UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | |

| Filed by the Registrantx | | Filed by a Party other than the Registrant¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

Stewart Enterprises, Inc.

(Name of Registrant as Specified In Its Charter)

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

x | | No Fee Required |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | | | |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | | | |

| | 2) | | Form. Schedule or Registration No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

| | | | |

1333 S. Clearview Parkway • Jefferson, LA 70121

Post Office Box 11250 • New Orleans, LA 70181

504-729-1400

March 6, 2012

To our shareholders:

You are cordially invited to the annual meeting of shareholders of Stewart Enterprises, Inc. to be held at 11:00 a.m. C.D.T. on April 19, 2012, at our corporate headquarters, 1333 South Clearview Parkway, Jefferson, Louisiana 70121.

The attached notice of meeting and proxy statement describe in detail the matters proposed by your board of directors to be considered and voted upon at the meeting.

This year, Stewart Enterprises is taking advantage of the Securities and Exchange Commission’s Notice and Access proxy rule, which allows companies to furnish proxy materials to shareholders by allowing them to access material on the internet instead of mailing a printed set to each shareholder, unless the shareholder requests delivery by traditional mail or electronically by e-mail. We believe this approach provides our shareholders with the proxy materials they need, while reducing printing and postage costs and reducing the environmental impact of our annual meeting. In accordance with these rules, we have sent a Notice of Internet Availability of Proxy Materials (“Notice”) to certain shareholders. The Notice contains instructions on how to access our proxy statement and annual report to shareholders on the internet, as well as how to vote either online, by telephone or in person at the annual meeting.

Regardless of how many shares you own, it is important that your shares be represented at the meeting.Please vote your shares by internet or telephone (or, if you received a printed set of materials by mail, by returning the accompanying proxy card) as soon as possible to ensure that your shares are voted at the meeting. Further instructions on how to vote your shares may be found in our proxy statement.

Sincerely,

/s/ Frank B. Stewart, Jr.

Frank B. Stewart, Jr.

Chairman of the Board

STEWART ENTERPRISES, INC.

1333 South Clearview Parkway

Jefferson, Louisiana 70121

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS OF STEWART ENTERPRISES, INC.:

You are cordially invited to the 2012 annual meeting of our shareholders to be held at our corporate headquarters, 1333 South Clearview Parkway, Jefferson, Louisiana 70121, on April 19, 2012 at 11:00 a.m. C.D.T., for the following purposes:

| | • | | to elect seven directors to serve a one-year term of office expiring at our 2013 annual meeting; |

| | • | | to hold an advisory vote on our executive compensation as disclosed in this proxy statement (the “say-on-pay” vote); |

| | • | | to approve the Stewart Enterprises, Inc. Executive Officer Annual Incentive Plan; |

| | • | | to approve the Amended and Restated Stewart Enterprises, Inc. 2010 Stock Incentive Plan; |

| | • | | to ratify the retention of our independent registered public accounting firm for the fiscal year ending October 31, 2012; and |

| | • | | to transact such other business as may properly come before the meeting or any adjournment thereof. |

This year, instead of mailing a printed copy of our proxy materials, including our annual report, to each shareholder of record, we provided access to these materials on the internet for at least some of our shareholders. This reduces the amount of paper necessary to produce these materials, as well as our costs associated with printing and mailing these materials to all shareholders. On March 6, 2012, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to certain shareholders of record as of February 21, 2012, and will post our proxy materials on the web address provided in the Notice. As more fully described in the Notice, shareholders may choose to access our proxy materials at the web address indicated in the Notice or may request a set of our proxy materials to be delivered by traditional mail or electronically by e-mail. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis in the future.

If you received a printed copy of the materials, we have enclosed a copy of our annual report to shareholders with this notice and proxy statement.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Lisa T. Winningkoff

Lisa T. Winningkoff

Secretary

Jefferson, Louisiana

March 6, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL SHAREHOLDER MEETING ON APRIL 19, 2012.

This proxy statement and our 2011 annual report are available at

http://bnymellon.mobular.net/bnymellon/stei

TABLE OF CONTENTS

STEWART ENTERPRISES, INC.

1333 South Clearview Parkway

Jefferson, Louisiana 70121

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS, ANNUAL MEETING, AND VOTING

| Q: | Why am I receiving these proxy materials? |

| A: | The board of directors of Stewart Enterprises, Inc. (the “Company”) is soliciting your proxy to vote at the 2012 annual meeting of shareholders because you owned shares of our Class A and/or Class B common stock at the close of business on February 21, 2012, the record date for the meeting, and are therefore entitled to vote at the meeting. The proxy statement, along with a proxy card or a voting instruction card, and our 2011 annual report are being made available to shareholders beginning March 6, 2012. We have made these materials available to shareholders on the internet and, in some cases, have delivered printed proxy materials to you. This proxy statement summarizes the information you need to know in order to vote at the annual meeting. You do not need to attend the annual meeting to vote your shares. |

| Q: | Why did I receive a Notice of Internet Availability of Proxy Materials (“Notice”) instead of a full set of proxy materials? |

| A: | In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we may deliver to shareholders our proxy materials, including this proxy statement and our 2011 annual report by providing access to these documents on the internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless requested. The Notice will instruct you as to how you may access and review the proxy materials on the internet. The Notice also instructs you as to how you may submit your vote via the internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting the materials in the Notice. |

| Q: | Where and when will the meeting be held? |

| A: | The meeting will be held at our corporate headquarters, 1333 South Clearview Parkway, Jefferson, Louisiana 70121, on April 19, 2012 at 11:00 a.m., C.D.T. |

| Q: | Who is soliciting my proxy? |

| A: | Our board of directors is soliciting your proxy to vote on all matters scheduled to come before our 2012 annual meeting of shareholders. By completing and returning the proxy card or voting instruction card, or by casting your vote via the internet or by phone, you are authorizing the proxy holder to vote your shares at our annual meeting as you have instructed. |

| Q: | What will I be voting on? |

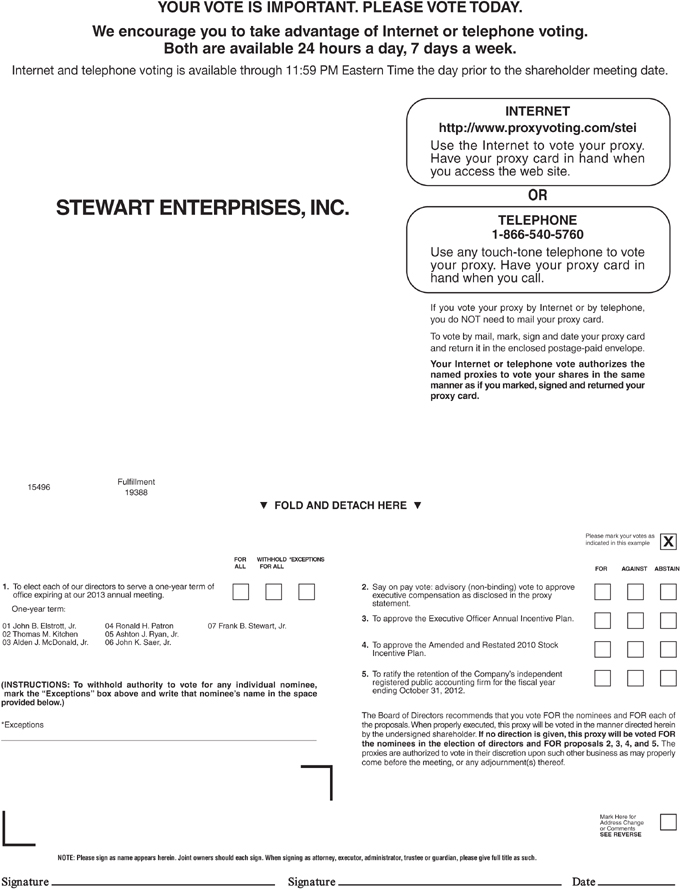

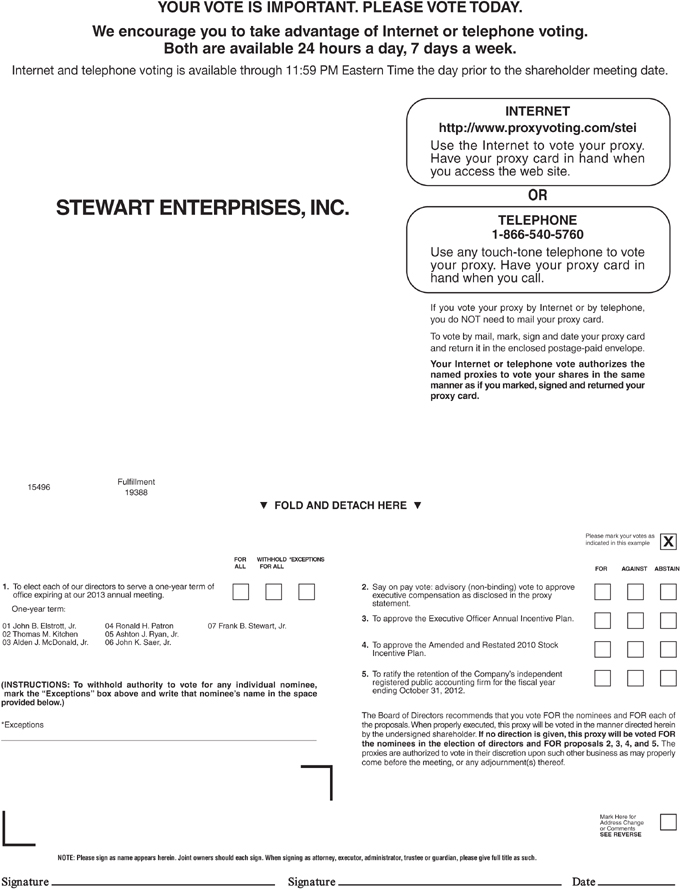

| A: | At the annual meeting, our shareholders will be asked (1) to elect seven directors to serve a one-year term of office expiring at our 2013 annual meeting, (2) to approve our executive compensation as disclosed in this proxy statement (the “say-on-pay” vote), (3) to approve the Stewart Enterprises, Inc. Executive Officer Annual Incentive Plan, (4) to approve the Amended and Restated Stewart Enterprises, Inc. 2010 Stock Incentive Plan, and (5) to ratify the retention of our independent registered public accounting firm for the fiscal year ending October 31, 2012. The board of directors does not know of any additional matters to be presented at our 2012 annual meeting other than those described in this proxy statement. However, if any other matters properly come before the meeting or any adjournment thereof, it is the intention of the persons named in the enclosed proxy to vote the shares represented by them in accordance with their best judgment. |

1

| Q: | How many votes may I cast? |

| A: | For all matters, you may cast one vote for every share of our Class A common stock and ten votes for every share of our Class B common stock that you owned on the record date. |

| Q: | How many votes can be cast by all shareholders? |

| A: | As of the record date, we had 83,340,466 shares of Class A common stock outstanding, each of which is entitled to one vote, and 3,555,020 shares of Class B common stock outstanding, each of which is entitled to ten votes. Accordingly, at the meeting 118,890,666 votes can be cast by all shareholders. As of the record date, Frank B. Stewart, Jr. beneficially owned 7,135,475 shares of our Class A common stock and all outstanding shares of our Class B common stock, entitling him to cast 42,685,675 votes for each matter brought before the meeting. |

| Q: | How many shares must be present to hold the meeting? |

| A: | Our bylaws provide that a majority of our Company’s total voting power constitutes a quorum and must be present or represented by proxy to conduct a meeting of our shareholders. Therefore, at our 2012 annual meeting, shares with at least 59,445,334 votes must be present in order for a quorum to exist. |

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | If your shares are registered directly in your name with our transfer agent, BNY Mellon Shareowner Services, you are considered, with respect to those shares, the “shareholder of record.” The Notice and/or proxy materials have been sent to you directly by us. |

| | If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name.” The Notice and/or proxy materials have been forwarded to you by your broker, bank or nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote your shares by following the voting instructions on the form that you receive from your broker, bank, or nominee. |

| A: | If you hold shares in street name and you do not provide voting instructions to your broker, bank, or nominee, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. |

| | Brokers generally have discretionary authority to vote shares held in street name on “routine” matters but not on “non-routine” matters. The proposal to ratify the retention of the independent registered public accounting firm is generally considered a “routine” matter. The proposal to elect directors, the say-on-pay vote, the proposal to approve the Stewart Enterprises, Inc. Executive Officer Annual Incentive Plan, and the proposal to approve the Amended and Restated Stewart Enterprises, Inc. 2010 Stock Incentive Plan are generally considered “non-routine” matters; therefore, if you do not provide voting instructions on those proposals, your shares will not be voted on those proposals. |

| | A “broker non-vote” occurs when a broker holding shares for you in street name submits a proxy that votes your shares on one or more matters, but does not vote (the “broker non-vote”) on “non-routine” matters with respect to which you have not given voting instructions. |

| | If you do not vote the shares held directly in your name, your shares will not be voted. |

| Q: | What vote is required to approve each item? How are broker non-votes counted? |

| A: | Our bylaws provide that directors are elected by a plurality of the votes cast by holders of Class A common stock and Class B common stock present in person or represented by proxy and entitled to vote at the annual meeting. This means that the nominees for available directorships who receive the highest number of affirmative votes cast are elected. |

| | You may vote “for” all director nominees or withhold your vote for any one or more of the director nominees. Only votes “for” are counted in determining whether a plurality has been cast in favor of a director. Abstentions, withheld votes, and broker non-votes will have no effect on the plurality vote for the election of directors. |

| | The say-on-pay vote, the vote on the Stewart Enterprises, Inc. Executive Officer Annual Incentive Plan, the vote on the Amended and Restated Stewart Enterprises, Inc. 2010 Stock Incentive Plan, and the ratification of the retention of our independent registered public accounting firm will each be decided by the vote of the holders of a majority of the voting power present in person or represented by proxy and entitled to vote with respect to such matter at the annual meeting. All other matters coming before the annual meeting will be decided by the vote of the holders of a majority of the voting power present in person or represented by proxy and entitled to vote with respect to such matter at the annual meeting, except as otherwise provided by statute, our articles of incorporation, or our bylaws. |

2

| | With respect to all proposals on the ballot other than the election of directors, and with respect to any other matter that is properly brought before the meeting, abstentions will have the effect of a vote against the proposal, and broker non-votes will be counted as not present with respect to the proposal. Shares represented at the meeting by proxies reflecting a vote on any proposal, along with broker non-votes, will be counted as present for quorum purposes. |

| A: | Record holders: You may vote your shares by internet or telephone by following the information provided on the Notice or, if you have received a printed set of proxy materials, by filling out the proxy card and returning it in the postage paid return envelope. |

| | Street holders: If your shares are held in street name, you must vote in accordance with the voting instruction form provided by your broker, bank, or nominee. The availability of telephone and internet voting will depend on your broker’s or bank’s voting process. |

| | In person at the annual meeting: You may also vote in person at the annual meeting, either by attending the meeting yourself or authorizing a representative to attend the meeting on your behalf. You may also execute a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a proxy from your broker, bank, or nominee naming you as the proxy holder and present it to the inspector of election with your ballot when you vote at the annual meeting. |

| Q: | Once I deliver my proxy, can I revoke or change my vote? |

| A: | Yes. You may revoke or change your proxy at any time before it is voted by giving a written revocation notice to our Secretary, by timely delivering a proxy with a later date, or by voting in person at the meeting. |

| Q: | What if I don’t vote for a proposal on the proxy card I return? |

| A: | Unless you give other instructions on your proxy card, or unless you give other instructions when you cast your vote by telephone or internet, the persons named as proxies will vote your shares: |

| | (1) | FOR each of the seven director nominees; |

| | (2) | FOR approval of the compensation of our Named Executive Officers as disclosed in this proxy statement; |

| | (3) | FOR approval of the Stewart Enterprises, Inc. Executive Officer Annual Incentive Plan; |

| | (4) | FOR approval of the Amended and Restated Stewart Enterprises, Inc. 2010 Stock Incentive Plan; and |

| | (5) | FOR the ratification of the retention of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2012. |

3

| | If you are a beneficial owner of shares and do not give voting instructions to your broker, bank, or nominee, they will be entitled to vote your shares with respect to the proposal to ratify the retention of our independent registered public accounting firm but not on any of the other proposals. |

| Q: | Who pays for soliciting proxies? |

| A: | We are paying for all costs of soliciting proxies. Our directors, officers, and employees may request the return of proxies by mail, telephone, internet, facsimile, telegram, or personal interview. We are also requesting that banks, brokerage houses, and other nominees or fiduciaries forward the soliciting material to their principals and that they obtain authorization for the execution of proxies. We will reimburse them for their expenses. |

| Q: | Could other matters be considered and voted upon at the meeting? |

| A: | Our board does not expect to bring any other matter before the annual meeting and is not aware of any other matter that may be considered at the meeting. In addition, pursuant to our bylaws, the time has elapsed for any shareholder to properly bring a matter before the meeting. However, if any other matter does properly come before the meeting, the proxy holders will vote the proxies at their discretion. |

| Q: | What happens if the meeting is postponed or adjourned? |

| A: | Unless a new record date is fixed, your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy at any time until it is voted. |

| Q: | How can shareholders present proposals for inclusion in our proxy materials relating to our 2013 annual meeting? |

| A: | Any shareholder who desires to present a proposal for inclusion in our proxy materials relating to our 2013 annual meeting must forward the proposal to our Secretary at the address shown on the first page of this Proxy Statement in time to arrive at our offices no later than November 2, 2012. |

| | All shareholder proposals must also comply with Section 2.14 of our bylaws in order to be eligible for consideration at a shareholders’ meeting. Our bylaws are filed with the SEC, and shareholders should refer to the bylaws for a complete description of the requirements. |

| | Any shareholder who wishes to present a proposal at our 2013 annual meeting must give us notice in advance of the meeting. The notice must be received by our Secretary no later than November 2, 2012, but this date is subject to change in accordance with our bylaws. If the date of our 2013 annual meeting is 30 calendar days earlier or later than April 19, 2013, then notice must be received no earlier than 90 days and no later than 60 days prior to the meeting, unless shareholders are given less than 70 days notice of the meeting, in which case the Secretary must receive notice of the shareholder proposal by the tenth day following the date that notice of the meeting was mailed or disclosed. The notice must contain: |

| | (1) | a complete and accurate description of the proposal; |

| | (2) | a statement that the shareholder (or the shareholder’s legal representative) intends to attend the meeting and present the proposal and that the shareholder intends to hold of record securities entitled to vote at the meeting through the actual meeting date; |

| | (3) | the shareholder’s name, address and the number of shares of our voting securities that the shareholder holds of record and beneficially as of the notice date; and |

| | (4) | a complete and accurate description of any material interest of the shareholder in the proposal. |

4

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Stock Ownership of Certain Beneficial Owners

As of February 21, 2012, the persons named below were, to our knowledge, the only beneficial owners of more than 5% of our outstanding shares of Class A common stock, determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), other than Frank B. Stewart, Jr., whose beneficial ownership of our Class A and Class B common stock is described in the next table.

| | | | | | | | | | |

Beneficial Owner | | Class | | | Amount and Nature of

Beneficial Ownership | | Percent

of Class(1) | |

Fidelity Management and Research 82 Devonshire Street Boston, MA 02109 | | | Class A | | | 11,406,507(2) | | | 13.7 | % |

Dimensional Fund Advisors, LP Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | | | Class A | | | 7,317,389(3) | | | 8.8 | % |

Westfield Capital Management Company, LP 1 Financial Center Boston, MA 02111 | | | Class A | | | 6,408,994(4) | | | 7.7 | % |

NewSouth Capital Management, Inc. 999 S. Shady Grove Rd. Suite 501 Memphis, TN 38120 | | | Class A | | | 6,081,042(5) | | | 7.3 | % |

BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | | Class A | | | 5,703,169(6) | | | 6.8 | % |

| (1) | Calculated on the basis of 83,340,466 shares of Class A common stock outstanding on February 21, 2012. |

| (2) | Based solely on information contained in a Schedule 13G/A filed with the SEC on February 14, 2012 by Fidelity Management and Research (“Fidelity”) indicating that all shares shown as beneficially owned are held with sole voting and investment power. Fidelity’s Schedule 13G/A reported 12,401,937 shares beneficially owned, of which 995,430 shares would be acquired upon the assumed conversion of our 3.375% senior convertible notes. Shares resulting from the assumed conversion of our senior convertible notes are not included in the beneficial ownership amount in the table above. |

| (3) | Based solely on information contained in a Schedule 13G/A filed with the SEC on February 10, 2012 by Dimensional Fund Advisors, LP (“Dimensional”). Dimensional possesses voting and/or investment power over these shares in its capacity as investment advisor to certain registered investment companies, commingled group trusts, and separate accounts (the “Funds”). Although Dimensional reports that it has sole voting power over 7,232,742 of these shares, and sole investment power over all 7,317,389 shares, it disclaims beneficial ownership of all reported shares, which are beneficially owned by the Funds, none of which individually owns more than 5% of the outstanding shares of our Class A common stock. |

| (4) | Based solely on information contained in a Schedule 13G/A filed with the SEC on February 13, 2012 by Westfield Capital Management Company, LP (“Westfield”), which holds these shares for the benefit of certain clients for whom it serves as investment advisor. Westfield possesses sole voting power over 4,271,184 of these shares, and sole investment power over all 6,408,994 shares. Westfield reports that, to its knowledge, none of its clients individually beneficially own more than 5% of the outstanding shares of our Class A common stock. |

5

| (5) | Based solely on information contained in a Schedule 13G filed with the SEC on February 14, 2012 by NewSouth Capital Management, Inc. (“NewSouth”), which holds these shares for the benefit of certain clients for whom it serves as investment advisor. NewSouth possesses sole voting power over 4,723,842 of these shares, and sole investment power over all 6,081,042 shares. NewSouth reports that, to its knowledge, none of its clients individually beneficially own more than 5% of the outstanding shares of our Class A common stock. |

| (6) | Based solely on information contained in a Schedule 13G filed with the SEC on February 9, 2012 by BlackRock, Inc., indicating that all shares shown as beneficially owned are held with sole voting and investment power. |

Stock Ownership of Management

The table below sets forth certain information concerning the beneficial ownership, as of February 21, 2012, of our Class A and Class B common stock by (1) each director and director nominee, (2) each executive officer for whom compensation information is disclosed under the caption “Executive Compensation” (our “Named Executive Officers”), and (3) all of our directors and executive officers as a group, determined in accordance with Rule 13d-3 of the Exchange Act. Unless otherwise indicated, all shares shown as beneficially owned are held with sole voting and investment power.

| | | | | | | | | | | | | | | |

Beneficial Owner | | Class | | Amount and Nature

of Beneficial

Ownership | | Percent of Class(1) |

Directors and Director Nominees | | | | | | | | | | | | | | | |

Frank B. Stewart, Jr.(2).......................................... | | | | Class A | | | | | 7,135,475 | (3) | | | | 8.5 | % |

| | | | Class B | | | | | 3,555,020 | (4) | | | | 100.0 | % |

Thomas M. Kitchen ............................................... | | | | Class A | | | | | 621,583 | (5) | | | | * | |

John B. Elstrott, Jr. ................................................ | | | | Class A | | | | | 16,850 | (6) | | | | * | |

Alden J. McDonald, Jr. ......................................... | | | | Class A | | | | | 98,555 | (7) | | | | * | |

Ronald H. Patron ................................................... | | | | Class A | | | | | 91,120 | (8) | | | | * | |

Ashton J. Ryan, Jr. ................................................ | | | | Class A | | | | | 85,120 | (8) | | | | * | |

John K. Saer, Jr. .................................................... | | | | Class A | | | | | 14,751 | (9) | | | | * | |

| | | |

Named Executive Officers(10) | | | | | | | | | | | | | | | |

Lewis J. Derbes, Jr. ............................................... | | | | Class A | | | | | 125,536 | (5) | | | | * | |

Kenneth G. Myers, Jr. ........................................... | | | | Class A | | | | | 235,024 | (5) | | | | * | |

Lawrence B. Hawkins ........................................... | | | | Class A | | | | | 370,370 | (5) | | | | * | |

G. Kenneth Stephens, Jr. ...................................... | | | | Class A | | | | | 312,202 | (5) | | | | * | |

Thomas J. Crawford(11)......................................... | | | | Class A | | | | | 365,897 | (5) | | | | * | |

| | | |

All directors and executive officers as a | | | | | | | | | | | | | | | |

group (19 persons)(12) ........................................... | | | | Class A | | | | | 9,605,419 | (13) | | | | 11.4 | % |

| | | | Class B | | | | | 3,555,020 | | | | | 100.0 | % |

| (1) | Calculated on the basis of 83,340,466 shares of Class A and 3,555,020 shares of Class B common stock outstanding as of February 21, 2012, and includes any shares the director, officer, or group has the right to acquire within 60 days. |

| (2) | Mr. Stewart’s mailing address is 111 Veterans Memorial Boulevard, Suite 160, Metairie, Louisiana 70005. |

6

| (3) | Includes 79,868 shares that Mr. Stewart is required to retain until he ceases to serve on our board of directors and 353,880 shares owned by the Frank B. Stewart, Jr. Foundation (a non-profit corporation), with respect to which Mr. Stewart shares voting and investment power. |

| (4) | Mr. Stewart owns 100% of our outstanding shares of Class B common stock. Each share of Class B common stock has ten votes per share and, unless otherwise required by law, the holder of Class B common stock votes together with the holders of Class A common stock on all matters brought before the shareholders. As of February 21, 2012, Mr. Stewart beneficially owned shares of Class A and B common stock having 42,685,675 votes, which represents approximately 35.9% of our total voting power. |

| (5) | The total number of shares of Class A common stock shown as beneficially owned by each Named Executive Officer includes the following: |

| | | | | | | | | | | | | | | |

Named Executive Officer | | Shares Acquirable

within 60 days

upon Exercise of

Stock Options | | Shares Held for the

Executive’s Benefit

under the Stewart

Enterprises Employees’

Retirement Trust

(“SEERT”)* | | Shares of Restricted

Stock as to which the

Executive has Sole

Voting Power but No

Investment Power |

Thomas M. Kitchen | | | | 215,000 | | | | | — | | | | | 213,332 | |

Lewis J. Derbes, Jr. | | | | 53,750 | | | | | — | | | | | 57,665 | |

Kenneth G. Myers, Jr. | | | | 117,500 | | | | | — | | | | | 83,333 | |

Lawrence B. Hawkins | | | | 174,107 | | | | | 6,476 | | | | | 58,333 | |

G. Kenneth Stephens, Jr. | | | | 174,107 | | | | | 4,645 | | | | | 53,333 | |

Thomas J. Crawford | | | | 195,000 | | | | | — | | | | | — | |

| * | Individuals participating in the SEERT have the right to direct the trustee of the SEERT as to how shares of our Class A common stock credited to their SEERT accounts are to be voted and have the right to dispose of the shares of our Class A common stock credited to their SEERT accounts through transfers to other SEERT investment funds. |

| (6) | Includes 8,850 shares that Mr. Elstrott is required to retain until he ceases to serve on our board of directors. |

| (7) | Includes 3,000 shares owned by Mr. McDonald through a family corporation with respect to which Mr. McDonald shares voting and investment power and 83,350 shares that Mr. McDonald is required to retain until he ceases to serve on our board of directors. |

| (8) | For each of Messrs. Patron and Ryan, includes 76,120 shares that the director is required to retain until he ceases to serve on our board of directors. |

| (9) | Includes 14,751 shares that Mr. Saer is required to retain until he ceases to serve on our board of directors. |

| (10) | Information regarding shares beneficially owned by Thomas M. Kitchen, our President and Chief Executive Officer, who is a Named Executive Officer in addition to Messrs. Derbes, Myers, Hawkins, Stephens, and Crawford appears immediately above under the caption “Directors and Director Nominees.” |

| (11) | Mr. Crawford served as our President and Chief Executive Officer until his retirement on April 7, 2011, when he was succeeded by Mr. Kitchen. |

| (12) | As of February 21, 2012, all directors and executive officers as a group beneficially owned shares of Class A and Class B common stock representing approximately 37.7% of our total voting power. |

7

| (13) | The total amount of Class A common stock reported here includes: 976,464 shares that such persons have the right to acquire within 60 days through the exercise of options; 47,760 shares held for such person’s benefit under the SEERT (see note 5); 607,990 shares of restricted stock for which such persons have sole voting but no investment power; 339,059 shares held by non-employee directors that may not be sold until the director no longer serves on our board; and 362,280 shares for which the reporting director or officer shares voting and investment power. This amount does not include 22,624 shares acquirable upon conversion of $250,000 principal amount of our senior convertible notes that mature on July 15, 2016, for which the reporting officer shares voting and investment power. |

8

ELECTION OF DIRECTORS (PROPOSAL 1)

Our directors are elected annually. Under our bylaws, directors are elected by plurality vote.

Upon the recommendation of our corporate governance and nominating committee, the board has re-nominated each of our seven current directors to serve another one-year term of office expiring at our 2013 annual meeting and until his successor is duly elected and qualified.

Unless authority to vote for the election of directors is withheld, the proxy holders named on the enclosed proxy intend to vote each of the proxies received in response to this solicitation “FOR” the election of each of the nominees. If any nominee is no longer a candidate at the time of the annual meeting, we intend to vote the proxies “FOR” the election of the other nominees and proxies may be voted for any substitute nominee designated by our board. If the board does not designate any substitute nominees, the size of our board will be reduced automatically by the total number of nominees withdrawn from consideration. Our board has no information or reason to believe that any nominee will not be a candidate or, if elected, will be unable or unwilling to serve as a director. In no event will the proxies be voted for more than seven nominees.

Our board unanimously recommends that you vote “FOR” each of the following seven nominees: John B. Elstrott, Jr., Thomas M. Kitchen, Alden J. McDonald, Jr., Ronald H. Patron, Ashton J. Ryan, Jr., John K. Saer, Jr., and Frank B. Stewart, Jr.

Biographic information for each director nominee is detailed below. Each director nominee’s biography contains information regarding his tenure as a director, his business experience, other public company directorships held currently or at any time during the last five years, and his experiences, qualifications, attributes, or skills that led the corporate governance and nominating committee and our board to determine that he should serve as a director of our Company.

| | | | |

| Name and Age | | Business Experience, Qualifications, and Skills | | Director

Since |

|

|

| | |

John B. Elstrott, Jr., 63 | | John B. Elstrott, Jr., Ph.D., is a Clinical Professor of Entrepreneurship and the founding director of the Levy-Rosenblum Institute for Entrepreneurship at Tulane University’s Freeman School of Business, which was started in 1991. Dr. Elstrott teaches graduate-level courses in entrepreneurship and, through his work at the Levy-Rosenblum Institute, helps to coordinate joint academic, government, and business initiatives designed to stimulate private enterprise. He has also invested personally in many entrepreneurial ventures. Prior to joining the Tulane University faculty, Dr. Elstrott was Chief Financial Officer of Celestial Seasonings, Inc. Since 1995, Dr. Elstrott has served as a director of Whole Foods Market, Inc. (“Whole Foods”), a Fortune 300 company and the world’s leader in natural and organic foods with more than 300 stores in North America and the United Kingdom. He currently serves as the Chairman of the Board of Whole Foods, having served as its Lead Director from 2001 to 2009. Dr. Elstrott is also a member of Whole Foods’ audit committee. With a Ph.D. in Economics and more than 40 years of experience as an entrepreneur and investor, Dr. Elstrott is a consultant to various privately-held family businesses as well as for-profit and not-for-profit corporations. Dr. Elstrott is also a Founder and Director of the Tulane Family Business Center. Given his extensive entrepreneurial experience, Dr. Elstrott is able to assist our Company in evaluating innovative growth strategies. His substantial experience with mergers and acquisitions at Whole Foods contributes to the board’s ability to assess acquisition opportunities. His service on the board of Whole Foods, particularly as Chairman (formerly Lead Director), and as a member of the audit committee, has given him a strong background in corporate governance, financial, accounting and risk assessment matters facing large publicly-traded companies. | | 2011 |

| | | | |

9

| | | | |

| Name and Age | | Business Experience, Qualifications, and Skills | | Director

Since |

|

|

| | |

Thomas M. Kitchen, 64 | | Thomas M. Kitchen has served as our President and Chief Executive Officer since April 7, 2011. Mr. Kitchen joined our board in February 2004, became Chief Financial Officer in December 2004, and became Senior Executive Vice President in March 2007. In addition, from June 2006 until March 2007, Mr. Kitchen served as acting Chief Executive Officer. Prior to joining the Company, Mr. Kitchen served for more than 12 years as Chief Financial Officer and a director of Avondale Industries, Inc., one of the nation’s largest shipbuilders, during the period in which it was an independent public company. He also served as Avondale’s President from 1999 until 2002, after Avondale was acquired by Litton Industries, Inc., and then by Northrop Grumman. Following his service at Avondale and before joining the Company, Mr. Kitchen was an investment management consultant. Mr. Kitchen is very active in community programs and serves on the boards of non-profit and private entities, including Boys Hope, Girls Hope, Jesuit High School, University of New Orleans (“UNO”) Foundation, UNO Research & Technology Foundation, the Business Council of New Orleans and the River Region and formerly served on the boards of the New Orleans Chamber of Commerce and the Catholic Foundation. Since becoming our President and Chief Executive Officer in April 2011, Mr. Kitchen has been a strong leader for our Company. During the more than six years he served as our Chief Financial Officer, he gained substantial experience with our business and industry and provided significant guidance to our board regarding ways to improve our operations, financial condition, and profitability. His many years of experience handling complex accounting, financial, regulatory, strategic, and organizational matters in a leadership role at Avondale Industries provided him with a broad range of business knowledge and experience. In addition, Mr. Kitchen’s financial and investment management background have made him a key member of our board’s investment committee, which oversees the management of our Company’s sizeable investment portfolio. | | 2004 |

| | | | | |

| | | | | |

| | |

Alden J. McDonald, Jr., 68 | | Alden J. McDonald, Jr. is President, Chief Executive Officer, director, and a founder of Liberty Bank and Trust Co. (“Liberty Bank”), a privately-held bank that is one of the five largest African-American-owned financial institutions in the United States. Since its founding in 1972, Liberty Bank has grown from one New Orleans office to 19 branch offices and loan production offices in six metropolitan areas and six states. Mr. McDonald has a long record of distinguished service on numerous community non-profit and for-profit boards. He serves as a board member of Ochsner Baptist Medical Center and University Medical Center Management Corporation and on the advisory board of Entergy New Orleans. He is a member of the grants committee of the Baptist Community Ministries, one of the largest private foundations in Louisiana. He has served as a Commissioner of the Port of New Orleans and as Chairman of the New Orleans Chamber of Commerce. | | 2001 |

| | | | |

| | | | |

10

| | | | |

| Name and Age | | Business Experience, Qualifications, and Skills | | Director

Since |

|

|

| | |

| | Mr. McDonald’s participation at our board meetings has provided a valuable diversity of perspective. Including his 39 years with Liberty Bank, Mr. McDonald has been a financial institution and banking entrepreneur for more than 43 years. His extensive banking industry experience provides him with significant knowledge in addressing financial, accounting, and regulatory matters, making him well-suited to serve on our audit committee and compensation committee. His experience leading a large multi-location growing business with a significant focus on serving retail customers has enabled him to share important operational, sales, and marketing insights with our board. | | |

| | | | | |

| | | | | |

| | |

Ronald H. Patron, 67 | | Ronald H. Patron is a private investor who retired from the Company’s management in 2001 after more than 18 years of service. Mr. Patron first joined the Company in 1983, and was appointed President of the Corporate Division and Chief Financial Officer in 1987. Mr. Patron was elected to the Company’s board in 1991. In 1998, Mr. Patron retired from his board seat and position as President of the Corporate Division, but continued to serve the Company as a consultant and our Chief Administrative Officer until his full retirement in 2001. Prior to his employment with our Company, Mr. Patron served as Chief Financial Officer and, later, Chief Executive Officer of Enertech, Inc., a publicly-traded company specializing in oil-related services. Mr. Patron was integrally involved in the initial public offering of each of Enertech and our Company. Mr. Patron is involved in numerous charitable and civic endeavors, including the Cystic Fibrosis Foundation. Mr. Patron’s extensive death care industry experience enables him to make important contributions to our board’s assessments of the challenges and opportunities facing our Company. Having served as our Chief Financial Officer during a period of rapid expansion, Mr. Patron also has considerable experience evaluating acquisition opportunities. His significant public-company financial and accounting expertise makes him an important member of our audit committee and investment committee. Having served on our board for a cumulative total of more than 11 years, he also brings to our board a strong understanding of public company corporate governance and executive compensation matters, providing him with a strong background to serve as Chairman of our compensation committee. | | 2006 |

| | | | | |

| | | | | |

| | |

Ashton J. Ryan, Jr., 64 | | Ashton J. Ryan, Jr., C.P.A., is the President, Chief Executive Officer and Chairman of the Board of First NBC Bank, a community bank he founded in 2006 in the aftermath of Hurricane Katrina to assist in the rebuilding of New Orleans. Mr. Ryan served as President and Chief Executive Officer of First Bank and Trust from October 1998 to July 2005. From July 1998 until October 1998, he served as Vice Chairman of Bank One, Louisiana and Chairman of its New Orleans market. Prior to its acquisition by Bank One in 1998, he served as President and Chief Executive Officer of First National Bank of Commerce, positions he held since 1991. Mr. Ryan spent the first 20 years of his career with Arthur Andersen and Company, specializing in auditing and consulting for financial institutions. | | 2004 |

| | | | |

| | | | |

11

| | | | |

| Name and Age | | Business Experience, Qualifications, and Skills | | Director

Since |

| | |

| | | Mr. Ryan is very active in community programs and serves on the boards of many non-profit and private entities, including Junior Achievement, the Urban League, and Catholic Charities of New Orleans. Mr. Ryan is a Certified Public Accountant and regularly teaches as an Adjunct Professor at Tulane University’s business school. Mr. Ryan’s extensive professional and practical experience in accounting and financial matters makes him highly qualified to serve as Chairman of our audit committee and of our investment committee. His experience leading and growing substantial banking organizations has also allowed him to make important contributions to our board’s consideration of operational, sales and marketing matters. His entrepreneurial experience has given him important additional background to evaluate the strategic opportunities available to our Company. | | |

| | | | | |

| | | | | |

| | |

John K. Saer, Jr., 54 | | John K. Saer, Jr. is a Managing Director of GI Partners, a real estate private equity firm with approximately $5.8 billion of capital under management. Mr. Saer joined GI Partners in November 2010 in conjunction with its appointment as manager and co-investor of CalEast Global Logistics LLC (“CalEast”), an owner/operator of a $3.4 billion industrial real estate platform sponsored by the California Public Employees’ Retirement System. Through his relationship with GI Partners, Mr. Saer serves as Executive Chairman of CenterPoint Properties Trust, the largest holding within the CalEast platform. Prior to joining GI Partners, Mr. Saer was a partner at Kohlberg Kravis Roberts & Co (“KKR”), a private equity firm with over $50 billion in assets under ownership and management. He joined KKR in 2001 after having spent eight years in senior financial and operational management positions with a KKR portfolio company, KSL Recreation, where he held positions as Vice President of Business Development and Acquisitions and Chief Financial Officer. While at KKR, Mr. Saer served as head of both the industrial and the real estate investing industry groups, and also as a member of the Portfolio Management Committee. Mr. Saer served on the boards of a number of KKR portfolio companies, including Biomet, Aveos, Borden Chemical, KSL Recreation, and KSL Holdings, and served as a member of the audit committees of Biomet, Borden Chemical, and KSL Recreation. Upon his retirement from full-time employment with KKR, Mr. Saer served as a senior advisor to KKR from October 2009 to June 2010. Mr. Saer has extensive experience in real estate management and finance as well as investment portfolio management, two areas that are of considerable importance to our Company, given our significant real estate holdings and sizeable investment portfolio. Given the substantial operational experience he gained at KSL Recreation, his board roles with KKR portfolio companies often involved an active role in assisting management teams with operational issues. His experience leading, managing and overseeing numerous business enterprises allows him to make meaningful contributions to our board. | | 2011 |

| | | | | |

| | | | | |

| | |

Frank B. Stewart, Jr., 76 | | Frank B. Stewart, Jr. currently serves as the Chairman of our board and is a member of the family that founded the Company. Mr. Stewart joined the family business in 1959 and became President and Chief Executive Officer in 1966. The family business was consolidated as Stewart Enterprises, Inc. in 1970, and, effective with that reorganization, Mr. Stewart became a member of our Company’s board. Mr. Stewart was appointed the board’s Chairman in 1984, overseeing our initial public offering in 1991 and an expansion that has resulted in our current position as the second-largest provider of funeral and cemetery products and services in the death care industry in the United States today. In 2003, after more than 44 years in the business, Mr. Stewart retired from all management positions with the Company, and became Chairman Emeritus. However, Mr. Stewart was appointed Chairman of our board again in April 2007, a position he continues to hold today. | | 1970 |

12

| | | | |

| Name and Age | | Business Experience, Qualifications, and Skills | | Director

Since |

|

|

| | |

| | Mr. Stewart has been a leader in the death care industry throughout his career. He served as President and a director of the Southern Cemetery Association, former President of the Louisiana Cemetery Association, and is a member of the International Cemetery, Cremation and Funeral Association (“ICCFA”). In 2010, the ICCFA honored Mr. Stewart with its Lifetime Achievement Award. Mr. Stewart is also the Chairman of the Board and sole owner of Stewart Capital, LLC, one of the largest private investment holding companies in the Gulf South. In addition to his business activities, Mr. Stewart has a strong commitment to community service demonstrated by his support of numerous charitable and civic organizations such as the Boy Scouts of America, the National World War II Museum, and the Business Council of New Orleans. He has served on many non-profit boards, including currently the Better Business Bureau, Crimestoppers, World Trade Center, and Navy League, and formerly served for many years on the Tulane University Board of Administrators and the Ochsner Medical Foundation Board, as well as the Boards of the Rotary Club of New Orleans and the Salvation Army. Mr. Stewart’s more than 50 years of industry and Company experience have given him an in-depth knowledge of industry history, trends and participants, providing him with an excellent background for evaluating strategic opportunities for our Company. He also has substantial sales, operational and acquisitions experience. As a member of the founding family, he is devoted to continually enhancing our Company’s performance and to maintaining our strong reputation of providing high-quality service to families at their time of need. As our largest shareholder, Mr. Stewart has a keen focus on creating value for all of our shareholders. | | |

| | | | | |

| | | | | |

Our board unanimously recommends a vote “FOR” each of the nominees listed above.

13

Director Nominating Process and Considerations

Each year in advance of our annual meeting of shareholders, our corporate governance and nominating committee is responsible for identifying and recommending to our full board of directors for its approval a slate of director nominees to be presented to the shareholders for election. As a part of this process, our corporate governance and nominating committee evaluates the effectiveness of the operation of our board and board committees and reviews the appropriateness of the composition and size of our board and board committees. In considering potential nominees, our corporate governance and nominating committee looks for individuals with the highest personal and professional ethics, integrity, and values, who can commit themselves to representing the long-term interests of all of our shareholders. Nominees must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. Nominees must be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serve on our board for an extended period of time. In reviewing the composition of our board and potential nominees, our corporate governance and nominating committee also considers the director independence and committee requirements of the NASDAQ Stock Market LLC (“NASDAQ”) listing rules and all legal requirements. Our board seeks independent directors with a broad diversity of experience, professions, skills, and backgrounds that will enhance the overall quality of the board’s deliberations and decisions. Our corporate governance and nominating committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees.

Although the committee has not established specific minimum qualifications for a position on the board of directors, it believes that candidates should have a record of outstanding business or professional achievement, and an impeccable reputation for integrity. The committee also believes that the experience and skills of the board members should be complementary, such that the board as a whole has a broad range of experiences. To identify potential director candidates, the committee primarily has sought suggestions from current board members and their contacts.

The committee will also accept suggestions from shareholders who follow the nomination procedures described below and may seek the assistance of a professional search firm from time to time in the future. The committee gathers such additional information on suggested candidates as it deems relevant, considers which candidates it wishes to pursue further based on the criteria described above, interviews the remaining candidates, deliberates, and then decides which candidate or candidates to recommend to the full board. The committee evaluates candidates suggested by shareholders in the same manner as candidates recommended by all other sources.

This year, the corporate governance and nominating committee reviewed the qualifications of the current directors and unanimously recommended to the board that all seven of them be re-nominated for a new one-year term. Our board unanimously approved this slate of seven director nominees to be submitted for election by our shareholders at the annual meeting.

Our corporate governance and nominating committee and board believe the nominees fulfill the criteria described above. Each of the nominees has a strong and unique background and experience that led our corporate governance and nominating committee to conclude that he should continue to serve as a director of our Company. These qualifications are described individually for each nominee in the table above. Our nominees have experience in a variety of areas important to our Company, such as executive management experience overseeing the operational management of large companies; strategic planning; mergers and acquisitions, finance, investment management, accounting and entrepreneurship; sales and marketing experience; and specific operational experience in the death care industry. Our corporate governance and nominating committee and board believe that these nominees together provide us with the range and depth of experience and capabilities needed to oversee the management of our Company.

Consideration of Candidates Recommended by Shareholders

Our board of directors is open to suggestions from our shareholders on candidates for election to the board. Any shareholder may suggest a nominee by sending the following information to our corporate governance and nominating committee:

| | • | | your name, mailing address, and telephone number; |

| | • | | the suggested nominee’s name, mailing address, and telephone number; |

14

| | • | | a statement as to whether the suggested nominee knows that his or her name is being suggested by you, and whether he or she has consented to being suggested and is willing to serve; |

| | • | | the suggested nominee’s resume or other description of his or her background and experience; and |

| | • | | your reasons for suggesting that the individual be considered. |

The information should be sent to the committee addressed as follows: Chairman, Corporate Governance and Nominating Committee, Stewart Enterprises, Inc., 1333 South Clearview Parkway, Jefferson, Louisiana 70121.

A shareholder of record who does not wish to follow the foregoing procedure but who wishes instead to nominate directly one or more persons for election to the board of directors must comply with the procedures established by our articles and bylaws. Pursuant to those procedures, the shareholder may nominate one or more persons for election at a meeting of shareholders only if the shareholder is entitled to vote at the meeting and provides timely notice in writing to our Secretary at our principal office, 1333 South Clearview Parkway, Jefferson, Louisiana 70121. To be timely, a shareholder’s notice must be received at our principal office not less than 45 days nor more than 90 days prior to the meeting; however, if less than 55 days notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder must be received at our principal office no later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or such public disclosure was made. The notice must include the following information with respect to each person the shareholder proposes to nominate:

| | • | | the person’s name, age, business address, and residential address; |

| | • | | the person’s principal occupation or employment; |

| | • | | the class and number of shares of our capital stock of which such person is the beneficial owner (as defined in Rule 13d-3 of the Exchange Act); |

| | • | | the person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected; and |

| | • | | any other information relating to such person that would be required to be disclosed in solicitations of proxies for the election of directors, or otherwise would be required, in each case pursuant to Regulation 14A of the Exchange Act. |

The notice also must include the following information with respect to the shareholder giving the notice:

| | • | | the name and address of the shareholder; and |

| | • | | the class and number of shares of our capital stock of which the shareholder is the beneficial owner (as defined in Rule 13d-3 of the Exchange Act). |

If requested in writing by our Secretary at least 15 days in advance of the meeting, the shareholder must disclose to our Secretary, within ten days of the request, whether the person is the sole beneficial owner of the shares held of record by the shareholder; and, if not, the name and address of each other person known by the shareholder of record to claim or have a beneficial interest in the shares.

15

BOARDOF DIRECTORS

Director Independence

Our board of directors currently consists of seven members. The board has determined that six of our board members — Messrs. Elstrott, McDonald, Patron, Ryan, Saer, and Stewart — are “independent” as defined by NASDAQ listing standards.

In determining the independence of the nominees, the board of directors considered, among other things, certain business relationships among individual nominees. Specifically, the board considered the fact that Mr. Stewart is an investor in First NBC Bank, of which Mr. Ryan is the Chairman of the Board, President and Chief Executive Officer and from which Mr. Stewart has secured a line of credit.

Board Leadership Structure

The positions of Chairman of the Board and Chief Executive Officer are presently held by two different individuals, namely Mr. Stewart and Mr. Kitchen, respectively. The board believes that this is the most appropriate leadership structure for the Company at this time. The principal responsibility of the Chief Executive Officer is to manage the business. The principal responsibilities of the Chairman of the Board are to manage the operations of the board of directors and its committees and provide counsel to the Chief Executive Officer on behalf of the board.

Board Meetings and Director Attendance

During the fiscal year ended October 31, 2011, our board held eight meetings. Each director attended 75% or more of the aggregate number of meetings of the board of directors and committees of which he was a member that were held during the period in which he served.

It is the policy of our board that directors are strongly encouraged to attend all annual shareholder meetings. All of our directors attended the 2011 annual meeting of shareholders.

In discharging their responsibilities, the board and board committees may invite persons who are not directors to participate in their meetings. These advisors may include the Company’s chief financial officer, internal auditor and independent accountants, the Company’s outside legal counsel, members of management or other internal staff, or consultants. Mr. John McNamara, financial advisor to Mr. Stewart, sometimes participates in board and committee meetings at the invitation of the board, subject to a confidentiality agreement. Mr. McNamara is not a member of the board of directors, is not compensated by the Company, and participates only in his capacity as advisor to Mr. Stewart.

Role of the Board in Risk Oversight

Our Company’s management is responsible for identifying, assessing, and managing our Company’s exposure to risk. Our board plays an important role in overseeing management’s performance of these duties.

As reflected in our Code of Business Conduct and Ethics, our board seeks to establish a “tone at the top,” communicating our board’s strong commitment to ethical behavior and compliance with the law. Our board regularly includes agenda items at its meetings relating to risk and discusses with management a range of topics relating to risk management, including regulatory obligations, litigation, disaster recovery and business continuity planning, insurance, and operational matters. Further, our board oversees the strategic direction of our Company and monitors the management of risks that impact our strategic goals. The material risks to our business identified by the Company are reviewed by the board and included in our filings with the SEC under the heading “Risk Factors.”

While risk oversight is a full board responsibility, we also empower our board committees to address risk oversight in their respective areas. For example, our audit committee regularly reviews our disclosure controls and procedures and internal controls over financial reporting and other legal and regulatory matters affecting our Company. Our audit committee also discusses our major financial risk exposures and steps management has taken to monitor and control these exposures. Our Director of Internal Audit reports to, and regularly meets in executive session with, our audit committee. In addition, our investment committee oversees the management of risks associated with our trust fund investments and, as discussed in greater detail below under “Composition and Role of Board Committees – Compensation Committee,” our compensation committee is responsible for assessing risks related to compensation.

16

As an example of our board’s involvement in risk oversight, in early 2008, at the direction of the audit committee, our internal audit department performed a comprehensive risk assessment of our Company. The assessment included surveys sent to senior managers followed by a meeting of senior managers at which the risks were identified, discussed, evaluated, and ranked according to potential impact and likelihood of occurrence. Risk categories included financial and non-financial risks, including, but not limited to, operational and competitive risks. The results of the process were discussed with the committee and the full board and were used among other things to help focus management planning and formulate the Company’s internal audit plan. The surveys have been updated each year in order to capture any changes in assessment of risks and to identify new risks.

Communicating with Directors

Our board of directors has adopted a procedure for shareholders to communicate with our directors. Any shareholder wishing to do so may write to the board of directors at the Company’s principal business address, 1333 South Clearview Parkway, Jefferson, Louisiana 70121. Any shareholder communication so addressed will be delivered unopened to the director to whom it is addressed or to the Chairman of the Board if addressed to the board of directors.

Availability of Corporate Governance Materials

You may access our articles of incorporation, our bylaws, our Code of Business Conduct and Ethics, and the charters for the audit, compensation, and corporate governance and nominating committees on our website atwww.stewartenterprises.com. You may also request printed copies, which will be sent to you without charge, by writing to us in care of the Secretary, Stewart Enterprises, Inc., 1333 South Clearview Parkway, Jefferson, Louisiana 70121.

17

COMPOSITION AND ROLE OF BOARD COMMITTEES

Our board currently has four standing committees: an audit committee, a compensation committee, a corporate governance and nominating committee, and an investment committee. Each committee is comprised entirely of independent non-management directors with the exception of the investment committee, on which Thomas M. Kitchen serves. In addition, each of the audit, compensation, and corporate governance and nominating committees is governed by a written charter that is reviewed annually and approved by the full board. A copy of each of these charters may be obtained on our website or by mail as described in “Board of Directors – Availability of Corporate Governance Materials.”

The current members of each committee are identified in the following table, which also indicates the number of meetings each committee held in fiscal 2011:

| | | | | | | | |

| | | Board Committee |

Director | | Audit | | Compensation | | Corporate

Governance and

Nominating | | Investment |

Thomas M. Kitchen | | | | | | | | X |

John B. Elstrott, Jr. | | X | | X | | X | | |

Alden J. McDonald, Jr. | | X | | X | | X | | |

Ronald H. Patron | | X | | Chairman | | X | | X |

Ashton J. Ryan, Jr. | | Chairman | | | | X | | Chairman |

John K. Saer, Jr. | | | | X | | X | | X |

Frank B. Stewart, Jr. | | | | | | Chairman | | |

Number of Meetings in 2011 | | 5 | | 6 | | 2 | | 4 |

Audit Committee

The audit committee oversees our Company’s accounting and financial reporting processes and the audit of our financial statements on behalf of our board. Management has the primary responsibility for the financial statements as well as the accounting and financial reporting processes, including the system of disclosure controls and procedures and internal controls over financial reporting.

The audit committee is also responsible for any audit committee reports the SEC requires us to include in our proxy statements. In this proxy statement, the requisite report may be found under the heading “Audit Committee Report.”

All members of the audit committee are independent, as independence for audit committee members is defined in NASDAQ listing standards and applicable SEC rules. The board has determined that three of the four committee members – Messrs. Ryan, Elstrott, and Patron – qualify as “audit committee financial experts,” as defined by SEC rules.

Compensation Committee

The purpose of the compensation committee is to assist the board in discharging its responsibilities relating to executive and director compensation. The committee has the sole authority to set annual compensation amounts and annual incentive plan criteria for executive officers, approve any contract under which compensation is awarded to an executive officer, and make awards to executive officers under our stock compensation plans. At least annually, the compensation committee also recommends to the board for its approval a compensation policy for non-employee members of the board. The committee is also responsible for the oversight of succession planning for key positions of the Company.

All members of the compensation committee are independent, as independence for compensation committee members is defined in NASDAQ listing standards, and each is a non-employee director as defined in Rule 16b-3 of the Exchange Act. In addition, all members of the committee are “outside directors” as defined in the regulations promulgated under Internal Revenue Code Section 162(m) (“Section 162(m)”), with the exception of Mr. Patron because he is a former officer of our Company.

18

The compensation committee’s charter allows it to delegate its authority to subcommittees of the committee, as it deems necessary or appropriate. In June 2011, the compensation committee formed a special subcommittee, the incentive awards subcommittee, which is responsible for administering certain incentive plans, including granting incentive awards intended to qualify for the “performance-based compensation” exception of Section 162(m). Under the subcommittee’s charter, its authority includes establishing and certifying any performance goals for, and granting incentive awards under, those plans. The members of the subcommittee consist of each of the compensation committee members (Messrs. Elstrott, McDonald, and Saer) who meet all three independence criteria for compensation committee members (NASDAQ’s listing standards, Rule 16b-3 of the Exchange Act, and Section 162(m)). Mr. McDonald currently serves as chairman of the subcommittee, which has made all decisions regarding awards intended to qualify as “performance-based compensation” since its establishment in June 2011.

In past years, the compensation committee has engaged Towers Watson (previously Towers Perrin) as its compensation consultant to provide information on executive and director compensation levels of similar companies for purposes of assuring that compensation is set at appropriate levels and that its compensation practices are reasonable and appropriate. The compensation committee last engaged Towers Watson in fiscal 2007. In fiscal 2011, the compensation committee engaged Ernst & Young LLP to assist in its review of compensation matters for fiscal 2012. For more information regarding the processes used by the compensation committee to determine executive compensation, see the section titled “Compensation Discussion and Analysis” below.

Risk Review of Compensation. The compensation committee performs an annual risk assessment of our Company’s compensation programs. In connection with the committee’s most recent such assessment, management inventoried our compensation programs and provided the inventory and a description of each plan to the committee. Management identified the elements of our compensation programs that could incentivize risk and reported to the compensation committee its assessment of those risks and mitigating factors particular to each risk. The compensation committee considered management’s analysis and report and has concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on our Company. Some of the factors considered by the committee include:

| | • | | the Company’s cash/equity mix provides an appropriate balance between short-term and long-term risk and reward decisions; |

| | • | | our annual incentive plans contain several different corporate performance metrics, and adjustments may only be made for certain pre-approved items; |

| | • | | our annual incentive plans include payout caps and a qualitative performance review for each participant; |

| | • | | with regard to commissions paid to our sales team (exclusive of sales funded by life insurance), such commissions are paid only when the principal amount of the sale is collected, and there are provisions to “charge back” the commission to the salesperson if the sale is subsequently cancelled prior to collecting 25% of the principal; |

| | • | | equity grants contain a mix of options and performance-based restricted stock; and |

| | • | | we have adopted a Compensation Recovery Policy and Stock Ownership Guidelines for executives. |

Corporate Governance and Nominating Committee

The corporate governance and nominating committee is responsible for corporate governance and the identification and recommendation to the full board of directors of candidates for nomination or re-nomination to the board of directors. The committee will consider candidates recommended by shareholders who follow the procedures described above under the caption “Election of Directors – Consideration of Candidates Recommended by Shareholders.”

All members of the corporate governance and nominating committee are independent, as independence for nominating committee members is defined in NASDAQ listing standards.

19

Investment Committee

The investment committee is responsible for assisting our board in its oversight of Investors Trust, Inc. (“ITI”), our wholly-owned subsidiary and an investment advisor registered with the SEC. ITI serves as investment advisor for our investment portfolio comprising our preneed funeral and cemetery merchandise and services trust and escrow accounts and our cemetery perpetual care trust and escrow accounts. As of October 31, 2011, ITI managed assets with a market value of approximately $791.7 million.

All of the members of the investment committee are independent, with the exception of Mr. Kitchen, who currently serves as our President and Chief Executive Officer.

20

DIRECTOR COMPENSATION

Overview

The compensation committee of our board of directors is responsible for reviewing and recommending director compensation to the full board for its approval. Currently, we pay our non-employee directors a mix of cash (consisting of an annual retainer and committee and chairmanship fees) and stock (shares of Class A common stock granted with a hold-until-retirement requirement). The director compensation policy was most recently revised in September 2010 to decrease cash compensation by $10,000 and increase stock compensation by the same amount. We do not provide any perquisites or retirement benefits to our non-employee directors.

Cash Compensation

The cash compensation paid to our non-employee directors consists of an annual retainer for board and committee service, plus an annual retainer for service as chair of certain committees or the full board. The schedule of retainers currently paid to our non-employee directors is as follows:

| | | | |

Position | | Annual Retainer

for Membership

($) | | Additional Retainer

for Service as Chair

($) |

Board of Directors | | 50,000 | | 30,000 |

Audit Committee | | 12,500 | | 15,000 |

Compensation Committee | | 10,000 | | 7,500 |

Corporate Governance & Nominating Committee | | 10,000 | | — |

Investment Committee | | 10,000 | | — |

The aggregate cash compensation paid to each non-employee director for fiscal 2011 is reported in the next table.

Stock Compensation

Over the past few years, the board has sought to increase the percentage of a director’s compensation that is received as equity. In September 2010, the compensation committee recommended, and the board approved, revisions to our non-employee director compensation policy to ensure that a substantial portion of each non-employee director’s annual compensation is equity-based. Beginning in fiscal 2011, each non-employee director receives, in addition to the annual cash retainers, a $95,000 annual equity retainer on the first business day of the Company’s fiscal year. Each non-employee director is permitted to elect to receive a maximum of 40% of that amount in cash to cover the related taxes (thus each would receive a minimum of 60% of the equity retainer in shares of our Class A common stock). The number of shares is determined by the closing price on the last trading day of the immediately-preceding fiscal year. The shares granted as director compensation are unrestricted, except that a director is not permitted to sell or transfer any shares he received as compensation until his board service ends.

Director Stock Ownership Policy

The compensation committee has a long-standing policy requiring that each non-employee director own common stock of the Company with a value equal to at least five times the amount of the annual cash retainer within five years after joining the board. Once a non-employee director has achieved the target level of stock ownership, the director should maintain at least that level of ownership for the duration of his service as a non-employee director. As of October 31, 2011, each of our non-employee directors who has served for five or more years was in compliance with the policy. Because they were first elected in fiscal 2011, Messrs. Elstrott and Saer each have until April 7, 2016 to comply with the policy.

21

Director Compensation Table – Fiscal 2011

The table below details all compensation the Company paid to our non-employee directors for the fiscal year ended October 31, 2011. Messrs. Kitchen and Crawford, who were employed during the fiscal year by the Company as executive officers, did not receive any additional compensation for their service as directors.

Fiscal 2011 Director Compensation

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash(1)

($) | | | Stock Awards(1)

($) | | | Other

($) | | | Total

($) | |

John B. Elstrott, Jr.(2) | | | 46,812 | | | | — | | | | — | | | | 46,812 | |

Alden J. McDonald, Jr. | | | 96,753 | | | | 80,747 | | | | — | | | | 177,500 | |

James W. McFarland(3) | | | 38,097 | | | | 95,000 | | | | — | | | | 133,097 | |

Ronald H. Patron | | | 130,432 | | | | 56,998 | | | | — | | | | 187,430 | |

Michael O. Read(3) | | | 59,675 | | | | 71,245 | | | | — | | | | 130,920 | |

Ashton J. Ryan, Jr. | | | 135,502 | | | | 56,998 | | | | — | | | | 192,500 | |

John K. Saer, Jr.(2) | | | 45,393 | | | | — | | | | — | | | | 45,393 | |

Frank B. Stewart, Jr. | | | 90,000 | | | | 95,000 | | | | 1,711 | (4) | | | 186,711 | |