they are not cash intensive to complete and they provide very robust payback by enhancing both copper and molybdenum recoveries. Ramp up to 55,000 tpd will occur following completion of the remainder of the Phase 2 program and completion of the in-pit crusher and conveyor. |

- 9 -

| | b) | The Prosperity Project was the subject of a feasibility study which was completed in September 2007 for a 70,000 tonnes per day operation with a twenty year mine life. An environmental assessment under the Canadian and British Columbia Environmental Assessment Acts is underway with the completion of both processes expected in the fall of 2009. |

The Company’s two non-material projects have developed as follows:

| | a) | The Harmony project was significantly moved towards mine development permitting during a period of active exploration during the late 1990s further described herein. Currently the property is being maintained in good standing but further technical work has been deferred. |

| | | |

| | b) | Taseko acquired the Aley project in 2007 and carried out an initial exploration program for niobium. Currently the Aley project is being maintained in good standing but further technical work has been deferred. |

The provincial government of British Columbia and the federal government of Canada both have jurisdiction over a wide variety of activities and persons affected by mining including local communities, habitat users and others having or claiming to have interests which may be affected by mining activity. The Company’s management believes that there is a reasonable level of public acceptance of mining in British Columbia and that responsible mining projects make a positive contribution to the Province of British Columbia and the local communities where or near to where these projects are located. This has enabled the Company to have positive dialogue with local communities, First Nations, and government agencies. It has also helped in advancing the Prosperity Project’s evaluation process forward.

In August 2006, the Company completed an offering of 7.125% convertible bonds in the aggregate principal amount of US$30,000,000. The proceeds from this offering were used for further investments in the Company’s producing assets.

In June 2007, the Company completed the acquisition of all the issued and outstanding shares in the capital of a private company whose sole asset was the Aley project (niobium) for a total cash consideration of $1.5 million, as well as 894,730 common shares. In addition, the Company also purchased the residual net smelter royalties from Teck Cominco Metals Limited (“Teck”) for a total cash consideration paid to Teck of $300,000 and the issuance of 240,000 common shares and 120,000 warrants. Each warrant is exercisable into one common share at the exercise price of $3.48 per share until June 4, 2009. The Aley project hosts a niobium deposit of uncertain size and grade. Niobium is a metal used in making high strength steel required in the manufacture of automobiles, bridges, pipes, jet turbines and other high technology applications.

On May 2, 2008, the Company completed the acquisition of all the issued and outstanding shares in the capital of a private company, Oakmont Ventures Ltd. (“Oakmont”), whose sole asset was the 30% net profits interest in certain claims that are part of the Gibraltar Mine property located adjacent to the Gibraltar East pit. This acquisition was completed through the issuance of 1,000,000 common shares of the Company with an aggregate value of $5,220,000.

As announced in a news release on December 11, 2008, proven and probable mineral reserves at the Gibraltar Mine have increased by approximately 105 million tons to a total of 472.4 million tons (See “Description of Business – Gibraltar Mine – Reserves”). In January 2009, the Company prepared a NI 43-101 compliant technical report containing the revised reserve estimates and updated capital and operating costs and filed it atwww.sedar.com.

- 10 -

On March 24, 2009, the Company announced that it had entered into an agreement with a syndicate of Underwriters which agreed to buy from Taseko 13,793,104 common shares at an issue price of $1.45 per common share (the “Offering”) for gross proceeds of approximately $20 million. The Company also intends to issue, via a non-brokered private placement at the same price as the Offering, approximately $5 million of common shares. The net proceeds from the Offering and the private placement are intended to be used for general working capital and corporate purposes. Closing of the Offering and the private placement is expected to occur on or about April 15, 2009 and is subject to execution of definitive agreements, securities regulatory approvals and customary closing conditions as of the date hereof.

The Company has not made any significant acquisitions or dispositions since January 2006.

ITEM 5. DESCRIPTION OF BUSINESS

Taseko is a mining company that generally seeks to acquire, explore and advance development of large tonnage mineral deposits which, under metals price assumptions that fall within historical averages, are potentially capable of supporting a mine for 10 years and longer.

- 11 -

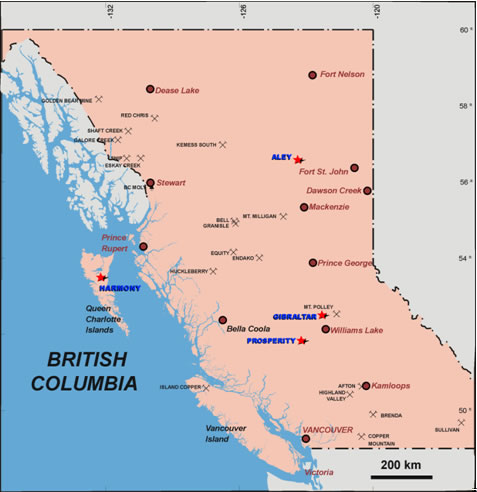

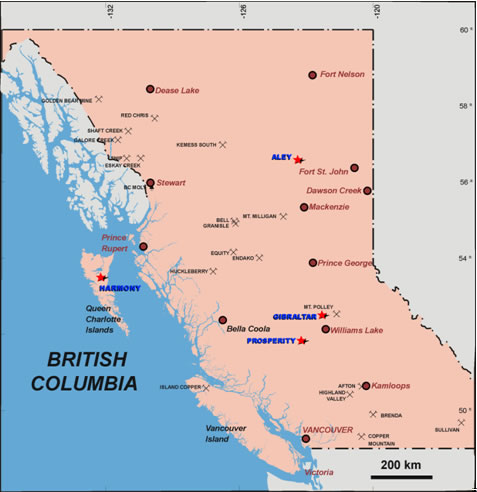

Figure 1 below shows the location of the Company’s four properties in British Columbia, Canada.

Figure 1: Location of the Taseko’s Properties

Source: Taseko

The Gibraltar Mine

Unless stated otherwise, information of a technical or scientific nature related to the Gibraltar Mine contained in this AIF is summarized or extracted from a technical report entitled “Technical Report on the 105 Million Ton Increase in Mineral Reserves at the Gibraltar Mine” dated January 23, 2009 (the “Gibraltar Technical Report”), prepared by Scott Jones, P. Eng. filed on Taseko’s profile on SEDAR atwww.sedar.com. Mr. Jones is not independent of Taseko by virtue of being employed by the Company as Vice-President, Engineering.

Property Description and Location

The Gibraltar Mine site covers approximately 109 square km, located at latitude 52°30’N and longitude 122°16’W in the Granite Mountain area, approximately 65 km north of the City of Williams Lake in south-central British Columbia, Canada. The Gibraltar Mine property consists of 249 tenures held 100% by the Company as summarized in Table 1 below.

- 12 -

Table 1: Mineral Tenures – Gibraltar Mine

| Tenure Type | Number | Area (ha) |

| Claims | 219 | 14,006.86 |

| Leases | 30 | 1,889.68 |

| Total | 249 | 15,896.54 |

There are 30 mining leases at Gibraltar which are valid until at least July 26, 2023 as long as renewal fees, which are due on an annual basis, are paid. Rights to the surface accompany each mining lease. Additionally all mining claims at Gibraltar are valid until February 15, 2011 with the exception of three claims that have expiry dates of June 12, June 24 and October 19 in 2009. It is intended that all leases and claims will be renewed prior to their renewal fees being due (in the case of the leases) and prior to their expiry in the case of the claims.

There are several land parcels for which surface rights were purchased outright. There is one fee simple lot at Gibraltar (L3728) on which the plant site is located and annual taxes are paid. In addition Gibraltar holds four other land parcels: DL9170, DL9483 and DL588.

The Gibraltar Mine has operated for most of the last 35 years from four open pits. Waste dumps have been developed in various areas adjacent to the open pits and tailings have been deposited in an impoundment area, located about three km north of the mill.

A mill expansion completed in 2008 included commissioning of a new 34’ diameter Semi-Autogenous Grinding (“SAG”) mill, conversion of the rod and ball mill circuit to ball mill grinding only, and replacement of rougher and cleaner flotation cells with large state of the art cells. The rated throughput capacity increased from 36,000 tons per day to 46,000 tons per day.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access to the Gibraltar Mine from Williams Lake, British Columbia is via Highway 97 to McLeese Lake, and then a paved road provides access to the Gibraltar Mine site, a total road distance of 65 km.

The Canadian National Railway has rail service to facilitate the shipping of copper concentrates through to the Pacific Ocean port of North Vancouver. A rail siding and storage shed for the shipment of concentrate is located 26 km from the mine site. Electricity is obtained from BC Hydro. Natural gas is provided by Avista Energy and Terasen Gas. The communities of Williams Lake and Quesnel are sufficiently close to the site to supply goods, services, and personnel to the Gibraltar Mine. The number of active personnel at the Gibraltar Mine at the end of December 2008 was 397 individuals.

The Gibraltar Mine mineral claims cover an area of gentle topography; local relief is in the order of 200 meters. The plant site is located at an elevation of approximately 1,100 meters above sea level. The project area has a moderate continental climate with cold winters and warm summers. Ambient air temperature ranges from a winter minimum of -34° C to a summer maximum of 35°C. The Gibraltar Mine operates year round.

Make-up fresh water for the mine site is obtained from a set of wells on the Gibraltar Mine property. The Company owns and operates the concentrate rail load-out facility on the CN rail line at Macalister.

Gibraltar Mine History

In 1964, Gibraltar Mines Ltd. (Gibraltar) acquired a group of claims in the McLeese Lake area from Malabar Mining Co. Ltd. Canadian Exploration Limited (Canex), at that time a wholly-owned subsidiary

- 13 -

of Placer Development (Placer), and Duval Corporation (Duval) had also been exploring on claims known as the Pollyanna Group which they had acquired adjacent to Gibraltar’s claims. In 1969, Gibraltar, Canex and Duval entered into an agreement providing for the commingling of Gibraltar’s claims with the Pollyanna Group. In 1971 Gibraltar acquired Duval’s remaining interest in the property.

Preliminary development of the Gibraltar Mine began in October 1970. The concentrator commenced production on March 8, 1972 and was fully operational by March 31, 1972. Mining and milling operations were suspended on December 1, 1993 due to low copper prices and recommenced in September 1994 following the increase in copper prices. A cathode copper plant design with an annual capacity of 4,535 tonnes (10 million lb.) of market-ready copper metal began operation in October 1986. Up to the 1998 shutdown, as discussed below, 38,430 tonnes (84.7 million lb.) of electro won copper had been produced from this facility.

In October 1996, Westmin Resources Limited (“Westmin”) acquired 100% control of Gibraltar and in December 1997, Boliden Limited Westmin (Canada) Limited (“Boliden”) acquired Westmin. In March 1998, Boliden announced that it would cease mining operation at Gibraltar Mine at the end of 1998.

On July 21, 1999, Taseko’s subsidiary, Gibraltar Mines Ltd., purchased the Gibraltar mine assets from Boliden Westmin (Canada) Limited (“Boliden”) and certain of its affiliates, including all mineral interests, mining and processing equipment and facilities, and assumed responsibility for reclamation obligations estimated at that time at about $33 million. Pursuant to the terms of the acquisition, Gibraltar acquired mining equipment, parts and supplies inventories valued at $19 million, an existing British Columbia Government environmental deposit of $8 million, and mineral interests valued at $3.3 million, and received $20.1 million in cash over 18 months from closing, of which $17 million was received pursuant to a 10-year non-interest bearing convertible debenture issued to Boliden and subsequently acquired by NVI Mining Ltd (“NVI”). Gibraltar assumed the estimated reclamation liability pertaining to the Gibraltar mine of $32.9 million and Taseko guaranteed Gibraltar’s obligations to Boliden. On April 2, 2008, NVI issued a notice to the Company to convert the principal amount of the debenture of $17,000,000 at an effective conversion rate of $5.14 per common share, which would have resulted in 3,307,393 common shares of the Company being issued to NVI. The Company issued 2,612,971 to NVI and made a cash payment of $3,569,000 in lieu of issuing the remaining 694,422 common shares as full and final settlement to NVI and accordingly the debenture is discharged as of the date hereof.

The total production history, to the end of 1998, amounted to 845,800 tonnes (1,860 million lb.) of copper, 8,900 tonnes (19.7 million lb.) of molybdenum and 38,400 tonnes (84.7 million lb.) of cathode copper from 305 million tonnes (336 million short tons) milled.

From 1999-2004, Taseko geologists and engineers explored for additional mineralized material and to better define known resources. The on-site staff also completed on-going reclamation work and maintained the Gibraltar mine for re-start. Operating and environmental permits were kept in good standing.

In October 1, 2004 when the mine re-opened, there were approximately 837 million tons of measured and indicated resources outlined at Gibraltar, including proven and probable sulphide reserves of 163.5 million tons grading 0.313% copper and 0.010% molybdenum at a 0.20% copper cut-off and 16.5 million tons of oxide reserves grading 0.148% Cu at a 0.10% acid soluble copper cut-off. The Gibraltar re-start decision was based on the initial four years of the 12-year mine plan. Mining operations recommenced under the Taseko Ledcor Joint Venture management arrangement. Milling production began in October of that year. Copper Cathode production recommenced in January 2006 at the SX-EW plant. In November of 2006 Taseko voluntarily withdrew from the joint venture with Ledcor and through Gibraltar assumed responsibility for all matters in connection with Gibraltar Mine.

- 14 -

Total production between restart and up to December 31, 2008 was 45.7 million tons milled, producing 225.8 million lb. of copper in concentrate, 6.9 million lb. cathode copper and 2.6 million lb. of molybdenum.

Red Mile Royalty Sale Agreements

On September 29, 2004, Gibraltar and 688888 B.C. Ltd. (“688888”), a wholly-owned subsidiary of Taseko, entered into certain related agreements. Pursuant to a Royalty Agreement among,inter alia, Gibraltar and Wilshire (GP) No. 2 Corporation, in its own capacity and in its capacity as general partner on behalf of all the limited partners of Red Mile Resources No. 2 Limited Partnership (“Red Mile”) (see “Material Contracts”), Gibraltar sold to Red Mile a royalty (the “Royalty Interest”) for $67,357,000 (the “Purchase Price”). Annual royalties payable by Gibraltar to Red Mile range from $0.01 per pound to $0.14 per pound of copper produced during the period from the Commencement of Commercial Production (as defined in the Royalty Agreement) to the later of (a) December 31, 2014, and (b) the date that is five years after the end of commercial production from the mine.

Pursuant to a Funding Pledge Agreement among,inter alia, Alberta Capital Trust Corporation (“Alberta Trust”) and Gibraltar (see “Material Contracts”), the Purchase Price was invested in a promissory note with Alberta Trust, and Gibraltar pledged the promissory note, along with interest earned and to be earned thereon, to secure its obligations under the Funding Pledge Agreement. Pursuant to a Pledge, Priorities and Direction Agreement (see “Material Contracts”), Gibraltar is entitled to have released to it funds held under the promissory note, and interest thereon, to fund its royalty obligations under the Royalty Agreement to the extent of its royalty payment obligations.

Pursuant to a Call Option Agreement among,inter alia, 688888 and Red Miles Resources Inc., in its capacity as general partner on behalf of all of the partners of Red Mile Resources Fund Limited Partnership (“RMRF”) (see “Material Contracts”), 688888 has an option to, directly or indirectly, reacquire the Royalty Interest by acquiring (“call”) from Red Mile the Royalty Interest or from RMRF all of the limited partnership units (“LP Units”) of Red Mile held by RMRF. Pursuant to the Royalty Agreement, RMRF has the right to require Gibraltar to purchase (“put”) all of Red Mile’s LP Units owned by RMRF.

Pursuant to the Royalty Agreement, Gibraltar has granted to Red Mile a net profits interest (“NPI”), which survives any “put” or “call” of the Red Mile LP Units. The NPI is applicable for the years 2011 to 2014 and varies depending on the average price of copper for any year during that period. No NPI is payable until Gibraltar reaches a pre-determined aggregate level of revenues less defined operating costs and expenditures.

Property Geology

The Gibraltar Mine generally consists of seven separate mineralized zones. Six of these – Pollyanna, Granite, Connector, Gibraltar East, Gibraltar West and Gibraltar West Extension – occur within the Granite Mountain batholith in a broad zone of shearing and alteration. A seventh copper mineralized body, the Sawmill zone, lies about six km to the south, along the southern edge of the batholith, within a complex contact zone between the batholith and Cache Creek Group rocks.

Two major structural orientations have been recognized at Gibraltar: the Sunset and Granite Creek mineralized systems. The Sunset system has a northwest strike with one set of structures dipping 35° to 45° to the south and a conjugate set, known as the Reverse Sunset, dipping 50° to 60° to the north. The Granite Creek system strikes east-west and dips 20° to 40° to the south with a subordinate set of structures dipping steeply in a northerly direction. Structures of the Sunset system that host

- 15 -

mineralization are mainly shear zones, with minor development of stockwork and associated foliation lamellae. Host structures of the Granite Creek system are predominantly oriented stockwork zones.

The Granite Creek system provides the major structures that control mineralization of Pollyanna, Granite and the Sawmill zones. These bodies have the characteristic large diffuse nature of porphyry copper type mineralization. The Gibraltar East deposit is essentially a system of interconnected Sunset zones, which create a large body of uniform grade. Gibraltar West and Gibraltar West Extension deposits are contained within a large complex shear zone.

Mineralization

Pyrite and chalcopyrite are the principal primary iron and copper sulphide minerals. Sixty percent of the copper occurs in fine-grained chalcopyrite. Coarser grained chalcopyrite also occurs, usually in quartz veins and shear zones. Small concentrations of bornite (a sulphide mineral of copper and iron), associated with magnetite and chalcopyrite, is present on the extremities of the Pollyanna and Sawmill deposits. Oxide copper mineralization is also present between the Gibraltar East and Pollyanna open pits in the Connector Zone. Molybdenite (molybdenum sulphide mineral) is a minor but economically important associate of chalcopyrite in the Pollyanna, Granite and Sawmill deposits.

Exploration

From 1999-2004, Taseko geologists and engineers explored for additional mineralized material and to better define known resources. At October 1, 2004 when the mine re-opened, there were approximately 837 million tons of measured and indicated resources outlined at the Gibraltar Mine, including proven and probable sulphide reserves of 163.5 million tons grading 0.313% copper and 0.010% molybdenum at a 0.20% copper cut-off and 16.5 million tons of oxide reserves grading 0.148% Cu at a 0.10% acid soluble copper cut-off. A core drilling program for pit definition for the Granite Lake and PGE Connector deposits and property exploration at the 98 Oxide Zone, was carried out between September and November 2005. A further drilling program carried out in 2006 was designed to define the mineral resources between the existing pits by tying together the extensive mineralization zones, and to test for additional mineralization at depth.

The 2007 program tested a number of targets to define further mineralization, provided definition drilling in the Pollyanna-Granite saddle zone and Granite West areas and included condemnation drilling for the proposed extensions of both the #5 and #6 Dump footprints. The targets for further mineralization were; Gibraltar South, Pollyanna North IP anomaly, Granite South and the Gunn Zone.

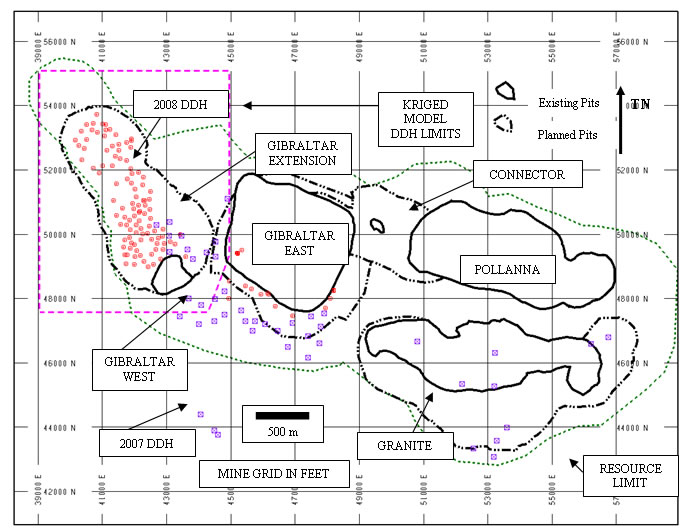

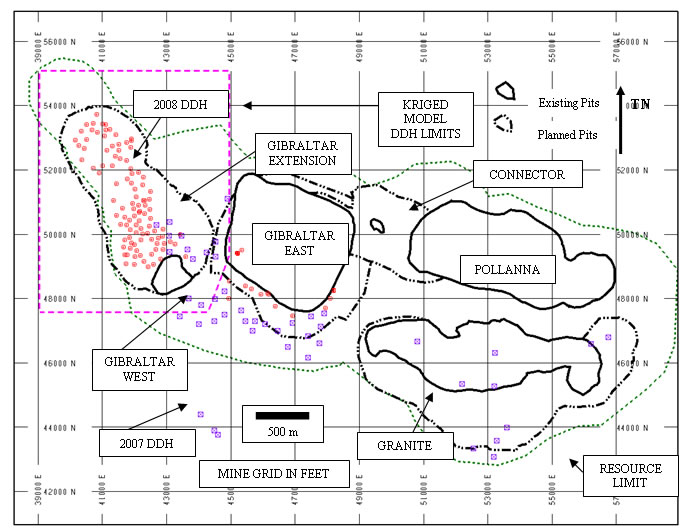

Data from an additional 47 holes totaling 52,175 feet (15,903 m) drilled in the 2007 program after July 2007 was not available in time for when resources were updated in 2007. In addition, a hole totaling 605 feet (184 m) was drilled in the Granite area at the end of the 2007 program but collared in January 2008. Figure 2 below shows the 2008 drilling and 2007 drilling not incorporated in 2007 resource estimates for the Gibraltar Mine.

- 16 -

Figure 2: 2007 and 2008 Diamond Drilling – Gibraltar Mine

Source: Gibraltar Technical Report

Holes drilled in the Gibraltar West pit area were incorporated into the 2008 reserve estimate for the new Gibraltar Extension Pit. The 2008 exploration program was conducted on the southern and eastern margins of the Gibraltar East pit and northwest of the Gibraltar West pit. The objective was to upgrade identified inferred resources to indicated or measured categories through “in-fill” drilling.

Drilling

The objective of the 2008 drilling program was to upgrade inferred resources in the Gibraltar East pit and Gibraltar West pit areas to measured or indicated resource categories. In total, 110,607 feet (33,713 m) of NQ and HQ size core were drilled in 125 holes. The 2008 drilling is summarized in Table 2 below.

Twenty-one holes totalling 22,753 feet (6,935 m) were drilled around the southern and eastern margins of the Gibraltar East pit. Thirteen of these holes were designed to upgrade the resources, three holes to target pockets of potential mineralization below the current pit, and five were abandoned, substituted or re-drilled due to difficulties in drilling conditions. The results of the completed holes are incorporated into the resource estimates disclosed in Table 4.

One hundred and four holes totalling 87,854 feet (26,778 m) were drilled northwest of the Gibraltar West pit. The objective was to test the continuity of the northwest-trending zone of mineralization and provide

- 17 -

sufficient drill hole density to generate reserves. Most of the holes were drilled at -90° dip. Two holes totaling 170 feet (52 m) did not reach bedrock and were excluded from the dataset used for the reserve estimate. Seven holes totaling 5,272 feet (1,607 m) were drilled at the outer edges of the deposit for geotechnical purposes. The new holes provided data for a re-evaluation of the deposit geology and generation of a reserve estimate for staged pits collectively named the Gibraltar Extension pit.

Table 2: 2008 Drilling Summary – Gibraltar Mine

| Target Area | No. of Holes | Feet | Metres |

| Gibraltar East | 45 | 50,082 | 15,265 |

| Gibraltar Extension* | 115 | 100,622 | 30,670 |

| Granite Pit Area | 11 | 12,512 | 3,814 |

| TOTAL ** | 171 | 163,217 | 49,749 |

*Excludes two holes (170 ft / 51.8 m) that did not reach bedrock

**Includes 48 holes (52,780 ft / 16,087 m) from 2007 drilling program

Sampling and Analytical Procedures

A total of 110,607 feet (33,713 m) was drilled in 125 drill holes in calendar 2008 averaging 883 ft (269 m) in length. This included 18 HQ core size holes, 2 holes which started HQ and ending NQ and 106 NQ size holes. Core recovery was measured on 10,564 drill runs averaging 9.2 ft (2.8 m) in length. Recovery was generally good, averaging 92.5% for the sampled intervals measured. The 10,435 half core samples taken in 2008 by Gibraltar personnel averaged 10 ft in length.

Drill core was boxed at the drill site and transported by company truck to a secure logging, sampling and sample preparation facility at the Gibraltar Mine. The drill core was mechanically split into two halves lengthwise. Half core was taken as an assay sample. The remaining half core and coarse reject after sample preparation at the analytical laboratories are stored at the Gibraltar Mine. The remaining pulps after analysis are stored at a secure warehouse at Port Kells, British Columbia.

The 2008 sample preparation was performed mainly by Acme, Vancouver (99.5%) and secondly by Eco Tech, Kamloops (0.5%) . The half-core samples were prepared at the respective laboratories using the same specifications. The entire sample was dried, and crushed to 70% passing 10 mesh (<2 mm). A 250 g split was then taken and the samples were pulverized to 95% passing 150 mesh (106 microns). The coarse reject samples were returned to Gibraltar Mine after analysis for long term storage. The sample pulps are retained at the Port Kells BC warehouse of Taseko.

Taseko implemented a rigorous quality control quality assurance (QA/QC) program after taking over the Gibraltar Mine. This QA/QC program was in addition to the QA/QC procedures used internally by the analytical laboratories. The results of this program indicate that analytical results are of high quality and suitable for use in detailed modeling and resource evaluation studies.

From 2006 – 2008 drill hole data was verified, including digitally as well as manually. The validation and verification work performed on the Gibraltar database indicates that it is of good quality and acceptable for use in geological and reserve modeling.

Gibraltar Mine Reserves and Resources

Proven and probable mineral reserves at the Gibraltar Mine have increased by approximately 105 million tons to a total of 472.4 million tons as of December 31, 2008.

- 18 -

One hundred seventy-three new diamond drill holes were completed between July 2007 and September 2008 of which 115 holes were included in the Gibraltar Extension geological model, and this has allowed for further expansion of reserves at the Gibraltar Mine.

The Gibraltar Extension deposit is a body of mineralization on the Gibraltar Mine property which has a shape and structure significantly different from other deposits that occur on the property. Drilling up until the 2008 drilling program had provided details of the northwest and southeast portions of the Gibraltar deposit but the central zone was under-drilled and poorly defined. The 2008 program objective was to test the continuity of mineralization between the two ends and increase drill hole density along the Gibraltar deposit to upgrade the resource model blocks from inferred to measured and indicated category so that proven and probable reserves could be estimated. The Gibraltar Extension reserve estimate involved a detailed re-evaluation of the geological model, generation of pit designs, and an overall mine life schedule.

The reserve estimates for the Gibraltar Extension deposit used long term metal prices of US$1.75/lb for copper and US$10.00/lb for molybdenum and a foreign exchange of Cdn$0.82 per US dollar. The estimates for the balance of the reserves used September 2007 NI 43-101 estimates reduced by actual 2008 mining with long term metal prices of US$1.50/lb for copper, US$10/lb for molybdenum and a foreign exchange of $0.80 per US dollar.

The proven and probable reserves at the Gibraltar Mine as of December 31, 2008 are tabulated in Table 3 below and are NI 43-101 and SEC Guide 7 compliant.

Table 3: Gibraltar Mine Mineral Reserves

at 0.20% Copper Cut-off

Pit |

Category | Tons

(millions) | Cu

(%) | Mo

(%) |

| Connector | Proven

Probable | 40.4

14.8 | 0.296

0.271 | 0.010

0.009 |

| Subtotal | 55.2 | 0.289 | 0.010 |

| Gibraltar East | Proven

Probable | 66.8

33.3 | 0.286

0.285 | 0.008

0.013 |

| Subtotal | 100.1 | 0.286 | 0.010 |

| Granite | Proven

Probable | 187.0

25.7 | 0.324

0.319 | 0.009

0.009 |

| Subtotal | 212.8 | 0.323 | 0.009 |

| Gibraltar Extension | Proven

Probable | 75.4

29.3 | 0.352

0.304 | 0.002

0.002 |

| Subtotal | 104.7 | 0.339 | 0.002 |

| Total | | 472.8 | 0.315 | 0.008 |

| Cautionary Note to Investors Concerning Estimates of Measured and Indicated Resources |

| |

This section uses the terms ‘measured resources’ and ‘indicated resources’. The Company advises investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.Investors are cautioned not to assume that any part or all of mineraldeposits in these categories will ever be converted into reserves. |

The mineral reserves stated above are contained within the mineral resources indicated in Table 4 below:

- 19 -

Table 4: Gibraltar Mine Mineral Resources

at 0.20% Copper Cut-off

Category | Tons

(millions) | Cu

(%) | Mo

%) |

| Measured | 597.7 | 0.302 | 0.008 |

| Indicated | 361.0 | 0.290 | 0.008 |

| Total | 958.7 | 0.298 | 0.008 |

There are also oxide reserves, identified in both the PGE Connector and Gibraltar pits as shown in Table 5 below. These oxide reserves are in addition to the sulphide reserves stated in Table 3 and are contained within the resources contained in Table 4.

Table 5: Gibraltar Mine – Oxide Mineral Reserves as of December 31, 2008

at 0.10% ASCu cut-off

Pit | Tons

(millions) | Cu

(%) | ASCu

(%) |

| Connector | 12.7 | 0.349 | 0.151 |

| Gibraltar East | 0.5 | 0.152 | 0.121 |

| Total | 13.2 | 0.341 | 0.150 |

The mineral resource and reserve estimations were completed by Gibraltar mine staff under the supervision of Scott Jones, P.Eng., Vice-President, Engineering, a Qualified Person under NI 43-101 and the author of the Gibraltar Technical Report. Mr Jones has verified the methods used to determine grade and tonnage in the geological model, reviewed the long range mine plan, and directed the updated economic evaluation.

Mining Operations

The Gibraltar Mine is a typical open pit operation that utilizes drilling, blasting, cable shovel loading and large-scale truck hauling to excavate rock. The Gibraltar Mine is planned to enable excavation of sulphide mineralized material of sufficient grade that can be economically mined, crushed, ground and processed to a saleable product by froth flotation. Tailings are pumped to a storage facility.

Rock containing lower grade sulphide mineralization or oxide mineralization is also mined but is not immediately processed. The lower grade sulphide material is stockpiled for later treatment in the mill. In addition, a portion of the low grade sulphide (waste) and all of the oxide material can be leached with sulphuric acid, which is naturally assisted by bacterial action, and the resultant copper sulphate solution can be processed to cathode copper in the Gibraltar Mine’s SX/EW plant. The SX/EW plant was re-commissioned during the first quarter of the fiscal 2007 and operated throughout the 15 months of the 2008 fiscal year.

Construction of the Phase 1 mill expansion was completed in February 2008. The ramp up to the rated processing capacity of 46,000 tpd has been ongoing since completion of the construction phase. Sustained periods of operation at the rated capacity have been more frequent and of longer duration as mill operations personnel continue to refine the metallurgical performance relating to grind size at higher mill throughput rates and metal recovery. The improved performance is evidenced by the recovery increasing from 73.2% in October 2008 to 82.2% in February 2009, a 12% increase.

- 20 -

The Phase 2 expansion program consists of modernizing and increasing the capacity of the regrind, cleaner flotation, and ancillary circuits along with installation of a two-stage tailings pumping system. Phase 2 is designed to increase concentrator capacity from 46,000 to 55,000 tpd. The construction schedule for Phase 2 has been modified as a result of management’s review of capital spending. The regrind mill and cleaner flotation circuits will be completed in the summer of 2009 as they are not cash intensive to complete and they provide very robust payback through increased copper and molybdenum recoveries. Ramp up to 55,000 tpd will occur following completion of the rest of the Phase 2 program and completion of the in-pit crusher and conveyor.

The Phase 3 expansion was designed to increase throughput capacity by a further 30,000 tpd to 85,000 tpd. The engineering for Phase 3 was well advanced and the estimated capital cost had been confirmed at $300 million for mill infrastructure and $50 million for mining equipment. With the exception of upgrading or replacing the molybdenum circuit, the entire project has been deferred as a result of the credit market conditions and copper market outlook. Once the economic conditions improve, the decision to move forward on this next phase of expansion will be reviewed.

Production in 2008

Taseko has changed its fiscal year end from September 30 to December 31. The following table was prepared by the Company and is a summary of the operating statistics for fifteen months ending December 31, 2008 compared to the twelve months ending September 30, 2007. All mining during the fifteen months of fiscal 2008 took place in the Polyanna and Granite pits.

Table 6: Gibraltar Production

| Fifteen months

ending December

31, 2008 | Twelve months

ending September 30,

2007 |

| Total tons mined (millions)1 | 51.8 | 35.4 |

| Tons of ore milled (millions) | 13.6 | 9.5 |

| Stripping ratio | 2.7 | 2.6 |

| Copper grade (%) | 0.351 | 0.328 |

| Molybdenum grade (%Mo) | 0.009 | 0.011 |

| Copper recovery (%) | 75.8 | 77.5 |

| Molybdenum recovery (%) | 31.8 | 29.6 |

| Copper production (millions lb)2 | 77.1 | 51.8 |

| Molybdenum production (thousands lb) | 841 | 580 |

| | 1 | Total tons mined includes sulphide ore, oxide ore, low grade stockpile material, overburden, and waste rock which were moved from within pit limit to outside pit limit during the period. |

| | 2 | 2008 copper production includes 72.5 million lb in concentrate and 4.6 million lb in cathode. |

Contracts and Markets

Gibraltar’s copper concentrate has a nominal 28% copper grade and no significant deleterious elements. Gibraltar’s copper concentrate is currently sold at prices based on London Metal Exchange (“LME”) quotations under an agreement with MRI Trading AG (“MRI”) of Switzerland (see “Material Contracts”), which includes 100% of off-take until 2011 and some opportunity for other sales after that time. Although 100% of Gibraltar’s copper concentrate is currently sold to MRI, in the event that MRI was unable to purchase Gibraltar’s copper concentrate as provided in the MRI sales agreement, a liquid

- 21 -

market exists. Gibraltar copper cathode is nominally 99.9%+ pure copper, and is currently sold under an agreement with Trafigura AG of Switzerland, which includes provisions for 100% of the cathode production. Gibraltar also has an agreement with Derek Raphael to treat a minimum of 75% of its molybdenum concentrate.

The copper market is volatile and cyclical. Copper is a commodity traded on the LME, the New York Commodity Exchange and the Shanghai Futures Exchange. The price of copper as reported on these exchanges is influenced significantly by numerous factors, including (i) the worldwide balance of copper demand and supply, (ii) rates of global economic growth, trends in industrial production and conditions in the housing and automotive industries, all of which correlate with demand for copper, (iii) economic growth and political conditions in China, which has become the largest consumer of refined copper in the world, and other major developing economies, (iv) speculative investment positions in copper and copper futures, (v) the availability and cost of substitute materials and (vi) currency exchange fluctuations.

Updated Capital and Operating Cost Estimates

As part of the Gibraltar Technical Report, capital & operating agreement cost estimates were updated. As the majority of the Gibraltar Mine’s facilities are operating, the only capital requirements are for the completion of the phase two mill expansion, the purchase of a new in-pit crusher/conveyor system and sustaining capital to maintain the integrity of the mining and processing equipment. The capital cost estimate for the mill expansion project is based on a thorough assessment that was completed for the feasibility study work in 2007. Sustaining capital is based on planned equipment replacement and upgrades with the costs estimated based on current supplier quotations, recent equipment acquisitions and engineering cost estimates.

The updated capital requirements are detailed in Table 7.

Table 7: Capital Cost Summary Gibraltar Mine – 2008

Area | Total Capital

(x $1,000) |

| Equipment | $70,017 |

| General Sustaining | $118,653 |

| Mill Expansion | $20,000 |

| Total | $208,670 |

The operating cost estimates in the Gibraltar life of mine plan are based on detailed scheduling of equipment capacities including estimates of average haulage distances and truck cycle times for each year of the plan. These schedules support detailed estimates of equipment operating hour requirements, major overhauls, manpower schedules, and primary inputs including diesel fuel, explosives, electricity, process reagents, etc. All of these factors have been derived from operating experience and reflect current operating parameters, unit costs of supply, and current and anticipated contracts. Updated, average life-of-mine unit operating costs are summarized in Table 8:

Table 8: Operating Cost Summary Gibraltar Mine – 2008

| Area | Life of Mine Cost |

| Mine cost/ton mined | $1.01 |

| Mill and G & A cost/ton milled | $2.71 |

| Total Sulphide Operating cost/ton milled | $6.84 |

Off site costs for transportation, treatment, and refining are based on current and anticipated contracts.

- 22 -

Production Forecast

The life of mine plan covers a period of twenty three years starting in fiscal 2009 and ending in fiscal 2032. The plan calls for the mining and processing of 472 million tons of ore from four pits: Granite, Gibraltar East, Connector and Gibraltar Extension. The average grade is estimated to be 0.315% copper and 0.008% molybdenum. The average strip ratio over the life of the plan is 3.1:1. The life of mine production requirements are summarized in Table 9 below.

Table 9: Life of Mine Production Units – Gibraltar Mine

| | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| TonnesMilled | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 | 20.1 |

| TonnesMined | 81.1 | 83.1 | 85.5 | 74.3 | 75.5 | 82.0 | 80.6 | 78.9 | 82.4 | 85.4 | 85.5 | 85.5 |

| | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| TonnesMilled | 20.1 | 20.1 | 20.1 | 20.0 | 20.0 | 20.0 | 20.0 | 20.0 | 20.0 | 20.0 | 20.0 | 13.4 |

| TonnesMined | 85.2 | 83.9 | 78.0 | 90.5 | 95.0 | 95.3 | 94.4 | 88.8 | 95.3 | 88.7 | 49.4 | 13.4 |

The concentrator is forecast to produce 2,571 million pounds of copper in concentrate and 28.8 million pounds of molybdenum in concentrate. The average mill throughput over the remainder of the mine life is approximately 54,573 tons per day.

Sufficient oxide ore was released in late 2006 to warrant restarting the site’s SX/EW plant. The existing oxide reserves will support profitable annual operation of the plant from 2009-2016 and 2021-2026. During the period 2017-2020, the plant will be shut down due to limited supply of oxide material. The mining schedule will release sufficient oxide material from the Connector pit starting in 2021 which will be the primary source of feed for running the SX/EW plant through to the remaining years of the life of the Gibraltar Mine.

Environmental Considerations

There have been no material environmental non-compliance incidents since the mine re-opened.

The current Environmental Protection Permit was last amended on April 12, 2006, and authorizes the discharge of tailings, sewage, and treated acid mine drainage to the tailings pond; tailings, sewage, open pit and waste dump drainage to the Gibraltar East pit.

Permit M-40, covering the reclamation plan and liabilities was last amended January, 2008. The reclamation plan includes a water management, treatment and monitoring program and establishment of vegetation on all areas in order to protect against wind and water erosion and to meet end land use objectives. In 2007, a decommissioning plan provided an assessment of the costs of reclamation and ongoing water treatment which was based on a five year mine plan. Closure costs were estimated to be $28 million, and Gibraltar has contributed $35 million held into a Qualified Environmental Trust fund with HSBC (Trust) Company Canada serving as a reclamation bond for the BC Government.

The Company was permitted by the Government of British Columbia to release $5 million from the Gibraltar Mine reclamation deposit in exchange for security on certain equipment of the Gibraltar Mine.

- 23 -

Subsequent to December 31, 2008, the Company obtained further approval and release $3.9 million from the reclamation deposit.

The reclamation plan and liability due to the additional mineral reserves disclosed in the Gibraltar Technical Report will be evaluated in the next decommissioning plan currently scheduled for 2012 or earlier if required by the Ministry of Energy and Mines.

Other permit considerations relative to the additional reserves described in the Gibraltar Technical Report may include approvals required for route changes to the access road, hydro transmission and water management pipeline, and these approvals will be pursued by the Company as required.

In 2002, Gibraltar and the Cariboo Regional District agreed to develop a landfill site on waste dumps in an area that would not be needed for the future operation of the mine. The landfill will provide reclamation credits to the land it occupies, as well as revenues to support ongoing site management costs. Construction of the landfill was initiated in June 2003 and operations began in October 2003.

The Prosperity Project

Unless stated otherwise, information of a technical or scientific nature related to the Prosperity Project contained in this AIF is summarized or extracted from a technical report entitled “Technical Report, Executive Summary Feasibility Study of the Prosperity Gold – Copper Project” dated October 15, 2007 (the “Prosperity Technical Report”), prepared by Scott Jones, P. Eng. filed on Taseko’s profile on SEDAR atwww.sedar.com. Mr. Jones is not independent of Taseko by virtue of being employed by the Company as Vice-President, Engineering.

Property Description and Location

The Prosperity Project is located at latitude 51° 28’ N and longitude 123° 37’ W in the Clinton Mining Division, approximately 125 km southwest of the City of Williams Lake, British Columbia, and consists of 124 mineral claims covering the mineral rights for approximately 121 square km. Of this, six fractional claims were staked in 2008 as part of taking the claims to lease, a process that is currently underway. The six fractional claims are in good standing until October 2009. All other claims are in good standing until April 2011. The claims are 100% owned by Taseko and are not subject to any royalties or carried interests.

The outer boundary of the property has been legally surveyed as part of the process of taking the claims to lease. As this is a relatively new project, there are no existing environmental liabilities on the property. No permits are required for the work (largely related to the environmental assessment process) that is currently underway. When additional site work is required, permit applications will be made. The Company does not hold any surface rights.

The property is located within territory that is the subject of an aboriginal Rights action. The Xeni Gwet’in First Nation has sought an injunction to prevent the provincial and federal governments from issuing any permits that would infringe on their aboriginal right to fish.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access from Williams Lake is via Highway 20 to Lee’s Corner, then via an all-weather main logging haulage road to the site, a total road distance of 192km. The Canadian National railway services Williams Lake and has rolling stock available to move copper concentrates by rail to points of sale in North

- 24 -

America. The City of Williams Lake is sufficiently close and is capable of supplying goods, services, and personnel to a mine.

Multiple high-voltage transmission lines from the existing Peace River hydroelectric power grid are situated 118 km east of the Prosperity Project, a natural gas transmission pipeline is situated 112 km northeast, and ample water is available nearby for a mining operation.

The Prosperity Project is located on the Fraser Plateau in the Taseko Lakes region on the eastern side of the Chilcotin Mountain Range, which forms part of British Columbia’s Coast Mountain Range. The landscape is characterized by the low rounded summits of the Chilcotin Range and moderately sloping upland. The Prosperity Project is located within the Fish Creek and Fish Lake watershed in a broad valley with slopes of moderate relief. Elevations at the site range between 1,450 m and 1,600 m above sea level.

Local climatic conditions are moderated primarily by elevation, aspect, physiography, and the proximity of the area to the Chilcotin Mountains. The annual mean temperature at the Prosperity Project site is estimated to be 2ºC. The coldest months of December and January average -10ºC, and the warmest months of July and August average 13ºC.

Prosperity Project History

Prospectors discovered mineralization in the 1930’s. Exploration continued intermittently and by a variety of operators until about 1991, and included extensive IP, magnetic and soil geochemistry surveys, and 176 percussion and diamond drill holes, totaling approximately 27,200 m. This work helped define the Prosperity project mineralization to a depth of 200 m, and outlined a copper-gold mineralized zone approximately 850 m in diameter.

In 1969, Taseko acquired the Prosperity Project and drilled 12 percussion holes totaling 1,265 m and six diamond drill holes totaling 1,036 m immediately to the south of the area where Phelps had explored, and Taseko discovered significant tonnage grading 0.25% to 0.30% copper.

In 1970, Nittetsu Mining Company optioned the Prosperity Project from Taseko Mines Limited and completed 236 m of core drilling in 4 holes before returning the property to Taseko. In 1972, Taseko tested the property with two additional diamond drill holes totaling 156 m. Quintana Minerals Corporation optioned the property from Taseko in 1973 and completed a 23-hole diamond drill program totaling 4,705 m during 1973-74.

Bethlehem Copper Corp. optioned the Prosperity Project in 1979 and by 1981 had completed 3,225 m of percussion drilling in 36 holes and 10,445 m of diamond drilling in 37 holes. Following the corporate merger of Bethlehem Copper Corp. and Cominco Ltd., Cominco acquired the Bethlehem option agreement on the Prosperity Project. Cominco continued to drill the property, completing 1,620 m of percussion drilling in 19 holes and 3,707 m of diamond drilling in 29 holes over the period 1982 to 1989.

Cominco work programs also included 50 line km of induced polarization, magnetic and soil geochemical surveys. The induced polarization survey outlined a 2 km by 3 km east-west trending zone of high chargeability. Also undertaken was a limited metallurgical testwork program which focused on achieving high copper recovery, with little emphasis on gold recovery, using a conventional copper flotation.

After a period of disagreement with Cominco which included a Court process, Taseko acquired 100% of the Prosperity Project free whatsoever of any royalties or third party interests in 1993 through settlement agreements.

- 25 -

Geological Setting

The Prosperity Project is located within the western-most portion of the Intermontane Belt at the boundary between the Intermontane and Coast morphologic belts. The surrounding area is underlain by poorly exposed, Late Paleozoic to Cretaceous litho tectonic assemblages which have been intruded by plutons of Mid-Cretaceous to Early Tertiary age. The main Coast Plutonic Complex is 50 km southwest of the Prosperity Project area.

The Yalakom Fault is the major fault in the region and lies to the southwest of the deposit on the Prosperity Project. Estimates of Eocene dextral strike-slip offsets for the Yalakom Fault have been postulated variously as ranging from 80 to 190 km, 125 to 175 km or 115 km. It may have imparted some related structural controls that are important to the localization of mineralization at the deposit.

Mineralization

The Prosperity Project hosts a large porphyry gold-copper deposit. The deposit is predominantly hosted in Cretaceous andesitic volcaniclastic and volcanic rocks. In the western portion of the deposit, the host rocks have been intruded by the multi-phase, steeply dipping Fish Creek Stock. The stock is surrounded by an east-west trending, south dipping swarm of subparallel quartz-feldspar porphyritic dykes. The stock and dykes comprise the Late Cretaceous Fish Lake Intrusive Complex that is spatially and genetically related to the deposit. Post mineralization porphyritic diorite occurs as narrow dykes that cross-cut all host rocks. The central portion of the deposit is cut by two major faults, striking north-south and dipping steeply to the west.

Pyrite and chalcopyrite are the principal sulphide minerals in the deposit on the Prosperity Project. They are uniformly distributed in disseminations, fracture fillings, veins and veinlets and may be accompanied by bornite and lesser molybdenite and tetrahedrite-tenantite. Native gold occurs as inclusions in and along microfractures with copper-bearing minerals and pyrite.

Exploration

Up to 1991, exploration programs at the Prosperity Project included extensive IP and magnetic geophysical and soil geochemical surveys, and 176 percussion and diamond drill holes totaling approximately 27,100 m. This work helped define the Prosperity Project mineralization to a depth of 200 m, and outlined a gold-copper mineralized zone approximately 850 m in diameter.

In 1991 Taseko drilled 10 holes totaling 7,506 m in a “cross” pattern to test the core of the deposit on the Prosperity Project over a north-south distance of 550 m. All of the holes intersected continuous significant copper and gold grades and extended the mineralization to 810m below surface. A scoping-level metallurgical testwork program was completed which demonstrated that acceptable gold and copper recoveries could be achieved by bulk sulphide flotation followed by regrinding and conventional copper flotation. Baseline environmental and monitoring studies were initiated by the Company.

Diamond drilling continued in 1992, and by the end of the year an additional 116 HQ and NQ diameter vertical drill holes totaling 60,558 m had been drilled, expanding the deposit to 1400 m east-west, 600 m north-south and to 850 m below surface.

Subsequent to 1993, the Company completed a 12 hole (4,605 m) inclined core drilling program in 1994 to investigate the distribution of fracture controlled gold and copper mineralization in the deposit. In addition, 22 holes (3,171 m) were drilled to investigate geotechnical conditions in the proposed Prosperity Project development areas.

- 26 -

In 1996 and 1997, an additional 107 holes (49,465 m) were completed in order to upgrade the confidence limits of the deposit. Of this total, 20 holes (2,203 m) were drilled vertically and 87 holes (47,262 m) were inclined. These holes significantly increased the density of pierce points in the deposit and added to the geotechnical and geochemical characterization of the rock in the deposit.

Over the 34-year period from 1963 to 1997, a total of 154,631 m has been drilled in 452 holes on the Prosperity Project. Of this total, 273 holes (83,453 m) were drilled vertically and 174 holes (71,178 m) were inclined. Sizes of cored holes have included BQ, HQ, and NQ totaling 148,322 m, with an average drill spacing of 70 m. The balance of 6,309 m is from percussion drilling. There has been no production from the Prosperity Project.

Work on the Prosperity Project was deferred from 2000-2005 first due to low metal prices and then later as the Company turned its attention to re-starting the Gibraltar Mine. In November 2005, work was reactivated on the Prosperity Gold-Copper Project. A pre-feasibility level study was completed in the first quarter of fiscal 2007, and a full feasibility study completed in September 2007.

Sampling and Analysis

A total of 63,937 drill core samples and 1,548 percussion samples have been taken for analysis on the Prosperity Project since 1969. Prior to 1991, a total of 6,905 were taken with an average length of three meters. From 1991 – 1998, 58,580 core samples were taken for assay with an average length of two meters except in instances where this was impractical.

During 1991-1994, drill core was mechanically split, one half of which was submitted for preparation and analysis. Of the total meterage drilled during 1996-97, 42% was subject to whole core sampling, 44% was sampled as sawn half-core, 5% of samples comprised the larger portion of core sawn 80:20. The remaining 9% was cored overburden, which was not generally sampled. In 1998 the samples were half sawn core and the remaining sample was put back in drilling order in the core box. Drill core remaining after sampling was returned to the core boxes, which were racked and stored at the Prosperity Project Site.

In 1991-1998 the drill core was boxed at the drill rig and transported twice daily by company truck to the logging, sampling and sample preparation compound at the Prosperity site. The core was geologically and geotechnically logged, given QA/QC designations, photographed and sampled under the supervision of Taseko geological and engineering staff. Samples were placed in shipping sacks and taken by company truck to Williams Lake and then shipped by commercial carriers to the Vancouver area analytical laboratories.

Taseko implemented a QA/QC program after taking over the Prosperity project in 1991. This was in addition to the QA/QC procedures used internally by the analytical laboratories. The results of this program indicate that analytical results are of high quality and suitable for use in detailed modeling and resource evaluation studies.

Taseko verified the post-1990 portion of the Prosperity Project drill hole database manually in 1992 and 1998, and another independent comprehensive audit and verification of the geology and assay results in 1998 found the geological work for the Prosperity Project to be done in a professional manner and according to industry standard.

- 27 -

Resource Estimates

| Cautionary Note to Investors Concerning Estimates of Measured and Indicated Resources |

| |

This section uses the terms ‘measured resources’ and ‘indicated resources’. The Company advises investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.Investors are cautioned not to assume that any part or all of mineraldeposits in these categories will ever be converted |

The mineral resources shown in Table 10 include the mineral reserves shown in Table 11. Resource estimates were based on a gold price of US$575/oz, a copper price of US$1.50/lb and an exchange rate of US$0.80 to Cdn$1.00.

Table 10: Prosperity Mineral Resources

at 0.14% copper cut-off – September 2007

Category

| Tonnes

(millions) | Gold

(g/t) | Copper

(%) |

| Measured | 547.1 | 0.46 | 0.27 |

| Indicated | 463.4 | 0.34 | 0.21 |

| Total | 1,010.5 | 0.41 | 0.24 |

Reserve Estimates

| Cautionary Note to Investors Concerning Reserve Estimates |

| |