TASEKO MINES LIMITED

Management’s Discussion and Analysis

and the terms of their exercise is set out in Notes 13 and 15 of the September 30, 2018 unaudited condensed consolidated interim financial statements.

Liquidity, cash flow and capital resources

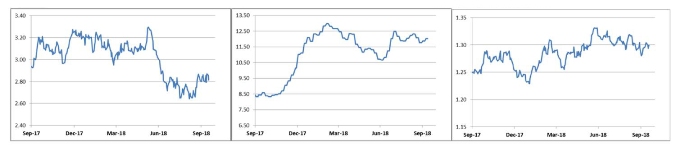

Copper sales volumes were significantly lower than production volumes during the third quarter of 2018 due to poor rail service between the mine and the port terminal. Operating cash flows for the period were $18.1 million, and were reduced by a negative working capital adjustment of $12.6 million, which primarily relates to the increase in inventories offset by an $8.0 million advance payment received from a customer.

Inventories increased to 18.5 million pounds of copper (100% basis) during the period, and the lower sales affected the Company’s third quarter cash flow by approximately $30 million. The excess inventory is expected to be sold in the fourth quarter of 2018.

The Company used $20.9 million of cash for investing activities in the third quarter, which included $6.8 million of cash payments for construction of the PTF at Florence, $7.6 million for capitalized stripping costs, $3.7 million on other capital expenditures for Gibraltar, $2.8 million on other project costs at the Florence and Aley projects.

Cash used for financing activities during the three months ended September 30, 2018 includes $3.5 million of principal and interest payments for capital leases and equipment loans.

During the nine months ended September 30, 2018, the Company generated operating cash flow of $50.0 million and used $69.3 million for investing activities. Investing activities in the period included $23.0 million of cash payments for construction of the PTF at Florence, $30.0 million for capitalized stripping costs, $8.7 million on other capital expenditures for Gibraltar, $7.1 million on other project costs at the Florence and Aley projects, and $1.1 million for the purchase of copper put options.

During the nine months ended September 30, 2017 the Company generated $106 million of positive cash flow from operating and investing activities, as a result of strong operating results at the Gibraltar Mine and including $44 million of cash proceeds from the sale of a silver stream to Osisko.

At September 30, 2018, the Company had cash and equivalents of $45 million (December 31, 2017 – $80 million) and continues to maintain a strategy of retaining a significant cash balance to reflect the volatile and capital intensive nature of the copper mining business. The Company continues to make monthly principal repayments for capital leases and equipment loans, however, there are no principal payments required on the senior secured notes until the maturity date in June 2022.

Liquidity outlook

The Company has a pipeline of development stage projects, including the Florence Copper Project and Aley Niobium Project, and additional funding will be required to advance these projects to production. To address project funding requirements, the Company may seek to raise additional capital through debt or equity financings or asset sales (including royalties, sales of project interests, or joint ventures). The senior secured notes (due in June 2022) allow for up to US$100 million of first lien secured debt to be issued as well as up to US$50 million of debt for equipment financing, all subject to the terms of the note indenture. The Company may also redeem or repurchase senior secured notes on the market. From time to time, the Company evaluates these alternatives, based on a number of factors including the prevailing market prices of its common shares and senior secured notes, metal prices, liquidity requirements, covenant restrictions and other factors, in order to determine the

14